Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Smart Sand, Inc. | snd-ex321_7.htm |

| EX-95.1 - EX-95.1 - Smart Sand, Inc. | snd-ex951_420.htm |

| EX-32.2 - EX-32.2 - Smart Sand, Inc. | snd-ex322_6.htm |

| EX-31.2 - EX-31.2 - Smart Sand, Inc. | snd-ex312_8.htm |

| EX-31.1 - EX-31.1 - Smart Sand, Inc. | snd-ex311_9.htm |

| EX-23.1 - EX-23.1 - Smart Sand, Inc. | snd-ex231_434.htm |

| EX-21.1 - EX-21.1 - Smart Sand, Inc. | snd-ex211_421.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Annual Period Ended December 31, 2016

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from ___ to ___

Commission file number 001-37936

SMART SAND, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

45-2809926 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

24 Waterway Avenue, Suite 350

The Woodlands, Texas 77380

(Address of principal executive offices) (Zip Code)

Telephone: (281) 231-2660

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.01 per share |

|

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

☐ |

|

|

|

|

Accelerated filer |

☐ |

|

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

☒ |

|

|

|

|

Smaller reporting company |

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The Company was not a public company as of the last business day of its most recently completed second quarter and therefore cannot calculate the aggregate market value of its voting and non-voting common equity held by non-affiliates at such date.

Number of shares of common shares outstanding, par value $0.001 per share as of March 13, 2017: 40,589,641.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of Form 10-K - Certain sections of the Proxy Statement for the 2017 Annual Meeting of Stockholders of Smart Sand, Inc.

|

|

|

|

PAGE |

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

4 |

|

|

Item 1A. |

|

17 |

|

|

Item 1B. |

|

34 |

|

|

Item 2. |

|

34 |

|

|

Item 3. |

|

38 |

|

|

Item 4. |

|

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

39 |

|

|

Item 6. |

|

41 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

42 |

|

Item 7A. |

|

63 |

|

|

Item 8. |

|

65 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

90 |

|

Item 9A. |

|

90 |

|

|

Item 9B. |

|

90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

91 |

|

|

Item 11. |

|

91 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

91 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

91 |

|

Item 14. |

|

91 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

92 |

|

|

|

|

|

|

|

|

93 |

||

|

|

|

|

|

|

|

94 |

||

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this Annual Report on Form 10-K are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "anticipate,'' “estimate,'' "expect," "project," "plan," "intend," "believe," "may," "will," "should," "can have," "likely" and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements we make relating to our estimated and projected costs, expenditures, cash flows, growth rates and financial results, our plans and objectives for future operations, growth or initiatives, strategies or the expected outcome or impact of pending or threatened litigation are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including:

|

|

• |

fluctuations in demand for raw frac sand; |

|

|

• |

the cyclical nature of our customers' businesses; |

|

|

• |

operating risks that are beyond our control, such as changes in the price and availability of transportation, natural gas or electricity; unusual or unexpected geological formations or pressures; pit wall failures or rock falls: or unanticipated ground, grade or water conditions: |

|

|

• |

our dependence on our Oakdale plant for current sales; |

|

|

• |

the level of activity in the oil and natural gas industries; |

|

|

• |

decreased demand for raw frac sand or the development of either effective alternative proppants or new processes to replace hydraulic fracturing; |

|

|

• |

federal, state and local legislative and regulatory initiatives relating to hydraulic fracturing and the potential for related regulatory action or litigation affecting our customers' operations; |

|

|

• |

our rights and ability to mine our properties and our renewal or receipt of the required permits and approvals from governmental authorities and other third parties; |

|

|

• |

our ability to implement our capacity expansion plans within our current timetable and budget and our ability to secure demand for our increased production capacity, and the actual operating costs once we have completed the capacity expansion; |

|

|

• |

our ability to successfully compete in raw frac sand market; |

|

|

• |

loss of, or reduction in, business from our largest customers; |

|

|

• |

increasing costs or a lack of dependability or availability of transportation services and transload network access or infrastructure; |

|

|

• |

increases in the prices of, or interruptions in the supply of, natural gas and electricity. or any other energy sources; |

|

|

• |

increases in the price of diesel fuel; |

|

|

• |

diminished access to water; |

|

|

• |

our ability to successfully complete acquisitions or integrate acquired businesses: |

|

|

• |

our ability to make capital expenditures to maintain, develop and increase our asset base and our ability to obtain needed capital or financing on satisfactory terms; |

|

|

• |

restrictions imposed by our indebtedness on our current and future operations: |

|

|

• |

contractual obligations that require us to deliver minimum amounts of frac sand or purchase minimum amounts of services; |

|

|

• |

the accuracy of our estimates of mineral reserves and resource deposits; |

|

|

• |

a shortage of skilled labor and rising costs in the mining industry; |

|

|

• |

our ability to attract and retain key personnel; |

3

|

|

• |

our ability to maintain effective quality control systems at our mining, processing and production facilities; |

|

|

• |

seasonal and severe weather conditions; |

|

|

• |

fluctuations in our sales and results of operations due to seasonality and other factors; |

|

|

• |

interruptions or failures in our information technology systems; |

|

|

• |

the impact of a terrorist attack or armed conflict; |

|

|

• |

extensive and evolving environmental, mining, health and safety, licensing, reclamation and other regulation (and changes in their enforcement or interpretation); |

|

|

• |

silica-related health issues and corresponding 1itigation: |

|

|

• |

our ability to acquire, maintain or renew financial assurances related to the reclamation and restoration of mining property; and |

|

|

• |

other factors disclosed in Item I A. "Risk Factors" and elsewhere in this Annual Report on Form 10-K. |

We derive many of our forward-looking statements from our operating budgets and forecasts, which are based on many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed under Item I A, "Risk Factors" and Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" in this Annual Report on Form 10-K. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements as well as other cautionary statements that are made from time to time in our other filings with the Securities and Exchange Commission (the "SEC") and public communications. You should evaluate all forward-looking statements made in this Annual Report on Form 10-K in the context of these risks and uncertainties.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this Annual Report on Form 10-K are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Overview

We are a pure-play, low-cost producer of high-quality Northern White raw frac sand, which is a preferred proppant used to enhance hydrocarbon recovery rates in the hydraulic fracturing of oil and natural gas wells. We sell our products primarily to oil and natural gas exploration and production companies and oilfield service companies under a combination of long-term take-or-pay contracts and spot sales in the open market. We believe that the size and favorable geologic characteristics of our sand reserves and the strategic location and logistical advantages of our facilities have positioned us as a highly attractive source of raw frac sand to the oil and natural gas industry.

We own and operate a raw frac sand mine and related processing facility near Oakdale, Wisconsin, at which we have approximately 332 million tons of proven recoverable sand reserves as of December 31, 2016. We began operations with 1.1 million tons of processing capacity in July 2012, expanded to 2.2 million tons capacity in August 2014 and increased to 3.3 million tons in September 2015. Our integrated Oakdale facility, with on-site rail infrastructure and wet and dry sand processing facilities, has access to two Class I rail lines and enables us to process and cost-effectively deliver up to approximately 3.3 million tons of raw frac sand per year.

