Attached files

| file | filename |

|---|---|

| EX-10.38 - EX-10.38 - Vivint Solar, Inc. | vslr-ex1038_462.htm |

| EX-32.2 - EX-32.2 - Vivint Solar, Inc. | vslr-ex322_8.htm |

| EX-32.1 - EX-32.1 - Vivint Solar, Inc. | vslr-ex321_6.htm |

| EX-31.2 - EX-31.2 - Vivint Solar, Inc. | vslr-ex312_11.htm |

| EX-31.1 - EX-31.1 - Vivint Solar, Inc. | vslr-ex311_9.htm |

| EX-23.1 - EX-23.1 - Vivint Solar, Inc. | vslr-ex231_518.htm |

| EX-21.1 - EX-21.1 - Vivint Solar, Inc. | vslr-ex211_459.htm |

| EX-10.53 - EX-10.53 - Vivint Solar, Inc. | vslr-ex1053_458.htm |

| EX-10.25 - EX-10.25 - Vivint Solar, Inc. | vslr-ex1025_461.htm |

| EX-10.18 - EX-10.18 - Vivint Solar, Inc. | vslr-ex1018_400.htm |

| EX-10.17 - EX-10.17 - Vivint Solar, Inc. | vslr-ex1017_399.htm |

| 10-K - 10-K - Vivint Solar, Inc. | vslr-10k_20161231.htm |

Exhibit 10.52

FIRST AMENDMENT TO LEASE

T-Stat One, LLC/Vivint Solar, Inc.

THIS AMENDMENT (this “Amendment”) is entered into as of the 20th day of July, 2015, between T-STAT ONE, LLC, a Utah limited liability company (“Landlord”), and VIVINT SOLAR, INC., a Delaware corporation (“Tenant”). (Landlord and Tenant are referred to in this Amendment collectively as the “Parties” and individually as a “Party.”)

FOR GOOD AND VALUABLE CONSIDERATION, the receipt and sufficiency of which are acknowledged, the Parties agree as follows:

1.Definition—Lease. As used in this Amendment, “Lease” means the Lease, dated in the initial paragraph as of August 12, 2014, entered into between Landlord, as landlord, and Tenant, as tenant, and, where applicable, as amended by this Amendment. Any term used in this Amendment that is capitalized but not defined shall have the same meaning as set forth in the Lease.

2.Purpose. The Parties desire to amend the Lease in accordance with the terms and conditions set forth in this Amendment.

3.Lease Definitions. The following definitions in Paragraph 1 of the Lease are revised to read as follows:

“Basic Monthly Rent” means the following amounts per calendar month for the periods indicated based on 152,120 rentable square feet, which amounts are subject to adjustment as set forth in the definition of “Premises”; provided, however, that if the Commencement Date occurs on a date other than the Projected Commencement Date, then the periods set forth below shall begin on such other date that is the Commencement Date (as memorialized in a certificate entered into between the Parties) and shall shift accordingly in a manner consistent with the definition of “Expiration Date” (with the Expiration Date being on the last day of the relevant month):

Annual Cost Per

PeriodsBasic Monthly RentRentable Square Foot

February 1, 2016 through$339,100.83 per month$26.75

June 30, 2016, inclusive

July 1, 2016 through $85,567.50 per month $6.75

January 31, 2017, inclusive

February 1, 2017 through$339,100.83 per month$26.75

January 31, 2018, inclusive

February 1, 2018 through$347,594.20 per month$27.42

January 31, 2019, inclusive

February 1, 2019 through$356,214.33 per month$28.10

January 31, 2020, inclusive

February 1, 2020 through$365,214.77 per month$28.81

January 31, 2021, inclusive

February 1, 2021 through$374,341.97 per month$29.53

January 31, 2022, inclusive

February 1, 2022 through$383,722.70 per month$30.27

January 31, 2023, inclusive

February 1, 2023 through$393,230.20 per month$31.02

January 31, 2024, inclusive

February 1, 2024 through$403,118.00 per month$31.80

January 31, 2025, inclusive

February 1, 2025 through$413,132.52 per month$32.59

January 31, 2026, inclusive

February 1, 2026 through$423,527.43 per month$33.41

January 31, 2027, inclusive

February 1, 2027 through$434,049.07 per month$34.24

January 31, 2028, inclusive

(if the first option to extend set forth in Paragraph 3.3 is exercised)

February 1, 2028 through$444,951.00 per month$35.10

January 31, 2029, inclusive

February 1, 2029 through$456,106.47 per month$35.98

January 31, 2030, inclusive

February 1, 2030 through$467,515.47 per month$36.88

January 31, 2031, inclusive

February 1, 2031 through$479,178.00 per month$37.80

January 31, 2032, inclusive

February 1, 2032 through$491,094.07 per month$38.74

January 31, 2033, inclusive

(if the second option to extend set forth in Paragraph 3.3 is exercised)

February 1, 2033 through$503,390.43 per month$39.71

January 31, 2034, inclusive

February 1, 2034 through$515,940.33 per month$40.70

-2-

February 1, 2035 through$528,870.53 per month$41.72

January 31, 2036, inclusive

February 1, 2036 through$542,054.27 per month$42.76

January 31, 2037, inclusive

February 1, 2037 through$555,618.30 per month$43.83

January 31, 2038, inclusive

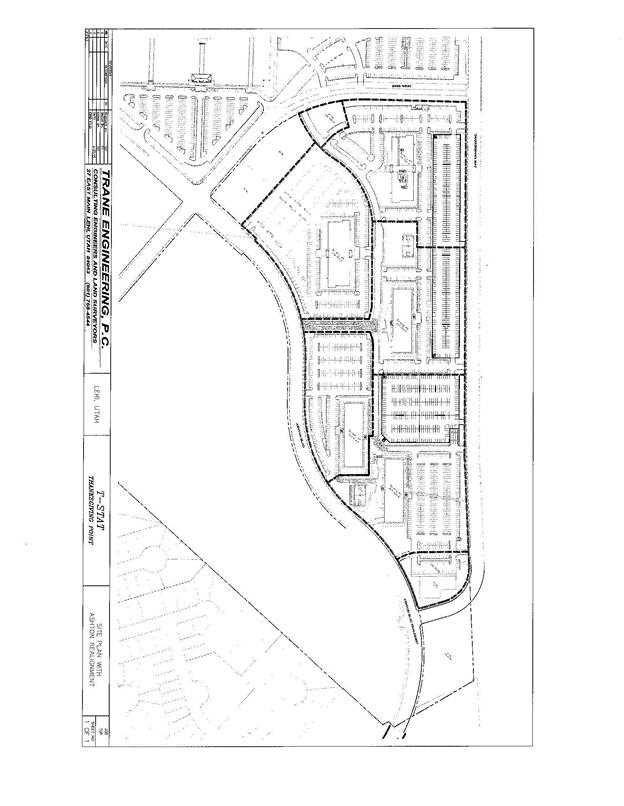

“Building” means the to-be-constructed building on the land generally shown on the attached Exhibit E, located in Lehi, Utah, which building will contain approximately 136,908 usable square feet and approximately 152,120 rentable square feet, subject to final measurement and verification as set forth in the definition of “Premises”.

