Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - J.Jill, Inc. | d272297dex231.htm |

| EX-10.18 - EX-10.18 - J.Jill, Inc. | d272297dex1018.htm |

| EX-10.17 - EX-10.17 - J.Jill, Inc. | d272297dex1017.htm |

| EX-10.16 - EX-10.16 - J.Jill, Inc. | d272297dex1016.htm |

| EX-10.15 - EX-10.15 - J.Jill, Inc. | d272297dex1015.htm |

| EX-10.14 - EX-10.14 - J.Jill, Inc. | d272297dex1014.htm |

| EX-10.13 - EX-10.13 - J.Jill, Inc. | d272297dex1013.htm |

| EX-10.11 - EX-10.11 - J.Jill, Inc. | d272297dex1011.htm |

| EX-10.10 - EX-10.10 - J.Jill, Inc. | d272297dex1010.htm |

| EX-10.9 - EX-10.9 - J.Jill, Inc. | d272297dex109.htm |

| EX-10.2 - EX-10.2 - J.Jill, Inc. | d272297dex102.htm |

| EX-10.1 - EX-10.1 - J.Jill, Inc. | d272297dex101.htm |

| EX-5.1 - EX-5.1 - J.Jill, Inc. | d272297dex51.htm |

| EX-3.2 - EX-3.2 - J.Jill, Inc. | d272297dex32.htm |

| EX-3.1 - EX-3.1 - J.Jill, Inc. | d272297dex31.htm |

| EX-1.1 - EX-1.1 - J.Jill, Inc. | d272297dex11.htm |

Table of Contents

As filed with the Securities and Exchange Commission on February 27, 2017

Registration No. 333-215993

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

J.Jill, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 5621 | 45-1459825 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

4 Batterymarch Park

Quincy, MA 02169

(617) 376-4300

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

David Biese

Chief Financial Officer

4 Batterymarch Park

Quincy, MA 02169

(617) 376-4300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Raphael M. Russo, Esq. Paul, Weiss, Rifkind, Wharton & Garrison LLP 1285 Avenue of the Americas New York, NY 10019-6064 (212) 373-3000 |

Marc D. Jaffe, Esq. Ian D. Schuman, Esq. Latham & Watkins LLP 885 Third Avenue New York, NY 10022 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☑ | Smaller reporting company ☐ |

(Do not check if a smaller reporting company)

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each Class of Securities to be Registered |

Amount to be Registered(1)(2) |

Proposed Maximum Offering Price per Share |

Proposed Maximum Offering Price(1)(2) |

Amount of Registration Fee(3) | ||||

| Common Stock, par value $0.01 per share |

13,416,667 | $16.00 | $214,666,672 | $24,880 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes offering price of 1,750,000 additional shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (3) | $11,590 of such fee was previously paid and the remaining amount of $13,290 is being paid herewith. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated February 27, 2017

PROSPECTUS

11,666,667 Shares

J.Jill, Inc.

Common Stock

This is J.Jill, Inc.’s initial public offering. All of the 11,666,667 shares of common stock are being sold by the selling stockholder. We will not receive any proceeds from the sale of shares to be offered by the selling stockholder.

We are an “emerging growth company” as defined under the federal securities laws and are eligible for reduced public company reporting requirements. Please see “Prospectus Summary—Implications of being an Emerging Growth Company.” We will also be a “controlled company” under the corporate governance rules for New York Stock Exchange listed companies and will be exempt from certain corporate governance requirements of the rules. See “Risk Factors—Risks Related to this Offering and Ownership of our Common Stock.”

We expect the public offering price to be between $14.00 and $16.00 per share. Currently, no public market exists for the shares. The shares have been approved for listing on the New York Stock Exchange under the symbol “JILL.”

Investing in the common stock involves risks that are described in the “Risk Factors” section beginning on page 17 of this prospectus.

| Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholder |

$ | $ | ||||||

| (1) | We refer you to the section “Underwriting” beginning on page 134 of this prospectus for additional information regarding underwriting compensation. |

The underwriters may also exercise their option to purchase up to an additional 1,750,000 shares from the selling stockholder at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2017.

| BofA Merrill Lynch | Morgan Stanley | Jefferies | ||||

| Deutsche Bank Securities | RBC Capital Markets |

UBS Investment Bank |

Wells Fargo Securities | |||

| Cowen and Company | Macquarie Capital | SunTrust Robinson Humphrey | ||

The date of this prospectus is , 2017.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

For investors outside the United States: neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

| 1 | ||||

| 17 | ||||

| 39 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 45 | ||||

| 47 | ||||

| 49 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

58 | |||

| 83 | ||||

| 97 | ||||

| 102 | ||||

| 118 | ||||

| 121 | ||||

| 123 | ||||

| 128 | ||||

| 130 | ||||

| 134 | ||||

| 142 | ||||

| 142 | ||||

| 142 | ||||

| F-1 |

You should rely only on the information contained in this prospectus and any related free writing prospectus that we may provide to you in connection with this offering. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

i

Table of Contents

Trademarks, Trade Names and Service Marks

We use various trademarks, trade names and service marks in our business, including without limitation J.Jill®, The J.Jill Wearever Collection® and Pure Jill®. This prospectus contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Industry and Market Data

Industry and market data used throughout this prospectus were obtained through company research, surveys and studies conducted by third parties and industry and general publications. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Statistical data in this prospectus related to our customers is based on the approximately 97% of transactions that we are able to match to an identifiable customer. Although we believe the industry and market data to be reliable as of the date of this prospectus, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein. While we are not aware of any misstatements regarding the industry data presented herein, estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors.”

Basis of Presentation

On May 8, 2015, an investment vehicle of investment funds affiliated with TowerBrook Capital Partners L.P. acquired all of our outstanding equity interests through the newly formed entities JJill Holdings, Inc. (“JJill Holdings”) and JJill Topco Holdings, LP (“JJill Topco Holdings”). We refer to such acquisition and the related financing transactions as the “Acquisition.” As a result of the Acquisition and related change in control, JJill Holdings applied purchase accounting as of May 8, 2015. We elected to push down the effects of the Acquisition to our consolidated financial statements. As such, the financial information provided in this prospectus is presented as “Predecessor” or “Successor” to indicate whether they relate to the period preceding the Acquisition or the period succeeding the Acquisition, respectively. Due to the change in the basis of accounting resulting from the Acquisition, the consolidated financial statements for the Predecessor periods and the consolidated financial statements for the Successor periods, included elsewhere in this prospectus, are not necessarily comparable.

Our fiscal year is the 52- or 53-week period ending on the Saturday closest to the January calendar month-end. The Predecessor period from February 1, 2015 to May 7, 2015, which is presented separately as the “2015 Predecessor Period” in this prospectus, consisted of approximately 14 weeks. The Successor period from May 8, 2015 to January 30, 2016, which is presented separately as the “2015 Successor Period” in this prospectus, consisted of approximately 38 weeks. References in this prospectus to “pro forma fiscal year 2015” refer to the unaudited pro forma consolidated statement of operations, which has been derived from our consolidated audited statements of operations included elsewhere in this prospectus and represents the addition of the Predecessor period from February 1, 2015 through May 7, 2015 and the Successor period from May 8, 2015 through January 30, 2016 and gives effect to the following as if they had occurred on February 1, 2015: (i) the Acquisition; (ii) the related Acquisition financing as provided for under our term loan credit agreement, dated as of May 8, 2015, by and among Jill Holdings LLC, Jill Acquisition LLC, a wholly-owned subsidiary of us, the various lenders party thereto and Jefferies Finance LLC as the administrative agent, as amended on May 27, 2016 by Amendment No. 1 thereto (the “Term Loan”) and our ABL credit agreement, dated as of May 8, 2015, by and among Jill Holdings LLC, Jill Acquisition LLC, certain subsidiaries from time to time party thereto, the lenders

ii

Table of Contents

party thereto and CIT Finance LLC as the administrative agent and collateral agent, as amended on May 27, 2016 by Amendment No. 1 thereto (the “ABL Facility”); and (iii) our merger with our direct parent company, JJill Holdings, which will occur prior to the completion of this offering, as if they had occurred on February 1, 2015. See “Unaudited Pro Forma Consolidated Financial Information” included elsewhere in this prospectus for additional information. References in this prospectus to “fiscal year 2016” refer to the fiscal year ending January 28, 2017, references to “fiscal year 2015” refer to the year ended January 30, 2016, references to “fiscal year 2014” refer to the fiscal year ended January 31, 2015 and references to “fiscal year 2013” refer to the fiscal year ended February 1, 2014.

