Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - FS Energy & Power Fund | a2231327zex-32_2.htm |

| EX-32.1 - EX-32.1 - FS Energy & Power Fund | a2231327zex-32_1.htm |

| EX-31.2 - EX-31.2 - FS Energy & Power Fund | a2231327zex-31_2.htm |

| EX-31.1 - EX-31.1 - FS Energy & Power Fund | a2231327zex-31_1.htm |

| EX-20.1 - EX-20.1 - FS Energy & Power Fund | a2231327zex-20_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

FOR THE TRANSITION PERIOD FROM TO |

||

COMMISSION FILE NUMBER: 814-00841

FS Energy and Power Fund

(Exact name of registrant as specified in its charter)

| Delaware | 27-6822130 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

201 Rouse Boulevard |

||

| Philadelphia, Pennsylvania | 19112 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (215) 495-1150

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Shares of Beneficial Interest, par value

$0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for shorter period that the registrant was required to submit and post such files). Yes o No o.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "accelerated filer," "large accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý.

There is no established market for the Registrant's common shares of beneficial interest. The Registrant closed the public offering of its common shares in November 2016. The last offering price at which the registrant issued shares in its public offering was $8.35 per share. Since the registrant closed its public offering, it has continued to issue shares pursuant to its distribution reinvestment plan. The most recent price at which the registrant has issued shares pursuant to the distribution reinvestment plan was $7.75 per share.

There were 441,963,332 shares of the Registrant's common shares of beneficial interest outstanding as of March 1, 2017.

Documents Incorporated by Reference

Portions of the registrant's definitive Proxy Statement relating to the Registrant's 2017 Annual Meeting of Shareholders, to be filed with the Securities and Exchange Commission within 120 days following the end of the Registrant's fiscal year, are incorporated by reference in Part III of this annual report on Form 10-K as indicated herein.

FS ENERGY AND POWER FUND

FORM 10-K FOR THE FISCAL YEAR

ENDED DECEMBER 31, 2016

TABLE OF CONTENTS

Many of the amounts and percentages presented in Part I have been rounded for convenience of presentation and all dollar amounts, excluding per share amounts, are presented in thousands unless otherwise noted.

FS Energy and Power Fund, or the Company, which may also be referred to as "we," "us" or "our," was organized in September 2010 and commenced investment operations in July 2011. We are an externally managed, non-diversified, closed-end management investment company that has elected to be regulated as a business development company, or BDC, under the Investment Company Act of 1940, as amended, or the 1940 Act. In addition, we have elected to be treated for U.S. federal income tax purposes, and intend to qualify annually, as a regulated investment company, or RIC, under Subchapter M of the Internal Revenue Code of 1986, as amended, or the Code. As of December 31, 2016, we had total assets of approximately $4.3 billion.

We are managed by FS Investment Advisor, LLC, or FS Advisor, a registered investment adviser under the Investment Advisers Act of 1940, as amended, or the Advisers Act, which oversees the management of our operations and is responsible for making investment decisions with respect to our portfolio. FS Advisor has engaged GSO Capital Partners LP, or GSO, to act as our investment sub-adviser. GSO assists FS Advisor in identifying investment opportunities and makes investment recommendations for approval by FS Advisor, according to guidelines set by FS Advisor. GSO, a registered investment adviser under the Advisers Act, oversaw approximately $93.3 billion in assets under management as of December 31, 2016. GSO is the credit platform of The Blackstone Group L.P., or Blackstone, a leading global alternative asset manager and provider of financial advisory services.

Our investment policy is to invest, under normal circumstances, at least 80% of our total assets in securities of energy and power, or Energy, companies. This investment policy may not be changed without at least 60 days' prior notice to holders of our common shares of any such change. We consider Energy companies to be those companies that engage in the exploration, development, production, gathering, transportation, processing, storage, refining, distribution, mining, generation or marketing of natural gas, natural gas liquids, crude oil, refined products, coal or power, including those companies that provide equipment or services to companies engaged in any of the foregoing. We concentrate our investments on debt securities in Energy companies that we believe have, or are connected to, a strong infrastructure and/or underlying asset base so as to enhance collateral coverage and downside protection for our investments. We may also make select equity investments in certain Energy companies meeting our investment objectives of current income generation and long-term capital appreciation. Our primary areas of focus will be the upstream, midstream, power and service and equipment sub-sectors of the Energy industry; however, we broadly define our "Energy Investment Universe" as follows:

- •

- Upstream—businesses that find, develop and extract energy

resources, including natural gas, crude oil and coal, from onshore and offshore reservoirs;

- •

- Midstream—businesses that gather, process, store and

transmit energy resources and their by-products, including businesses that own pipelines, gathering systems, gas processing plants, liquefied natural gas facilities and other energy infrastructure;

- •

- Downstream—businesses that refine, market and distribute

refined energy resources, such as customer-ready natural gas, propane and gasoline, to end-user customers;

- •

- Power—businesses engaged in the generation, transmission

and distribution of power and electricity or in the production of alternative energy; and

- •

- Service and Equipment—businesses that provide services and/or equipment to aid in the exploration and production of oil and natural gas, including seismic, drilling, completion and production activities, as well as those companies that support the operations and development of power assets.

1

Our investment objectives are to generate current income and long-term capital appreciation. We seek to meet our investment objectives by:

- •

- utilizing the experience and expertise of FS Advisor and GSO in sourcing, evaluating and structuring transactions;

- •

- employing a conservative investment approach focused on current income and long-term investment performance;

- •

- focusing primarily on debt investments in a broad array of private Energy companies within the United States;

- •

- making select equity investments in certain Energy companies that have strong growth potential;

- •

- investing primarily in established, stable enterprises with positive cash flow and strong asset and collateral coverage so as to limit the risk

of potential principal loss; and

- •

- maintaining rigorous portfolio monitoring in an attempt to anticipate and pre-empt negative events within our portfolio.

Our portfolio is comprised primarily of income-oriented securities, which refers to debt securities and income-oriented preferred and common equity interests, of privately-held Energy companies within the United States. We intend to weight our portfolio towards senior and subordinated debt. In addition to investments purchased from dealers or other investors in the secondary market, we expect to invest in primary market transactions and directly originated investments as this will provide us with the ability to tailor investments to best match a project's or company's needs with our investment objectives. Our portfolio may also be comprised of select income-oriented preferred or common equity interests, which refers to equity interests that pay consistent, high-yielding dividends, that we believe will produce both current income and long-term capital appreciation. These income-oriented preferred or common equity interests may include interests in master limited partnerships, or MLPs. MLPs are entities that (i) are structured as limited partnerships or limited liability companies, (ii) are publicly traded, (iii) satisfy certain requirements to be treated as partnerships for U.S. federal income tax purposes and (iv) primarily own and operate midstream and upstream Energy companies. In connection with certain of our debt investments or any restructurings of these debt investments, we may on occasion receive equity interests, including warrants or options, as additional consideration or otherwise in connection with a restructuring. In addition, a portion of our portfolio may be comprised of minority interests in the form of common or preferred equity or other equity-related securities, such as rights and warrants that may be converted into or exchanged for common stock or other equity or the cash value of common stock or other equity, in our target companies, as well as derivatives, including total return swaps and credit default swaps. Depending on market conditions, we may increase or decrease our exposure to less senior portions of the capital structure or other more opportunistic investments. We expect that the size of our individual investments will generally range between $5 million and $75 million each, although investments may vary proportionately as the size of our capital base changes and will ultimately be at the discretion of FS Advisor, subject to oversight by our board of trustees.