“Expiration Date” means the date that is the last day of the month, twelve (12) years after the later of the following:

(i)the Commencement Date, if the Commencement Date occurs on the first day of a calendar month; or

(ii)the first day of the first full calendar month following the Commencement Date, if the Commencement Date does not occur on the first day of a calendar month,

as such date may be extended or sooner terminated in accordance with this Lease.

“Permitted Use” means only the following, and no other purpose: general office purposes, including normal and reasonable uses customarily incidental thereto, such as executive, administrative, technical support, customer service, call center, data functions and research and development. In no event may the Premises be used as an executive office suite operation without Landlord’s prior consent.

“Premises” means all of the usable area of the Building, comprising in the aggregate a total of approximately 136,908 usable square feet and approximately 152,120 rentable square feet, all as shown on Appendix 1 to the attached Exhibit A, subject to final measurement and verification as set forth below in this definition. The Premises do not include, and Landlord reserves, the land and other area beneath the floor of the Premises, the pipes, ducts, conduits, wires, fixtures and equipment above the suspended ceiling of the Premises and the structural elements that serve the Premises or comprise the Building; provided, however, that, subject to Paragraphs 9.2 and 17.1, Tenant may, at Tenant’s sole cost and expense, install Tenant’s voice and data lines, wiring, cabling and facilities above the suspended ceiling of the Premises for the conduct by Tenant of business in the Premises for the Permitted Use. Landlord’s reservation includes the right to install, use, inspect, maintain, repair, alter and replace those areas and items and to enter the Premises in order to do so in accordance with and subject to Paragraph 9.3. For all purposes of this Lease, the calculation of usable square feet contained within the Premises and the Building

-3-

shall be subject to final measurement and verification by the Architect, at Landlord’s sole cost and expense, according to ANSI/BOMA Standard Z65.1-2010 (or any successor standard), and the rentable square feet contained within the Premises and the Building shall be the quotient of the usable square feet so calculated divided by .9. (The immediately preceding sentence shall be the sole and exclusive method used for the measurement and calculation of usable and rentable square feet under this Lease for the Premises and the Building.) On request of Tenant, Landlord shall provide Tenant with a copy of the Architect’s verification and certification as to the actual usable and rentable square feet of the Premises prior to the Commencement Date. In the event of a variation between the square footage set forth above in this definition and the square footage set forth in such verification and certification, the Parties shall amend this Lease accordingly to conform to the square footage set forth in such verification and certification, amending each provision that is based on usable or rentable square feet, including, without limitation, Basic Monthly Rent, Security Deposit, Tenant’s Parking Stall Allocation, Tenant’s Percentage of Operating Expenses and the TI Allowance, and shall appropriately reconcile any payments already made pursuant to those provisions; provided, that if the Architect and Tenant’s architect disagree on the amount of usable or rentable square feet within the Premises and the Building, and such disagreement is not resolved within ten (10) business days after such measurement and verification is completed by the Architect, such disagreement shall be resolved by an independent, licensed architect mutually selected by the Parties, acting reasonably, the cost of which architect shall be shared equally by the Parties.

“Projected Commencement Date” means February 1, 2016; provided, however, that if for any reason the Commencement Date has not occurred on or before the Projected Commencement Date, Tenant’s sole and exclusive remedy therefor shall be only as expressly set forth in Paragraph 3.2.

“Security Deposit” means an amount equal to Basic Monthly Rent for the final calendar month of the initial period constituting the Term ($434,049.07), which amount is subject to adjustment as set forth in the definition of “Premises”.

“Tenant Delay” has the meaning set forth in Paragraph 4 of the attached Exhibit A; provided, however, that as of April 20, 2015, there have been no Tenant Delays.

“Tenant’s Parking Stall Allocation” means seven hundred (700) parking stalls, inclusive of the twenty-four (24) underground, reserved parking stalls described in Paragraph 19.1.

“Tenant’s Percentage of Operating Expenses” means 100.000 percent, which is the percentage determined by dividing the rentable square feet of the Premises (152,120 rentable square feet) by the rentable square feet of the Building (152,120 rentable square feet) (whether or not leased), multiplying the quotient by 100 and rounding to the third (3rd) decimal place, which percentage is subject to adjustment as set forth in the definition of “Premises”.

4.Accounting; Electricity.

-4-

4.1.Accounting. The phrase “to the extent applicable to cash-basis accounting” contained in the definition of “Operating Expenses” in Paragraph 1 of the Lease and in Paragraph 5.3(a) of the Lease is deleted in both places.

4.2.Electricity. Notwithstanding anything contained in the Lease or in this Amendment to the contrary, the cost of all electricity used on the Property shall be paid directly by Tenant to the provider when due, and shall not be part of the Operating Expenses. Inasmuch as Tenant will be paying directly for the costs for any such excess, there will be no extra charge under Paragraph 8.2(a)(i) of the Lease for excess electric current provided to the Premises, and no charge for after-hours lighting as described in Paragraph 8.3 of the Lease. The standard charge for after-hours HVAC shall, as of the Commencement Date, be approximately $12.50 per hour instead of $25.00 per hour.

5.Construction Cost Reporting. The following new Paragraph 2.2(c) is added to the Lease:

(c) Prior to the Commencement Date, within four (4) business days after receipt of a request from Tenant, Landlord shall provide to Tenant a cumulative update setting forth all construction cost data for the construction of the Building and such other data as is reasonably requested by Tenant, all of which may be publicly disclosed in Tenant’s financial statements.

