Attached files

| file | filename |

|---|---|

| EX-32.1 - Mr. Amazing Loans Corp | ex32-1.htm |

| EX-31.1 - Mr. Amazing Loans Corp | ex31-1.htm |

| EX-21.1 - Mr. Amazing Loans Corp | ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-55463

IEG Holdings Corporation

(Exact name of registrant as specified in its charter)

| Florida | 90-1069184 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

| 6160 West Tropicana Ave, Suite E-13 | ||

| Las Vegas, Nevada | 89103 | |

| (Address of principal executive offices) | (Zip Code) |

(702) 227-5626

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

[X] Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [X] |

| Non-accelerated filer [ ] | Smaller reporting company [ ] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

As of June 30, 2016, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $63,119,378 based on the last reported sale price of our common stock on the OTCQX, which was $24.00 per share on June 30, 2016.

As of March 6, 2017, there were 9,714,186 shares of the registrant’s common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

| 2 |

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Securities and Exchange Commission (the “SEC”) encourages companies to disclose forward-looking information so that investors can better understand a company’s future prospects and make informed investment decisions. This annual report on Form 10-K and other written and oral statements that we make from time to time contain such forward-looking statements that set out anticipated results based on management’s plans and assumptions regarding future events or performance. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance. In particular, these include statements relating to future actions, future performance or results of current and anticipated sales efforts, expenses, the outcome of contingencies, such as legal proceedings, and financial results. Factors that could cause our actual results of operations and financial condition to differ materially are discussed in greater detail under Item 1A - “Risk Factors” of this annual report on Form 10-K.

We caution that the factors described herein and other factors could cause our actual results of operations and financial condition to differ materially from those expressed in any forward-looking statements we make and that investors should not place undue reliance on any such forward-looking statements. Further, any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors emerge from time to time, and it is not possible for us to predict all of such factors. Further, we cannot assess the impact of each such factor on our results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

| 3 |

Business Overview

We provide unsecured online consumer loans under the brand name “Mr. Amazing Loans” via our website and online application portal at www.mramazingloans.com. We started our business and opened our first office in Las Vegas, Nevada in 2010. We currently offer $5,000 and $10,000 unsecured consumer loans that mature in five years. We are currently licensed and originating direct consumer loans in 19 states – Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Maryland, Missouri, Nevada, New Jersey, New Mexico, Ohio, Oregon, Pennsylvania, Texas, Utah and Virginia. We provide loans to residents of these states through our online application portal, with all loans originated, processed and serviced out of our centralized Las Vegas head office, which eliminates the need for physical offices in all of these states.

Our strategy is to address the market needs of underbanked consumers that tend to be ignored by mainstream institutional credit providers such as banks and credit unions, and charged excessive fees and interest by fringe lenders such as payday lenders. In the current global environment, we believe there is a substantial need and opportunity for the small personal loans we offer.

All of our personal loans are offered at prevailing statutory rates with fixed affordable repayments and no prepayment penalties. We conduct full underwriting on all applications including credit checks and review of bank statements to ensure customers have capacity to repay their loans, and have designed our loans to help customers reach a stronger financial position.

We plan to continue expanding our state coverage in 2017 by obtaining state lending licenses in six additional states, increasing our coverage to 25 states and approximately 240 million people. As soon as we receive new state licenses we will add to our existing online marketing and distribution channels which we expect will generate immediate business at a customer acquisition cost within our desired budget.

Recent Developments

On January 5, 2017, we commenced a tender offer to purchase up to all outstanding shares of common stock of OneMain Holdings Inc., a NYSE-listed company; provided, however, that we are willing to accept any number of shares of OneMain common stock, even if such shares, in the aggregate, constitute less than a majority of OneMain’s outstanding common stock (the “OneMain Tender Offer”). The OneMain Tender Offer was scheduled to expire at 12:00 a.m., Eastern time, on February 6, 2017, unless extended. On February 7, 2017, we extended the OneMain Tender Offer such that it will expire at 5:00 p.m., Eastern time, on Monday, March 27, 2017, unless it is extended or earlier terminated. Complete terms and conditions of the OneMain Tender Offer are set forth in the Tender Offer Statement on Schedule TO and in the registration statement on Form S-4, each of which we originally filed with the SEC on January 5, 2017, and each of which as may be amended. This description and other information in this annual report on Form 10-K regarding the OneMain Tender Offer is included in this annual report on Form 10-K solely for informational purposes. Nothing in this annual report on Form 10-K should be construed as an offer to sell, nor the solicitation of an offer to buy, any shares in connection with the OneMain Tender Offer.

In January 2017, our Board of Directors approved a stock repurchase program authorizing the open market repurchase of up to $2,000,000 of our common stock. Purchases under the program are authorized through December 31, 2017. No shares will be repurchased under the program until the OneMain Tender Offer has closed or has been terminated.

In December 2016, we launched a private offering of up to $10 million aggregate principal amount of our 12% senior unsecured notes due December 31, 2026 (the “Notes”), on a self-underwritten basis. As of March 3, 2016, no Notes have been sold. There can be no assurance that the private offering of Notes will be completed. We intend to use the net proceeds of the offering to increase the size of our loan book. This description and other information in this annual report on Form 10-K regarding the Notes offering is included in this annual report on Form 10-K solely for informational purposes. Nothing in this annual report on Form 10-K should be construed as an offer to sell, nor the solicitation of an offer to buy, any Notes.

Market

We provide unsecured online consumer loans under the brand name “Mr. Amazing Loans” via our website and online application portal at www.mramazingloans.com. We started our business and opened our first office in Las Vegas, Nevada in 2010. We currently offer $5,000 and $10,000 unsecured consumer loans that mature in five years. We are currently licensed and originating direct consumer loans in 19 states – Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Maryland, Missouri, Nevada, New Jersey, New Mexico, Ohio, Oregon, Pennsylvania, Texas, Utah and Virginia. We provide loans to residents of these states through our online application portal, with all loans originated, processed and serviced out of our centralized Las Vegas head office, which eliminates the need for physical offices in all of these states.

| 4 |

Our strategy is to address the funding needs of “under-banked” consumers that tend to be ignored by mainstream institutional credit providers such as traditional banks and credit unions, and charged high advanced fees and interest by fringe lenders such as payday lenders. In the current economic environment, we believe there is a substantial need for the small personal loans that we offer.

All of our personal loans are offered at less than prevailing maximum statutory rates with fixed repayments and no prepayment penalties. We conduct full underwriting on all applications, including credit checks and review of bank statements to ensure customers have the capacity to repay their loans.

We plan to continue expanding our state coverage by obtaining state lending licenses in an additional six states, increasing our coverage to 25 states in 2017. As soon as we receive new state licenses, we are prepared to re-focus our existing online marketing and distribution channel resources to those states, which we expect will continue to lower our average customer acquisition cost.

