Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INNOVATE Corp. | a8-kreinvestorpresentation.htm |

HC2 HOLDINGS, INC.

© HC2 Holdings, Inc. 2017

Fourth Quarter and Full Year 2016

Conference Call

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Special Note Regarding Forward-Looking Statements. Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: This presentation contains, and certain oral statements

made by our representatives from time to time may contain, forward-looking statements. Generally, forward-looking statements include information describing actions, events, results, strategies

and expectations and are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or

“continues” or similar expressions. The forward-looking statements in this presentation include without limitation statements regarding our expectation regarding building shareholder value. Such

statements are based on the beliefs and assumptions of HC2's management and the management of HC2's subsidiaries and portfolio companies. The Company believes these judgments are

reasonable, but you should understand that these statements are not guarantees of performance or results, and the Company’s actual results could differ materially from those expressed or

implied in the forward-looking statements due to a variety of important factors, both positive and negative, that may be revised or supplemented in subsequent reports on Forms 10-K, 10-Q and

8-K. Such important factors include, without limitation, issues related to the restatement of our financial statements; the fact that we have historically identified material weaknesses in our internal

control over financial reporting, and any inability to remediate future material weaknesses; capital market conditions; the ability of HC2's subsidiaries and portfolio companies to generate

sufficient net income and cash flows to make upstream cash distributions; volatility in the trading price of HC2 common stock; the ability of HC2 and its subsidiaries and portfolio companies to

identify any suitable future acquisition opportunities; our ability to realize efficiencies, cost savings, income and margin improvements, growth, economies of scale and other anticipated benefits

of strategic transactions; difficulties related to the integration of financial reporting of acquired or target businesses; difficulties completing pending and future acquisitions and dispositions;

effects of litigation, indemnification claims, and other contingent liabilities; changes in regulations and tax laws; and risks that may affect the performance of the operating subsidiaries and

portfolio companies of HC2. These risks and other important factors discussed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and

Exchange Commission (“SEC”), and our other reports filed with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this

presentation .

You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to HC2 or persons acting on its behalf are expressly qualified in their entirety by

the foregoing cautionary statements. All such statements speak only as of the date made, and HC2 undertakes no obligation to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures

In this presentation, HC2 refers to certain financial measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), including Core Operating

Subsidiary Adjusted EBITDA, Total Adjusted EBITDA (excluding Insurance) and Insurance AOI.

Management believes that Adjusted EBITDA measures provide investors with meaningful information for gaining an understanding of certain results as it is frequently used by the financial

community to provide insight into an organization’s operating trends and facilitates comparisons between peer companies, because interest, taxes, depreciation, amortization and the other

items for which adjustments are made as noted in the definition of Adjusted EBITDA below can differ greatly between organizations as a result of differing capital structures and tax strategies.

Adjusted EBITDA can also be a useful measure of a company’s ability to service debt. In addition, management uses Adjusted EBITDA measures in evaluating certain of the Company’s

segments performance because they eliminate the effects of considerable amounts of noncash depreciation and amortization and items not within the control of the Company’s operations

managers. While management believes that these non-US GAAP measurements are useful as supplemental information, such adjusted results are not intended to replace our US GAAP financial

results and should be read together with HC2’s results reported under GAAP.

Management defines Adjusted EBITDA as Net income (loss) adjusted to exclude the impact of depreciation and amortization; amortization of equity method fair value adjustments at

acquisition; (gain) loss on sale or disposal of assets; lease termination costs; asset impairment expense; (gain) loss on early extinguishment or restructuring of debt; interest expense; net gain (loss)

on contingent consideration; other (income) expense, net; foreign currency transaction (gain) loss included in cost of revenue; income tax (benefit) expense; (gain) loss from discontinued

operations; noncontrolling interest; bonus to be settled in equity; share-based compensation expense; acquisition and nonrecurring items; and other costs. Adjusted EBITDA excludes results of

our Insurance segment. A reconciliation of Adjusted EBITDA to Net income (loss) is included in the financial tables at the end of this release.

Management recognizes that using Adjusted EBITDA as a performance measure has inherent limitations as an analytical tool as compared to net income (loss) or other U.S. GAAP financial

measures, as these non-GAAP measures exclude certain items, including items that are recurring in nature, which may be meaningful to investors. As a result of the exclusions, Adjusted EBITDA

should not be considered in isolation and do not purport to be alternatives to net income (loss) or other U.S. GAAP financial measures as a measure of our operating performance.

Management believes that Insurance AOI measures, used frequently in the insurance industry, provide investors with meaningful information for gaining an understanding of certain results and

provides insight into an organization’s operating trends and facilitates comparisons between peer companies.

Management defines Insurance AOI as Net income (loss) for the Insurance segment adjusted to exclude the impact of net investment gains (losses), including other-than-temporary impairment

losses recognized in operations; asset impairment; intercompany elimination and acquisition and non-recurring items. Management believes that Insurance AOI provides a meaningful financial

metric that helps investors understand certain results and profitability. While these adjustments are an integral part of the overall performance of the Insurance segment, market conditions

impacting these items can overshadow the underlying performance of the business. Accordingly, we believe using a measure which excludes their impact is effective in analyzing the trends of

our operations.

By accepting this document, each recipient agrees to and acknowledges the foregoing terms and conditions.

Safe Harbor Disclaimers

1

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Agenda

2

OVERVIEW AND

FINANCIAL HIGHLIGHTS

Philip Falcone Chairman, President and CEO

Q AND A

Philip Falcone

Michael Sena

Andrew Backman

Chairman, President and CEO

Chief Financial Officer

Managing Director – Investor & Public Relations

Quarterly and Full Year

Overview

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

4Q16 and FY16 Highlights and Recent Developments

4

Solid fourth quarter results again highlight the unique value HC2 brings

to the market with our diverse, uncorrelated industry holdings

– Construction: Continued margin improvement; Record backlog and deal pipeline

– Marine Services: Strong joint venture performance; Incremental off shore power installation;

Incremental CWind maintenance contribution; Awarded Atlantic Cable Maintenance

Agreement extension (“ACMA”)

– Telecommunications: Continued growth in wholesale volumes and customer expansion

– Energy: Continued executing footprint expansion strategy via acquisition of 18 CNG stations

from Questar Fueling Co. and Constellation CNG; Increased delivery of gasoline gallon

equivalents

Adjusted EBITDA for Core Operating Subsidiaries*

– $37.9 million in Fourth Quarter, up 20.3% from $31.5 million in Third Quarter 2016

– $109.1 million for Full Year 2016, up 12.4% from $97.1 million for Full Year 2015

Cash and Investments as of December 31, 2016:

– $1.5 billion of consolidated cash, cash equivalents and investments, which includes

the Insurance segment; essentially unchanged from prior quarter

– $90.9 million in Consolidated Cash (excluding Insurance segment)

Cumulative outstanding amount of Preferred Equity reduced to $30.0 million from $42.7

million at end of 3Q16, and from $55.0 million of total preferred issued

* Core Operating Subsidiaries include Construction, Marine Services,

Telecommunications and Energy. Construction formerly Manufacturing: Energy

formerly Utilities.