6.Security Deposit; Basic Monthly Rent.

(a) Based on the new rentable square footage of the Premises set forth in Paragraph 3 of this Amendment, the amount of the Security Deposit is $434,049.07. Therefore, concurrently with the execution and delivery of this Amendment, Tenant shall pay to Landlord the sum of $135,749.07, the additional incremental amount of the Security Deposit, or such greater amount as is necessary to cause the Security Deposit held by Landlord to equal $434,049.07.

(b) Based on the new rentable square footage of the Premises and the increased initial Basic Monthly Rent amount set forth in Paragraph 3 of this Amendment, the amount of the advance Basic Monthly Rent payment due under Paragraph 4(c) of the Lease is $339,100.83, none of which has yet been paid by Tenant to Landlord. Therefore, concurrently with the execution and delivery of this Amendment, Tenant shall pay to Landlord the sum of $339,100.83 as such advance payment.

7.Extension. Paragraph 3.3 of the Lease is deleted in its entirety and is replaced with the following new Paragraph 3.3:

3.3.Extension.

(a)Tenant shall have the option to extend the initial period constituting the Term under this Lease for two (2) additional periods of five (5) years each, provided that Tenant gives Landlord notice of the exercise of each such option on or before the date that is twenty-four (24) months prior to the expiration of the then-existing period constituting the Term, and that at the time each such notice is given and on the commencement of the extension term concerned:

(i)this Lease is in full force and effect;

-5-

(ii)no Tenant Default then exists; and

(iii)Tenant has not assigned this Lease or subleased all or any portion of the Premises under any then-existing sublease (excluding any Non-Consent Transfer), and such extension is not being made in connection with or for the purpose of facilitating any such assignment or sublease.

Each such extension term shall commence at 12:01 a.m. on the first day following the expiration of the immediately preceding period constituting the Term.

(b)During each such extension term, all provisions of this Lease shall apply, except for any provision relating to the improvement of the Premises by Landlord or at Landlord’s expense.

(c)If Tenant exercises either such option in a timely manner, the Parties shall, within thirty (30) days thereafter, enter into an amendment to this Lease reflecting the new Basic Monthly Rent and the new Expiration Date. If Tenant fails to exercise either such option in a timely manner, the relevant option to extend (and any subsequent option to extend) shall automatically terminate and be of no further force or effect.

8.Rooftop Equipment. Paragraph 3.4 of the Lease is deleted in its entirety and is replaced with the following new Paragraph 3.4:

3.4. Rooftop Equipment. Tenant may, at its sole cost and expense (without charge, other than as contemplated by Paragraph 5 with respect to Operating Expenses), but under Landlord’s supervision, install, maintain and from time to time replace, on a nonexclusive basis (meaning that there may be Landlord (but not other tenant) satellite dishes, antenna or equipment on the roof of the Building, but not unsightly, prominent towers that would detract from the Building appearance), one or more solar panels, antennas and other solar and networking equipment solely for Tenant’s personal use in the Premises, together with a connection to the Premises (such solar panels, antennas and other solar and networking equipment, together with any lines, wires, conduits or related improvements installed by Tenant in connection therewith, are referred to collectively as the “Rooftop Equipment”), with a non-penetrating base on the roof of the Building, in accordance with specifications reasonably approved in advance by Landlord, provided that:

(a) Tenant shall obtain Landlord’s prior approval of the proposed location of the Rooftop Equipment and the method for fastening the Rooftop Equipment to the roof;

(b) Tenant shall, at its sole cost and expense, comply with all Laws, the conditions of any bond, warranty or insurance maintained by Landlord on the roof and any applicable requirements of any covenants, conditions and restrictions affecting the Property (whether recorded on or after the date of the Lease);

-6-

(c) Tenant shall not interfere with any other Landlord satellite dish, antenna, communication facility or equipment then present on the roof; and

(d) the Rooftop Equipment shall be within the roof screen walls so as not to be visible from the exterior of the Building.

Tenant shall maintain the Rooftop Equipment at all times in a good, safe and clean condition. Tenant shall repair any damage to the Building caused by Tenant’s installation, maintenance, replacement, use or removal of the Rooftop Equipment. The Rooftop Equipment shall remain the property of Tenant during the Term and after Lease end, and Tenant shall, at its sole cost and expense, remove the Rooftop Equipment at Lease end, unless the Parties mutually agree that the Rooftop Equipment is to remain in place and become the sole property of Landlord at Lease end. In such event, at Lease end, the Rooftop Equipment shall be left by Tenant in place, in good condition and working order, and shall become the sole property of Landlord. If the Rooftop Equipment is removed, Tenant shall repair and restore the area(s) of the Building concerned to their condition prior to the installation of the Rooftop Equipment (subject only to normal and reasonable wear and tear that would have occurred absent the installation of the Rooftop Equipment). If a Tenant Default occurs and, as a result, Landlord retakes possession of the Premises (with or without terminating the Lease), or if Tenant fails to remove the Rooftop Equipment at Lease end without the Parties’ mutual agreement as set forth above, then Landlord may, at Tenant’s sole cost and expense, remove the Rooftop Equipment and repair and restore the area(s) of the Building concerned to their condition prior to the installation of the Rooftop Equipment, and Tenant shall promptly reimburse Landlord for all costs and expenses incurred by Landlord in connection with such removal, repair and restoration and any storage of the Rooftop Equipment. Tenant shall indemnify, defend and hold harmless Landlord from and against all claims, liabilities, losses, damages, costs and expenses, including, without limitation, attorneys’ fees and costs, incurred by or asserted against Landlord and arising out of Tenant’s installation, maintenance, replacement, use or removal of the Rooftop Equipment.

