Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________

FORM 10-K

______________________________________________________

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-54673

______________________________________________________

KBS LEGACY PARTNERS APARTMENT REIT, INC.

(Exact Name of Registrant as Specified in Its Charter)

______________________________________________________

Maryland | 27-0668930 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

800 Newport Center Drive, Suite 700 Newport Beach, California | 92660 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(949) 417-6500

(Registrant’s Telephone Number, Including Area Code)

______________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

None | None | |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value per share

______________________________________________________________________

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment of this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer | ¨ | Accelerated Filer | ¨ | |||

Non-Accelerated Filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

There is no established market for the Registrant’s shares of common stock. On December 8, 2015, the board of directors of the Registrant approved an estimated value per share of the Registrant’s common stock of $10.29 based on the estimated value of the Registrant’s assets less the estimated value of the Registrant’s liabilities, divided by the number of shares outstanding, all as of September 30, 2015. For a full description of the methodologies used to value the Registrant’s assets and liabilities in connection with the calculation of the estimated value per share as of December 8, 2015, see Part II, Item 5, “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities - Market Information” of the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2015. On December 9, 2016, the board of directors of the Registrant approved an estimated value per share of the Registrant’s common stock of $9.35 based on the estimated value of the Registrant’s assets less the estimated value of the Registrant’s liabilities, divided by the number of shares outstanding, all as of September 30, 2016. For a full description of the methodologies used to value the Registrant’s assets and liabilities in connection with the calculation of the estimated value per share as of December 9, 2016, see Part II, Item 5, “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities - Market Information” in this Annual Report on Form 10-K.

There were approximately 20,607,997 shares of common stock held by non-affiliates as of June 30, 2016, the last business day of the Registrant’s most recently completed second fiscal quarter.

As of March 6, 2017, there were 20,860,094 outstanding shares of common stock of the Registrant.

TABLE OF CONTENTS

ITEM 1. | |||

ITEM 1A. | |||

ITEM 1B. | |||

ITEM 2. | |||

ITEM 3. | |||

ITEM 4. | |||

ITEM 5. | |||

ITEM 6. | |||

ITEM 7. | |||

ITEM 7A. | |||

ITEM 8. | |||

ITEM 9. | |||

ITEM 9A. | |||

ITEM 9B. | |||

ITEM 10. | |||

ITEM 11. | |||

ITEM 12. | |||

ITEM 13. | |||

ITEM 14. | |||

ITEM 15. | |||

1

FORWARD-LOOKING STATEMENTS

Certain statements included in this Annual Report on Form 10-K are forward-looking statements. Those statements include statements regarding the intent, belief or current expectations of KBS Legacy Partners Apartment REIT, Inc. and members of our management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Actual results may differ materially from those contemplated by such forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law.

The following are some of the risks and uncertainties, although not all of the risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward-looking statements:

• | We are dependent on our advisor and sub-advisor to manage our investments and to provide certain other services. We are dependent on Legacy Partners, Inc., formerly known as Legacy Partners Residential, Inc. (“LPI”), an affiliate of our sub-advisor, to provide property management services for our investments. |

• | All of our executive officers, some of our directors and other key real estate professionals are also officers, managers, directors, key professionals and/or holders of a controlling interest in our advisor, the sub-advisor, our dealer manager and other sponsor-affiliated entities. As a result, they face conflicts of interest, including significant conflicts created by our advisor’s compensation arrangements with us and other programs and investors advised by our sponsors. Fees paid to our advisor in connection with the management of our properties are based on the cost of the property, not on the quality of the services rendered to us. This arrangement could result in unanticipated actions. |

• | We did not raise the maximum offering amount in our public offerings. Because we raised substantially less than the maximum offering amount, we were not able to invest in as diverse a portfolio of real estate properties as we otherwise would and the value of an investment in us will vary more widely with the performance of specific assets. There is a greater risk that stockholders will lose money in their investment in us, as we have less diversity in our portfolio. |

• | We pay substantial fees to and expenses of our advisor and its affiliates and, in connection with our public offerings, we paid substantial fees to participating broker-dealers. These payments increase the risk that our stockholders will not earn a profit on their investment in us and increase the risk of loss to our stockholders. |

• | From time to time during our operational stage, we have used proceeds from financings to fund distributions. Our organizational documents permit us to pay distributions from any source, including offering proceeds, which may constitute a return of capital. We have not established a limit on the amount of distributions that we may fund from sources other than from cash flows from operations. In addition, depending on the number of our properties we sell in connection with our implementation of our strategic alternatives, we may have to adjust the ongoing distribution rate subsequent to such sales in order to maintain the current distribution coverage. |

• | We may incur debt until our total liabilities would exceed 75% of the cost of our tangible assets (before deducting depreciation and other non-cash reserves), and we may exceed this limit with the approval of the conflicts committee of our board of directors. To the extent financing in excess of this limit is available on attractive terms, our conflicts committee may approve debt such that our total liabilities would exceed this limit. High debt levels could limit the amount of cash we have available to distribute and could result in a decline in the value of an investment in us. |

• | Disruptions in the financial markets and uncertain economic conditions could adversely affect our ability to implement our business strategy and generate returns to stockholders. |

• | We depend on tenants for our revenue. Revenues from our real property investments could decrease due to a reduction in tenants (caused by factors including, but not limited to, tenant defaults or early termination or non-renewal of existing tenant leases) and/or lower rental rates, limiting our ability to pay distributions to our stockholders. |

2

• | During any calendar year, once we have redeemed $1.5 million of shares under our share redemption program, including shares redeemed in connection with a stockholder’s death, “qualifying disability,” or “determination of incompetence” (both as defined in the share redemption program and together with redemptions in connection with a stockholder’s death, “Special Redemptions”), the remaining $0.5 million of the $2.0 million annual limit shall be reserved exclusively for Special Redemptions. In January 2016, we exhausted the $1.5 million of funds available for all redemptions for 2016 and in August 2016, we exhausted the remaining $0.5 million of funds available for Special Redemptions for 2016. As of December 31, 2016, we had $1.4 million of outstanding and unfulfilled ordinary redemption requests and $0.3 million of outstanding and unfulfilled Special Redemption requests. The annual limitation was reset on January 1, 2017, and we had an aggregate of $2.0 million of funds available for all redemptions, subject to the limitations in the share redemption program, including the requirement that the first $1.5 million of funds is available for all redemptions and the last $0.5 million is available solely for Special Redemptions. We exhausted $1.5 million of funds available for all redemptions for 2017 in January 2017 and $0.3 million of funds available for Special Redemptions for 2017 in January and February 2017. As such, we will only be able to process $0.2 million of redemption requests related to Special Redemptions for the remainder of 2017. |

• | Our Special Committee (defined below) has completed its analysis of potential strategic alternatives and as a result, we anticipate that we will pursue certain strategic asset sales and hold the majority of our real estate properties in an effort to create additional stockholder value, while still paying ongoing distributions. We intend to use some of the net proceeds after paying sale-related expenses including, in certain cases, paying off the notes payable related to such assets, from any strategic asset sales we close to: (i) make renovations at certain remaining real estate properties, which we believe could increase property-level net operating income (“NOI”) and create additional stockholder value; and (ii) pay a special distribution to our stockholders. However, there is no assurance that this process will result in stockholder liquidity, or provide a return to stockholders that equals or exceeds our estimated value per share. |

All forward-looking statements should be read in light of the risks identified in Part I, Item 1A of this Annual Report on Form 10-K.

