Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Orchids Paper Products CO /DE | v461281_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Orchids Paper Products CO /DE | v461281_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Orchids Paper Products CO /DE | v461281_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Orchids Paper Products CO /DE | v461281_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Orchids Paper Products CO /DE | v461281_ex23-1.htm |

| EX-21 - EXHIBIT 21 - Orchids Paper Products CO /DE | v461281_ex21.htm |

| EX-10.14 - EXHIBIT 10.14 - Orchids Paper Products CO /DE | v461281_ex10-14.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-32563

ORCHIDS PAPER PRODUCTS COMPANY

| A Delaware corporation | 23-2956944 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

4826 Hunt Street, Pryor, Oklahoma 74361

(Address of principal executive offices)

Registrant's telephone number, including area code: (918) 825-0616

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, $0.001 Par Value | NYSE MKT |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of "accelerated filer", "large accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check One).

| Large Accelerated Filer ¨ Accelerated Filer x Non-accelerated Filer ¨ Smaller Reporting Company ¨ | |

| (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant's common equity held by non-affiliates was approximately $325.2 million as of June 30, 2016. As of March 1, 2017, there were outstanding 10,302,891 shares of common stock, none of which are held in treasury.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for the Registrant's 2017 Annual Meeting of Stockholders (the "Annual Meeting of Stockholders") to be filed within 120 days after December 31, 2016, are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

| i |

Throughout this Form 10-K we "incorporate by reference" certain information from parts of other documents filed with the Securities and Exchange Commission (the "SEC"). The SEC allows us to disclose important information by referring to it in that manner. Please refer to such information.

In Item 1A, we discuss some of the business risks and factors that could cause the Company's actual results to differ materially from those stated in our forward-looking statements and from our historical results.

Overview of Our Business

We are a customer focused, national supplier of high-quality consumer tissue products. We produce bulk tissue paper, known as parent rolls, and convert parent rolls into finished products, including paper towels, bathroom tissue and paper napkins. We generally sell parent rolls not required by our converting operation to other converters. Our integrated manufacturing facilities have flexible production capabilities, which allow us to produce high quality tissue products within short production times for customers in our target regions. This vertical integration, a low variable cost per unit, and the use of operating leverage in securing a higher contribution margin on added volume, we believe, all provide competitive advantage from a cost standpoint. We predominately sell our products under private labels to our core customer base in the “at home” market, which consists primarily of dollar stores, discount retailers and grocery stores that offer limited alternatives across a wide range of products. Our focus historically has been the dollar stores (which are also referred to as discount retailers) and the broader discount retail market because of their overall market growth, consistent order patterns and low number of stock keeping units (“SKUs”). The “at-home” tissue market consists of several quality levels, including a value tier, premium tier and ultra-premium tier. To a lesser extent, we service customers in the “away from home” market. Our core customer base in the “away from home” market consists of companies in the janitorial market and food service market. Most of the products we sell in the “away from home” market are included in the value tier. While we expect to continue to service this market in the near term, we currently do not consider the “away from home” market a growth vehicle for us.

Our facilities have been designed to have the flexibility to produce and convert parent rolls across different product tiers and to use both virgin and recycled fibers to maximize quality and to control costs. We own an integrated facility in Pryor, Oklahoma with modern paper making and converting equipment, which primarily services the central United States. We recently invested approximately $39 million at this facility for a new paper machine and a new converting line. The new paper machine commenced operations in the first quarter of 2015 and provides us with an additional 17,000 tons of parent roll capacity. The new paper machine has improved our margins by reducing our manufacturing cost and providing us additional parent roll capacity, resulting in total capacity of approximately 74,000 tons of parent rolls per year at our Pryor facility. In addition, our new converting line commenced operations in June 2015, adding 12,500 tons of capacity, for a total of 82,500 tons of converting capacity in our Pryor facility. In June 2014, we expanded our geographic presence to service the United States West coast through a strategic transaction with Fabrica de Papel San Francisco, S.A. de C.V. (“Fabrica”), one of the largest tissue manufacturers by capacity in Mexico (the “Fabrica Transaction”). The Fabrica Transaction provided us exclusive access to Fabrica’s U.S. customers, enabling us to further penetrate the region, and the supply agreement (“Supply Agreement”) we entered into with Fabrica has provided access to up to 19,800 tons of product each year at cost.

As part of our strategy to be a national supplier of high quality consumer tissue products, we constructed a world-class integrated tissue operation in Barnwell, South Carolina, which is expected to be operational in the first half of 2017. We believe that this new facility will allow us to better serve our existing customers in the Southeastern United States, while also enabling us to penetrate new customers in this region. The facility is designed to provide highly flexible, cost competitive production across all quality tiers with paper making capacity of between 35,000 and 40,000 tons per year and converting capacity of between 30,000 and 32,000 tons per year. The first converting line was operational by the end of the first quarter of 2016 and the second converting line was operational by the end of the third quarter of 2016. The paper machine will utilize a highly versatile process capable of producing all quality grades, including ultra-premium tier products. We estimate the total costs of the project to be approximately $150 million, which are being financed through a combination of bank debt, the proceeds from our April 2015 follow-on stock offering, financing related to a New Market Tax Credit transaction, and operating cash flows.

| 1 |

Converted Products

The capacity of our twelve converting lines in Pryor, Oklahoma and two converting lines in Barnwell, South Carolina,are highly dependent upon the mix of products produced (e.g. bath tissue versus paper towels versus napkins) and the configuration of products produced (e.g. one roll pack versus multi-roll packs, the size of multi-roll packs (6-count versus 8-count versus 12-count), and sheet counts), and other factors affecting effective operational efficiencies. We have increased our capabilities to emboss, print, and scent our converted products as part of our innovation strategy.

Parent Rolls

We purchase various types of fibers to manufacture bulk rolls of tissue paper, called "parent rolls," which we then convert into a broad line of finished tissue products. The fiber we source to manufacture our parent rolls primarily consists of pre-consumer recycled grades, with a lesser amount consisting of virgin kraft grades. As we continue our efforts to expand our product offerings into the higher quality tiers of the market, the percentage of virgin kraft grades that we purchase will likely increase. Our paper mill in Pryor has a pulping process, which takes recycled fibers and kraft fibers and processes them for use in our three paper machines. Our pulping operation has the ability to selectively process our mixed basket of fibers to achieve maximum quality and to control costs. In 2015, we replaced two of our older paper machines in Pryor with a new paper machine, which increased our tissue paper making capacity from approximately 57,000 tons to approximately 74,000 tons, depending upon the mix of paper grades produced. The new machine also reduced our manufacturing costs, improved product quality and increased manufacturing flexibility.

Generally, our parent roll production operation runs on a 24/7 operating schedule. Parent rolls we produce in excess of converting production requirements are sold, subject to other inventory management considerations, on the open market. Our strategy is to sell all of the parent rolls we manufacture as converted products (such as paper towels, bathroom tissue and napkins), which generally carry higher margins than non-converted parent rolls. Parent rolls are a commodity product and thus are subject to market pricing. We plan to continue to sell any excess parent roll capacity on the open market as long as market pricing is profitable. When converting production requirements exceed paper mill capacity, we supplement our paper making capacity by purchasing parent rolls on the open market, which we believe has an unfavorable impact on our gross profit margin. During the construction phase of our new paper machine, our total tissue paper production was reduced and we were required to purchase parent rolls on the outside market during the fourth quarter of 2014 and first quarter of 2015 to meet our converting requirements. In 2014, we ran all of our paper machines on a full-time basis until we began decommissioning two older paper machines in September of 2014 in preparation of construction and installation of the new paper machine.

