Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - BROADRIDGE FINANCIAL SOLUTIONS, INC. | ex993supstats.htm |

| EX-99.1 - EXHIBIT 99.1 - BROADRIDGE FINANCIAL SOLUTIONS, INC. | ex991earningsrelease-20161.htm |

| 8-K - 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | form8-kre2q2017earnings.htm |

1 © 2014 |

Earnings Webcast &

Conference Call

Second Quarter and First Six Months of Fiscal 2017

February 8, 2017

EXHIBIT 99.2

2

Forward-Looking Statements

This presentation and other written or oral statements made from time to time by representatives of Broadridge Financial Solutions, Inc. ("Broadridge"

or the "Company") may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements

that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,”

“we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, information appearing in the “Fiscal Year

2017 Financial Guidance” section are forward-looking statements.

These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to

differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our

Annual Report on Form 10-K for the fiscal year ended June 30, 2016 (the “2016 Annual Report”), as they may be updated in any future reports filed

with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this presentation and are expressly

qualified in their entirety by reference to the factors discussed in the 2016 Annual Report.

These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients;

Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of

Broadridge’s services with favorable pricing terms; changes in laws and regulations affecting Broadridge’s clients or the services provided by

Broadridge; any material breach of Broadridge security affecting its clients’ customer information; declines in participation and activity in the

securities markets; the failure of Broadridge’s outsourced data center services provider to provide the anticipated levels of service; a disaster or other

significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions

and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s

ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any

obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to

reflect the occurrence of unanticipated events, other than as required by law.

3

Use of Non-GAAP Financial Measures

Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures

The Company’s results in this presentation are presented in accordance with U.S. GAAP except where otherwise noted. In certain circumstances, results have

been presented that are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP measures are Adjusted Operating income,

Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share, and Free cash flow. These Non-GAAP financial measures should be

viewed in addition to, and not as a substitute for, the Company’s reported results.

The Company believes its Non-GAAP financial measures help investors understand how management plans, measures and evaluates the Company’s business

performance. Management believes that Non-GAAP measures provide consistency in its financial reporting and facilitates investors’ understanding of the

Company’s operating results and trends by providing an additional basis for comparison. Management uses these Non-GAAP financial measures to, among other

things, evaluate the Company's ongoing operations, for internal planning and forecasting purposes and in the calculation of performance-based compensation. In

addition, and as a consequence of the importance of these Non-GAAP financial measures in managing its business, the Company’s Compensation Committee of

the Board of Directors incorporates Non-GAAP financial measures in the evaluation process for determining management compensation.

Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted Net Earnings and Adjusted Earnings per Share

These Non-GAAP measures reflect Operating income, Operating income margin, Net earnings, and Diluted earnings per share, as adjusted to exclude the impact

of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of the Company's ongoing operating

performance. These adjusted measures exclude the impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and

Integration Costs. Amortization of Acquired Intangibles and Purchased Intellectual Property represents non-cash expenses associated with the Company's

acquisition activities. Acquisition and Integration Costs represent certain transaction and integration costs associated with the Company’s acquisition activities.

The Company excludes Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs from these measures

because excluding such information provides the Company with an understanding of the results from the primary operations of its business and these items do

not reflect ordinary operations or earnings. Management believes these measures may be useful to an investor in evaluating the underlying operating

performance of the Company's business.

Free Cash Flow

In addition to the Non-GAAP financial measures discussed above, the Company provides Free cash flow information because it considers Free cash flow to be a

liquidity measure that provides useful information to management and investors about the amount of cash generated that could be used for dividends, share

repurchases, strategic acquisitions and other discretionary investments. Free cash flow is a Non-GAAP financial measure and is defined by the Company as Net

cash flows provided by operating activities less Capital expenditures and Software purchases and capitalized internal use software.

Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables

that are part of this presentation.

Use of Material Contained Herein

The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its

initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty

to update or revise the information contained in this presentation.

