Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Air Transport Services Group, Inc. | a2017form8kcoverfeb14inves.htm |

The global leader in midsize wide-body

leasing and operating solutions

Joe Hete

President & CEO

Quint Turner

Chief Financial Officer

Stifel, Nicolaus & Co.

Transportation & Logistics Conference

February 14, 2017

Safe Harbor Statement

Except for historical information contained herein, the matters discussed in this presentation

contain forward-looking statements that involve risks and uncertainties. There are a number of

important factors that could cause Air Transport Services Group's ("ATSG's") actual results to

differ materially from those indicated by such forward-looking statements. These factors include,

but are not limited to, our operating airlines' ability to maintain on-time service and control costs;

ABX Air's ability to provide flight crews to meet its customers' requirements; the number and

timing of deployments and redeployments of our aircraft to customers; the cost and timing with

respect to which we are able to purchase and modify aircraft to a cargo configuration; the

successful implementation and operation of the new air network for Amazon; changes in market

demand for our assets and services, and other factors that are contained from time to time in

ATSG's filings with the U.S. Securities and Exchange Commission, including its Annual Report

on Form 10-K and Quarterly Reports on Form 10-Q. Readers should carefully review this

presentation and should not place undue reliance on ATSG's forward-looking statements. These

forward-looking statements were based on information, plans and estimates as of the date of this

presentation. ATSG undertakes no obligation to update any forward-looking statements to reflect

changes in underlying assumptions or factors, new information, future events or other changes.

2

World’s Only Comprehensive Turn-key Solution Provider

For customers seeking midsize freighter services, ATSG offers all elements of the

solution set, ranging from an entry-point ACMI lease to a dedicated dry-leased fleet with

flight crews, maintenance and logistical support from five strong operating companies.

Dry Leasing of 767-300s,

767-200s, 757-200s

Engine Leasing

Conversion Management

Engine PBH Services

Certification Support

Leasing ACMI-CMI Support Services

ACMI

CMI

Wet Leasing

Ad-Hoc Charter

Heavy & Line Maintenance

Component Services

Engineering Services

Boeing & Airbus Experience

P-to-F Conversions

3

Sort Operations

GSE Leasing, Service

MHE Service

2016 Accomplishments

Freighter fleet expands as five Boeing 767-300s entered service in 2016, with more due in 2017

based on current commitments. 80% of 767s in service at year-end are leased for terms averaging

4+ years.

Agreements with Amazon completed in March call for long-term placements of 20 leased and

operated 767 freighters, plus warrants for Amazon to acquire up to 19.9% of ATSG shares.

Diversified, growing revenue streams Revenues up 19% excluding reimbursements thru nine

months of 2016. DHL represented 35% of revenues; Amazon 24%, U.S. Military 13%.

Record projected Adjusted EBITDA for 2016 of $211 million, up 7%.

Logistics business grows through expanded ground support roles for major customers.

PEMCO acquired at year-end, expanding AMES’s MRO capabilities and capacity, and adding

conversion and MRO facilities in China, S. America and U.S. serving Boeing and Airbus airframes.

Improved shareholder value as stock price increased 58% in 2016, exceeding peers and major

market indices, backed by $63 million in share repurchases. Credit facility amendment added

$100M in capacity and more buyback flexibility.

4

10

47

7

10

41

7

17

30

220

24

1

Externally Leased 767 Fleet on Track to Double in 3 Years

5

YE 2014 YE 2015

CAM-Owned 767Fs

YE 2016

Focus on regional air networks driving demand for more of our midsize 767 freighters,

longer-term dry leases, and more CMI, maintenance and logistics support.

