Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2016

Commission file number 1-5153

Marathon Oil Corporation

(Exact name of registrant as specified in its charter)

Delaware | 25-0996816 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

5555 San Felipe Street, Houston, TX 77056-2723

(Address of principal executive offices)

(713) 629-6600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, par value $1.00 | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☑ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of Common Stock held by non-affiliates as of June 30, 2016: $12,696 million. This amount is based on the closing price of the registrant’s Common Stock on the New York Stock Exchange on that date. Shares of Common Stock held by executive officers and directors of the registrant are not included in the computation. The registrant, solely for the purpose of this required presentation, has deemed its directors and executive officers to be affiliates.

There were 847,201,196 shares of Marathon Oil Corporation Common Stock outstanding as of February 15, 2017.

Documents Incorporated By Reference:

Portions of the registrant’s proxy statement relating to its 2017 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A under the Securities Exchange Act of 1934, are incorporated by reference to the extent set forth in Part III, Items 10-14 of this report.

MARATHON OIL CORPORATION

Unless the context otherwise indicates, references to "Marathon Oil," "we," "our" or "us" in this Annual Report on Form 10-K are references to Marathon Oil Corporation, including its wholly owned and majority-owned subsidiaries, and its ownership interests in equity method investees (corporate entities, partnerships, limited liability companies and other ventures over which Marathon Oil exerts significant influence by virtue of its ownership interest).

Table of Contents | |||

Definitions

Throughout this report, the following company or industry specific terms and abbreviations are used.

AMPCO – Atlantic Methanol Production Company LLC, a company located in Equatorial Guinea in which we own a 45% equity interest.

AOSP – Athabasca Oil Sands Project, an oil sands mining, transportation and upgrading joint venture located in Alberta, Canada, in which we hold a 20% non-operated working interest.

bbl – One stock tank barrel, which is 42 United States gallons liquid volume.

bcf – Billion cubic feet.

boe – Barrels of oil equivalent.

btu – British thermal unit, an energy equivalence measure.

Capital Program – Includes capital expenditures, cash investments in equity method investees and other investments, exploration costs that are expensed as incurred rather than capitalized, such as geological and geophysical costs and certain staff costs, and other miscellaneous investment expenditures.

DD&A – Depreciation, depletion and amortization.

Development well – A well drilled within the proved area of an oil or natural gas reservoir to the depth of a stratigraphic horizon known to be productive.

Downstream business – The refining, marketing and transportation operations, spun-off on June 30, 2011 and treated as discontinued operations.

Dry well – A well found to be incapable of producing either oil or natural gas in sufficient quantities to justify completion.

E.G. – Equatorial Guinea.

EGHoldings – Equatorial Guinea LNG Holdings Limited, a liquefied natural gas production company located in E.G. in which we own a 60% equity interest.

EIA – United States Energy Information Agency.

EPA – United States Environmental Protection Agency.

E&P - Exploration and production.

Exploratory well – A well drilled to find oil or natural gas in an unproved area or find a new reservoir in a field previously found to be productive in another reservoir.

FASB – Financial Accounting Standards Board.

FPSO - Floating production, storage and offloading vessel.

Henry Hub price - a natural gas benchmark price quoted at settlement date average.

IRS – United States Internal Revenue Service.

LNG – Liquefied natural gas.

LPG – Liquefied petroleum gas.

Liquid hydrocarbons or liquids – Collectively, crude oil, synthetic crude oil, condensate and natural gas liquids.

LLS – Louisiana Light Sweet crude oil, an oil index benchmark price as per Bloomberg Finance LLP: LLS St. James.

Marathon Oil – Marathon Oil Corporation and its consolidated subsidiaries: the company as it exists following the June 30, 2011 spin-off of the downstream business.

mbbld – Thousand barrels per day.

mboed – Thousand barrels of oil equivalent per day.

mcf – Thousand cubic feet.

mmbbl – Million barrels.

mmboe – Million barrels of oil equivalent.

1

mmbtu – Million British thermal units.

mmcfd – Million cubic feet per day.

mmta – Million metric tonnes per annum.

MPC – Marathon Petroleum Corporation – the separate independent company, which owns and operates the downstream business.

mt – metric tonnes

mtd – Thousand metric tonnes per day.

Net acres or Net wells – The sum of the fractional working interests owned by us in gross acres or gross wells.

NGL or NGLs – Natural gas liquid or natural gas liquids, which are naturally occurring substances found in natural gas, including ethane, butane, isobutane, propane and natural gasoline, that can be collectively removed from produced natural gas, separated into these substances and sold.

NYMEX - New York Mercantile Exchange.

OECD – Organization for Economic Cooperation and Development.

OPEC – Organization of Petroleum Exporting Countries.

Operational availability – A term used to measure the ability of an asset to produce to its maximum capacity over a specified period of time, after consideration of internal losses.

Productive well – A well that is not a dry well. Productive wells include producing wells and wells that are mechanically capable of production.

Proved developed reserves – Proved reserves that can be expected to be recovered through existing wells with existing equipment and operating methods or for which the cost of the required equipment is relatively minor compared to the cost of a new well and through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well.

Proved reserves – Proved crude oil and condensate, NGLs, natural gas and synthetic crude oil reserves are those quantities of crude oil and condensate, NGLs, natural gas and synthetic crude oil, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations-prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time.

Proved undeveloped reserves – Proved reserves that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion or through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well. Undrilled locations can be classified as having proved undeveloped reserves if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances justify a longer time. Reserves on undrilled acreage shall be limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances.

PSC – Production sharing contract.

Quest CCS – Quest Carbon Capture and Storage project at the AOSP in Alberta, Canada.

Reserve replacement ratio – A ratio which measures the amount of proved reserves added to our reserve base during the year relative to the amount of liquid hydrocarbons and natural gas produced.

Royalty interest – An interest in an oil or natural gas property entitling the owner to a share of oil or natural gas production free of costs of production.

SAGE – United Kingdom Scottish Area Gas Evacuation system composed of a pipeline and processing terminal.

SAR or SARs – Stock appreciation right or stock appreciation rights.

SCOOP – South Central Oklahoma Oil Province.

SEC – United States Securities and Exchange Commission.

2

Seismic – An exploration method of sending energy waves or sound waves into the earth and recording the wave reflections to indicate the type, size, shape and depth of subsurface rock formation (3-D seismic provides three-dimensional pictures and 4-D factors in changes that occurred over time).

STACK – Sooner Trend, Anadarko (basin), Canadian (and) Kingfisher (counties).

TD - Total depth or the bottom of a drilled hole.

Total proved reserves – The summation of proved developed reserves and proved undeveloped reserves.

U.K. – United Kingdom.

U.S. – United States of America.

U.S. GAAP – Accounting principles generally accepted in the U.S.

WCS – Western Canadian Select, an oil index benchmark price with monthly pricing based upon average adjusted for differentials unique to western Canada.

Working interest – The interest in a mineral property, which gives the owner that share of production from the property. A working interest owner bears that share of the costs of exploration, development and production in return for a share of production. Working interests are sometimes burdened by overriding royalty interests or other interests.

WTI – West Texas Intermediate crude oil, an oil index benchmark price as quoted by NYMEX.

3

Disclosures Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These are statements, other than statements of historical fact, that give current expectations or forecasts of future events, including without limitation: our operational, financial and growth strategies, including drilling plans and projects, planned wells, rig count, inventory, seismic, exploration plans, maintenance activities, drilling and completion improvements, cost reductions, non-core asset sales, and financial flexibility; our ability to successfully effect those strategies and the expected timing and results thereof; our 2017 capital program and the planned allocation thereof; planned capital expenditures and the impact thereof; expectations regarding future economic and market conditions and their effects on us; our ability and strategies to manage through the lower commodity price cycle; our financial and operational outlook, and ability to fulfill that outlook; our financial position, balance sheet, liquidity and capital resources, and the benefits thereof; resource and asset potential; reserve estimates; growth expectations; and future production and sales expectations, and the drivers thereof. In addition, many forward-looking statements may be identified by the use of forward-looking terminology such as “anticipates,” “believes,” “estimates,” “expects,” “targets,” “plans,” “projects,” “could,” “may,” “should,” “would” or similar words indicating that future outcomes are uncertain. While we believe that our assumptions concerning future events are reasonable, we can give no assurance that these expectations will prove to be correct. A number of factors could cause results to differ materially from those indicated by such forward-looking statements including, but not limited to:

• | conditions in the oil and gas industry, including supply/demand levels for crude oil and condensate, NGLs, natural gas and synthetic crude oil and the resulting impact on price; |

• | changes in expected reserve or production levels; |

• | changes in political or economic conditions in the jurisdictions in which we operate, including changes in foreign currency exchange rates, interest rates, inflation rates, and global and domestic market conditions; |

• | risks relating to our hedging activities; |

• | capital available for exploration and development; |

• | drilling and operating risks; |

• | well production timing; |

• | availability of drilling rigs, materials and labor, including the costs associated therewith; |

• | difficulty in obtaining necessary approvals and permits; |

• | non-performance by third parties of their contractual obligations; |

• | unforeseen hazards such as weather conditions, acts of war or terrorist acts and the governmental or military response thereto; |

• | cyber-attacks; |

• | changes in safety, health, environmental, tax and other regulations; |

• | other geological, operating and economic considerations; and |

• | other factors discussed in Item 1. Business, Item 1A. Risk Factors, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 7A. Quantitative and Qualitative Disclosures About Market Risk, and elsewhere in this report. |

All forward-looking statements included in this report are based on information available to us on the date of this report. Except as required by law, we assume no duty to revise or update any forward-looking statements whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this report.