9.Crown Signage. Paragraph 3.5(g) of the Lease is deleted in its entirety and is replaced with the following new Paragraph 3.5(g):

(g)In connection with the Crown Signage, Tenant shall, at Tenant’s sole cost and expense, comply with all Laws, the conditions of any warranty or insurance maintained by Landlord on the Building and any applicable requirements of any covenants, conditions and restrictions affecting the Property. The size, location, design, color and all other aspects and specifications of the Crown Signage must be submitted to, and approved in advance by, Landlord, the applicable municipality and the architectural review committee (“ARC”) of Thanksgiving Point prior to the manufacture and installation of the Crown Signage; provided, however, that if the size, location, design, color and all other aspects and specifications of the Crown Signage are approved by the applicable municipality and ARC, then Landlord also shall approve the same. All designs and specifications for the Crown Signage must be in full compliance with the signage ordinance of the applicable municipality. Tenant shall be solely responsible for any cleanup, damage or other mishaps that may occur during the installation or removal of the Crown Signage by Tenant and agrees to fully indemnify Landlord for all injuries to

-7-

persons or damage to property related thereto. Final, executed releases of lien by all signage and installation companies must be provided by Tenant to Landlord prior to Tenant making final payment to the signage and installation companies.

10.Lease of Additional Building. Paragraph 3.6 of the Lease is deleted in its entirety and is replaced with the following new Paragraph 3.6:

3.6.Lease of Additional Building. Commencing on the full execution and delivery of this Lease and continuing until (but not including) January 1, 2018, and provided that (i) this Lease is in full force and effect, (ii) no Tenant Default then exists, (iii) Tenant has not assigned this Lease or subleased all or any portion of the Premises under any then-existing sublease (excluding any Non-Consent Transfer), (iv) the right of expansion described in this Paragraph 3.6 is not being exercised in connection with or for the purpose of facilitating any such assignment or sublease, and (v) on the request of Landlord’s affiliate, Tenant provides to Landlord current financial statements for Tenant, prepared in accordance with generally accepted accounting principles consistently applied and certified by Tenant to be true and correct, demonstrating sufficient Tenant financial strength for such additional space, Tenant may, on written notice given to Landlord prior to January 1, 2018, elect to lease all (but not less than all) of the building (the “Adjacent Building”) to be constructed by Landlord’s affiliate on the approximately 5.85 acres of land (the “Adjacent Land”) adjacent to the Property, as the Adjacent Land is generally described on the attached Exhibit F. If Tenant makes such election in a timely manner, Tenant and Landlord’s affiliate shall reasonably negotiate the terms and conditions of such lease, beginning with the form of this Lease, which shall include, without limitation, the following terms:

(a)the term of such lease shall be at least ten (10) years, with the projected commencement date within twelve (12) months after such lease is fully executed and delivered;

(b)the basic monthly rent on the commencement date of such lease shall be, on a per rentable square foot basis, the same as the Basic Monthly Rent that is payable on such date under this Lease, and shall thereafter increase annually by 2.5% on a cumulative basis;

(c)the tenant improvement allowance for the Adjacent Building shall be $50.00 per usable square feet;

(d)Landlord’s affiliate shall provide a minimum of seven hundred (700) parking stalls for Tenant’s use; and

(e)the exterior common amenities shall be located just North of the Adjacent Building.

The Adjacent Building shall have substantially the same design, build out and finishes as the Building. If Tenant and Landlord’s affiliate are able to agree on the terms and conditions of such lease (other than those set forth above) within thirty (30) days after receipt by Landlord of Tenant’s notice of election, Tenant and Landlord’s affiliate shall

-8-

promptly enter into a new lease prepared by Landlord’s affiliate in form similar to this Lease, reflecting the agreed on terms and conditions of such lease. If Tenant and Landlord’s affiliate, after using their best efforts, are unable to agree on the other terms and conditions of such lease within such thirty (30)-day period (as evidenced by the execution and delivery of a new lease), or if Tenant fails to give such notice of exercise to Landlord prior to January 1, 2018, then such option to lease additional space shall automatically terminate and thereafter cease to have any further force or effect. Landlord represents to Tenant that, as of the date of this Lease, Landlord is an affiliate of the owner of the Adjacent Land, and has the authority to bind Landlord’s affiliate to the terms of this Paragraph 3.6. The provisions of this Paragraph 3.6 shall survive the termination of this Lease if, but only if, the lease to Tenant of the entire Thanksgiving Station Building Two is still in full force and effect.

11.Leasing Restriction. The following new Paragraph 3.8 is added to the Lease:

3.8.Protected Business--Restrictions.

(a)Provided that this Lease is in full force and effect and no Tenant Default then exists, then for so long as (but only for so long as) the following two (2) conditions are met (the “Conditions”):

(1)all of Thanksgiving Station Building One or all of Thanksgiving Station Building Two is actually leased and occupied by Vivint Solar, Inc. or a Non-Consent Transferee; and

(2)such occupant is a company specializing in solar power, including, without limitation, solar panel sales and distribution (the “Protected Business”), then neither Landlord nor Landlord’s affiliates shall:

(i)lease premises in the Project to any other company that specializes in the Protected Business; or

(ii)grant rights for signage advertising the Protected Business to be erected in the Project by any person other than Tenant.

(b)If at any time the Conditions are met as to neither (i) all of Thanksgiving Station Building One, nor (ii) all of Thanksgiving Station Building Two, then this Paragraph 3.8 shall automatically terminate and thereafter have no further force or effect.

Except as expressly set forth in this Paragraph 3.8, there is no other leasing or signage restriction on Landlord or Landlord’s affiliates with respect to the Project and no other restriction on other uses or tenants created by this Lease, and no such other restriction may be implied, inferred, construed or deemed to exist.

12.Basic Monthly Rent. Paragraph 4(c) of the Lease is deleted in its entirety and is replaced with the following new Paragraph 4(c):

-9-

(c)In addition to the foregoing, concurrently with its execution and delivery of this Lease, Tenant shall pay to Landlord in advance Basic Monthly Rent for the first full calendar month following the Commencement Date in which full Basic Monthly Rent is payable (that is, $26.75 per rentable square foot on an annual basis), which shall be applied by Landlord to pay Basic Monthly Rent for such month on the date due.

13.Generator. Paragraph 8.1(c) of the Lease is deleted in its entirety and is replaced with the following new Paragraph 8.1(c):

(c)Tenant may, at its sole cost and expense, install its own backup generator, in which case Tenant shall receive a credit of $35,000.00 applicable to its TI Allowance. Alternatively, if Tenant elects to connect to the Building backup generator prior to Landlord’s commencement of the construction of the Tenant Improvements, such connection shall be made by Landlord for Tenant, at Tenant’s sole cost and expense (subject to the TI Allowance), and an additional $0.50 per rentable square foot of the Premises (on an annual basis) shall be added to any Basic Monthly Rent payable on the Commencement Date.

