Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - China Health Industries Holdings, Inc. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - China Health Industries Holdings, Inc. | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - China Health Industries Holdings, Inc. | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the quarterly period ended December 31, 2016

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from ____________ to ____________

Commission File Number: 000-51060

CHINA HEALTH INDUSTRIES HOLDINGS,

INC.

(Exact name of registrant as specified in its

charter)

| Delaware | 86-0827216 |

| (State or other jurisdiction of | (IRS Employer |

| incorporation or organization) | Identification No.) |

168 Binbei Street, Songbei District

Harbin City,

Heilongjiang Province

People’s Republic of China 150028

(Address of principal executive offices) (Zip Code)

86-451-88100688

(Issuer's telephone number,

including area code)

Not Applicable

(Former name, former address and

former fiscal year, if changed since last report)

Indicate by check mark whether the issuer (1) filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| ( Do not check if a smaller reporting company ) |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

APPLICABLE ONLY TO CORPORATE ISSUERS:

As of February 8, 2017, there were 65,539,737 shares of common stock, $0.0001 par value, issued and outstanding.

TABLE OF CONTENTS

| Page | ||

| PART I | FINANCIAL INFORMATION |

4 |

| Item 1. | Financial Statements (Unaudited) | 4 |

| Condensed Consolidated Balance Sheets As of December 31, 2016 and June 30, 2016 (Unaudited) |

4 | |

|

Condensed Consolidated Statements of Operations and Comprehensive Income For the Three and Six Months Ended December 31, 2016 and 2015 (Unaudited) |

5 | |

|

Condensed Consolidated Statements of Cash Flows For the Six Months Ended December 31, 2016 and 2015 (Unaudited) |

6 | |

|

Notes to Condensed Consolidated Financial Statements As of December 31, 2016 (Unaudited) |

7 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 27 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 36 |

| Item 4. | Controls and Procedures | 36 |

| PART II | OTHER INFORMATION | 38 |

| Item 6. | Exhibits | 38 |

| Signatures | 38 | |

| Exhibits/Certifications | 39 | |

PART I - FINANCIAL INFORMATION

| Item 1. | Financial Statements |

| CHINA HEALTH INDUSTRIES HOLDINGS, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (UNAUDITED) |

|

|

December 31, | June 30, | ||||

|

|

2016 | 2016 | ||||

|

ASSETS |

||||||

|

|

||||||

|

Current assets |

||||||

|

Cash and cash equivalents |

$ | 20,275,994 | $ | 29,783,152 | ||

|

Short term investment |

8,641,797 | - | ||||

|

Interest receivable |

432,090 | - | ||||

|

Accounts receivable, net |

1,673,667 | 1,145,131 | ||||

|

Inventory |

490,870 | 414,784 | ||||

|

Other receivables, net |

44,908 | 35,484 | ||||

|

Advance to suppliers |

390,698 | 154,430 | ||||

|

Current assets held for discontinued operation |

- | 14,339 | ||||

|

Total current assets |

31,950,024 | 31,547,320 | ||||

|

|

||||||

|

Property, plant and equipment, net |

3,545,606 | 3,866,765 | ||||

|

Intangible assets, net |

3,788,757 | 4,191,059 | ||||

|

Construction in progress |

654,778 | 670,051 | ||||

|

Other assets held for discontinued operation |

- | 3,602 | ||||

|

Total assets |

$ | 39,939,165 | $ | 40,278,797 | ||

|

|

||||||

|

LIABILITIES AND EQUITY |

||||||

|

|

||||||

|

Current liabilities |

||||||

|

Short-term loans |

$ | 1,440,300 | $ | 1,504,687 | ||

|

Accounts payable and accrued expenses |

442,041 | 487,172 | ||||

|

Other payables |

51,921 | 37,036 | ||||

|

Advance from customers |

173,349 | 164,122 | ||||

|

Related party debts |

3,004,109 | 2,713,406 | ||||

|

Wages payable |

237,932 | 173,004 | ||||

|

Taxes payable |

749,400 | 467,674 | ||||

|

Current liabilities held for discontinued operation |

- | 482,013 | ||||

|

Total current liabilities |

6,099,052 | 6,029,114 | ||||

|

|

||||||

|

Equity |

||||||

|

Common stock, ($0.0001 par value, 300,000,000 shares authorized, 65,539,737 and 65,839,737 issued and outstanding as of December 31, 2016 and June 30, 2016, respectively) |

6,554 | 6,554 | ||||

|

Additional paid-in capital |

521,987 | 521,987 | ||||

|

Accumulated other comprehensive income |

(919,083 | ) | 784,045 | |||

|

Statutory reserve |

38,679 | 38,679 | ||||

|

Retained earnings |

34,191,976 | 32,898,244 | ||||

|

Total stockholders' equity |

33,840,113 | 34,249,509 | ||||

|

Non-controlling interests |

- | 174 | ||||

|

Total equity |

33,840,113 | 34,249,683 | ||||

|

|

||||||

|

Total liabilities and equity |

$ | 39,939,165 | $ | 40,278,797 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

| CHINA HEALTH INDUSTRIES HOLDINGS, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND |

| COMPREHENSIVE INCOME (LOSS) |

| (UNAUDITED) |

| For the Three Months Ended | For the Six Months Ended | |||||||||||

| December | December | |||||||||||

| December 31, 2016 | December 31, 2015 | 31, 2016 | 31, 2015 | |||||||||

|

|

||||||||||||

|

REVENUE |

$ | 1,891,496 | $ | 2,725,651 | $ | 3,071,664 | $ | 4,681,719 | ||||

|

|

||||||||||||

|

COST OF GOODS SOLD |

1,179,037 | 2,000,198 | 1,934,322 | 3,419,162 | ||||||||

|

|

||||||||||||

|

GROSS PROFIT |

712,459 | 725,453 | 1,137,342 | 1,262,557 | ||||||||

|

|

||||||||||||

|

OPERATING EXPENSES |

||||||||||||

|

Selling, general and administrative expenses |

327,091 | 651,141 | 757,355 | 1,000,020 | ||||||||

|

Depreciation and amortization expenses |

243,459 | 150,069 | 392,334 | 332,030 | ||||||||

|

Total operating expenses |

570,550 | 801,210 | 1,149,689 | 1,332,050 | ||||||||

|

|

||||||||||||

|

INCOME (LOSS) FROM OPERATIONS |

141,909 | (75,757 | ) | (12,347 | ) | (69,493 | ) | |||||

|

|

||||||||||||

|

OTHER INCOME/(EXPENSES) |

||||||||||||

|

Interest income |

17,579 | 17,417 | 37,488 | 35,524 | ||||||||

|

Interest expense |

(21,051 | ) | (26,855 | ) | (42,737 | ) | (58,479 | ) | ||||

|

Investment income |

219,635 | - | 444,728 | - | ||||||||

|

Other income/(expenses), net |

194,369 | 11,856 | 203,362 | 21,375 | ||||||||

|

Bank charges |

(702 | ) | - | (702 | ) | - | ||||||

|

Gain on disposal of subsidiary |

1,157,590 | - | 1,157,590 | - | ||||||||

|

Total other income (expenses), net |

1,567,420 | 2,418 | 1,799,729 | (1,580 | ) | |||||||

|

|

||||||||||||

|

INCOME/(LOSS) BEFORE INCOME TAXES |

1,709,329 | (73,339 | ) | 1,787,382 | (71,073 | ) | ||||||

|

|

||||||||||||

|

Provision for income taxes |

439,620 | 38,477 | 493,650 | 70,883 | ||||||||

|

|

||||||||||||

|

NET INCOME (LOSS) FROM CONTINUING OPERATIONS |

1,269,709 | (111,816 | ) | 1,293,732 | (141,956 | ) | ||||||

|

|

||||||||||||

|

NET LOSS FROM DISCONTINUED OPERATIONS |

- | (193 | ) | - | (389 | ) | ||||||

|

|

||||||||||||

|

NET INCOME (LOSS) |

1,269,709 | (112,009 | ) | 1,293,732 | (142,345 | ) | ||||||

|

Less: net loss attributable to non-controlling interests |

- | (2 | ) | - | (4 | ) | ||||||

|

NET INCOME (LOSS) ATTRIBUTABLE TO CHINA HEALTH INDUSTRIES HOLDINGS |

1,269,709 | (112,007 | ) | 1,293,732 | (142,341 | ) | ||||||

|

|

||||||||||||

|

NET INCOME (LOSS) FROM CONTINUING OPERATIONS |

1,269,709 | (111,816 | ) | 1,293,732 | (141,956 | ) | ||||||

|

|

||||||||||||

|

NET LOSS FROM DISCONTINUED OPERATIONS |

- | (193 | ) | - | (389 | ) | ||||||

|

|

||||||||||||

|

OTHER COMPREHENSIVE LOSS |

||||||||||||

|

Foreign currency translation loss |

(803,510 | ) | (675,918 | ) | (921,221 | ) | (1,575,396 | ) | ||||

|

|

||||||||||||

|

COMPREHENSIVE INCOME (LOSS) |

466,199 | (787,927 | ) | 372,511 | (1,717,741 | ) | ||||||

|

Less: comprehensive loss attributable to non-controlling interests |

8 | 6 | 8 | 13 | ||||||||

|

COMPREHENSIVE LOSS ATTRIBUTABLE TO CHINA HEALTH INDUSTRIES HOLDINGS |

$ | 466,207 | $ | (787,921 | ) | $ | 372,519 | $ | (1,717,728 | ) | ||

|

Net income (loss) attributable to China Health Industries Holdings' shareholders per share are: |

||||||||||||

|

Basic & diluted income (loss) per share |

$ | 0.0193 | $ | (0.0017 | ) | $ | 0.0197 | $ | (0.0022 | ) | ||

|

Weighted average shares outstanding: |

||||||||||||

|

Basic & diluted weighted average shares outstanding |

65,784,302 | 65,539,737 | 65,812,020 | 65,539,737 | ||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

| CHINA HEALTH INDUSTRIES HOLDINGS, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (UNAUDITED) |

|

|

For the Six Months Ended | |||||

|

|

December 31, | December 31, | ||||

|

|

2016 | 2015 | ||||

|

Cash Flows from Operating Activities |

||||||

|

Net income (loss) available to China Health Industries Holdings |

$ | 1,293,732 | $ | (142,341 | ) | |

|

Net loss from discontinued operations |

- | 389 | ||||

|

Net income (loss) from continuing operations |

1,293,732 | (141,952 | ) | |||

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

||||||

|

Depreciation and amortization expenses |

520,038 | 432,571 | ||||

|

Provision for doubtful accounts |

- | 761 | ||||

|

Non-controlling interests |

- | (4 | ) | |||

|

Short term investment income |

(444,728 | ) | - | |||

|

Share-based compensation |

- | 112,500 | ||||

|

Gain on disposal of subsidiaries |

(1,157,590 | ) | - | |||

|

Changes in operating assets and liabilities, |

||||||

|

Accounts receivable |

(528,536 | ) | (555,145 | ) | ||

|

Other receivables |

221,024 | (2,125 | ) | |||

|

Inventory |

(76,086 | ) | 109,962 | |||

|

Advance to suppliers and prepaid expenses |

(236,268 | ) | (20,858 | ) | ||

|

Interest receivable |

(432,090 | ) | - | |||

|

Accounts payables and accrued expenses |

(45,131 | ) | 17,696 | |||

|

Advance from customers and other payables |

(457,388 | ) | (5,222 | ) | ||

|

Amounts due to related parties |

194,096 | - | ||||

|

Wages payable |

64,928 | 45,376 | ||||

|

Taxes payable |

281,726 | 121,903 | ||||

|

Net cash (used in)/provided by operating activities from continuing operations |

(802,273 | ) | 115,463 | |||

|

Net cash (used in)/provided by operating activities from discontinued operations |

17,254 | - | ||||

|

Net cash provided by operating activities |

(785,019 | ) | 115,463 | |||

|

|

||||||

|

Cash Flows from Investing Activities |

||||||

|

Expenditure in short term investment |

(8,197,069 | ) | - | |||

|

Notes receivable |

- | (14,284 | ) | |||

|

Purchases of property, plant and equipment |

- | (4,997 | ) | |||

|

Expenditure in construction in progress |

(13,399 | ) | (49,971 | ) | ||

|

Proceeds from disposal of subsidiaries |

921,792 | - | ||||

|

Net cash used in investing activities from continuing operations |

(7,288,676 | ) | (69,252 | ) | ||

|

Net cash used in investing activities from discontinued operations |

- | - | ||||

|

Net cash used in investing activities |

(7,288,676 | ) | (69,252 | ) | ||

|

|

||||||

|

Cash Flows from Financing Activities |

||||||

|

Proceeds from related party debts |

85,085 | 55,155 | ||||

|

Payment of short term loans |

(64,387 | ) | (45,700 | ) | ||

|

Net cash provided by financing activities from continuing operations |

20,698 | 9,455 | ||||

|

Net cash provided by financing activities from discontinued operations |

- | - | ||||

|

Net cash provided by financing activities |

20,698 | 9,455 | ||||

|

|

||||||

|

Effect of exchange rate changes on cash and cash equivalents from continuing operations |

(1,436,907 | ) | (906,514 | ) | ||

|

Effect of exchange rate changes on cash and cash equivalents from discontinued operations |

(25,832 | ) | (395 | ) | ||

|

|

||||||

|

Net decrease in cash and cash equivalents from continuing operations |

(9,507,158 | ) | (850,848 | ) | ||

|

Net decrease in cash and cash equivalents from discontinued operations |

(8,578 | ) | (395 | ) | ||

|

|

||||||

|

Cash and cash equivalents, beginning balance from continuing operations |

29,783,152 | 21,113,832 | ||||

|

Cash and cash equivalents, beginning balance from discontinued operations |

8,578 | 9,195 | ||||

|

|

||||||

|

Cash and cash equivalents, ending balance from continuing operations |

$ | 20,275,994 | $ | 20,262,984 | ||

|

Cash and cash equivalents, ending balance from discontinued operations |

$ | - | $ | 8,800 | ||

|

|

||||||

|

Supplemental cash flow information |

||||||

|

Cash paid for income taxes |

$ | 42,999 | $ | 58,479 | ||

|

Cash paid for interest expense |

$ | 650,264 | $ | 346,183 | ||

|

|

||||||

|

Non-cash activities: |

||||||

|

Loan from related party for the construction of a facility |

$ | 452,141 | $ | 480,633 | ||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

| CHINA HEALTH INDUSTRIES HOLDINGS, INC. AND SUBSIDIARIES |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

Note 1 - ORGANIZATION AND BUSINESS BACKGROUND

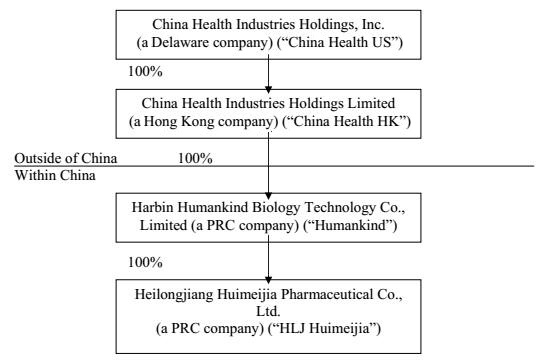

China Health Industries Holdings, Inc. (“China Health US”) was incorporated in the State of Arizona on July 11, 1996 and was the successor of the business known as Arizona Mist, Inc. which began in 1989. On May 9, 2005, it entered into a Stock Purchase Agreement and Share Exchange (effecting a reverse merger) with Edmonds 6, Inc. (“Edmonds 6”), a Delaware corporation, and changed its name to Universal Fog, Inc. Pursuant to this agreement, Universal Fog, Inc. (which has been in continuous operation since 1996) became a wholly-owned subsidiary of Edmonds 6.