As used in this prospectus, unless otherwise indicated or the context otherwise requires, references to:

| • | the “Company,” “J.Jill,” “we,” “us” and “our” refer to J.Jill, Inc. and its consolidated subsidiaries; |

| • | “TowerBrook” means TowerBrook Capital Partners L.P. or the investment funds affiliated with TowerBrook Capital Partners L.P. or an investment vehicle of such funds, as the context requires; |

| • | “GAAP” refers to U.S. generally accepted accounting principles; |

| • | “retention rate” refers to, for a one-year period or fiscal year, the percentage of customers that made at least one purchase at J.Jill in the previous one-year period or fiscal year and also made at least one purchase at J.Jill in such one-year period or fiscal year; |

| • | “4-wall contribution” refers to a particular store’s or group of stores’ net sales, less product costs and direct operating costs, including payroll, occupancy and other operating costs specifically associated with that store or group of stores. 4-wall contribution is an assessment of store-level profitability and a supplemental measure of the operating performance of our stores that is neither required by, nor presented in accordance with, GAAP and our calculations thereof may not be comparable to those reported by other companies. We present this measure as we believe it is frequently used by securities analysts, investors and other interested parties to evaluate companies in our industry and we use it internally as a benchmark to compare our performance to that of our competitors. This measure has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP; |

| • | “payback” or “payback period” refer to, for a particular store or group of stores, the period of time from its opening measured in years, that it takes for the cumulative 4-wall contribution for a particular store or group of stores to equal our net cash investment in that store or group of stores; |

| • | “cash-on-cash return” is calculated by dividing the 4-wall contribution for a particular store or group of stores by our total net cash investment in that store or group of stores. Cash-on-cash return is a supplemental measure of operating performance that is neither required by, nor presented in accordance with, GAAP and our calculations thereof may not be comparable to those reported by other companies. We present this measure as we believe it is frequently used by securities analysts, investors and other interested parties to evaluate companies in our industry and we use it internally as a benchmark to compare our performance to that of our competitors. This measure has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP; |

| • | “total company comparable sales” refers to net sales from our full-price stores, open for more than 52 weeks, and our direct channel. When a store in the total company comparable store base is temporarily closed for remodeling or other reasons, it is included in total company comparable sales only using the full weeks it was open. Total company comparable sales for fiscal year 2012 are based on 52 weeks and exclude the 53rd week in fiscal year 2012; |

| • | “average unit volume” is calculated by dividing our total net retail sales by our total number of stores; |

iii

Table of Contents

| • | “active customer base” refers to unique customers who have made a purchase within the past twelve months; |

| • | “Aided Brand Awareness” refers to a measure of the number of people who recognize the J.Jill brand from a list of possible names offered as a prompt in a customer survey we conducted; |

| • | “Net Promoter Score” refers to a customer loyalty metric used in a customer survey we conducted, that was calculated based on responses to a single question: How likely are you to recommend J.Jill to your friends and family?; |

| • | “full-price store” or “full-price location” refer to a store that is not a clearance store; and |

| • | “E-commerce business” refers to the orders of J.Jill’s products that are placed through our website, www.jjill.com. |

Non-GAAP Financial Measures

The following financial measures presented in this prospectus are key performance indicators used by management and typically used by our competitors in the retail industry, but are not recognized under GAAP:

| • | “Adjusted EBITDA” represents net income (loss) plus interest expense, provision (benefit) for income taxes, depreciation and amortization, the amortization of the step-up to fair value of merchandise inventory resulting from the application of a purchase accounting adjustment related to the Acquisition, certain Acquisition-related expenses, sponsor fees, equity-based compensation expense, write-off of property and equipment and other non-recurring expenses, primarily consisting of outside legal and professional fees associated with certain non-recurring transactions and events; and |

| • | “Adjusted EBITDA margin” represents, for any period, Adjusted EBITDA as a percentage of net sales. |

Adjusted EBITDA and Adjusted EBITDA margin are supplemental measures of our operating performance that are neither required by, nor presented in accordance with, GAAP and our calculations thereof may not be comparable to those reported by other companies. We present these measures as we believe they are frequently used by securities analysts, investors and other interested parties to evaluate companies in our industry and we use them internally as a benchmark to compare our performance to that of our competitors. These measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP.

Adjusted EBITDA is not a measurement of our financial performance under GAAP and should not be considered as an alternative to net income (loss), operating income or any other performance measures derived in accordance with GAAP or as an alternative to cash flows from operating activities as a measure of our liquidity. We believe Adjusted EBITDA facilitates operating performance comparisons from period to period by isolating the effects of some items that vary from period to period without any correlation to ongoing operating performance. Potential differences between our measure of Adjusted EBITDA versus other similar companies’ measures of Adjusted EBITDA may be caused by variations in capital structures (affecting interest expense), tax positions (such as the impact on periods or changes in effective tax rates or net operating losses) and the age and book depreciation of facilities and equipment (affecting relative depreciation expense). Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

For a discussion of the use of these financial measures and a reconciliation of net income to Adjusted EBITDA and the calculation of Adjusted EBITDA margin, see “Prospectus Summary—Summary Consolidated Historical and Pro Forma Financial and Other Data.”

iv

Table of Contents

The following summary contains selected information about us and about this offering. It does not contain all of the information that is important to you and your investment decision. Before you make an investment decision, you should review this prospectus in its entirety, including matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto included elsewhere in this prospectus. Some of the statements in the following summary constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

In this prospectus, unless otherwise indicated or the context otherwise requires, references to the “Company,” “J.Jill,” “we,” “us,” and “our” refer to J.Jill, Inc. and its consolidated subsidiaries.

