Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DYNASIL CORP OF AMERICA | v460170_8k.htm |

Exhibit 99.1

Dynasil Corporation of America Annual Meeting of Stockholders Peter Sulick, Chairman, President and CEO February 23, 2017

2 Forward - Looking Statements The statements made in this presentation which are not statements of historical fact are forward looking statements within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 . Forward - looking statements involve known and unknown risks, uncertainties and other factors . The words “potential,” “develop,” “promising,” “believe,” “will,” “would,” “expect,” “anticipate,” “intend,” “estimate,” “plan,” “may,” “likely,” “could,” and other expressions which are predictions of or indicate future events and trends and which do not constitute historical matters identify forward - looking statements . Forward - looking statements include statements regarding management’s discussion of the company’s strategic plans and objectives and the development of, and potential market for, Xcede’s product pipeline . Future results of operations, projections, and expectations, which may relate to this presentation, involve certain risks and uncertainties that could cause actual results to differ materially from the forward - looking statements . Factors that would cause or contribute to such differences include, but are not limited to, our ability to develop and commercialize the Xcede patch, including obtaining regulatory approvals, the size and growth of the potential markets for our products and our ability to serve those markets, the rate and degree of market acceptance of any of our products, our ability to identify acquisition and other strategic opportunities, our ability to obtain and maintain intellectual property protection for our products, competition, the loss of key management and technical personnel, the availability of financing sources, as well as the factors detailed in the Company's Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q, as well as in the Company's other Securities and Exchange Commission filings . We undertake no obligation to update the foregoing information to reflect subsequently occurring events or circumstances .

3 Corporate Objectives - Ongoing 1. Continued growth in Optics revenue through organic growth and opportunistic acquisitions. 2. Conversion of job shop revenue stream across the Optics companies to more predictable, longer term, recurring revenue. 3. Develop technology and transfer into commercial development: • RMD scintillator technology (CLYC, CsI , Thin Film, SrI , others) • Dynasil Biomedical – Xcede Patch 4. Maintain conformity with loan covenants. Improve overall cost of capital through conversion to lower cost funding where possible. 5. Capital allocation to support the above objectives . 6. Focus on shareholder returns.

4 Financial Summary Fiscal Year 2016 vs. 2015 Revenue increased from $40.5 million in fiscal 2015 to $ 43.4 million in 2016. • Optics revenue increased 9%, from $21.8 million to $23.7 million. • Contract Research revenue increased 5% from $18.8 million to $19.8 million Net Income from Operations, pre - Xcede of $2,749,000 vs. $1,851,000 in 2015, an increase of 49% Net Income from Operations of $679,000 versus $134,000 in the prior year, an increase of 407%

5 Fiscal Year 2016 Performance Highlights Record Revenue at Two Optics Operational Units EMF – Revenue growth in HUD Hilger – Continued support for CsI and LYSO product development Substantial devaluation of the Pound Sterling following Brexit vote RMD – Maintained $30+ million backlog and approximately $19 million in revenue. Grew commercial revenue. Developed a commercial product pipeline. Separate report to follow Xcede – Initial financing attempt failed. Successful with a combination of Cook Biotech Inc./Dynasil financing with additional angel money. Timeline now in place for First in Human trials in fiscal 2017/2018. Separate report to follow Corporate 1. Launched new corporate website, work begun on Dynasil - branded e - commerce site 2. Hired EVP of Photonics with responsibility for three of our business units 3. CFO retired, promoted Corporate Controller to CFO

6 Debt Total Debt Dec. 2012: $11.5 M Dec. 2016: $3.5 M

7 Corporate Objectives - 2016 1. Secure external funding of Xcede Technologies for ongoing development of the tissue sealant technology. • Funding secured for First - in - Human trials and to carry the company through June, 2018 2. Yield improvements across our Optics companies. • Increased from 31% to 34% gross margin 3. Continued commercial revenue growth in the double digit range. • 9% growth 4. Maintenance of 18+ month backlog in our research operation – continued management diligence on matching approved project funding with direct and indirect costs. • Met

8 Corporate Objectives - 2016 5. Capital support of specific revenue opportunities: • Chamber upgrades at both EMF sites • Two upgrades completed for approximately $275,000 • LYSO array fabrication and processing at Hilger • Project completed for approximately $637,000 • New filter product line at Optometrics • New product line completed for approximately $50,000 6. Development of a long - term strategic plan for Company operations through 2020. • Board - level project initiated Summer, 2016 and ongoing.