3

PART I

ITEM 1. | BUSINESS |

Overview

KBS Legacy Partners Apartment REIT, Inc. (the “Company”) was formed on July 31, 2009 as a Maryland corporation that elected to be taxed as a real estate investment trust (“REIT”) beginning with the taxable year ended December 31, 2010 and intends to continue to operate in such a manner. As used herein, the terms “we,” “our” and “us” refer to the Company and as required by context, KBS Legacy Partners Limited Partnership, a Delaware limited partnership formed on August 4, 2009 (the “Operating Partnership”), and its subsidiaries. We conduct our business primarily through our Operating Partnership, of which we are the sole general partner.

We invested in and manage a portfolio of high quality apartment communities located throughout the United States. Our portfolio consists of “core” apartment communities that were already well-positioned and producing rental income at acquisition. As of December 31, 2016, we owned 11 apartment complexes.

KBS Capital Advisors LLC (“KBS Capital Advisors”) is our external advisor. As our advisor, KBS Capital Advisors is responsible for managing our day-to-day operations and our portfolio of real estate assets. Subject to the terms of the advisory agreement between KBS Capital Advisors and us, KBS Capital Advisors delegates certain advisory duties to a sub-advisor, KBS-Legacy Apartment Community REIT Venture, LLC (the “Sub-Advisor”), which is a joint venture among KBS Capital Advisors and Legacy Partners Residential Realty LLC (“LPRR LLC”). LPRR LLC was formed in the State of Delaware on July 10, 2009 to be the co-manager of the Sub-Advisor. Notwithstanding such delegation to the Sub-Advisor, KBS Capital Advisors retains ultimate responsibility for the performance of all the matters entrusted to it under the advisory agreement. KBS Capital Advisors made recommendations on all investments to our board of directors. A majority of our board of directors, including a majority of our independent directors acting through the conflicts committee, approved our investments. KBS Capital Advisors, either directly or through the Sub-Advisor, also provides asset-management, marketing, investor-relations and other administrative services on our behalf. LPI is the property manager for our real estate property investments. Our Sub-Advisor owns 20,000 shares of our common stock. We have no paid employees.

On March 12, 2010, we commenced our initial public offering of 280,000,000 shares of common stock for sale to the public, of which 80,000,000 shares were offered pursuant to our dividend reinvestment plan (the “Initial Offering”). We retained KBS Capital Markets Group LLC (“KBS Capital Markets Group”), an affiliate of our advisor, to serve as the dealer manager for the Initial Offering pursuant to a dealer manager agreement dated March 12, 2010 (the “Initial Dealer Manager Agreement”).

On May 31, 2012, we filed a registration statement on Form S-11 with the SEC to register a follow-on public offering (the “Follow-on Offering” and together with the Initial Offering, the “Offerings”). Pursuant to the registration statement, as amended, we registered up to an additional $2,000,000,000 of shares of common stock for sale to the public and up to an additional $760,000,000 of shares pursuant to our dividend reinvestment plan. The SEC declared our registration statement for the Follow-on Offering effective on March 8, 2013.

We retained KBS Capital Markets Group to serve as the dealer manager for the Follow-on Offering pursuant to a dealer manager agreement dated March 8, 2013 (the “Follow-on Dealer Manager Agreement” and together with the Initial Dealer Manager Agreement, the “Dealer Manager Agreements”). On March 12, 2013, we ceased offering shares pursuant to the Initial Offering and on March 13, 2013, we commenced offering shares to the public pursuant to the Follow-on Offering. We ceased offering shares of common stock in the primary Follow-on Offering on March 31, 2014 and completed subscription processing procedures on April 30, 2014. We continue to offer shares under our dividend reinvestment plan.

Through its completion on March 12, 2013, we sold 18,088,084 shares of common stock in the Initial Offering for gross offering proceeds of $179.2 million, including 368,872 shares of common stock under our dividend reinvestment plan for gross offering proceeds of $3.5 million. We sold 1,496,198 shares of common stock in our primary Follow-on Offering for gross offering proceeds of $15.9 million.

As of December 31, 2016, we had sold an aggregate of 21,683,960 shares of common stock in the Offerings for gross offering proceeds of $215.9 million, including an aggregate of 2,468,550 shares of common stock under our dividend reinvestment plan for gross offering proceeds of $24.4 million. Also as of December 31, 2016, we had redeemed 807,692 shares sold in the Offerings for $7.9 million. We have used substantially all of the net proceeds from the primary Offerings to invest in and manage a portfolio of high quality apartment communities located throughout the United States as described above.

4

As described further herein, we have entered into agreements with certain affiliates pursuant to which they provide services to us. Peter M. Bren, Keith D. Hall, Peter McMillan III and Charles J. Schreiber, Jr. control and indirectly own KBS Capital Advisors and KBS Capital Markets Group. We refer to these individuals as our “KBS sponsors.” Through their trusts, C. Preston Butcher, W. Dean Henry and Guy K. Hays own and control LPRR LLC. We refer to these individuals as our “Legacy sponsors.”

Objectives and Strategies

Our primary investment objectives are:

• | to provide our stockholders with attractive and stable cash distributions; and |

• | to preserve and return our stockholders’ capital contributions. |

Our goals and objectives for 2017 include the following: (i) making strategic asset sales as described above and using a portion of the proceeds to pay a special distribution to our stockholders; (ii) undertaking renovations at certain assets to create additional stockholder value; (iii) maintaining portfolio occupancy; (iv) increasing portfolio net cash flow and modified funds from operations (“MFFO”); and (v) increasing the net asset value of our portfolio. However, we can give no assurances that we will be successful in implementing any of these goals or objectives or that the successful implementation of any or all of such goals or objectives will result in additional stockholder value or the payment of special distributions to our stockholders.

On January 21, 2016, our board of directors formed a special committee (the “Special Committee”) composed of all of our independent directors to explore the availability of strategic alternatives involving our company with the goal of providing liquidity options for our stockholders while preserving and maximizing overall returns on our investment portfolio. While we conduct this process, we remain 100% focused on managing our properties.

As part of the process of exploring strategic alternatives, on April 5, 2016, the Special Committee engaged Robert A. Stanger & Co., Inc. (“Stanger”) to act as our financial advisor and to assist us and the Special Committee with this process. Under the terms of the engagement, Stanger provided various financial advisory services, as requested by the Special Committee as customary for an engagement in connection with exploring strategic alternatives. Subsequently, we engaged Holliday Fenoglio Fowler, L.P., a leading provider of commercial real estate and capital markets services and an unaffiliated independent third party (“HFF”), to market our real estate properties for sale. We are not obligated to enter into any particular transaction or any transaction at all. HFF has completed the initial marketing of our real estate properties and received offers for both our entire portfolio and individual properties. Based on feedback received during the marketing process, we anticipate that we will pursue certain strategic asset sales and hold the majority of our real estate properties in an effort to create additional stockholder value, while still paying ongoing distributions. We believe that holding the majority of our real estate properties will allow certain debt prepayment obligations to decrease as the loans secured by those properties move closer to maturity, which should create additional stockholder value. Depending on the number of properties sold, we may have to adjust the ongoing distribution rate subsequent to such sales in order to maintain the current distribution coverage.