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

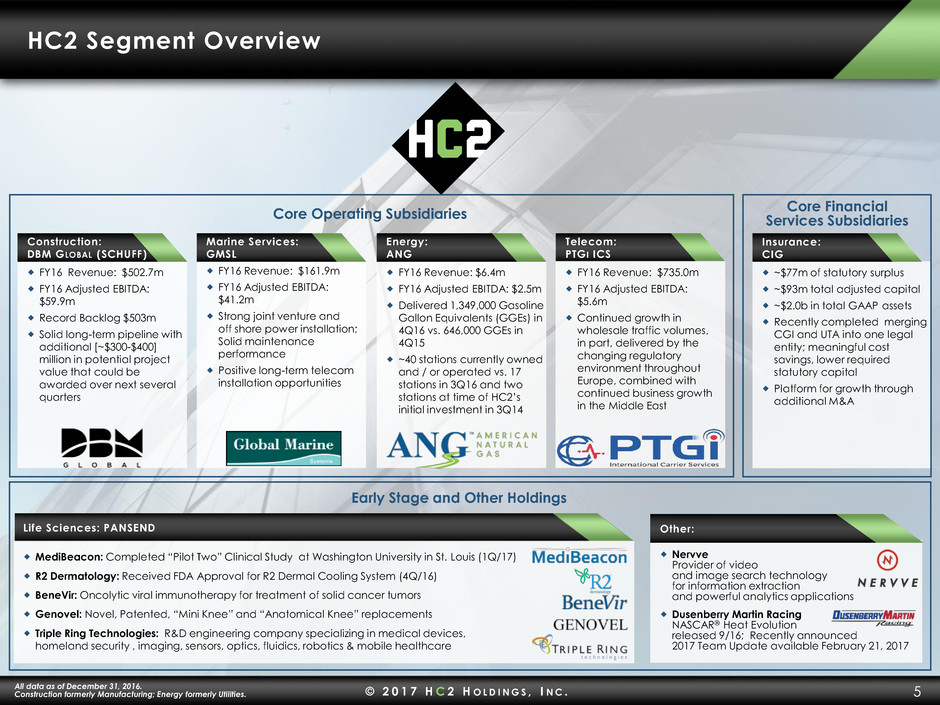

HC2 Segment Overview

5

Early Stage and Other Holdings

Core Operating Subsidiaries

FY16 Revenue: $502.7m

FY16 Adjusted EBITDA:

$59.9m

Record Backlog $503m

Solid long-term pipeline with

additional [~$300-$400]

million in potential project

value that could be

awarded over next several

quarters

Construction:

DBM GLOBAL (SCHUFF)

FY16 Revenue: $161.9m

FY16 Adjusted EBITDA:

$41.2m

Strong joint venture and

off shore power installation;

Solid maintenance

performance

Positive long-term telecom

installation opportunities

Marine Services:

GMSL

FY16 Revenue: $6.4m

FY16 Adjusted EBITDA: $2.5m

Delivered 1,349,000 Gasoline

Gallon Equivalents (GGEs) in

4Q16 vs. 646,000 GGEs in

4Q15

~40 stations currently owned

and / or operated vs. 17

stations in 3Q16 and two

stations at time of HC2’s

initial investment in 3Q14

Energy:

ANG

Telecom:

PTGI ICS

FY16 Revenue: $735.0m

FY16 Adjusted EBITDA:

$5.6m

Continued growth in

wholesale traffic volumes,

in part, delivered by the

changing regulatory

environment throughout

Europe, combined with

continued business growth

in the Middle East

Life Sciences: PANSEND

MediBeacon: Completed “Pilot Two” Clinical Study at Washington University in St. Louis (1Q/17)

R2 Dermatology: Received FDA Approval for R2 Dermal Cooling System (4Q/16)

BeneVir: Oncolytic viral immunotherapy for treatment of solid cancer tumors

Genovel: Novel, Patented, “Mini Knee” and “Anatomical Knee” replacements

Triple Ring Technologies: R&D engineering company specializing in medical devices,

homeland security , imaging, sensors, optics, fluidics, robotics & mobile healthcare

Nervve

Provider of video

and image search technology

for information extraction

and powerful analytics applications

Dusenberry Martin Racing

NASCAR® Heat Evolution

released 9/16; Recently announced

2017 Team Update available February 21, 2017

Other:

Core Financial

Services Subsidiaries

~$77m of statutory surplus

~$93m total adjusted capital

~$2.0b in total GAAP assets

Recently completed merging

CGI and UTA into one legal

entity; meaningful cost

savings, lower required

statutory capital

Platform for growth through

additional M&A

Insurance:

CIG

All data as of December 31, 2016.

Construction formerly Manufacturing; Energy formerly Utilities.

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Segment Financial Summary

6

Adjusted EBITDA for Core Operating Subsidiaries $37.9m for Q4 2016

All data as of December 31, 2016

Construction formerly Manufacturing; Energy formerly Utilities.

