Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Sunshine Bancorp, Inc. | d347119d8k.htm |

Investor Presentation 4th Quarter 2016 Exhibit 99.1

Except for the historical information contained in this presentation, the matters discussed may be deemed to be forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like “believe,” “expect,” “anticipate,” “estimate” and “intend” or future or conditional verbs such as “will,” “would,” “should,” “could” or “may”. Forward-looking statements, by their nature, are subject to risks and uncertainties. Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures; changes in the interest rate environment; demand for loans in Sunshine Bank’s market area; adverse changes in general economic conditions, either nationally or in Sunshine Bank’s market areas; adverse changes within the securities markets; the successful integration of our acquisitions; legislative and regulatory changes that could adversely affect the business in which the Company and Sunshine Bank are engaged; the future earnings and capital levels of Sunshine Bank; the possibility that anticipated benefits of the FBC merger transaction will not be realized, including without limitations, anticipated revenues, expenses, earnings, and other financial results and other risks detailed from time to time in the Company’s Securities and Exchange Commission filings. We caution readers not to place undue reliance on forward-looking statements contained in this presentation. The Company disclaims any obligation to revise or update any forward-looking statements contained in this presentation to reflect future events or developments. Forward-Looking Statements

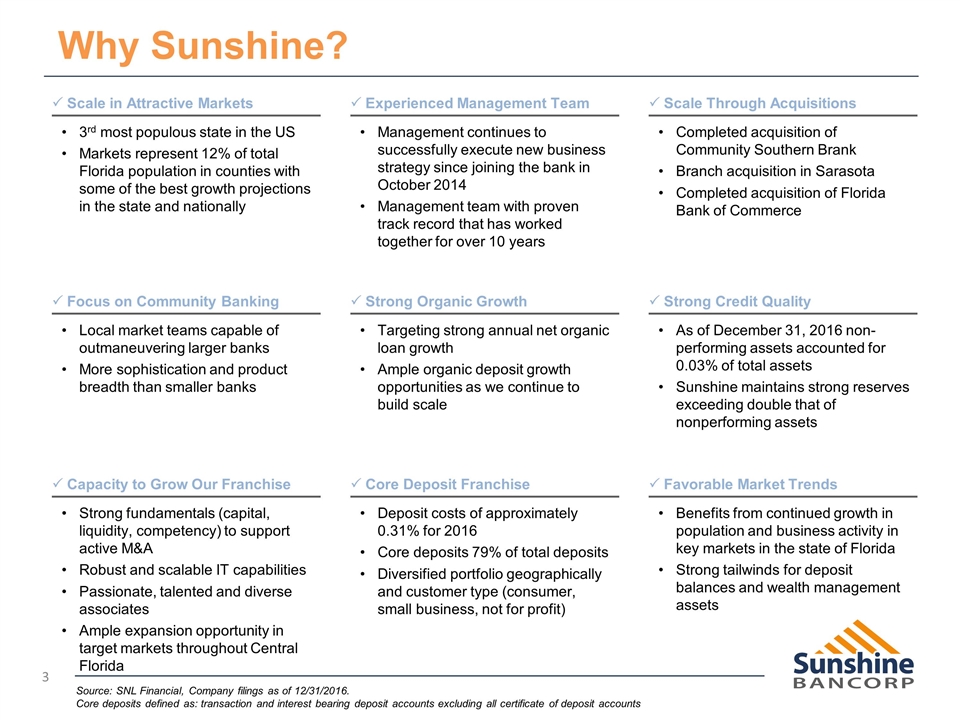

Why Sunshine? P Scale in Attractive Markets 3rd most populous state in the US Markets represent 12% of total Florida population in counties with some of the best growth projections in the state and nationally P Focus on Community Banking Local market teams capable of outmaneuvering larger banks More sophistication and product breadth than smaller banks P Core Deposit Franchise Deposit costs of approximately 0.31% for 2016 Core deposits 79% of total deposits Diversified portfolio geographically and customer type (consumer, small business, not for profit) P Capacity to Grow Our Franchise Strong fundamentals (capital, liquidity, competency) to support active M&A Robust and scalable