Attached files

| file | filename |

|---|---|

| EX-12.1 - EX-12.1 - AV Homes, Inc. | avhi-20161231ex1215fc558.htm |

| EX-23.2 - EX-23.2 - AV Homes, Inc. | avhi-20161231ex2324c8abf.htm |

| EX-10.12 - EX-10.12 - AV Homes, Inc. | avhi-20161231ex10121603c.htm |

| EX-21 - EX-21 - AV Homes, Inc. | avhi-20161231ex21f28b6c3.htm |

| EX-31.2 - EX-31.2 - AV Homes, Inc. | avhi-20161231ex3126293d5.htm |

| EX-10.17 - EX-10.17 - AV Homes, Inc. | avhi-20161231ex101715e8d.htm |

| EX-10.8 - EX-10.8 - AV Homes, Inc. | avhi-20161231ex108521d0e.htm |

| EX-32.2 - EX-32.2 - AV Homes, Inc. | avhi-20161231ex322b01be1.htm |

| EX-31.1 - EX-31.1 - AV Homes, Inc. | avhi-20161231ex311869607.htm |

| EX-32.1 - EX-32.1 - AV Homes, Inc. | avhi-20161231ex321551215.htm |

| EX-10.19 - EX-10.19 - AV Homes, Inc. | avhi-20161231ex10193d8b2.htm |

| EX-10.18 - EX-10.18 - AV Homes, Inc. | avhi-20161231ex1018206d7.htm |

| EX-23.1 - EX-23.1 - AV Homes, Inc. | avhi-20161231ex2314ab102.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016.

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to _____________.

001-07395

Commission File Number

AV HOMES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

23-1739078 |

|

|

(State or other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

|

8601 N. Scottsdale Rd., Suite 225, Scottsdale, Arizona |

85253 |

|

|

(Address of Principal Executive Offices) |

(Zip Code ) |

(480) 214-7400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of exchange on which registered |

|

|

Common Stock, $1.00 Par Value |

The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K.

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated filer ☐ |

Accelerated filer ☒ |

Non-accelerated filer ☐ |

Smaller reporting company ☐ |

|

|

|

(Do not check if smaller reporting company) |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

Aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was $147,711,792 as of June 30, 2016.

As of February 16, 2017, there were 22,510,432 shares of common stock, $1.00 par value, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for its 2017 Annual Meeting of Stockholders are incorporated by reference into Part III.

2

The following business description should be read in conjunction with our audited consolidated financial statements and accompanying notes thereto appearing elsewhere in this Annual Report on Form 10-K. Unless otherwise indicated or the context otherwise requires, all references in this Annual Report on Form 10-K to “we,” “us,” “our,” “AV Homes,” or the “Company” refer to AV Homes, Inc. and its consolidated subsidiaries.

Company Overview

AV Homes, Inc. is a homebuilder engaged in the business of homebuilding and community development in Florida, the Carolinas and Arizona. Our business focuses on the development and construction of (i) primary residential communities serving first-time and move-up buyers, including under our local Bonterra Builders and Royal Oak Homes brands, and (ii) active adult communities, which are age-restricted to the age 55 and over active adult demographic. As of December 31, 2016, we owned 4,675 developed residential lots, 2,531 partially developed residential lots, 7,914 undeveloped residential lots, and 6,979 acres of mixed-use, commercial, and industrial land. We utilize our deep experience, strong operating platform, and land inventory to capitalize on the strengthening housing environment and favorable demographic trends within our core markets. We are publicly held and our common stock is traded on the NASDAQ Stock Market under the symbol “AVHI.”

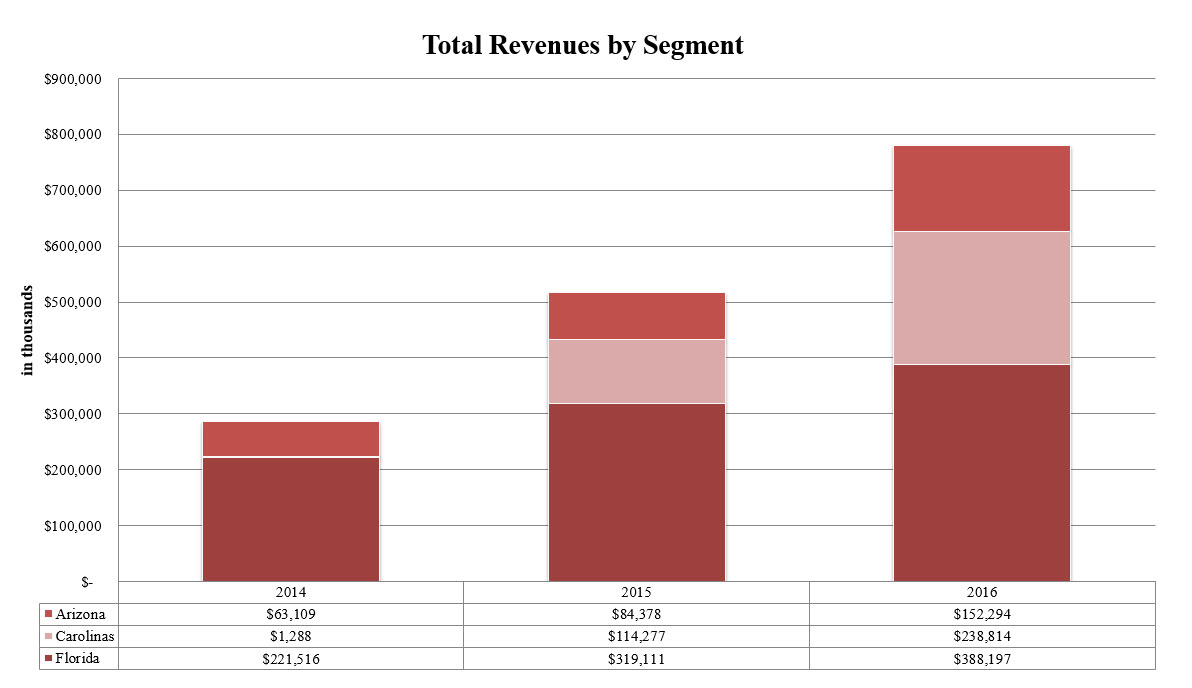

Our performance in our core segments of Florida, the Carolinas and Arizona improved for the year ended December 31, 2016 as compared to prior years. We expanded our market presence and significantly increased the number of homes we have sold. During the year ended December 31, 2016, we closed on 2,465 homes at an average sales price of approximately $310,000 per closed home, generating approximately $764 million of homebuilding revenue, as compared to the year ended December 31, 2015, in which we closed on 1,750 homes at an average sales price of approximately $285,000 per closed home, generating approximately $499 million of homebuilding revenue. The number of housing contracts (net of cancellations) signed in 2016 increased 16.4% to 2,369 as compared to 2015 and we had 703 homes in backlog with a sales value of approximately $236 million as of December 31, 2016 compared to 799 homes in backlog with a sales value of approximately $244 million as of December 31, 2015.