($m) FY 2016 Q4 2016 Q3 2016 Q2 2016 Q1 2016

Adjusted

EBITDA

Core Operating Subsidiaries

Construction $59.9 $20.7 $14.5 $13.2 $11.5

Marine Services 41.2 14.8 14.1 11.8 0.5

Energy 2.5 0.9 0.7 0.5 0.4

Telecom 5.6 1.5 2.2 1.5 0.3

Total Core Operating $109.1 $37.9 $31.5 $27.1 $12.7

Early Stage and Other Holdings

Life Sciences ($12.0) ($3.8) ($2.9) ($2.7) ($2.6)

Other (11.2) 0.9 (4.8) (3.3) (4.0)

Total Early Stage and Other ($23.2) ($2.9) ($7.7) ($6.0) ($6.6)

Non-Operating Corporate ($25.7) ($8.6) ($5.5) ($5.9) ($5.7)

Total HC2 (excluding Insurance) $60.2 $26.5 $18.2 $15.2 $0.3

Adjusted

Operating

Income

Core Financial Services

Insurance ($15.9) ($6.9) ($1.7) ($4.7) ($2.6)

Note: Reconciliations of Adjusted EBITDA and Adjusted Operating Income to U.S. GAAP Net Income in appendix. Table may not foot due to rounding. Adjusted Operating Income for Q1 2016 has been

adjusted to exclude certain intercompany eliminations to better reflect the results of the Insurance segment, and remain consistent with internally reported metrics. Additional details in appendix. Q1 and Q3

2016 benefitted from the release of valuation allowance impacting the net tax provision for each quarter.

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

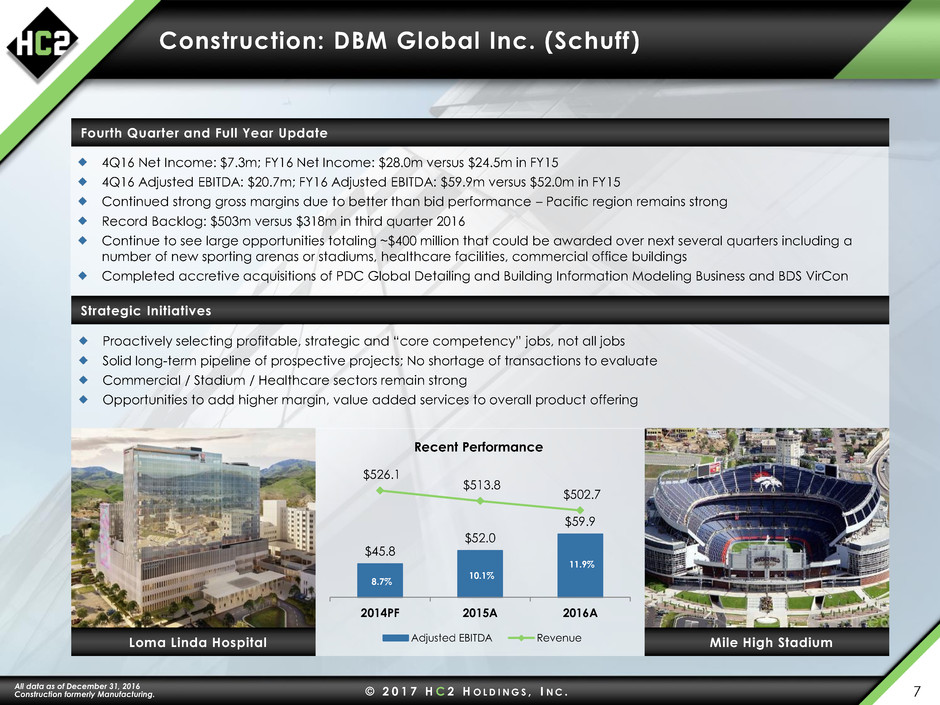

Construction: DBM Global Inc. (Schuff)

7

4Q16 Net Income: $7.3m; FY16 Net Income: $28.0m versus $24.5m in FY15

4Q16 Adjusted EBITDA: $20.7m; FY16 Adjusted EBITDA: $59.9m versus $52.0m in FY15

Continued strong gross margins due to better than bid performance – Pacific region remains strong

Record Backlog: $503m versus $318m in third quarter 2016

Continue to see large opportunities totaling ~$400 million that could be awarded over next several quarters including a

number of new sporting arenas or stadiums, healthcare facilities, commercial office buildings

Completed accretive acquisitions of PDC Global Detailing and Building Information Modeling Business and BDS VirCon

Fourth Quarter and Full Year Update

Proactively selecting profitable, strategic and “core competency” jobs, not all jobs

Solid long-term pipeline of prospective projects; No shortage of transactions to evaluate

Commercial / Stadium / Healthcare sectors remain strong

Opportunities to add higher margin, value added services to overall product offering

Strategic Initiatives

Mile High Stadium Loma Linda Hospital

$45.8

$52.0

$59.9

$526.1

$513.8

$502.7

2014PF 2015A 2016A

Recent Performance

Adjusted EBITDA Revenue

All data as of December 31, 2016

Construction formerly Manufacturing.

10.1%

11.9%

8.7%

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

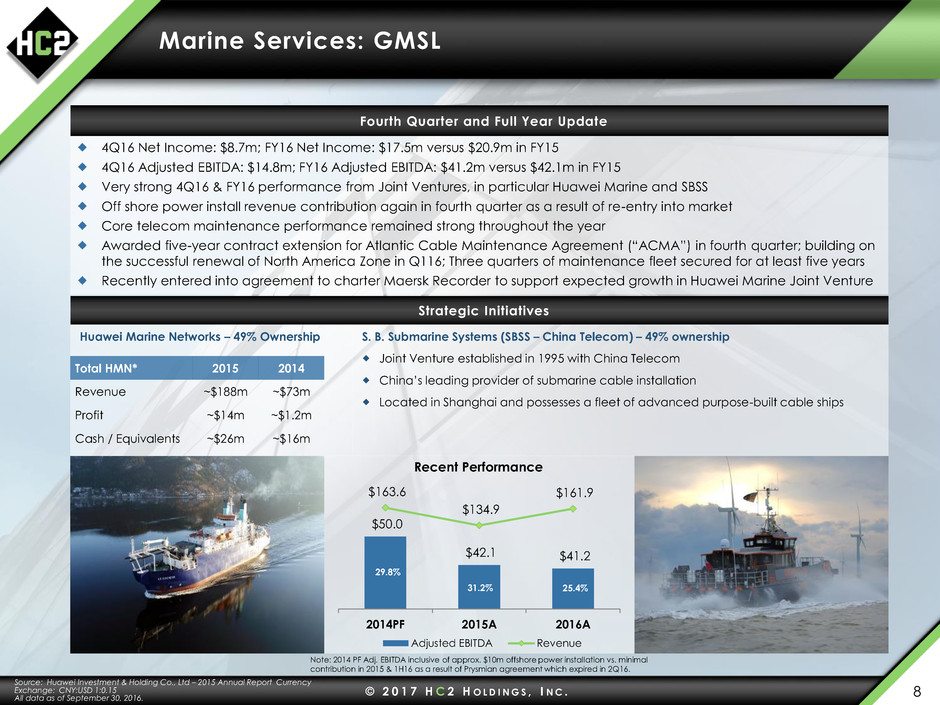

Marine Services: GMSL

8

S. B. Submarine Systems (SBSS – China Telecom) – 49% ownership

Joint Venture established in 1995 with China Telecom

China’s leading provider of submarine cable installation

Located in Shanghai and possesses a fleet of advanced purpose-built cable ships

Source: Huawei Investment & Holding Co., Ltd – 2015 Annual Report Currency

Exchange: CNY:USD 1:0.15

All data as of September 30, 2016.