4

PART I

Item 1. Business

General

Marathon Oil Corporation (NYSE: MRO) is an independent exploration and production company based in Houston, Texas, focused on U.S. unconventional resource plays with operations in North America, Europe and Africa. Our corporate headquarters is located at 5555 San Felipe Street, Houston, Texas 77056-2723 and our telephone number is (713) 629-6600. Each of our three reportable operating segments is organized and managed based upon both geographic location and the nature of the products and services it offers. The three segments are:

• | North America E&P – explores for, produces and markets crude oil and condensate, NGLs and natural gas in North America; |

• | International E&P – explores for, produces and markets crude oil and condensate, NGLs and natural gas outside of North America and produces and markets products manufactured from natural gas, such as LNG and methanol, in E.G.; and |

• | Oil Sands Mining – mines, extracts and transports bitumen from oil sands deposits in Alberta, Canada, and upgrades the bitumen to produce and market synthetic crude oil and vacuum gas oil. |

We were incorporated in 2001.

See Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations, for a more detailed discussion of our operating results, cash flows and outlook, including our 2017 Capital Program.

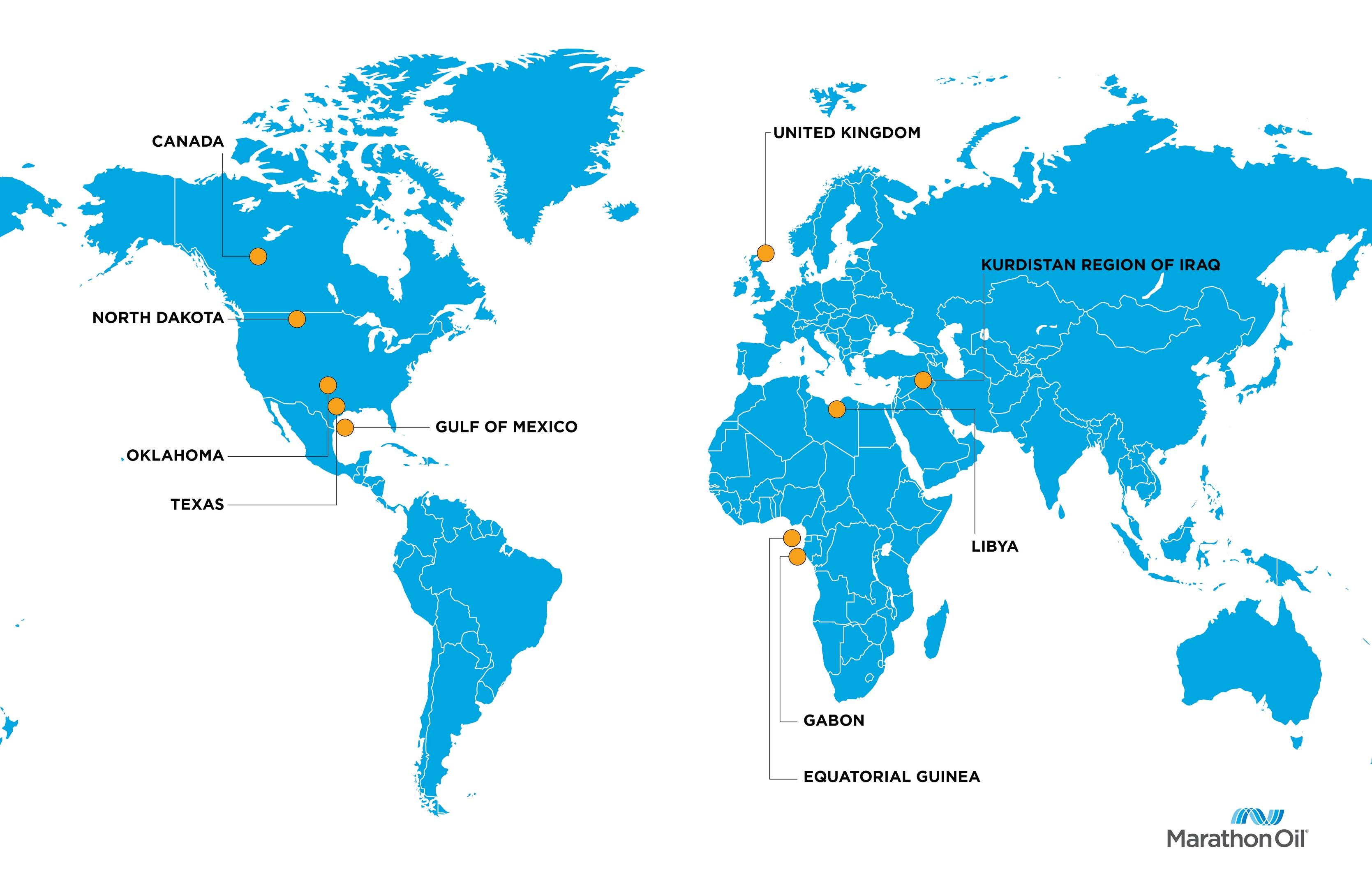

The map below shows the locations of our worldwide operations.

5

Segment and Geographic Information

For reportable operating segment and geographic financial information, see Item 8. Financial Statements and Supplementary Data – Note 7 to the consolidated financial statements.

In the following discussion regarding our North America E&P, International E&P and Oil Sands Mining segments, references to net wells, acres, sales or investment indicate our ownership interest or share, as the context requires.

North America E&P Segment

We are engaged in oil and gas exploration, development and production activities in the U.S. Our primary focus in the North America E&P segment is concentrated within our three quality unconventional resource plays.

North America E&P-- Unconventional Resource Plays

Oklahoma Resource Basins – We hold approximately 365,000 net surface acres and includes 61,000 net acres added in the PayRock acquisition in the STACK Meramec play during 2016. In the SCOOP and STACK areas we hold net acres with rights to the Woodford, Springer, Meramec, Osage, Oswego, Granite Wash and other Pennsylvanian and Mississippian plays. Our primary 2017 focus will be in the Meramec play in the STACK and the Woodford and Springer plays in the SCOOP.

Eagle Ford - We hold approximately 145,000 net acres in south Texas where we have been operating since 2011. We operate more than 1,365 gross (962 net) producing wells, 32 central gathering and treating facilities and approximately 865 miles of gathering pipeline in the Eagle Ford. We also own and operate the Sugarloaf gathering system, a 42-mile natural gas pipeline through the heart of our acreage in Karnes, Atascosa and Bee Counties of south Texas.

Approximately 95% of the crude oil and condensate production is transported by pipeline with connections to multiple sales points. The ability to transport more barrels by pipeline enables us to improve/optimize price realizations, reduce costs, improve reliability and lessen our environmental footprint.

Bakken – We hold approximately 270,000 net acres in North Dakota and eastern Montana, where we have been operating since 2006. Our large scale water gathering system is handling nearly 70% of our produced water. We are currently transporting about 75% of our oil production on pipeline. In an effort to optimize price realizations, we sell our production in local North Dakota markets and to select purchasers who may elect to transport outside of the state.

Other North America

Our remaining properties in North America primarily consist of a number of outside operated assets in the Gulf of Mexico, the largest of which is the Gunflint field located on Mississippi Canyon Blocks 948, 949, 992 (N/2) and 993 (N/2). The Gunflint field, in which we hold an 18% non-operated working interest, achieved first oil in the third quarter of 2016.

