Attached files

| file | filename |

|---|---|

| 8-K - JPM CONFERENCE 15MAR2017 8-K - JETBLUE AIRWAYS CORP | jpminvestor15mar20178-k.htm |

1

1

JP Morgan Aviation, Transportation and

Industrials Conference

MARCH 15, 2017

2

2

SAFE HARBOR

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the

Exchange Act, which represent our management's beliefs and assumptions concerning future events. When used in this document and in

documents incorporated herein by reference, the words “expects,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,”

“may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Forward-looking statements

involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from

those expressed in the forward-looking statements due to many factors, including, without limitation, our extremely competitive industry; volatility

in financial and credit markets which could affect our ability to obtain debt and/or financing or to raise funds through debt or equity issuances;

volatility in fuel prices, maintenance costs and interest rates; our ability to implement our growth strategy; our significant fixed obligations and

substantial indebtedness; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on high daily

aircraft utilization; our dependence on the New York and Boston metropolitan markets and the Northeast Corridor of the United States and the

effect of increased congestion in these markets; our reliance on automated systems and technology; our being subject to potential unionization,

work stoppages, slowdowns and/or increased labor costs; our reliance on a limited number of suppliers; our presence in some international

emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from

information security breaches or cyber-attacks; changes in or additional government regulation; changes in our industry due to other airlines'

financial condition; acts of war or terrorism; global economic conditions or an economic downturn leading to a continuing or accelerated decrease

in demand for air travel; the spread of infectious diseases; adverse weather conditions or natural disasters; and external geopolitical events and

conditions. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it

should be clearly understood that the internal projections, beliefs and assumptions upon which we base our expectations may change prior to the

end of each quarter or year and you should not place undue reliance on these statements. Further information concerning these and other factors

is contained in the Company's Securities and Exchange Commission filings, including but not limited to, the Company's 2016 Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q. In light of these risks and uncertainties, the forward-looking events discussed in this

presentation might not occur. We undertake no obligation to update any forward-looking statements to reflect events or circumstances that may

arise after the date of this presentation.

The following presentation also includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of

1934. We refer you to the reconciliations made available in our Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K (available on

our website at jetblue.com and at sec.gov) and in our December 2016 fourth quarter earnings call, which reconcile the non-GAAP financial

measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with

U.S. GAAP.

3

3

JetBlue: Driving shareholder value

• Prioritizing margin commitment

• New leaders to drive change

• Implementing structural cost initiatives

• Improving operational performance

• Revenue management initiatives

• Unique business model

• 2016 margins show impact of commercial

initiatives launched in 2014

• Six profitable focus cities

• Strong balance sheet

2017: IMPLEMENTING STRATEGIES TO IMPROVE MARGINS AND ROIC

4

4

JetBlue: Committed to shareholder value

1

2

Targeting value-accretive growth opportunities3

Generating shareholder value through revenue initiatives

Structural costs & restyle to drive medium-term earnings improvement

5

5

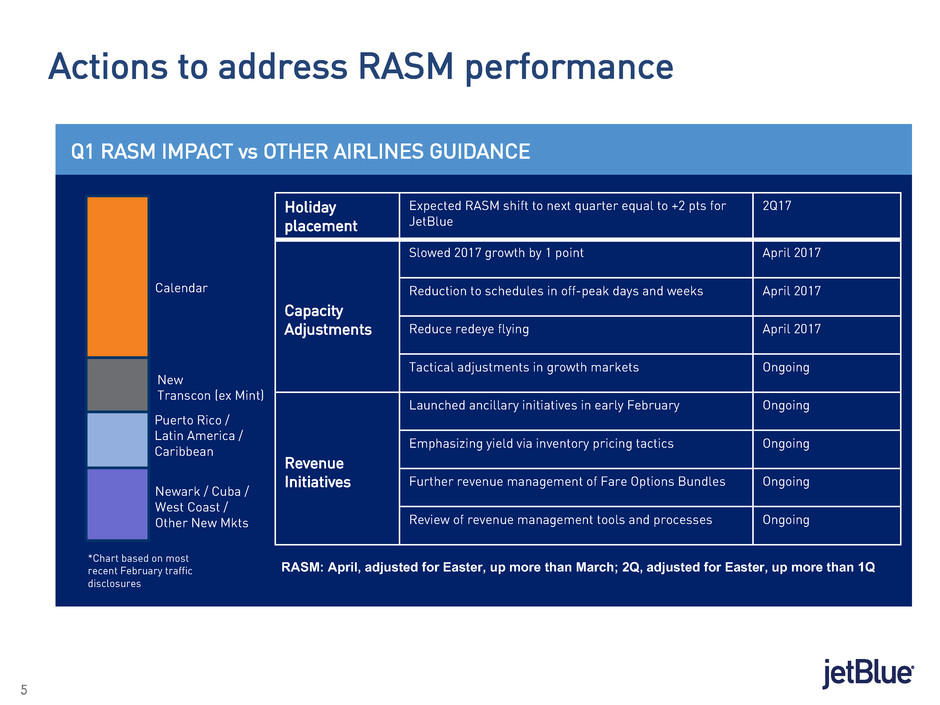

Actions to address RASM performance

New

Transcon (ex Mint)

