Attached files

| file | filename |

|---|---|

| 8-K - FOUR OAKS FINCORP, INC. 8-K - FOUR OAKS FINCORP INC | a51526554.htm |

Exhibit 99.1

FOUR OAKS BANK 1 Investor Presentation March 2017 Proprietary and Confidential

Disclosure 2

Four Oaks Fincorp Overview 3 Founded in 1912 and headquartered in Four Oaks, NCBank holding company with Four Oaks Bank and Trust as the principal subsidiary14 locations, predominately in the Raleigh MSA$735 million balance sheetTotal loans: $515 millionTotal deposits: $558 millionDTA: $18 million - fully recaptured Solid Tier 1 Capital – 12/31/16FOFN: 9.5%; FOB: 11.0%Exchange: OTCQX; Ticker: FOFN Executed a 1 for 5 reverse split in March, supported by a $1 million share repurchase planOutstanding shares post split = 6.8 million (pre-split = 34 million)Recent trading price: $3.40 per share Market cap: $115 millionTangible Book: $2.01 per share Price to TBV: 1.69xKen Lehman owns 48.3% of o/s shares; total insider holdings = 54%No dividend currently paid

Foundational Work 4 Restructured the balance sheetImproved asset quality; adjusted credit cultureRestructured the organization and leadership teamGrew loans and depositsUpgraded the technology infrastructureImproved governance, risk management and our regulatory postureExited Third Party Payment Processor businessCaptured the deferred tax asset valueReturned to sustained and increasing profitability

