Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - METLIFE INC | d308320dex991.htm |

| 8-K - 8-K - METLIFE INC | d308320d8k.htm |

Exhibit 99.2

Non-GAAP Financial Information

Explanatory Note on Non-GAAP Financial Information

Any references in Exhibit 99.1 to this Form 8-K (except in this Explanatory Note on Non-GAAP Financial Information) to:

(i) net income (loss); (ii) operating earnings; and (iii) operating earnings per share.

should be read as, respectively:

(i) net income (loss) available to MetLife, Inc.’s

common shareholders; and

(ii) operating earnings available to common shareholders.

(iii) operating earnings available to common shareholders per diluted common share.

In Exhibit

99.1 to this Form 8-K, MetLife presents certain measures of its performance that are not calculated in accordance with accounting principles generally accepted in the United

States of America (“GAAP”). MetLife believes that these non-GAAP financial measures enhance the understanding of MetLife’s performance by highlighting the results of

operations and the underlying profitability drivers of the business. The following non-GAAP financial measures should not be viewed as substitutes for the most directly comparable financial measures

Non-GAAP financial measures:

(i) operating earnings available to common shareholders; and

(ii) operating earnings available to common shareholders per diluted share.

Comparable GAAP financial measures:

(i) net income (loss) available to

MetLife, Inc.’s common shareholders; and (ii) net income (loss) available to MetLife, Inc.’s common shareholders per diluted common share.

Reconciliations of these non-GAAP measures to the most directly comparable GAAP measures are included in this Exhibit 99.2 to this Form 8-K and in MetLife’s

fourth quarter 2016 quarterly financial supplement, which is available at www.metlife.com.

MetLife’s definitions of the various non-GAAP and other financial

measures discussed in this news release may differ from those used by other companies:

Explanatory Note on Non-GAAP Financial Information (Continued)

Operating earnings and related measures

operating earnings available to common shareholders

operating earnings available to common shareholders per diluted common share

These measures are used by management to evaluate performance and allocate resources. Consistent with GAAP guidance for segment reporting, operating earnings is

also MetLife’s

GAAP measure of segment performance. Operating earnings and other financial measures based on operating earnings are also the measures by which

MetLife senior management’s and many other employees’ performance is evaluated for the purposes of determining their compensation under applicable compensation plans. Operating earnings and other financial measures based on operating

earnings allow analysis of our performance relative to our business plan and facilitate comparisons to industry results.

Operating earnings is defined as operating

revenues less operating expenses, both net of income tax. Operating earnings available to common shareholders is defined as operating earnings less preferred stock dividends.

Operating revenues and operating expenses

These financial measures, along with the related

operating premiums, fees and other revenues, focus on our primary businesses principally by excluding the impact of market volatility, which could distort trends, and revenues and costs related to non-core products and divested businesses and

certain entities required to be consolidated under GAAP. Also, these measures exclude results of discontinued operations and other businesses that have been or will be sold or exited by MetLife and are referred to as divested businesses. In

addition, for the year ended December 31, 2016, operating revenues and operating expenses exclude the financial impact of converting MetLife’s Japan operations to calendar-year end reporting without retrospective application of this change

to prior periods and is referred to as lag elimination. Operating revenues also excludes net investment gains (losses) (NIGL) and net derivative gains (losses) (NDGL). Operating expenses also excludes goodwill impairments.

The following additional adjustments are made to revenues, in the line items indicated, in calculating operating revenues:

Universal life and investment-type product policy fees excludes the amortization of unearned revenue related to NIGL and NDGL and certain variable annuity guaranteed minimum income

benefits (GMIB) fees (GMIB fees);

Net investment income: (i) includes earned income on derivatives and amortization of premium on derivatives that are hedges

of investments or that are used to replicate certain investments but do not qualify for hedge accounting treatment (“investment hedge adjustments”), (ii) excludes post-tax operating earnings adjustments relating to insurance joint

ventures accounted for under the equity method, (iii) excludes certain amounts related to contractholder-directed unit-linked investments, and (iv) excludes certain amounts related to securitization entities that are variable interest

entities (VIEs) consolidated under GAAP; and

Other revenues are adjusted for settlements of foreign currency earnings hedges.

