Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - BrightSphere Investment Group plc | omam123116ex322.htm |

| EX-32.1 - EXHIBIT 32.1 - BrightSphere Investment Group plc | omam123116ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - BrightSphere Investment Group plc | omam123116ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - BrightSphere Investment Group plc | omam123116ex311.htm |

| EX-23.1 - EXHIBIT 23.1 - BrightSphere Investment Group plc | omam123116ex231.htm |

| EX-21.1 - EXHIBIT 21.1 - BrightSphere Investment Group plc | omam123116ex211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016 | |

OR | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Commission File Number 001-3668

OM Asset Management plc

(Exact name of registrant as specified in its charter)

England and Wales (State or other jurisdiction of incorporation or organization) | 98-1179929 (IRS Employer Identification Number) | ||

Ground Floor, Millennium Bridge House

2 Lambeth Hill

London EC4V 4GG, United Kingdom

+44-20-7002-7000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

Ordinary Shares ($.001 par value) | New York Stock Exchange | |

(Title of each class) | Name of each exchange on which registered | |

Securities registered pursuant to Section 12(g) of the Act:

None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

(Do not check if a smaller reporting company) | |||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

At June 30, 2016, the aggregate market value of the common stock held by non-affiliates of the registrant, based upon the closing price of $13.35 on that date on the New York Stock Exchange, was $525,482,139. Calculation of holdings by non-affiliates is based upon the assumption, for this purpose only, that executive officers, directors and any persons holding 10% or more of the registrant’s common stock are affiliates. There were 114,704,674 shares of the registrant’s common stock outstanding on February 17, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement to be delivered to shareholders in connection with the Annual Meeting of Shareholders to be held on or about April 29, 2017 are incorporated by reference into Part III.

TABLE OF CONTENTS

Page | ||

Part I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Part II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Part III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Part IV | ||

Item 15. | ||

Forward-Looking Statements

This Annual Report on Form 10-K includes forward-looking statements, as that term is used in the Private Securities Litigation Reform Act of 1995, including information relating to anticipated growth in revenues, margins or earnings, anticipated changes in our business, anticipated future performance of our business, anticipated future investment performance of our Affiliates, our expected future net cash flows, our anticipated expense levels, changes in expense, the expected effects of acquisitions and expectations regarding market conditions, and other statements that are not historical facts. The words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “can be,” “may be,” “aim to,” “may affect,” “may depend,” “intends,” “expects,” “believes,” “estimate,” “project,” and other similar expressions are intended to identify such forward-looking statements. Such statements are subject to various known and unknown risks and uncertainties and we caution readers that any forward-looking information provided by or on behalf of us is not a guarantee of future performance.

Actual results may differ materially from those in forward-looking information as a result of various factors, some of which are beyond our control, including but not limited to those discussed under the heading “Risk Factors” in Item 1A of this Annual Report on Form 10-K. Due to such risks and uncertainties and other factors, we caution each person receiving such forward-looking information not to place undue reliance on such statements. Further, such forward-looking statements speak only as of the date of this Annual Report and we undertake no obligations to update any forward looking statement to reflect events or circumstances after the date of this Annual Report or to reflect the occurrence of unanticipated events.

Our future revenue, earnings and financial performance may fluctuate due to numerous factors, such as: the earnings of our Affiliates; the total value and composition of our Affiliates’ assets under management; the concentration of revenues in limited numbers of Affiliates and asset classes; the quality and autonomous nature of our relations with our Affiliates; our Affiliates’ exposure to liability; our ability to grow our Affiliates or acquire new firms; the nature of our Affiliates’ advisory agreements; market fluctuations, client investment decisions and investment returns; our or our Affiliates’ levels of debt and expenses; our Affiliates’ ability to maintain fee levels; the integrity of our and our Affiliates’ brands and reputations; our and our Affiliates’ ability to limit employee misconduct; our and our Affiliates’ ability to manage actual or potential conflicts of interest that may arise in our business; our competitors’ performance; the performance and retention of existing personnel; our or our Affiliates’ ability to recruit new personnel; our or our Affiliates ability to launch new products; our reliance on third-party service providers; our and our Affiliates’ ability to execute strategies; our and our Affiliates’ ability to conform to compliance guidelines; potential litigation (including administrative or tax proceedings) or regulatory actions; software and insurance costs; our access to capital; fluctuations in and risks associated with real estate and timber markets; modifications of relevant tax laws or interpretations thereof and potential increases in our tax liability; the level of control over us retained by our Parent, or the outcome of our Parent’s plan to divest of us in the future; and the other factors discussed in Item 1A, “Risk Factors.”

Unless we state otherwise or the context otherwise requires, references in this Annual Report on Form 10-K to “OMAM” refer to OM Asset Management plc and for all periods after our reorganization (as described in this report, which we refer to as the Reorganization), references to the “Company” refer to OMAM, and references to “we,” “our” and “us” refer to OMAM and its consolidated subsidiaries and equity accounted Affiliates, excluding discontinued operations, after giving effect to the Reorganization. For all periods prior to the Reorganization, references to the “Company” refer to Old Mutual (US) Holdings Inc., or OMUSH, a Delaware corporation and indirect, wholly owned subsidiary of OMAM, and references to “we,” “our” and “us” refer to OMUSH and its predecessors and their respective consolidated subsidiaries and equity accounted Affiliates, excluding discontinued operations. For periods subsequent to the Reorganization, references to the “Center” refer to the holding company excluding the Affiliates and/or OMAM Inc., or OMUS, a Delaware corporation and indirect, wholly owned subsidiary of OMAM. Unless we state otherwise or the context otherwise requires, references in this Annual Report on Form 10-K to “Affiliates” or an “Affiliate” refer to the boutique asset management firms in which we have an ownership interest, and references to our Affiliates’ sponsored investment entities are “Funds.” References in this Annual Report to our “Parent” refer to Old Mutual plc. References to the “Offering” refer to our initial public offering which occurred on October 8, 2014. None of the information in this Annual Report on Form 10-K

1

constitutes either an offer or a solicitation to buy or sell any of our Affiliates’ products or services, nor is any such information a recommendation for any of our Affiliates’ products or services.

Performance measures used in this report

We present economic net income, or ENI, to help us describe our operating and financial performance. ENI is the key measure our management uses to evaluate the financial performance of, and make operational decisions for, our business. ENI is not audited, and is not a substitute for net income or other performance measures that are derived in accordance with accounting principles generally accepted in the United States, or U.S. GAAP. Furthermore, our calculation of ENI may differ from similarly titled measures provided by other companies. Please refer to “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Supplemental Performance Measure—Economic Net Income” for a more thorough discussion of ENI and a reconciliation of ENI to U.S. GAAP net income.

PART I

Item 1. Business.