9 The Future: 2017 - 2018 • Actively bidding on optical assembly business which could add both substantial revenue and profitability, as well as move the company “up the food chain ”. • Launching e - commerce website with specific product offerings not otherwise available in the marketplace, as well as traditional products. New e - commerce site will be Dynasil - branded with sub links to the individual companies’ websites. • Xcede funded through first - in - human trial; opportunity for monetization through acquisition, sale, dividend to the Dynasil stockholders or additional financing over the next 18 months.

10 The Future: 2017 - 2018 (continued) • Commercial revenue growth for RMD expected to double this year and again double over the next two years. • Hilger array business expected to return to 2016 levels by summer 2017; CsI business also expected to increase over the next 18 months. • Possible consolidation of the EMF sites.

RMD Highlights Kanai Shah, President February 23, 2017

FY - 2016 Review 12 Closed FY16 at $19.7M Have current backlog of ~$30 M Continued push for larger, longer projects & strategic bidding Introduced exciting new products 6 Patents Awarded, 18 Applications Filed. 68 Total Patents R&D 100 Award Finalist

Current Development Projects of Interest 13

14 LunaH Map: Measuring and Mapping Lunar Southern Pole Volatiles • Measure the spatial concentration of water at the south pole, specifically in the permanently shadowed regions. • Cosmic Ray interactions in the soil result in moderated neutrons related to the water concentration. • RMD is building the detector to measure the spatial distribution of neutrons. 1000200030004000500060007000 0.2 0.4 0.6 0.8 1.0 K:ResearchFilesNASA\C16-018LunaH-MapHardware Development\PMTtestingssemblyssembly410_28_2016\ Asm4 10_28_16 Set03.opj PSD ratio Energy (KeV) 10.1 7.7 1 in PSD = 0.017 1 in E = 94.6 6.9 5.7

Nanoimprinted Photonic Crystals for Enhanced Scintillator Performance 15 Nanoconical photonic crystal (pitch : 800 nm, height : 1275 nm) • Nanoimprinted photonic crystals – low - cost and scalable technique to enhance performance of scintillators (light extraction, energy/timing resolution). • Demonstrated ~40% improvement in light yield and energy resolution in GYGAG, LYSO, and even in highly hygroscopic crystals like SrI 2 . • Enables current scintillators to perform in the realm of new materials cost savings Imprinted PhC 1 inch Imprinted PhC 22mm, 10 mm thick LYSO Packaged, Teflon wrapped SrI 2 scintillator with PhC window 0 100 200 300 400 500 600 700 800 900 0.00 0.05 0.10 0.15 0.20 0.25 0.30 0.35 0.40 SrI 2 :Eu + Normal window SrI 2 :Eu + Imprinted window Normalized Intensity Channel No. PMT: R6233-100; -650V,3x-gain,6s shaping-time, 100pF preamp, Tcol = 600s 137 Cs Spectra E~3.8% 600 E~3.3% 855 LY: +35% E: +14%

Metal - Loaded Plastic Scintillators for Gamma - ray Detection □ Tin - Loaded 0 500 1000 500 1000 1500 2000 BGO HM-78 T ~ 25C Plastic #HM-78 counts MCA # LY ~ 9,550 ph/MeV 137 Cs spectra R6233-100, HV = -650 V, ST = 1 us 376 635 ER ~ 10.0% □ Lead - Loaded 120 160 200 0 200 400 600 800 1000 181.6 T ~ 25C Plastic #HM-78 R6233-100 / 1100 V / Bridgeport W n = 6.2 W g = 3.2 FOM = 1.8 @ 1 MeVee counts ratio 164.5 Model Equation Reduced Chi-Sq r Adj. R-Square Peak1(0) Peak1(0) Peak1(0) Peak1(0) Peak1(0) Peak1(0) Peak1(0) Peak1(0) Peak2(0) Peak2(0) Peak2(0) Peak2(0) Peak2(0) Peak2(0) Peak2(0) Peak2(0) 10 100 1000 0.8 0.9 1.0 1.1 1.2 Na Cs Na Co Am Cs Sn-plastic 2" x 2" LaBr3Ce NaITl relative light yield energy, keV ER ~9% Dual mode plastics developed with tin and lead loading in standard PSD plastics Good energy resolution (~10% FWHM at 662 keV) demonstrated for 1” and 2” samples PSD FOM of 1.5 and higher demonstrated Improvements in clarity and scale - up now targeted

