Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PRUDENTIAL BANCORP, INC. | form8k.htm |

Annual Shareholder Meeting (NASDAQ: PBIP) February 23, 2017

DisclaimerThis presentation may contain certain forward-looking statements, including statements about the financial condition, results of operations and earnings outlook for Prudential Bancorp, Inc. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as "believe," "expect," "anticipate," "estimate" and "intend" or future or conditional verbs such as "will," "would," "should," "could" or "may." Forward-looking statements, by their nature, are subject to risks and uncertainties. A number of factors, many of which are beyond the Company's control, could cause actual conditions, events or results to differ significantly from those described in the forward-looking statements. The Company's reports filed periodically with the Securities and Exchange Commission describe some of these factors, including general economic conditions, changes in interest rates, deposit flows, the cost of funds, changes in credit quality and interest rate risks associated with the Company's business and operations. Other factors described include changes in our loan portfolio, changes in competition, fiscal and monetary policies, legislation and regulatory changes, difficulties and delays in integrating the Polonia Bancorp, Inc. business or fully realizing anticipated cost savings and other benefits of the merger with Polonia, and business disruptions following the merger.Investors are encouraged to access the Company's periodic reports filed with the Securities and Exchange Commission for financial and business information regarding the Company at www.prudentialsavingsbank.com under the Investor Relations menu. We undertake no obligation to update any forward-looking statements.

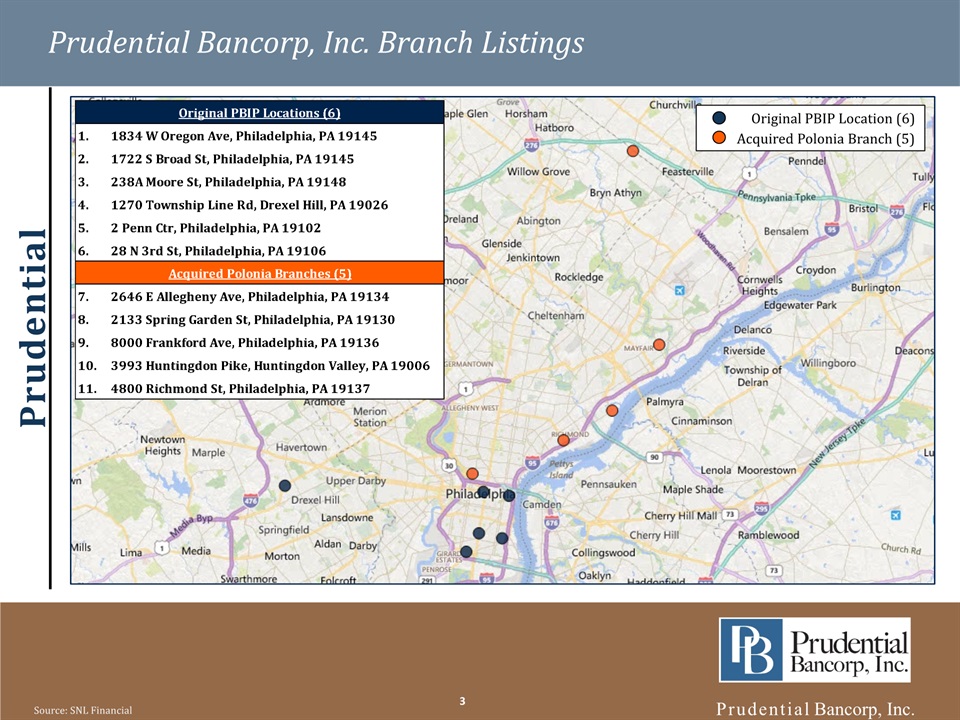

Prudential Bancorp, Inc. (“the Company”) is the holding company for Prudential Bank (“the Bank”)The Bank operates out of its main office in Philadelphia, Pennsylvania, its executive offices in Huntingdon Valley, Montgomery County, Pennsylvania as well as 9 additional full-service branch offices, eight of which are in Philadelphia and one in Drexel Hill, Delaware CountyA community oriented savings bank with roots in Philadelphia dating back to 1886The Company conducts business in Philadelphia, Delaware, Bucks, Chester and Montgomery Counties, Pennsylvania, several contiguous counties in southern New Jersey, and to a lesser extent, the entire Mid-Atlantic region. Source: SNL Financial Prudential Bancorp, Inc. Overview