Overview

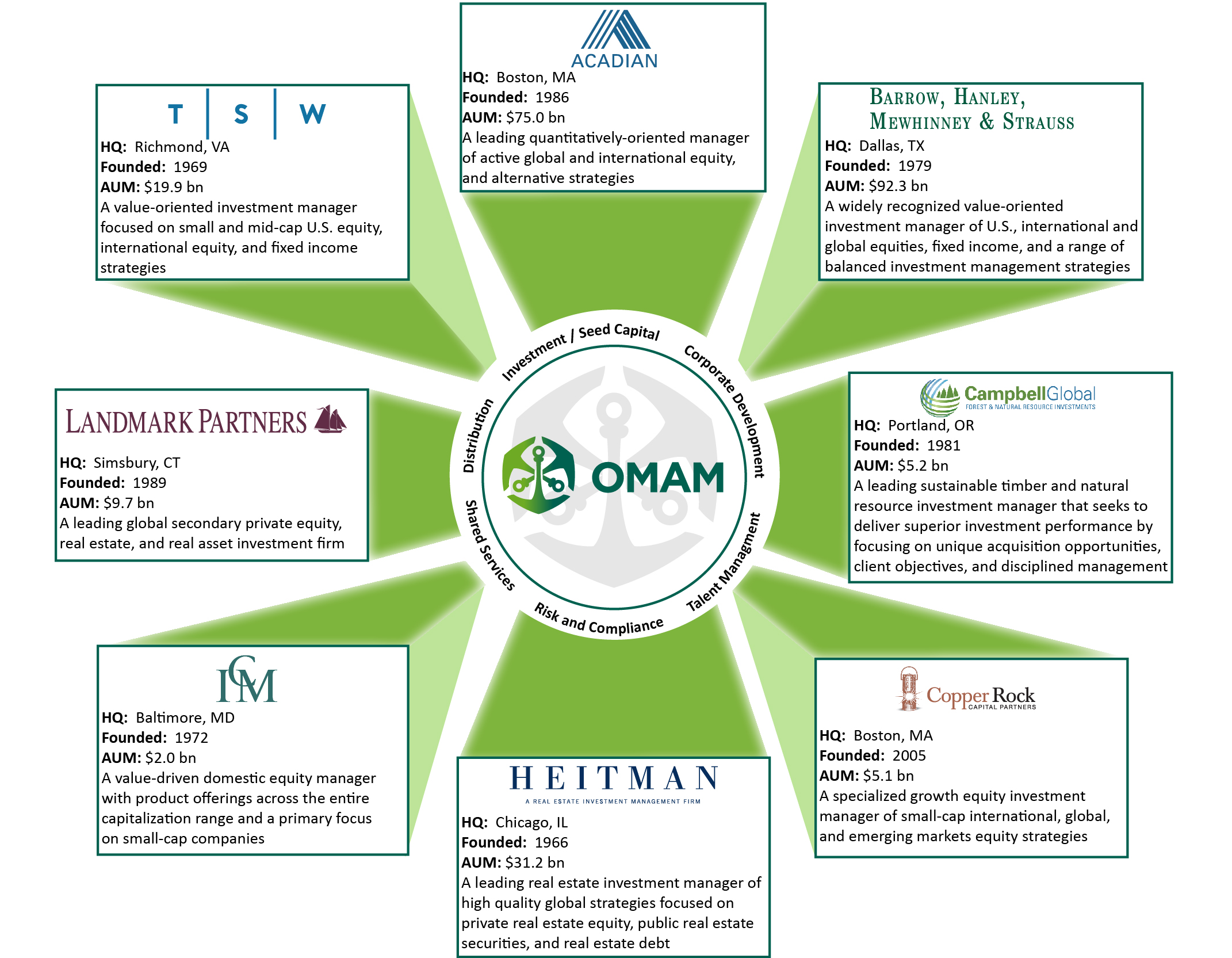

We are a global, diversified, multi-boutique asset management company with $240.4 billion of assets under management as of December 31, 2016. We currently operate our business through our eight Affiliates. We are currently a majority-owned indirect subsidiary of Old Mutual plc, an international investment, savings, insurance and banking group established in 1845.

Our business model combines the investment talent, entrepreneurialism, focus and creativity of leading asset management boutiques with the resources and capabilities of a larger firm. We have a permanent partnership structure with our Affiliates that preserves the unique culture that has made each of them successful and provides them with investment and day-to-day operational autonomy. We ensure that key management professionals at each Affiliate retain meaningful levels of equity in their own businesses to maintain strong alignment of interests between us, our Affiliates, their clients, and our shareholders. Our approach to investing in Affiliates includes a profit-sharing arrangement to provide incentives for growth and prudent business management across multiple generations of Affiliate partners.

We have broad and deep experience in working with boutique asset managers, and we leverage the expertise and resources within our organization to engage actively with our Affiliates and provide them with capabilities generally unavailable to specialist asset management firms. We work with our Affiliates to identify and execute upon growth opportunities for their businesses in areas such as business line expansion and product development, as well as activities critical to the operational success of investment boutiques, including talent management, risk management and compliance support. Our Center-led Global Distribution team complements and enhances the distribution capabilities of our Affiliates. Furthermore, our collaboration with our Affiliates extends to the commitment of seed and co-investment capital to launch new products and investment capital to financially support new growth initiatives. Our business development professionals, all of whom have prior experience executing M&A transactions for asset managers, facilitate growth opportunities for both us and individual Affiliates by sourcing and structuring investments in new Affiliates as well as add-on acquisitions on behalf of existing Affiliates.

2

Currently, our business comprises interests in the following Affiliates:

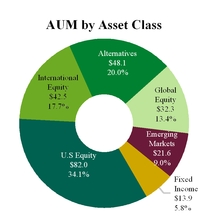

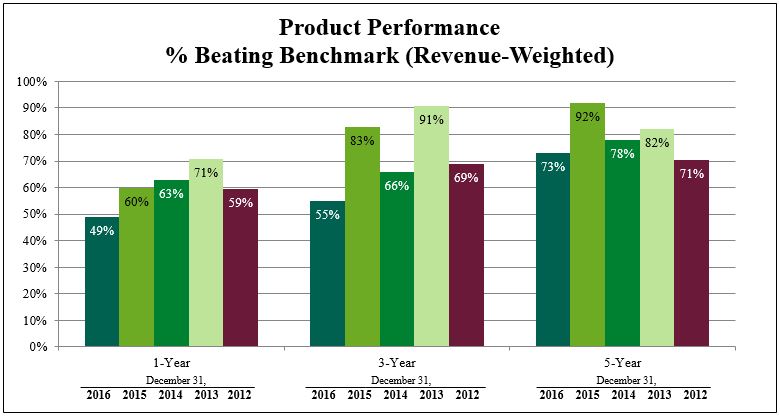

Our diversification, by Affiliate, asset class, geography and investment strategy, enhances relative earnings stability and provides multiple sources of growth for us. Collectively, our Affiliates offer 120 distinct, active investment strategies in U.S., global, international and emerging markets equities; U.S. fixed income; and alternative investments, including timber, real estate and secondary Funds. In addition, there is significant diversification within each of our Affiliate firms through the breadth of their respective investment capabilities. We believe our Affiliates have generated competitive absolute and relative performance records. As of December 31, 2016, the percentage of our revenue represented by assets under management, or AUM, outperforming their investment benchmarks on a one-, three-, and five-year basis was 49%, 55% and 73%, respectively. As a result, our Affiliates have, from 2012 through 2016, attracted five straight years of positive net revenue flows, including $11.0 million for the year ended December 31, 2016, representing 1.5% of beginning-of-period run rate management fee revenue, including equity-accounted Affiliates. For the year ended December 31, 2016, our client inflows of $29.9 billion earned a blended annualized fee rate of 41.9 bps and were concentrated in higher fee rate global/non-U.S. equities and alternative assets, while our outflows and hard asset disposals of $(31.5) billion earned a blended annualized fee rate of 36.3 bps and were concentrated in lower fee rate U.S. equity and sub-advisory assets. Client asset flows were $(1.6) billion in net flows for the twelve months ended December 31, 2016, representing (0.7)% of beginning-of-period AUM.

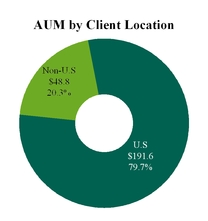

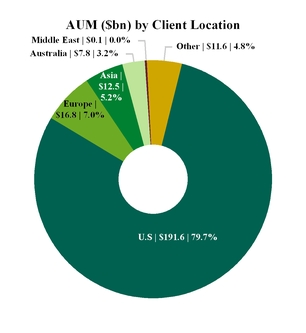

3

Through our Affiliates, we serve a diverse investor base in the institutional and sub-advisory channels in the U.S. and around the world. These clients are highly sophisticated, value the stability and equity ownership of our Affiliates, and typically reward our Affiliates’ strong process-driven investment performance with long-term relationships and asset flows. Our sub-advisory clients also provide access to the growing retail and defined-contribution marketplace where decision makers take a more institutional approach to choosing asset management providers. Our Affiliates currently manage assets for non-U.S. clients in 30 countries, including Australia, Canada, Ireland, Japan, the Netherlands, South Africa, South Korea, Switzerland, and the United Kingdom. Our Center-led Global Distribution platform, launched in 2012, has contributed to the increase of our non-U.S. assets under management. As a result of this effort, in the past five years, we have raised $12.9 billion of new client assets for our Affiliates.

Positive net revenue flows and investment performance, in conjunction with the successful execution of our business strategy, have led to growth in revenues and net income. We measure financial performance primarily through ENI, a non-GAAP measure that we believe better reflects our underlying economic performance and returns to shareholders. Our ENI revenues grew from $450.8 million in 2012 to $678.5 million in 2016, or a compound annual growth rate, or CAGR, across those years of 10.8%. Over this period, our pre-tax ENI grew from $131.3 million in 2012 to $190.7 million in 2016, a CAGR of 9.8%. Our U.S. GAAP revenues excluding consolidated Funds were $435.6 million in 2012 and $663.4 million in 2016, representing a CAGR of 11.1%. Our U.S. GAAP net income from continuing operations attributable to controlling interests increased from $24.0 million in 2012 to $120.2 million in 2016, a CAGR of 49.6%. For additional information regarding economic net income, and reconciliations to U.S. GAAP, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Supplemental Performance Measure—Economic Net Income.”

Total AUM: $240.4 billion

$ in billions as of December 31, 2016

4

Competitive Strengths

We believe our success as a multi-boutique asset management company is driven by the following competitive strengths:

Well-Established, Diverse Affiliates. Through our eight Affiliates, we are well-diversified by brand, strategy and asset class, providing multiple sources of revenue and growth opportunities for our business across global market cycles, while limiting downside risk. Each Affiliate has its own brand and investment processes and generally operates in distinct asset classes. Our assets under management across Affiliates are invested in both U.S. and global/non-U.S. equities (34.1% and 40.1%, respectively) as well as fixed income and alternative assets, including timber, real estate and secondary Funds. We are also well-diversified by investment strategy within each asset class, with 120 distinct investment strategy composites. The breadth of our investment capabilities and distinct brand identities appeal to a wide range of clients. We have a well-diversified client base with low levels of client concentration. Our business serves over 900 institutional and sub-advisory clients, with our top 25 client relationships representing approximately 31% of run rate gross management fee revenue, including our equity-accounted Affiliates, as of December 31, 2016. Total run rate gross management fee revenue reflects the sum for each account at each of our eight Affiliates, of the product of (a) assets under management in each account at December 31, 2016, multiplied by (b) the relevant management fee rate on that account. This calculation includes all accounts at each of our equity-accounted Affiliates.