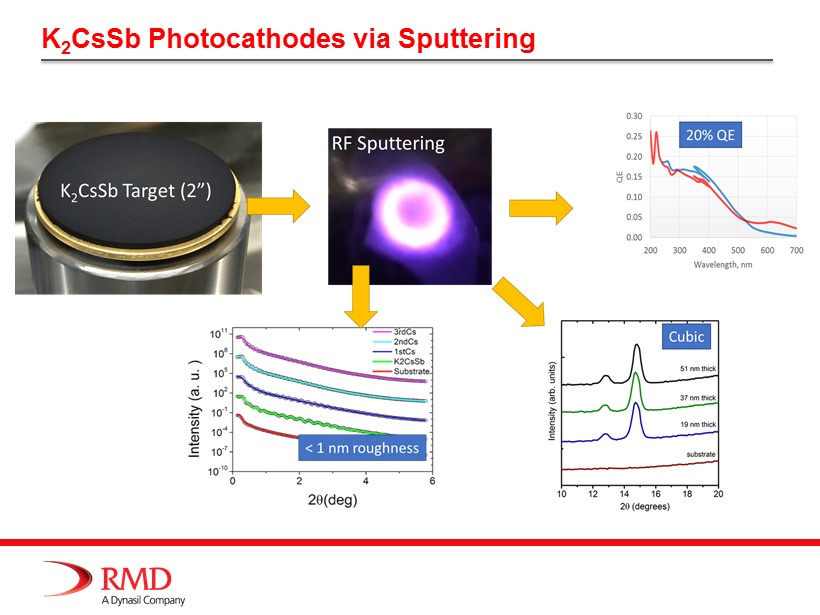

K 2 CsSb Photocathodes via Sputtering

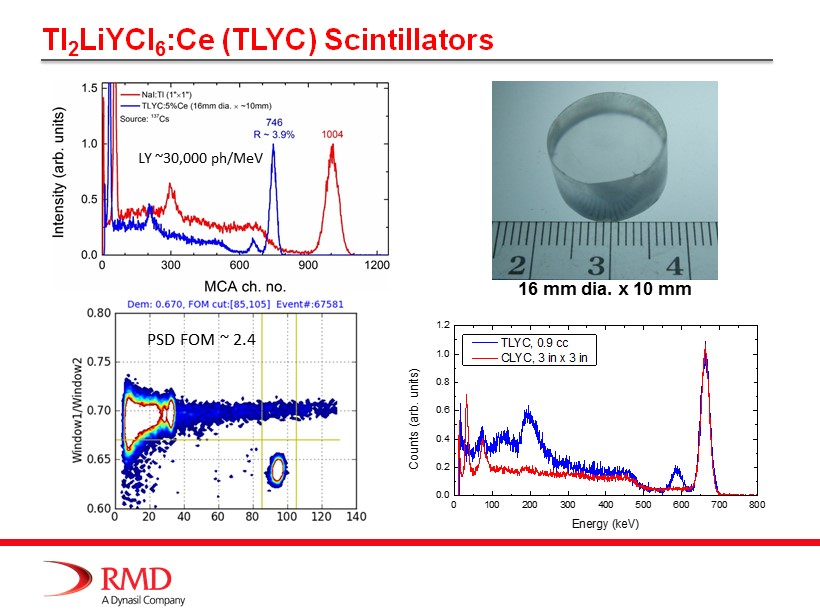

Tl 2 LiYCl 6 :Ce (TLYC) Scintillators 16 mm dia. x 10 mm 0 100 200 300 400 500 600 700 800 0.0 0.2 0.4 0.6 0.8 1.0 1.2 Counts (arb. units) Energy (keV) TLYC, 0.9 cc CLYC, 3 in x 3 in LY ~30,000 ph /MeV PSD FOM ~ 2.4

Large Area Li 1 - x Na X I (LNI) Films for High Resolution Neutron Imaging with PSD 19 650 µm, the highest resolution ever reported using a neutron sensitive Anger camera