4

Highlights

Solid 2Q financial results

Solid recurring fee revenue growth across both ICS and GTO segments

Continued momentum in Closed sales

NACC integration on track

Updating guidance for fiscal 2017

o Reaffirming guidance for Recurring revenue, Adjusted EPS and

Closed sales

o Reducing guidance for total revenue and GAAP EPS growth

o On track to achieve three year targets

5

Second Quarter 2017 Summary

Total revenue growth of 40% and recurring fee revenue growth of 34%

o NACC acquisition drove much of the growth

o 6% organic growth of recurring fee revenue

Continued growth in Adjusted operating income and Adjusted EPS

o Profit growth driven by acquisition of NACC and organic growth in recurring

fee revenues partially offset by decline in quarterly event-driven revenues

o Diluted EPS also impacted by integration expenses and higher acquisition-

related amortization

Record Q2 Closed sales up 15% – up 18% versus first half of fiscal year

2016

Balanced capital allocation

o Tuck-in acquisition of $25 million

o $60 million of net share buybacks

6

Business Update

Broad momentum across both GTO and ICS

o Reflects breadth of products and focus on clients

Record Closed sales highlights growing recognition of power of

Broadridge’s utility solutions

o Tier one bank adopts BR’s SaaS equity trade processing platform

o Signed another major broker-dealer for tax services

Business environment remains stable

o Calendar year 2017 expected to be strong year for mutual fund proxies:

timing versus Broadridge fiscal year not yet finalized

o Post election trading increase a tailwind

o Mutual fund interim record growth remains low by historical standards

NACC integration going well

o Digital strategy moving forward

o On plan to achieve $20 million synergy realization goal

7

2Q16 Recurring

Revs.

Closed Sales Client Losses Internal Growth Acquisitions 2Q17 Recurring

Revs.

$ 399 M

$536 M+7%

-3%

2%

+28% +34%

2Q16 Total Revs. Recurring Event Driven Distribution FX 2Q17 Total Revs.

$893 M

+21%

-4%

23%

$639 M

-1%

+40%

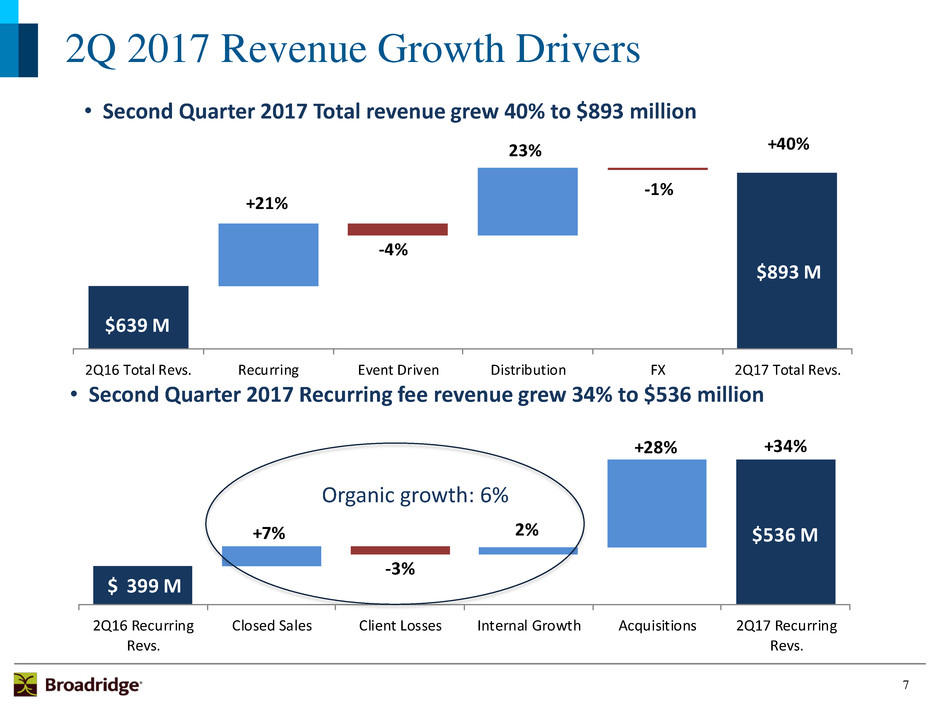

2Q 2017 Revenue Growth Drivers

• Second Quarter 2017 Total revenue grew 40% to $893 million

• Second Quarter 2017 Recurring fee revenue grew 34% to $536 million

Organic growth: 6%

8

1H16 Recurring

Revs.