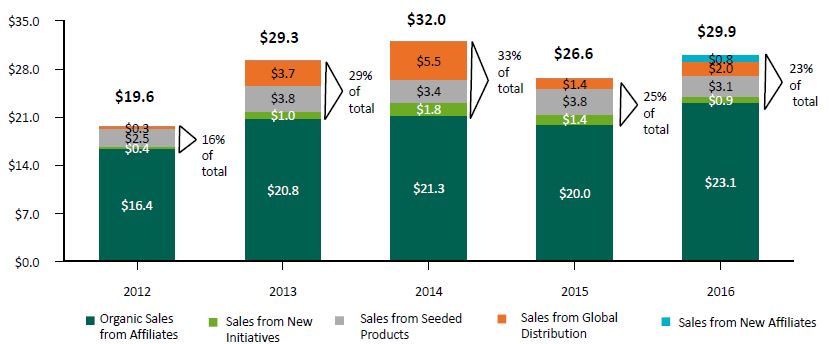

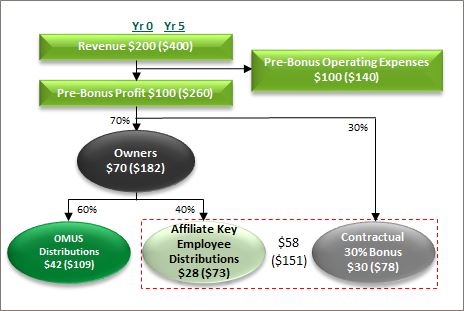

Differentiated Multi-Boutique Model Drives Growth. Our business is differentiated among multi-boutique asset management firms by our focus on active engagement with our Affiliates to enhance their organic growth potential. We have a two-pronged approach for successfully collaborating with our Affiliate firms. First, we align our interests with those of our Affiliates by providing Affiliate partners with equity in their own firms and through a profit-sharing structure that sets bonuses as a percentage of pre-bonus profit. This structure gives our Affiliate partners meaningful wealth creation opportunities through equity ownership and encourages investments in long-term growth while maintaining an appropriate focus on profitability, efficient capital management and risk control. Second, we offer our Affiliates strategic and financial support to grow and enhance their businesses. Strategic guidance includes helping Affiliates to expand into new products, strategies, geographies or channels, including through lift-outs of new investment teams or the acquisition of add-on businesses, as well as seed and co-investment capital to help launch new investment strategies. In addition, our Center-led Global Distribution team complements and enhances the distribution capabilities of our Affiliates. We also help Affiliates with talent management, risk management and compliance support, as well as other shared services. Utilizing our strategic capabilities enables our Affiliates to capitalize on growth opportunities while maintaining their focus on delivering superior investment performance, innovative offerings, and excellent service to their clients. In 2016, 23% of the Company’s gross sales resulted from Center-led initiatives, including sales from a new Affiliate.

Track Record of Competitive Investment Performance Across Market Cycles. Our Affiliates have produced competitive long-term investment performance across their product offerings, generating outperformance relative to benchmarks across market cycles. Through December 31, 2016, 96 of our Affiliates’ 114 strategies that have performance benchmarks have outperformed their relevant benchmarks since inception. These strategies represent 96% of the total assets in the 114 strategies that have performance benchmarks. Investment performance is calculated on a gross basis, excluding the impact of management, administration, and performance fees. Based on our current average management fee rate, investment returns net of fees would be on average approximately 35 bps lower than gross returns (excluding products which are not benchmarked). For the rolling 10-year period ending December 31, 2016, approximately 92% of benchmarked assets have outperformed their relevant benchmarks. Our Affiliates’ five largest benchmarked investment strategies, Barrow, Hanley, Mewhinney & Strauss (BHMS) Large Cap Value, Acadian Asset Management (AAM) Emerging Markets Equity, AAM Global Equity, AAM Global Managed Volatility, and TSW International have each outperformed their relevant benchmarks since inception by 1.3%, 2.9%, 1.7%, 2.4%, and 1.9%, respectively, on an annualized basis.

5

Attractive Financial Model. Our multi-boutique model generates strong, recurring free cash flow to our business that we can use for growth initiatives on behalf of existing Affiliates, investments in new Affiliates, or return to shareholders through dividends and stock repurchases. Our ENI revenue has grown 10.8% annually since 2012 as net client cash flows generated positive annualized revenue in each year from 2012 through 2016. Our revenue consists largely of recurring management fees on assets under management and is not heavily dependent upon more volatile performance fees. We earn an attractive margin on revenue enhanced by our profit-sharing model that enables us to participate directly in margin expansion as our Affiliates grow. Our ENI operating margin (calculated before Affiliate key employee distributions) grew from 33% for 2012 to 37% for 2015, before falling to 35% in 2016 as we continued to invest in the business. Our comparable U.S. GAAP operating margin was (9)% for 2012 (21% excluding consolidated Funds) and 23% for 2016 (23% excluding consolidated Funds).

Experienced Multi-Boutique Management Team. The members of our senior management team have significant experience in the asset management industry, with a particular focus on managing multi-boutique businesses. With an average industry tenure of approximately 27 years, each of our senior executives brings a deep understanding of how to structure and maintain relationships that provide Affiliate firms with the proper incentives and resources to continue to generate strong growth. In 2011, our senior management team took over a business that generated $112.3 million of pre-tax ENI (including discontinued operations). The team led a significant restructuring of the Company that resulted in an 81.7% increase in pre-tax ENI to $204.1 million in 2014, while significantly improving net client revenue flows and margins.

Strong Growth Prospects from New Affiliate Partnerships. We have established a reputation as a collaborative and supportive partner to our Affiliates and seek to partner with additional high quality managers who provide scalable institutional quality investment capabilities in asset classes in which we seek an enhanced presence. We have a strong pipeline of potential opportunities generated from our long-standing relationships across the industry, our internal prospecting activities, and our relationships with intermediaries. We have a well-defined set of criteria for executing investments in new Affiliates and believe we can enhance growth and diversify risk across our business by selectively expanding our portfolio of investment boutiques. We believe our business model is attractive to the owners of boutique asset management firms, as it provides them an opportunity to realize a portion of the value they have created, while maximizing the value of their retained equity by accelerating the growth of their businesses alongside an experienced and supportive partner.

In August 2016, we acquired a majority equity interest in Landmark Partners, LLC, or Landmark, a leading, global secondary private equity, real estate, and real asset investment firm. Landmark has produced strong returns for its investors since inception in 1989, and is well positioned for continued growth. In addition, our partnership will enable us to work collaboratively with the Landmark team to expand their product set and further diversify their business into emerging secondary asset classes. Our Global Distribution team will also work with Landmark to bring its products to new markets outside the U.S.

