Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - VECTOR GROUP LTD | newvalleyfactsheetmarch2.htm |

| EX-99.2 - EXHIBIT 99.2 - VECTOR GROUP LTD | vectorgroupfactsheetmarc.htm |

| 8-K - 8-K - VECTOR GROUP LTD | a8-kmarch2017factsheet.htm |

March 2017

INVESTOR PRESENTATION

DISCLAIMER

This document and any related oral presentation does not constitute an offer or invitation to subscribe for, purchase or otherwise acquire any equity

securities or debt securities instruments of Vector Group Ltd. (“Vector”, “Vector Group Ltd.” or “the Company”) and nothing contained herein or its

presentation shall form the basis of any contract or commitment whatsoever.

The distribution of this document and any related oral presentation in certain jurisdictions may be restricted by law and persons into whose possession this

document or any related oral presentation comes should inform themselves about, and observe, any such restriction. Any failure to comply with these

restrictions may constitute a violation of the laws of any such other jurisdiction.

The information contained herein does not constitute investment, legal, accounting, regulatory, taxation or other advice and the information does not take

into account your investment objectives or legal, accounting, regulatory, taxation or financial situation or particular needs. You are solely responsible for

forming your own opinions and conclusions on such matters and the market and for making your own independent assessment of the information.

You are solely responsible for seeking independent professional advice in relation to the information and any action taken on the basis of the

information.

The following presentation may contain "forward-looking statements,” including any statements that may be contained in the presentation that

reflect Vector’s expectations or beliefs with respect to future events and financial performance, such as the expectation that the tobacco

transition payment program could yield substantial incremental free cash flow. These forward- looking statements are subject to certain risks and

uncertainties that could cause actual results to differ materially from those contained in any forward-looking statement made by or on behalf of the

Company, including the risk that changes in Vector’s capital expenditures impact its expected free cash flow and the other risk factors described in Vector’s

annual report on Form 10-K for the year ended December 31, 2016, as filed with the SEC. Please also refer to Vector's Current Reports on Forms 8-K, filed

on October 2, 2015, November 15, 2016 and March 1, 2017 (Commission File Number 1-5759) as filed with the SEC for information, including cautionary

and explanatory language, relating to Non-GAAP Financial Measures in this Presentation labeled "Adjusted".

Results actually achieved may differ materially from expected results included in these forward-looking statements as a result of these or other factors. Due

to such uncertainties and risks, potential investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of

the date on which such statements are made. The Company disclaims any obligation to, and does not undertake to, update or revise and forward-

looking statements in this presentation.

2

INVESTMENT HIGHLIGHTS & PORTFOLIO

Diversified Holding Company with two unrelated, but complementary, businesses with iconic brand names: tobacco (Liggett

Group) and real estate (Douglas Elliman)

History of strong earnings, and Adjusted EBITDA has increased from $178.3 million in 2011 (1) to $280.2 million for the twelve

months ended December 31, 2016(2)

Tobacco Adjusted EBITDA of $268.9 million for the twelve months ended December 31, 2016 (3)

Douglas Elliman, which is a 70.59%-owned subsidiary, produced Revenues of $675.3 million and Adjusted EBITDA of

$36.7 million for the twelve months ended December 31, 2016 (4)

Diversified New Valley portfolio of consolidated and non-consolidated real estate investments

Maintains substantial liquidity with cash, marketable securities and long-term investments of $651 million as of December

31, 2016(5) and has no significant debt maturities until February 2019

Uninterrupted quarterly cash dividends since 1995 and an annual 5% stock dividend since 1999

Seasoned management team with average tenure of 23 years with Vector Group

Management team and directors beneficially own approximately 13% of Vector Group

Perpetual cost advantage over the largest U.S. tobacco companies – annual cost advantage ranged between $163 million

and $169 million from 2011 to 2016(6)

3

Overview

(1) Vector’s Net income for the year ended December 31, 2011 was $74.5M. Adjusted EBITDA is a Non-GAAP Financial Measure. Please refer to Exhibit 99.2 of the Company’s Current Report on Form 8-K, dated November 15, 2016 (Table 2) for a reconciliation

of Net income to Adjusted EBITDA as well as the Disclaimer to this document on Page 2.

