Attached files

| file | filename |

|---|---|

| EX-99.4 - EXHIBIT 99.4 - Hi-Crush Inc. | exhibit994-fy16proformashc.htm |

| EX-99.3 - EXHIBIT 99.3 - Hi-Crush Inc. | exhibit993-whitehall2016fi.htm |

| EX-99.1 - EXHIBIT 99.1 - Hi-Crush Inc. | exhibit991-permianbasinsan.htm |

| EX-23.1 - EXHIBIT 23.1 - Hi-Crush Inc. | exhibit231-pwcconsentxwhit.htm |

| 8-K - 8-K - Hi-Crush Inc. | form8-kxwhitehallfinancials.htm |

INVESTOR PRESENTATION

FEBRUARY 2017

Forward Looking Statements

Some of the information included herein may contain forward-looking statements within the meaning of the federal securities laws. Forward-

looking statements give our current expectations and may contain projections of results of operations or of financial condition, or forecasts of

future events. Words such as “may,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,” “plan,” “estimate,” “anticipate,”

“could,” “believe,” “project,” “budget,” “potential,” or “continue,” and similar expressions are used to identify forward-looking statements. They can

be affected by assumptions used or by known or unknown risks or uncertainties. Consequently, no expected results of operations or financial

condition or other forward-looking statements can be guaranteed. When considering these forward-looking statements, you should keep in mind

the risk factors and other cautionary statements in Hi-Crush Partners LP’s (“Hi-Crush”) reports filed with the Securities and Exchange

Commission (“SEC”), including those described under Item 1A, “Risk Factors” of Hi-Crush’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2016. Actual results may vary materially. You are cautioned not to place undue reliance on any forward-looking statements. You

should also understand that it is not possible to predict or identify all such factors and should not consider the risk factors in our reports filed with

the SEC or the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ

materially from the results contemplated by such forward-looking statements include: whether we are able to complete the Whitehall and Permian

Basin Sand Company acquisitions, the volume of frac sand we are able to sell; the price at which we are able to sell frac sand; the outcome of any

litigation, claims or assessments, including unasserted claims; changes in the price and availability of natural gas or electricity; changes in

prevailing economic conditions; and difficulty collecting receivables. All forward-looking statements are expressly qualified in their entirety by the

foregoing cautionary statements. Hi-Crush’s forward-looking statements speak only as of the date made and Hi-Crush undertakes no obligation

to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

We will file a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest,

you should read the prospectus in that registration statement and the related preliminary prospectus supplement and other documents we will file

with the SEC for more complete information about us and this offering. You may get these documents for free by visiting EDGAR on the SEC

website at www.sec.gov. Alternatively, we, the underwriters or any dealer participating in the offering will arrange to send you the preliminary

prospectus supplement and the prospectus if you request it from Credit Suisse Securities (USA) LLC, Attention: Prospectus Department, One

Madison Avenue, New York, New York, 10010, or by telephone at +1 (800) 221-1037, or by email at newyork.prospectus@credit-suisse.com.

Under no circumstances may any copy of this presentation, if obtained, be retained, copied or transmitted.

2

Offering Overview

3

Issuer: Hi-Crush Partners, LP

Listing / Ticker Symbol: NYSE / HCLP

Offering Size: 20.5 million units (100% primary)

Use of Proceeds:

To fund the cash purchase price of the Whitehall Dropdown and

to fund the purchase price of the Permian Basin Acquisition,

with the balance to be funded through the issuance of $75.0

million of newly issued common units to the seller

Over-Allotment Option: 15% (100% primary)

Expected Pricing: February 24, 2017

Lock-Up Period: 45 days for Company, management and directors

Bookrunners: Credit Suisse, Mizuho Securities

Sources, Uses, and Pro Forma Capitalization

4

($ in millions)

Sources

Equity to the public

1

$438

Equity consideration to PBSC sellers 75

Total sources $513

Uses

PBSC acquisition $275

Whitehall dropdown

2

140

Cash to balance sheet 98

Total uses $513

($ in millions) 12/31/2016 Adj. Pro forma

3

Adj.