IT capabilities Passionate, talented and diverse associates Ample expansion opportunity in target markets throughout Central Florida P Strong Credit Quality As of December 31, 2016 non-performing assets accounted for 0.03% of total assets Sunshine maintains strong reserves exceeding double that of nonperforming assets P Experienced Management Team Management continues to successfully execute new business strategy since joining the bank in October 2014 Management team with proven track record that has worked together for over 10 years P Favorable Market Trends Benefits from continued growth in population and business activity in key markets in the state of Florida Strong tailwinds for deposit balances and wealth management assets P Scale Through Acquisitions Completed acquisition of Community Southern Brank Branch acquisition in Sarasota Completed acquisition of Florida Bank of Commerce P Strong Organic Growth Targeting strong annual net organic loan growth Ample organic deposit growth opportunities as we continue to build scale Source: SNL Financial, Company filings as of 12/31/2016. Core deposits defined as: transaction and interest bearing deposit accounts excluding all certificate of deposit accounts

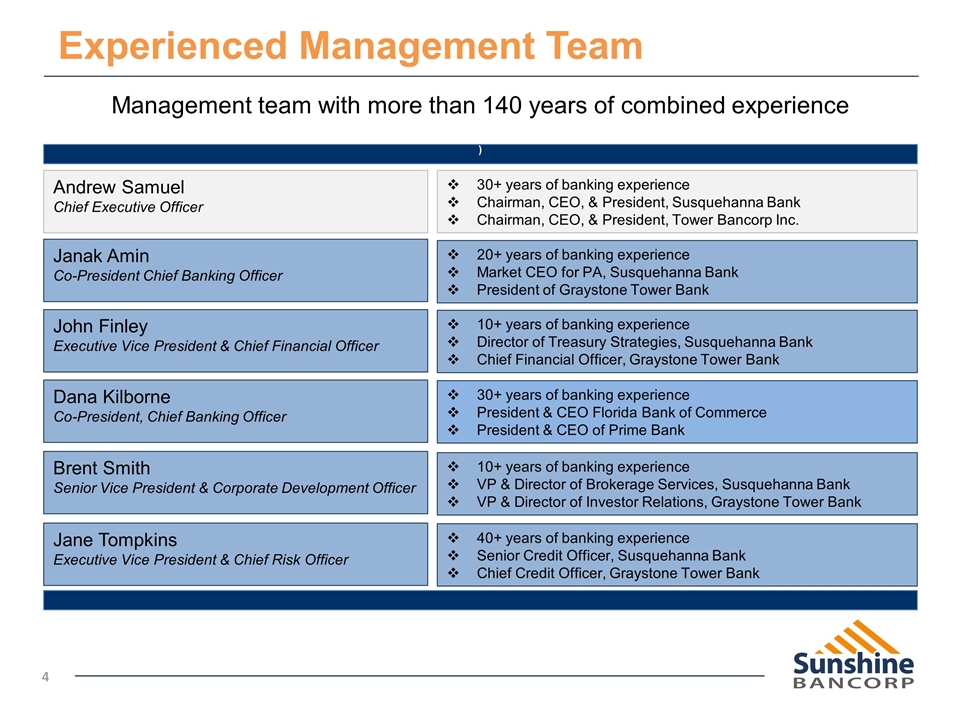

Experienced Management Team ) Andrew Samuel Chief Executive Officer 30+ years of banking experience Chairman, CEO, & President, Susquehanna Bank Chairman, CEO, & President, Tower Bancorp Inc. John Finley Executive Vice President & Chief Financial Officer 10+ years of banking experience Director of Treasury Strategies, Susquehanna Bank Chief Financial Officer, Graystone Tower Bank Janak Amin Co-President Chief Banking Officer 20+ years of banking experience Market CEO for PA, Susquehanna Bank President of Graystone Tower Bank Management team with more than 140 years of combined experience Jane Tompkins Executive Vice President & Chief Risk Officer 40+ years of banking experience Senior Credit Officer, Susquehanna Bank Chief Credit Officer, Graystone Tower Bank Brent Smith Senior Vice President & Corporate Development Officer 10+ years of banking experience VP & Director of Brokerage Services, Susquehanna Bank VP & Director of Investor Relations, Graystone Tower Bank Dana Kilborne Co-President, Chief Banking Officer 30+ years of banking experience President & CEO Florida Bank of Commerce President & CEO of Prime Bank