14.Financial Statements. The last sentence in Paragraph 18.2 of the Lease is deleted in its entirety and is replaced with the following new sentence:

Tenant shall have no obligation to produce financial statements in addition to those, if any, then existing, and shall have no obligation to produce financial statements more often than once in any twelve (12)-month period.

15.Parking. Paragraph 19.1 of the Lease is deleted in its entirety and is replaced with the following new Paragraph 19.1:

19.1.Parking. Parking on the Property is provided generally to tenants of the Building and the adjacent buildings on a non-reserved, first-come-first-served basis. Tenant and Tenant’s Occupants shall have the non-exclusive right (together with tenants of the adjacent buildings) without charge, other than as contemplated by Paragraph 5 with respect to Operating Expenses, to use a number of parking stalls located on the Property equal to Tenant’s Parking Stall Allocation only, and shall not use a number of parking stalls greater than Tenant’s Parking Stall Allocation (excluding de minimis, occasional excess use), unless prior consent has been given by Landlord; provided, however, that as part of Tenant’s Parking Stall Allocation, Landlord shall provide to Tenant, and mark with appropriate signage (at Tenant’s cost), a minimum of twenty-four (24) reserved, underground covered parking stalls, with elevator access to all floors of the Building and roll-down security door, at no other additional cost in the parking structure under the Building in a mutually acceptable location. Another parking structure shall be located approximately as shown on the site plan attached as Appendix 1 to the attached Exhibit A, which will be used exclusively by the Building and Thanksgiving Station Building Two.

16.Notices. The notice address for Tenant set forth in Paragraph 22.3 of the Lease is deleted in its entirety and is replaced with the following new notice addresses:

-10-

Vivint Solar, Inc.

3301 North Thanksgiving Way, Suite 500

Lehi, Utah 84043

Attention: D. Evan Pack

E-mail: evan.pack@vivintsolar.com

with a required copy to:

Vivint Solar, Inc.

3301 North Thanksgiving Way, Suite 500

Lehi, Utah 84043

Attention: Vivint Solar Legal Department

E-mail: solarlegal@vivintsolar.com

17.Entire Agreement. The first sentence in Paragraph 22.16 of the Lease is deleted in its entirety and is replaced with the following new sentence:

This Lease (including Exhibits A, B, C, D, E and F (with any Appendixes to Exhibit A)) exclusively encompasses the entire agreement of the Parties, and supersedes all previous negotiations, understandings and agreements between the Parties, whether oral or written, including, without limitation, any oral discussions, letters of intent and email correspondence.

18.Floor Plans and Site Plan. Paragraph 1(a) of Exhibit A attached to the Lease is deleted in its entirety and is replaced with the following new Paragraph 1(a):

(a)Preliminary drawings of the floor plans of the Premises and the site plan of the Property are attached as Appendix 1. The attachment of the site plan of the Property as part of said Appendix 1 is only for the purpose of indicating the approximate location and configuration of improvements to be constructed on the Property (subject in all respects to receipt of approval from Lehi City), and shall have no other purpose or effect, including without limitation, the purpose or effect of constituting any representation, warranty or guaranty whatever of the actual location, design or existence of any improvements shown thereon that are not located on the Property.

19.Base Building Improvements. Paragraph 1(b) of Exhibit A attached to the Lease is deleted in its entirety and is replaced with the following new Paragraph 1(b):

(b)Landlord shall cause the Base Building Improvements (the “Base Building Improvements”) described on the attached Appendix 2 to be completed in accordance with the plans and specifications (the “Building Plans”) prepared by Landlord, at Landlord’s cost and expense, and Laws. The Parties shall work together to select an appropriate core/shell architect (the “Architect”). In addition, Landlord shall seek input from and consult with Tenant regarding the design and layout of the Base Building Improvements, and shall use reasonable efforts to incorporate Tenant’s comments and suggestions in the preparation of the Building Plans so long as such comments and

-11-

suggestions do not increase the cost of the Base Building Improvements (unless Tenant agrees to bear such cost, subject to the TI Allowance). Landlord has, at Landlord’s sole cost and expense, engaged RAPT Studios to assist in the design of the Base Building Improvements. Landlord shall, at Tenant’s sole cost and expense, subject to the TI Allowance, engage RAPT Studios to assist in the design of the Tenant Improvements, unless otherwise agreed by Tenant. The Base Building Improvements shall be made at Landlord’s sole cost and expense (which shall not be less than $98.00 per rentable square foot of the Building, inclusive of up to $100,000.00 of Landlord’s costs for the Amenities, as defined in paragraph 19 of the attached Appendix 2, but exclusive of the fees for the preparation of the Building Plans and the fees paid to RAPT Studios), and the cost thereof shall not reduce the TI Allowance, except as provided in Paragraph 2 of this Exhibit and except that any changes, alterations, modifications or upgrades to:

(i)the Base Building Improvements or the Building Plans requested by Tenant and approved by Landlord; or

(ii)the Tenant Improvements or the Tenant Improvement Plans (both defined below) that result in changes, alterations, modifications or upgrades to the Base Building Improvements or the Building Plans,

shall be made at Tenant’s sole cost and expense, subject to the TI Allowance.

20.TI Allowance. Paragraph 3(a) of Exhibit A attached to the Lease is deleted in its entirety and is replaced with the following new Paragraph 3(a):

(a)Landlord shall contribute the amount of $7,850,000.00 (the “TI Allowance”) toward the costs incurred for the Tenant Improvements and Change Orders, including, without limitation, painting, carpeting, voice and data cabling, signage, tile, wall covering, light fixtures, plans, permits, insurance and architectural fees (but expressly excluding Tenant’s Property); provided, however, that if all or any portion of the TI Allowance is not used on or before the date that is one (1) year after the Commencement Date, the TI Allowance or such portion that is not used shall be lost and shall no longer be available to Tenant. In calculating the cost of Tenant Improvements and Change Orders, Landlord shall give Tenant the benefit of any cash, trade and quantity discounts actually received by Landlord.

21.Appendixes. Appendixes 1 and 2 to Exhibit A attached to the Lease are deleted in their entirety and are replaced with the new Appendixes 1 and 2 attached to this Amendment. Appendix 3 to Exhibit A attached to the Lease is deleted in its entirety (and all references to Appendix 3 in the Lease are also deleted).