Overview

Our Company

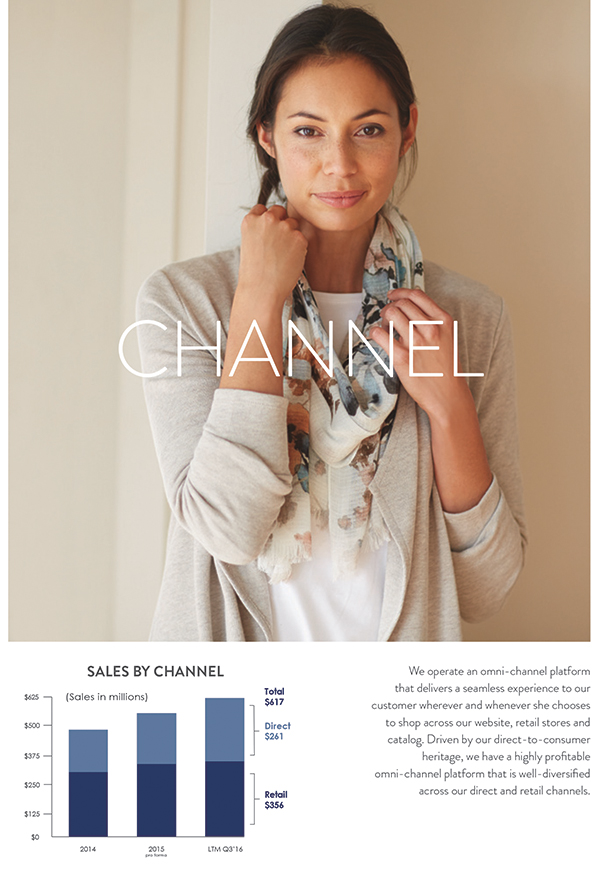

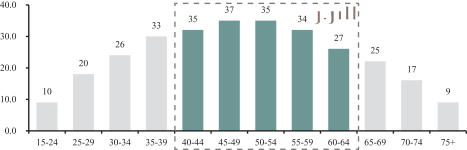

J.Jill is a nationally recognized women’s apparel brand focused on a loyal, engaged and affluent customer in the attractive 40-65 age segment. The J.Jill brand represents an easy, relaxed and inspired style that reflects the confidence and comfort of a woman with a rich, full life. We operate a highly profitable omni-channel platform that is well diversified across our direct (42% of net sales for the twelve months ended October 29, 2016) and retail (58% of net sales for the twelve months ended October 29, 2016) channels. We began as a catalog company and have been a pioneer of the omni-channel model with a compelling presence across stores, website and catalog since 1999. We have developed an industry-leading customer database that allows us to match approximately 97% of transactions to an identifiable customer. We take a data-centric approach, in which we leverage our database and apply our insights to manage our business as well as to acquire and engage customers to drive optimum value and productivity. Our goals are to Create a great brand, to Build a successful business and to Make J.Jill a great place to work. To achieve this, we have aligned our strategy and team around four guiding pillars – Brand, Customer, Product and Channel.

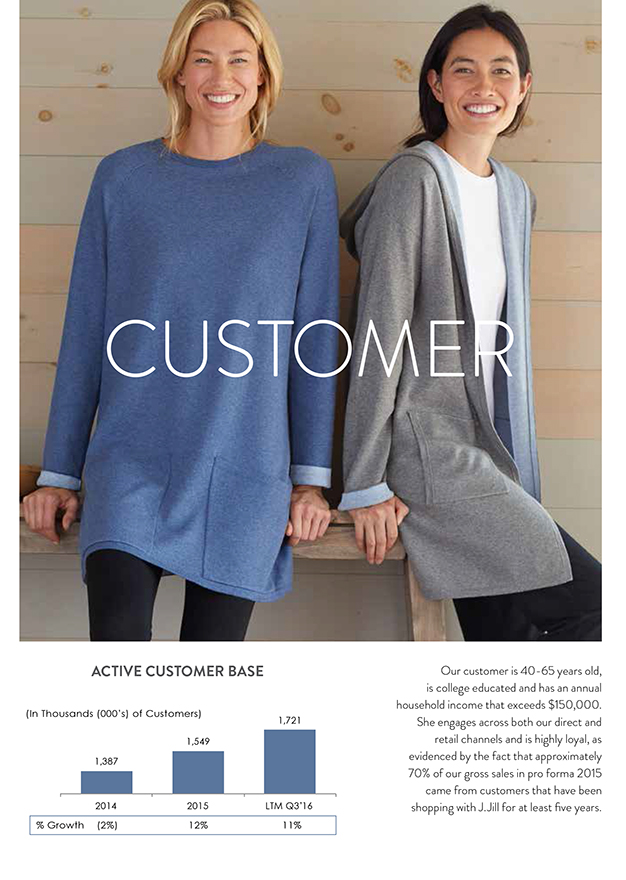

Brand and Customer. Our brand promise to the J.Jill woman is to delight her with great wear-now product, to inspire her confidence through J.Jill’s approach to dressing and to provide her with friendly, guiding service wherever and whenever she chooses to shop. While we find that women of all ages are attracted to our brand, our typical customer is 40-65 years old, is college educated and has an annual household income that exceeds $150,000. She leads a busy, yet balanced life, as she works outside the home, is involved in her community and has a family with children. She engages across both our direct and retail channels and is highly loyal, as evidenced by the fact that approximately 70% of our gross sales in pro forma fiscal year 2015 came from customers that have been shopping with J.Jill for at least five years.

Product. Our customers strongly associate our products with a modern balance of style, quality, comfort and ease suitable for a broad range of occasions at accessible prices. Our product assortment is marketed under the J.Jill brand name, sold exclusively through our direct and retail channels, and includes knit and woven tops, bottoms and dresses as well as sweaters, outerwear and accessories across a full range of sizes, including Misses, Petites, Women’s and Tall. We also offer most of these products across our two sub-brands, Pure Jill and Wearever. We design and merchandise our products in-house around clear product stories, grounded with essential yet versatile styles and fabrications updated each month with fresh colors, layering options, novelty and fashion. Each of our monthly merchandised collections includes approximately 40% new styles, which provides a consistent flow of fresh product.

Channel. We operate an omni-channel platform that delivers a seamless experience to our customer wherever and whenever she chooses to shop across our website, retail stores and catalog. Driven by our direct-to-consumer heritage, we have a highly profitable omni-channel platform that is well-diversified across our direct

1

Table of Contents

and retail channels. As of January 28, 2017, our retail store portfolio consists of 275 stores in 43 states. Of these stores, 273 are full-price locations averaging approximately 3,750 square feet, with approximately half of our stores located in lifestyle centers and approximately half in premium malls. Our stores have produced strong and consistent performance, with 98% of our full-price locations generating positive 4-wall contribution in pro forma fiscal year 2015. Our new store openings have produced an average payback of approximately two years. We introduced a new store design in 2013 that showcases our brand concept and elevates, yet simplifies the J.Jill shopping experience. Within our direct channel, E-commerce represented 88% of net sales for the twelve months ended October 29, 2016 and catalog orders represented 12% of net sales for the twelve months ended October 29, 2016. Our website provides customers with continuous access to the entire J.Jill product offering and features rich content, including updates on new collections and guidance on how to wear and wardrobe our styles, as well as the ability to chat live with a customer service representative. We produce 25 annual editions of our catalog and circulated 57 million copies in 2015. Our catalog, combined with an increased investment in online marketing, drives customer acquisition and engagement across all of our channels. Our omni-channel approach allows us to drive customer response and purchasing behavior in all channels.

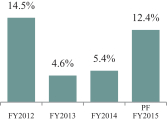

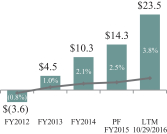

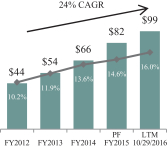

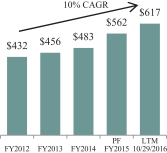

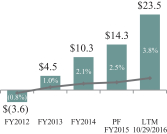

Under the leadership of Paula Bennett, our President and Chief Executive Officer, we have delivered strong, consistent growth in sales and profitability. We have established a solid foundation to support long-term, sustainable growth by investing to build our team, market our brand and enhance our systems, distribution center and data insight capabilities. Net income in pro forma fiscal year 2015 was $14.3 million. We believe our customer-focused strategy, foundational investments and data insights have resulted in consistent, profitable growth and industry-leading Adjusted EBITDA margins of 14.6% in pro forma fiscal year 2015. For a reconciliation of our Adjusted EBITDA to our net income, please see “Prospectus Summary—Summary Consolidated Historical and Pro Forma Financial and Other Data.” Recent financial highlights include:

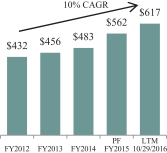

| • | Total net sales growth from $432 million in fiscal year 2012, to $562 million in pro forma fiscal year 2015, reflecting a 9% compound annual growth rate (“CAGR”), and to $617 million for the twelve months ended October 29, 2016, reflecting a 10% CAGR; |

