Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION OF CFO SECTION 906 - GENESIS ENERGY LP | gel12312016exhibit322.htm |

| EX-32.1 - CERTIFICATION OF CEO SECTION 906 - GENESIS ENERGY LP | gel12312016exhibit321.htm |

| EX-31.2 - CERTIFICATION OF CFO SECTION 302 - GENESIS ENERGY LP | gel12312016exhibit312.htm |

| EX-31.1 - CERTIFICATION OF CEO SECTION 302 - GENESIS ENERGY LP | gel12312016exhibit311.htm |

| EX-23.2 - CONSENT OF DELOITTE & TOUCHE LLP - GENESIS ENERGY LP | gel12312016exhibit232.htm |

| EX-23.1 - CONSENT OF DELOITTE & TOUCHE LLP - GENESIS ENERGY LP | gel12312016exhibit231.htm |

| EX-21.1 - SUBSIDIARIES OF THE REGISTRANT - GENESIS ENERGY LP | gel12312016exhibit211.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 1-12295

GENESIS ENERGY, L.P.

(Exact name of registrant as specified in its charter)

Delaware | 76-0513049 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

919 Milam, Suite 2100, Houston, TX 77002

(Address of principal executive offices) (Zip code)

(713) 860-2500

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Units | NYSE | |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | x | Accelerated filer | ¨ |

Non-accelerated filer | o | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2) of the Act). Yes o No x

The aggregate market value of the Class A common units held by non-affiliates of the Registrant on June 30, 2016 (the last business day of Registrant’s most recently completed second fiscal quarter) was approximately $3.5 billion based on $38.37 per unit, the closing price of the common units as reported on the NYSE. For purposes of this computation, all executive officers, directors and 10% owners of the registrant are deemed to be affiliates. Such a determination should not be deemed an admission that such executive officers, directors and 10% beneficial owners are affiliates. On February 24, 2017, the Registrant had 117,939,221 Class A Common Units and 39,997 Class B Common Units outstanding.

GENESIS ENERGY, L.P.

2016 FORM 10-K ANNUAL REPORT

Table of Contents

Page | ||

Item 1 | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

2

Definitions

Unless the context otherwise requires, references in this annual report to “Genesis Energy, L.P.,” “Genesis,” “we,” “our,” “us” or like terms refer to Genesis Energy, L.P. and its operating subsidiaries. As generally used within the energy industry and in this annual report, the identified terms have the following meanings:

Bbl or Barrel: One stock tank barrel, or 42 U.S. gallons liquid volume, used in reference to crude oil or other liquid hydrocarbons.

Bbls/day: Barrels per day.

Bcf: Billion cubic feet of gas.

CO2: Carbon dioxide.

DST: Dry short tons (2,000 pounds), a unit of weight measurement.

FERC: Federal Energy Regulatory Commission.

Gal: Gallon.

MBbls: Thousand Bbls.

MBbls/d: Thousand Bbls per day.

Mcf: Thousand cubic feet of gas.

mmBtu: One million British thermal units, an energy measurement.

MMcf: Thousand Mcf.

NaHS: (commonly pronounced as “nash”) Sodium hydrosulfide.

NaOH or Caustic Soda: Sodium hydroxide.

Natural gas liquid(s) or NGL(s): The combination of ethane, propane, normal butane, isobutane and natural gasolines that, when removed from natural gas, become liquid under various levels of higher pressure and lower temperature.

Sour gas: Natural gas containing more than four parts per million of hydrogen sulfide.

Wellhead: The point at which the hydrocarbons and water exit the ground.

FORWARD-LOOKING INFORMATION

The statements in this Annual Report on Form 10-K that are not historical information may be “forward looking statements” as defined under federal law. All statements, other than historical facts, included in this document that address activities, events or developments that we expect or anticipate will or may occur in the future, including things such as plans for growth of the business, future capital expenditures, competitive strengths, goals, references to future goals or intentions and other such references are forward-looking statements, and historical performance is not necessarily indicative of future performance. These forward-looking statements are identified as any statement that does not relate strictly to historical or current facts. They use words such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “could,” “plan,” “position,” “projection,” “strategy,” “should” or “will,” or the negative of those terms or other variations of them or by comparable terminology. In particular, statements, expressed or implied, concerning future actions, conditions or events or future operating results or the ability to generate sales, income or cash flow are forward-looking statements. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Future actions, conditions or events and future results of operations may differ materially from those expressed in these forward-looking statements. Many of the factors that will determine these results are beyond our ability or the ability of our affiliates to control or predict. Specific factors that could cause actual results to differ from those in the forward-looking statements include, among others:

• | demand for, the supply of, our assumptions about, changes in forecast data for, and price trends related to crude oil, liquid petroleum, natural gas, NaHS, caustic soda and CO2, all of which may be affected by economic activity, capital expenditures by energy producers, weather, alternative energy sources, international events, conservation and technological advances; |

3

• | throughput levels and rates; |

• | changes in, or challenges to, our tariff rates; |

• | our ability to successfully identify and close strategic acquisitions on acceptable terms (including obtaining third-party consents and waivers of preferential rights), develop or construct energy infrastructure assets, make cost saving changes in operations and integrate acquired assets or businesses into our existing operations; |

• | service interruptions in our pipeline transportation systems, and processing operations; |

• | shutdowns or cutbacks at refineries, petrochemical plants, utilities or other businesses for which we transport crude oil, petroleum, natural gas or other products or to whom we sell such products; |

• | risks inherent in marine transportation and vessel operation, including accidents and discharge of pollutants; |

• | changes in laws and regulations to which we are subject, including tax withholding issues, regulations regarding qualifying income, accounting pronouncements, and safety, environmental and employment laws and regulations; |

• | the effects of production declines resulting from the suspension of drilling in the Gulf of Mexico and the effects of future laws and government regulation resulting from the Macondo accident and oil spill in the Gulf; |

• | planned capital expenditures and availability of capital resources to fund capital expenditures; |

• | our inability to borrow or otherwise access funds needed for operations, expansions or capital expenditures as a result of our credit agreement and the indentures governing our notes, which contain various affirmative and negative covenants; |

• | loss of key personnel; |

• | cash from operations that we generate could decrease or fail to meet expectations, either of which could reduce our ability to pay quarterly cash distributions at the current level or continue to increase quarterly cash distributions in the future; |

• | an increase in the competition that our operations encounter; |

• | cost and availability of insurance; |

• | hazards and operating risks that may not be covered fully by insurance; |

• | our financial and commodity hedging arrangements, which may reduce our earnings, profitability and cash flow; |

• | changes in global economic conditions, including capital and credit markets conditions, inflation and interest rates; |

• | natural disasters, accidents or terrorism; |

• | changes in the financial condition of customers or counterparties; |

• | adverse rulings, judgments, or settlements in litigation or other legal or tax matters; |

• | the treatment of us as a corporation for federal income tax purposes or if we become subject to entity-level taxation for state tax purposes; and |

• | the potential that our internal controls may not be adequate, weaknesses may be discovered or remediation of any identified weaknesses may not be successful and the impact these could have on our unit price. |

You should not put undue reliance on any forward-looking statements. When considering forward-looking statements, please review the risk factors described under “Risk Factors” discussed in Item 1A. These risks may also be specifically described in our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and Form 8-K/A and other documents that we may file from time to time with the SEC. Except as required by applicable securities laws, we do not intend to update these forward-looking statements and information.

4

PART I

Item 1. Business

General

We are a growth-oriented master limited partnership formed in Delaware in 1996 and focused on the midstream segment of the crude oil and natural gas industry in the Gulf Coast region of the United States, Wyoming and in the Gulf of Mexico. Our common units are traded on the New York Stock Exchange under the ticker symbol “GEL.” Our principal executive offices are located at 919 Milam, Suite 2100, Houston, Texas 77002 and our telephone number is (713) 860-2500. Except to the extent otherwise provided, the information contained in this annual report is as of December 31, 2016.