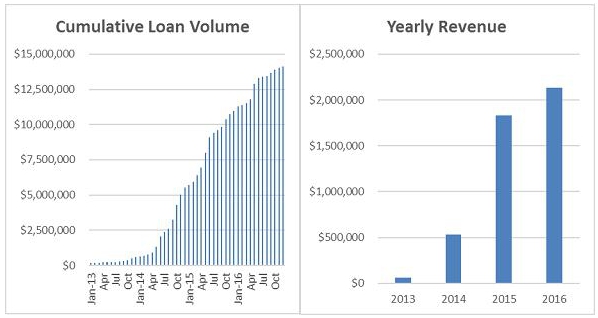

We have a history of reporting recurring losses and have not generated positive net cash flows from operations. For the years ended December 31, 2016 and 2015, we generated revenue of $2,135,046 and $1,835,165, respectively, and had net losses of $4,728,869 and $5,698,198, respectively.

We were organized as a Florida corporation on January 21, 1999, originally under the name Interact Technologies, Inc. In February 2013, we changed our name to IEG Holdings Corporation. We have two wholly-owned subsidiaries, IEC, our U.S. operating entity that holds all of our state licenses, leases, employee contracts and other operating and administrative assets, and IEC SPV, a bankruptcy remote special purpose entity that holds our U.S. loan receivables.

Market

We operate in the consumer finance industry serving the large and growing population of consumers who have limited access to credit from banks, credit card companies and other lenders. According to the Federal Deposit Insurance Corporation, 7.7% (1 in 13) of households in the United States were unbanked in 2013. This proportion represented nearly 9.6 million households. According to the Center for Financial Services December 2015 report, the rapid rise of short term credit, which grew 37% from 2012 to 2014, while single payment credit grew only 0.1% over the same period, is starkly apparent. With anticipated regulatory changes likely to alter the feasibility of offering loans due in one lump sum, many companies are investing more heavily in installment-based credit products, while new players are seeking to upend the economics of small-dollar loans through online channels and alternative underwriting. The strong marketing and new account approval rates of subprime credit cards have also provided consumers with increased access to funds available on a short-term basis. Together, these shifts in the consumer lending industry suggest that total revenue for short term credit products, sized at $29 billion in 2014, will soon outpace that of single payment credit products, sized at $38 billion for the same year. In fact, short term credit products already generate nearly twice as much annual revenue as single payment credit products.

Installment lending to non-prime consumers is one of the most highly fragmented sectors of the consumer finance industry. We are a state-licensed Internet-based personal loan company serving in the consumer installment lending industry. Our online lending platform provides the distribution network to efficiently address this growing market of consumers without the significant costs and overhead associated with an extensive branch network. We believe we are well positioned to capitalize on the significant growth and expansion opportunity created by the continued shift of consumers to online services, such as online banking and in our case online personal loans.

We are currently licensed and providing loans online to residents of Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Maryland, Missouri, Nevada, New Jersey, New Mexico, Ohio, Oregon, Pennsylvania, Texas, Utah and Virginia, with plans to continue to expand across the United States by acquiring additional state lending licenses. The following is a breakdown of our cumulative loan origination amounts in each licensed state for our current active loan portfolio as at December 31, 2016:

| State | Origination Volume ($) | Current Principal ($) | Number

of Loans | |||||||||

| Alabama | 115,000 | 89,203 | 18 | |||||||||

| Arizona | 807,000 | 307,766 | 99 | |||||||||

| California | 995,000 | 779,210 | 163 | |||||||||

| Florida | 2,260,000 | 1,073,758 | 278 | |||||||||

| Georgia | 1,433,023 | 800,393 | 177 | |||||||||

| Illinois | 1,761,000 | 936,025 | 212 | |||||||||

| Kentucky | 15,000 | 14,426 | 3 | |||||||||

| Louisiana | 15,000 | 12,839 | 3 | |||||||||

| Maryland (1) | 0 | 0 | 0 | |||||||||

| Missouri | 413,000 | 254,103 | 59 | |||||||||

| Nevada | 1,708,000 | 663,594 | 175 | |||||||||

| New Jersey | 1,607,000 | 843,708 | 196 | |||||||||

| New Mexico | 35,000 | 27,056 | 6 | |||||||||

| Ohio (2) | 0 | 0 | 0 | |||||||||

| Oregon | 290,000 | 163,429 | 37 | |||||||||

| Pennsylvania | 810,000 | 562,073 | 117 | |||||||||

| Texas | 740,000 | 347,538 | 91 | |||||||||

| Utah | 75,000 | 49,829 | 11 | |||||||||

| Virginia | 1,030,000 | 599,398 | 137 | |||||||||

| (1) | Maryland was added as a licensed state in October 2016. | |

| (2) | Ohio was added as a licensed state in December 2016. |

| 5 |

Business Strategy

Our business strategy is to lower the cost of providing consumer loans by leveraging our online lending platform and distribution network, while continuing to obtain additional state licenses to enable further loan book growth and portfolio diversification. Our strategy includes a number of key elements:

| ● | State-Licensed Model: Our state-licensed business model is a key element of our business strategy. We are currently licensed in Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Maryland, Missouri, Nevada, New Jersey, New Mexico, Ohio, Oregon, Pennsylvania, Texas, Utah and Virginia and plan to continue expanding across the United States by acquiring additional state lending licenses. | |

| ● | Online Distribution: We launched online lending in March 2013 and commenced online advertising in July 2013. Upon fulfillment of state regulatory requirements, we received approval from regulators in Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Maryland, Missouri, Nevada, New Jersey, New Mexico, Ohio, Oregon, Pennsylvania, Texas, Utah and Virginia to operate solely online in these states. This allows us to fully service all 19 states from our centralized Las Vegas headquarters, which we believe is a key competitive advantage over brick and mortar lenders. | |

| ● | Cost-Effective Customer Acquisition: Our customer acquisition costs have been reduced since we launched online lending and marketing. | |

| ● | Continue to Grow Loan Book: Total cumulative loan originations as of December 31, 2016 have increased 154% to $14,109,023 since our January 1, 2015 total of $5,549,023. This growth in lending is attributable to launching online lending and joint venturing with a number of new marketing partners, however, such past growth is not necessarily indicative or predictive of our future results of operation. We also plan to obtain an additional six state lending licenses in 2017. | |

| ● | Strategic Acquisitions: We have reviewed, and continue to review, opportunities to expand our business through acquisition or merger in the consumer finance sector. We are pursuing opportunities that provide synergies with our existing business and specifically target potential acquisitions that are significantly accretive to net asset value and/or provide significant revenue growth opportunities via a minority or majority shareholding. |

Competitive Strengths

We believe our competitive strengths are:

| ● | Large Market and Scope for Growth: Large personal and payday loan market in the United States presents opportunity for significant growth and expansion. | |

| ● | Regulation: We are materially compliant with state lending licenses in Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Maryland, Missouri, Nevada, New Jersey, New Mexico, Ohio, Oregon, Pennsylvania, Texas, Utah and Virginia, and are well positioned for current and future regulatory changes due to ongoing compliance and conservative business model. | |

| ● | Customer Proposition: Our unsecured $5,000 and $10,000 installment loans are all offered over five years and feature affordable weekly repayments. Rates range from 19.9% - 29.9% APR which make us a low cost alternative to payday loans which have an average APR of over 400%. |

| 6 |

| ● | Online Distribution: Special approval has been granted by the Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Maryland, Missouri, Nevada, New Jersey, New Mexico, Ohio, Oregon, Pennsylvania, Texas, Utah and Virginia regulators to operate our business without a physical office location in each state. As a result, we have closed offices in Arizona, Illinois and Florida and moved to full online loan distribution, enabling us to offer loans to residents in all 19 of our licensed states from our Las Vegas headquarters. We plan to apply for the same regulatory approval for six additional states in 2017. | |

| ● | Customer Acquisition: We launched online advertising in July 2013 with positive results from search engine cost per click advertising and online lead generation. In addition, we engaged a number of new marketing partners in 2014, 2015 and 2016, including online lead generators and direct mail. All of these avenues provide opportunities for strong growth at low customer acquisition costs. | |

| ● | Barriers to Entry: We believe that state licensure acts as a barrier to entry into our segment of the consumer loan market. We are strongly positioned with approval to operate under 19 state licenses from one centralized head office. |

