Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - WEX Inc. | wex20161231ex322.htm |

| EX-32.1 - EXHIBIT 32.1 - WEX Inc. | wex20161231ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - WEX Inc. | wex20161231ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - WEX Inc. | wex20161231ex311.htm |

| EX-23.1 - EXHIBIT 23.1 - WEX Inc. | wex20161231ex231.htm |

| EX-21.1 - EXHIBIT 21.1 - WEX Inc. | wex20161231ex211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number 001-32426

WEX INC.

(Exact name of registrant as specified in its charter)

Delaware | 01-0526993 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

97 Darling Avenue South Portland, Maine | 04106 | |

(Address of principal executive offices) | (Zip Code) | |

(207) 773-8171

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |||

Common Stock, $0.01 par value | New York Stock Exchange | |||

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

þ Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

þ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ | Accelerated filer ¨ | |

Non-accelerated filer ¨ | Smaller reporting company ¨ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

¨ Yes þ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant (assuming for the purpose of this calculation, but without conceding, that all directors, officers and any 10 percent or greater stockholders are affiliates of the registrant) as of June 30, 2016, the last business day of the registrant’s most recently completed second fiscal quarter, was $3,395,699,049 (based on the closing price of the registrant’s common stock on that date as reported on the New York Stock Exchange).

There were 42,741,195 shares of the registrant’s common stock outstanding as of March 2, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s Proxy Statement for the 2017 Annual Meeting of Stockholders are incorporated by reference in Part III. With the exception of the sections of the 2017 Proxy Statement specifically incorporated herein by reference, the 2017 Proxy Statement is not deemed to be filed as part of the 10-K.

TABLE OF CONTENTS

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

Item 16. | ||

Unless otherwise indicated or required by the context, the terms “we,” “us,” “our,” “WEX,” or the “Company,” in this Annual Report on Form 10-K mean WEX Inc. and all of its subsidiaries that are consolidated under Generally Accepted Accounting Principles in the United States.

FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for statements that are forward-looking and are not statements of historical facts. This Annual Report includes forward-looking statements including, but not limited to, statements about management’s plan and goals, the “Strategy” section of this Annual Report in Item 1 and the “Remediation Activities” section of this Annual Report in Item 9A. Any statements in this Annual Report that are not statements of historical facts are forward-looking statements. When used in this Annual Report, the words “may,” “could,” “anticipate,” “plan,” “continue,” “project,” “intend,” “estimate,” “believe,” “expect” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such words. Forward-looking statements relate to our future plans, objectives, expectations and intentions and are not historical facts and accordingly involve known and unknown risks and uncertainties and other factors that may cause the actual results or performance to be materially different from future results or performance expressed or implied by these forward-looking statements. The following factors, among others, could cause actual results to differ materially from those contained in forward-looking statements made in this Annual Report and in oral statements made by our authorized officers: the effects of general economic conditions on fueling patterns as well as payment and transaction processing activity; the impact of foreign currency exchange rates on the Company’s operations, revenue and income; changes in interest rates; the impact of fluctuations in fuel prices; the effects of the Company’s business expansion and acquisition efforts; potential adverse changes to business or employee relationships, including those resulting from the completion of an acquisition; competitive responses to any acquisitions; uncertainty of the expected financial performance of the combined operations following completion of an acquisition; the ability to successfully integrate the Company's acquisitions, including Electronic Funds Source LLC's operations and employees; the ability to realize anticipated synergies and cost savings; unexpected costs, charges or expenses resulting from an acquisition; the Company's failure to successfully operate and expand ExxonMobil's European and Asian commercial fuel card programs; the failure of corporate investments to result in anticipated strategic value; the impact and size of credit losses; the impact of changes to the Company's credit standards; breaches of the Company’s technology systems or those of our third-party service providers and any resulting negative impact on our reputation, liabilities or relationships with customers or merchants; the Company’s failure to maintain or renew key agreements; failure to expand the Company’s technological capabilities and service offerings as rapidly as the Company’s competitors; the actions of regulatory bodies, including banking and securities regulators, or possible changes in banking or financial regulations impacting the Company’s industrial bank, the Company as the corporate parent or other subsidiaries or affiliates; the impact of the Company’s outstanding notes on its operations; the impact of increased leverage on the Company's operations, results or borrowing capacity generally, and as a result of acquisitions specifically; the incurrence of impairment charges if our assessment of the fair value of certain of our reporting units changes; the uncertainties of litigation; as well as other risks and uncertainties identified in Item 1A of this Annual Report and in connection with such forward-looking statements. Our forward-looking statements and these factors do not reflect the potential future impact of any alliance, merger, acquisition, disposition or stock repurchases. The forward-looking statements speak only as of the date of the initial filing of this Annual Report and undue reliance should not be placed on these statements. We disclaim any obligation to update any forward-looking statements as a result of new information, future events or otherwise.

PART I

ITEM 1. BUSINESS

Our Company

WEX Inc. is a leading provider of corporate payment solutions. WEX Inc. began operations in 1983 as a Maine corporation and was acquired in February 1996 by an entity that subsequently merged with HFS Incorporated to form Cendant Corporation in December 1997. In June 1999, our predecessor, Wright Express, was sold to Avis Group Holdings, Inc., which was acquired by Cendant Corporation in March 2001. In anticipation of our initial public offering, the Company’s operations were transferred to a Delaware LLC, which was converted into a Delaware corporation in 2005 in conjunction with our initial public offering on February 16, 2005 (NYSE:WEX). Over the past 30 years, we have expanded the scope of our business from a fleet payment provider into a multi-channel provider of corporate payment solutions.

Beginning in the fourth quarter of 2015, WEX established three business segments: Fleet Solutions, Travel and Corporate Solutions and Health and Employee Benefit Solutions. Previously, the Company had reported two business segments, Fleet Payment Solutions and Other Payment Solutions. Disaggregating the Other Payment Solutions segment into the Travel and Corporate Solutions and Health and Employee Benefit Solutions segments enhanced the Company's transparency and aligned our reporting with how we now operate our business.

1

Our products and services enable us to provide exceptional payment security and control across a wide spectrum of payment sectors.

Fleet Solutions provides customers with fleet vehicle payment processing services specifically designed for the needs of commercial and government fleets. During the year ended December 31, 2016, Fleet Solutions revenue represented approximately 63 percent of our total revenue. As of December 31, 2016, the segment services over 10.5 million vehicles. Management estimates that WEX fleet cards are accepted at over 90 percent of fuel locations in each of the United States and Australia. With the acquisition of ExxonMobil’s European commercial fleet card portfolio ("Esso portfolio in Europe") in December 2014, WEX fleet cards are accepted at all ExxonMobil stations throughout Europe.

Travel and Corporate Solutions focuses on the complex payment environment of business-to-business payments, providing customers with payment processing solutions for their corporate payment and transaction monitoring needs. Travel and Corporate Solutions revenue, which represented approximately 21 percent of our total revenue during the year ended December 31, 2016, is generated primarily in the online travel market. The Travel and Corporate Solutions segment has operations in North America, Europe, South America and Asia-Pacific.

Health and Employee Benefit Solutions represented approximately 16 percent of our total revenue during the year ended December 31, 2016. During 2015, our wholly-owned subsidiary Evolution1 acquired Benaissance, a leading provider of integrated software-as-a-service ("SaaS") technologies and services for healthcare premium billing, payment and workflow management, to complement our healthcare financial technology platform products and services. During 2016, we collectively rebranded Evolution1 and Benaissance as WEX Health. The Health and Employee Benefit Solutions segment also includes payroll related benefits offered to customers in Brazil.

The Company’s U.S. operations include WEX Inc. and our wholly-owned subsidiaries WEX Bank, WEX FleetOne, Electronic Funds Source LLC ("EFS") and WEX Health. Our international operations include our wholly-owned operations, WEX Fuel Cards Australia, WEX Prepaid Cards Australia, WEX New Zealand, WEX Asia, WEX Europe Limited, UNIK S.A., a Brazil-based company that we refer to as "WEX Brazil," and a majority equity position in WEX Europe Services Limited and its subsidiaries.