To seek to enhance our returns, we intend to employ leverage as market conditions permit and at the discretion of FS Advisor, but in no event will leverage employed exceed 50% of the value of our assets, as required by the 1940 Act.

During the year ended December 31, 2016, we made investments in portfolio companies totaling $1,488,179. During the same period, we sold investments for proceeds of $680,239 and received principal repayments of $544,813. As of December 31, 2016, our investment portfolio, with a total fair value of $3,910,440 (23% in first lien senior secured loans, 22% in second lien senior secured loans, 10% in senior secured bonds, 27% in subordinated debt and 18% in equity/other), consisted of interests in 84 portfolio companies. The portfolio companies that comprised our portfolio as of such date had an average annual earnings before interest, taxes, depreciation and amortization, or EBITDA, of approximately $304.3 million. As of December 31, 2016, the investments in our portfolio were purchased at a weighted average price of 97.2% of par value and our estimated gross annual portfolio yield, prior to leverage (which represents the expected yield to be generated by us on our investment portfolio based on the composition of our portfolio as of such date), was 8.8% based upon the amortized cost of our investments.

2

Based on our annual cash distribution amount of $0.7085 per share and our final public offering price of $8.35 per share, the annualized distribution rate to shareholders as of December 31, 2016 was 8.49%. Based on our annual cash distribution amount of $0.7085 per share and the price at which we issued shares pursuant to our distribution reinvestment plan of $7.70 per share, the annualized distribution rate to shareholders as of December 31, 2016 was 9.20%. The annualized distribution rate to shareholders, in each case, is expressed as a percentage equal to the annual cash distribution amount per share, divided by our final public offering price per share or our distribution reinvestment price, as applicable, as of the dates indicated above.

Our estimated gross portfolio yield may be higher than an investor's yield on an investment in our common shares. Our estimated gross portfolio yield does not reflect operating expenses that may be incurred by us. Our estimated gross portfolio yield and annualized distribution rate to shareholders do not represent actual investment returns to shareholders, are subject to change and, in the future, may be greater or less than the rates set forth above. See "Item 1A. Risk Factors" for a discussion of the uncertainties, risks and assumptions associated with these statements.

As a BDC, we are subject to certain regulatory restrictions in making our investments. For example, BDCs generally are not permitted to co-invest with certain affiliated entities in transactions originated by the BDC or its affiliates in the absence of an exemptive order from the U.S. Securities and Exchange Commission, or SEC. However, BDCs are permitted to, and may, simultaneously co-invest in transactions where price is the only negotiated term. In an order dated June 4, 2013, the SEC granted exemptive relief permitting us, subject to the satisfaction of certain conditions, to co-invest in certain privately negotiated investment transactions with certain affiliates of FS Advisor, including FS Investment Corporation, FS Investment Corporation II, FS Investment Corporation III, FS Investment Corporation IV and any future BDCs that are advised by FS Advisor or its affiliated investment advisers, or collectively, our co-investment affiliates. We believe this relief has and may continue to enhance our ability to further our investment objectives and strategy. We believe this relief may also increase favorable investment opportunities for us, in part, by allowing us to participate in larger investments, together with our co-investment affiliates, than would be available to us if such relief had not been obtained. Because we did not seek exemptive relief to engage in co-investment transactions with GSO and its affiliates, we will continue to be permitted to co-invest with GSO and its affiliates only in accordance with existing regulatory guidance (e.g., where price is the only negotiated term).

While a BDC may list its shares for trading in the public markets, we have currently elected not to do so. We believe that a non-traded structure is more appropriate for the long-term nature of the assets in which we invest. This structure allows us to operate with a long-term view, similar to that of other types of private investment funds, instead of managing to quarterly market expectations. Furthermore, while our distribution reinvestment and share repurchase prices are subject to adjustment in accordance with the 1940 Act and our share pricing policy, because our common shares will not be listed on a national securities exchange, our shareholders will not be subject to the daily share price volatility associated with the public markets. However, the net asset value of our common shares may be volatile.

Public Offering of Shares

In November 2016, we closed our continuous public offering of shares to new investors. We sold 449,543,498 common shares (as adjusted for share distributions) for gross proceeds of $4,362,119, including common shares issued under our distribution reinvestment plan, in our continuous public offering.

Share Repurchase Program

To provide our shareholders with limited liquidity, we intend to continue to conduct quarterly tender offers pursuant to our share repurchase program. During the year ended December 31, 2016, we repurchased 9,685,608 common shares at an average price per share of $6.949 for aggregate consideration totaling $67,307. During the year ended December 31, 2015, we repurchased 4,833,902 common shares at an average price per share of $8.277 for aggregate consideration totaling $40,009. During the year ended December 31, 2014, we repurchased 1,041,178 common shares at an average

3

price per share of $9.856 for aggregate consideration totaling $10,262. On January 3, 2017, we repurchased 2,239,480 common shares at $7.700 per share for aggregate consideration totaling $17,244.

We currently intend to limit the number of common shares to be repurchased during any calendar year to the number of common shares we can repurchase with the proceeds we receive from the issuance of common shares under our distribution reinvestment plan. At the discretion of our board of trustees, we may also use cash on hand, cash available from borrowings and cash from the liquidation of securities investments as of the end of the applicable period to repurchase common shares. In addition, we will limit the number of common shares to be repurchased in any calendar year to 10% of the weighted average number of common shares outstanding in the prior calendar year, or 2.5% in each quarter, though the actual number of common shares that we offer to repurchase may be less in light of the limitations listed above.

On October 13, 2016, we amended the terms of our share repurchase program, or the amended share repurchase program, which was first effective for our quarterly repurchase offer for the fourth quarter of 2016. Prior to amending the share repurchase program, we offered to repurchase common shares at a price equal to 90% of the offering price in effect on the date of repurchase. Under the amended share repurchase program, we intend to offer to repurchase common shares at a price equal to the price at which common shares are issued pursuant to our distribution reinvestment plan on the distribution date coinciding with the applicable share repurchase date. The price at which common shares are issued under our distribution reinvestment plan is determined by our board of trustees or a committee thereof, in its sole discretion, and will be (i) not less than the net asset value per common share as determined in good faith by our board of trustees or a committee thereof, in its sole discretion, immediately prior to the payment date of the distribution and (ii) not more than 2.5% greater than the net asset value per common share as of such date. Our board of trustees may amend, suspend or terminate the share repurchase program at any time upon 30 days' notice.

Distributions

Effective November 30, 2016 and subject to applicable legal restrictions and the sole discretion of our board of trustees, we intend to authorize, declare and pay ordinary cash distributions on a monthly basis. From time to time, we may also pay special interim distributions in the form of cash or common shares at the discretion of our board of trustees. The timing and amount of any future distributions to shareholders are subject to applicable legal restrictions and the sole discretion of our board of trustees.