6

Growth Strategy

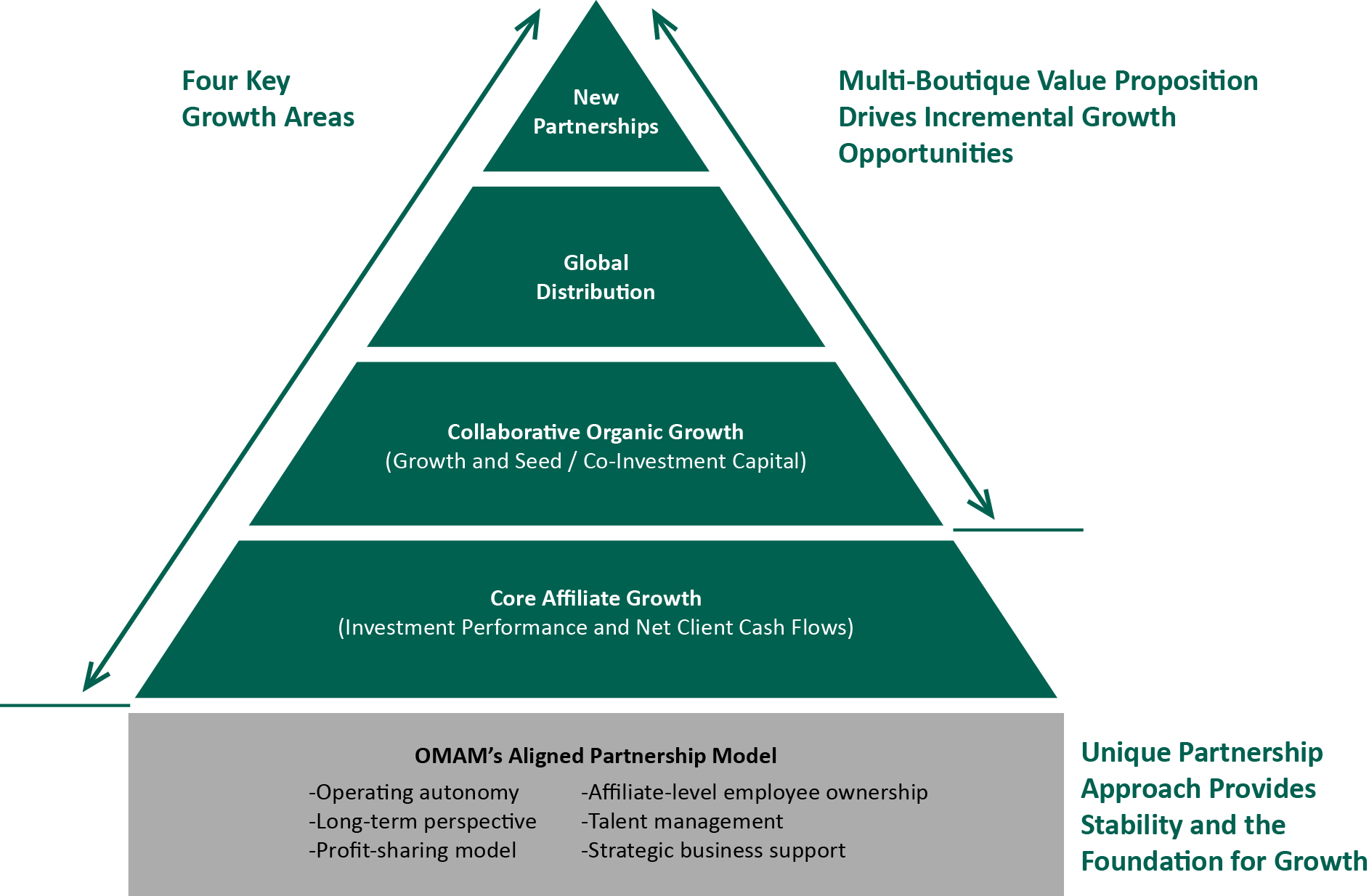

The cornerstone of our multi-boutique model is to combine the investment talent, entrepreneurialism, focus and creativity of leading asset management boutiques with the expertise and capital of a larger firm in areas where our resources can provide distinct advantages. We provide strategic capabilities to our Affiliates, enabling them to focus on delivering superior investment performance, innovative offerings, and excellent service to their clients. We strive to maintain and enhance the characteristics which have made our Affiliates market leaders in their areas of expertise, namely their cultures, investment processes, incentive structures and brands. Our focus is working with a select group of diverse Affiliates with whom we can build scalable business platforms leveraging their core investment and distribution capabilities.

Our growth strategy is based on the incentives inherent in our aligned partnership model. As a permanent partner dedicated to providing our Affiliates with operational autonomy, our structure is designed to align our economic interests with those of our Affiliates to promote long-term client-driven growth. Through retained Affiliate equity ownership and a profit-sharing partnership model, we ensure appropriate focus on key issues critical to the long-term success of each Affiliate, particularly investment performance, client service, talent management and risk management.

Our future growth and success will be driven by the following four core strategies:

Core Affiliate Growth. Our growth strategy is rooted in core Affiliate growth. Our Affiliates are strong, at-scale investment management boutiques with highly-defined and rigorous investment strategies for which there is real demand in the institutional marketplace. Our Affiliates have excellent long-term performance records and have generated strong growth through net client revenue flows. See “—Affiliates”

7

Collaborative Organic Growth. Our collaboration with our Affiliates enables them to grow and enhance their businesses in ways that they could not do on their own. We leverage the broad industry experience of our senior management to evaluate, structure, and support Affiliate growth opportunities, including expansion into new products and strategies, geographies and channels. In addition, we provide seed and co-investment capital to help launch new products. See “—Collaborative Growth Initiatives”

Global Distribution. Our Affiliates are recognized for their long-term investment performance and high quality client service, and have strong client and consultant relationships in their core institutional marketplaces. However, there are certain areas of distribution outside of their core markets that are more scale-oriented or specialized in nature. To assist our Affiliates in penetrating these markets, we offer a range of distribution capabilities in a transparent, opt-in partnership-based model that is supported by an experienced sales team focused on cultivating broad and deep relationships within the U.S. sub-advised and variable annuity channels and non-U.S. institutional markets. See “—Distribution Model and Client Base” for further discussion of our Center-led Global Distribution platform.

Investments in New Affiliates. We will selectively pursue partnerships with additional boutique asset managers that can enhance our growth potential and diversify our earnings drivers. Our partnership strategy targets asset classes that complement our existing Affiliates’ capabilities or provide additional expertise in capacity-constrained investment strategies. Within each asset class, we seek to partner with market leaders that have track records of operating as successful, stand-alone enterprises. We target profitable and growing businesses that have the potential to build a meaningful global presence in a given asset class. Asset class attractiveness, operating scale, and depth of talent are prerequisites to partnership. However, cultural fit and a shared strategic vision ultimately provide the foundation for a successful relationship.

Successful Execution of the Growth Strategy

Since 2012, the execution of the growth strategy described above has contributed meaningfully to an increase in gross sales at the Company. On an annual basis, between 16% and 33% of gross sales can be directly tracked to Center-led activities including new initiatives, product seeding, global distribution, and sales from new Affiliates acquired by the Company. The chart below breaks out these sales contributions by category.

Sources of Gross Sales, 2012 through 2016 ($ in billions)

8

Our Operating Model and Holding Company Activities

Overview

We manage our business through eight Affiliates, each of which operates autonomously and employs its own distinct investment processes. We work with our Affiliates to identify and execute upon growth opportunities in areas such as distribution, business line expansion and product development, as well as in activities critical to the success and stability of boutique asset managers, including talent management, risk management and compliance support. Our collaboration with our Affiliates extends to the commitment of seed and co-investment capital to launch new products and investment capital to financially support new growth initiatives. We also provide focused shared service support in areas our Affiliates desire. We align incentives with our Affiliates through our permanent partnership structure, which provides employee partners of our Affiliates with equity in their respective firms through an equity recycling program, and participation in established profit-sharing arrangements.

Affiliate Partnership Model

We are a permanent partner dedicated to providing our Affiliates with operational autonomy in a structure that aligns our common economic interests. By offering Affiliate management direct participation in the growth and profitability of their businesses through equity ownership and a profit-share-based bonus pool, we provide our Affiliates with a strong incentive to manage their businesses for the long-term, investing with us to build equity value over time.

• | Affiliate Operating Autonomy. Affiliates retain day-to-day operating autonomy over their businesses, including decisions related to hiring, compensation, investment processes, product distribution and branding. We retain oversight through Affiliate board representation, remuneration committee participation, and certain approval rights, including approval of each Affiliate’s annual business plan. |

• | Affiliate Partners Have Retained Equity in their Own Firms. Partners in each of our Affiliates own meaningful equity positions in their respective businesses. Among our consolidated Affiliates, their equity stakes range from approximately 15% to 40%, in some cases following a distribution preference to OMAM. Affiliate equity, which in certain cases may be put back to us over time at a fixed multiple of trailing earnings, subject to limits, allows partners to benefit from long-term increases in their franchise value. We facilitate the recycling of Affiliate equity back to the next generation of Affiliate partners at the same multiple so that the impact to us is generally cash-neutral. |

• | Profit-Share Economics. Rather than invest in a fixed percentage of Affiliate revenues (a “revenue-share” model), Affiliate partners and we each invest in the underlying profits of their respective businesses, a model we refer to as a “profit-share” model (with the exception of ICM, which has a revenue-share model). ICM’s revenue share model is a legacy economic arrangement that has not been restructured. Distributions of profit to the Affiliate equity-holders are based on their proportionate ownership of their businesses, in some cases following a preferred return to us. In addition, bonus pools for Affiliates are typically contractually set at 25% to 35% of Affiliate pre-bonus profit. This enables us to participate in the margin increases of our Affiliates, while incentivizing Affiliate management and us to jointly support growth initiatives. For additional information on our profit-sharing model, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—The Economics of Our Business.” |

Collaborative Growth Initiatives

Our business is differentiated from other multi-boutique asset management companies by our focus on active engagement with our Affiliates to enhance their organic growth potential. Our collaboration with Affiliates generally consists of the following:

• | Strategic Affiliate Growth Opportunities. As part of our partnership approach with Affiliates, we play an active role in working alongside Affiliates to identify and analyze potential growth strategies for their businesses. Dedicated professionals at OMAM help to formulate a plan of execution and develop an economic structure to appropriately share risk and reward between us and Affiliate equity-holders. |

We have collaborated with our Affiliates on a number of growth initiatives to further diversify and strengthen our business. Our Affiliates have been able to leverage our strategic capabilities in areas such as capital support (including seed capital and co-investments), corporate development, global distribution, product expansion, and talent acquisition and management to strengthen their franchises. Our strategic

9

support has accelerated, and continues to accelerate, our Affiliates’ growth through a range of collaborative projects including, among other things, (i) the creation of new and complementary investment products through both the extension of existing proficiencies as well as the acquisition of new talent, (ii) the introduction of an Affiliate’s business line into global markets through the development and support of a framework for expansion (including evaluating acquisition opportunities and advancing distribution), and (iii) the development of best in class operational infrastructure to support further growth.

