Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Sucampo Pharmaceuticals, Inc. | f8k_030817.htm |

| EX-99.1 - EXHIBIT 99.1 - Sucampo Pharmaceuticals, Inc. | exh_991.htm |

EXHIBIT 99.2

March 8, 2017 Fourth Quarter 2016 Corporate Update and Financial Results

Introductions and Forward - Looking Statements Silvia Taylor, SVP Investor Relations & Corporate Affairs

Agenda Introductions and Forward - Looking Statements Silvia Taylor Corporate Update Peter Greenleaf Pipeline Update Peter Kiener , D. Phil Financial Update Andrew Smith Closing Remarks Peter Greenleaf 3

Forward Looking Statement This presentation contains "forward - looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations and involve risks and uncertainties, which may cause results to differ materially from those set forth in the statements. The forward - looking statements may include statements regarding produc t development, and other statements that are not historical facts. The following factors, among others, could cause actual resu lts to differ from those set forth in the forward - looking statements: the impact of pharmaceutical industry regulation and health care legisla tion; Sucampo's ability to accurately predict future market conditions; dependence on the effectiveness of Sucampo's patents and ot her protections for innovative products; the effects of competitive products on Sucampo’s products; and the exposure to litigatio n a nd/or regulatory actions. No forward - looking statement can be guaranteed and actual results may differ materially from those projected. Sucampo undertakes no obligation to publicly update any forward - looking statement, whether as a result of new information, future events, or otherwise . Forward - looking statements in this press release should be evaluated together with the many uncertainties that affect Sucampo's business, particularly those mentioned in the risk factors and cautionary statements in Sucampo's most recent Form 10 - K as filed with the Securities and Exchange Commission on March 11, 2016, as amended, as well as its filings with the Securities and Exchange Commission on Forms 8 - K and 10 - Q since the filing of the Form 10 - K, all of which Sucampo incorporates by reference. 4