Customers

We supply both large national customers and regional customers while targeting high growth regions of the United States and high growth distribution channels. Our largest customers are Dollar General and Family Dollar, which accounted for 50% of our converted product sales in 2016. Our products are a daily consumable item. Therefore, the order stream from our customer base is fairly consistent with limited seasonal fluctuations. Changes in the national economy do not materially affect the market for our products due to their non-discretionary nature and high degree of household penetration; however, discount stores, a principal element of our customer base, may have higher sales during economic downturns. Demand for tissue typically grows in line with overall population, and our customers are typically located in regions of the U.S. where the population is growing faster than the national average. Private label markets have been growing as more consumers watch for value; however, competition between brand names and private labels continue a give and take. We are also introducing and expanding upon our brand-lines.

We focus our sales efforts on areas within approximately 500 miles of our manufacturing facilities, as we believe this radius maximizes our freight cost advantage. Our target region around our Oklahoma facility includes the lower Mid-West. The Fabrica Transaction allowed us to more effectively service customers that are located in the Southwest. We believe our manufacturing facility in Barnwell, South Carolina will help us meet the growing demand in the Southeast. Demand for tissue in the “at home” tissue market has historically been closely correlated to population growth and, as such, performs well in a variety of economic conditions. Our expanded target region has experienced strong population growth in the past years relative to the national average, and these trends are expected to continue.

| 2 |

Our products are sold primarily under our customers’ private labels and, to a lesser extent, under our brand names such as Orchids Supreme, Clean Scents, Tackle®, Colortex®, My Size®, Velvet®, and Big Mopper®. The Fabrica Transaction gave us the exclusive right to sell products under Fabrica’s brand names in the United States, including under the names Virtue®, Truly Green®, Golden Gate Paper® and Big Quality®. All of our converted product net sales are derived through truckload purchase orders from our customers. Parent roll net sales are derived from purchase orders that generally cover a one-month time-period. We do not have supply contracts with any of our customers, which is the standard practice within our industry.

In 2016, we generated net revenue of $164.5 million, of which 96% came from the sale of converted products and 4% came from the sale of parent rolls. Our converted product revenue consisted of 46% from paper towels, 52% from bathroom tissue, and 2% from paper napkins. In 2016, 50% of our converted product net revenue came from two discount retailers. The balance of 2016 converted product net sales came from other discount retailers, grocery stores, grocery wholesalers and cooperatives, convenience stores, janitorial supply companies and companies in the food service market.

Our profitability depends on several key factors, including but not limited to:

| ● | the volume of converted product sales; |

| ● | the cost of fiber used in producing paper; |

| ● | the market price of our products; |

| ● | the efficiency of operations in both our paper mill and converting facilities; and |

| ● | the cost of energy. |

| ● | the costs of labor and maintenance; |

| ● | financial leverage undertaken, inclusive of its impacts upon interest expense and debt service; |

| ● | capital spending requirements, inclusive of impacts upon depreciation; and |

| ● | working capital and other cash flow management |

The private label tissue market is highly competitive, and many discount retail customers are extremely price sensitive. As a result, it is difficult to affect price increases. We expect these competitive conditions to continue.

History

We were formed in April 1998 following the acquisition of our present facilities located in Pryor, Oklahoma and subsequently changed our name to Orchids Paper Products Company. In July 2005, we completed our initial public offering, and in July 2009, we completed a follow-on stock offering. In 2014, in conjunction with the Fabrica Transaction, we acquired certain papermaking and converting assets located in Mexicali, Mexico, as well as Fabrica’s U.S. business. In April 2015, we completed a follow-on stock offering. The proceeds of $32.1 million were used to help fund the construction of our greenfield site in Barnwell, South Carolina.

Competitive Conditions

We believe the principal competitive factors in the markets in which we operate are product-quality attributes, price, customer service, positive customer-relationships, low cost, investing capital wisely in modern equipment and technologies, a strategically located manufacturing footprint, innovation to differentiate our products, an experienced management team with a proven track record, a broad line of product offering, and flexible converting capabilities. This flexibility allows us to meet the particular demands of individual retailers. We believe the product quality attributes that can be produced from our converting lines, new processes on our newest paper machines and other new product development initiatives will allow us to effectively compete in the higher tier markets.

Competition in the tissue market is significantly affected by geographic location, as freight costs represent a material portion of end-product costs. We believe it is generally economically feasible for us to ship within an approximate 900-mile radius of the production site; however, we primarily focus on an approximate 500-mile radius, as we believe this radius maximizes our freight cost advantage over our competitors. In our markets, we believe there are the following significant private-label competitors: Georgia Pacific, Cascades, Sofidel, Clearwater Paper Corporation, Kruger Inc., Resolute Forest Products, Royal Paper, and Asia Pulp and Paper.

The private label tissue market is highly fragmented. Large capital expenditures required to establish a paper mill and converting facility and difficulties in obtaining environmental and local permits for parent roll manufacturing facilities may discourage new entrants into the market. A number of competitors have been announcing their own capacity expansions, principally in structured tissue, intended to service the ultra-premium market. Population growth and other trends may consume the added capacity within the next three years, but the greater impact may be upon the ultra-premium products and their margins, a market that Orchids has only be servicing on the West Coast, prior to constructing its Barnwell, South Carolina, facility. The Barnwell, South Carolina, facility is the only private-label manufacturer, of whom we are aware, using a relatively new ultra-premium tissue capability developed by Valmet that is expected to produce a high-quality structured tissue at a lower cost than the NTT technology announced by others.

| 3 |

Product Overview

We offer our customers an array of private label products, including bathroom tissue, paper towels and paper napkins, across the value, premium and ultra-premium market segments. In 2016, 49% of our converted product case shipments were paper towels, 49% were bathroom tissue and 2% were paper napkins. Of our converted products sold in 2016, 71% were packaged as private label products in accordance with our customers' specifications. The remaining 29% were packaged under our brands and those licensed from Fabrica. We have not actively promoted our brand names and do not believe our brand names have significant market recognition, however through innovation and future promotions, we hope to change this. Our core customer base consists of discount retailers (including dollar stores). We also sell our products to grocery stores, grocery wholesalers and cooperatives, convenience stores, janitorial supply stores and stores in the food service market. Our recent growth has come from providing products from all market tiers to discount retailers, primarily dollar stores, as well as grocery stores. We believe we were among the first to focus on serving customers in the discount retail channel and we have benefited from their increased emphasis on consumables, such as tissue products and the expansion of their private label product line into higher tiers as part of their merchandising strategies. By seeking to provide improved product quality, consistently competitive prices, and superior customer service, we believe we have differentiated ourselves from our competitors and generated momentum with discount retailers. In 2016, approximately 67% of our converted product net sales were derived from sales to the discount retail channel.