In 2016, we continued our progress on portfolio management, with approximately $1.3 billion of non-core assets sales, which mainly included Wyoming and West Texas properties. See Item 8. Financial Statements and Supplementary Data - Note 6 to the consolidated financial statements for information about these dispositions.

International E&P Segment

We are engaged in a range of activities, including oil and gas exploration, development and production across our international locations in E.G., Gabon, the Kurdistan Region of Iraq, Libya and the U.K. We include the results of our natural gas liquefaction operations and methanol production operations in E.G. in our International E&P segment.

Africa

Equatorial Guinea – Production – We own a 63% operated working interest under a PSC in the Alba field which is offshore E.G. Operational availability from our company-operated facilities averaged approximately 97% in 2016.

Equatorial Guinea – Gas Processing – We own a 52% interest in Alba Plant LLC, an equity method investee, which operates an onshore LPG processing plant located on Bioko Island. Alba field natural gas, under a long-term contract at a fixed price per btu, is processed by the LPG plant. The LPG plant extracts secondary condensate and LPG from the natural gas stream and uses some of the remaining dry natural gas in its operations.

We also own 60% of EGHoldings and 45% of AMPCO, both of which are accounted for as equity method investments. EGHoldings operates a 3.7 mmta LNG production facility and AMPCO operates a methanol plant, both located on Bioko Island. These facilities allow us to further monetize natural gas production from the Alba field. AMPCO had gross sales totaling 1,100 mt in 2016. Methanol production is sold to customers in Europe and the U.S.

The LNG production facility sells LNG under a 3.4 mmta, or 460 mmcfd, sales and purchase agreement. Under the agreement, which runs through 2023, the purchaser takes delivery of the LNG on Bioko Island, with pricing linked principally to the Henry Hub index. Gross sales of LNG from this production facility totaled 3.6 mmta in 2016.

6

Libya – We hold a 16% non-operated working interest in the Waha concessions, which encompass almost 13 million gross acres located in the Sirte Basin of eastern Libya. Civil and political unrest has interrupted our production operations in recent years. During 2016, Force Majeure was lifted in September, production commenced shortly thereafter and liftings resumed in December. See Item 8. Financial Statements and Supplementary Data – Note 12 to the consolidated financial statements for additional information about our Libya operations.

Other International

United Kingdom – Our operated asset in the U.K. sector of the North Sea is the Brae area complex where we are the operator and have a 42% working interest in the South, Central, North and West Brae fields, a 39% working interest in the East Brae field, and a 28% working interest in the nearby Braemar field.

The strategic location of the Brae platforms, along with pipeline and onshore infrastructure, has generated third-party processing and transportation business since 1986. Currently, the operators of 31 third-party fields are contracted to use the Brae system and 72 mboed are being processed or transported through the Brae infrastructure. In addition to generating processing and pipeline tariff revenue, this third-party business optimizes infrastructure usage.

The working interest owners of the Brae area producing assets collectively own a 50% non-operated interest in the SAGE pipeline system, which has a total wet natural gas capacity of 1.1 bcf per day. The SAGE terminal at St. Fergus in northeast Scotland processes natural gas from the SAGE pipeline as well as approximately 0.3 bcf per day of third-party natural gas.

We own non-operated working interests in the Foinaven area complex, consisting of a 28% working interest in the main Foinaven field, a 47% working interest in East Foinaven and a 20% working interest in the T35 and T25 fields. The export of Foinaven liquid hydrocarbons is via shuttle tanker from an FPSO to market. All natural gas sales are to the non-operated Magnus platform for use as injection gas.

Kurdistan Region of Iraq – In 2016, we relinquished to the Kurdistan Regional Government our 45% operated working interest in the Harir block located northeast of Erbil. We have non-operated interests in two blocks located north-northwest of Erbil: Atrush with a 15% working interest and Sarsang with a 20% working interest.

International E&P Exploration

Equatorial Guinea – Exploration – We hold a 63% operated working interest in the Deep Luba discovery on the Alba Block and an 80% operated working interest in the Corona well on Block D. We plan to develop Block D through unitization with the Alba field. Negotiations have been substantially completed and we are awaiting approval from the host government.

Gabon – Exploration – We hold a 21.25% non-operated working interest in the Diaba License G4-223 and its related permit offshore Gabon, and a 100% participating interest and operatorship in the Tchicuate block where we have an exploration and production sharing agreement.

In 2015, we entered into agreements to sell our East Africa exploration acreage in Ethiopia and Kenya. This transaction closed during the first quarter of 2016. See Item 8. Financial Statements and Supplementary Data - Note 6 to the consolidated financial statements for information about these dispositions.

Oil Sands Mining Segment

We hold a 20% non-operated interest in the AOSP, an oil sands mining and upgrading joint venture located in Alberta, Canada. Other JV partners include Shell Canada Limited with a 60% ownership interest and Chevron Canada Limited with a 20% ownership interest. Shell Canada Limited operates the joint venture, which produces bitumen from oil sands deposits in the Athabasca region utilizing mining techniques and upgrades the bitumen into synthetic crude oils. The AOSP’s mining and extraction assets are located near Fort McMurray, Alberta, and include the Muskeg River and the Jackpine mines. Gross design capacity of the combined mines is 255,000 (51,000 net) barrels of bitumen per day.

As of December 31, 2016, we own or have rights to participate in developed and undeveloped surface mineable leases totaling approximately 155,000 gross (31,000 net) acres. The underlying developed leases are held for the duration of the project, with royalties payable to the province of Alberta.

Reserves

Proved reserves are disclosed by continent and by country if the proved reserves related to any geographic area, on an oil equivalent barrel basis, represent 15% or more of our total proved reserves. A geographic area can be an individual country, group of countries within a continent or a continent. Other International ("Other Int’l"), includes the U.K. and the Kurdistan Region of Iraq. Approximately 79% of our proved reserves are located in OECD countries.

7

The following tables set forth estimated quantities of our total proved crude oil and condensate, NGLs, natural gas and synthetic crude oil reserves based upon an SEC pricing for period ended December 31, 2016.

North America | Africa | ||||||||||||||||||||||

December 31, 2016 | U.S. | Canada | Total | E.G. | Other | Total | Other Int'l | Total | |||||||||||||||

Proved Developed Reserves | |||||||||||||||||||||||

Crude oil and condensate (mmbbl) | 238 | — | 238 | 45 | 172 | 217 | 13 | 468 | |||||||||||||||

Natural gas liquids (mmbbl) | 78 | — | 78 | 24 | — | 24 | — | 102 | |||||||||||||||

Natural gas (bcf) | 648 | — | 648 | 943 | 95 | 1,038 | 5 | 1,691 | |||||||||||||||

Synthetic crude oil (mmbbl) | — | 692 | 692 | — | — | — | — | 692 | |||||||||||||||

Total proved developed reserves (mmboe) | 424 | 692 | 1,116 | 226 | 188 | 414 | 14 | 1,544 | |||||||||||||||

Proved Undeveloped Reserves | |||||||||||||||||||||||

Crude oil and condensate (mmbbl) | 325 | — | 325 | — | — | — | 9 | 334 | |||||||||||||||

Natural gas liquids (mmbbl) | 92 | — | 92 | — | — | — | — | 92 | |||||||||||||||

Natural gas (bcf) | 640 | — | 640 | — | 110 | 110 | 5 | 755 | |||||||||||||||

Synthetic crude oil (mmbbl) | — | — | — | — | — | — | — | — | |||||||||||||||

Total proved undeveloped reserves (mmboe) | 524 | — | 524 | — | 18 | 18 | 10 | 552 | |||||||||||||||

Total Proved Reserves | |||||||||||||||||||||||

Crude oil and condensate (mmbbl) | 563 | — | 563 | 45 | 172 | 217 | 22 | 802 | |||||||||||||||

Natural gas liquids (mmbbl) | 170 | — | 170 | 24 | — | 24 | — | 194 | |||||||||||||||

Natural gas (bcf) | 1,288 | — | 1,288 | 943 | 205 | 1,148 | 10 | 2,446 | |||||||||||||||

Synthetic crude oil (mmbbl) | — | 692 | 692 | — | — | — | — | 692 | |||||||||||||||

Total proved reserves (mmboe) | 948 | 692 | 1,640 | 226 | 206 | 432 | 24 | 2,096 | |||||||||||||||

As of December 31, 2016, we had total estimated proved reserves of 802 mmbbl of crude oil and condensate, 194 mmbbl of NGLs, 2,446 bcf of natural gas, and 692 mmbbl of synthetic crude oil. Combined, total estimated proved reserves are 2,096 mmboe, of which liquids represents 81 percent. As of December 31, 2016, we had estimated proved developed reserves totaled 1,544 mmboe or 74% and estimated proved undeveloped reserves totaling 552 mmboe or 26% of our total proved reserves. For additional detail on reserves, see Item 8. Financial Statements and Supplementary Data - Supplementary Information on Oil and gas Producing Activities.