In addition to the Oakdale facility, we own a second property in Jackson County, Wisconsin, which we call the Hixton site. The Hixton site is also located adjacent to a Class I rail line and is fully permitted to initiate operations and is available for future development. As of August 2014, our Hixton site had approximately 100 million tons of proven recoverable sand reserves.

We incorporated in Delaware in July 2011. On November 9, 2016, we completed our initial public offering (the “IPO”) of 11,700,000 shares of our common stock at a price to the public of $11.00 per share ($10.34 per share, net of the underwriting discount) pursuant to a Registration Statement on Form S-1, as amended (File No. 333-213692) (the “Registration Statement”),

4

initially filed with the SEC on September 19, 2016 pursuant to the Securities Act. The material provisions of the IPO are described in the Registration Statement. We granted the underwriters an option for a period of 30 days to purchase up to an additional 877,500 shares of Common Stock at the initial offering price, and the Selling Shareholders granted the underwriters an option for a period of 30 days to purchase up to an aggregate additional 877,500 shares of Common Stock at the initial offering price. On November 23, 2016, the underwriters exercised in full their option to purchase additional shares of common stock from us and the Selling Shareholders.

On February 1, 2017, we entered into an Underwriting Agreement providing for the offer and sale of 1,500,000 shares of common stock at a price of $17.50 per share ($16.58 per share, net of the underwriting discount), generating net proceeds to us of $24.3 million before underwriting discounts and expenses. We intend to use the net proceeds from this offering for future capital projects and general corporate services. The offering closed on February 7, 2017. Additionally, the Selling Shareholders sold 4,450,000 shares of common stock at a price of $17.50 per share. We received no proceeds from the sale of common stock by the Selling Shareholders. The Selling Shareholders granted the underwriters an option for a period of 30 days to purchase up to an additional 892,500 shares of common stock. On February 10, 2017, the underwriters exercised in full their option to purchase additional shares of common stock from the Selling Shareholders. We received no proceeds from the sale of common stock to the underwriters by the Selling Shareholders.

For the years ended December 31, 2016, 2015 and 2014, we generated net income of approximately $10.4 million, $5.0 million and $7.6 million respectively, and Adjusted EBITDA of approximately $37.8 million, $23.9 million and $33.3 million, respectively. For the definition of Adjusted EBITDA and a reconciliation to its most directly comparable financial measure calculated and presented in accordance with Generally Accepted Accounting Principles (“GAAP”), please read “Note Regarding Non-GAAP Financial Measures.” For more financial information about our business, please read “Selected Financial Data.”

Over the past decade, exploration and production companies have increasingly focused on exploiting the vast hydrocarbon reserves contained in North America’s unconventional oil and natural gas reservoirs by utilizing advanced techniques, such as horizontal drilling and hydraulic fracturing. In recent years, this focus has resulted in exploration and production companies drilling more and longer horizontal wells, completing more hydraulic fracturing stages per well and utilizing more proppant per stage in an attempt to maximize the volume of hydrocarbon recoveries per wellbore. From 2010 to 2015 frac sand demand experienced strong growth, growing at an average annual rate of 25%. In addition, raw frac sand’s share of the total proppant market continues to increase, growing from approximately 78% in 2010 to approximately 92% in 2015 as exploration and production companies continue to look closely at overall well cost, completion efficiency and design optimization, which has led to a greater use of raw frac sand in comparison to resin-coated sand and manufactured ceramic proppants.

Northern White raw frac sand, which is found predominantly in Wisconsin and limited portions of Minnesota and Illinois, is highly valued by oil and natural gas producers as a preferred proppant due to its favorable physical characteristics. We believe that the market for high-quality raw frac sand, like the Northern White raw frac sand we produce, particularly finer mesh sizes, will grow based on the potential recovery in the development of North America’s unconventional oil and natural gas reservoirs as well as the increased proppant volume usage per well. According to Kelrik, a notable driver impacting demand for fine mesh sand is increased proppant loadings, specifically, larger volumes of proppant placed per frac stage. Kelrik expects the trend of using larger volumes of finer mesh materials, such as 100 mesh sand and 40/70 sand, to continue.

Competitive Strengths

We believe that we will be able to successfully execute our business strategies because of the following competitive strengths:

|

|

• |

Long-lived, strategically located, high-quality reserve base. We believe our Oakdale facility is one of the few raw frac sand mine and production facilities that has the unique combination of a large high-quality reserve base of primarily fine mesh sand that is contiguous to its production and primary rail loading facilities. Our Oakdale facility is situated on 1,196 acres in a rural area of Monroe County, Wisconsin, on a Class I rail line, and contains approximately 332 million tons of proven recoverable reserves as of December 31, 2016. We have an implied current proven reserve life of approximately 101 years based on our current annual processing capacity of 3.3 million tons per year. As of December 31, 2016, we have utilized 135 acres for facilities and mining operations, or only 11% of this location’s acreage. We believe that with further development and permitting, the Oakdale facility ultimately could be expanded to allow production of up to 9 million tons of raw frac sand per year. |

5

We believe our reserve base positions us well to take advantage of current market trends of increasing demand for finer mesh raw frac sand. Approximately 80% of our reserve mix today is 40/70 mesh substrate and 100 mesh substrate, considered to be the finer mesh substrates of raw frac sand. We believe that if oil and natural gas exploration and production companies continue recent trends in drilling and completion techniques to increase lateral lengths per well, the number of frac stages per well, the amount of proppant used per stage and the utilization of slickwater completions, that the demand for the finer grades of raw frac sand will continue to increase, which we can take advantage of due to the high percentage of high-quality, fine mesh sand in our reserve base.

We also believe that having our mine, processing facilities and primary rail loading facilities at our Oakdale facility provides us with an overall low-cost structure, which enables us to compete effectively for sales of raw frac sand and to achieve attractive operating margins. The proximity of our mine, processing plants and primary rail loading facilities at one location eliminates the need for us to truck sand on public roads between the mine and the production facility or between wet and drying processing facilities, eliminating additional costs to produce and ship our sand.

