Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - FIFTH THIRD BANCORP | d285237dex994.htm |

| EX-99.3 - EX-99.3 - FIFTH THIRD BANCORP | d285237dex993.htm |

| EX-99.1 - EX-99.1 - FIFTH THIRD BANCORP | d285237dex991.htm |

| 8-K - FORM 8-K - FIFTH THIRD BANCORP | d285237d8k.htm |

4Q16

Earnings Presentation January 24, 2017

Refer to earnings release dated January 24, 2017 for further information.

Exhibit 99.2 |

Cautionary

statement This presentation contains statements that we believe are

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. These

statements relate to our financial condition, results of operations,

plans, objectives, future performance or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “anticipates,” “potential,” “estimate,”

“forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or

conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk

factors set forth in our most recent Annual Report on Form 10-K as

updated from time to time by our Quarterly Reports on Form 10-Q. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make. Moreover, you should treat these statements as speaking

only as of the date they are made and based only on information then

actually known to us. There is a risk that additional information may become known during the company’s quarterly closing process or as a result of subsequent events that could affect the accuracy of the statements and financial information contained herein.

There are a number of important factors that could cause future results to differ

materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) general economic or real estate market conditions, either nationally or in the

states in which Fifth Third, one or more acquired entities and/or the

combined company do business, weaken or are less favorable than expected; (2) deteriorating credit quality; (3) political developments, wars or other hostilities may disrupt or increase volatility in securities markets or other economic conditions; (4) changes in the interest rate

environment reduce interest margins; (5) prepayment speeds, loan

origination and sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate sources of funding and liquidity; (7) maintaining capital requirements and adequate sources of funding and liquidity may limit Fifth Third’s operations

and potential growth; (8) changes and trends in capital markets; (9)

problems encountered by larger or similar financial institutions may adversely affect the banking industry and/or Fifth Third; (10) competitive pressures among depository institutions increase significantly; (11) effects of critical accounting policies and judgments; (12)

changes in accounting policies or procedures as

may be required by the Financial Accounting Standards Board (FASB) or other regulatory

agencies; (13) legislative or regulatory changes or actions, or significant litigation, adversely affect Fifth Third, one or more acquired entities and/or the combined company or the businesses in which Fifth Third, one or more

acquired entities and/or the combined company are engaged, including the

Dodd-Frank Wall Street Reform and Consumer Protection Act; (14) ability to maintain favorable ratings from rating agencies; (15) fluctuation of Fifth Third’s stock price; (16) ability to attract and retain key personnel; (17) ability to receive dividends from its

subsidiaries; (18) potentially dilutive effect of future acquisitions on

current shareholders’ ownership of Fifth Third; (19) effects of accounting or financial results of one or more acquired entities; (20) difficulties from Fifth Third’s investment in, relationship with, and nature of the operations of Vantiv, LLC; (21) loss of income from any sale or potential sale

of businesses; (22) difficulties in separating the operations of any

branches or other assets divested; (23) losses or adverse impacts on the carrying values of branches and long-lived assets in connection with their sales or anticipated sales; (24) inability to achieve expected benefits from branch consolidations and planned sales within desired

timeframes, if at all; (25) ability to secure confidential information

and deliver products and services through the use of computer systems and telecommunications networks; and (26) the impact of reputational risk created by these developments on such matters as business generation and retention, funding and liquidity.

You should refer to our periodic and current reports filed with the Securities and

Exchange Commission, or “SEC,” for further information on other

factors, which could cause actual results to be significantly different

from those expressed or implied by these forward-looking statements.

In this presentation, we may sometimes provide non-GAAP financial information.