China Health Industries Holdings Limited (“China Health HK”) was incorporated on July 20, 2007 in Hong Kong under the Companies Ordinance as a limited liability company. China Health HK was formed for the purpose of seeking and consummating a merger or acquisition with a business entity organized as a private corporation, partnership, or sole proprietorship as defined by Financial Accounting Standards Board (“FASB”) ACS Topic 915 (“Development Stage Entities”).

Harbin Humankind Biology Technology Co., Limited (“Humankind”) was incorporated in Harbin City, Heilongjiang Province, the People’s Republic of China (the “PRC”) on December 14, 2003, as a limited liability company under the Company Law of the PRC. Humankind is engaged in the manufacturing and sale of health products.

On August 20, 2007, the sole shareholder of China Health HK entered into a share purchase agreement (the “Share Purchase Agreement”) with the owners of Humankind. Pursuant to the Share Purchase Agreement, China Health HK purchased 100% of the equity interests in Humankind for a cash consideration of $60,408 (the “Share Purchase”). Subsequent to the completion of the Share Purchase, Humankind became a wholly-owned subsidiary of China Health HK. Since the owner of Humankind owned a majority of the outstanding shares of China Health HK’s common stock immediately following the execution of the Share Purchase Agreement, it was deemed to be the acquirer in the reverse merger and the Share Purchase was accounted for as a “reverse merger.” Consequently, the assets and liabilities and the historical operations that have been reflected in the financial statements for periods prior to the Share Purchase are those of Humankind and have been recorded at the historical cost basis. After completion of the Share Purchase, China Health HK’s consolidated financial statements include the assets and liabilities of both China Health HK and Humankind, the historical operations of Humankind, and the operations of China Health HK and its subsidiaries from the closing date of the Share Purchase.

On October 14, 2008, Humankind set up a 99% owned subsidiary, Harbin Huimeijia Medicine Company (“Huimeijia”), with its primary business being manufacturing and distributing medicine. Mr. Xin Sun, the majority owner of China Health US, owned 1% of Huimeijia. Huimeijia is consolidated in the consolidated financial statements of China Health HK.

On December 31, 2008, China Health HK entered into a reverse merger with Universal Fog, Inc., a U.S. publicly traded shell company (the “Transaction”). China Health HK was the acquirer in the Transaction, and the Transaction has been treated as a recapitalization of China Health US. After the Transaction and a 20:1 reverse stock split, Mr. Xin Sun owned 61,203,088 shares of common stock, representing 98.3% of the 62,234,737 total outstanding shares of common stock of China Health US. On April 7, 2009, Mr. Sun transferred 28,200,000 shares of common stock to 296 individuals, leaving him with 33,003,088 shares of common stock of China Health US, or approximately 53.03% of the total outstanding shares of common stock. Universal Fog, Inc. changed its name to China Health Industries Holdings, Inc. on February 19, 2009.

On November 22, 2013, Humankind completed the acquisition of Heilongjiang Huimeijia Pharmaceutical Co., Ltd. (“HLJ Huimeijia”) for a total purchase price of $16,339,869 (RMB100,000,000). HLJ Huimeijia was founded on October 30, 2003, and is engaged in the manufacturing and distribution of tincture, ointments, rubber paste (including hormones), topical solution, suppositories, liniment (including traditional Chinese medicine extractions), enemas and oral liquids. HLJ Huimeijia’s predecessor is Heilongjiang Xue Du Pharmaceutical Co., Ltd., which has established its brand name in the market through its supply of high quality medical products. HLJ Huimeijia is categorized as a “high and new technology” enterprise by the Science Technology Department in Heilongjiang Province. HLJ Huimeijia has 21 products which have been approved by, and have received approval numbers issued by, the China State Food and Drug Administration (the “CFDA”). In addition, HLJ Huimeijia is the holder of one patent for utility models, five patents for external design and three trademarks in China, including the Chinese brand name of “Xue Du” which has an established reputation among customers in northeastern China.

7

On December 24, 2014, Humankind entered into a Stock Transfer Agreement (the “Original Agreement”) with Xiuzheng Pharmaceutical Group Co., Ltd. a company incorporated under the laws of the PRC and located in Jilin province (“Xiuzheng Pharmacy” or the “Buyer”), Mr. Xin Sun, the CEO of the Company, and Huimeijia, a 99% owned subsidiary of Humankind and 1% owned by Mr. Xin Sun, pursuant to which, Humankind and Mr. Xin Sun (the “Equity Holders”), would sell their respective equity interests in Huimeijia, to Xiuzheng Pharmacy. On February 9, 2015, the four parties entered into a supplementary agreement (the “Supplementary Agreement”) to modify the terms of the Original Agreement, pursuant to which, the Equity Holders and Huimeijia (collectively the “Assets Transferors”) would only sell the 19 drug approval numbers (the “Assets”) to Xiuzheng Pharmacy. The Equity Holders would have retained their equity interests in Huimeijia, but would have pledged such equity interests to Xiuzheng Pharmacy until the Assets were transferred. On October 12, 2016, the four parties agreed to rescind the Supplementary Agreement and entered into a new supplementary agreement, pursuant to which, the four parties agreed to execute the transfer of the equity interests based on the Original Agreement, and according to which the Equity Holders sold their respective equity interests in Huimeijia to Xiuzheng Pharmacy for a total cash consideration of RMB 8,000,000 (approximately $1,306,186, the “Purchase Price”) to the Equity Holders. As of the date of this report, 80% of the Purchase Price was paid,Huimeijia has completed the changes in business registration, and Xiuzheng Pharmacy obtained a newly issued document business license issued by the local State Administration of Industry and Commerce in Harbin (“Harbin SAIC”) to Huimeijia in which the ownership of Huimeijia has now been recorded as being held by Xiuzheng Pharmacy with Harbin SAIC, and the legal representative (a person that is authorized to take most of the corporate actions on behalf of a company under the corporate laws in China) of Huimeijia has now been appointed by the Buyer. The transfer of all the Assets to the Buyer and the remainder of the Purchase Price to the Equity Holders are pending (See Note 3). The gain on the disposal of Huimeijia was $1,157,590.

China Health US, China Health HK, Humankind, Huimeijia and HLJ Huimeijia are collectively referred herein to as the “Company.”

As of December 31, 2016, the Company’s corporate structure was as follows:

8

Note 2 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

This summary of significant accounting policies of the Company is presented to assist in understanding the Company’s financial statements. The financial statements and notes are representations of the Company’s management, which is responsible for their integrity and objectivity. These accounting policies conform to generally accepted accounting principles in the United States ("US GAAP") and have been consistently applied in the preparation of the unaudited condensed consolidated financial statements.

The accompanying unaudited condensed consolidated financial statements have been prepared by Company without audit pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”). Certain information and disclosures normally included in financial statements prepared in accordance with US GAAP have been condensed or omitted as allowed by such rules and regulations, and management believes that the disclosures are adequate to make the information presented not misleading. These unaudited condensed consolidated financial statements should be read in conjunction with the audited financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended June 30, 2016. These unaudited condensed consolidated financial statements include all adjustments, which in the opinion of management are necessary to a fair presentation of financial position and results of operations. All such adjustments are of a normal and recurring nature. The results of operations for the six months ended December 31, 2016 may not be indicative of results that may be expected for the year ended June 30, 2017.

Principles of Consolidation

The accompanying unaudited condensed consolidated financial statements include China Health US and its four subsidiary companies, including China Health HK, Humankind, Huimeijia, and HLJ Huimeijia. All significant intercompany balances and transactions have been eliminated in consolidation and combination.