Products

We currently provide $5,000 and $10,000 online consumer loans unsecured over a five-year term with rates ranging from 19.9% to 29.9% annual percentage rate. Our current loan portfolio also includes loans remaining from our previous product offerings which were $2,000 to $10,000 loans unsecured over a three- to five-year term at 18.0% to 29.9%.

Our personal loan products are fully amortizing, fixed rate, unsecured installment loans and all loans are offered at prevailing statutory rates, with our standard loan product being a 29.9% interest rate and annual percentage rate, fully amortizing, five-year unsecured personal loan. The variations from this standard loan product in certain states is due to individual state requirements and to comply with our state lending licenses; for example, Florida requires a blended rate which caps the maximum rate on a $5,000 loan at 24%.

The following is a breakdown of loan terms and interest rates for each currently licensed state:

| State | IEG

Holdings’ APR for $5,000 Loans | Maximum Permitted Rate for $5,000 Loans | IEG Holdings’ APR for $10,000 Loans | Maximum Permitted Rate for $10,000 Loans | ||||||||||||

| Alabama | 29.90 | % | 36.00 | %(1) | 29.90 | % | 36.00 | %(1) | ||||||||

| Arizona | 24.90 | % | 24.90 | % | 23.90 | % | 23.90 | % | ||||||||

| California | 29.90 | % | 36.00 | % | 29.90 | % | 36.00 | % | ||||||||

| Florida | 23.90 | % | 24.00 | % | 19.90 | % | 21.00 | % | ||||||||

| Georgia | 29.90 | % | 30.00 | % | 29.90 | % | 30.00 | % | ||||||||

| Illinois | 29.90 | % | 36.00 | % | 29.90 | % | 36.00 | % | ||||||||

| Kentucky | 29.90 | % | 30.00 | % | 29.90 | % | 30.00 | % | ||||||||

| Louisiana | 28.90 | % | 28.90 | % | 25.50 | % | 25.50 | % | ||||||||

| Maryland | 24.00 | % | 24.00 | % | 24.00 | % | 24.00 | % | ||||||||

| Missouri | 29.90 | % | 30.00 | % | 29.90 | % | 29.90 | % | ||||||||

| Nevada | 29.90 | % | 36.00 | %(1) | 29.90 | % | 36.00 | %(1) | ||||||||

| New Jersey | 29.90 | % | 30.00 | % | 29.90 | % | 30.00 | % | ||||||||

| New Mexico | 29.90 | % | 36.00 | %(1) | 29.90 | % | 36.00 | %(1) | ||||||||

| Ohio | 25.00 | % | 25.00 | % | — | (2) | — | (2) | ||||||||

| Oregon | 29.90 | % | 36.00 | % | 29.90 | % | 36.00 | % | ||||||||

| Pennsylvania | 29.90 | % | 30.00 | % | 29.90 | % | 30.00 | % | ||||||||

| Texas | 28.86 | % | 28.86 | % | 25.84 | % | 25.84 | % | ||||||||

| Utah | 29.90 | % | 36.00 | %(1) | 29.90 | % | 36.00 | %(1) | ||||||||

| Virginia | 29.90 | % | 30.00 | % | 29.90 | % | 30.00 | % | ||||||||

| (1) | There is no rate limit in this jurisdiction. However, in order to comply with the Servicemembers Civil Relief Act, the maximum APR is 36.0%. |

| (2) | We do not offer $10,000 loans in Ohio. |

| 7 |

The following is an illustrative profile of our personal loans:

| Loan Product | - | $5,000 and $10,000 loans | |

| - | 5 years | ||

| - | 28.9% average APR | ||

| - | Fixed rate, fully amortizing | ||

| - | No hidden or additional fees | ||

| - | No prepayment penalties |

| Loan Purpose | Loans available for any purpose. Common uses include: |

| - | Debt consolidation | ||

| - | Medical expenses | ||

| - | Home improvements | ||

| - | Auto repairs | ||

| - | Major purchase | ||

| - | Discretionary spending | ||

| Average Borrower Demographic | - | 600 - 750 credit score | |

| - | $40,000 - $100,000 income | ||

| - | 25 - 60 years old |

We commenced originating personal loans online in July 2013. Prior to that, we provided loans to customers via our office network, which comprised one office in each state as required by state licensing regulations. Our online loan origination platform now means that a qualifying customer can obtain a loan from us without having to come into an office location. We have maintained our full underwriting processes, identity verifications and fraud checks to ensure that online customers are verified to the same degree that customers were when they obtained a loan in an office. We expect our website and application portal, www.mramazingloans.com, to be a key driver of customer conversions and loan book growth.

The following graphs depict our monthly loan origination values from January 2013 through December 2016 and our yearly revenue for 2013 through 2016:

The following table sets forth the minimum, maximum and average credit score, income and age of our current borrowers as of December 31, 2016:

Average Borrower Demographic of Current Loan Portfolio as at December 31, 2016

| Demographic | Minimum | Maximum | Average | |||||||

| Credit Score | 559 | 889 | 652 | |||||||

| Income | $ | 24,000 | 750,000 | 64,162 | ||||||

| Age | 23 | 83 | 45 | |||||||

| 8 |

Customer Acquisition

Since launching online lending in July 2013, our marketing efforts have been focused on online customer acquisition. We saw significant increases in loan applications and inquiries as a result of search engine advertising and commenced banner advertising, remarketing and search engine optimization in 2014. We commenced online video advertising in 2015. We have also engaged numerous online lead generators who provide personal loan leads on a daily basis with a combination of cost per funded loan and cost per application expense. We are continuing to develop relationships with additional lead generation partners to drive further growth. We also supplement our online marketing efforts with traditional direct mail advertising.

Loan Underwriting

Applicants apply online providing income, employment and banking information in the pre-approval process. The pre-approval process utilizes a soft credit pull, electronic review of 60-90 day banking history and if the applicant successfully meets the minimum pre-approval criteria they are invited to proceed. Upon accepting the conditional pre-approval, the applicant authorizes a full credit report from Experian and verification of employment. Applicants are provided disclosures and privacy statements during this process.

Once the application has been transmitted, a full credit report is obtained and the automated preliminary underwriting is completed based on stated income and expense data obtained from the credit report. The automated preliminary underwriting includes, but is not limited to, credit score, number of credit inquiries, outstanding unpaid collections, length of credit history, length of employment, debt to income ratio and internet protocol, or “IP,” address to verify location of applicant.