Pro forma as

adjusted

4

Cash $4 $438 $442 ($340) $102

Revolving credit facility – – –

Term loan

5

190 190 190

Other notes payable 7 7 7

T tal debt $196 $196 $196

artners' equity 290 438 728 75 803

Total capitalization $487 $438 $924 $75 $999

Net debt $192 ($438) ($245) $95

RCF size 75 75 75

Liquidity 71 508 168

1) Net proceeds from $450mm equity offering with gross spread of 2.75%

2) Whitehall dropdown purchase price also includes contingent consideration to be paid out upon meeting certain hurdles, which is

not reflected in this number

3) A pro forma basis to give effect to the issuance and sale of our common units in this offering

4) A pro forma as adjusted basis to give effect to the application of proceeds of the offering in the Whitehall Dropdown and Permian

Basin Sand Company acquisition

5) Presented net of discounts and issuance costs

Strategic Update

Strategically Positioned in the Upswing

6

Strategic Asset

Positioning

• Acquiring Permian Basin Sand: Acquiring 1,226 contiguous acres with 55+ million

tons of high-quality 100 mesh reserves in the heart of the Permian; developing low-

cost 3mm TPY production facility

• Developed last-mile solution: Announced PropStream™ integrated delivery

solution, expanding logistics capabilities all the way to the well site through

containerized delivery system

1 Hi-Crush Proppants LLC

M&A and Asset

Development

• Executed strategic drop downs: Announced two drop downs (Whitehall and Blair

facilities) since August 2016 at attractive price from sponsor1; allows HCLP to fully

participate in the activity upswing

• Restarting idle mines to meet demand: Restarted Augusta facility and planned

restart of Whitehall (March/April 2017) to meet increased customer demand and

strategically serve volumes in high-activity areas

Liquidity &

Capital

Flexibility

• Funding growth with equity: Using primary common unit offerings to strengthen

capital position and finance drop downs (Blair, Whitehall) and M&A (Permian Basin

Sand)

• Maintaining liquidity and flexibility: Executed revolver amendment in April 2016 to

improve flexibility; no new debt issued to finance recent transactions; exited 2016

with total liquidity of $71mm

Permian Basin Sand Company Acquisition

7

Acquisition Overview

• 55+ million tons of high-quality 100 mesh

reserves

• Unique deposit of above-ground sand,

strategically positioned in the heart of the

Permian Basin

• Located within 75-mile radius of significant

Delaware and Midland Basin activity

• Advantaged trucking proximity to key

demand markets; location drives value and

margin premium

• Eliminates rail transportation costs and

significantly reduces order lead times

• Total consideration of $275mm, funded

with cash from primary common unit

offering and common units to seller

• Closing expected by March 2017, subject

to normal closing conditions

Strategic Alignment

• Developing purpose-built 3mm TPY production

facility; production expected to commence by

late 3Q17 or early 4Q17

• Production costs expected to be in-line with all

other large scale Hi-Crush facilities

• Contract with blue chip customer in place for

1mm TPY

• Year-round operation of wet plant; simplifies

inventory planning process

• Enhances logistics capabilities & service offering

• Opportunity to leverage PropStream capabilities

and avoid logistical bottlenecks; creates highly

efficient mine-to-well solution servicing all of the

Permian basin

• Potential reserve expansion opportunities on

additional acreage under option

Permian Basin Sand – Optimally & Uniquely Positioned

8

• Location: Optimally located to serve both the

Delaware and Midland Basins in the Permian

• Cost advantage: Location and proximity

advantage lowers trucking cost to well, supporting

lowest cost sand not just in-basin but to well site

• Permian activity: Large resource potential with

multiple pay-zones driving outsized activity growth

• Customers: Multiple large and active operators in

region; potential for linked sales with PropStream

• Trends: Completion techniques, including longer

laterals and greater proppant loadings maximizes

demand per well

• Demand: Potential frac sand supply shortfall for

Permian demand could be 25mm+ tons in 2018;