We intend to use some of the net proceeds after paying sale-related expenses including, in certain cases, paying off the notes payable related to such assets, from any strategic asset sales we close to: (i) make renovations at certain remaining real estate properties, which we believe could increase property-level NOI and create additional stockholder value; and (ii) pay a special distribution to our stockholders. However, there is no assurance that this process will result in stockholder liquidity, or provide a return to stockholders that equals or exceeds our estimated value per share. Any future special distributions we pay from the proceeds of future dispositions will reduce our estimated value per share and this reduction will be reflected in our updated estimated value per share, which we expect to update no later than December 2017.

On December 29, 2016, we, through the Owner (defined below in Part I, Item 2), entered into an agreement for purchase and sale (the “Wesley Village Agreement”) for the sale of Wesley Village (defined below in Part I, Item 2) to Bluerock Real Estate, LLC (the “Purchaser”). The Wesley Village Agreement was subsequently terminated, reinstated and amended and on March 9, 2017, we completed the sale of Wesley Village. For information relating to the Wesley Village Agreement, see Part I, Item 2, “Properties - Wesley Village Agreement.” For information relating to the termination and reinstatement of, and the amendments to, the Wesley Village Agreement, and the subsequent sale of Wesley Village, see Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Subsequent Events - Termination and Reinstatement of, and Amendments to, the Wesley Village Agreement; Disposition of Wesley Village.”

5

Real Estate Portfolio

We made all of our equity investments in core apartment communities that have relatively low investment risk characteristics, with the goal of attaining a portfolio of income-producing properties that provide attractive and stable returns to our investors. Core apartment communities are high quality, well positioned, existing properties producing rental income, generally with at least 85% occupancy. Such properties are generally newer properties that are well-located in major urban or suburban submarkets. Core apartment communities generally have fewer near-term capital expenditure requirements (with minor deferred maintenance or cosmetic improvements, if any, required) and have the demonstrated ability to produce high occupancies and stable cash flows. As a result, core apartment communities tend to have a relatively low investment risk profile.

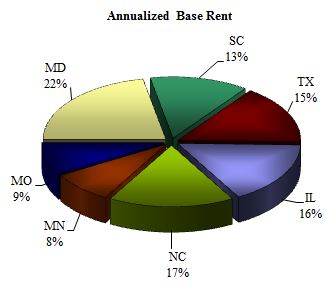

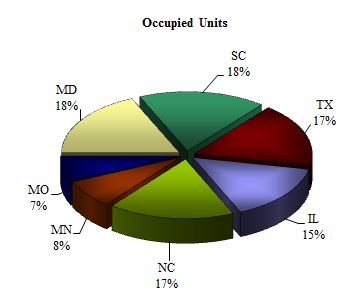

As of December 31, 2016, we owned 11 apartment communities. The properties we owned as of December 31, 2016 encompass 3.1 million rentable square feet. The following charts illustrate our geographic diversification based on total occupied units and total annualized base rent as of December 31, 2016.

We generally intend to hold our core properties for five to ten years, which we believe is a reasonable period to enable us to capitalize on the potential for increased income and capital appreciation of properties. Our Legacy sponsors developed a well-defined exit strategy for each of our investments and periodically perform a hold-sell analysis on each asset in order to determine the optimal time to sell the asset and generate a strong return for our stockholders. Periodic reviews of each asset focus on the remaining available value enhancement opportunities for the asset and the demand for the asset in the marketplace. Economic and market conditions may influence us to hold our investments for different periods of time. We may sell an asset before the end of the expected holding period if we believe that market conditions and asset positioning have maximized its value to us or the sale of the asset would otherwise be in the best interests of our stockholders.

Description of Our Apartment Leases. We expect that all of our apartment communities will lease to their tenants under similar lease terms. Consistent with the multifamily industry, we anticipate that our lease terms will range from month-to-month up to fourteen months. These terms provide maximum flexibility for us to implement rental increases when the market will bear such increases.

6

Property Management and Other Services. In connection with certain of our property acquisitions, we, through separate indirect wholly owned subsidiaries, entered into separate Property Management — Account Services Agreements (each, a “Services Agreement”) with Legacy Partners Residential L.P. (“LPR”), an affiliate of the Sub-Advisor, pursuant to which LPR provided certain account maintenance and bookkeeping services related to these properties. Under each Services Agreement, we paid LPR a monthly fee in an amount equal to 1% of each property’s gross monthly collections. Unless otherwise provided for in an approved operating budget for a property, LPR was responsible for all expenses that it incurred in rendering services pursuant to each Services Agreement. Each Services Agreement had an initial term of one year and continued thereafter on a month-to-month basis unless either party gave 30 days’ prior written notice of its desire to terminate the Services Agreement. Notwithstanding the foregoing, we had the right to terminate each Services Agreement at any time without cause upon 30 days’ prior written notice to LPR. As described below, as of June 9, 2015, each of the Services Agreements had been terminated.

During the year ended December 31, 2015, we, through indirect wholly owned subsidiaries (each, a “Property Owner”), entered into property management agreements with LPI (each, a “Property Management Agreement”), pursuant to which LPI provides, among other services, general property management services, including bookkeeping and accounting services, construction management services and budgeting and business plans for our properties, as follows:

Property Name | Effective Date | Management Fee Percentage | ||

Watertower Apartments | 04/07/2015 | 2.75% | ||

Crystal Park at Waterford | 04/14/2015 | 3.00% | ||

The Residence at Waterstone | 04/28/2015 | 3.00% | ||

Lofts at the Highlands | 05/05/2015 | 3.00% | ||

Legacy at Martin’s Point | 05/12/2015 | 3.00% | ||

Poplar Creek | 05/14/2015 | 3.00% | ||

Wesley Village | 05/19/2015 | 3.00% | ||

Legacy Grand at Concord | 05/21/2015 | 3.00% | ||

Millennium Apartment Homes (1) | 05/27/2015 | 3.00% | ||

Legacy Crescent Park (1) | 05/29/2015 | 3.00% | ||

Legacy at Valley Ranch | 06/09/2015 | 3.00% | ||

____________________

(1) Under the Property Management Agreement, the Property Owner will pay LPI the Management Fee Percentage in an amount equal to the greater of (a) 3% of the Gross Monthly Collections (as defined in the Property Management Agreement) or (b) $4,000 per month.