We provide an integrated suite of services to refiners, crude oil and natural gas producers, and industrial and commercial enterprises. We currently have two distinct, complimentary types of operations-(i) our onshore-based refinery-centric operations located primarily in the Gulf Coast region of the U.S., which focus on providing a suite of services primarily to refiners, and (ii) our offshore Gulf of Mexico crude oil and natural gas pipeline transportation and handling operations, which focus on providing a suite of services primarily to integrated and large independent energy companies who make intensive capital investments (often in excess of billions of dollars) to develop numerous large-reservoir, long-lived crude oil and natural gas properties. Our onshore-based operations occur upstream of, at, and downstream of refinery complexes. Upstream of refineries, we aggregate, purchase, gather and transport crude oil, which we sell to refiners. Within refineries, we provide services to assist in sulfur removal/balancing requirements. Downstream of refineries, we provide transportation services as well as market outlets for finished refined petroleum products and certain refining by-products. In our offshore crude oil and natural gas pipeline transportation and handling operations, we provide service to one of the most active drilling and development regions in the U.S.—the Gulf of Mexico, a producing region representing approximately 18% of the crude oil production in the U.S. in 2016. We have a diverse portfolio of customers, operations and assets, including pipelines, refinery-related plants, storage tanks and terminals, railcars, rail loading and unloading facilities, barges and other vessels, and trucks. Substantially all of our revenues are derived from providing services to refiners, integrated and large independent crude oil and natural gas companies, and industrial and commercial enterprises.

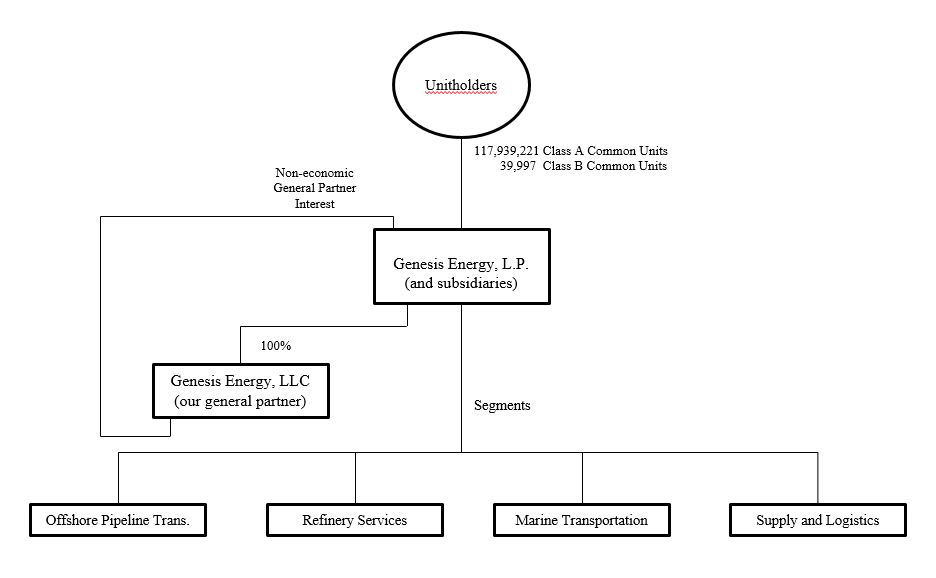

We conduct our operations and own our operating assets through our subsidiaries and joint ventures. Our general partner, Genesis Energy, LLC, a wholly-owned subsidiary that owns a non-economic general partner interest in us, has sole responsibility for conducting our business and managing our operations. Our outstanding common units (including our Class B common units) representing limited partner interests constitute all of the economic equity interests in us.

In the fourth quarter of 2016, we reorganized our operating segments as a result of the way our Chief Executive Officer, who is our chief operating decision maker, evaluates the performance of operations, develops strategy and allocates resources. The results of our onshore pipeline transportation segment, formerly reported under its own segment, are now reported in our supply and logistics segment. This change is consistent with the increasingly integrated nature of our onshore operations.

As a result of the above changes, we currently manage our businesses through four divisions that constitute our reportable segments - offshore pipeline transportation, refinery services, marine transportation, and supply and logistics. Our disclosures related to prior periods have been recast to reflect our reorganized segments.

Offshore Pipeline Transportation Segment

We conduct our offshore crude oil and natural gas pipeline transportation and handling operations through our offshore pipeline transportation segment, which focuses on providing a suite of services to integrated and large independent energy companies who make intensive capital investments (often in excess of billions of dollars) to develop numerous large-reservoir, long-lived crude oil and natural gas properties in the Gulf of Mexico, primarily offshore Texas, Louisiana, Mississippi and Alabama. This segment provides services to one of the most active drilling and development regions in the U.S.—the Gulf of Mexico, a producing region representing approximately 18% of the crude oil production in the U.S. in 2016. Even though those large-reservoir properties and the related pipelines and other infrastructure needed to develop them are capital intensive, we believe they are generally much less sensitive to short-term commodity price volatility, particularly once a project has been sanctioned. Due to the size and scope of these activities, our customers are predominantly large integrated oil companies and large independent crude oil producers.

We own interests in various offshore crude oil and natural gas pipeline systems, platforms and related infrastructure. We own interests in approximately 1,437 miles of crude oil pipelines with an aggregate design capacity of approximately 1,810 MBbls per day, a number of which pipeline systems are substantial and/or strategically located. For example, we own a 64% interest in the Poseidon pipeline system and 100% of the Cameron Highway pipeline system, or CHOPS, which is one of the largest crude oil pipelines (in terms of both length and design capacity) located in the Gulf of Mexico. We also own 100% of the Southeast Keathley Canyon Pipeline Company, LLC ("SEKCO"), which is a deepwater pipeline servicing the Lucius field in the southern Keathley Canyon area of the Gulf of Mexico.

5

Our interests in offshore natural gas pipeline systems and related infrastructure includes approximately 1,157 miles of pipe with an aggregate design capacity of approximately 4,863 MMcf per day. We also own an interest in six offshore hub platforms with aggregate processing capacity of approximately 2,256 MMcf per day of natural gas and 167 MBbls per day of crude oil.

Our offshore pipelines generate cash flows from fees charged to customers or substantially similar arrangements that otherwise limit our direct exposure to changes in commodity prices. Each of our offshore pipelines currently has significant available capacity to accommodate future growth in the fields from which the production is dedicated to that pipeline, including fields that have yet to commence production activities, as well as volumes from non-dedicated fields.

Refinery Services Segment

We primarily (i) provide services to ten refining operations located mostly in Texas, Louisiana, Arkansas, Oklahoma, Montana and Utah; (ii) operate significant storage and transportation assets in relation to those services; and (iii) sell NaHS (pronounced nash, and also known as sodium hydrosulfide) and NaOH (also known as caustic soda) to large industrial and commercial companies. Our refinery services primarily involve processing refiners’ high sulfur (or “sour”) gas streams to remove the sulfur. Our refinery services footprint also includes NaHS and caustic soda terminals, and we utilize railcars, ships, barges and trucks to transport product. Our refinery services contracts are typically long-term in nature and have an average remaining term of three years. NaHS is a by-product derived from our refinery sulfur removal services process, and it constitutes the sole consideration we receive for these services. A majority of the NaHS we receive is sourced from refineries owned and operated by large companies, including Phillips 66, CITGO, HollyFrontier, Calumet and Ergon. We sell our NaHS to customers in a variety of industries, with the largest customers involved in mining of base metals, primarily copper and molybdenum, and the production of pulp and paper. We believe we are one of the largest marketers of NaHS in North and South America.

Marine Transportation Segment

We own a fleet of 83 barges (74 inland and 9 offshore) with a combined transportation capacity of 2.9 million barrels and 43 push/tow boats (34 inland and 9 offshore). Our marine transportation segment is a provider of transportation services by tank barge primarily for refined petroleum products, including heavy fuel oil and asphalt, as well as crude oil. Refiners accounted for approximately 80% of our marine transportation volumes for 2016.