Closed Sales Client Losses Internal Growth Acquisitions 1H17 Recurring

Revs.

$792 M

$1,053 M

+6%

-3%

1%

+28% +33%

1H16 Total Revs. Recurring Event Driven Distribution Other 1H17 Total Revs.

$1.8 Bn

+21%

-2%

27%

$1.2 Bn

-1%

+45%

1H 2017 Revenue Growth Drivers

• Six Months Fiscal 2017 Total revenue grew 45% to $1.8 billion

• Six Months Fiscal 2017 Recurring fee revenue grew 33% to $1.1 billion

Organic growth: 5%

9

$0.33

$0.25

$0.38

$0.39

$0.20

$0.25

$0.30

$0.35

$0.40

$0.45

2Q 2016 2Q 2017

Diluted EPS Adjusted EPS

+3%

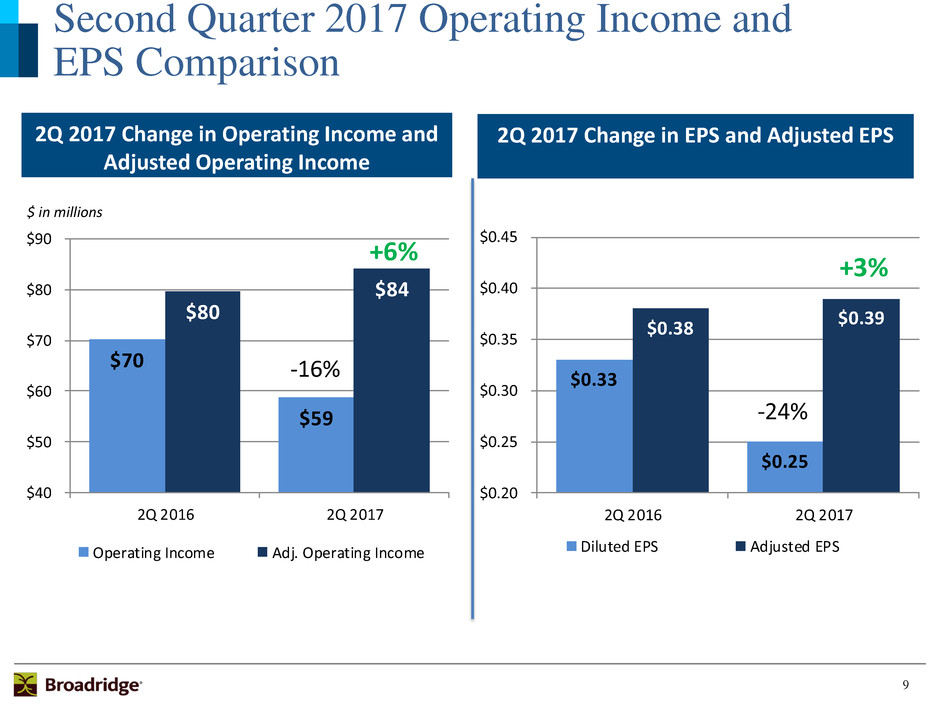

-24%Second Quarter 2017 Operating Income and

EPS Comparison

$ in millions

2Q 2017 Change in Operating Income and

Adjusted Operating Income

2Q 2017 Change in EPS and Adjusted EPS

$70

$59

$80

$84

$40

$50

$60

$70

$80

$90

2Q 2016 2Q 2017

Operating Income Adj. Operating Income

+6%

-16%

10

$0.61