In addition to the Oakdale facility, we own the Hixton site in Jackson County, Wisconsin. The Hixton site is a second fully permitted location adjacent to a Class I rail line that is fully permitted to initiate operations and is available for future development. As of August 2014, our Hixton site had approximately 100 million tons of proven recoverable sand reserves.

|

|

• |

Intrinsic logistics advantage. We believe that we are one of the few raw frac sand producers with a facility custom-designed for the specific purpose of delivering raw frac sand to all of the major U.S. oil and natural gas producing basins by an on-site rail facility that can simultaneously accommodate multiple unit trains. Our on-site transportation assets at Oakdale include approximately seven miles of rail track in a double-loop configuration and three rail car loading facilities that are connected to a Class I rail line owned by Canadian Pacific. We believe our customized on-site logistical configuration typically yields lower operating and transportation costs compared to manifest train or single-unit train facilities as a result of our higher rail car utilization, more efficient use of locomotive power and more predictable movement of product between mine and destination. In addition, we have recently constructed a transload facility on a Class I rail line owned by Union Pacific in Byron Township, Wisconsin, approximately 3.5 miles from the Oakdale facility. This transload facility allows us to ship sand directly to our customers on more than one Class I rail carrier. This facility commenced operations in June 2016 and provides increased delivery options for our customers, greater competition among our rail carriers and potentially lower freight costs. With the addition of this transload facility, we believe we are the only mine in Wisconsin with dual served railroad shipment capabilities on the Canadian Pacific and Union Pacific rail networks. Our Hixton site is also located adjacent to a Class I rail line. |

|

|

• |

Significant organic growth potential. We believe that we have a significant pipeline of attractive opportunities to expand our sales volumes and production capacity at our Oakdale facility, which commenced commercial operations in July 2012 and was expanded to 3.3 million tons of annual processing capacity in September 2015. We currently have plans to increase our wet and dry plant processing capacity in order to produce up to approximately 4.4 million tons of raw frac sand per year. We currently have one wet plant and one dryer in storage at Oakdale that will be utilized as part of this capacity expansion. We believe these units could be installed and operational in approximately six to nine months from commencement of construction. We believe, under current regulations and permitting requirements, that we can ultimately expand our annual production capacity at Oakdale to as much as 9 million tons. Other growth opportunities include the ability to expand our Byron Township transload facility to handle multiple unit trains simultaneously and to invest in transload facilities located in the shale operating basins. Investments in additional rail loading facilities should enable us to provide more competitive transportation costs and allow us to offer additional pricing and delivery options to our customers. We also have opportunities to expand our sales into the industrial sand market which would provide us the opportunity to diversify our customer base and sales product mix. |

Additionally, as of December 31, 2016, we have approximately 2.1 million tons of washed raw frac sand inventory at our Oakdale facility available to be processed through our dryers and sold in the market. This inventory of available washed raw frac sand provides us with the ability to quickly meet changing market demand and strategically sell sand on a spot basis to expand our market share of raw frac sand sales if market conditions are favorable.

|

|

• |

Strong balance sheet and financial flexibility. We believe we have a strong balance sheet and ample liquidity to pursue our growth initiatives. As of March 13, 2017, we have approximately $117.6 million in liquidity from cash on hand and full availability of our $45 million revolving credit facility. Additionally, unlike some of our peers, we have minimal exposure to unutilized rail cars. As of March 13, 2017, we have 1,540 rail cars under long-term leases, of which 1,010 are currently rented to our customers, which minimizes our exposure to storage and leasing expense for rail cars that are currently not being utilized for sand shipment and provides us greater flexibility in managing our transportation costs prospectively. |

6

|

|

• |

Experienced management team. The members of our senior management team bring significant experience to the market environment in which we operate. Their expertise covers a range of disciplines, including industry-specific operating and technical knowledge as well as experience managing high-growth businesses. |

Business Strategies

Our principal business objective is to be a pure-play, low-cost producer of high-quality raw frac sand and to increase stockholder value. We expect to achieve this objective through the following business strategies:

|

|

• |

Focusing on organic growth by increasing our capacity utilization and processing capacity. We intend to continue to position ourselves as a pure-play producer of high-quality Northern White raw frac sand, as we believe the proppant market offers attractive long-term growth fundamentals. While demand for proppant has declined since late 2014 in connection with the downturn in commodity prices and the corresponding decline in oil and natural gas drilling and production activity in 2015 and 2016, we believe that the demand for proppant is increasing in the short term and will continue to increase over the medium and long term as commodity prices rise from their lows in 2016, which should lead producers to resume completion of their inventory of drilled but uncompleted wells and undertake new drilling activities. We expect this demand growth for raw frac sand will be driven by increased horizontal drilling, increased proppant loadings per well (as operators increase lateral length and increase proppant per lateral foot above current levels), increased wells drilled per rig and the cost advantages of raw frac sand over resin-coated sand and manufactured ceramics. As market dynamics improve, we will continue to evaluate economically attractive facility enhancement opportunities to increase our capacity utilization and processing capacity. For example, our current annual processing capacity is approximately 3.3 million tons per year and we expect to increase this annual processing capacity to 4.4 million tons per year by the end of 2017. We believe that with further development and permitting the Oakdale facility could ultimately be expanded to allow production to as much as 9 million tons of raw frac sand per year. |

|

|

• |

Optimizing our logistics infrastructure and developing additional origination and destination points. We intend to further optimize our logistics infrastructure and develop additional origination and destination points. We expect to capitalize on our Oakdale facility’s ability to simultaneously accommodate multiple unit trains to maximize our product shipment rates, increase rail car utilization and lower transportation costs. With our recently developed transloading facility located on the Union Pacific rail network approximately 3.5 miles from our Oakdale facility, we have the ability to ship our raw frac sand directly to our customers on more than one Class I rail carrier. This facility provides increased delivery options for our customers, greater competition among our rail carriers and potentially lower freight costs. In addition, we intend to continue evaluating ways to reduce the landed cost of our products at the basin for our customers, such as investing in transload and storage facilities and assets in our target shale basins to increase our customized service offerings and provide our customers with additional delivery and pricing alternatives, including selling product on an “as-delivered” basis at our target shale basins. |

|

|

• |

Focusing on being a low-cost producer and continuing to make process improvements. We will continue to focus on being a low-cost producer, which we believe will permit us to compete effectively for sales of raw frac sand and to achieve attractive operating margins. Our low-cost structure results from a number of key attributes, including, among others, our (i) relatively low royalty rates compared to other industry participants, (ii) balance of coarse and fine mineral reserve deposits and corresponding contractual demand that minimizes yield loss and (iii) Oakdale facility’s proximity to two Class I rail lines and other sand logistics infrastructure, which helps reduce transportation costs, fuel costs and headcount needs. We have strategically designed our operations to provide low per-ton production costs. For example, we completed the construction of a natural gas connection to our Oakdale facility in October 2015 that provides us the optionality to source lower cost natural gas (as compared to propane under current commodity pricing) as a fuel source for our drying operations. In addition, we seek to maximize our mining yields on an ongoing basis by targeting sales volumes that more closely match our reserve gradation in order to minimize mining and processing of superfluous tonnage and continue to evaluate the potential of mining by dredge to reduce the overall cost of our mining operations. |

7

|

|

• |

Maintaining financial strength and flexibility. We plan to pursue a disciplined financial policy to maintain financial strength and flexibility. We believe that our cash on hand, available borrowing capacity and ability to access debt and equity capital markets will provide us with the financial flexibility necessary to achieve our organic expansion and acquisition strategy. |

Our Customers and Contracts

We sell raw frac sand under long-term take-or-pay contracts as well as in the spot market if we have excess production and the spot market conditions are favorable. As of March 13, 2017, we have approximately 63.3% of our current annual production capacity contracted under four long-term take-or-pay contracts, with a volume-weighted average remaining term of approximately 3.1 years.

