Attached files

| file | filename |

|---|---|

| EX-99.1 - WIRELESS TELECOM GROUP INC | c87490_ex99-1.htm |

| 8-K - WIRELESS TELECOM GROUP INC | c87490_8k.htm |

Exhibit 99.2

Investor Deck February 21, 2017 Acquisition of CommAgility

2 Wireless Telecom Group Safe Harbor Statement Forward Looking Statements Except for historical information, the matters discussed in this presentation may be considered “forward - looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act o f 1934, as amended. Such statements include declarations regarding the intent, belief or expectations of the Company and its management and include the statements regarding increased revenues, immediate accretion, improved probability margins and other financial benefits of the transaction . Investors are cautioned that any such forward - looking statements are not guarantees of future performance and involve a number of risks and uncertainties that could materially affect actual results, including, among others, the Company’s ability to successfully integrate CommAgility, the ability to attract and retain key management, engineers and other key personnel of CommAgility , changes in exchange rates between our reporting currency, the dollar, and the British pound sterling, potential risks that arise from operating an multinational business, including compliance with ch ang ing regulatory environments, the Foreign Corrupt Practices Act and other similar laws, compliance with changing laws and regulations, potential economic and regulatory impact of the U.K.’s withdrawal from the European Union, the ability of management to successfully implement the Company’s business plan and strategy, product demand and development of competitive technologies in the Company’s or CommAgility’s market sector, the impact of competitive products and pricing, the loss of any significant customers of the Company or CommAgility, the Company’s ability to protect its and CommAgility’s property rights, the effects of adoption of newly announced accounting standards, the effects of economic conditions generally and tra de, legal and other economic risks, as other risks and uncertainties set forth in the Annual Report on Form 10 - K for the year ended December 31, 2015, and other filings with the Securities and Exchange Commission. These forward - looking statements speak only as of the date of this release and the Company does not undertake any obligation to update or revise any forward - looking information to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise, as except as required by law . Non - GAAP Financial Measures Certain CommAgility financial measures are presented in UK GAAP or are non - GAAP items. See Slide 13 for reconciliation of these items to US GAAP.

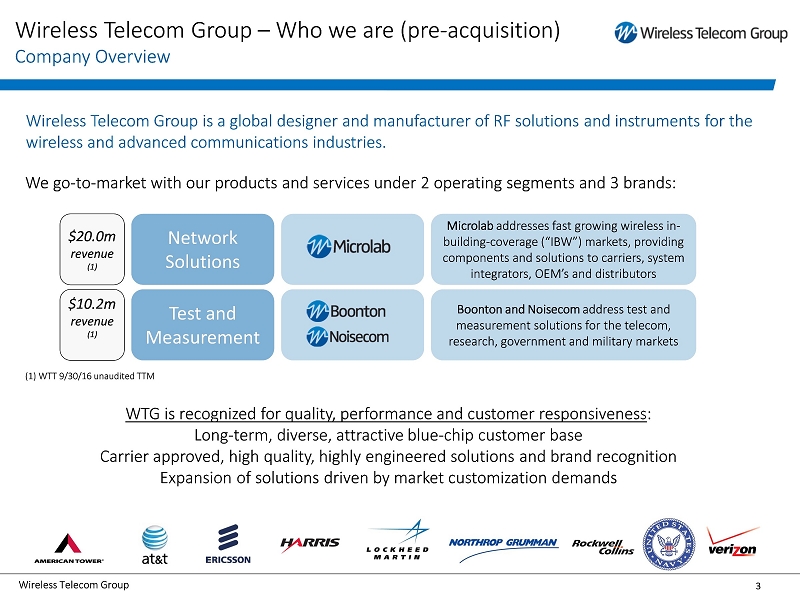

3 Wireless Telecom Group Wireless Telecom Group – Who we are (pre - acquisition) Company Overview Wireless Telecom Group is a global designer and manufacturer of RF solutions and instruments for the wireless and advanced communications industries. We go - to - market with our products and services under 2 operating segments and 3 brands: Network Solutions Test and Measurement Microlab addresses fast growing wireless in - building - coverage (“IBW”) markets, providing components and solutions to carriers, system integrators, OEM’s and distributors Boonton and Noisecom address test and measurement solutions for the telecom, research, government and military markets $20.0m revenue (1) $10.2m revenue (1) WTG is recognized for quality, performance and customer responsiveness : Long - term, diverse, attractive blue - chip customer b ase Carrier approved, high quality, highly engineered solutions and brand recognition Expansion of solutions driven by market customization demands (1) WTT 9/30/16 unaudited TTM