We also own the M/T American Phoenix, an ocean going tanker with 330,000 barrels of cargo capacity. The M/T American Phoenix is currently transporting refined products.

We are a provider of transportation services for our customers and, in almost all cases, do not assume ownership of the products that we transport. Most of our marine transportation services are conducted under term contracts, some of which have renewal options for customers with whom we have traditionally had long-standing relationships. For more information regarding our charter arrangements, please refer to the marine transportation segment discussion below. All of our vessels operate under the U.S. flag and are qualified for domestic trade under the Jones Act.

Supply and Logistics Segment

Our supply and logistics segment owns and/or leases our increasingly integrated suite of onshore crude oil and refined products infrastructure, including pipelines, trucks, terminals, railcars, and rail loading and unloading facilities. It uses those assets, together with other modes of transportation owned by third parties and us, to service its customers and for its own account. The increasingly integrated nature of our supply and logistics assets is particularly evident in certain of our recently completed or ongoing growth initiatives in areas such as Louisiana, Texas and Wyoming.

We own five onshore crude oil pipeline systems, with approximately 580 miles of pipe located primarily in Alabama, Florida, Louisiana, Mississippi, Texas and Wyoming. The Federal Energy Regulatory Commission, or FERC, regulates the rates charged by four of our onshore systems to their customers. The rates for the other onshore pipeline are regulated by the Railroad Commission of Texas. Our onshore pipelines generate cash flows from fees charged to customers. Each of our onshore pipelines has significant available capacity to accommodate potential future growth in volumes.

We own two CO2 pipelines with approximately 270 miles of pipe. We have leased our NEJD System, comprised of 183 miles of pipe in North East Jackson Dome, Mississippi, to an affiliate of an independent crude oil company through 2028. We receive a fixed quarterly payment under the NEJD arrangement. That company also has the exclusive right to use our Free State pipeline, comprised of 86 miles of pipe, pursuant to a transportation agreement that expires in 2028. Payments on the Free State pipeline are subject to an "incentive" tariff which provides that the average rate per mcf that we charge during any month decreases as our aggregate throughput for that month increases above specified thresholds.

We have access to a suite of more than 200 trucks, 400 trailers, 523 railcars, and terminals and tankage with 4.6 million barrels of storage capacity (excluding capacity associated with our common carrier crude oil pipelines) in multiple locations along the Gulf Coast. Our crude-by-rail operations consist of a total of six facilities, either in operation or under

6

construction, designed to load and/or unload crude oil. The two facilities located in Texas and Wyoming were designed primarily to load crude oil produced locally onto railcars for further transportation to refining markets. The four other facilities (two in Louisiana, one in Mississippi and one in Florida) were designed primarily to unload crude oil from railcars into pipelines, or onto barges, for delivery to refinery customers. In addition, four of these facilities are directly connected to our integrated pipeline and terminal infrastructure. Usually, our supply and logistics segment experiences limited direct commodity price risk because it utilizes back-to-back purchases and sales, matching sale and purchase volumes on a monthly basis. Unsold volumes are hedged with NYMEX derivatives to offset the remaining price risk.

Our Objectives and Strategies

Our primary objective continues to be to deliver the best value to our unitholders while never wavering from our commitment to safe and responsible operations. A lot has changed, we recognize, in how the market apparently values unit prices for MLPs or other midstream entities over the last year and a half to two years. The move to eliminate our IDRs over six years ago and our track record of delivering annualized double-digit growth in distributions were historically rewarded. However, we have recently concluded the valuation metrics demanded by the markets have changed in recent times, especially in light of numerous freezes, cuts or total elimination of distributions over the recent energy business cycle by other entities in our space with which we compete commercially and/or for external capital.

We now believe the best way to promote unit price appreciation under current conditions is to exercise strong financial discipline designed primarily to maintain and enhance our financial flexibility across the business cycle. We believe prospectively we can naturally restore our financial flexibility with cash flows from operations. During 2016, we accelerated that process by issuing additional equity and lowering the future growth rate of quarterly distributions.

Business Strategy

Our primary business strategy is to provide an integrated suite of services to refiners, crude oil and natural gas producers, and industrial and commercial enterprises. Successfully executing this strategy should enable us to generate and grow sustainable cash flows. We currently have two distinct, complimentary types of operations: (i) our onshore-based crude oil and refined petroleum products transportation, supply and logistics, and handling operations, focusing predominantly on refinery-centric customers (as opposed to producers), and (ii) our offshore Gulf of Mexico crude oil and natural gas pipeline transportation and handling operations, focusing on integrated and large independent energy companies who make intensive capital investments (often in excess of billions of dollars) to develop numerous large-reservoir, long-lived crude oil and natural gas properties. Refiners are the shippers of approximately 80% of the volumes transported on our onshore crude pipelines, and refiners contract for approximately 80% of the use of our inland barges, which are used primarily to transport intermediate refined products (not crude oil) between refining complexes. The shippers on our offshore pipelines are mostly integrated and large independent energy companies who have developed, and continue to explore for, numerous large-reservoir, long-lived crude oil properties whose production is ideally suited for the vast majority of refineries along the Gulf Coast, unlike the lighter crude oil and condensates produced from numerous onshore shale plays. Those large-reservoir properties and the related pipelines and other infrastructure needed to develop them are capital intensive and yet, we believe, economically viable, in most cases, even in this lower commodity price environment.

We intend to develop our business by:

• | Identifying and exploiting incremental profit opportunities, including cost synergies, across an increasingly integrated footprint; |

• | Optimizing our existing assets and creating synergies through additional commercial and operating advancement; |

• | Leveraging customer relationships across business segments; |

• | Attracting new customers and expanding our scope of services offered to existing customers; |

• | Expanding the geographic reach of our businesses; |

• | Economically expanding our pipeline and terminal operations; |

• | Evaluating internal and third party growth opportunities (including asset and business acquisitions) that leverage our core competencies and strengths and further integrate our businesses; and |

• | Focusing on health, safety and environmental stewardship. |

7

Financial Strategy

We believe that preserving financial flexibility is an important factor in our overall strategy and success. Over the long-term, we intend to:

• | Increase the relative contribution of recurring and throughput-based revenues, emphasizing longer-term contractual arrangements; |

• | Prudently manage our limited direct commodity price risks; |

• | Maintain a sound, disciplined capital structure; and |

• | Create strategic arrangements and share capital costs and risks through joint ventures and strategic alliances. |

Competitive Strengths

We believe we are well positioned to execute our strategies and ultimately achieve our objectives due primarily to the following competitive strengths:

• | We have limited direct commodity price risk exposure. The volumes of crude oil, refined products or intermediate feedstocks we purchase are either subject to back-to-back sales contracts or are hedged with NYMEX derivatives to limit our direct exposure to movements in the price of the commodity, although we cannot completely eliminate commodity price exposure. Our risk management policy requires us to monitor the effectiveness of the hedges to maintain a value at risk of such hedged inventory not in excess of $2.5 million. In addition, our service contracts with refiners allow us to adjust the rates we charge for processing to maintain a balance between NaHS supply and demand. |

• | Our businesses encompass a balanced, diversified portfolio of customers, operations and assets. We operate four business segments and own and operate assets that enable us to provide a number of services primarily to refiners, crude oil and natural gas producers, and industrial and commercial enterprises that use NaHS and caustic soda. Our business lines complement each other by allowing us to offer an integrated suite of services to common customers across segments. Our businesses are primarily focused on providing (i) onshore-based refinery-centric crude oil and refined products transportation and handling services and (ii) offshore crude oil and natural gas pipeline transportation and related handling services in the Gulf of Mexico to mostly integrated and large independent energy companies. We are not dependent upon any one customer or principal location for our revenues. |

• | Some of our pipeline transportation and related assets are strategically located. Our pipelines are critical to the ongoing operations of our refiner and producer customers. In addition, a majority of our terminals are located in areas that can be accessed by truck, rail or barge. |

• | We believe we are one of the largest marketers of NaHS in North and South America. We believe the scale of our well-established refinery services operations as well as our integrated suite of assets provides us with a unique cost advantage over some of our existing and potential competitors. |