Preparation of Reserve Estimates

All estimates of reserves are made in compliance with SEC Rule 4-10 of Regulation S-X. Crude oil and condensate, NGLs, natural gas and synthetic crude oil reserve estimates are reviewed and approved by our Corporate Reserves Group ("CRG"), which includes our Director of Corporate Reserves and his staff of Reserve Coordinators. Crude oil and condensate, NGLs, natural gas and synthetic crude oil reserve estimates are developed or reviewed by Qualified Reserves Estimators ("QREs"). QREs are petro-technical professionals located throughout our organization who meet the qualifications we have established for employees engaged in estimating reserves and resources. QREs have the education, experience, and training necessary to estimate reserves and resources in a manner consistent with all external reserve estimation regulations and internal resource estimation directives and practices. QREs generally hold at least a Bachelor of Science degree in the appropriate technical field, have a minimum of three years of industry experience with at least one year in reserve estimation and have completed our QRE training course. All reserves changes (including proved) must be approved by the CRG. Additionally, any change to proved reserve estimates in excess of 5 mmboe on a total field basis, within a single month, must be approved by the Director of Corporate Reserves.

The Director of Corporate Reserves, who reports to our Chief Financial Officer, has a Bachelor of Science degree in petroleum engineering and is a registered Professional Engineer in the State of New Mexico. In his 30 years with Marathon Oil, he has held numerous engineering and management positions, including more recently managing reservoir engineering and geoscience for our Eagle Ford development in South Texas. He is a 25 year member of the Society of Petroleum Engineers ("SPE").

Technologies used in proved reserves estimation includes statistical analysis of production performance, decline curve analysis, pressure and rate transient analysis, pressure gradient analysis, reservoir simulation and volumetric analysis. The

8

observed statistical nature of production performance coupled with highly certain reservoir continuity or quality within the reliable technology areas and sufficient proved developed locations establish the reasonable certainty criteria required for booking proved reserves.

Estimates of synthetic crude oil reserves were prepared by GLJ Petroleum Consultants of Calgary, Alberta, Canada, third-party consultants during 2015 and 2014. Their reports for all years are filed as exhibits to this Annual Report on Form 10-K. The individual responsible, during 2015 and 2014, for the estimates of our synthetic crude oil reserves had 15 years of experience in petroleum engineering, has conducted surface mineable oil sands evaluations since 2009 and is a registered Practicing Professional Engineer in the Province of Alberta.

Audits of Estimates

We engage third-party consultants to provide, at a minimum, independent estimates for fields that comprise 80% of our total proved reserves over a rolling four-year period. We exceeded this percentage for the four-year period ended December 31, 2016, with 84% of our total proved reserves independently audited. An audit tolerance at a field level of +/- 10%, to our internal estimates, has been established. Should the third-party consultants’ initial analysis fall outside our tolerance band, both parties will re-examine the information provided, request additional data and refine their analysis, if appropriate. In the very limited instances where differences outside the 10% tolerance cannot be resolved by year end, a plan to resolve the difference is developed and executive management consent is obtained. The audit process did not result in any significant changes to our reserve estimates for 2016, 2015 or 2014.

During 2016, 2015 and 2014, Netherland, Sewell & Associates, Inc. prepared a reserves certification for the last three reporting periods for the Alba field in E.G. The NSAI summary reports are filed as an exhibit to this Annual Report on Form 10-K. Members of the NSAI team have multiple years of industry experience, having worked for large, international oil and gas companies before joining NSAI. NSAI’s technical team members meet or exceed the education, training, and experience requirements set forth in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information promulgated by the Society of Petroleum Engineers. The senior technical advisor has over 12 years of practical experience in petroleum engineering and the estimation and evaluation of reserves and is a registered Professional Engineer in the State of Texas. The second team member has over 10 years of practical experience in petroleum geosciences and is a licensed Professional Geoscientist in the State of Texas.

Ryder Scott Company also performed audits of the prior years' reserves of several of our fields in 2016, 2015 and 2014. Their summary reports are filed as exhibits to this Annual Report on Form 10-K. The team lead for Ryder Scott has over 34 years of industry experience, having worked for a major financial advisory services group before joining Ryder Scott. He is a 25 year member of SPE and is a registered Professional Engineer in the State of Texas.

9

Productive and Drilling Wells

For our North America E&P and International E&P segments, the following table sets forth gross and net productive wells, service wells and drilling wells as of December 31 for the years presented.

Productive Wells(a) | |||||||||||||||||||||||

Oil | Natural Gas | Service Wells | Drilling Wells | ||||||||||||||||||||

Gross | Net | Gross | Net | Gross | Net | Gross | Net | ||||||||||||||||

2016 | |||||||||||||||||||||||

U.S. (b) | 4,533 | 1,650 | 1,830 | 708 | 821 | 85 | 42 | 10 | |||||||||||||||

E.G. | — | — | 17 | 11 | 2 | 1 | — | — | |||||||||||||||

Other Africa | 1,071 | 175 | 7 | 1 | 94 | 16 | — | — | |||||||||||||||

Total Africa | 1,071 | 175 | 24 | 12 | 96 | 17 | — | — | |||||||||||||||

Other International | 62 | 23 | 35 | 14 | 23 | 8 | — | — | |||||||||||||||

Total | 5,666 | 1,848 | 1,889 | 734 | 940 | 110 | 42 | 10 | |||||||||||||||

2015 | |||||||||||||||||||||||

U.S. | 7,198 | 2,878 | 1,796 | 750 | 2,727 | 747 | |||||||||||||||||

E.G. | — | — | 17 | 11 | 2 | 1 | |||||||||||||||||

Other Africa | 1,071 | 175 | 7 | 1 | 94 | 16 | |||||||||||||||||

Total Africa | 1,071 | 175 | 24 | 12 | 96 | 17 | |||||||||||||||||

Other International | 59 | 21 | 39 | 16 | 24 | 8 | |||||||||||||||||

Total | 8,328 | 3,074 | 1,859 | 778 | 2,847 | 772 | |||||||||||||||||

2014 | |||||||||||||||||||||||

U.S. | 7,058 | 2,919 | 2,246 | 1,023 | 2,638 | 760 | |||||||||||||||||

E.G. | — | — | 16 | 11 | 2 | 1 | |||||||||||||||||

Other Africa | 1,071 | 175 | 7 | 1 | 94 | 16 | |||||||||||||||||

Total Africa | 1,071 | 175 | 23 | 12 | 96 | 17 | |||||||||||||||||

Other International | 55 | 20 | 39 | 16 | 24 | 8 | |||||||||||||||||

Total | 8,184 | 3,114 | 2,308 | 1,051 | 2,758 | 785 | |||||||||||||||||

(a) | Of the gross productive wells, wells with multiple completions operated by us totaled 8, 12 and 31 as of December 31, 2016, 2015 and 2014. Information on wells with multiple completions operated by others is unavailable to us. |

(b) | Reduction in December 31, 2016 gross and net productive wells and service wells is primarily due to the dispositions of our West Texas and Wyoming assets in 2016. See Item 8. Financial Statements and Supplementary Data - Note 6 to the consolidated financial statements for information about these dispositions. |

10

Drilling Activity

For our North America E&P and International E&P segments, the table below sets forth, by geographic area, the number of net productive and dry development and exploratory wells completed as of December 31 for the years represented.