will need to be filled by Northern White or additional

regional supply like Permian Basin Sand

• Permits: >2,700 horizontal wells permitted within

75-mile radius of Permian Basin Sand since

January 20162

100-mile radius of Permian Basin Sand

Delaware Basin counties

Midland Basin counties

Heat map of proppant consumption

Strong Radius of Demand1

Sources: 1 Navport; 2 IHS

Our Location Advantage

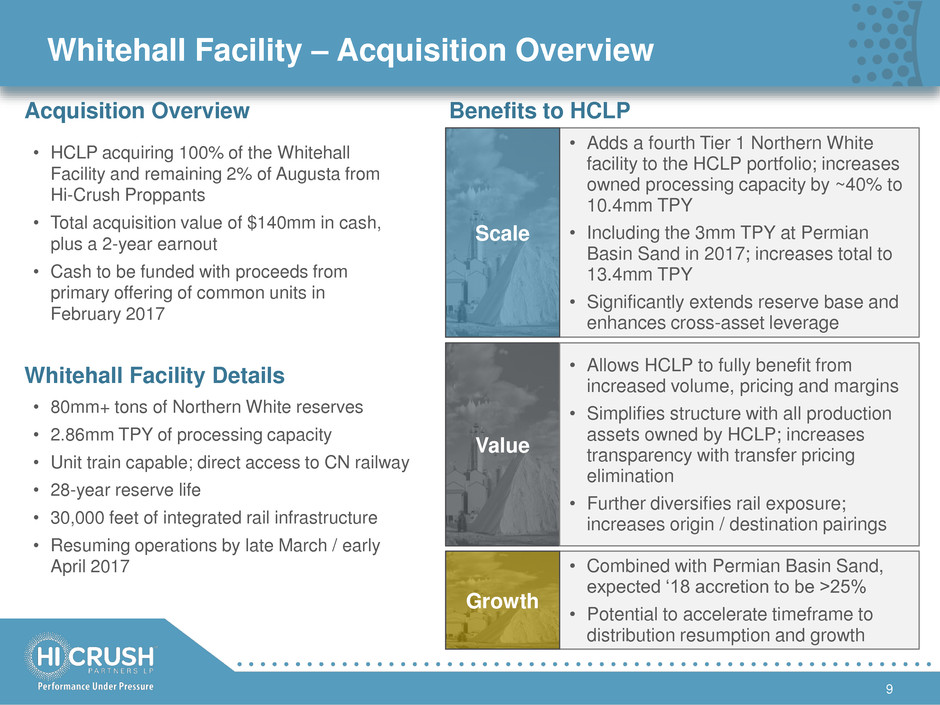

• Adds a fourth Tier 1 Northern White

facility to the HCLP portfolio; increases

owned processing capacity by ~40% to

10.4mm TPY

• Including the 3mm TPY at Permian

Basin Sand in 2017; increases total to

13.4mm TPY

• Significantly extends reserve base and

enhances cross-asset leverage

Whitehall Facility – Acquisition Overview

9

Scale

Value

• Allows HCLP to fully benefit from

increased volume, pricing and margins

• Simplifies structure with all production

assets owned by HCLP; increases

transparency with transfer pricing

elimination

• Further diversifies rail exposure;

increases origin / destination pairings

Acquisition Overview Benefits to HCLP

• HCLP acquiring 100% of the Whitehall

Facility and remaining 2% of Augusta from

Hi-Crush Proppants

• Total acquisition value of $140mm in cash,

plus a 2-year earnout

• Cash to be funded with proceeds from

primary offering of common units in

February 2017

Whitehall Facility Details

• 80mm+ tons of Northern White reserves

• 2.86mm TPY of processing capacity

• Unit train capable; direct access to CN railway

• 28-year reserve life

• 30,000 feet of integrated rail infrastructure

• Resuming operations by late March / early

April 2017 • Combined with Permian Basin Sand,

expected ‘18 accretion to be >25%

• Potential to accelerate timeframe to

distribution resumption and growth

Growth

Business Update

Leveraging Our Competitive Advantages

11

1) Annual capacity, including 2.86mm tons of annual capacity at the Whitehall facility, which is expected to restart in late March or early April 2017.

Facilities and capacity include 3mm TPY Permian Basin Sand production facility, which is expected to be completed in the second half of 2017.

2) Includes Permian Basin Sand

Factor Our Position The Hi-Crush Advantage

Size & Scale

Five facilities, 13.4mm1

tons of annual capacity

Top-tier supplier with operational flexibility and

ability to meet dynamic customer needs

Supply

Diversity

Sizable supplier of

Northern-White and

regional frac sand2

By 3Q17 or 4Q17, expect to operate 13.4mm

TPY of low-cost, high-quality production with

diversity of grades and sand types2

Low Cost

Market leading cost

structure

Industry-leading cost structure provides

competitive, financial and operational

advantages from mine-site to well-site

Distribution

Network

Two class-1 rail origins;

strategic and expanding

terminal network

Direct access to UP and CN railroads;

combined with PropStream last-mile solution,

extends low-cost competitive advantages to the

well site

Customer

Relationships

Strong, long-term

relationships

Gaining profitable market share through close

partnerships with key customers, vendor

consolidation and supply attrition

Balance

Sheet

Ample liquidity &

significant capital

flexibility

Provides resources needed for upswing;

