Attached files

| file | filename |

|---|---|

| EX-99.1 - 4Q2016 EARNINGS RELEASE - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | exh9914q20168-k.htm |

| 8-K - 8-K 4Q16 EARNINGS RELEASE - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | a4q20168-kcoverpage.htm |

Fourth Quarter 2016

Financial Review

January 23, 2017

2

Forward-Looking Statements and Use of Non-GAAP Financial Measures

Statements in this presentation that are based on other than historical data or that express the Company’s

expectations regarding future events or determinations are forward-looking within the meaning of the Private

Securities Litigation Reform Act of 1995. Statements based on historical data are not intended and should not be

understood to indicate the Company’s expectations regarding future events. Forward-looking statements provide

current expectations or forecasts or intentions regarding future events or determinations. These forward-looking

statements are not guarantees of future performance or determinations, nor should they be relied upon as

representing management’s views as of any subsequent date. Forward-looking statements involve significant risks

and uncertainties, and actual results may differ materially from those presented, either expressed or implied, in

this presentation. Factors that could cause actual results to differ materially from those expressed in the forward-

looking statements include the actual amount and duration of declines in the price of oil and gas, our ability to

meet our efficiency and noninterest expense goals, as well as other factors discussed in the Company’s most

recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, filed with the Securities and Exchange

Commission (“SEC”) and available at the SEC’s Internet site (http://www.sec.gov).

Except as required by law, the Company specifically disclaims any obligation to update any factors or to publicly

announce the result of revisions to any of the forward-looking statements included herein to reflect future events

or developments.

This document contains several references to non-GAAP measures, including pre-provision net revenue and the

“efficiency ratio,” which are common industry terms used by investors and financial services analysts. Certain of

these non-GAAP measures are key inputs into Zions’ management compensation and are used in Zions’ strategic

goals that have been and may continue to be articulated to investors. Therefore, the use of such non-GAAP

measures are believed by management to be of substantial interest to the consumers of these financial

disclosures and are used prominently throughout the disclosures. A full reconciliation of the difference between

such measures and GAAP financials is provided within the document, and users of this document are encouraged

to carefully review this reconciliation.

Strong growth in EPS: Diluted earnings per share increased substantially from the

year-ago period, to $0.60 in 4Q16 from $0.43

Strong growth in pre-provision net revenue (1): 25% growth over year-ago period

• A 7.2% year-over-year increase in adjusted revenue (1)

• A 0.6% year-over-year increase in adjusted noninterest expense (1)

Tracking on the efficiency initiative:

• Efficiency ratio equaled 64.5% in 4Q16 and 65.8% for FY16, meeting our target of “less than

66%” for the full year

• Committed to “low 60s” for 2017

Loans: Due primarily to continued discipline on commercial real estate concentration

limits as well as paydowns on energy loans, loans increased only slightly from the prior

quarter (period end loans increased 0.3% vs. 3Q16)

Maintaining overall healthy credit quality: Reduced credit costs largely attributable

to reduced problem loans in the oil & gas portfolio

• Criticized, classified and nonaccrual oil and gas balances declined 16%, 11%, and 15%,

respectively, relative to balances at September 30, 2016

• Non oil & gas loan quality remains strong

3

Fourth Quarter 2016 Key Performance Indicators

Solid PPNR growth; improving credit costs and profitability

(1) Adjusted for items such as severance, provision for unfunded lending commitments, securities gains and

losses and debt extinguishment costs. See Appendix for GAAP to non-GAAP reconciliation tables.

Zions’ Announced Financial Targets

4

On June 1, 2015 Zions announced several financial targets, including:

2H15 FY16 FY17

Hold to

below

$1.58 (2)

billion

Hold to

below

$1.58 (1)

billion

Slightly

above

$1.58 (1)

billion

TBD

≤70% <66% Low 60s TBD

50% >80% 100% TBD

100% -- -- -- --

-- -- -- --

Lower by

~$20

million vs.

2014A

Expected

to beat by

$10mm+

Adjusted

Noninterest Expense1

Gross Cost Savings of

$120 million

Pay Off High Cost

Subordinated Debt

Preferred Equity

Dividends

Efficiency Ratio

(1) Adjusted for items such as severance, provision for unfunded lending commitments, securities gains and

losses and debt extinguishment costs. See Appendix for GAAP to non-GAAP reconciliation tables.

(2) Reduced by $20 million from original stated target of “less than $1.60 billion,” driven by an accounting

adjustment made in 1Q16 which effectively re-categorized corporate card rewards program expense from a

separate line item to now be netted against its associated revenue.

Pre-Provision Net Revenue

Adjusted Pre-Provision Net Revenue (1)

5

Steady improvement driven by disciplined expense and balance sheet management

(1) Adjusted for items such as severance, provision for unfunded lending commitments, securities gains and

losses and debt extinguishment costs. See Appendix for GAAP to non-GAAP reconciliation table.

($mm)

174

182

211

208

217

$100

$125

$150

$175

$200

$225

4Q15 1Q16 2Q16 3Q16 4Q16

Adjusted pre-provision net

revenue has strengthened

measurably over the past year, up

25%

Persistent improvement driven by

success on multiple fronts:

Improved expense control,

Improved return on liquid assets (cash

into securities)