Three Years of Focus 5

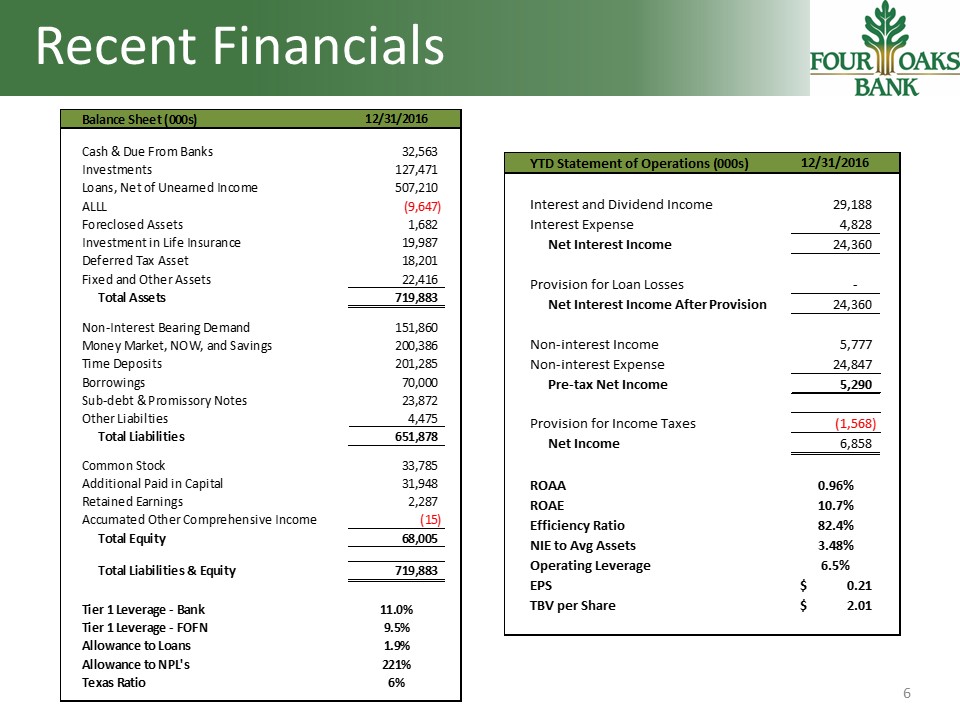

Recent Financials 6

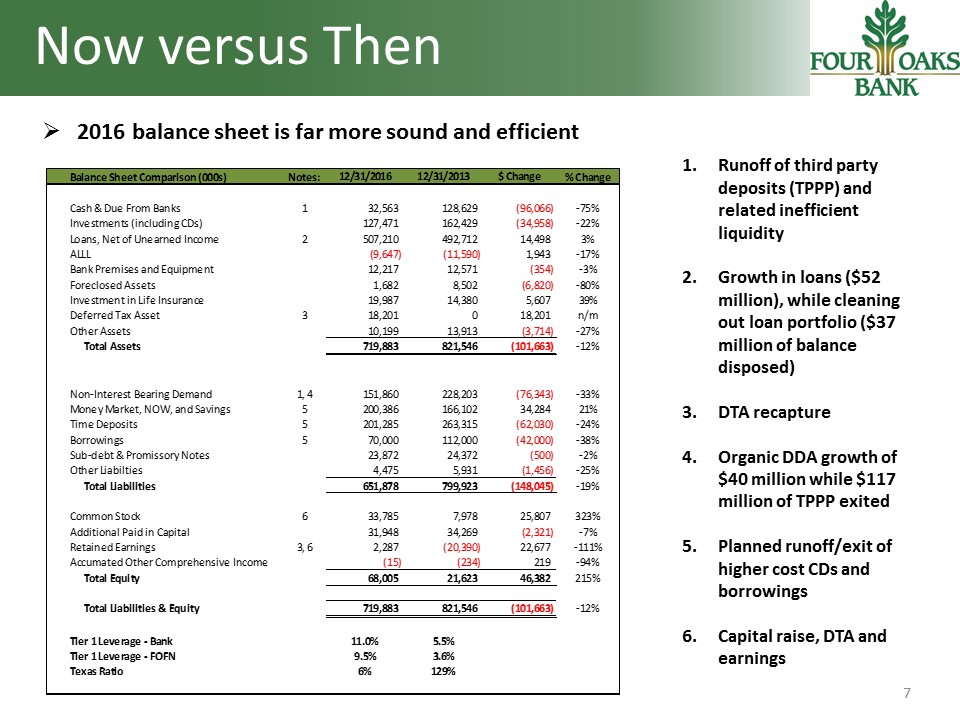

Now versus Then 7 Runoff of third party deposits (TPPP) and related inefficient liquidityGrowth in loans ($52 million), while cleaning out loan portfolio ($37 million of balance disposed)DTA recaptureOrganic DDA growth of $40 million while $117 million of TPPP exitedPlanned runoff/exit of higher cost CDs and borrowingsCapital raise, DTA and earnings 2016 balance sheet is far more sound and efficient

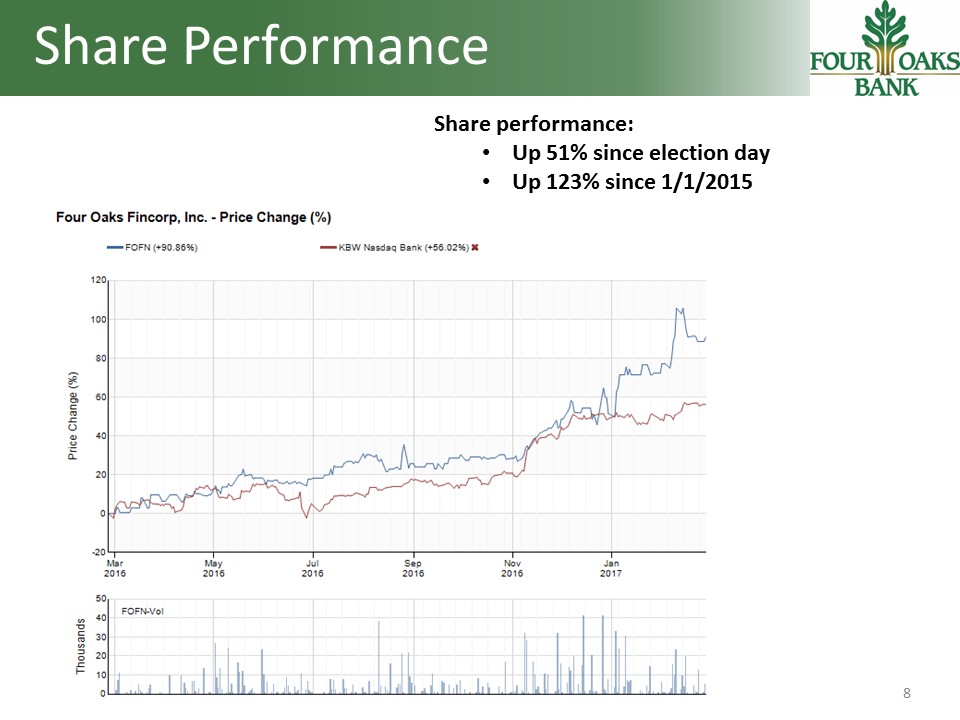

Share Performance 8 Year end 2016 versus year end 2013 Share performance: Up 51% since election day Up 123% since 1/1/2015

Why FOFN? 9 Two and a half years after the capital raise, we have an opportunity for significant additional value creation.