The second step in the underwriting process for those applicants that are conditionally approved based on stated income, credit score, number of credit inquires, outstanding unpaid collections, length of credit history and length of employments, debt to income ratio, IP address, is to validate the actual income (current pay invoices and prior year W-2) and a review of the 60-90 day read-only statements from the applicant’s primary bank for satisfactory money management. During this process the pay invoices are reviewed for garnishments, hardship loans and other legal liens allowed on wages. Bank statements are transmitted electronically directly to underwriting to ensure the integrity of the information. This process allows the underwriter to review the money management of every applicant and to assess the ability to take on additional expense. It also provides the underwriter with additional debt not found on traditional credit reports such as payday loans, title loans and IRS payments that could affect the ability of the applicant to assume additional debt. If all conditions are met as it relates to money management, maximum debt to income, minimum length of employment, and satisfactory credit history the underwriter recommends final approval and request to draw documents.

The final step in the underwriting process is to present the completed file to the Chief Credit Officer for final approval and order to draw documents. The file is then reviewed for any exceptions to policy, compliance with the underwriting policies and to ensure the loan system is reflective of what has been presented by the underwriter. The applicant is then approved for a $5,000 or $10,000 loan based on income, ability to repay and credit strength. Rate and loan terms are fixed (fixed rate and fixed term can vary based on regulatory state maximums) as we do not utilize risk based variable pricing models eliminating the risk of discrimination and other compliance related issues.

The closing process is completed by contacting the applicant, communicating the lending decision and reviewing loan terms and conditions. Upon acceptance an identity check using Experian’s Precise Identity Screening is completed and if successful loan documents are emailed for electronic signature, and returned to us for final verifications, document review and funding.

Servicing

All of our loan servicing is handled in our centralized Las Vegas head office. All servicing and collection activity is conducted and documented using an industry standard loan service software system which handles and records all records and transactions of loan originations, loan servicing, collections and reporting.

Our primary third-party servicing arrangement is with CyberRidge, LLC, a company that licenses its consumer loan software to us. We use this software for our loan management system. We have a servicing agreement with CyberRidge, LLC which renews automatically unless either party notifies the other, at least 60 days prior to the end of the renewal term. We believe the risk of termination is low as we are a paying customer of CyberRidge, LLC and have maintained a positive working relationship since 2012. In the unlikely event that the agreement was terminated, we believe 60 days’ notice would be sufficient to find a suitable replacement with minimal disruption to our business.

| 9 |

Portfolio Ledger Stratification as at December 31, 2016

| Current

Unpaid Principal Balance |

% | |||||||

| 0 - 30 days | $ | 6,799,362 | 89.61 | % | ||||

| 31 - 60 days | 257,299 | 3.39 | % | |||||

| 61 - 90 days | 163,590 | 2.16 | % | |||||

| 91 - 120 days | 210,790 | 2.78 | % | |||||

| 121 - 184 days | 156,308 | 2.06 | % | |||||

| Total | $ | 7,587,349 | 100 | % | ||||

At December 31, 2016, we also had 83 loans delinquent or in default (defined as 91+ days past due) representing 4.84% of the number of loans in our active portfolio. Loans become eligible for lender to take legal action at 60 days past due.

Regulation

Consumer loans in the United States are regulated at both the federal and state level. National oversight is provided by the Federal Trade Commission, which enforces the following credit laws that protect consumers’ rights to get, use and maintain credit:

| ● | The Truth in Lending Act promotes the informed use of consumer credit, by requiring disclosures about its terms and cost to standardize the manner in which costs associated with borrowing are calculated and disclosed. | |

| ● | The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nation’s credit reporting companies. If a company denies an application, under the Fair Credit Reporting Act consumers have the right to the name and address of the credit reporting company they contacted, provided the denial was based on information given by the credit reporting company. | |

| ● | The Equal Opportunity Credit Act prohibits credit discrimination on the basis of sex, race, marital status, religion, national origin, age, or receipt of public assistance. Creditors may ask for this information (except religion) in certain situations, but they may not use it to discriminate against consumers when deciding whether to grant you credit. | |

| ● | The Fair Credit Billing Act and Electronic Fund Transfer Act establish procedures for resolving mistakes on credit billing and electronic fund transfer account statements. | |

| ● | The Fair Debt Collection Practices Act (the “FDCPA”) applies to personal, family, and household debts. The FDCPA prohibits debt collectors from engaging in unfair, deceptive, or abusive practices while collecting these debts. |

In addition, the CFPB, a federal oversight body organized in connection with the Dodd-Frank Act has broad authority over our business. The CFPB is a new agency which commenced operations in 2011, and there continues to be uncertainty as to how the agency’s actions or the actions of any other new agency could impact our business or that of our issuing banks. The CFPB has the authority to write regulations under federal consumer financial protection laws, such as the Truth in Lending Act and the Equal Credit Opportunity Act, and to enforce those laws against and examine financial institutions for compliance. The CFPB is authorized to prevent “unfair, deceptive or abusive acts or practices” through its regulatory, supervisory and enforcement authority. To assist in its enforcement, the CFPB maintains an online complaint system that allows consumers to log complaints with respect to various consumer finance products, including the loan products we facilitate. This system could inform future CFPB decisions with respect to its regulatory, enforcement or examination focus.

We are subject to the CFPB’s jurisdiction, including its enforcement authority, as a servicer and acquirer of consumer credit. The CFPB may request reports concerning our organization, business conduct, markets and activities. The CFPB may also conduct on-site examinations of our business on a periodic basis if the CFPB were to determine, through its complaint system, that we were engaging in activities that pose risks to consumers.

There continues to be uncertainty as to how the CFPB’s strategies and priorities, including in both its examination and enforcement processes, will impact our businesses and our results of operations going forward. Actions by the CFPB could result in requirements to alter or cease offering affected loan products and services, making them less attractive and restricting our ability to offer them.

Consumer loans are also regulated at the state level, and the regulatory requirements vary between states. We are licensed in the following states:

| ● | Alabama (Consumer Credit License, No. MC 22125, which commenced on August 13, 2015) | |

| ● | Arizona (Consumer Lender License, No. CL0918180, which commenced on May 20, 2011) | |

| ● | California (Finance Lender License, No. 60 DBO 35873, which commenced on July 7, 2015) |

| 10 |

| ● | Florida (Consumer Finance Company License, No. CF9900865, which commenced on August 29, 2011) | |

| ● | Georgia (Certificate of Authority, No. 14021183, which commenced on March 4, 2014) | |

| ● | Illinois (Consumer Installment Loan License, No. CI3095, which commenced on April 13, 2011) | |

| ● | Kentucky (Consumer Finance License, No. CL327249, which commenced on December 17, 2015) | |

| ● | Louisiana (License No. 1226052-980840, which was issued on October 2, 2015) | |

| ● | Maryland (License No. 2307, which commenced on October 25, 2016) | |

| ● | Missouri (Consumer Installment Loan License, No. ###-##-####, which commenced on April 7, 2014) | |

| ● | Nevada (Installment Loan License, No. II22748, which commenced on June 15, 2010) | |

| ● | New Jersey (Consumer Lender License, No. L066960, which commenced on April 24, 2014) | |

| ● | New Mexico (Certificate of Authority, No. 5012554, which commenced on January 29, 2015) | |

| ● | Ohio (License No. SL 400243, which commenced on December 21, 2016) | |

| ● | Oregon (Consumer Finance License, No. 0407-001-C, which commenced on January 8, 2015) | |

| ● | Pennsylvania (Consumer Lender License, No. 49269, which commenced on December 23, 2014) | |

| ● | Texas (Regulated Lender License, No. 1400031843-150319, which commenced on November 14, 2014) | |

| ● | Utah (Consumer Lender License which commenced on February 5, 2015) | |

| ● | Virginia (Certificate of Authority, No. CIS0368, which commenced on March 5, 2014) |