4Q16 Net Income: $8.7m; FY16 Net Income: $17.5m versus $20.9m in FY15

4Q16 Adjusted EBITDA: $14.8m; FY16 Adjusted EBITDA: $41.2m versus $42.1m in FY15

Very strong 4Q16 & FY16 performance from Joint Ventures, in particular Huawei Marine and SBSS

Off shore power install revenue contribution again in fourth quarter as a result of re-entry into market

Core telecom maintenance performance remained strong throughout the year

Awarded five-year contract extension for Atlantic Cable Maintenance Agreement (“ACMA”) in fourth quarter; building on

the successful renewal of North America Zone in Q116; Three quarters of maintenance fleet secured for at least five years

Recently entered into agreement to charter Maersk Recorder to support expected growth in Huawei Marine Joint Venture

Fourth Quarter and Full Year Update

Huawei Marine Networks – 49% Ownership

Strategic Initiatives

Total HMN* 2015 2014

Revenue ~$188m ~$73m

Profit ~$14m ~$1.2m

Cash / Equivalents ~$26m ~$16m

$50.0

$42.1 $41.2

$163.6

$134.9

$161.9

2014PF 2015A 2016A

Recent Performance

Adjusted EBITDA Revenue

Note: 2014 PF Adj. EBITDA inclusive of approx. $10m offshore power installation vs. minimal

contribution in 2015 & 1H16 as a result of Prysmian agreement which expired in 2Q16.

29.8%

31.2% 25.4%

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

-$0.4

$0.9

$2.5

$1.8

$6.8

$6.4

2014A 2015A 2016A

Recent Performance

Adjusted EBITDA

Revenue

Energy: ANG

9

All data as of December 31, 2016.

Energy formerly Utilities.

4Q16 Net Loss: ($0.06)m; FY16 Net Income: $0.01m versus ($0.27)m in FY15

4Q16 Adjusted EBITDA: $0.87m; FY16 Adjusted EBITDA: $2.54m versus $0.87m in FY15

Delivered 1,349,000 Gasoline Gallon Equivalents (GGEs) in the fourth quarter versus 937,000 GGEs in the third quarter of 2016

and 646,000 in the year-ago quarter

Recently acquired 18 CNG stations from Questar Fueling Co. and Constellation CNG

~40 stations currently owned and / or operated vs. 17 stations in 3Q16 vs. 2 stations at time of initial investments (3Q14)

Continue to expand fueling station footprint via organic and M&A opportunities

Fourth Quarter and Full Year Update

39.6%

12.8%

(14.1%)

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Telecommunications: PTGi-ICS

10

$(1.2)

$2.0

$5.6

$162.0

$460.4

$735.0

2014A 2015A 2016A

Recent Performance

Adjusted EBITDA

Revenue

All data as of December 31, 2016.

Strong quarterly results again due to continued growth in wholesale traffic volumes, in part delivered by the

changing regulatory environment throughout the European market combined with growth in the Middle East

region, resulting in increased traffic and margin

– 4Q16 Net Loss: ($2.6)m; FY16 Net Income: $1.4m versus $2.8m in FY15

– Adjusted EBITDA continues positive trend as the overall business continues to mature post restructuring

– 4Q16 Adjusted EBITDA: $1.5m; FY16 Adjusted EBITDA: $5.6m versus $2.0m in FY15

– 7th consecutive quarter of positive Adjusted EBITDA

One of the key objectives: leverage the infrastructure and management expertise within PTGi-ICS

– Over 800+ wholesale interconnections globally provides HC2 the opportunity to leverage the existing cost effective

infrastructure by bolting on higher margin products and M&A opportunities

– A focused strategic initiative has been launched within PTGi-ICS to identify potential M&A opportunities

Fourth Quarter and Full Year Update

0.8%

0.4%

(0.1%)

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Insurance: Continental Insurance Group

11

Note: Reconciliation of Adjusted Operating Income to U.S. GAAP Net Income in

appendix. All data as of December 31, 2016.

Continental Insurance, Inc. (CII) serves as a platform for run-off LTC books of business and for acquiring additional

run-off LTC businesses

– 4Q16 Net Loss: ($2.1)m; FY16 Net Loss: ($14.0)m

– 4Q16 Adjusted Operating Income: ($6.9)m; FY16 Adjusted Operating Income ($15.9)m

– ~$77m statutory surplus at end of fourth quarter

– ~$93m total adjusted capital at end of fourth quarter

– ~$2.0b in total GAAP assets at December 31, 2016

– Recently completed merging CGI and UTA into one legal entity; Beneficial to statutory capital

CII Strategy:

– A concentrated focus on LTC and acquisitions of additional books of run-off LTC business

– A platform to provide a vehicle for multi-line insurers who do not consider LTC a core business segment to exit the

market

– Enhancing efficiency and effectiveness through scale and a concentrated focus on LTC

Fourth Quarter and Full Year Update

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Pansend Life Sciences

12

HC2’s Life Sciences Segment Is Focused on the

Development of Innovative Healthcare Technologies and Products

80% equity ownership of company focused on immunotherapy; Oncolytic virotherapy for treatment of solid cancer

tumors

Founded by Dr. Matthew Mulvey & Dr. Ian Mohr (who co-developed T-Vec); Biovex (owner of T-Vec) acquired by

Amgen for ~$1billion

Benevir’s T-Stealth is a second generation oncolytic virus with new features and new intellectual property

BeneVir holds exclusive worldwide license to develop BV-2711 (T-Stealth)

67% equity ownership of dermatology company focused on lightening and brightening skin

Founded by Pansend in partnership with Mass. General Hospital and inventors Dr. Rox Anderson, Dieter Manstein

and Dr. Henry Chan

Over $10 billion global market

77% equity ownership in company with unique knee replacements based on technology from Dr. Peter Walker,

NYU Dept. of Orthopedic Surgery and one of the pioneers of the original Total Knee.