Prudential Bancorp, Inc. Branch Listings Source: SNL Financial Original PBIP Location (6)Acquired Polonia Branch (5)

Announced entering into a definitive agreement with Polonia Bancorp, Inc. on June 2, 2016The merger is expected to be significantly accretive to the combined company’s earnings per share in 2017 and thereafter. The modest tangible book value dilution experienced at closing is expected to be earned back in approximately one year The acquisition was completed on January 1, 2017Each share of Polonia common stock had the option to receive $11.09 per share in cash or 0.7460 of a share of Prudential common stock, subject to allocation provisions to assure that, in the aggregate, total merger consideration consisted of 50% stock and 50% cash considerationPrudential issued approximately 1,274,200 shares of its common stock and approximately $18.9 million of cashPrudential, on a consolidated basis, has approximately $838.9 million in assets, $508.8 million in loans and $563.7 million in deposits Prudential’s existing branch network has expanded into the Philadelphia market with a total of 11 branches in Philadelphia, Delaware and Montgomery counties Acquisition of Polonia Bancorp, Inc. Highlights Source: Company Documents

15% organic asset growth from $487.2 million in 2015 to $559.5 million in 2016 (excluding the acquisition of Polonia)Continued the process of diversifying the loan portfolio from primarily fixed-rate residential lending to adjustable-rate commercial/construction lending in order to increase net earnings and decrease interest rate riskImproved efficiency ratio from decrease in non-interest expense2016 efficiency ratio of 72.87% compared to 81.04% in 2015Steadily improving Loan / Deposit ratio2016 Loan / Deposit ratio of 89.5% compared to 82.7% and 86.4% in 2014 and 2015, respectively 2016 Fiscal Year¹ Highlights (1) Third Quarter concludes PBIP’s Fiscal YearSource: Company Documents

Source: Company Documents Loan Portfolio Composition 9/30/2015 9/30/2016 Total Loans: $351,891 Total Loans: $330,556

Investment Portfolio Composition Source: Company Documents 9/30/2015 9/30/2016 Portfolio Value: $177,193 Portfolio Value: $143,840

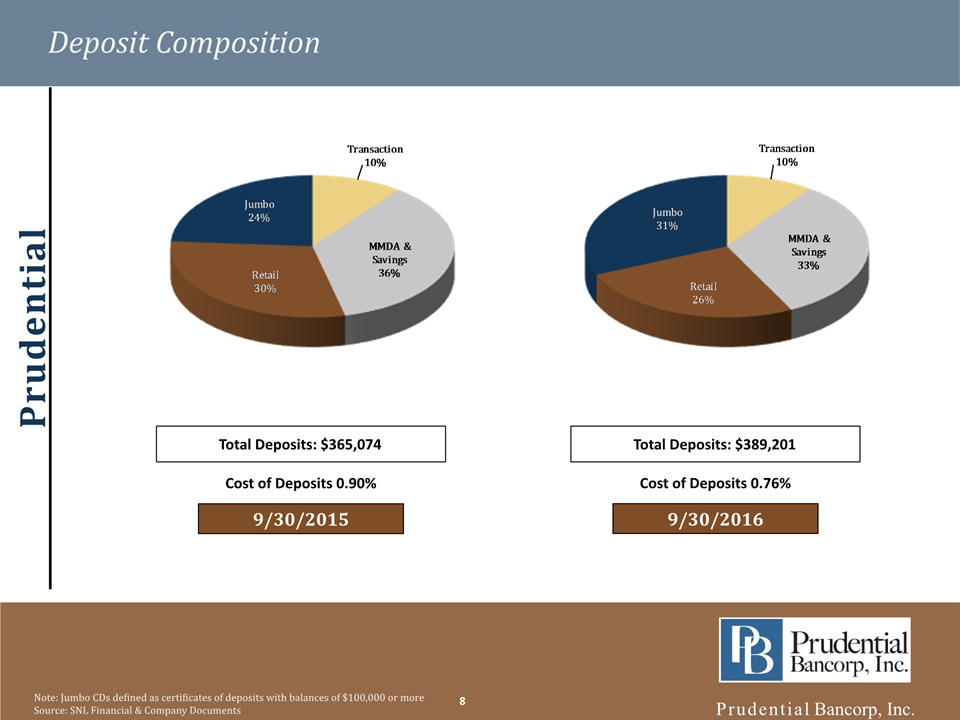

Note: Jumbo CDs defined as certificates of deposits with balances of $100,000 or moreSource: SNL Financial & Company Documents Deposit Composition 9/30/2015 9/30/2016 Total Deposits: $389,201 Total Deposits: $365,074 Cost of Deposits 0.90% Cost of Deposits 0.76%