(2) Vector’s Net income for the twelve months ended December 31, 2016 was $71.1 million. Adjusted EBITDA is a Non-GAAP FinancialMeasure. Please refer to Exhibit 99.1 of the Company’s Current Report on Form 8-K, filed on March 1, 2017, for a

reconciliation of Net income to Adjusted EBITDA as well as the Disclaimer to this document on Page 2.

(3) All “Liggett” and “Tobacco” financial information in this presentation includes the operations of Liggett Group LLC, Vector Tobacco Inc., and Liggett Vector Brands LLC unless otherwise noted. Tobacco Adjusted EBITDA is a Non-GAAP Financial Measure and is

defined in Table 3 of Exhibit 99.1 to the Company’s Current Report on Form 8-K, dated March 1, 2017.

(4) Douglas Elliman’s revenues were $675.3 million and its Net income was $21.1 million for the twelve months ended December 31, 2016. Adjusted EBITDA is a Non-GAAP Financial Measure. Please refer to Exhibit 99.1 of the Company’s Current Report on

Form 8-K, dated March 1, 2017, for a reconciliation of Adjusted EBITDA to net income (Table 10) as well as the Disclaimer to this document.

(5) Excludes real estate investments.

(6) Cost advantage applies only to cigarettes sold below applicable market share exemption.

TOBACCO OPERATIONS

4

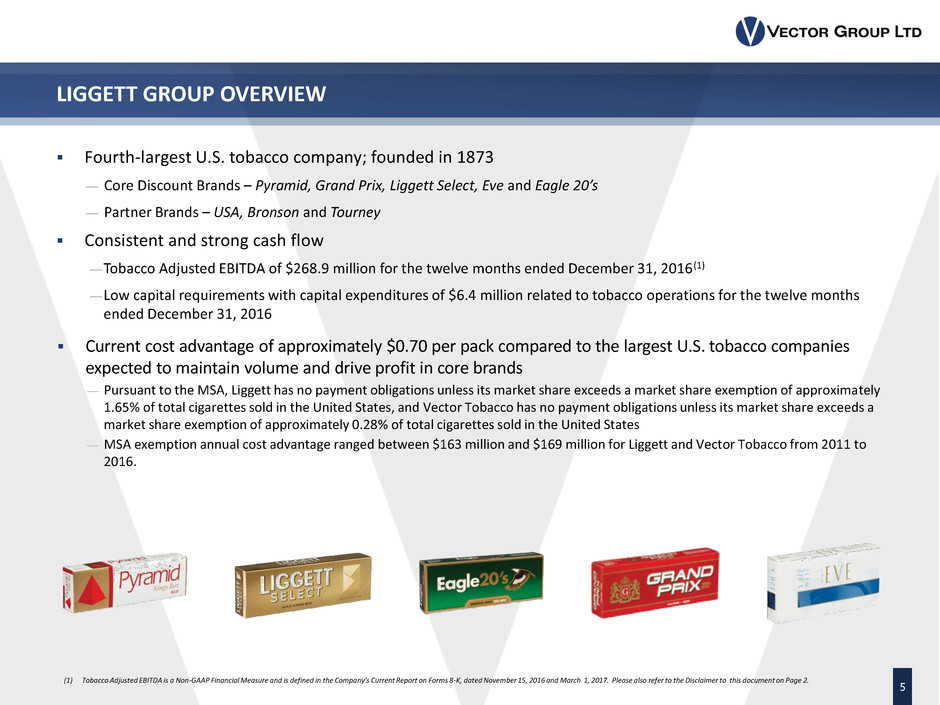

LIGGETT GROUP OVERVIEW

Fourth-largest U.S. tobacco company; founded in 1873

— Core Discount Brands – Pyramid, Grand Prix, Liggett Select, Eve and Eagle 20’s

— Partner Brands – USA, Bronson and Tourney

Consistent and strong cash flow

—Tobacco Adjusted EBITDA of $268.9 million for the twelve months ended December 31, 2016(1)

—Low capital requirements with capital expenditures of $6.4 million related to tobacco operations for the twelve months

ended December 31, 2016

Current cost advantage of approximately $0.70 per pack compared to the largest U.S. tobacco companies

expected to maintain volume and drive profit in core brands

— Pursuant to the MSA, Liggett has no payment obligations unless its market share exceeds a market share exemption of approximately

1.65% of total cigarettes sold in the United States, and Vector Tobacco has no payment obligations unless its market share exceeds a

market share exemption of approximately 0.28% of total cigarettes sold in the United States

— MSA exemption annual cost advantage ranged between $163 million and $169 million for Liggett and Vector Tobacco from 2011 to

2016.