enhances ability to pursue attractive growth

opportunities

Focused

Strategy

A clear strategy to win

long-term

Positioned to profitably capture long-term

market share with higher activity

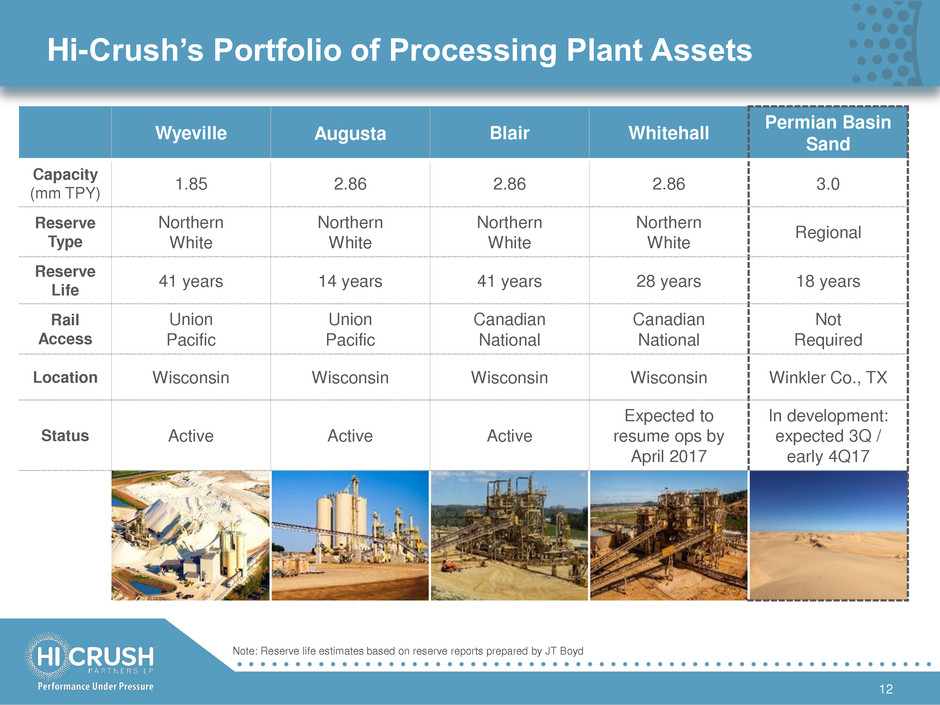

Hi-Crush’s Portfolio of Processing Plant Assets

12

Note: Reserve life estimates based on reserve reports prepared by JT Boyd

Wyeville Augusta Blair Whitehall

Permian Basin

Sand

Capacity

(mm TPY)

1.85 2.86 2.86 2.86 3.0

Reserve

Type

Northern

White

Northern

White

Northern

White

Northern

White

Regional

Reserve

Life

41 years 14 years 41 years 28 years 18 years

Rail

Access

Union

Pacific

Union

Pacific

Canadian

National

Canadian

National

Not

Required

Location Wisconsin Wisconsin Wisconsin Wisconsin Winkler Co., TX

Status Active Active Active

Expected to

resume ops by

April 2017

In development:

expected 3Q /

early 4Q17

Strong Frac Sand Fundamentals

13

Supportive FundamentalsTargeting of

Shale &

Unconventional

Increased

Horizontal

Drilling

Longer Laterals

Lengths

More Stages per

Foot

More Sand per

Stage

More Wells

Drilled per Rig

GREATER FRAC SAND INTENSITY

Greater frac sand intensity driven by multiple unchanged factors

• Sand intensity trends key driver of

increased demand; “super fracs” growing to

25,000+ tons per well

• Drilled but uncompleted well (“DUC”)

backlog growing in Q1 2017 and represents

significant pent-up demand for frac sand

• Supply reduced; re-entry of high-cost or

idled operations into the market may be

slow and difficult

• New sand supply constrained by multiple

factors

Leverage to Current Upcycle vs Prior Peak1

14

2,000 rigs

27 days

13 wells

13 wells

26,000 wells

2,500 tons

65,000,000 tons

Rig Count

# of rigs

Rig Efficiency

Days/well drilled

Rig Productivity

Wells drilled/year/rig

Completions

Well completions/year/rig

Wells Completed

Well completions/year

Average Sand Usage

Tons/well

Potential Demand

Tons/year

Old Model

1) Hypothetical example for illustrative purposes only; some results rounded

900 rigs

19 days

19 wells

20 wells

18,000 wells

5,250 tons

94,500,000 tons

New Model

-DUC Inventory Drawdown

DUCs completed/year/rig

1 well

+45%

Calculated

Calculated

-55%

Calculated

Logistics Flexibility Critical

15

1) Map reflects owned and operated terminals only; does not include 15+ 3rd party terminals utilized by Hi-Crush to deliver sand to customers.