Under the Property Management Agreements, each Property Owner pays LPI: (i) a monthly fee based on a percentage (as described in the table above, the “Management Fee Percentage”) of the Gross Monthly Collections (as defined in each Property Management Agreement), (ii) a construction supervision fee equal to a percentage of construction costs to the extent overseen by LPI and as further detailed in each Property Management Agreement, (iii) a leasing commission at a rate to be agreed upon between the Property Owner and LPI for executed retail leases that were procured or obtained by LPI, (iv) certain reimbursements if included in an approved capital budget and (v) certain reimbursements if included in the approved operating budget, including the reimbursement of the salaries and benefits for on-site personnel. Unless otherwise provided for in an approved operating budget, LPI is responsible for all expenses that it incurs in rendering services pursuant to each Property Management Agreement. Each Property Management Agreement had an initial term of one year and each has continued on a month-to-month basis pursuant to its terms. Either party may terminate a Property Management Agreement provided it gives 30 days’ prior written notice of its desire to terminate such agreement. Notwithstanding the foregoing, the Property Owner may terminate each Property Management Agreement at any time without cause upon 30 days’ prior written notice to LPI. The Property Owner may also terminate the Property Management Agreement with cause immediately upon notice to LPI and the expiration of any applicable cure period. LPI may terminate each Property Management Agreement at any time without cause upon prior written notice to the Property Owner which, depending upon the terms of the particular Property Management Agreement, requires either 30, 60 or 90 days prior written notice. LPI may terminate the Property Management Agreement for cause if a Property Owner commits any material default under the Property Management Agreement and the default continues for a period of 30 days after notice from LPI to a Property Owner for a default or, in the case of Watertower Apartments, Lofts at the Highlands, Wesley Village, Legacy Grand at Concord, Millennium Apartment Homes and Legacy Crescent Park, if a monetary default continues for a period of 10 days after notice of such monetary default.

7

The properties were previously managed by third-party property management companies pursuant to the terms of individual property management agreements (together, the “Prior Management Agreements”). The termination of services under the Prior Management Agreements and the Services Agreements (with respect to The Residence at Waterstone, Lofts at the Highlands, Legacy at Martin’s Point, Poplar Creek, Wesley Village, Legacy Grand at Concord, Millennium Apartment Homes and Legacy Crescent Park) were negotiated to coincide with the Effective Date of the respective Property Management Agreements. The Management Fee Percentage and any other fees and reimbursements payable to LPI by the Property Owner under each Property Management Agreement are approximately equal to the applicable percentage and other fees and reimbursements payable to the prior third party management companies and LPR by the Property Owner under the now-terminated Services Agreements and Prior Management Agreements.

Financing Objectives

We financed all of our real estate investments with a combination of the proceeds we received from the Offerings and debt. We used debt financing to increase the amount available for investment and to increase overall investment yields to us and our stockholders. We may use debt financing to pay for capital improvements or repairs to properties; to refinance existing indebtedness; to pay distributions; or to provide working capital. As of December 31, 2016, we had $282.6 million of fixed-rate debt outstanding with a weighted-average interest rate of 3.3%. We limit our total liabilities to 75% of the cost (before deducting depreciation and other noncash reserves) of our tangible assets; however, we may exceed that limit if the majority of the conflicts committee approves each borrowing in excess of such limitation and we disclose such borrowings to our stockholders in our next quarterly report with an explanation from the conflicts committee of the justification for the excess borrowing. As of December 31, 2016, our borrowings and other liabilities were approximately 64% of the cost (before deducting depreciation and other noncash reserves) of our tangible assets.

Market Outlook ─ Multifamily Real Estate and Finance Markets

Strong demand and trailing supply have been dominant themes for professionally managed, multifamily rental real estate (“Multifamily”) in the United States since the recession of 2008-2009. Although the U.S. Multifamily outlook remains positive, supply and affordability are becoming concerns in a growing number of urban core markets, most notably, New York City, San Francisco, Los Angeles, Miami and other prominent coastal cities. The beneficiaries of these “urban-core concerns” have increasingly been suburban markets. With more renters opting for the suburbs, vacancy has been declining and rents increasing in suburban markets. This trend is likely to continue, assuming the economy continues to grow and suburban markets remain affordable compared to their urban counterparts. These factors bode well for our portfolio, which is predominantly located in suburban markets.

It is approaching eight years since the recession of 2008-2009. Since that time, the U.S. economy has experienced modest, but sustained, real GDP and job growth. The pace of growth eased in 2016 however, as compared to 2014 and 2015. Real GDP growth in 2014 and 2015 was 2.4% and 2.6%, respectively, versus 1.6% for 2016. Similarly, the United States added 3.0 and 2.7 million jobs in 2014 and 2015, respectively, versus 2.2 million jobs gained in 2016. It is noteworthy that the easing of economic growth in 2016 occurred predominantly in the first half of the year. Following annualized real GDP growth of 0.8% and 1.4% in the first and second quarters of 2016, real GDP growth spiked in the third quarter to 3.5% and again eased to 1.9% in the fourth quarter.

U.S. Multifamily construction of new multifamily units was at historical lows following the recession, as demand was anemic stemming from the loss of approximately 8.6 million jobs. A historical high of prime-age renters (20-34 year olds) were living with their parents waiting for the job market to recover at the time. In anticipation of the economic recovery and a release of this pent-up demand, multifamily developers began increasing the number of new construction units, rebounding from 98,000 in 2009 to over 350,000 units in 2015. By the end of 2016, not only had nearly twice as many jobs been filled than had been lost during the recession, but Multifamily supply outpaced demand for the first time since the recession.

As with many multifamily experts, we see the 2016 supply imbalance as a temporary phenomenon and unrelated to our portfolio. Supply concerns are predominantly focused in a limited number of urban core markets, and our portfolio is suburban weighted. Also, the majority of the new construction pipeline in 2017 is focused in urban core markets. Moreover, Multifamily supply is projected to slow towards historic norms over the next 1-2 years, as banks have been gradually tightening their construction lending standards and equity investors have been becoming more selective about the developments they pursue.

8

Multifamily demand remains strong and is projected to sustain its fundamentals for the next few years. Vacancy was 4.8% and 4.6% in 2014 and 2015, respectfully, and is projected to remain in this range through 2019. This compares favorably to the historical equilibrium vacancy rate of 5.6%. With more supply generally, Multifamily rent growth has eased somewhat. In 2016, rent growth was 3.4%, as compared to 4.2% and 5.0% in 2014 and 2015, respectively. Rent growth is expected to ease further in 2017 to 3.1%, but still above the historical norm of 2.9%, as pipeline supply is completed. However, with persistent demand and easing supply as noted, rent growth is projected to resume in 2018.

With Multifamily supply and affordability concerns centered primarily in urban core markets, particularly with regard to large coastal cities, more and more renters are opting for the suburbs. According to CBRE Research, the least affordable Multifamily markets in the U.S. in 2011 have become even more unaffordable in the years since then. Furthermore, according to the latest data available from the U.S. Census Bureau, 1.8 million more people moved to the suburbs than to urban cores. This shift of demand towards the suburbs is projected to continue and well located, relatively affordable (as compared to their urban core counterparts) suburban apartments are likely to continue to perform well in the short-term (2-3 years).

In the medium- and long-term, we believe the prospects for Multifamily real estate investment continue to be promising. We expect several positive demographic trends, as noted below, will drive the demand for multifamily housing for the remainder of this decade and well into the next.