Please note that although non-GAAP financial measures provide useful insight to analysts, investors and regulators, they should not be considered in isolation or relied upon as a substitute for analysis using GAAP measures. We provide

GAAP reconciliations for non- GAAP measures in a later slide in this

presentation as well as in our earnings release, both of which are available in the investor relations section of our website, www.53.com. Management has provided forward-looking guidance on certain non-GAAP measures in connection with this presentation in order to facilitate

comparability with the Bancorp’s historical performance and

financial condition as reflected in these non-GAAP measures. Such forward-looking non-GAAP measures include return on tangible common equity; net interest margin (FTE); net interest income (FTE); adjusted noninterest income excluding mortgage banking net revenue; and adjusted

noninterest income, excluding certain transactions and adjustments

related to the Bancorp’s investment in Vantiv, Visa total return swap, and branch sales, closures and consolidations. Bancorp’s management does not estimate on a forward-looking basis the impact of items similar to those that it has excluded to generate these non-GAAP measures on

a historical basis because the occurrence and amounts of items such as

these are difficult to predict. As a result, the Bancorp has not provided reconciliations of its forward-looking non-GAAP measures. © Fifth Third Bank | All Rights Reserved 2 |

3 Adjusted 1 NII of $925 million, up $12 million sequentially; adjusted 1 NIM of 2.91%, up 3 bps sequentially Reported NII decreased $4 million vs. 3Q16; NIM (FTE) decreased 2 bps to 2.86% 1 vs. 3Q16 Adjusted 1 noninterest income up 2% vs. 3Q16 Reported noninterest income down 26% vs. 3Q16 primarily driven by Vantiv-related items Tightly-managed operating expenses; adjusted 1 noninterest expenses down 2% vs. 3Q16 Reported noninterest expenses down 1% vs. 3Q16 Improving charge-offs and criticized assets; commercial full year NCO ratio at 15 year low Executing on North Star initiatives Overall solid credit quality in-line with expectations Fourth quarter 2016 Diluted EPS $0.49 Included $0.01 net positive impact for certain items 2 Net income $395 million Fourth quarter 2016 highlights 1 Non-GAAP measure: See Reg G reconciliation on pages 22 and 23 of this presentation and use of non-GAAP measures on page 32 of the earnings release 2 See page 4 of the presentation for impact of certain items Full year 2016 Diluted EPS

$1.93

Net Income $1.6 billion © Fifth Third Bank | All Rights Reserved |

Pre-tax items included in 4Q16 results

had a net positive $0.01 EPS impact:

A $16 million pre-tax (~$10 million

after-tax ) reduction to net interest

income for refunds offered to

certain card customers

A $9 million pre-tax (~$6 million

after-tax ) gain from the net exercise

of the Vantiv warrant A $6 million pre-tax (~$4 million after-tax ) benefit related to the valuation of the Visa total return swap A $6 million tax benefit from the early adoption of an accounting standard Credit trends NCO ratio of 31 bps; down 14 bps vs. 3Q16 Portfolio NPA ratio of 80 bps; up 5 bps vs. 3Q16 4Q16 in review Non-GAAP measure: See Reg G reconciliation on pages 22 and 23 of this presentation and use of non-GAAP measures on page 32 of the earnings release Assumes a 35% tax rate ($ millions) 4Q16 Seq. YOY Loans & leases (ex. HFS) $92,964 (1%) (1%) Core deposits $100,949 2% 1% Net interest income $903 - - Taxable equivalent adjustment 6 - 20% Net interest income (taxable equivalent) 909 - 1% Provision for loan and lease losses 54 (33%) (41%) Noninterest income 620 (26%) (44%) Noninterest expense 960 (1%) - Net income attributable to Bancorp $395 (23%) (40%) Net income available to common shareholders $372 (26%) (41%) Earnings per share, diluted 0.49 (25%) (38%) Net interest margin (FTE) 2.86% (2bps) 1bp Efficiency ratio (FTE) 62.8% 730bps 1480bps Return on average assets 1.11% (33bps) (72bps) Return on average common equity 9.7% (310bps) (750bps) Return on average tangible common equity 11.6% (360bps) (900bps) Tangible book value per share $ 16.60 (4%) 8% 1 2 1 1 1 2 © Fifth Third Bank | All Rights Reserved 4 1 Average Balances Income Statement Data Financial Ratios 2 2 2 |