Loan growth and other balance sheet

management

Customer-related fee income growth

This positive trend is expected to

continue in the near term

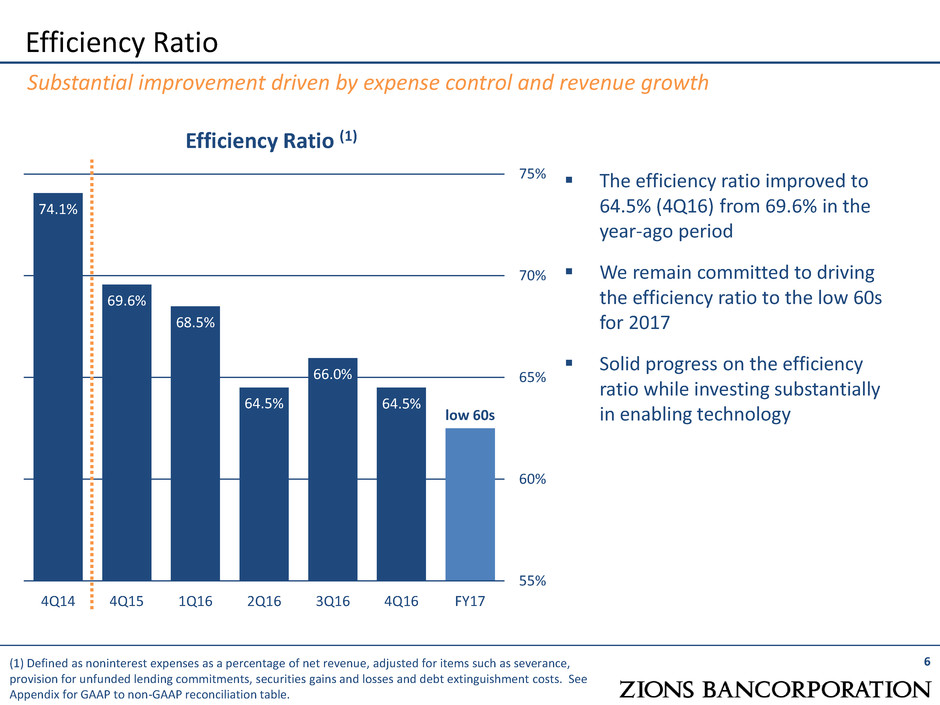

Efficiency Ratio

Efficiency Ratio (1)

6

Substantial improvement driven by expense control and revenue growth

(1) Defined as noninterest expenses as a percentage of net revenue, adjusted for items such as severance,

provision for unfunded lending commitments, securities gains and losses and debt extinguishment costs. See

Appendix for GAAP to non-GAAP reconciliation table.

The efficiency ratio improved to

64.5% (4Q16) from 69.6% in the

year-ago period

We remain committed to driving

the efficiency ratio to the low 60s

for 2017

Solid progress on the efficiency

ratio while investing substantially

in enabling technology

74.1%

69.6%

68.5%

64.5%

66.0%

64.5%

low 60s

55%

60%

65%

70%

75%

4Q14 4Q15 1Q16 2Q16 3Q16 4Q16 FY17

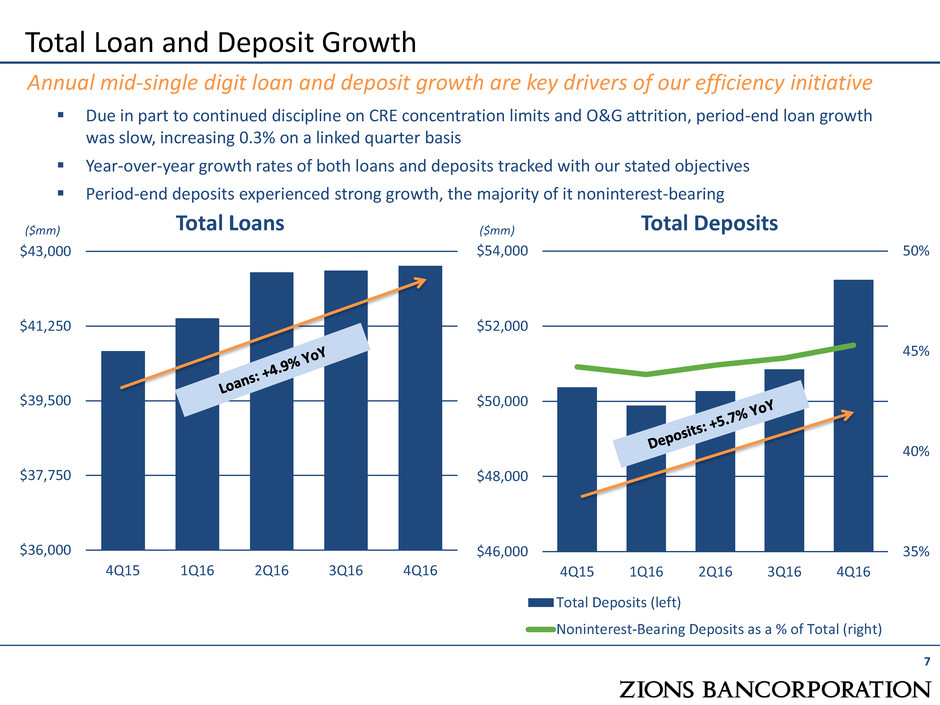

Total Loan and Deposit Growth

Total Loans Total Deposits

7

Annual mid-single digit loan and deposit growth are key drivers of our efficiency initiative

Due in part to continued discipline on CRE concentration limits and O&G attrition, period-end loan growth

was slow, increasing 0.3% on a linked quarter basis

Year-over-year growth rates of both loans and deposits tracked with our stated objectives

Period-end deposits experienced strong growth, the majority of it noninterest-bearing

($mm)

$36,000

$37,750

$39,500

$41,250

$43,000

4Q15 1Q16 2Q16 3Q16 4Q16

35%

40%

45%

50%

$46,000

$48,000

$50,000

$52,000

$54,000

4Q15 1Q16 2Q16 3Q16 4Q16

Total Deposits (left)

Noninterest-Bearing Deposits as a % of Total (right)

($mm)