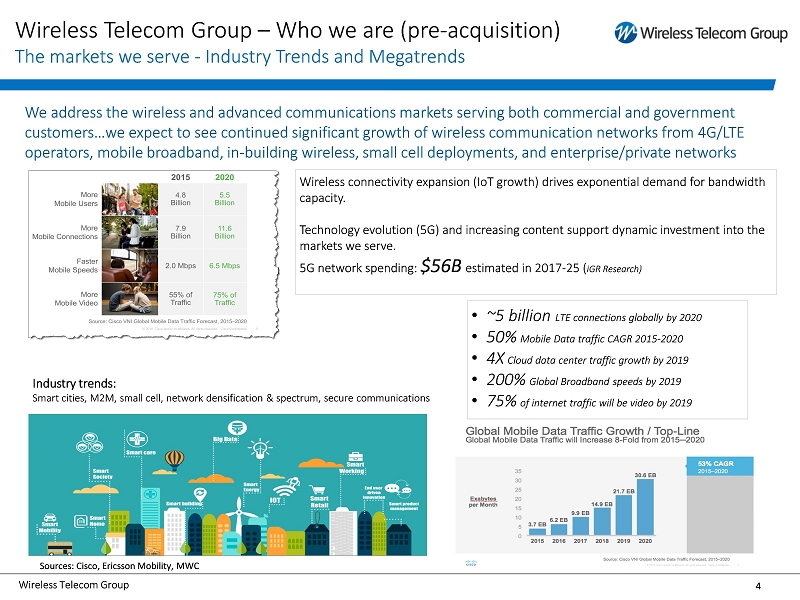

4 Wireless Telecom Group Wireless Telecom Group – Who we are (pre - acquisition) The markets we serve - Industry Trends and Megatrends Industry trends: Smart cities, M2M, small cell, network densification & spectrum, secure communications Sources: Cisco, Ericsson Mobility, MWC We address the wireless and advanced communications markets serving both commercial and government customers…we expect to see continued significant growth of wireless communication networks from 4G/LTE operators, mobile broadband, in - building wireless, small cell deployments, and enterprise/private networks Wireless connectivity expansion ( IoT growth) drives exponential demand for bandwidth capacity. Technology evolution (5G) and increasing content support dynamic investment into the markets we serve. 5G network spending: $56B estimated in 2017 - 25 ( iGR Research) • ~ 5 billion LTE connections globally by 2020 • 50 % Mobile Data traffic CAGR 2015 - 2020 • 4X Cloud data center traffic growth by 2019 • 200 % Global Broadband speeds by 2019 • 75% of internet traffic will be video by 2019