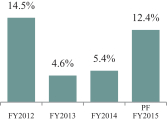

| • | Positive total company comparable sales growth in 17 of the last 19 consecutive quarters, including in each of the last ten consecutive quarters; |

| • | Net income growth from a loss of $3.6 million in fiscal year 2012, to $14.3 million in pro forma fiscal year 2015 and to $23.5 million for the twelve months ended October 29, 2016; |

| • | Net income margin expansion of 330 basis points, from (0.8%) in fiscal year 2012, to 2.5% in pro forma fiscal year 2015, and of 460 basis points to 3.8% for the twelve months ended October 29, 2016; |

| • | 19 consecutive quarters of positive Adjusted EBITDA growth; |

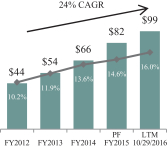

| • | Adjusted EBITDA growth from $44 million in fiscal year 2012, to $82 million in pro forma fiscal year 2015, reflecting a 23% CAGR, and to $99 million for the twelve months ended October 29, 2016, reflecting a 24% CAGR; and |

| • | Adjusted EBITDA margin expansion of 440 basis points, from 10.2% in fiscal year 2012, to 14.6% in pro forma fiscal year 2015, and of 580 basis points to 16.0% for the twelve months ended October 29, 2016. |

2

Table of Contents

$ in millions

| Net Sales |

Total Company Comparable Sales | |

|

| |

| Net Income & Margin |

Adjusted EBITDA & Margin | |

|

| |

Competitive Strengths

We attribute our success to the following competitive strengths:

Distinct, Well-Recognized Brand. The J.Jill brand represents an easy, relaxed and inspired style that reflects the confidence and comfort of a woman with a rich, full life. We have cultivated a differentiated brand that resonates with our customers, as evidenced by the fact that we have one of the highest levels of brand satisfaction and one of the highest aided brand awareness scores relative to our peers. Through our commitment to our customer and our brand building activities, we have created significant brand trust and an emotional connection with our customers that we believe will facilitate sustainable sales growth and market share gains over time.

Industry-Leading Omni-Channel Business. We have developed a powerful, omni-channel business model comprised of our industry-leading direct channel and our retail stores. Our direct and retail channels complement and drive traffic to one another, and we leverage our targeted marketing initiatives to acquire new customers across all channels. While 64% of new to brand customers first engage with J.Jill through our retail stores, we have a strong track record of migrating customers from a single-channel customer to a more valuable, omni-channel customer. On average, our omni-channel customers purchase on nearly three more occasions per year and spend nearly three more times per year than our single-channel customers. As a result, our direct penetration has grown rapidly and accounted for 42% of net sales for the twelve months ended October 29, 2016 driven primarily by growth in our E-commerce business. We believe our strong omni-channel capabilities enable us to deliver a seamless brand experience to our customer, wherever and whenever she chooses to shop.

3

Table of Contents

Data-Centric Approach That Drives Consistent Profitability and Mitigates Risk. We believe we have strong customer and transaction data capabilities, but it is our use of the data that distinguishes us from our competitors. We have developed industry-leading data capture capabilities that allow us to match approximately 97% of transactions to an identifiable customer, which we believe is significantly ahead of the industry standard. We maintain an extensive customer database that tracks customer details from personal identifiers and demographic overlay (e.g., name, address, age and household income) and transaction history (e.g., orders, returns and order value). We continually leverage this database and apply our insights to operate our business, as well as to acquire new customers and then create, build and maintain a relationship with each customer to drive optimum value. For example, in fiscal year 2015 we utilized insights from our data to expand our marketing investment and focus our initiatives to emphasize customer acquisition. This drove growth in active customers by 12% and new customers by 15%. We also increased spend per customer by 6% as customers purchased more frequently and spent more per transaction. We believe our data-centric approach allows us to respond to customer preferences and mitigate risk leading to consistent, predictable operating and financial performance over time.

Affluent and Loyal Customer Base. We target an attractive demographic of affluent women in the 40-65 age range, a segment of the population that is experiencing outsized population growth between 2010 and 2020 in the United States, according to the U.S. Census Bureau. With an average annual household income that exceeds $150,000, our customer has significant spending power. She is highly loyal as evidenced by the fact that approximately 70% of our gross sales in pro forma fiscal year 2015 came from customers that have been shopping with J.Jill for at least five years. Customers who remain with our brand for five years or longer spend nearly twice as much and shop with us 1.5 times more per year than a new-to-brand customer. Our private label credit card program also drives customer loyalty and encourages spending, as average spend per card holder is over two times higher than non-card holders. We believe we will continue to develop long-term customer relationships that will drive profitable sales growth.

Customer-Focused Product Assortment. Our customers strongly associate our product with a modern balance of style, quality, comfort and ease suitable for a broad range of occasions at accessible price points, with an average selling price of $45. Our customer-focused assortment spans a full range of sizes and is designed to provide easy wardrobing that is relevant to her lifestyle. Each year we offer 12 merchandise collections that are introduced approximately every four weeks and designed and delivered to provide a consistent flow of fresh products. We create product newness through the use of different fabrics, colors, patterns and silhouettes, with approximately 40% new styles delivered in each monthly collection, which motivates our customer to visit our stores and/or our website more frequently. We have an in-house, customer centric product design and development process that leverages our extensive database of customer feedback and allows us to identify and incorporate changes in our customers’ preferences, mitigating fashion risk. We believe our customer focused approach to product development and continual delivery of fresh, high quality products drives traffic, frequency and conversion.

Highly Experienced Leadership Team, Delivering Superior Results. Our leadership team is led by President and Chief Executive Officer, Paula Bennett, who joined J.Jill in 2008 and is responsible for leading our successful revitalization and profitable growth. Ms. Bennett is a retail veteran with over 35 years of experience who understands the importance of a strong brand, possesses deep knowledge of our customers and has extensive direct and retail channel experience. Ms. Bennett previously served as Chief Operating Officer of Eileen Fisher, Inc. and also held leadership positions at Bloomingdale’s and Tiffany & Co. She has built a team from leading global organizations with an average of 25 years of industry experience and significant expertise in merchandising, marketing, retail, E-commerce, human resources and finance. We have developed a strong and collaborative culture aligned around our goals to Create a great brand, Build a successful business and Make J.Jill a great place to work. Additionally, we have enhanced and realigned our organizational structure to further elevate the omni-channel customer experience including the recent hires of a Chief Information Officer and a Senior Vice President of Marketing. Our leadership team is aligned and incentivized around growing Adjusted EBITDA and has delivered superior and consistent operating results, growing net sales by a 10% CAGR, Adjusted EBITDA by a 24% CAGR and Adjusted EBITDA margin by 580 basis points from fiscal year 2012 through the twelve months ended October 29, 2016.

4

Table of Contents

Business Growth Strategies

Key drivers of our growth strategy include:

Grow Size and Value of Our Active Customer Base. We have a significant opportunity to continue to attract new customers to our brand and to grow the size and value of our active customer base across all channels. Historically, we grew our business by driving spend per customer. We strategically increased our marketing investment to drive growth through the acquisition of new customers, reactivation of lapsed customers and the retention of existing customers. This investment has proven effective as, for example, in fiscal year 2015 we increased our marketing investment by 16%, resulting in active customer base growth of 12%, including new customer growth of 15%. We also experienced an increase in spend per customer by 6% as customers purchased more frequently and spent more per transaction. In addition, in fiscal year 2015, the number of our omni-channel customers, who purchase on nearly three more occasions per year and spend nearly three more times per year than our single-channel customers, increased by 21%. We recently began a brand voice and customer segmentation initiative which, upon completion, will further enhance our ability to target the highest value customers and increase customer spending. Through these initiatives, we believe we will continue to attract new customers to our brand, migrate customers from single-channel to more profitable omni-channel customers and increase overall customer retention and spend.