WEX Bank, a Utah industrial bank incorporated in 1998, is a Federal Deposit Insurance Corporation (“FDIC”) insured depository institution. The functions performed at WEX Bank contribute to the U.S. and Canadian operations of Fleet Solutions and the international operations of Travel and Corporate Solutions by providing a funding mechanism, among other services. With our ownership of WEX Bank, we have access to low-cost sources of capital. WEX Bank raises capital primarily through the issuance of brokered deposit accounts and provides the financing and makes credit decisions that enable the Fleet Solutions and Travel and Corporate Solutions segments to extend credit to customers. WEX Bank approves customer applications, maintains appropriate credit lines for each customer, is the account issuer, and is the counterparty for the customer relationships for most of our programs. Operations such as sales, marketing, merchant relations, customer service, software development and IT are performed as a service within our organization but outside of WEX Bank. WEX Bank’s primary regulators are the Utah Department of Financial Institutions ("Utah DFI") and the FDIC. The activities performed by WEX Bank are integrated into the operations of our Fleet Solutions and Travel and Corporate Solutions segments.

Developments

Prior to our initial public offering in 2005, the Company’s growth had primarily been organic. Our growth in the past several years has been supplemented by acquisitions. Our acquisitions over the last few years include:

• | On July 1, 2016, we acquired EFS, a provider of customized payment solutions for fleet and corporate customers with a focus on the large and mid-sized over-the-road fleets, in order to expand our customer footprint and utilize EFS's technology to better serve the needs of all fleet customers. |

• | On November 18, 2015, our wholly-owned subsidiary Evolution1 acquired Benaissance, a leading provider of integrated SaaS technologies and services for healthcare premium billing, payment and workflow management, to complement our healthcare payments products and services. |

• | On August 31, 2015, we acquired the remaining 49 percent ownership in UNIK S.A., a majority-owned subsidiary prior to this transaction. |

• | On December 1, 2014, our majority owned subsidiary, WEX Europe Services Limited, acquired the assets of ExxonMobil's European commercial fuel card program, which includes operations, funding, pricing, sales and marketing in nine countries in Europe. |

2

• | On July 16, 2014, we acquired Evolution1, a leading provider of financial technology platform solutions within the healthcare industry. |

• | On October 15, 2013, our majority-owned subsidiary WEX Brazil acquired FastCred, a provider of fleet cards to the heavy truck or over-the-road segment of the fleet market in Brazil. |

• | On October 4, 2012, we acquired FleetOne, a provider of fleet cards and fleet-related payment solutions to the over-the-road segment of the fleet market. |

• | On August 30, 2012, we acquired a 51 percent controlling interest in WEX Brazil, a provider of payroll cards, private label and processing services in Brazil, specializing in the retail, government and transportation sectors. |

• | On May 11, 2012, we acquired CorporatePay Limited, located in London, England, a provider of corporate prepaid solutions to the travel industry in the United Kingdom. |

On July 29, 2014, we sold our Pacific Pride subsidiary for $49.7 million, which resulted in a pre-tax book gain of $27.5 million. The Company decided to sell the operations of Pacific Pride as it did not align with the long-term strategy of the core fleet business. The Company entered into a multi-year agreement with the buyer that will continue to allow WEX branded card acceptance at Pacific Pride locations.

On January 7, 2015, we sold the operations of rapid! PayCard for $20.0 million, which resulted in a pre-tax book gain of $1.2 million. Our primary focus in the U.S. continues to be in the fleet, travel, and healthcare industries. As such, we divested the operations of rapid! PayCard, which were not material to our annual revenue, net income or earnings per share.

Competitive Strengths

We believe the following strengths distinguish us from our competitors:

• | Our proprietary closed-loop fuel networks in the U.S. and Australia are among the largest in each country. We describe our fleet payment processing networks as “closed-loop” as we have a direct contractual relationship with both the merchant and the fleet, and only WEX transactions can be processed on these networks. We have built networks that management estimates to provide coverage to over 90 percent of fuel locations in the U.S. and Australia, as well as wide acceptance in Europe, Canada and Brazil. This provides our customers with the convenience of broad acceptance. |

• | Our proprietary closed-loop fuel networks provide us with access to a higher level of fleet-specific information and control as compared to what is typically available on an open-loop network. This provides high level purchase controls at the point of sale, including the flexibility of allowing fleets to restrict purchases and receive automated alerts. Additionally, we have the ability to refine the information reporting provided to our fleet customers and customers of our strategic relationships. |

• | We offer a differentiated set of products and services, including security and purchase controls, to allow our customers and the customers of our strategic relationships to better manage their vehicle fleets. We provide customized analysis and reporting on the efficiency of fleet vehicles and the purchasing behavior of fleet vehicle drivers. We make this data available to fleet customers through both traditional reporting services and sophisticated web-based data analysis tools. |

• | Our long-standing strategic relationships, multi-year contracts and high contract renewal rates have contributed to the stability and recurring nature of our revenue base. We believe that we offer a compelling value to our customers relative to our competitors given the breadth and quality of our products and services and our deep understanding of our customers’ operational needs. We have a large installed customer base, with more than 10.5 million vehicles serviced as of December 31, 2016 and co-branded strategic relationships with five of the largest U.S. fleet management providers and with dozens of oil companies that use our private label solutions. Our wide site acceptance, together with our private-label portfolios and value-added product and service offerings, drive high customer satisfaction levels, with a U.S. fleet retention rate in excess of 97 percent (based on the 2016 rate of voluntary customer attrition). |

• | Our capabilities in the over-the-road segment of the market enhance our ability to serve fleet customers who operate both heavy duty trucks and cars or light duty vehicles in the U.S. and Canada as well as to blend the small fleet and private label businesses for greater scale. The July 2016 acquisition of EFS expanded our customer footprint within the over-the-road market segment. |

• | Our purchase of ExxonMobil's commercial fuel card program which uses a closed-loop network in Europe, combined with the long term supply agreement to serve the current and future Esso portfolio in Europe, provides us with a strong foundation in the large European fleet market. |

3

• | Our travel and corporate payment products offer corporate customers enhanced security and control for complex payment needs, while the recently added EFS Corporate Payment Solutions set of products expands our presence into the electronic accounts payable segment of the market. Our strategic relationships include four of the largest online travel agencies in the world. We continue to expand our online travel payment solution capabilities and geographies, which currently include North America, Europe, South America and Asia-Pacific. As of December 31, 2016, we settle transactions in 21 different currencies. |

• | The demand for our payment processing, account servicing and transaction processing services combined with significant operating scale has historically driven strong revenue growth and earnings potential. We have an extensive history of organic revenue growth driven by our various marketing channels, our extensive network of fuel and service providers, and our growth in transaction volume. Further, we have completed a number of strategic acquisitions to expand our product and service offerings, which have contributed to our revenue growth and diversification of our products and services. |

• | WEX Health has become a leading provider of cloud-based healthcare payments technology, through the acquisition of Evolution1 in 2014 and Benaissance in 2015. Our large partner network expands our opportunities in the growing healthcare financial technology platform market. WEX Health benefits from both high retention rates and revenue predictability as a result of its SaaS business model. |

• | We have an enterprise-wide risk management program that helps us to address inherent risks related to funding and liquidity, our extension of credit and interest rates. Our ownership of WEX Bank provides us with access to low cost sources of capital, which provide liquidity to fund our short-term card receivables. We have maintained a long record of low credit losses due to the short-term, non-revolving credit issued to our customer base. Our credit risk management program is enhanced by our proprietary scoring models, managing credit lines and early suspension policy. Interest rate risk is managed through diversified funding sources at WEX Bank including interest bearing money market deposits and certificates of deposit with varying maturities. Some of our merchant contracts include some ability to raise rates if interest rates rise. |

• | We have an experienced and committed management team that has substantial industry knowledge and a proven track record of financial success. The team has been successful in driving strong growth with consistent operating performance. We believe that our management team positions us well to continue successfully implementing our growth strategy and capturing operating efficiencies. |