GLuGAG Ceramics : PET 20 0 50 100 150 200 250 300 350 400 0.01 0.1 1 Normalized Intensity Time (ns) GLuGAG Primary Decays 0.6 mol% Ce, no Mg: 79.0 ns 0.6 mol% Ce, 0.2 mol% Mg: 40.5 ns 40 60 80 100 40 60 80 100 0.0 0.3 1.2 Initial Decay Time (ns) Light Yield (Photons/MeV) GLuGAG:Ce,Ca 0.6 Numbers show calcium concentration in mol% Development of GLuGAG composition for PET • Scale up to larger sizes • Gd/Lu ratio studies • Codoping for faster decay • Shaped ceramics Pixels: 2 x2 x 20 mm 3 45 x 45 x5 mm 3 plate 12x12 Ceramic Array 2.6x2.6x20 mm3 pixels Garnet Array read by 8x8 SiPM Rings & Domes

Current Commercial Projects of Interest 21

22 22 Thermo Fisher Scientific’s New SPRD GN with CLYC - SiPM • Extensive 2 year joint engineering effort between RMD & Thermo Fisher • RMD passed a comprehensive audit to become a supplier to Thermo Fisher, February 2016 • Product Launch: August 2016 • Thermo wins order for 325 SPRD GNs for Washington DC STC program • RMD supplied 325 CLYC - SiPM detectors by Jan, 2017

23 HiRIS - High Resolution Imaging System’s CsI - SiPM Modules • HiRIS project, started in Fall 2015, SLI subcontracted RMD to design & build CsI - SiPM modules. • RMD provided 20 prototypes in August 2016 for CDR • RMD prototypes outperformed two well - known competitors, making RMD the prime HiRIS vendor, September 2016 • RMD supplied 486 CsI - SiPM detectors by Jan 2017

Dynasil Annual Stockholders’ Meeting February 23 2017 Linda Zuckerman, Ph.D. President & CEO

3 2 Agenda 25 1 IP Strategy & Update Financing to next value inflection point Current Operational Progress: from “Bench” to Pre - Clinical & Clinical Development Phase Focus on Driving Xcede’s Value: 4 Evaluating in - licensing opportunities About Xcede 5

5 4 3 2 About Xcede 26 1 Large Market Opportunity Initial cumulative target markets of over $1 Billion Unique Technology Fully bioresorbable , hemostatic patch backed by extensive IP protection Strong Strategic Partnerships Executed and late stage partnership agreements with Mayo Clinic and Cook Biotech, Inc. Experienced Management Extensive experience in taking products from development to approval Product Pipeline First product in Pre - Clinical/Clinical Phase Dedicated to the development and commercialization of innovative hemostatic and sealant products for surgery with an emphasis on severe, traumatic bleeding

Partners • Cook Biotech Inc., − Clinical Development: Perform first - in - human (FIH) trials for up to $1.5M (Promissory note in November 2016) − Preclinical Development Agreement : Perform all ISO 10993 studies for FIH − Manufacturing Agreement : Manufacture, supply and option to distribute Xcede Patch − Royalty Agreement: Licensed adhesive technology for products outside of Xcede’s field of use with royalties (1.5% or 3%) • Mayo Clinic – Access to clinicians, preferred pricing (limited) Ownership • Subsidiary of DYSL BioMedical − Significant equity investment of $1.2M over 18 months in November 2016 − Will result in 62 % ownership in Xcede • Minority ownership by: − Mayo Clinic − Various private investors and funds Xcede Technologies, Inc. 27