Increase Direct Sales. Given our strong foundation that positions us to capitalize on the growth of online and mobile shopping, we believe we have the opportunity to grow our direct sales from 42% of our net sales to approximately 50% over the next few years. According to Euromonitor, online apparel sales are expected to grow at a CAGR of approximately 15% from 2015 to 2020, which is significantly above the long-term growth of the broader apparel industry. We are undertaking several initiatives to enhance our capabilities and drive additional direct sales. We are in the process of re-platforming our website to improve our customers’ personalized shopping experience and increase the ease of navigation, checkout and overall engagement. Our new platform, managed by our experienced team, will provide us with the opportunity to expand internationally. In addition, our mobile platform provides us with the ability to effectively engage with our customer on her mobile device by providing her with access to product research and the ability to connect with the brand socially. We believe our powerful direct platform will enable us to further strengthen our dominant market position and broaden our customer reach.

Profitably Expand Our Store Base. Based on our proven new store economics, we believe that we have the potential to grow our store base by up to 100 stores over the long term from our total of 275 stores as of January 28, 2017. We will target new locations in lifestyle centers and premium malls, and we plan to open 10-15 new stores in fiscal year 2017 and in each year thereafter. Our new store model targets an average of approximately $1.0 million of net sales per store and approximately $270,000 of 4-wall contribution within the first full year of operations. We introduced a new store design concept in 2013 that showcases our brand concept and elevates, yet simplifies the J.Jill shopping experience. The new store concept provides a welcoming, easy-to-shop format that guides her through clearly merchandised product stories. All of our new and refreshed stores will reflect our new design concept. We also plan to selectively close underperforming stores on an annual basis, including one in 2016.

Strengthen Omni-Channel Capabilities. We are pursuing a variety of initiatives designed to enhance our omni-channel capabilities focused on best serving our customer, wherever and whenever she chooses to shop. We have recently enhanced our management team to focus on the omni-channel customer experience, including the recent hires of a Chief Information Officer and a Senior Vice President of Marketing. We will continue to leverage our insight into customer attributes and behavior, which will guide strategic investments in our business. For example, we will enhance our ability to seamlessly manage our inventory across all of our channels. We also plan to implement technology to further fulfill customer demand, including ship from store to customer and order online for pickup in store. We expect our sustainable model, combined with our omni-channel initiatives, will continue to drive traffic, increase average transaction value and enhance conversion across all of our channels.

5

Table of Contents

Enhance Product Assortment. We believe there is an opportunity to grow our business by selectively broadening and enhancing our assortment in certain product categories, including our Pure Jill and Wearever sub-brands, our Women’s and Petite’s businesses, and accessories. Based on strong demand for our extended size product and our sub-brands, we believe we have the opportunity to expand and focus these categories in selected stores as well as test the offering in stand-alone store formats. We also believe we have the opportunity to continue to optimize our assortment architecture and productivity by delivering the right mix and flow of fashion and basics to our channels. In addition, we will continue delivering high quality customer focused product assortments across each of our channels, while strengthening visual merchandising. Through our focused and enhanced product offering, particularly in our sub-brands and extended sizes, we believe we will continue to drive profitable sales growth over time.

Recent Developments

Our audited consolidated financial statements for the fiscal year ended January 28, 2017 (“fiscal year 2016”) are not yet available. We have presented preliminary estimated ranges of certain of our financial results below for fiscal year 2016, based on information currently available to management. We have provided ranges, rather than specific amounts, for certain financial results below, primarily because our financial closing procedures for the three months and year ended January 28, 2017 are not yet complete. As a result, our actual results may vary materially from the estimated preliminary results included herein and will not be publicly available until after the closing of this offering. Accordingly, you should not place undue reliance on these estimates. The preliminary financial data included in this prospectus has been prepared by, and is the responsibility of, management. Our independent registered public accounting firm has not audited, reviewed, compiled, or performed any procedures with respect to the preliminary estimated financial data below and does not express an opinion or any other form of assurance with respect thereto. See “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Special Note Regarding Forward-Looking Statements” for additional information regarding factors that could result in differences between the preliminary estimated ranges of certain financial results presented below and the financial results we will ultimately report for fiscal year 2016.

For the thirteen weeks ended January 28, 2017, we estimate that our net sales will range from $166.4 million to $167.4 million, an increase of $21.5 million, or 14.8%, at the mid-point of the estimated net sales range when compared with net sales of $145.4 million for the thirteen weeks ended January 30, 2016. The increase in net sales was due to an increase in total comparable company sales of approximately 10.7% to 10.9% for the thirteen weeks ended January 28, 2017. As of January 28, 2017, our inventory balance was $66.6 million.

For fiscal year 2016, we estimate that our net sales will range from $638.5 million to $639.5 million, an increase of $77.0 million, or 13.7%, using the mid-point of the estimated net sales range when compared with net sales of $562.0 million for pro forma fiscal year 2015. The increase in net sales was due to an increase in total comparable company sales of approximately 11.1% to 11.3% for fiscal year 2016, primarily driven by an increase in our active customer base from 1.5 million during pro forma fiscal year 2015 to 1.7 million for fiscal year 2016. Omni-channel customers represent approximately 22% of our active customer base for fiscal year 2016, an increase from 20% for pro forma fiscal year 2015. Our direct channel was responsible for 43% of our net sales for fiscal year 2016, an increase from 40% for pro forma fiscal year 2015. Within our direct channel, E-commerce represented 89% of net sales for fiscal year 2016 and catalog orders represented 11% of net sales for fiscal year 2016. Our retail channel was responsible for 57% of our net sales for fiscal year 2016, a decrease from 60% for pro forma fiscal year 2015.

For fiscal year 2016, we estimate that our net income (loss) and total comprehensive income (loss) will range from $22.5 million to $24.1 million, an increase of $9.0 million, or 62.9%, using the mid-point of the estimated range when compared with net income (loss) and total comprehensive income (loss) of $14.3 million for pro forma fiscal year 2015.

6

Table of Contents

For fiscal year 2016, we estimate that our Adjusted EBITDA will range from $104.4 million to $106.5 million, an increase of $23.5 million, or 28.7%, using the mid-point of the estimated range when compared with our Adjusted EBITDA of $82.0 million for pro forma fiscal year 2015. Adjusted EBITDA is a non-GAAP financial measure that has limitations as an analytical tool. Adjusted EBITDA should not be considered as an alternative to, or substitute for, net income (loss), which is calculated in accordance with GAAP. To address these limitations we reconciled Adjusted EBITDA to the nearest GAAP financial measure, net income (loss), below. For an explanation of how we define Adjusted EBITDA and Adjusted EBITDA margin and why we believe the presentation of Adjusted EBITDA and Adjusted EBITDA margin information is useful to investors, see “—Summary Consolidated Historical And Pro Forma Financial And Other Data.”

Our management has determined that net income (loss) is the only component of our comprehensive income (loss). Accordingly, there is no difference between net income (loss) and comprehensive income (loss). The following table provides a reconciliation of net income (loss) to Adjusted EBITDA and the calculation of Adjusted EBITDA margin for the ranges presented for fiscal year 2016 and for pro forma fiscal year 2015.

| For the Fiscal Year Ended January 28, 2017 |

For the Fiscal Year Ended January 30, 2016 |

|||||||||||

| (in thousands) |

Low | High | Pro Forma (unaudited) |

|||||||||

| Statements of Operations Data: |

||||||||||||

| Net income (loss) |

$ | 22,503 | $ | 24,103 | $ | 14,295 | ||||||

| Interest expense, net |

18,670 | 18,670 | 16,893 | |||||||||

| Provision (benefit) for income taxes |

16,200 | 17,300 | 10,223 | |||||||||

| Depreciation and amortization |

36,219 | 36,219 | 37,802 | |||||||||

| Equity-based compensation expense(a) |

623 | 623 | 609 | |||||||||

| Write-off of property and equipment(b) |

385 | 385 | 349 | |||||||||

| Other non-recurring expenses(c) |

9,800 | 9,200 | 1,784 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 104,400 | $ | 106,500 | $ | 81,955 | ||||||

|

|

|

|

|

|

|

|||||||

| Net sales |

$ | 638,500 | $ | 639,500 | $ | 562,015 | ||||||

| Adjusted EBITDA margin |

16.4 | % | 16.7 | % | 14.6 | % | ||||||

| Total Company Comparable Sales |

11.1 | % | 11.3 | % | 12.4 | % | ||||||

| (a) | Represents expenses associated with equity incentive units granted to our management. Prior to the Acquisition, incentive units were accounted for as a liability-classified award and the related compensation expense was recognized based on changes in the intrinsic value of the award at each reporting period. Subsequent to the Acquisition, new incentive units were granted to management and are accounted for as equity-classified awards with the related compensation expense recognized based on fair value at the date of the grants. |

| (b) | Represents the net gain or loss on the disposal of fixed assets. |

| (c) | Represents items management believes are not indicative of ongoing operating performance. These expenses are primarily composed of legal and professional fees associated with non-recurring events. The pro forma fiscal year 2015 and fiscal year 2016 expenses are primarily due to legal, accounting, and professional fees incurred in connection with this offering. |

Risks Relating to Our Business and Our Common Stock

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized in the “Risk Factors” section of this prospectus immediately following this prospectus summary.