Organic Growth Strategic Acquisition Strategic Partnerships Branch Acquisitions Building Franchise Value

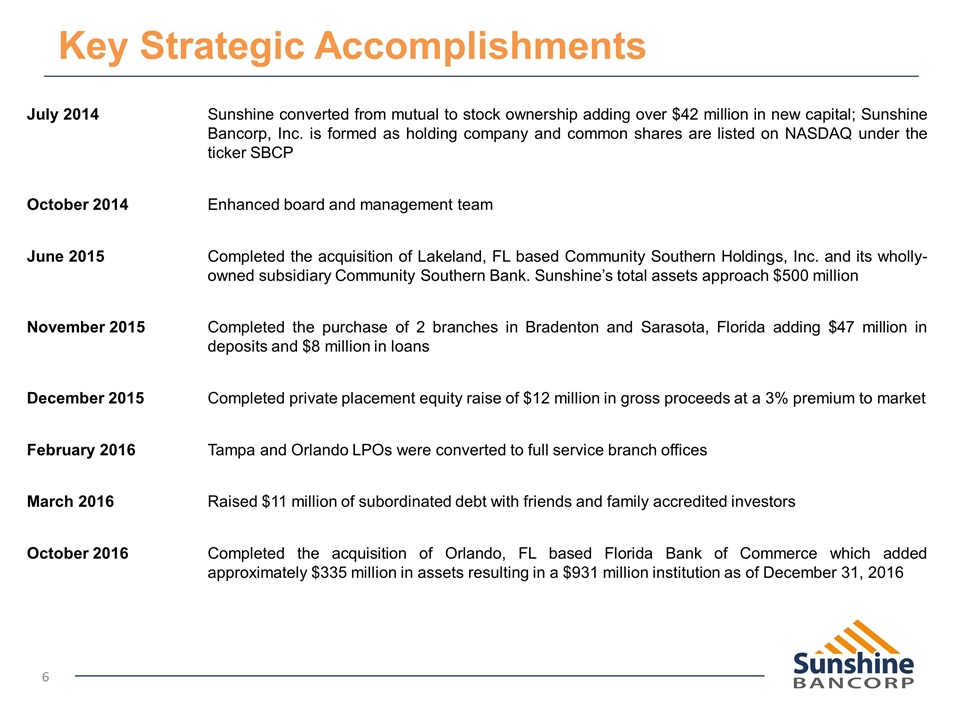

Key Strategic Accomplishments July 2014 Sunshine converted from mutual to stock ownership adding over $42 million in new capital; Sunshine Bancorp, Inc. is formed as holding company and common shares are listed on NASDAQ under the ticker SBCP October 2014Enhanced board and management team June 2015Completed the acquisition of Lakeland, FL based Community Southern Holdings, Inc. and its wholly-owned subsidiary Community Southern Bank. Sunshine’s total assets approach $500 million November 2015Completed the purchase of 2 branches in Bradenton and Sarasota, Florida adding $47 million in deposits and $8 million in loans December 2015 Completed private placement equity raise of $12 million in gross proceeds at a 3% premium to market February 2016Tampa and Orlando LPOs were converted to full service branch offices March 2016Raised $11 million of subordinated debt with friends and family accredited investors October 2016Completed the acquisition of Orlando, FL based Florida Bank of Commerce which added approximately $335 million in assets resulting in a $931 million institution as of December 31, 2016

