Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Xenia Hotels & Resorts, Inc. | a8-kmarch2017investorprese.htm |

Investor Presentation

March 2017

Forward-Looking Statements

This presentation has been prepared by Xenia Hotels & Resorts, Inc. (the “Company” or “Xenia”) solely for informational purposes. This presentation

contains, and our responses to various questions from investors may include, “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements include statements about our plans, strategies and financial performance, the amount and

timing of future cash distributions, our lodging portfolio, and our prospects and future events. Such statements involve known and unknown risks that

are difficult to predict. As a result, our actual financial results, performance, achievements or prospects may differ materially from those expressed or

implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as “may,” “could,”

“expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would,” “illustrative,” “forecasts,”

“guidance,” “project” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking

statements are necessarily based upon estimates and assumptions that, while considered reasonable by the Company and its management based on

their knowledge and understanding of the business and industry, are inherently uncertain. These statements are not guarantees of future

performance, and stockholders should not place undue reliance on forward-looking statements. Actual results may differ materially from those

expressed or forecasted in the forward-looking statements due to a variety of risks, uncertainties and other factors, including but not limited to the

factors listed and described under “Risk Factors” in the Company’s most recent Annual Report on Form 10-K, as updated by any subsequent Quarterly

Report on Form 10-Q, in each case as filed with the U.S. Securities and Exchange Commission (“SEC”). These factors are not necessarily all of the

important factors that could cause our actual financial results, performance, achievements or prospects to differ materially from those expressed in or

implied by any of our forward-looking statements. Other unknown or unpredictable factors also could harm our results. All forward-looking

statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above.

Forward-looking statements speak only as of the date they are made, and we do not undertake or assume any obligation to update publicly any of

these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors

affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no

inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

On February 3, 2015, Xenia was spun off from InvenTrust Properties Corp. (“InvenTrust”). Prior to the separation, the Company effectuated certain

reorganization transactions which were designed to consolidate the ownership of its hotels into its operating partnership, consolidate its TRS lessees

in its TRS, facilitate its separation from InvenTrust, and enable the Company to qualify as a REIT for federal income tax purposes. Unless otherwise

indicated or the context otherwise requires, all financial and operating data herein reflect the operations of the Company after giving effect to the

reorganization transactions, the disposition of other hotels previously owned by the Company, and the spin-off.

Xenia Hotels & Resorts® and related trademarks, trade names and service marks of Xenia appearing in this presentation are the property of Xenia.

Unless otherwise noted, all other trademarks, trade names or service marks appearing in this presentation are the property of their respective

owners, including but not limited to Marriott International, Inc., Kimpton, Hyatt Hotels Corporation, Aston, Fairmont, Hilton Worldwide Holdings Inc.,

and Loews, or their respective parents, subsidiaries or affiliates. None of the owners of these trademarks, their respective parents, subsidiaries or

affiliates or any of their respective officers, directors, members, managers, shareholders, owners, agents or employees, has any responsibility for the

creation or contents of this presentation.

This document is not an offer to buy or the solicitation of an offer to sell any securities of the Company. Unless as specifically noted otherwise, all

information is as of February 28, 2017.

1

Company Overview

HI

FL

NM

DE

MD

TX

OK

KS

NE

SD

NDMT

WY

CO

UT

ID

AZ

NV

WA

CA

OR

KY

ME

NY

PA

VT

NH

RICT

WV

INIL

NC

TN

SC

ALMS

AR

LA

MO

IA

MN

WI

NJ

GA

DC

VA

OH

MI

MA

Primarily Located in Top 25 Lodging Markets and Key Leisure Destinations

Premium Full Service, Lifestyle and Urban Upscale Mix

Approximately 80% Luxury and Upper Upscale Hotels

Primarily Branded Hotels

42

HOTELS

10,911

ROOMS

20

STATES & DC

30

MARKETS

Aston Waikiki Beach Hotel

RiverPlace Hotel

Renaissance Austin

Andaz Savannah

Hilton Garden Inn Washington DCWestin Houston Galleria

2

Primarily Branded Hotels

60%

10%

10%

6%

5%

4%

3%

Independent

2%

Marriott

Westin

Renaissance

Autograph Collection

Courtyard

Residence Inn

Hilton Garden Inn

Hampton Inn

Andaz

Hyatt Regency

Hyatt Centric

Note: As a percentage of rooms as of 2/28/2017. Totals may not equal 100% due to rounding.

3

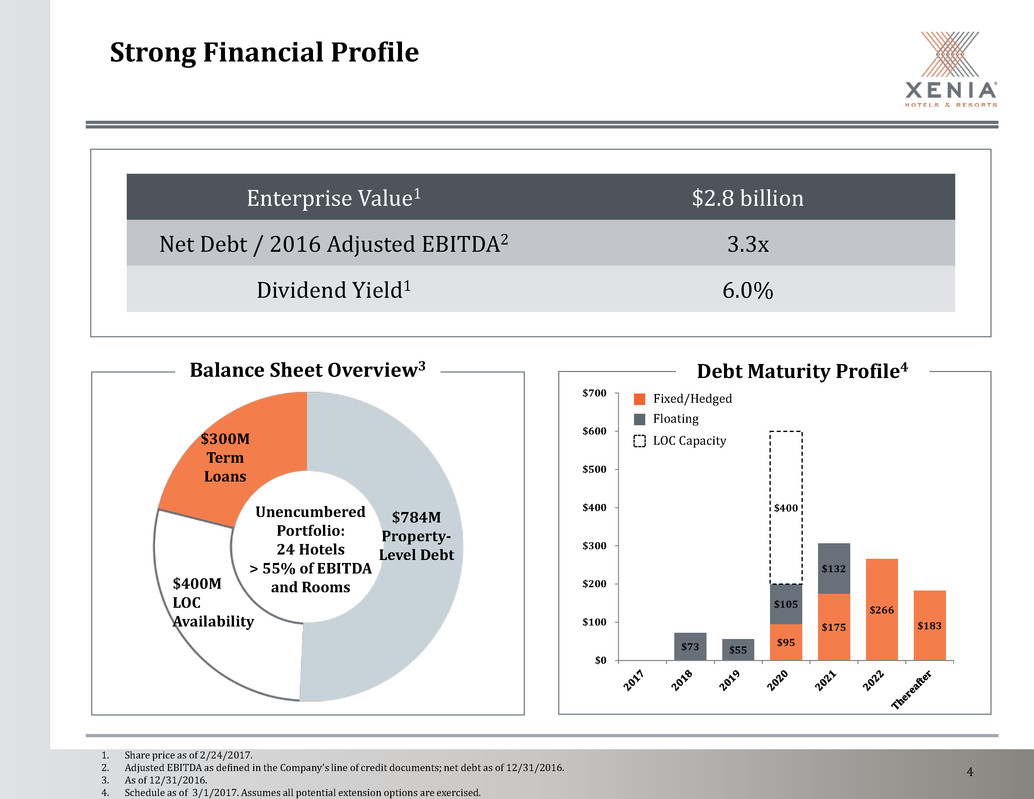

Strong Financial Profile

1. Share price as of 2/24/2017.

2. Adjusted EBITDA as defined in the Company’s line of credit documents; net debt as of 12/31/2016.

3. As of 12/31/2016.

4. Schedule as of 3/1/2017. Assumes all potential extension options are exercised.

Enterprise Value1 $2.8 billion

Net Debt / 2016 Adjusted EBITDA2 3.3x

Dividend Yield1 6.0%

Balance Sheet Overview3

$300M

Term

Loans

$784M

Property-

Level Debt

$400M

LOC

Availability

Debt Maturity Profile4

Unencumbered

Portfolio:

24 Hotels

> 55% of EBITDA

and Rooms

Fixed/Hedged

Floating

LOC Capacity

$95

$175

$266

$183

$73 $55

$105

$132

$400

$0

$100

$200

$300

$400

$500

$600

$700

4

2016 Highlights

Andaz Napa– Napa, CA

2016 Highlights

1. TTM as of month prior to disposition

2. Adjusted EBITDA as defined in the Company’s line of credit documents; net debt as of 12/31/2016

Differentiated Asset Management Platform

• Hotel EBITDA margin up 6 basis points despite 0.3% RevPAR decline with 73.2% flow-through

• Xenia’s proprietary Property Optimization Process (POP) completed at nine hotels in 2016

Continued Focus on Quality

• Acquired a high-quality, luxury asset in Boston with strong-growth opportunities

• Culled assets from lower end of the portfolio (average <$15k TTM1 EBITDA/key and average RevPAR >25%

discount to remainder of portfolio). Exited weakest properties in 3 markets with multi property exposure

• ~80% of assets are luxury or upscale. ADR of ~$201 across portfolio

Strong, Flexible Balance Sheet and Attractive Share Repurchases

• 3.3x net debt / 2016 Adjusted EBITDA2

• 24 properties unencumbered by debt (>55% of EBITDA)

• Full capacity available on $400 million Line of Credit and $216 million of cash on balance sheet

• Repurchased $75 million of common stock at an 8.8x weighted average EBITDA multiple

6

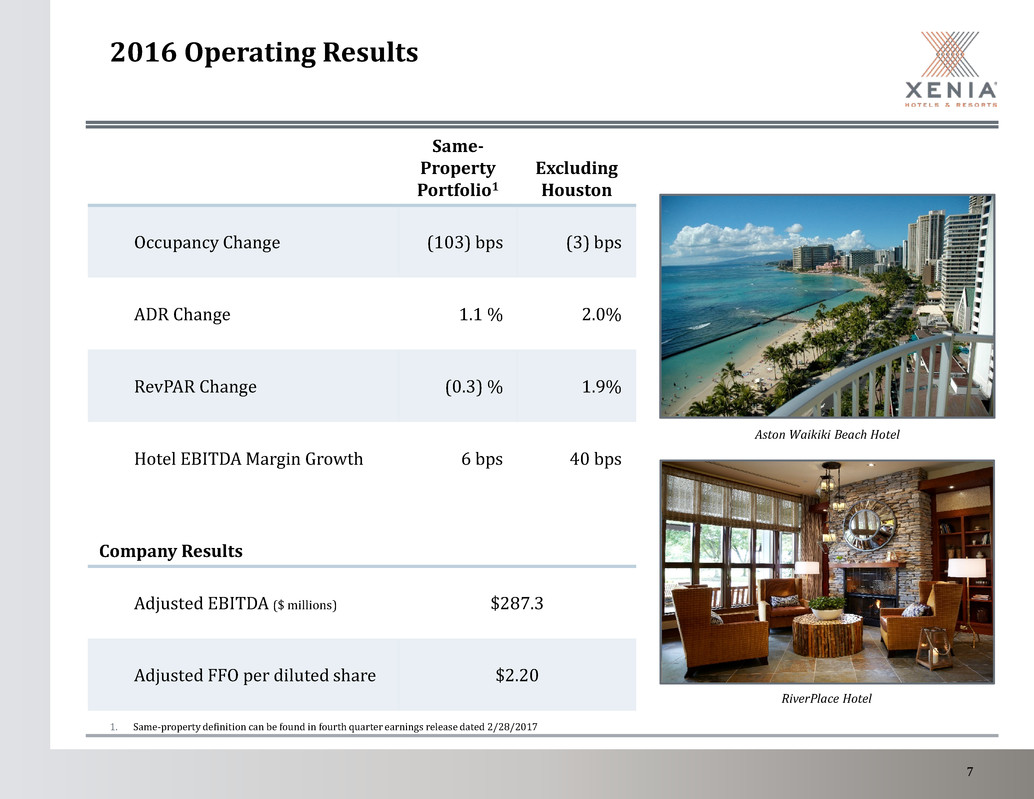

2016 Operating Results

1. Same-property definition can be found in fourth quarter earnings release dated 2/28/2017

Same-

Property

Portfolio1

Excluding

Houston

Occupancy Change (103) bps (3) bps

ADR Change 1.1 % 2.0%

RevPAR Change (0.3) % 1.9%

Hotel EBITDA Margin Growth 6 bps 40 bps

Company Results

Adjusted EBITDA ($ millions) $287.3

Adjusted FFO per diluted share $2.20

Aston Waikiki Beach Hotel

RiverPlace Hotel

7

Continued Focus on Cost Controls and Margin Retention

• Despite declines of 0.3% in RevPAR and 1.6% in Total Revenues in 2016, and challenges with the

Company’s Houston-area hotels, Xenia was able to maintain Hotel EBITDA margin with a 6 basis

point increase year over year

• These results were achieved largely through efficiencies in departmental operations and expense

controls via Xenia’s differentiated Asset Management platform.

2016

Hotel EBITDA

Margin Change

Andaz Napa +462 bps

Marriott San Francisco Airport Waterfront +385 bps

Marriott Dallas City Center +308 bps

Hampton Inn & Suites Baltimore Inner Harbor +266 bps

Hyatt Regency Santa Clara +136 bps

Hotel Monaco Denver +107 bps

Hilton Garden Inn Washington DC Downtown +107 bps

Andaz Napa

Marriott Dallas City Center

Hotel Monaco Denver

Hampton Inn & Suites Baltimore Inner

Harbor

8

2016 Property Optimization Process Initiatives

Scheduling to demand and

appropriate productivity levels

in multiple departments

All

Departments

F&B

Rooms Other

Xenia’s proprietary Property Optimization Process (POP) was

completed at nine hotels in 2016

Restaurant operating hours

adjustments

Menu/banquet pricing

enhancements

Service charge increases in

banquets and room service

Energy

Energy usage reduction and

LED lighting implementation

Improved sustainability efforts

such as guest opt-out options

on linens and towel change

Implementation or increase of

ancillary fees such as rollaway

beds and early departures

Enhanced guest retail efforts

through product mix

INITIATIVES

9

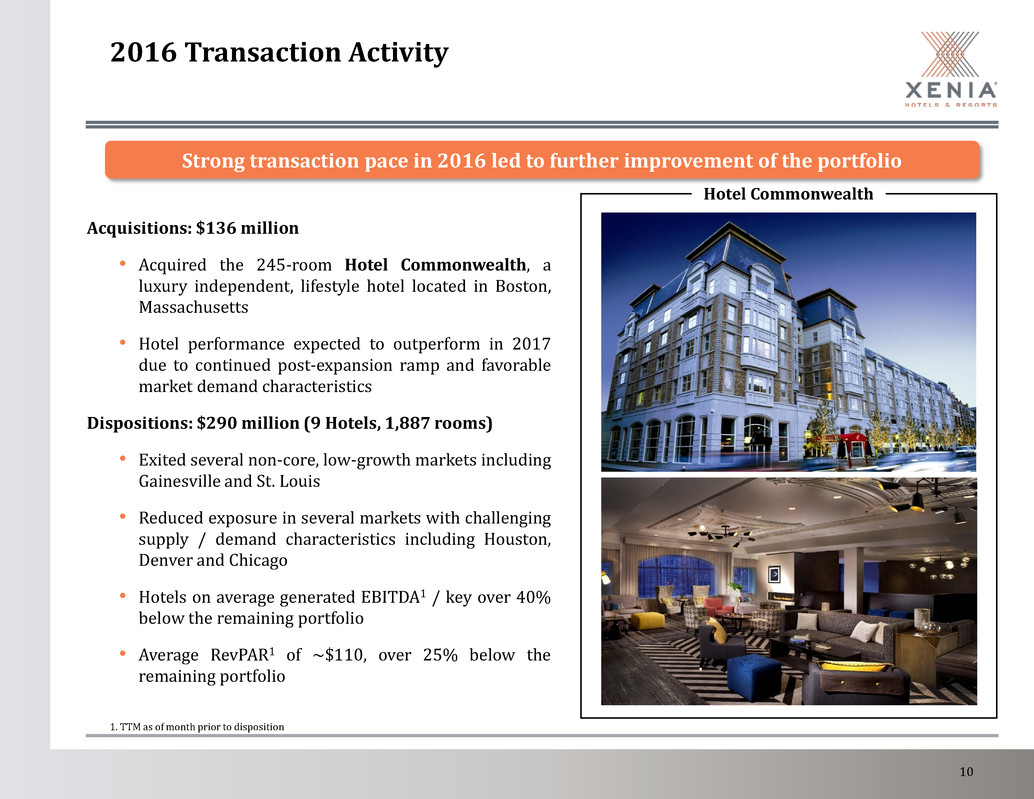

2016 Transaction Activity

Acquisitions: $136 million

• Acquired the 245-room Hotel Commonwealth, a

luxury independent, lifestyle hotel located in Boston,

Massachusetts

• Hotel performance expected to outperform in 2017

due to continued post-expansion ramp and favorable

market demand characteristics

Dispositions: $290 million (9 Hotels, 1,887 rooms)

• Exited several non-core, low-growth markets including

Gainesville and St. Louis

• Reduced exposure in several markets with challenging

supply / demand characteristics including Houston,

Denver and Chicago

• Hotels on average generated EBITDA1 / key over 40%

below the remaining portfolio

• Average RevPAR1 of ~$110, over 25% below the

remaining portfolio

aa

Hotel Commonwealth

Strong transaction pace in 2016 led to further improvement of the portfolio

1. TTM as of month prior to disposition

10

Recent Capital Markets Activity

• Xenia used ~$300 million in proceeds to fortify balance sheet and maintain a “best in class” leverage profile

~$280 million of Swaps

Reduced interest rate risk by swapping LIBOR on five loans

New Loans, Refinancings, and Modifications

~$50 million of incremental proceeds

~$275 million of Loan Payoffs

Addressed all debt maturities through April 2018

Grand Bohemian Hotel Charleston Hotel Palomar Philadelphia Andaz San Diego

• Lowered interest rate, lengthened duration, and reduced exposure to variable rate debt

11

2017 Outlook

Bohemian Hotel Savannah Riverfront – Savannah, GA

2017 Guidance

As of 2/28/2017, not being updated or reconfirmed

Additional Details:

Low High

RevPAR Change

(includes current 42 hotels)

(2.0)% 0.0%

Adjusted EBITDA $241 million $255 million

Adjusted FFO $195 million $209 million

Adjusted FFO per Diluted Share $1.82 $1.95

Capital Expenditures $85 million $95 million

• Average RevPAR declines of 8% to 12% at the Company's Houston-area hotels, due to the impact of continued weakness in corporate demand,

the addition of new supply, and disruption due to renovations at the Westin Galleria and Westin Oaks. The Company's Houston-area hotels are

expected to negatively impact portfolio RevPAR change by approximately 100 basis points.

• Disruption due to renovations is expected to negatively impact portfolio RevPAR change by approximately 50 basis points.

• In 2016, the nine hotels that were sold during the year contributed approximately $17 million to Adjusted EBITDA.

• General and administrative expense of $22 million to $24 million, excluding non-cash share-based compensation.

• Interest expense of $41 million to $43 million, excluding non-cash loan related costs. The expected reduction in interest expense relative to

2016 is a result of changes in debt outstanding, offset by changes in the mix of fixed and variable rate debt, and an expected change in the LIBOR

curve.

• Income tax expense of $5 million to $6 million.

13

Market

% of 2016

EBITDA1

2017

Comparative Outlook Additional Commentary

Houston, TX 10% Continued weakness in demand related to energy sectorSignificant new supply to be absorbed

San Francisco, CA 7% Soft downtown market due to Moscone renovationAirport location expected to outperform downtown

Dallas, TX 7% Weak citywide convention demandNew supply downtown in the market

Oahu Island, HI 6% Expected low but stable growth

Boston, MA 6%

Increased citywide convention demand

Continued ramp-up post expansion at Hotel

Commonwealth

Santa Clara, CA 6% Tough Q1 comparison due to Super Bowl in 2016

Denver, CO 5% Weak citywide convention demandNew supply downtown

Napa Valley, CA 5% Post-renovation ramp at Marriott

Atlanta, GA 5% Group pace up >20%Continued development of new Braves complex

Washington, D.C. 4%

Inauguration/administration change

Group pace up >65% with citywide demand up

Demand growth expected to surpass supply growth

Near Term 2017 Market Outlook

Top 10 Markets By EBITDA1

1. Represents percentage of 2016 Year-End Portfolio Hotel EBITDA

14

Key Investment Highlights

Broad portfolio mix

Focus on quality

Differentiated portfolio management

Strong financial profile

Canary Santa BarbaraHyatt Regency Santa Clara Residence Inn Boston Cambridge

15

Broad Portfolio Mix

Andaz San Diego – San Diego, CA

Geographic Diversity + Variety of Hotels =

Superior Positioning

Flexibility to choose the best type of asset in each market

Premium Full Service

~ 55% of Rooms

Lifestyle

~ 25% of Rooms

Urban Upscale

~ 20% of Rooms

• Traditional luxury and

upper upscale assets

featuring restaurants,

meeting space and a range

of other amenities

• Prime locations with

corporate, group, and

leisure demand generators

• Unique luxury and upper

upscale assets with smaller

footprints and more

modern, boutique style

• Emphasis on local influence

and unmatched experience

• One-of-a-kind restaurant

and bar experiences

• Premium branded select

service assets

• In proximity to multiple

demand generators in

urban locations

• Select service model allows

for efficient cost structure

and higher profit margin

17

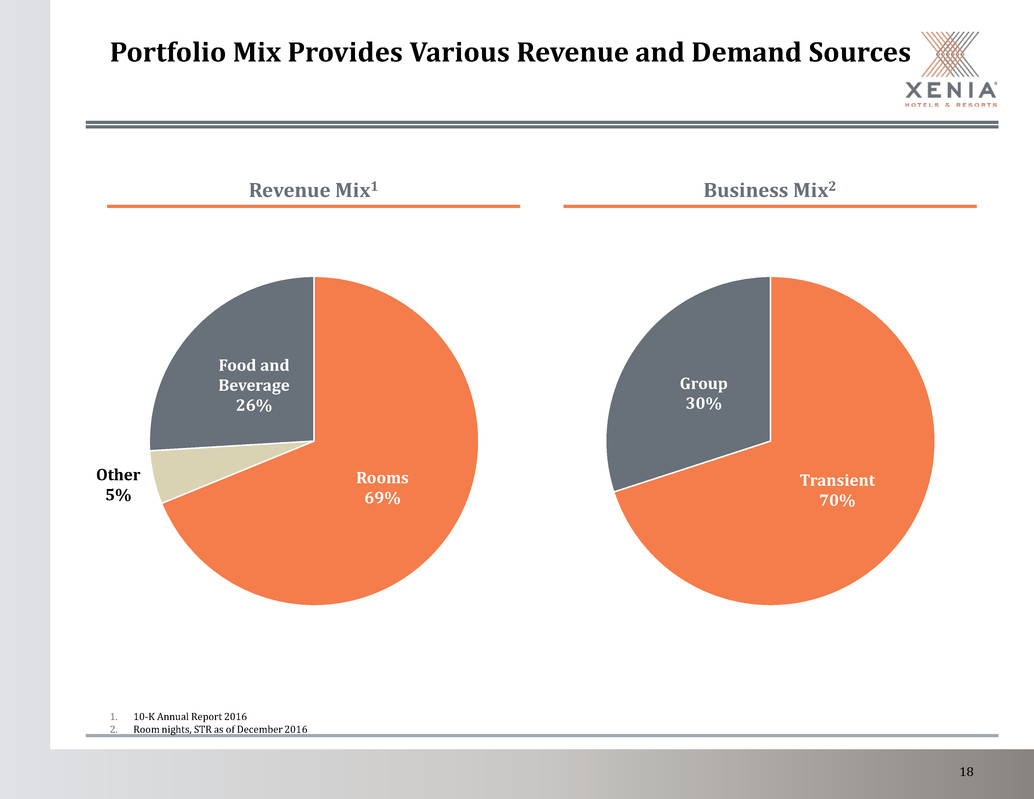

Portfolio Mix Provides Various Revenue and Demand Sources

1. 10-K Annual Report 2016

2. Room nights, STR as of December 2016

Business Mix2

Transient

70%

Group

30%

Revenue Mix1

Rooms

69%

Other

5%

Food and

Beverage

26%

18

Leisure as a Driver of Demand

Key leisure destination hotels have multiple

sources of demand resulting in 7-day-a-week

business.

In 2016, our key leisure destination

hotels achieved

• 82.4% Occupancy

• $234.09 ADR

• $192.93 RevPAR

In addition, several hotels in our portfolio

located outside of key leisure destinations

drive significant leisure business based on

their location in the market.

• Santa Clara

• Boston

• Orlando

• Houston

Marriott Napa Valley Hotel & Spa

Canary Santa Barbara

Aston Waikiki Beach Hotel

Hyatt Centric Key West Resort & Spa

Bohemian Hotel Celebration

Andaz Savannah

19

Focus on Quality

Hotel Commonwealth – Boston, MA

Focus on Quality Drives Portfolio Transformation

1. InvenTrust acquired two hotel portfolios in 2007, which were placed under Xenia’s asset management platform.

2. Includes Grand Bohemian Hotel Charleston and Grand Bohemian Hotel Mountain Brook.

Since inception in 2007, transformed portfolio and significantly improved quality

through strategic transactions. Only three hotels in current portfolio were owned in 2007

Over $5.5 billion of transaction activity

since 2007

$79

$152

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

2007 2016

Portfolio RevPAR

Acquisitions Dispositions

Prior

Platform1

80 Hotels 0 Hotels

2007-2009 25 Hotels 0 Hotels

2010 5 Hotels 7 Hotels

2011 3 Hotels 7 Hotels

2012 7 Hotels 15 Hotels

2013 14 Hotels 5 Hotels

2014 1 Hotel 55 Hotels

2015 5 Hotels2 1 Hotel

2016 1 Hotel 9 Hotels

21

Capital Investment Drives Internal Growth

Hotel Project

2015 Completions

Marriott San Francisco Airport Waterfront

Guestroom and bathroom renovation and addition of three

guest rooms

Hyatt Regency Santa Clara Guestroom renovation and addition of two guest rooms

Andaz Napa Guestroom, public areas and façade

2016 Completions

Hyatt Centric Key West Resort

Renovated bar, relocated new spa, guestroom renovation and

addition of two guest rooms

Marriott Napa Valley Hotel & Spa

Guestroom and bathroom renovation, pool, outdoor function

space, and meeting rooms

Hyatt Regency Santa Clara Hyatt Centric Key West Resort Marriott Napa Valley

• Xenia continually reviews opportunities to invest and recycle capital to maintain quality,

as well as increase long-term value and generate attractive returns.

Marriott San Francisco

Airport Waterfront

Note: Select projects

22

Capital Investment Drives Internal Growth (Cont.)

Hotel Project

2017 & 2018 Planned Projects

Andaz San Diego Guestroom renovation

Andaz Savannah Guestroom renovations

Hilton Garden Inn Washington DC Downtown Guestroom renovation

Hotel Monaco Chicago Guestroom renovation and restaurant repositioning

Hotel Monaco Denver Guestroom renovation

Hyatt Regency Santa Clara Lobby and meeting space renovation

Lorien Hotel and Spa Guestroom renovation

Marriott Chicago at Medical District/UIC Guestroom renovation

Marriott Dallas City Center Guestroom renovation

Marriott San Francisco Airport Waterfront Meeting space and lobby renovation

Marriott Woodlands Waterway Hotel Guestroom renovation

Residence Inn Denver Downtown Guestroom renovation

Westin Galleria Houston Guestroom renovation

Westin Oaks Houston Guestroom renovation

Marriott Dallas City Center Marriott Woodlands Waterway Hotel Residence Inn Denver DowntownHotel Monaco Chicago

Note: Select projects

23

Portfolio Weighted Towards Premium Hotels

Note: As a percentage of rooms. Totals may not equal 100% due to rounding

1. As defined by STR; Hotel Commonwealth included in Luxury (classified as Independent by STR)

Nearly 80% of rooms are Luxury or Upper Upscale1

Luxury

14%

Upper

Upscale

65%

Upscale

20%

Upper

Midscale

1%

Hotel Commonwealth

Andaz San Diego

24

Key Considerations for Portfolio Changes

Acquisitions Dispositions

Size Greater than $50 million Varies

Quality Upper upscale or luxury Varies- More heavily weighted towards upscale/midscale

Location

Top lodging market or key leisure destination

Desirable location within the market

Diversified demand generators

Secondary / tertiary market

Sub-optimal location within the market

Limited demand generators

Condition Appropriate required capital reinvestment (short and long-term)

Significant near-term capex requirements with

inadequate returns on investment

(e.g. PIP, competitive positioning capex, etc.)

Functional obsolescence

Barriers to Entry /

Supply

CBD or dense in-fill market

At or below replacement cost

Limited supply risk

(both in process and availability of land)

Low barriers to entry

Significant supply concerns

25

Differentiated Portfolio Management

Andaz Napa – Napa, CA

Differentiated Approach Drives Value Creation

Broad Footprint with Variety of Asset Types

Branded Hotels

Manager Diversification

Portfolio Management Platform Harvests Value

Multiple Demand and Revenue Sources

27

Asset Management Platform Drives Performance

Note: For those hotels operated by Marriott, our historical annual operating results represented here from 2011 to 2013 include a 52-53 week fiscal calendar used by Marriott at that time.

Otherwise presented for the calendar year. USALI 11 adjustments for 2014 when available and as reported by hotel operator.

1. Excludes hotels subsequently sold and the Andaz Napa due to earthquake disruption in the first year after acquisition

32%

33%

34%

35%

36%

37%

38%

39%

40%

$0

$100

$200

$300

$400

$500

$600

$700

Year Prior to Acquisition Acquisition Year Acquisition Year +1 Acquisition Year +2

$

M

ill

io

ns

Room Rev Other Rev GOP Margin

Properties Acquired Between 2010-20141

28

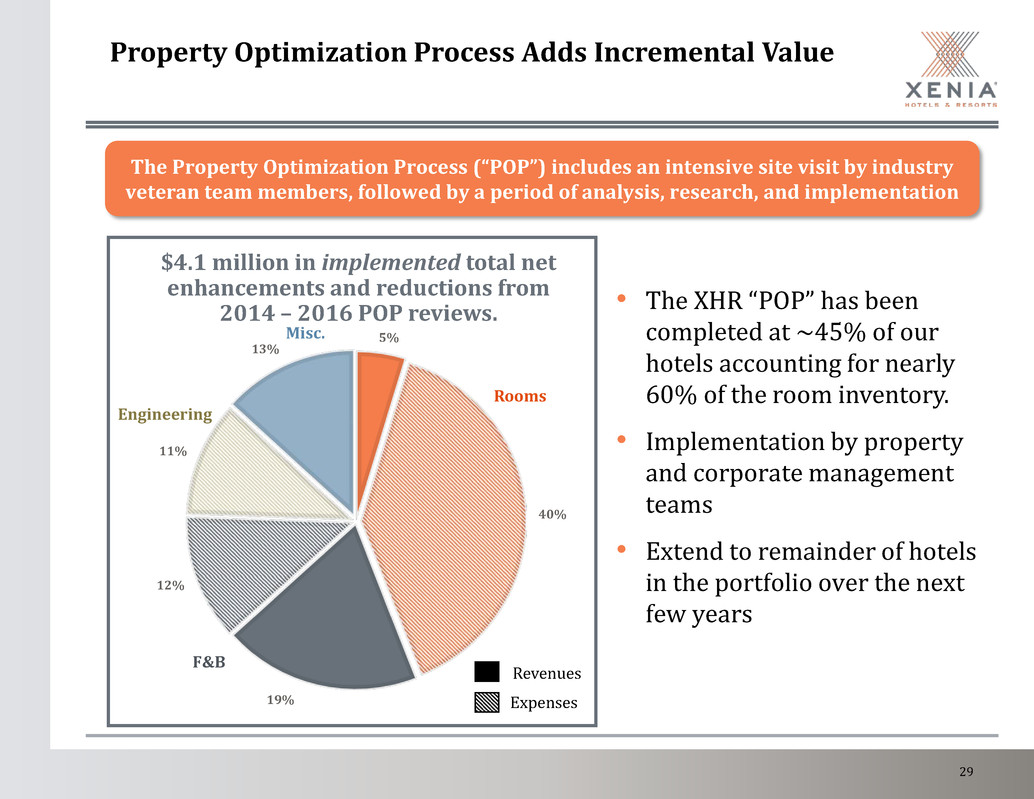

Property Optimization Process Adds Incremental Value

The Property Optimization Process (“POP”) includes an intensive site visit by industry

veteran team members, followed by a period of analysis, research, and implementation

Revenues

Expenses

Rooms

F&B

Engineering

Misc.

• The XHR “POP” has been

completed at ~45% of our

hotels accounting for nearly

60% of the room inventory.

• Implementation by property

and corporate management

teams

• Extend to remainder of hotels

in the portfolio over the next

few years

$4.1 million in implemented total net

enhancements and reductions from

2014 – 2016 POP reviews.

5%

40%

19%

12%

11%

13%

29

Case Study: Marriott San Francisco Airport Waterfront

Improvement Opportunity

• Need for capital investment with last renovations

completed in 2006 through 2008.

• Through strategic relationship with Marriott, launched

the first “M Club Lounge” in the Marriott system.

• Completed $18.4 million comprehensive guest room and

bathroom renovation in 2015.

• “POP” analysis and other strategic improvements

initiated and implemented post-renovation.

• $4.4 million meeting space and public area renovations

to be completed in 2017.

Acquisition

March 2012

$108 million - $157,664 per key

Total Current Investment: $132.8 million

30

Case Study: Marriott San Francisco Airport Waterfront

(continued)

1. YE 2016 compared to T12 at acquisition.

For hotels operated by Marriott, historical annual operating results represented here, 2013 and prior, include a 52-53 week fiscal calendar used by Marriott at that time.

Asset Performance1

RevPAR $82.90 or 73.3%

Total Revenue $24.4 million or 56.3%

GOP $17.0 million or 127.8%

EBITDA Margin 1,040 bps

Market Share 8.9 index points

$9,335

EBITDA

• Optimized market mix with increased focus

on negotiated corporate and high quality

group business

• Incremental revenue and savings

implemented based on “Property

Optimization Process” findings

o Improved efficiencies in housekeeping

and engineering operations

o Implemented amenity fees

o Optimized F&B items and offerings

$21,642

31

Strong Financial Profile

Hilton Garden Inn Washington D.C.

Conservative Leverage Profile

Sources: SNL Financial

1. 2016 Adjusted EBITDA as reported; net debt as of 12/31/2016

2. Adjusted EBITDA definition varies from Line of Credit definition. Per Line of Credit definition Net Debt/Adjusted EBITDA is 3.3x

Net Senior Capital / 2016 Adjusted EBITDA1

7.3x

7.0x

4.8x 4.7x

3.5x

3.1x 3.1x

2.8x

2.3x

HT FCH PEB CHSP LHO XHR RLJ DRH SHO

Net Debt Preferred Equity

2

33

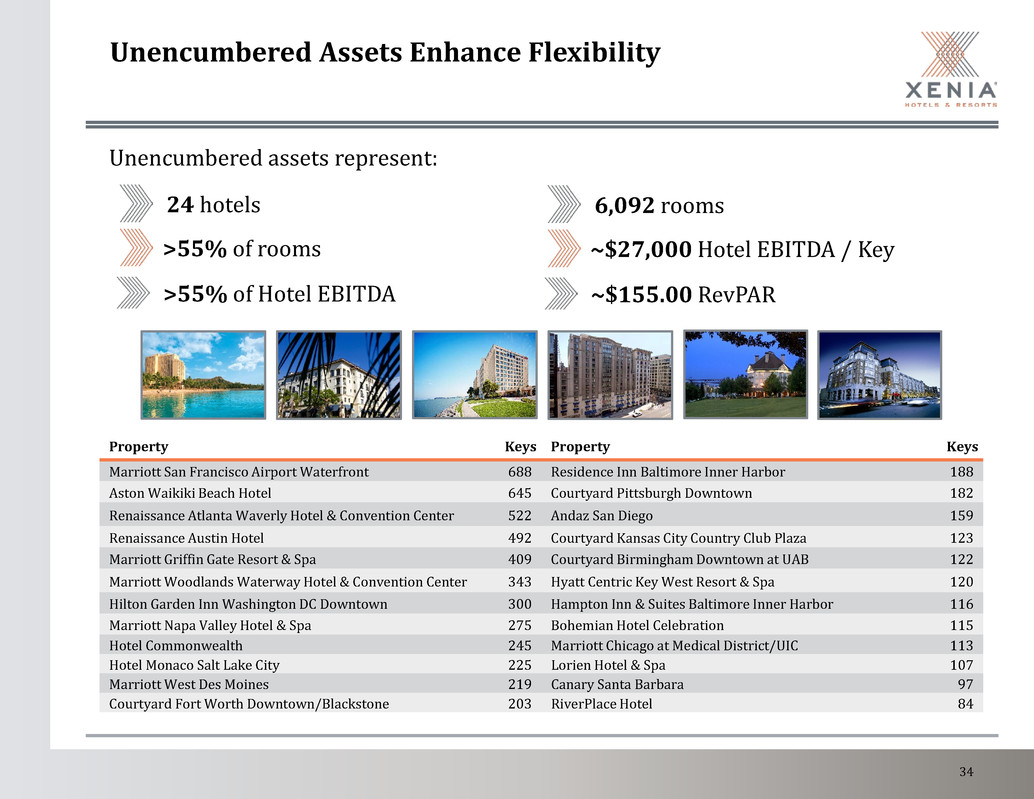

Unencumbered Assets Enhance Flexibility

Property Keys Property Keys

Marriott San Francisco Airport Waterfront 688 Residence Inn Baltimore Inner Harbor 188

Aston Waikiki Beach Hotel 645 Courtyard Pittsburgh Downtown 182

Renaissance Atlanta Waverly Hotel & Convention Center 522 Andaz San Diego 159

Renaissance Austin Hotel 492 Courtyard Kansas City Country Club Plaza 123

Marriott Griffin Gate Resort & Spa 409 Courtyard Birmingham Downtown at UAB 122

Marriott Woodlands Waterway Hotel & Convention Center 343 Hyatt Centric Key West Resort & Spa 120

Hilton Garden Inn Washington DC Downtown 300 Hampton Inn & Suites Baltimore Inner Harbor 116

Marriott Napa Valley Hotel & Spa 275 Bohemian Hotel Celebration 115

Hotel Commonwealth 245 Marriott Chicago at Medical District/UIC 113

Hotel Monaco Salt Lake City 225 Lorien Hotel & Spa 107

Marriott West Des Moines 219 Canary Santa Barbara 97

Courtyard Fort Worth Downtown/Blackstone 203 RiverPlace Hotel 84

Unencumbered assets represent:

>55% of rooms

24 hotels

>55% of Hotel EBITDA

~$27,000 Hotel EBITDA / Key

6,092 rooms

~$155.00 RevPAR

34

Debt Maturity Profile, inclusive of extensions

Note: Schedule as of March 1, 2017. Assumes all potential extension options are exercised

1. Includes seven floating rate loans for which LIBOR has been fixed over the life of the loans

2. Unsecured Line of Credit of $400 million shown at fully extended maturity

No maturities through April 2018; manageable maturities in 2018 and 2019

Fixed 1

Floating

Line of Credit Capacity 2

WA Fixed Rate

Maturing Debt

N/A N/A N/A 3.13% 2.79% 3.77% 4.14% N/A 4.48% 4.53%

WA Floating Rate

Maturing Debt

N/A 3.04% 2.66% 3.01% 3.09% N/A N/A N/A N/A N/A

# Loans

Maturing

0 2 1 8 3 3 1 0 1 1

$95

$175

$266

$60 $63 $60 $73 $55

$105

$132

$400

$0

$100

$200

$300

$400

$500

$600

$700

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

35

Dividends, Share Repurchases, and TSR Highlights

1. Share price as of 2/24/2017

2. Calculated using 2016 Adjusted FFO less 5% FF&E reserve on full year 2016 revenues

3. Peers include APLE, CHSP, DRH, FCH, HT, LHO, PEB, RLJ, SHO

Dividend Yield1

6.0%

Payout Ratio2

61.6%

Strong

Dividend Dividend / Share

$1.10

2016 Coverage

1.62x

Executing against share repurchase authorization

Approximately $75 million purchased in 2016

8.8x weighted average EBITDA multiple

Over $100 million remaining authorization

2016 Total Shareholder Return

XHR 35.5%

Comparable Lodging

REITs3

16.6%

MSCI US REIT Index 8.6%

36

What You Can Continue to Expect from Us

Opportunistic investing

Transaction-oriented mindset with focus on quality

Aggressive asset management initiatives

Healthy balance sheet throughout the cycle

Leveraging relationships with brands and managers

37

Non-GAAP Financial Measures

We consider the following non-GAAP financial measures useful to investors as key supplemental measures of our operating performance: Gross Operating Profit (GOP), GOP margin, EBITDA, Adjusted EBITDA, FFO and

Adjusted FFO. These non-GAAP financial measures should be considered along with, but not as alternatives to, net income or loss, operating profit, cash from operations, or any other operating performance measure as

prescribed per GAAP. Please refer to the Company's filings with the SEC and its earnings releases, which are available in the investor relations section of the Company’s website at www.xeniareit.com, for disclosure of the

Company's net income, for reconciliations of GOP and GOP Margin, EBITDA and EBITDA Margin, FFO and Adjusted FFO, Adjusted FFO per diluted share, to net income and for additional detail on the Company's use of non-

GAAP measures.

Gross Operating Profit (GOP) and GOP Margin

We calculate hotel GOP in accordance with the Uniform System Accounts for the Lodging Industry (USALI) Eleventh Revised Edition, which defines GOP as net income or loss (calculated in accordance with GAAP) after

adding back base and incentive management fees, non-operating income and expenses, replacement reserve and excluding franchise fees. We believe GOP provides another financial measure in evaluating and facilitating

comparison of operating performance between periods of our underlying hotel property entities.

EBITDA and Adjusted EBITDA

EBITDA is a commonly used measure of performance in many industries and is defined as net income or loss (calculated in accordance with GAAP) excluding interest expense, provision for income taxes (including income

taxes applicable to sale of assets) and depreciation and amortization. The Company considers EBITDA useful to an investor regarding results of operations, in evaluating and facilitating comparisons of operating

performance between periods and between REITs by removing the impact of capital structure (primarily interest expense) and asset base (primarily depreciation and amortization) from operating results, even though

EBITDA does not represent an amount that accrues directly to common stockholders. In addition, EBITDA is used as one measure in determining the value of hotel acquisitions and dispositions and along with FFO and

Adjusted FFO, it is used by management in the annual budget process for compensation programs. The Company further adjusts EBITDA for certain additional items such as hotel property acquisitions and pursuit costs,

amortization of share-based compensation, equity investment adjustments, the cumulative effect of changes in accounting principles, impairment of real estate assets, operating results from properties sold and other costs it

believes do not represent recurring operations and are not indicative of the performance of its underlying hotel property entities. The Company believes Adjusted EBITDA provides investors with another financial measure

in evaluating and facilitating comparison of operating performance between periods and between REITs that report similar measures. Hotel EBITDA and Hotel EBITDA Margin The Company calculates Hotel EBITDA in

accordance with USALI, which defines hotel EBITDA as net income or loss (calculated in accordance with GAAP) after adding back replacement reserves. Hotel EBITDA Margin is calculated by dividing Hotel EBITDA by Total

Operating Revenues.

Hotel EBITDA and Hotel EBITDA Margin

The Company calculates Hotel EBITDA in accordance with the current edition of USALI, which is defined as net income or loss (calculated in accordance with GAAP) after adding back replacement reserves. Hotel EBITDA

Margin is calculated by dividing Hotel EBITDA by Total Operating Revenues.

FFO and Adjusted FFO

We calculate FFO in accordance with standards established by the National Association of Real Estate Investment Trusts (NAREIT), which defines FFO as net income or loss (calculated in accordance with GAAP), excluding

real estate-related depreciation, amortization and impairments, gains (losses) from sales of real estate, the cumulative effect of changes in accounting principles, similar adjustments for unconsolidated partnerships and

joint ventures, and items classified by GAAP as extraordinary. Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values

instead have historically risen or fallen with market conditions, most industry investors consider presentations of operating results for real estate companies that use historical cost accounting to be insufficient by

themselves. We believe that the presentation of FFO provides useful supplemental information to investors regarding our operating performance by excluding the effect of real estate depreciation and amortization, gains

(losses) from sales for real estate, impairments of real estate assets, extraordinary items and the portion of these items related to unconsolidated entities, all of which are based on historical cost accounting and which may

be of lesser significance in evaluating current performance. We believe that the presentation of FFO can facilitate comparisons of operating performance between periods and between REITs, even though FFO does not

represent an amount that accrues directly to common stockholders. Our calculation of FFO may not be comparable to measures calculated by other companies who do not use the NAREIT definition of FFO or do not

calculate FFO per diluted share in accordance with NAREIT guidance. Additionally, FFO may not be helpful when comparing us to non-REITs.

We further adjust FFO for certain additional items that are not in NAREIT’s definition of FFO such as hotel property acquisition and pursuit costs, amortization of debt origination costs and share-based compensation,

operating results from properties that are sold and other expenses we believe do not represent recurring operations. We believe that Adjusted FFO provides investors with useful supplemental information that may

facilitate comparisons of ongoing operating performance between periods and between REITs that make similar adjustments to FFO and is beneficial to investors’ complete understanding of our operating performance.

FFO, Adjusted FFO, EBITDA and Adjusted EBITDA do not represent cash generated from operating activities under GAAP and should not be considered as alternatives to net income or loss, operating profit, cash flows from

operations or any other operating performance measure prescribed by GAAP. Although we present and use FFO, Adjusted FFO, EBITDA and Adjusted EBITDA because we believe they are useful to investors in evaluating and

facilitating comparisons of our operating performance between periods and between REITs that report similar measures, the use of these non-GAAP measures has certain limitations as analytical tools. These non-GAAP

financial measures are not measures of liquidity, nor are they indicative of funds available to fund our cash needs, including our ability to fund capital expenditures, contractual commitments, working capital, service debt or

make cash distributions. These measures do not reflect cash expenditures for long-term assets and other items that we have incurred and will incur. These non-GAAP financial measures may include funds that may not be

available for management’s discretionary use due to functional requirements to conserve funds for capital expenditures, property acquisitions, and other commitments and uncertainties. These non-GAAP financial measures

as presented may not be comparable to non-GAAP financial measures as calculated by other real estate companies. Therefore, these measures should not be considered in isolation or as an alternative to GAAP measures. For

a reconciliation of net income (loss) to EBITDA and Adjusted EBITDA for historical periods presented and our calculation of Hotel EBITDA, please refer to our website www.xeniareit.com

Adjusted FFO per diluted share

The Company calculates Adjusted FFO per diluted share by dividing the Adjusted FFO for the respective period by the diluted weighted average number of common stock shares for the corresponding period. The Company’s

diluted weighted average number of common shares outstanding is calculated by taking the weighted average of the common stock outstanding for the respective period plus the effect of any dilutive securities. Any anti-

dilutive securities are excluded from the diluted earnings per-share calculation.

38