State licensing statutes impose a variety of requirements and restrictions on us, including:

| ● | record-keeping requirements; | |

| ● | restrictions on servicing practices, including limits on finance charges and fees; | |

| ● | disclosure requirements; | |

| ● | examination requirements; | |

| ● | surety bond and minimum net worth requirements; | |

| ● | financial reporting requirements; | |

| ● | notification requirements for changes in principal officers, stock ownership or corporate control; | |

| ● | restrictions on advertising; and | |

| ● | review requirements for loan forms. |

The statutes also subject us to the supervisory and examination authority of state regulators in certain cases.

We did not incur any costs in connection with the compliance with any federal, state, or local environmental laws.

| 11 |

Competition

We operate in a highly competitive environment. Several personal consumer loan companies operate in the United States. Our competitors include:

| ● | large, publicly-traded, state-licensed personal loan companies, | |

| ● | peer-to-peer lending companies, such as Lending Club and Prosper, | |

| ● | online personal loan companies, such as Avant, | |

| ● | “brick and mortar” personal loan companies, including those that have implemented websites to facilitate online lending, and | |

| ● | payday lenders, tribal lenders and other online consumer loan companies. |

We believe we compete based on affordable repayment terms, favorable interest rates and low overhead due to on-line distribution. We believe that in the future we will face increased competition from these companies as we expand our operations. Most of the entities against which we compete, or may compete, are larger and have greater financial resources than us. No assurance can be given that increased competition will not have an adverse effect on our company.

Office Location

Our executive office, which also serves as our centralized operational headquarters and Nevada branch, is located at 6160 West Tropicana Ave, Suite E-13, Las Vegas, Nevada 89103. This facility occupies a total of approximately 2,125 square feet under a lease that expires in September 2017. Our annual rental cost for this facility is approximately $56,313, plus a proportionate share of operating expenses of approximately $12,112 annually. We believe this facility is adequate for our current and near term future needs due to our online strategy and our ability to operate 7 days a week with unrestricted hours of operation from this location.

Employees

As of December 31, 2016, we had five full-time employees and one part-time employee. None of our employees is represented by a union. We consider our relations with our employees to be good.

Corporate History

We were organized as a Florida corporation on January 21, 1999, under the name Interact Technologies, Inc. (“Interact”). Interact was formed for the purpose of acquiring certain medical technology. On February 18, 1999, we changed our name to Fairhaven Technologies, Inc. (“Fairhaven”). Fairhaven’s business plan continued to involve the acquisition of certain medical technology. By June 1999, Fairhaven abandoned its business plan and had no operations until December 2001. On December 14, 2001, we changed our name to Ideal Accents, Inc. Ideal Accents, Inc. was engaged primarily in the business of accessorizing cars and trucks at the new vehicle dealer level. Ideal Accents, Inc. ceased operations in 2005. IEC, our wholly owned subsidiary, commenced operations in 2010 and in February 2013, we changed our name to IEG Holdings Corporation.

In 2005, Mr. Mathieson, our Chief Executive Officer and sole director, founded IEG in Sydney, Australia. IEG launched the Mr. Amazing Loans business in the United States via IEGC in 2010. On January 28, 2013, IEGC entered into a stock exchange agreement (the “Stock Exchange Agreement”) among IEGC, its sole stockholder, IEG, and our company. Under the terms of the Stock Exchange Agreement, we agreed to acquire a 100% interest in IEGC for 272,447 shares of our common stock after giving effect to a 1-for-6 reverse stock split (also adjusted for the 1-for-100 reverse stock split that took effect June 17, 2015 and the net 1-for-10 reverse stock split that was effective on October 27, 2016). On February 14, 2013, we filed an amendment to our articles of incorporation, as amended, with the Secretary of State of Florida which had the effect of:

| ● | changing our name from Ideal Accents, Inc. to IEG Holdings Corporation, | |

| ● | increasing the number of shares of our authorized common stock to 1,000,000,000, $0.001 par value, | |

| ● | creating 50,000,000 shares of “blank-check” preferred stock, and | |

| ● | effecting the Reverse Stock Split pursuant to the terms of the Stock Exchange Agreement. |

FINRA approved the amendment to our articles of incorporation, as amended, on March 11, 2013.

| 12 |

On March 13, 2013, we completed the acquisition of IEGC under the terms of the Stock Exchange Agreement and issued to IEG 272,447 shares of our common stock after giving effect to the Reverse Stock Split whereby we acquired a 100% interest in IEGC. The stock exchange agreement between IEGC, IEG and IEG Holdings resulted in a reverse acquisition with a public shell, with IEGC being the accounting acquirer. IEG Holdings issued 90 shares of its common stock to the stockholders of IEG (IEG transferred its ownership in IEGC to its stockholders, which is why the shares were issued to the ultimate stockholders of IEG rather than to IEG itself) for each share of IEGC, in exchange for 100% ownership interest in IEGC. We determined that IEGC was the accounting acquirer because of the following facts and circumstances:

| 1. | After consummation of the transaction, the ultimate stockholders of IEGC own 99.1% of the outstanding shares of IEG Holdings; | |

| 2. | The board of directors of IEG Holdings immediately after the transaction is comprised exclusively of former directors of IEGC; and | |

| 3. | The operations of IEG Holdings immediately after the transaction are those of IEGC. |

After completing the Stock Exchange Agreement and terminating all Australian operations via the sale of the remaining loan book, IEG entered into voluntary liquidation on June 25, 2014. In August 2015, IEGC assigned all of its tangible and intangible assets to IEG Holdings and IEGC was dissolved.

On May 1, 2015, we filed articles of amendment to our amended and restated articles of incorporation, as amended, with the Secretary of State of Florida. The amendment was approved by FINRA, and became effective, on June 17, 2015. The articles of amendment effected (i) a 1-for-100 reverse stock split, and (ii) an increase in our authorized capital stock from 2,550,000,000 shares to 3,050,000,000 shares, of which 3,000,000,000 shares are common stock and 50,000,000 are preferred stock.

On September 10, 2015, we filed articles of amendment to our amended and restated articles of incorporation, as amended, with the Secretary of State of Florida. The articles of amendment had the effect, among other things, of adjusting the conversion ratio of the Series H preferred stock, from 1,333/100,000 (0.01333) to 2,666/100,000 (0.02666) shares of common stock for each Series H preferred share, to account for the Company’s offering to existing stockholders of the Company commenced August 3, 2015.

