Attached files

Exhibit 13.1

|

Company/Index

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

|

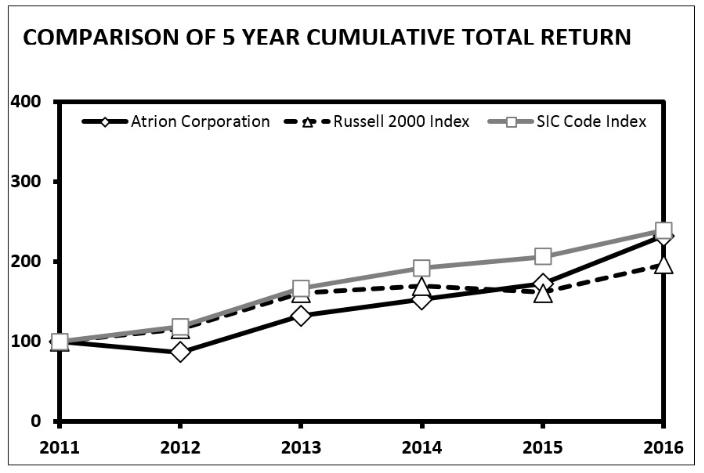

Atrion

Corporation

|

$100.00

|

$86.56

|

$132.20

|

$153.07

|

$173.12

|

$232.44

|

|

Russell 2000

Index

|

$100.00

|

$116.35

|

$161.52

|

$169.42

|

$161.95

|

$196.45

|

|

SIC Code

Index

|

$100.00

|

$118.75

|

$166.81

|

$192.53

|

$206.24

|

$239.63

|

The

graph set forth above compares the total cumulative return for the

five-year period ended December 31, 2016 on the Company's common

stock, the Russell 2000 Index and SIC Code 3841 Index--Surgical and

Medical Instruments (compiled by Zacks Investment Research, Inc.),

assuming $100 was invested on December 31, 2011 in our common

stock, the Russell 2000 Index and the SIC Code Index and dividends

were reinvested.