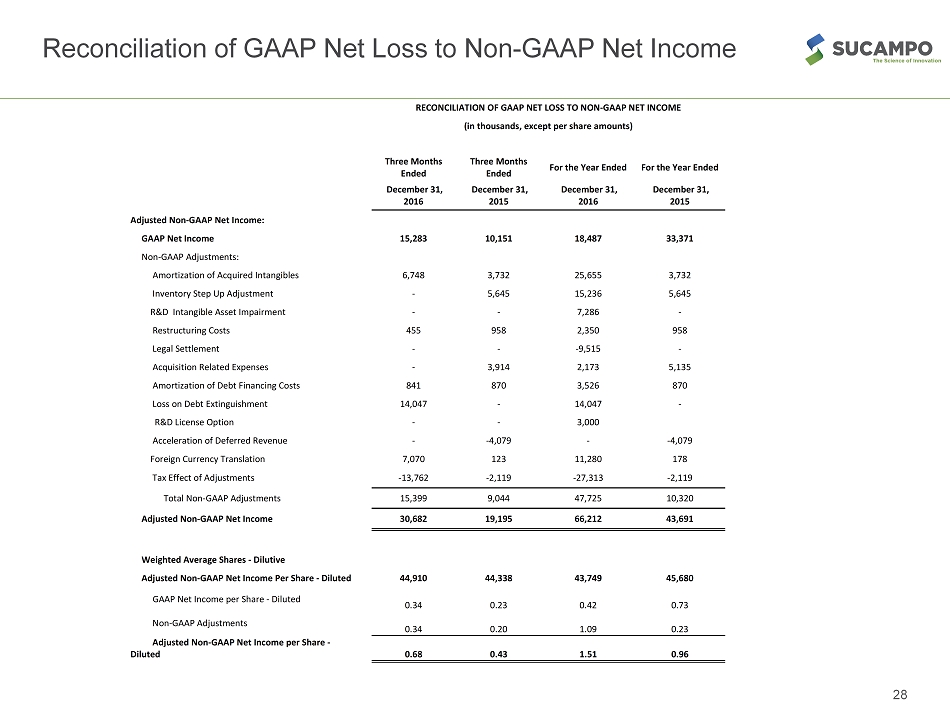

Non - GAAP Metrics This presentation contains three financial metrics (Adjusted Net Income, EBITDA and Adjusted EBITA) that are considered “non - GAAP” financial metrics under applicable Securities and Exchange Commission rules and regulations. These non - GAAP financial metr ics should be considered supplemental to and not a substitute for financial information prepared in accordance with generally acc ept ed accounting principles. The company’s definition of these non - GAAP metrics may differ from similarly titled metrics used by other s. Adjusted Net Income adjusts for specified items that can be highly variable or difficult to predict, and various non - cash items, which includes amortization of acquired intangibles, inventory step - up adjustment, R&D intangible asset impairment, restructuring cost s, legal settlement, acquisition related expenses, amortization of debt financing costs, debt extinguishment, R&D license option expen se, acquisition related acceleration of deferred revenue, foreign currency translations and the tax impact of these adjustments. EBI TDA reflects net income excluding the impact of provision for income taxes, interest expense, interest income, depreciation, R&D int angible asset impairment, amortization of acquired intangibles, and inventory step - up adjustments. Adjusted EBITDA reflects EBITDA and a djusts for specified items that can be highly variable or difficult to predict, and various non - cash items, which includes share based compensation expense, restructuring costs, acquisition related expenses, debt extinguishment, R&D license option, legal settl eme nt, foreign currency translations and the acquisition related acceleration of deferred revenue. The company views these non - GAAP fin ancial metrics as a means to facilitate management’s financial and operational decision - making, including evaluation of the company’s h istorical operating results and comparison to competitors’ operating results. These non - GAAP financial metrics reflect an additional way o f viewing aspects of the company’s operations that, when viewed with GAAP results may provide a more complete understanding of factors and trends affecting the company’s business. The determination of the amounts that are excluded from these non - GAAP financial metrics is a matter of management judgment and depends upon, among other factors, the nature of the underlying expense or income amounts. Because non - GAAP financial metrics exclude the effect of items that will increase or decrease the company’s reported results of operations, management strongly enc ourages investors to review the company’s consolidated financial statements and publicly - filed reports in their entirety. 5