Available Information

AV Homes, Inc. was incorporated in the state of Delaware in 1970. Our principal executive offices are located at 8601 N. Scottsdale Rd., Suite 225, Scottsdale, Arizona 85253, and our telephone number is (480) 214-7400. Our website address is www.avhomesinc.com. Information on our website does not constitute part of this Annual Report on Form 10-K.

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, we file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). You may read and copy materials that we have filed with the SEC at the Public Reference Room of the SEC at 100 F Street, NE, Washington, D.C. 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically.

You can access financial and other information on our website, www.avhomesinc.com. The information on or accessible through our website is not incorporated by reference in this Annual Report on Form 10-K. We make available, free of charge, copies of our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after filing or furnishing such material electronically or otherwise with the SEC.

3

Our Strengths

We believe we are well-positioned to execute our core business strategies as a result of the following competitive strengths:

Transformed from a land company to an efficient, process-driven homebuilder. Beginning in 2011, we implemented a strategic planning initiative to restructure our overhead costs and reposition the Company as a cost-efficient and process-driven homebuilder. Pursuant to this initiative, we re-aligned our business to capitalize on the demographic trends and homebuilding recovery in our core markets. Specifically, our management re-evaluated all of our land holdings to identify core assets for development and homebuilding activities, as well as non-core land positions to be sold in favorable market conditions. We also recruited a new team of senior and operating management with longstanding experience in the homebuilding industry, strengthening us to take advantage of the ongoing housing recovery. In addition, we repositioned and diversified our consumer market segmentation mix and broadened our geographical diversification to maximize our opportunity to drive profitable growth.

Significant expertise in our core markets. We have significant geographic expertise in the Florida, the Carolinas and Arizona markets. In addition, as a result of our experience in developing communities for the active adult population for almost two decades, we have market expertise in serving the housing and lifestyle aspirations of the vast Baby Boomer population. Our management team has a deep understanding of the active adult and primary residential markets and the preferences of the buyers in these markets. We also supplement our expertise in our markets by utilizing a research-based approach to understanding the lifestyle preferences of these buyer markets.

Favorable demographics and real estate market recovery. In the active adult market, we believe the demographic trends and lifestyle aspirations of aging Baby Boomers provide us with a favorable environment for future business.

Reputation for unique high-quality homes in desirable locations. We believe that our reputation for delivering high-quality homes in desirable locations, coupled with our unique amenities and home designs emphasizing lifestyle and value, drive customers to our developments. We seek to provide the highest level of customer service to our homebuyers by involving them in multiple phases of the construction process. Homebuyer involvement allows our sales staff to enhance their knowledge and relationship with our buyers. Our selling process focuses on the homes’ features, benefits, quality, and design, as opposed to merely price and square footage. In order to ensure that our buyers are able to make informed decisions, we generally utilize customer-friendly design centers focused on meeting our customers’ range of needs as they move through the process of purchasing a home.

Business Strategy

Our primary business is homebuilding and community development, which includes the acquisition, development and building of active adult and primary residential home communities, in Florida, the Carolinas and Arizona. Our core business strategies, which we believe give us long-term competitive advantages relative to other builders, are intended to promote our growth, drive profitability and generate cash liquidity. Those strategies are summarized below.

Strategically expand our primary segments to capitalize on market recoveries. We focus on strategic development of land and communities to ensure sales of homes in high buyer-demand environments, which will allow us to obtain higher home prices and gross margins, as well as yielding a strong pace of sales and higher returns. We employ a deliberate land acquisition strategy focused on making prudent investments in high-demand markets in addition to exploring opportunities to broaden our geographic footprint. We also intend to maximize near-term value through developing communities where appropriate on our existing buildable land positions.

Serve the lifestyle and housing needs of the 55+ active adults. Millions of Baby Boomers will continue to age toward and reach retirement. This demographic supports a growing interest in lifestyle-oriented, age-qualified communities, especially throughout the Sun Belt. We serve the lifestyle and housing needs of these active adults with innovative communities uniquely tailored to their lifestyle ambitions through our Solivita and Vitalia at Tradition

4

communities in Florida, our CantaMia and Encore at Eastmark communities in Arizona, and our Creekside at Bethpage community in Raleigh, North Carolina.

Maintain core focus on operational improvements to drive profitability while managing construction and labor costs. We utilize proven technologies and processes to drive profitability as well as strategies and procedures designed to streamline our homebuilding operations. With keen insight into our customers’ buying habits, we are simplifying processes and employing value-engineering practices to help us deliver high-quality, well-built homes with the value our customers expect and the margins that enhance our profitability. Additionally, as we gain scale in our markets, we work to unbundle the building materials to achieve further cost savings by bidding out individual cost components, with the goal of improving our profitability over time.

Exercise prudent balance sheet management to maintain ample liquidity for growth. We believe that it is critical for us to maintain a strong balance sheet with ample liquidity so that we can service our debt obligations, support on-going homebuilding operations, and take advantage of growth opportunities in our core markets. As of December 31, 2016, we had $67.8 million of cash and cash equivalents, $1.2 million of restricted cash, an undrawn $190 million senior secured credit facility, and $280.0 million of outstanding debt.

Profitably monetize non-core commercial and industrial land positions and scattered lots. We continue to opportunistically sell non-core commercial and industrial land positions, as well as scattered lot positions and land assets that are in excess of our needed supply in a given market. We sold $3.6 million under this plan in 2016 for a profit of $2.3 million, $6.5 million in 2015 for a profit of $5.6 million, and $32.6 million in 2014 for a profit of $10.6 million.

Our Operations

Our primary business is homebuilding, which includes the acquisition, development and building of active adult and primary residential home communities in Florida, the Carolinas and Arizona. For further information regarding our financial condition and results of operations, please see Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Key Operating Metrics

We track the following key operating metrics in connection with our homebuilding operations:

Contracts signed. Net contracts signed for a given period represents the number of contracts we have entered into with homebuyers for the purchase and sale of homes, less the number of contracts that were cancelled in the same period. We consider a home sales contract cancelled when the customer terminates the contract or when we provide notice of termination due to a failure on the part of the customer to close on the home or meet a contingency under the contract.

Home starts. Home starts is the number of new homes on which we have started construction in a given period. Home starts are monitored by management in order to minimize the time between contract signing and closing.

Closings. Closings represents the number of home sales closed in the period. We recognize revenue equal to the sales price of a home when the sales are closed and title passes to the purchasers.

Backlog. Backlog is the number of homes we are building that are under contract for sale that have not closed as of the end of the period being presented. The dollar value of backlog is the revenue anticipated to be realized at closing equal to the purchase price provided in the applicable contract. Backlog is an important indicator of home closings and homebuilding revenues in future periods.

Average sales price. Average sales price represents total homebuilding revenue for a given period divided by the number of closings for such period.

5

Construction

Construction time for our homes depends on the availability of labor and materials, the type and size of the home, location and weather conditions. Construction of a home in our active adult communities or primary residential communities is typically completed within five months following commencement of construction.

We act as the general contractor for the construction of our homes and communities. We typically engage subcontractors on a project-by-project basis to complete construction at a negotiated fixed price. Agreements with our subcontractors and material suppliers are generally entered into after competitive bidding. Our subcontract agreements typically require the subcontractor to meet certain insurance requirements and to indemnify us against claims related to their work. Our project managers and superintendents supervise the construction of each home, schedule and manage the activities of subcontractors and suppliers, subject their materials and work to quality control standards and assure compliance with zoning and building codes.