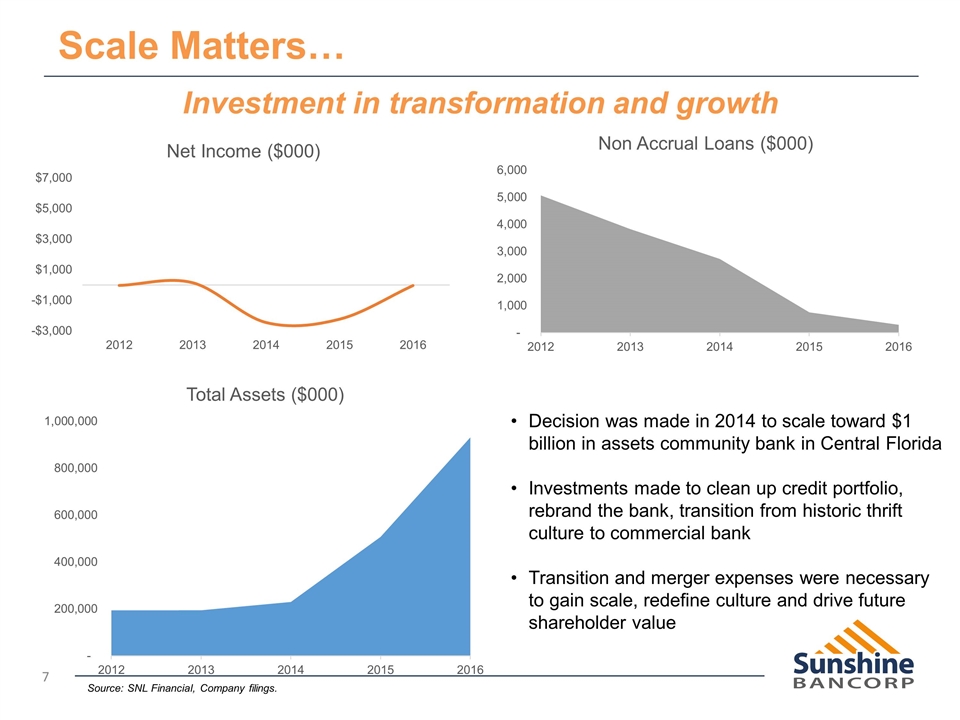

Scale Matters… Investment in transformation and growth Decision was made in 2014 to scale toward $1 billion in assets community bank in Central Florida Investments made to clean up credit portfolio, rebrand the bank, transition from historic thrift culture to commercial bank Transition and merger expenses were necessary to gain scale, redefine culture and drive future shareholder value Source: SNL Financial, Company filings.

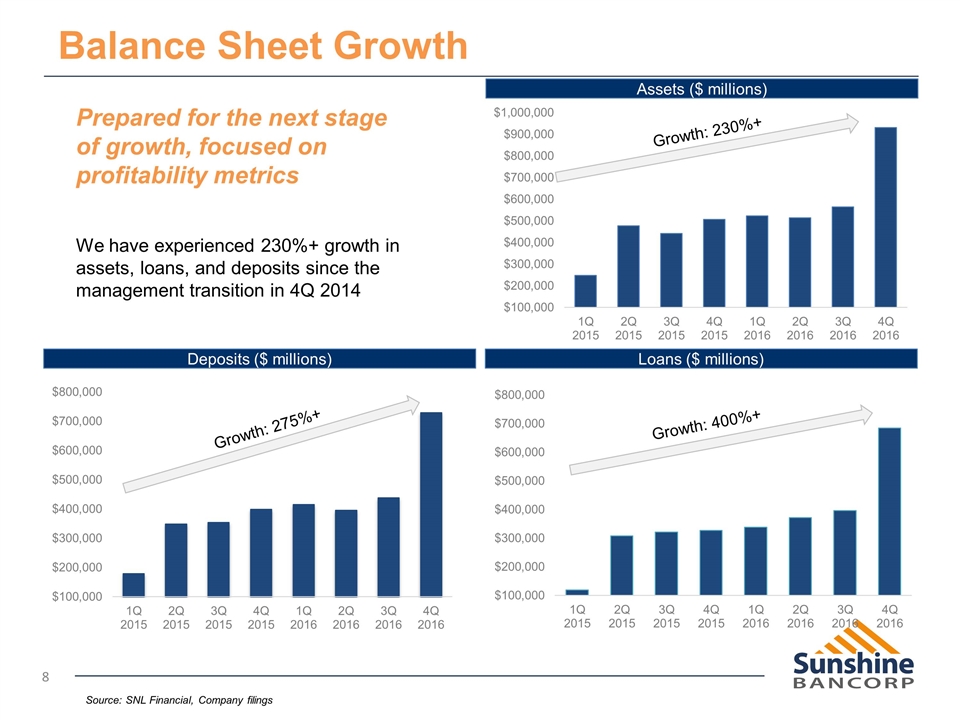

Balance Sheet Growth Deposits ($ millions) Loans ($ millions) Assets ($ millions) Growth: 230%+ Growth: 275%+ Growth: 400%+ Source: SNL Financial, Company filings Prepared for the next stage of growth, focused on profitability metrics We have experienced 230%+ growth in assets, loans, and deposits since the management transition in 4Q 2014