Nonperforming Asset Detail (1) Includes one borrower relationship aggregating $12.3 millionSource: Company Documents

Summary Balance Sheet Comparison Dollars in thousands except per share data(1) Includes $145.7 million in deposits held in escrow in connection with subscriptions received in the second-step conversion, of which $74.3 million in excess subscription funds was subsequently returned to potential subscribers(2) The Company had no intangible assets as of the dates presented. Thus, the tangible rations and tangible book value are the same as the ratios calculated under GAAPSource: Company Documents

Summary Income Statement Comparison (1) Calculated by dividing non-interest expense by the sum of net interest income and non-interest incomeSource: Company Documents

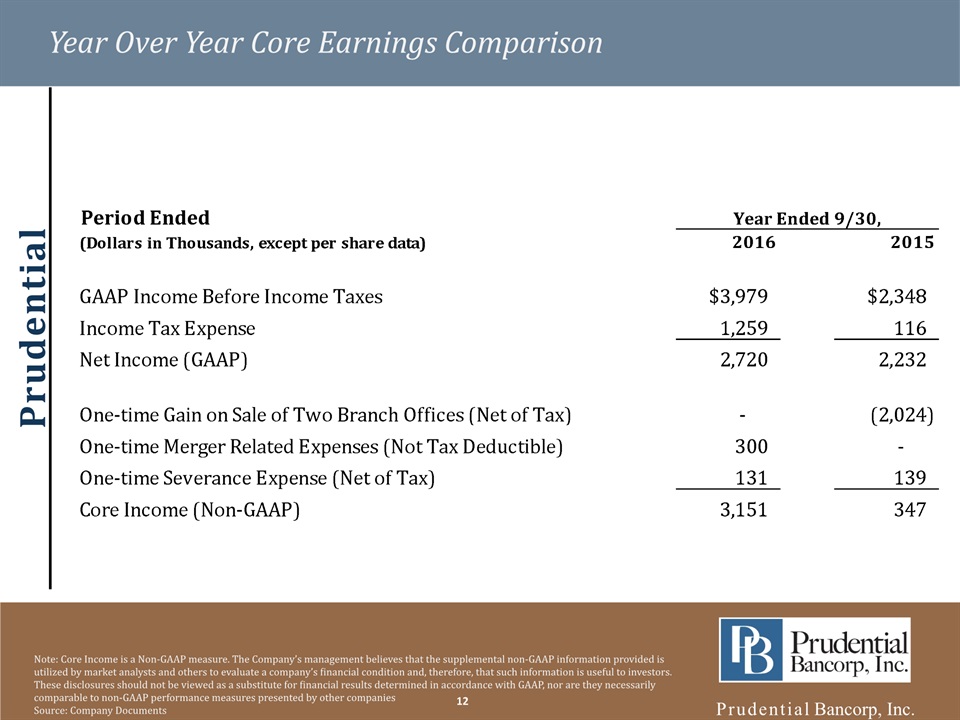

Year Over Year Core Earnings Comparison Note: Core Income is a Non-GAAP measure. The Company’s management believes that the supplemental non-GAAP information provided is utilized by market analysts and others to evaluate a company’s financial condition and, therefore, that such information is useful to investors. These disclosures should not be viewed as a substitute for financial results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures presented by other companiesSource: Company Documents

Net Interest Margin (1) Calculated by dividing net interest income by average interest-earning assetsSource: Company Documents Net Interest Margin¹

Note: Market data as of 2/21/2017Source: SNL Financial Stock Price Performance Since Second-Step IPO

Comparison Summary of Q4 Fiscal 2016 and Q4 Fiscal 2015 Source: Company Documents

Thank you for your attendance today! Prudential Bancorp, Inc. Annual Shareholder Meeting

Annual Shareholder Meeting (NASDAQ: PBIP) February 23, 2017