Development | Exploratory | |||||||||||||||||||||||||

Oil | Natural Gas | Dry | Total | Oil | Natural Gas | Dry | Total | Total | ||||||||||||||||||

2016 | ||||||||||||||||||||||||||

U.S. | 64 | 12 | — | 76 | 70 | 27 | — | 97 | 173 | |||||||||||||||||

E.G. | — | — | — | — | — | — | — | — | — | |||||||||||||||||

Other Africa | — | — | — | — | — | — | — | — | — | |||||||||||||||||

Total Africa | — | — | — | — | — | — | — | — | — | |||||||||||||||||

Other International | — | — | — | — | — | — | — | — | — | |||||||||||||||||

Total | 64 | 12 | — | 76 | 70 | 27 | — | 97 | 173 | |||||||||||||||||

2015 | ||||||||||||||||||||||||||

U.S. | 135 | 36 | 11 | 182 | 49 | 48 | 1 | 98 | 280 | |||||||||||||||||

E.G. | — | 1 | — | 1 | — | — | 1 | 1 | 2 | |||||||||||||||||

Other Africa | — | — | — | — | — | — | — | — | — | |||||||||||||||||

Total Africa | — | 1 | — | 1 | — | — | 1 | 1 | 2 | |||||||||||||||||

Other International | 1 | — | — | 1 | — | — | — | — | 1 | |||||||||||||||||

Total | 136 | 37 | 11 | 184 | 49 | 48 | 2 | 99 | 283 | |||||||||||||||||

2014 | ||||||||||||||||||||||||||

U.S. | 253 | 43 | 1 | 297 | 49 | 19 | 4 | 72 | 369 | |||||||||||||||||

E.G. | — | — | — | — | — | — | 1 | 1 | 1 | |||||||||||||||||

Other Africa | 1 | — | — | 1 | — | — | — | — | 1 | |||||||||||||||||

Total Africa | 1 | — | — | 1 | — | — | 1 | 1 | 2 | |||||||||||||||||

Other International | 1 | — | — | 1 | — | — | — | — | 1 | |||||||||||||||||

Total | 255 | 43 | 1 | 299 | 49 | 19 | 5 | 73 | 372 | |||||||||||||||||

Acreage

We believe we have satisfactory title to our North America E&P and International E&P properties in accordance with standards generally accepted in the industry; nevertheless, we can be involved in title disputes from time to time which may result in litigation. In the case of undeveloped properties, an investigation of record title is made at the time of acquisition. Drilling title opinions are usually prepared before commencement of drilling operations. Our title to properties may be subject to burdens such as royalty, overriding royalty, carried, net profits, working and other similar interests and contractual arrangements customary in the industry. In addition, our interests may be subject to obligations or duties under applicable laws or burdens such as net profits interests, liens related to operating agreements, development obligations or capital commitments under international PSCs or exploration licenses.

The following table sets forth, by geographic area, the gross and net developed and undeveloped acreage held in our North America E&P and International E&P segments as of December 31, 2016.

Developed | Undeveloped | Developed and Undeveloped | |||||||||||||||

(In thousands) | Gross | Net | Gross | Net | Gross | Net | |||||||||||

U.S. | 1,399 | 1,053 | 413 | 386 | 1,812 | 1,439 | |||||||||||

Canada | — | — | 142 | 54 | 142 | 54 | |||||||||||

Total North America | 1,399 | 1,053 | 555 | 440 | 1,954 | 1,493 | |||||||||||

E.G. | 45 | 29 | 92 | 73 | 137 | 102 | |||||||||||

Other Africa | 12,909 | 2,108 | 2,519 | 753 | 15,428 | 2,861 | |||||||||||

Total Africa | 12,954 | 2,137 | 2,611 | 826 | 15,565 | 2,963 | |||||||||||

Other International | 86 | 31 | 171 | 32 | 257 | 63 | |||||||||||

Total | 14,439 | 3,221 | 3,337 | 1,298 | 17,776 | 4,519 | |||||||||||

11

In the ordinary course of business, based on our evaluations of certain geologic trends and prospective economics, we have allowed certain lease acreage to expire and may allow additional acreage to expire in the future. If production is not established or we take no other action to extend the terms of the leases, licenses or concessions, additional undeveloped acreage will expire in future years. We plan to continue the terms of certain of these licenses and concession areas or retain leases through operational or administrative actions.

Net Production

North America | Africa | |||||||||||||||||||||||||

U.S. | Canada | Total | E.G. | Other | Total | Other Int'l | Disc Ops | Total | ||||||||||||||||||

Year Ended December 31, | ||||||||||||||||||||||||||

2016 | ||||||||||||||||||||||||||

Crude and condensate (mbbld)(a) | 131 | — | 131 | 20 | 3 | 23 | 12 | — | 166 | |||||||||||||||||

Natural gas liquids (mbbld) | 40 | — | 40 | 11 | — | 11 | — | — | 51 | |||||||||||||||||

Natural gas (mmcfd)(b) | 314 | — | 314 | 425 | — | 425 | 28 | — | 767 | |||||||||||||||||

Synthetic crude oil (mbbld)(c) | — | 48 | 48 | — | — | — | — | — | 48 | |||||||||||||||||

Total production (mboed) | 223 | 48 | 271 | 102 | 3 | 105 | 17 | — | 393 | |||||||||||||||||

2015 | ||||||||||||||||||||||||||

Crude and condensate (mbbld)(a) | 171 | — | 171 | 19 | — | 19 | 14 | — | 204 | |||||||||||||||||

Natural gas liquids (mbbld) | 39 | — | 39 | 10 | — | 10 | — | — | 49 | |||||||||||||||||

Natural gas (mmcfd)(b) | 351 | — | 351 | 410 | — | 410 | 21 | — | 782 | |||||||||||||||||

Synthetic crude oil (mbbld)(c) | — | 45 | 45 | — | — | — | — | — | 45 | |||||||||||||||||

Total production (mboed) | 269 | 45 | 314 | 97 | — | 97 | 18 | — | 429 | |||||||||||||||||

2014 | ||||||||||||||||||||||||||

Crude and condensate (mbbld)(a) | 157 | — | 157 | 21 | 7 | 28 | 11 | 48 | 244 | |||||||||||||||||

Natural gas liquids (mbbld) | 29 | — | 29 | 10 | — | 10 | — | — | 39 | |||||||||||||||||

Natural gas (mmcfd)(b) | 310 | — | 310 | 439 | 1 | 440 | 21 | 37 | 808 | |||||||||||||||||

Synthetic crude oil (mbbld)(c) | — | 41 | 41 | — | — | — | — | — | 41 | |||||||||||||||||

Total production (mboed) | 238 | 41 | 279 | 104 | 7 | 111 | 15 | 54 | 459 | |||||||||||||||||

(a) | The amounts correspond with the basis for fiscal settlements with governments, representing equity tanker liftings and direct deliveries of liquid hydrocarbons. |

(b) | Excludes volumes acquired from third parties for injection and subsequent resale. |

(c) | Upgraded bitumen excluding blendstocks. |

Average Production Cost per Unit (a)

North America | Africa | ||||||||||||||||||||||||||||||||

(Dollars per boe) | U.S. | Canada | Total | E.G. | Other | Total | Other Int'l | Disc Ops | Total | ||||||||||||||||||||||||

2016 | $ | 9.84 | $ | 29.36 | $ | 13.35 | $ | 2.17 | N.M. | $ | 2.17 | $ | 23.13 | $ | — | $ | 11.02 | ||||||||||||||||

2015 | 10.65 | 38.42 | 14.69 | 2.37 | N.M. | 2.37 | 27.23 | — | 12.62 | ||||||||||||||||||||||||

2014 | 13.34 | 46.63 | 18.73 | 4.03 | N.M. | 4.03 | 47.06 | 8.92 | 15.37 | ||||||||||||||||||||||||

(a) | Production, severance and property taxes are excluded; however, shipping and handling as well as other operating expenses are included in the production costs used in this calculation. See Item 8. Financial Statements and Supplementary Data – Supplementary Information on Oil and Gas Producing Activities - Results of Operations for Oil and Gas Production Activities for more information regarding production costs. |

N.M. Not meaningful information due to limited sales.