5 Avg +1% YoY $95.7 $94.7 $94.9 $94.9 $97.0 94% 94% 95% 95% 92% 4Q15 1Q16 2Q16 3Q16 4Q16 $29.0 $29.7 $30.1 $29.8 $30.8 4Q15 1Q16 2Q16 3Q16 4Q16 Average securities Short-term investments FY: 2% loan growth (EOP, excluding HFS) Continuing to maintain pricing discipline $93.6 $93.3 $93.9 $93.5 $93.0 4Q15 1Q16 2Q16 3Q16 4Q16 Balance sheet Loan & lease balances 1 ($ billions) • Transaction deposits up 2% vs. 3Q16, driven by increased: – Commercial interest checking – Consumer money market • Average loan-to-core deposit ratio of 92% • Modified LCR of 128% at 4Q16 Core deposit balances 1 ($ billions) $100.9 $99.7 Securities and short-term investments 1 ($ billions) • Average securities up $1.8B YoY driven by: – Opportunistically deploying cash at more attractive entry points than those experienced in prior quarters • Securities portfolio / total assets of 21.7% compared to 20.4% in 4Q15 1 All balances are on an average basis; loans balances exclude HFS • Commercial down 1% vs. 3Q16; flat YoY – C&I down 1% vs. 3Q16 and 1% YoY – CRE up 1% vs. 3Q16 and 7% YoY • Consumer flat vs. 3Q16; down 2% YoY – Auto down 3% vs. 3Q16 and 13% YoY – HE down 2% vs. 3Q16 and 7% YoY – Mortgage up 3% vs. 3Q16 and 10% YoY $98.9 $99.0 $98.7 Transaction Other time Loan-to-core deposit ratio Current Outlook: Avg -1% YoY $31.3 $31.6 $32.0 $31.7 $32.6 © Fifth Third Bank | All Rights Reserved |

6 FY: NII (FTE) up 3.5 - 5% and NIM (FTE) of 2.95 – 3.00% Q1: NII (FTE) up 1.5 – 2% and NIM (FTE) up 8 - 9 bps from reported results (lower-end of FY ranges assumes no additional rate hikes, higher-end assumes June & September rate hikes)

1 Non-GAAP measure: See Reg G reconciliation on pages 22 and 23 of this presentation and use of non-GAAP measures on page 32 of the earnings release

$925 • Adjusted NII & NIM performance driven by: - improved short-term market rates - continued pricing discipline • NII was up $21 million, or 2% • NIM up 6 bps 4Q16 vs. 3Q16 4Q16 vs. 4Q15 • Adjusted NII & NIM performance driven by: - improved short-term market rates - continued pricing discipline • NII was up $12 million, or 1% • NIM up 3 bps Current Outlook 1 : NII and NIM (FTE) 1 ($ millions) Net interest income © Fifth Third Bank | All Rights Reserved |

7 © Fifth Third Bank | All Rights Reserved $1,104 $637 $599 $840 $620 $623 $578 $602 $596 $608 4Q15 1Q16 2Q16 3Q16 4Q16 Noninterest income ($ millions) Noninterest income Adjusted noninterest income FY: adjusted up 3.5 - 4%, excluding mortgage Q1: adjusted flat sequentially, excluding mortgage and TRA payment (mortgage revenue excluded given volatility from significant increase in interest rates at the end of 2016)

Noninterest income 1 Non-GAAP measure: See Reg G reconciliation on pages 22 and 23 of this presentation and use of non-GAAP measures on page 32 of the earnings release 2 2016 excludes all items previously disclosed in the “noninterest income excluding certain items” section of the 2016 earnings releases,

including all Vantiv transactions and gains, branch valuation adjustments

and gains, the Visa total return swap, the impact of transferring certain nonconforming investments to HFS, the gain on the agent card portfolio, the gain on non-branch facility, and gains/losses on securities, resulting in $2.384BN in 2016 ($2.1BN excluding all mortgage banking net revenue)

Adjusted 1 noninterest income up $12 million, or 2%; performance driven by: Annual Vantiv TRA payment Partially offset by lower corporate banking revenue 4Q16 vs. 3Q16 4Q16 vs. 4Q15 Adjusted 1 noninterest income down $15 million, or 2%; performance driven by: Decrease in mortgage banking net revenue 1 Current Outlook 1,2 : |

8 Noninterest expense 1 Non-GAAP measure: See Reg G reconciliation on pages 22 and 23 of this presentation and use of non-GAAP measures on page 32 of the earnings release