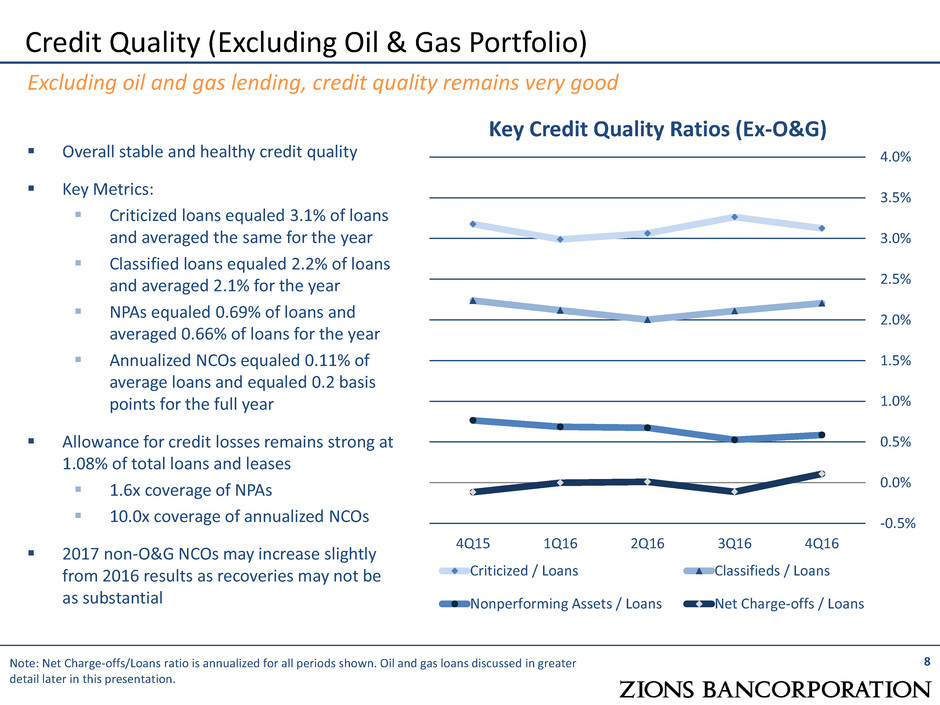

Credit Quality (Excluding Oil & Gas Portfolio)

8

Key Credit Quality Ratios (Ex-O&G)

Excluding oil and gas lending, credit quality remains very good

Overall stable and healthy credit quality

Key Metrics:

Criticized loans equaled 3.1% of loans

and averaged the same for the year

Classified loans equaled 2.2% of loans

and averaged 2.1% for the year

NPAs equaled 0.69% of loans and

averaged 0.66% of loans for the year

Annualized NCOs equaled 0.11% of

average loans and equaled 0.2 basis

points for the full year

Allowance for credit losses remains strong at

1.08% of total loans and leases

1.6x coverage of NPAs

10.0x coverage of annualized NCOs

2017 non-O&G NCOs may increase slightly

from 2016 results as recoveries may not be

as substantial

-0.5%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

4Q15 1Q16 2Q16 3Q16 4Q16

Criticized / Loans Classifieds / Loans

Nonperforming Assets / Loans Net Charge-offs / Loans

Note: Net Charge-offs/Loans ratio is annualized for all periods shown. Oil and gas loans discussed in greater

detail later in this presentation.

Oil & Gas (O&G) Credit Quality

9

O&G Key Credit Quality Ratios

O&G credit quality remains challenged, although recovery in commodity prices has

aided in the portfolio’s overall improvement

Relative to September 30, 2016:

Criticized O&G loans declined by $152

million, the second consecutive linked-

quarter dollar decrease since the cycle

began

Classified O&G loans declined by $85

million, also the second consecutive

linked-quarter dollar decrease since

2014

O&G NPAs declined by $52 million

Annualized NCOs equaled 3.0% of

average loans, primarily related to

classified loans under contract to sell

$470 million of equity raised in 4Q16 to

O&G portfolio companies, more than

double the level achieved in 3Q16

Allowance for credit losses remains strong,

at 9% of O&G balances

0.7x coverage of NPAs

3.0x coverage of annualized NCOs

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

4Q15 1Q16 2Q16 3Q16 4Q16

Criticized / Loans Classifieds / Loans

Nonperforming Assets / Loans Net Charge-offs / Loans

Note: Net Charge-offs/Loans ratio is annualized for all periods shown.