$0.52

$0.71

$0.75

$0.40

$0.50

$0.60

$0.70

$0.80

1H 2016 1H 2017

Diluted EPS Adjusted EPS

+6%

-15%

Six Months Fiscal Year 2017 Operating Income

and EPS Comparison

$ in millions

Six Months Fiscal 2017 Change in Operating

Income and Adjusted Operating Income

Six Months Fiscal 2017 Change in EPS and

Adjusted EPS

$129

$125

$148

$166

$100

$120

$140

$160

$180

1H 2016 1H 2017

Operating Income Adj. Operating Income

+12%

-3%

11

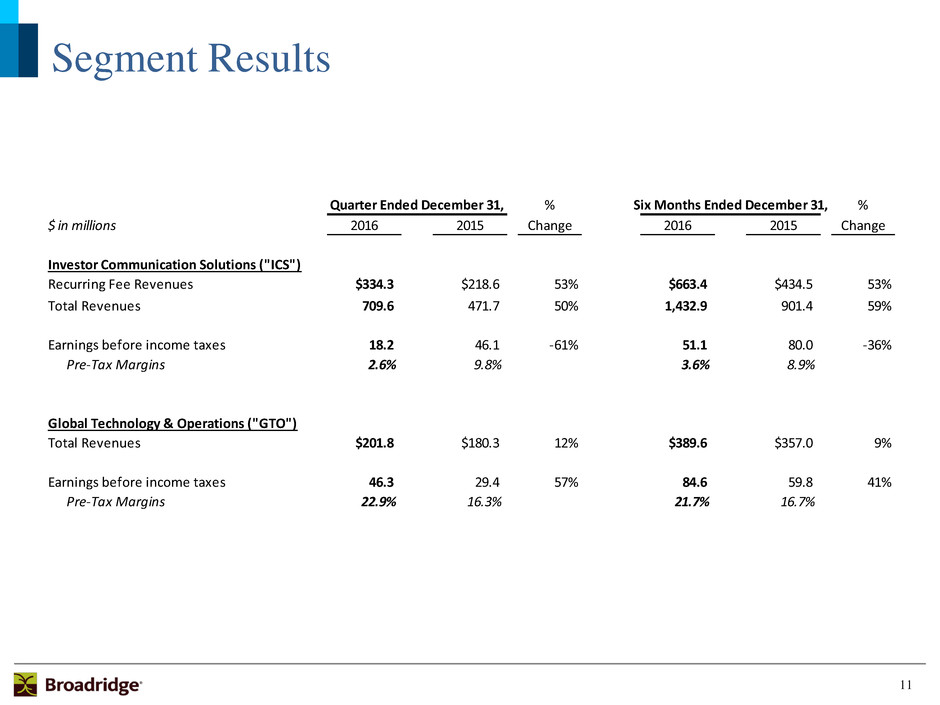

Segment Results

Quarter Ended December 31, % Six Months Ended December 31, %

$ in millions 2016 2015 Change 2016 2015 Change

Investor Communication Solutions ("ICS")

Recurring Fee Revenues $334.3 $218.6 53% $663.4 $434.5 53%

Total Revenues 709.6 471.7 50% 1,432.9 901.4 59%

Earnings before income taxes 18.2 46.1 -61% 51.1 80.0 -36%

Pre-Tax Margins 2.6% 9.8% 3.6% 8.9%

Global Technology & Operations ("GTO")