Demand for proppants in 2015 and through the first half of 2016 dropped due to the downturn in commodity prices since late 2014 and the corresponding reduction in oil and natural gas drilling, completion and production activity. The change in demand during this period impacted contract discussions and negotiated terms with our customers as existing contracts were adjusted, resulting in a combination of reduced average selling prices per ton, and adjustments to take-or-pay volumes and lengths of contracts. We believe we have mitigated the short-term negative impact on revenues of some of these adjustments through contractual shortfall and reservation payments. During the market downturn, customers began to purchase more volumes on a spot basis as compared to committing to term contracts, and this trend continued until oil and natural gas drilling and completion activity began to increase beginning in the fourth quarter of 2016. However, drilling and completion activity has begun to return to higher levels, and we believe customers will begin to more actively consider contracting proppant volumes under term contracts rather than continuing to rely on buying proppant on a spot basis in the market.

Product Purchase Agreements and Spot Sales

On December 14, 2016, we entered into a multi-year Master Product Purchase Agreement (the “Rice PPA”) with Rice Drilling B, LLC (“Rice”), a subsidiary of Rice Energy Inc. Rice began purchasing frac sand under the Rice PPA in January 2017. The Rice PPA is structured as a take-or-pay agreement and includes a monthly nonrefundable capacity reservation charge. In connection with the Rice PPA, on December 14, 2016, we also entered into a Railcar Usage Agreement with Rice, pursuant to which Rice will borrow railcars from us to transport the purchased products.

On March 8, 2017, we entered into a multi-year Master Product Purchase Agreement (the “PPA”) with Liberty Oilfield Services, LLC (the “Buyer”) for finer mesh sands. We expect that the Buyer will begin purchasing frac sand under the PPA in May 2017. The PPA is structured as a take-or-pay agreement.

We are currently in discussions with certain existing and prospective customers in the pressure pumping and exploration and production industries to enter into long-term, take-or-pay agreements with minimum volume commitments, particularly for finer mesh sand. We also have experienced a recent increase in interest for recurring spot sales in the open market and have conducted some spot sales on a select basis. If we were to enter into any such long-term agreement or conduct additional spot sales, the additional volumes we sell could be material to our performance and prospects. We can provide no assurance, however, that we will be able to enter into any of these agreements or complete any such sales. Entry into the long-term contractual agreements is subject to, among other things, agreement on the purchase price for our frac sand and the negotiation and execution of definitive documentation, and entry into spot sales is subject to agreement on the terms of any such sale.

Capital Plans

Based on our assessment of increased demand for our products, particularly fine mesh sand, we have decided to increase the wet and dry plant processing capacity at our Oakdale facility in order to produce up to approximately 4.4 million tons of raw frac sand per year. We have also decided to expand rail and logistics infrastructure in Wisconsin to support this potential increase in customer demand. Additionally, we continue to evaluate other proposed projects and related expenditures, such as investments in transload facilities located in the shale operating basins, in light of customer demand and energy market trends. There can be no assurance, however, that all or any of these initiatives will be executed or that the results therefrom will be materially beneficial to our financial performance.

8

Industry Trends Impacting Our Business

Unless otherwise indicated, the information set forth under “—Industry Trends Impacting Our Business,” including all statistical data and related forecasts, is derived from The Freedonia Group’s Industry Study #3302, “Proppants in North America,” published in September 2015, Spears & Associates’ “Hydraulic Fracturing Market 2005-2017” published in the fourth quarter 2016, PropTester, Inc. and Kelrik, LLC’s “2015 Proppant Market Report” published in March 2016 and Baker Hughes’ “North America Rotary Rig Count” published in July 2016. While we are not aware of any misstatements regarding the proppant industry data presented herein, estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors.”

Demand Trends

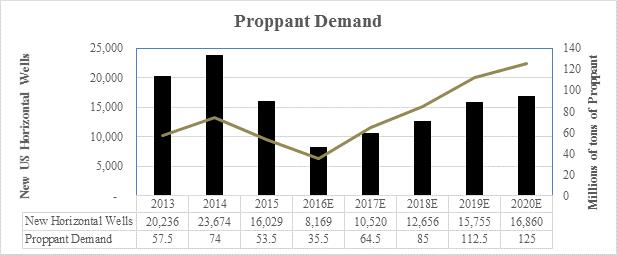

According to Spears, the U.S. proppant market, including raw frac sand, ceramic and resin-coated proppant, was approximately 35.5 million tons in 2016. Kelrik estimates that the total raw frac sand market in 2015 represented approximately 92.3% of the total proppant market by weight. Market demand in 2015 dropped by approximately 28% from 2014 record demand levels (and a further estimated decrease of 43% in 2016 from 2015) due to the downturn in commodity prices since late 2014, which led to a corresponding decline in oil and natural gas drilling and production activity. According to the Freedonia Group, during the period from 2009 to 2014, proppant demand by weight increased by 42% annually. Spears estimates from 2016 through 2020 proppant demand is projected to grow by 37.0% per year, from 35.5 million tons per year to 125 million tons per year, representing an increase of approximately 89.5 million tons in annual proppant demand over that time period.

Demand growth for raw frac sand and other proppants is primarily driven by advancements in oil and natural gas drilling and well completion technology and techniques, such as horizontal drilling and hydraulic fracturing. These advancements have made the extraction of oil and natural gas increasingly cost-effective in formations that historically would have been uneconomic to develop. While current horizontal rig counts have fallen significantly from their peak of approximately 1,370 in 2014, rig count grew at an annual rate of 18.7% from 2009 to 2014. Additionally, the percentage of active drilling rigs used to drill horizontal wells, which require greater volumes of proppant than vertical wells, has increased from 42.2% in 2009 to 68.4% in 2014, and as of July 2016 the percentage of rigs drilling horizontal wells is 77% according to the Baker Hughes Rig Count. Moreover, the increase of pad drilling has led to a more efficient use of rigs, allowing more wells to be drilled per rig. As a result of these factors, well count, and hence proppant demand, has grown at a greater rate than overall rig count. Spears estimates that in 2018, proppant demand will exceed the 2014 peak (of approximately 74 million tons) and reach 85 million tons even though the projection assumes approximately 10,000 fewer wells will be drilled. Spears estimates that average proppant usage per well will be approximately 5,000 tons per well by 2020. Kelrik notes that current sand-based slickwater completions use in excess of 7,500 tons per well of proppant.