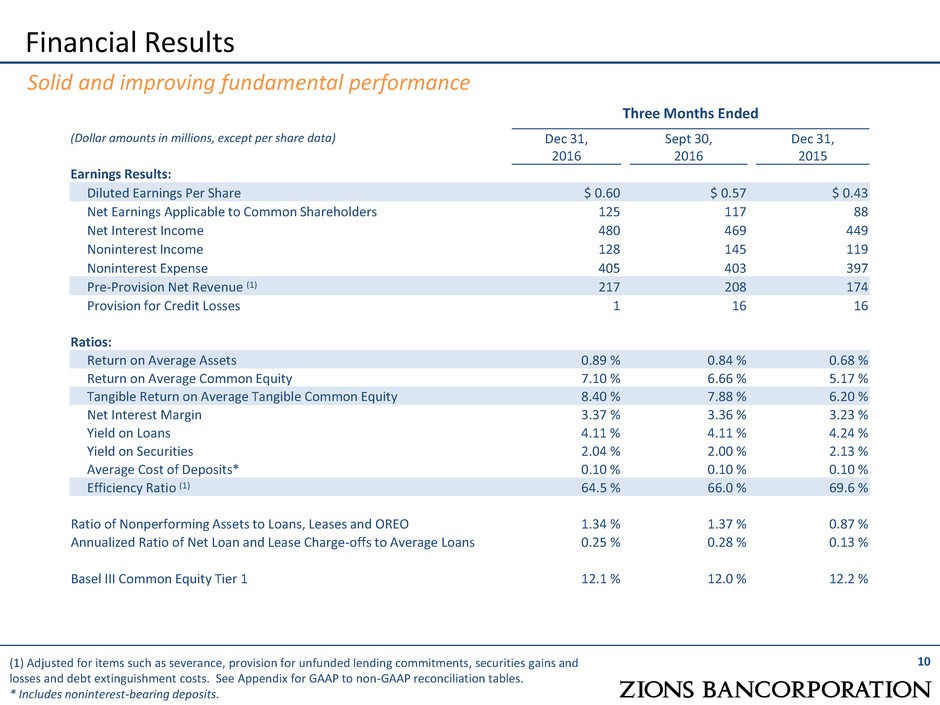

Financial Results

10

Solid and improving fundamental performance

Three Months Ended

(Dollar amounts in millions, except per share data) Dec 31,

2016

Sept 30,

2016

Dec 31,

2015

Earnings Results:

Diluted Earnings Per Share $ 0.60 $ 0.57 $ 0.43

Net Earnings Applicable to Common Shareholders 125 117 88

Net Interest Income 480 469 449

Noninterest Income 128 145 119

Noninterest Expense 405 403 397

Pre-Provision Net Revenue (1) 217 208 174

Provision for Credit Losses 1 16 16

Ratios:

Return on Average Assets 0.89 % 0.84 % 0.68 %

Return on Average Common Equity 7.10 % 6.66 % 5.17 %

Tangible Return on Average Tangible Common Equity 8.40 % 7.88 % 6.20 %

Net Interest Margin 3.37 % 3.36 % 3.23 %

Yield on Loans 4.11 % 4.11 % 4.24 %

Yield on Securities 2.04 % 2.00 % 2.13 %

Average Cost of Deposits* 0.10 % 0.10 % 0.10 %

Efficiency Ratio (1) 64.5 % 66.0 % 69.6 %

Ratio of Nonperforming Assets to Loans, Leases and OREO 1.34 % 1.37 % 0.87 %

Annualized Ratio of Net Loan and Lease Charge-offs to Average Loans 0.25 % 0.28 % 0.13 %

Basel III Common Equity Tier 1 12.1 % 12.0 % 12.2 %

(1) Adjusted for items such as severance, provision for unfunded lending commitments, securities gains and

losses and debt extinguishment costs. See Appendix for GAAP to non-GAAP reconciliation tables.

* Includes noninterest-bearing deposits.

Loan Growth by Type

11

Solid loan growth achieved in targeted growth categories

Year-over-Year Loan Growth

Loan growth in Commercial and

Industrial (C&I), Term Commercial

Real Estate (CRE), Residential

Mortgage (1-4 Family)

Declines in National Real Estate

(NRE), and Oil and Gas (O&G)

Over the next four quarters, we expect

moderate total loan growth, driven

by:

Continued solid growth in

consumer-related

Moderate growth in non-O&G

C&I, Construction and Land

Development (C&D), and Term

CRE

Some further attrition in O&G

Continued attrition in NRE

Note: National Real Estate (NRE) is a division of Zions Bank (which is a division of ZB, N.A.) with a focus on small

business loans with low LTV ratios, which generally are in line with SBA 504 program parameters. “Other” loans

includes municipal and other consumer loan categories.

Note: Bubble size indicates relative balance as of 4Q16.

C&I (ex-O&G)

Owner Occupied

(ex-NRE)

C&D

Term CRE (ex-

NRE)

1-4 Family

National Real

Estate

O&G

Home Equity

Other

-30%

-20%

-10%

0%

10%

20%

30%

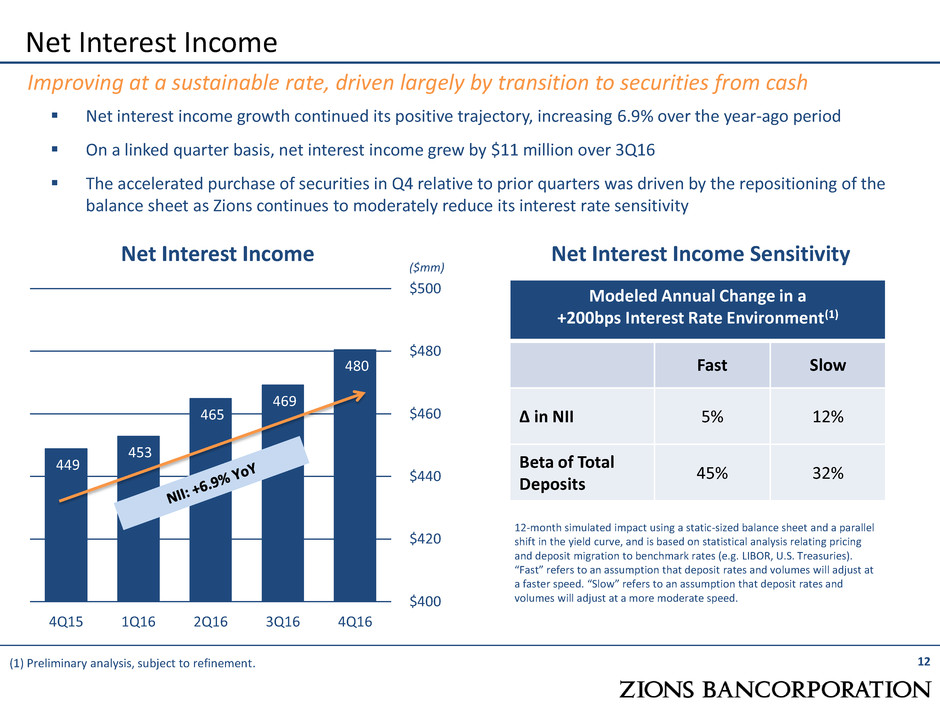

Net interest income growth continued its positive trajectory, increasing 6.9% over the year-ago period

On a linked quarter basis, net interest income grew by $11 million over 3Q16

The accelerated purchase of securities in Q4 relative to prior quarters was driven by the repositioning of the

balance sheet as Zions continues to moderately reduce its interest rate sensitivity

Net Interest Income

Net Interest Income

12

Improving at a sustainable rate, driven largely by transition to securities from cash

($mm)

449

453

465

469

480

$400

$420

$440

$460

$480

$500

4Q15 1Q16 2Q16 3Q16 4Q16

(1) Preliminary analysis, subject to refinement.