The following table reflects the cash distributions per share that we have declared and paid on our common shares during the years ended December 31, 2016, 2015 and 2014:

| |

Distribution | ||||||

|---|---|---|---|---|---|---|---|

| For the Year Ended December 31, | Per Share | Amount | |||||

2014 |

$ | 0.6882 | $ | 163,043 | |||

2015 |

$ | 0.7085 | $ | 238,833 | |||

2016 |

$ | 0.7085 | $ | 288,982 | |||

On December 23, 2016, January 30, 2017 and February 27, 2017, our board of trustees declared regular monthly cash distributions for January 2017, February 2017 and March 2017, respectively. These distributions have been or will be paid monthly to shareholders of record as of monthly record dates previously determined by our board of trustees in the amount of $0.059042 per share.

For additional information regarding our distributions and our distribution reinvestment plan, including certain related tax considerations, see "Item 5. Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities—Distributions" and "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—RIC Status and Distributions."

About FS Advisor

FS Advisor is a subsidiary of our affiliate, Franklin Square Holdings, L.P. (which does business as FS Investments), or FS Investments, a national sponsor of alternative investments designed for the individual investor. FS Advisor is registered as an investment adviser with the SEC under the Advisers

4

Act and is led by substantially the same personnel that form the investment and operations team of FB Income Advisor, LLC, FSIC II Advisor, LLC, FSIC III Advisor, LLC, FSIC IV Advisor, LLC, FS Global Advisor, LLC and FS Energy Advisor, LLC, FB Income Advisor, LLC, FSIC II Advisor, LLC, FSIC III Advisor, LLC and FSIC IV Advisor, LLC are registered investment advisers that manage FS Investments' four other affiliated BDCs, FS Investment Corporation, FS Investment Corporation II, FS Investment Corporation III and FS Investment Corporation IV, respectively. FS Global Advisor, LLC is a registered investment adviser that manages FS Investments' affiliated closed-end management investment company, FS Global Credit Opportunities Fund. FS Energy Advisor, LLC is a registered investment adviser that manages FS Investments' affiliated closed-end management investment company which operates as an interval fund, FS Energy Total Return Fund.

In addition to managing our investments, the managers, officers and other personnel of FS Advisor also currently manage the following entities through affiliated investment advisers:

| Name | Entity | Investment Focus | Gross Assets(1) |

|||||

|---|---|---|---|---|---|---|---|---|

FS Investment Corporation |

BDC | Primarily invests in senior secured loans, second lien secured loans and, to a lesser extent, subordinated loans of private U.S. companies. | $ | 4,110,071 | ||||

FS Investment Corporation II |

BDC | Primarily invests in senior secured loans, second lien secured loans and, to a lesser extent, subordinated loans of private U.S. companies. | $ | 4,967,858 | ||||

FS Investment Corporation III |

BDC | Primarily invests in senior secured loans, second lien secured loans and, to a lesser extent, subordinated loans of private U.S. companies. | $ | 3,662,739 | ||||

FS Investment Corporation IV |

BDC | Primarily invests in senior secured loans, second lien secured loans and, to a lesser extent, subordinated loans of private U.S. companies. | $ | 176,089 | ||||

FS Global Credit Opportunities Fund(2) |

Closed-end management investment company | Primarily invests in secured and unsecured floating and fixed rate loans, bonds and other types of credit instruments. | $ | 1,971,450 | ||||

FS Energy Total Return Fund(3) |

Closed-end management investment company | Primarily invests in the equity and debt securities of natural resource companies. | — | |||||

- (1)

- As

of December 31, 2016.

- (2)

- Two

funds affiliated with FS Global Credit Opportunities Fund, FS Global Credit Opportunities Fund—T and FS Global Credit Opportunities Fund ADV, or

together, the FSGCOF Offered Funds, which have the same investment objectives and strategy as FS Global Credit Opportunities Fund, currently offer common shares of beneficial interest to the public

and invest substantially all of the net proceeds of their respective offerings in FS Global Credit Opportunities Fund. Two other funds affiliated with FS Global Credit Opportunities Fund, FS Global

Credit Opportunities Fund—A and FS Global Credit Opportunities Fund—D, or together, the FSGCOF Closed Funds, which also have the same investment objectives and strategy as FS

Global Credit Opportunities Fund, closed their respective continuous public offerings to new investors in April 2016.

- (3)

- The managers, officers and other personnel of FS Advisor will also manage FS Energy Total Return Fund, which as of December 31, 2016 had not commenced investment operations through an affiliated investment adviser, FS Energy Advisor, LLC.

Our chairman, president and chief executive officer, Michael C. Forman, has led FS Advisor since its inception. In 2007, he co-founded FS Investments with the goal of delivering alternative investment solutions, advised by what FS Investments believes to be best-in-class institutional asset managers, to individual investors nationwide. In addition to leading FS Advisor, Mr. Forman currently serves as chairman, president and chief executive officer of FB Income Advisor, LLC, FSIC II Advisor, LLC, FS Investment Corporation II, FSIC III Advisor, LLC, FS Investment Corporation III, FSIC IV Advisor, LLC, FS Investment Corporation IV, FS Global Advisor, LLC, FS Global Credit Opportunities Fund, FSGCOF Offered Funds, FS Energy Advisor, LLC and FS Energy Total Return Fund. Mr. Forman also currently serves as chairman and chief executive officer of FS Investment Corporation.

FS Advisor's senior management team has significant experience in private lending and private equity investing, and has developed an expertise in using all levels of a firm's capital structure to produce income-generating investments, while focusing on risk management. The team also has extensive knowledge of the managerial, operational and regulatory requirements of publicly registered alternative asset entities, such as BDCs. We believe that the active and ongoing participation by FS Investments and its affiliates in the credit markets, and the depth of experience and disciplined investment approach of FS Advisor's management team, will allow FS Advisor to successfully execute our investment strategy.

5

All investment decisions require the unanimous approval of FS Advisor's investment committee, which is currently comprised of Mr. Forman, Gerald F. Stahlecker, Zachary Klehr and Sean Coleman. Our board of trustees, including a majority of independent trustees, oversees and monitors our investment performance and annually reviews the investment advisory and administrative services agreement and the investment sub-advisory agreement to determine, among other things, whether the fees payable under such agreements are reasonable in light of the services provided.

About GSO

From time to time, FS Advisor may enter into sub-advisory relationships with registered investment advisers that possess skills that FS Advisor believes will aid it in achieving our investment objectives. FS Advisor has engaged GSO to act as our investment sub-adviser. GSO assists FS Advisor in identifying investment opportunities and makes investment recommendations for approval by FS Advisor, according to guidelines set by FS Advisor. GSO also serves as the investment sub-adviser to FS Global Credit Opportunities Fund. In addition, GSO's wholly-owned subsidiary, GSO/Blackstone Debt Funds Management LLC, or GDFM, serves as the investment sub-adviser to FS Investment Corporation, FS Investment Corporation II, FS Investment Corporation III and FS Investment Corporation IV. GSO is a Delaware limited partnership with principal offices located at 345 Park Avenue, New York, New York 10154.

GSO is the credit platform of Blackstone, a leading global alternative asset manager. As of December 31, 2016, GSO and its affiliates, excluding Blackstone, managed approximately $93.3 billion of assets across multiple strategies and investment types within the leveraged finance marketplace, including leveraged loans, high-yield bonds, distressed, mezzanine and private equity. GSO has extensive experience investing in Energy companies. From 2005 through 2016, funds managed by GSO have invested over $17 billion in Energy companies. As investment sub-adviser, GSO utilizes its experience in Energy investing and makes recommendations to FS Advisor in a manner that is consistent with its existing investment and monitoring processes.