5

(1) Tobacco Adjusted EBITDA is a Non-GAAP Financial Measure and is defined in the Company’s Current Report on Forms 8-K, dated November 15, 2016 and March 1, 2017. Please also refer to the Disclaimer to this document on Page 2.

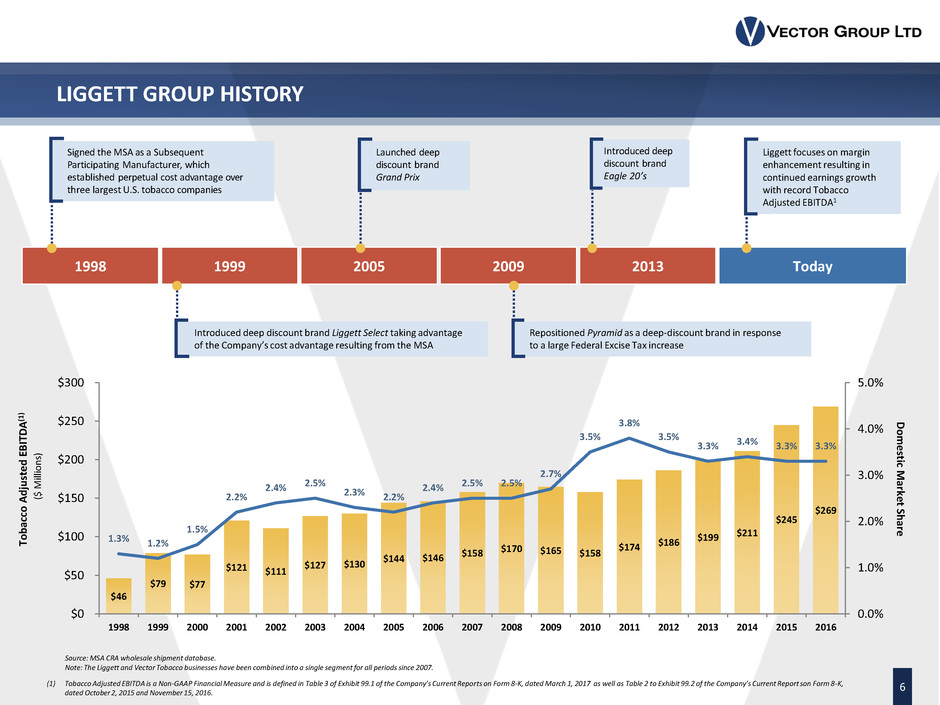

LIGGETT GROUP HISTORY

6

Source: MSA CRA wholesale shipment database.

Note: The Liggett and Vector Tobacco businesses have been combined into a single segment for all periods since 2007.

(1) Tobacco Adjusted EBITDA is a Non-GAAP Financial Measure and is defined in Table 3 of Exhibit 99.1 of the Company’s Current Reports on Form 8-K, dated March 1, 2017 as well as Table 2 to Exhibit 99.2 of the Company’s Current Report son Form 8-K,

dated October 2, 2015 and November 15, 2016.

1998 1999 2005 2009 2013 Today

Signed the MSA as a Subsequent

Participating Manufacturer, which

established perpetual cost advantage over

three largest U.S. tobacco companies

Introduced deep discount brand Liggett Select taking advantage

of the Company’s cost advantage resulting from the MSA

Launched deep

discount brand

Grand Prix

Repositioned Pyramid as a deep-discount brand in response

to a large Federal Excise Tax increase

Introduced deep

discount brand

Eagle 20’s

Liggett focuses on margin

enhancement resulting in

continued earnings growth

with record Tobacco

Adjusted EBITDA1

$46

$79 $77

$121 $111

$127 $130

$144 $146

$158 $170 $165 $158

$174 $186

$199 $211

$245

$269

1.3% 1.2%

1.5%

2.2%

2.4% 2.5% 2.3% 2.2%

2.4% 2.5% 2.5%

2.7%

3.5%

3.8%

3.5%

3.3% 3.4% 3.3% 3.3%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

$0

$50

$100

$150

$200

$250

$300

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

To

b

ac

co

A

d

ju

st

e

d

EB

IT

D

A

(1

)