Modeled Annual Change in a

+200bps Interest Rate Environment(1)

Fast Slow

∆ in NII 5% 12%

Beta of Total

Deposits

45% 32%

12-month simulated impact using a static-sized balance sheet and a parallel

shift in the yield curve, and is based on statistical analysis relating pricing

and deposit migration to benchmark rates (e.g. LIBOR, U.S. Treasuries).

“Fast” refers to an assumption that deposit rates and volumes will adjust at

a faster speed. “Slow” refers to an assumption that deposit rates and

volumes will adjust at a more moderate speed.

Net Interest Income Sensitivity

Active Balance Sheet Management: Securities Portfolio Growth

13

Short to medium duration portfolio; limited duration extension risk

Total Securities

(end of period balances)

($mm)

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

4Q15 1Q16 2Q16 3Q16 4Q16

Other Securities

Municipal Securities

Small Business Administration Loan-Backed Securities

Agency Securities

Agency MBS Securities

Added net $3.2 billion of securities

during 4Q16

Securities Portfolio Duration

Current: ~3.2 years

200 bps increase from current

interest rates: ~3.3 years

Future net additions to securities

balances not limited by cash

currently on the balance sheet

Loans

74%

Securities

22%

Cash

4%

Net Interest Income Drivers

14

December 2016 rate hike expected to benefit net interest income in 1Q17

Net Interest Margin (NIM)

Earning Asset Mix

Relative to the prior quarter, the

4Q16 NIM was 3.37%, up one

basis point

Securities yield increased 4

bps to 2.04%, due to reduced

premium amortization

Yield on loans was stable, at

4.11%

Cost of deposits was stable, at

0.10%

Fed funds rate increase in

December 2016 is expected to

benefit 1Q17

Loan portfolio interest rate

characteristics1:

Loans repricing within:

1 year: 67%

1-5 years: 24%

5+ years: 9%

3.23% 3.35% 3.39% 3.36% 3.37%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

4.5%

5.0%

4Q15 1Q16 2Q16 3Q16 4Q16

Loan Yield

Securities Yield

Interest Expense / Interest Earning Assets: Red

Net Interest Margin

Cash Yield: Gray

Loans

76%

Securities

8%

Cash

15%

CDOs

1%

1Q15 4Q16

(1) Loans repricing within 1 year includes loans with fixed interest rates that mature within the next year, or are tied to

other rate indices that reprice within 1 year. The 1-5 year and 5+ year categories include fixed rate loans that mature during

those respective periods and loans tied to rate indices also repricing during those periods.

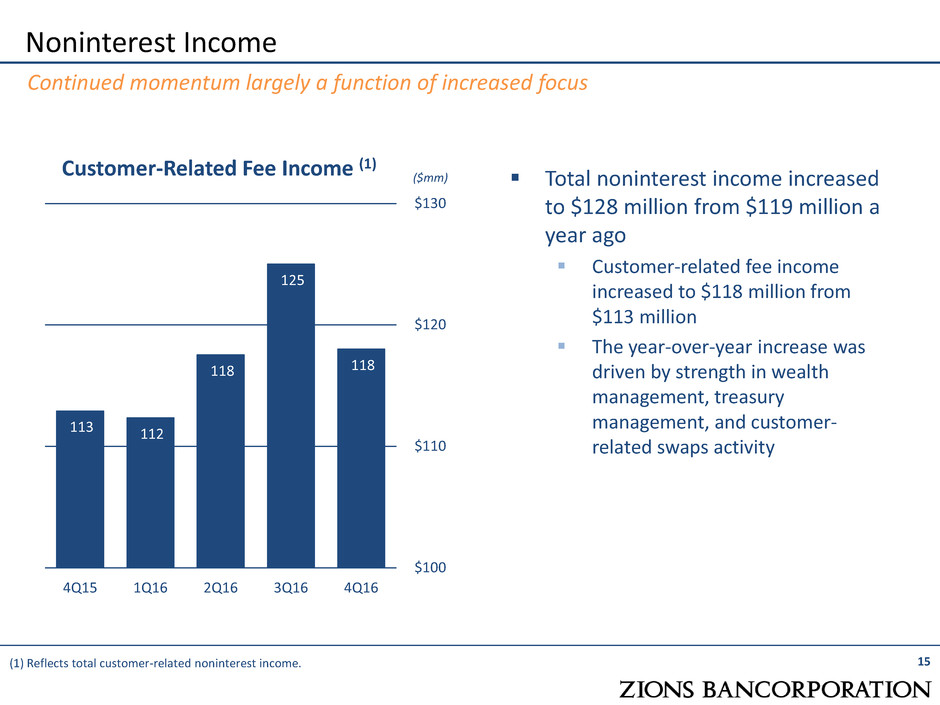

113 112

118

125

118

$100

$110

$120

$130

4Q15 1Q16 2Q16 3Q16 4Q16

Total noninterest income increased

to $128 million from $119 million a

year ago

Customer-related fee income

increased to $118 million from

$113 million

The year-over-year increase was

driven by strength in wealth

management, treasury

management, and customer-

related swaps activity

Noninterest Income

15

Continued momentum largely a function of increased focus

(1) Reflects total customer-related noninterest income.