• | Some of our supply and logistics assets are operationally flexible. Our portfolio of trucks, railcars, barges and terminals affords us flexibility within our existing regional footprint and provides us the capability to enter new markets and expand our customer relationships. |

• | Our marine transportation assets provide waterborne transportation throughout North America. Our fleet of barges and boats provide service to both inland and offshore customers within a large North American geographic footprint. All of our vessels operate under the U.S. flag and are qualified for U.S. coastwise trade under the Jones Act. |

• | Our businesses provide relatively consistent consolidated financial performance. Our historically consistent and improving financial performance, combined with our goal of a conservative capital structure over the long term, has allowed us to generate relatively stable and increasing cash flows, allowing us to increase our distribution for forty-six consecutive quarters as of our most recent distribution declaration. |

• | We are financially flexible and have significant liquidity. As of December 31, 2016, we had $412.3 million available under our $1.7 billion revolving credit agreement, including up to $125.5 million available under the $200 million petroleum products inventory loan sublimit and $90.5 million available for letters of credit. Our inventory borrowing base was $74.5 million at December 31, 2016. |

• | Our expertise and reputation for high performance standards and quality enable us to provide refiners with economic and proven services. Our extensive understanding of the sulfur removal process and crude oil refining can provide us with an advantage when evaluating new opportunities and/or markets. |

• | We have an experienced, knowledgeable and motivated executive management team with a proven track record. Our executive management team has an average of more than 25 years of experience in the midstream sector. Its members |

8

have worked in leadership roles at a number of large, successful public companies, including other publicly-traded partnerships. Through their equity interest in us, our executive management team is incentivized to create value by increasing cash flows.

Recent Developments and Status of Certain Growth Initiatives

The following is a brief listing of developments since December 31, 2015. Additional information regarding most of these items may be found elsewhere in this report.

Houston Area Crude Oil Pipeline and Terminal Infrastructure

We are constructing new, and expanding existing, crude oil pipeline and terminal facilities in Webster, Texas and Texas City, Texas as a result of expanding our crude oil pipeline and terminal infrastructure in the Houston area. We are constructing a new crude oil pipeline that will deliver crude oil received from upstream crude oil pipelines (including CHOPS, which delivers crude oil originating in the deepwater Gulf of Mexico to the Texas City area) to our new Texas City Terminal, which will ultimately connect to our existing 18-inch Webster to Texas City crude oil pipeline. Our new Texas City Terminal will initially include approximately 750,000 barrels of crude oil tankage. As a part of this project, we are also making the necessary upgrades on our existing 18-inch Webster to Texas City crude oil pipeline to reverse the direction of flow. The result of this expanded crude oil infrastructure will allow additional optionality to Houston and Baytown area refineries, including the Exxon-Mobil Baytown refinery, its largest refinery in the U.S.A., and provide additional delivery outlets for other crude oil pipelines. We expect these assets to become operational in the first half of 2017.

Raceland Terminal and Crude Oil Pipeline

We are constructing a new crude oil terminal and pipeline in Raceland, Louisiana that will be connected to existing midstream infrastructure that will provide further distribution to the Louisiana refining markets. Our new Raceland Terminal will consist of 515,000 barrels of crude oil tankage and unit train unloading facilities capable of unloading up to two unit trains per day. We are constructing a new crude oil pipeline that will deliver crude oil received from the Poseidon system, which currently delivers crude oil originating in the deepwater Gulf of Mexico to the Houma, Louisiana area, to our Raceland Terminal for further distribution. We expect these assets to become fully operational in the first half of 2017.

Inland Marine Barge Transportation Expansion

We ordered 28 new-build barges and 18 new-build push boats for our inland marine barge transportation fleet. We have accepted delivery of 20 of those barges and 14 of those push boats through December 31, 2016. We expect to take delivery of those remaining vessels periodically into 2017.

Baton Rouge Terminal

We constructed a new crude oil, intermediates and refined products import/export terminal in Baton Rouge that is located near the Port of Greater Baton Rouge and is connected to the port's existing deepwater docks on the Mississippi River. We constructed approximately 1.1 million barrels of tankage for the storage of crude oil, intermediates and/or refined products with the capability to expand to provide additional terminaling services to our customers. In addition, we constructed a new pipeline from the terminal that will allow for deliveries to existing ExxonMobil facilities in the area, as well as connect our previously constructed 17 mile line to the terminal allowing for receipts from the Scenic Station Rail Facility. Shippers to Scenic Station will have access to both the local Baton Rouge refining market, as well as the ability to access other attractive refining markets via our Baton Rouge Terminal. Our Baton Rouge Terminal and related facilities became operational early in the fourth quarter of 2016.

Wyoming Crude Oil Pipeline

In the third quarter of 2015, we completed construction of a new 60 mile crude oil pipeline to transport crude oil from new receipt point stations in Campbell County and Converse County, Wyoming to our existing Pronghorn Rail Facility. This new crude oil pipeline has an initial capacity of approximately 30,000 barrels per day and is supplied by truck volumes and third party gathering infrastructure in the Powder River Basin.

We also constructed a new 75 mile pipeline from our Pronghorn Rail Facility to a delivery point at our new Guernsey Station in Platte County, Wyoming. This Pronghorn to Guernsey pipeline has an initial capacity of approximately 45,000 barrels per day and will allow for connectivity to additional downstream pipeline markets at Guernsey, including regional refineries and Cushing, Oklahoma via the Pony Express Pipeline. This pipeline became operational in the first quarter of 2016.

9

Forty-six Consecutive Distribution Rate Increases

We have increased our quarterly distribution rate for forty-six consecutive quarters. On February 14, 2017, we paid a quarterly cash distribution of $0.710 (or $2.84 on an annualized basis) per unit to unitholders of record as of January 31, 2017, an increase of 1.4% from the distribution in the prior quarter, and an increase of 8.4% from the distribution in February 2016. As in the past, future increases (if any) in our quarterly distribution rate will depend on our ability to execute critical components of our business strategy.

Ownership Structure

We conduct our operations and own our operating assets through subsidiaries and joint ventures. As is customary with publicly traded limited partnerships, Genesis Energy, LLC, our general partner, is responsible for operating our business, including providing all necessary personnel and other resources.

The following chart depicts our organizational structure at December 31, 2016.

Description of Segments and Related Assets

We conduct our businesses through four operating segments: offshore pipeline transportation, refinery services, marine transportation and supply and logistics. These segments are strategic business units that provide a variety of energy-related services. Financial information with respect to each of our segments can be found in Note 12 to our Consolidated Financial Statements in Item 8.

We have a diverse portfolio of customers, operations and assets, including pipelines, refinery-related plants, storage tanks and terminals, railcars, rail loading and unloading facilities, barges and other vessels, and trucks. Substantially all of our revenues are derived from providing services to refiners, integrated and large independent crude oil and natural gas companies, and large industrial and commercial enterprises. Our onshore-based operations occur upstream of, at, and downstream of refinery complexes. Upstream of refineries, we aggregate, purchase, gather and transport crude oil, which we sell to refiners. Within refineries, we provide services to assist in sulfur removal/balancing requirements. Downstream of refineries, we provide transportation services as well as market outlets for finished refined petroleum products and certain refining byproducts.

10

Offshore Pipeline Transportation

Offshore Crude Oil and Natural Gas Pipelines

We own interests in several crude oil and natural gas pipelines and related infrastructure located offshore in the Gulf of Mexico, a producing region representing approximately 18% of the crude oil production in the U.S. in 2016.