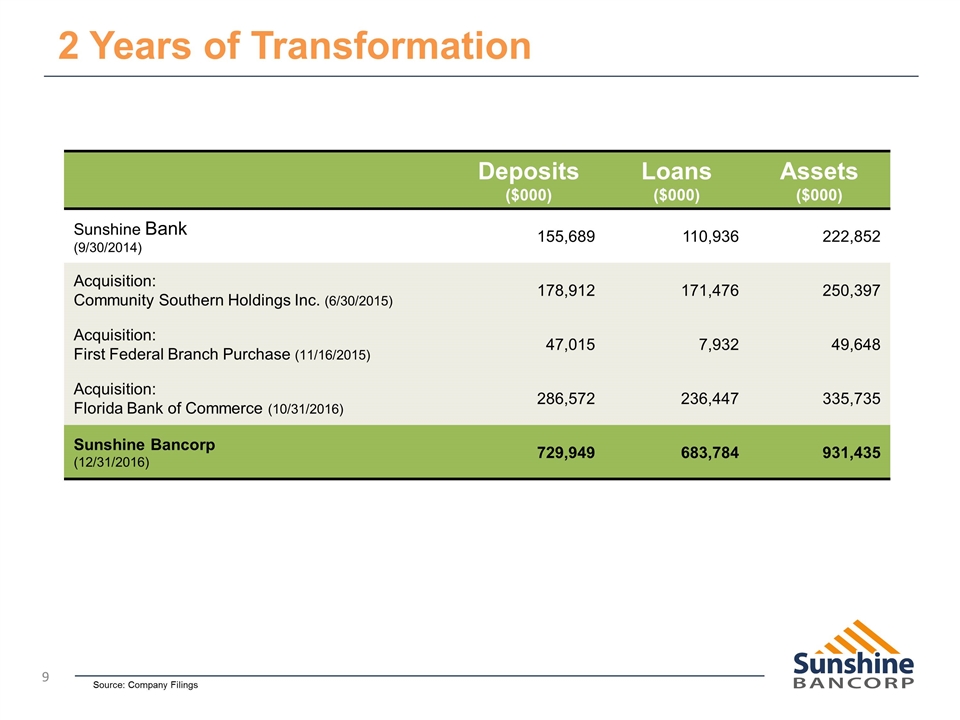

2 Years of Transformation Deposits ($000) Loans ($000) Assets ($000) Sunshine Bank (9/30/2014) 155,689 110,936 222,852 Acquisition: Community Southern Holdings Inc. (6/30/2015) 178,912 171,476 250,397 Acquisition: First Federal Branch Purchase (11/16/2015) 47,015 7,932 49,648 Acquisition: Florida Bank of Commerce (10/31/2016) 286,572 236,447 335,735 Sunshine Bancorp (12/31/2016) 729,949 683,784 931,435 Source: Company Filings

Our M&A Strategy Use M&A to Gain Immediate Scale and Complement Organic Growth Strategy Gain market share and improve profitability through the realization of operating leverage Focus on opportunities where branch efficiencies can be realized, or the target provides a foothold in a contiguous, high priority market Emphasis on Identifying Strong Geographic Fits Long term strategy to expand presence from Orlando to Sarasota High priority expansion opportunities in the Tampa and Orlando MSAs, as well as high quality contiguous markets Focus on Attractive Financial Impacts Capitalize on accretion potential of smaller banks and branch opportunities Improve loan mix, core deposit base, and scale with larger opportunities Discipline with respect to key financial metrics: EPS accretion, capital dilution, and earn back Demographics that are Equal to or Better than Current Footprint Above average population, personal income, and household formation growth High density of and projected growth in commercial activity Leverage management’s expertise to effectively negotiate and integrate bank acquisitions