Customer-Related Fee Income (1) ($mm)

Noninterest Expense

($mm)

397 396

382

403 405

$-

$50

$100

$150

$200

$250

$300

$350

$400

$450

4Q15 1Q16 2Q16 3Q16 4Q16

Noninterest Expense

16

Expense controls have resulted in performance that met our stated goal

Total NIE increased 1.8% versus the year-ago

period; adjusted NIE declined by 0.6% (1)

In 4Q16, elevated noninterest expense

directly resulted in lower than planned

management incentive compensation

Full year 2016 adjusted noninterest expense

achieved the stated FY16 target of less than

$1.58 billion

Expect adjusted noninterest expense to

increase between 2% and 3% for FY17 vs.

FY16A

Reflects expected increase in technology

expenditure

Normal salary adjustments

Partially offset by additional cost savings

efforts

(1) Adjusted for items such as severance, provision for unfunded lending commitments, securities gains and

losses and debt extinguishment costs. See Appendix for GAAP to non-GAAP reconciliation tables.

Continue to Achieve Positive Operating Leverage

Maintain annual mid-single digit loan growth rates while maintaining strong CRE concentration limits

Continue to moderately reduce the Company’s interest rate sensitivity

Continue to purchase medium duration securities with limited duration extension risk

Continue to increase market share in residential mortgage

Maintain mid-single digit growth rates in customer-related fee income

Maintain strong expense controls: expect noninterest expense to increase between 2% and 3% in

FY17 vs. FY16, while continuing to invest in substantial technology overhaul

Maintain continued alignment of compensation expense to profitability improvement objectives

Implement Technology Upgrade Strategies

Increase the Return on and of Capital

Improvements in operating leverage lead to stronger returns on capital

Improvements to risk profile and risk management expected to lead to increasing returns of capital

Target: repurchase up to $180 million of common equity from 3Q16 to 2Q17 (~3% of shares

outstanding)

Completed $90 million in 2H16

Shares repurchased equaled 2.9 million, or approximately 1.4% of shares outstanding in 2H16

Execute on our Community Bank Model – doing business on a “Local” basis

17

2017-2018 Objectives:

(1) Reduced by $20 million from original stated target of “less than $1.60 billion”, driven by an accounting

adjustment made in 1Q16 which effectively re-categorized corporate card rewards program expense from a

separate line item to now be netted against its associated revenue.

Growth Through Simplification and Focus

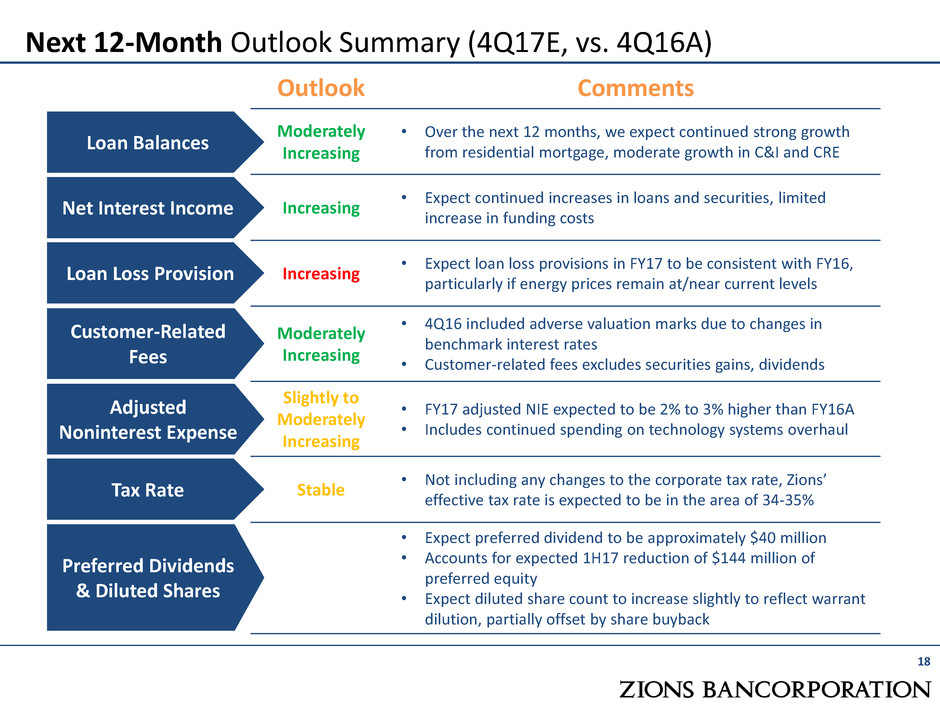

Next 12-Month Outlook Summary (4Q17E, vs. 4Q16A)

18

Outlook Comments

Moderately

Increasing

• Over the next 12 months, we expect continued strong growth

from residential mortgage, moderate growth in C&I and CRE

Increasing

• Expect continued increases in loans and securities, limited

increase in funding costs

Increasing

• Expect loan loss provisions in FY17 to be consistent with FY16,

particularly if energy prices remain at/near current levels

Moderately

Increasing

• 4Q16 included adverse valuation marks due to changes in

benchmark interest rates

• Customer-related fees excludes securities gains, dividends

Slightly to

Moderately

Increasing

• FY17 adjusted NIE expected to be 2% to 3% higher than FY16A

• Includes continued spending on technology systems overhaul

Stable

• Not including any changes to the corporate tax rate, Zions’