(13 with CMI) (15 with CMI)

(28 with CMI)

Dry leased ACMI/Charter Staging/Unassigned Undergoing cargo modification

767 Dry Leases

During 2016

Q1: DHL 1 – 767-300

Raya 1 – 767-200

Q2: Amazon 8 – 767-200

Amerijet 1 – 767-300

Q3: Amazon 3 – 767-200

Q4: Amazon 1 – 767-200

Amazon 2 – 767-300

DHL 1 – 767-300

July 2017E

(32 with CMI)

1

Target Growing Network Demand

E-commerce, distributed manufacturing trends creating demand for new express networks

Abundant ACMI and Dry Lease Opportunities

MIDDLE EAST

• Strong double-digit growth in 2015

• Aging network fleets due for replacement

• CAM completes two 767 dry leases to DHL-Mideast

ASIA

• Rapid e-commerce, distributed manufacturing growth

• Air express markets growing at similar pace

• Air networks operating narrow-body freighters will

require upgrades as payloads increase

AMERICAS

• Consistent DHL network growth

• Amazon’s rapid e-commerce growth

• Miami airport hub supports Latin America trade lanes

• 767 range/payload an ideal fit for north-south routes

EUROPE

• Investment in Sweden’s West Atlantic AB yields

additional 767 dry leases

• Opportunities with other carriers

6

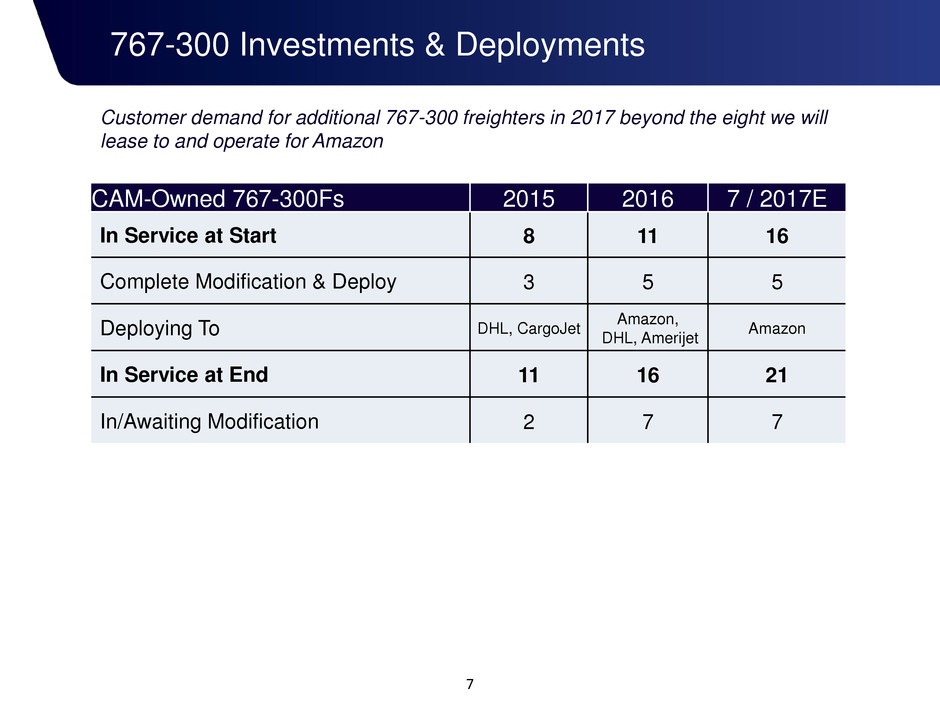

767-300 Investments & Deployments

7

CAM-Owned 767-300Fs 2015 2016 7 / 2017E

In Service at Start 8 11 16

Complete Modification & Deploy 3 5 5

Deploying To DHL, CargoJet

Amazon,

DHL, Amerijet

Amazon

In Service at End 11 16 21

In/Awaiting Modification 2 7 7

Customer demand for additional 767-300 freighters in 2017 beyond the eight we will