Explanatory Note on Non-GAAP Financial Information (Continued)

The following additional adjustments are made to expenses, in the line items indicated, in calculating operating expenses:

Policyholder benefits and claims and policyholder dividends excludes: (i) changes in the policyholder dividend obligation related to NIGL and NDGL, (ii) inflation-indexed

benefit adjustments associated with contracts backed by inflation-indexed investments and amounts associated with periodic crediting rate adjustments based on the total return of a contractually referenced pool of assets and other pass through

adjustments, (iii) benefits and hedging costs related to GMIBs (GMIB costs), and (iv) market value adjustments associated with surrenders or terminations of contracts (Market value adjustments);

Interest credited to policyholder account balances includes adjustments for earned income on derivatives and amortization of premium on derivatives that are hedges of policyholder

account balances but do not qualify for hedge accounting treatment and excludes amounts related to net investment income earned on contractholder-directed unit-linked investments;

Amortization of DAC and value of business acquired (VOBA) excludes amounts related to: (i) NIGL and NDGL, (ii) GMIB fees and GMIB costs and (iii) Market value

adjustments;

Amortization of negative VOBA excludes amounts related to Market value adjustments;

Interest expense on debt excludes certain amounts related to securitization entities that are VIEs consolidated under GAAP; and

Other operating expenses excludes costs related to: (i) noncontrolling interests, (ii) implementation of new insurance regulatory requirements, and

(iii) acquisition, integration and other costs.

Operating earnings also excludes the recognition of certain contingent assets and liabilities that could not

be recognized at acquisition or adjusted for during the measurement period under GAAP business combination accounting guidance.

The tax impact of the adjustments

mentioned above are calculated net of the U.S. or foreign statutory tax rate, which could differ from the Company’s effective tax rate. Additionally, the provision for income tax (expense) benefit also includes the impact related to the timing

of certain tax credits, as well as certain tax reforms.

The following additional information is relevant to an understanding of MetLife’s performance results:

Asymmetrical and non-economic accounting refer to: (i) the portion of net derivative gains (losses) on embedded derivatives attributable to the inclusion of

MetLife’s credit spreads in the liability valuations, (ii) hedging activity that generates net derivative gains (losses) and creates fluctuations in net income because hedge accounting cannot be achieved and the item being hedged does not

a have an offsetting gain or loss recognized in earnings, (iii) inflation-indexed benefit adjustments associated with contracts backed by inflation-indexed investments and amounts associated with periodic crediting rate adjustments based on the

total return of a contractually referenced pool of assets and other pass through adjustments, and (iv) impact of changes in foreign currency exchange rates on the re-measurement of foreign denominated unhedged funding agreements and financing

transactions to the U.S. dollar and the remeasurement of certain liabilities from non-functional currencies to functional currencies. MetLife believes that excluding the impact of asymmetrical and non-economic accounting from total GAAP results

enhances investor understanding of MetLife’s performance by disclosing how these accounting practices affect reported GAAP results.

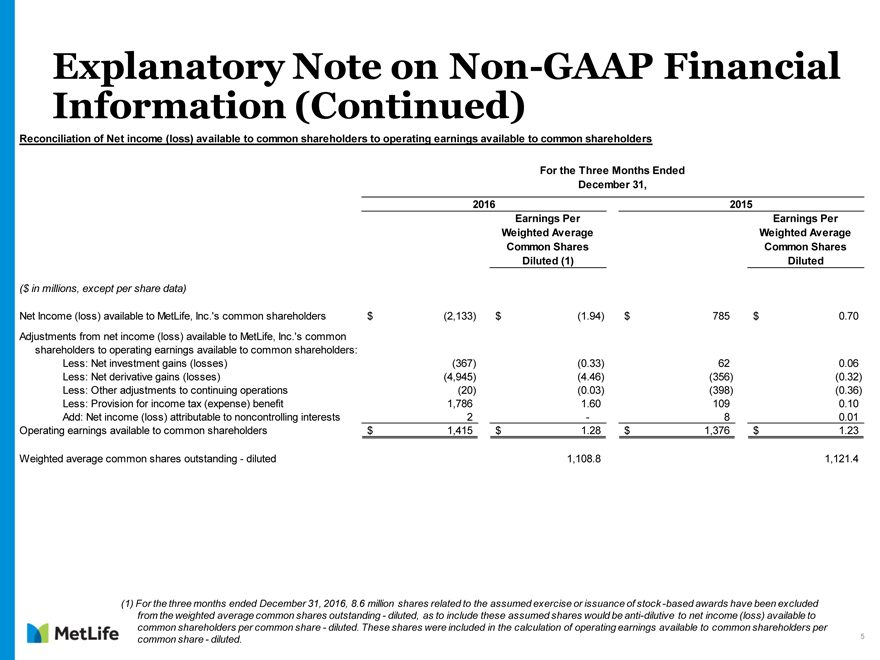

Explanatory Note on Non-GAAP Financial Information (Continued)

Reconciliation of Net income (loss) available to common shareholders to operating earnings available to common shareholders