FY: 1% annual growth Q1: 2% growth year-over-year $963 $986 $983 $973 $960 $951 $971 $971 $966 $951 4Q15 1Q16 2Q16 3Q16 4Q16 Noninterest expense Adjusted noninterest expense Noninterest expense ($ millions) • Adjusted 1 noninterest expense down 2%; performance driven by: - Decrease in tech and comm. expense - Decrease in provision for unfunded commitments - Seasonally lower marketing expense 4Q16 vs. 3Q16 4Q16 vs. 4Q15 • Adjusted 1 noninterest expense flat; performance driven by: - Lower card and processing expense - Lower net occupancy • Partially offset by increased compensation expense as a result of personnel additions in risk and compliance and IT 1 Current Outlook: © Fifth Third Bank | All Rights Reserved |

9 • Expense growth in 2017 includes the impact of North Star initiatives • Excluding the impact of these incremental expenses, 2017 expenses would be expected to decrease by 50 bps compared to our guidance of 1% growth year-end 2017 Select North Star Initiatives Expanded mortgage capacity via new system Teller automation Omni-channel distribution investments New credit card products and investments in analytics GreenSky - originations Specialty and Asset-Based Lending growth New vertical build-outs End-to-end process re-design Continued capital markets growth Enhanced profitability measurement capabilities Treasury Mgmt. product expansion and optimization Compensation plan re-design / headcount rationalization Renegotiate major vendor contracts Automation and robotics initiatives Non-branch rationalization and workspace management Primary Focus Revenue / Expense R + E E R + E R R R R R + E R R + E E E E E Ongoing initiatives <50% 50-75% 76-100% R year-end 2018 year-end 2019 Progress towards full financial run-rate impact GreenSky - full channel integration & digital capabilities R North Star initiatives |

10 • 4Q16 net charge-offs of 0.31%, down 14 bps from 3Q16, including a $36MM decrease in C&I loan NCOs • 4Q16 portfolio NPAs up $40MM from 3Q16 - Single credit drove increase in NPAs • 4Q16 criticized asset ratio down 53 bps; lowest since 2007 • 4Q16 reserve of 1.36% down 1 bp sequentially Credit quality overview NCOs range-bound with potential quarterly variability Provision reflective of loan growth $1,272 $1,295 $1,299 $1,272 $1,253 1.37% 1.38% 1.38% 1.37% 1.36% 4Q15 1Q16 2Q16 3Q16 4Q16 Reserve coverage ($ millions) Allowance for Loan & Lease Losses (ALLL) ALLL / Loans and Leases $80 $96 $87 $107 $73 Current Outlook: $46 $42 $41 $44 $45 4Q15 1Q16 2Q16 3Q16 4Q16 Net charge-offs ($ millions) Commercial Consumer Total NCO Ratio $419 $611 $602 $513 $564 $228 $214 $203 $185 $174 0.70% 0.88% 0.86% 0.75% 0.80% $647 $825 $805 $698 $738 4Q15 1Q16 2Q16 3Q16 4Q16 Commercial Consumer Total NPA Ratio HFI non-performing assets ($ millions) $54 $46 $63 $28 0.34% 0.42% 0.37% 0.45% 0.31% $34 © Fifth Third Bank | All Rights Reserved |

11 Strong capital and liquidity position 1 Current period regulatory capital ratios are estimated 2 Net of issuance for employee stock compensation; including the issuance, gross payout ratios were 77% in 2014, 78% in 2015, and 66% in 2016

Capital Update

CET1 strong and improved to 10.40%, up 23 bps sequentially and 58 bps from

4Q15 Tier I risk-based capital 11.51%; Total risk-based capital

15.00%; Leverage 9.90% Share repurchases reduced common shares outstanding

by 35 million shares in 2016

$986 million of total capital returned to common shareholders

2 Liquidity Update Modified LCR of 128% in 4Q16, up from 115% in 3Q16 9.8% 9.8% 9.9% 10.2% 10.4% 4Q15 1Q16 2Q16 3Q16 4Q16 Common Equity Tier 1 Ratio (Basel III) 1 Impacted by 3Q16 Vantiv TRA gains recognized but not realized; excluding impact, payout rate was 66% © Fifth Third Bank | All Rights Reserved 42% 48% 37% 30% 26% 26% 72% 74% 63% 2014 2015 2016 Share Repurchases Dividends Total Capital Returned to Common Shareholders 2 |