lease to and operate for Amazon

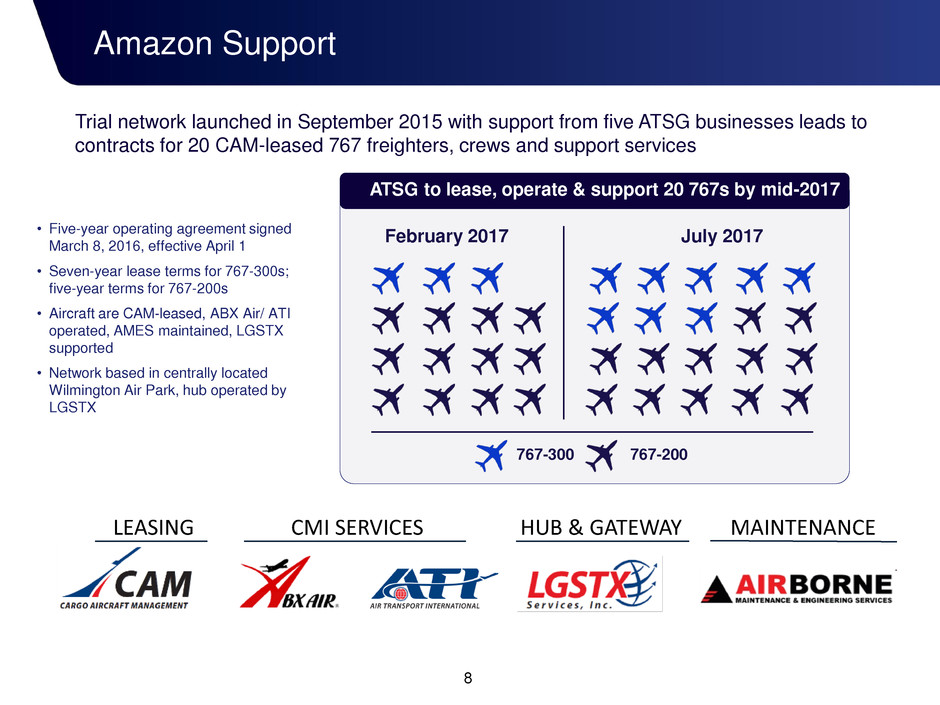

• Five-year operating agreement signed

March 8, 2016, effective April 1

• Seven-year lease terms for 767-300s;

five-year terms for 767-200s

• Aircraft are CAM-leased, ABX Air/ ATI

operated, AMES maintained, LGSTX

supported

• Network based in centrally located

Wilmington Air Park, hub operated by

LGSTX

Trial network launched in September 2015 with support from five ATSG businesses leads to

contracts for 20 CAM-leased 767 freighters, crews and support services

ATSG to lease, operate & support 20 767s by mid-2017

February 2017 July 2017

767-300 767-200

Amazon Support

LEASING CMI SERVICES HUB & GATEWAY MAINTENANCE

8

9

Amazon to receive ATSG warrants for purchase of up to 19.9% of ATSG

common shares at $9.73 per share through March 2021

Warrant A Warrant B-1

7.7M shares

issued, vested

1.6M shares

to be issued and vest

March 2018

Warrant B-2

~0.5M shares (adjusts to 19.9%)

now expected to be issued and vest

September 2020 based on subsequent

share buybacks

5.1M shares

Pro-rata vesting as eight

767Fs are leased

through mid-2017

• Investment Agreement for warrants signed March 8, 2016

• ATSG shareholders overwhelmingly approved increase in authorized shares and other enabling measure at annual

meeting on May 12, 2016

• Amazon may appoint a Board observer, and, alternatively, upon acquiring 10% of ATSG shares, nominate one candidate

for election to ATSG’s Board

• Approximately 9.0 million ATSG warrants issued and vested through 12/31/2016

• Share repurchases will reduce final number of warrants required to true-up Amazon holdings to 19.9% in 2020

Amazon Pact Sealed With Investment Agreement

Dry leasing and airline fleet utilization, along with support services

backing, driving revenue and cash flow growth in 2016 and beyond

10

• 9 Mo. revenue gain driven by more

767 dry leases, Amazon support,

maintenance and logistics gains

• Adjusted Pre-tax Earnings excludes

non-cash pension expense, affiliate’s

debt issuance charge, lease

incentive, financial Instrument gain

o Includes $6.5 million in extra

expense in 3Q, stemming from

premium pilot pay and other

costs

• Adjusted EPS for 2016 excludes

$0.05 for lease incentive

amortization and warrant revaluation,

net of tax

• 4Q ABX pilot work stoppage

projected to have $7M negative

impact on 4Q and YE revenues,

Adj. Pre-tax and Adj. EBITDA.

~$0.07 impact on Adj. EPS.

$438

$547

$41

$48

$0.40 $0.39 $141

$155

2016 Nine Months Results & 2016 Outlook

Revenues Adj. Pre-Tax

Earnings*

(Cont. Oper.)

Adj. EPS*

(Cont. Oper.)

Adj. EBITDA*

(Cont. Oper.)