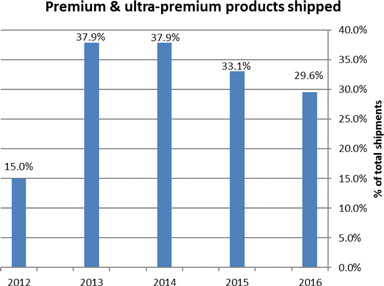

With strategic capital investments and new product development work on our paper machines and converting equipment, we are increasingly able to provide higher quality products and broaden our product offering into the higher tier markets through improved quality of paper, increased packaging configurations, enhanced graphics, improved embossing, and use of scents. The following graph shows shipments of our premium and ultra-premium tier products as a percentage of total cases shipped. Shipments of premium tier and ultra-premium tier products as a percentage of total cases shipped decreased following the Fabrica Transaction in June 2014 as a majority of the products shipped under the Supply Agreement are considered value tier products. Further, demand for our value products has outpaced that for higher grades. The Barnwell, South Carolina, paper mill, when completed in 2017 will have the flexibility to produce all grades of paper whereas Pryor’s mill has the ability to produce value and premium grades.

| 4 |

Our ability to increase net sales depends significantly upon our ability to win private label bids and grow our own brands. We have been bidding, with new and existing retailers, into new distribution channels and into premium and ultra-premium tier markets. We are focusing on diversifying our customer base and reducing customer concentration by implementing private label programs with grocery store customers and new discount retailers.

Our largest customers are Dollar General and Family Dollar. Sales to these two customers represented 50% of our converted product sales in 2016. The following provides additional details regarding our relationships with our largest customers:

Dollar General. Dollar General is our largest customer, accounting for approximately 36% of our net sales in 2016. With annual revenue of $20.4 billion and 13,000 stores in 43 states, Dollar General is the largest small-box discount retailer in the United States. We currently supply value tier products to six of Dollar General's 14 distribution centers and supply premium tier products to all of Dollar General's distribution centers.

Family Dollar. Family Dollar, which became a wholly owned subsidiary of Dollar Tree in 2015, is our second largest customer, accounting for approximately 14% of our net sales in 2016. Family Dollar is a leading discount retailer with more than 8,200 stores in 46 states. Family Dollar currently has eleven distribution centers throughout the United States. We currently supply value tier products to all of Family Dollar's distribution centers and premium tier products to five of Family Dollar's distribution centers.

Sales and Marketing Team

We maintain an internal sales team of seven employees led by our Vice President of Sales and Marketing. Our sales staff directly services seven customers representing approximately 72% of our sales in 2016 and indirectly services all other customers by supervising our network of approximately 40 brokers. Our sales staff and broker network are instrumental in establishing and maintaining strong relationships with our customers. Our management team recognizes that these brokers have relationships with many of our customers, and we work with these brokers in an effort to increase our business with these accounts. Our sales and marketing organization seeks to collaborate with our brokers to leverage these relationships. With each of our key customers, however, our senior management team participates with the independent brokers in all critical customer meetings to establish and maintain direct customer relationships.

A majority of our brokers provide marketing support to their retail accounts, which includes shelf placement of products and in-store merchandising activities to support our product distribution. We generally pay our brokers commissions ranging from 1% to 3% of the sales they generate. Commissions totaling $1.1 million and $1.1 million were paid in the years ended December 31, 2016 and 2015, respectively.

Manufacturing

We own and operate a paper mill, converting facility and a finished goods warehouse, located in Pryor, Oklahoma. Additionally, we own and operate a new converting facility in Barnwell, South Carolina, which began production during 2016, with one converting line beginning operations in first quarter and the second converting line beginning operations in the third quarter. As a result of the Fabrica Transaction, we own papermaking and converting assets in Mexicali, Mexico, which are operated by Fabrica under a lease agreement (“Equipment Lease Agreement”). The following table sets forth our volume, in tons, of parent rolls manufactured, sold, purchased and converted for each of the past five years, including products produced in Mexico by Fabrica subsequent to the Fabrica Transaction in June 2014:

| Year Ended December 31, | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| (In tons) | ||||||||||||||||||||

| Total manufactured | 92,580 | 91,326 | 68,023 | 57,734 | 56,775 | |||||||||||||||

| Sold to third parties | (7,048 | ) | (7,436 | ) | (4,922 | ) | (6,726 | ) | (10,334 | ) | ||||||||||

| Purchased from third parties | 261 | 2,963 | 492 | 1,155 | - | |||||||||||||||

| Converted | 85,793 | 86,853 | 63,593 | 52,163 | 46,441 | |||||||||||||||

| 5 |

Pryor, Oklahoma Facility

Our Oklahoma paper mill, which consists of two facilities totaling 162,000 square feet and a 29,400 square foot paper warehouse, produces parent rolls that are then converted into tissue products at our adjacent converting facility or are sold to other converters. The paper mill facility has three paper machines, which produce paper made primarily from pre-consumer solid bleached sulfate paper, or "SBS paper." We utilize these high grades of recycled fiber along with a basket of other fibers, including virgin bleached pulp kraft fiber such as northern bleached softwood, eucalyptus and northern bleached hardwood, to produce our parent rolls. The mix of fiber used is dependent upon the quality attributes required for the particular grades of product. As we continue our efforts to gain converted product business in the higher quality premium and ultra-premium tier markets, we expect to increase our use of virgin bleached pulp kraft fiber to produce a portion of the paper that will service these higher tier markets. However, new de-inking technologies may permit the use of an increased percentage of recycled fiber in the higher-grade papers in the future.

Generally, our Oklahoma paper mill operates 24 hours a day, 363 days a year, with a two-day annual planned maintenance shutdown. Our parent roll production capacity has typically exceeded the requirements of our converting operation and any excess parent rolls that we have we sell into the open market. However, in September of 2014, we demolished two older paper machines in order to begin construction of the new paper machine, which started up in March 2015. As a result, we purchased parent rolls from third parties during the fourth quarter of 2014 and the first quarter of 2015.

We convert parent rolls into finished tissue products at our converting facility. The converting process, which varies slightly by product category, generally includes embossing, laminating, and perforating or cutting the parent rolls as they are unrolled; pressing two or more plies together in the case of multiple-ply products; printing designs for certain products and cutting into rolls or stacks; wrapping in polyethylene film; the addition of scents to the core when specified, and packing in corrugated boxes or on display-ready pallets for shipment.

In our 300,000 square-foot Oklahoma converting facility, we operate our higher-speed, more flexible converting lines 24 hours a day 7 days a week and utilize our other converting lines as needed. We believe this schedule allows us to provide world-class customer service while optimizing our operating costs. In 2015, we installed another high-speed, flexible converting line. The converting facility produced approximately 8.6 million cases, or 58,000 tons, in 2016, under available capacity due to reduction in demand brought on by increased brand promotions with key retailers.

One of the key advantages of our converting plant is its flexible manufacturing capabilities, which enables us to provide our customers with a variety of package sizes and format options and enables our customers to fit products into particular price categories. We believe our converting facility, together with our low direct labor costs and overhead, combine to produce relatively low overall operating costs.

Our 245,000 square foot finished goods warehouse is located adjacent to our converting facility and has the capacity to hold approximately 600,000 cases of finished product. Our targeted finished goods inventory level is three to four weeks of sales. We utilize third party warehousing from time to time to accommodate changes in inventory carry levels to support customer shipment requirements.

