Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Adynxx, Inc. | v461366_8k.htm |

Exhibit 99.1

Alliqua BioMedical Investor Presentation March 2017 NASDAQ: ALQA

Safe Harbor Statement Forward Looking Statements Safe Harbor Statement This presentation contains forward - looking statements . Forward - looking statements are generally identifiable by the use of words like "may," "will," "should," "could," "expect," "anticipate," "estimate," "believe," "intend," or "project" or the negative of these words or other variations on these words or comparable terminology . Such statements are based on management's good faith expectations and are subject to numerous factors, risks and uncertainties that may cause actual results, the outcome of events, timing and performance to differ materially from those expressed or implied by such statements . These factors, risks and uncertainties include, but are not limited to, the adequacy of the Company’s liquidity to pursue its complete business objectives ; inadequate capital ; the Company’s ability to obtain and retain sufficient reimbursement from third party payers for its products ; loss or retirement of key executives ; adverse economic conditions or intense competition ; loss of a key customer or supplier ; entry of new competitors and products ; adverse federal, state and local government regulation ; technological obsolescence of the Company’s products ; technical problems with the Company’s research and products ; the Company’s ability to expand its business through strategic acquisitions ; the Company’s ability to integrate acquisitions and related businesses ; price increases for supplies and components ; and the inability to carry out research, development and commercialization plans . In addition, other factors that could cause actual results to differ materially are discussed in our filings with the SEC, including our Annual Report on Form 10 - K and our Quarterly Reports on Form 10 - Q . Investors and security holders are urged to read these documents free of charge on the SEC's web site at www . sec . gov . We undertake no obligation to publicly update or revise our forward - looking statements as a result of new information, future events or otherwise .

Alliqua BioMedical – The Vision RESTORING TISSUE. REBUILDING LIVES. To build a leading regenerative technology company that commercializes differentiated regenerative medical products which assist the body in the repair of human tissue. Due to their clinical efficaciousness and cost effectiveness, these products will enhance the quality of life to patients and build shareholder value. 2

Name Title Previous Employers David Johnson Chief Executive Officer, Director Chief Executive Officer Division President Brian Posner Chief Financial Officer Chief Financial Officer Brad Barton Chief Operating Officer President of ConvaTec Americas Nino Pionati Chief Strategy and Marketing Officer VP of Marketing President of Global Marketing & B.D. VP of Marketing Gregory Robb VP of Operations VP of Operations Management Board of Directors Name Experience Dr. Jerome Zeldis (Chairman) Chief Medical Officer Winston Kung VP - Business Development CBO - Celgene Cellular Therapeutics Dir. - Healthcare Investment Banking VP - Global M&A Jeffrey Sklar Managing Partner Name Experience Joseph Leone Chief Financial Officer Gary Restani President & CEO President Division President Division President Mark Wagner President & CEO President & CEO Product Manager Experienced & Committed Management Team and Board