• | Seed Capital. As of December 31, 2016, we have approximately $125 million committed to seed capital, which is currently invested in 27 products across seven different asset classes. Our Affiliates’ use of seed capital generally falls into two categories: incubation capital and scale capital. Incubation capital is used to establish a track record for a new investment strategy. These new strategies generally take three to five years to season to the point where they are recommended by consultants or become attractive for clients. Alternatively, scale capital is used to extend a product with an established track record into a co-mingled fund, and is generally outstanding for a shorter period of time. Scale capital allows third-party clients to invest in the new fund without individually representing too substantial a percentage of the vehicle. Over $18 billion of our current AUM are in products which have been seeded by us since 2004, and our seeding program has generated an annualized internal rate of return to OMAM and our Parent of approximately 26% over this period, including investment returns on the seeded products and the incremental value generated by third party assets raised, including annual profits and a terminal value. |

We expect to maintain our seed portfolio at approximately $125 - $150 million to support product development on an ongoing basis. At December 31, 2016, approximately $83 million of seed capital under management was provided by our Parent. As part of the ongoing evolution of our relationship with our Parent, in June 2016 we agreed to purchase all remaining seed capital investments provided by our Parent on or around June 30, 2017.

• | Co-Investment Capital. We also provide co-investment capital to support the formation of closed-end, long-term partnerships managed by our Affiliates. These fixed-life partnerships typically require us and/or the Affiliate to invest 1% to 3% of the product’s capital to align interests with those of their clients. Of our current $35.0 million portfolio of co-investments at fair value ($18.8 million of which is owed to or directly owned by our Parent), 87% is managed by Heitman (investing in real estate) and 13% is managed by Campbell Global (investing in timber). In consideration for providing co-investment capital, which is typically illiquid for approximately seven to ten years, we receive returns on our underlying partnership investment, our proportionate share of profits on assets in the fund, and the potential for fund incentive fee allocations. In connection with the Offering, as discussed further in “—Business History” herein, we entered into a co-investment deed with our Parent to provide it with the economic benefits related to the return of capital and incentive fee allocations with respect to specified co-investments currently held on our balance sheet. In addition, in the fourth quarter of 2015 we provided approximately $50 million of interim financing to Campbell Global for a $420 million U.S. timberland acquisition. This financing was repaid when the property was sold to a third-party investor in January 2017. |

Strategic Business Support

While each of our Affiliates operates on an autonomous basis, we seek opportunities to increase efficiency and promote the long-term stability of their respective businesses by offering strategic support. This support typically leverages our scale across the Affiliate base or provides distinctive strategic operational expertise to our Affiliates.

• | Talent Management. We are highly focused on talent management and have significant experience collaborating with Affiliates to develop talent, design incentive structures, promote continued Affiliate equity ownership and establish succession plans. A key area of focus is senior management succession planning. While this is an infrequent occurrence at each Affiliate, it represents a key point of vulnerability and opportunity that is highly scrutinized by both clients and employees. Our objectivity and experience as an external partner has been instrumental in managing through the challenges of a number of successful succession processes at our Affiliates. |

10

• | Risk Management and Compliance Support. Our Affiliates maintain comprehensive risk management and compliance functions, supplemented by our own, Company-based risk management and compliance teams. Our dedicated risk, legal and compliance teams work through a well-established reporting and communication structure to constantly assess risk in the context of the execution of our and our Affiliates’ business strategies. We also provide a centralized internal audit function. We view risk management as a continuous part of the management process and have created a consistent, holistic program to identify, assess, communicate and monitor risk throughout our organization. |

• | Shared Services. We offer shared services to our Affiliates in areas such as operational support, human resources, payroll and benefits administration, finance and accounting, information technology outsourcing and security, eBusiness support, and risk management systems. Affiliate participation in these services is optional; however, all of our Affiliates currently participate in one or more of our shared services. The shared services we provide generally are charged back to Affiliates on a cost-basis. |

Capital Management

Our asset management business generates significant, recurring free cash flow that can be re-invested in the growth-oriented strategies described above to create value for our shareholders. Strategic and efficient management of our Company’s capital underpins our approach to investing in these strategies. In particular, we believe we can generate strong returns on allocated capital by (i) providing seed capital to fund new products and strategies; (ii) committing co-investment capital to launch new fund partnerships in which our Affiliates act as the general partner; (iii) providing investment capital to support organic growth; (iv) investing in new Affiliates; and (v) implementing opportunistic share repurchase programs. Management undertakes detailed business case analyses with respect to all investment opportunities, and only considers those that yield an acceptable return while operating within the parameters of our risk appetite.

Holding Company Management Team

Since 2011, when a number of key executives joined OMAM, including our CEO and CFO, our senior management team has defined a core set of operating principles and repositioned our business around them. As a result, we refocused our business strategy on market-leading, institutionally-driven, active investment management, which led to a rationalization of our Affiliate base. In addition, our senior management realigned our structure to focus on supporting our Affiliates in areas where we believe we can provide the greatest benefit, particularly collaborative growth initiatives, talent management and shared services. Our team also developed and launched our Global Distribution platform to expand our Affiliates’ marketing reach into specialty U.S. distribution channels and non-U.S. markets. Additionally, our management team successfully led our Company through its initial public offering, two subsequent secondary offerings, as well as the acquisition of Landmark Partners in 2016, which represented the first new Affiliate investment since our management team joined OMAM. For additional details, refer to “—Business History” herein.

11

Overview of Affiliates

Acadian Asset Management LLC, or Acadian ($75.0 billion in AUM as of December 31, 2016), founded in 1986, is a leading quantitatively-oriented manager of active global and international equity, and alternative strategies. The firm pursues a fundamentally-grounded, data rich and highly structured approach to investing that seeks to identify and exploit systematic and structural inefficiencies in the markets. Acadian applies a range of investment and risk considerations to a universe of over 33,500 securities taken from 100 global markets. Managed strategies include global, international and emerging markets equities, long/short strategies, and managed volatility strategies. Its flagship Emerging Markets Equity strategy has outperformed its benchmark, MSCI Emerging Markets (Net), by 2.9% (USD, gross of fees) on an annualized basis since its inception in 1994 through December 31, 2016.

Acadian invests on behalf of a wide range of institutional clients across the globe, including public and private funds, endowments and foundations, and retail clients through sub-advisory channels. The firm’s clients are domiciled in over 17 countries across Asia, Australia, Europe and North America. Acadian’s management team is led by Chief Executive Officer Churchill Franklin and Chief Investment Officer John Chisholm. The firm has 94 investment and research professionals and manages approximately 60 distinct investment strategies.

Barrow, Hanley, Mewhinney & Straus LLC, or Barrow Hanley ($92.3 billion in AUM as of December 31, 2016), founded in 1979, has an outstanding long-term track record of providing its clients with superior performance and client service in a wide range of value-oriented investment strategies. The firm applies a strict definition of value that guides all of its investment decisions, as it employs disciplined, bottom-up analysis to construct value equity portfolios of U.S., non-U.S., global and emerging market securities that exhibit below-market price-to-earnings ratios, below-market price-to-book ratios, and above-market dividend yields, regardless of market conditions. The firm’s value-oriented fixed income portfolios seek to achieve higher total returns with below-benchmark volatility by identifying temporarily mispriced securities with yield-to-maturity advantages over Treasury bonds of comparable maturity. Barrow Hanley’s flagship large cap value equity product, which had over $45.7 billion in assets at December 31, 2016, has a 37-year track record.

Barrow Hanley has a diverse and longstanding clientele; more than 25 of its clients have maintained their relationships with Barrow Hanley for more than 20 years. In addition to direct relationships with institutional investors, the firm serves as a sub-advisor to more than 45 highly regarded mutual funds, and is one of four external sub-advisors managing the $47 billion Vanguard Windsor II Fund. The firm is led by executive directors James Barrow and Ray Nixon, Jr. and a team of 20 managing directors specializing in multiple asset classes. The firm has 41 investment professionals managing 25 distinct strategy composites.

12

Overview of Affiliates (cont.)