For the Three Months Ended December 31,

2016 2015

Earnings Per Earnings Per Weighted Average Weighted Average Common Shares Common Shares Diluted (1) Diluted

($ in millions, except per share data)

Net Income (loss) available to MetLife, Inc.‘s

common shareholders $(2,133) $ (1.94) $ 785 $ 0.70 Adjustments from net income (loss) available to MetLife, Inc.‘s common shareholders to operating earnings available to common shareholders: Less: Net investment gains (losses)

(367) (0.33) 62 .06 Less: Net derivative gains (losses) (4,945) (4.46) (356) (0.32) Less: Other adjustments to continuing operations (20) (0.03) (398) (0.36) Less: Provision for income tax (expense) benefit 1,786 1.60

109 0.10 Add: Net income (loss) attributable to noncontrolling interests 2 - 8 0.01 Operating earnings available to common shareholders $ 1,415 $ 1.28 $ 1,376 $ 1.23

Weighted average common shares outstanding - diluted 1,108.8 1,121.4

(1) For

the three months ended December 31, 2016, 8.6 million shares related to the assumed exercise or issuance of stock -based awards have been excluded from the weighted average common shares outstanding - diluted, as to include these assumed

shares would be anti-dilutive to net income (loss) available to common shareholders per common share - diluted. These shares were included in the calculation of operating earnings available to common shareholders per common share - diluted.

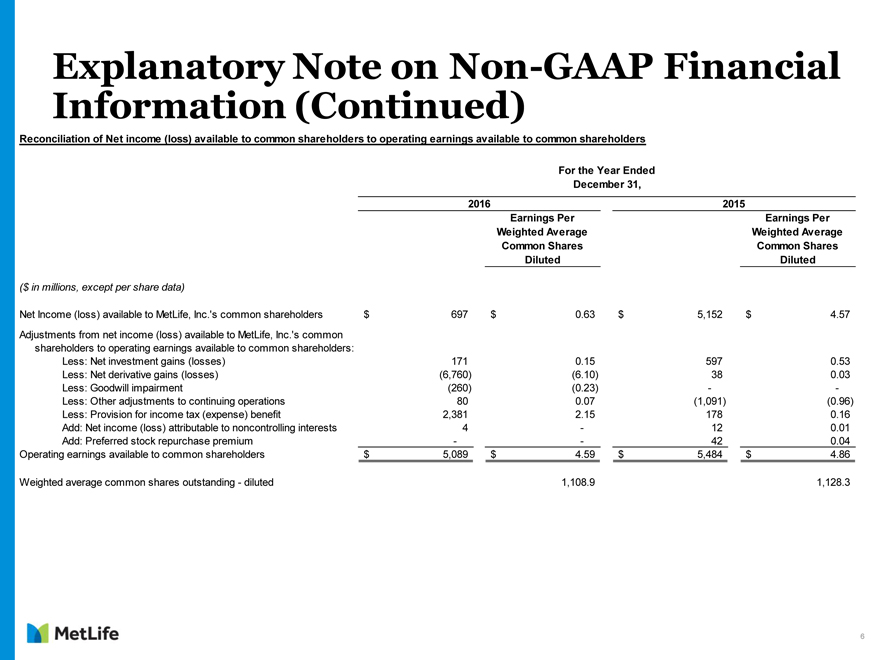

Explanatory Note on Non-GAAP Financial Information (Continued)

Reconciliation of Net income (loss) available to common shareholders to operating earnings available to common shareholders

For the Year Ended December 31,

2016 2015

Earnings Per Earnings Per Weighted Average Weighted Average Common Shares Common Shares Diluted Diluted

($ in millions, except per share data)

Net Income (loss) available to MetLife, Inc.‘s

common shareholders $ 697 $ 0.63 $ 5,152 $ 4.57 Adjustments from net income (loss) available to MetLife, Inc.‘s common shareholders to operating earnings available to common shareholders: Less: Net investment gains (losses) 171 0.15 597 0.53

Less: Net derivative gains (losses) (6,760) (6.10) 38 0.03 Less: Goodwill impairment (260) (0.23) - -Less: Other adjustments to continuing operations 80 0.07 (1,091) (0.96) Less: Provision for income tax (expense) benefit 2,381

2.15 178 0.16 Add: Net income (loss) attributable to noncontrolling interests 4 - 12 0.01 Add: Preferred stock repurchase premium - - 42 0.04 Operating earnings available to common shareholders $ 5,089 $ 4.59 $ 5,484 $ 4.86

Weighted average common shares outstanding - diluted 1,108.9 1,128.3

MetLife

Navigating life

together