Blackstone is a leading global alternative asset manager and provider of financial advisory services. It is one of the largest independent managers of private capital in the world, with assets under management of approximately $366.6 billion as of December 31, 2016. Blackstone's alternative asset management businesses include the management of private equity funds, real estate funds, funds of hedge funds, credit-oriented funds, collateralized loan obligation vehicles, separately managed accounts and publicly-traded closed-end mutual funds. Blackstone is a publicly-traded limited partnership that has common units which trade on the New York Stock Exchange LLC under the ticker symbol "BX." Information about Blackstone and its various affiliates, including certain ownership, governance and financial information, is disclosed in Blackstone's periodic filings with the SEC, which can be obtained from Blackstone's website at http://ir.blackstone.com or the SEC's website at www.sec.gov. Information contained on Blackstone's website and in Blackstone's filings with the SEC are not incorporated by reference into this annual report on Form 10-K and shareholders should not consider that information to be part of this annual report on Form 10-K.

Market Opportunity

With oil prices benefiting from the Organization of the Petroleum Exporting Countries' decision to cut production in November 2016, performance of energy high yield bonds and energy senior secured loans remained positive during the fourth quarter of 2016. Largely range-bound between $40 and $50 per barrel throughout November 2016, oil prices ended 2016 at a 17-month high as the agreed-to 1.8 million barrel-per-day output cut was set to take effect. The "spread-to-worst" of the Bank of America Merrill Lynch High Yield Energy Index, or the Energy Index, which measures the difference from the Energy Index's worst performing security to Treasuries, tightened over the quarter ended December 31, 2016 from 643 basis points as of September 30, 2016 to 454 basis points as of December 31, 2016. Overall, the Energy Index ended the fourth quarter of 2016 with a yield-to-worst of 6.4% after reaching levels earlier in the year not seen since November 2008.

West Texas Intermediate (WTI) crude prices, which began the year at $36.76 per barrel, reached an eleven month high on June 8, 2016 and ended at $53.72 per barrel as of December 31, 2016. The average par weighted price of the Energy Index began the year at $64.89, reached a year-to-date low of

6

$52.17 on February 11, 2016 and significantly rebounded to $97.83 as of December 31, 2016. Since December 31, 2016, OPEC's high deal compliance rate continued to push oil prices higher, though rising inventory levels remain an overhang for the industry.

Characteristics of and Risks Related to Investments in Private Companies

We invest primarily in income-oriented securities of privately-held Energy companies within the United States. Investments in private companies pose significantly greater risks than investments in public companies. First, private companies have reduced access to the capital markets, resulting in diminished capital resources and ability to withstand financial distress. As a result, these companies, which may present greater credit risk than public companies, may be unable to meet the obligations under their debt and equity securities that we hold. Second, the investments themselves may often be illiquid. The securities of many of the companies in which we invest are not publicly traded or actively traded on the secondary market and are, instead, traded on a privately negotiated over-the-counter secondary market for institutional investors. In addition, our directly originated investments generally will not be traded on any secondary market, and a trading market for such investments may not develop. These securities may also be subject to legal and other restrictions on resale. As such, we may have difficulty exiting an investment promptly or at a desired price prior to maturity or outside of a normal amortization schedule. These investments may also be difficult to value because little public information generally exists about private companies, requiring an experienced due diligence team to analyze and value the potential portfolio company. Finally, these companies may not have third-party debt ratings or audited financial statements. We must therefore rely on the ability of FS Advisor and/or GSO to obtain adequate information through their due diligence efforts to evaluate the creditworthiness of, and risks involved in investing in, these companies, and to determine the optimal time to exit an investment. These companies and their financial information will also generally not be subject to the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and other rules and regulations that govern public companies that are designed to protect investors.

Investment Strategy

Our investment policy is to invest, under normal circumstances, at least 80% of our total assets in securities of Energy companies. This investment policy may not be changed without at least 60 days' prior notice to holders of our common shares of any such change. In accordance with the best interests of our shareholders, FS Advisor monitors our targeted investment mix as economic conditions evolve.

When identifying prospective portfolio companies, we focus primarily on the attributes set forth below, which we believe help us generate higher total returns with an acceptable level of risk. While these criteria provide general guidelines for our investment decisions, we caution investors that, if we believe the benefits of investing are sufficiently strong, not all of these criteria necessarily will be met by each prospective portfolio company in which we choose to invest. These attributes are:

- •

- Deeply-rooted asset value. We seek to invest in companies that have

significant asset value rather than speculative investments that rely solely on rising energy commodity prices, exploratory drilling success or factors beyond the control of a portfolio company. We

focus on Energy companies that have strong potential for enhancing asset value through factors within their control. Examples of these types of factors include operating cost reductions and revenue

increases driven by improved operations of previously under-performing or under-exploited assets. Such investments are expected to have significant collateral coverage and downside protection

irrespective of the broader economy.

- •

- Defensible market positions. We seek to invest in companies that have

developed strong positions within their sub-sector and exhibit the potential to maintain sufficient cash flows and profitability to service our debt in a range of economic environments. We seek

companies that can protect their competitive advantages through scale, scope, customer loyalty, product pricing or product quality versus their competitors, thereby minimizing business risk and

protecting profitability.

- •

- Proven management teams. We focus on companies that have experienced management teams with an established track record of success. We typically require our portfolio companies to have proper incentives in place, which may include non-cash and performance-based compensation, to align management's goals with ours.

7

- •

- Commodity price management. We seek to invest in companies that

appropriately manage their commodity price exposure through the use of hedging with highly-rated counterparties, contracts such as power purchase agreements or tolling agreements and other instruments

that seek to minimize the company's exposure to significant commodity price swings.

- •

- Allocation among various issuers and sub-sectors. We seek to allocate our

portfolio broadly among issuers and sub-sectors within the Energy Investment Universe, thereby attempting to reduce the risk of a downturn in any one company or sub-sector having a disproportionate

adverse impact on the value of our portfolio.

- •

- Viable exit strategy. While we attempt to invest in securities that may be sold in a privately negotiated over-the-counter market, providing us a means by which we may exit our positions, we expect that a large portion of our portfolio may not be sold on this secondary market. For any investments that are not able to be sold within this market, we focus primarily on investing in companies whose business models and growth prospects offer attractive exit possibilities, including repayment of our investments, an initial public offering of equity securities, a merger, a sale or a recapitalization, in each case with the potential for capital gains.

In addition, in an order dated June 4, 2013, the SEC granted exemptive relief that, subject to the satisfaction of certain conditions, expanded our ability to co-invest in certain privately negotiated investment transactions with our co-investment affiliates, which we believe has and may continue to enhance our ability to further our investment objectives and strategy.

Potential Competitive Strengths

We believe that we offer investors the following potential competitive strengths:

Global Platform with Seasoned Investment Professionals.

We believe that the breadth and depth of the experience of FS Advisor's senior management team, with the resources of GSO's investment team, which together are dedicated to sourcing, structuring, executing, monitoring and harvesting a broad range of private investments, provides us with a significant competitive advantage in sourcing and analyzing what we believe to be attractive investment opportunities.

Long-term Investment Horizon.