“Mini-Knee” for early osteoarthritis of the knee

“Anatomical Knee” – A Novel Total Knee Replacement

Strong patent portfolio

42% equity ownership in company with unique technology and device for monitoring of real-time kidney function

Current standard diagnostic tests measure kidney function are often inaccurate and not real-time

MediBeacon’s Optical Renal Function Monitor will be first and only, non-invasive system to enable real-time, direct

monitoring of renal function at point-of-care

$3.5 billion potential market

Profitable technology and product development company

Areas of expertise include medical devices, homeland security, imaging systems, sensors, optics, fluidics, robotics

and mobile healthcare

Located in Silicon Valley and Boston area with over 90,000 square feet of working laboratory and incubator space

Contract R&D market growing rapidly

Customers include Fortune 500 companies and start-ups

All data as of March 7, 2017.

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

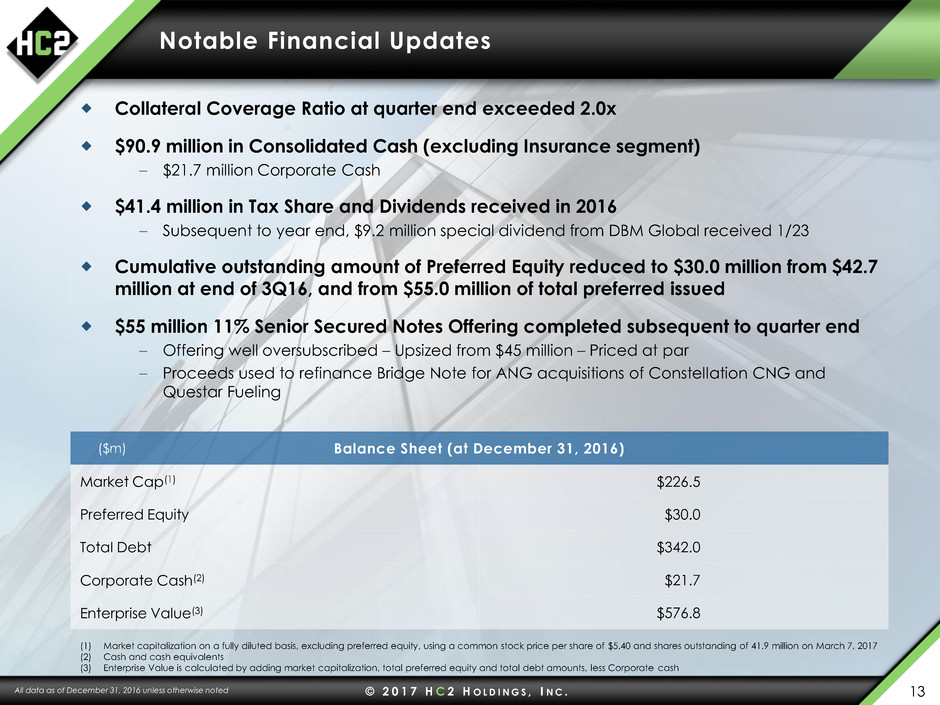

Notable Financial Updates

13

Collateral Coverage Ratio at quarter end exceeded 2.0x

$90.9 million in Consolidated Cash (excluding Insurance segment)

– $21.7 million Corporate Cash

$41.4 million in Tax Share and Dividends received in 2016

– Subsequent to year end, $9.2 million special dividend from DBM Global received 1/23

Cumulative outstanding amount of Preferred Equity reduced to $30.0 million from $42.7

million at end of 3Q16, and from $55.0 million of total preferred issued

$55 million 11% Senior Secured Notes Offering completed subsequent to quarter end

– Offering well oversubscribed – Upsized from $45 million – Priced at par

– Proceeds used to refinance Bridge Note for ANG acquisitions of Constellation CNG and

Questar Fueling

All data as of December 31, 2016 unless otherwise noted

(1) Market capitalization on a fully diluted basis, excluding preferred equity, using a common stock price per share of $5.40 and shares outstanding of 41.9 million on March 7, 2017

(2) Cash and cash equivalents

(3) Enterprise Value is calculated by adding market capitalization, total preferred equity and total debt amounts, less Corporate cash

Balance Sheet (at December 31, 2016)

Market Cap(1) $226.5

Preferred Equity $30.0

Total Debt $342.0

Corporate Cash(2) $21.7

Enterprise Value(3) $576.8

($m)

Questions and Answers

Appendix:

Reconciliations

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Reconciliation of Adjusted EBITDA to U.S. GAAP Net Income (Loss)

Twelve Months Ended December 31, 2016

16

(in thousands)

Construction

Marine

Services

Telecom Energy

Life

Sciences

Other and

Eliminations

Net Income (loss) attributable to HC2 Holdings, Inc. $ (94,549)

Less: Net Income (loss) att ributable to HC2 Holdings Insurance

Segment

(14,028)

Net Income (loss) attributable to HC2 Holdings, Inc., excluding

Insurance Segment

28,002$ 17,447$ 1,435$ 7$ (7,646)$ (24,800)$ (94,966)$ (80,521)$

Adjustments to reconcile net income (loss) to Adjusted EBITDA:

Depreciation and amortization 1,892 22,007 504 2,248 124 1,480 9 28,264

Depreciation and amortization (included in cost of rev enue) 4,370 - - - - - - 4,370

Amortization of equity method fair v alue adjustment at acquisition - (1,371) - - - - - (1,371)

(Gain) loss on sale or disposal of assets 1,663 (9) 708 - - - - 2,362

Lease termination costs - - 179 - - - - 179

Interest expense 1,239 4,774 - 211 - 1,164 35,987 43,375

Net loss on contingent consideration - (2,482) - - - - 11,411 8,929

Other (income) expense, net (163) (2,424) (87) (8) (3,213) 9,987 (1,277) 2,815

Foreign currency (gain) loss (included in cost of rev enue) - (1,106) - - - - - (1,106)

Income tax (benefit) expense 18,727 1,394 2,803 (535) 1,558 3,250 11,245 38,442

Noncontrolling interest 1,834 974 - (4) (3,111) (2,575) - (2,882)