Mexicali, Mexico Assets

The papermaking and converting equipment we own in Mexico, which had a net book value of $6.1 million at December 31, 2016, is operated by Fabrica under the Equipment Lease Agreement entered into in conjunction with the Fabrica Transaction. In accordance with the terms of the transaction, Fabrica has discretion on the most effective manner in which to use these assets. Fabrica may use these assets to provide parent rolls or products under the Supply Agreement or may utilize its other assets to produce products purchased under the Supply Agreement, depending on quality requirements and machine capabilities. The terms of the Supply Agreement allow us to purchase up to 19,800 annual tons of converted products from Fabrica.

Barnwell, South Carolina Facility

We have completed a 300,000 square foot converting facility, housing two converting lines with annual converting capacity between 30,000 and 32,000 tons. A 115,000 square foot paper mill, housing one tissue paper machine with annual paper making capacity between 35,000 and 40,000 tons, remains under construction and is expected to be completed around the end of the first quarter of 2017, with the principal ramp-up expected in the second quarter of 2017. The facility will also include a recycling / de-inking facility, expected to be completed in June of 2017, with a ramp-up principally scheduled for the third quarter of 2017.

| 6 |

The first converting line began producing converted products in the first quarter of 2016, and the second converting line began production late in the third quarter of 2016. The converting facility produced approximately 600,000 cases, or 4,500 tons, in 2016. Construction of the paper machine began in 2015, with completion and ramp-up projected in the first half of 2017.

Distribution

Our products are delivered to our customers in truckload quantities. For our facilities in Oklahoma and South Carolina, most of our customers arrange for transportation of our products to their distribution centers at their cost. In 2016, approximately 77% of our shipments from Pryor and Barnwell were picked up by the customer or their agent. For our remaining shipments, we arrange for third-party freight companies to deliver the products. In 2016, Fabrica arranged for and Orchids paid for third-party freight companies to deliver shipments under the Supply Agreement.

Raw Materials and Energy

In our Oklahoma facility, the principal raw materials used to manufacture our parent rolls are fiber, primarily recycled fibers and to a lesser extent virgin kraft fibers, and water. Currently, recycled fiber accounts for a majority of the fiber used to produce our parent rolls. The pulping process at the paper mill is currently configured to primarily process a particular class of recycled fiber known as SBS paper. Pursuant to an exclusive supply agreement, Dixie Pulp and Paper, Inc. supplies all of our recycled fiber needs under an evergreen contract. Under the terms of the contract, unless either party gives notice at least ninety days prior to the end of the term, the agreement automatically renews each year for another five-year term. This agreement is intended to ensure our long-term supply of quality recycled fiber on terms that we believe are reasonable. If we were unable to purchase a sufficient quantity of SBS paper or if prices materially increased, we could reconfigure our pulping plant to process other forms of fiber, or we could use an alternative type of fiber with our existing pulping process. Reconfiguring our pulping plant would require additional capital expenditures, which could be substantial. Purchasing alternative types of fiber could result in higher fiber costs. We use virgin kraft fibers in the production of premium and ultra- premium tier products. As our business in that market segment grows, we expect our consumption of virgin kraft fiber will increase.

Energy is a key cost factor in our business operations. Electricity for all facilities is being provided by local public utilities. We use natural gas to fire boilers to supply our own steam to our mills. We utilize third-party energy suppliers to purchase all of our natural gas requirements through a combination of a fixed price contract and at-market purchases.

Under a supply contract, a natural gas vendor will supply approximately 80% to 90% of our natural gas requirements at our Pryor facilities through December 2017 as follows:

| Price per | ||||||||||||

| Period | MMBTUs | MMBTU | ||||||||||

| January 2017 | - | March 2017 | 114,850 | $ | 4.06 | |||||||

| April 2017 | - | June 2017 | 117,050 | $ | 4.06 | |||||||

| July 2017 | - | September 2017 | 118,550 | $ | 4.06 | |||||||

| October 2017 | - | December 2017 | 117,055 | $ | 4.06 | |||||||

The remainder of Pryor’s natural gas requirements through December 2017 are expected to be purchased on the open market.

As we begin production at our Barnwell mill in 2017, we will increase our exposure to changes in the price of natural gas. We have entered into a supply agreement for Barnwell whereby all of its natural gas requirements will be met through October of 2018 under a variable rate, established as $0.36 per MMBTU over the then current NYMEX rate.

| 7 |

Backlog

Our tissue products generally require short production times. Typically, we have a backlog of approximately two weeks of sales. As of December 31, 2016, our backlog of customer orders was 615,774 cases, or approximately $8.0 million, of finished converted products and 103 tons of parent rolls, or approximately $0.1 million. As of December 31, 2015, our backlog of customer orders was 638,904 cases, or approximately $8.8 million, of finished converted products and 1,264 tons of parent rolls, or approximately $1.2 million.

Trademarks and Trade Names

We sell some of our tissue products under our various brand names, including Orchids Supreme, Clean Scents, Tackle®, Colortex®, My Size®, Velvet®, and Big Mopper®. We also sell tissue products under brand names licensed from Fabrica, such as, Virtue®, Truly Green®, Golden Gate Paper® and Big Quality®. Our brand names are trademarked with the United States Patent and Trademark Office. We intend to renew our registered trademarks prior to expiration. We do not believe these trademarks are presently significant corporate assets.

Employee and Labor Relations

As of December 31, 2016, we had approximately 406 full-time employees of whom 270 were union hourly employees, 42 were non-union hourly and 94 were non-union salaried employees. Of our employees, approximately 371 were engaged in manufacturing and production and 35 were engaged in sales, clerical and administration. This includes approximately 53 employees in Barnwell, all non-union. Fabrica supplies all labor, material, etc. in Mexicali for production under the Supply Agreement, so we have no employees in Mexico. Our hourly employees in Oklahoma are represented under collective bargaining agreements with the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial & Service Workers International Union Local 5-930 and Local 5-1480 at the mill and converting facility, respectively. In 2015, we negotiated a new three-year contract with our hourly employees at the mill, which expires in February 2018. In 2012, we negotiated a new four-year contract with our hourly employees in the converting plant, which expired on June 25, 2016, at which time it was extended for six months with limited modifications. We are currently operating under the terms of the interim agreement and expect to finalize negotiations for a new contract in the first quarter of 2017. We have not experienced a work stoppage in the last ten years and no material grievance proceedings, material arbitrations, labor disputes, strikes or labor disturbances are currently pending or threatened against us. We believe we have good relations with our union employees at our facilities in Pryor.

Environmental, Health and Safety Matters

Our operations are subject to various environmental, health and safety laws and regulations promulgated by federal, state and local governments. These laws and regulations impose stringent standards on us regarding, among other things, air emissions, water discharges, use and handling of hazardous materials, use, handling and disposal of waste, and remediation of environmental contamination. Since our products are made primarily from SBS paper, we have not made extensive use of chemicals.

The U.S. Environmental Protection Agency (the "EPA") requires that certain pulp and paper mills meet stringent air emissions and waste water discharge standards for toxic and hazardous pollutants. These standards are commonly known as the "Cluster Rules." Our operations are not subject to the current Cluster Rules. If, however, due to a revision in the rules or a change in our operations we were to become subject to the Cluster Rules, we might need to incur significant capital expenditures in order to become compliant.