7

Table of Contents

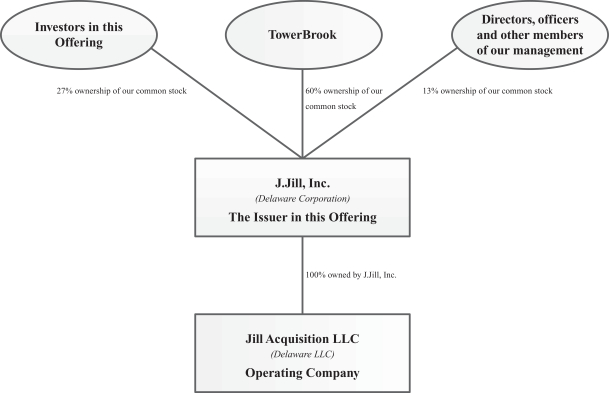

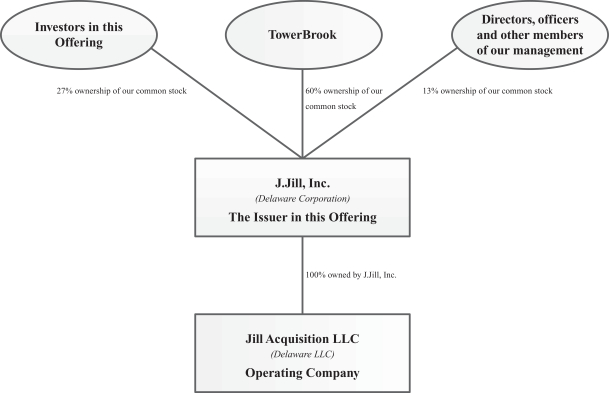

Corporate Conversion

On February 24, 2017, we converted from a Delaware limited liability company named Jill Intermediate LLC into a Delaware corporation and changed our name to J.Jill, Inc. In conjunction with the conversion, all of our outstanding equity interests converted into 43,747,944 shares of common stock. Jill Intermediate LLC had one class of equity interests, all of which were held by JJill Holdings, our former direct parent company, and JJill Topco Holdings, the direct parent company of JJill Holdings. In conjunction with our conversion into a Delaware corporation, JJill Holdings and JJill Topco Holdings each received shares of our common stock in proportion to the percentage of Jill Intermediate LLC’s equity interests held by them prior to the conversion. Following our conversion into a Delaware corporation, JJill Holdings, our former direct parent, merged with and into us, and we were the surviving entity to such merger. We are a holding company, and Jill Acquisition LLC, our wholly-owned subsidiary, will remain the operating company for our business assets. All of the shares of our common stock are held by JJill Topco Holdings, our current direct parent. Following the completion of this offering, JJill Topco Holdings plans to distribute all of the shares of our common stock held by it, other than the shares it sells in this offering, to its partners in accordance with the terms of its limited partnership agreement. For more information, please see “Corporate Conversion.”

The diagram below depicts our organizational structure immediately following the consummation of this offering and the transactions described above:

Our Sponsor

We were acquired by TowerBrook in May 2015. TowerBrook is an investment management firm that is based in the United States and Europe. It focuses on making investments in European and North American companies.

8

Table of Contents

Following this offering, TowerBrook will control approximately 60% of the voting power of our outstanding common stock (or 57% if the underwriters exercise their option to purchase additional shares). As a result, TowerBrook will control any action requiring the general approval of our stockholders, including the election of our board of directors (which will control our management and affairs), the adoption of amendments to our certificate of incorporation and bylaws and the approval of any merger or sale of substantially all of our assets. Because TowerBrook will hold more than 50% of the voting power of our outstanding common stock, we will be a “controlled company” under the corporate governance rules for New York Stock Exchange listed companies. We will therefore be permitted to, and we intend to, elect not to comply with certain corporate governance requirements. See “Management—Controlled Company.” We will also be party to a Stockholders Agreement with TowerBrook, pursuant to which TowerBrook will be entitled to certain veto rights including with respect to any payment or declaration of any dividend or other distribution on our equity securities (subject to certain exceptions specified therein), as long as TowerBrook beneficially owns at least 50% of our common stock. See “Certain Relationships and Related Party Transactions—Stockholders Agreement.”

Control by TowerBrook may give rise to actual or perceived conflicts of interest with holders of our common stock. TowerBrook’s significant ownership in us, its rights under the Stockholders Agreement and its resulting ability to effectively control us may discourage a third party from making a significant equity investment in us or a transaction involving a change of control, including transactions in which holders of shares of our common stock might otherwise receive a premium for such holders’ shares over the then-current market price. See “Risk Factors— Risks Related to this Offering and Ownership of Our Common Stock” for a summary of the potential conflicts of interests that may arise as a result of our control by TowerBrook.

Implications of being an Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or “JOBS Act” enacted in April 2012. As an “emerging growth company,” we may take advantage of specified reduced reporting and other requirements that are otherwise applicable to public companies. These provisions include, among other things:

| • | being permitted to present only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus; |

| • | exemption from the auditor attestation requirement in the assessment of our internal controls over financial reporting; |

| • | exemption from new or revised financial accounting standards applicable to public companies until such standards are also applicable to private companies; |

| • | exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board (United States), requiring mandatory audit firm rotation or a supplement to our auditor’s report in which the auditor would be required to provide additional information about the audit and our financial statements; |

| • | an exemption from the requirement to seek non-binding advisory votes on executive compensation and golden parachute arrangements; and |

| • | reduced disclosure about executive compensation arrangements. |

We may take advantage of these provisions until the end of the fiscal year following the fifth anniversary of our initial public offering or such earlier time that we are no longer an “emerging growth

9

Table of Contents

company.” We will cease to be an “emerging growth company” if we have $1.0 billion or more in “total annual gross revenues” during our most recently completed fiscal year, if we become a “large accelerated filer” with a market capitalization of $700 million or more, or as of any date on which we have issued more than $1.0 billion in non-convertible debt over the three-year period to such date. We may choose to take advantage of some, but not all, of these reduced burdens. For example, we have taken advantage of the reduced reporting requirement with respect to disclosure regarding our executive compensation arrangements and expect to take advantage of the exemption from auditor attestation on the effectiveness of our internal control over financial reporting. For as long as we take advantage of the reduced reporting obligations, the information that we provide stockholders may be different from information provided by other public companies. We are irrevocably electing to “opt out” of the extended transition period relating to the exemption from new or revised financial accounting standards and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-“emerging growth companies.”

In addition, upon the closing of this offering, we will be a “controlled company” within the meaning of the New York Stock Exchange corporate governance standards because more than 50% of our voting common stock will be owned by TowerBrook. For further information on the implications of this distinction, see “Risk Factors—Risks Related to this Offering and Ownership of Our Common Stock” and “Management—Board Committees.”