While demand for proppant has declined since late 2014 in connection with the downturn in commodity prices and the corresponding decline in oil and natural gas drilling and production activity, we believe that the demand for proppant will increase over the medium and long term as commodity prices rise from their lows in 2016, which will lead producers to resume completion of their inventory of drilled but uncompleted wells and undertake new drilling activities. Further, we believe that demand for proppant will be amplified by the following factors:

|

|

• |

improved drilling rig productivity, resulting in more wells drilled per rig per year; |

|

|

• |

completion of exploration and production companies’ inventory of drilled but uncompleted wells; |

9

|

|

• |

increases in the length of the typical horizontal wellbore; |

|

|

• |

increases in the number of fracture stages per foot in the typical completed horizontal wellbore; |

|

|

• |

increases in the volume of proppant used per fracturing stage; |

|

|

• |

renewed focus of exploration and production companies to maximize ultimate recovery in active reservoirs through downspacing; and |

|

|

• |

increasing secondary hydraulic fracturing of existing wells as early shale wells age. |

Recent growth in demand for raw frac sand has outpaced growth in demand for other proppants, and industry analysts predict that this trend will continue. As well completion costs have increased as a proportion of total well costs, operators have increasingly looked for ways to improve per well economics by lowering costs without sacrificing production performance. To this end, the oil and natural gas industry is shifting away from the use of higher-cost proppants towards more cost-effective proppants, such as raw frac sand. Evolution of completion techniques and the substantial increase in activity in U.S. oil and liquids-rich resource plays has further accelerated the demand growth for raw frac sand.

Historically, oil and liquids-rich wells use a higher proportion of coarser proppant while dry gas wells typically use finer grades of sand. In the past, with the majority of U.S. exploration and production spending focused on oil and liquids-rich plays, demand for coarser grades of sand exceeded demand for finer grades; however, due to innovations in completion techniques, demand for finer grade sands have shown a considerable resurgence. According to Kelrik, a notable driver impacting demand for fine mesh sand is increased proppant loadings, specifically, larger volumes of proppant placed per frac stage. Kelrik expects the trend of using larger volumes of finer mesh materials such as 100 mesh sand and 40/70 sand, to continue.

Supply Trends

In recent years, through the fall of 2014, customer demand for high-quality raw frac sand outpaced supply. Several factors contributed to this supply shortage, including:

|

|

• |

the difficulty of finding raw frac sand reserves that meet API specifications and satisfy the demands of customers who increasingly favor high-quality Northern White raw frac sand; |

|

|

• |

the difficulty of securing contiguous raw frac sand reserves large enough to justify the capital investment required to develop a processing facility; |

|

|

• |

the challenges of identifying reserves with the above characteristics that have rail access needed for low-cost transportation to major shale basins; |

|

|

• |

the hurdles to securing mining, production, water, air, refuse and other federal, state and local operating permits from the proper authorities; |

|

|

• |

local opposition to development of certain facilities, especially those that require the use of on-road transportation, including moratoria on raw frac sand facilities in multiple counties in Wisconsin and Minnesota that hold potential sand reserves; and |

|

|

• |

the long lead time required to design and construct sand processing facilities that can efficiently process large quantities of high-quality raw frac sand. |

Supplies of high-quality Northern White raw frac sand are limited to select areas, predominantly in western Wisconsin and limited areas of Minnesota and Illinois. The ability to obtain large contiguous reserves in these areas is a key constraint and can be an important supply consideration when assessing the economic viability of a potential raw frac sand facility. Further constraining the supply and throughput of Northern White raw frac sand is that not all of the large reserve mines have onsite excavation and processing capability. Additionally, much of the recent capital investment in Northern White raw frac sand mines was used to develop coarser deposits in western Wisconsin. With the shift to finer sands in the liquid and oil plays, many mines may not be economically viable as their ability to produce finer grades of sand may be limited.

10

We operate in a highly regulated environment overseen by many government regulatory and enforcement bodies at the local, state and federal levels. To conduct our mining operations, we are required to have obtained permits and approvals that address environmental, land use and safety issues at our Oakdale facility, Byron transload facility and our Hixton mine location. Our current and planned areas for excavation at our Oakdale property are permitted for extraction of our proven reserves. Outlying areas at the edge of our Oakdale property’s boundaries that lie in areas designated as wetlands will require additional local, state and federal permits prior to mining and reclaiming those areas.

We also meet requirements for several international standards concerning safety, greenhouse gases and rail operations. We have voluntarily agreed to meet the standards of the Wisconsin DNR’s “Green Tier” program and the “Wisconsin Industrial Sand Association.” Further, we have agreed to meet the standards required to maintain our ISO 9001/14001 quality/environmental management system registrations. These voluntary requirements are tracked and managed along with our permits.

While resources invested in securing permits are significant, this cost has not had a material adverse effect on our results of operations or financial condition. We cannot assure that existing environmental laws and regulations will not be reinterpreted or revised or that new environmental laws and regulations will not be adopted or become applicable to us. Revised or additional environmental requirements that result in increased compliance costs or additional operating restrictions could have a material adverse effect on our business.

Our Customers and Contracts

Our core customers are major oil and natural gas exploration and production and oilfield service companies. These customers have signed long-term take-or-pay contracts, which mitigate our risk of non-performance by such customers. Our contracts provide for a true-up payment in the event the customer does not take delivery of the minimum annual volume of raw frac sand specified in the contract and has not purchased in certain prior periods an amount exceeding the minimum volume, resulting in a shortfall. The true-up payment is designed to compensate us, at least in part, for our margins for the applicable contract year and is calculated by multiplying the contract price (or, in some cases, a discounted contract price) by the tonnage shortfall. Any sales of the shortfall volumes to other customers on the spot market would provide us with additional margin on these volumes. Additionally, some of our contracts include monthly reservation charges that the customer is required to pay for minimum monthly volumes regardless of whether the customer takes delivery of the sand. For the year ended December 31, 2016, EOG Resources, US Well Services, Weatherford and Nabors Completion & Production Services accounted for 37%, 22% and 25% and 11%, respectively, of our total revenues, and the remainder of our revenues represented sales to five customers. For the year ended December 31, 2015, EOG Resources, US Well Services, Weatherford, and Archer Pressure Pumping accounted for 35.0%, 24.6%, 18.4% and 15.8%, respectively, of our total revenues, and the remainder of our revenues represented sales to three customers. For the year ended December 31, 2014, Weatherford, EOG Resources and US Well Services accounted for 32.1%, 30.6%, 16%, respectively, of our total revenues, and the remainder of our revenues represented sales to eleven customers. Please read “Risk Factors—Risks Inherent in Our Business—A substantial majority of our revenues have been generated under contracts with a limited number of customers, and the loss of, material nonpayment or nonperformance by or significant reduction in purchases by any of them could adversely affect our business, results of operations and financial condition.” As of March 13, 2017, we have approximately 63.3% of our current annual production capacity contracted under long-term take-or-pay contracts, with a volume-weighted average remaining term of approximately 3.1 years. For the years ended December 31, 2016, 2015 and 2014, we generated approximately 97.6%, 96.4% and 90.1%, respectively, of our revenues from raw frac sand delivered under long-term take-or-pay contracts. We sell raw frac sand under long-term contracts as well as in the spot market if we have excess production and the spot market conditions are favorable.