($

M

ill

io

n

s)

D

o

m

e

st

ic M

arke

t

Sh

are

7

ADJUSTED U.S. TOBACCO INDUSTRY MARKET SHARE (1, 2)

46.7%

48.8% 47.4% 47.6%

21.2% 19.6% 19.9% 19.5%

2.9% 3.7% 2.7% 2.2%

2.4% 2.4%

3.4% 3.3%

7.7% 8.8%

12.4% 13.3%

9.3% 8.8%

6.7% 6.5%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

2003 2006 2014 2016 2003 2006 2014 2016 2003 2006 2014 2016 2003 2006 2014 2016

28.9% 28.4%

32.4% 32.8%

Philip Morris USA R.J. Reynolds

2.89%

3.65%

2.71% 2.22%

2.44% 2.36%

3.36% 3.30%

9.26%

8.81%

6.74%

6.46%

0.00%

5.00%

10.00%

15.00%

2003 2006 2014 2016 2003 2006 2014 2016

12.15% 12.47%

9.45%

8.68%

ITG Brands Liggett Group

12.2% 12.5%

9.5% 8.7%

Newport – acquired by RJR in 2015

Brands acquired by ITG in 2015

Legacy brands

Source: The Maxwell Report’s sales estimates for the cigarette Industry for the years ended 2003 (February 2004), 2006 (February 2007) and 2015 (March 2016) and internal company estimates.

(1) Actual Market Share in 2003, 2006 and 2014 reported in the Maxwell Report for R.J. Reynolds was 29.6%, 27.6%, 23.1% and 32.6%, respectively, and, for ITG Brands, was 2.9%, 3.7%., 2.7% and 8.7%, respectively. Adjusted market share has been computed by Vector

Group Ltd. by applying historical market share of each brand to the present owner of brand. Thus, the graph assumes each company owned its current brands on January 1, 2003. The legacy brands market share of R.J. Reynolds in 2003 includes the market share of

Brown & Williamson, which was acquired by R.J. Reynolds in 2004. In 2015, R.J. Reynolds acquired Lorillard Tobacco Company, which manufactured the Newport brand, and sold a portfolio of brands, including the Winston, Salem, Kool and Maverick brands to ITG

Brands.

(2) Does not include smaller manufacturers, whose cumulative market shares were 9.8%, 7.9%, 8.8% and 7.6% in 2003, 2006, 2014 and 2016, respectively.

TOBACCO LITIGATION AND REGULATORY UPDATES

Liggett led the industry in acknowledging the addictive properties of nicotine while seeking a legislated settlement of

litigation

In 2013, Liggett reached a settlement with approximately 4,900 Engle progeny plaintiffs, which represented substantially all

of Liggett’s pending litigation

— Liggett agreed to pay $60 million in a lump sum in 2014 and the balance in installments of $3.4 million in the following 14

years (2015 – 2028)

In 2016, Liggett reached a settlement that resolved an additional 124 Engle progeny plaintiffs . Under the terms of the

agreement, Liggett will pay a total of $17.65 million, of which $14 million was paid in 2016 and the balance in 2018.

— Approximately 125 Engle progeny plaintiffs remain at December 31, 2016.

— Liggett is also a defendant in approximately 40 non-Engle smoking-related individual cases and 4 smoking-related actions

where either a class had been certified or plaintiffs were seeking class certification.

8

Litigation

Regulatory

Since 1998, the MSA has restricted the advertising and marketing of tobacco products

In 2009, Family Smoking Prevention and Tobacco Control Act granted the FDA power to regulate the manufacture, sale,

marketing and packaging of tobacco products

— FDA is prohibited from issuing regulations that ban cigarettes

Federal Excise Tax is $1.01/pack (since April 1, 2009) and additional state and municipal excise taxes exist.

REAL ESTATE OPERATIONS

9

REAL ESTATE OVERVIEW

New Valley, which owns 70.59% of Douglas Elliman Realty, LLC, is a diversified real estate company that is

seeking to acquire or invest in additional real estate properties or projects

New Valley has invested approximately $206 million1, as of December 31, 2016, in a broad portfolio of real

estate projects.