12 © Fifth Third Bank | All Rights Reserved Current outlook 1 Non-GAAP measure: See Reg G reconciliation on pages 22 and 23 of this presentation and use of non-GAAP measures on page 32 of the earnings release 2 2016 excludes all items previously disclosed in the “noninterest income excluding certain items” section of the earnings release,

including all Vantiv transactions and gains, branch valuation

adjustments and gains, the Visa total return swap, the impact of transferring certain nonconforming investments to HFS, the gain on the agent card portfolio, the gain on non-branch facility, and gains/losses on securities, resulting in $2.384B in 2016 ($2.1B excluding all mortgage banking revenue)

Note: Previous and current outlook excludes potential, but currently unforecasted,

items, such as any potential additional Vantiv gains or losses, future capital actions, or changes in regulatory or accounting guidance Outlook as of January 24, 2017; please see cautionary statement on slide 2 regarding forward-looking statements

Total loans & leases

(excl. HFS) Net interest income (FTE) 1 Net interest margin (FTE) 1 Noninterest income 1,2 Noninterest expense Effective tax rate Credit items FY 2017: 2% annual growth (EOP) FY 2017: Up 3.5 –

5% (lower-end w/ no additional hikes, higher-end w/ June & Sept

hikes) Q1 2017: Up 1.5 – 2% from the reported fourth

quarter NII FY 2017: 2.95% - 3.00% (lower-end w/ no

additional hikes, higher-end w/ June & Sept hikes) Q1 2017: Up by 8 - 9 bps from the reported fourth quarter NIM FY 2017: Adjusted up 3.5

– 4%, excluding

mortgage Q1 2017: Adjusted flat, excluding mortgage and Q4 TRA payment mortgage revenue excluded given volatility from significant increase in interest rates at the end of 2016

FY 2017: 1%

annual growth Q1 2017: 2% growth

year-over-year

FY 2017: mid 25% range (assumes no Federal corporate

tax reform) NCOs range-bound with potential quarterly

variability Provision reflective of loan growth

|

13 © Fifth Third Bank | All Rights Reserved Appendix |

14 PPNR and efficiency ratio trends Non-GAAP measures: See Reg G reconciliation on pages 22 and 23 of this presentation and use of non-GAAP measures on page 32 of the earnings release Prior quarters include similar adjustments © Fifth Third Bank | All Rights Reserved ($ in millions) 4Q15 1Q16 2Q16 3Q16 4Q16 Net interest income (FTE) $904 $909 $908 $913 $909 Add: Noninterest income 1,104 637 599 840 620 Less: Noninterest expense 963 986 983 973 960 Pre-provision net revenue $1,045 $560 $524 $780 $569 Adjustments to remove (benefit) / detriment : 2 In net interest income: Bankcard refunds - - - - 16 In noninterest income: Gain on sale of Vantiv shares (331) - - - - Gain on Vantiv warrant actions (89) - - - (9) Vantiv TRA settlement payment (49) - - - - Gain from termination and settlement of Vativ TRA - - - (280) - Gain on sale from the sale of a non-branch facility - - - (11) - Branch and land valuation adjustments - - - 28 - Valuation of 2009 Visa total return swap 10 (1) 50 12 (6) Transfer of nonconforming investments under Volcker to HFS - - - 9 - Vantiv warrant valuation (21) (47) (19) 2 - Gain on sale of certain branches - (8) (11) - - Gain on sale of the agented bankcard loan portfolio - - (11) - - Gain from sales of troubled debt restructurings - - - - - Impairment associated with aircraft leases - - - - - Securities (gains) / losses (1) (3) (6) (4) 3 In noninterest expense: Contribution to Fifth Third Foundation 10 - - 3 5 Severance expense 2 15 3 4 4 Retirement eligibility changes - - 9 - - Executive Retirements - - - - - Adjusted PPNR $576 $516 $539 $543 $582 PPNR reconciliation 1 1 2 • Adjusted PPNR up 7% vs. 3Q16 driven by: – Improvements in NII, noninterest income and noninterest expense resulted in ~200 bps decline in adjusted efficiency ratio • Adjusted PPNR up 1% YoY – Improvement in NII and flat expenses, partially offset by lower noninterest income resulted in ~20 bps decline in adjusted efficiency ratio $576 $516 $539 $543 $582 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 4Q15 1Q16 2Q16 3Q16 4Q16 PPNR Trend ($ millions) Adjusted PPNR Reported PPNR 48.0% 63.8% 65.3% 55.5% 62.8% 62.2% 65.3% 64.3% 64.0% 62.0% 4Q15 1Q16 2Q16 3Q16 4Q16 Efficiency ratio Efficiency Ratio Adjusted Efficiency Ratio |