10 Intentionally blank

The Raleigh Market 11 MSA population of 1.3 millionGrowth through 2022 is projected to be 8+% per year72% of net population growth in NC through 2025 will be in Raleigh and Charlotte MSAs (UNC Center of Demography)Wake County population is projected to double by 2035 (Census projection)Raleigh was named:No 2 in “America’s Hottest Spots for Tech Jobs” (Forbes)Best Big City in the Southeast (Money)Scored 14 out of 106 cities in Small Business Vitality Score (ACBJ)Apex was named “Best Place to Live” (Money, 2015)Chapel Hill / Durham – the remainder of the “Triangle” Population of 550kProjected growth of 6+%

Our Markets 12 We operate 12 full service branches and 2 loan production offices in 4 countiesWe are fortunate - our two primary market counties are among the fastest growing pair in the state and region. We want to grow – in the right markets, in the right way.

Wake and Johnston Counties 13 11 of our full service branches are shown – 10 of the branches are in Wake and Johnston Counties (Raleigh MSA)2 LPO’s – Apex and North RaleighBranch in Dunn (Harnett County) and a branch in Wallace (Duplin County) – outside Raleigh MSARecently closed Southern Pines LPO and Harrells, NC limited service location Significant growth in and around Apex and Holly Springs - 1Solid growth in North Raleigh – 2Growth finally starting (after a decade of waiting) toward Zebulon – 3Continual growth in Johnston County - 4 1 2 3 4 World HQ BranchLPO

14 Source: SNL Financial and Company public filings Return to Profitability Dollar Value in Millions Includes $16.6 million in DTA recapture and limited tax expense Includes $3.6 million DTA recapture

15 After Tax Income – Proforma Source: SNL Financial and Company public filings, Company calculation Dollar Value in Thousands Primarily balance sheet restructuring and solid loan growth Note: Proforma income calculated using NIAT adjusted for DTA impact and 1X cost event in 4Q 2016

Equity & Leverage Ratio - FOFN Dollar Value in Millions Source: SNL Financial and Company public filings Note: FOB (Bank) Tier 1 = 11.0% at 12/31/16 Rights Offering DTA Recapture 16

17 Total Assets & Margin Dollar Value in Millions Source: SNL Financial and Company public filings Paydown of expensive LT debt and runoff of above market CDs has allowed for an increase in NIM

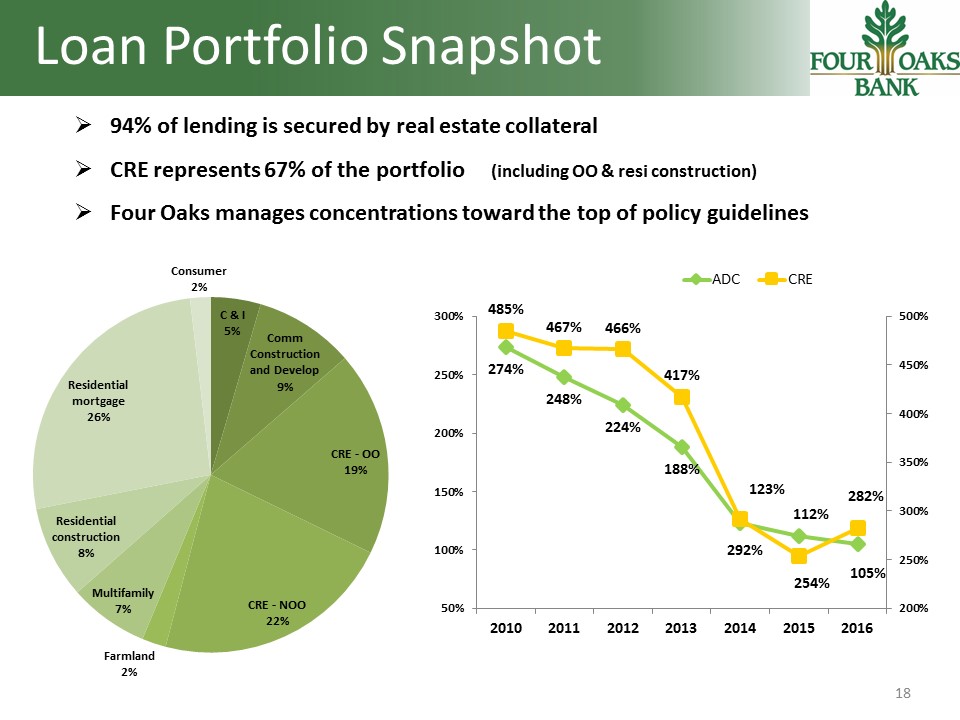

Loan Portfolio Snapshot 18 94% of lending is secured by real estate collateralCRE represents 67% of the portfolio (including OO & resi construction)Four Oaks manages concentrations toward the top of policy guidelines