Purchase of Raw Materials

We engage several suppliers in each region in order to eliminate or minimize any shortages in materials or labor. We also have national supplier contracts for certain items such as appliances where economies of scale can be leveraged. We choose each of our suppliers based on price, quality, reputation, scalability and ability to meet our construction timelines. We do not maintain inventories of construction materials except for materials being utilized just-in-time for homes under construction.

Prices of materials may fluctuate due to various factors, including demand or supply shortages, which may be beyond the control of our suppliers. Although we have historically been able to offset increases in the costs of materials and labor with increases in the prices of our homes, we may not be able to do so in the future because sales of homes are frequently made in advance of construction. In the ordinary course of business, our construction budgets contain a contingency amount for price increases.

Purchase of Land

We buy improved lots and tracts of raw land or unimproved lots that require development. Generally, earnest money deposits on new land purchases have historically ranged from 5% to 20% of the final purchase price. Additionally, we will use option contracts to acquire lots on a metered basis. Our liability, in the event we do not perform as agreed in the terms of the option contract, is generally forfeiture of our earnest money deposit to the land seller. As of December 31, 2016, we had $4.2 million of earnest money deposits outstanding on new land purchases and land option contracts.

Marketing and Sales

We market our homes through a variety of means, including our website, social media and other Internet channels, as well as the use of model homes, newspaper, magazine and billboard advertising. We also seek to customize our marketing efforts based on location to address the needs and preferences of local homebuyers. We employ sales professionals who are compensated through a combination of salaries and sales commissions to encourage and reward increased sales performance. We use a customer relationship management system to track our traffic and automate follow-up with our contact lists. We also use outside sales brokers in certain markets.

We use model homes in our communities to provide homebuyers the opportunity to view fully furnished and landscaped homes. We typically use one or more model homes in each community. Additionally, in our active adult communities, we have homes that we use as Discovery Day units. These homes are used for prospective buyers to stay for short periods of time for exposure to the overall experience of the community.

In order to provide a more tailored product, our homebuyers have the option of customizing their homes through our design center services. Each floor plan has available options that may be added or modified in order to suit the requirements of individual homebuyers.

6

We report a home as sold pursuant to a written sales contract that usually requires the homebuyer to make a cash deposit. Such sales contracts often contain contingencies such as the ability to receive mortgage financing. We have preferred relationships with select vendors to provide customer financing and title services. In connection with our sales process, we generally require all of our buyers to pre-qualify with a preferred mortgage financing provider.

We conduct pre-closing home orientation and post-closing surveys for the homebuyer, which we believe is an integral part of our customer service program. We conduct home orientations with homebuyers immediately before closing. Prior to these orientations, we inspect the home and create a list of unfinished construction items and address outstanding issues promptly. We believe that delivering a high-quality finished home to our homeowners enhances our reputation for quality and service. Typically, we engage an outside firm to conduct comprehensive follow-up surveys with our homeowners to determine their level of satisfaction several months after closing. These surveys provide us with valuable feedback on the quality of the homes we deliver and the services we provide.

Primary Residential Community Development

With our acquisition of the Royal Oak Homes business in 2014 and the Bonterra Builders business in 2015, we have significantly expanded our focus on the primary residential market, which continues to improve since the most recent housing downturn. We believe that continued investment in this segment will provide us with a balanced portfolio. In addition to our recent acquisitions, we have continued to expand organically in our existing Central Florida, Charlotte and greater Phoenix markets, while also expanding into the Jacksonville, Florida and Raleigh, North Carolina markets. During the year ended December 31, 2016, we had 1,770 home closings in the primary residential market compared to 1,236 home closings for the same period in 2015.

Active Adult Community Development

A primary component of our business is the development of active adult communities and the construction and sales of residences within those communities. We intend to grow this component of our business and continue to seek and evaluate opportunities to expand our active adult operations both in terms of assets and geography. Our current major active adult communities include:

Solivita

Solivita commenced active sales in 2000 and is comprised of 10,089 lots on 7,193 acres in Central Florida, south of the Orlando metropolitan area. As of December 31, 2016, 4,258 of the 5,589 planned residences in the actively developed area have been sold and closed, with approximately 4,500 lots to be developed in future phases. Solivita offers its residents numerous activities year-round through the community’s Lifestyles program, which includes approximately 148,000 square feet of recreation facilities. These facilities include two fitness centers, 14 heated swimming pools, restaurants, arts and crafts rooms, a billiard room, a café, and other meeting and ballroom facilities. We also developed and own two 18-hole championship golf courses. The community’s activity park houses a variety of sports and games facilities, including an official softball field, bocce ball courts, shuffleboard courts, pickleball courts, tennis courts, horseshoe pits, dog parks and an outdoor pavilion. Social activities at Solivita include over 300 clubs, including such diverse interests as dragon boats, photography, travel, pickleball, softball, theatre and motorcycle riding and Veterans affairs.

CantaMia

CantaMia is a 1,695 lot active adult community located on 541 acres in the Estrella Mountain Ranch master-planned community in Goodyear, Arizona, west of Phoenix. Residents have exclusive use of the 30,000 square foot recreation and lifestyle facility that has, as its focal point, an eighteen acre man-made lake system. Amenities include an exercise facility, indoor/outdoor swimming pools, a demonstration kitchen, a library, a technology center, an arts/crafts studio, rooms for games and club activities, a movement studio for yoga and aerobics, and a café. CantaMia also has outdoor sporting venues, including swimming, pickleball, bocce ball, tennis and horseshoes. As of December 31, 2016, a total of 546 homes have closed since we started selling in 2010.

7

Vitalia at Tradition

Vitalia at Tradition (“Vitalia”) is a 1,153 lot, 452-acre active adult community located in Port St. Lucie, Florida, between Vero Beach and West Palm Beach on Florida’s east coast. We acquired this property in 2009 in its partially developed condition. We have completed new model homes and the recreational center amenity, and have commenced development of additional roadways. As of December 31, 2016, a total of 629 homes have closed since 2009.

Encore at Eastmark

Encore at Eastmark (“Encore”) is our latest active adult community in the Arizona market and is located in the Southeast Valley of metropolitan Phoenix, in the City of Mesa, Arizona. Encore is a 310-acre master-planned community, located within the much larger master-planned community of Eastmark. Encore offers four different product lines designed for the active adult demographic encompassing 973 lots. Residents have exclusive use of the 15,000 square foot recreation and lifestyle facility. Amenities include an exercise facility, outdoor swimming pool, a library, an arts/crafts studio, rooms for games and club activities, a movement studio for yoga and aerobics, and a café. Encore also has outdoor sporting venues, including pickleball, bocce ball, and tennis. As of December 31, 2016, a total of 223 homes have closed since we started selling in 2015.

Creekside at Bethpage

Creekside at Bethpage (“Creekside”) is our first entry into the Raleigh/Durham market. This community is part of the larger Bethpage mixed-use development, which consists of residential, retail, multi-family and commercial uses. Creekside is a 292-acre parcel with a preliminary total of 653 lots that is age-restricted and targets the active adult segment. Creekside has five different product lines ranging from 1,200 to 4,000 square feet.