Total Revenues $201.8 $180.3 12% $389.6 $357.0 9%

Earnings before income taxes 46.3 29.4 57% 84.6 59.8 41%

Pre-Tax Margins 22.9% 16.3% 21.7% 16.7%

12

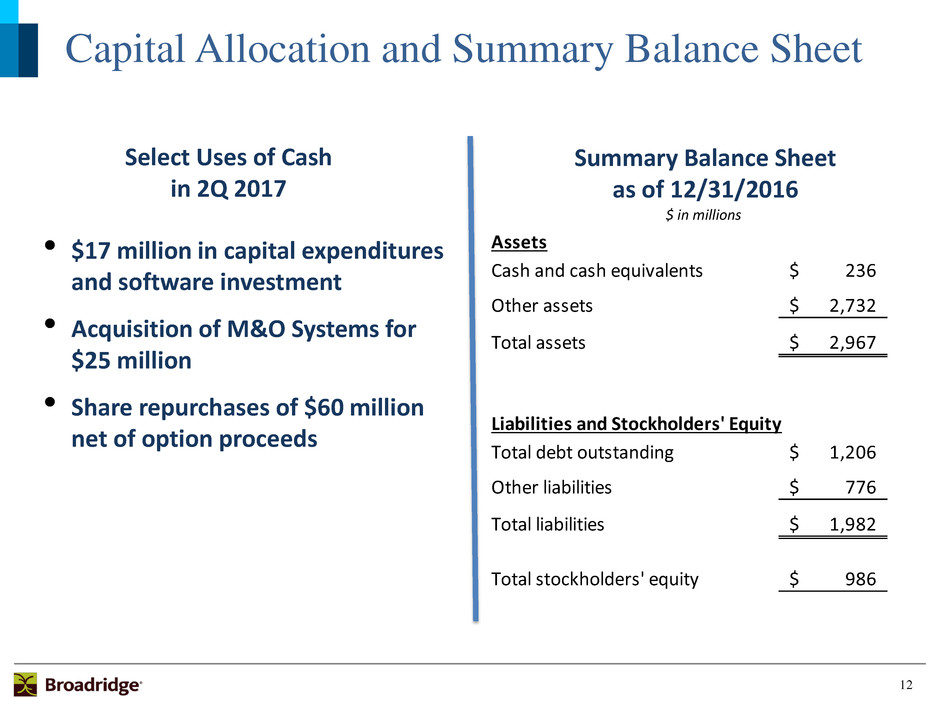

Capital Allocation and Summary Balance Sheet

Summary Balance Sheet

as of 12/31/2016

Select Uses of Cash

in 2Q 2017

• $17 million in capital expenditures

and software investment

• Acquisition of M&O Systems for

$25 million

• Share repurchases of $60 million

net of option proceeds

$ in millions

Assets

Cash and cash equivalents 236$

Other assets 2,732$

Total assets 2,967$

Liabilities and Stockholders' Equity

Total debt outstanding 1,206$

Other liabilities 776$

Total liabilities 1,982$

Total stockholders' equity 986$

13

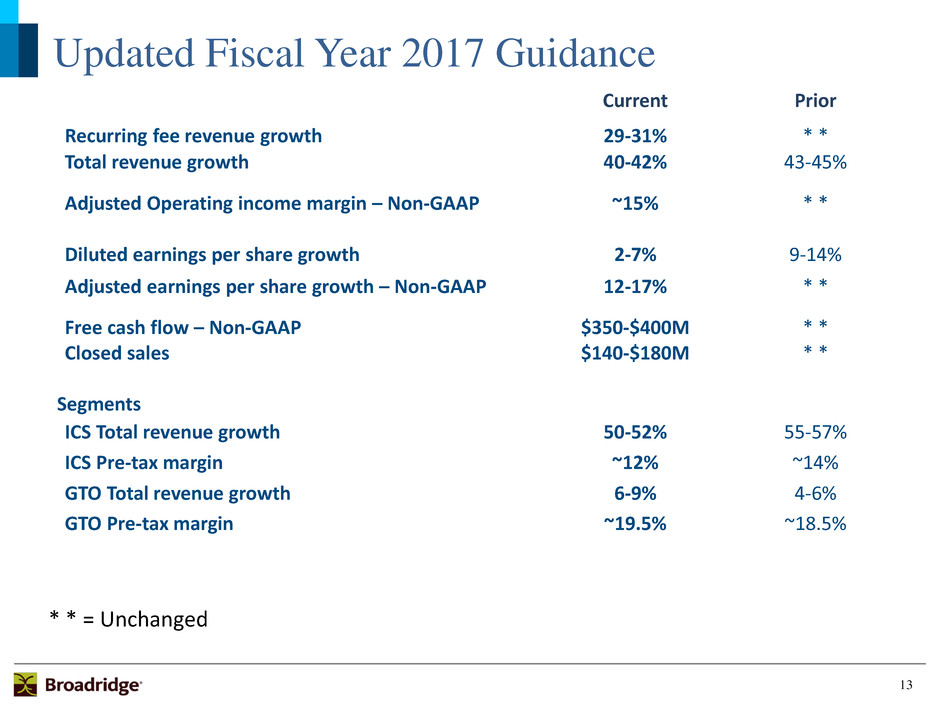

Current Prior

Recurring fee revenue growth 29-31% * *

Total revenue growth 40-42% 43-45%

Adjusted Operating income margin – Non-GAAP ~15% * *

Diluted earnings per share growth 2-7% 9-14%

Adjusted earnings per share growth – Non-GAAP 12-17% * *

Free cash flow – Non-GAAP $350-$400M * *