Q4 and FY 2016 Corporate Update Peter Greenleaf, Chairman and CEO

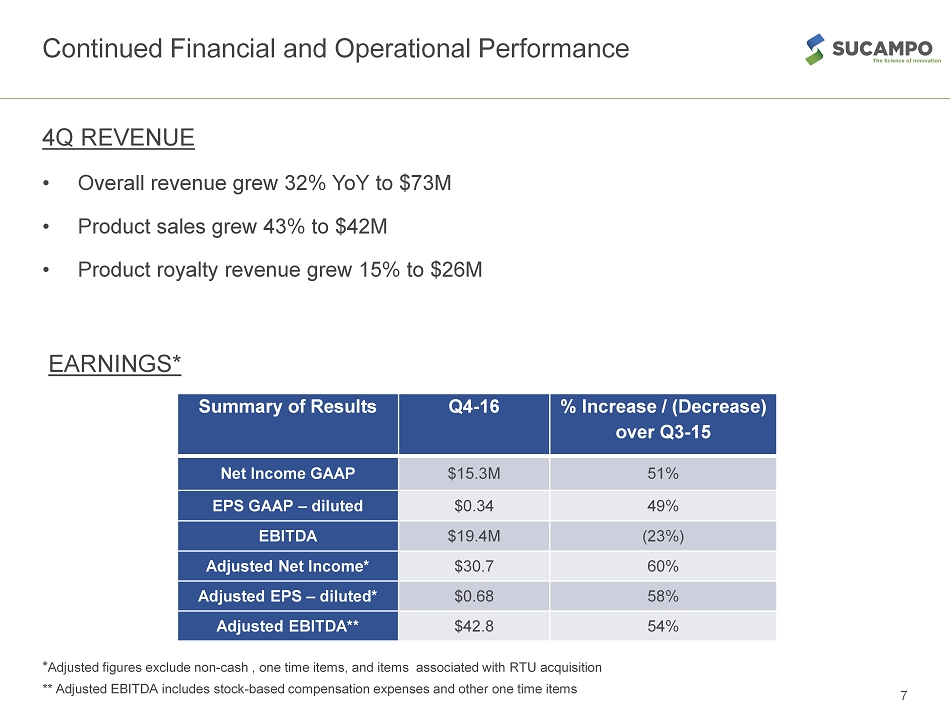

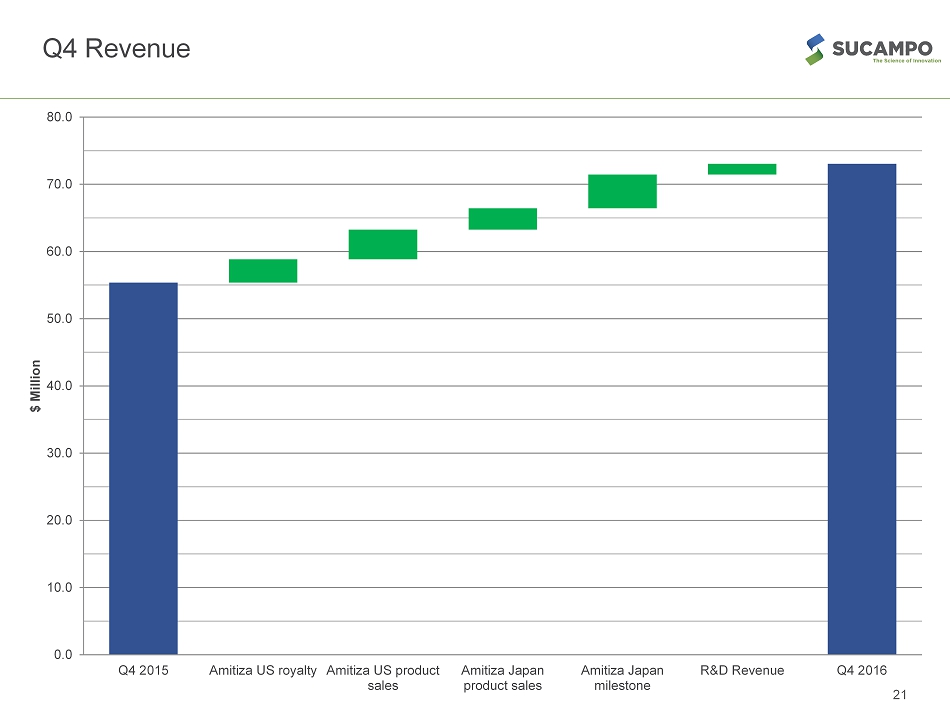

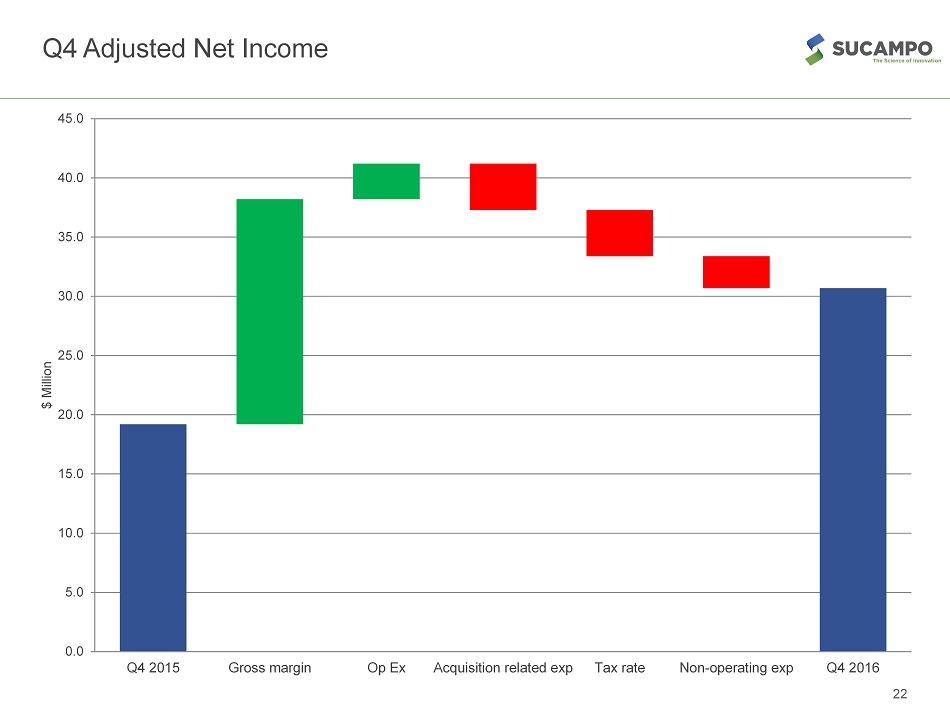

Continued Financial and Operational Performance 4Q REVENUE • Overall revenue grew 32% YoY to $73M • Product sales grew 43% to $42M • Product royalty revenue grew 15% to $26M EARNINGS* * Adjusted figures exclude non - cash , one time items, and items associated with RTU acquisition ** Adjusted EBITDA includes stock - based compensation expenses and other one time items 7 Summary of Results Q4 - 16 % Increase / (Decrease) over Q3 - 15 Net Income GAAP $15.3M 51% EPS GAAP – diluted $0.34 49% EBITDA $19.4M (23%) Adjusted Net Income* $30.7 60% Adjusted EPS – diluted* $0.68 58% Adjusted EBITDA** $42.8 54%

Pipeline Progress • Significant changes to pipeline completed • Two key programs remaining: – Life - cycle management of AMITIZA – Phase 3 partnership with CPP in FAP 8

Positioning Sucampo for Mid to Long - Term Growth • Significant progress in integration of RTU following late 2015 acquisition – Including manufacturing of AMITIZA and RESCULA • Collaboration and option agreement with CPP completed in 2016 • Settlement and license agreement with Dr. Reddy’s regarding lubiprostone – Provides additional clarity on future value of AMITIZA franchise • Paragraph IV certification notice letter received on March 2 regarding ANDA submitted to US FDA by Amneal Pharmaceuticals requesting approval to market, sell and use a generic version of 8 mcg and 24 mcg AMITIZA for OIC – Sucampo intends to file a patent infringement lawsuit within 45 days of notice date 9