The table below reflects our interests in our operating offshore crude oil pipelines:

Offshore crude oil pipelines | Operator | System Miles | Design Capacity (Bbls/day) (1) | Interest Owned | Throughput (Bbls/day) 100% basis | Throughput (Bbls/day) net to ownership interest | |||||||||||

Main Lines | |||||||||||||||||

CHOPS | Genesis | 380 | 500,000 | 100 | % | 204,533 | 204,533 | ||||||||||

Poseidon | Genesis | 367 | 350,000 | 64 | % | 262,829 | 168,211 | ||||||||||

Odyssey | Shell Pipeline | 120 | 200,000 | 29 | % | 106,933 | 31,011 | ||||||||||

Eugene Island Pipeline and Other | Genesis/Shell Pipeline | 184 | 39,000 | 23 | % | 7,468 | 7,468 | ||||||||||

Total | 1,051 | 1,089,000 | 581,763 | 411,223 | |||||||||||||

Lateral Lines (2) | |||||||||||||||||

SEKCO | Genesis | 149 | 115,000 | 100 | % | ||||||||||||

Shenzi Crude Oil Pipeline | Genesis | 83 | 230,000 | 100 | % | ||||||||||||

Allegheny Crude Oil Pipeline | Genesis | 40 | 140,000 | 100 | % | ||||||||||||

Marco Polo Crude Oil Pipeline | Genesis | 37 | 120,000 | 100 | % | ||||||||||||

Constitution Crude Oil Pipeline | Genesis | 67 | 80,000 | 100 | % | ||||||||||||

Viosca Knoll Crude Oil Pipeline | Genesis | 6 | 5,000 | 100 | % | ||||||||||||

Tarantula | Genesis | 4 | 30,000 | 100 | % | ||||||||||||

(1) | Capacity figures presented represent 100% of the design capacity; except for Eugene Island, which represents our net capacity in the undivided interest (23%) in that system. Ultimate capacities can vary primarily as a result of pressure requirements, installed pumps, related facilities and the viscosity of the crude oil actually moved. |

(2) | Represents 100% owned lateral crude oil pipelines which, other than our Viosca Knoll Crude Oil Pipeline, ultimately flow into our other offshore crude oil pipelines (including CHOPS and Poseidon) and thus are excluded from main lines above. |

• | CHOPS. CHOPS is comprised of 24- to 30-inch diameter pipelines designed to deliver crude oil from fields in the Gulf of Mexico to refining markets along the Texas Gulf Coast via interconnections with refineries located in Port Arthur and Texas City, Texas. CHOPS also includes two strategically located multi-purpose offshore platforms. |

• | Poseidon. The Poseidon system is comprised of 16- to 24-inch diameter pipelines to deliver crude oil from developments in the central and western offshore Gulf of Mexico to other pipelines and terminals onshore and offshore Louisiana. An affiliate of Shell owns the remaining 36% interest in Poseidon. |

• | Odyssey. The Odyssey system is comprised of 12- to 20-inch diameter pipelines to deliver crude oil from developments in the eastern Gulf of Mexico to other pipelines and terminals onshore Louisiana. An affiliate of Shell owns the remaining 71% interest in Odyssey. |

• | Eugene Island. The Eugene Island system is comprised of a network of crude oil pipelines, the main pipeline of which is 20 inches in diameter, to deliver crude oil from developments in the central Gulf of Mexico to other pipelines and terminals onshore Louisiana. Other owners in Eugene Island include affiliates of Exxon Mobil, Chevron, ConocoPhillips and Shell Oil Company. |

11

• | SEKCO Pipeline. SEKCO is a deepwater pipeline serving the Lucius crude oil and natural gas field located in the southern Keathley Canyon area of the Gulf of Mexico. SEKCO has crude oil transportation agreements with seven Gulf of Mexico producers, including Anadarko U.S. Offshore Corporation, Exxon Mobil Corporation, Eni Petroleum US LLC, Petrobras America and Inpex Corporation. Those producers have dedicated their production from Lucius to that pipeline for the life of the reserves. We expect the SEKCO pipeline to also provide capacity for additional projects in the deepwater Gulf of Mexico in the future. |

• | Shenzi Crude Oil. The Shenzi Crude Oil Pipeline gathers crude oil production from the Shenzi production field located in the Green Canyon area of the Gulf of Mexico offshore Louisiana for delivery to both our CHOPS and Poseidon pipeline systems. |

• | Allegheny Crude Oil. The Allegheny Crude Oil Pipeline connects the Allegheny and South Timbalier 316 platforms in the Green Canyon area of the Gulf of Mexico with the CHOPS and Poseidon pipelines. |

• | Marco Polo Crude Oil. The Marco Polo Crude Oil Pipeline transports crude oil from our Marco Polo crude oil platform to an interconnect with the Allegheny Crude Oil Pipeline in Green Canyon Block 164. |

• | Constitution Crude Oil. The Constitution Crude Oil Pipeline gathers crude oil from the Constitution, Caesar Tonga and Ticonderoga production fields located in the Green Canyon area of the Gulf of Mexico for delivery to either the CHOPS or Poseidon pipelines. |

None of our offshore crude oil pipelines are rate regulated with the exception of Eugene Island, which is regulated by the FERC.

The table below reflects our interests in our operating offshore natural gas pipelines:

Offshore natural gas pipelines | Operator | System Miles | Design Capacity (MMcf/day) (1) | Interest Owned | |||||||

Independence Trail | Genesis | 135 | 1,000 | 100 | % | ||||||

Viosca Knoll Gathering System | Genesis | 107 | 600 | 100 | % | ||||||

High Island Offshore System | Genesis | 287 | 500 | 100 | % | ||||||

Anaconda Gathering System | Genesis | 183 | 300 | 100 | % | ||||||

Green Canyon Laterals | Genesis | 34 | 213 | Various (2) | |||||||

Manta Ray Offshore Gathering System | Enbridge | 237 | 800 | 25.7 | % | ||||||

Nautilus System | Enbridge | 101 | 600 | 25.7 | % | ||||||

Total | 1,084 | 4,013 | |||||||||

(1) | Capacity figures presented represent 100% of the design capacity. |

(2) | We proportionately consolidate our undivided interests, which range from 2.7% to 33.3%, in 28 miles of the Green Canyon Lateral pipelines. The remainder of the laterals are wholly owned. |

• | Independence Trail. The Independence Trail pipeline transports natural gas from certain pipeline interconnects to the Tennessee Gas Pipeline at a pipeline interconnect on the West Delta 68 pipeline junction platform. Natural gas transported on the Independence Trail Pipeline originates from production fields in the Atwater Valley, DeSoto Canyon, Lloyd Ridge and Mississippi Canyon areas of the Gulf of Mexico. |

• | Viosca Knoll Gathering System. Viosca Knoll gathers natural gas from producing fields located in the Main Pass, Mississippi Canyon and Viosca Knoll areas of the Gulf of Mexico for delivery to several major interstate pipelines, including the High Point Gas Transmission, Transco, Dauphin Island Gathering System, Tennessee Gas Pipeline and Destin Pipelines. |

• | High Island. The High Island Offshore System (HIOS) transports natural gas from producing fields located in the Galveston, Garden Banks, West Cameron, High Island and East Breaks areas of the Gulf of Mexico to interconnects with the TC Offshore system and Kinetica Energy Express. HIOS includes 201 miles of pipeline and eight pipeline junction and service platforms that are regulated by the FERC. In addition, this system included the 86-mile East Breaks Gathering System, which connects HIOS to the Hoover-Diana deepwater platform located in Alaminos Canyon Block 25. |

• | Anaconda. The Anaconda Gathering System gathers natural gas from producing fields located in the Green Canyon area of the Gulf of Mexico for delivery to the Nautilus System. |

• | Green Canyon. The Green Canyon Laterals represent a collection of small diameter pipelines that gather natural gas for delivery to HIOS and various other downstream pipelines. |

12

• | Manta Ray. The Manta Ray Offshore Gathering System gathers natural gas from producing fields located in the Green Canyon, Southern Green Canyon, Ship Shoal, South Timbalier and Ewing Bank areas of the Gulf of Mexico for delivery to numerous downstream pipelines, including the Nautilus System. This system includes three pipeline junction platforms. |

• | Nautilus. The Nautilus System connects the Anaconda Gathering system and Manta Ray Offshore Gathering System to the Neptune natural gas processing plant located in south Louisiana. |

Offshore Hub Platforms

Offshore Hub platforms are typically used to interconnect the offshore pipeline network; provide an efficient means to perform pipeline maintenance; locate compression, separation and production handling equipment and similar assets; and conduct drilling operations during the initial development phase of a crude oil and natural gas property. The results of operations from offshore platform services are primarily dependent upon the level of commodity charges and/or demand-type fees billable to customers. Revenue from commodity charges is based on a fee per unit of volume delivered to the platform (typically per MMcf of natural gas or per barrel of crude oil) multiplied by the total volume of each product delivered. Demand-type fees are similar to firm capacity reservation agreements for a pipeline in that they are charged to a customer regardless of the volume the customer actually delivers to the platform. Contracts for platform services often include both demand-type fees and commodity charges, but demand-type fees generally expire after a contractually fixed period of time and in some instances may be subject to cancellation by customers.