10

New Valley Adjusted EBITDA(2)

$51.3M

$40.2M

$26.9M

2013 2014 2015 2016

New Valley Revenues – December 31, 2016

$9M

$30M

$641M

$680M

Real Estate Brokerage Commissions

Property Management

Other

(1) Net of cash returned.

(2) New Valley’s net income was $59.4M, $21.4M, $11.7M and $13.5M for the periods presented. Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation of Net income to Adjusted EBITDA, please see Vector Group Ltd.’s

Current Reports on Forms 8-K, filed on October 2, 2015 (Exhibit 99.2) and March 1, 2017 (Exhibit 99.1), Form 10-K for the fiscal year ended December 31, 2016 (Commission File Number 1-5759) as well as the Disclaimer to this document

on Page 2. New Valley’s Adjusted EBITDA do not include an allocation of Vector Group Ltd.’s Corporate and Other Expenses (for purposes of computing Adjusted EBITDA) of $13.5M, $11.4M, $13.2M and $15.3M for the periods presented,

respectively.

$27.9M

Douglas Elliman Adjusted EBITDA(1)

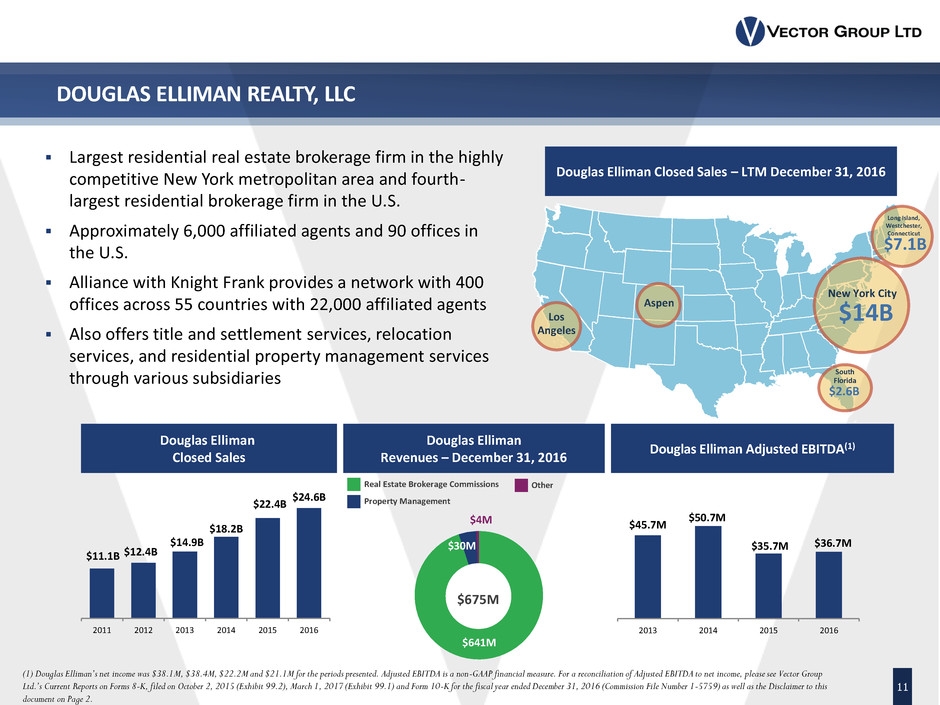

DOUGLAS ELLIMAN REALTY, LLC

11

Largest residential real estate brokerage firm in the highly

competitive New York metropolitan area and fourth-

largest residential brokerage firm in the U.S.

Approximately 6,000 affiliated agents and 90 offices in

the U.S.

Alliance with Knight Frank provides a network with 400

offices across 55 countries with 22,000 affiliated agents

Also offers title and settlement services, relocation

services, and residential property management services

through various subsidiaries

(1) Douglas Elliman’s net income was $38.1M, $38.4M, $22.2M and $21.1M for the periods presented. Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation of Adjusted EBITDA to net income, please see Vector Group

Ltd.’s Current Reports on Forms 8-K, filed on October 2, 2015 (Exhibit 99.2), March 1, 2017 (Exhibit 99.1) and Form 10-K for the fiscal year ended December 31, 2016 (Commission File Number 1-5759) as well as the Disclaimer to this

document on Page 2.