We believe our manufacturing facilities are in compliance in all material respects with all existing federal, state and local environmental regulations, but we cannot predict whether more stringent air, water and solid waste disposal requirements will be imposed by government authorities in the future. Pursuant to applicable federal, state and local statutes and regulations, we believe that we possess, either directly or through the Oklahoma Ordinance Works Authority ("OOWA") and the City of Barnwell, all of the environmental permits and approvals necessary for the operation of our Oklahoma and South Carolina facilities.

| 8 |

OOWA, the operator of the industrial park in which we operate in Oklahoma, holds the waste water permit that covers our Oklahoma facilities and controls, among other things, the level of biological oxygen demand ("BOD") and total suspended solids ("TSS") we are allowed to send to the OOWA following pre-treatment at our facility. The OOWA reduced our BOD and TSS limits effective with a permit issued August 1, 2007. We have invested capital in recent years to improve the capability and increase capacity in our Oklahoma waste water treatment facility and believe our facility is well suited to meet our current permit limits.

The City of Barnwell (the “City”) holds the waste water permit that covers our South Carolina facilities and controls, among other things, the level of TSS we are allowed to send to the City following pre-treatment at our facility. We believe our South Carolina facility is engineered to well suit our permit limits once our paper machine begins operating in 2017.

Our assets in Mexicali are operated by Fabrica under the Equipment Lease Agreement entered into as part of the Fabrica Transaction. In accordance with the terms of this agreement, Fabrica has indemnified us from and against any and all claims, actions, suits, losses, damage, demands and liabilities of every nature in any way arising directly or indirectly from the use, possession, maintenance, operations or control of the equipment located in Mexico, including environmental matters.

Executive Officers and Key Employees

Set forth below is the name, age as of March 9, 2017, position and a brief account of the business experience of each of our executive officers. Each of Messrs. Schoen and Gloss served in the capacities set forth below as of December 31, 2016 and continue to serve in such capacities as of the date of this report.

| Name | Age | Position | ||

| Jeffrey S. Schoen | 56 | Chief Executive Officer and President, Director | ||

| Rodney D. Gloss | 60 | Chief Financial Officer |

Jeffrey S. Schoen, 56, Chief Executive Officer and President, Director

Mr. Schoen was appointed President and Chief Executive Officer of Orchids Paper Products in November 2013. Mr. Schoen joined the Board of Directors of Orchids Paper Products in February 2007 and served as Chairman from May 2013 to November 2013. Mr. Schoen worked for Cumberland Swan Holdings, Inc., a manufacturer of private label personal care products, from 2002 to 2006, last serving as Executive Vice President and General Manager. Mr. Schoen worked for Paragon Trade Brands, Inc., a manufacturer of private label disposable diapers and training pants, from 1999 to 2002, last serving as Vice President-Operations. Mr. Schoen held various positions when he worked for Kimberly Clark—Infant Care, from 1985 to 1993, last serving as Maintenance & Stores Manager.

Rodney D. Gloss, 60, Chief Financial Officer

Mr. Gloss has been our Chief Financial Officer since September 2016. Prior to joining us, he served as Vice President and Chief Financial Officer for Atna Resources Ltd., a public gold mining company, from 2011 to 2016 and as Corporate Controller of Alacer Gold Corporation, a public international gold mining and exploration company, from 2010 to 2011. Prior to 2010, Mr. Gloss served in senior financial positions with Intrepid Potash, Inc., a publicly traded potash producer, and Timminco Ltd., a public manufacturer, principally of magnesium products. Mr. Gloss is a certified public accountant and holds an MBA from UCLA.

Available Information

We file annual, quarterly and current reports and other information with the Securities and Exchange Commission (the "SEC"). You may read and copy any document we file with the SEC at the SEC's public reference room at 100 F Street, NE, Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for information on the public reference room. The SEC maintains an internet site that contains annual, quarterly and current reports, proxy and information statements and other information that issuers (including Orchids Paper Products Company) file electronically with the SEC. The SEC's internet site is www.sec.gov. In addition, we make available free of charge our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K through our website at www.orchidspaper.com. Such reports are made available as soon as reasonably practicable after they are filed with or furnished to the SEC. Information available on the website is not incorporated by reference and is not deemed to be part of this Form 10-K.

| 9 |

We operate in a changing environment that involves numerous known and unknown risks and uncertainties that could materially affect our operations. The risks, uncertainties and other factors set forth below may cause our actual results, performances or achievements to be materially different from those expressed or implied by our forward-looking statements. If any of these risks or events occur, our business, financial condition or results of operations may be adversely affected. The risk factors set forth below are not exhaustive and are not the only risks that may affect our business. Our business could also be affected by additional risks not currently known to us or described below. We may amend or supplement the risk factors described below from time to time in other reports we file with the SEC in the future.

Risks Related To Our Business

There can be no assurance that we will be able to complete the construction project of our South Carolina facility on schedule or at all. Our failure to realize the benefits that we anticipate from this investment could substantially adversely affect our strategic plans and our financial position and results of operations.

There can be no assurance that the paper mill construction, installation of the paper machines, installation of the recycling equipment, ramp-up of the mill, or ramp-up of the converting production lines at our Barnwell, South Carolina facility will proceed on schedule for the anticipated cost or at all. If the equipment suppliers fail to timely deliver the proper equipment or the construction of the paper mill facility is delayed due to unforeseen issues, we may be unable to complete the construction project and bring the facility to full capacity in a timely and cost effective manner, and as a result our business and projections could be adversely impacted.

We have indebtedness, which subjects us to restrictive covenants relating to the operation of our business.

As a result of closing the Fabrica Transaction, the expansion of our Pryor facility, and the construction of our South Carolina facility, our indebtedness is now substantially greater than our indebtedness prior to these events. At December 31, 2016, we had $142.0 million of indebtedness. In 2017, under the terms of our existing loan agreement, we anticipate making principal payments of $7.6 million and interest payments of more than $6 million. Interest payments are principally variable with our leverage ratio and with LIBOR rates. Operating with this amount of leverage and with variable interest rates may require us to direct a significant portion of our cash flow from operations to service debt, which reduces the funds otherwise available for operations, capital expenditures, payment of dividends, the pursuit of future business opportunities and other corporate purposes. It may also limit our flexibility in planning for or reacting to changes in our business and our industry and may impair our ability to obtain additional financing.

The terms of our loan agreements require us to meet specified financial ratios and other financial and operating covenants, which restrict our ability to incur additional debt, place liens on our assets, make capital expenditures, effect mergers or acquisitions, dispose of assets or pay dividends in certain circumstances. The financial covenants include that we must maintain a certain debt to Adjusted EBITDA ratio for a given period. Adjusted EBITDA is defined in the Credit Agreement, and is as quoted by the Company. Specifically this covenant ratio requires that we maintain, as determined at the end of each of our fiscal quarters, a ratio of (i) the aggregate amount of all debt (exclusive of capitalized loan amortization fees), to (ii) (Adjusted) EBITDA of not less than 5.75:1, 5.5:1, 4.5:1, 4:1 and 3.5:1 for the periods ending March 31, 2017, June 30, 2017, September 30, 2017, December 31, 2017, and March 31, 2018 and each quarter thereafter, respectively. The financial covenants also include that Fixed Charges, as defined in the Credit Agreement, will not exceed a ratio 1.2:1 of an alternative Adjusted EBITDA figure, also defined in the Credit Agreement. If we fail to meet those financial ratios and covenants and our lenders do not waive them, we may be required to pay fees and penalties, and our lenders could accelerate the maturity of our debt and proceed against any pledged collateral, which could force us to seek alternative financing, or otherwise adversely affect our business operations and/or liquidity. If this were to happen, we may be unable to obtain additional financing or it may not be available on terms acceptable to us.