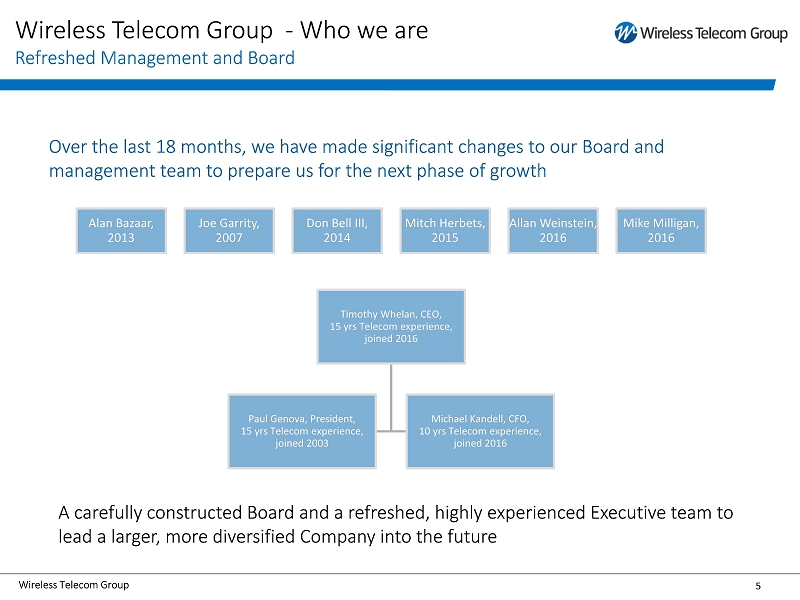

5 Wireless Telecom Group Wireless Telecom Group - Who we are Refreshed Management and Board Timothy Whelan, CEO, 15 yrs Telecom experience, joined 2016 Paul Genova, President, 15 yrs Telecom experience, joined 2003 Michael Kandell, CFO, 10 yrs Telecom experience, joined 2016 Alan Bazaar, 2013 Joe Garrity, 2007 Don Bell III, 2014 Mitch Herbets, 2015 Allan Weinstein, 2016 Mike Milligan, 2016 Over the last 18 months, we have made significant changes to our Board and management team to prepare us for the next phase of growth A carefully constructed Board and a refreshed, highly experienced Executive team to lead a larger, more diversified Company into the future

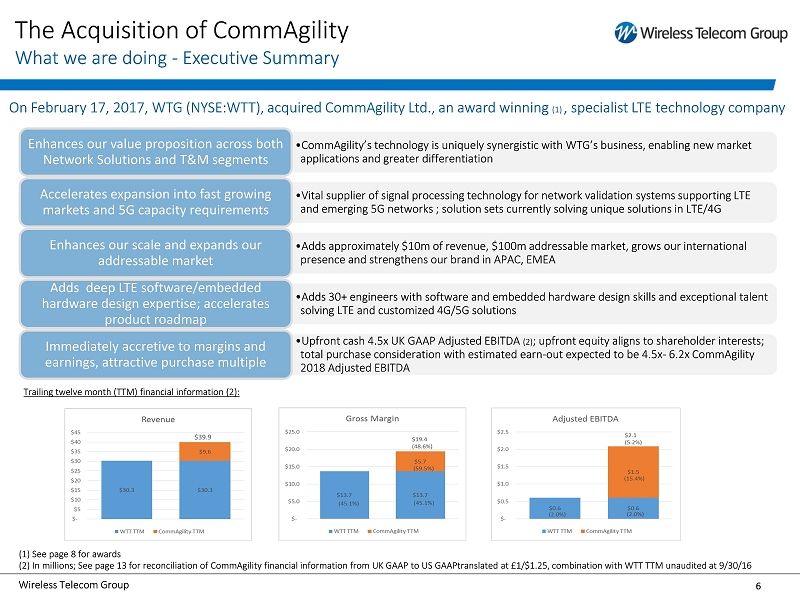

6 Wireless Telecom Group The Acquisition of CommAgility What we are doing - Executive Summary On February 17, 2017, WTG (NYSE:WTT), acquired CommAgility Ltd., an award winning (1) , specialist LTE technology company • CommAgility’s technology is uniquely synergistic with WTG’s business, enabling new market applications and greater differentiation Enhances our value proposition across both Network Solutions and T&M segments • Vital supplier of signal processing technology for network validation systems supporting LTE and emerging 5G networks ; solution sets currently solving unique solutions in LTE/4G Accelerates expansion into fast growing markets and 5G capacity requirements • Adds approximately $10m of revenue, $100m addressable market, grows our international presence and strengthens our brand in APAC, EMEA Enhances our scale and expands our addressable market • Adds 30+ engineers with software and embedded hardware design skills and exceptional talent solving LTE and customized 4G/5G solutions Adds deep LTE software/embedded hardware design expertise; accelerates product roadmap • Upfront cash 4.5x UK GAAP Adjusted EBITDA (2) ; upfront equity aligns to shareholder interests; total purchase consideration with estimated earn - out expected to be 4.5x - 6.2x CommAgility 2018 Adjusted EBITDA Immediately accretive to margins and earnings, attractive purchase multiple (1) See page 8 for awards (2) In millions; See page 13 for reconciliation of CommAgility financial information from UK GAAP to US GAAPtranslated at £1/$ 1.25, combination with WTT TTM unaudited at 9/30/16 Trailing twelve month (TTM) financial information (2):