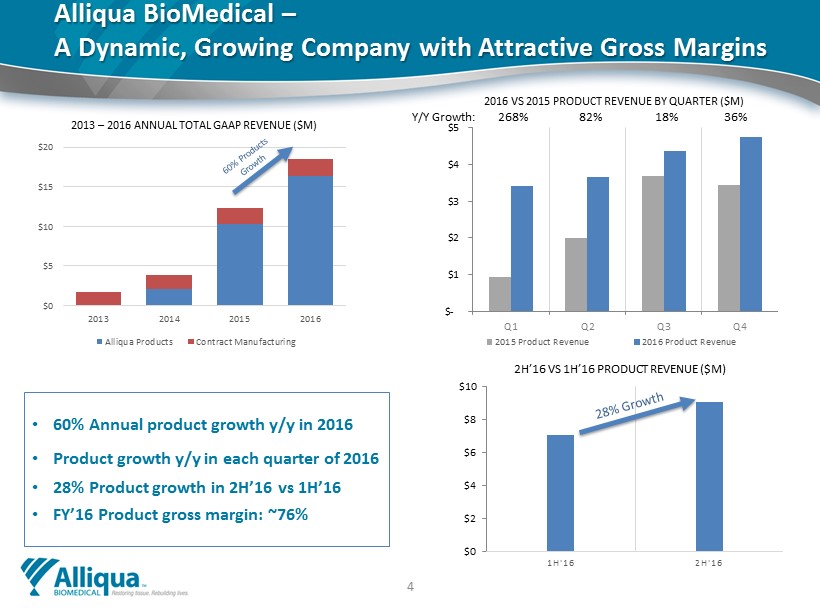

Alliqua BioMedical – A Dynamic, Growing Company with Attractive Gross Margins • 60% Annual p roduct g rowth y/y in 2016 • Product growth y/y in each quarter of 2016 • 28% Product growth in 2H’16 vs 1H’16 • FY’16 Product gross margin: ~76% 4 $0 $2 $4 $6 $8 $10 1H'16 2H'16 Millions 2H’16 VS 1H’16 PRODUCT REVENUE ($M) $0 $5 $10 $15 $20 2013 2014 2015 2016 2013 – 2016 ANNUAL TOTAL GAAP REVENUE ($M) Alliqua Products Contract Manufacturing $- $1 $2 $3 $4 $5 Q1 Q2 Q3 Q4 2016 VS 2015 PRODUCT REVENUE BY QUARTER ($M) 2015 Product Revenue 2016 Product Revenue Y/Y Growth: 268% 82% 18% 36%

• Global advanced wound care market estimated at $8+ Billion (1) – The U.S. represents more than 1/3 rd of the global market – The U.S. market is highly fragmented among private and micro - cap companies as well as large diversified companies • Large and growing patient population – Growth in wound incidence expected due to demographic trends in obesity Advanced Wound and Tissue Repair (1) Source: 2012 Kalorama Information Wound Care Markets 2012 and Alliqua BioMedical management estimates (2) Smart Trak 5 Burn Wounds Trauma Wounds Surgical Wounds Diabetic Foot Ulcers Pressure Ulcers Venous Leg Ulcers Arterial Ulcers ACUTE WOUNDS CHRONIC WOUNDS Wound Type Incidence (2) ~460,000 per year ~430,000 per year ~4.7 million per year ~1.5 million per year ~4.6 million per year ~1.0 million per year ~250,000 per year $8+ Billion Total Addressable Market (1) Compelling Market Size – $8 Billion

Biologics – A Fast, Growing & Sustainable Market 6 • Fastest growing sector… today and tomorrow • Diabetes, obesity & the aging population will continue to drive demand • Technological advancements will sustain growth In 2016, Alliqua grew sales of its biologic products in excess of 115 %

Building the Regenerative Technology Portfolio • Unique – differentiated • Risk Adjusted – regulatory & reimbursement • Clinically efficacious • Economic value proposition • Strong margin profile The Criteria • Regenerative medicine products for acute & chronic w ounds Targeting

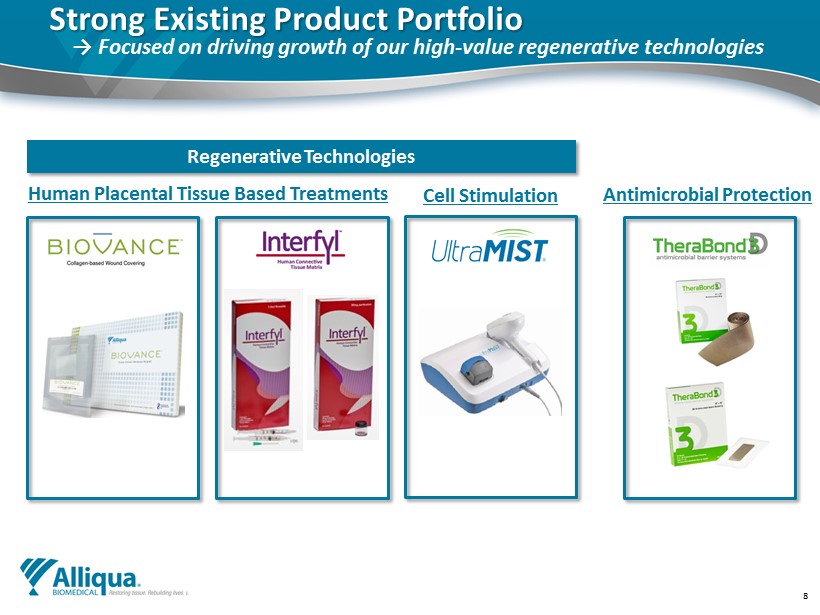

8 Human Placental Tissue Based Treatments Cell Stimulation Antimicrobial Protection Regenerative Technologies Strong Existing Product Portfolio → Focused on driving growth of our high - value regenerative technologies

9 PRODUCT OVERVIEW & FEATURES REIMBURSEMENT COVERAGE • BIOVANCE is an amniotic membrane allograft derived from placental tissue – BIOVANCE acts as a barrier membrane and is intended to protect underlying tissue and preserve tissue plane boundaries with minimized adhesion and scar formation • The natural function of the amniotic brings protection and support to the wound it covers – Acellular composition reduces i nflammation – Supports tissue growth – Provides a biological barrier to infection – Minimizes pain upon application – Maintains a moist wound environment • Reimbursement – HOPD • 93% Medicare • 65% BCBS – Surgery - DRG *Source: SmartTRAK data 2015 & 2016 PRODUCT SALES TRAJECTORY CLINICAL SUPPORT 100% Growth - year over year BIOVANCE: Acellular Amniotic Membrane Allograft → Capturing share in a rapidly expanding biologics market