effective tax rate is expected to be in the area of 34-35%

• Expect preferred dividend to be approximately $40 million

• Accounts for expected 1H17 reduction of $144 million of

preferred equity

• Expect diluted share count to increase slightly to reflect warrant

dilution, partially offset by share buyback

Customer-Related

Fees

Loan Balances

Net Interest Income

Loan Loss Provision

Tax Rate

Preferred Dividends

& Diluted Shares

Adjusted

Noninterest Expense

Impact of Warrants

Oil & Gas (O&G) Portfolio Detail

CRE Portfolio: Subtype, cash flow coverage, collateral coverage

High O&G Employment Counties: Consumer Credit Scores

Loan Growth by Bank Brand and Loan Type

GAAP to Non-GAAP Reconciliation

19

Appendix

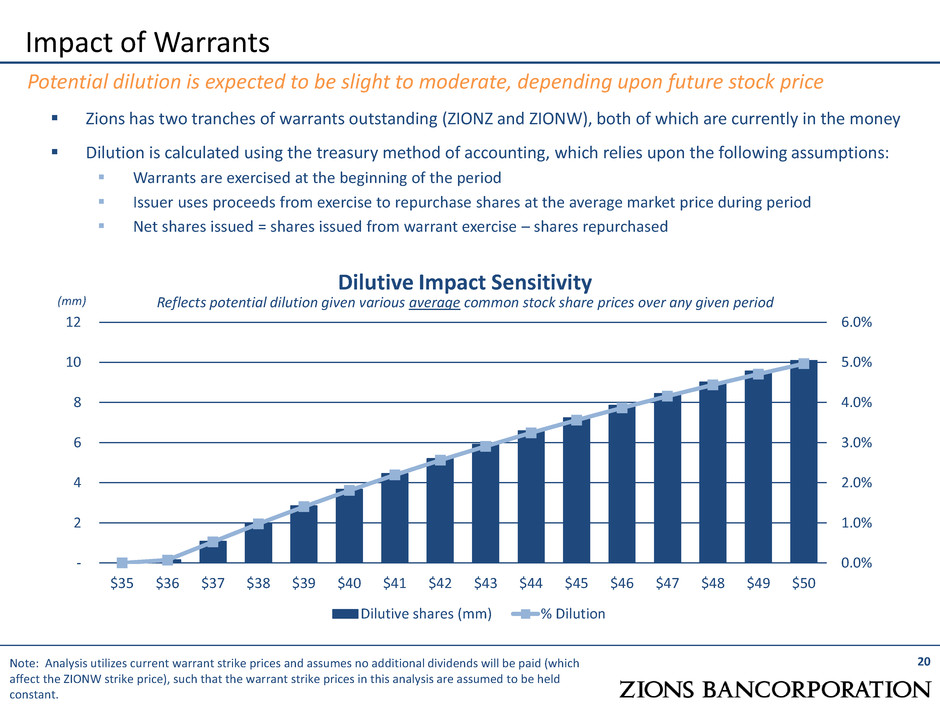

Zions has two tranches of warrants outstanding (ZIONZ and ZIONW), both of which are currently in the money

Dilution is calculated using the treasury method of accounting, which relies upon the following assumptions:

Warrants are exercised at the beginning of the period

Issuer uses proceeds from exercise to repurchase shares at the average market price during period

Net shares issued = shares issued from warrant exercise – shares repurchased

Impact of Warrants

Dilutive Impact Sensitivity

Reflects potential dilution given various average common stock share prices over any given period

20

Potential dilution is expected to be slight to moderate, depending upon future stock price

(mm)

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

-

2

4

6

8

10

12

$35 $36 $37 $38 $39 $40 $41 $42 $43 $44 $45 $46 $47 $48 $49 $50

Dilutive shares (mm) % Dilution

Note: Analysis utilizes current warrant strike prices and assumes no additional dividends will be paid (which

affect the ZIONW strike price), such that the warrant strike prices in this analysis are assumed to be held

constant.

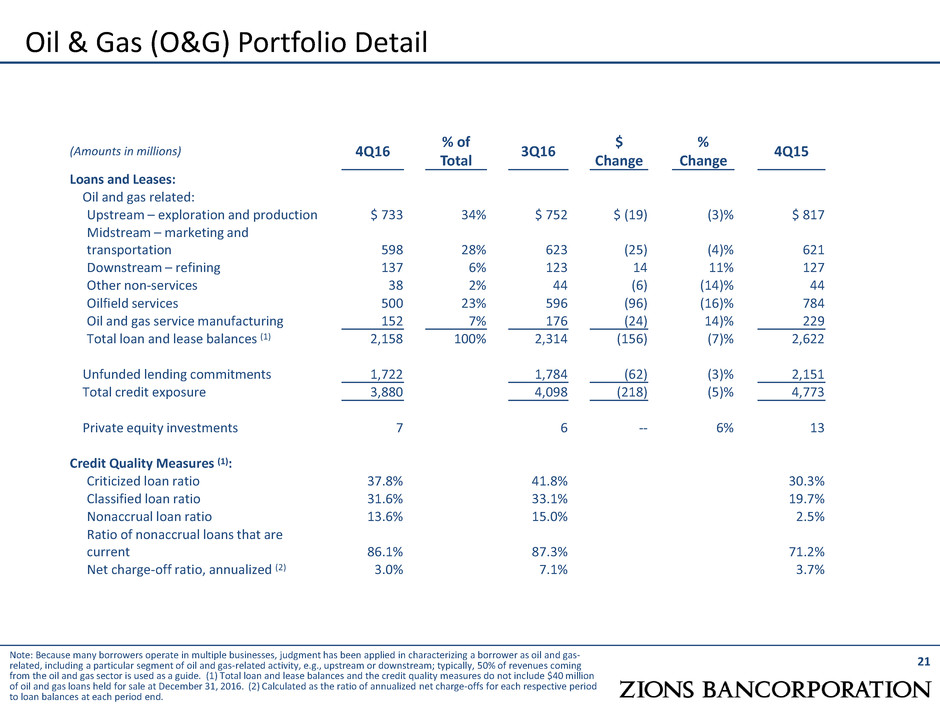

21

Note: Because many borrowers operate in multiple businesses, judgment has been applied in characterizing a borrower as oil and gas-

related, including a particular segment of oil and gas-related activity, e.g., upstream or downstream; typically, 50% of revenues coming

from the oil and gas sector is used as a guide. (1) Total loan and lease balances and the credit quality measures do not include $40 million

of oil and gas loans held for sale at December 31, 2016. (2) Calculated as the ratio of annualized net charge-offs for each respective period

to loan balances at each period end.