Closed sales $140-$180M * *

Segments

ICS Total revenue growth 50-52% 55-57%

ICS Pre-tax margin ~12% ~14%

GTO Total revenue growth 6-9% 4-6%

GTO Pre-tax margin ~19.5% ~18.5%

Updated Fiscal Year 2017 Guidance

* * = Unchanged

14

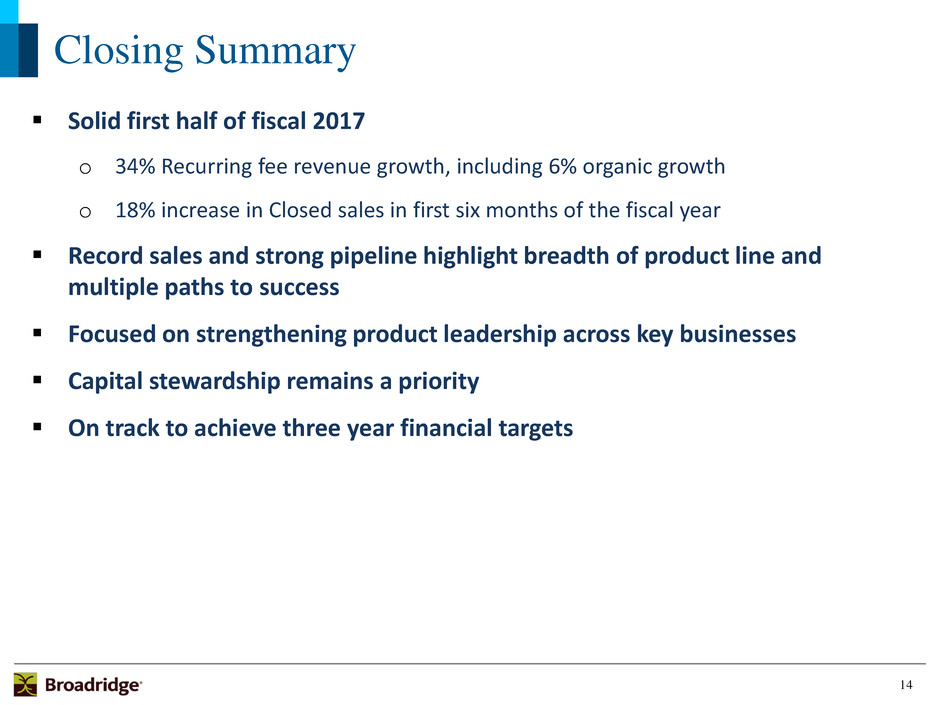

Closing Summary

Solid first half of fiscal 2017

o 34% Recurring fee revenue growth, including 6% organic growth

o 18% increase in Closed sales in first six months of the fiscal year

Record sales and strong pipeline highlight breadth of product line and

multiple paths to success

Focused on strengthening product leadership across key businesses

Capital stewardship remains a priority

On track to achieve three year financial targets

15

Appendix

16

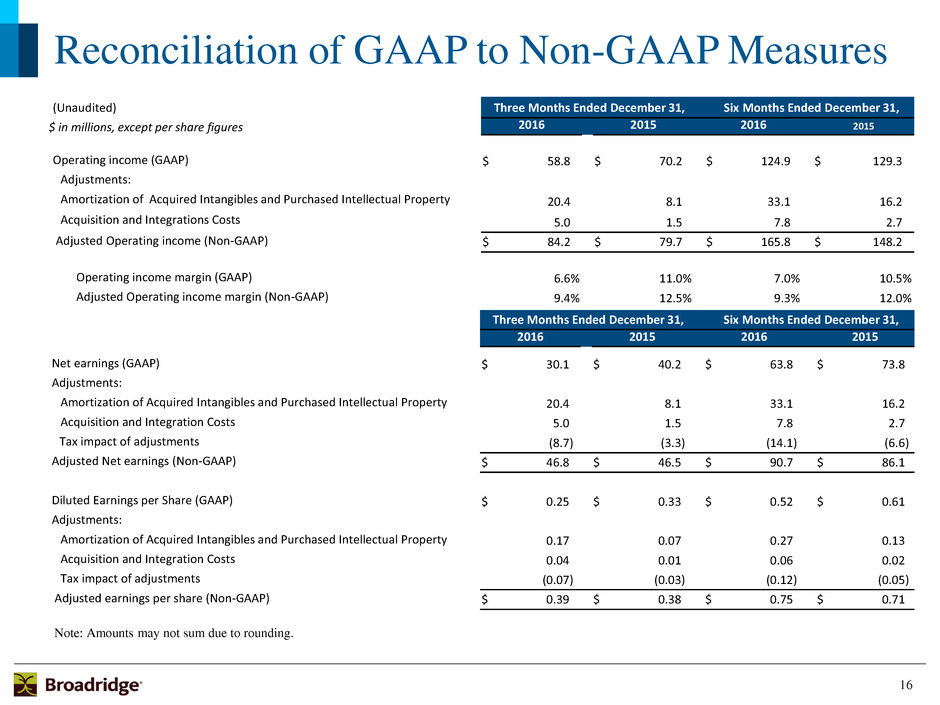

Reconciliation of GAAP to Non-GAAP Measures

(Unaudited) Three Months Ended December 31, Six Months Ended December 31,

$ in millions, except per share figures 2016 2015 2016 2015

Operating income (GAAP) $ 58.8 $ 70.2 $ 124.9 $ 129.3

Adjustments:

Amortization of Acquired Intangibles and Purchased Intellectual Property 20.4 8.1 33.1 16.2