On November 22, 2013, China Health US, through its wholly owned subsidiary Humankind, completed the acquisition of HLJ Huimeijia. HLJ Huimeijia and Humankind are under the common control of Mr. Xin Sun, the CEO of China Health US, before and after the date of transfer. Humankind’s accounting policy adopted the guidance in ASC 805-50-05-5 for the transfer of net assets between entities under common control to apply a method similar to the pooling-of-interests method. Under this method, the financial statements of Humankind shall report results of operations for the period in which the transfer occurs as though the transfer of net assets had occurred at the beginning of the period. Results of operations for that period will thus comprise both those of the previously separate entities combined from the beginning of the period to the date the transfer is completed and those of the combined operations from that date to the end of the period. Similarly, Humankind shall present the statements of financial position and other financial information as of the beginning of the period as though the assets and liabilities had been transferred at that date. Financial statements and financial information of Humankind presented for prior years also shall be retrospectively adjusted to furnish comparative information.

Reclassifications

Certain prior year balances were reclassified to conform to the current period's presentation with consideration of reflecting Huimeijia business as discontinued operations. None of these reclassifications had an impact on reported financial position or cash flows for any of the periods presented.

9

Segment Reporting

FASB Accounting Standard Codification (“ASC”) Topic 280, “Segment Reporting,” established standards for reporting information about operating segments on a basis consistent with the Company's internal organizational structure as well as information about geographical areas, business segments and major customers in financial statements for details on the Company's business segments. The Company has three reportable operating segments: Humankind, HLJ Huimeijia and “Others”. The segments are grouped based on the types of products provided.

Fair Value of Financial Instruments

The provisions of accounting guidance, FASB ASC Topic 820 that applies to the Company requires all entities to disclose the fair value of financial instruments, both assets and liabilities recognized and not recognized on the balance sheets, for which it is practicable to estimate fair value, and defines fair value of a financial instrument as the amount at which the instrument could be exchanged in a current transaction between willing parties.

Fair Value Measurements

FASB ASC Topic 820, “Fair Value Measurements and Disclosures,” clarifies the definition of fair value for financial reporting, establishes a framework for measuring fair value and requires additional disclosures about the use of fair value measurements.

Various inputs are considered when determining the fair value of the Company’s debt. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in these securities. These inputs are summarized in the three broad levels listed below.

Level 1 –observable market inputs that are unadjusted quoted prices for identical assets or liabilities in active markets.

Level 2 –other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.).

Level 3 –significant unobservable inputs (including the Company’s own assumptions in determining the fair value of investments).

The carrying value of financial assets and liabilities recorded at fair value is measured on a recurring or nonrecurring basis. Financial assets and liabilities measured on a non-recurring basis are those that are adjusted to fair value when a significant event occurs. The Company had no financial assets or liabilities carried and measured on a nonrecurring basis during the reporting periods. Financial assets and liabilities measured on a recurring basis are those that are adjusted to fair value each time a financial statement is prepared. The Company had no financial assets or liabilities carried and measured on a recurring basis during the reporting periods.

The availability of inputs observable in the market varies from instrument to instrument and depends on a variety of factors including the type of instrument, whether the instrument is actively traded, and other characteristics particular to the transaction. For many financial instruments, pricing inputs are readily observable in the market, the valuation methodology used is widely accepted by market participants, and the valuation does not require significant management discretion. For other financial instruments, pricing inputs are less observable in the market and may require management judgment.

10

Translation of Foreign Currencies

Humankind, Huimeijia and HLJ Huimeijia maintain their books and accounting records in PRC currency “Renminbi” (“RMB”), which has been determined as the functional currency. Transactions denominated in currencies other than RMB are translated into RMB at the exchange rates prevailing on the date of the transactions, as quoted by the Federal Reserve Board. Foreign currency exchange gains and losses resulting from these transactions are included in operations.

Humankind, Huimeijia and HLJ Huimeijia’s financial statements are translated into the reporting currency, the United States Dollar (“USD”). Assets and liabilities of the above entities are translated at the prevailing exchange rate at each reporting period end date. Contributed capital accounts are translated using the historical rate of exchange when capital is injected. Income and expense accounts are translated at the average rate of exchange during the reporting period. Translation adjustments resulting from the translation of these financial statements are reflected as accumulated other comprehensive income in shareholders’ equity and non-controlling interests.

Statement of Cash Flows

In accordance with Statement FASB ASC Topic 230, “Statement of Cash Flows,” cash flow from the Company's operations is calculated based upon the local currencies and translated to the reporting currency using an average foreign exchange rate for the reporting period. As a result, amounts related to assets and liabilities reported in the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with US GAAP requires management to make estimates and judgments that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities on the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company bases its estimates and judgments on historical experience and on various other assumptions and information that are believed to be reasonable under the circumstances. Estimates and assumptions of future events and their effects cannot be perceived with certainty and, accordingly, these estimates may change as new events occur, as more experience is acquired, as additional information is obtained and as the Company’s operating environment changes. Significant estimates and assumptions by management include, among others; useful lives of long-lived assets and intangible assets, valuation of inventory, accounts receivable and notes receivable, impairment analysis of long-lived assets, construction in progress, intangible assets and deferred taxes. While the Company believes that the estimates and assumptions used in the preparation of the financial statements are appropriate, actual results could differ from those estimates. Estimates and assumptions are periodically reviewed and the effects of revisions are reflected in the financial statements in the period they are determined to be necessary.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, deposits in banks with maturities of three months or less, and all highly liquid investments which are unrestricted as to withdrawal or use, and which have original maturities of three months or less at the time of purchase.

As of December 31, 2016 and June 30, 2016, the Company’s uninsured bank balance was mainly maintained at financial institutions located in the PRC and Hong Kong. The uninsured bank balances of continuing operations were $20,275,994 and $29,783,152 as of December 31, 2016 and June 30, 2016, respectively. The uninsured bank balances of discontinued operations were $0 and $8,578 as of December 31, 2016 and June 30, 2016, respectively. The Company has no insured bank balance as of December 31, 2016 and June 30, 2016, respectively.

Short-term investments, held-to-maturity investments

The Company’s held-to-maturity investments consist of financial products purchased from investment guarantee corporations. The Company’s short term held-to-maturity investments are classified as short-term investments on the consolidated balance sheets based on their contractual maturity dates which are less than one year and are stated at their amortized costs.

11

The Company reviews its investments for other-than-temporary impairment (“OTTI”) based on the specific identification method. The Company considers available quantitative and qualitative evidence in evaluating potential impairment of its investments. If the cost of an investment exceeds the investment’s fair value, the Company considers, among other factors, general market conditions, expected future performance of the investees, the duration and the extent to which the fair value of the investment is less than the cost, and the Company’s intent and ability to hold the investment. OTTI is recognized as a loss in the income statement.

Accounts Receivable

Accounts receivable are recorded at the invoiced amount and do not bear interest. The Company extends unsecured credit to its customers in the ordinary course of business but mitigates the associated risks by performing credit checks and actively pursuing past due accounts. An allowance for doubtful accounts is established and determined based on management’s assessment of known requirements, aging of receivables, payment and bad debt history, the customer’s current credit worthiness, changes in customer payment patterns and the economic environment. From November 1, 2013, the Company changed its credit policy by offering ninety (90) day payment terms for sales agents, whereas the payment terms for sales agents before November 1, 2013 were thirty (30) day. As of December 31, 2016 and June 30, 2016, the balances of accounts receivable from the continuing operations of the Company, were $1,673,667 and $1,145,131, respectively. As of December 31, 2016 and June 30, 2016, the balances of accounts receivable from discontinued operations, were both nil. The Company determines the allowance based on aging data, historical collection experience, customer specific facts and economic conditions. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company evaluated the nature of all accounts receivable then provided allowance for doubtful accounts. The Company has determined that an allowance of $48,705 and $52,129 from the continuing operations of the Company was appropriate as of December 31, 2016 and June 30, 2016, respectively. The Company has determined that an allowance of nil from discontinued operations was appropriate as of December 31, 2016 and June 30, 2016.