• | U.S. population growth - The U.S. Census Bureau projects that the U.S. population will increase by approximately 38 million (12%) between 2015 and 2030. Note that, currently, about 36% of people choose to rent as opposed to own a home. |

• | Baby Boomers downsizing - The population age 65 and over is increasing, driven by Baby Boomers, from approximately 48 million in 2015 to about 74 million in 2030. Despite generally having enough income to purchase a home, many Baby Boomers are downsizing, opting for the convenience and amenities of Multifamily properties. |

• | Echo Boom - The children of the Baby Boom generation, dubbed the Echo Boomers, will have increased the prime rental age group, 20 to 34 year olds, by 2 million (69 million total) from 2015 to 2020. This age cohort is expected to remain at this elevated level, up 4 million from 2010, through 2030 according to the U.S. Census Bureau. |

Finally, with regard to the Multifamily investment market, although interest rates increased in 2016 and are likely to increase modestly in 2017, Multifamily capitalization rates have not increased and values have remained stable. Increasing interest rates have historically had a negative effect on Multifamily values. However, three key factors are bouying values. First, Multifamily market fundamentals, as described above, are strong and their forecast promising. Secondly, the spread between 10-year U.S. Treasuries and capitalization rates has been atypically wide in recent years and can therefore absorb modest interest rate hikes without increasing capitalization rates. Lastly, U.S. commercial real estate, including Multifamily, is a favored investment for foreign capital due to the lack of attractive risk-adjusted returns in the foreseeable future elsewhere.

Economic Dependency

We are dependent on our advisor and the Sub-Advisor for certain services that are essential to us, including the management of the daily operations of our investment portfolio; the disposition of investments and other general and administrative responsibilities. We are also dependent on LPI to provide the property management services under the Property Management Agreements. In the event that these companies are unable to provide any of the respective services, we will be required to obtain such services from other sources.

Competitive Market Factors

We will face competition from various entities in relation to our apartment communities, including other REITs, pension funds, insurance companies, investment funds and companies, partnerships, and developers. Many of these entities have substantially greater financial resources than we do and may be willing to accept lower returns on their investment. Competition from these entities may increase the bargaining power of persons or entities seeking to buy apartment communities. Although we believe that we are well-positioned to compete effectively in each facet of our business, there is enormous competition in our market sector and there can be no assurance that we will compete effectively or that we will not encounter increased competition in the future that could limit our ability to conduct our business effectively.

For example, we face competition from other apartment communities for tenants. This competition could reduce occupancy levels and revenues at our apartment communities, which would adversely affect our operations. We expect to face competition from many sources. We will face competition from other apartment communities both in the immediate vicinity and in the larger geographic market where our apartment communities will be located. Overbuilding of apartment communities may occur. If so, this will increase the number of apartment units available and may decrease occupancy and apartment rental rates.

9

Compliance with Federal, State and Local Environmental Law

Under various federal, state and local environmental laws, ordinances and regulations, a current or previous real property owner or operator may be liable for the cost of removing or remediating hazardous or toxic substances on, under or in such property. These costs could be substantial. Such laws often impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. Environmental laws also may impose liens on properties or restrictions on the manner in which properties may be used or businesses may be operated, and these restrictions may require substantial expenditures or prevent us from entering into leases with prospective tenants that may be impacted by such laws. Environmental laws provide for sanctions for noncompliance and may be enforced by governmental agencies or, in certain circumstances, by private parties. Certain environmental laws and common law principles could be used to impose liability for the release of and exposure to hazardous substances, including asbestos-containing materials and lead-based paint. Third parties may seek recovery from real property owners or operators for personal injury or property damage associated with exposure to released hazardous substances and governments may seek recovery for natural resource damage. The cost of defending against claims of environmental liability, of complying with environmental regulatory requirements, of remediating any contaminated property, or of paying personal injury, property damage or natural resource damage claims could reduce our cash available for distribution to our stockholders.

Each of our real estate properties was subject to a Phase I environmental assessment prior to the time it was acquired. Our real estate properties are subject to potential environmental liabilities arising primarily from historic activities at or in the vicinity of the properties. Based on our environmental diligence and assessments of our properties and our purchase of pollution and remediation legal liability insurance, we do not believe that environmental conditions at our properties are likely to have a material adverse effect on our operations.

Employees

We have no paid employees. The employees of our advisor and the Sub-Advisor, or their affiliates, provide management, acquisition, advisory and certain administrative services for us.

Principal Executive Office

Our principal executive offices are located at 800 Newport Center Drive, Suite 700, Newport Beach, California 92660. Our telephone number, general facsimile number and web address are (949) 417-6500, (949) 417-6501 and www.kbslegacyreit.com, respectively.

Industry Segments

As of December 31, 2016, we had invested in 11 apartment communities. Substantially all of our revenue and net income (loss) is from real estate, and therefore, we currently operate in one business segment.

Available Information

Access to copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other filings with the SEC, including amendments to such filings, may be obtained free of charge from the following website, www.kbslegacyreit.com, or through the SEC’s website, www.sec.gov. These filings are available promptly after we file them with, or furnish them to, the SEC.

10

ITEM 1A. | RISK FACTORS |

The following are some of the risks and uncertainties that could cause our actual results to differ materially from those presented in our forward-looking statements. The risks and uncertainties described below are not the only ones we face but do represent those risks and uncertainties that we believe are material to us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also harm our business.

Risks Related to an Investment in Us

Because we raised substantially less than the maximum offering amount in our Offerings, we were not able to invest in as diverse a portfolio of properties as we otherwise would, which will cause the value of our stockholders’ investment in us to vary more widely with the performance of specific assets, and cause our general and administrative expenses to constitute a greater percentage of our revenue, potentially increasing the risk that our stockholders will lose money in their investment. These results could be exacerbated to the extent we are able to sell certain of our assets.

The proceeds we raised in our Offerings were lower than our sponsors and dealer manager originally expected. Therefore, we made fewer investments than originally intended resulting in less diversification in terms of the number of investments owned and the geographic regions in which our investments are located. Adverse developments with respect to a single property, or a geographic region, will have a greater adverse impact on our operations than they otherwise would. In addition, our inability to raise substantial funds increased our fixed operating expenses as a percentage of our revenue and reduced our net income, increasing the risk that our stockholders will lose money on their investment. Because of the size of our portfolio, any disposition activity will cause our general and administrative expenses, which are not directly related to the size of our portfolio, to increase significantly as a percentage of our cash flow from operations. To the extent we are able to dispose of certain of our assets as part of our implementation of our strategic alternatives, these effects may be exacerbated or we may have to adjust our ongoing distribution rate in order to maintain current distribution coverage.

Because no public trading market for our shares currently exists, it will be difficult for our stockholders to sell their shares and, if they are able to sell their shares, they will likely sell them at a substantial discount to the price at which they acquired the shares and our estimated value per share.

Our charter does not require our directors to seek stockholder approval to liquidate our assets by a specified date, nor does our charter require our directors to list our shares for trading on a national securities exchange by a specified date. There is no public market for our shares and we have no plans at this time to list our shares on a national securities exchange. Until our shares are listed, if ever, our stockholders may not sell their shares unless the buyer meets the applicable suitability and minimum purchase standards and such sale complies with state and federal securities laws. In addition, our charter prohibits the ownership of more than 9.8% of our stock by any person, unless exempted by our board of directors, which may inhibit large investors from desiring to purchase our shares. Moreover, our share redemption program includes numerous restrictions that limit our stockholders’ ability to sell their shares to us and our board of directors could amend, suspend or terminate our share redemption program upon 30 days’ notice.