22.Exhibit B--Rules.

(a)For so long as (but only for so long as) Tenant is the sole occupant of the Building, food trucks serving Tenant’s Occupants may be parked on the Property in areas reasonably designated by Tenant, and in such areas, such trucks will not be considered an obstruction prohibited by Paragraph 1 of Exhibit B attached to the Lease. If Tenant is not the sole occupant of the Building, food trucks serving Tenant’s Occupants may be parked on the Property only in areas reasonably designated by Landlord, and in

-12-

such areas, such trucks will not be considered an obstruction prohibited by Paragraph 1 of Exhibit B attached to the Lease. Notwithstanding the foregoing to the contrary, no food trucks or equipment trucks are permitted on the top deck of the exterior parking structure located on the Property.

(b)Paragraphs 10, 17 and 22 of said Exhibit B are deleted in their entirety.

(c)Paragraph 21 of said Exhibit B is deleted in its entirety and is replaced with the following new Paragraph 21:

21.Public Areas. Subject to the terms and conditions of the Lease, Landlord may control and operate the Common Areas, in such manner as Landlord reasonably deems best for the benefit of the tenants, consistent with Comparable Buildings, provided that such control and operation shall not unreasonably interfere with Tenant’s access to, or use of, the Premises.

23.Exhibit F. Exhibit F attached to the Lease is deleted in its entirety and is replaced with the new Exhibit F attached to this Amendment.

24.LEED Certification. The Building shall be certified Silver or better pursuant to the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED®) building certification program.

25.Signage Restriction. For so long as (but only for so long as) Tenant is the sole tenant within the Project, Landlord shall not erect any pole sign or billboard-type signage within the area shown on Attachment A, incorporated by this reference.

26.Solar Panels. Tenant may, at its sole cost and expense (without charge, other than as contemplated by Paragraph 5 of the Lease with respect to Operating Expenses), but under Landlord’s supervision, install, maintain and from time to time replace within the parking area located on the Property one or more solar panels solely for Tenant’s personal use in the Premises, together with a connection to the Premises (such solar panels, together with any lines, wires, conduits or related improvements installed by Tenant in connection therewith, are referred to collectively as the “Solar Panels”), provided that:

(a)the size, location, design, color and all other aspects of, and the plans and specifications for, the Solar Panels must be submitted to, and approved in advance by, Landlord; and

(b)Tenant shall, at its sole cost and expense, comply with all Laws and any applicable requirements of any covenants, conditions and restrictions affecting the Property (whether recorded on or after the date of the Lease).

Tenant shall maintain the Solar Panels at all times in a good, safe and clean condition. Tenant shall repair any damage to the Property caused by Tenant’s installation, maintenance, replacement, use or removal of the Solar Panels. The Solar Panels shall remain the property of Tenant during the Term and after Lease end, and Tenant shall, at its sole cost and expense, remove the Solar Panels at Lease end, unless the Parties mutually agree that the Solar Panels are to remain in place and become the sole property of Landlord at Lease end. In such event, at Lease end, the Solar Panels shall be left by Tenant in place, in good condition and working order, and shall become the sole property of Landlord. If the Solar Panels are removed, Tenant shall repair and restore the area(s) of the Property concerned to their condition prior to the installation of the

-13-

Solar Panels (subject only to normal and reasonable wear and tear that would have occurred absent the installation of the Solar Panels). If a Tenant Default occurs and, as a result, Landlord retakes possession of the Premises (with or without terminating the Lease), or if Tenant fails to remove the Solar Panels at Lease end without the Parties’ mutual agreement as set forth above, then Landlord may, at Tenant’s sole cost and expense, remove the Solar Panels and repair and restore the area(s) of the Property concerned to their condition prior to the installation of the Solar Panels, and Tenant shall promptly reimburse Landlord for all costs and expenses incurred by Landlord in connection with such removal, repair and restoration and any storage of the Solar Panels. Tenant shall indemnify, defend and hold harmless Landlord from and against all claims, liabilities, losses, damages, costs and expenses, including, without limitation, attorneys’ fees and costs, incurred by or asserted against Landlord and arising out of Tenant’s installation, maintenance, replacement, use or removal of the Solar Panels.

27.Enforceability. Each Party represents and warrants that:

(a)such Party was duly formed and is validly existing and in good standing under the laws of the state of its formation;

(b)such Party has the requisite power and authority under all applicable laws and its governing documents to execute, deliver and perform its obligations under this Amendment;

(c)the individual executing this Amendment on behalf of such Party has full power and authority under such Party’s governing documents to execute and deliver this Amendment in the name of, and on behalf of, such Party and to cause such Party to perform its obligations under this Amendment;

(d)this Amendment has been duly authorized, executed and delivered by such Party; and

(e)this Amendment is the legal, valid and binding obligation of such Party, and is enforceable against such Party in accordance with its terms.

28.Brokerage Commissions. Except as may be set forth in one or more separate agreements between (i) Landlord and Landlord’s broker, or (ii) Landlord or Landlord’s broker and Tenant’s broker:

(a)Landlord represents and warrants to Tenant that no claim exists for a brokerage commission, finder’s fee or similar fee in connection with this Amendment based on any agreement made by Landlord; and

(b)Tenant represents and warrants to Landlord that no claim exists for a brokerage commission, finder’s fee or similar fee in connection with this Amendment based on any agreement made by Tenant.

Landlord shall indemnify, defend and hold harmless Tenant from and against any claim for a brokerage commission, finder’s fee or similar fee in connection with this Amendment based on an actual or alleged agreement made by Landlord. Tenant shall indemnify, defend and hold harmless Landlord from and against any claim for a brokerage commission, finder’s fee or similar fee in connection with this Amendment based on an actual or alleged agreement made by Tenant.

-14-

29.Entire Agreement. The Lease, as amended by this Amendment, exclusively encompasses the entire agreement of the Parties, and supersedes all previous negotiations, understandings and agreements between the Parties, whether oral or written, including, without limitation, any oral discussions, letters of intent and email correspondence. The Parties acknowledge and represent, by their signatures below, that the Parties have not relied on any representation, understanding, information, discussion, assertion, guarantee, warranty, collateral contract or other assurance, except those expressly set forth in the Lease and this Amendment, made by or on behalf of any other Party or any other person whatsoever, prior to the execution of this Amendment. The Parties waive all rights and remedies, at law or in equity, arising or which may arise as the result of a Party’s reliance on such representation, understanding, information, discussion, assertion, guarantee, warranty, collateral contract or other assurance.