15 © Fifth Third Bank | All Rights Reserved Strong liquidity profile 1 Available and contingent borrowing capacity (4Q16): – FHLB ~$10.8B available, ~$14.7B total – Federal Reserve ~$31.5B Holding Company: Modified LCR of 128% Holding Company cash at 12/31/16: $2.4B Cash currently sufficient to satisfy all fixed obligations in a stressed environment for ~24 months (debt maturities, common and preferred dividends, interest and other expenses) without accessing capital markets, relying on dividends from subsidiaries or any other actions $500MM maturity in 1Q17 Bank Entity: $250MM of debt matured in 4Q16 The Bank did not issue any additional debt in 4Q16 2017 Funding Plans: The $650MM debt maturity at the Bank will take place in 2Q17 Fifth Third would not be required to replace 2017 debt maturities to maintain our current senior debt ratings under the Moody’s LGF methodology Any additional debt issuance in 2017 would result from general balance sheet management and prudent liquidity risk management $500 $500 $500 $1,100 $2,312 2017 2018 2019 2020 2021 2022 on Fifth Third Bancorp Fifth Third Capital Trust (Bancorp) Holding company unsecured debt maturities ($ millions) $650 $1,850 $2,600 $2,100 $750 2017 2018 2019 2020 2021 2022 on Bank unsecured debt maturities ($ millions – excl. Retail Brokered & Institutional CDs) Demand 25% Interest checking 19% Savings/ MMDA 24% Consumer time 3% Foreign Office 0% Non-Core Deposits 2% S-T borrowings 3% Other liabilities 3% Equity 11% L-T debt 10% Heavily core funded as of 12/31/2016 S-T wholesale 5% |

16 © Fifth Third Bank | All Rights Reserved Balance sheet positioning Commercial Loans 1,2 Investment Portfolio Consumer Loans1 Note: Data as of 12/31/16 Includes HFS Loans & Leases Fifth Third had $4.48BN 1ML receive-fix swaps outstanding against C&I loans, which are being included in fixed

Fifth Third had $3.46BN 3ML receive-fix swaps outstanding against long term debt,

which are being included in floating, long term debt with swaps outstanding reflected at fair value • Fixed: $14.0B 1, 2 • Float: $42.5B 1, 2 • 1ML based: 62% (of total commercial) • 3ML based: 8% (of total

commercial) • Prime based: 4% (of total

commercial) • Weighted avg. life: 1.65 years • 50% allocation to bullet/locked-out cash flow securities • Investment portfolio yield: 3.17% • Duration: 4.9 years • Net unrealized pre-tax gain: $159MM • 99% AFS • Fixed: $25.1B • Float: $11.3B • 12ML based: 3% (of total

consumer) •

Prime based: 24% (of total

consumer) • Weighted avg. life: 3.76 years • Auto weighted avg. life: 1.39 years Long Term Debt3 Key Characteristics Balance Sheet Mix Fixed vs. Floating Level 1 100% Fix / 0% Float Level 2A 100% Fix / 0% Float Non-HQLA /Other 78% Fix / 22% Float C&I 20% Fix / 80% Float Commercial Mortgage 24% Fix / 76% Float 2% Fix / 98% Float Commercial Construction 100% Fix / 0% Float Commercial Lease Resi Mtg & Construction 88% Fix / 12% Float Auto 99% Fix / 1% Float 8% Fix / 92% Float Home Equity 30% Fix / 70% Float Credit Card 100% Fix / 0% Float Other • Fixed: $10.3B • Float: $4.0B • 1ML based: <1% (of total

long term debt) • 3ML based: 28% (of total long

term debt) •

Weighted avg. life: 4.38 years

Senior Debt 76% Fix / 24% Float Sub Debt 55% Fix / 45% Float 97% Fix / 3% Float Auto Securiz. Proceeds 0% Fix / 100% Float TRUPS 100% Fix / 0% Float Other 34% 46% 20% 74% 12% 7% 7% 64% 27% 8% 1% <1% 21% 28% 2% 6% 43% 1 2 3 3 1 3 3 1 1 |

17 Interest rate risk management Data as of 12/31/16 1 Actual results may vary from these simulated results due to differences between forecasted and actual balance sheet composition, timing, magnitude, and frequency of interest rate changes, as well as other changes in market conditions and management strategies.