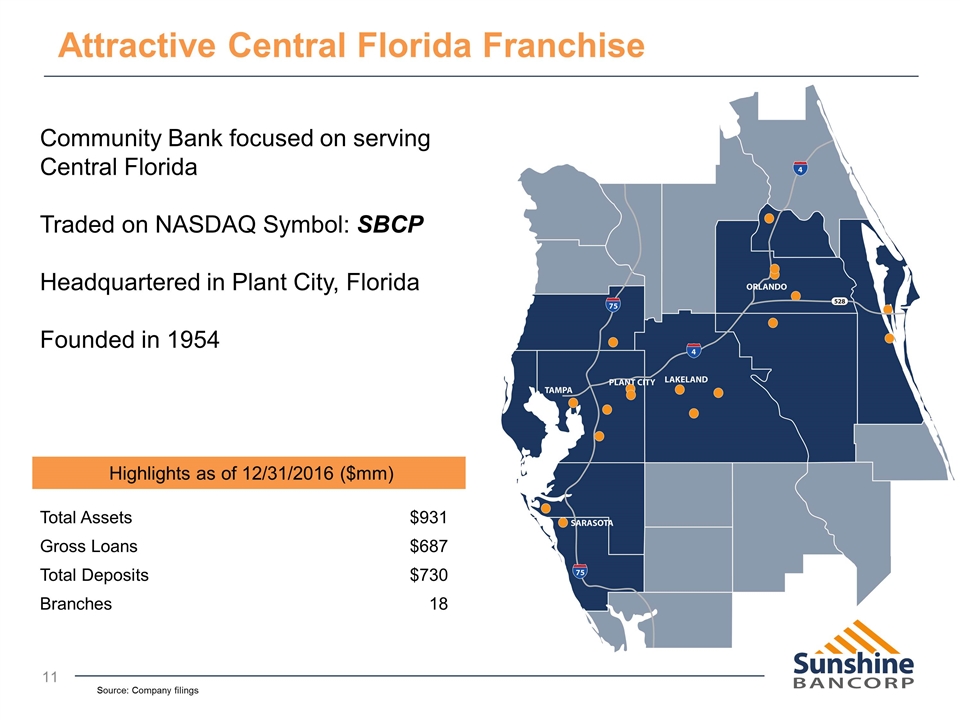

Total Assets $931 Gross Loans $687 Total Deposits $730 Branches 18 Attractive Central Florida Franchise Source: Company filings Highlights as of 12/31/2016 ($mm) Community Bank focused on serving Central Florida Traded on NASDAQ Symbol: SBCP Headquartered in Plant City, Florida Founded in 1954