Strategy

Our Company’s path forward will be shaped by the following three strategic priorities:

• | Drive continued growth. We continue to see significant organic growth opportunities across each of our Fleet Solutions, Travel and Corporate Solutions, and Health and Employee Benefit Solutions segments. We seek to capture this growth opportunity through our product excellence, marketing capabilities, sales force productivity, and revenue management practices. Our acquisition strategy will complement our organic growth by both enhancing scale and adding differentiation to our current offerings. |

• | Lead through superior technology. We have built and differentiate ourselves in the marketplace on a distinctive set of technologies in our Fleet Solutions, Travel and Corporate Solutions, and Health and Employee Benefit Solutions segments. As our markets continue to evolve, our ability to quickly and cost effectively innovate and deliver superior technological solutions will set us apart from our peers. |

• | Set standard for operational excellence. We stand apart in our segments by reliably delivering the best solutions to our partners and customers. We are continually optimizing our cost structure and capturing new revenue synergies across our lines of business. Gains in operational efficiency simplify our business, making us more nimble to capture market opportunities as they arise. |

4

FLEET SOLUTIONS SEGMENT

Overview

The Fleet Solutions segment provides customers with fleet vehicle payment processing services specifically designed for the needs of commercial and government fleets. We are a leading provider of fleet vehicle payment processing services with over 10.5 million vehicles at year end using our fleet payment solutions to purchase fuel and maintenance services. Our competitive advantages in the fleet market include brand strength and product offerings, commitment to customer satisfaction and a unique financing model with attractive credit terms. Our fleet products are based upon proprietary technology with closed-loop networks in the U.S., Australia and Europe and wide site acceptance domestically and abroad.

As part of our value proposition, we deliver security through individualized driver identification and real-time transaction updates, purchase controls and sophisticated reporting tools. We collect a broad array of information at the point of sale, including the amount of the expenditure, the identity of the driver and vehicle, the odometer reading, the identity of the fuel or vehicle maintenance provider and the items purchased. We use this information to provide customers with analytical tools to help them effectively manage their vehicle fleets and control costs. We deliver value to our customers by providing customized offerings for accepting merchants, processing payments and providing information management products and services to fleets.

Our proprietary closed-loop networks allow us to provide our customers with highly detailed, fleet-specific information and customized controls that are not typically available on open-loop networks, such as limiting purchases to fuel only and restricting the time of day and day of the week when fuel is purchased. Our network also enables us to avoid dependence on third-party processors. In addition, our relationships with both fleets and merchants enable us to provide security and controls and provide customizable reporting.

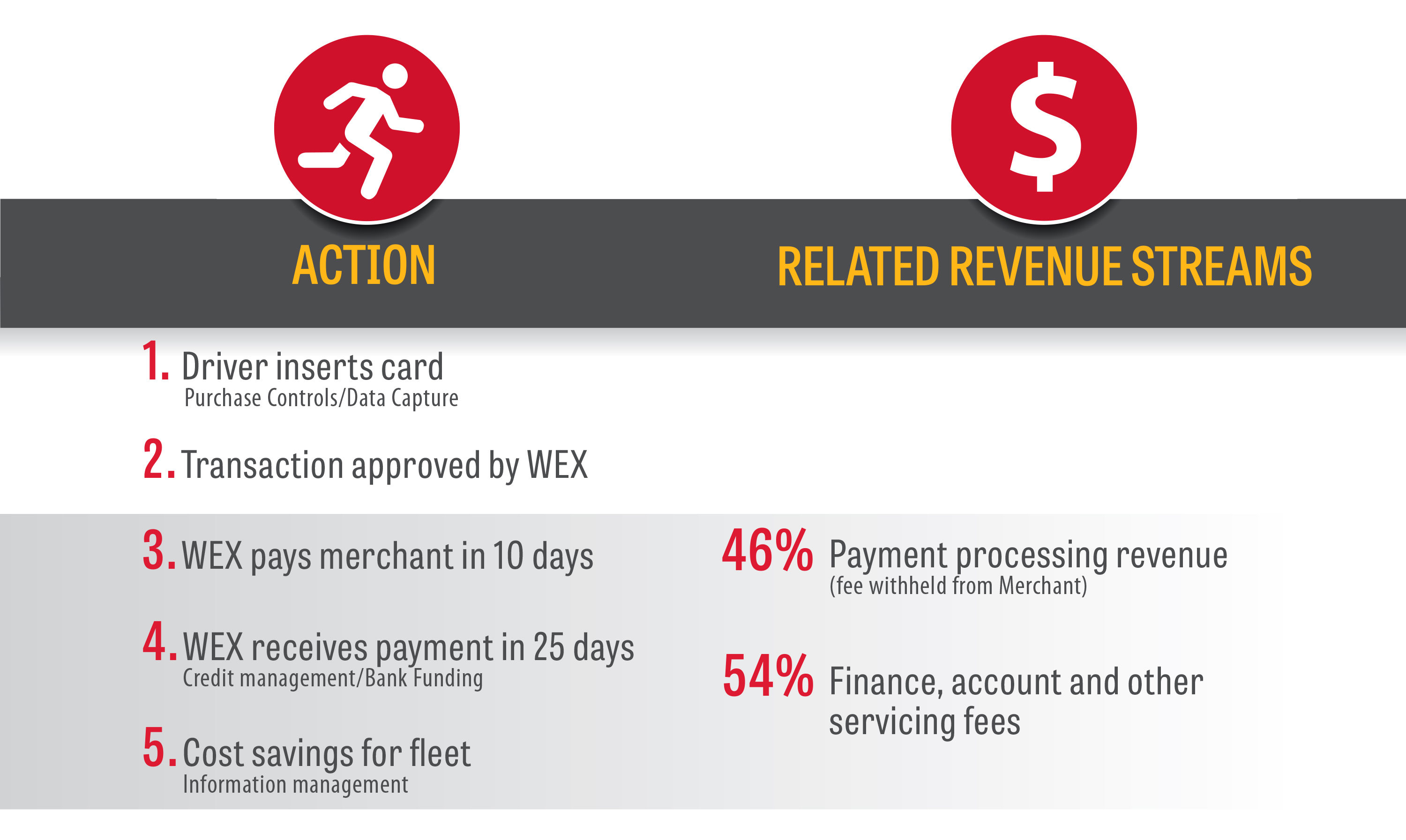

The following illustrates our proprietary closed-loop network:

Payment processing transactions represent a majority of the revenue stream in the Fleet Solutions segment. In a payment processing transaction, we extend short-term credit to the fleet customer and pay the purchase price for the fleet customer’s transaction, less the payment processing fees we retain, to the merchant. Revenue from our WEX Europe Services operations is primarily generated by transactions where our revenue is derived from the difference between the negotiated price of the fuel from the supplier and the price charged to the fleet customer. We collect the total purchase price from the fleet customer, normally within 30 days from the billing date.

5

The following illustration depicts our business process for a typical WEX direct network domestic fuel payment processing transaction:

With the recent acquisition of EFS, we have diversified our market position in the over-the-road fleet segment. We offer customizable over-the-road fleet payment solutions that address comprehensive business needs including:

• | Real-time interactive interfaces delivering data integrity through a seamless user interface |

• | Alternative payment and money transfer options |

• | Comprehensive settlement solutions |

• | Real-time reports and analytics for compliance and cost-optimization |

• | Fuel reconciliation and mobile optimization tools |

Products and Services

Payment processing fees are based on a percentage of the aggregate dollar amount of the customer’s purchase, a fixed amount per transaction or a combination of both. Additionally, payment processing revenue related to our WEX Europe Services operations is specifically derived from the difference between our negotiated price of the fuel from the supplier and the agreed upon price paid by the fleets. In 2016, we processed approximately 386 million payment processing transactions, compared to 343 million payment processing transactions in 2015. Additionally, we receive revenue from account servicing fees, factoring receivables and finance fees.