The sales center and model complex opened in October 2015. The surrounding amenities consist of a 14,000 square foot clubhouse with tennis courts, pickleball courts, bocce ball, an urban garden and a swimming pool, which were completed and opened in the fall of 2016. As of December 31, 2016, a total of 106 homes have closed since we started selling in 2015.

Segment Information

Our reportable segment information regarding revenues, results of operations and assets is incorporated herein by reference to Note 13, Segment Information, to the consolidated financial statements included in Part II of this report.

Trademarks

We have federally registered trademarks and service marks or pending applications for federal registration for several of our entities, operations and communities, including AV Homes®, Stonegate®, Solivita®, Royal Oak Homes®, CantaMia® and Vitalia®.

Employees

As of December 31, 2016, we employed 332 individuals on a full-time or part-time basis. Relations with our employees are satisfactory and there have been no work stoppages.

Regulation

Our business is subject to extensive federal, state and local statutes, ordinances and regulations that affect every aspect of our business, such as environmental, hazardous waste and land-use requirements, and can result in substantial expense to AV Homes.

8

Homes and residential communities that we build must comply with federal, state and local laws, regulations, and ordinances relating to, among other things, zoning, construction permits or entitlements, construction material requirements, density requirements, and requirements relating to building design and property elevation, building codes and the handling of waste. These laws and regulations are subject to frequent change and often result in increased construction or other costs related to our business. In some instances, we must comply with laws that require commitments from us to provide roads and other offsite infrastructure to be in place prior to the commencement of new construction. These laws and regulations may result in fees and assessments, including, without limitation, fees and assessments for schools, parks, streets and highways and other public improvements, the costs of which can be substantial.

The residential homebuilding industry is also subject to a variety of federal, state and local statutes, ordinances, rules and regulations concerning the protection of human health and the environment. These environmental laws include such areas as storm water and surface water management, soil, groundwater, endangered or imperiled species, natural resources and wetlands protection, and air quality protection and enhancement. Complying with environmental laws for existing conditions may result in delays, may cause us to incur substantial compliance and other costs, and may prohibit or severely restrict homebuilding activity in environmentally sensitive regions or areas.

Competition

The homebuilding industry is highly competitive. Homebuilders compete not only for homebuyers, but also for desirable properties, financing, raw materials and skilled labor. We compete with other local, regional and national homebuilders, often within larger subdivisions, that are designed, planned and developed by such homebuilders. We also compete with the resale market, including within our own communities, as well as foreclosure sales and the rental market. In addition, the consolidation of some homebuilding companies may create additional competitors that have greater financial, marketing and sales resources than we do and thus are able to compete more effectively against us, and there may be new entrants in the markets in which we currently conduct business. These competitive conditions in the homebuilding industry can affect our business and financial results through lower sales, lower selling prices, increased selling incentives, lower profit margins, impairments in the value of inventory and other assets, difficulty in acquiring suitable land, raw materials, and skilled labor at acceptable prices or terms, and delays in construction of our homes.

Seasonality

Our business is affected to some extent by the seasonality of home sales, which generally produce increased closings in the latter half of the year. However, periods of economic downturn in the industry can alter seasonal patterns.

Our business, financial condition, results of operations, cash flows, future performance, and the prevailing market price and performance of our common stock, may be adversely affected by a number of factors, including the matters discussed below. Certain statements and information set forth in this Annual Report on Form 10-K, as well as other written or oral statements made from time to time by us or by our authorized officers on our behalf, constitute “forward-looking statements” within the meaning of the Federal Private Securities Litigation Reform Act of 1995. Forward-looking statements in this document speak only as of the date of this Annual Report on Form 10-K and we undertake no duty or obligation to update or revise our forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Although we believe that the expectations, plans, intentions and projections reflected in our forward-looking statements are reasonable, such statements are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

9

The risks, uncertainties and other factors that our stockholders and prospective investors should consider include the following:

The homebuilding industry is cyclical and affected by a variety of factors. Deterioration in industry conditions or in broader economic conditions could have material adverse effects on our business and financial results.

The homebuilding industry is highly cyclical and may be significantly affected by changes in general economic and business conditions, such as:

|

· |

employment and income levels; |

|

· |

availability of financing for homebuyers; |

|

· |

short and long term interest rates; |

|

· |

consumer confidence; |

|

· |

labor availability; |

|

· |

levels of new and existing homes for sale or rent; |

|

· |

shifting housing demand due to population and demographic changes; and |

|

· |

the supply of developable land in our markets and the United States generally. |

Changes in these conditions may occur on a national scale, as was largely the case in the most recent downturn, or may acutely affect some of the regions or markets in which we operate more than others. Adverse conditions affecting certain markets could have a proportionately greater impact on us than on other homebuilding companies with smaller presences in these locally affected markets.

Adverse changes in economic conditions can cause demand and prices for our homes to diminish, cause us to take longer to build our homes, and/or make it more costly for us to do so. We may not be able to recover increased costs by raising prices in the event market conditions are weak and because the price of each home we sell is usually set several months before the home is delivered, as many customers sign their home purchase contracts before construction begins. Adverse economic conditions could also impact our customers’ ability to obtain suitable financing and cause some homebuyers to cancel or refuse to honor their home purchase contracts altogether. Any such adverse change nationally or in any of our markets could have a material adverse effect on our business, liquidity and results of operations.

Our success depends on the availability of suitable land acquisition opportunities at acceptable prices and our having sufficient liquidity to acquire such properties.

Our success in developing land and in building and selling homes depends in part upon the continued availability of suitable undeveloped land, partially developed land and improved lots at prices that meet our investment criteria. Such availability depends on a number of factors outside of our control, including competition in local markets for land and lots and restrictive governmental regulations. Should suitable land opportunities become less available, the number of homes we may be able to build and sell would be reduced, which would have an adverse effect on our revenue and profits. In addition, our ability to make land purchases will depend upon us having sufficient liquidity to fund such purchases. We may be at a disadvantage in competing for land due to our debt obligations and restrictive covenants and as a result of our reduced access to capital compared to some of our competitors.

If we are unable to develop our communities successfully or within expected timeframes, our results of operations could be adversely affected.

Before a community generates any revenues, time and material expenditures are required to acquire land, obtain development approvals and, in many cases, construct significant portions of project infrastructure, amenities, model homes and sales facilities. A decline in our ability to develop and market our communities successfully and to generate positive cash flow from these operations in a timely manner would have a material adverse effect on our business and results of operations and on our ability to service our debt and to meet our working capital requirements.

10

Increases in interest rates and reductions in the availability of mortgage financing could lower demand for our products, negatively impact our backlog and impact our operating results.

A substantial majority of our customers finance their homes through lenders that provide mortgage loans. Interest rates have been near historical lows for several years, which has increased the purchasing power of potential homebuyers. Increases in interest rates could lower demand for new homes because monthly mortgage costs would increase for potential homebuyers. Even if potential new homebuyers do not need financing, changes in interest rates could make it harder for them to sell their existing homes to potential buyers who need financing. This could prevent or limit our ability to attract new customers as well as our ability to fully realize our backlog because our sales contracts often include financing or other contingencies.