30.General Provisions. In the event of any conflict between the provisions of the Lease and the provisions of this Amendment, the provisions of this Amendment shall control. Except as set forth in this Amendment, the Lease is ratified and affirmed in its entirety. This Amendment shall inure to the benefit of, and be binding on, the Parties and their respective successors and assigns. This Amendment shall be governed by, and construed and interpreted in accordance with, the laws (excluding the choice of laws rules) of the state of Utah. This Amendment may be executed in any number of duplicate originals or counterparts, each of which when so executed shall constitute in the aggregate but one and the same document. Each exhibit referred to in, and attached to, this Amendment is an integral part of this Amendment and is incorporated in this Amendment by this reference.

[Remainder of page intentionally left blank; signatures on following page]

-15-

THE PARTIES have executed this Amendment on the respective dates set forth below, to be effective as of the date first set forth above.

LANDLORD:

T-STAT ONE, LLC,

a Utah limited liability company

By/s/ Nathan W. Ricks

Nathan W. Ricks

Manager

Date7/20/15

TENANT:

VIVINT SOLAR, INC.,

a Delaware corporation

By/s/ Paul Dickson

Print or Type Name of Signatory:

Paul Dickson

Its

Date7/20/15

-16-

Base Building Improvements and Tenant Improvements

Base Building Improvements

(to be provided at Landlord’s sole cost and expense)

General Building Information

|

1. |

Code: 2009 International Building Code |

|

2. |

Jurisdiction: Lehi City and State of Utah |

|

3. |

Type of Construction: Type IIA, Occupancy Classification B |

|

4. |

Building Height: 5 Stories + Mechanical Penthouse |

|

5. |

Fire Sprinklers: Wet Fire Sprinkler system throughout |

|

6. |

Structural Design: Reinforced concrete walls for the bathroom and elevators cores, wide flange structural steel columns and beams, and lightweight composite concrete floor over metal decking. |

|

7. |

Floor Live Loads: |

|

|

a) |

Office and partitions:50 PSF + 20 PSF |

|

|

b) |

Lobbies and main floor:100 PSF |

|

|

c) |

Corridors above main floor:80 PSF |

|

|

d) |

Mechanical rooms:125 PSF |

|

|

e) |

Concentrated Loads - All Areas:2000 PSF |

|

8. |

Floor to Floor heights: 13’-10” (structure) |

|

9. |

Ceiling heights: |

|

|

a) |

Lobbies and corridors 9’-6” to 11’ (finished) |

|

|

b) |

Tenant Areas 9’ to 9’-6” ceilings finished |

|

10. |

Elevators: |

Appendix 2-1

Three high speed, high efficient Otis Gen2 traction elevators servicing all floors including cab finishes.

|

11. |

Two exit steel stairways with concrete pans from all floors – painted and finished. |

|

12. |

Heating, Ventilation and Air Conditioning (HVAC): |

|

|

a) |

Ventilation and cooling is provided by a floor-by-floor Variable Air Volume (VAV) system served by one (1) roof-mounted, air-cooled liquid chiller of 350 tons nominal capacity. Chilled water is circulated through a closed loop vertical plumbing riser to air handlers located in the equipment room on each floor. Supply and return air ducts are extended from the air handler into the lease area and looped around each floor to supply conditioned air to the VAV terminal boxes. |

|

|

b) |

Air conditioning equipment capacity is sized using the following load assumptions: Occupancy load: Average of one person per 175 square feet of usable office space. |

|

|

c) |

Heating: One (1) natural gas-fired boiler of 2 million BTU’s, located in the mechanical penthouse on the roof, and is providing hot water to all VAV terminal boxes through a vertical plumbing riser in the building core with plumbing loops on each floor. |

|

13. |

Domestic Water: |

Cold and warm water is provided to all restrooms and showers in the core of the building via 2 stand-alone, gas-fired hot water heaters in the penthouse. A circulation pump will continuously circulate warm water from the boiler through a vertical plumbing riser in the core of the building. Cold domestic water is stubbed out into lease space on each floor for future tenant use. The hot water side is serviced with a water softener located in the penthouse.

|

14. |

Fire Protection System. |

A fire riser is constructed to meet applicable national and local Building code requirements. The fire protection water supply enters the Building underground at the fire control room on the main floor near the exterior of the Building. Wet standpipes rise vertically through the stairwells. Branch lines complete with sprinkler heads are installed in the building core. A main branch line (defined as 2-½” in diameter or larger) is extended from the core into the tenant lease areas on each floor in two directions as part of the Base Building Improvements. The main branch line extended into tenant lease areas along with secondary branch lines (defined as 2” in diameter or less) and all sprinkler head installation are at Tenant’s sole cost and expense, to the extent that such costs (together with all other costs payable by Tenant) exceed the TI Allowance.

|

15. |

Electrical Systems: |

Electrical service is installed to meet applicable national and local building codes.

|

|

a) |

Power to Panel Electrical service is provided from the electrical utilities service entry point to the switchboard and panels in the equipment room located on each floor. |

|

|

• |

Lighting load: Average lighting load is .60 watts per one square foot for all areas. |

|

|

• |

Office equipment load: Average of one personal computer (CPU and monitor) per 240 square feet of usable office space. |

Appendix 2-2

|

|

c) |

Communication conduit and interduct is provided from the elevator core to Thanksgiving Way and to Ashton Boulevard for Qwest copper lines and fiber lines as well as conduits for other communication providers. Conduit has also been extended between buildings for future communication connections in Thanksgiving Station. Tenant must have arrangements made with a communication provider in the park for communication services no later than 75 days prior to occupancy. |

|

|

d) |

Emergency back-up generator is provided for life safety in the building core and shell. |

|

16. |

Access Control System |

An after-hour exterior door access control system is installed as part of the Base Building Improvements. The system includes electro-magnetic locks installed at the head of all exterior doors and is connected to a server in the main floor electrical room. Card readers are installed at primary entrances to the Building. Scheduling and monitoring of after-hour usage is controlled by a computer in Landlord’s office. The system is expandable. The incremental cost for additional expansion control modules and/or cards and readers for Tenant use is at Tenant’s sole cost and expense, to the extent that such costs exceed the TI Allowance.