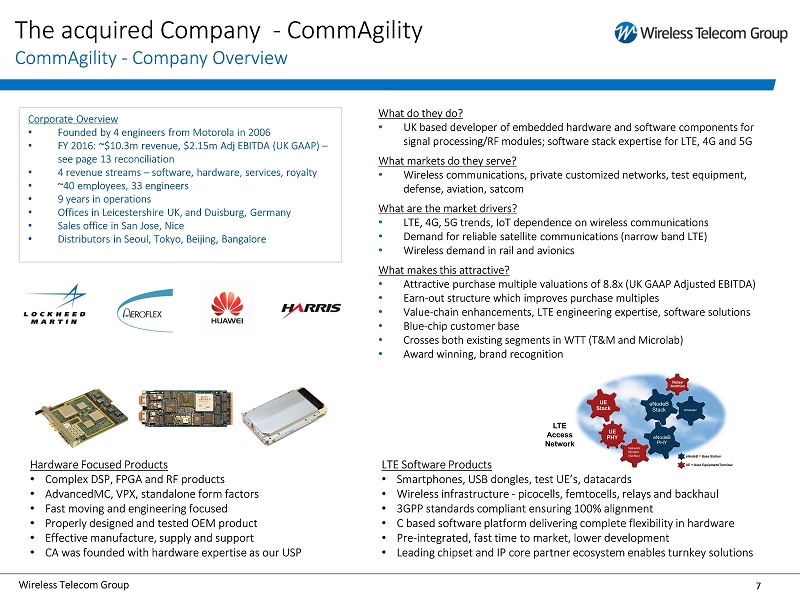

7 Wireless Telecom Group The acquired Company - CommAgility CommAgility - Company Overview What do they do? • UK based developer of embedded hardware and software components for signal processing/RF modules; software stack expertise for LTE, 4G and 5G What markets do they serve? • Wireless communications, private customized networks, test equipment, defense, aviation, satcom What are the market drivers? • LTE, 4G, 5G trends, IoT dependence on wireless communications • Demand for reliable satellite communications (narrow band LTE) • Wireless demand in rail and avionics What makes this attractive? • Attractive purchase multiple valuations of 8.8x (UK GAAP Adjusted EBITDA) • Earn - out structure which improves purchase multiples • Value - chain enhancements, LTE engineering expertise, software solutions • Blue - chip customer base • Crosses both existing segments in WTT (T&M and Microlab ) • Award winning, brand recognition Corporate Overview • Founded by 4 engineers from Motorola in 2006 • FY 2016: ~$10.3m revenue, $2.15m Adj EBITDA (UK GAAP) – see page 13 reconciliation • 4 revenue streams – software, hardware, services, royalty • ~40 employees, 33 engineers • 9 years in operations • Offices in Leicestershire UK, and Duisburg, Germany • Sales office in San Jose, Nice • Distributors in Seoul, Tokyo, Beijing, Bangalore Hardware Focused Products • Complex DSP, FPGA and RF products • AdvancedMC , VPX, standalone form factors • Fast moving and engineering focused • Properly designed and tested OEM product • Effective manufacture, supply and support • CA was founded with hardware expertise as our USP LTE Software Products • Smartphones, USB dongles, test UE’s, datacards • Wireless infrastructure - picocells , femtocells, relays and backhaul • 3GPP standards compliant ensuring 100% alignment • C based software platform delivering complete flexibility in hardware • Pre - integrated, fast time to market, lower development • Leading chipset and IP core partner ecosystem enables turnkey solutions