2 Re-pricing percentage or “beta” is the estimated change in yield over 12 months as a result of a shock or ramp 100 bps parallel

shift in the yield curve •

NII benefits from asset rate reset in a rising rate environment

– 58% of total loans are floating rate considering impacts of interest rate swaps (75% of

total commercial and 31% of total consumer) – Investment portfolio duration of 4.9 years – Short-term borrowings represent approximately 18% of total wholesale funding, or 3% of total funding

– Approximately $12 billion in non-core funding matures beyond one year • Interest rate sensitivity tables are based on conservative deposit assumptions – 70% beta on all interest-bearing deposit and sweep balances (~50% betas experienced in 2004 –

2006 Fed tightening cycle) – No modeled re-pricing lag – Modeled non-interest bearing commercial DDA runoff of approximately $2.5 billion (about 10%) for each 100

bps increase in rates – DDA runoff rolls into an interest bearing product with a 100% beta Change in Interest Rates (bps) +200 Shock Change in Interest Rates (bps) +100 Shock +200 Ramp over 12 months 1.88% 6.78% (4.00%) +25 Shock +100 Ramp over 12 months 1.13% 4.32% - -75 Shock -75 Ramp over 6 months (5.77%) (10.62%) - Betas 25% Higher Betas 25% Lower Change in Interest Rates (bps) 12 Months 13-24 Months 12 Months Change in Interest Rates (bps) 12 Months 13-24 Months 12 Months 13-24 Months +200 Ramp over 12 months 1.61% 6.24% 2.15% +200 Ramp over 12 months (1.56%) (0.10%) 5.32% 13.66% +100 Ramp over 12 months 1.00% 4.05% 1.27% +100 Ramp over 12 months (0.59%) 0.88% 2.85% 7.76% 7.31% 4.58% - Estimated NII Sensitivity with Demand Deposit Balance Changes % Change in NII (FTE) (12.00%) % Change in NII (FTE) $1B Balance Decrease $1B Balance Increase 13-24 Months (4.96%) - - - Estimated NII Sensivity with Deposit Beta Changes (2.00%) (6.00%) (0.36%) - (0.14%) 12 Months 13-24 Months 12 Months 13-24 Months Estimated NII Sensitivity Profile and ALCO Policy Limits Estimated EVE Sensitivity Profile and ALCO Policy Limits % Change in NII (FTE) ALCO Policy Limits Change in EVE ALCO Policy Limit © Fifth Third Bank | All Rights Reserved |

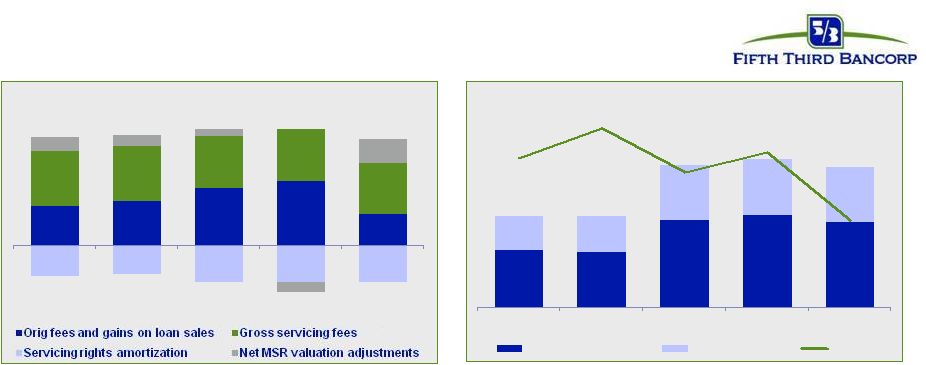

18 Mortgage banking results • $2.7B in originations, up 54% YoY; 41% purchase volume • 4Q16 mortgage banking drivers: – Origination fees and gain on sale revenue down $31MM, or 51%, vs. 3Q16 – Gain on sale margin down 132 bps vs. 3Q16 – Net MSR valuation adjustments of positive $23MM; servicing rights amortization of $35MM