B nus to b settled in equity - - - - - - 2,503 2,503

Share-based payment expense - 1,682 - 597 251 273 5,545 8,348

Acquisition and nonrecurring items 2,296 290 18 27 - - 3,825 6,456

Adjusted EBITDA 59,860$ 41,176$ 5,560$ 2,543$ (12,037)$ (11,221)$ (25,718)$ 60,163$

Total Core Operating Subsidiaries 109,139$

Twelve Months Ended December 31, 2016

Core Operating Subsidiaries Early Stage & Other Non-

operating

Corporate

HC2

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

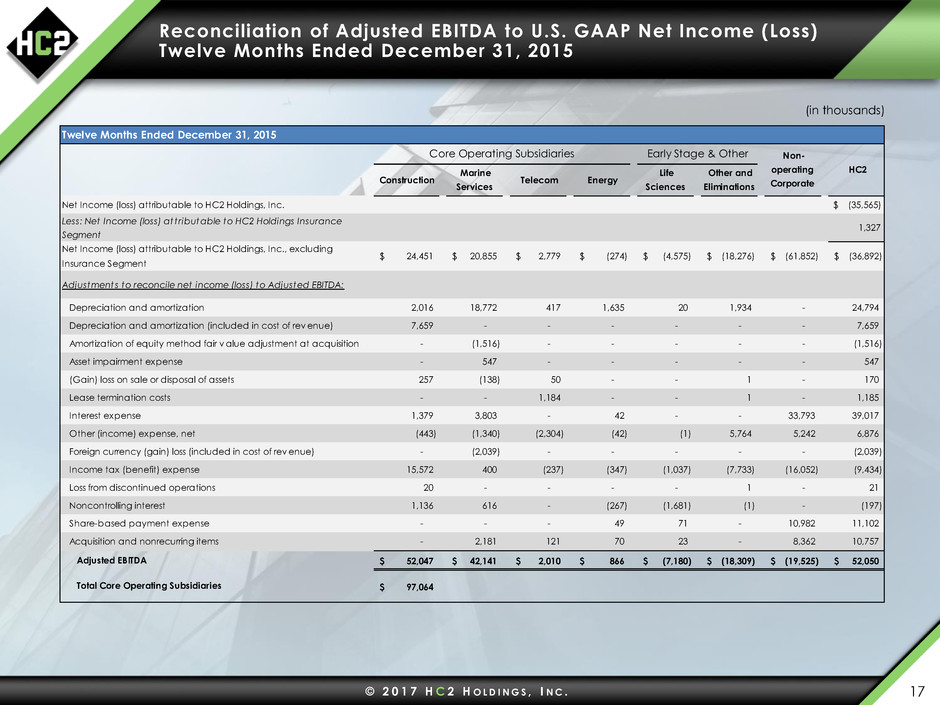

Reconciliation of Adjusted EBITDA to U.S. GAAP Net Income (Loss)

Twelve Months Ended December 31, 2015

17

(in thousands)

Construction

Marine

Services

Telecom Energy

Life

Sciences

Other and

Eliminations

Net Income (loss) attributable to HC2 Holdings, Inc. $ (35,565)

Less: Net Income (loss) att ributable to HC2 Holdings Insurance

Segment

1,327

Net Income (loss) attributable to HC2 Holdings, Inc., excluding

Insurance Segment

24,451$ 20,855$ 2,779$ (274)$ (4,575)$ (18,276)$ (61,852)$ (36,892)$

Adjustments to reconcile net income (loss) to Adjusted EBITDA:

Depreciation and amortization 2,016 18,772 417 1,635 20 1,934 - 24,794

Depreciation and amortization (included in cost of rev enue) 7,659 - - - - - - 7,659

Amortization of equity method fair v alue adjustment at acquisition - (1,516) - - - - - (1,516)

Asset impairment expense - 547 - - - - - 547

(Gain) loss on sale or disposal of assets 257 (138) 50 - - 1 - 170

Lease termination costs - - 1,184 - - 1 - 1,185

Interest expense 1,379 3,803 - 42 - - 33,793 39,017

Other (income) expense, net (443) (1,340) (2,304) (42) (1) 5,764 5,242 6,876

Foreign currency (gain) loss (included in cost of rev enue) - (2,039) - - - - - (2,039)

Income tax (benefit) expense 15,572 400 (237) (347) (1,037) (7,733) (16,052) (9,434)

Loss from discontinued operations 20 - - - - 1 - 21

N nc ntrolling interest 1,136 616 - (267) (1,681) (1) - (197)

Share-based payment expense - - - 49 71 - 10,982 11,102

Acquisition and nonrecurring items - 2,181 121 70 23 - 8,362 10,757

Adjusted EBITDA 52,047$ 42,141$ 2,010$ 866$ (7,180)$ (18,309)$ (19,525)$ 52,050$

Total Core Operating Subsidiaries 97,064$

Twelve Months Ended December 31, 2015

Core Operating Subsidiaries Early Stage & Other Non-

operating

Corporate

HC2

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Reconciliation of Adjusted EBITDA to U.S. GAAP Net Income (Loss)

Twelve Months Ended December 31, 2014

18

(in thousands)

Construction

Marine

Services

Telecom Energy Total

Life

Sciences

Other Total

As Reported

Net income (loss) (14,391)$ 19,278$ 17,718$ (1,068)$ 236$ 36,164$ (3,759)$ 29,219$ 25,460$ (51,410)$ 10,214$

Adjustments to reconcile net income (loss) to Adjusted EBITDA:

Depreciation and amortization 6,719 4,139 15,161 528 484 20,312 1 - 1 - 20,313

Depreciation and amortization (included in cost of rev enue) 4,350 4,350 - - - 4,350 - - - - 4,350

Amortization of equity method fair v alue adjustment at acquisition (385) - (385) - - (385) - - - - (385)

Asset impairment expense 291 - - 291 - 291 - - - - 291

(Gain) loss on sale or disposal of assets (162) (2) 104 (160) - (58) - - - - (58)

Lease termination costs - - - - - - - - - - -

Interest expense 12,347 1,627 4,708 1 20 6,356 - - - 10,700 17,056

Loss on early extinguishment of debt 11,969 - - - - - - - 11,969 11,969

Other (income) expense, net (702) (476) (2,410) (831) (1,431) (5,148) - 1,610 1,610 217 (3,321)

I come tax (benefit) expense (22,869) 13,318 1,069 58 103 14,548 - (31,828) (31,828) (963) (18,243)

Loss from discontinued operations 146 35 3,007 - - 3,042 - 157 157 3,199

Noncontrolling interest 2,559 3,569 3,059 - 229 6,857 (1,038) 1 (1,037) - 5,820

Share-based payment expense 11,028 - - - - - - - - 11,028 11,028

Acquisition related costs 13,044 - 7,966 - - 7,966 - - - 5,078 13,044

Other costs - - - - - - - - - - -

Adjusted EBITDA 23,944$ 45,838$ 49,997$ (1,181)$ (359)$ 94,295$ (4,796)$ (841)$ (5,637)$ (13,381)$ 75,277$

Pro Forma

Twelve Months Ended December 31, 2014

HC2

Holdings, Inc.