Following the most recent downturn in the housing industry, which began with defaults on subprime loans, lenders, regulators and others questioned the adequacy of lending standards and other credit requirements for several loan products and programs. This resulted in a tightening of lending and qualification standards. Fewer loan products, tighter loan qualifications and a reduced willingness of lenders to make loans, in turn, have made it more difficult for many buyers to sell their homes or to finance the purchase of our homes. A further reduction in loan products or tightening of qualification standards would have a further adverse effect on our results.

Additionally, the federal government plays a significant role in supporting mortgage lending through its conservatorship of Fannie Mae and Freddie Mac, both of which purchase home mortgages and mortgage-backed securities originated by mortgage lenders, and its insurance of mortgages originated by lenders through the FHA and the VA. The availability and affordability of mortgage loans, including consumer interest rates for such loans, could be adversely affected by a curtailment or cessation of the federal government’s mortgage-related programs or policies. The FHA may continue to impose stricter loan qualification standards, raise minimum down payment requirements, impose higher mortgage insurance premiums and other costs, and/or limit the number of mortgages it insures. Because the availability of Fannie Mae, Freddie Mac, FHA- and VA-backed mortgage financing is an important factor in marketing and selling many of our homes, any limitations, restrictions or changes in the availability of such government-backed financing could reduce our home sales, which could have a material adverse effect on our business, prospects, liquidity, financial condition and results of operations.

Price increases, supply shortages and other risks related to demand for building materials could increase our costs and delay deliveries.

In recent years the purchase price of building materials, including the price of concrete, lumber, drywall, and other important materials, has increased. Additionally, the homebuilding industry has, from time to time, experienced raw material shortages and been adversely affected by volatility in global commodity prices. Shortages in concrete, lumber, drywall or other important materials could result in delays in the start or completion of, or increase the cost of completing, our homes, which could adversely impact our results of operations.

Our business and results of operations are dependent on the availability and skill of subcontractors. If we experience shortages in labor skill or supply, there could be delays and increased costs in developing our communities.

Substantially all of our construction work is done by third-party subcontractors with us acting as the general contractor. Accordingly, the timing and quality of our construction depend on the availability and skill of our subcontractors. Access to qualified labor may be affected by circumstances beyond our control, including labor disputes, shortages in qualified trades people and changes in immigration laws and trends in labor force migration. While we generally anticipate being able to obtain sufficient materials and reliable subcontractors, and believe that our relationships with subcontractors are good, the availability of qualified subcontractors in our markets has at times been constrained. We do not have long-term contractual commitments with any subcontractors, and there can be no assurance that skilled subcontractors will continue to be available at reasonable rates and in the areas in which we conduct our operations.

To the extent the demand for labor and materials increases as it has in recent years, our average per home cost of labor and building materials will likely increase, and our operating margins and results of operations may be adversely

11

affected. Further, the inability to contract with skilled subcontractors at reasonable costs on a timely basis could have a material adverse effect on our business, prospects and results of operations.

Homebuilding is very competitive, and competitive conditions could adversely affect our business or financial results.

The homebuilding industry is highly competitive. Homebuilders compete not only for homebuyers, but also for desirable properties, financing, raw materials and skilled labor. We compete with other local, regional and national homebuilders, often within larger subdivisions that are designed, planned and developed by such homebuilders. We also compete with the home re-sale market, foreclosures and rental properties. In addition, many of our competitors have greater financial, marketing and sales resources than we do and thus are able to compete more effectively against us. Finally, any damage to our reputation, which may spread widely and quickly through digital and social media, could impair our ability to compete for homebuyers. These competitive conditions in the homebuilding industry can affect our business and result in lower sales, lower selling prices and lower profit margin, among other things.

Our business is capital intensive and requires access to sufficient capital.

Our business is capital intensive and requires significant up-front expenditures to acquire land and begin development. We must make significant capital expenditures to commence development of a community and bear the costs of the development until we sell the homes. Accordingly, our ability to access capital is a key factor in our ability to cover our operating expenses, service our indebtedness, and fund our other liquidity needs. We expect to seek and raise additional capital from time to time from a variety of sources, including bank financings and/or securities offerings, to cover our liquidity needs and grow our business. Deterioration in our creditworthiness or a constriction of the capital markets could reduce the sources of liquidity available to us and increase our cost of capital. Any difficulty in obtaining sufficient capital for planned development expenditures could cause project delays and any such delay could result in cost increases and may adversely affect our sales and future results of operations and cash flows.

We may not be able to generate sufficient cash to service all of our indebtedness, including our outstanding notes, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

As of December 31, 2016, the total principal amount of our debt was $280.0 million. Our ability to make scheduled payments on or refinance our debt obligations, including the 8.50% Senior Notes due 2019 and the 6.00% Senior Convertible Notes due 2020 (collectively, the “Notes”) and our revolving credit facility, depends on our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business, legislative, regulatory and other factors beyond our control. If we are significantly and negatively impacted by any of the foregoing, we may be unable to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness, including the Notes, as the same shall become due and payable.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we could face substantial liquidity problems and could be forced to reduce or delay investments and capital expenditures or to dispose of material assets or operations, seek additional debt or equity capital or restructure or refinance our indebtedness, including the Notes. Under such circumstances, we may not be able to affect any such alternative measures on commercially reasonable terms or at all and, even if successful, those alternative actions may not allow us to meet our scheduled debt service obligations. The credit agreement governing our revolving credit facility and the indentures that govern the Notes restrict our ability to dispose of assets and use the proceeds from those dispositions and may also restrict our ability to raise debt or equity capital to be used to repay other indebtedness when it becomes due. We may not be able to consummate those dispositions or to obtain proceeds in an amount sufficient to meet any debt service obligations when due.

If we cannot make scheduled payments on our debt, we will be in default and holders of the Notes could declare all outstanding principal and interest to be due and payable, the lenders under the revolving credit facility could terminate their commitments to loan money, the lenders could foreclose against the assets securing their borrowings and we could be forced into bankruptcy or liquidation.

12

The terms of the credit agreement governing our revolving credit facility and the indentures governing the Notes restrict our current and future operations, particularly our ability to respond to changes or to take certain actions.

The indentures governing the Notes contain, and the credit agreement governing our revolving credit facility contains, a number of restrictive covenants that impose significant operating and financial restrictions on us and may limit our ability to engage in acts that may be in our long-term best interest, including restrictions on our ability to:

|

· |

incur additional indebtedness and guarantee indebtedness; |

|

· |

pay dividends or make other distributions or repurchase or redeem our capital stock; |

|

· |

prepay, redeem or repurchase certain debt; |

|

· |

issue certain preferred stock or similar equity securities; |

|

· |

make loans and investments; |

|

· |

sell assets; |

|

· |

incur liens; |

|

· |

enter into transactions with affiliates; |

|

· |

alter the business we conduct; |

|

· |

enter into agreements restricting our subsidiaries’ ability to pay dividends; and |

|

· |

consolidate, merge or sell all or substantially all of our assets. |

In addition, the restrictive covenants in the credit agreement governing our revolving credit facility require us to maintain specified financial ratios and satisfy other financial condition tests. Our ability to meet those financial ratios and tests can be affected by events beyond our control.