|

17. |

Surveillance System: |

Landlord has an IP based video surveillance system that monitors all exterior building entrances and parking lots. Surveillance cameras are mounted on the roof, in the main floor lobby, and in the main floor exit corridors. All cameras are monitored and controlled on a computer in Landlord’s office.

|

18. |

Parking: |

A minimum of 90% of all parking stalls are sized 9’ x’18’. Handicap accessible parking stalls are provided according to all applicable laws along with designated parking stalls for high fuel efficient vehicles and secure bicycle storage.

|

19. |

Special Amenities: |

Landlord shall install a basketball court and pavilion on the Property and such other amenities, if any, as are reasonably agreed to by the Parties, all of which shall be referred to as the “Amenities.” As part of Landlord’s minimum of $98.00 per rentable square foot of the Building for the Base Building Improvements, Landlord shall spend at least $100,000 in connection with the Amenities. If, as a result of Tenant requests (which shall be subject to the reasonable approval of Landlord), Landlord spends more than $100,000 in connection with the Amenities, all incremental costs of the Amenities above $100,000 (not to exceed an additional $200,000) shall be divided equally between Landlord and Tenant. With respect to such incremental costs of the Amenities above $100,000, such costs allocated to Tenant may not be paid for out of the TI Allowance, and

Appendix 2-3

such costs allocated to Landlord may not be paid out of the $98.00 per rentable square foot of the Building for the Base Building Improvements.

Base Building Improvement Standard Finishes

Base Building Improvements are constructed in accordance with applicable national and local building and life-safety code requirements including stairwells, elevators, restrooms, mechanical systems, fire protection systems and electrical systems on each floor, finished per the following Building standards:

|

• |

Exterior Building Finishes: Combination of EFIS, reflective glass and glass curtain walls, aluminum frames & entrances. |

|

• |

Exterior common areas of hardscape and landscape completed per approved site plan including lighted walkways to building entrances, up lighting on the building exterior and lighted parking areas. |

Interior Common Areas

|

• |

Restrooms: finished floors, tile wainscot, walls (above the wainscot) and ceilings are painted sheetrock, recessed and surface mounted lighting and wall sconces are provided. Motion censored faucets and paper towel dispensers. The men’s’ restrooms have wall mounted fixtures with pressurized flush values with motion censored water closets along with waterless urinals to conserve water. The women’s restrooms have dual flush valves in each water closet to conserve water. |

|

• |

2 Drinking fountains per floor located just outside the restrooms. |

|

• |

Equipment rooms: Concrete walls, sealed concrete floors; exposed structure ceilings; fluorescent strip lighting hung from structure above. |

|

• |

Stairwells: Concrete and steel stairs and landings, with sealed concrete walls, sealed concrete floors and painted steel handrails. Lighting for emergency egress is included. |

|

• |

Elevators: finished floors and walls. |

|

• |

Life-safety exit and egress lighting with alarms and horns as required by code. |

|

• |

Building signage including stairwells, exiting, and elevator instructions as per code. |

No-Smoking

Tenants, employees, or visitors may not smoke in the building or within 25 feet of any door or operable window. A designated smoking area has been provided on the outside corner of the building with a smoker’s pole for proper disposal of cigarette butts.

Lease Areas

All improvements, except as provided above and specifically noted elsewhere, within the Premises are excluded from the Base Building Improvements and are at Tenant’s sole cost and expense, to the extent that such costs (together with all other costs payable by Tenant) exceed the TI Allowance, including but not limited to: interior partitions; sheetrock on perimeter walls; sheetrock column wraps; doors; hardware; interior sidelights; interior glass walls; ceilings; painting; floor coverings; cabinetry; millwork; VAV boxes: HVAC finish; plumbing; electrical service from the panel; phone/data/communication service from the first floor point of demarcation; wall finishes; lighting; building permits and project management services as described.

Appendix 2-4

(to be provided at Tenant’s sole cost and expense, subject to the TI Allowance)

Structure and Shell

|

|

• |

Any structural support required for Tenant equipment |

|

|

• |

Any structural support required for roof-mounted Tenant equipment |

HVAC and Plumbing

|

|

• |

Building standard HVAC, including VAV boxes, medium and low-pressure ductwork, diffusers, sensors and controls. |

|

|

• |

Independent HVAC/cooling systems for computer rooms, server rooms, etc. |

|

|

• |

Plumbing and fixtures for kitchens, break rooms, additional restrooms, drinking fountains, etc. |

Electrical and Fire Sprinkler System

|

|

• |

Fire sprinkler drops and finish sprinkler heads |

|

|

• |

Building standard light fixtures |

|

|

• |

Illuminated exit lights in Tenant corridors and space |

|

|

• |

Tenant electrical panels , electrical wiring from panels to equipment, outlets, furniture, cubicles, FF&E, etc. |

|

|

• |

Building standard switches and power outlets |

|

|

• |

Building standard voice and data boxes |

Finishes and Miscellaneous

|

|

• |

Building standard acoustical ceilings |

|

|

• |

Building standard sheetrock ceilings |

|

|

• |

Building standard paints, wall coverings, etc. |

|

|

• |

Building standard doors |

|

|

• |

Interior walls (framing, insulation, sheetrock, finishes, etc.) |

|

|

• |

Additional thermal insulation (exterior walls), as requested by Tenant |

|

|

• |

Additional sound insulation (interior walls), as requested by Tenant |

|

|

• |

Tenant lobby and corridor finishes |

|

|

• |

Floor coverings (carpet, ceramic tile, VCT tile, etc.) including base |

|

|

• |

Window blinds |

|

|

• |

Cabinetry (break room, kitchen, offices, copy centers, etc.) |

|

|

• |

All other finishes and improvements not included in Base Building Improvements |

|

|

• |

Tenant signage/logo |

|

|

• |

Voice and data cabling |

Tenant Property (to be provided at Tenant’s sole cost and expense)

Miscellaneous

|

|

• |

Tenant furniture, fixtures and equipment |

|

|

• |

All Tenant personal property |

Appendix 2-5

Adjacent Land

(See attached)

Exhibit F-1

Restricted Signage Area

(See attached)

Attachment A-1