Advance to Suppliers

The Company periodically makes advances to certain vendors for purchases of raw materials, or service providers for services relating to construction plans for its plant, equipment and production lines for the GMP upgrading, and records these payments as advance to suppliers. As of December 31, 2016 and June 30, 2016, advance to suppliers, held for continuing operations, amounted to $390,698 and $154,430, respectively. As of December 31, 2016 and June 30, 2016, advance to suppliers, held for discontinued operations, amounted to $0 and $558, respectively.

Inventory

Inventory consists of raw materials, work in progress and finished goods of manufactured products.

Inventory is stated at lower of cost or market and consists of materials, labor and overhead. HLJ Huimeijia uses the weighted average method for inventory valuation. The other entities of the Company use the first-in, first-out (“FIFO”) method for inventory valuation. Overhead costs included in finished goods include direct labor cost and other costs directly applicable to the manufacturing process. The Company evaluates inventory for excess, slow moving, and obsolete inventory as well as inventory the value of which is in excess of its net realizable value. This evaluation includes analysis of sales levels by product and projections of future demand. If future demand or market conditions are less favorable than the Company’s projections, a write-down of inventory may be required, and would be reflected in cost of goods sold in the period the revision is made. There was no inventory allowance, held for continuing operations and discontinued operations, provided for the six months ended December 31, 2016 and 2015, respectively.

12

Impairment of Long-Lived Assets

The Company’s long-lived assets and other assets are reviewed for impairment in accordance with the guidance of the FASB ASC Topic 360-10, “Property, Plant, and Equipment,” and FASB ASC Topic 205, “Presentation of Financial Statements.” The Company tests for impairment losses on long-lived assets used in operations whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. Recoverability of an asset to be held and used is measured by a comparison of the carrying amount of the asset to the future undiscounted cash flows expected to be generated by the asset. If such asset is considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds its fair value. Impairment evaluations involve management’s estimates on asset useful lives and future cash flows. Actual useful lives and cash flows could be different from those estimated by management which could have a material effect on the Company’s reporting results and financial position. Fair value is determined through various valuation techniques including discounted cash flow models, quoted market values and third-party independent appraisals, as considered necessary. As of December 31, 2016 and June 30, 2016, the Company had not experienced impairment losses on its long-lived assets for both the continuing and discontinued operations. However, there can be no assurances that demand for the Company’s products or services will continue, which could result in an impairment of long-lived assets in the future.

Property, Plant and Equipment

Property, plant and equipment are carried at the lower of cost or fair value. Maintenance, repairs and minor renewals are expensed as incurred, major renewals and improvements that extend the lives or increase the capacity of plant assets are capitalized.

When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in the results of operations in the reporting period of disposition.

Depreciation is calculated on a straight-line basis over the estimated useful life of the assets. The depreciable lives applied are:

| Building, Warehouse and Improvements | 20 to 30 years | ||

| Office Equipment | 3 to 7 years | ||

| Vehicles | 5 to15 years | ||

| Machinery and Equipment | 7 to 15 years |

Intangible Assets

The Company evaluates intangible assets in accordance with FASB ASC Topic 350, “Intangibles — Goodwill and Other.” Intangible assets deemed to have indefinite lives are not amortized, but are subject to annual impairment tests. If the assumptions and estimates used to allocate the purchase price are not correct, or if business conditions change, purchase price adjustments or future asset impairment charges could be required. The value of the Company’s intangible assets could be impacted by future adverse changes such as: (i) any future declines in the Company’s operating results, (ii) a decline in the valuation of technology, including the valuation of the Company’s common stock, (iii) a significant slowdown in the worldwide economy, or (iv) any failure to meet the performance projections included in the Company’s forecasts of future operating results. In accordance with FASB ASC Topic 350, the Company tests intangible assets for impairment on an annual basis or more frequently if the Company believes indicators of impairment exist. Impairment evaluations involve management estimates of asset useful lives and future cash flows. Significant management judgment is required in the forecasts of future operating results that are used in the evaluations. It is possible, however, that the plans and estimates used may be incorrect. If the Company’s actual results, or the plans and estimates used in future impairment analysis, are lower than the original estimates used to assess the recoverability of these assets, we could incur additional impairment charges in a future period. Based on such evaluations, there was no impairment recorded for intangible assets, held for both the continuing and discontinued operations, for the six months ended December 31, 2016 and 2015, respectively.

13

Construction in Progress

Construction in progress represents the costs incurred in connection with the construction of buildings or new additions to the Company’s plant facilities. Costs classified as construction in progress include all costs of obtaining the asset and bringing it to the location and condition necessary for its intended use. No depreciation is provided for construction in progress until such time as the assets are completed and are placed into service.

The Company reviews the carrying value of construction in progress for impairment whenever events and circumstances indicate that the carrying value of an asset may not be recoverable from the estimated future cash flows expected to result from its use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value of the assets, an impairment loss is recognized equal to an amount by which the carrying value exceeds the fair value of the assets. The factors considered by management in performing this assessment include current operating results, trends and prospects, the manner in which the property is used, and the effects of obsolescence, demand, competition and other economic factors. Based on this assessment, there was no impairment recorded for construction in progress, held for both the continuing and discontinued operations, for the six months ended December 31, 2016 and 2015, respectively.

Revenue Recognition

The Company recognizes revenue when it is both earned and realized or realizable. The Company’s policy is to recognize revenue when title to the product, ownership and risk of loss have transferred to the customer, persuasive evidence of an arrangement exists and collection of the sales proceeds is reasonably assured, all of which generally occur upon shipment of goods to customers. The majority of the Company’s revenue relates to the sale of inventory to customers, and revenue is recognized when title and the risks and rewards of ownership pass to the customer. Given the nature of the Company’s business and the applicable rules guiding revenue recognition, the Company’s revenue recognition practices do not contain estimates that materially affect the results of operations. The Company records revenue at the discounted selling price and allows its customers to return products for exchange or credit subject to certain limitations. A provision for such returns is recorded based upon historical experience. There has been no provision recorded for returns based upon historical experience, held for both the continuing and discontinued operations, for the six months ended December 31, 2016 and 2015, respectively.

Cost of Goods Sold

Cost of goods sold consists primarily of the costs of raw materials, freight charges, direct labor, depreciation of plants and machinery, warehousing and overhead costs associated with the manufacturing process and commission expenses.

Income Taxes

The Company adopts FASB ASC Topic 740, “Income Taxes,” which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized.

In July 2006, the FASB issued FIN 48(ASC 740-10), “Accounting for Uncertainty in Income Taxes — An Interpretation of FASB Statement No. 109 (ASC 740),” which requires income tax positions to meet a more-likely-than-not recognition threshold to be recognized in the financial statements. Under FIN 48(ASC 740-10), tax positions that previously failed to meet the more-likely-than-not threshold should be recognized in the first subsequent financial reporting period in which that threshold is met. Previously recognized tax positions that no longer meet the more-likely-than-not threshold should be derecognized in the first subsequent financial reporting period in which that threshold is no longer met.

14

As a result of the implementation of FIN 48 (ASC 740-10), the Company undertook a comprehensive review of its portfolio of tax positions in accordance with recognition standards established by FIN 48 (ASC 740-10). The Company recognized no material adjustments to liabilities or stockholders’ equity as a result of the implementation. The adoption of FIN 48 did not have a material impact on the Company’s financial statements.

The application of tax laws and regulations is subject to legal and factual interpretation, judgment and uncertainty. Tax laws and regulations themselves are subject to change as a result of changes in fiscal policy, changes in legislation, the evolution of regulations and court rulings. Therefore, the actual liability may be materially different from the Company’s estimates, which could result in the need to record additional tax liabilities or potentially reverse previously recorded tax liabilities or deferred tax asset valuation allowance.

Enterprise Income Tax

Under the Provisional Regulations of PRC Concerning Income Tax on Enterprises promulgated by the PRC (the “EIT Law”), income tax is payable by enterprises at a rate of 25% of their taxable income.

Value Added Tax

The Provisional Regulations of PRC Concerning Value Added Tax promulgated by the State Council came into effect on January 1, 1994. Under these regulations and the Implementing Rules of the Provisional Regulations of the PRC Concerning Value Added Tax, value added tax (“VAT”) is imposed on goods sold in, or imported into, the PRC and on processing, repair and replacement services provided within the PRC.