Our long-term investment horizon gives us great flexibility, which we believe allows us to maximize returns on our investments. Unlike most private equity and venture capital funds, we are not required to return capital to our shareholders once we exit a portfolio investment. Such funds typically can only be invested once and must be returned to investors after a specific time period. These provisions often force private equity and venture capital funds to seek liquidity events, including initial public offerings, mergers or recapitalizations, more quickly than they otherwise might, potentially resulting in a lower return to investors. We believe that freedom from such capital return requirements, which allows us to invest using a longer term focus, provides us with the opportunity to increase total returns on invested capital, compared to other private company investment vehicles.

GSO Transaction Sourcing Capability.

FS Advisor seeks to leverage GSO's access to transaction flow. GSO seeks to generate investment opportunities through syndicate and club deals (generally, investments made by a small group of investment firms), through its trading platform, relationships with investment banks, which may be exclusive to GSO, and, subject to regulatory constraints as discussed under "—Regulation" and the allocation policies of GSO and its affiliates, as applicable, also through GSO's direct origination channels. These include significant contacts to participants in the credit and leveraged finance marketplace, which it can draw upon in sourcing investment opportunities for us. With respect to syndicate and club deals, GSO has built a network of relationships with commercial and investment banks, finance companies and other investment funds as a result of the long track record of its investment professionals in the leveraged finance marketplace. With respect to GSO's origination channel, FS Advisor seeks to leverage the global presence of GSO and its long-standing personal

8

contacts within the Energy industry to generate access to directly originated transactions with attractive investment characteristics. GSO also has a trading platform, which, we believe, allows us access to the secondary market for investment opportunities.

Disciplined, Income-Oriented Investment Philosophy.

FS Advisor and GSO employ a conservative investment approach focused on current income and long-term investment performance. This investment approach involves a multi-stage selection process for each investment opportunity, as well as ongoing monitoring of each investment made, with particular emphasis on early detection of deteriorating credit conditions at portfolio companies which would result in adverse portfolio developments. This strategy is designed to maximize current income and minimize the risk of capital loss while maintaining the potential for long-term capital appreciation.

Investment Expertise Across All Levels of the Corporate Capital Structure.

FS Advisor and GSO believe that their broad expertise and experience investing at all levels of a company's capital structure enable us to manage risk while affording us the opportunity for significant returns on our investments. We attempt to capitalize on this expertise in an effort to produce and maintain an investment portfolio that will perform in a broad range of economic conditions. In addition, we seek to leverage this broad-ranging capability to enable us to provide Energy companies with financing that most closely aligns with their particular capital needs. We believe that such flexibility is valuable to Energy companies and provides us with a competitive advantage over other capital providers that are more limited in the securities in which they invest.

Operating and Regulatory Structure

Our investment activities are managed by FS Advisor and supervised by our board of trustees, a majority of whom are independent. Under the investment advisory and administrative services agreement, we have agreed to pay FS Advisor an annual base management fee based on the average value of our gross assets as well as incentive fees based on our performance. See "See Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Contractual Obligations" for a description of the fees we pay to FS Advisor.

From time to time, FS Advisor may enter into sub-advisory relationships with registered investment advisers that possess skills or attributes that FS Advisor believes will aid it in achieving our investment objectives. FS Advisor has engaged GSO to act as our investment sub-adviser. GSO assists FS Advisor in identifying investment opportunities and makes investment recommendations for consideration and approval by FS Advisor according to guidelines set by FS Advisor. FS Advisor oversees GSO and our day-to-day operations, including the provision of general ledger accounting, fund accounting, legal services, investor relations and other administrative services. FS Advisor also performs, or oversees the performance of, our corporate operations and required administrative services, which includes being responsible for the financial records that we are required to maintain and preparing reports for our shareholders and reports filed with the SEC. In addition, FS Advisor assists us in calculating our net asset value, overseeing the preparation and filing of tax returns and the printing and dissemination of reports to our shareholders, and generally overseeing the payment of our expenses and the performance of administrative and professional services rendered to us by others.

We reimburse FS Advisor for expenses necessary to perform services related to our administration and operations, including FS Advisor's allocable portion of the compensation and related expenses of certain personnel of FS Investments providing administrative services to us on behalf of FS Advisor. The amount of this reimbursement is set at the lesser of (1) FS Advisor's actual costs incurred in providing such services and (2) the amount that we estimate we would be required to pay alternative service providers for comparable services in the same geographic location. FS Advisor is required to allocate the cost of such services to us based on factors such as assets, revenues, time allocations and/or other reasonable metrics. Our board of trustees reviews the methodology employed in determining how the expenses are allocated to us and the proposed allocation of administrative expenses among us and certain affiliates of FS Advisor. Our board of trustees then assesses the reasonableness of such reimbursements for expenses allocated to us based on the breadth, depth and quality of such services as compared to the estimated cost to us of obtaining similar services from third-party service providers

9

known to be available. In addition, our board of trustees considers whether any single third party service provider would be capable of providing all such services at comparable cost and quality. Finally, our board of trustees, among other things, compares the total amount paid to FS Advisor for such services as a percentage of our net assets to the same ratio as reported by other comparable BDCs. We do not reimburse FS Advisor for any services for which it receives a separate fee, or for rent, depreciation, utilities, capital equipment or other administrative items allocated to a controlling person of FS Advisor.

In addition, we have contracted with State Street Bank and Trust Company, or State Street, to provide various accounting and administrative services including, but not limited to, preparing preliminary financial information for review by FS Advisor, preparing and monitoring expense budgets, maintaining accounting and corporate books and records, processing trade information provided by us and performing testing with respect to RIC compliance.

As a BDC, we are required to comply with certain regulatory requirements. Also, while we are permitted to finance investments using debt, our ability to use debt will be limited in certain significant respects pursuant to the 1940 Act. Within the limits of existing regulation, we will adjust our use of debt, according to market conditions, to the level we believe will allow us to generate maximum risk-adjusted returns. See "—Regulation." We have elected to be treated for U.S. federal income tax purposes, and intend to qualify annually, as a RIC under Subchapter M of the Code.

Investment Types

Our portfolio is comprised primarily of income-oriented securities, which refers to debt securities and income-oriented preferred and common equity interests, of privately-held Energy companies within the United States. We intend to weight our portfolio towards senior and subordinated debt. In addition to investments purchased from dealers or other investors in the secondary market, we expect to invest in primary market transactions and directly originated investments as this will provide us with the ability to tailor investments to best match a project's or company's needs with our investment objectives. Our portfolio may also be comprised of select income-oriented preferred or common equity interests, which refers to equity interests that pay consistent, high-yielding dividends, that we believe will produce both current income and long-term capital appreciation. These income-oriented preferred or common equity interests may include interests in MLPs. In connection with certain of our debt investments or any restructuring of these debt investments, we may on occasion receive equity interests, including warrants or options, as additional consideration or otherwise in connection with a restructuring. In addition, a portion of our portfolio may be comprised of minority interests in the form of common or preferred equity or other equity-related securities, such as rights and warrants that may be converted into or exchanged for common stock or other equity or the cash value of common stock or other equity, in our target companies, as well as derivatives, including total return swaps and credit default swaps. FS Advisor will seek to tailor our investment focus as market conditions evolve. Depending on market conditions, we may increase or decrease our exposure to less senior portions of the capital structure or other more opportunistic investments.