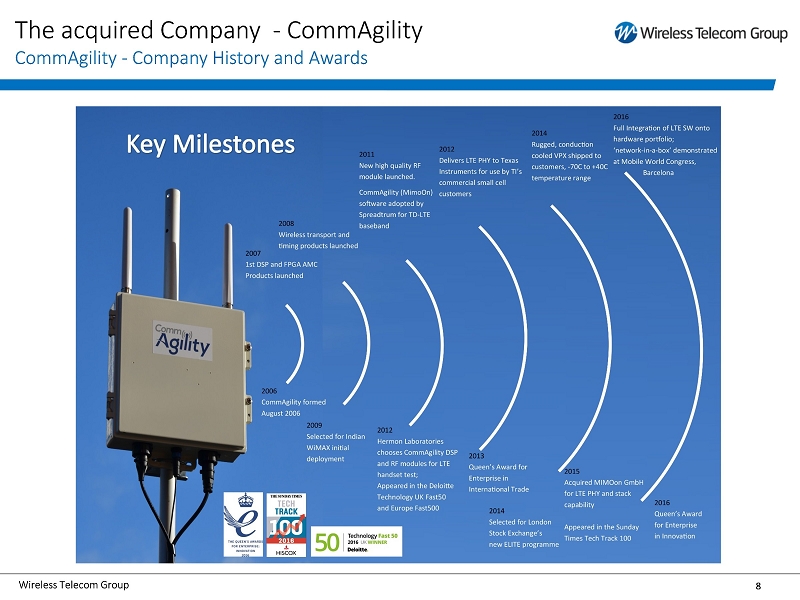

8 Wireless Telecom Group The acquired Company - CommAgility CommAgility - Company History and Awards

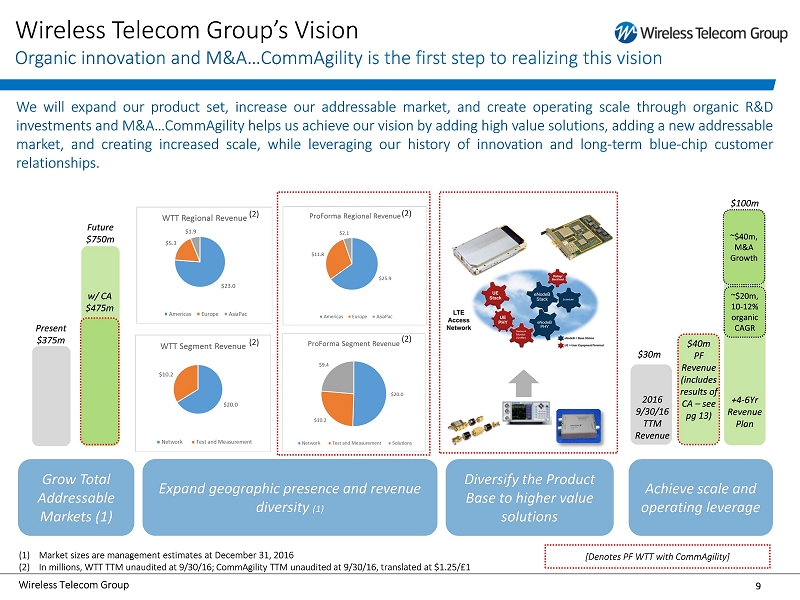

9 Wireless Telecom Group Wireless Telecom Group’s Vision Organic innovation and M&A…CommAgility is the first step to realizing this vision We will expand our product set, increase our addressable market, and create operating scale through organic R&D investments and M&A … CommAgility helps us achieve our vision by adding high value solutions, adding a new addressable market, and creating increased scale, while leveraging our history of innovation and long - term blue - chip customer relationships . Grow Total Addressable Markets (1) Expand geographic presence and revenue diversity (1) Diversify the Product Base to higher value solutions Achieve scale and operating leverage $30m $100m $40m PF Revenue (includes results of CA – see pg 13) Present $375m Future $750m w/ CA $475m [Denotes PF WTT with CommAgility] +4 - 6Yr Revenue Plan 2016 9/30/16 TTM Revenue (1) Market sizes are management estimates at December 31, 2016 (2) In millions, WTT TTM unaudited at 9/30/16; CommAgility TTM unaudited at 9/30/16, translated at $1.25/£1 ~$20m, 10 - 12% organic CAGR ~$40m, M&A Growth (2) (2) (2) (2)