Corporate Information

We were originally organized as Jill Intermediate LLC, a Delaware limited liability company, in February 2011. On February 24, 2017, we completed transactions pursuant to which we converted into a Delaware corporation and changed our name to J.Jill, Inc. Our principal executive office is located at 4 Batterymarch Park, Quincy, MA 02169, and our telephone number is (617) 376-4300. Our website address is www.jjill.com. Our website and the information contained on, or that can be accessed through, our website will not be deemed to be incorporated by reference in, and are not considered part of, this prospectus. You should not rely on our website or any such information in making your decision whether to purchase shares of our common stock.

10

Table of Contents

The Offering

| Issuer in this offering |

J.Jill, Inc. |

| Common stock offered by the selling stockholder |

11,666,667 shares (or 13,416,667 shares, if the underwriters exercise in full their option to purchase additional shares as described below). |

| Option to purchase additional shares |

The selling stockholder has granted the underwriters an option to purchase up to an additional 1,750,000 shares. The underwriters may exercise this option at any time within 30 days from the date of this prospectus. See “Underwriting.” |

| Common stock outstanding immediately after this offering |

43,747,944 shares. |

| Use of proceeds |

The selling stockholder will receive all the proceeds from the sale of shares of our common stock in this offering. We will not receive any proceeds from the sale of shares of our common stock in this offering. |

| Controlled company |

Upon completion of this offering, TowerBrook will continue to beneficially own more than 50% of our outstanding common stock. As a result, we are eligible to, and we intend to, avail ourselves of the “controlled company” exemptions under the rules of the New York Stock Exchange (“NYSE”), including exemptions from certain of the corporate governance listing requirements. See “Management—Controlled Company” |

| Voting rights |

Holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. |

| Dividend policy |

We do not currently intend to pay dividends on our common stock. We plan to retain any earnings for use in the operation of our business and to fund future growth. |

| Listing |

Our common stock has been approved for listing on the NYSE under the symbol “JILL.” |

| Risk factors |

You should read the section entitled “Risk Factors” beginning on page 17 of, and the other information included in, this prospectus for a discussion of some of the risks and uncertainties you should carefully consider before deciding to invest in our common stock. |

The number of shares of our common stock to be outstanding immediately after the closing of this offering is based on 43,747,944 shares of common stock outstanding as of October 29, 2016 and, except as otherwise indicated, all information in this prospectus, reflects and assumes the following:

| • | assumes an initial public offering price of $15.00 per share of common stock, the midpoint of the price range on the cover of this prospectus; |

11

Table of Contents

| • | reflects the completion of our corporate conversion from a Delaware limited liability company to a Delaware corporation and the merger of JJill Holdings with and into us, as described under “Corporate Conversion”; |

| • | reflects the conversion of all of our outstanding equity interests into 43,747,944 shares of our common stock, which was effectuated on February 24, 2017; |

| • | assumes no exercise of the underwriters’ option to purchase 1,750,000 additional shares of common stock in this offering; and |

| • | does not reflect an additional 2,237,303 shares of our common stock reserved for future grant under our Equity Incentive Plan (as defined herein) which we expect to adopt in connection with this offering. |

12

Table of Contents

SUMMARY CONSOLIDATED HISTORICAL AND PRO FORMA FINANCIAL AND OTHER DATA

The following tables present our summary consolidated financial and other data as of and for the periods indicated. The summary consolidated statements of operations data for the fiscal years ended February 1, 2014 and January 31, 2015, the periods from February 1, 2015 to May 7, 2015 (Predecessor) and from May 8, 2015 to January 30, 2016 (Successor), and the summary consolidated balance sheet data as of January 31, 2015 and January 30, 2016 are derived from our audited consolidated financial statements included elsewhere in this prospectus. Our historical audited results are not necessarily indicative of the results that should be expected in any future period.

The summary consolidated statements of operations data for the period from May 8, 2015 to October 31, 2015 (Successor) and the thirty-nine weeks ended October 29, 2016 (Successor) and the summary consolidated balance sheet data as of October 29, 2016 are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. We have prepared our unaudited consolidated financial statements on the same basis as our audited consolidated financial statements and have included all adjustments, consisting only of normal recurring adjustments that, in our opinion, are necessary to present fairly the financial information set forth in those statements. The results for any interim period are not necessarily indicative of the results that may be expected for the full year and our historical unaudited results are not necessarily indicative of the results that should be expected in any future period.

We have derived the summary consolidated statements of operations data for the twelve months ended October 29, 2016 by adding the summary consolidated statements of operations data for the thirty-nine weeks ended October 29, 2016 to the summary consolidated statements of operations data for the 2015 Successor Period and subtracting the summary consolidated statements of operations data for the period from May 8, 2015 to October 31, 2015. We believe that presentation of the summary consolidated statements of operations data for the twelve months ended October 29, 2016 is useful to investors because it presents information about how our business has performed in the twelve month period immediately preceding the date of our most recent interim financial statements, which allows investors to review our current performance trends over a period consisting of our four most recent consecutive fiscal quarters.

For purposes of presenting a comparison of our fiscal year 2013 and fiscal year 2014 results, in addition to standalone results for the 2015 Predecessor Period and 2015 Successor Period, we have also presented summary unaudited pro forma consolidated financial and other data for the fiscal year ended January 30, 2016. The unaudited pro forma consolidated statement of operations for the fiscal year ended January 30, 2016 has been derived from the historical audited statements of operations included elsewhere in this prospectus, and represents the addition of the 2015 Predecessor Period and the 2015 Successor Period and gives effect to certain transactions, as described in “Unaudited Pro Forma Consolidated Financial Information” contained elsewhere in this prospectus, as if they had occurred on February 1, 2015. We believe that this presentation provides meaningful information about our results of operations on a period to period basis. The unaudited pro forma consolidated statement of operations is presented for illustrative purposes and does not purport to represent what the results of operations would actually have been if the transactions had occurred as of the date indicated or what the results of operations would be for any future periods.

13

Table of Contents

The summary historical financial data presented below does not purport to project our financial position or results of operations for any future date or period and should be read together with “Selected Historical Consolidated Financial and Other Data,” “Unaudited Pro Forma Consolidated Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and related notes thereto included elsewhere in this prospectus.

| Interim Periods | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Predecessor | Pro Forma (unaudited) |

Predecessor |

Successor |

Predecessor |

Successor (unaudited) |

|||||||||||||||||||||||||||||||||||||||||||||||

| (in thousands, except share and per share data) |

For the Year Ended |

For the Year Ended |

For the Year Ended |

For the |

For the |

For the |

For the |

For

the |

Twelve |

|||||||||||||||||||||||||||||||||||||||||||

| Statements of Operations Data: |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net sales |

$ | 456,026 | $ | 483,400 | $ | 562,015 | $ | 141,921 | $ | 420,094 | $ | 141,921 | $ | 274,741 | $ | 472,139 | $ | 617,492 | ||||||||||||||||||||||||||||||||||

| Costs of goods sold |

161,261 | 164,792 | 188,852 | 44,232 | 155,091 | 44,232 | 101,185 | 149,673 | 203,579 | |||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Gross profit |

294,765 | 318,608 | 373,163 | 97,689 | 265,003 | 97,689 | 173,556 | 322,466 | 413,913 | |||||||||||||||||||||||||||||||||||||||||||

| Selling, general and administrative expenses |

267,319 | 279,557 | 331,752 | 80,151 | 246,482 | 80,151 | 161,236 | 273,882 | 359,128 | |||||||||||||||||||||||||||||||||||||||||||

| Acquisition-related expenses |

— | — | — | 13,341 | — | 13,341 | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Operating income |

27,446 | 39,051 | 41,411 | 4,197 | 18,521 | 4,197 | 12,320 | 48,584 | 54,785 | |||||||||||||||||||||||||||||||||||||||||||

| Interest expense |

19,064 | 17,895 | 16,893 | 4,599 | 11,893 | 4,599 | 7,922 | 13,630 | 17,601 | |||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Income (loss) before provision for income taxes |