Senior Debt

Senior debt is situated at the top of the capital structure. Because this debt has priority in payment, it carries the lowest risk among all investments in a company. Generally, senior debt in which we may invest is expected to have a maturity period of three to seven years, offer some form of amortization, and have first priority security interests in the assets of the borrower. Senior debt is comprised of first lien and second lien debt positions. Second lien debt is granted a second priority security interest in the assets of the borrower, which means that any realization of collateral will generally be applied to pay first lien debt in full before second lien debt positions are paid and the value of the collateral may not be sufficient to repay in full both first lien secured debt and second lien secured debt. Generally, in normalized markets, we expect that the variable interest rate on our first lien debt typically will range between 4.0% and 9.0% over a standard benchmark, such as the prime rate or the London Interbank Offered Rate, or LIBOR. In normalized markets, we expect that the variable interest rate on second lien debt will range between 6.0% and 10.0% over a standard benchmark. In addition, we may receive additional returns from any warrants we may receive in connection with these investments.

10

Subordinated Debt

In addition to senior debt, we may invest a portion of our assets in subordinated debt of private companies. Subordinated debt usually ranks junior in priority of payment to first lien and second lien secured loans and is often unsecured, but is situated above preferred equity and common equity in the capital structure. In return for their junior status compared to first lien and second lien secured loans, subordinated debt typically offers higher returns through both higher interest rates and possible equity ownership in the form of warrants, enabling the lender to participate in the capital appreciation of the borrower. These warrants typically require only a nominal cost to exercise. We intend to generally target subordinated debt with interest-only payments throughout the life of the security, with the principal due at maturity. Typically, subordinated debt investments have maturities of five to ten years. Generally, in normalized markets, we expect these securities to carry a fixed rate or a floating current yield of 8.0% to 12.0% over a standard benchmark. In addition, we may receive additional returns from any warrants we may receive in connection with these investments. In some cases, a portion of the total interest may accrue or be paid-in-kind, or PIK.

Preferred Equity

Preferred equity typically includes a stated value or liquidation preference structurally ahead of common equity holders. Holders of preferred equity can be entitled to a wide range of voting and other rights, depending on the structure of each separate security. Preferred equity can also include a conversion feature whereby the securities convert into common stock based on established parameters according to set ratios. We seek to invest in primarily income-oriented equity securities of Energy companies in a manner consistent with our status as a BDC.

Other Equity Securities

We may also invest in other equity securities which are typically structurally subordinate to all other securities within the capital structure and do not have a stated maturity. As compared to more senior securities, equity interests have greater risk exposure, but also have the potential to provide a higher return. Some of these investments may take the form of common units in MLPs. MLPs typically pay their unitholders quarterly distributions, offering investors a current yield and the opportunity for a more stable return profile.

Net Profits Interests, Royalty Interests, Volumetric Production Payments, or VPPs

We may invest in energy-specific non-operating investments including net profits interests, royalty interests or VPPs. Such non-operating interests do not include the rights and obligations of operating a mineral property (costs of exploration, development and operation) and do not bear any part of the net losses. Net profits interests and royalty interests are contractual agreements whereby the holders of such interests are entitled to a portion of the mineral production or proceeds therefrom. A VPP is a type of structured investment whereby the owner sells a specific volume of production in a field or property to an investor and the investor receives a specific quota of production on a monthly basis in either raw output or proceeds therefrom. A VPP is typically set to expire after a certain length of time or after a specified aggregate total volume of the commodity has been delivered. If the producer cannot meet the supply quota for a given period, the supply obligation rolls forward to future cycles until the buyer is made financially whole.

Non-U.S. Securities

We may invest in non-U.S. securities, which may include securities denominated in U.S. dollars or in non-U.S. currencies, to the extent permitted by the 1940 Act.

11

Other Securities

We may also invest from time to time in derivatives, such as total return swaps and credit default swaps. We anticipate that any use of derivatives would primarily be as a substitute for investing in conventional securities. Any use of derivatives may subject us to additional risks. See "Item 1A. Risk Factors—Risks Related to Our Investments—We may from time to time enter into total return swaps, credit default swaps or other derivative transactions which expose us to certain risks, including credit risk, market risk, liquidity risk and other risks similar to those associated with the use of leverage."

Cash and Cash Equivalents

We may maintain a certain level of cash or cash equivalent instruments to make follow-on investments, if necessary, in existing portfolio companies or to take advantage of new opportunities.

Sources of Income

The primary means through which our shareholders may receive a return of value is through interest income, dividends and capital gains generated by our investments. In addition to these sources of income, we may receive fees paid by our portfolio companies, including one-time closing fees paid at the time each investment is made. Closing fees typically range from 1.0% to 3.0% of the purchase price of an investment. In addition, we may generate revenues in the form of non-recurring commitment, origination, structuring or diligence fees, fees for providing managerial assistance, consulting fees, prepayment fees and performance-based fees.

Risk Management

We seek to limit the downside potential of our investment portfolio by:

- •

- applying our investment strategy guidelines for portfolio investments;

- •

- requiring a total return on investments (including both interest and potential appreciation) that adequately compensates us for credit risk;

- •

- allocating our portfolio among various issuers and sub-sectors, and size permitting, with an adequate number of companies, across different

sub-sectors of the Energy industry, with different types of collateral; and

- •

- negotiating or seeking debt and other securities with covenants or features that protect us while affording portfolio companies flexibility in managing their businesses consistent with preservation of capital.

Such restrictions may include affirmative and negative covenants, default penalties, lien protection, change of control provisions and board rights. We may also enter into interest rate hedging transactions at the sole discretion of FS Advisor. Such transactions will enable us to selectively modify interest rate exposure as market conditions dictate.

Affirmative Covenants

Affirmative covenants require borrowers to take actions that are meant to ensure the solvency of the company, facilitate the lender's monitoring of the borrower and ensure payment of interest and loan principal due to lenders. Examples of affirmative covenants include covenants requiring the borrower to maintain adequate insurance, accounting and tax records, and to produce frequent financial reports for the benefit of the lender.

Negative Covenants

Negative covenants impose restrictions on the borrower and are meant to protect lenders from actions that the borrower may take that could harm the credit quality of the lender's investments. Examples of negative covenants include restrictions on the payment of dividends and restrictions on the issuance of additional debt without the lender's approval. In addition, certain covenants restrict a borrower's activities by requiring it to meet certain earnings interest coverage ratio and leverage ratio requirements. These covenants are also referred to as financial or maintenance covenants.

12

Investment Process

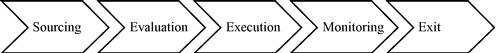

The investment professionals employed by FS Advisor and GSO have spent their careers developing the resources necessary to invest in private companies. Our transaction process is highlighted below.

Sourcing

In order to source transactions, FS Advisor seeks to leverage GSO's significant access to transaction flow, along with GSO's trading platform, which allows for access to the syndicated loan market, which may be a key source of investment opportunities for us. GSO seeks to generate investment opportunities through its trading platform, through syndicate and club deals, through relationships with investment banks, which may be exclusive to GSO, and, subject to regulatory constraints and the allocation policies of GSO and its affiliates, as applicable, through GSO's direct origination channels. GSO also relies on its relationships with private equity sponsors, investment banks and commercial banks to source investment opportunities. With respect to syndicate and club deals, GSO has built a network of relationships with commercial and investment banks, finance companies and other investment funds as a result of the long track record of its investment professionals in the leveraged finance marketplace. GSO may compensate certain brokers or other financial services firms out of its own profits or revenues for services provided in connection with the identification of appropriate investment opportunities. With respect to GSO's origination channel, FS Advisor seeks to leverage the global presence of GSO and its long-standing personal contacts within the Energy industry to generate access to directly originated transactions with what we believe to be attractive investment characteristics.