Campbell Global LLC, or Campbell Global ($5.2 billion in AUM as of December 31, 2016), founded in 1981, brings more than three decades of experience and leadership to sustainable timberland and natural resource investment management. As a full-service firm, it acquires and manages timberland for investors, while providing high quality service and expert management. The firm delivers superior investment performance by focusing on unique acquisition opportunities, client objectives, and disciplined management. Campbell Global currently manages more than 2.6 million acres (1.1 million hectares) worldwide.

Campbell Global has a diversified institutional client base that includes corporations, governments and endowments. As of December 31, 2016 the firm employed over 231 individuals across the U.S., Australia, Brazil and New Zealand, and provides its clients with an integrated, full-service approach to timberland investment through its broad expertise in sourcing and executing timberland acquisitions, as well as asset management and disposition. Campbell Global’s management team is led by Chief Executive Officer and Chairman John Gilleland. The firm has 34 investment professionals managing its investment portfolio.

Copper Rock Capital Partners LLC, or Copper Rock ($5.1 billion in AUM as of December 31, 2016), founded in 2005, offers specialized, growth equity investment management focused on small and small/mid-capitalization strategies in international, global and emerging markets growth equities. Copper Rock’s investment strategy seeks to outperform in up-markets due to the firm’s pure fundamental growth approach and also to protect clients’ capital through portfolio construction and a strong sell discipline.

Copper Rock’s client base includes pension plans, institutional investors and mutual funds located in the U.S., Canada, the United Kingdom, Ireland, Denmark, South Africa and Australia. Copper Rock’s management team is led by the firm’s Chairman and Chief Investment Officer Steve Dexter and Chief Executive Officer Mike Forrester. The firm has seven investment professionals managing four distinct investment strategies.

13

Overview of Affiliates (cont.)

Heitman LLC,* or Heitman ($31.2 billion in AUM as of December 31, 2016), founded in 1966, globally invests in and manages portfolios of real estate and real estate securities for its clients, which include public and corporate pension funds, endowments and foundations, and private investors. Heitman’s investment expertise is centered in the three primary segments of the global real estate property and capital markets: private real estate equity, public real estate securities and real estate debt.

With headquarters in Chicago and ten other offices worldwide, Heitman’s investment teams are based on the ground in the key global markets, providing its investment professionals with a deep understanding of the local and regional real estate dynamics needed to implement its strategies.

The firm’s management team is led by its Chief Executive Officer, Maury Tognarelli. As of December 31, 2016, Heitman had eighteen portfolio managers covering private equity, public securities and real estate debt. The firm’s clients are supported by 34 professionals situated around the globe whose sole responsibilities are dedicated to client service and marketing.

* accounted for under the equity method of accounting.

Investment Counselors of Maryland, LLC,* or ICM ($2.0 billion in AUM as of December 31, 2016), founded in 1972, focuses on value-driven equities and invests through a well-established, bottom-up investment process that it applies across the entire capitalization range, with an emphasis on small- and mid-cap companies. The firm employs a team orientation in making investment decisions. Each member of ICM’s investment team has a sector focus and is responsible for generating and analyzing ideas within that sector. The most promising investment ideas are reviewed by the entire team, and the ultimate buy/sell decisions are made by the respective portfolio manager teams.

For over four decades, ICM has been managing assets for institutional clients and high net worth individuals through separate accounts and an institutional mutual fund, and has generated excellent results for its clients over this time. ICM’s management team is led by Managing Partner and Chief Investment Officer, William V. Heaphy. The firm has eight investment professionals managing four distinct investment strategies.

* accounted for under the equity method of accounting.

14

Overview of Affiliates (cont.)

Landmark Partners, LLC, or Landmark ($9.7 billion in AUM as of December 31, 2016), founded in 1989 and acquired by OMAM in August 2016, specializes in secondary market transactions of private equity and real estate investments. The firm has one of the longest track records in the industry and is a leading source of liquidity to owners of interests in real estate, real asset, venture, mezzanine, and buyout limited partnerships. Landmark has formed 29 Funds over the last 26 years. These Funds have been capitalized at more than $15.5 billion, which has been deployed across over 1,900 partnership interests that comprise over 25,000 underlying company and property investments.

Landmark’s investor base is mostly comprised of institutional investors including: sovereign wealth funds, public pensions, corporate pensions, insurance companies, asset managers, and foundations located globally.

Landmark is led by President and Managing Partner, Timothy Haviland and Chairman and Managing Partner, Francisco Borges, supported by a team of ten Partners. As of December 31, 2016, Landmark employed 92 individuals across four offices in Boston, MA; New York, NY; and Simsbury, CT in the United States and London in the United Kingdom.

Thompson, Siegel & Walmsley LLC, or TSW ($19.9 billion in AUM as of December 31, 2016), founded in 1969, applies a value-oriented investment approach across a range of products in U.S. and international equities, fixed income and alternative investments. TSW’s singular investment objective is to outperform its benchmarks, net of fees, over rolling three- to five-year periods. TSW employs a proprietary screening process to generate focused lists of companies that are most attractive within different market capitalization ranges. The firm’s investment teams then use fundamental analysis to construct portfolios, which they believe possess catalysts that can unlock value.

TSW has a diverse client base that includes corporations, public pensions, high-net-worth families and individuals, and sub-advisory clients and has generated a strong track record of providing investors with excellent long-term results. The firm’s management team is led by Chairman Lawrence Gibson, Chief Executive Officer Horace Whitworth, President Frank Reichel, Managing Director, John Reifsnider and Director of Operations, Lori Anderson. The firm has 26 investment professionals managing thirteen investment strategy composites.

15

Distribution Model and Client Base

Our distribution is focused on the institutional and sub-advisory channels, reached through both Affiliate-led and complementary, Center-led sales efforts. Our Affiliates have teams of established sales and client service professionals with broad and deep relationships across the major segments of the institutional investor community. Consistent with our partnership philosophy, Affiliates develop and maintain client relationships independently of both us and each other, while maintaining the option to participate in Center-led complementary distribution initiatives in the domestic sub-advisory and selected global markets. In aggregate, our Affiliates have approximately 170 sales and marketing professionals servicing over 900 institutional and sub-advisory clients.

We launched our Center-led Global Distribution platform in 2012, which consists of a team of experienced channel and regional marketing specialists focused on developing new business opportunities for our Affiliates. In the U.S., complementing and enhancing the distribution capabilities of the Affiliates, we have one executive and four sales and marketing professionals focused on cultivating relationships in the sub-advisory (mutual fund and variable annuity) channel. We also maintain independent relationships with institutional investment consultants. If requested, our team also provides strategic marketing support for the Affiliates. Outside the U.S., where scale is a meaningful advantage to support geographic reach and servicing capabilities, we have a Global Distribution team consisting of ten dedicated and strategically deployed sales and marketing professionals focused on developing client relationships and gathering assets in Canada, the United Kingdom, Europe, Asia (excluding Japan) and the Middle East. Within these channels and jurisdictions, our objective is to cultivate broad and deep relationships with key consultants and institutional investors and to generate new client opportunities for those Affiliates who take advantage of our Global Distribution platform. From January 1, 2012 through December 31, 2016, we have raised $12.9 billion in client assets for our Affiliates. As a result of our Center-led Global Distribution platform, we expect our non-U.S. assets under management to increase.

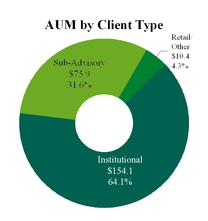

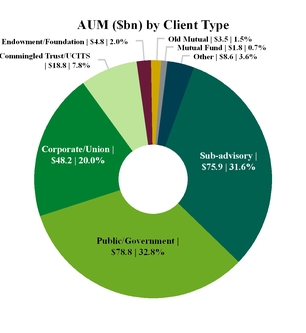

The institutional channel accounts for 64% of our AUM. Within this channel, we have strong relationships in the public/government pension market (33% of our AUM) and the corporate plan market (20% of our AUM), which comprise a substantial portion of the institutional investment market overall, particularly in the U.S. Our institutional marketplace clients are highly diverse across segments and geographies and have various growth characteristics.

While our Affiliates market primarily to institutional investors, we participate in the individual investor market through the sub-advisory channel, which represents 32% of our AUM. Within this channel, we manage assets for mutual funds, giving us exposure to a retail investor base and the defined contribution market. We have approximately 75 sub-advisory mandates on over 55 leading platforms, including Vanguard, American Beacon, Principal and Transamerica. Our top ten sub-advisory relationships account for approximately 26% of AUM and 15% of run rate ENI management fees, including equity-accounted Affiliates, and have an average tenure of over ten years. We have experienced rapid growth in this channel, with sub-advisory assets growing over 85%, or 13% annually, from January 1, 2012 through December 31, 2016.