At December 31, 2016, our debt to Adjusted EBITDA ratio was 4.26, and the Fixed Charge Coverage ratio was 1.86. These ratios are highly sensitive to changes in Adjusted EBITDA, and relatively sensitive to levels of debt and Fixed Charges. If we do not comply with these covenants in the current quarter or future quarters, it could result in a default under the Credit Agreement, which may require us to seek and obtain a waiver from our lender, seek other amendments to our Credit Agreement, raise additional equity funds to pay-down debt, limit fixed charges inclusive of dividends, refinance the debt under more favorable terms, and/or undertake some combination of these in order to remain in compliance with the covenants. In such an event, there can be no assurance that we will be able to be successfully undertake such efforts and remain in compliance with the covenants, particularly in the short-term given the sensitivity to unforeseen changes in Adjusted EBITDA. Also, if a default under the Credit Agreement is not cured or waived, the default could result in the acceleration of debt under our Credit Agreement, which could require us to repay debt prior to the date it is otherwise due and could adversely affect our financial condition.

| 10 |

Additionally, our indebtedness is secured by all or substantially all of our assets. Therefore, if we default on any of our debt obligations, it could result in the lenders foreclosing on our assets. In such an event, the lenders' rights to such assets would likely be superior to those of our shareholders.

We face intense competition and if we cannot successfully compete in the marketplace, our business, financial condition and operating results may be materially adversely affected.

The consumer market for private label tissue products is highly competitive. Many of our competitors have greater financial, managerial, sales and marketing and capital resources than we do, which may allow them to respond more quickly to new opportunities or changes in customer requirements. These competitors may also be larger in size or scope than us, which may allow them to achieve greater economies of scale or allow them to better withstand periods of declining prices and adverse operating conditions.

By promoting their branded products, brand-competitors may erode private label tissue sales. Three large companies, Proctor and Gamble, Kimberly-Clark, and Georgia Pacific, have material shares of the brand-market in the United States, and their size may allow them to achieve greater economies of scale or allow them to better withstand adverse competition, declining prices, and adverse operating conditions. As a general business observation, consumers seem to prefer branded products over private-label unless a greater value proposition is perceived, hence competition between brands and private label can be intense.

Our ability to successfully compete depends upon a variety of factors, including:

| ● | aggressive pricing by competitors, which may force us to decrease prices in order to maintain market share; |

| ● | our ability to improve plant efficiencies and operating rates and lower manufacturing costs; |

| ● | the availability, quality and cost of labor and raw materials, particularly recycled fiber; and |

| ● | the cost of energy. |

Our tissue paper products are commodity products, and if we do not maintain competitive prices, we may lose significant market share. Our ability to keep our prices at competitive levels depends in large part on our ability to control our costs. In addition, consolidation among retailers may put additional pressure on us to reduce our prices in order to maintain market share. If we are unable to effectively adjust our cost structure to address such increased competitive pressures, our sales level and profitability could be harmed and our operations could be materially adversely affected.

Increased competition in our region may affect our business.

Orchids has diversified regionally and by developing new channels and products. We anticipate continuing to diversify, but increased competition remains a significant risk. Private label manufacturers have announced greenfield capacity additions, principally in structured tissue lines, and while not generally in the same geographic regions in which we have operated, capacity additions may always affect the existing business and/or delay inroads into new higher-end product and brand markets. Continued or increased competition from brands may also affect our business by diminishing consumer demand for private-label products or delaying our inroads into brand markets.

A substantial percentage of our net sales are attributable to two large customers, any or all of which may decrease or cease purchases at any time.

Our two largest customers, Dollar General and Family Dollar accounted for 36% and 14%, respectively, of our net sales in 2016. We expect that sales to a limited number of customers will continue to account for a substantial portion of our net sales for the foreseeable future. Sales to these customers are made pursuant to purchase orders and not supply agreements. We may not be able to keep our key customers, or these customers may cancel purchase orders or reschedule or decrease their level of purchases from us. Any substantial decrease or delay in sales to one or more of our key customers would harm our sales and financial results. In particular, the loss of sales to one or more distribution centers would result in a sudden and significant decrease in our sales. If sales to current key customers cease or are reduced, we may not obtain sufficient orders from other customers necessary to offset any such losses or reductions.

| 11 |

We primarily use pre-consumer solid bleached sulfate paper, or SBS paper, and, to a lesser extent, virgin kraft fibers to produce parent rolls and any disruption in our supply or increase in the cost of pre-consumer SBS paper or virgin kraft could disrupt our production and harm our ability to produce tissue at competitive prices.

We do not produce any of the fiber we use to produce our parent rolls. We depend heavily on access to sufficient, reasonably priced quantities of fiber to manufacture our tissue products. Our paper mill is configured to convert recycled fiber, specifically SBS paper, and virgin kraft fiber into paper pulp for use in our paper production lines. In 2016, we purchased approximately 79,000 tons of SBS paper at a total cost of $19.1 million compared to 73,000 tons of SBS paper at a total cost of $19.7 million in 2015. In 2016, we purchased approximately 9,000 tons of virgin kraft at a total cost of $5.5 million compared to 11,000 tons of virgin kraft at a total cost of $6.8 million in 2015. Prices for SBS paper and virgin kraft have fluctuated significantly in the past and will likely continue to fluctuate significantly in the future, principally due to market imbalances between supply and demand. In addition, the market price of SBS fiber can also be influenced by market swings in the price of virgin pulp and other fiber grades. If either the available supply of SBS paper and/or virgin kraft diminishes or the demand for SBS paper and/or virgin kraft increases, it could substantially increase our cost of fiber, require us to purchase alternate fiber grades at increased costs, or cause a production slow-down or stoppage until we are able to identify new sources of fiber or reconfigure our pulping plant to process other available forms of paper fiber. We could experience a material adverse effect on our business, financial condition and results of operations should the price or supply of SBS paper and/or virgin kraft be disrupted. Further, we currently obtain all of our recycled fiber from a single supplier, Dixie Pulp and Paper, Inc. ("Dixie") and the majority of our virgin kraft from Itochu Pulp and Paper Corp. (“Itochu”). If our relationship with Dixie and/or Itochu is altered or terminated for any reason, we will have to seek alternative channels to obtain our recycled and virgin kraft fiber, and there can be no assurance that we would be able to make arrangements that adequately meet our needs or on reasonable terms. Furthermore, we may not be able to pass increased fiber costs on to our customers if the market does not allow us to raise the prices of our finished products.

Fabrica’s failure to execute under the Supply Agreement could adversely affect our business.