Our current contracts include agreed price ranges indexed to the price of crude oil (based upon the average WTI as listed on www.eia.doe.gov). Our contracts contain provisions allowing for upward adjustment including: (i) annual percentage price escalators, or (ii) market factor increases, including a natural gas surcharge and/or a propane surcharge which are applied if the Average Natural Gas Price or the Average Quarterly Mont Belvieu TX Propane Spot Price, respectively, as listed by the U.S. Energy Information Administration, are above the benchmark set in the contract for the preceding calendar quarter.

Our contracts generally provide that, if we are unable to deliver the contracted minimum volume of raw frac sand, the customer has the right to purchase replacement raw frac sand from alternative sources, provided that our inability to supply is not the result of an excusable delay. In the event that the price of replacement raw frac sand exceeds the contract price and our inability to supply the contracted minimum volume is not the result of an excusable delay, we are responsible for the price difference. At December 31, 2016, we had significant levels of raw frac sand inventory on hand; therefore, the likelihood of any such penalties was considered remote.

11

Each of our contracts contains a minimum volume purchase requirement and provides for delivery of raw frac sand free carrier (“FCA”) at our Oakdale facility. Certain of our contracts allow the customer to defer a portion of the annual minimum volume to future contract years, subject to a maximum deferral amount. The mesh size specifications in our contracts vary and include a mix of 20/40, 30/50, 40/70 and 100 mesh raw frac sand. In the event that one or more of our current contract customers decides not to continue purchasing our raw frac sand following the expiration of its contract with us, we believe that we will be able to sell the volume of sand that they previously purchased to other customers through long-term contracts or sales on the spot market.

Our Relationship with Our Sponsor

Our sponsor is a fund managed by Clearlake Capital Group, L.P., which, together with its affiliates and related persons, we refer to as Clearlake. Clearlake Capital Group, L.P. is a leading private investment firm founded in 2006. With a sector-focused approach, the firm seeks to partner with world-class management teams by providing patient, long-term capital to dynamic businesses that can benefit from Clearlake’s operational improvement approach, O.P.S.SM. The firm’s core target sectors are industrials and energy; software, and technology-enabled services; and consumer. Clearlake currently has over $3 billion of assets under management and its senior investment principals have led or co-led 90 investments. We believe our relationship with Clearlake provides us with a unique resource to effectively compete for acquisitions within the industry by being able to take advantage of their experience in acquiring businesses to assist us in seeking out, evaluating and closing attractive acquisition opportunities over time.

Competition

The proppant industry is highly competitive. Please read “Risk Factors—Risks Inherent in Our Business—We face significant competition that may cause us to lose market share.” There are numerous large and small producers in all sand producing regions of the United States with whom we compete. Our main competitors include Badger Mining Corporation, Emerge Energy Services LP, Fairmount Santrol, Hi-Crush Partners LP, Unimin Corporation and U.S. Silica Holdings, Inc.

Although some of our competitors have greater financial and other resources than we do, we believe that we are competitively well positioned due to our low cost of production, transportation infrastructure and high-quality, balanced reserve profile. The most important factors on which we compete are product quality, performance, sand characteristics, transportation capabilities, reliability of supply and price. Demand for raw frac sand and the prices that we will be able to obtain for our products, to the extent not subject to a fixed price or take-or-pay contract, are closely linked to proppant consumption patterns for the completion of oil and natural gas wells in North America. These consumption patterns are influenced by numerous factors, including the price for hydrocarbons, the drilling rig count and hydraulic fracturing activity, including the number of stages completed and the amount of proppant used per stage. Further, these consumption patterns are also influenced by the location, quality, price and availability of raw frac sand and other types of proppants such as resin-coated sand and ceramic proppant.

Seasonality

Our business is affected to some extent by seasonal fluctuations in weather that impact the production levels at our wet processing plant. While our dry plants are able to process finished product volumes evenly throughout the year, our excavation and our wet sand processing activities are limited to non-winter months. As a consequence, we experience lower cash operating costs in the first and fourth quarter of each calendar year, and higher cash operating costs in the second and third quarter of each calendar year when we overproduce to meet demand in the winter months. These higher cash operating costs are capitalized into inventory and expensed when these tons are sold. We may also sell raw frac sand for use in oil and natural gas producing basins where severe weather conditions may curtail drilling activities and, as a result, our sales volumes to those areas may be reduced during such severe weather periods. For a discussion of the impact of weather on our operations, please read “Risk Factors—Seasonal and severe weather conditions could have a material adverse impact on our business, results of operations and financial condition” and “Risk Factors—Our cash flow fluctuates on a seasonal basis.”

Insurance

We believe that our insurance coverage is customary for the industry in which we operate and adequate for our business. As is customary in the proppant industry, we review our safety equipment and procedures and carry insurance against most, but not all, risks of our business. Losses and liabilities not covered by insurance would increase our costs. To address the hazards inherent in our business, we maintain insurance coverage that includes physical damage coverage, third-party general liability insurance, employer’s liability, business interruption, environmental and pollution and other coverage, although coverage for environmental and pollution-related losses is subject to significant limitations.

12

Environmental and Occupational Health and Safety Regulations

We are subject to stringent and complex federal, state and local laws and regulations governing the discharge of materials into the environment or otherwise relating to protection of worker health, safety and the environment. Compliance with these laws and regulations may expose us to significant costs and liabilities and cause us to incur significant capital expenditures in our operations. Any failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, imposition of remedial obligations, and the issuance of injunctions delaying or prohibiting operations. Private parties may also have the right to pursue legal actions to enforce compliance as well as to seek damages for non-compliance with environmental laws and regulations or for personal injury or property damage. In addition, the clear trend in environmental regulation is to place more restrictions on activities that may affect the environment, and thus, any changes in, or more stringent enforcement of, these laws and regulations that result in more stringent and costly pollution control equipment, the occurrence of delays in the permitting or performance of projects, or waste handling, storage, transport, disposal or remediation requirements could have a material adverse effect on our operations and financial position.

We do not believe that compliance by us and our customers with federal, state or local environmental laws and regulations will have a material adverse effect on our business, financial position or results of operations or cash flows. We cannot assure you, however, that future events, such as changes in existing laws or enforcement policies, the promulgation of new laws or regulations or the development or discovery of new facts or conditions adverse to our operations will not cause us to incur significant costs. The following is a discussion of material environmental and worker health and safety laws, as amended from time to time that relate to our operations or those of our customers that could have a material adverse effect on our business.

Air Emissions

Our operations are subject to the federal Clean Air Act (“CAA”) and related state and local laws, which restrict the emission of air pollutants and impose permitting, monitoring and reporting requirements on various sources. These regulatory programs may require us to install emissions abatement equipment, modify operational practices, and obtain permits for existing or new operations. Obtaining air emissions permits has the potential to delay the development or continued performance of our operations. Over the next several years, we may be required to incur certain capital expenditures for air pollution control equipment or to address other air emissions-related issues. Changing and increasingly stricter requirements, future non-compliance, or failure to maintain necessary permits or other authorizations could require us to incur substantial costs or suspend or terminate our operations.