Douglas Elliman Closed Sales – LTM December 31, 2016

$45.7M

$50.7M

$35.7M

2013 2014 2015 2016

$36.7M

Douglas Elliman

Closed Sales

$11.1B $12.4B

$14.9B

$18.2B

$22.4B

2011 2012 2013 2014 2015 2016

$24.6B

Douglas Elliman

Revenues – December 31, 2016

$4M

$30M

$641M

$675M

Real Estate Brokerage Commissions

Property Management

Other

Long Island,

Westchester,

Connecticut

$7.1B

New York City

$14B

South

Florida

$2.6B

Aspen

Los

Angeles

NEW VALLEY’S REAL ESTATE INVESTMENTS AT DECEMBER 31, 2016

12

87 Park

(Miami Beach)

Monad Terrace

(Miami Beach)

Sagaponack

(East Hampton)

Maryland Portfolio

(Baltimore County)

The Plaza at Harmon

Meadow (New Jersey)

West Hollywood Edition

(West Hollywood)

New York City

Investments

(see Page 13)

Escena

(Palm Springs)

Commercial Retail/

Office Assets

Apartments/

Condominiums/Hotels

Land Development/Real

Estate Held for Sale, net

Coral Beach

and Tennis Club

Bermuda

International Investments

Mosaic II

(ST Portfolio)

(Houston)

(1) For the percentage of each real estate project owned, please refer to the “Summary of Real Estate Investments” section of Item 7 -Management’s Discussion and Analysis of Financial Condition and Results of Operations” of Vector Group Ltd.’s Form 10-K

for the annual period ended December 31, 2016 (Commission File Number 1-5759).

Takanasee

(New Jersey)

(1)

Wynn Las Vegas

Retail (Nevada)

NEW VALLEY’S REAL ESTATE INVESTMENTS IN NEW YORK CITY

1. The Marquand Upper East Side

2. 10 Madison Square Park West Flatiron District/NoMad

3. 11 Beach Street TriBeCa

4. 20 Times Square Times Square

5. 111 Murray Street TriBeCa

6. 160 Leroy Street Greenwich Village

7. PUBLIC Chrystie House Lower East Side

8. The Dutch Long Island City

9. Queens Plaza Long Island City

10. Park Lane Hotel Central Park South

11. 125 Greenwich Street Financial District

12. 76 Eleventh Avenue West Chelsea

13

1

10

4

2

12

9

8

6

5 3

11

7

(1) For the percentage of each real estate project owned, please refer to the “Summary of Real Estate Investments” section of Item 7 -Management’s Discussion and Analysis of Financial Condition and Results of Operations -of Vector Group Ltd.’s Form 10-K for

the annual period ended December 31 2016 (Commission File Number 1-5759).

(1)

NEW VALLEY’S REAL ESTATE SUMMARY AS OF DECEMBER 31, 2016

14

Net cash

invested

Cumulative earnings /

(loss)(2)

Carrying

value(2)(3)

Projected

cumulative area

Projected construction

end date

Range of ownership

Number of

investments

Land owned

New York City SMSA $ 12,848 $ - $ 12,848 N/A 100.0% 1

All other U.S. areas 2,644 8,148 10,792 450 Acres N/A 100.0% 1

$ 15,492 $ 8,148 $ 23,640 2

Condominium and Mixed Use Development (Minority interest owned)

New York City SMSA(3) $ 92,371 $ 34,090 $ 126,461 2,846,700 Square feet 2015 - 2019 3.1% - 49.5% 11

All other U.S. areas 42,522 3,737 46,259 593,000 Square feet 2017 - 2019 15.0% - 48.5% 4

$ 134,893 $ 37,827 $ 172,720 3,439,700 Square feet 15

Apartments (Minority interest owned)

All other U.S. areas 7,025 1,262 8,287 6,005 Apartments N/A 7.6% - 16.3% 2

$ 7,025 $ 1,262 $ 8,287 2

Hotels (Minority interest owned)