We offer the following services:

• | Customer service, account activation and account retention: We offer customer service, account activation and account retention services to fleets and fleet management companies and the fuel and vehicle maintenance providers on our network. Our services include promoting the adoption and use of our products and programs and account retention programs on behalf of our customers and partners. |

• | Authorization and billing inquiries and account maintenance: We handle authorization and billing questions, account changes and other issues for fleets through our dedicated customer contact centers, which are available |

6

24 hours a day, seven days a week. Fleet customers also have self-service options available to them through our websites.

• | Premium fleet services: We assign designated account managers to businesses and government agencies with large fleets. These representatives have in-depth knowledge of both our programs and the operations and objectives of the fleets they service. |

• | Credit and collections services: We have developed proprietary account approval, credit management and fraud detection programs. Our underwriting model produces a proprietary score, which we use to predict the likelihood of an account becoming delinquent within 12 months of activation. We also use a credit maintenance model to manage ongoing accounts, which helps us to predict the likelihood of account delinquency over an ongoing 18-month time horizon. We have developed a collections scoring model that we use to rank and prioritize past due accounts for collection activities. We also employ fraud specialists who monitor accounts, alert customers and provide case management expertise to minimize losses and reduce program abuse. |

• | Merchant services: Our representatives work with fuel and vehicle maintenance providers to enroll these providers in our network, test all network and terminal software and hardware, and to provide training on our sale, transaction authorization and settlement processes. |

Information Management

We provide standard and customized information to customers through monthly vehicle analysis reports, custom reports and our websites. We also alert customers of unusual transactions or transactions that fall outside of pre-established parameters. Customers can access their account information through our website including account history and recent transactions, and download the related details. In addition, fleet managers can elect to be notified by email when limits are exceeded in specified purchase categories, including limits on transactions within a time range and gallons per day.

Marketing Channels

We market our fleet products and services directly to commercial and government vehicle fleet customers with small, medium and large fleets, and over-the-road, long haul fleets. Our product suite includes payment processing and transaction processing services, WEX branded fleet cards in North America and Motorpass/Motorcharge-branded fleet cards in Australia. For the fourth quarter of 2016, our direct line of business serviced approximately 3.5 million vehicles. During the same period, our over-the-road line of business serviced approximately 1.1 million vehicles, marketed under the EFS, EFS Transportation Services, T-Chek and Fleet One brands.

We also market our products and services indirectly through co-branded and private label relationships. With a co-branded relationship product, we market our products and services for, and in collaboration with, both fuel providers and fleet management companies using their brand names and our logo on a co-branded fleet card. These companies seek to offer our payment processing and information management services as a component of their total offering to their fleet customers. During the fourth quarter of 2016, our co-branded marketing channel serviced approximately 1.8 million vehicles.

Our private label programs market our products and services for, and in collaboration with, fuel retailers, using only their brand names. The fuel retailers with which we have formed strategic relationships offer our payment processing and information management products and services to their fleet customers in order to establish and enhance customer loyalty. These fleets use these products and services to purchase fuel at locations of the fuel retailer with whom we have the private label relationship. During the fourth quarter of 2016, our private label marketing channel serviced approximately 4.1 million vehicles.

Fuel Price Derivatives

A portion of our company-wide revenue is derived from fees paid to us by fuel providers based on a negotiated percentage of the purchase price of fuel purchased by our customers. Accordingly, this revenue is impacted by fuel prices. To address fluctuations in fuel prices, we previously hedged a portion of our U.S. fuel-price related earnings exposure to improve the management of potential cash flow volatility created by changes in U.S. fuel prices and to enhance the visibility and predictability of our anticipated future cash flows.

During the fourth quarter of 2014 we suspended purchases under our fuel derivatives program due to unusually low prices in the commodities market. We continued to hold fuel price derivative instruments through the first quarter of 2016 that were executed in the third quarter of 2014 for approximately 20 percent of the anticipated quarterly exposure to domestic earnings based on assumptions at time of purchase. After the first quarter of 2016, we no longer were partially hedged for changes in fuel prices. Management continues to monitor the fuel price market and evaluate our alternatives as it relates to this hedging program.

7

These derivative instruments did not qualify for hedge accounting under accounting guidance. Accordingly, both realized and unrealized gains and losses on our fuel price-sensitive derivative instruments affected our current period earnings.

TRAVEL AND CORPORATE SOLUTIONS SEGMENT

Overview

Our Travel and Corporate Solutions segment is comprised of our virtual and prepaid products with which we provide innovative corporate purchasing and payment capabilities that can be integrated with our customers’ internal systems to streamline their corporate payments, accounts payable and reconciliation processes.

Products and Services

The Travel and Corporate Solutions segment allows businesses to centralize purchasing, simplify complex supply chain processes and eliminate the paper check writing associated with traditional purchase order programs. Our product suite includes virtual, credit, debit and prepaid products.

Our virtual card is used for transactions where no card is presented, including, for example, transactions conducted over the telephone, by mail, by fax or on the Internet. Our virtual card also can be used for transactions that require pre-authorization, such as hotel reservations. Under our virtual card programs, each transaction is assigned a unique account number with a customized credit limit and expiration date. These controls are in place to limit fraud and unauthorized spending. The unique account number limits purchase amounts and tracks, settles and reconciles purchases more easily, creating efficiencies and cost savings for our customers. The virtual card products offer both credit and debit options.

Our electronic accounts payable solution utilizes virtual card payments that are both broadly accepted and highly secure. This product reduces manual processing costs and facilitates comprehensive payment terms management to maximize margin improvement, efficiency and control.

Our prepaid and gift card products are offered through WEX Prepaid Card Australia and WEX Europe Limited to companies throughout Australia and Europe. These products provide secure payment and financial management solutions with single card options, access to open or closed loop redemption, load limits and variable expirations.