A breach of the covenants or restrictions under the indentures governing the Notes or under the credit agreement governing our revolving credit facility could result in an event of default under the applicable indebtedness. Such a default may allow the creditors to accelerate the related debt and may result in the acceleration of any other debt to which a cross-acceleration or cross-default provision applies. In addition, an event of default under the credit agreement governing our revolving credit facility would permit the lenders under our revolving credit facility to terminate all commitments to extend further credit under that facility. Furthermore, if we were unable to repay the amounts due and payable under our revolving credit facility, those lenders could proceed against the collateral granted to them to secure that indebtedness. In the event our lenders or noteholders accelerate the repayment of our borrowings, we and our subsidiaries may not have sufficient assets to repay that indebtedness. As a result of these restrictions, we may be:

|

· |

limited in how we conduct our business; |

|

· |

unable to raise additional debt or equity financing to operating during general economic or business downturns; or |

|

· |

unable to compete effectively or to take advantage of new business opportunities. |

These restrictions may affect our ability to grow in accordance with our strategy. In addition, our future financial results, our substantial indebtedness and our credit ratings could adversely affect the availability and terms of our financing.

Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

Borrowings under our revolving credit facility are at variable rates of interest and expose us to interest rate risk. If interest rates were to increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same, and our net income and cash flows, including cash available for servicing our indebtedness, will correspondingly decrease.

13

Despite our current level of indebtedness, we and our subsidiaries may still be able to incur substantially more debt. This could further exacerbate the risks to our financial condition described above.

We and our subsidiaries may be able to incur significant additional indebtedness in the future. Although the indentures related to our Notes contain, and the credit agreement governing our revolving credit facility contains, restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of qualifications and exceptions, and the additional indebtedness incurred in compliance with these restrictions could be substantial. These restrictions also will not prevent us from incurring obligations that do not constitute indebtedness. If new debt is added to our current debt levels, the related risks that we face could intensify.

Additionally, agreements governing any future indebtedness may contain restrictions on our ability to incur indebtedness, grant certain liens to support indebtedness, enter into certain affiliate transactions and make certain distributions. These covenants could adversely affect our ability to finance our future operations or capital needs, engage in, expand or pursue our business activities and prevent us from engaging in certain transactions that might otherwise be considered beneficial to us.

We may be unable to purchase the Notes upon a fundamental change.

We may not have the funds necessary to fulfill our obligations under the 6.00% Senior Convertible Notes due 2020 following a “fundamental change,” as defined in the indenture governing such notes. Upon the occurrence of a defined fundamental change, which definition includes a change of control (whether it be voluntary or involuntary), we will be required to offer to repurchase all of the applicable outstanding notes at 100% of the principal amount thereof, plus accrued and unpaid interest to the date of repurchase. Similarly, our 8.50% Senior Notes due 2019 require us to repurchase all or a portion of the outstanding notes at 101% of their principal amount, plus accrued and unpaid interest upon certain change of control transactions. However, we may not have sufficient funds at the time of any such event to make the required repurchase of the Notes. Our failure to make or complete an offer to repurchase Notes in connection with any such event would place us in default under each indenture governing the applicable Notes.

An inability to obtain additional letters of credit and surety bonds could limit our future growth.

In addition, we use letters of credit and surety bonds to secure our performance under various construction and land development agreements, escrow agreements, financial guarantees and other arrangements. Should our future performance or economic conditions continue to make such letters of credit and surety bonds costly or difficult to obtain or lead to us being required to collateralize such instruments to a greater extent than previously, our business and financial results could be adversely affected.

Cancellations of home sales orders in backlog may increase as homebuyers choose to not honor their contracts.

Our backlog reflects sales contracts with our homebuyers for homes that have not yet been delivered. In cases of cancellation, we remarket the home and, subject to certain exceptions, usually retain any deposits. Nevertheless, the deposits may not cover the additional costs involved in remarketing the home, replacing installed options, reducing the sales price or increasing incentives on the completed home for greater marketability and carrying higher inventory. If prices for new homes decline, if competitors increase their use of sales incentives, if interest rates increase, if the availability of mortgage financing diminishes or if there is a downturn in local or regional economies or in the national economy, U.S. homebuyers may terminate their existing home purchase contracts with us in order to negotiate for a lower price or because they cannot, or will not, complete the purchase. Any significant increase in cancellations of home sales orders in backlog in the future could have a material adverse impact on our results of operations and financial condition.

14

The geographic concentration of our operations in Florida, the Carolinas and Arizona subjects us to an increased risk of loss of revenue or decreases in the market value of our land and homes in these regions from factors which may affect any of these regions.

Our operations are concentrated in Florida, the Carolinas and Arizona. Due to the concentrated nature of our operations, negative factors affecting one or more of these geographic regions at the same time could result in a relatively greater impact on our results of operations than they might have on other companies that have a more diversified portfolio of operations.

Inflation or deflation could adversely affect our business and financial results.

Inflation can adversely affect us by increasing costs of land, materials and labor. We may not be able to offset any such cost increases with higher sales prices. In addition, inflation is often accompanied by higher interest rates, which have a negative impact on housing demand. In such an environment, we may not be able to raise home prices sufficiently to keep up with the rate of inflation and we may not be able to pass on any such increases to customers who have already entered into sales contracts, which may be well in advance of the construction of the home, which could cause our margins to decrease. Moreover, with inflation, our costs of capital increase, and the purchasing power of our cash resources may decline.

Alternatively, a significant period of deflation could cause a decrease in overall spending and borrowing levels. This could lead to a further deterioration in economic conditions, including an increase in the rate of unemployment. Deflation could also cause the value of our inventories to decline or reduce the value of existing homes below the related mortgage loan balance, making it impractical for potential homebuyers to sell their existing homes in favor of a new home.

Elimination or reduction of the tax benefits associated with owning a home could dissuade potential customers from buying our homes and adversely affect our business or financial results.

Significant expenses of owning a home, including mortgage interest and real estate taxes, generally are deductible expenses for an individual’s federal, and in some cases, state income taxes, subject to various limitations under current tax law and policy. If the federal government or a state government changes its income tax laws, as has been discussed from time to time, to eliminate or substantially modify these income tax deductions, the after-tax cost of owning a new home would increase for many of our potential customers. The resulting loss or reduction of homeowner tax deductions, if such tax law changes were enacted without offsetting provisions, would adversely impact demand for and sales prices of new homes. In addition, increases in property tax rates by local governmental authorities can adversely affect the ability of potential customers to obtain financing or the desire of potential customers to purchase new homes.

Homebuilding is subject to home warranty and construction defect claims and other litigation risks in the ordinary course of business that can be significant. Our operating expenses could increase if we are required to pay higher insurance premiums or incur substantial litigation costs with respect to such claims and risks.