8,382 | 21,156 | 24,518 | (402 | ) | 6,628 | (402 | ) | 4,398 | 34,954 | 37,184 | |||||||||||||||||||||||||||||||||||||||||

| Provision (benefit) for income taxes |

3,884 | 10,860 | 10,223 | 1,499 | 2,322 | 1,499 | 1,541 | 12,924 | 13,705 | |||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Net income |

$ | 4,498 | $ | 10,296 | $ | 14,295 | $ | (1,901 | ) | $ | 4,306 | $ | (1,901 | ) | $ | 2,857 | $ | 22,030 | $ | 23,479 | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Net income (loss) per share attributable to common stockholders(1): |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic |

$ | 0.10 | $ | 0.24 | $ | 0.35 | $ | (0.04 | ) | $ | 0.10 | $ | (0.04 | ) | $ | 0.07 | $ | 0.50 | $ | 0.54 | ||||||||||||||||||||||||||||||||

| Diluted |

$ | 0.10 | $ | 0.24 | $ | 0.34 | $ | (0.04 | ) | $ | 0.10 | $ | (0.04 | ) | $ | 0.07 | $ | 0.50 | $ | 0.54 | ||||||||||||||||||||||||||||||||

| Weighted average number of common shares outstanding(1): |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic |

43,747,944 | 43,747,944 | 40,333,974 | 43,747,944 | 43,747,944 | 43,747,944 | 43,747,944 | 43,747,944 | 43,747,944 | |||||||||||||||||||||||||||||||||||||||||||

| Diluted |

43,747,944 | 43,747,944 | 42,531,433 | 43,747,944 | 43,747,944 | 43,747,944 | 43,747,944 | 43,747,944 | 43,747,944 | |||||||||||||||||||||||||||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted |

$ | 54,241 | $ | 65,720 | $ | 81,955 | $ | 23,672 | $ | 59,699 | $ | 23,672 | $ | 44,277 | $ | 83,539 | $ | 98,961 | ||||||||||||||||||||||||||||||||||

| Adjusted EBITDA margin(3) |

11.9 | % | 13.6 | % | 14.6 | % | 16.7 | % | 14.2 | % | 16.7 | % | 16.1 | % | 17.7 | % | 16.0 | % | ||||||||||||||||||||||||||||||||||

14

Table of Contents

| Successor | ||||||||

| (in thousands) |

January 30, 2016 |

October 29, 2016 |

||||||

| Balance Sheet data (at end of period): |

||||||||

| Cash |

$ | 27,505 | $ | 4,955 | ||||

| Net operating assets and liabilities(4) |

3,477 | 19,749 | ||||||

| Total assets |

582,032 | 578,468 | ||||||

| Current and non-current portions of long-term debt, net of discount and debt issuance costs |

239,978 | 277,256 | ||||||

| Total equity |

166,571 | 118,754 | ||||||

| (1) | See Note 15 to our audited consolidated financial statements included elsewhere in this prospectus for additional information regarding the calculation of basic and diluted net income (loss) per share attributable to common stockholders. Except for the pro forma periods, there are no potentially dilutive securities outstanding in any historical period presented, basic and diluted net income (loss) per share attributable to common stockholders is the same in each historical period. See Note 12 to our Unaudited Pro Forma Consolidated Statement of Operations Adjustments within “Unaudited Pro Forma Consolidated Financial Information” included elsewhere in this prospectus for additional information regarding the calculation of pro forma basic and diluted net income. |

| (2) | Adjusted EBITDA represents net income (loss) plus interest expense, provision (benefit) for income taxes, depreciation and amortization, the amortization of the step-up to fair value of merchandise inventory resulting from the application of a purchase accounting adjustment related to the Acquisition, certain Acquisition-related expenses, sponsor fees, equity-based compensation expense, write-off of property and equipment and other non-recurring expenses, primarily consisting of outside legal and professional fees associated with certain non-recurring transactions and events. We present Adjusted EBITDA on a consolidated basis because our management uses it as a supplemental measure in assessing our operating performance, and we believe that it is helpful to investors, securities analysts and other interested parties as a measure of our comparative operating performance from period to period. Adjusted EBITDA is not a measurement of financial performance under GAAP. It should not be considered an alternative to net income (loss) as a measure of our operating performance or any other measure of performance derived in accordance with GAAP. Adjusted EBITDA has limitations as an analytical tool, and you should not consider such measure either in isolation or as a substitute for analyzing our results as reported under GAAP. Our definition and calculation of Adjusted EBITDA is not necessarily comparable to other similarly titled measures used by other companies due to different methods of calculation. To address these limitations we reconciled Adjusted EBITDA to the nearest GAAP financial measure, net income (loss). |

The following provides a reconciliation of net income (loss) to Adjusted EBITDA for the periods presented and the calculation of Adjusted EBITDA margin:

| Interim Periods | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Predecessor | Pro Forma (unaudited) |

Predecessor |

Successor |

Predecessor |

Successor (unaudited) |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) |

For the Year |

For the Year |

For the Year |

For the Year |

For

the |

For the |

For

the |

For the |

For the Nine Weeks |

Twelve |

||||||||||||||||||||||||||||||||||||||||||||||

| Statements of Operations Data: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) |

$ | (3,601 | ) | $ | 4,498 | $ | 10,296 | $ | 14,295 | $ | (1,901 | ) | $ | 4,306 | $ | (1,901 | ) | $ | 2,857 | $ | 22,030 | $ | 23,479 | |||||||||||||||||||||||||||||||||

| Interest expense |

19,183 | 19,064 | 17,895 | 16,893 | 4,599 | 11,893 | 4,599 | 7,922 | 13,630 | 17,601 | ||||||||||||||||||||||||||||||||||||||||||||||

| Provision (benefit) for income |

(2,583 | ) | 3,884 | 10,860 | 10,223 | 1,499 | 2,322 | 1,499 | 1,541 | 12,924 | 13,705 | |||||||||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization |

27,333 | 22,910 | 19,051 | 37,802 | 5,147 | 28,702 | 5,147 | 20,112 | 27,282 | 35,872 | ||||||||||||||||||||||||||||||||||||||||||||||

| Inventory step-up(a) |

— | — | — | — | — | 10,471 | — | 10,471 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Acquisition-related expenses(b) |

— | — | — | — | 13,341 | — | 13,341 | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Sponsor fees(c) |

1,000 | 1,000 | 1,000 | — | 250 | — | 250 | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Equity-based compensation expense(d) |

417 | 1,930 | 5,152 | 609 | 441 | 168 | 441 | 119 | 458 | 507 | ||||||||||||||||||||||||||||||||||||||||||||||

| Write-off of property and equipment(e) |

250 | 386 | 58 | 349 | 112 | 237 | 112 | 48 | 384 | 573 | ||||||||||||||||||||||||||||||||||||||||||||||

| Other non-recurring expenses(f) |

1,914 | 569 | 1,408 | 1,784 | 184 | 1,600 | 184 | 1,207 | 6,831 | 7,224 | ||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA |

$ | 43,913 | $ | 54,241 | $ | 65,720 | $ | 81,955 | $ | 23,672 | $ | 59,699 | $ | 23,672 | $ | 44,277 | $ | 83,539 | $ | 98,961 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| Net sales |

$ | 431,881 | $ | 456,026 | $ | 483,400 | $ | 562,015 | $ | 141,921 | $ | 420,094 | $ | 141,921 | $ | 274,741 | $ | 472,139 | $ | 617,492 | ||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA margin(3) |

10.2 | % | 11.9 | % | 13.6 | % | 14.6 | % | 16.7 | % | 14.2 | % | 16.7 | % | 16.1 | % | 17.7 | % | 16.0 | % | ||||||||||||||||||||||||||||||||||||