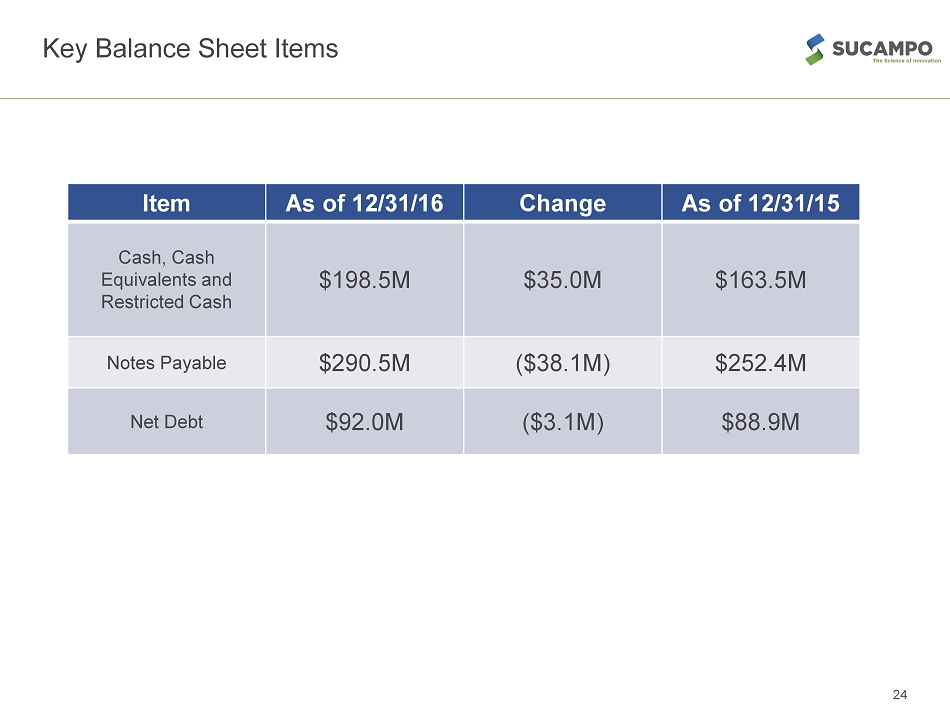

Strong Balance Sheet • Completed a $300M convertible senior notes offering in late 2016 in private placement to qualified institutional buyers • Proceeds used to pay off $250M credit facility • Use of proceeds includes completing additional transactions 10

Strong Q4 2016 U.S. AMITIZA Performance • Takeda’s AMITIZA net sales for royalty calculation purposes – Q4 grew 11% YoY to $114M • Royalty revenue grew 15% YoY to $26M – Driven by price increase in January 2016 and volume • U.S. AMITIZA product sales to Takeda of $13M • Total U.S. revenue of $39M • AMITIZA TRx – Q4 IMS: ~384,000 TRx, decrease of approximately 2% YoY – 12 months of 2016 IMS: TRx growth of approximately 1% YOY 11

Expected AMITIZA U.S. Growth Drivers • Competitive positioning in commercial and Part D payer plans – CVS Caremark preferred formulary • Highly - targeted DTC television campaign in select key markets • Encouraging growth trends for AMITIZA early in 2017 • Takeda took 6% price increase in January of 2017 12

Japan AMITIZA Performance • Sucampo Q4 revenue: $26.2M, growth of 46% YoY – Includes $10M milestone related to achievement of certain revenue targets • Excluding milestone payments, Q4 revenue grew 25% YoY • Driven by volume – Increased 41% YoY for the full year of 2016 • Growth drivers: – Strong market growth – Only branded constipation prescription medicine – Broad label of constipation 13

2017 Guidance Reiterated • Total revenue: $220 million to $230 million • Adjusted net income: $80 million to $90 million • Adjusted EPS: $1.35 to $1.50 • Adjusted EBITDA: $145 million to $155 million • Revenue does not include any milestone payments Adjusted net income guidance excludes amortization of acquired intangibles of approximately $22.58 million, debt financing related costs of $3.1 million. Adjusted EBITDA guidance excludes stock option related costs of $6.0 million. 14