16

Across our Affiliates, our client base is highly diverse with no significant concentration in our portfolio, though some Affiliates may have client exposures that are meaningful to their individual businesses. As of December 31, 2016, our Affiliates’ top five client relationships represented 15% of total run rate gross management fee revenue, including equity-accounted Affiliates, and our Affiliates’ top 25 clients represented 31% of run rate gross management fee revenue, including equity-accounted Affiliates. Old Mutual plc and its subsidiaries (other than us and our Affiliates) contributed less than 1% of total gross management fee revenue, including equity-accounted Affiliates.

Total AUM: | $240.4 bn |

Data as of December 31, 2016

Products and Investment Performance

Product Mix

Our Affiliates offer leading products in U.S., global, international and emerging markets equities; U.S. fixed income; and alternative investments, including timber, real estate and secondary Funds.

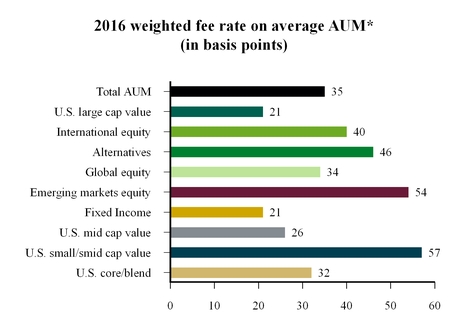

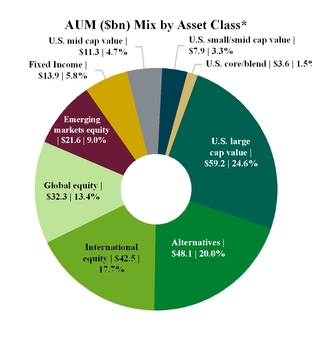

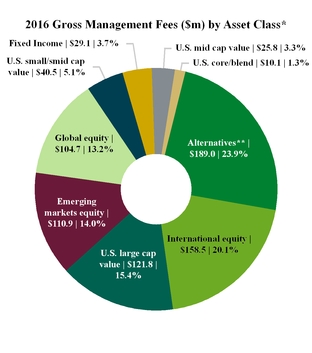

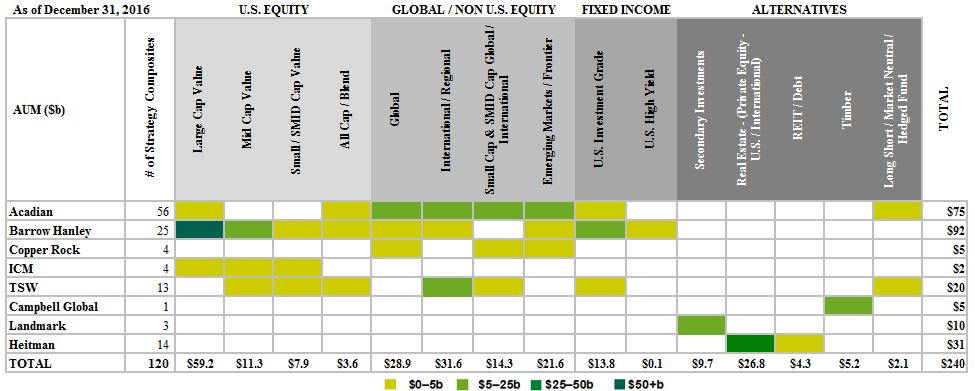

The charts below present our average fee rates, assets under management, and gross management fee revenue including equity-accounted Affiliates by asset class and illustrate the diversification benefits of our multi-boutique business model. Our largest asset class, U.S. large cap value equities, represents 24.6% of our AUM as of December 31, 2016; however, with a weighted average fee rate of approximately 21 basis points, this asset class represents only 15.4% of our gross management fee revenue, including equity-accounted Affiliates in 2016. Each of five asset classes represents 13% or more of our gross management fee revenue, including equity-accounted Affiliates, providing a balanced earnings stream to our business. Moreover, within our three largest asset classes by revenue—alternative investments, U.S. large cap value equities, and international equities—we offer a range of strategies which provide further stability to our earnings.

17

Data as of December 31, 2016

* Includes equity-accounted Affiliates

Total AUM: $240.4 bn | Total Management Fees: $790.4 m* |

Data as of December 31, 2016 | Data as of December 31, 2016 |

* Includes equity-accounted Affiliates

** Alternatives include gross management fees of Landmark from date of acquisition in August 2016

18

We have product breadth and diversity within individual Affiliates as well as across our Affiliates. For example, Barrow Hanley, whose core offerings consist of leading value-oriented U.S. equity strategies, also offers a highly-rated suite of non-U.S. equity and U.S. investment grade fixed income investment products that adhere to the firm’s traditional value discipline. Similarly, Acadian applies its quantitative approach across a range of equities, in terms of geography as well as market capitalization.

Our Affiliates’ product offerings are well-positioned in areas of investor demand, and the diversity of investment style and asset class enables us to participate in growing segments of the industry in multiple investing environments. The chart below illustrates the diversity of our assets under management by asset class and Affiliate. In total, our Affiliates manage 120 strategy composites, including four Affiliates that manage at least ten strategies each.

Investment Performance

Investment PerformanceWhile each of our Affiliates has distinct investment processes and generally operates in different asset classes, our unifying mission is to produce risk-adjusted performance, or alpha, for our clients. We measure alpha generation relative to the specific benchmarks our Affiliates’ clients use to evaluate our performance in our Affiliates’ strategies. Looking at this measure on a consolidated basis, our Affiliates have competitive near- and long-term performance records and are well-positioned for continued growth.

19

In the chart below, which measures revenue-weighted performance relative to benchmarks over the last five years, we typically have had between 50% and 90% of our revenue derived from products performing ahead of their respective benchmarks on a one-, three- and five-year basis. In evaluating prospective investments, we believe institutional investors generally give the three-year performance of an investment product the greatest weighting. The overall decline in investment performance during 2016 reflects an investing environment characterized by macroeconomic-driven volatility and higher demand for bond proxies in the equities markets in the first three quarters of 2016. This has presented challenges for our Affiliates who employ long-term strategies in value portfolios. In the fourth quarter of 2016, there was a strong shift in the broader market away from yield securities, toward financials and value equities, which has resulted in improved 1-year investment performance from previous interim periods.

Data as of December 31 for the years 2012 to 2016

20

In addition to analyzing our Affiliates’ performance on a revenue-weighted basis, which gives us a perspective on product performance with respect to our Affiliates’ existing client base, we also consider the number of our Affiliates’ at-scale product strategies (defined as strategies with greater than $100 million of AUM) beating benchmarks. This latter measure, labeled as “equal-weighted,” indicates the opportunity we have to generate sales in a variety of market environments. For instance, strong performance in a newer, smaller product such as small-cap emerging markets may not affect revenue-weighted performance, but it can have a meaningful effect on revenue growth given client demand for this higher fee product. The chart below indicates performance on a revenue-weighted and equal-weighted (by product) basis relative to benchmark, as at December 31, 2016. In addition, we have indicated the percentage of our assets beating their benchmarks over the same time periods. While we believe the first two methodologies provide better insight into our performance trends, we have also included AUM-weighted performance, as this is a more standard industry performance metric.

Data as of December 31, 2016

Competition

We and our Affiliates face competition from many segments in the asset management industry. At the Company level, we compete with other acquirers of investment management firms, including investment management holding companies, insurance companies, banks and private equity firms. Our Affiliates compete globally with international and domestic investment management firms, hedge funds and other subsidiaries of financial institutions for institutional assets.

Many of the organizations our Affiliates compete with offer investment strategies similar to those offered by our firms, and these organizations may have greater financial resources and distribution capabilities than we or our Affiliates are able to offer. Additionally, there are limited barriers to entry for new investment managers. Our Affiliates compete with these organizations to attract and retain institutional clients and their assets based on the following primary factors:

• | the investment performance records of our Affiliates’ investment strategies; |

• | the breadth of active investment strategies offered by our Affiliates in the asset classes in which they specialize; |

• | the alignment of our Affiliates’ investment strategies to the current market conditions and investment preferences of potential clients; |

• | the quality and reputation of the investment teams that execute the investment strategies at our Affiliates; |

• | the strength of our Affiliates’ and our distribution teams; and |

• | the strength of our Affiliates’ client service and long-term client relationships. |

21

Business History

The predecessor of OMAM was formed in 1980. OMAM was formed on May 29, 2014 as a private limited company under the laws of England and Wales. Upon the consummation of the Reorganization (discussed below), we changed our name to OM Asset Management plc.

In 2011 and 2012, OMAM appointed new members of senior management. The executive team undertook a strategic review and implemented a strategic repositioning of our business to focus on actively managed, alpha-generating institutional investment products. Pursuant to this assessment, during 2011 through 2013 we divested our interests in several former Affiliate firms. We substantially completed this process in the first quarter of 2014. In the second quarter of 2014, we transferred a former Affiliate, Rogge Global Partners plc, to a subsidiary of our Parent. In August 2016, we completed the acquisition of Landmark Partners.