• Multiple owned and

operated in-basin terminals

• Access to all major U.S. oil

and gas basins

• Direct loading and

unloading of unit trains

• Major presence in

Marcellus and Utica

• Expanding in Permian and

other regions; new Pecos

terminal under

development

• PropStream service

offering enhances logistics

capabilities with last-mile

solution

• Permian Basin Sand

increases flexibility to

efficiently serve Permian

Basin demand

Rail Served Sand Facility

Existing Terminal1

Bakken

DJ Basin

Permian

MidCon

Eagle Ford

Marcellus /

Utica

Wisconsin

Augusta

Wyeville

Whitehall

Blair

Logistics Overview

Terminal Under Development

Permian Basin

Sand

Mine-to-Well Sand Facility

Pecos Terminal Further Enhances Texas Position

16

Terminal Overview

• Complements Permian Basin Sand acquisition as

incremental demand in Delaware basin to be

supplied by Northern White sand

• Unit train terminal facility with vertical storage in-

basin; also manifest capable with rail-to-truck

operations

• First to market to secure market leading position

and provide customers access to best-in-class asset

• Critical launching point for last-mile operations,

including PropStream integrated logistics solution

• Furthers Hi-Crush strategy of owning and operating

key logistics infrastructure to provide frac sand from

the mine to the well

• Projected Completion Date – October 2017

The Pecos Rail Terminal

Dedicated rail park and transload terminal for proppant

strategically located in the Delaware Basin

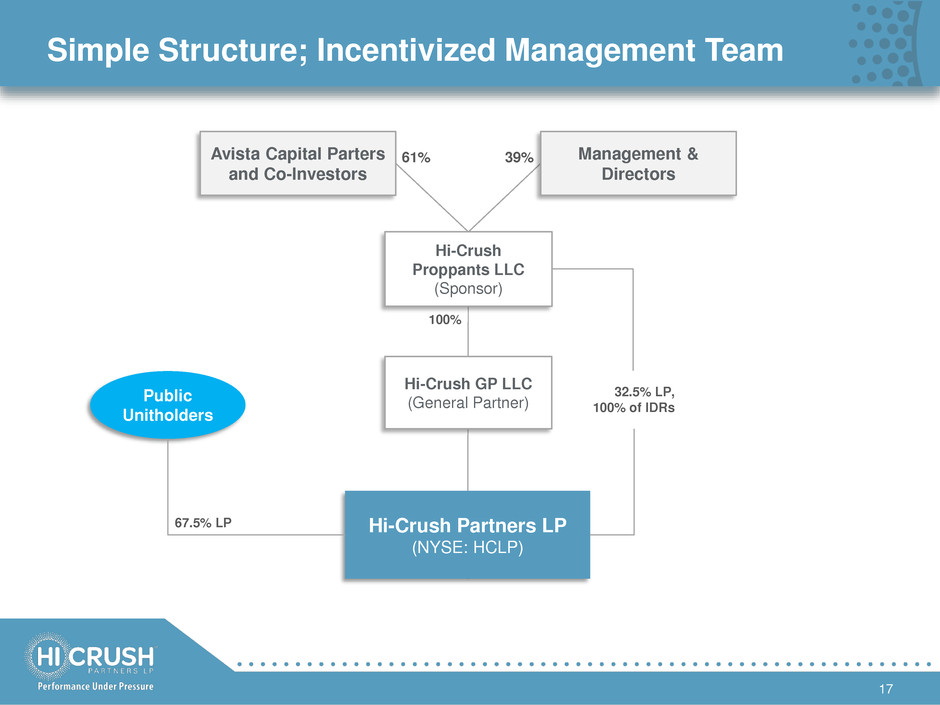

Simple Structure; Incentivized Management Team

17

39%61%

100%

67.5% LP

32.5% LP,

100% of IDRs

Hi-Crush

Proppants LLC

(Sponsor)

Avista Capital Parters

and Co-Investors

Management &

Directors

Hi-Crush Partners LP

(NYSE: HCLP)

Public

Unitholders

Hi-Crush GP LLC

(General Partner)