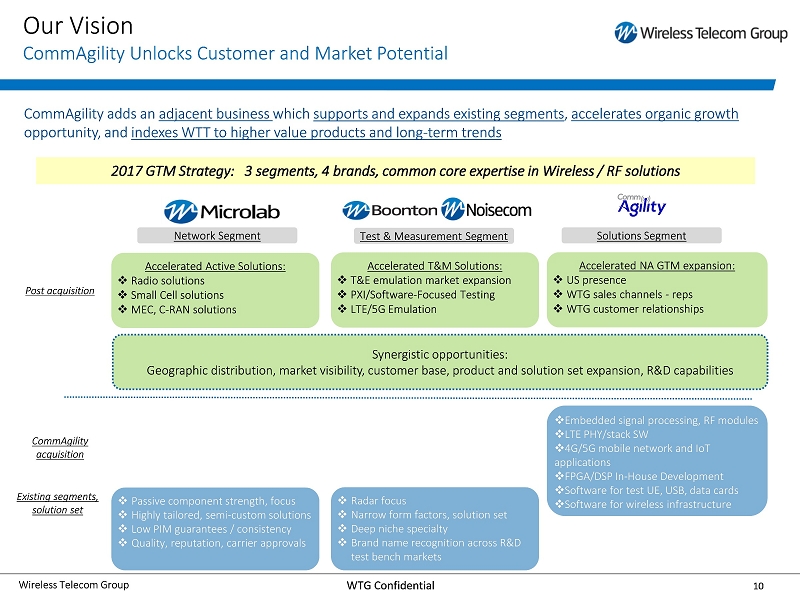

10 Wireless Telecom Group WTG Confidential CommAgility adds an adjacent business which supports and expands existing segments , accelerates organic growth opportunity, and indexes WTT to higher value products and long - term trends □ Embedded signal processing, RF modules □ LTE PHY/stack SW □ 4G/5G mobile network and IoT applications □ FPGA/DSP In - House Development □ Software for test UE, USB, data cards □ Software for wireless infrastructure □ Radar focus □ Narrow form factors, solution set □ Deep niche specialty □ Brand name recognition across R&D test bench markets Network Segment Test & Measurement Segment Solutions Segment □ Passive component strength, focus □ Highly tailored, semi - custom solutions □ Low PIM guarantees / consistency □ Quality , reputation, carrier approvals Existing segments, solution set Post acquisition 2017 GTM Strategy: 3 segments, 4 brands, common core expertise in Wireless / RF solutions Accelerated Active Solutions: □ Radio solutions □ Small Cell solutions □ MEC, C - RAN solutions Accelerated T&M Solutions: □ T&E emulation market expansion □ PXI/Software - Focused Testing □ LTE / 5G Emulation Accelerated NA GTM expansion: □ US presence □ WTG sales channels - reps □ WTG customer relationships CommAgility acquisition Our Vision CommAgility Unlocks Customer and Market Potential Synergistic opportunities: G eographic distribution, market visibility, customer base, product and solution set expansion, R&D capabilities

11 Wireless Telecom Group Appendix

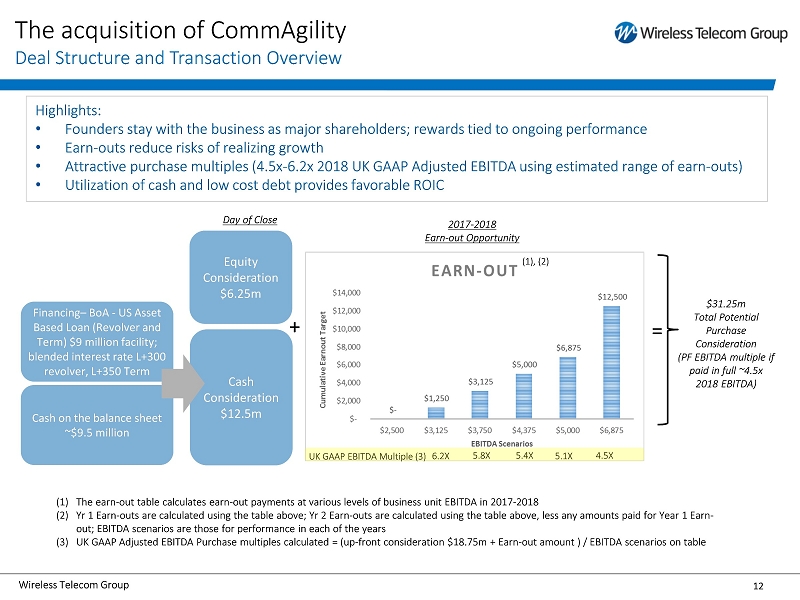

12 Wireless Telecom Group The acquisition of CommAgility Deal Structure and Transaction Overview Day of Close 2017 - 2018 Earn - out Opportunity $31.25m Total Potential Purchase Consideration (PF EBITDA multiple if paid in full ~4.5x 2018 EBITDA) Highlights: • Founders stay with the business as major shareholders; rewards tied to ongoing performance • Earn - outs reduce risks of realizing growth • Attractive purchase multiples (4.5x - 6.2x 2018 UK GAAP Adjusted EBITDA using estimated range of earn - outs) • Utilization of cash and low cost debt provides favorable ROIC Equity Consideration $6.25m Financing – BoA - US Asset Based Loan (Revolver and Term) $9 million facility; blended interest rate L+300 revolver, L+350 Term Cash Consideration $12.5m + = Cash on the balance sheet ~$9.5 million (1) The earn - out table calculates earn - out payments at various levels of business unit EBITDA in 2017 - 2018 (2) Yr 1 Earn - outs are calculated using the table above; Yr 2 Earn - outs are calculated using the table above, less any amounts paid for Year 1 Earn - out; EBITDA scenarios are those for performance in each of the years (3) UK GAAP Adjusted EBITDA Purchase multiples calculated = (up - front consideration $18.75m + Earn - out amount ) / EBITDA scenarios o n table (1), (2) 6.2X 5.4X 5.1X 4.5X 5.8X UK GAAP EBITDA Multiple (3)