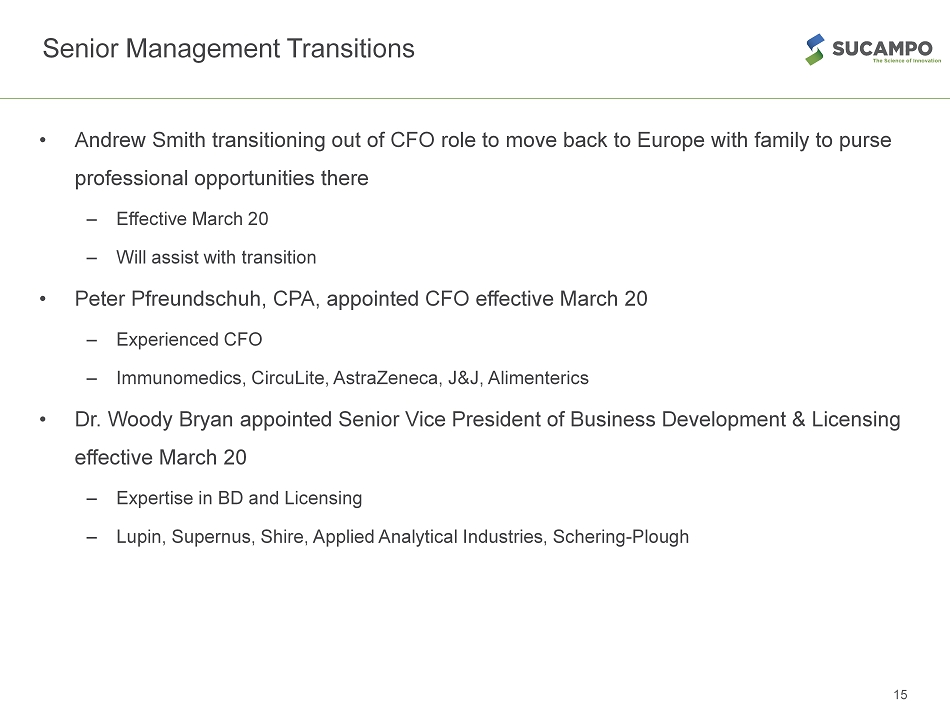

Senior Management Transitions • Andrew Smith transitioning out of CFO role to move back to Europe with family to purse professional opportunities there – Effective March 20 – Will assist with transition • Peter Pfreundschuh , CPA, appointed CFO effective March 20 – Experienced CFO – Immunomedics , CircuLite , AstraZeneca, J&J, Alimenterics • Dr. Woody Bryan appointed Senior Vice President of Business Development & Licensing effective March 20 – Expertise in BD and Licensing – Lupin , Supernus , Shire, Applied Analytical Industries, Schering - Plough 15

Pipeline Update Peter Kiener , D. Phil, CSO

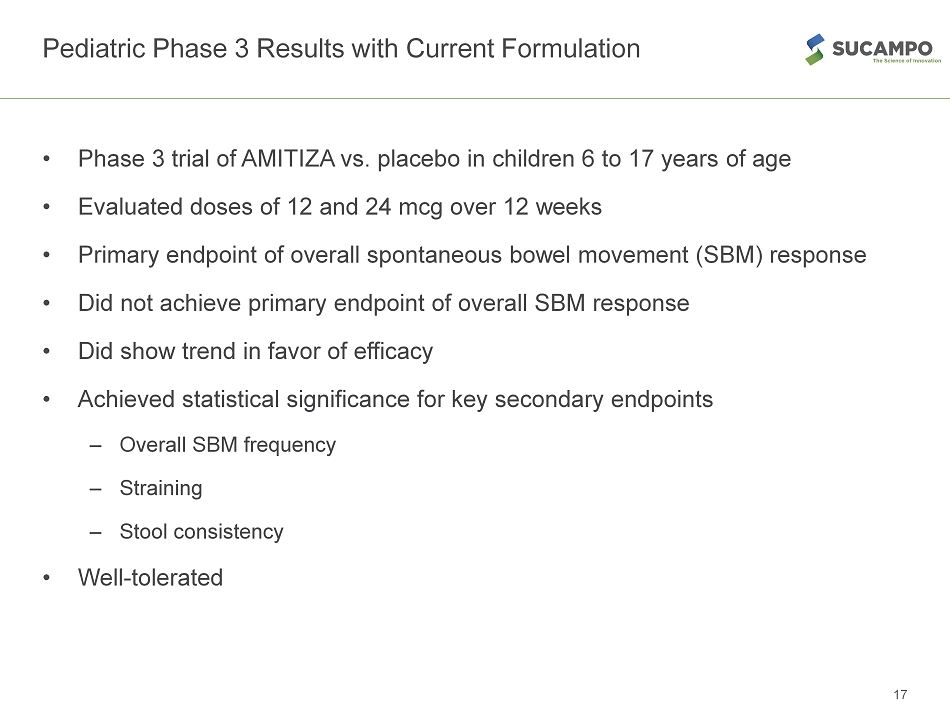

Pediatric Phase 3 Results with Current Formulation • Phase 3 trial of AMITIZA vs. placebo in children 6 to 17 years of age • Evaluated doses of 12 and 24 mcg over 12 weeks • Primary endpoint of overall spontaneous bowel movement (SBM) response • Did not achieve primary endpoint of overall SBM response • Did show trend in favor of efficacy • Achieved statistical significance for key secondary endpoints – Overall SBM frequency – Straining – Stool consistency • Well - tolerated 17