Puerto Rico /

Latin America /

Caribbean

Newark / Cuba /

West Coast /

Other New Mkts

Holiday

placement

Expected RASM shift to next quarter equal to +2 pts for

JetBlue

2Q17

Capacity

Adjustments

Slowed 2017 growth by 1 point April 2017

Reduction to schedules in off-peak days and weeks April 2017

Reduce redeye flying April 2017

Tactical adjustments in growth markets Ongoing

Revenue

Initiatives

Launched ancillary initiatives in early February Ongoing

Emphasizing yield via inventory pricing tactics Ongoing

Further revenue management of Fare Options Bundles Ongoing

Review of revenue management tools and processes Ongoing

Calendar

Q1 RASM IMPACT vs OTHER AIRLINES GUIDANCE

*Chart based on most

recent February traffic

disclosures

RASM: April, adjusted for Easter, up more than March; 2Q, adjusted for Easter, up more than 1Q

6

6

Revenue and cost initiatives to drive margins, ROIC

and shareholder value

REVENUE INITIATIVES

2014 and beyond

• Fare options

• Co-brand credit cards

• Cabin restyling

• Mint

• Targeted growth

COST INITIATIVES

2017 and beyond

• Structural cost initiatives

• Improving on-time performance

JetBlue’s product and cost combination can produce solid margins and returns

Delivering on revenue initiatives and implementing cost control initiatives

Targeted growth in profitable markets

Sustain above-industry average margins

7

7

2014 revenue initiatives delivering on expectations

Fare options

Cabin restyling

Mint

Credit cards and

partnerships

• ~$60m incremental annual earnings benefit by mid 2019

• Successful implementation

• Improving economics and improved customer experience

• Full A321 fleet completed; A320s begin in 2017

• Best-in-class cabin driving margins

• Improving performance on existing routes

• Growing as a proportion of the network

TOOLKIT INITIATIVES

Diverse

network

Profitable

Focus Cities

Product and

People

Ample Growth

Potential

• Effective platform for customer segmentation

• Dynamic pricing and bundles

• Standardized fees in international markets

OVERVIEW

Achieving $450 million 2014 commitment

8

8

JetBlue: Committed to shareholder value

1

2

Targeting value-accretive growth opportunities3

Generating shareholder value through revenue initiatives

Structural costs & restyle to drive medium-term earnings improvement

9

9

$250-$300m in structural cost savings by 2020

Maintenance

Planning

Crew

Resourcing Model

Parts

Optimization

Crew Resourcing

Model

Corporate

Automation

Customer

Self-Service

Capex

Governance

Tech Ops

Airports

Corporate

TOTAL

Distribution Channel Strategy Digital Offering

COST CATEGORY

EXPECTED 2020

RUN-RATE SAVINGS KEY LEVERS DRIVING SAVINGS

$100-$125m

$55-$65m

$75-$90m

~$20m

$250-$300m

Strategic

Sourcing

10

10

Structural cost program helps mitigate cost escalation

in labor and contracts

2017 CASM EX-FUEL HEADWINDS AND TAILWINDS

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

Stage Length Salaries,

Wages &

Benefits,

MM&R and

Profit Sharing

All Other 2017

(Midpoint of

Guidance)

Unit cost short-term pressures:

• Labor

• Maintenance

• IT agreements

CASM ex-fuel CAGR flat to 1%

(through 2020)

~1.5pt

~1.0pt

~0.0pt

~2.5%

11

11

Operational performance initiatives will help lower

costs

Metric

YoY Variance (% pts)

From A Yr Ago

On-time Departures (D0) +7.6

On-Time Arrivals (A0) +7.3

On-Time DOT Arrivals (A14) +3.7

Turn +7.9

Improvements on performance metrics

• Reduce overtime expenses

• Reduce interrupted trip costs

• Reduce voucher compensation

ACHIEVING VISIBLE YEAR-OVER-YEAR IMPROVEMENTS ON METRICS

12

12

JetBlue: Committed to shareholder value

1

2

Targeting value-accretive growth opportunities3

Generating shareholder value through revenue initiatives

Structural costs & restyle to drive medium-term earnings improvement

13

13

41%

32%

25%

NYC Ft. Lauderdale Boston

Focused on ROIC-accretive network investments

Growth targeted on 3 focus cities

• Over last 5 years, over 98% of our growth has

been in three of our six focus cities

Focused on high-return opportunities

• Mint: High ROIC tool that broadens our

customer reach

• NYC: Using A321s to better leverage high

value geography

• Boston: Targeted growth plan paying

dividends

• Ft. Lauderdale: Strong potential for profitable

growth

INCREMENTAL ASMs, 2011-2016

14

14

RASM (top 3 carriers)

Source: US DOT OD1B, T100, Form 41 for YE2Q16

Fort Lauderdale: Strong revenue premium with

local focus

PERCENT LOCAL TRAFFIC (top 3 carriers)

5.00

7.00

9.00

11.00

13.00

B6 WN NKJBLU LUV SAVE

Note: Stage adjusted. Unshaded area reflects estimated ancillary revenue

REVENUE PREMIUMS SHOW THAT OUR PRODUCT HAS HIGH POTENTIAL

• Revenue premiums vs. competition

• Room for growth in the market

• More than an inbound leisure market

• VFR, leisure, business

• Adding Mint service to West Coast flights

15

15

JetBlue: Driving shareholder value

2017: IMPLEMENTING STRATEGIES TO IMPROVE MARGINS AND ROIC

• Prioritizing margin commitment

• New leaders to drive change

• Implementing structural cost initiatives

• Improving operational performance

• Revenue management initiatives

• Unique business model

• 2016 margins show impact of commercial

initiatives launched in 2014

• Six profitable focus cities

• Strong balance sheet