2015 2016 2015 2016 2015 2016 2015 2016

* Non-GAAP metrics. See table at end of this presentation for reconciliation to nearest GAAP results for

Adjusted Pretax Earnings and Adjusted EBITDA. See the following slide for Adjusted EPS reconciliation.

$M $M $M

$197

$211

FY2016

Adj. EBITDA

Guidance

(Cont. Oper.)

2015 2016E

$M

E

EPS Adjustments Reflect Warrant Valuation

11

Going forward, ATSG’s GAAP earnings will reflect:

• Incremental non-cash gain or loss in financial instruments each quarter, net of tax, based on effect of mark-to-market

changes in ATSG stock price on value of warrant liability.

• non-cash lease revenue reduction associated with the amortization of value for warrants

These changes will be excluded on a quarterly basis from Adjusted Pretax Earnings, Adjusted EPS, and Adjusted EBITDA

from continuing operations

2.2x

2.4x

1.9x

1.6x

2.1x

2012 2013 2014 2015 9/30/2016

Debt Obligations / Adjusted EBITDA*

44

49

53

55

58

Strong Capital Base to Support Fleet Growth

• Adjusted EBITDA is a non-GAAP metric. Debt Obligations, fleet totals are as of end of period.

See table at end of this presentation for reconciliation to nearest GAAP results.

12

Strong Adjusted EBITDA generation in 2016 backing expanded capacity under May

2016 credit facility amendments to maintain conservative balance sheet

757 & 767 Owned Freighters

Share Repurchases since May 2015

13

$-

$20

$40

$60

$80

$100

$120

2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Authorized Repurchases

Continuing at moderate pace following $50M Red Mountain repurchase in 3Q 2016

Highlights and Outlook

Strong growth trajectory Double-digit revenue growth from business with new express networks,

global network integrators and regional operators attracted to midsize freighter assets, and unique model that

offers short-term ACMI flexibility and long-term dry-leasing cost advantages backed by support services.

Attractive assets World’s largest fleet of 100% owned midsize converted Boeing freighters available

on a dedicated basis, with wide range of freighter network applications. Converted freighters offer decades of

reliable service with lower investment, backed by best-in-class maintenance and conversion capabilities.

Lease-driven sustained cash flow Business model emphasizes long-term returns from dry-

leasing freighter assets to leading network operators, enhanced by unique combinations of airline,

maintenance, logistics and network management services. Not a federal cash taxpayer until 2019 or later.

Strong balance sheet Debt leverage over last two years less than 2X Adjusted EBITDA, not

expected to exceed 2.5X in 2016; credit facility amended in May to provide access to more credit at attractive

rates to achieve growth objectives, return capital to shareholders.

Appetite for strategic growth through targeted, complementary acquisitions such as PEMCO to

extend footprint, add capabilities and add support capacity for current and prospective customers worldwide.

Delivering shareholder value Fleet investments and share repurchases will continue to generate

attractive returns, generating even greater ATSG value. Adjusted EBITDA for 2016 projected at $211M, up 7%