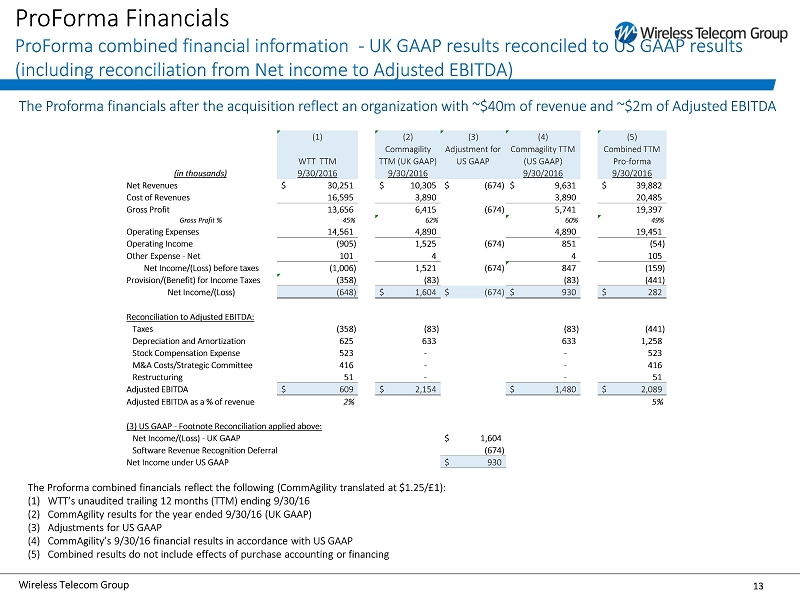

13 Wireless Telecom Group ProForma Financials ProForma combined financial information - UK GAAP results reconciled to US GAAP results (including reconciliation from Net income to Adjusted EBITDA) The Proforma combined financials reflect the following (CommAgility translated at $1.25/£1): (1) WTT’s unaudited trailing 12 months (TTM) ending 9/30/16 (2) CommAgility results for the year ended 9/30/16 (UK GAAP) (3) Adjustments for US GAAP (4) CommAgility’s 9/30/16 financial results in accordance with US GAAP (5) Combined results do not include effects of purchase accounting or financing The Proforma financials after the acquisition reflect an organization with ~$40m of revenue and ~$2m of Adjusted EBITDA (1) (2) (3) (4) (5) WTT TTM Commagility TTM (UK GAAP) Adjustment for US GAAP Commagility TTM (US GAAP) Combined TTM Pro-forma (in thousands) 9/30/2016 9/30/2016 9/30/2016 9/30/2016 Net Revenues 30,251$ 10,305$ (674)$ 9,631$ 39,882$ Cost of Revenues 16,595 3,890 3,890 20,485 Gross Profit 13,656 6,415 (674) 5,741 19,397 Gross Profit % 45% 62% 60% 49% Operating Expenses 14,561 4,890 4,890 19,451 Operating Income (905) 1,525 (674) 851 (54) Other Expense - Net 101 4 4 105 Net Income/(Loss) before taxes (1,006) 1,521 (674) 847 (159) Provision/(Benefit) for Income Taxes (358) (83) (83) (441) Net Income/(Loss) (648) 1,604$ (674)$ 930$ 282$ Reconciliation to Adjusted EBITDA: Taxes (358) (83) (83) (441) Depreciation and Amortization 625 633 633 1,258 Stock Compensation Expense 523 - - 523 M&A Costs/Strategic Committee 416 - - 416 Restructuring 51 - - 51 Adjusted EBITDA 609$ 2,154$ 1,480$ 2,089$ Adjusted EBITDA as a % of revenue 2% 5% (3) US GAAP - Footnote Reconciliation applied above: Net Income/(Loss) - UK GAAP 1,604$ Software Revenue Recognition Deferral (674) Net Income under US GAAP 930$