As a homebuilder, we are subject to home warranty and construction defect claims arising in the ordinary course of business. Construction defects may occur on projects and developments and may arise during a significant period of time after completion. Defects arising on a development attributable to us may lead to significant contractual or other liabilities as well as reputational harm. As a consequence, we maintain products and completed operations excess liability insurance, obtain indemnities and certificates of insurance from subcontractors generally covering claims related to damages resulting from faulty workmanship and materials, and create warranty and customer service reserves for the homes we sell based on historical experience in our markets and our judgment of the risks associated with the types of homes built. Although we actively monitor our insurance reserves and coverage, because of the uncertainties inherent to these matters, we cannot provide assurance that our insurance coverage, our subcontractor arrangements and our reserves will be adequate to address all of our warranty and construction defect claims in the future.

15

In addition, decreases in home values as a result of general economic conditions may result in an increase in construction defect claims, as well as claims based on marketing and sales practices. Our reserves may not cover all of the claims arising from such issues, or we may experience litigation costs and losses that could impact our profitability. Even if we are successful in defending such claims, we may incur significant costs.

A major health and safety incident relating to our business could be costly in terms of potential liabilities and reputational damage.

Building sites are inherently dangerous, and operating in the homebuilding industry poses certain inherent health and safety risks. Due to health and safety regulatory requirements and the number of projects we work on, health and safety performance is critical to the success of all areas of our business. Any failure in health and safety performance may result in penalties for non-compliance with relevant regulatory requirements, and a failure that results in a major or significant health and safety incident is likely to be costly in terms of potential liabilities incurred as a result. Such a failure could generate significant negative publicity and have a corresponding impact on our reputation, our relationships with relevant regulatory agencies or governmental authorities, and our ability to sell homes, which, in turn, could have a material adverse effect on our business, financial condition and operating results.

Our business is seasonal in nature, and our quarterly operating results can fluctuate.

Our quarterly operating results generally fluctuate by season. We typically experience the highest new home order activity in the winter and spring months, although new order activity is also highly dependent on the number of actively selling communities and the timing of new community openings as well as other market factors. We may experience higher liquidity demands during the first half of the calendar year as we incur the costs associated with new construction resulting from the increased sales volume. If, due to construction delays or other reasons, we are unable to deliver our expected number of homes in the second half of the calendar year, our full year results of operations may be adversely affected.

We may be adversely affected by weather conditions and natural disasters.

Weather conditions and natural disasters, such as hurricanes, tornadoes, earthquakes, wildfires, droughts and floods, can harm our homebuilding business. These can delay home closings, the development of raw land positions, adversely affect the cost or availability of materials or labor, or damage homes under construction. The climates of certain of the states in which we operate present increased risks of adverse weather or natural disasters. In particular, a large portion of our homebuilding operations are concentrated in Florida and the Carolinas, which are subject to increased risk of hurricanes. Furthermore, if our insurance does not fully cover losses resulting from these events or any related business interruption, our assets, financial condition and capital resources could be adversely affected.

Resource shortages or rate fluctuations could have an adverse effect on our operations.

The areas in which we operate are subject to resource shortages, including significant changes to the availability of potable and non-potable water. Shortages of natural resources, particularly water, may make it more difficult for us to obtain regulatory approval for new developments or present challenges within existing developments. We may incur additional costs and may not be able to complete construction on a timely basis if such shortages continue. Furthermore, these shortages may adversely affect the regional economies in which we operate, which may reduce demand for our homes. In addition, the cost of petroleum products, which are used both to deliver our materials and to transport our employees to our job sites, fluctuates and may increase as a result of geopolitical events or accidents. This could also result in higher prices for any product utilizing petrochemicals. These cost increases may have an adverse effect on our operating margin and results of operations.

Values of, and costs associated with, our land and lot inventory could adversely affect our business or financial results.

The risks inherent in controlling or purchasing, holding and developing land for new home construction are substantial and increase as consumer demand for housing decreases. The value of undeveloped land, developed lots and

16

housing inventories can fluctuate significantly as a result of changing market conditions. If the fair market value of the land, lots and inventories we hold decreases, we may be required to reduce the carrying value of these assets and take significant impairment charges. We may have acquired options on or bought and developed land at a cost we will not be able to recover fully or on which we cannot build and sell homes profitably. In addition, our deposits for developed lots controlled under option or similar contracts may be put at risk. In addition, inventory carrying costs can be significant and can result in reduced margins or losses in poorly performing communities or markets. Because future market conditions are uncertain, we cannot provide assurance that we will be successful in managing our future inventory risks or avoiding future impairment charges. Any material write-downs of assets could have a material adverse effect on our business, prospects, liquidity, financial condition and results of operations.

In addition, some real estate investments are relatively difficult to sell quickly. As a result, our ability to promptly sell one or more properties in response to changing economic, financial and investment conditions may be limited, and we may be forced to hold non-income producing assets for an extended period of time. We cannot predict whether we will be able to sell any property for the price or on the terms that we set or whether any price or other terms offered by a prospective purchaser would be acceptable to us. We also cannot predict the length of time needed to find a willing purchaser and to close the sale of a property.

An oversupply of alternatives to new homes and reduction in homebuyer demand can adversely impact our ability to sell new homes.

An oversupply of alternatives to new homes, including foreclosed homes, homes held for sale by investors and speculators, other existing homes and rental properties, can adversely impact our ability to sell new homes, depress new home prices and reduce margins on the sales of new homes. High levels of foreclosures not only contribute to additional inventory available for sale, but can also reduce appraisal valuations for new homes, potentially resulting in lower sales prices.

Reduced home sales may impair our ability to recoup development costs or force us to absorb additional costs.

We incur many costs before we begin to build homes in a community. Depending on the stage of development a land parcel is in when acquired, such costs may include costs of preparing land; finishing and entitling lots; installing roads, sewers, water systems and other utilities; building amenities in our age-restricted and age-targeted communities; paying taxes and other costs related to ownership of the land on which we plan to build homes; and incurring promotional marketing and overhead expenses to prepare for the opening of a new home community for sales. In addition, local municipalities may impose requirements resulting in additional costs. If the rate at which we sell and deliver homes slows or falls, or if we delay the opening of new home communities for sales due to adjustments in our marketing strategy or other reasons, we may incur additional costs, and it will take a longer period of time for us to recover our costs.

TPG Aviator, L.P. is a significant stockholder and may have conflicts of interest with us in the future.

TPG Aviator, L.P. (“TPG Aviator”) beneficially owned approximately 43.5% of our common stock as of December 31, 2016, and is our largest single stockholder. In addition, so long as TPG Aviator owns at least 10% of our issued and outstanding common stock, TPG Aviator has a pre-emptive right to participate in our future equity issuances, subject to certain conditions. This concentration of ownership in one stockholder could potentially be disadvantageous to other stockholders’ interests. In addition, if TPG Aviator were to sell or otherwise transfer all or a large percentage of its holdings, our stock price could decline and we could find it difficult to raise capital, if needed, through the sale of additional equity securities.

The interests of TPG Aviator and its affiliates may differ from the interests of our other stockholders in material respects. For example, TPG Aviator and its affiliates may have an interest in directly or indirectly pursuing acquisitions, divestitures, financings or other transactions that, in their judgment, could enhance their other equity investments, even though such transactions might involve risks to us. TPG Aviator and its affiliates are in the business of making or advising on investments in companies, including businesses that directly or indirectly compete with our business. They

17

may also pursue acquisition opportunities that may be complementary to our business, and, as a result, those acquisition opportunities may not be available to us.