The table below reflects our interests in our operating offshore hub platforms:

Offshore hub platform | Operator | Water Depth (Feet) | Natural Gas Capacity (MMcf/day) (1) | Crude Oil Capacity (Bbls/day) (1) | Interest Owned | |||||||||

Marco Polo | Anadarko | 4,300 | 300 | 120,000 | 100 | % | ||||||||

Viosca Knoll 817 | Genesis | 671 | 145 | 5,000 | 100 | % | ||||||||

Garden Banks 72 (2) | Genesis | 518 | 216 | 36,000 | 50 | % | ||||||||

East Cameron 373 | Genesis | 441 | 195 | 3,000 | 100 | % | ||||||||

Total | 856 | 164,000 | ||||||||||||

(1) | Capacity figures presented represent 100% of the design capacity. |

(2) | We proportionately consolidate our undivided interest in the Garden Banks 72 platform. |

• | Marco Polo. The Marco Polo platform, which is located in Green Canyon Block 608, processes crude oil and natural gas from production fields located in the South Green Canyon area of the Gulf of Mexico. |

• | Viosca Knoll. The Viosca Knoll 817 platform primarily serves as a base for gathering deepwater production in the Viosca Knoll area, including the Ram Powell development. |

• | Garden Banks. The Garden Banks 72 platform serves as a base for gathering deepwater production from the Garden Banks area of the Gulf of Mexico. This platform also serves as a junction platform for the CHOPS and Poseidon pipeline systems. |

• | East Cameron. The East Cameron 373 platform processes production from the Garden Banks and East Cameron areas of the Gulf of Mexico. |

Customers

Due to the cost of finding, developing and producing crude oil properties in the deepwater regions of the Gulf of Mexico, most of our offshore pipeline customers are integrated crude oil companies and other large producers, and those producers desire to have longer-term arrangements ensuring that their production can access the markets.

Usually, our offshore crude oil pipeline customers enter into buy-sell or other transportation arrangements, pursuant to which the pipeline acquires possession (and, sometimes, title) from its customer of the relevant production at a specified location (often a producer’s platform or at another interconnection) and redelivers possession (and title, if applicable) to such customer of an equivalent volume at one or more specified downstream locations (such as a refinery or an interconnection with another pipeline). Most of the production handled by our offshore pipelines is pursuant to life-of-reserve commitments that include both firm and interruptible capacity arrangements.

Revenues from customers of our offshore pipeline transportation segment did not account for more than ten percent of our consolidated revenues.

13

Competition

The principal competition for our offshore pipelines includes other crude oil and natural gas pipeline systems as well as producers who may elect to build or utilize their own production handling facilities. Our offshore pipelines compete for new production on the basis of geographic proximity to the production, cost of connection, available capacity, transportation rates and access to onshore markets. In addition, the ability of our offshore pipelines to access future reserves will be subject to our ability, or the producers’ ability, to fund the significant capital expenditures required to connect to the new production. In general, most of our offshore pipelines are not subject to regulatory rate-making authority, and the rates our offshore pipelines charge for services are dependent on the quality of the service required by the customer and the amount and term of the reserve commitment by that customer.

Refinery Services

Our refinery services segment primarily (i) provides sulfur-extraction services to ten refining operations located mostly in Texas, Louisiana, Arkansas, Oklahoma and Utah, (ii) operates significant storage and transportation assets in relation to those services and (iii) sells NaHS and caustic soda to large industrial and commercial companies. Our refinery services primarily involve processing refiners' high sulfur (or “sour”) gas streams that the refineries have generated from crude oil processing operations. Our process applies our proprietary technology, which uses large quantities of caustic soda (the primary raw material used in our process) to act as a scrubbing agent under prescribed temperature and pressure to remove sulfur. Sulfur removal in a refinery is a key factor in optimizing production of refined products such as gasoline, diesel and aviation fuel. Our sulfur removal technology returns a clean (sulfur-free) hydrocarbon stream to the refinery for further processing into refined products, and simultaneously produces NaHS. The resultant NaHS constitutes the sole consideration we receive for our refinery services activities. A majority of the NaHS we receive is sourced from refineries owned and operated by large companies, including Phillips 66, CITGO, HollyFrontier, Calumet and Ergon. Our ten refinery services contracts have an average remaining life of three years. This includes the extended term of our recently renegotiated refinery services contract with Phillips 66 at our Westlake, Louisiana facility, which now extends through 2026. The timing upon which these contracts renew vary based upon location and terms specified within each specific contract.

Our refinery services footprint includes NaHS and caustic soda terminals in the Gulf Coast, the Midwest, Montana, Utah, British Columbia and South America. In conjunction with our supply and logistics segment, we sell and deliver (via railcars, ships, barges and trucks) NaHS and caustic soda to approximately 150 customers. We believe we are one of the largest marketers of NaHS in North and South America. By minimizing our costs through utilization of our own logistical assets and leased storage sites, we believe we have a competitive advantage over other suppliers of NaHS. NaHS is used in the specialty chemicals business (plastic additives, dyes and personal care products), in pulp and paper business, and in connection with mining operations (nickel, gold and separating copper from molybdenum) as well as bauxite refining (aluminum). NaHS has also gained acceptance in environmental applications, including waste treatment programs requiring stabilization and reduction of heavy and toxic metals and flue gas scrubbing. Additionally, NaHS can be used for removing hair from hides at the beginning of the tannery process.

Caustic soda is used in many of the same industries as NaHS. Many applications require both chemicals for use in the same process. For example, caustic soda can increase the yields in bauxite refining, pulp manufacturing and in the recovery of copper, gold and nickel. Caustic soda is also used as a cleaning agent (when combined with water and heated) for process equipment and storage tanks at refineries.

Customers

We provide on-site sulfur removal services utilizing NaHS units at ten refining locations. Even though some of our customers have elected to own the sulfur removal facilities located at their refineries, we operate those facilities. We market all of our NaHS as well as small amounts of NaHS for a handful of third parties.

We sell our NaHS to customers in a variety of industries, with the largest customers involved in mining of base metals, primarily copper and molybdenum and the production of pulp and paper. We sell to customers in the copper mining industry in the western U.S., Canada and Mexico. We also export the NaHS to South America for sale to customers for mining in Peru and Chile. No sulfur removal customer or NaHS sales customer is responsible for more than ten percent of our consolidated revenues. Many of the industries that our NaHS customers are in (such as copper mining and the pulp and paper industry) participate in global markets for their products. As a result, this creates an indirect exposure for NaHS to global demand for the end products of our customers. Provisions in our service contracts with refiners allow us to adjust our sour gas processing rates (sulfur removal) to maintain a balance between NaHS supply and demand.

We sell caustic soda to many of the same customers who purchase NaHS from us, including pulp and paper manufacturers and customers in the copper mining industry. We also supply caustic soda to some of the refineries in which we operate for use in cleaning processing equipment.

14

Competition

Our competitors for the supply of NaHS consist primarily of parties who produce NaHS as a by-product of or an alternative to other sulfur derivative products, including fertilizers, pesticides, other agricultural products, plastic additives and lubricants. Typically our competitors for the supply of NaHS have only one location and they do not have the logistical infrastructure that we have to supply customers. These competitors often reduce NaHS production when demand for their alternative sulfur derivatives is high and increase NaHS production when demand for these alternatives is low. Also, they tend to supply less when prices and demand for elemental sulfur are higher and supply more NaHS when the price of elemental sulfur falls.