12

Average Sales Price per Unit(a)

North America | Africa | ||||||||||||||||||||||||||||||||||

(Dollars per unit) | U.S. | Canada | Total | E.G. | Other | Total | Other Int'l | Disc Ops | Total | ||||||||||||||||||||||||||

2016 | |||||||||||||||||||||||||||||||||||

Crude and condensate (bbl) | $ | 38.57 | $ | — | $ | 38.57 | $ | 38.85 | $ | 57.69 | $ | 40.95 | $ | 43.21 | $ | — | $ | 39.23 | |||||||||||||||||

Natural gas liquids (bbl) | 13.15 | — | 13.15 | 1.00 | (b) | — | 1.00 | 26.41 | — | 10.68 | |||||||||||||||||||||||||

Natural gas (mcf) | 2.38 | — | 2.38 | 0.24 | (b) | — | 0.24 | 4.80 | — | 1.26 | |||||||||||||||||||||||||

Synthetic crude oil (bbl) | — | 37.57 | 37.57 | — | — | — | — | — | 37.57 | ||||||||||||||||||||||||||

2015 | |||||||||||||||||||||||||||||||||||

Crude and condensate (bbl) | $ | 43.50 | $ | — | $ | 43.50 | $ | 42.83 | $ | — | $ | 42.83 | $ | 53.91 | $ | — | $ | 44.14 | |||||||||||||||||

Natural gas liquids (bbl) | 13.37 | — | 13.37 | 1.00 | (b) | — | 1.00 | 32.53 | — | 11.16 | |||||||||||||||||||||||||

Natural gas (mcf) | 2.66 | — | 2.66 | 0.24 | (b) | — | 0.24 | 6.85 | — | 1.50 | |||||||||||||||||||||||||

Synthetic crude oil (bbl) | — | 40.13 | 40.13 | — | — | — | — | — | 40.13 | ||||||||||||||||||||||||||

2014 | |||||||||||||||||||||||||||||||||||

Crude and condensate (bbl) | $ | 85.25 | $ | — | $ | 85.25 | $ | 81.01 | $ | 94.70 | $ | 84.48 | $ | 94.31 | $ | 109.80 | $ | 90.37 | |||||||||||||||||

Natural gas liquids (bbl) | 33.42 | — | 33.42 | 1.00 | (b) | — | 1.00 | 67.73 | — | 25.25 | |||||||||||||||||||||||||

Natural gas (mcf) | 4.57 | — | 4.57 | 0.24 | (b) | 3.11 | 0.25 | 8.27 | 9.94 | 2.55 | |||||||||||||||||||||||||

Synthetic crude oil (bbl) | — | 83.35 | 83.35 | — | — | — | — | — | 83.35 | ||||||||||||||||||||||||||

(a) | Excludes gains or losses on commodity derivative instruments. |

(b) | Primarily represents fixed prices under long-term contracts with Alba Plant LLC, AMPCO and/or EGHoldings, which are equity method investees. We include our share of income from each of these equity method investees in our International E&P Segment. |

Marketing

Our reportable operating segments include activities related to the marketing and transportation of substantially all of our crude oil and condensate, NGLs, natural gas and synthetic crude oil. These activities include the transportation of production to market centers, the sale of commodities to third parties and the storage of production. We balance our various sales, storage and transportation positions in order to aggregate volumes to satisfy transportation commitments and to achieve flexibility within product types and delivery points. Such activities can include the purchase of commodities from third parties for resale.

Delivery Commitments

We have committed to deliver quantities of crude oil and condensate, NGLs, natural gas and synthetic crude oil to customers under a variety of contracts. As of December 31, 2016, the contracts for fixed and determinable quantities were at variable, market-based pricing and related primarily to the following sales commitments:

2017 | 2018 | 2019 | Thereafter | Commitment Period Through | |||||||||

Eagle Ford | |||||||||||||

Crude and condensate (mbbld) | 105 | 80 | 66 | 51 | 2020 | ||||||||

Natural gas (mmcfd) | 210 | 168 | 168 | 46 - 168 | 2022 | ||||||||

Bakken | |||||||||||||

Crude and condensate (mbbld) | 5 | 10 | 10 | 5-10 | 2027 | ||||||||

OSM | |||||||||||||

Synthetic crude oil (mbbld) | 10 | — | — | — | |||||||||

All of these contracts provide the options of delivering third-party volumes or paying a monetary shortfall penalty if production is inadequate. Certain volumetric requirements can also be met through purchases of third-party volumes. In addition to the sales contracts discussed above, we have entered into numerous agreements for transportation and processing of our equity production. Some of these contracts have volumetric requirements which could require monetary shortfall penalties if our production is inadequate to meet the terms.

13

Competition

Competition exists in all sectors of the oil and gas industry and, in particular, in the exploration for and development of new reserves. We compete with major integrated and independent oil and gas companies, as well as national oil companies, for the acquisition of oil and natural gas leases and other properties. See Item 1A. Risk Factors for discussion of specific areas in which we compete and related risks.

We also compete with other producers of synthetic crude oil for the sale of our synthetic crude oil to refineries primarily in North America. Because not all refineries are able to process or refine synthetic crude oil in significant volumes, sufficient market demand may not exist at all times to absorb our share of the synthetic crude oil production from the AOSP at economically viable prices.

Environmental, Health and Safety Matters

The Health, Environmental, Safety and Corporate Responsibility Committee of our Board of Directors is responsible for overseeing our position on public issues, including environmental, health and safety matters. Our Corporate Health, Environment, Safety and Security organization has the responsibility to ensure that our operating organizations maintain environmental compliance systems that support and foster our compliance with applicable laws and regulations. Committees comprised of certain of our officers review our overall performance associated with various environmental compliance programs. We also have a Corporate Emergency Response Team which oversees our response to any major environmental or other emergency incident involving us or any of our properties.

Our businesses are subject to numerous laws and regulations relating to the protection of the environment, health and safety at the national, state and local levels. These laws and their implementing regulations and other similar state and local laws and rules can impose certain operational controls for minimization of pollution, recordkeeping, monitoring and reporting requirements or other operational or siting constraints on our business, result in costs to remediate releases of regulated substances, including crude oil, into the environment, or require costs to remediate sites to which we sent regulated substances for disposal. In some cases, these laws can impose strict liability for the entire cost of clean-up on any responsible party without regard to negligence or fault and impose liability on us for the conduct of others (such as prior owners or operators of our assets) or conditions others have caused, or for our acts that complied with all applicable requirements when we performed them. We have incurred and will continue to incur capital, operating and maintenance, and remediation expenditures as a result of environmental laws and regulations.

New laws have been enacted and regulations are being adopted by various regulatory agencies on a continuing basis and the costs of compliance with these new laws and regulations can only be broadly appraised until their implementation becomes more defined.

For a discussion of environmental capital expenditures and costs of compliance for air, water, solid waste and remediation, see Item 3. Legal Proceedings and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Management’s Discussion and Analysis of Environmental Matters, Litigation and Contingencies.

Air and Climate Change

The EPA finalized a more stringent National Ambient Air Quality Standard ("NAAQS") for ozone in October 2015. This more stringent ozone NAAQS could result in additional areas being designated as non-attainment, including areas in which we operate, which may result in an increase in costs for emission controls and requirements for additional monitoring and testing, as well as a more cumbersome permitting process. Although there may be an adverse financial impact (including compliance costs, potential permitting delays and increased regulatory requirements) associated with this revised regulation, the extent and magnitude of that impact cannot be reliably or accurately estimated due to the present uncertainty regarding any additional measures and how they will be implemented. The EPA's final rule has been judicially challenged by both industry and other interested parties, and the outcome of this litigation may also impact implementation and revisions to the rule.

In June 2016, the EPA published a suite of final rules specifically targeting methane emissions from the oil and gas industry, aggregation of air emissions sources and minor source permitting for operations on tribal lands. The EPA has also announced that it intends to impose methane emission standards for existing sources and has issued information collection requests for oil and natural gas facilities. We are currently evaluating the impact of these rules on our operations. If we are unable to comply with the terms of these regulations, we could be required to forego construction or implement modifications to certain operations. These regulations may also increase compliance costs for some facilities we own or operate, and result in administrative, civil and/or criminal penalties for non-compliance.

14

In 2010, the EPA promulgated rules that require us to monitor and submit an annual report on our greenhouse gas emissions. In October 2015, the EPA finalized rules that added new sources to the scope of the greenhouse gas monitoring and reporting requirements. These new sources include gathering and boosting facilities as well as completions and workovers from hydraulically fractured oil wells. The revisions also include the addition of well identification reporting requirements for certain facilities. Further, state, national and international requirements to reduce greenhouse emissions are being proposed and in some cases promulgated (see discussion above regarding regulation of methane emissions from the oil and gas industry by the EPA). Potential legislation and regulations pertaining to climate change could also affect our operations. The cost to comply with these laws and regulations cannot be estimated at this time.

In November 2016, the Bureau of Land Management (“BLM”) issued a final rule to further restrict venting and/or flaring of gas from facilities subject to BLM jurisdiction, and to modify certain royalty requirements. These regulations are currently subject to a challenge under the Congressional Review Act, which if successful, would result in complete withdrawal of these requirements. If not withdrawn, this rule is expected to result in additional costs of compliance as well as increased monitoring, recordkeeping and recording for some of our facilities. If we are unable to comply with the terms of these regulations, we could be required to forego certain operations. These regulations may also result in administrative, civil and/or criminal penalties for non-compliance.