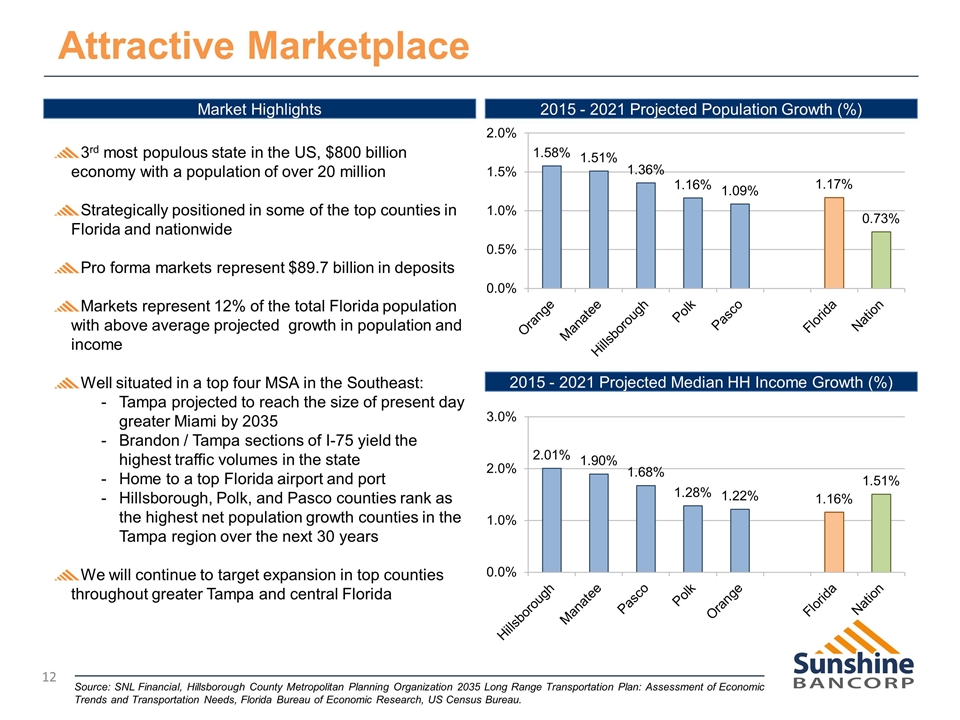

Attractive Marketplace Market Highlights 2015 - 2021 Projected Population Growth (%) 2015 - 2021 Projected Median HH Income Growth (%) 3rd most populous state in the US, $800 billion economy with a population of over 20 million Strategically positioned in some of the top counties in Florida and nationwide Pro forma markets represent $89.7 billion in deposits Markets represent 12% of the total Florida population with above average projected growth in population and income Well situated in a top four MSA in the Southeast: Tampa projected to reach the size of present day greater Miami by 2035 Brandon / Tampa sections of I-75 yield the highest traffic volumes in the state Home to a top Florida airport and port Hillsborough, Polk, and Pasco counties rank as the highest net population growth counties in the Tampa region over the next 30 years We will continue to target expansion in top counties throughout greater Tampa and central Florida Source: SNL Financial, Hillsborough County Metropolitan Planning Organization 2035 Long Range Transportation Plan: Assessment of Economic Trends and Transportation Needs, Florida Bureau of Economic Research, US Census Bureau.

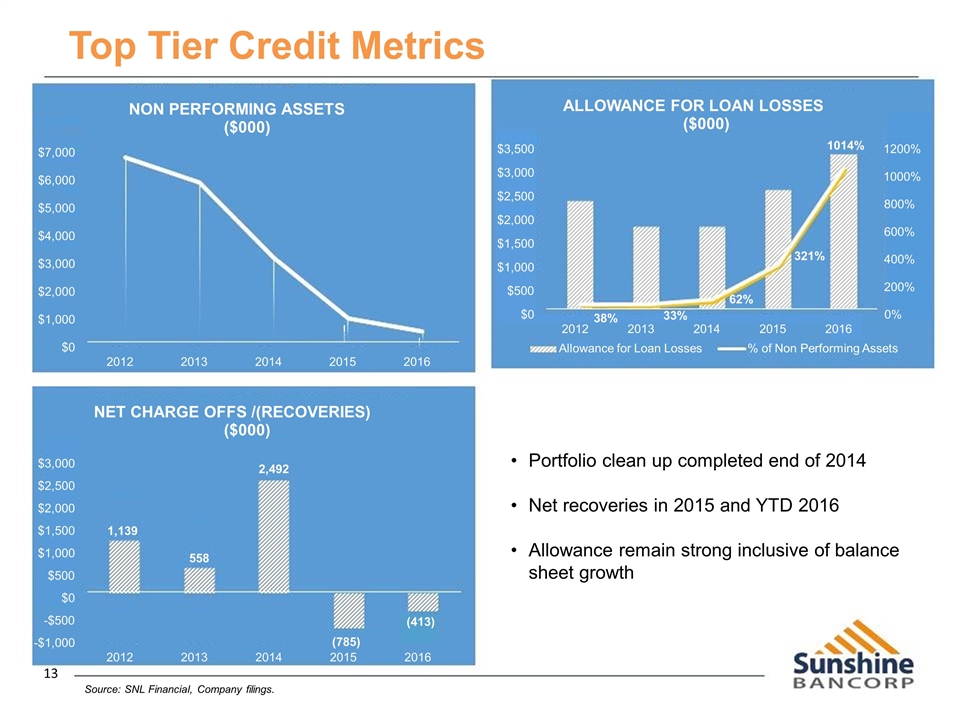

Top Tier Credit Metrics Source: SNL Financial, Company filings. $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 2012 2013 2014 2015 2016 NON PERFORMING ASSETS ($000) 38% 62% 321% 1014% 0% 200% 400% 600% 800% 1000% 1200% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2012 2013 2014 2015 2016 ALLOWANCE FOR LOAN LOSSES ($000) Allowance for Loan Losses % of Non Performing Assets 1,139 558 2,492 (785) (413) - $1,000 - $500 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 2012 2013 2014 2015 2016 NET CHARGE OFFS /(RECOVERIES) ($000) Portfolio clean up completed end of 2014 Net recoveries in 2015 and YTD 2016 Allowance remain strong inclusive of balance sheet growth 13 33%