FDA Feedback • FDA to review complement of data from AMITIZA phase 3 pediatric program – Including final long term safety and efficacy data from 9 - month extension • FDA confirmed aggregate data will be sufficient to submit sNDA for pediatric indication • Expect to file sNDA in 2H 2017 • Phase 3 study of pediatric sprinkle formulation to begin in 1H 2018 18

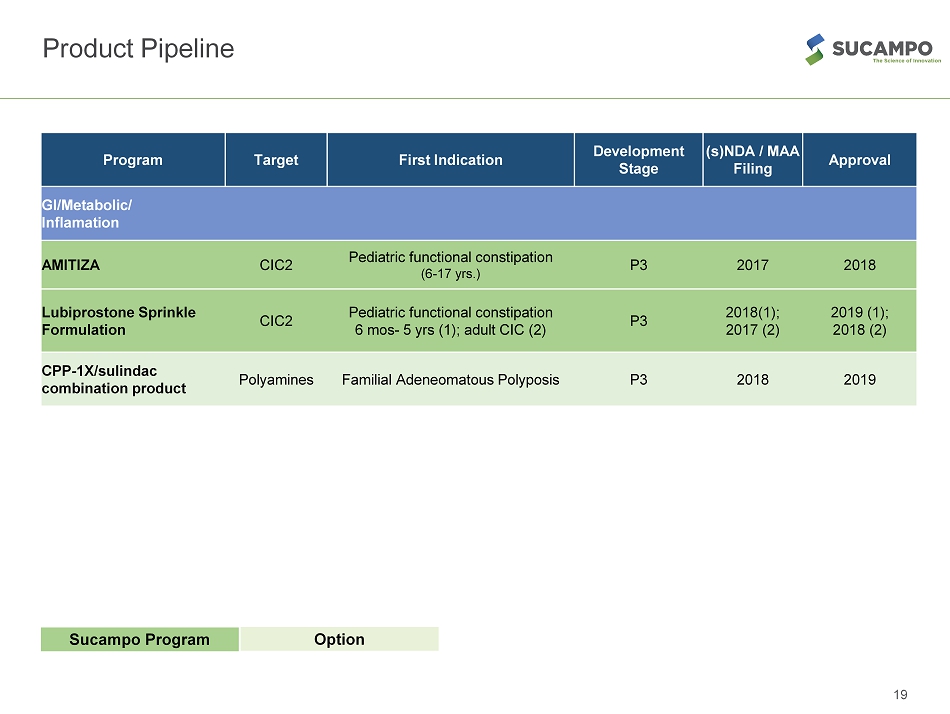

19 Product Pipeline Sucampo Program Option Program Target First Indication Development Stage (s)NDA / MAA Filing Approval GI/Metabolic/ Inflamation AMITIZA CIC2 Pediatric functional constipation (6 - 17 yrs.) P3 2017 2018 Lubiprostone Sprinkle Formulation CIC2 Pediatric functional constipation 6 mos - 5 yrs (1); adult CIC (2) P3 2018(1); 2017 (2) 2019 (1); 2018 (2) CPP - 1X/sulindac combination product Polyamines Familial Adeneomatous Polyposis P3 2018 2019

Financial Update Andrew Smith, CFO

Q4 Revenue 21 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 Q4 2015 Amitiza US royalty Amitiza US product sales Amitiza Japan product sales Amitiza Japan milestone R&D Revenue Q4 2016 $ Million

Q4 Adjusted Net Income 22 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 45.0 Q4 2015 Gross margin Op Ex Acquisition related exp Tax rate Non-operating exp Q4 2016 $ Million