Under the Supply Agreement with Fabrica de Papel San Francisco, S.A. de C.V. (“Fabrica”), we have the right to purchase up to 19,800 tons of parent rolls and equivalent converting capacity for certain specified product during each twelve-month period following the effective date of the Supply Agreement, which has an initial term of twenty years. Fabrica’s failure to execute under this agreement could result in our inability to service existing customers, thereby reducing sales volumes and profitability. A failure to execute would also harm the relationships we have established with those customers serviced under the Supply Agreement. Furthermore, Fabrica’s failure to execute under this agreement could require us to look for other sources of capacity that are less favorable to us, thereby increasing costs and reducing profits.

Our foreign activities are subject to additional inherent risks.

We currently source a significant amount of our converted products from Mexico, i.e. the 19,800 tons from the Supply Agreement, and we expect to continue to do so. Accordingly, we are subject to political, legal, tax and economic risks such as:

| ● | the effects of local political, labor and economic developments and unrest; |

| ● | significant or abrupt changes in the applicable regulatory or legal climate; |

| ● | significant changes to regulations or laws or the interpretation or enforcement of them, including with respect to tax and profit sharing matters arising out of the use of outsourced suppliers; |

| ● | exchange controls and export restrictions; |

| ● | currency fluctuations, particularly in the exchange rate between the U.S. dollar and the Mexican Peso; |

| ● | failure to maintain compliance with corruption and transparency statutes, including the U.S. Foreign Corrupt Practices Act; |

| ● | laws or policies of foreign countries and the United States affecting trade, investment and taxation; and |

| ● | civil disturbances, war and terrorist actions. |

The occurrence of any one or combination of these events, many of which are beyond our control, could materially adversely affect our financial condition or results of operations.

| 12 |

Increased competition and or deterioration in business conditions could adversely affect our ability to realize anticipated growth from the Fabrica Transaction.

We desired to acquire assets and certain operations from Fabrica with the expectation that the acquisition will result in various benefits for us, including, among others, a competitive manufacturing cost, business and growth opportunities, and increased revenue streams. Increased competition and/or deterioration in business conditions may limit our ability to expand upon Fabrica’s former business. As such, we may not be able to realize the synergies, goodwill, business opportunities and growth prospects anticipated in connection with the Fabrica Transaction.

Changes in the policies of our retail trade customers and increasing dependence on key retailers in developed markets may adversely affect our business.

Our products are sold in a highly competitive marketplace, which is experiencing increased concentration and the growing presence of large format retailers and discounters. With the consolidation of retail trade, especially in developed markets, we are increasingly dependent on key retailers, and some of these retailers, including the large format retailers, may have greater bargaining power than we do. They may use this leverage to demand higher trade discounts or allowances, which could lead to reduced profitability. We may also be negatively affected by changes in the policies of retail trade customers, such as inventory de-stocking, limitations on access to shelf space, and delisting of our products. If we lose a significant customer or if sales of our products to a significant customer materially decrease, our business, financial condition and results of operations may be materially adversely affected.

Excess supply in the markets may reduce the prices we are able to charge for our products.

New paper machines or new converting equipment may be built or idle machines may be activated by other paper companies, which would add more capacity to the tissue markets. Increased production capacity could cause an oversupply resulting in lower market prices for our products and increased competition, either of which could have a material adverse effect on our business, financial condition and operating results.

The availability of and prices for energy will significantly impact our business.

The production of our products requires a significant amount of energy and we rely primarily on natural gas and electricity for our energy needs. The prices of these inputs are subject to change based on many factors that are beyond our control, such as worldwide supply and demand and government regulation. In particular, natural gas prices are highly volatile. Beginning in April 2009 and continuing through December 2017, approximately 70% to 90% of our natural gas requirements at our Pryor facilities were/are covered by a fixed price contract. The remainder of our requirements through December 2017 are expected to be purchased at market rates. Our natural gas requirements at our Barnwell paper mill, when it begins production in the first half of 2017 through October of 2018, are covered by a contract calling for deliveries at $0.36 per MMBTU greater than NYMEX market index (See Item 1—Business, Raw Materials and Energy). Our average price per MMBTU was $3.92 in 2016 compared to $4.11 in 2015 and $5.05 in 2014. During the year ended December 31, 2016, we consumed 515,000 MMBTU of natural gas at a total cost of $2.0 million and 62.1 million kilowatt hours of electricity at a total cost of $3.1 million. If our energy costs increase, our cost of sales will increase, and our operating results may be materially, adversely affected. Furthermore, we may not be able to pass increased energy costs on to our customers if the market does not allow us to raise the prices of our finished products. If price adjustments significantly trail the increase in energy costs or if we cannot effectively hedge against these costs, our operating results may be materially adversely affected.

Failure to purchase the contracted quantity of natural gas may result in financial exposure.

As discussed above in Item 1—Business, Raw Materials and Energy, we have entered into a fixed price contract to purchase approximately 80% to 90% of our natural gas requirements at our Pryor facilities, or 467,505 MMBTUs in 2017, with the remainder purchased on the open market. A significant interruption in our parent roll production due to tornado, fire or other natural disaster, adverse market conditions or mechanical failure could reduce our natural gas requirements to a level below that of our contracted amount. If we are unable to purchase the contracted amounts and the market price at that time is less than the contracted price, we would be obligated under the terms of our agreement to reimburse an amount equal to the difference between the contracted amount and the amount actually purchased multiplied by the difference between our contract price and a price designed in the contract, which typically approximates spot price.

Our exposure to variable interest rates may affect our financial health.

Debt incurred under our existing revolving credit and most of our term loan agreements accrues interest at a variable rate. Specifically, our interest is calculated on LIBOR or the base rate plus an interest rate margin, which is calculated quarterly. As of December 31, 2016, our weighted average bank debt interest rate was 2.64% compared to a weighted average interest rate of 2.17% at December 31, 2015. In addition to varying with the underlying LIBOR rates, most of our rates vary dependent on our debt to Adjusted EBITDA ratio as of the end of each prior quarter. Presently, the maximum margin added to LIBOR when the leverage ratio climbs to 5:1 or higher, is 4.0%. Any increase in the interest rates on our debt would result in a higher interest expense, which would require us to dedicate more of our cash flow from operations to make payments on our debt and reduce funds available to us for our operations and future business opportunities, which could have a material adverse effect on our results of operations. For more information on our liquidity, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources."

| 13 |

We depend on our management team to operate the Company and execute our business plan.

We are highly dependent on the principal members of our management staff, in particular Jeffrey Schoen, our Chief Executive Officer, and Rodney Gloss, our Chief Financial Officer. We have entered into employment arrangements with Jeffrey Schoen and Rodney Gloss, under which their employment is "at will" and, subject to certain conditions, may be terminated by either party at any time, for any reason, with or without notice. The loss of either of our executive officers or our inability to attract and retain other qualified personnel could harm our business and our ability to compete.

Labor interruptions would adversely affect our business.

All of our hourly paid employees in Oklahoma are represented by the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial & Service Workers International Union. The collective bargaining agreement with Local 5-930, which represents the paper mill workers, will expire in February 2018, and the collective bargaining agreement with Local 5-1480, which represents the converting facility workers, expired in June 2016, at which time it was extended for six months with limited modifications. We are currently operating under the terms of the interim agreement and expect to finalize negotiations for a new contract in the first quarter of 2017. Negotiations of new collective bargaining agreements may result in significant increases in the cost of labor or could break down and result in a strike or other disruption of our operations. If any of the preceding were to occur, it could impair our ability to manufacture our products and result in increased costs and/or decreased operating results. In addition, some of our key customers and suppliers are also unionized. Disruption in their labor relations could also have an adverse effect on our business.