VAT payable in the PRC is charged on an aggregated basis at a rate of 13% or 17% (depending on the type of goods involved) on the full price collected for the goods sold or, in the case of taxable services provided, at a rate of 17% on the charges for the taxable services provided, but excluding, in respect of both goods and services, any amount paid in respect of VAT included in the price or charges, and less any deductible VAT already paid by the taxpayer on purchases of goods and services in the same financial year. As of December 31, 2016 and June 30, 2016, VAT payables from the continuing operations of the Company were $211,782 and $183,813, respectively. As of December 31, 2016 and June 30, 2016, VAT payables were both nil for the discontinued operations.

Sales-Related Taxes

Pursuant to the tax law and regulations of the PRC, the Company is obligated to pay 7% and 5% of the annual aggregate VAT paid by the Company as taxes for the purposes of maintaining and building cities and educational facilities, which fees are included as sales-related taxes. Sales-related taxes are recorded when sales revenue is recognized. Sales-related taxes from the continuing operations of the Company were $26,805 and $33,901 for the six months ended December 31, 2016 and 2015, respectively. Sales-related taxes from the discontinued operations were both nil for the six months ended December 31, 2016 and 2015.

Concentrations of Business and Credit Risks

All of the Company’s manufacturing is located in the PRC. There can be no assurance that the Company will be able to successfully continue to manufacture its products and failure to do so would have a material adverse effect on the Company’s financial position, results of operations and cash flows. Also, the success of the Company’s operations is subject to numerous contingencies, some of which are beyond management’s control. These contingencies include general economic conditions, prices of raw materials, competition, governmental and political conditions, and changes in regulations.

15

Since the Company is dependent on trade in the PRC, the Company is subject to various additional political, economic and other uncertainties. Among other risks, the Company’s operations will be subject to the risks of restrictions on transfer of funds, domestic customs, changing taxation policies, foreign exchange restrictions, and political and governmental regulations.

The Company operates in China, which may give rise to significant foreign currency risks from fluctuations and the degree of volatility of foreign exchange rates between U.S. dollars and RMB. The results of operations denominated in foreign currency are translated at the average rate of exchange during the reporting periods.

Earnings Per Share

Basic earnings per common share are computed by dividing net earnings applicable to common shareholders by the weighted-average number of common shares outstanding during the period. When applicable, diluted earnings per common share is determined using the weighted-average number of common shares outstanding during the period, adjusted for the dilutive effect of common stock equivalents, consisting of shares that might be issued upon exercise of common stock options and warrants. For the six months ended December 31, 2016 and 2015, the Company had no potential dilutive common stock equivalents outstanding.

Potential common shares issued are calculated using the treasury stock method, which recognizes the use of proceeds that could be obtained upon the exercise of options and warrants in computing diluted earnings per share. It assumes that any proceeds would be used to purchase common stock at the average market price of the common stock during the period.

FASB ASC Topic 260, “Earnings Per Share,” requires a reconciliation of the numerator and denominator of the basic and diluted earnings per share (EPS) computations.

Recent Accounting Pronouncements

In May 2014, the FASB issued Accounting Standards Update (“ASU”) No. 2014-09, “Revenue from Contracts with Customers: Topic 606” (ASU 2014-09), to supersede nearly all existing revenue recognition guidance under U.S. GAAP. The core principle of ASU 2014-09 is to recognize revenues when promised goods or services are transferred to customers in an amount that reflects the consideration that is expected to be received for those goods or services. ASU 2014-09 defines a five step process to achieve this core principle and, in doing so, it is possible more judgment and estimates may be required within the revenue recognition process than are required under existing U.S. GAAP, including identifying performance obligations in a contract, estimating the amount of variable consideration to include in the transaction price and allocating the transaction price to each separate performance obligation. ASU 2014-09 is effective for us beginning July 1, 2018 using either of two methods: (i) retrospective to each prior reporting period presented with the option to elect certain practical expedients as defined within ASU 2014-09; or (ii) retrospective with the cumulative effect of initially applying ASU 2014-09 recognized at the date of initial application and providing certain additional disclosures as defined per ASU 2014-09. We are continuing to evaluate the impacts of our pending adoption of Topic 606.

In August 2016, the FASB issued ASU No. 2016-15, Statement of Cash Flows (Topic 230): “Classification of Certain Cash Receipts and Cash Payments”, to address diversity in how certain cash receipts and cash payments are presented and classified in the statement of cash flows. The amendments provide guidance on the following nine specific cash flow issues: (1) Debt Prepayment or Debt Extinguishment Costs; (2) Settlement of Zero-Coupon Debt Instruments or Other Debt Instruments with Coupon Interest Rates That Are Insignificant in Relation to the Effective Interest Rate of the Borrowing; (3) Contingent Consideration Payments Made after a Business Combination; (4)Proceeds from the Settlement of Insurance Claims; (5) Proceeds from the Settlement of Corporate-Owned Life Insurance Policies, including Bank-Owned; (6) Life Insurance Policies; (7) Distributions Received from Equity Method Investees; (8) Beneficial Interests in Securitization Transactions; and (9) Separately Identifiable Cash Flows and Application of the Predominance Principle. The amendments are effective for public business entities for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. For all other entities, the amendments are effective for fiscal years beginning after December 15, 2018, and interim periods within fiscal years beginning after December 15, 2019. Early adoption is permitted, including adoption in an interim period. The amendments should be applied using a retrospective transition method to each period presented. If it is impracticable to apply the amendments retrospectively for some of the issues, the amendments for those issues would be applied prospectively as of the earliest date practicable. The Company is currently evaluating the impact of this new standard on its consolidated financial statements and related disclosures.

16

In October 2016, the FASB has issued ASU No. 2016-16, Income Taxes (Topic 740): “Intra-Entity Transfers of Assets Other Than Inventory”. The amendments require an entity to recognize income tax consequences of an intra-entity transfer of an asset other than inventory when the transfer occurs and remove the exception to postpone recognition until the asset has been sold to an outside party. The amendments are effective for public business entities for annual reporting periods beginning after December 15, 2017, including interim reporting periods within those annual reporting periods. For all other entities, the amendments are effective for annual reporting periods beginning after December 15, 2018, and interim reporting periods within annual reporting periods beginning after December 15, 2019. Early adoption is permitted. The Company is currently evaluating the impact of this new standard on its consolidated financial statements and related disclosures.

In October 2016, the FASB has issued ASU No. 2016-17, Consolidation (Topic 810): “Interest Held through Related Parties That Are under Common Control”, to provide guidance on the evaluation of whether a reporting entity is the primary beneficiary of a variable interest entity, or VIE by amending how a reporting entity, that is a single decision maker of a VIE, treats indirect interests in that entity held through related parties that are under common control. The amendments are effective for public business entities for fiscal years beginning after December 15, 2016, including interim periods within those fiscal years. For all other entities, the amendments are effective for fiscal years beginning after December 15, 2016, and interim periods within fiscal years beginning after December 15, 2017. Early adoption is permitted, including adoption in an interim period. The Company is currently evaluating the impact of this new standard on its consolidated financial statements and related disclosures.

In November 2016, the FASB issued ASU No. 2016-18, Statement of Cash Flows (Topic 230): “Restricted Cash”(“ASU 2016-18”). ASU 2016-18 requires that a statement of cash flows explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. ASU 2016-18 will become effective for us beginning April 1, 2018, or fiscal 2019. ASU 2016-18 is required to be applied retrospectively. Upon the adoption, amounts described as restricted cash will be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period amounts shown on the statements of cash flows.