Core Operating Early Stage and Other Non-

operating

Corporate

HC2

Holdings,

Inc.

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Reconciliation of Adjusted EBITDA to U.S. GAAP Net Income (Loss)

Three Months Ended December 31, 2016

19

(in thousands)

Construction

Marine

Services

Telecom Energy

Life

Sciences

Other and

Eliminations

Net Income (loss) attributable to HC2 Holdings, Inc. $ (61,464)

Less: Net Income (loss) att ributable to HC2 Holdings Insurance

Segment

(2,050)

Net Income (loss) attributable to HC2 Holdings, Inc., excluding

Insurance Segment

7,292$ 8,667$ (2,572)$ (61)$ (4,655)$ (3,536)$ (64,549)$ (59,414)$

Adjustments to reconcile net income (loss) to Adjusted EBITDA:

Depreciation and amortization 629 5,214 115 769 37 430 5 7,199

Depreciation and amortization (included in cost of rev enue) 1,322 - - - - - - 1,322

Amortization of equity method fair v alue adjustment at acquisition - (325) - - - - - (325)

(Gain) loss on sale or disposal of assets 2,626 1 708 - - - - 3,335

Lease termination costs - - - - - - - -

Interest expense 322 1,091 - 69 - 1,163 9,116 11,761

Net loss on contingent consideration - (2,482) - - - - 11,411 8,929

Other (income) expense, net (75) (1,234) 487 391 10 99 (966) (1,288)

Foreign currency (gain) loss (included in cost of rev enue) - 864 - - - - - 864

Income tax (benefit) expense 6,086 2,150 2,803 (535) 1,558 3,250 32,726 48,038

Noncontrolling interest 594 464 - (253) (809) (513) - (517)

B nus to b settled in equity - - - - - - 2,503 2,503

Share-based payment expense - 375 - 490 67 35 712 1,679

Acquisition and nonrecurring items 1,868 24 - - - - 490 2,382

Adjusted EBITDA 20,664$ 14,809$ 1,541$ 870$ (3,792)$ 928$ (8,552)$ 26,468$

Total Core Operating Subsidiaries 37,884$

Three Months Ended December 31, 2016

Core Operating Subsidiaries Early Stage & Other Non-

operating

Corporate

HC2

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Reconciliation of Adjusted EBITDA to U.S. GAAP Net Income (Loss)

Three Months Ended September 30, 2016

20

(in thousands)

Construction

Marine

Services

Telecom Energy

Life

Sciences

Other and

Eliminations

Net Income (loss) attributable to HC2 Holdings, Inc. $ (4,558)

Less: Net Income (loss) att ributable to HC2 Holdings Insurance

Segment

(2,189)

Net Income (loss) attributable to HC2 Holdings, Inc., excluding

Insurance Segment

6,962$ 8,696$ 1,796$ 27$ (2,285)$ (8,160)$ (9,404)$ (2,368)$

Adjustments to reconcile net income (loss) to Adjusted EBITDA:

Depreciation and amortization 431 5,554 144 582 32 380 4 7,127

Depreciation and amortization (included in cost of rev enue) 1,321 - - - - - - 1,321

Amortization of equity method fair v alue adjustment at acquisition - (329) - - - - - (329)

(Gain) loss on sale or disposal of assets (23) - - - - - - (23)

Lease termination costs - - (159) - - - - (159)

Interest expense 304 1,328 - 119 - - 8,969 10,720

Other (income) expense, net (12) (2,013) 422 (24) (2) 3,892 835 3,098

Foreign currency (gain) loss (included in cost of rev enue) - (283) - - - - - (283)

Income tax (benefit) expense 4,672 96 - - - - (7,851) (3,083)

N nc ntrolling interest 411 465 - 27 (770) (974) - (841)

Share-based payment expense - 546 - 3 128 37 1,088 1,802

Acquisition and nonrecurring items 429 - - - - - 821 1,250

Adjusted EBITDA 14,495$ 14,060$ 2,203$ 734$ (2,897)$ (4,825)$ (5,538)$ 18,232$

Total Core Operating Subsidiaries 31,492$

Three Months Ended September 30, 2016

Core Operating Subsidiaries Early Stage & Other Non-

operating

Corporate

HC2

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Reconciliation of Adjusted EBITDA to U.S. GAAP Net Income (Loss)

Three Months Ended June 30, 2016

21

(in thousands)

Construction

Marine

Services

Telecom Energy

Life

Sciences

Other and

Eliminations

Net Income (loss) attributable to HC2 Holdings, Inc. $ 1,935

Less: Net Income (loss) att ributable to HC2 Holdings Insurance

Segment

(2,293)

Net Income (loss) attributable to HC2 Holdings, Inc., excluding

Insurance Segment

9,364$ 6,002$ 1,009$ 68$ (2,004)$ (2,608)$ (7,603)$ 4,228$

Adjustments to reconcile net income (loss) to Adjusted EBITDA:

Depreciation and amortization 303 6,084 140 468 36 336 - 7,367

Depreciation and amortization (included in cost of rev enue) (206) - - - - - - (206)

Amortization of equity method fair v alue adjustment at acquisition - (359) - - - - - (359)

(Gain) loss on sale or disposal of assets (1,845) 7 - - - 1 - (1,837)

Lease termination costs - - 338 - - - - 338

Interest expense 303 1,285 - 14 - 1 8,966 10,569

Other (income) expense, net (32) 211 29 (344) - (10) 465 319

Foreign currency (gain) loss (included in cost of rev enue) - (1,540) - - - - - (1,540)

Income tax (benefit) expense 4,524 (212) - - - 1 (9,404) (5,091)

N nc ntrolling interest 768 200 - 244 (812) (1,044) - (644)