At January 1, 2014, OMUSH was a subsidiary of OM Group (UK) Limited, or OMGUK, which was and is in turn wholly owned by our Parent. The board of directors of our Parent elected to undertake an initial public offering of the Company’s ordinary shares, or the Offering. We and our Parent determined that certain transactions, the Reorganization, should be undertaken in preparation for the Offering, which are more fully described in Note 1, “Organization and Description of the Business” in our Consolidated Financial Statements included in Item 8 herein. On October 8, 2014, we priced our initial public offering and on October 9, 2014, began trading on the New York Stock Exchange under the ticker symbol “OMAM”.

On June 22, 2015, we completed a secondary public offering by our Parent of 13,300,000 ordinary shares of our Company pursuant to the Securities Act of 1933, as amended, or the Securities Act. Additionally, the underwriters in the secondary public offering exercised their full overallotment option and purchased an additional 1,995,000 shares of our Company from our Parent. On December 16, 2016, we completed an additional secondary public offering by our Parent of 13,000,000 ordinary shares of our Company pursuant to the Securities Act of 1933. Additionally, the underwriters in the secondary public offering exercised their full overallotment option and purchased an additional 1,950,000 shares of our Company from our Parent. Concurrently with that offering, we repurchased and retired six million ordinary shares from our Parent in a private transaction pursuant to a share repurchase program approved by our shareholders. At December 31, 2016, our Parent owned 51.1% of our outstanding ordinary shares.

On March 11, 2016, our Parent announced the results of a strategic review, which included a plan to separate its underlying businesses, including OMAM. Our Parent further announced on December 12, 2016 its intention to continue the reduction of its holdings in OMAM in an orderly manner which balances value, cost, time and risk.

Employees

As of December 31, 2016, we had 1,286 full-time equivalent employees, of which 87 were employees of the Company and 1,199 were employees of our Affiliates. None of our employees or those of our Affiliates are subject to any collective bargaining agreements. We believe our relationships with our employees to be good and have not experienced interruptions to operations due to labor disagreements.

22

Operations, Systems and Technology

We generally use both third-party commercial technology solutions and services to support investment management and operational activities, including functions such as portfolio management, trading, investment accounting, client reporting and financial reporting. Certain Affiliates have built proprietary systems to support the investment process where competitive advantages to do so exist. Systems and processes are customized as necessary to support our investment processes and operations. Information security, business continuity and data privacy programs have been implemented to help mitigate risks.

Our web site is www.omam.com. Our web site provides information about us, and from time to time we may use it as a distribution channel of material company information. We routinely post financial and other important information in the “Investor Relations” section of our web site and we encourage investors to consult that section regularly. That section of our web site includes “Public Filings” where one can download copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, including exhibits, and any other report filed or furnished with the U.S. Securities and Exchange Commission, or the SEC, pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. We make these reports available through our web site as soon as reasonably practicable after our electronic filing of such materials with, or the furnishing of them to, the SEC. The information contained or incorporated on our web site is not a part of this Annual Report on Form 10-K.

23

Item 1A. Risk Factors

You should carefully consider the following risk factors in addition to the other information included or incorporated by reference in this Annual Report on Form 10-K before investing in our ordinary shares. Any of the following risks could have a material adverse effect on our business, financial condition, results of operations or cash flow. If any of the following risks and uncertainties actually occurs, you may lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

Business Risks

Our overall financial results are dependent on the ability of our Affiliates to generate earnings.

OMAM is a holding company and is not a registered investment adviser under United States, or U.S., federal or state law. As such, OMAM does not manage investments for clients and does not directly receive management fees. All of OMAM’s revenue generation is dependent on our Affiliates who are (or have subsidiaries who are) registered investment advisers under the Investment Advisers Act of 1940, as amended, or the Advisers Act, and receive the majority of their fees based on the market values of assets under management. Substantially all of OMAM’s cash flows consist of distributions received from our Affiliates. As a result, OMAM’s cash flows and ability to fund operations are largely dependent upon the profitability of our Affiliates.

Each Affiliate is required to make certain cash distributions to us under the operating agreement we enter into with such Affiliate. Distributions to us from an Affiliate may be subject to the Affiliate maintaining sufficient working capital, regulatory requirements, claims of creditors of the Affiliate and applicable bankruptcy and insolvency laws. Any material decrease in profits at, or material reduction in distributions from, our Affiliates could negatively impact our business and results of operations.

The ability of our Affiliates to attract and retain assets under management and generate earnings is dependent on our Affiliates maintaining competitive investment performance, as well as market and other factors.

Our financial performance is dependent upon the abilities of our Affiliates to minimize the risk of outflows through sound relative investment performance over measured periods of time compared to relevant benchmarks and peer performance results. The performance of our Affiliates’ investment strategies, which can be impacted by factors within and/or outside the control of our Affiliates, including general market and economic conditions, is critical to retaining existing client assets and investors, including in mutual funds and private funds our Affiliates advise or sub-advise, and attracting new client and investor assets. Poor performance can be caused by our Affiliates’ choices in investing in sectors, industries, companies or assets that do not perform as well as others. Additionally, companies in which our Affiliates invest may incur negative changes in their financial conditions or suffer other adverse events that could reduce the values of the Affiliates’ investments in those companies.

Net flows related to our investment strategies can be affected by investment performance relative to other competing investment strategies or to established benchmarks. Investment management strategies are rated, ranked or assessed by independent third parties, distribution partners, and industry periodicals and services. These assessments often influence the investment decisions of our Affiliates’ clients and investors in mutual funds and private funds our Affiliates advise or sub-advise. If the performance or assessment of our Affiliates’ investment strategies is seen as underperforming relative to peers, it could, among other things, result in an increase in the withdrawal of assets by existing clients and investors in mutual funds and private funds our Affiliates advise or sub-advise, the termination of an Affiliate as a sub-adviser to a mutual fund and the inability to attract additional investments from existing and new clients or investors. If a significant portion of clients or investors decides to withdraw their investments or terminate their investment management agreements or sub-advisory agreements with our Affiliates, our Affiliates’ abilities to generate earnings would decline and our results of operations and financial condition would be affected.

24

In addition, assets could be withdrawn for any number of reasons other than poor absolute or relative investment performance, including macro-economic factors unrelated to investment performance, a reduction in market demand for the asset classes, products or strategies offered by our Affiliates, the loss of key personnel, price declines in the securities markets generally, price declines in those assets in which client assets are concentrated or changes in investment patterns of clients. Any of these factors could have a negative impact on the revenues and profits of an Affiliate and an adverse impact on our results of operations and financial condition.

Our relationships with our Affiliates are critical to our success.

Maintaining strong relationships with our Affiliates is critical to our business model. Any potential disagreements over matters such as economics or management policies, growth strategies and compensation philosophy would impact our relationships with our Affiliates if not effectively managed. Furthermore, dissatisfaction by the management teams of our Affiliates with the services that we provide to them and the conditions upon which such services are provided also could result in a strained relationship with the management of that Affiliate. Any strains in the relationships that we have with our Affiliates could be detrimental to our overall business.

Each of our Affiliates operates under ownership, governance and economic arrangements that we and such Affiliate negotiated either at inception or during the course of our relationship. Periodically, these arrangements are reviewed and, in some instances, may be renegotiated and revised. Any renegotiation that results in a reduction in our ownership interest in an Affiliate and/or a revision to the economic arrangements could reduce the economic benefits derived by us from that Affiliate.

We derive a substantial portion of our revenue from a limited number of Affiliates and investment strategies.

As of December 31, 2016, Acadian and Barrow Hanley represented approximately 70% of our assets under management, from which we derive a substantial portion of our revenue. An adverse change in the operating results of either of these Affiliates, whether as a result of poor investment performance, withdrawals of assets under management or otherwise, could have a substantial impact on our results of operations.

While our Affiliates invest in a number of asset classes, a significant portion of our assets are invested in a limited number of investment strategies. As of December 31, 2016, $106.9 billion, or 44%, of our assets under management were concentrated across five investment strategies: Barrow Hanley’s Large Cap Value Equity ($45.7 billion, or 19%), Heitman’s Real Estate Domestic Private Equity ($23.0 billion, or 9%), Acadian’s Emerging Markets Equity ($16.9 billion, or 7%), Acadian’s Global Equity ($12.0 billion, or 5%) and Acadian’s Global Managed Volatility Equity ($9.3 billion, or 4%). Consequently, our results of operations are dependent upon the abilities of our Affiliates that manage these investment strategies to minimize the risk of outflows through relatively strong performance over measured periods of time compared to relevant benchmarks and peer performance results. Also, certain investors may evaluate us on the basis of the asset-weighted performance of our assets under management. A relatively small change in the relative performance of one of our largest strategies, such as Barrow Hanley’s large-cap value equity, could have a significant impact on the asset-weighted performance of our assets under management. Such volatility could adversely affect investors’ perception of us.

Our business model limits our ability to manage our Affiliates’ investment management practices and certain other aspects of their day-to-day operations.