For additional information, see Item 1A. Risk Factors. As part of our commitment to environmental stewardship, we estimate and publicly report greenhouse gas emissions from our operations. We are working to continuously improve the accuracy and completeness of these estimates. In addition, we continuously strive to improve operational and energy efficiencies through resource and energy conservation where practicable and cost effective.

Hydraulic Fracturing

Hydraulic fracturing is a commonly used process that involves injecting water, sand and small volumes of chemicals into the wellbore to fracture the hydrocarbon-bearing rock thousands of feet below the surface to facilitate higher flow of hydrocarbons into the wellbore. Our business uses this technique extensively throughout our operations. Hydraulic fracturing has been regulated at the state and local level through permitting and compliance requirements. Federal, state and local-level laws or regulations targeting various aspects of the hydraulic fracturing process are being considered, or have been proposed or implemented. For example, the U.S. Congress has considered legislation that would require additional regulation affecting the hydraulic fracturing process, and may be expected to do so in future legislative sessions. Further, various state and local-level initiatives in regions with substantial shale resources have been or may be proposed or implemented to further regulate hydraulic fracturing practices, limit water withdrawals and water use, require disclosure of fracturing fluid constituents, restrict which additives may be used, or implement temporary or permanent bans on hydraulic fracturing.

For additional information, see Item 1A. Risk Factors.

Transportation

A number of state and federal rules apply to the transportation of liquid hydrocarbons. In 2015, the U.S. Department of Transportation (“DOT”) finalized a rule relating to testing and classification of liquid hydrocarbons and imposing additional restrictions on the types of rail cars that may be used in certain types of liquid hydrocarbon service. Similarly, in August 2016, the Pipeline and Hazardous Materials Safety Administration (“PHMSA”), a sub-agency of DOT, published a final rule setting additional safety requirements and retrofits for rail cars. PHMSA is also considering revising its regulations to require particular methods for conducting vapor pressure testing and sampling of unrefined petroleum-based products for transportation. Although our businesses do not own rail cars and purchasers of our liquid hydrocarbons make arrangements for its transportation, such regulations could increase transportation costs which are passed on to Marathon Oil by liquid hydrocarbon purchasers. In addition, PHMSA has proposed or announced the intention to propose various rules related to pipeline transportation of natural gas and/or liquid hydrocarbons. For example, in October 2015, PHMSA published a notice of proposed rulemaking amending its hazardous liquid pipeline safety regulations and in April 2016, published a notice of proposed rulemaking addressing natural gas transmission and gathering lines. Such regulations could increase the regulatory burden on our businesses where we own or operate pipelines or could otherwise increase costs to third parties that are passed on to Marathon Oil.

Water

In 2014, the EPA and the U.S. Army Corps of Engineers published proposed regulations which expand the surface waters that are regulated under the Clean Water Act and its various programs. While these regulations were finalized largely as proposed in 2015, the rule has been stayed by the courts pending a substantive decision on the merits. If this rule is ultimately implemented, the expansion of CWA jurisdiction will result in additional costs of compliance as well as increased monitoring, recordkeeping and recording for some of our facilities.

15

Concentrations of Credit Risk

We are exposed to credit risk in the event of nonpayment by counterparties, a significant portion of which are concentrated in energy-related industries. The creditworthiness of customers and other counterparties is subject to continuing review, including the use of master netting agreements, where appropriate. In 2016, sales to Irving Oil and Valero Marketing and Supply and each of their respective affiliates accounted for approximately 17% and 10% of our total revenues. In 2015, sales to Irving Oil and Shell Oil and each of their respective affiliates accounted for approximately 13% and 11% of our total revenues. In 2014, sales to Shell Oil and its affiliates accounted for approximately 10% of our total revenues.

Trademarks, Patents and Licenses

We currently hold a number of U.S. and foreign patents and have various pending patent applications. Although in the aggregate our trademarks, patents and licenses are important to us, we do not regard any single trademark, patent, license or group of related trademarks, patents or licenses as critical or essential to our business as a whole.

Employees

We had 2,117 active, full-time employees as of December 31, 2016.

Executive Officers of the Registrant

The executive officers of Marathon Oil and their ages as of February 1, 2017, are as follows:

Lee M. Tillman | 55 | President and Chief Executive Officer | ||

Sylvia J. Kerrigan | 51 | Executive Vice President, General Counsel and Secretary | ||

T. Mitch Little | 53 | Executive Vice President—Operations | ||

Patrick J. Wagner | 52 | Interim Chief Financial Officer and Vice President-Corporate Development and Strategy | ||

Catherine L. Krajicek | 55 | Vice President—Conventional | ||

Gary E. Wilson | 55 | Vice President, Controller and Chief Accounting Officer | ||

Mr. Tillman was appointed president and chief executive officer in August 2013. Mr. Tillman is also a member of our Board of Directors. Prior to this appointment, Mr. Tillman served as vice president of engineering for ExxonMobil Development Company (a project design and execution company), where he was responsible for all global engineering staff engaged in major project concept selection, front-end design and engineering. Between 2007 and 2010, Mr. Tillman served as North Sea production manager and lead country manager for subsidiaries of ExxonMobil in Stavanger, Norway. Mr. Tillman began his career in the oil and gas industry at Exxon Corporation in 1989 as a research engineer and has extensive operations management and leadership experience.

Ms. Kerrigan was appointed executive vice president, general counsel and secretary in October 2012, having served as vice president, general counsel and secretary since November 2009. Prior to these appointments, Ms. Kerrigan served as assistant general counsel since January 2003.

Mr. Little was appointed executive vice president of operations in August 2016 after having served as vice president, conventional since December 2015, vice president international and offshore exploration and production operations since September 2013, and as vice president, international production operations since September 2012. Prior to that, Mr. Little was resident manager of our Norway operations and served as general manager, worldwide drilling and completions. Mr. Little joined Marathon Oil in 1986 and has since held a number of engineering and management positions of increasing responsibility.

Mr. Wagner was appointed vice president—corporate development in April 2014, and since August 2016 has been serving as interim chief financial officer. Prior to joining Marathon Oil, he served as senior vice president, western business unit, for QR Energy LP (an oil and natural gas producer) and the affiliated Quantum Resources Management, which he joined in early 2012 as vice president, exploitation. Prior to that, Mr. Wagner was managing director in Houston for Scotia Waterous, the oil and gas arm of Scotiabank (an international banking services provider), from 2010 to 2012. Before joining Scotia, Mr. Wagner was vice president, Gulf of Mexico, for Devon Energy Corp. (an oil and natural gas producer), having joined Devon in 2003 as manager, international exploitation.

Ms. Krajicek was appointed vice president—conventional assets in August 2016 after having served as vice president of technology and innovation since December 2015. Prior to that, Ms. Krajicek served as vice president, health, environment, safety and security from January 2015 through December 2015. Ms. Krajicek joined Marathon Oil in 2007 and has since held a number of positions of increasing responsibility. Prior to joining the Company, Ms. Krajicek spent 22 years with Conoco and then ConocoPhillips (a multinational energy corporation), where she held a variety of reservoir engineering and asset management and development management positions for upstream and mid-stream businesses under development, both in the U.S. and internationally.

Mr. Wilson was appointed vice president, controller and chief accounting officer in October 2014. Prior to joining Marathon Oil, he served in various finance and accounting positions of increasing responsibility at Noble Energy, Inc. (a global

16

exploration and production company) since 2001, including as director corporate accounting from February 2014 through September 2014, director global operations services finance from October 2012 through February 2014, director controls and reporting from April 2011 through September 2012, and international finance manager from September 2009 through March 2011.

Available Information

Our website is www.marathonoil.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and other reports and filings with the SEC are available free of charge on our website as soon as reasonably practicable after the reports are filed or furnished with the SEC. Information contained on our website is not incorporated into this Annual Report on Form 10-K or our other securities filings. Our filings are also available in hard copy, free of charge, by contacting our Investor Relations office.