8

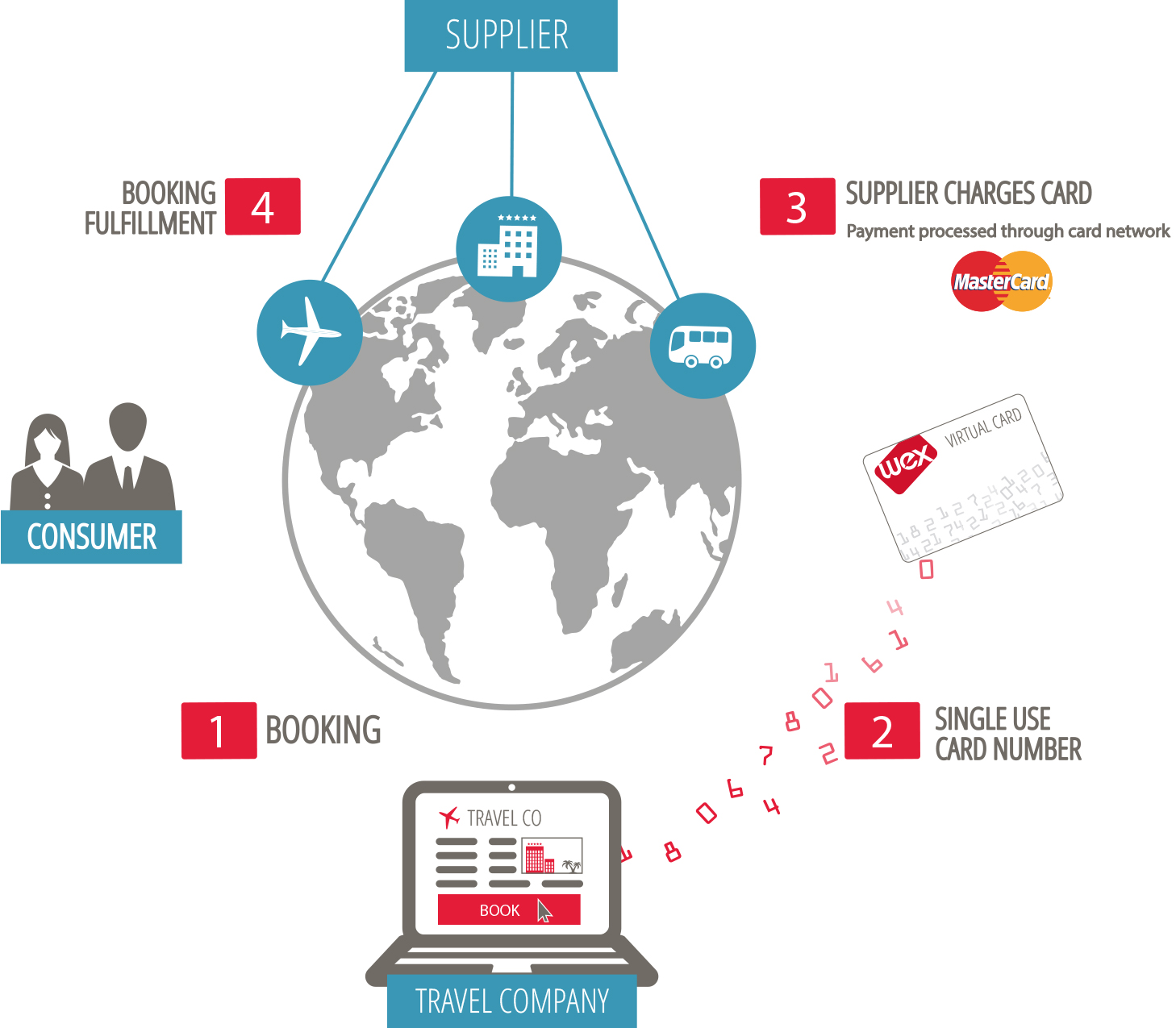

The following illustration depicts our business process for a typical travel virtual card product transaction:

1 Guest books a hotel through a travel website owned by an online travel company

2 Online travel company reserves room at hotel through reservation system using a WEX virtual card number to reserve the room.

3 Upon checkout, hotel authorizes payment using the WEX virtual card number. The WEX virtual card restricts charge to predetermined cost of room, incidental expenses are paid for by guest.

4 Online travel company pays WEX. WEX earns fee by retaining percentage of the online travel company reimbursement payment.

Marketing Channels

We market our Travel and Corporate Solutions segment products and services directly to new and existing customers. Our products are marketed to commercial and government organizations and we use existing open-loop networks.

9

HEALTH AND EMPLOYEE BENEFIT SOLUTIONS SEGMENT

Overview

Our Health and Employee Benefit Solutions segment is comprised of our healthcare payment products and SaaS platforms with which we provide simplified payment capabilities in a complex healthcare market as well as employee benefit products in Brazil.

Products and Services

Prior to 2016, the Health and Employee Benefit Solutions segment product suite included our 1Pay and 1Plan payment solution products and our ExchangePoint, COBRAPoint, 1Cloud and 1Direct SaaS platforms. During 2016, we collectively rebranded this product suite as the WEX Health Cloud.

With our healthcare payment products, we provide payments in the complex healthcare market. We partner with health plans, third-party administrators, financial institutions, payroll companies and software providers to provide a software as a service product to support employers' healthcare benefits programs and to administer flexible spending, health saving and reimbursement accounts, and other healthcare related employee and dependent benefits.

We currently have approximately 500 partners with relationships with 200,000 employers, reaching 17 million consumers. Revenue is generated primarily from SaaS based monthly fees to partners and interchange fees from spending on customer debit cards issued under flexible spending, health savings and reimbursement accounts. Cards are branded with either Visa or MasterCard and operate on a restricted open loop network.

Our paycard products are offered through our wholly-owned subsidiary, WEX Brazil. Employees using our paycard products have access to salary advances payable in up to 24 monthly installments which are secured by future salary earnings. These advances are funded by borrowings under our credit facilities in Brazil.

Health and Employee Benefit Solutions segment revenues are generated primarily from platform usage subscription fees and interchange fees from spending on the paycard products.

Marketing Channels

We market our Health and Employee Benefit Solutions products and services to consumers through an extensive partner network, which includes health plans, third party administrators, financial institutions, payroll providers and software providers. Our employee benefit products are marketed to consumers through employers in Brazil.

OTHER ITEMS

Employees

As of December 31, 2016, WEX Inc. and its subsidiaries had approximately 2,600 employees, of which approximately 1,900 were located in the United States. None of our U.S.-based employees are subject to a collective bargaining agreement. In Europe, certain employees are members of trade unions or works councils. In Brazil, certain employees are members of unions. The Company believes that its relations with its employees, unions and work councils are generally satisfactory.

Competition

We have a strong competitive position in each of our segments. Our product features and extensive account management services are key factors behind our position in the fleet industry. We face competition in all of our segments. Our competitors vie with us for prospective direct fleet customers as well as for companies with which to form strategic relationships. We compete with companies that perform payment and transaction processing or similar services. Financial institutions that issue Visa, MasterCard and American Express credit and charge cards currently compete against us primarily in the Fleet Solutions and Travel and Corporate Solutions segments. We also compete with other healthcare payment service providers.

The most significant competitive factors include the breadth of features offered, functionality, servicing capability and price. For more information regarding risks related to competition, see the information in Item 1A, under the heading “Our industry continues to become increasingly competitive, which makes it more challenging for us to maintain profit margins at historical levels.”

10

Technology

We believe that investment in technology is a crucial step in maintaining and enhancing our competitive position in the marketplace. Our data center network and infrastructure is supported by secure data centers with redundant locations. We have data centers in various locations in the United States including South Portland, Maine and Aurora, Colorado. We also have data centers and infrastructure located in various locations throughout Europe, Australia, New Zealand and Brazil.

Our fleet fuel-based closed-loop proprietary platforms capture detailed information from the fuel and maintenance locations within our network. Operating a proprietary network not only enhances our value proposition, it also enables us to limit dependence on third-party processors and to respond rapidly to changing customer needs with system upgrades, while maintaining a more secure environment than an open-loop network typically allows. Our virtual card open-loop network uses internally developed software and third-party processors. Our infrastructure has been designed around industry-standard architectures to reduce downtime in the event of outages or catastrophic occurrences. At WEX Health, we maintain an integrated multi-account payment platform, including a mobile application. In Australia, New Zealand, Brazil and the United Kingdom, we use standalone platforms to support operations.

Our secure networks are designed to isolate our databases from unauthorized access. We use security protocols among all applications, and our employees access critical components on a need-only basis. As of December 31, 2016, we have not experienced any material incidents in network, application or data security. We are continually improving our technology to enhance customer relationships and to increase efficiency and security. We also review technologies and services provided by others in order to maintain the high level of service expected by our customers and continue to invest in our infrastructure.

For information regarding technology related risks, see the information in Item 1A under the headings “We may not be able to adequately protect our information systems, including the data we collect about our customers, which could subject us to liability and damage our reputation”, “Our failure to effectively implement new technology could jeopardize our position as a leader in our industry” and “We are dependent on technology systems and electronic communications networks managed by third parties, which could result in our inability to prevent service disruptions.”

Seasonality

Our businesses are affected by seasonal variations. For example, fuel prices are typically higher during the summer and online travel sales are typically higher during the third quarter. In addition, we experience seasonality in our healthcare segment, as consumer spend is correlated with insurance deductibles, typically resulting in higher spend in the early part of the year until employees meet their deductibles and during the fourth quarter as consumers utilize remaining annual contributions.

Intellectual Property

We rely on a combination of patent, copyright, trade secret and trademark laws, confidentiality procedures, contractual provisions and other similar measures to protect the proprietary information and technology used in our business. We generally enter into confidentiality, professional services and/or license agreements with our consultants and corporate partners and control access to and distribution of our technology, documentation and other proprietary information. Despite the efforts to protect our proprietary rights, unauthorized parties may attempt to copy or otherwise obtain the use of our products or technology that we consider proprietary and third parties may attempt to develop similar technology independently. We pursue registration and protection of our trademarks in the U.S. and other countries in which we operate or plan to operate. We market our products and services using the WEX, FleetOne, EFS and the WEX Health Cloud brand names in the U.S., the Motorpass and Motorcharge brand names in Australia and the WEX Brazil brand name in Brazil.