Evaluation

Initial Review. In its initial review of an investment opportunity to present to FS Advisor, GSO's transaction team examines information furnished by the target company and external sources, including rating agencies, if applicable, to determine whether the investment meets our basic investment criteria and other guidelines specified by FS Advisor, within the context of proper allocation of our portfolio among various issuers and industry sub-sectors, and offers an acceptable probability of attractive returns with identifiable downside risk. For the majority of securities available on the secondary market, a comprehensive analysis is conducted and continuously maintained by a dedicated GSO research analyst, the results of which are available for the transaction team to review. In the case of a directly originated transaction, FS Advisor and GSO conduct detailed due diligence investigations as necessary.

Credit Analysis/Due Diligence. Before undertaking an investment, the transaction teams from GSO and FS Advisor conduct a thorough due diligence review of the opportunity to ensure the company fits our investment strategy, which may include:

- •

- a full operational analysis to identify the key risks and opportunities of the target's business, including a detailed review of historical and

projected financial results;

- •

- a detailed analysis of industry dynamics, competitive position, regulatory, tax and legal matters;

- •

- on-site visits, if deemed necessary;

- •

- background checks to further evaluate management and other key personnel;

- •

- a review by legal and accounting professionals, environmental or other industry consultants, if necessary;

- •

- financial sponsor due diligence, including portfolio company and lender reference checks, if necessary; and

13

- •

- a review of management's experience and track record.

When possible, our advisory team seeks to structure transactions in such a way that our target companies are required to bear the costs of due diligence, including those costs related to any outside consulting work we may require.

Execution

Recommendation. FS Advisor has engaged GSO to identify and recommend investment opportunities for its approval. GSO seeks to maintain a defensive approach toward its investment recommendations by emphasizing risk control in its transaction process, which includes (i) the pre-review of each opportunity by one of its portfolio managers to assess the general quality, value and fit relative to our portfolio, (ii) where possible, transaction structuring with a focus on preservation of capital in varying economic environments and (iii) ultimate approval of investment recommendations by GSO's investment committee.

Approval. After completing its internal transaction process, GSO makes formal recommendations for review and approval by FS Advisor. In connection with its recommendation, it transmits any relevant underwriting material and other information pertinent to the decision-making process. In addition, GSO makes its staff available to answer inquiries by FS Advisor in connection with its recommendations. The consummation of a transaction requires unanimous approval of the members of FS Advisor's investment committee.

Monitoring

Portfolio Monitoring. FS Advisor, with the help of GSO, monitors our portfolio with a focus toward anticipating negative credit events. To maintain portfolio company performance and help to ensure a successful exit, FS Advisor and GSO work closely with the lead equity sponsor, loan syndicator, portfolio company management, consultants, advisers and other security holders to discuss financial position, compliance with covenants, financial requirements and execution of the company's business plan. In addition, depending on the size, nature and performance of the transaction, we may occupy a seat or serve as an observer on a portfolio company's board of directors or similar governing body.

Typically, FS Advisor and GSO receive financial reports detailing operating performance, sales volumes, margins, cash flows, financial position and other key operating metrics on a quarterly basis from our portfolio companies. FS Advisor and GSO use this data, combined with due diligence gained through contact with the company's customers, suppliers, competitors, market research and other methods, to conduct an ongoing, rigorous assessment of the company's operating performance and prospects. GSO may rely on brokers or other financial services firms that may help identify potential investments from time to time for assistance in monitoring these investments.

In addition to various risk management and monitoring tools, FS Advisor uses an investment rating system to characterize and monitor the expected level of returns on each investment in our portfolio. FS Advisor uses an investment rating scale of 1 to 5. The following is a description of the conditions associated with each investment rating:

| Investment Rating |

Summary Description | |

|---|---|---|

| 1 | Investment exceeding expectations and/or capital gain expected. | |

2 |

Performing investment generally executing in accordance with the portfolio company's business plan—full return of principal and interest expected. |

|

3 |

Performing investment requiring closer monitoring. |

|

4 |

Underperforming investment—some loss of interest or dividend possible, but still expecting a positive return on investment. |

|

5 |

Underperforming investment with expected loss of interest and some principal. |

14

FS Advisor monitors and, when appropriate, changes the investment ratings assigned to each investment in our portfolio. In connection with valuing our assets, our board of trustees reviews these investment ratings on a quarterly basis. In the event that our advisory team determines that an investment is underperforming, or circumstances suggest that the risk associated with a particular investment has significantly increased, FS Advisor will attempt to sell the asset in the secondary market, if applicable, or to implement a plan to attempt to exit the investment or to correct the situation.

The following table shows the distribution of our investments on the 1 to 5 investment rating scale at fair value as of December 31, 2016 and 2015:

| |

December 31, 2016 | December 31, 2015 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Investment Rating | Fair Value |

Percentage of Portfolio |

Fair Value |

Percentage of Portfolio |

|||||||||

1 |

$ | 115,927 | 3 | % | $ | 159,204 | 5 | % | |||||

2 |

2,719,833 | 70 | % | 1,340,637 | 44 | % | |||||||

3 |

899,835 | 23 | % | 1,288,144 | 42 | % | |||||||

4 |

85,427 | 2 | % | 203,084 | 7 | % | |||||||

5 |

89,418 | 2 | % | 78,429 | 2 | % | |||||||

| | | | | | | | | | | | | | |

|

$ | 3,910,440 | 100 | % | $ | 3,069,498 | 100 | % | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

The amount of the portfolio in each grading category may vary substantially from period to period resulting primarily from changes in the composition of the portfolio as a result of new investment, repayment and exit activities. In addition, changes in the grade of investments may be made to reflect our expectation of performance and changes in investment values. The increase in the amount of our investments rated a two or three is due primarily to the pronounced increase in the price of oil, decreased volatility in the Energy credit markets and general improvement in the Energy markets during the year ended December 31, 2016.

Valuation Process. Each quarter, we value investments in our portfolio, and such values are disclosed each quarter in reports filed with the SEC. Investments for which market quotations are readily available are recorded at such market quotations. With respect to investments for which market quotations are not readily available, our board of trustees determines the fair value of such investments in good faith, utilizing the input of our valuation committee, FS Advisor and any other professionals or materials that our board of trustees deems worthy and relevant, including GSO and independent third-party valuation services, if applicable. See "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies—Valuation of Portfolio Investments."

Managerial Assistance. As a BDC, we must offer, and provide upon request, managerial assistance to certain of our portfolio companies. This assistance could involve, among other things, monitoring the operations of our portfolio companies, participating in board and management meetings, consulting with and advising officers of portfolio companies and providing other organizational and financial guidance. Depending on the nature of the assistance required, FS Advisor or GSO will provide such managerial assistance on our behalf to portfolio companies that request this assistance. To the extent fees are paid for these services, we, rather than FS Advisor or GSO, will retain any fees paid for such assistance.