19 NPAs and Texas Ratio Dollar Value in Millions Source: SNL Financial and Company public filings

20 Intentionally blank

Deposits and Cost 21 Dollar Value in Millions Notes: TPPP deposits of $117 million – exited during 20152011-2013: exit of high priced CDs, incl. brokered Year end 2016 deposit composition Source: SNL Financial and Company public filings

Organizational Update 22 Market leaders and their teams have continued to perform very wellAverage tenure of market leaders: 14 years with FOBDavid Rupp became President in March, 2015; CEO in July, 2015Ayden Lee and David Rupp completed their transition in December 2015, with Ayden filling the Chairman’s roleExecutive team of six is made up of three long time Four Oaks leaders and three new team members Jeff Pope – Chief Banking Officer (26 years)Lisa Herring – Chief Operating Officer / Chief Risk Officer (14 yrs)Deanna Hart – Chief Financial Officer (13 years) David Rupp – Chief Executive OfficerRocky Herring – Chief Credit OfficerLarry DesPres – Chief Information OfficerKen Lehman and David Rupp joined the Board of Directors in March, 2015

Risk Management Update 23 Asset Resolution Plan completed in 2015Credit processes and credit culture continue to improveThird Party Payment Processing exited in 4Q 2015Reset the regulatory relationship; dramatically improvedExited the 2011 Written Agreement; entered into a much reduced 2015 Written Agreement with the FRB onlyOperating process now in continual improvement modeInterest rate risk now a primary focus; deposit pricing disciplineTechnology risk management and cyber security is an area of increasing investment and emphasis

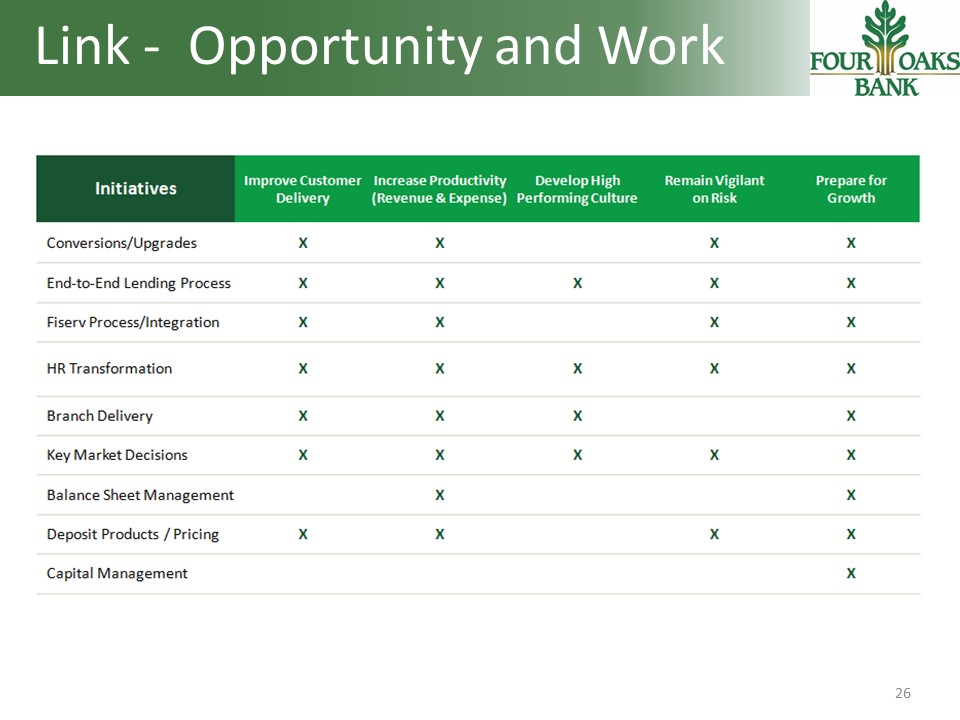

2017 – The Work Ahead 24 Improve Customer DeliveryAcross both branch and electronic channelsDeploy near term product set in retail, electronic banking and cardsIncrease ProductivityBoth revenue and expense across existing franchiseAdopt practical changes to the current business model Develop a High Performing CultureThrough initiatives and HR transformation Remain Vigilant on RiskCredit, operating, compliance and technologyMarket / Interest rate – prepare for inflation and / or stagflationPrepare Our Platform for GrowthOrganic Strategic Areas of focus in the coming year:

Strategic Initiatives 25 Existing product conversions and upgradesEnd to end lending re-engineeringContinued progress on Fiserv integrationTechnology transformationHR transformationAdjustments to our branch delivery modelKey market decisionsDeposit products and pricingBalance sheet managementCapital management

Link - Opportunity and Work 26

2017 Timeline 27