Regulation - United States

The Company and its affiliates are subject to certain state and federal laws and regulations which govern insured depository institutions and their affiliates as well as our operations in the healthcare market. WEX Bank is subject to supervision and examination by both the Utah DFI and the FDIC. The Company and its affiliates are subject to certain limitations on transactions with affiliates set forth in the Federal Reserve Act (“FRA”). The Company is subject to anti-tying provisions in the Bank Holding Company Act. State and Federal laws and regulations limit the loans WEX Bank may make to one borrower and the types of investments WEX Bank may make.

Below is a description of the material elements of the laws, regulations, policies and other regulatory matters affecting the operations of WEX in the United States.

11

Exemption from Certain Requirements of the Bank Holding Company Act

As an industrial bank organized under the laws of Utah that does not accept demand deposits that may be withdrawn by check or similar means, WEX Bank meets the criteria for exemption from the definition of “bank” under the Bank Holding Company Act. As a result, the Company is generally, except as stated above, not subject to the Bank Holding Company Act.

Restrictions on Intercompany Borrowings and Transactions

Sections 23A and 23B of the FRA and the implementing regulations limit the extent to which the Company can borrow or otherwise obtain credit from or engage in other “covered transactions” with WEX Bank. “Covered transactions” include loans or extensions of credit, purchases of or investments in securities, purchases of assets, including assets subject to an agreement to repurchase, acceptance of securities as collateral for a loan or extension of credit, or the issuance of a guarantee, acceptance, or letter of credit. Although the applicable rules do not serve as an outright ban on engaging in “covered transactions,” they do limit the amount of covered transactions WEX Bank may have with any one affiliate and with all affiliates in the aggregate. The applicable rules also require that the Company engage in such transactions with WEX Bank only on terms and under circumstances that are substantially the same, or at least as favorable to WEX Bank, as those prevailing at the time for comparable transactions with nonaffiliated companies. Furthermore, with certain exceptions, each loan or extension of credit by WEX Bank to the Company or its other affiliates must be secured by collateral with a market value ranging from 100 percent to 130 percent of the amount of the loan or extension of credit, depending on the type of collateral.

The Consumer Financial Protection Bureau

The Dodd-Frank Act established the Consumer Financial Protection Bureau ("CFPB") to regulate the offering of consumer financial products or services under the federal consumer financial laws. In addition, the CFPB was granted general authority to prevent covered persons or service providers from committing or engaging in unfair, deceptive or abusive acts or practices under federal law in connection with any transaction with a consumer for a consumer financial product or service. The CFPB has broad rulemaking authority for a wide range of consumer protection laws. The legislation also gives the state attorneys general the ability to enforce applicable federal consumer protection laws.

Brokered Deposits

Under FDIC regulations, depending upon their capital classification, banks may be restricted in their ability to accept brokered deposits. “Well capitalized” banks are permitted to accept brokered deposits, but banks that are not “well capitalized” are not permitted to accept such deposits. The FDIC may, on a case-by-case basis, permit banks that are “adequately capitalized” to accept brokered deposits if the FDIC determines that acceptance of such deposits would not constitute an unsafe or unsound banking practice.

Other Financial Regulatory Requirements

WEX Bank must monitor and report unusual or suspicious account activity, as well as transactions involving amounts in excess of prescribed limits, as required by the Bank Secrecy Act and Internal Revenue Service regulations. The USA PATRIOT Act of 2001 substantially broadened the scope of U.S. anti-money laundering laws and regulations by imposing significant new compliance and due diligence obligations, identifying new crimes and penalties and expanding the extra-territorial jurisdiction of the United States. The United States Treasury Department has proposed and, in some cases, issued a number of implementing regulations which impose obligations on financial institutions to maintain appropriate policies, procedures and controls to detect, prevent and report money laundering and terrorist financing and to verify the identity of their customers. Certain of those regulations impose specific due diligence requirements on financial institutions that maintain correspondent or private banking relationships with non-U.S. financial institutions or persons. Failure of a financial institution to maintain and implement adequate programs to combat money laundering and terrorist financing could have serious legal and reputational consequences for the institution.

The U.S. federal government has imposed economic sanctions that affect transactions with designated foreign countries, nationals and others. These sanctions, which are administered by the United States Treasury’s Office of Foreign Assets Control (“OFAC”), take many different forms but generally include one or more of the following elements: (i) restrictions on trade with or investment in a sanctioned country, including prohibitions against direct or indirect imports from and exports to a sanctioned country and prohibitions on “U.S. persons” engaging in financial transactions relating to making investments in, or providing investment-related advice or assistance to, a sanctioned country; and (ii) a blocking of assets in which the government or specially designated nationals of the sanctioned country have an interest, by prohibiting transfers of property subject to U.S. jurisdiction (including property in the possession or control of U.S. persons). Blocked assets (for example, property and bank deposits) cannot be paid out, withdrawn, set off or transferred in any manner without a license from OFAC. Failure to comply with these sanctions could have serious legal and reputational consequences.

12

Under the Financial Services Modernization Act of 1999, also referred to as the “Gramm-Leach-Bliley Act" (or “GLBA”), the Company and WEX Bank are required to maintain a comprehensive written information security program that includes administrative, technical and physical safeguards relating to customer information. However, this requirement does not generally apply to information about companies or about individuals who obtain financial products or services for business, commercial, or agricultural purposes. The GLBA also requires the Company and WEX Bank to provide initial and annual privacy notices to customers that describe in general terms their information sharing practices. If the Company and WEX Bank intend to share nonpublic personal information about customers with affiliates and/or nonaffiliated third parties, they must provide customers with a notice and a reasonable period of time for each consumer to “opt out” of any such disclosure. In addition to U.S. federal privacy laws, states also have adopted statutes, regulations and other measures governing the collection and distribution of nonpublic personal information about customers. In some cases these state measures are preempted by federal law, but if not, the Company and WEX Bank must monitor and comply with such laws in the conduct of its business.

Escheat Laws

We are subject to unclaimed or abandoned property state laws in the United States and in certain foreign countries that require us to transfer to certain government authorities the unclaimed property of others that we hold when that property has been unclaimed for a certain period of time. Moreover, we are subject to audit by state and foreign regulatory authorities with regard to our escheatment practices.

Restrictions on Dividends

WEX Bank is subject to various regulatory requirements relating to the payment of dividends, including requirements to maintain capital above regulatory minimums. A banking regulator may determine that the payment of dividends would be inappropriate and could prohibit payment. Further, WEX Bank may not pay a dividend if it is undercapitalized or would become undercapitalized as a result of paying the dividend. Utah law permits WEX Bank to pay dividends out of the net profits of the industrial bank after providing for all expenses, losses, interest, and taxes accrued or due, but if WEX Bank’s surplus account is less than 100 percent of its capital stock, WEX Bank must transfer up to 10 percent of its net profits to the surplus account prior to the payment of any dividends.

Company Obligations to WEX Bank

Any non-deposit obligation of WEX Bank to the Company is subordinate, in right of payment, to deposits and other indebtedness of WEX Bank. In the event of the Company’s bankruptcy, any commitment by the Company to a federal bank regulatory agency to maintain the capital of WEX Bank will be assumed by the bankruptcy trustee and entitled to priority of payment.

Restrictions on Ownership of WEX Inc. Common Stock

WEX Bank, and therefore the Company, is subject to bank regulations that impose requirements on entities that might control WEX Bank through control of the Company. These requirements are discussed in Item 1A under the heading “If any entity controls 10 percent or more of our common stock and such entity has caused a violation of applicable banking laws by its failure to obtain any required approvals prior to acquiring that common stock, we have the power to, and may be required to, restrict such entity’s ability to vote shares held by it.”

Healthcare Regulation

The federal and state governments in the U.S. continue to enact and consider many broad-based legislative and regulatory proposals that could materially impact various aspects of our health-related business.

The Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act (collectively referred to as "Health Care Reform") mandated broad changes affecting insured and self-insured health benefit plans that impact our current business model, including our relationship with current and future customers, producers and health care providers, products, services, processes and technology. Health Care Reform left many details to be established through regulations. While federal agencies have published proposed and final regulations with respect to most provisions, some issues remain uncertain. The current U.S. Administration and Congress have signaled their intent to significantly or completely repeal Health Care Reform and the associated implementing regulations, and it is unclear what, if any, measures may be implemented to replace it. Accordingly, there may be an extended period of uncertainty and unpredictability in the U.S. health care market, which may materially affect the availability and cost of health coverage, the viability of health care providers and health benefit plans, the proportion of persons in the U.S. who have health insurance; the distribution between privately funded and government funded health insurance; and the future demand for, and profitability of, the offerings of our health-related business under our current business model.

13

In connection with the processing of data, we frequently undertake or are subject to specific compliance obligations under privacy and data security-related laws, including the Health Insurance Portability and Accountability Act of 1996, or HIPAA, the Gramm-Leach-Bliley Act, and similar state and federal laws governing the collection, use, protection and disclosure of nonpublic personally identifiable information, including individually identifiable health information.

HIPAA and its implementing regulations, as amended by the Health Information Technology for Economic and Clinical Health Act, or the HITECH Act, impose requirements relating to the privacy, security and transmission of individually identifiable health information. Among other things, HIPAA, as amended by the HITECH Act, and its implementing regulations, subjects us to regulations and contractual obligations that impose privacy and security standards and breach notification and reporting requirements.

In addition to federal data privacy and security laws and regulations, we are subject to state laws governing confidentiality and security of personally identifiable information and additional state-imposed breach notification and reporting requirements.

Regulation - Foreign

The conduct of our businesses and the use of our products and services outside the U.S., are subject to various foreign laws and regulations administered by government entities and agencies in the countries and territories where we operate. It is our policy to abide by the applicable laws and regulations in the jurisdictions around the world in which we do business.

Asia-Pacific

Australia

The Company’s Australian operations are subject to laws and regulations of the Commonwealth of Australia governing banking and payment systems, financial services, consumer credit and money laundering. Because none of WEX Australia, WEX Fuel Cards Australia or WEX Prepaid Cards Australia holds an Australian Financial Services License or credit license or is an authorized deposit-taking institution, they operate within a framework of regulatory relief and exemptions afforded them on the basis that they satisfy the requisite conditions. The Australian operations are also subject to the Privacy Act (1988) and the Australian Privacy Principles.

Asia, including Singapore

The Company's operations in Asia are subject to the operation of the laws and regulation of the countries in which we operate, including laws with regards to banking and payment systems, financial services, money laundering and data protection.

Europe

The Company’s European operations are subject to laws and regulations of the European Union and the countries in which we operate including, among others, those governing payment services, data protection and information security, consumer credit and anti-money laundering.

Brazil

The Company’s Brazilian operations are subject to laws and regulations of the Brazilian government, in particular the Central Bank of Brazil. Brazil’s labor systems are governed by the Consolidation of Brazilian Labor Laws. Brazil is a signatory of the World Trade Organization’s Trade-Related Aspects of Intellectual Property Rights agreement. This agreement establishes a minimum protection standard to property rights and requires signatory countries to review and adapt national laws that meet that standard.

Segments and Geographic Information

For an analysis of financial information about our segments as well as our geographic areas, see Item 8 - Note 23 of our consolidated financial statements included elsewhere in this Annual Report on Form 10-K.

Available Information

The Company’s principal executive offices are located at 97 Darling Avenue, South Portland, ME 04106. Our telephone number is (207) 773-8171, and our Internet address is www.wexinc.com. The Company’s annual, quarterly and current reports, proxy statements and certain other information filed with the SEC, as well as amendments thereto, may be obtained free of charge from our website. These documents are posted to our website as soon as reasonably practicable after we have filed or furnished these documents with the SEC. These documents are also available at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at

14

1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The Company’s Audit Committee Charter, Compensation Committee Charter, Finance Committee Charter, Corporate Governance Committee Charter, Corporate Governance Guidelines and Code of Business Conduct and Ethics are available without charge through the “Corporate Governance” portion of the Investor Relations page of the Company’s website. Copies will also be provided, free of charge, to any stockholder upon written request to Investor Relations at the address above or by telephone at (866) 230-1633.

The Company’s Internet site and the information contained on it are not incorporated into this Form 10-K and should not be considered part of this report.

15

ITEM 1A. RISK FACTORS

The risks and uncertainties described below are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of those risks actually occurs, our business, financial condition, results of operations and cash flows could suffer. The risks and uncertainties discussed below also include forward-looking statements and our actual results may differ materially from those discussed in these forward-looking statements.

Risks Relating to Our Company

A significant portion of our revenues are related to the dollar amount of fuel purchased by our customers, and, as a result, volatility in fuel prices could have an adverse effect on our revenues.

Our customers in our Fleet Solutions segment primarily purchase fuel. Accordingly, a significant part of our revenue is dependent on fuel prices, which are prone to volatility. As of December 31, 2016, management estimates that approximately 18 percent of our total revenues result from fees paid to us by fuel providers based on a negotiated percentage of the purchase price of fuel purchased by our customers. We estimate that during 2016, each one cent decline in average domestic fuel prices below average actual prices would result in approximately a $1.2 million decline in 2016 revenue. Therefore, extended declines in the price of fuel would have a material adverse effect on our total revenues. In the fourth quarter of 2014, we suspended our fuel price hedging program and as of the second quarter of 2016, we no longer had any remaining fuel hedging derivatives outstanding. With the suspension of our fuel price hedging program, we are exposed to the full impact of fuel price declines and our net income in future quarters is exposed to fuel price volatility unless the fuel price hedging program is reinstated. If fuel prices decline, the lack of a hedge will negatively impact our revenue and income.

Fuel prices are dependent on many factors, all of which are beyond our control. These factors include, among others:

• | supply and demand for oil and gas, and expectations regarding supply and demand; |

• | speculative trading; |

• | actions by major oil exporting nations; |

• | political conditions in other oil-producing, gas-producing or supply-route countries, including revolution, insurgency, terrorism or war; |

• | refinery capacity; |

• | weather; |

• | the prices of foreign exports and the availability of alternate fuel sources; |

• | value of the U.S. dollar versus other major currencies; |

• | general worldwide economic conditions; and |

• | governmental regulations, taxes and tariffs. |

Another component of our revenue stream is the late fees that our customers pay on past due balances. As a result, a decrease in the price of fuel leads to a decline in the amount of late fees we earn from customers who fail to pay us timely.

A portion of our revenue in Europe is derived from the difference between the negotiated price of the fuel from the supplier and the price charged to the fleet customer. As a result, a contraction in these differences would reduce revenues and could adversely affect our operating results.

Revenue from our fuel portfolio in Europe is derived from transactions where our revenue is tied to the difference between the negotiated price of the fuel from the supplier and the price charged to the fleet customer. The merchant’s cost of fuel is dependent on several factors including, among others, the factors described above affecting fuel prices. We experience fuel-price related revenue contraction when the merchant’s cost of fuel increases at a faster rate than the fuel price we charge to our fleet customers, or the fuel-price we charge to our fleet customers decreases at a faster rate than the merchant’s cost of fuel. Accordingly, we generate less revenue, which could adversely affect our operating results.

16

Changes in interchange fees could decrease our revenue.

A portion of our revenue is generated by network processing fees charged to merchants, known as interchange fees, associated with transactions processed using our cards. Interchange fee amounts associated with cards are affected by a number of factors, including regulatory limits and fee changes. In addition, interchange fees are the subject of intense legal and regulatory scrutiny and competitive pressures in the electronic payments industry. These factors could result in lower interchange fees generally in the future. Temporary or permanent decreases in the interchange fees associated with our card transactions, could adversely affect our business and operating results.

If we fail to adequately assess and monitor credit risks posed by our customers, we could experience an increase in credit loss.