– $48MM in gross servicing fees • YoY decline in mortgage banking revenue driven primarily by lower origination fees and gains

on loan sales 1 Gain on sale margin represents gains on all loans originated for sale $1.11 $1.06 $1.70 $1.79 $1.66 $0.66 $0.70 $1.05 $1.09 $1.06 2.89% 3.47% 2.62% 3.01% 1.69% 4Q15 1Q16 2Q16 3Q16 4Q16 Originations for sale Originations HFI Margin Mortgage originations and gain-on-sale margins ($ billions) 37 42 54 61 30 53 52 50 49 48 (29) (27) (35) (35) (35) 13 11 6 (9) 23 4Q15 1Q16 2Q16 3Q16 4Q16 Mortgage banking revenue ($ millions) © Fifth Third Bank | All Rights Reserved 1 |

19 © Fifth Third Bank | All Rights Reserved • 4Q16 warrant net exercise and share sale successfully executed; resulted in ~$6MM after-tax gain and 4 bps increase in CET1 • Vantiv gains monetized since 4Q15 resulting in ~$493MM in after-tax value to shareholders: – 4Q15: $32MM related to TRA termination and settlement – 4Q15: $273MM related to warrant cancellation and share sale gains – 3Q16: $182MM related to TRA termination and settlement – 4Q16: $6MM warrant net exercise and share sale gains • Transactions reduce future volatility in reported results • 17.9% ownership interest in Vantiv Holdings LLC • Will continue to account for ownership under equity method of accounting • Significant contractual arrangements between Fifth Third and Vantiv Continuing to monetize our Vantiv stake |

20 NPL rollforward NPL HFI Rollforward Commercial 4Q15 1Q16 2Q16 3Q16 4Q16 286 $ 341 $ 543 $ 539 $ 460 $ Transfers to nonaccrual status 165 306 104 145 162 Transfers to accrual status (3) (3) (6) - (4) Transfers from held for sale

- - - - - Transfers to held for sale (12) (3) - (36) (3) Loans sold from portfolio

(2) (6) (2) (3) - Loan paydowns/payoffs (37) (39) (52) (112) (53) Transfers to OREO (13) (1) (3) (1) (3) Charge-offs (46) (60) (51) (81) (40) Draws/other extensions of credit 3 8 6 9 5 341 $ 543 $ 539 $ 460 $ 524 $ Consumer 4Q15 1Q16 2Q16 3Q16 4Q16 172 $ 165 $ 158 $ 154 $ 141 $ Transfers to nonaccrual status 56 55 56 45 43 Transfers to accrual status

(28) (33) (31) (28) (21) Transfers from held for sale - - - - - Transfers to held for sale - - - - - Loans sold from portfolio - - - - - Loan paydowns/payoffs (10) (9) (11) (10) (8) Transfers to OREO (9) (6) (7) (7) (5) Charge-offs (16) (14) (11) (13) (14) Draws/other extensions of credit - - - - - 165 $ 158 $ 154 $ 141 $ 136 $ Total NPL 506 $ 701 $ 693 $ 601 $ 660 $ Total new nonaccrual loans - HFI 221 $ 361 $ 160 $ 190 $ 205 $ Beginning NPL amount Ending Commercial NPL Beginning NPL amount Ending Consumer NPL © Fifth Third Bank | All Rights Reserved |

Credit

trends Residential Mortgage

Commercial & Industrial

Home Equity & Automobile

Commercial Real Estate * Excludes loans held-for-sale 21 © Fifth Third Bank | All Rights Reserved |

22 © Fifth Third Bank | All Rights Reserved Regulation G non-GAAP reconciliation See page 32 of the earnings release for a discussion on the use of non-GAAP financial measures |

23 Regulation G non-GAAP reconciliation See page 32 of the earnings release for a discussion on the use of non-GAAP financial measures

©

Fifth Third Bank | All Rights Reserved |