Share-based payment expense - 152 - 90 34 40 1,359 1,675

Acquisition and nonrecurring items - - 18 - - - 313 331

Adjusted EBITDA 13,179$ 11,830$ 1,534$ 540$ (2,746)$ (3,283)$ (5,904)$ 15,150$

Total Core Operating Subsidiaries 27,083$

Three Months Ended June 30, 2016

Core Operating Subsidiaries Early Stage & Other Non-

operating

Corporate

HC2

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

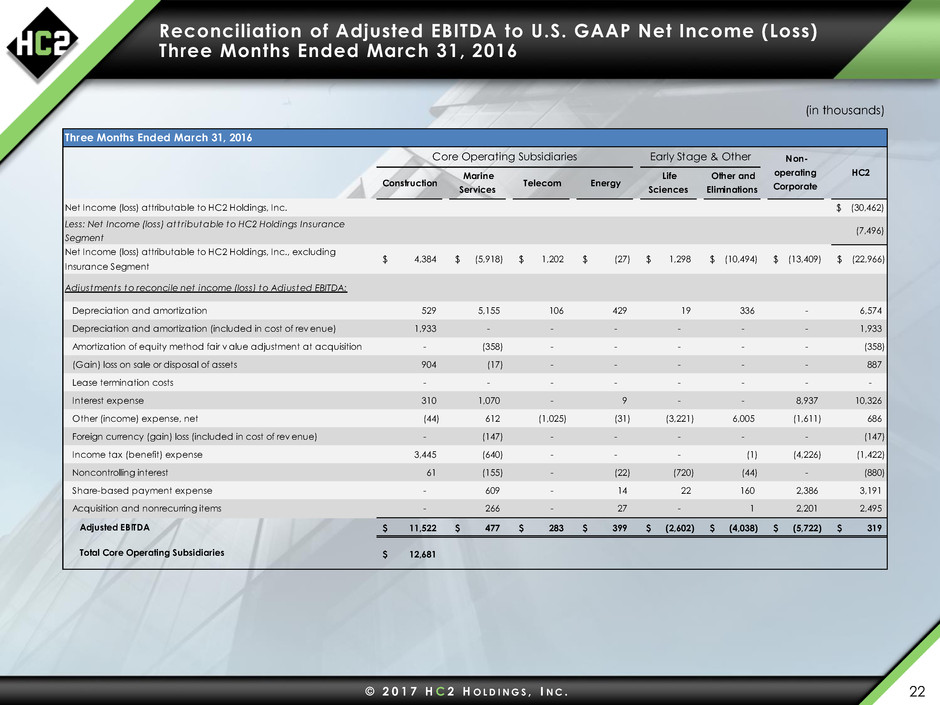

Reconciliation of Adjusted EBITDA to U.S. GAAP Net Income (Loss)

Three Months Ended March 31, 2016

22

(in thousands)

Construction

Marine

Services

Telecom Energy

Life

Sciences

Other and

Eliminations

Net Income (loss) attributable to HC2 Holdings, Inc. $ (30,462)

Less: Net Income (loss) att ributable to HC2 Holdings Insurance

Segment

(7,496)

Net Income (loss) attributable to HC2 Holdings, Inc., excluding

Insurance Segment

4,384$ (5,918)$ 1,202$ (27)$ 1,298$ (10,494)$ (13,409)$ (22,966)$

Adjustments to reconcile net income (loss) to Adjusted EBITDA:

Depreciation and amortization 529 5,155 106 429 19 336 - 6,574

Depreciation and amortization (included in cost of rev enue) 1,933 - - - - - - 1,933

Amortization of equity method fair v alue adjustment at acquisition - (358) - - - - - (358)

(Gain) loss on sale or disposal of assets 904 (17) - - - - - 887

Lease termination costs - - - - - - - -

Interest expense 310 1,070 - 9 - - 8,937 10,326

Other (income) expense, net (44) 612 (1,025) (31) (3,221) 6,005 (1,611) 686

Foreign currency (gain) loss (included in cost of rev enue) - (147) - - - - - (147)

Income tax (benefit) expense 3,445 (640) - - - (1) (4,226) (1,422)

N nc ntrolling interest 61 (155) - (22) (720) (44) - (880)

Share-based payment expense - 609 - 14 22 160 2,386 3,191

Acquisition and nonrecurring items - 266 - 27 - 1 2,201 2,495

Adjusted EBITDA 11,522$ 477$ 283$ 399$ (2,602)$ (4,038)$ (5,722)$ 319$

Total Core Operating Subsidiaries 12,681$

Three Months Ended March 31, 2016

Core Operating Subsidiaries Early Stage & Other Non-

operating

Corporate

HC2

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Reconciliation of Insurance AOI to U.S. GAAP Net Income (Loss)

Quarterly and Full Year 2016

23

The calculation of Insurance Net Loss has been revised to exclude adjustments for intercompany eliminations as they are not considered relevant in evaluating the performance of our

Insurance segment. For first quarter 2016, this resulted in a change to the previously reported Insurance loss of ($12.3) mil lion for the quarter to a loss of ($7.5) million.

The calculation of Insurance AOI has been revised to exclude adjustments for intercompany eliminations as they are not considered relevant in evaluating the performance of our

Insurance segment. For first quarter 2016, this resulted in a change to the previously reported Insurance AOI loss of ($3.6) million for the quarter to a loss of ($2.6) million.

(in thousands)

Three Months Ended

December 31,

Three Months Ended

September 30,

Three Months Ended

June 30,

Three Months Ended

March 31,

Year Ended

December 31,

2016 2016 2016 2016 2016

Net loss - Insurance segment (2,051)$ (2,189)$ (2,293)$ (7,496)$ (14,028)$

Effect of inv estment (gains) losses (7,696) 220 (2,418) 4,875 (5,019)

Asset impairment expense 2,400 - - - 2,400

Acquisition and non-recurring items 445 269 - - 714

Insurance AOI (6,901)$ (1,701)$ (4,710)$ (2,621)$ (15,933)$

Adjusted Operating Income - Insurance ("Insurance AOI")

HC2 HOLDINGS, INC.

© HC2 Holdings, Inc. 2017

A n d r e w G . B a c k m a n • i r @ h c 2 . c om • 2 1 2 . 2 3 5 . 2 6 9 1 • 4 5 0 P a r k A v e n u e , 3 0 t h F l o o r , N e w Y o r k , N Y 1 0 0 2 2

March 2017