NOTE 3 - ASSETS SALE

On December 24, 2014, Humankind entered into a stock transfer agreement (the “Original Agreement”) with Xiuzheng Pharmaceutical Group Co., Ltd. a company incorporated under the laws of the PRC and located in Jilin province (“XiuzhengPharmacy”or the “Buyer”), Mr. Xin Sun, the CEO of Humankind, and Huimeijia, pursuant to which, Humankind and Mr. Xin Sun (the “Equity Holders”), would sell their respective equity interests in Huimeijia to Xiuzheng Pharmacy. The transfer of the 100% equity interests of Huimeijia to the Buyer was for a total cash consideration of RMB 8,000,000 (approximately $1,306,186) to the Equity Holders.

On February 9, 2015, the four parties entered into a supplementary agreement (the “Supplementary Agreement”) to modify the terms of the Original Agreement, pursuant to which, the Equity Holders and Huimeijia (collectively the “Assets Transferors”) would only sell the 19 drug approval numbers (including the tablet, capsule, powder, mixture, oral liquid, syrup and oral solution under the 19 approval numbers; licenses including the original copies of Business License, Organization Code Certificate, Tax Registration Certificate, Drug Production Permit and GMP Certificate, and other documents and original copies related to the production and operation of the 19 drugs) (the “Assets”) to Xiuzheng Pharmacy. The Equity Holders would have retained their equity interests in Huimeijia, but would have pledged such equity intereststo Xiuzheng Pharmacy until the Assets were transferred, at which time all the cash consideration shall be paid by the Buyer. The total cash consideration would have been the same as under the Original Agreement, i.e., RMB 8,000,000 (approximately $1,306,186) to the Assets Transferors. In the event that the Assets had failed to be transferred to the Buyer due to the fault of the Assets Transferors, the paid consideration would have been returned to the Buyer with interest accrued. If the failure of the transfer of the Assets were a result of changes in government policy or force majeure, the paid cash consideration would have been returned to the Buyer but without any interest.

17

On October 12, 2016, the four parties agreed to rescind the Supplementary Agreement and entered into a new supplementary agreement (the “Agreement”), pursuant to which, the four parties agreed to execute the transfer of the equity interests based on the Original Agreement, and according to which the Equity Holders sold their respective equity interests in Huimeijia to Xiuzheng Pharmacy. The transfer of 100% of the equity interests of Huimeijia to the Buyer was for a total cash consideration of RMB 8,000,000 (approximately $1,306,186) (the “Purchase Price”) to the Equity Holders. 40% of the Purchase Price was due within 10 business days after the signing of the Agreement; 40% of the Purchase Price was due within 10 business days after the completion of the changes in business registration described in the Original Agreement and Xiuzheng Pharmacy obtaining documents evidencing its ownership on Huimeijia; 15% of the Purchase Price is due within 10 business days after the transfer of all of the Drugs is approved by Heilongjiang FDA; and 5% of the Purchase Price is due within 10 business days after all of the Drugs have been transferred to Xiuzheng Pharmacy or its designee and Humankind and Mr. Xin Sun instruct Xiuzheng Pharmacy to complete three-batches production of all forms of the drugs included in the Drugs. As of the date of this report, 80% of the Purchase Price was paid and the Company has completed the changes in business registration and Xiuzheng Pharmacy obtained the newly issued business license issued by the local State Administration of Industry and Commerce in Harbin (“Harbin SAIC”) to Huimeijia,in which the ownership of Huimeijia has now been recorded as being held by Xiuzheng Pharmacy, with Harbin SAIC and the legal representative (a person that is authorized to take most of the corporate actions on behalf of a company under the corporate laws in China) of Huimeijia now persons appointed by the Buyer. The transfer of all the drug licenses to the Buyer and the remainder of the Purchase Price to the Equity Holders are pending.

The gain on the disposal of Huimeijia was $1,157,590.

NOTE 4 – SHORT TERM INVESTMENTS

Short term investments consist of held-to-maturity investments.

Held to maturity investments

Held-to-maturity investments consist of various financial products purchased from Harbin Hongxiang Investment Guarantee Co., Ltd., which are classified as held-to-maturity investments as the Company has the positive intent and ability to hold the investments to maturity. The maturity of these financial products is one year, with contractual maturity dates of July 19, 2017 and estimated annual interest rates ranging of 10%. They are classified as short term investments on the consolidated balance sheets as its contractual maturity dates are less than one year. The repayments of principal of the financial products are not guaranteed by the Hongxiang Investment Guarantee Co., Ltd. from which the financial products were purchased. Historically, the Company has received the principal and the interest in full upon maturity of these investments. Harbin Hongxiang Investment Guarantee Co., Ltd., the financial institution that handled the Company’s short term investment with is the related party of the Company.

While these financial products are not publicly traded, the Company estimated that their fair value approximate their amortized costs considering their short term maturities and high credit quality. No OTTI loss was recognized for the period ended December 31, 2016 and June 30, 2016.

NOTE 5 - ACCOUNTS RECEIVABLE

The Company’s accounts receivable, held for continuing operations, were $1,673,667 and $1,145,131, respectively, net of allowance for doubtful accounts amounting to $48,705 and $52,129 as of December 31, 2016 and June 30, 2016, respectively. The Company’s accounts receivable, held for discontinued operations, were both nil, net of allowance for doubtful accounts amounting to nil as of December 31, 2016 and June 30, 2016, respectively.

18

NOTE 6 - INVENTORY

Inventory from the continuing operations of the Company consisted of following:

| December 31, | June 30, | |||||

| 2016 | 2016 | |||||

| Raw Materials | $ | 160,204 | $ | 122,569 | ||

| Supplies and Packing Materials | 132,782 | 130,472 | ||||

| Work-in-Progress | 136,653 | 118,233 | ||||

| Finished Goods | 61,231 | 48,713 | ||||

| Total | 490,870 | 419,987 | ||||

| Less: Inventory, Held for Discontinued Operations | - | 5,203 | ||||

| Inventory, Held for Continuing Operations | $ | 490,870 | $ | 414,784 |

For the six months ended December 31, 2016 and 2015, the Company has not made provision for inventory from the continued and discontinued operations in regards to excessive, slow moving or obsolete items.

NOTE 7 - CONSTRUCTION IN PROGRESS

Construction in progress from the continuing operations of the Company consisted of the following:

| December 31, | June 30, | |||||

| 2016 | 2016 | |||||

| Plant - HLJ Huimeijia | $ | 654,778 | $ | 670,051 | ||

| Plant and Production Lines - Huimeijia | - | 1,806 | ||||

| Total | 654,778 | 671,857 | ||||

| Less: Construction in Progress, Held for Discontinued Operations | - | 1,806 | ||||

| Construction in Progress, Held for Continuing Operations | $ | 654,778 | $ | 670,051 |

On April 6, 2012, HLJ Huimeijia entered into an agreement with a contractor for the plant, the estimated total cost of construction was approximately $2.09 million (RMB 12,800,000), anticipated to be completed by December 2016. As of December 31, 2016, 36% of construction had been completed and $654,778 (RMB 4,546,121) had been recorded as a cost of construction in progress.

NOTE 8 - PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment from the continuing operations of the Company consisted of the following:

| December 31, | June 30, | |||||

| 2016 | 2016 | |||||

| Building, Warehouses and Improvements | $ | 4,152,006 | $ | 4,360,191 | ||

| Machinery and Equipment | 1,172,993 | 1,232,861 | ||||

| Office Equipment | 60,922 | 69,330 | ||||

| Vehicles | 195,708 | 204,457 | ||||

| Others | 21,604 | - | ||||

| Less: Accumulated Depreciation | (2,057,628 | ) | (1,998,278 | ) | ||

| Total | 3,545,606 | 3,868,561 | ||||

| Less: Property and Equipment, net, Held for Discontinued Operations | - | 1,796 | ||||

| Property and Equipment, net, held for continuing operations | $ | 3,545,606 | $ | 3,866,765 |

19

Depreciation expense from the continuing operations of the Company was $361,117 and $173,033 for the six months ended December 31, 2016 and 2015, respectively. Depreciation expense from the discontinued operations was nil and $389 for the six months ended December 31, 2016 and 2015, respectively. Depreciation expense charged to operations from the continuing operations of the Company was $274,847 and $68,303 for the six months ended December 31, 2016 and 2015, respectively. Depreciation expense charged to cost of goods sold from the continuing operations of the Company was $86,270 and $104,730 for the six months ended December 31, 2016 and 2015, respectively. Depreciation expense charged to operations from the discontinued operations was nil and $389 for the six months ended December 31, 2016 and 2015, respectively. Depreciation expense charged to cost of goods sold from the discontinued operations was both nil for the six months ended December 31, 2016 and 2015, respectively.