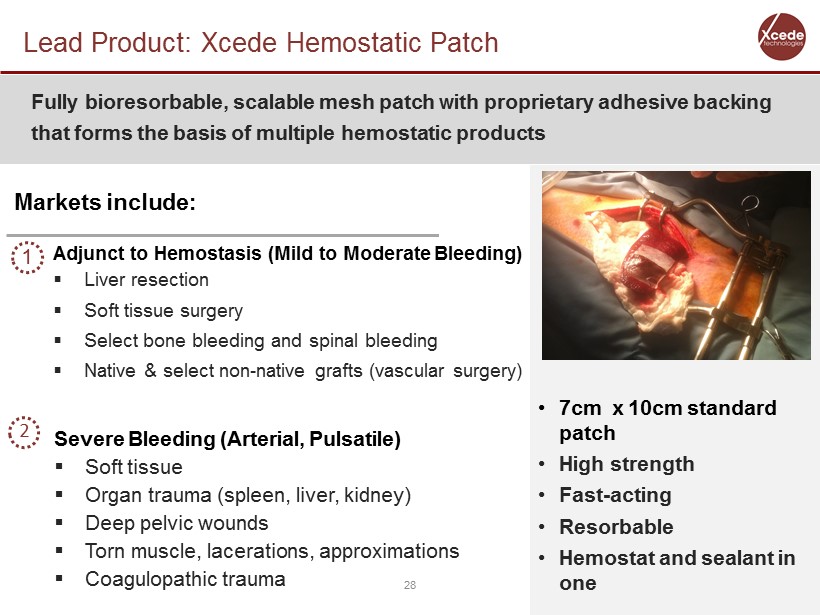

Lead Product: Xcede Hemostatic Patch 28 Fully bioresorbable , scalable mesh patch with proprietary adhesive backing that forms the basis of multiple hemostatic products Adjunct to Hemostasis (Mild to Moderate Bleeding) ▪ Liver resection ▪ Soft tissue surgery ▪ Select bone bleeding and spinal bleeding ▪ Native & select non - native grafts (vascular surgery) Severe Bleeding (Arterial, Pulsatile) ▪ Soft tissue ▪ Organ trauma (spleen, liver, kidney) ▪ Deep pelvic wounds ▪ Torn muscle, lacerations, approximations ▪ Coagulopathic trauma Markets include: • 7cm x 10cm standard patch • High strength • Fast - acting • Resorbable • Hemostat and sealant in one 2 1

Current Progress: Pre - Clinical Development Phase 29 Pre - clinical Bleeding Studies (Efficacy) Spleen Crush Pass Liver/Spleen Hemostasis Models Pass Aortic Puncture Model Pass Liver Grade V Injury Pass PreClinical Efficacy and Biocompatiblity Studies: ongoing Planned and Studies Cytotoxicity Sensitization Irritation/ Intracutaneous R eactivity Acute Systemic Toxicity Pyrogenicity Subchronic Systemic Toxicity Genotoxicity Hemocompatibility Long Term Implant with Satellite Groups for Early Time Points Anticipated completion summer 2017

Current Progress: Clinical Development 30 First - in - Human Clinical Study: Safety and Efficacy in Liver Resection Endpoints Safety 1 The incidence and severity of treatment - emergent adverse events 2 The incidence and grade of treatment - emergent clinical laboratory abnormalities Efficacy 1 Time to Hemostasis (TTH): Proportion of subjects achieving hemostasis within 1, 3, and 5 minutes, and mean and median TTH Exploratory 1 Length of operating room time 2 Length of hospital stay 3 Transfusions and blood products use Estimated start date: 2H 2017

Addressable US and EU Markets for the Xcede Patch EU Hemostasis Market $537 M $87 M $1.09 Billion $465 M Untapped Severe Bleeding Market (US & EU Combined) 31 US Hemostasis Market

Competitive Advantages 32 Mechanicals Thrombins + Gelatins “ Flowables ” Fibrin Sealants Other Patches & Pads Xcede Patch Competitive Price X X X High Burst Strength X Fast - Acting Ability to achieve Hemostasis in 60s* XXX Resorbable X X X X X Ready - to - use X X X Pliable / Conforms to complex topographies X X X Room Temperature Storage & Stability X X X X May be cut or sutured X X X * Based on preclinical studies