Demand for NaHS faces competition from alternative sulfidity management mediums such as sulfidic caustic, emulsified sulfur, salt cake and flake NaHS. Changes in the value, supply and/or demand of these alternative products can impact the volume and/or value of our NaHS sold.

Typically, our competitors for sulfur removal services include refineries themselves through the use of their sulfur removal processes.

Our competitors for sales of caustic soda include manufacturers of caustic soda. These competitors supply caustic soda to our refinery services operations and support us in our third-party caustic soda sales. By utilizing our storage capabilities and having access to transportation assets, we sell caustic soda to third parties who gain efficiencies from acquiring both NaHS and caustic soda from one source.

We do not have any NaHS sales customer or sulfur removal customer that accounted for more than ten percent of our consolidated revenues.

Marine Transportation

Our marine transportation segment consists of (i) our inland marine fleet which transports heavy refined petroleum products, including asphalt, principally serving refineries and storage terminals along the Gulf Coast, Intracoastal Canal and western river systems of the U.S., principally along the Mississippi River and its tributaries, (ii) our offshore marine fleet which transports crude oil and refined petroleum products, principally serving refineries and storage terminals along the Gulf Coast, Eastern Seaboard, Great Lakes and Caribbean, and (iii) our modern double-hulled, Jones Act qualified tanker M/T American Phoenix which is currently under charter serving a customer along the Gulf Coast until 2020. The below table includes operational information relating to our marine transportation fleet:

Inland | Offshore | American Phoenix | |||

Aggregate Fleet Design Capacity (Bbls) (in thousands) | 2,058 | 884 | 330 | ||

Individual Vessel Capacity Range (Bbls) (in thousands) (1) | 23-39 | 65-136 | 330 | ||

Number of: | |||||

Push/Tug Boats | 34 | 9 | — | ||

Barges | 74 | 9 | — | ||

Product Tankers | — | — | 1 | ||

(1) | Represents capacity per barge ranges on our inland and offshore barge, as well as the capacity of our M/T American Phoenix. |

Customers

Our marine customers are primarily refiners and some large energy companies. Our M/T American Phoenix is currently operating under a long term charter into 2020 with Phillips 66. We are a provider of transportation services for our customers and, in almost all cases, do not assume ownership of the products we transport. Marine transportation services are conducted under term contracts, some of which have renewal options for customers with whom we have traditionally had long-standing relationships, as well as spot contracts. Most have been our customers for many years and we generally anticipate continued relationships; however, there is no assurance that any individual contract will be renewed.

A term contract is an agreement with a specific customer to transport cargo from a designated origin to a designated destination at a set rate (affreightment) or at a daily rate (time charter). The rate may or may not escalate during the term of the contract; however, the base rate generally remains constant and contracts often include escalation provisions to recover changes in specific costs such as fuel. Time charters, which insulate us from revenue fluctuations caused by weather and navigational delays and temporary market declines, represented over 95% of our marine transportation revenues under term contracts during

15

2016, 2015 and 2014. A spot contract is an agreement with a customer to move cargo from a specific origin to a designated destination for a rate negotiated at the time the cargo movement takes place. Spot contract rates are at the current “market” rate and are subject to market volatility. We typically maintain a higher mix of term contracts to spot contracts to provide a predictable revenue stream while maintaining spot market exposure to take advantage of new business opportunities and existing customers’ peak demands. During 2016, 2015 and 2014, approximately 62%, 75% and 80%, respectively, of our marine transportation revenues were from term contracts and 38%, 25% and 20%, respectively, were from spot contracts.

Revenues from customers of our marine transportation segment did not account for more than ten percent of our consolidated revenues.

Competition

Our competitors for the marine transportation of crude oil and heavy refined petroleum products are both midstream MLPs with marine transportation divisions, along with companies that are in the business of solely marine transportation operations. Competition among common marine carriers is based on a number of factors including proximity to production, refineries and connecting infrastructures, customer service, and transportation pricing.

Our marine transportation segment also competes with other modes of transporting crude oil and heavy refined petroleum products, including pipeline, rail and trucking operations. Each such mode of transportation has different advantages and disadvantages, which often are fact and circumstance dependent. For example, without requiring longer-term economic commitments from shippers, marine and truck transportation can offer shippers much more flexibility to access numerous markets in multiple directions (i.e. pipelines tend to flow in a single direction and are geographically limited by their receipt and delivery points with other pipelines and facilities), and marine transportation offers shippers certain economies of scale as compared to truck transportation. In addition, due to construction costs and timing considerations, marine and truck transportation can provide cost effective and immediate services to a nascent producing region, whereas new pipelines can be very expensive and time consuming to construct and may require shippers to make longer-term economic commitments, such as take-or-pay commitments. On the other hand, in mature developed areas serviced by extensive, multi-directional pipelines, with extensive connections to various market, pipeline transportation may be preferred by shippers, especially if shippers are willing to make longer-term economic commitments, such as take-or-pay commitments.

Supply and Logistics

We provide supply and logistics services to Gulf Coast crude oil refineries and producers through a combination of purchasing, transporting, storing, blending and marketing of crude oil and refined products (primarily fuel oil, asphalt, and other heavy refined products). In connection with these services, we utilize our increasingly integrated portfolio of logistical assets consisting of pipelines, trucks, terminals, railcars and barges. The increasingly integrated nature of our supply and logistics assets is particularly evident in certain of our recently completed or ongoing growth initiatives in areas such as Louisiana, Texas and Wyoming. Our crude oil related services include gathering crude oil from producers at the wellhead, transporting crude oil by gathering line, truck, railcar and barge to pipeline injection points, transporting crude oil for our gathering and marketing operations and for other shippers on our pipelines and marketing crude oil to refiners. Not unlike our crude oil operations, we also gather refined products from refineries, transport refined products via pipeline, truck, railcar and barge, and sell refined products to customers in wholesale markets. For certain of these services, we generate fee-based income related to the transportation services provided. In some cases, we also profit from the difference between the price at which we re-sell the crude oil and petroleum products less the price at which we purchase the crude oil and products, minus the associated costs of aggregation and transportation.

Our crude oil supply and logistics operations are concentrated in Texas, Louisiana, Alabama, Florida, Mississippi and Wyoming. These operations help to ensure (among other things) a base supply source for our crude oil pipeline systems, refinery customers and other shippers while providing our producer customers with a market outlet for their production. We attempt to limit our direct commodity price risk in our supply and logistics segment by utilizing back-to-back purchases and sales, matching sale and purchase volumes on a monthly basis and hedging unsold volumes (primarily with NYMEX derivatives to offset the remaining price risk); however, we cannot completely eliminate commodity price risks. By utilizing our network of pipelines, trucks, railcars, barges, and terminals, we are able to provide transportation related services to, and in many cases back-to-back gathering and marketing arrangements with, crude oil refiners and producers. Additionally, our crude oil gathering and marketing expertise and knowledge base provide us with an ability to capitalize on opportunities that arise from time to time in our market areas. We gather and market approximately 50,000 barrels per day of crude oil, much of which is produced from large resource basins throughout Texas and the Gulf Coast. Our crude oil pipelines transport many of these barrels, as well barrels for third party producers and refiners to which we charge fees for our transportation services. Given our network of terminals, we also have the ability to store crude oil during periods of contango (crude oil prices for future deliveries are higher than for current deliveries) for delivery in future months. When we purchase and store crude oil during periods of contango, we attempt to limit direct commodity price risk by simultaneously entering into a contract to sell the inventory in a future period, either with a counterparty or in the crude oil futures market. The most substantial component of the

16

costs we incur while aggregating crude oil and petroleum products relates to operating our fleet of owned and leased trucks and railcars and incurring transportation related costs.