New York City SMSA $ 27,778 $ (5,883) $ 21,895 628 Hotel rooms N/A 5.2% 1

International 5,869 (2,832) 3,037 101 Hotel rooms N/A 49.0% 1

$ 33,647 $ (8,715) $ 24,932 729 Hotel rooms 2

Commercial (Minority interest owned)

New York City SMSA $ 4,936 $ (1,646) $ 3,290 219,382 Square feet N/A 49.0% 1

All other U.S. areas 10,000 - 10,000 90,000 Square feed N/A 2.1% 1

$ 14,936 $ (1,646) $ 13,290 2

Total $ 205,993 $ 36,876 $ 242,869 23

SUMMARY

New York City SMSA(3) $ 137,933 $ 26,561 $ 164,494 14

All other U.S. areas 62,191 13,147 75,338 8

International 5,869 (2,832) 3,037 1

$ 205,993 $ 36,876 $ 242,869 23

(1) For the percentage of each real estate project owned, please refer to the “Summary of Real Estate Investments” section of Item 7 -Management’s Discussion and Analysis of Financial Condition and Results of Operations of Vector Group Ltd.’s Form 10-K for

the period ended December 31, 2016 (Commission File Number 1-5759).

(2) Includes interest expense capitalized to real estate ventures of $21,362.

(3) Carrying value includes non-controlling interest of $3,845.

(Dollars in thousands)

(1)

FINANCIAL DATA

$51 $40 $27 $28

$199 $211 $245

$269

2013 2014 2015 2016

ADJUSTED HISTORICAL FINANCIAL DATA

$483

$563 $680

$1,014

$1,021

$1,011

2013 2014 2015 2016

16

$9

$1,498

$1,691

$1,593

Tobacco Real Estate E-Cigarettes Corporate & Other

Adjusted Revenues(1) Adjusted EBITDA(1)

$236 $227

$280

$246

(1) Vector’s revenues for the periods presented were $1,096, $1,080, $1,591 and $1,691, respectively. Vector’s Net income for the periods presented was $30.7, $37.3, $36.9 and $71.1, respectively Adjusted Revenues and Adjusted

EBITDA are Non-GAAP Financial Measures. Please refer to the Company’s Current Report on Forms 8-K, filed on November 15, 2016 and March 1, 2017 (Exhibit 99.1) for a reconciliation of Non-GAAP financial measures to GAAP as well

as the Disclaimer to this document on Page 2.

($13) ($11) ($13)

($13)

$(1)

$(16)

(Dollars in millions)

($13)

Tobacco Real Estate E-Cigarettes Corporate & Other

$1,660

$1,017

$643

($1)

Vector Group Ltd. 100.0 112.1 143.4 112.5 135.4 192.7 227.0 219.3 279.5 411.4 513.2 557.6 558.6

S&P 500 100.0 115.8 122.2 77.0 97.4 112.0 114.4 132.7 175.6 199.7 202.4 226.6 240.1

S&P MidCap 100.0 110.3 119.1 76.0 104.3 132.1 129.8 152.9 204.1 224.0 219.1 264.5 276.0

NYSE ARCA Tobacco 100.0 140.2 154.2 123.0 173.7 207.4 243.9 289.5 319.0 317.0 384.1 484.4 496.9

Dow Jones Real Estate Total

Return

100.0 135.5 110.9 66.5 86.9 110.4 117.1 139.2 141.6 180.2 184.1 198.0 207.2

HISTORICAL STOCK PERFORMANCE

17

Note: The graph above compares the total annual return of Vector’s Common Stock, the S&P 500 Index, the S&P MidCap 400 Index, the NYSE ARCA Tobacco Index and the Dow Jones Real Estate Total Return for the period from December31,2005 through

February 28, 2017. The graph assumes that all dividends and distributions were reinvested. Source: Bloomberg LP

Value of $100 Invested – December 31, 2005

C

u

m

u

la

ti

ve

R

e

tu

rn

Vector Group Ltd. S&P 500 S&P MidCap NYSE ARCA Tobacco Dow Jones Real Estate Total Return

500%

400%

300%

200%

100%

0%

458.6%

396.9%

176.0%

140.1%

107.2%

Feb -17Dec-15Dec-14Dec-13Dec-12Dec-11Dec-10Dec-09Dec-08Dec-07Dec-06Dec-05 Dec -16