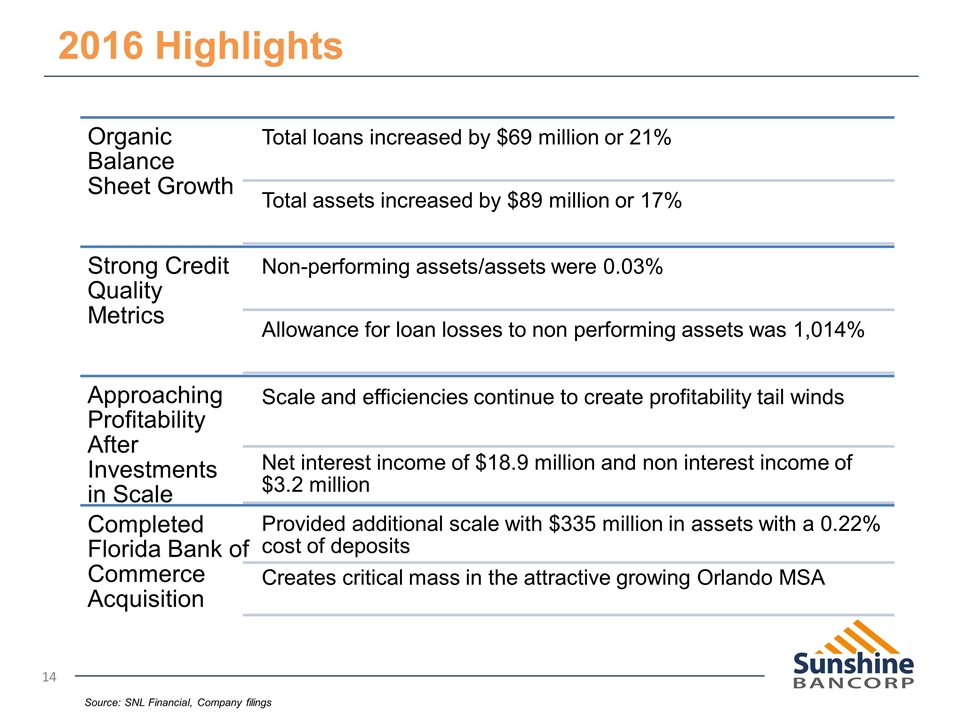

2016 Highlights Source: SNL Financial, Company filings Organic Balance Sheet Growth Total loans increased by $69 million or 21% Total assets increased by $89 million or 17% Non-performing assets/assets were 0.03% Strong Credit Quality Metrics Approaching Profitability After Investments in Scale Scale and efficiencies continue to create profitability tail winds Net interest income of $18.9 million and non interest income of $3.2 million Allowance for loan losses to non performing assets was 1,014% Completed Florida Bank of Commerce Acquisition Provided additional scale with $335 million in assets with a 0.22% cost of deposits Creates critical mass in the attractive growing Orlando MSA

Focus Next Six Months Continue Strong Organic Growth Successfully Integrate Florida Bank of Commerce Maintain Credit Discipline and Superior Credit Metrics Focus on Profitability Metrics in 1Q 2017

Strong Foundation and Track Record to Date $931 million asset institution with a strong core deposit base situated in top growth markets New management achieved immediate scale through acquisitions and organic growth Clear view on pro forma profitability through integration of recent acquisitions Proven Leadership Team Demonstrated history of maximizing shareholder value Proven ability to leverage capital effectively Proven ability to build and grow much larger institutions Clearly articulated pathway through our next stage of growth Presence in Top Growth Markets Clear focus on Florida’s top markets for fundamental growth Strategy pairs experienced, local decision makers with strong, centralized management team and infrastructure Clear Vision for Growth Leverage strategies developed at prior institutions to grow both organically and through targeted acquisitions across three channels: Commercial and not for profit banking Retail banking Fee based business lines (mortgage and wealth management) Compelling Valuation Investment Highlights