Onshore Crude Oil Pipelines

Through the onshore pipeline systems and related assets we own and operate, we transport crude oil for our gathering and marketing operations and for other shippers pursuant to tariff rates regulated by FERC or the Railroad Commission of Texas, or TXRRC. Accordingly, we offer transportation services to any shipper of crude oil, if the products tendered for transportation satisfy the conditions and specifications contained in the applicable tariff. Pipeline revenues are a function of the level of throughput and the particular point where the crude oil is injected into the pipeline and the delivery point. We also may earn revenue from pipeline loss allowance volumes. In exchange for bearing the risk of pipeline volumetric losses, we deduct volumetric pipeline loss allowances and crude oil quality deductions. Such allowances and deductions are offset by measurement gains and losses. When our actual volume losses are less than the related allowances and deductions, we recognize the difference as income and inventory available for sale valued at the market price for the crude oil.

The margins from our onshore crude oil pipeline operations are generated by the difference between the sum of revenues from regulated published tariffs and pipeline loss allowance revenues and the fixed and variable costs of operating and maintaining our pipelines.

We own and operate five onshore common carrier crude oil pipeline systems: the Texas System, the Jay System, the Mississippi System, the Louisiana System and the Wyoming System.

Texas System | Jay System | Mississippi System | Louisiana System | Wyoming System | |||||

Product | Crude Oil | Crude Oil | Crude Oil | Crude Oil Intermediates Refined Products | Crude Oil | ||||

Interest Owned | 100% | 100% | 100% | 100% | 100% | ||||

Design Capacity (Bbls/day) (1) | Existing 8" - 60,000 Looped 18" - 275,000 | 150,000 | 45,000 | 350,000 | 30,000/ 45,000 | ||||

2016 Throughput (Bbls/day) | 33,814 | 14,815 | 10,247 | 44,295 | 10,959 | ||||

System Miles | 47 | 135 | 235 | 25 | 135 | ||||

Approximate owned tankage storage capacity (Bbls) | 360,000 | 230,000 | 247,500 | 350,000 | 450,000 | ||||

Location | Hastings Junction, TX to Webster, TX Webster, TX to Texas City, TX | Southern AL/FL to Mobile, AL | Soso, MS to Liberty, MS | Port Hudson, LA to Baton Rouge, LA Baton Rouge, LA to Port Allen, LA | Wright, WY (Campbell County) to Douglas, WY (Pronghorn) Douglas, WY to Guernsey, WY | ||||

Rate Regulated | TXRRC | FERC | FERC | FERC | FERC | ||||

(1) | Our Wyoming pipeline system has an initial capacity of approximately 30,000 barrels per day from Campbell County to the Pronghorn Rail Facility and an initial capacity of 45,000 barrels per day from the Pronghorn Rail Facility to Platte County, Wyoming. |

• | Texas System. Our Texas System transports crude oil from Hastings Junction (south of Houston) to several delivery points near Houston, Texas (including our Webster, Texas facility and ultimately into the Texas City refining market). This system also takes delivery of crude oil volumes at Texas City for delivery to our Webster, Texas facility, which ultimately connects to other crude oil pipelines. We earn a tariff for our transportation services, with the tariff rate per barrel of crude oil varying with the distance from injection point to delivery point. See "Recent Developments and |

17

Status of Certain Growth Initiatives" for further information surrounding developments and current growth initiatives surrounding our Houston area crude oil infrastructure project.

• | Jay System. Our Jay System provides crude oil shippers access to refineries, pipelines and storage near Mobile, Alabama. That system also includes gathering connections to approximately 46 wells, additional crude oil storage capacity of 20,000 barrels in the field, an interconnect with our Walnut Hill rail facility, a delivery connection to a refinery in Alabama and an interconnection to another common carrier pipeline that delivers crude oil into Mississippi. |

• | Mississippi System. Our Mississippi System provides shippers of crude oil in Mississippi indirect access to refineries, pipelines, storage, terminals and other crude oil infrastructure located in the Midwest. That system is adjacent to several crude oil fields that are in various phases of being produced through tertiary recovery strategy, including CO2 injection and flooding. We provide transportation services on our Mississippi pipeline through an “incentive” tariff which provides that the average rate per barrel that we charge during any month decreases as our aggregate throughput for that month increases above specified thresholds. |

• | Louisiana System. Our Louisiana System transports crude oil from Port Hudson to our Baton Rouge Scenic Station rail unloading facility and continues downstream to the Anchorage Tank Farm servicing Exxon Mobil Corporation's Baton Rouge refinery. This refinery is one of the largest refinery complexes in North America, with more than 500,000 barrels per day of refining capacity. Our Louisiana system also connects the Anchorage Tank Farm to our new Port of Baton Rouge Terminal (which was also built to service Exxon's Baton Rouge refinery), allowing bidirectional flow of crude oil, intermediates and refined products between the Anchorage Tank Farm and this terminal. |

This pipeline system serves as a key asset in our increasingly integrated Baton Rouge area midstream infrastructure, which also includes terminal and rail facilities as discussed previously.

Additionally, as discussed in "Recent Developments and Growth Initiatives" above, in the fourth quarter of 2013, we began construction on a new terminal, crude oil pipeline and unit train unloading facility in Raceland, Louisiana which will be connected to existing midstream infrastructure that will provide further distribution to the Louisiana refining markets. We expect this facility to be operational in the first half of 2017.

• | Wyoming System. Our Wyoming System transports crude oil from receipt point stations in Campbell County and Converse County, Wyoming to our Pronghorn Rail Facility near Douglas, Wyoming. This crude oil pipeline has an initial capacity of approximately 30,000 barrels per day and is supplied by truck volumes and third party gathering infrastructure in the Powder River Basin. This pipeline system became operational in the third quarter of 2015. We have also completed construction of a new 75 mile pipeline from our Pronghorn Rail Facility to a delivery point at our new Guernsey Station in Platte County, Wyoming. This Pronghorn to Guernsey pipeline has an initial capacity of approximately 45,000 barrels per day and will allow for connectivity to additional downstream pipeline markets at Guernsey, including regional refineries and Cushing, Oklahoma via the Pony Express Pipeline. This pipeline became operational in the first quarter of 2016. |

This pipeline system serves as a key asset in our increasingly integrated Wyoming midstream infrastructure, which also includes terminal and rail facilities as discussed previously.

Other Supply and Logistics Operations

We own five operational crude oil rail loading/unloading facilities located in Baton Rouge, Louisiana; Walnut Hill, Florida; Wink, Texas; Natchez, Mississippi and Douglas, Wyoming which provide synergies to our existing asset footprint. We generally earn a fee for loading or unloading railcars at these facilities. Three of these facilities, our Baton Rouge, Louisiana, Walnut Hill, Florida, and Douglas, Wyoming facilities are directly connected to our existing integrated crude oil pipeline and terminal infrastructure. See further discussion of these facilities above.

Within our supply and logistics business segment, we employ many types of logistically flexible assets. These assets include 200 trucks, 400 trailers, 523 railcars, and terminals and other tankage with 4.6 million barrels of leased and owned storage capacity in multiple locations along the Gulf Coast, accessible by pipeline, truck, rail or barge, in addition to tankage related to our crude oil pipelines, previously mentioned. Our leased railcars consist of approximately 51 refined product railcars and 472 crude oil railcars.

Our refined products supply and logistics operations are concentrated in the Gulf Coast region, principally Texas and Louisiana, and in Wyoming. Through our footprint of owned and leased pipelines, trucks, leased railcars, terminals and barges, we are able to provide Gulf Coast area refineries with transportation services as well as market outlets for certain heavy refined products. We primarily engage in the transportation and supply of fuel oil, asphalt, and other heavy refined products to our customers in wholesale markets. We have the ability from time to time to obtain various grades of refined products from our refinery customers and blend them to meet the requirements of our other market customers. However, because our refinery customers may choose to manufacture such refined products based on a number of economic and operating factors, we cannot predict the timing of contribution margins related to our blending services.

18

CO2 Pipelines