We are subject to credit risk posed by our customers, many of which are small-to mid-sized businesses. Because we often fund a customer's entire receivable while our revenue is generated from only a small percentage of that amount, our risk of loss is amplified by the customer's failure to pay. We use various formulas and models to screen potential customers and establish appropriate credit limits, but these formulas and models cannot eliminate all potential credit risks and may not prevent us from approving applications that are fraudulently completed. Moreover, businesses that are good credit risks at the time of application may deteriorate over time and we may fail to detect such changes. In addition, changes to our policies on the types and profiles of businesses to which we extend credit could also have an adverse impact on our credit losses. In times of economic slowdown, the number of our customers who default on payments owed to us tends to increase. If we fail to adequately manage our credit risks, our provision for credit losses on the income statement could be significantly higher.

Fluctuations in foreign currency exchange rates could affect our financial results.

We earn revenues, pay expenses, own assets and incur liabilities in countries using currencies other than the U.S. dollar. Such currencies include, but are not limited to, the Australian dollar, the Euro, British Pound sterling, New Zealand dollar and Brazilian Real. Because our consolidated financial statements are presented in U.S. dollars, we must translate revenues, income and expenses, as well as assets and liabilities, into U.S. dollars at exchange rates in effect during or at the end of each reporting period. Realized and unrealized gains and losses on foreign currency transactions as well as the re-measurement of our cash, receivable and payable balances that are denominated in foreign currencies, are recorded directly in the consolidated statements of income. In addition, gains and losses associated with the Company's foreign currency exchange derivatives are recorded on the consolidated statements of income.

Therefore, increases or decreases in the value of the U.S. dollar against other major currencies that we use to conduct our business will affect our revenues, operating income and the value of balance sheet items denominated in those currencies. Fluctuations in foreign currency exchange rates, particularly fluctuations in the U.S. dollar against other currencies, may materially affect our financial results.

Our exposure to counterparty risk could create an adverse effect on our financial condition.

We engage in a number of transactions where counterparty risk is a relevant factor, including transactions with customers, derivatives counterparties and those businesses we work with to provide services, among others. These risks are dependent upon market conditions and also the real and perceived viability of the counterparty. The failure or perceived weakness of any of our counterparties has the potential to expose us to risk of loss in certain situations. Certain contracts and arrangements that we enter into with counterparties may provide us with indemnification clauses to protect us from financial loss. If the counterparty fails to, or is unable to fulfill these indemnification clauses, we may incur losses as well as harm to our reputation.

We have substantial indebtedness, which may materially and adversely affect our financial flexibility and our ability to meet our debt service obligations.

Our 2016 Credit Agreement provides for a tranche A term facility in an amount equal to $455 million that matures on July 1, 2021, a tranche B term loan facility in an amount equal to $1,200 million that matures on July 1, 2023 and a $470 million secured revolving credit facility, with a $250 million sublimit for letters of credit and a $20 million sublimit for swingline loans, that terminates on July 1, 2021. In addition to the 2016 Credit Agreement, our indebtedness consists of our 4.750 percent senior notes due 2023 (the “Notes”), deposits issued by WEX Bank and other liabilities outstanding. Our indebtedness could, among other things:

17

• | require us to dedicate a substantial portion of our cash flow to repaying our indebtedness, thus reducing the amount of funds available for other general corporate purposes; |

• | limit our ability to borrow additional funds necessary for working capital, capital expenditures or other general corporate purposes; |

• | increase our vulnerability to adverse general economic or industry conditions; and |

• | limit our flexibility in planning for, or reacting to changes in, our business. |

There can be no assurance that we will be able to meet our indebtedness obligations, including any of our obligations under the Notes. In addition, we may need to incur substantial additional indebtedness in the future to fund our operations or certain strategic objectives. However, we may not be able to obtain the additional financing necessary for these purposes.

In addition, under the 2016 Credit Agreement, unless otherwise agreed by the requisite lenders under the revolving credit facility, we are required to remain in compliance with a consolidated EBITDA to consolidated interest charge ratio, measured quarterly, of no less than 3.25 to 1.00; and a consolidated funded indebtedness (excluding up to $350 million of consolidated funded indebtedness due to permitted securitization transactions and excluding the amount of consolidated funded indebtedness constituting the non-recourse portion of permitted factoring transactions) to consolidated EBITDA ratio, measured quarterly, of no more than 5.40 to 1.00, which ratio shall step down to 5.25 to 1.00 at December 31, 2016, 5.00 to 1.00 at December 31, 2017, 4.25 to 1.00 at December 31, 2018 and 4.00 to 1.00 at December 31, 2019. The 2016 Credit Agreement also contains various affirmative and negative covenants that, subject to certain customary exceptions, restrict our ability to, among other things, create liens over our property, incur additional indebtedness, enter into sale and lease-back transactions, make loans, advances or other investments, make non-ordinary course asset sales, declare or pay dividends or make other distributions with respect to equity interests, change the nature of our business, enter into certain agreements which restrict our ability to pay dividends or other distributions or create liens on our property, transact business with affiliates and/or merge or consolidate with any other person. Our ability to comply with these provisions may be affected by events beyond our control. Failure to comply with the financial covenants or any other non-financial or restrictive covenant in our 2016 Credit Agreement could create a default. Upon a default, our lenders could accelerate the indebtedness under the facilities (except only the requisite lenders under the revolving credit facility may accelerate the revolving credit facility due to a breach of the financial covenants), foreclose against their collateral or seek other remedies, which could trigger a default under the Notes and would jeopardize our ability to continue our current operations.

Despite our substantial indebtedness, we may still be able to incur more debt, intensifying the risks described above.

Subject to restrictions in our 2016 Credit Agreement, we may incur additional indebtedness, which could increase the risks associated with our already substantial indebtedness. Subject to certain limitations, including compliance with the covenants in our 2016 Credit Agreement, we have the ability to borrow additional funds under our 2016 Credit Agreement.

This indebtedness could have the effect, among other things, of reducing our flexibility to respond to changing business and economic conditions and increasing interest expense.

Moreover, we may be required to raise substantial additional financing to fund working capital, capital expenditures, acquisitions or other general corporate requirements. Our ability to arrange additional financing or refinancing will depend on, among other factors, our financial position and performance, as well as prevailing market conditions and other factors beyond our control. There can be no assurance that we will be able to obtain additional financing or refinancing on terms acceptable to us or at all.

Volatility in the financial markets may negatively impact our ability to access credit and the terms at which we would access such credit.

Adverse conditions in the credit market may limit our ability to access credit at a time when we would like or need to do so. Our senior secured revolving credit facility under the 2016 Credit Agreement expires in July 2021 when the outstanding balance of the revolving credit facility and the tranche A term loan will be due, and in 2023 the tranche B term loan and the Notes will be due. Any limitation on the availability of funds or credit facilities could have an impact on our ability to refinance the maturing debt or react to changing economic and business conditions which could adversely impact us.

Volatility in the financial markets may negatively impact WEX Bank’s ability to attract and retain deposits.

Adverse conditions in the credit market may limit WEX Bank’s ability to attract deposits at a time when it would like or need to do so. A significant credit ratings downgrade, material capital market disruptions, significant withdrawals by depositors at WEX Bank, or adverse changes to its industrial bank charter could impact our ability to maintain adequate liquidity

18

and impact our ability to provide competitive offerings to our customers. Any limitation of availability of deposits could have an impact on our ability to finance our U.S. accounts receivable which would adversely impact us.

Our industrial bank subsidiary is subject to funding risks associated with its reliance on brokered deposits.

Under applicable regulations, if WEX Bank were no longer “well capitalized,” it would not be able to accept brokered deposits without the approval of the FDIC. WEX Bank’s inability to accept brokered deposits, or a loss of a significant amount of its brokered deposits, could adversely affect our liquidity. Additionally, such circumstances could require it to raise deposit rates in an attempt to attract new deposits, or to obtain funds through other sources at higher rates, which would adversely affect our results of operations.