On December 1, 2015, we filed articles of amendment to our amended and restated articles of incorporation, as amended, with the Secretary of State of Florida. The articles of amendment had the effect, among other things, of adjusting the conversion ratio of the Series H preferred stock, from 2,666/100,000 (0.02666) to 5,332/100,000 (0.05332) shares of common stock for each Series H preferred share, to account for the Company’s offering to existing stockholders of the Company commenced December 1, 2015.

On January 8, 2016, we filed articles of amendment to our amended and restated articles of incorporation, as amended, with the Secretary of State of Florida. The articles of amendment had the effect, among other things, of adjusting the conversion ratio of the Series H preferred stock, from 5,332/100,000 (0.05332) to 0.1 shares of common stock for each Series H preferred share, to account for the Company’s offering to existing stockholders of the Company commenced January 8, 2016.

On March 22, 2016, we filed articles of amendment to our amended and restated articles of incorporation, as amended. The amendment had the effect, among other things, of adjusting the conversion ratio of the Series H preferred stock from 0.1 shares to 0.2 shares of common stock for each Series H preferred share, to account for our offering to existing stockholders commenced March 16, 2016.

Effective April 1, 2016, we amended our amended and restated articles of incorporation, as amended, in order to effect a 1-for-100 reverse stock split. No fractional shares were issued. Rather, we paid stockholders who would have received a fractional share an amount equal to the average closing price per share of our common stock on the OTCQB, averaged over the period of 30 consecutive calendar days ending on (and including) April 1, 2016. In addition, after the reverse stock split was effected on April 1, 2016, we amended our amended and restated articles of incorporation, as amended, to effect (i) a 100-for-1 forward stock split, and (ii) a reduction in the number of authorized shares of common stock from 3 billion to 200 million.

On May 16, 2016, we filed articles of amendment to our amended and restated articles of incorporation, as amended, with the Secretary of State of Florida. The articles of amendment had the effect, among other things, of:

| (i) | Reducing the dividend rate on our Series H preferred stock from 10% per annum to 8% per annum, | |

| (ii) | Extending the date after which we may redeem the unconverted outstanding shares of Series H preferred stock from June 30, 2016 to December 31, 2016, | |

| (iii) | Extending the date on which the holders of our Series H preferred stock may convert their shares into shares of our common stock from June 30, 2016 to December 31, 2016, and | |

| (iv) | Removing the requirement to adjust the Series H preferred stock conversion ratio when we conduct a rights offering to our existing stockholders. |

| 13 |

On October 12, 2016, we filed articles of amendment to our amended and restated articles of incorporation, as amended, with the Secretary of State of Florida. The articles of amendment had the effect of:

| (i) | Adjusting the conversion ratio of the Series H preferred stock, from two to 0.2 shares of common stock for each Series H preferred share, to account for Company’s reverse/forward split effective October 27, 2016, and | |

| (ii) | Amending the redemption date of the Series H preferred stock from “[a]ny time after the December 31, 2016” to “[a]ny time after 6:00 p.m. Eastern time on December 31, 2016.” |

Effective October 27, 2016, we effected a reverse stock split of our outstanding shares of common stock, at the ratio of 1-for-1,000. No fractional shares were issued. Rather, we paid stockholders who would have received a fractional share an amount equal to the average closing price per share of our common stock on the OTCQX, averaged over the period of 30 consecutive calendar days preceding the reverse stock split. Immediately following the completion of the reverse stock split, we effected a forward stock split of our common stock on a 100-for-1 share basis and a reduction of the number of authorized shares of common stock from 200,000,000 to 40,000,000.

Effective December 5, 2016, we increased our number of authorized shares of common stock from 40,000,000 to 300,000,000.

Legal Proceedings

We are not a party to any pending or threatened litigation.

Emerging Growth Company Status

We are an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We intend to take advantage of all of these exemptions.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards, and delay compliance with new or revised accounting standards until those standards are applicable to private companies. We have elected to take advantage of the benefits of this extended transition period.

We could be an emerging growth company until the last day of the first fiscal year following the fifth anniversary of our first common equity offering, although circumstances could cause us to lose that status earlier if our annual revenues exceed $1.0 billion, if we issue more than $1.0 billion in non-convertible debt in any three-year period or if we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act.

The risk factors in this section describe the material risks to our business, prospects, results of operations, financial condition or cash flows, and should be considered carefully. In addition, these factors constitute our cautionary statements under the Private Securities Litigation Reform Act of 1995 and could cause our actual results to differ materially from those projected in any forward-looking statements (as defined in such act) made in this annual report on Form 10-K. Investors should not place undue reliance on any such forward-looking statements. Any statements that are not historical facts and that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “intends,” “plans,” “believes” and “projects”) may be forward-looking and may involve estimates and uncertainties which could cause actual results to differ materially from those expressed in the forward-looking statements.

Further, any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors emerge from time to time, and it is not possible for us to predict all of such factors. Further, we cannot assess the impact of each such factor on our results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

| 14 |

Risks Related to Our Business and Industry

Our limited operating history and our failure since inception to achieve an operating profit makes our future prospects and financial performance unpredictable.

We commenced operations in 2010 and as a result, we have a limited operating history upon which a potential investor can evaluate our prospects and the potential value of an investment in our company. In addition, we have not made an operating profit since our incorporation. We remain subject to the risks inherently associated with new business enterprises in general and, more specifically, the risks of a new financial institution and, in particular, a new Internet-based financial institution. Our prospects are subject to the risks and uncertainties frequently encountered by companies in their early stages of development, including the risk that we will not be able to implement our business strategy. If we are unable to implement our business strategy and grow our business, our business will be materially adversely affected.

We may not be able to implement our plans for growth successfully, which could adversely affect our future operations.

Since January 2015, the amount we have loaned to borrowers (our loan book) has increased by 154% from $5,549,023 to $14,109,023 as of December 31, 2016. We expect to continue to grow our loan book and number of customers at an accelerated rate in the future. Our future success will depend in part on our continued ability to manage our growth. We may not be able to achieve our growth plans, or sustain our historical growth rates or grow at all. Various factors, such as economic conditions, regulatory and legislative considerations and competition, may also impede our ability to expand our market presence. If we are unable to grow as planned, our business and prospects could be adversely affected.

Our inability to manage our growth could harm our business.

We anticipate that our loan book and customer base will continue to grow significantly over time. To manage the expected growth of our operations and personnel, we will be required to, among other things:

| ● | improve existing and implement new transaction processing, operational and financial systems, procedures and controls; | |

| ● | maintain effective credit scoring and underwriting guidelines; and | |

| ● | increase our employee base and train and manage this growing employee base. |

If we are unable to manage growth effectively, our business, prospects, financial condition and results of operations could be adversely affected.

We may need to raise additional capital that may not be available, which could harm our business.

Our growth will require that we generate additional capital either through retained earnings or the issuance of additional debt or equity securities. Additional capital may not be available on terms acceptable to us, if at all. Any equity financings could result in dilution to our stockholders or reduction in the earnings available to our common stockholders. If adequate capital is not available or the terms of such capital are not attractive, we may have to curtail our growth and our business, and our business, prospects, financial condition and results of operations could be adversely affected.

As an online consumer loan company whose principal means of delivering personal loans is the Internet, we are subject to risks particular to that method of delivery.