As of December 31, 2016, the building of HLJ Huimeijia with the book value of $1,604,882 has been mortgaged for the working capital loan in the principal amount of $1,440,300 (RMB 10,000,000). As of June 30, 2016, the building of HLJ Huimeijia with the book value of $1,676,627 has been mortgaged for the working capital loan in the principal amount of $1,504,687 (RMB 10,000,000).

NOTE 9 - INTANGIBLE ASSETS

The following is a summary of intangible assets from the continuing operations of the Company:

| December 31, 2016 | June 30, 2016 | |||||

| Land Use Rights – Humankind | $ | 912,860 | $ | 953,670 | ||

| Health Supplement Product Patents – Humankind | 4,320,899 | 4,514,061 | ||||

| Pharmaceutical Patents - HLJ Huimeijia | 129,048 | 134,817 | ||||

| Land Use Rights - HLJ Huimeijia | 624,382 | 652,295 | ||||

| Less: Accumulated Amortization | (2,198,432 | ) | (2,063,784 | ) | ||

| Total | 3,788,757 | 4,191,059 | ||||

| Less: Intangible Assets, net, Held for Discontinued Operations | - | - | ||||

| Intangible Assets, net, Held for Continuing Operations | $ | 3,788,757 | $ | 4,191,059 |

All land in the PRC belongs to the State. Enterprises and individuals can pay the State a fee to obtain the right to use a piece of land for commercial purposes or residential purposes for an initial period of 50 years or 70 years, respectively. The land use right can be sold, purchased, and exchanged in the market. The successor owner of the land use right will have the right to use the land for the time remaining on the initial period.

Amortization expense from the continuing operations of the Company was $117,487 and $264,117 for the six months ended December 31, 2016 and 2015, respectively. Amortization expense from the discontinued operations was both nil for the six months ended December 31, 2016 and 2015.

As of December 31, 2016, land use rights of HLJ Huimeijia with the book value of $624,382 have been mortgaged for a working capital loan in the principal amount of $1,440,300 (RMB 10,000,000). As of June 30, 2016, land use rights of HLJ Huimeijia with the book value of $652,295 have been mortgaged for a working capital loan in the principal amount of $1,504,687 (RMB 10,000,000).

NOTE 10 - SHORT-TERM LOAN

On November 12, 2015, HLJ Huimeijia entered into a short-term loan agreement with a bank for a working capital loan in the principal amount of RMB 10,000,000, at an interest rate of 5.66% from November 12, 2015 to November 10, 2016. The loan was secured by the land use right and the building of HLJ Huimeijia, with a maturity date of November 10, 2016.

On November 17, 2016, the agreement was renewed with an interest rate of 6.09%, with a maturity date of November 16, 2017.

20

As of December 31, 2016 and June 30, 2016, the Company’s short-term loan from its continuing operations was $1,440,300 and $1,504,687, respectively. As of December 31, 2016 and June 30, 2016, the Company’s short-term loan from the discontinued operations was both nil.

Interest expenses from the continuing operations of the Company were $42,737 and $58,479 for the six months ended December 31, 2016 and 2015, respectively. Interest expenses from the discontinued operations were both nil for the six months ended December 31, 2016 and 2015, respectively.

NOTE 11 - RELATED PARTY DEBTS

Related party debts, which represent temporary short-term loans from Mr. Xin Sun and Mr. Kai Sun, consisted of the following:

| December 31, 2016 | June 30, 2016 | |||||

| Mr. Xin Sun | $ | 2,970,429 | $ | 2,678,220 | ||

| Mr. Kai Sun | 33,680 | 35,186 | ||||

| Total | 3,004,109 | 2,713,406 | ||||

| Less: Related Party Debts, Held for Discontinued Operations | - | - | ||||

| Related Party Debts, Held for Continuing Operations | $ | 3,004,109 | $ | 2,713,406 |

These loans are unsecured and non-interest bearing and have no fixed terms of repayment; therefore, they are deemed payable on demand. Mr. Kai Sun is a PRC citizen and a family member of Mr. Xin Sun, the CEO of the Company.

NOTE 12 - INCOME TAXES

(a) Corporate income taxes

United States

China Health US was organized in the United States. China Health US had no taxable income for US income tax purposes for the six months ended December 31, 2016 and 2015, respectively. As of December 31, 2016, China Health US has a net operating loss carry forward for United States income taxes. Net operating loss carry forwards are available to reduce future years’ taxable income. Management believes that the realization of the benefits from these losses appears uncertain due to the Company’s operating history and the continued losses of the US entity. Accordingly, the Company has provided a 100% valuation allowance on the deferred tax asset to reduce the asset to zero. There were no changes in the valuation allowance for the six months ended December 31, 2016 and 2015. Management reviews this valuation allowance periodically and makes adjustments accordingly.

Hong Kong

China Health HK was incorporated in Hong Kong and is subject to Hong Kong taxation on its activities conducted in Hong Kong and income arising in or derived from Hong Kong. No provision for income taxes have been made as China Health HK has no taxable income in Hong Kong.

People’s Republic of China

Under the EIT Law, the standard EIT rate is 25%. The PRC subsidiaries of the Company are subject to PRC income taxes on an entity basis on income arising in or derived from the tax jurisdiction in which they operate.

The provision for income taxes from the continuing operations of the Company consisted of the following for the three and six months ended December 31, 2016 and 2015:

21

| For the Three Months Ended | For the Six Months Ended | |||||||||||

| December 31, | December 31, | |||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||

| Current provision: | ||||||||||||

| USA | $ | - | $ | - | $ | - | $ | - | ||||

| China | 439,620 | 38,477 | 493,650 | 70,883 | ||||||||

| Total current provision | 439,620 | 38,477 | 493,650 | 70,883 | ||||||||

| Deferred provision: | ||||||||||||

| USA | - | - | - | - | ||||||||

| China | - | - | - | - | ||||||||

| Total deferred provision | - | - | - | - | ||||||||

| Total provision for income taxes | 439,620 | 38,477 | 493,650 | 70,883 | ||||||||

| Less: Provision for income taxes, held for discontinued operations | - | - | - | - | ||||||||

| Provision for income taxes, held for continuing operations | $ | 439,620 | $ | 38,477 | $ | 493,650 | $ | 70,883 | ||||

Significant components of deferred tax assets from the continuing operations of the Company were as follows:

| December 31, | June 30, | |||||

| 2016 | 2016 | |||||

| Deferred tax assets | ||||||

| Net operating loss carry forward | $ | - | $ | 118,259 | ||

| Allowance for doubtful accounts | - | - | ||||

| Valuation allowance | - | (118,259 | ) | |||

| Deferred tax assets, net | - | - | ||||

| Less: Deferred tax assets, net, held for discontinued operations | - | - | ||||

| Deferred tax assets, net, held for continuing operations | $ | - | $ | - |

As of December 31, 2016 and June 30, 2016, the Company accrued a 100% valuation allowance on its deferred tax assets based on the assessment on the probability of future reversion.

(b) Uncertain tax positions

There were no unrecognized tax benefits as of December 31, 2016 and June 30, 2016, respectively. Management does not anticipate any potential future adjustments in the next twelve months which would result in a material change to its tax positions. For the six months ended December 31, 2016 and 2015, the Company did not incur any interest and penalties arising from its tax payments.

NOTE 13 - COMMITMENTS AND CONTINGENCIES

The Company’s assets are located in the PRC and revenues are derived from operations in the PRC.