Climate change

In recent years, the U.S. Congress has considered legislation to reduce emissions of greenhouse gases (“GHG”). It presently appears unlikely that comprehensive climate legislation will be passed by either house of Congress in the near future, although energy legislation and other regulatory initiatives are expected to be proposed that may be relevant to GHG emissions issues. In addition, a number of states are addressing GHG emissions, primarily through the development of emission inventories or regional GHG cap and trade programs. Depending on the particular program, we could be required to control GHG emissions or to purchase and surrender allowances for GHG emissions resulting from our operations. Independent of Congress, the EPA has adopted regulations controlling GHG emissions under its existing authority under the CAA. For example, following its findings that emissions of GHGs present an endangerment to human health and the environment because such emissions contributed to warming of the Earth’s atmosphere and other climatic changes, the EPA has adopted regulations under existing provisions of the CAA that, among other things, establish construction and operating permit reviews for GHG emissions from certain large stationary sources that are already potential major sources for conventional pollutants. In addition, the EPA has adopted rules requiring the monitoring and reporting of GHG emissions from specified production, processing, transmission and storage facilities in the United States on an annual basis. Also, the United States is one of almost 200 nations that, in December 2015, agreed to the Paris Agreement, an international climate change agreement in Paris, France that calls for countries to set their own GHG emissions targets and be transparent about the measures each country will use to achieve its GHG emissions targets. The agreement was signed in April 2016, and became effective November 2016. The United States is one of over 70 nations having ratified or otherwise consented to be bound by the agreement. Although it is not possible at this time to predict how new laws or regulations in the United States or any legal requirements imposed following the United States’ agreeing to the Paris Agreement that may be adopted or issued to address GHG emissions would impact our business, any such future laws, regulations or legal requirements imposing reporting or permitting obligations on, or limiting emissions of GHGs from, our equipment and operations could require us to incur costs to reduce emissions of GHGs associated with our operations as well as delays or restrictions in our ability to permit GHG emissions from new or modified sources. In addition, substantial limitations on GHG emissions could adversely affect demand for the oil and natural gas we produce. Finally, it should be noted that increasing concentrations of GHGs in the Earth’s atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, floods and other climatic events; if any such effects were to occur, they could have an adverse effect on our exploration and production operations.

13

The Clean Water Act (“CWA”), and analogous state laws impose restrictions and strict controls with respect to the discharge of pollutants, including spills and leaks of oil and other substances, into state waters or waters of the United States. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. Spill prevention control and countermeasure requirements require containment to mitigate or prevent contamination of navigable waters in the event of an oil overflow, rupture or leak, and the development and maintenance of Spill Prevention Control and Countermeasure, or SPCC, plans at our facilities. The CWA and regulations implemented thereunder also prohibit the discharge of dredge and fill material into regulated waters, including jurisdictional wetlands, unless authorized by the Army Corps of Engineers pursuant to an appropriately issued permit. In addition, the CWA and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. The EPA has issued final rules attempting to clarify the federal jurisdictional reach over waters of the United States but this rule has been stayed nationwide by the U.S. Sixth Circuit Court of Appeals as that appellate court and numerous district courts ponder lawsuits opposing implementation of the rule. In February 2016, a split three-judge panel of the Sixth Circuit Court of Appeals concluded that it has jurisdiction to review challenges to these final rules and the Sixth Circuit subsequently elected not to review this decision en banc but it is currently unknown whether other federal Circuit Courts or state courts currently considering this rulemaking will place their cases on hold, pending the Sixth Circuit’s hearing of the case. Federal and state regulatory agencies can impose administrative, civil and criminal penalties as well as other enforcement mechanisms for non-compliance with discharge permits or other requirements of the CWA and analogous state laws and regulations.

Hydraulic Fracturing

We supply raw frac sand to hydraulic fracturing operators in the oil and natural gas industry. Hydraulic fracturing is an important and increasingly common practice that is used to stimulate production of natural gas and oil from low permeability hydrocarbon bearing subsurface rock formations. The hydraulic fracturing process involves the injection of water, proppants, and chemicals under pressure into the formation to fracture the surrounding rock, increase permeability and stimulate production. Although we do not directly engage in hydraulic fracturing activities, our customers purchase our raw frac sand for use in their hydraulic fracturing activities. Hydraulic fracturing is typically regulated by state oil and natural gas commissions and similar agencies. Some states have adopted, and other states are considering adopting, regulations that could impose new or more stringent permitting, disclosure or well construction requirements on hydraulic fracturing operations. Aside from state laws, local land use restrictions may restrict drilling in general or hydraulic fracturing in particular. Municipalities may adopt local ordinances attempting to prohibit hydraulic fracturing altogether or, at a minimum, allow such fracturing processes within their jurisdictions to proceed but regulating the time, place and manner of those processes. In addition, federal agencies have started to assert regulatory authority over the process and various studies have been conducted or are currently underway by the EPA, and other federal agencies concerning the potential environmental impacts and, in some instances, have pursued voter ballot initiatives of hydraulic fracturing activities. At the same time, certain environmental groups have suggested that additional laws may be needed to more closely and uniformly limit or otherwise regulate the hydraulic fracturing process, and legislation has been proposed by some members of Congress to provide for such regulation.

The adoption of new laws or regulations at the federal or state levels imposing reporting obligations on, or otherwise limiting or delaying, the hydraulic fracturing process could make it more difficult to complete natural gas wells, increase our customers’ costs of compliance and doing business, and otherwise adversely affect the hydraulic fracturing services they perform, which could negatively impact demand for our raw frac sand. In addition, heightened political, regulatory, and public scrutiny of hydraulic fracturing practices could expose us or our customers to increased legal and regulatory proceedings, which could be time-consuming, costly, or result in substantial legal liability or significant reputational harm. We could be directly affected by adverse litigation involving us, or indirectly affected if the cost of compliance limits the ability of our customers to operate. Such costs and scrutiny could directly or indirectly, through reduced demand for our raw frac sand, have a material adverse effect on our business, financial condition and results of operations.

Non-Hazardous and Hazardous Wastes

The Resource Conservation and Recovery Act (“RCRA”) and comparable state laws control the management and disposal of hazardous and non-hazardous waste. These laws and regulations govern the generation, storage, treatment, transfer and disposal of wastes that we generate. In the course of our operations, we generate waste that are regulated as non-hazardous wastes and hazardous wastes, obligating us to comply with applicable standards relating to the management and disposal of such wastes. In addition, drilling fluids, produced waters, and most of the other wastes associated with the exploration, development, and production of oil or natural gas, if properly handled, are currently exempt from regulation as hazardous waste under RCRA and, instead, are regulated under RCRA’s less stringent non-hazardous waste provisions, state laws or other federal laws. However, it is possible that certain oil and natural gas drilling and production wastes now classified as non-hazardous could be classified as hazardous wastes in the future. For

14

example, in May 2016, several non-governmental environmental groups filed suit against the EPA in the U.S. District Court for the District of Columbia for failing to timely assess its RCRA Subtitle D criteria regulations for oil and natural gas wastes, asserting that the agency is required to review its Subtitle D regulations every three years but has not conducted an assessment on those oil and natural gas waste regulations since July 1988. A loss of the RCRA exclusion for drilling fluids, produced waters and related wastes could result in an increase in our customers’ costs to manage and dispose of generated wastes and a corresponding decrease in their drilling operations, which developments could have a material adverse effect on our business.