Q4 Adjusted EBITDA 23 0.0 10.0 20.0 30.0 40.0 50.0 Q4 2015 Gross margin Operating expense Exchange loss Q4 2016 $ Million

Key Balance Sheet Items Item As of 12 /31/16 Change As of 12/31/15 Cash, Cash Equivalents and Restricted Cash $198.5M $35.0M $163.5M Notes Payable $290.5M ($38.1M) $252.4M Net Debt $92.0M ($3.1M) $88.9M 24

Closing Remarks Peter Greenleaf, Chairman and CEO

2017 Areas of Focus 1. Deliver outstanding financial performance, both top and bottom line 2. Progress pipeline programs 3. Evaluate and execute on additional opportunities for growth 26

Q&A Session

Reconciliation of GAAP Net Loss to Non - GAAP Net Income 28 RECONCILIATION OF GAAP NET LOSS TO NON-GAAP NET INCOME (in thousands, except per share amounts) Three Months Ended Three Months Ended For the Year Ended For the Year Ended December 31, 2016 December 31, 2015 December 31, 2016 December 31, 2015 Adjusted Non-GAAP Net Income: GAAP Net Income 15,283 10,151 18,487 33,371 Non-GAAP Adjustments: Amortization of Acquired Intangibles 6,748 3,732 25,655 3,732 Inventory Step Up Adjustment - 5,645 15,236 5,645 R&D Intangible Asset Impairment - - 7,286 - Restructuring Costs 455 958 2,350 958 Legal Settlement - - -9,515 - Acquisition Related Expenses - 3,914 2,173 5,135 Amortization of Debt Financing Costs 841 870 3,526 870 Loss on Debt Extinguishment 14,047 - 14,047 - R&D License Option - - 3,000 Acceleration of Deferred Revenue - -4,079 - -4,079 Foreign Currency Translation 7,070 123 11,280 178 Tax Effect of Adjustments -13,762 -2,119 -27,313 -2,119 Total Non-GAAP Adjustments 15,399 9,044 47,725 10,320 Adjusted Non-GAAP Net Income 30,682 19,195 66,212 43,691 Weighted Average Shares - Dilutive Adjusted Non-GAAP Net Income Per Share - Diluted 44,910 44,338 43,749 45,680 GAAP Net Income per Share - Diluted 0.34 0.23 0.42 0.73 Non-GAAP Adjustments 0.34 0.20 1.09 0.23 Adjusted Non-GAAP Net Income per Share - Diluted 0.68 0.43 1.51 0.96

Reconciliation of Income from Operations to Adjusted EBITDA 29 RECONCILIATION OF INCOME FROM OPERATIONS TO ADJUSTED EBITDA (in thousands, except per share amounts) Three Months Ended Three Months Ended For the Year Ended For the Year Ended December 31, 2016 December 31, 2015 December 31, 2016 December 31, 2015 GAAP Net Income 15,283 10,151 18,487 33,371 Adjustments: Taxes -8,433 -684 -4,112 10,304 Interest expense 5,620 6,070 23,761 6,854 Interest Income -5 -27 -72 -181 Depreciation 217 221 904 623 R&D Intangible Asset Impairment - 7,286 - Amortization of Acquired Intangibles 6,748 3,732 25,655 3,732 Inventory Step Up Adjustment 5,645 15,236 5,645 EBITDA 19,430 25,108 87,145 60,348 Non-GAAP Adjustments: Share Based Compensation Expense 1,838 1,742 7,258 7,349 Restructuring Costs 455 958 2,350 958 Acquisition Related Expenses - 3,914 2,173 5,135 Loss on Debt Extinguishment 14,047 14,047 - R&D License Option 3,000 Legal Settlement - - -9,515 - Foreign Currency Translation 7,070 123 11,280 178 Acceleration of Deferred Revenue - -4,079 -4,079 Total Non-GAAP Adjustments 23,410 2,658 30,593 9,541 Adjusted EBITDA 42,840 27,766 117,738 69,889