Acquisition and Integrations Costs 5.0 1.5 7.8 2.7

Adjusted Operating income (Non-GAAP) $ 84.2 $ 79.7 $ 165.8 $ 148.2

Operating income margin (GAAP) 6.6 % 11.0 % 7.0 % 10.5 %

Adjusted Operating income margin (Non-GAAP) 9.4 % 12.5 % 9.3 % 12.0 %

Three Months Ended December 31, Six Months Ended December 31,

2016 2015 2016 2015

Net earnings (GAAP) $ 30.1 $ 40.2 $ 63.8 $ 73.8

Adjustments:

Amortization of Acquired Intangibles and Purchased Intellectual Property 20.4 8.1 33.1 16.2

Acquisition and Integration Costs 5.0 1.5 7.8 2.7

Tax impact of adjustments (8.7 ) (3.3 ) (14.1 ) (6.6 )

Adjusted Net earnings (Non-GAAP) $ 46.8 $ 46.5 $ 90.7 $ 86.1

Diluted Earnings per Share (GAAP) $ 0.25 $ 0.33 $ 0.52 $ 0.61

Adjustments:

Amortization of Acquired Intangibles and Purchased Intellectual Property 0.17 0.07 0.27 0.13

Acquisition and Integration Costs 0.04 0.01 0.06 0.02

Tax impact of adjustments (0.07 ) (0.03 ) (0.12 ) (0.05 )

Adjusted earnings per share (Non-GAAP) $ 0.39 $ 0.38 $ 0.75 $ 0.71

Note: Amounts may not sum due to rounding.