Our manufacturing operations may experience shutdowns due to unforeseen operational problems or maintenance outages, which may cause significant lost production which would adversely affect our financial position and results of operations.

We currently manufacture and process the majority of our tissue paper products in Pryor, Oklahoma. Any natural disaster or other serious disruption to our facilities due to tornado, fire or any other calamity could damage our capital equipment or supporting infrastructure and materially impair our ability to manufacture and process tissue paper products. Even a short-term disruption in our production output could damage relations with our customers, causing them to reduce or eliminate the amount of finished products they purchase from us. Any such disruption could result in lost sales, increased costs and reduced profits.

Furthermore, unexpected production disruptions due to any number of circumstances, including shortages of raw materials, disruptions in the availability of transportation, labor disputes and mechanical or process failures, could cause us to shut down our paper mill or our converting operation, or any part thereof.

If any part of our facilities is shut down, it may experience a prolonged start-up period, regardless of the reason for the shutdown. Those start-up periods could range from several days to several months, depending on the reason for the shutdown and other factors. The shutdown of our facilities for a substantial period of time for any reason could have a material adverse effect on our financial position and results of operations.

Our operations require substantial capital, and we may not have adequate capital resources to provide for all of our cash requirements.

Our operations require substantial capital. Expansion or replacement of existing facilities or equipment may require substantial capital expenditures. For example, in 2016 we built two new converting lines in our new Barnwell facility, which cost approximately $43 million. In 2015 in Pryor, we built a new paper machine and installed a new converting line, which cost approximately $39 million. In 2010, we built a new finished goods warehouse and installed a new converting line, which cost approximately $27 million. In 2009 and 2010, under new environmental standards we were required to build a water treatment facility costing approximately $7 million to reduce BOD and TSS from our discharge water. We are currently building a new facility in Barnwell, South Carolina, which is expected to cost approximately $150.0 million, of which we have incurred $119.2 million to date, including the $43 million for the converting lines that began production in 2016. If our capital resources are inadequate to provide for our operating needs, capital expenditures and other cash requirements, this shortfall could have a material adverse effect on our business and liquidity.

| 14 |

Our business is subject to governmental regulations and any imposition of new regulations or failure to comply with existing regulations could involve significant additional expense.

Our operations are subject to various environmental, health and safety laws and regulations promulgated by federal, state and local governments. These laws and regulations impose stringent standards on us regarding, among other things, air emissions, water discharges, use and handling of hazardous materials, use, handling and disposal of waste, and remediation of environmental contamination. Any failure to comply with applicable environmental laws, regulations or permit requirements may result in civil or criminal fines or penalties or enforcement actions. These may include regulatory or judicial orders enjoining or curtailing operations or requiring corrective measures, installing pollution control equipment or remedial actions, any of which could involve significant expenditures. Future development of such laws and regulations may require capital expenditures to ensure compliance. We may discover currently unknown environmental problems or conditions in relation to our past or present operations, or we may face unforeseen environmental liabilities in the future. These conditions and liabilities may require site remediation or other costs to maintain compliance or correct violations of environmental laws and regulations; or result in governmental or private claims for damage to person, property or the environment, any of which could have a material adverse effect on our financial condition and results of operations. In addition, we may be subject to strict liability and, under specific circumstances, joint and several liabilities for the investigation and remediation of the contamination of soil, surface and ground water, including contamination caused by other parties, at properties that we own or operate and at properties where we or our predecessors arranged for the disposal of regulated materials.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud and, as a result, our business could be harmed and current and potential stockholders could lose confidence in us, which could cause our stock price to fall.

We have completed an evaluation of our internal control systems to allow management to report on, and our independent registered public accounting firm to attest to, our internal control over financial reporting in compliance with the management assessment and auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002. In our report under Section 404, which is included in Item 9A of this report, we have concluded that our internal control over financial reporting is effective.

A material weakness or significant deficiency in internal control over financial reporting could materially affect our reported financial results and the market price of our stock could significantly decline. Additionally, adverse publicity related to the disclosure of a material weakness or significant deficiency in internal controls could have a negative effect on our reputation, business and stock price. Although management's assessment and auditor's attestation may provide some level of comfort to the investing public, even the best designed and executed systems of internal controls can only provide reasonable assurance against misreported results and the prevention of fraud.

The parent roll market is a commodity market and subject to fluctuations in demand and pricing.

Overall demand for parent rolls can fluctuate due to changes in the demand for converted products and due to new paper machine start-ups. A significant reduction in demand or increase in paper making capacity can result in an over-supply of parent rolls, which could negatively affect the market price for parent rolls. A significant reduction in parent roll selling prices could reduce our net sales, decrease our profits and cause us to shut down some of our excess paper making capacity.

If we are unable to continue to implement our business strategies, our financial conditions and operating results could be materially affected.

Our future operating results will depend, in part, on the extent to which we can successfully implement our business strategies in a cost effective manner. However, our strategies are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. If we are unable to successfully implement our business strategies, our business, financial condition and operating results could be materially adversely affected.

| 15 |

We may not be able to sell the capacity generated from our converting lines.

We continue to focus on increasing the capacity of our twelve converting lines at our Pryor location. Additionally, the two converting lines at our South Carolina facility are believed to have added an additional 30,000 to 32,000 tons of annual capacity. However, we may not be able to sell enough of our products to fully utilize such capacity. . While the winning of private label bids and new branded sales business, previously announced, are expected to contribute greatly, there are no assurances that the promised volumes will be ordered by the customers. Our strategy includes converting and selling more of our parent roll tonnage as converted product. Converted products sell at a higher price per ton than parent rolls and typically carry a higher margin on a tonnage basis. If we are unable to increase our sales of converted product to fully utilize the capacity from our converting lines, it could result in lost opportunity for increased margins and the need to temporarily or permanently curtail the production of one or more of our converting lines.

Risks Related To Our Common Stock

We may not sustain our quarterly dividend.

On February 21, 2011, our Board of Directors initiated a quarterly cash dividend. We paid dividends totaling $1.40 per share in 2016, 2015 and 2014. However, we may not sustain regular quarterly dividend payments. The declaration and payment of future dividends to holders of our common stock will be at the discretion of our Board of Directors, and will depend upon many factors, including our financial condition, earnings, capital requirements of our businesses, legal requirements, regulatory constraints, industry practice and other factors that the Board of Directors deems relevant. Further, our Credit Agreement contains an indirect restriction on the payment of dividends, as dividends paid are included in calculating the Fixed Charge Coverage Ratio under our Credit Agreement. If payments of dividends would otherwise result in us not meeting the Fixed Charge Coverage Ratio, we will be unable to pay dividends. We cannot assure you that our business will generate cash flow from operations in an amount sufficient to enable us to make distributions on our common stock.

Our certificate of incorporation, bylaws and Delaware law contain provisions that could discourage a takeover.

Our certificate of incorporation, bylaws and Delaware law contain provisions that might enable our management to resist a takeover. These provisions may: