Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Delek Logistics Partners, LP | dkl-8kxinvestorpresentatio.htm |

Delek Logistics Partners, LP

Investor Presentation

March 2017

2

Disclaimers

These slides and any accompanying oral and written presentations contain forward-looking statements by Delek Logistics Partners, LP (defined as “we”, “our”, or

”Delek Logistics”) that are based upon our current expectations and involve a number of risks and uncertainties. Statements concerning current estimates,

expectations and projections about our future results, performance, prospects and opportunities and other statements, concerns, or matters that are not

historical facts are "forward-looking statements," as that term is defined under United States securities laws.

Investors are cautioned that the following important factors, among others, may affect these forward-looking statements: our substantial dependence on Delek

US Holdings, Inc. (“Delek”) (NYSE: DK) or its assignees and their respective ability to pay us under our commercial agreements; risks and costs relating to the age

and operational hazards of our assets including, without limitation, costs, penalties, regulatory or legal actions and other affects related to releases, spills and

other hazards inherent in transporting and storing crude oil and intermediate and finished petroleum products; the timing and extent of changes in commodity

prices and demand for crude oil and refined products; the suspension, reduction or termination of Delek's or its assignees' or any third-party's obligations under

our commercial agreements; as it relates to potential future growth opportunities and other potential benefits for Delek Logistics, the risks and uncertainties

related to the expec ted timing and likelihood of completion of the proposed merger between Delek and Alon USA Energy, Inc. (“Alon”)(NYSE:ALJ), including the

timing, receipt and terms and conditions of any required governmental and regulatory approvals of the proposed merger that could reduce anticipated benefits

or cause the parties to abandon the transaction, the ability to successfully integrate the businesses of Delek and Alon, the occurrence of any event, change or

other circumstances that could give rise to the termination of the merger agreement, the possibility that stockholders of Delek may not approve the issuance of

new shares of common stock as consideration for the merger or that stockholders of Alon may not approve the merger agreement, the risk that the parties may

not be able to satisfy the conditions to the proposed transaction in a timely manner or at all, risks related to disruption of management time from ongoing

business operations due to the proposed transaction, the risk that problems may arise in successfully integrating the businesses of the companies, which may

result in the combined company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve cost-

cutting synergies or it may take longer than expected to achieve those synergies and other factors discussed in our other fi lings with the United States Securities

and Exchange Commission.

Forward-looking statements should not be read as a guarantee of future performance or results and will not be accurate indications of the times at, or by which

such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management's good faith belief

with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in

the statements. We undertake no obligation to update or revise any such forward-looking statements.

Non-GAAP Disclosures:

Delek Logistics believes that the presentation of EBITDA, distributable cash flow and distribution coverage ratio provide useful information to investors in

assessing its financial condition, its results of operations and cash flow its business is generating. EBITDA, distributable cash flow and distribution coverage ratio

should not be considered in isolation or as alternatives to net income, operating income, cash from operations or any other measure of financial performance or

liquidity presented in accordance with U.S. GAAP. EBITDA, distributable cash flow and distribution coverage ratio have important limitations as analytical tools

because they exclude some, but not all items that affect net income and net cash provided by operating activities. Additionally, because EBITDA and distributable

cash flow may be defined differently by other partnerships in its industry, Delek Logistics' definitions of EBITDA and distributable cash flow may not be

comparable to similarly titled measures of other partnerships. Please see the appendix for a reconciliation of EBITDA, and distributable cash flow to their most

directly comparable financial measures calculated and presented in accordance with U.S. GAAP.

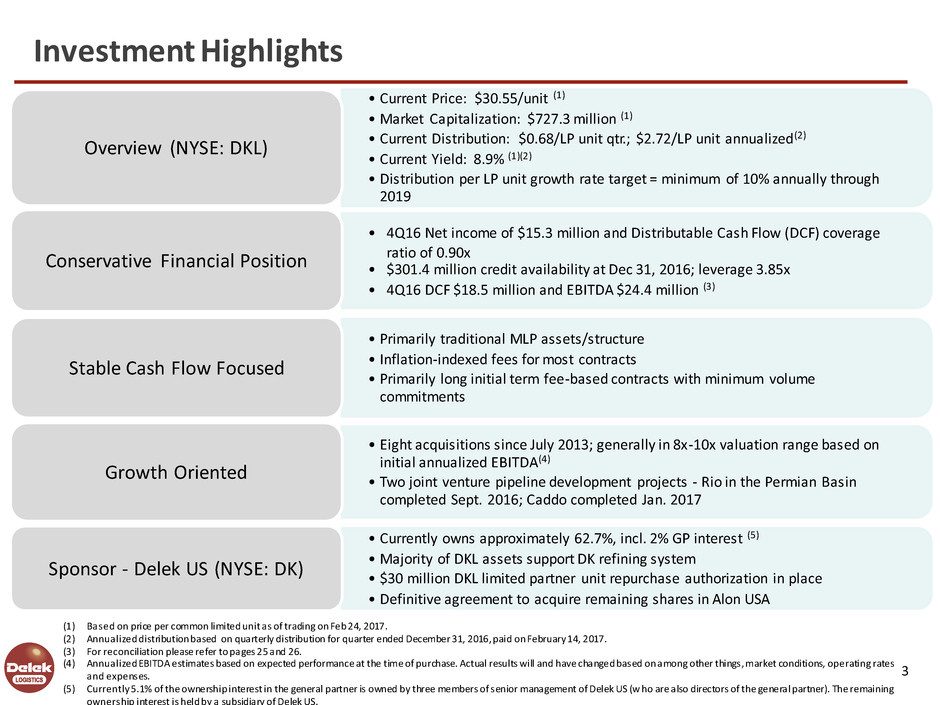

Investment Highlights

(1) Based on price per common limited unit as of trading on Feb 24, 2017.

(2) Annualized distribution based on quarterly distribution for quarter ended December 31, 2016, paid on February 14, 2017.

(3) For reconciliation please refer to pages 25 and 26.

(4) Annualized EBITDA estimates based on expected performance at the time of purchase. Actual results will and have changed based on among other things, market conditions, operating rates

and expenses.

(5) Currently 5.1% of the ownership interest in the general partner is owned by three members of senior management of Delek US (w ho are also directors of the general partner). The remaining

ownership interest is held by a subsidiary of Delek US.

3

• Current Price: $30.55/unit (1)

•Market Capitalization: $727.3 million (1)

• Current Distribution: $0.68/LP unit qtr.; $2.72/LP unit annualized(2)

• Current Yield: 8.9% (1)(2)

• Distribution per LP unit growth rate target = minimum of 10% annually through

2019

Overview (NYSE: DKL)

• 4Q16 Net income of $15.3 million and Distributable Cash Flow (DCF) coverage

ratio of 0.90x

• $301.4 million credit availability at Dec 31, 2016; leverage 3.85x

• 4Q16 DCF $18.5 million and EBITDA $24.4 million (3)

Conservative Financial Position

• Primarily traditional MLP assets/structure

• Inflation-indexed fees for most contracts

• Primarily long initial term fee-based contracts with minimum volume

commitments

Stable Cash Flow Focused

• Eight acquisitions since July 2013; generally in 8x-10x valuation range based on

initial annualized EBITDA(4)

• Two joint venture pipeline development projects - Rio in the Permian Basin

completed Sept. 2016; Caddo completed Jan. 2017

Growth Oriented

• Currently owns approximately 62.7%, incl. 2% GP interest (5)

•Majority of DKL assets support DK refining system

• $30 million DKL limited partner unit repurchase authorization in place

• Definitive agreement to acquire remaining shares in Alon USA

Sponsor - Delek US (NYSE: DK)

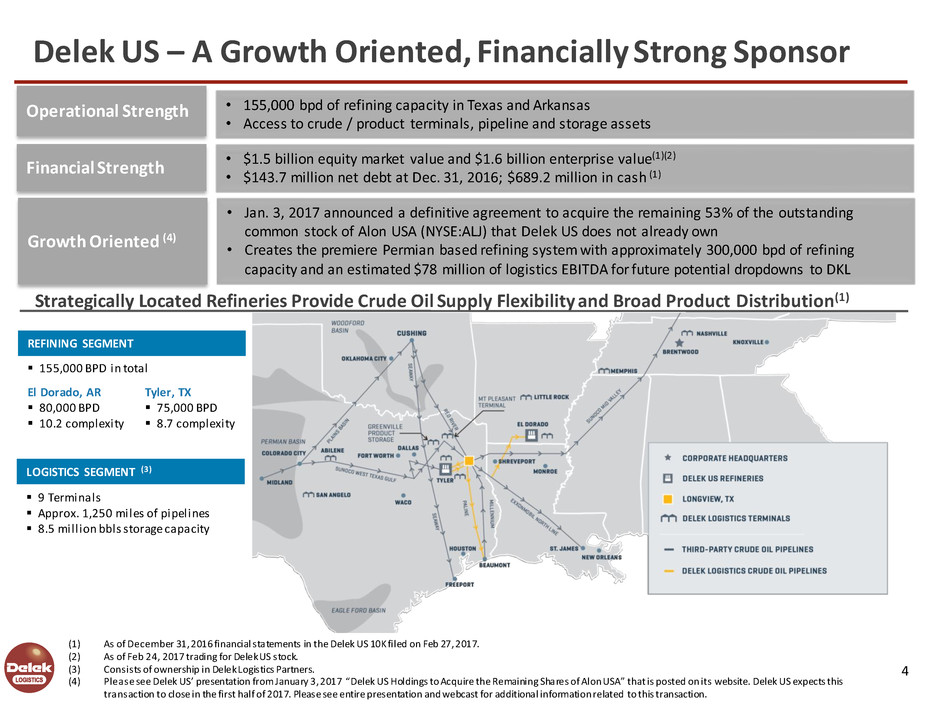

Delek US – A Growth Oriented, Financially Strong Sponsor

• 155,000 bpd of refining capacity in Texas and Arkansas

• Access to crude / product terminals, pipeline and storage assets

Operational Strength

(1) As of December 31, 2016 financial statements in the Delek US 10K filed on Feb 27, 2017.

(2) As of Feb 24, 2017 trading for Delek US stock.

(3) Consists of ownership in Delek Logistics Partners.

(4) Please see Delek US’ presentation from January 3, 2017 “Delek US Holdings to Acquire the Remaining Shares of Alon USA” that is posted on its website. Delek US expects this

transaction to close in the first half of 2017. Please see entire presentation and webcast for additional information related to this transaction.

Strategically Located Refineries Provide Crude Oil Supply Flexibility and Broad Product Distribution(1)

• $1.5 billion equity market value and $1.6 billion enterprise value(1)(2)

• $143.7 million net debt at Dec. 31, 2016; $689.2 million in cash (1)

Financial Strength

REFINING SEGMENT

155,000 BPD in total

El Dorado, AR

80,000 BPD

10.2 complexity

Tyler, TX

75,000 BPD

8.7 complexity

9 Terminals

Approx. 1,250 miles of pipelines

8.5 mill ion bbls storage capacity

LOGISTICS SEGMENT (3)

4

• Jan. 3, 2017 announced a definitive agreement to acquire the remaining 53% of the outstanding

common stock of Alon USA (NYSE:ALJ) that Delek US does not already own

• Creates the premiere Permian based refining system with approximately 300,000 bpd of refining

capacity and an estimated $78 million of logistics EBITDA for future potential dropdowns to DKL

Growth Oriented (4)

Delek Acquisition of Alon to Create Premier Permian Based Refining System

DKL positioned to provide logistics support for 300,000 bpd of Crude Throughput Capacity (~69% Permian Basin Based)

5

• Creates the premier Permian based refining company

• 7th largest independent refiner with 302,000 barrels

per day crude throughput capacity

• Access to approximately 207,000 barrels per day of

Permian sourced crude

• Largest exposure to Permian crude of the independent

refiners as percentage of crude slate

• Permian Basin production expected to continue to

grow

• Improved drilling efficiencies have benefited

production economics

• DKL positioned to benefit by providing future

logistics support to a larger refining system

Permian Basin Crude Oil Production (2)

Combined Access to Permian Basin Crude

Permian Crude Access as % of Crude Slate (3)

1) Barclays research. Company reports. TSO includes WNR.

2) TPH Research report, “Permian Basin Crude Oil Supply/Demand”, Drillinginfo , EIA, - December 2016.

3) TPH Research; Crude slate - TSO includes WNR acquisition; WNR includes 100% of NTI; PBF includes both Chalmette & Torrance

Note: Information on this slide is derived from Delek US’ presentation from January 3, 2017 “Delek US Holdings to Acquire the Remaining Shares of Alon USA” that is posted o n its

website. Delek US expects this transaction to close in the first half of 2017. Please see entire presentation and webcast for additional information related to this transaction.

90 117

207

61%

75%

69%

0%

20%

40%

60%

80%

0

50

100

150

200

250

ALJ DK Combined

%

o

f

C

ru

de

S

la

te

In

0

0

0

b

p

d

Refining Peers by Crude Capacity (Mbbls) (1)

185 302

443

879

1,149

1,794

2,107

2,485

CVR Energy Delek + Alon Holly

Frontier

PBF Energy Tesoro Marathon

Petroleum

Phillips 66 Valero

0

1,000

2,000

3,000

4,000

2009 2011 2013 2015E 2017E 2019E

In

0

00

b

pd

0%

20%

40%

60%

80%

%

o

f

cr

ud

e

sl

at

e

Delek Acquisition of Alon to Create Strong Platform for Logistics Growth

Increases Dropdown Inventory; Growing Logistics Assets Support Larger Crude Sourcing and Product Marketing System

6

• Delek Logistics Partners provides

platform to unlock logistics value

• Increased access to Permian and

Delaware basin through presence of

Big Spring refinery

• Improves ability to develop

crude oil gathering and

terminalling assets

1) 2017E based on current sell-side consensus per Factset as of 12/30/16. Information for illustrative purposes only to show potential based on estimated dropdown assets listed.

Actual amounts will vary based on market conditions, which assets are dropped, timing of dropdowns, actual performance of the assets and Delek Logistics in the future.

2) Based on 7x multiple. Assumed for illustrative purposes. Will vary based on market conditions and valuations at the time of the dropdown of each asset.

3) Please see slide 27 for a reconciliation of EBITDA.

Note: This slide is derived from Delek US’ presentation from January 3, 2017 “Delek US Holdings to Acquire the Remaining Sha res of Alon USA” that is posted on its website. Delek US

expects this transaction to close in the first half of 2017. Please see entire presentation and webcast for additional information related to this transaction.

Strong EBITDA Growth Profile Supporting Distribution Growth (1)

$112

$12

$34

$32 $190

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

$200.0

2017 DKL

EBITDA (1)

Asphalt Drop

down Inventory

Big Spring Drop

Down Inventory

Krotz Springs

Drop Down

Inventory

Total EBITDA

Potential

• Drop downs, excluding Krotz Springs, create significant cash flow to Delek US

• $42-$50m EBITDA equates to ~$300-350m cash proceeds to DK (2)

• Provides visibility for continued DKL LP double digit distribution growth

• Significant GP benefits

Dropdown Item

Estimated EBITDA

($ million / year)

Asphalt Terminals $11-13

Big Spring Asphalt Terminal $9-11

Big Spring assets $8-10

Big Spring Wholesale Marketing $14-16

Total Excluding Krotz Springs $42-50

Krotz Springs assets $30-34

Total $72-84 (3)

($ in millions)

Delek Logistics Partners, LP

Overview

Stable Asset Base Positioned for Growth

8

~765 miles (1) of crude

and product

transportation

pipelines, including the

195 mile crude oil

pipeline from Longview

to Nederland, TX

~ 600 mile crude oil

gathering system in AR

Storage facilities with

7.3 million barrels of

active shell capacity

Rail Offloading Facility

Pipelines/Transportation

Segment

Wholesale and

marketing business in

Texas

9 light product

terminals: TX, TN, AR

Approx. 1.2 million

barrels of active shell

capacity

Wholesale/ Terminalling

Segment

Growing logistics assets support crude sourcing and product marketing for customers

1) Includes approximately 240 miles of leased pipeline capacity.

Improving Performance and Financial Flexibility to Support Growth

9

1) Amounts provided in the Nov. 1, 2012 IPO prospectus showing pro forma results forecasted performance for 12 months ending Sept. 30, 2013. Reconciliation on pg. 25

2) Reconciliation provided on page 25. Results in 2013 and 2014 are as reported excluding predecessor costs related to the drop down of the tank farms and product terminals at both Tyler and El Dorado

during the respective periods. Also, excluded are predecessor costs related to the crude oil storage tank and rail offloading racks acquired in March 2015. Tyler assets were acquired in July 2013 and El

Dorado assets acquired Feb. 2014.

3) Reconciliation on pg. 25.

4) Reconciliation on pg. 26.

Solid Net Income and EBITDA performance since IPO in Nov. 2012

$36.0

$47.8

$72.0 $66.8 $62.8

$48.9

$63.8

$95.4 $96.5 $97.3

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

Forecast 12 Months Ended

9/30/13(1)

2013 (2) 2014 (2) 2015 (3) 2016 (3)

$

in

m

ill

io

n

s

Net Income EBITDA

$52.9

$80.3 $81.1 $81.7

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

$90.0

2013 2014 2015 2016

$

in

m

ill

ion

s

Distributable Cash Flow

DCF supported distribution growth (4)

$164.8

$251.8

$351.6 $392.6

$223.2

$440.8

$347.0 $301.4

-$50

$50

$150

$250

$350

$450

$550

$650

$750

Dec. 31, 2013 Dec. 31, 2014 Dec. 31, 2015 31-Dec-16

$

in

m

ill

ion

s

Borrowings Excess Capacity

Financial Flexibility to support continued growth

Increased Distribution with Conservative Coverage and Leverage

10

Distribution per unit has been increased sixteenth consecutive times since the IPO

$0.375 $0.385 $0.395 $0.405 $0.415 $0.425

$0.475 $0.490 $0.510 $0.530 $0.550

$0.570 $0.590 $0.610 $0.630 $0.655

$0.680

MQD (1) 1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 3Q 14 4Q 14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Increased 81% through 4Q 2016 distribution

1.39x 1.32x 1.35x 1.30x

1.61x 2.02x 1.42x 1.67x

1.23x 1.47x 1.50x 1.17x 1.19x 1.31x 0.99x 0.90x

1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 4Q15 1Q16 2Q16 3Q16 4Q16

Distributable Cash Flow Coverage Ratio (2)(3)

1.70x 1.58x

2.28x 2.40x

3.21x 2.69x 2.55x 2.56x 3.00x 3.14x

3.11x 3.49x 3.48x 3.47x 3.70x 3.85x

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Revolver Leverage Ratio (4)

(1) MQD = minimum quarterly distribution set pursuant to the Partnership Agreement.

(2) Distribution coverage based on distributable cash flow divided by distribution amount in each period. Please see page 26 for reconciliation.

(3) 4Q16 based on total distributions paid on February 14, 2017.

(4) Leverage ratio based on LTM EBITDA as defined by credit facility covenants for respective periods.

Avg. 1.35x in 2013

Avg. 1.68x in 2014

Avg. 1.37x in 2015

Avg. 1.09x in 2016

Going Forward

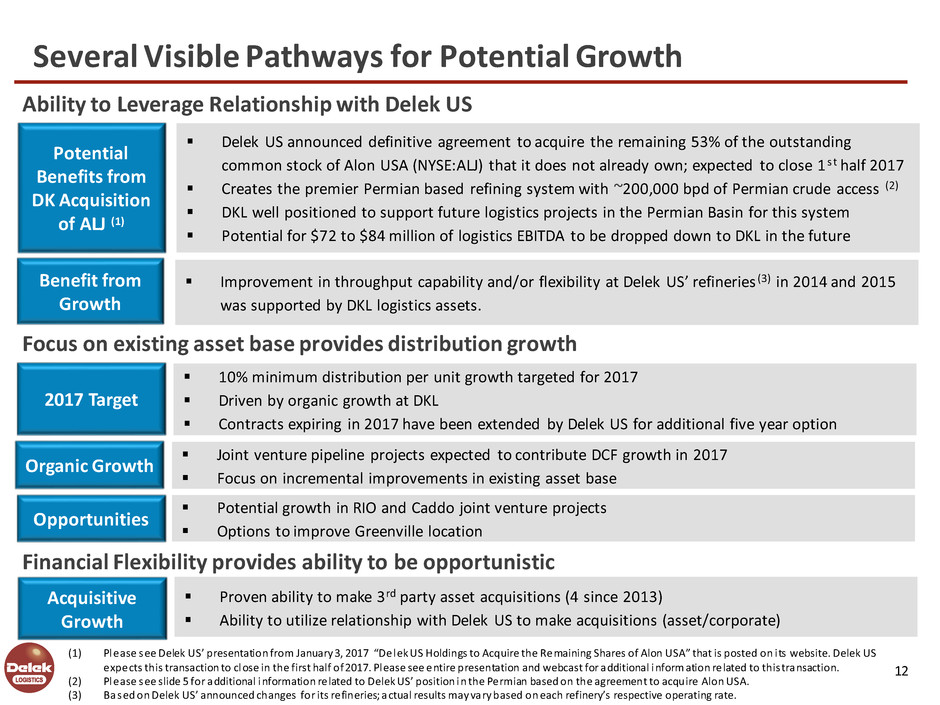

Several Visible Pathways for Potential Growth

12

2017 Target

Acquisitive

Growth

10% minimum distribution per unit growth targeted for 2017

Driven by organic growth at DKL

Contracts expiring in 2017 have been extended by Delek US for additional five year option

Proven ability to make 3rd party asset acquisitions (4 since 2013)

Ability to utilize relationship with Delek US to make acquisitions (asset/corporate)

Focus on existing asset base provides distribution growth

(1) Please see Delek US’ presentation from January 3, 2017 “Delek US Holdings to Acquire the Remaining Shares of Alon USA” that is posted on i ts website. Delek US

expects this transaction to close in the first half of 2017. Please see entire presentation and webcast for additional inform ation related to this transaction.

(2) Please see slide 5 for additional information related to Delek US’ position in the Permian based on the agreement to acquire Alon USA.

(3) Based on Delek US’ announced changes for its refineries; actual results may vary based on each refinery’s respective operating rate.

Organic Growth

Joint venture pipeline projects expected to contribute DCF growth in 2017

Focus on incremental improvements in existing asset base

Financial Flexibility provides ability to be opportunistic

Opportunities

Potential growth in RIO and Caddo joint venture projects

Options to improve Greenville location

Benefit from

Growth

Improvement in throughput capability and/or flexibility at Delek US’ refineries (3) in 2014 and 2015

was supported by DKL logistics assets.

Ability to Leverage Relationship with Delek US

Potential

Benefits from

DK Acquisition

of ALJ (1)

Delek US announced definitive agreement to acquire the remaining 53% of the outstanding

common stock of Alon USA (NYSE:ALJ) that it does not already own; expected to close 1 st half 2017

Creates the premier Permian based refining system with ~200,000 bpd of Permian crude access (2)

DKL well positioned to support future logistics projects in the Permian Basin for this system

Potential for $72 to $84 million of logistics EBITDA to be dropped down to DKL in the future

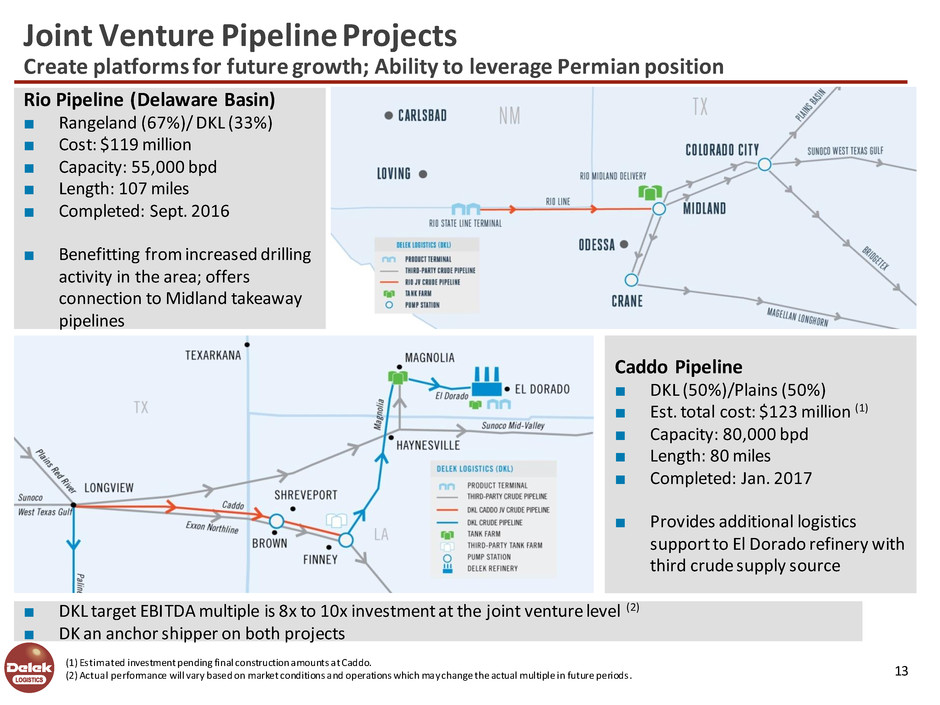

Joint Venture Pipeline Projects

13

Caddo Pipeline

■ DKL (50%)/Plains (50%)

■ Est. total cost: $123 million (1)

■ Capacity: 80,000 bpd

■ Length: 80 miles

■ Completed: Jan. 2017

■ Provides additional logistics

support to El Dorado refinery with

third crude supply source

Rio Pipeline (Delaware Basin)

■ Rangeland (67%)/ DKL (33%)

■ Cost: $119 million

■ Capacity: 55,000 bpd

■ Length: 107 miles

■ Completed: Sept. 2016

■ Benefitting from increased drilling

activity in the area; offers

connection to Midland takeaway

pipelines

(1) Estimated investment pending final construction amounts at Caddo.

(2) Actual performance will vary based on market conditions and operations which may change the actual multiple in future periods.

■ DKL target EBITDA multiple is 8x to 10x investment at the joint venture level (2)

■ DK an anchor shipper on both projects

Create platforms for future growth; Ability to leverage Permian position

Peer Comparisons (1)

14

Current Yield as of 2/24/17

Leverage Ratio (1)

2.7x

3.5x 3.6x 3.9x 4.0x

4.1x

5.0x 5.4x 5.4x 5.5x

6.0x

-

1.0

2.0

3.0

4.0

5.0

6.0

7.0

WNRL MPLX VLP DKL MMP HEP EPD PSXP SXL PAA TLLP

8.9% 8.2% 8.2% 7.3% 7.0% 6.7% 6.5% 5.9% 5.6% 4.4% 4.0% 3.3%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

DKL SXL PBFX WNRL PAA HEP TLLP EPD MPLX MMP PSXP VLP

(1) DKL based on a combination of 3Q 2016 and 4Q 2016 reported results depending on timing of the earnings release. Peer inform ation based on company reports and Capital IQ 2/22/17.

15

Questions and Answers

Majority of assets support

Delek US‘ strategically

located inland refining

system

Inflation-indexed fees for

most contracts

Majority of all margin

generated by long term,

fee-based contracts with

volume minimums

Agreements with Delek US

related to capex/opex

reimbursement and limit

Delek US force majeure

abilities

Limited commodity price

exposure

Primarily Traditional,

stable MLP assets

Appendix

Delek US' Refineries are Strategically Positioned and Flexible

17

Inland refinery located in East Texas

75,000 bpd, 8.7 complexity

Primarily processes inland light sweet crudes

(100% in 2016)

94% yield of gasoline, diesel and jet fuel in

2016

El Dorado Refinery (1) Tyler Refinery (1)

Inland refinery located in southern Arkansas

80,000 bpd, 10.2 complexity

(configured to run light or medium sour

crude)

Supply flexibility that can source West Texas,

locally produced, and/or Gulf Coast crude

90% yield of gasoline and diesel in 2016

Associated gathering system positioned for

Brown Dense development

(1) As reported by Delek US.

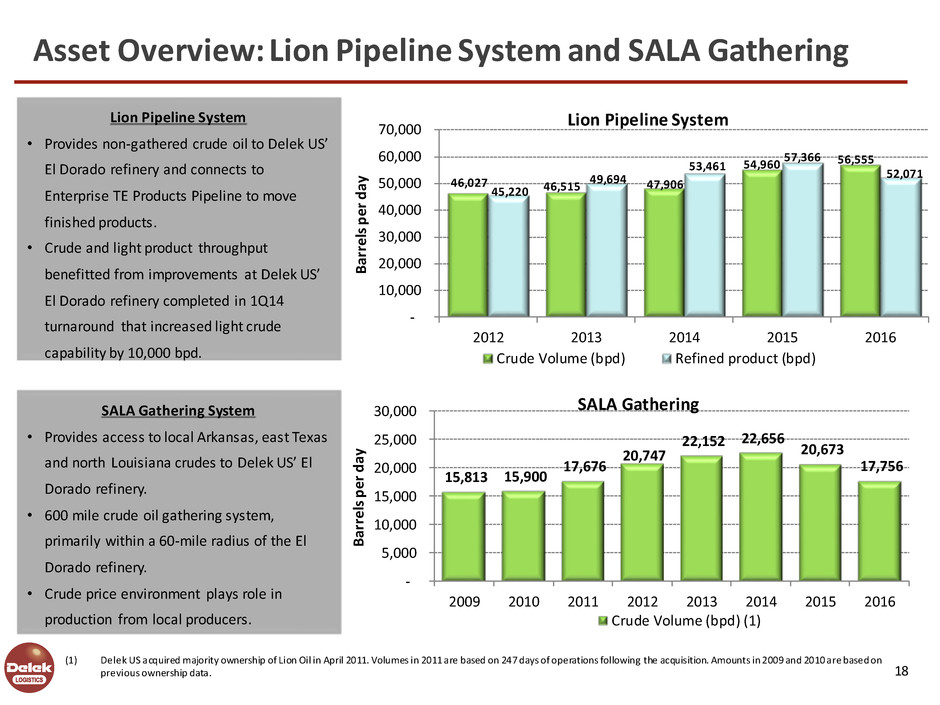

Asset Overview: Lion Pipeline System and SALA Gathering

18

SALA Gathering System

• Provides access to local Arkansas, east Texas

and north Louisiana crudes to Delek US’ El

Dorado refinery.

• 600 mile crude oil gathering system,

primarily within a 60-mile radius of the El

Dorado refinery.

• Crude price environment plays role in

production from local producers.

15,813 15,900

17,676

20,747

22,152 22,656

20,673

17,756

-

5,000

10,000

15,000

20,000

25,000

30,000

2009 2010 2011 2012 2013 2014 2015 2016

B

a

rr

el

s

p

er

d

ay

SALA Gathering

Crude Volume (bpd) (1)

46,027 46,515 47,906

54,960 56,555

45,220

49,694

53,461

57,366

52,071

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

2012 2013 2014 2015 2016

B

ar

re

ls

p

er

d

ay

Lion Pipeline System

Crude Volume (bpd) Refined product (bpd)

Lion Pipeline System

• Provides non-gathered crude oil to Delek US’

El Dorado refinery and connects to

Enterprise TE Products Pipeline to move

finished products.

• Crude and light product throughput

benefitted from improvements at Delek US’

El Dorado refinery completed in 1Q14

turnaround that increased light crude

capability by 10,000 bpd.

(1) Delek US acquired majority ownership of Lion Oil in April 2011. Volumes in 2011 are based on 247 days of operations following the acquisition. Amounts in 2009 and 2010 are based on

previous ownership data.

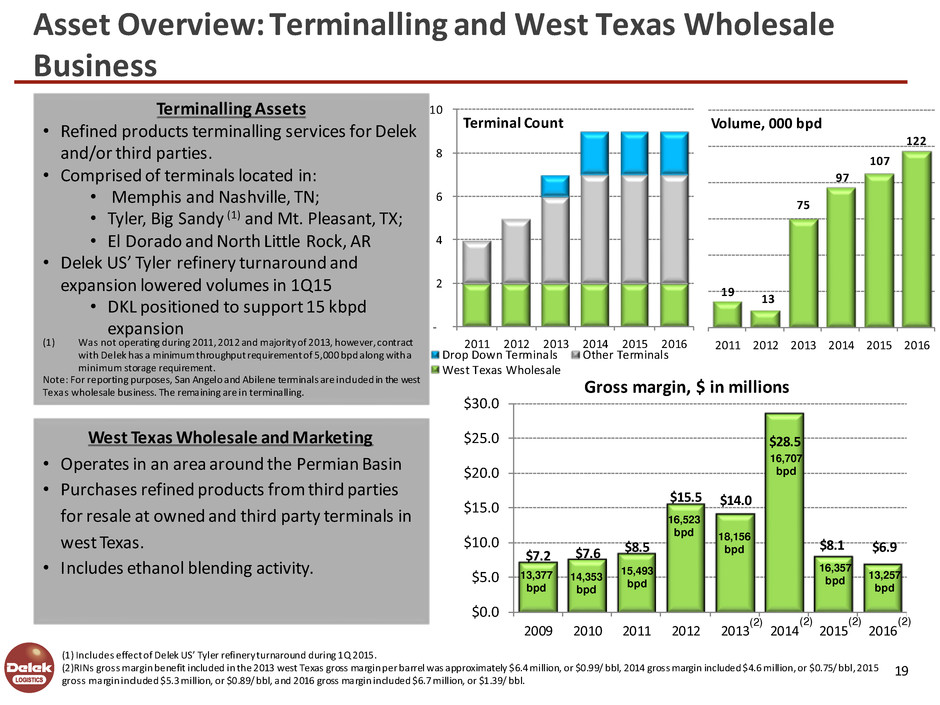

Asset Overview: Terminalling and West Texas Wholesale

Business

19

West Texas Wholesale and Marketing

• Operates in an area around the Permian Basin

• Purchases refined products from third parties

for resale at owned and third party terminals in

west Texas.

• Includes ethanol blending activity.

19

13

75

97

107

122

2011 2012 2013 2014 2015 2016

Volume, 000 bpd

Terminalling Assets

• Refined products terminalling services for Delek

and/or third parties.

• Comprised of terminals located in:

• Memphis and Nashville, TN;

• Tyler, Big Sandy (1) and Mt. Pleasant, TX;

• El Dorado and North Little Rock, AR

• Delek US’ Tyler refinery turnaround and

expansion lowered volumes in 1Q15

• DKL positioned to support 15 kbpd

expansion

(1) Was not operating during 2011, 2012 and majority of 2013, however, contract

with Delek has a minimum throughput requirement of 5,000 bpd along with a

minimum storage requirement.

Note: For reporting purposes, San Angelo and Abilene terminals are included in the west

Texas wholesale business. The remaining are in terminalling.

-

2

4

6

8

10

2011 2012 2013 2014 2015 2016

Terminal Count

Drop Down Terminals Other Terminals

West Texas Wholesale

$7.2 $7.6

$8.5

$15.5 $14.0

$28.5

$8.1 $6.9

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

2009 2010 2011 2012 2013 2014 2015 2016

Gross margin, $ in millions

13,377

bpd

14,353

bpd

15,493

bpd

16,523

bpd 18,156

bpd

16,707

bpd

16,357

bpd

13,257

bpd

(1) Includes effect of Delek US’ Tyler refinery turnaround during 1Q 2015.

(2)RINs gross margin benefit included in the 2013 west Texas gross margin per barrel was approximately $6.4 million, or $0.99/ bbl, 2014 gross margin included $4.6 million, or $0.75/ bbl, 2015

gross margin included $5.3 million, or $0.89/ bbl, and 2016 gross margin included $6.7 million, or $1.39/ bbl.

(2) (2) (2) (2)

Asset Overview: Paline Pipeline

20

Approximately 195 mile crude oil pipeline -

Mainline pipeline flows from north to south

FERC tariff in place and actively marketing available

capacity to potential shippers

Base at $1.50/bbl with temporary incentive

tariff of $1.00/bbl at 1,000 bpd to 9,999 bpd;

$0.75/bbl at 10,000 bpd or greater

Flexibility to explore options for available capacity

on this pipeline

Evaluations of potential increases in

utilization and capacity of Paline system may

offer future growth

Explore ability to reverse to flow from the

Gulf Coast to allow potential shippers to take

advantage of crude oil price differentials

Note: The previous contract that expired on June 30, 2016 had 35,000 bpd of mainline capacity reserved for third parties to use exclusively during a term that began on

January 1, 2015. DKL elected to extend the contract at 10,000 bpd from July 1, 2016 to December 31, 2016. Fol lowing the December 31, 2016 expiration, volume shipped is

subject to the FERC tariff and incentive rates that are currently in place.

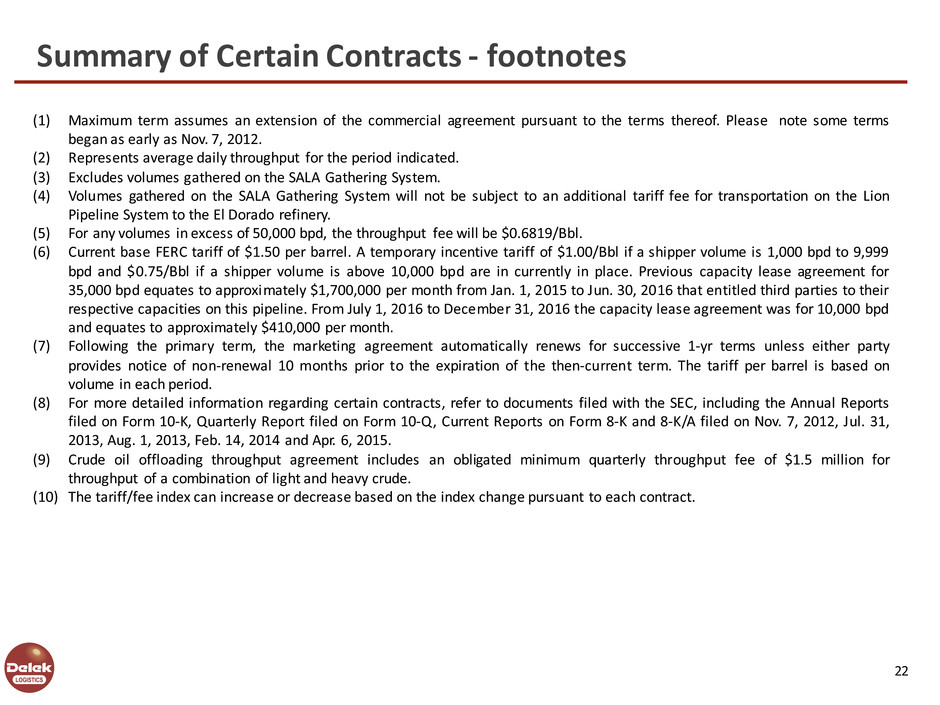

Summary of Certain Contracts (8)

21

Summary of Certain Contracts - footnotes

22

(1) Maximum term assumes an extension of the commercial agreement pursuant to the terms thereof. Please note some terms

began as early as Nov. 7, 2012.

(2) Represents average daily throughput for the period indicated.

(3) Excludes volumes gathered on the SALA Gathering System.

(4) Volumes gathered on the SALA Gathering System will not be subject to an additional tariff fee for transportation on the Lion

Pipeline System to the El Dorado refinery.

(5) For any volumes in excess of 50,000 bpd, the throughput fee will be $0.6819/Bbl.

(6) Current base FERC tariff of $1.50 per barrel. A temporary incentive tariff of $1.00/Bbl if a shipper volume is 1,000 bpd to 9,999

bpd and $0.75/Bbl if a shipper volume is above 10,000 bpd are in currently in place. Previous capacity lease agreement for

35,000 bpd equates to approximately $1,700,000 per month from Jan. 1, 2015 to Jun. 30, 2016 that entitled third parties to their

respective capacities on this pipeline. From July 1, 2016 to December 31, 2016 the capacity lease agreement was for 10,000 bpd

and equates to approximately $410,000 per month.

(7) Following the primary term, the marketing agreement automatically renews for successive 1-yr terms unless either party

provides notice of non-renewal 10 months prior to the expiration of the then-current term. The tariff per barrel is based on

volume in each period.

(8) For more detailed information regarding certain contracts, refer to documents filed with the SEC, including the Annual Reports

filed on Form 10-K, Quarterly Report filed on Form 10-Q, Current Reports on Form 8-K and 8-K/A filed on Nov. 7, 2012, Jul. 31,

2013, Aug. 1, 2013, Feb. 14, 2014 and Apr. 6, 2015.

(9) Crude oil offloading throughput agreement includes an obligated minimum quarterly throughput fee of $1.5 million for

throughput of a combination of light and heavy crude.

(10) The tariff/fee index can increase or decrease based on the index change pursuant to each contract.

Amended and Restated Omnibus Agreement

23

Key Provisions

Delek US will indemnify Delek Logistics for certain liabilities, including environmental and other liabilities, relating to contributed

assets.

Delek US has a ROFR if Delek Logistics sells any assets that serves Delek US' refineries or the Paline Pipeline.

GP will not receive a management fee from the Partnership; Delek Logistics will pay Delek US an annual fee for G&A services and

will reimburse the GP and/or Delek US for certain expenses.

Limitations on exposure to assets contributed by Delek US relative to maintenance capital expenditures and certain expenses

associated with repair/clean-up related events.

For additional detailed information regarding this agreement, please refer to documents filed with the SEC, including the Current

Report on Form 8-K filed Apr. 6, 2015 and the quarterly report 10Q filed August 6, 2015, as amended on November 6, 2015.

Summary Organization Structure

24

37.3% interest

Limited partner-common

94.9%

ownership interest (1)

2.0% interest

General partner interest

Incentive distribution rights

Delek Logistics Partners, LP

NYSE: DKL

(the Partnership)

100% ownership interest

Public Unitholders

Operating Subsidiaries

60.7% interest

Limited partner-common

Delek Logistics GP, LLC

(the General Partner)

Delek US Holdings, Inc.

NYSE: DK

(1) Currently a 5.1% interest in the Delek US ownership interest in the general partner is held by three members of senior management of Delek US. The remaining ownership interest will be

indirectly held by Delek.

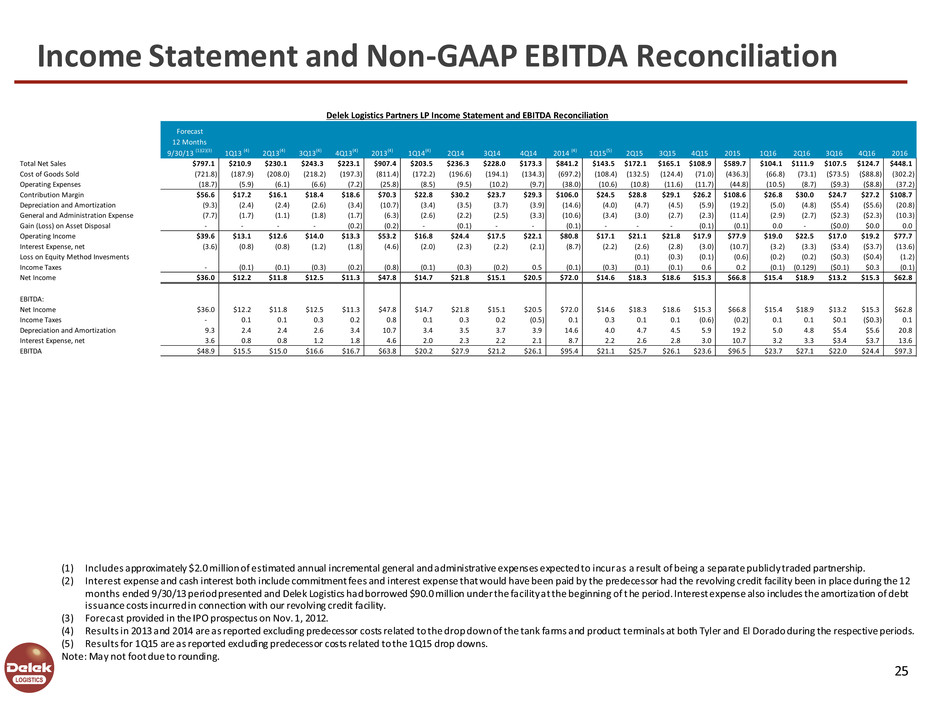

Income Statement and Non-GAAP EBITDA Reconciliation

25

(1) Includes approximately $2.0 million of estimated annual incremental general and administrative expenses expected to incur as a result of being a separate publicly traded partnership.

(2) Interest expense and cash interest both include commitment fees and interest expense that would have been paid by the predecessor had the revolving credit facility been in place during the 12

months ended 9/30/13 period presented and Delek Logistics had borrowed $90.0 million under the facility at the beginning of t he period. Interest expense also includes the amortization of debt

issuance costs incurred in connection with our revolving credit facility.

(3) Forecast provided in the IPO prospectus on Nov. 1, 2012.

(4) Results in 2013 and 2014 are as reported excluding predecessor costs related to the drop down of the tank farms and product terminals at both Tyler and El Dorado during the respective periods.

(5) Results for 1Q15 are as reported excluding predecessor costs related to the 1Q15 drop downs.

Note: May not foot due to rounding.

Forecast

12 Months

9/30/13 (1)(2)(3) 1Q13 (4) 2Q13(4) 3Q13(4) 4Q13(4) 2013(4) 1Q14(4) 2Q14 3Q14 4Q14 2014 (4) 1Q15(5) 2Q15 3Q15 4Q15 2015 1Q16 2Q16 3Q16 4Q16 2016

Total Net Sales $797.1 $210.9 $230.1 $243.3 $223.1 $907.4 $203.5 $236.3 $228.0 $173.3 $841.2 $143.5 $172.1 $165.1 $108.9 $589.7 $104.1 $111.9 $107.5 $124.7 $448.1

Cost of Goods Sold (721.8) (187.9) (208.0) (218.2) (197.3) (811.4) (172.2) (196.6) (194.1) (134.3) (697.2) (108.4) (132.5) (124.4) (71.0) (436.3) (66.8) (73.1) ($73.5) ($88.8) (302.2)

Operating Expenses (18.7) (5.9) (6.1) (6.6) (7.2) (25.8) (8.5) (9.5) (10.2) (9.7) (38.0) (10.6) (10.8) (11.6) (11.7) (44.8) (10.5) (8.7) ($9.3) ($8.8) (37.2)

Contribution Margin $56.6 $17.2 $16.1 $18.4 $18.6 $70.3 $22.8 $30.2 $23.7 $29.3 $106.0 $24.5 $28.8 $29.1 $26.2 $108.6 $26.8 $30.0 $24.7 $27.2 $108.7

Depreciation and Amortization (9.3) (2.4) (2.4) (2.6) (3.4) (10.7) (3.4) (3.5) (3.7) (3.9) (14.6) (4.0) (4.7) (4.5) (5.9) (19.2) (5.0) (4.8) ($5.4) ($5.6) (20.8)

General and Administration Expense (7.7) (1.7) (1.1) (1.8) (1.7) (6.3) (2.6) (2.2) (2.5) (3.3) (10.6) (3.4) (3.0) (2.7) (2.3) (11.4) (2.9) (2.7) ($2.3) ($2.3) (10.3)

Gain (Loss) on Asset Disposal - - - - (0.2) (0.2) - (0.1) - - (0.1) - - - (0.1) (0.1) 0.0 - ($0.0) $0.0 0.0

Operating Income $39.6 $13.1 $12.6 $14.0 $13.3 $53.2 $16.8 $24.4 $17.5 $22.1 $80.8 $17.1 $21.1 $21.8 $17.9 $77.9 $19.0 $22.5 $17.0 $19.2 $77.7

Interest Expense, net (3.6) (0.8) (0.8) (1.2) (1.8) (4.6) (2.0) (2.3) (2.2) (2.1) (8.7) (2.2) (2.6) (2.8) (3.0) (10.7) (3.2) (3.3) ($3.4) ($3.7) (13.6)

Loss on Equity Method Invesments (0.1) (0.3) (0.1) (0.6) (0.2) (0.2) ($0.3) ($0.4) (1.2)

Income Taxes - (0.1) (0.1) (0.3) (0.2) (0.8) (0.1) (0.3) (0.2) 0.5 (0.1) (0.3) (0.1) (0.1) 0.6 0.2 (0.1) (0.129) ($0.1) $0.3 (0.1)

Net Income $36.0 $12.2 $11.8 $12.5 $11.3 $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8

EBITDA:

Net Income $36.0 $12.2 $11.8 $12.5 $11.3 $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8

Income Taxes - 0.1 0.1 0.3 0.2 0.8 0.1 0.3 0.2 (0.5) 0.1 0.3 0.1 0.1 (0.6) (0.2) 0.1 0.1 $0.1 ($0.3) 0.1

Depreciation and Amortization 9.3 2.4 2.4 2.6 3.4 10.7 3.4 3.5 3.7 3.9 14.6 4.0 4.7 4.5 5.9 19.2 5.0 4.8 $5.4 $5.6 20.8

Interest Expense, net 3.6 0.8 0.8 1.2 1.8 4.6 2.0 2.3 2.2 2.1 8.7 2.2 2.6 2.8 3.0 10.7 3.2 3.3 $3.4 $3.7 13.6

EBITDA $48.9 $15.5 $15.0 $16.6 $16.7 $63.8 $20.2 $27.9 $21.2 $26.1 $95.4 $21.1 $25.7 $26.1 $23.6 $96.5 $23.7 $27.1 $22.0 $24.4 $97.3

Delek Logistics Partners LP Income Statement and EBITDA Reconciliation

Reconciliation of Cash Available for Distribution

26

(1) Distribution for forecast period based on $1.50 per unit; Distribution for year ended December 31, 2013, 2014, 2015 and 2016 based on actual amounts distributed during the periods; does

not include a LTIP accrual. Coverage is defined as cash available for distribution divided by total distribution.

(2) Results in 2013, 2014 and 2015 are as reported excluding predecessor costs related to the drop down of the tank farms and product terminals at both Tyler and El Dorado during the

respective periods.

Note: May not foot due to rounding and annual adjustments that occurred in year end reporting.

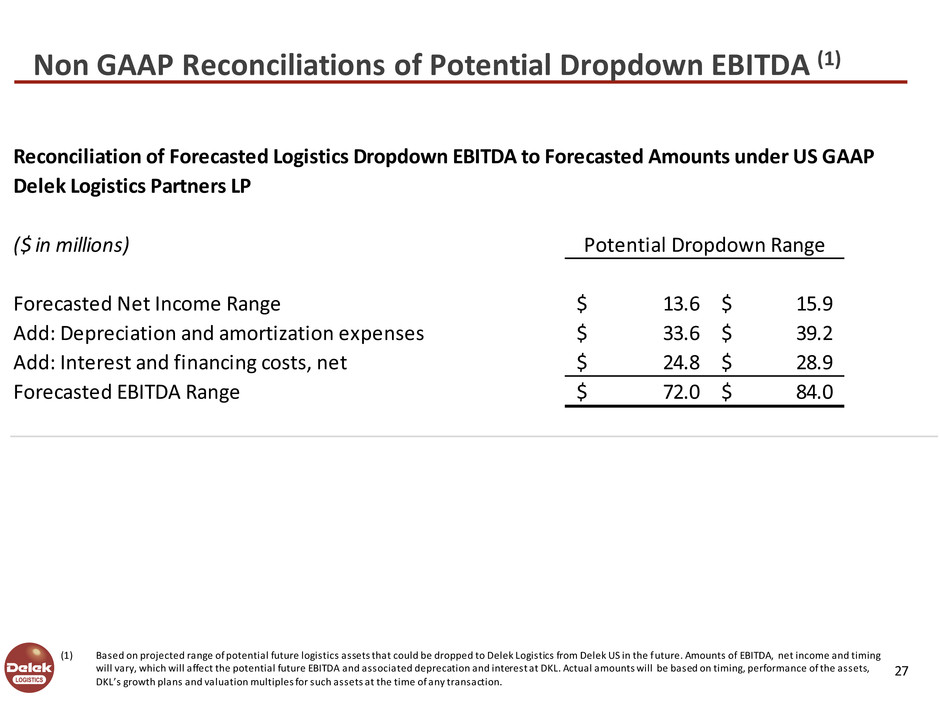

Non GAAP Reconciliations of Potential Dropdown EBITDA (1)

27

(1) Based on projected range of potential future logistics assets that could be dropped to Delek Logistics from Delek US in the future. Amounts of EBITDA, net income and timing

will vary, which will affect the potential future EBITDA and associated deprecation and interest at DKL. Actual amounts will be based on timing, performance of the assets,

DKL’s growth plans and valuation multiples for such assets at the time of any transaction.

Reconciliation of Forecasted Logistics Dropdown EBITDA to Forecasted Amounts under US GAAP

Delek Logistics Partners LP

($ in millions)

Forecasted Net Income Range 13.6$ 15.9$

Add: Depreciation and amortization expenses 33.6$ 39.2$

Add: Interest and financing costs, net 24.8$ 28.9$

Forecasted EBITDA Range 72.0$ 84.0$

Potential Dropdown Range

28

Investor Relations Contact:

Assi Ginzburg Keith Johnson

Executive Vice President, CFO Vice President of Investor Relations

615-435-1452 615-435-1366