17

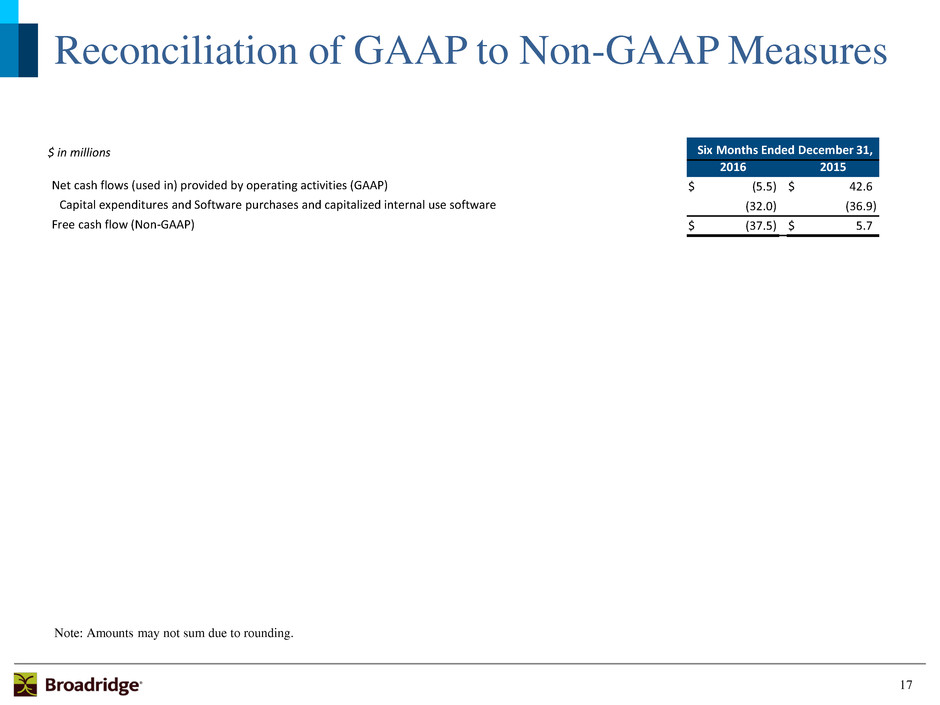

Reconciliation of GAAP to Non-GAAP Measures

$ in millions Six Months Ended December 31,

2016 2015

Net cash flows (used in) provided by operating activities (GAAP) $ (5.5 ) $ 42.6

Capital expenditures and Software purchases and capitalized internal use software (32.0 ) (36.9 )

Free cash flow (Non-GAAP) $ (37.5 ) $ 5.7

Note: Amounts may not sum due to rounding.

18

Fiscal Year 2017 Guidance

Adjusted Earnings Per Share Growth Rate (1)

Diluted earnings per share (GAAP) 2% - 7%

Adjusted earnings per share (Non-GAAP) 12% - 17%

Adjusted Operating Income Margin (2)

Operating income margin % (GAAP) ~13%

Adjusted Operating income margin % (Non-GAAP) ~15%

Free Cash Flow

Net cash flows provided by operating activities (GAAP) $470 - $550 million

Capital expenditures and Software purchases and capitalized internal use software (120) - (150) million

Free cash flow (Non-GAAP) $350 - $400 million

(1) Adjusted EPS growth (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased Intellectual Property

and Acquisition and Integration Costs and is calculated using diluted shares outstanding. Fiscal year 2017 Non-GAAP Adjusted EPS guidance estimates exclude

estimated Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs, net of taxes, of approximately

$0.47 per share.

(2) Adjusted Operating income margin (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased

Intellectual Property and Acquisition and Integration Costs. Fiscal year 2017 Non-GAAP Adjusted Operating income margin guidance estimates exclude

estimated Amortization of Acquired Intangibles and Purchased Intellectual Property and Acquisition and Integration Costs of approximately $87 million.