Our stockholders agreement with TPG Aviator grants TPG Aviator certain rights that may restrain our ability to take various actions in the future.

In connection with TPG Aviator’s June 2013 investment in us, we entered into a stockholders agreement with TPG Aviator, pursuant to which we granted TPG Aviator certain rights that may restrict our ability to take certain actions in the future. Under the stockholders agreement, we agreed to increase the size of our board of directors to ten members and we appointed four directors designated by TPG Aviator.

TPG Aviator has the right to nominate a specified number of directors to the board and to appoint a specified number of such directors to each committee of the board of directors for so long as TPG Aviator’s ownership percentage of our common stock is equal to or greater than 5%. TPG Aviator is entitled to nominate to the board: (i) four directors if TPG Aviator’s ownership percentage of our common stock is at least 30%, (ii) three directors if TPG Aviator’s ownership percentage is at least 20% but less than 30%, (iii) two directors if TPG Aviator’s ownership percentage is at least 15% but less than 20%, and (iv) one director if TPG Aviator’s ownership percentage is at least 5% but less than 15%.

In addition, we agreed to constitute each of our compensation committee and finance committee as a five member committee and (i) for so long as the ownership of TPG Aviator and its affiliates of our common stock is at least 15%, TPG Aviator has the right to have two TPG Aviator designated board members appointed to each such committee (of which all such TPG Aviator designees have been appointed), and (ii) for so long as the ownership of TPG Aviator and its affiliates of our common stock is at least 5% but less than 15%, TPG Aviator has the right to have one TPG Aviator designated board member appointed to each such committee. For so long as the ownership of TPG Aviator and its affiliates of our common stock is at least 5%, each other committee of our board will be constituted as three member committees, and TPG Aviator has the right to have one TPG Aviator designated board member appointed to each such committee (of which all such TPG Aviator designees have been appointed).

In addition, for so long as TPG Aviator’s ownership percentage of our common stock is equal to or greater than 5%, the rights and responsibilities of the finance committee of the board will include approval of (1) except for certain permitted issuances relating to outstanding rights to purchase or acquire our capital stock, compensation arrangements and acquisition transactions, any sale or issuance of any capital stock or other security, (2) any redemption, purchase, repurchase or other acquisition of securities by AV Homes or any subsidiary, other than in connection with equity compensation arrangements, (3) any incurrence of indebtedness or certain debt-like obligations, with limited exceptions, (4) any hiring or firing of members of senior management, (5) any land or builder acquisitions or dispositions, any acquisitions or dispositions of subsidiaries or any other acquisitions or dispositions, in each case, that are greater than $5.0 million (including total expected capital requirements and development costs), (6) any capital expenditures or land commitments over an agreed upon budget, as approved by our board of directors, or otherwise greater than $10.0 million, and (7) any entry into new markets or lines of business. During such period, the rights and responsibilities of the compensation committee will include approval of (1) any adoption of any new, or expansion of any existing, equity incentive plan, and (2) any changes to, or the adoption of, any compensation arrangements for any members of our board of directors or senior management. During such period, our board may not approve such matters without the requisite committee approval, which in most cases will require the approval of at least one of the committee members appointed by TPG Aviator.

Pursuant to the terms of the stockholders agreement, TPG Aviator also has the right to consent to certain actions related to our corporate existence and governance, including any change in the rights and responsibilities of either the finance committee or the compensation committee, for so long as TPG Aviator’s ownership percentage of our common stock is equal to or greater than 10% and equal to or greater than 25% of the number of shares owned by them at closing of the TPG Aviator investment.

18

We are dependent on the services of our senior management team and certain of our key employees, and the loss of their services could hurt our business.

We believe that our management’s experience is a competitive strength, and that our future success depends upon our ability to retain these executives. In addition, we believe that our ability to attract, train, assimilate and retain new skilled personnel is important to the success of our business. If we are unable to retain our senior management team and certain of our key employees, or attract, train, assimilate or retain other skilled personnel in the future, it could hinder the execution of our business strategy.

Our current efforts to grow and expand our operations could have a material adverse effect on our cash flows or profitability.

In 2015, we announced the acquisition of Bonterra Builders, LLC, which significantly expanded our operations in the Carolinas, and we continue to consider opportunities for growth, in both our existing markets and in new markets. Additional growth of our business, either through increased land purchases, the development of larger projects or the acquisition of existing homebuilders, may have a material adverse effect on our cash flows or profitability. Any expansion of our business into new markets or new businesses, or significant growth in existing markets, could divert the attention of senior management from our existing business and could fail due to our relative lack of experience in those markets or businesses. In addition, when we acquire other homebuilders, such acquisitions could be difficult to integrate with our operations and could require us to assume unanticipated liabilities and expenses. Acquisitions also involve numerous risks, including (i) the risk of impairing inventory and other assets related to the acquisition, (ii) risks associated with our ability to implement and maintain effective controls, procedures and policies for the acquired business, (iii) the diversion of management’s attention and resources from other business concerns, (iv) risks associated with entering markets in which we have limited or no direct experience, (v) risks associated with the combination of different corporate cultures, and (vi) the potential loss of key employees of the acquired company.

Government regulations could increase the cost and limit the availability of our development and homebuilding projects and adversely affect our business or financial results.

We are subject to extensive and complex regulations that affect land development and home construction, including zoning, density restrictions, building design and building standards. These regulations often provide broad discretion to the administering governmental authorities as to the conditions we must meet prior to being approved, if approved at all. Land parcels we acquire are often undeveloped and sometimes do not have all (or sometimes any) of the governmental approvals necessary to develop and construct homes. If we are unable to obtain these approvals or obtain approvals that restrict our ability to use the land in ways we do not anticipate, the value of the parcel will be negatively impacted. We are subject to determinations by these authorities as to the adequacy of water and sewage facilities, roads and other local services. Laws and regulations are subject to frequent change and often result in increased construction or other costs related to our business. In some instances, we must comply with laws that require commitments from us to provide roads and other offsite infrastructure to be in place prior to the commencement of new construction. New housing developments may also be subject to various fees and assessments for schools, parks, streets and other public improvements. Any of these regulatory issues can limit or delay home construction and increase our operating costs.

We are also subject to a variety of local, state and federal laws and regulations concerning land use and the protection of health, safety and the environment. The particular impact and requirements of environmental laws that apply to any given community vary greatly according to the community site, the site’s environmental conditions and the present and former use of the site. We expect that increasingly stringent requirements will be imposed on homebuilders in the future. Environmental laws may result in delays, cause us to implement time consuming and expensive compliance programs and prohibit or severely restrict development in certain environmentally sensitive regions or areas. Environmental regulations can also have an adverse impact on the availability and price of certain raw materials, such as lumber. Furthermore, we could incur substantial costs, including cleanup costs, fines, penalties and other sanctions and damages from third-party claims for property damage or personal injury, as a result of our failure to comply with, or liabilities under, applicable environmental laws and regulations.

19