Among other restrictions, during any calendar year, redemptions are limited to the amount of net proceeds from the sale of shares under our dividend reinvestment plan during the prior calendar year; provided, that we may not redeem more than $2.0 million of shares in the aggregate during any calendar year. Furthermore, once we have redeemed $1.5 million of shares under the share redemption program, including pursuant to redemptions sought in connection with a Special Redemption, the remaining $0.5 million of the $2.0 million annual limit shall be reserved exclusively for shares being redeemed in connection with Special Redemptions. In establishing the $2.0 million limitation, our board of directors considered the cash requirements necessary to effectively manage our assets.

Because of these limitations on the dollar value of shares that may be redeemed under our share redemption program, in January 2016, we exhausted the $1.5 million of funds available for all redemptions for 2016 and in August 2016, we exhausted the remaining $0.5 million of funds available for Special Redemptions for 2016. As of December 31, 2016, we had $1.4 million of outstanding and unfulfilled ordinary redemption requests and $0.3 million of outstanding and unfulfilled Special Redemption requests. The annual limitation was reset on January 1, 2017, and we had an aggregate of $2.0 million of funds available for all redemptions, subject to the limitations in the share redemption program, including the requirement that the first $1.5 million of funds is available for all redemptions and the last $0.5 million is available solely for Special Redemptions. We exhausted $1.5 million of funds available for all redemptions for 2017 in January 2017 and an aggregate of $0.3 million of funds available for Special Redemptions for 2017 in January and February 2017. As such, we will only be able to process $0.2 million of redemption requests related to Special Redemptions for the remainder of 2017.

11

Therefore, it will be difficult for our stockholders to sell their shares promptly or at all. If our stockholders are able to sell their shares, they would likely have to sell them at a substantial discount to the price for which the stockholders acquired the shares or to our estimated value per share. It is also likely that our stockholders’ shares would not be accepted as the primary collateral for a loan. Because of the illiquid nature of the shares, investors should purchase our shares through our dividend reinvestment plan only as a long-term investment and be prepared to hold them for an indefinite period of time.

From inception through December 31, 2016, we have experienced a cumulative net loss which could adversely impact our ability to conduct operations and pay distributions.

From inception through December 31, 2016, we have had a cumulative net loss of $19.8 million. Included in the cumulative net loss amount was $60.0 million of depreciation of real estate assets and amortization of lease-related costs. In the event that we continue to incur net losses in the future or such losses increase, we will have less money available to pay distributions to our stockholders, and our financial condition, results of operations, cash flow and ability to service our indebtedness may be adversely impacted.

Disruptions in the financial markets and uncertain economic conditions could adversely affect the values of our investments.

Disruptions in the financial markets and uncertain economic conditions could adversely affect the values of our investments. Furthermore, a decline in economic conditions could negatively impact real estate fundamentals and result in lower occupancy, lower rental rates and declining real estate values. These could have the following negative effects on us:

• | the values of our real estate investments could decrease below the amounts we pay for such investments; and |

• | revenues from our properties could decrease due to fewer tenants and/or lower rental rates, making it more difficult for us to pay distributions or meet our debt service obligations on debt financing. |

These factors could impair our ability to pay distributions to our stockholders and decrease the value of an investment in us.

We have a limited operating history, which makes our future performance difficult to predict.

We were incorporated in the State of Maryland on July 31, 2009 and have a limited operating history. As of March 6, 2017, we owned 11 apartment communities. We cannot assure our stockholders that we will be able to operate our business successfully or implement our operating policies and strategies described in our prospectus. Our stockholders should not assume that our performance will be similar to the past performance of other real estate investment programs sponsored by affiliates of our sponsors.

Because we are dependent upon our advisor and its affiliates to conduct our operations and LPI to manage our real estate properties, any adverse changes in the financial health of our advisor or its affiliates or LPI or our relationship with them could hinder our operating performance and the return on our stockholders’ investment.

We are dependent on KBS Capital Advisors to conduct our operations and on LPI to manage our real estate properties. Our advisor depends upon the fees and other compensation that it receives from us, KBS Real Estate Investment Trust, Inc. (“KBS REIT I”), KBS Real Estate Investment Trust II, Inc. (“KBS REIT II”), KBS Real Estate Investment Trust III, Inc. (“KBS REIT III”), KBS Strategic Opportunity REIT, Inc. (“KBS Strategic Opportunity REIT”), KBS Strategic Opportunity REIT II, Inc. (“KBS Strategic Opportunity REIT II”), KBS Growth & Income REIT, Inc. (“KBS Growth & Income REIT”) and other KBS-sponsored programs in connection with the purchase, management and sale of assets to conduct its operations. Any adverse changes in the financial condition of KBS Capital Advisors or LPI or our relationship with KBS Capital Advisors or LPI could hinder their ability to successfully conduct our operations and manage our portfolio of investments.

We have paid distributions from financings and expect that in the future we may not pay distributions solely from our cash flows from operations. To the extent that we pay distributions from sources other than our cash flows from operations, the overall return to our stockholders may be reduced.

Our organizational documents permit us to pay distributions from any source, including offering proceeds or borrowings (both of which may constitute a return of capital). We have paid distributions from financings and expect that in the future we may not pay distributions solely from our cash flows from operations, in which case distributions may be paid in whole or in part from debt financing. We may also fund such distributions from the sale of assets. Depending on the number of properties we sell, we may adjust the ongoing distribution rate subsequent to such sales in order to maintain the current distribution coverage. To the extent that we pay distributions from sources other than our cash flows from operations, the overall return to our stockholders may be reduced. In addition, to the extent distributions exceed cash flows from operations, a stockholder’s basis in our stock will be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize capital gain. There is no limit on the amount of distributions we may fund from sources other than from cash flows from operations.

12

For the year ended December 31, 2016, we paid aggregate distributions of $13.4 million, including $7.7 million of distributions paid in cash and $5.7 million of distributions reinvested through our dividend reinvestment plan. Funds from operations (“FFO”) for the year ended December 31, 2016 was $17.4 million and cash flows from operations was $13.9 million. We funded our total distributions paid for the year ended December 31, 2016, which includes cash distributions and distributions reinvested by stockholders, with cash flows from operations. For the year ended December 31, 2016, FFO represented 130% of total distributions paid. For more information, see Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Funds from Operations” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Distributions” in this Annual Report.

The loss of or the inability of our advisor and LPRR LLC and their affiliates to engage and retain the services of key real estate professionals could delay or hinder implementation of our business strategies, which could limit our ability to pay distributions and decrease the value of an investment in our shares.

Our success depends to a significant degree upon the contributions of Messrs. Bren, Butcher, Henry and McMillan, each of whom would be difficult to replace. Neither we nor our affiliates have employment agreements with these individuals and they may not remain associated with us. If any of these persons were to cease their association with us, our operating results could suffer. We do not intend to maintain key person life insurance on any person. We believe that our future success depends, in large part, upon our advisor’s and LPRR LLC’s and their affiliates’ ability to attract and retain highly skilled managerial, operational and marketing professionals. Competition for such professionals is intense, and our advisor and LPRR LLC and their affiliates may be unsuccessful in attracting and retaining such skilled individuals. Further, we have established strategic relationships with firms that have special expertise in certain services or detailed knowledge regarding real properties in certain geographic regions. Maintaining such relationships will be important for us to effectively compete with other investors in such regions. We may be unsuccessful in maintaining such relationships. If we lose or are unable to obtain the services of highly skilled professionals or do not establish or maintain appropriate strategic relationships, our ability to implement our business strategies could be delayed or hindered, and the value of our stockholders’ investment may decline.