14

ATSG – a solid growth story with value appeal

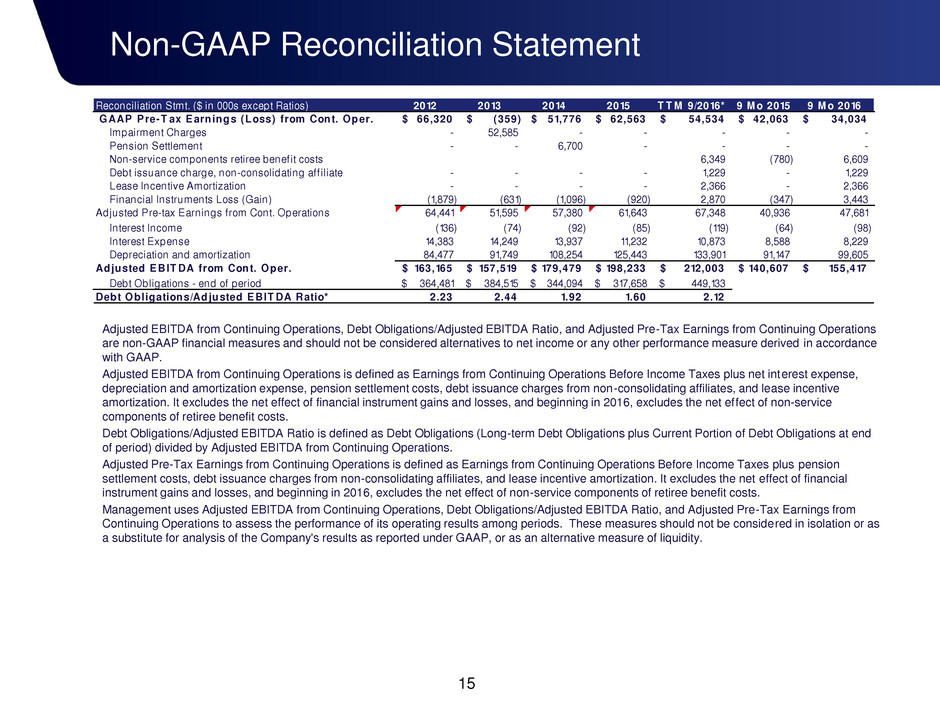

Non-GAAP Reconciliation Statement

15

2012 2013 2014 2015 T T M 9/2016* 9 M o 2015 9 M o 2016

66,320$ (359)$ 51,776$ 62,563$ 54,534$ 42,063$ 34,034$

Impairment Charges - 52,585 - - - - -

Pension Settlement - - 6,700 - - - -

Non-service components retiree benefit costs 6,349 (780) 6,609

Debt issuance charge, non-consolidating aff iliate - - - - 1,229 - 1,229

Lease Incentive Amortization - - - - 2,366 - 2,366

Financial Instruments Loss (Gain) (1,879) (631) (1,096) (920) 2,870 (347) 3,443

64,441 51,595 57,380 61,643 67,348 40,936 47,681

Interest Income (136) (74) (92) (85) (119) (64) (98)

Interest Expense 14,383 14,249 13,937 11,232 10,873 8,588 8,229

Depreciation and amortization 84,477 91,749 108,254 125,443 133,901 91,147 99,605

163,165$ 157,519$ 179,479$ 198,233$ 212,003$ 140,607$ 155,417$

364,481$ 384,515$ 344,094$ 317,658$ 449,133$

2.23 2.44 1.92 1.60 2.12

Reconciliation Stmt. ($ in 000s except Ratios)

Debt Obligations/Adjusted E BIT DA Ratio*

GAAP P re-T ax E arnings (Loss) f rom Cont. Oper.

Adjusted E BIT DA from Cont. Oper.

Debt Obligations - end of period

Adjusted Pre-tax Earnings from Cont. Operations

Adjusted EBITDA from Continuing Operations, Debt Obligations/Adjusted EBITDA Ratio, and Adjusted Pre-Tax Earnings from Continuing Operations

are non-GAAP financial measures and should not be considered alternatives to net income or any other performance measure derived in accordance

with GAAP.

Adjusted EBITDA from Continuing Operations is defined as Earnings from Continuing Operations Before Income Taxes plus net interest expense,

depreciation and amortization expense, pension settlement costs, debt issuance charges from non-consolidating affiliates, and lease incentive

amortization. It excludes the net effect of financial instrument gains and losses, and beginning in 2016, excludes the net effect of non-service

components of retiree benefit costs.

Debt Obligations/Adjusted EBITDA Ratio is defined as Debt Obligations (Long-term Debt Obligations plus Current Portion of Debt Obligations at end

of period) divided by Adjusted EBITDA from Continuing Operations.

Adjusted Pre-Tax Earnings from Continuing Operations is defined as Earnings from Continuing Operations Before Income Taxes plus pension

settlement costs, debt issuance charges from non-consolidating affiliates, and lease incentive amortization. It excludes the net effect of financial

instrument gains and losses, and beginning in 2016, excludes the net effect of non-service components of retiree benefit costs.

Management uses Adjusted EBITDA from Continuing Operations, Debt Obligations/Adjusted EBITDA Ratio, and Adjusted Pre-Tax Earnings from

Continuing Operations to assess the performance of its operating results among periods. These measures should not be considered in isolation or as

a substitute for analysis of the Company's results as reported under GAAP, or as an alternative measure of liquidity.