10 PRODUCT OVERVIEW & FEATURES Interfyl – Alliqua’s Second Entry I n to the Biologics Market → Strong commercial traction since launch in September 2016 • FDA Cleared, 361 Product • Extracellular connective tissue matrix – Replaces Damaged Integumental Soft Tissue – Provides mechanical and structural support to facilitate the tissue repair process • Offered in both particulate and flowable forms – Can be used to fill voids and correct defects in soft tissue • Broad range of surgical indications, including lower extremity applications METHOD OF ACTION Interfyl provides a scaffold for fibroblasts & keratinocytes to attach to & proliferate

World Class Development Partners….. 11 Developing Regenerative Technologies for the Future & Largest ALQA shareholder (~20% of shares outstanding) Retains one board s eat

12 TREATMENT OVERVIEW & FEATURES • MIST Therapy is a painless, noncontact, low frequency ultrasound delivered through a saline mist to the wound bed – The only known noncontact, low - frequency, ultrasound device cleared by the FDA – One of only two medical devices with an indication “to promote wound healing ” • MIST uses the ultrasound waves to stimulate the cells below the wound bed surface, a region that was previously inaccessible to wound care practitioners – Accelerates healing and wound closure – Reduces wound inflammation and bacteria/bioburden – Increases blood flow to the afflicted area KEY HIGHLIGHTS • Outstanding economics • Standard of care “Game Changer ” • 100% Medicare reimbursement • High m argin profile • Mayo Clinic is currently the largest customer CLINICAL DATA Large and Compelling Portfolio of Clinical Support MIST Therapy® → Ultrasound Healing Therapy - Changing Standard of Care

13 35 Direct selling resources 29 DISTRIBUTION PARTNERS Product Supply Group Purchasing Agreements (GPO Contracts) Hybrid Sales & Distribution Infrastructure → Continuing to enhance our distribution capabilities + 10 1099 agent principals Planned distribution infrastructure for 2017:

14 1. Focused on increasing penetration in specific target markets: • Focused on further penetrating the surgical segment of the market in biologics • Replacing underperforming reps. with 1099 agent p rinciples; leveraging their established relationships in the surgical space • Driving continued traction of Interfyl in the surgical space following launch in late - 2016 • Leveraging favorable reimbursement headwind and recent commercial traction in the hospital outpatient market in our MIST Therapy Business 2. Focused on “Peer - to - Peer ” Education – Leveraging the experiences of KOLs and strongest physician advocates: • Hosting Biologics Bioskills labs in major metropolitan areas across the country • Creating “Centers of Excellence” for MIST Therapy – targeting 5 in 2017 • Organizing hands - on MIST Therapy workshops to educate potential new customers Alliqua Today – “Full Speed Ahead” Pursuing a focused sales strategy in 2017 to drive products growth Focused on Selling Clinical & Economic Outcomes

• 2017 Products growth to be fueled by regenerative therapies: ▪ E xpecting continued strong sales growth in biologics portfolio with contributions from MIST Therapy Sustainable Alliqua Product Growth Expecting ~21% P roducts growth in 2017 $0 $5 $10 $15 $20 2014 2015 2016 2017 Guidance Revenue ($M) ALQA Products Mid - Point of Products Revenue Guidance Implies 21% Growth Y/Y 15

16 ($, 000s) Q4’16 (12/31/16) FY’16 (12/31/16) Products Revenue $4,671 (+36% y/y) $16,088 (+60% y/y) Total Revenue: $4,942 (+25% y/y) $18,240 (+50% y/y) Gross Margin: 66% (60% in Q4’15) 64% (57% in FY’15) Cash: $5,580 Gross Debt: $13,800 Basic Shares O/S (1) : 35,110 Fully Diluted Shares O/S (1) : 46,925 Mkt Cap (1) – (Basic shares): ~$25 Million Avg. Daily Volume (1) – LTM (Shares): ~173,000 FY’17 Products Revenue Guidance $19.0 – 19.9 Million FY’17 Total Revenue Guidance $19.8 – 20.7 Million (1) Data as of March 3, 2017 and reflects financing of $2.8 million executed on February 27, 2017 Financial Summary

17 Nasdaq: ALQA Alliqua BioMedical, Inc. AlliquaBioMedical@westwicke.com 1010 Stony Hill Road, Suite 200 Yardley, PA 19067 (215) 702 - 8550