Our rights and the rights of our stockholders to recover claims against our independent directors are limited, which could reduce our stockholders’ and our recovery against them if they negligently cause us to incur losses.

Maryland law provides that a director has no liability in that capacity if he performs his duties in good faith, in a manner he reasonably believes to be in the company’s best interests and with the care that an ordinarily prudent person in a like position would use under similar circumstances. Our charter provides that no independent director shall be liable to us or our stockholders for monetary damages and that we will generally indemnify them for losses unless they are grossly negligent or engage in willful misconduct. As a result, our stockholders and we may have more limited rights against our independent directors than might otherwise exist under common law, which could reduce our stockholders’ and our recovery from these persons if they act in a negligent manner. In addition, we may be obligated to fund the defense costs incurred by our independent directors (as well as by our other directors, officers, employees (if we ever have employees) and agents) in some cases, which would decrease the cash otherwise available for distribution to our stockholders.

We face risks associated with security breaches through cyber-attacks, cyber intrusions or otherwise, as well as other significant disruptions of our information technology (IT) networks and related systems.

We face risks associated with security breaches, whether through cyber-attacks or cyber intrusions over the Internet, malware, computer viruses, attachments to e-mails, persons inside our organization or persons with access to systems inside our organization, and other significant disruptions of our IT networks and related systems. The risk of a security breach or disruption, particularly through cyber-attack or cyber intrusion, including by computer hackers, foreign governments and cyber terrorists, has generally increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. Our IT networks and related systems are essential to the operation of our business and our ability to perform day-to-day operations. Although we make efforts to maintain the security and integrity of these types of IT networks and related systems, and we have implemented various measures to manage the risk of a security breach or disruption, there can be no assurance that our security efforts and measures will be effective or that attempted security breaches or disruptions would not be successful or damaging. Even the most well protected information, networks, systems and facilities remain potentially vulnerable because the techniques used in such attempted security breaches evolve and generally are not recognized until launched against a target, and in some cases are designed not to be detected and, in fact, may not be detected. Accordingly, we may be unable to anticipate these techniques or to implement adequate security barriers or other preventative measures, and thus it is impossible for us to entirely mitigate this risk.

A security breach or other significant disruption involving our IT networks and related systems could:

• | disrupt the proper functioning of our networks and systems and therefore our operations; |

• | result in misstated financial reports, violations of loan covenants and/or missed reporting deadlines; |

13

• | result in our inability to properly monitor our compliance with the rules and regulations regarding our qualification as a REIT; |

• | result in the unauthorized access to, and destruction, loss, theft, misappropriation or release of, proprietary, confidential, sensitive or otherwise valuable information of ours or others, which others could use to compete against us or which could expose us to damage claims by third-parties for disruptive, destructive or otherwise harmful purposes and outcomes; |

• | require significant management attention and resources to remedy any damages that result; |

• | subject us to claims for breach of contract, damages, credits, penalties or termination of leases or other agreements; or |

• | damage our reputation among our stockholders. |

Any or all of the foregoing could have a material adverse effect on our results of operations, financial condition and cash flows.

Although we have begun the implementation of our strategic alternatives, there are no assurances that we will be successful in executing such strategy or in creating additional stockholder value or continuing to pay distributions at the current rates or paying a special distribution to our stockholders.

Although we have begun the implementation of our strategic alternatives, we can give no assurances that this strategy will be successful. There are many factors that may affect our ability to execute such strategy including, among other factors, our ability to dispose of some of our real estate properties at the times and the prices we expect and our ability to fund and execute our plan to renovate certain of our real estate properties. Further, although we have begun to implement our strategic alternatives and intend to pursue strategic asset sales for certain of our real estate properties and to renovate certain others, we can give no assurances that the execution of such strategy will create additional stockholder value or that we will be able to continue to pay distributions at the current rates or pay a special distribution to our stockholders at the time and at the amount we expect. Depending on the number of properties sold, we may have to adjust the ongoing distribution rate subsequent to such sales in order to maintain the current distribution coverage. Any future special distributions we pay from the proceeds of future dispositions will reduce our estimated value per share and this reduction will be reflected in our updated estimated value per share, which we expect to update no later than December 2017.

On December 29, 2016, we, through the Owner, entered into the Wesley Village Agreement for the sale of Wesley Village to the Purchaser. The Wesley Village Agreement was subsequently terminated, reinstated and amended and on March 9, 2017, we completed the sale of Wesley Village. For information relating to the Wesley Village Agreement, see Part I, Item 2, “Properties - Wesley Village Agreement.” For information relating to the termination and reinstatement of, and the amendments to, the Wesley Village Agreement, and the subsequent sale of Wesley Village, see Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Subsequent Events - Termination and Reinstatement of, and Amendments to, the Wesley Village Agreement; Disposition of Wesley Village.”

Risks Related to Conflicts of Interest

Our sponsors and their respective affiliates, including our advisor, LPI, all of our executive officers and some of our directors and other key real estate professionals, face conflicts of interest caused by their compensation arrangements with us, which could result in actions that are not in the long-term best interests of our stockholders.

Our advisor and its affiliates and LPI receive substantial fees from us. These fees could influence our advisor’s and LPI’s advice to us as well as the judgment of their affiliates. Among other matters, these compensation arrangements could affect their judgment with respect to:

• | the continuation, renewal or enforcement of our agreements with KBS Capital Advisors and its affiliates, including the advisory agreement; |

• | various matters relating to the management of our real estate properties, including relating to construction projects at our real estate properties; |

• | sales of properties (including, subject to the approval of our conflicts committee, sales to affiliates), which entitle KBS Capital Advisors to disposition fees and possible subordinated incentive fees; |

• | whether and when to terminate our advisory agreement with KBS Capital Advisors, which may entitle KBS Capital Advisors to receive a subordinated performance fee that, under certain circumstances, we may be required to pay even though our stockholders do not ultimately realize a return on their investment in us; and |

• | whether and when we seek to sell the company or its assets, which sale could entitle KBS Capital Advisors to a subordinated incentive fee and terminate the asset management fee. |

The fees our advisor receives in connection with the management of our assets are based on the cost of the investment, and not based on the quality of the investment or the quality of the services rendered to us.

14

Our sponsors, our officers, KBS Capital Advisors and the real estate professionals assembled by our advisor and LPI will face competing demands relating to their time and this may cause our operations and our stockholders’ investment in us to suffer.

We rely on our sponsors, our officers, KBS Capital Advisors and on real estate professionals that our advisor and LPI retain to provide services to us, for the day-to-day operation of our business and management of our real estate properties. Mr. Bren, Jeffrey K. Waldvogel and Ms. Stacie K. Yamane are executive officers of KBS REIT I, KBS REIT II, KBS REIT III and KBS Growth & Income REIT, Mr. McMillan is an executive officer of KBS REIT I, KBS REIT II and KBS REIT III and Mr. Bren is an executive officer of KBS Realty Advisors and its affiliates, the advisors of the other KBS-sponsored programs and the investment advisors to KBS-advised investors in real estate and real estate-related assets. In addition, Messrs. McMillan and Waldvogel and Ms. Yamane are executive officers of KBS Strategic Opportunity REIT and KBS Strategic Opportunity REIT II. In addition, KBS Real Estate Investment Trust II and KBS Strategic Opportunity REIT have announced that they are exploring strategic alternatives, and KBS REIT I has announced the passage by its stockholders of a plan of complete liquidation and dissolution of KBS REIT I, the pursuit of each of which would create further demands on the time of our advisor’s real estate, debt finance, management and accounting professionals.