The public may read and copy any materials we file with the SEC at its Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Additionally, we make available free of charge on our website:

• | our Code of Business Conduct and Code of Ethics for Senior Financial Officers; |

• | our Corporate Governance Principles; and |

• | the charters of our Audit and Finance Committee, Compensation Committee, Corporate Governance and Nominating Committee and Health, Environmental, Safety and Corporate Responsibility Committee. |

17

Item 1A. Risk Factors

We are subject to various risks and uncertainties in the course of our business. The following summarizes significant risks and uncertainties that may adversely affect our business, financial condition or results of operations. When considering an investment in our securities, you should carefully consider the risk factors included below as well as those matters referenced in the foregoing pages under "Disclosures Regarding Forward-Looking Statements" and other information included and incorporated by reference into this Annual Report on Form 10-K.

The substantial decline in crude oil and condensate, NGLs, natural gas and synthetic crude oil prices since 2014 has reduced our operating results and cash flows and, regardless of the recent increase in prices, could still adversely impact our future rate of growth and the carrying value of our assets.

Prices for crude oil and condensate, NGLs, natural gas and synthetic crude oil fluctuate widely. Our revenues, operating results and future rate of growth are highly dependent on the prices we receive for our crude oil and condensate, NGLs, natural gas and synthetic crude oil. Historically, the markets for crude oil and condensate, NGLs, natural gas and synthetic crude oil have been volatile and may continue to be volatile in the future. Although, prices for WTI and Brent crude oil, Henry Hub natural gas and natural gas liquids have increased in the last several months, prices are still significantly below their highs from 2014. Many of the factors influencing prices of crude oil and condensate, NGLs, natural gas and synthetic crude oil are beyond our control. These factors include:

• | worldwide and domestic supplies of and demand for crude oil and condensate, NGLs, natural gas and synthetic crude oil; |

• | the cost of exploring for, developing and producing crude oil and condensate, NGLs, natural gas and synthetic crude oil; |

• | the ability of the members of OPEC and certain non-OPEC members, such as Russia, to agree to and maintain production controls; |

• | the production levels of non-OPEC countries, including production levels in the shale plays in the United States; |

• | the level of drilling, completion and production activities by other exploration and production companies, and variability therein, in response to market conditions; |

• | political instability or armed conflict in oil and natural gas producing regions; |

• | changes in weather patterns and climate; |

• | natural disasters such as hurricanes and tornadoes; |

• | the price and availability of alternative and competing forms of energy; |

• | the effect of conservation efforts; |

• | epidemics or pandemics; |

• | technological advances affecting energy consumption and energy supply; |

• | domestic and foreign governmental regulations and taxes; and |

• | general economic conditions worldwide. |

The long-term effects of these and other factors on the prices of crude oil and condensate, NGLs, natural gas and synthetic crude oil are uncertain. Historical declines in commodity prices have adversely affected our business by:

• | reducing the amount of crude oil and condensate, NGLs, natural gas and synthetic crude oil that we can produce economically; |

• | reducing our revenues, operating income and cash flows; |

• | causing us to reduce our capital expenditures, and delay or postpone some of our capital projects; |

• | requiring us to impair the carrying value of our assets; |

• | reducing the standardized measure of discounted future net cash flows relating to crude oil and condensate, NGLs, natural gas and synthetic crude oil; and |

• | increasing the costs of obtaining capital, such as equity and short- and long-term debt. |

Future decreases in prices could have similar adverse effects on our business.

18

If crude oil and condensate, NGLs, natural gas and synthetic crude oil prices remain substantially below their 2014 highs or fall below current levels, it could adversely affect the abilities of our counterparties to perform their obligations to us, including abandonment obligations, which could negatively impact our financial results.

We often enter into arrangements to conduct certain business operations, such as oil and gas exploration and production, oil sands mining or transportation of crude oil and condensate, NGLs, natural gas and synthetic crude oil, with partners and other counterparties in order to share risks associated with those operations. In addition, we market our products to a variety of purchasers. If commodity prices remain at or fall below current levels, some of our counterparties may experience liquidity problems and may not be able to meet their financial and other obligations, including abandonment obligations, to us. The inability of our joint venture partners to fund their portion of the costs under our joint venture agreements, or the nonperformance by purchasers, contractors or other counterparties of their obligations to us, could negatively impact our operating results and cash flows.

Estimates of crude oil and condensate, NGLs, natural gas and synthetic crude oil reserves depend on many factors and assumptions, including various assumptions that are based on conditions in existence as of the dates of the estimates. Any material changes in those conditions or other factors affecting those assumptions could impair the quantity and value of our reserves.

The proved reserve information included in this Annual Report on Form 10-K has been derived from engineering and geoscience estimates. Estimates of crude oil and condensate, NGLs, natural gas and synthetic crude oil reserves were prepared, in accordance with SEC regulations, by our in-house teams of reservoir engineers and geoscience professionals and were reviewed and approved by our Corporate Reserves Group. Prior to 2016, the synthetic crude oil reserves estimates were prepared by GLJ, a third-party consulting firm experienced in working with oil sands. Reserves were valued based on SEC pricing for the periods ended December 31, 2016, 2015 and 2014, as well as other conditions in existence at those dates. The table below provides the 2016 SEC pricing for certain benchmark prices:

SEC Pricing 2016 | |||

WTI Crude oil (per bbl) | $ | 42.75 | |

Henry Hub natural gas (per mmbtu) | $ | 2.49 | |

Brent crude oil (per bbl) | $ | 43.53 | |

Mont Belvieu NGLs (per bbl) | $ | 15.89 | |

If commodity prices were to significantly drop below average prices used to estimate 2016 proved reserves (see table above), we would expect price related reserve revisions that could have a material impact on proved reserve volumes and the present value of our proved reserves. In this scenario, our OSM proved reserves represent the largest risk to be reclassified to non-proved reserves or resource category. Future reserve revisions could also result from changes in capital funding, drilling plans and governmental regulation, among other things.

Reserve estimation is a subjective process that involves estimating volumes to be recovered from underground accumulations of crude oil and condensate, NGLs, natural gas and bitumen that cannot be directly measured (bitumen is mined and then upgraded into synthetic crude oil.) Estimates of economically producible reserves and of future net cash flows depend on a number of variable factors and assumptions, including:

• | location, size and shape of the accumulation as well as fluid, rock and producing characteristics of the accumulation; |

• | historical production from the area, compared with production from other analogous producing areas; |

• | volumes of bitumen in-place and various factors affecting the recoverability of bitumen and its conversion into synthetic crude oil such as historical upgrader performance; |

• | the assumed impacts of regulation by governmental agencies; |

• | assumptions concerning future operating costs, taxes, development costs and workover and repair costs; and |

• | industry economic conditions, levels of cash flows from operations and other operating considerations. |

As a result, different petroleum engineers and geoscientists, each using industry-accepted geologic and engineering practices and scientific methods, may produce different estimates of proved reserves and future net cash flows based on the same available data. Because of the subjective nature of such reserve estimates, each of the following items may differ materially from the estimated amounts:

• | the amount and timing of production; |

19

• | the revenues and costs associated with that production; and |

• | the amount and timing of future development expenditures. |

If we are unsuccessful in acquiring or finding additional reserves, our future crude oil and condensate, NGLs, natural gas and synthetic crude oil production would decline, thereby reducing our cash flows and results of operations and impairing our financial condition.

The rate of production from crude oil and condensate, NGLs, natural gas and synthetic crude oil properties generally declines as reserves are depleted. Except to the extent we acquire interests in additional properties containing proved reserves, conduct successful exploration and development activities or, through engineering studies, optimize production performance or identify additional reservoirs not currently producing or secondary recovery reserves, our proved reserves will decline materially as crude oil and condensate, NGLs, natural gas and synthetic crude oil are produced. Accordingly, to the extent we are not successful in replacing the crude oil and condensate, NGLs, natural gas and synthetic crude oil we produce, our future revenues will decline. Creating and maintaining an inventory of prospects for future production depends on many factors, including:

• | obtaining rights to explore for, develop and produce crude oil and condensate, NGLs, natural gas and synthetic crude oil in promising areas; |

• | drilling success; |

• | the ability to complete long lead-time, capital-intensive projects timely and cost effectively; |

• | the ability to find or acquire additional proved reserves at acceptable costs; and |

• | the ability to fund such activity. |

Future exploration and drilling results are uncertain and involve substantial costs.

Drilling for crude oil and condensate, NGLs and natural gas involves numerous risks, including the risk that we may not encounter commercially productive reservoirs. The costs of drilling, completing and operating wells are often uncertain, and drilling operations may be curtailed, delayed or canceled as a result of a variety of factors, including:

• | unexpected drilling conditions; |

• | title problems; |

• | pressure or irregularities in formations; |

• | equipment failures or accidents; |