Exit

While we attempt to invest in securities that may be sold in a privately negotiated over-the-counter market, providing us a means by which we may exit our positions, we expect that a large portion of our portfolio may not be sold on this secondary market. For any investments that are not able to be sold within this market, we focus primarily on investing in companies whose business models and growth prospects offer attractive exit possibilities, including repayment of our investments, an initial public offering of equity securities, a merger, a sale or a recapitalization, in each case with the potential for capital gains.

15

Financing Arrangements

To seek to enhance our returns, we employ leverage as market conditions permit and at the discretion of FS Advisor, but in no event may leverage employed exceed 50% of the value of our assets, as required by the 1940 Act. Our wholly-owned, special-purpose financing subsidiaries, Bryn Mawr Funding LLC, or Bryn Mawr Funding; Berwyn Funding LLC, or Berwyn Funding; FSEP Term Funding LLC, or FSEP Funding; Energy Funding LLC, or Energy Funding; Foxfields Funding LLC, or Foxfields Funding; Gladwyne Funding LLC, or Gladwyne Funding; Strafford Funding LLC, or Strafford Funding and Wayne Funding LLC, or Wayne Funding, have entered into financing arrangements with Barclays Bank PLC, or Barclays; BNP Paribas Prime Brokerage, Inc., or BNP; Deutsche Bank AG, New York Branch, or Deutsche Bank; Natixis, New York Branch, or Natixis; Fortress Credit Co LLC, or Fortress; Goldman Sachs Bank USA, or Goldman; and Wells Fargo Securities, LLC and Wells Fargo Bank, National Association, or Wells Fargo, respectively. The following table presents summary information with respect to our outstanding financing arrangements as of December 31, 2016:

| Facility | Type of Arrangement |

Rate | Amount Outstanding |

Amount Available |

Maturity Date | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Barclays Credit Facility |

Revolving | L+3.25% | — | $ | 100,000 | May 18, 2021 | ||||||

BNP Facility |

Prime Brokerage | L+1.10%(1) | $ | 113,737 | $ | 186,263 | September 27, 2017(2) | |||||

Deutsche Bank Credit Facility |

Revolving | L+2.05%(3) | $ | 200,000 | $ | 115,000 | June 11, 2017 | |||||

Fortress Facility |

Term | L+5.00%(4) | $ | 155,000 | — | November 6, 2020 | ||||||

Goldman Facility |

Repurchase | L+3.38%(5) | $ | 325,000 | — | September 15, 2018 | ||||||

Natixis Credit Facility |

Revolving | CP+2.25% | $ | 50,328 | — | July 11, 2023 | ||||||

Wells Fargo Credit Facility |

Revolving | L+2.50% to 2.75% | $ | 29,600 | $ | 30,400 | September 9, 2018 | |||||

- (1)

- Beginning

on January 2, 2017, borrowings under Berwyn Funding and BNP, or the BNP facility, will accrue interest at a rate equal to LIBOR plus 1.35%.

- (2)

- The

financing arrangement entered into by the BNP facility, is generally terminable upon 270 days' notice by either party. As of December 31, 2016,

neither Berwyn Funding nor BNP had provided notice of its intent to terminate the BNP facility.

- (3)

- Prior

to June 11, 2016, borrowings under the Deutsche Bank credit facility accrued interest at a rate equal to LIBOR plus 1.80% per annum. Beginning on

June 11, 2016, borrowings under the Deutsche Bank credit facility accrue interest at a rate equal to LIBOR plus 2.05% per annum.

- (4)

- The

financing arrangement entered into by Foxfields Funding and Fortress, or the Fortress facility, accrues interest at a rate equal to LIBOR plus 5.00%, subject to

a floor of 0.75%.

- (5)

- Prior to September 21, 2016, borrowings under the Goldman facility accrued interest at a rate equal to LIBOR plus 2.75% per annum. Beginning on September 21, 2016, borrowings under the Goldman facility accrue interest at a rate equal to LIBOR plus 3.38% per annum.

Our average borrowings and weighted average interest rate, including the effect of non-usage fees, for the year ended December 31, 2016 were $918,992 and 3.69%, respectively. As of December 31, 2016, our weighted average effective interest rate on borrowings was 3.85%.

See Note 8 to our consolidated financial statements contained in this annual report on Form 10-K for additional information regarding our financing arrangements.

Regulation

We have elected to be regulated as a BDC under the 1940 Act. The 1940 Act contains prohibitions and restrictions relating to transactions between BDCs and their affiliates, principal underwriters and affiliates of those affiliates or underwriters. The 1940 Act requires that a majority of our trustees be persons other than "interested persons," as that term is defined in the 1940 Act. In addition, the 1940 Act provides that we may not change the nature of our business so as to cease to be, or to withdraw our election as, a BDC unless approved by a majority of our outstanding voting securities.

The 1940 Act defines "a majority of the outstanding voting securities" as the lesser of (i) 67% or more of the voting securities present at a meeting if the holders of more than 50% of our outstanding voting securities are present or represented by proxy or (ii) 50% of our voting securities. Furthermore, our investment policy is to invest, under normal circumstances, at least 80% of our total assets in securities of Energy companies. This investment policy may not be changed without at least 60 days' prior notice to holders of our common shares of any such change.

16

We will generally not be able to issue and sell our common shares at a price per share, after deducting selling commissions and dealer manager fees, that is below our net asset value per share. See "Item 1A. Risk Factors—Risks Related to Business Development Companies—Regulations governing our operation as a BDC and RIC will affect our ability to raise, and the way in which we raise, additional capital or borrow for investment purposes, which may have a negative effect on our growth." We may, however, sell our common shares, or warrants, options or rights to acquire our common shares, at a price below the then-current net asset value of our common shares if our board of trustees determines that such sale is in our best interests and the best interests of our shareholders, and our shareholders approve such sale. In addition, we may generally issue new common shares at a price below our net asset value per share in rights offerings to existing shareholders, in payment of dividends and in certain other limited circumstances.

As a BDC, we are subject to certain regulatory restrictions in making our investments. For example, BDCs generally are not permitted to co-invest with certain affiliated entities in transactions originated by the BDC or its affiliates in the absence of an exemptive order from the SEC. However, BDCs are permitted to, and may, co-invest in transactions where price is the only negotiated term. In an order dated June 4, 2013, the SEC granted exemptive relief permitting us, subject to the satisfaction of certain conditions, to co-invest in certain privately negotiated investment transactions with our co-investment affiliates. Under the terms of this relief, a "required majority" (as defined in Section 57(o) of the 1940 Act) of our independent trustees must make certain conclusions in connection with a co-investment transaction, including that (1) the terms of the proposed transaction, including the consideration to be paid, are reasonable and fair to us and our shareholders and do not involve overreaching of us or our shareholders on the part of any person concerned and (2) the transaction is consistent with the interests of our shareholders and is consistent with our investment objectives and strategy. We believe this relief has and may continue to enhance our ability to further our investment objectives and strategy. We believe this relief may also increase favorable investment opportunities for us, in part, by allowing us to participate in larger investments, together with our co-investment affiliates, than would be available to us if such relief had not been obtained. Because we did not seek exemptive relief to engage in co-investment transactions with GSO and its affiliates, we will continue to be permitted to co-invest with GSO and its affiliates only in accordance with existing regulatory guidance (e.g., where price is the only negotiated term).

Qualifying Assets