We are predominantly an online consumer loan company and there are a number of unique factors that Internet-based loan companies face. These include concerns for the security of personal information, the absence of personal relationships between lenders and customers, the absence of loyalty to a conventional hometown branch, customers’ difficulty in understanding and assessing the substance and financial strength of an online loan company, a lack of confidence in the likelihood of success and permanence of online loan companies and many individuals’ unwillingness to trust their personal details and financial future to a relatively new technological medium such as the Internet. As a result, some potential customers may be unwilling to establish a relationship with us.

Conventional “brick and mortar” consumer loan companies, in growing numbers, are offering the option of Internet-based lending to their existing and prospective customers. The public may perceive conventional established loan companies as being safer, more responsive, more comfortable to deal with and more accountable as providers of their lending needs. We may not be able to offer Internet-based lending that has sufficient advantages over the Internet-based lending services and other characteristics of conventional “brick and mortar” consumer loan companies to enable us to compete successfully.

| 15 |

We may not be able to make technological improvements as quickly as some of our competitors, which could harm our ability to compete with our competitors and adversely affect our results of operations, financial condition and liquidity.

Both the Internet and the financial services industry are undergoing rapid technological changes, with frequent introductions of new technology-driven products and services. In addition to improving the ability to serve customers, the effective use of technology increases efficiency and enables financial institutions to reduce costs. Our future success will depend in part upon our ability to address the needs of our customers by using technology to provide products and services that will satisfy customer demands, as well as to create additional efficiencies in our operations. We may not be able to effectively implement new technology-driven products and services or be successful in marketing these products and services to our customers. If we are unable, for technical, legal, financial or other reasons, to adapt in a timely manner to changing market conditions, customer requirements or emerging industry standards, our business, prospects, financial condition and results of operations could be adversely affected.

A significant disruption in our computer systems or a cyber security breach could adversely affect our operations.

We rely extensively on our computer systems to manage our loan origination and other processes. Our systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, cyber security breaches, vandalism, severe weather conditions, catastrophic events and human error, and our disaster recovery planning cannot account for all eventualities. If our systems are damaged, fail to function properly or otherwise become unavailable, we may incur substantial costs to repair or replace them, and may experience loss of critical data and interruptions or delays in our ability to perform critical functions, which could adversely affect our business and results of operations. Any compromise of our security could also result in a violation of applicable privacy and other laws, significant legal and financial exposure, damage to our reputation, loss or misuse of the information and a loss of confidence in our security measures, which could harm our business.

Our ability to protect the confidential information of our borrowers and investors may be adversely affected by cyber-attacks, computer viruses, physical or electronic break-ins or similar disruptions.

We process certain sensitive data from our borrowers and investors. While we have taken steps to protect confidential information that we receive or have access to, our security measures could be breached. Any accidental or willful security breaches or other unauthorized access to our systems could cause confidential borrower and investor information to be stolen and used for criminal purposes. Security breaches or unauthorized access to confidential information could also expose us to liability related to the loss of the information, time-consuming and expensive litigation and negative publicity. If security measures are breached because of third-party action, employee error, malfeasance or otherwise, or if design flaws in our software are exposed and exploited, our relationships with borrowers and investors could be severely damaged, and we could incur significant liability.

Because techniques used to sabotage or obtain unauthorized access to systems change frequently and generally are not recognized until they are launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. In addition, federal regulators and many federal and state laws and regulations require companies to notify individuals of data security breaches involving their personal data. These mandatory disclosures regarding a security breach are costly to implement and often lead to widespread negative publicity, which may cause borrowers and investors to lose confidence in the effectiveness of our data security measures. Any security breach, whether actual or perceived, would harm our reputation, we could lose borrowers and investors and our business and operations could be adversely affected.

Any significant disruption in service on our platform or in our computer systems, including events beyond our control, could prevent us from processing or posting payments on loans, reduce the attractiveness of our marketplace and result in a loss of borrowers or investors.

In the event of a system outage and physical data loss, our ability to perform our servicing obligations, process applications or make loans available would be materially and adversely affected. The satisfactory performance, reliability and availability of our technology are critical to our operations, customer service, reputation and our ability to attract new and retain existing borrowers and investors.

Any interruptions or delays in our service, whether as a result of third-party error, our error, natural disasters or security breaches, whether accidental or willful, could harm our relationships with our borrowers and investors and our reputation. Additionally, in the event of damage or interruption, our insurance policies may not adequately compensate us for any losses that we may incur. Our disaster recovery plan has not been tested under actual disaster conditions, and we may not have sufficient capacity to recover all data and services in the event of an outage. These factors could prevent us from processing or posting payments on the loans, damage our brand and reputation, divert our employees’ attention, reduce our revenue, subject us to liability and cause borrowers and investors to abandon our marketplace, any of which could adversely affect our business, financial condition and results of operations.

| 16 |

We contract with third parties to provide services related to our online web lending and marketing, as well as systems that automate the servicing of our loan portfolios. See “—We depend on third-party service providers for our core operations including online lending and loan servicing and interruptions in or terminations of their services cold materially impair the quality of our services.” While there are material cybersecurity risks associated with these services, we require that our vendors provide industry-leading encryption, strong access control policies, Statement on Standards for Attestation Engagements (SSAE) 16 audited data centers, systematic methods for testing risks and uncovering vulnerabilities, and industry compliance audits to ensure data and assets are protected. To date, we have not experienced any cyber incidents that were material, either individually or in the aggregate.

Our unsecured loans generally have delinquency and default rates higher than prime and secured loans, which could result in higher loan losses.

We are in the business of originating unsecured personal loans. As of December 31, 2016, approximately 3% of our customers are subprime borrowers, which we define as borrowers having credit scores below 600 on the credit risk scale developed by VantageScore Solutions, LLC. Unsecured personal loans and subprime loans generally have higher delinquency and default rates than secured loans and prime loans. Subprime borrowers are associated with lower collection rates and are subject to higher loss rates than prime borrowers. Subprime borrowers have historically been, and may in the future become, more likely to be affected, or more severely affected, by adverse macroeconomic conditions, particularly unemployment. If our borrowers default under an unsecured loan, we will bear a risk of loss of principal, which could adversely affect our cash flow from operations. Delinquency interrupts the flow of projected interest income from a loan, and default can ultimately lead to a loss. We attempt to manage these risks with risk-based loan pricing and appropriate management policies. However, we cannot assure you that such management policies will prevent delinquencies or defaults and, if such policies and methods are insufficient to control our delinquency and default risks and do not result in appropriate loan pricing, our business, financial condition, liquidity and results of operations could be harmed. If aspects of our business, including the quality of our borrowers, are significantly affected by economic changes or any other conditions in the future, we cannot be certain that our policies and procedures for underwriting, processing and servicing loans will adequately adapt to such changes. If we fail to adapt to changing economic conditions or other factors, or if such changes affect our borrowers’ capacity to repay their loans, our results of operations, financial condition and liquidity could be materially adversely affected. At December 31, 2016, we had 181 loans considered past due at 31+ days past due, representing 10.39% of the number of loans in our active portfolio. At December 31, 2016, we had 83 loans delinquent or in default (defined as 91+ days past due) representing 4.84% of the number of loans in our active portfolio. Loans become eligible for a lender to take legal action at 60 days past due.