Mr. Butcher is Chairman of the Board of LPI, a firm that, through affiliated entities, manages a residential real estate portfolio. Mr. Henry is Chief Executive Officer of LPI, for which Mr. Hays acts as President. As a result of their interests in other programs, their obligations to other investors and the fact that they engage in and they will continue to engage in other business activities, on behalf of themselves and others, Messrs. Bren, Butcher, Henry, Hays, McMillan and Waldvogel and Ms. Yamane face conflicts of interest in allocating their time among us and other KBS- and Legacy-sponsored programs and other business activities in which they are involved. Should our advisor breach its fiduciary duty to us by inappropriately devoting insufficient time or resources to our business, the returns on our investments, and the value of our stockholders’ investment in us, may decline.

All of our executive officers, some of our directors and the key real estate professionals assembled by our advisor and LPI face conflicts of interest related to their positions and/or interests in affiliates of our sponsors, which could hinder our ability to implement our business strategy and to generate returns to our stockholders.

All of our executive officers, some of our directors and key real estate professionals assembled by our advisor and LPI are also executive officers, directors, managers, key professionals and/or holders of a direct or indirect controlling interest in our advisor, the sub-advisor and other sponsor-affiliated entities. Through sponsor-affiliated entities, some of these persons also serve as the investment advisors to KBS-advised investors in real estate and real estate-related assets. Through KBS Capital Advisors and KBS Realty Advisors, some of these persons work on behalf of KBS REIT I, KBS REIT II, KBS REIT III, KBS Strategic Opportunity REIT, KBS Strategic Opportunity REIT II, KBS Growth & Income REIT and other KBS-sponsored programs and KBS-advised investors. And through LPI, some of these persons serve as managers for other institutional investors. As a result, they owe fiduciary duties to each of these entities, their members and limited partners and these investors, which fiduciary duties may from time to time conflict with the fiduciary duties that they owe to us and our stockholders. Their loyalties to these other entities and investors could result in action or inaction that breaches their fiduciary duties to us and is detrimental to our business, which could harm the implementation of our business strategy. If we do not successfully implement our business strategy, we may be unable to generate the cash needed to pay distributions to our stockholders and the value of our assets may decrease.

Risks Related to Our Corporate Structure

Ownership limitations may restrict change of control or business combination opportunities in which our stockholders might receive a premium for their shares.

In order for us to qualify as a REIT for each taxable year, no more than 50% of the value of our outstanding capital stock may be owned, directly or indirectly, by five or fewer individuals during the last half of any calendar year. “Individuals” for this purpose include natural persons, and some entities such as private foundations. To preserve our REIT qualification, our charter generally prohibits any person from directly or indirectly owning more than 9.8% in value of our capital stock. This ownership limitation could have the effect of delaying, deferring or preventing a takeover or other transaction including an extraordinary transaction (such as a merger, tender offer or sale of all or substantially all of our assets), in which holders of our common stock might receive a premium for their shares over the then prevailing market price or which holders might believe to be otherwise in their best interests.

15

Our charter permits our board of directors to issue stock with terms that may subordinate the rights of our common stockholders or discourage a third party from acquiring us in a manner that could result in a premium price to our stockholders.

Our board of directors may classify or reclassify any unissued common stock or preferred stock and establish the preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends and other distributions, qualifications and terms or conditions of redemption of any such stock. Thus, our board of directors could authorize the issuance of preferred stock with priority as to distributions and amounts payable upon liquidation over the rights of the holders of our common stock. Such preferred stock could also have the effect of delaying, deferring or preventing a change in control of us, including an extraordinary transaction (such as a merger, tender offer or sale of all or substantially all of our assets) that might provide a premium price to holders of our common stock.

Our stockholders’ investment return may be reduced if we are required to register as an investment company under the Investment Company Act; if we or our subsidiaries become an unregistered investment company, we could not continue our business.

Neither we nor any of our subsidiaries intend to register as investment companies under the Investment Company Act. If we or any of our subsidiaries were obligated to register as investment company, we would have to comply with a variety of substantive requirements under the Investment Company Act that impose, among other things:

• | limitations on capital structure; |

• | restrictions on specified investments; |

• | prohibitions on transactions with affiliates; and |

• | compliance with reporting, record keeping, voting, proxy disclosure and other rules and regulations that would significantly increase our operating expenses. |

Under the relevant provisions of Section 3(a)(1) of the Investment Company Act, an investment company is any issuer that:

• | pursuant to Section 3(a)(1)(A), is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities (the “primarily engaged test”); or |

• | pursuant to Section 3(a)(1)(C), is engaged or proposes to engage in the business of investing, reinvesting, owning, holding or trading in securities and owns or proposes to acquire “investment securities” having a value exceeding 40% of the value of such issuer’s total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis (the “40% test”). “Investment securities” excludes U.S. government securities and securities of majority-owned subsidiaries that are not themselves investment companies and are not relying on the exception from the definition of investment company under Section 3(c)(1) or Section 3(c)(7) (relating to private investment companies). |

With respect to the primarily engaged test, we and our Operating Partnership are holding companies. Through the majority-owned subsidiaries of our Operating Partnership, we and our Operating Partnership are primarily engaged in the non-investment company businesses of these subsidiaries, namely the business of purchasing real estate assets.

We believe that neither we nor our Operating Partnership are required to register as an investment company based on the following analyses. With respect to the 40% test, the entities through which we and our Operating Partnership own our assets are majority-owned subsidiaries that will not themselves be investment companies and will not be relying on the exceptions from the definition of investment company under Section 3(c)(1) or Section 3(c)(7).

16

If any of the subsidiaries of our Operating Partnership fail to meet the 40% test, we believe they will usually, if not always, be able to rely on Section 3(c)(5)(C) of the Investment Company Act for an exception from the definition of an investment company. (Otherwise, they should be able to rely on the exceptions for private investment companies pursuant to Section 3(c)(1) and Section 3(c)(7) of the Investment Company Act.) As reflected in no-action letters, the SEC staff’s position on Section 3(c)(5)(C) generally requires that an issuer maintain at least 55% of its assets in “mortgages and other liens on and interests in real estate,” or qualifying assets; at least 80% of its assets in qualifying assets plus real estate-related assets; and no more than 20% of the value of its assets in other than qualifying assets and real estate-related assets, which we refer to as miscellaneous assets. To constitute a qualifying asset under this 55% requirement, a real estate interest must meet various criteria based on no-action letters. We expect that each of the subsidiaries of our Operating Partnership relying on Section 3(c)(5)(C) will invest at least 55% of its assets in qualifying assets, and approximately an additional 25% of its assets in other types of real estate-related assets. If any subsidiary relies on Section 3(c)(5)(C), we expect to rely on guidance published by the SEC staff or on our analyses of guidance published with respect to types of assets to determine which assets are qualifying real estate assets and real estate-related assets.