Site Remediation

The Comprehensive Environmental Response, Compensation, and Liability Act, as amended (“CERCLA”) and comparable state laws impose strict, joint and several liability without regard to fault or the legality of the original conduct on certain classes of persons that contributed to the release of a hazardous substance into the environment. These persons include the owner and operator of a disposal site where a hazardous substance release occurred and any company that transported, disposed of, or arranged for the transport or disposal of hazardous substances released at the site. Under CERCLA, such persons may be liable for the costs of remediating the hazardous substances that have been released into the environment, for damages to natural resources, and for the costs of certain health studies. In addition, where contamination may be present, it is not uncommon for the neighboring landowners and other third parties to file claims for personal injury, property damage and recovery of response costs. We have not received notification that we may be potentially responsible for cleanup costs under CERCLA at any site.

Endangered Species

The Endangered Species Act (“ESA”) restricts activities that may affect endangered or threatened species or their habitats. Similar protections are offered to migratory birds under the Migratory Bird Treaty Act. As a result of a settlement approved by the U.S. District Court for the District of Columbia in 2011, the U.S. Fish and Wildlife Service is required to consider listing numerous species as endangered or threatened under the Endangered Species Act before the completion of the agency’s 2017 fiscal year. Current ESA listings and the designation of previously unprotected species as threatened or endangered in areas where we or our customers operate could cause us or our customers to incur increased costs arising from species protection measures and could result in delays or limitations in our or our customers’ performance of operations, which could adversely affect or reduce demand for our raw frac sand.

Mining and Workplace Safety

Our sand mining operations are subject to mining safety regulation. MSHA is the primary regulatory organization governing raw frac sand mining and processing. Accordingly, MSHA regulates quarries, surface mines, underground mines and the industrial mineral processing facilities associated with and located at quarries and mines. The mission of MSHA is to administer the provisions of the Federal Mine Safety and Health Act of 1977 and to enforce compliance with mandatory miner safety and health standards. As part of MSHA’s oversight, representatives perform at least two unannounced inspections annually for each above-ground facility. To date, these inspections have not resulted in any citations for material violations of MSHA standards.

OSHA has promulgated new rules for workplace exposure to respirable silica for several other industries. Respirable silica is a known health hazard for workers exposed over long periods. The MSHA is expected to adopt similar rules, although they may change as a result of multiple legal challenges against the OSHA rules. Airborne respirable silica is associated with a limited number of work areas at our site and is monitored closely through routine testing and MSHA inspection. If the workplace exposure limit is lowered significantly, we may be required to incur certain capital expenditures for equipment to reduce this exposure. Smart Sand voluntarily adheres to the National Industrial Sand Association’s (NISA) respiratory protection program, and ensures that workers are provided with fitted respirators and ongoing radiological monitoring.

Environmental Reviews

Our operations may be subject to broad environmental review under the National Environmental Policy Act, as amended, (“NEPA”). NEPA requires federal agencies to evaluate the environmental impact of all “major federal actions” significantly affecting the quality of the human environment. The granting of a federal permit for a major development project, such as a mining operation, may be considered a “major federal action” that requires review under NEPA. As part of this evaluation, the federal agency considers a broad array of environmental impacts, including, among other things, impacts on air quality, water quality, wildlife (including threatened and endangered species), historic and archeological resources, geology, socioeconomics, and aesthetics. NEPA also requires the consideration of alternatives to the project. The NEPA review process, especially the preparation of a full environmental impact statement, can be time consuming and expensive. The purpose of the NEPA review process is to inform federal agencies’ decision-making on whether federal approval should be granted for a project and to provide the public with an opportunity to comment on the environmental impacts of a proposed project. Though NEPA requires only that an environmental evaluation be conducted and does not mandate a particular result, a federal agency could decide to deny a permit or impose certain conditions on its approval, based on its environmental review under NEPA, or a third party could challenge the adequacy of a NEPA review and thereby delay the issuance of a federal permit or approval.

15

We are subject to a variety of state and local environmental review and permitting requirements. Some states, including Wisconsin where our current projects are located, have state laws similar to NEPA; thus our development of a new site or the expansion of an existing site may be subject to comprehensive state environmental reviews even if it is not subject to NEPA. In some cases, the state environmental review may be more stringent than the federal review. Our operations may require state-law based permits in addition to federal permits, requiring state agencies to consider a range of issues, many the same as federal agencies, including, among other things, a project’s impact on wildlife and their habitats, historic and archaeological sites, aesthetics, agricultural operations, and scenic areas. Wisconsin has specific permitting and review processes for commercial silica mining operations, and state agencies may impose different or additional monitoring or mitigation requirements than federal agencies. The development of new sites and our existing operations also are subject to a variety of local environmental and regulatory requirements, including land use, zoning, building, and transportation requirements.

Demand for raw frac sand in the oil and natural gas industry drove a significant increase in the production of frac sand. As a result, some local communities expressed concern regarding silica sand mining operations. These concerns have generally included exposure to ambient silica sand dust, truck traffic, water usage and blasting. In response, certain state and local communities have developed or are in the process of developing regulations or zoning restrictions intended to minimize dust from becoming airborne, control the flow of truck traffic, significantly curtail the amount of practicable area for mining activities, provide compensation to local residents for potential impacts of mining activities and, in some cases, ban issuance of new permits for mining activities. To date, we have not experienced any material impact to our existing mining operations or planned capacity expansions as a result of these types of concerns. We would expect this trend to continue as oil and natural gas production increases.

In August 2014, we were accepted as a “Tier 1” participant in Wisconsin’s voluntary “Green Tier” program, which encourages, recognizes and rewards companies for voluntarily exceeding environmental, health and safety legal requirements. Successful Tier 1 participants are required to demonstrate a strong record of environmental compliance, develop and implement an environmental management system meeting certain criteria, conduct and submit annual performance reviews to the Wisconsin Department of Natural Resources, promptly correct any findings of non-compliance discovered during these annual performance reviews, and make certain commitments regarding future environmental program improvements. Our most recent annual report required under the Tier 1 protocol was submitted to the Green Tier Program contact on July 28, 2016.

Employees

As of December 31, 2016, we employed 103 people. None of our employees are subject to collective bargaining agreements. We consider our employee relations to be good.

Executive Officers of the Registrant

Charles E. Young