If our estimates of loan receivable losses are not adequate to absorb actual losses, our provision for loan receivable losses would increase, which would adversely affect our results of operations.

We maintain an allowance for loans receivable losses. To estimate the appropriate level of allowance for loan receivable losses, we consider known and relevant internal and external factors that affect loan receivable collectability, including the total amount of loan receivables outstanding, historical loan receivable charge-offs, our current collection patterns, and economic trends. If customer behavior changes as a result of economic conditions and if we are unable to predict how the unemployment rate, housing foreclosures, and general economic uncertainty may affect our allowance for loan receivable losses, our provision may be inadequate. Our allowance for loan receivable losses is an estimate, and if actual loan receivable losses are materially greater than our allowance for loan receivable losses, our financial position, liquidity, and results of operations could be adversely affected.

Our risk management efforts may not be effective which could result in unforeseen losses.

We could incur substantial losses and our business operations could be disrupted if we are unable to effectively identify, manage, monitor, and mitigate financial risks, such as credit risk, interest rate risk, prepayment risk, liquidity risk, and other market-related risks, as well as operational risks related to our business, assets and liabilities. Our risk management policies, procedures, and techniques, including our scoring methodology, may not be sufficient to identify all of the risks we are exposed to, mitigate the risks we have identified or identify additional risks to which we may become subject in the future.

We face strong competition for customers and may not succeed in implementing our business strategy.

Our business strategy depends on our ability to remain competitive. There is strong competition for customers from personal loan companies and other types of consumer lenders, including those that use the Internet as a medium for lending or as an advertising platform. Our competitors include:

| ● | large, publicly-traded, state-licensed personal loan companies such as OneMain; | |

| ● | peer-to-peer lending companies such as LendingClub Corp. and Prosper Marketplace Inc.; | |

| ● | online personal loan companies such as Avant; | |

| ● | “brick and mortar” personal loan companies, including those that have implemented websites to facilitate online lending; and | |

| ● | payday lenders, tribal lenders and other online consumer loan companies. |

| 17 |

Some of these competitors have been in business for a long time and have name recognition and an established customer base. Most of our competitors are larger and have greater financial and personnel resources. In order to compete profitably, we may need to reduce the rates we offer on loans, which may adversely affect our business, prospects, financial condition and results of operations. To remain competitive, we believe we must successfully implement our business strategy. Our success depends on, among other things:

| ● | having a large and increasing number of customers who use our loans for financing needs; | |

| ● | our ability to attract, hire and retain key personnel as our business grows; | |

| ● | our ability to secure additional capital as needed; | |

| ● | our ability to offer products and services with fewer employees than competitors; | |

| ● | the satisfaction of our customers with our customer service; | |

| ● | ease of use of our websites; and | |

| ● | our ability to provide a secure and stable technology platform for providing personal loans that provides us with reliable and effective operational, financial and information systems. |

If we are unable to implement our business strategy, our business, prospects, financial condition and results of operations could be adversely affected.

We depend on third-party service providers for our core operations including online lending and loan servicing, and interruptions in or terminations of their services could materially impair the quality of our services.

We rely substantially upon third-party service providers for our core operations, including online web lending and marketing and vendors that provide systems that automate the servicing of our loan portfolios which allow us to increase the efficiency and accuracy of our operations. These systems include tracking and accounting of our loan portfolio as well as customer relationship management, collections, funds disbursement, security and reporting. This reliance may mean that we will not be able to resolve operational problems internally or on a timely basis, which could lead to customer dissatisfaction or long-term disruption of our operations. If these service arrangements are terminated for any reason without an immediately available substitute arrangement, our operations may be severely interrupted or delayed. If such interruption or delay were to continue for a substantial period of time, our business, prospects, financial condition and results of operations could be adversely affected.

If we lose the services of any of our key management personnel, our business could suffer.

Our future success significantly depends on the continued service and performance of our Chief Executive Officer, Paul Mathieson and our Chief Operating Officer, Carla Cholewinski. Competition for these employees is intense and we may not be able to attract and retain key personnel. We do not maintain any “key man” or other related insurance. The loss of the service of our Chief Executive Officer or our Chief Operating Officer, or the inability to attract additional qualified personnel as needed, could materially harm our business.

We have incurred, and will continue to incur, increased costs as a result of being a public reporting company.

In April 2015, we became a public reporting company. As a public reporting company, we incur significant legal, accounting and other expenses that we did not incur as a non-reporting company, including costs associated with our SEC reporting requirements. We expect that the additional reporting and other obligations imposed on us under the Exchange Act, will increase our legal and financial compliance costs and the costs of our related legal, accounting and administrative activities significantly. Management estimates that compliance with the Exchange Act reporting requirements as a reporting company will cost in excess of $200,000 annually. Given our current financial resources, these additional compliance costs could have a material adverse impact on our financial position and ability to achieve profitable results. These increased costs will require us to divert money that we could otherwise use to expand our business and achieve our strategic objectives.

| 18 |

We operate in a highly competitive market, and we cannot ensure that the competitive pressures we face will not have a material adverse effect on our results of operations, financial condition and liquidity.

The consumer finance industry is highly competitive. Our success depends, in large part, on our ability to originate consumer loan receivables. We compete with other consumer finance companies as well as other types of financial institutions that offer similar products and services in originating loan receivables. Some of these competitors may have greater financial, technical and marketing resources than we possess. Some competitors may also have a lower cost of funds and access to funding sources that may not be available to us. While banks and credit card companies have decreased their lending to non-prime customers in recent years, there is no assurance that such lenders will not resume those lending activities. Further, because of increased regulatory pressure on payday lenders, many of those lenders are starting to make more traditional installment consumer loans in order to reduce regulatory scrutiny of their practices, which could increase competition in markets in which we operate.

Negative publicity could adversely affect our business and operating results.

Negative publicity about our industry or our company, including the quality and reliability of our marketplace, effectiveness of the credit decisioning and scoring models used in the marketplace, changes to our marketplace, our ability to effectively manage and resolve borrower and investor complaints, privacy and security practices, litigation, regulatory activity and the experience of borrowers and investors with our marketplace or services, even if inaccurate, could adversely affect our reputation and the confidence in, and the use of, our marketplace, which could harm our business and operating results. Harm to our reputation can arise from many sources, including employee misconduct, misconduct by our partners, outsourced service providers or other counterparties, failure by us or our partners to meet minimum standards of service and quality, inadequate protection of borrower and investor information and compliance failures and claims.

Our business is subject to extensive regulation in the jurisdictions in which we conduct our business.

Our operations are subject to regulation, supervision and licensing under various federal, state and local statutes, ordinances and regulations. In most states in which we operate, a consumer credit regulatory agency regulates and enforces laws relating to consumer lenders such as us. These rules and regulations generally provide for licensing as a consumer lender, limitations on the amount, duration and charges, including interest rates, for various categories of loans, requirements as to the form and content of finance contracts and other documentation, and restrictions on collection practices and creditors’ rights. In certain states, we are subject to periodic examination by state regulatory authorities. Some states in which we operate do not require special licensing or provide extensive regulation of our business.