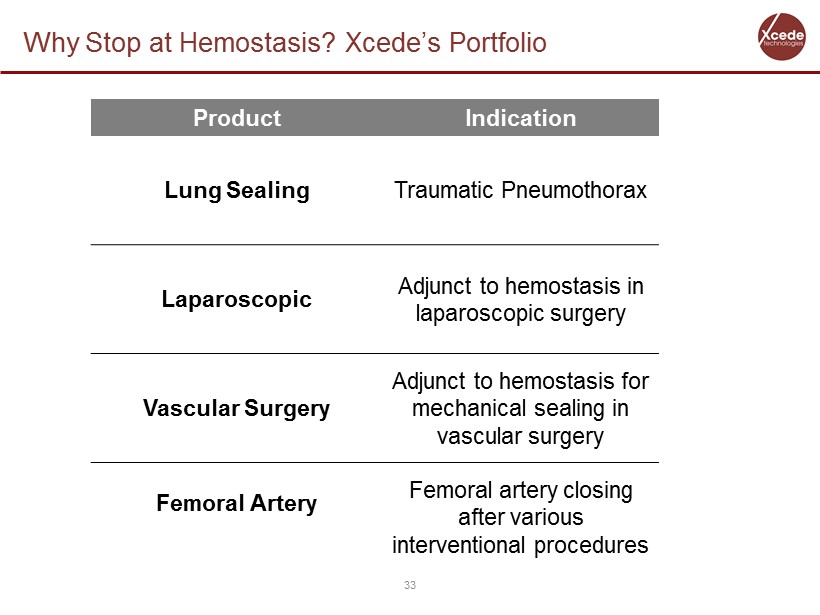

Why Stop at Hemostasis? Xcede’s Portfolio 33 Product Indication Lung Sealing Traumatic Pneumothorax Laparoscopic Adjunct to hemostasis in laparoscopic surgery Vascular Surgery Adjunct to hemostasis for mechanical sealing in vascular surgery Femoral Artery Femoral artery closing after various interventional procedures

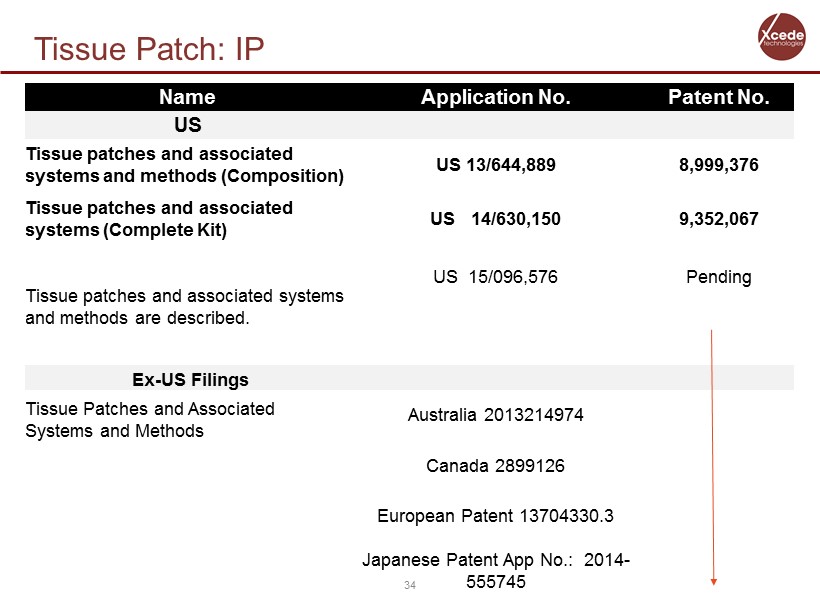

Tissue Patch: IP 34 Name Application No. Patent No. US Tissue patches and associated systems and methods (Composition) US 13/644,889 8,999,376 Tissue patches and associated systems (Complete Kit) US 14/630,150 9,352,067 Tissue patches and associated systems and methods are described. US 15/096,576 Pending Ex - US Filings Tissue Patches and Associated Systems and Methods Austrialia 2013214974 Canada 2899126 European Patent 13704330.3 Japanese Patent App No.: 2014 - 555745

Name ApplicationNo. Patent No. US Filings Adhesive Compositions and Related Methods (Adhesive compositions) US 14/821,625 9,540,548 Adhesive Compositions and Related Methods (Solvents) US 14/983,396 Pending Adhesive Compositions and Related Methods (Single solvent & Manufacturing) US 14/983,396 Ex US Filings Adhesive Compositions and Related Methods International Patent PCT/US2015/044225 Adhesive Compositions and Related Methods International Patent. PCT/US2016/045780 Adhesive Compositions: IP 35

3 2 Summary 36 1 Strong IP Strategy - Patents issuing to protect IP - Working through “national phase” to keep Ex - US markets Secured Financing to Next Value Inflection P oint - DYSL $ 1.2 M investment - CBI $ 1.5 M loan Moved Product from “Bench” to Pre - Clinical & Clinical Development Phase - Toxicology studies ongoing - Clinical trial planning underway - Successful manufacture of “clinical grade” Xcede Patch Continuing to Build Xcede’s Value: 4 Evaluating In - Licensing Opportunities - Recognizing we may be able to create additional value through in - licensing - Ongoing evaluation of candidates complementary to Patch

37 Questions

Dynasil Corporation of America Annual Meeting of Stockholders Peter Sulick Chairman, President and CEO February 23, 2017