Oil & Gas (O&G) Portfolio Detail

(Amounts in millions) 4Q16

% of

Total

3Q16

$

Change

%

Change

4Q15

Loans and Leases:

Oil and gas related:

Upstream – exploration and production $ 733 34% $ 752 $ (19) (3)% $ 817

Midstream – marketing and

transportation 598 28% 623 (25) (4)% 621

Downstream – refining 137 6% 123 14 11% 127

Other non-services 38 2% 44 (6) (14)% 44

Oilfield services 500 23% 596 (96) (16)% 784

Oil and gas service manufacturing 152 7% 176 (24) 14)% 229

Total loan and lease balances (1) 2,158 100% 2,314 (156) (7)% 2,622

Unfunded lending commitments 1,722 1,784 (62) (3)% 2,151

Total credit exposure 3,880 4,098 (218) (5)% 4,773

Private equity investments 7 6 -- 6% 13

Credit Quality Measures (1):

Criticized loan ratio 37.8% 41.8% 30.3%

Classified loan ratio 31.6% 33.1% 19.7%

Nonaccrual loan ratio 13.6% 15.0% 2.5%

Ratio of nonaccrual loans that are

current 86.1% 87.3% 71.2%

Net charge-off ratio, annualized (2) 3.0% 7.1% 3.7%

$-

$100

$200

$300

$400

$500

4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Allowance for Credit Losses Upstream Services Other

Oil & Gas (O&G) Portfolio Trends

22

Loan Balances by O&G Segment

Classifieds by O&G Segment

Steadily declining balances in Upstream and Services

Nonaccruals by O&G Segment

($mm)

$-

$500

$1,000

$1,500

4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Upstream Services Other

($mm) ($mm)

$-

$100

$200

$300

$400

$500

4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Upstream Services Other

O&G balances and commitments continue to

decline, down 18% and 19%, respectively, over

the past four quarters

Criticized, classified and nonaccrual levels all fell

in 4Q16

Net charge-offs were $43 million during 2015, and

$130 million during 2016

O&G Loan Loss Expectation

O&G loan losses are expected to decline substantially over the next 12 months as

compared to the last 12 months (1)

Most of the expected loss is likely to come from services loans

55% of classified O&G loans are from services loans

80% of O&G losses incurred since Sep 30, 2014 are from services loans

Healthy sponsor support has resulted in loss levels that were lower than otherwise would have

been experienced

Improved borrower and sponsor sentiment in 2H16 vs 1H16

Strong Reserve Against O&G Loans

Zions’ O&G allowance for credit losses is:

9% of O&G loan balances

24% of criticized O&G loan balances

23

Oil & Gas Loss Outlook and Reserve

The outlook is improving for the O&G portfolio

(1) Assuming oil and gas commodity prices remain relatively stable.

24 Note: Data as of 4Q16.

The Derivative Effect: Zions’ Commercial Real Estate Portfolio in Texas

Houston is approximately 3/5 of total Texas exposure. Construction and Land Development

loans in Houston have declined by more than 80% since prior credit cycle

$0 $100 $200 $300

Office

Hospitality

Industrial

Not RE Secured

Land

Retail

Other

Multifamily

Commercial Construction

($500mm outstanding)

Houston (52%) TX-not Houston (48%)

$0 $100 $200

Land

Other

Single Family Housing

Residential Construction

($250mm outstanding)

Houston (69%) TX-not Houston (31%)

$0 $100 $200 $300 $400 $500

Hospitality

Other

Industrial

Office

Retail

Multifamily

Commercial Term

($1,700mm outstanding)

Houston (54%) TX-not Houston (46%)

Commercial Real Estate Portfolio Summary

25

Credit Quality Remains Strong

Note: Data as of 4Q16.

CRE Balances up 10% YoY, Delinquencies

and nonaccruals improved YoY, Classifieds

stable

Criticized balance by type (Total CRE: 2.5%)

Commercial Construction – 6.1%

Home Builder Construction – 0.0%

CRE Term – 2.2%

32% of total CRE in CA, 22% in TX, 14% in

UT/ID, 12% in AZ

2016 Dec

($bn)

2016 Sep

($bn)

QoQ ($MM)

2015 Dec

($bn)

YoY

Term Balance $9.3 $9.3 $25 $8.5 9.90%

Construction Balance $2.0 $2.1 -$120 $1.9 8.90%

Delinquencies 0.26% 0.61% -36bp 0.32% -6bp

Non-Maturity Delinquencies 0.11% 0.18% -6bp 0.20% -9bp

Nonaccrual Loans 0.32% 0.27% +5bp 0.46% -14bp

% of Nonaccruals Current 52.0% 63.3% -11.3% 56.3% -4.3%

Classifieds (% of loans) 1.30% 1.26% +4bp 1.37% -7bp

Net Charge-Offs TTM ($MM) -1.7 (-2 bp) -7.1 (-7 bp) +5bp -14.8 (-15 bp) +13bp

0% 5% 10% 15% 20% 25% 30% 35%

Washington

Colorado

Other

Nevada

Arizona

Utah/Idaho

Texas

California

CRE Balances by Collateral Location

Term CRE (82%) Commercial Construction (11%) Residential Construction (7%)

CRE Term Portfolio

26

Strong CRE metrics and conservative structures, Houston emphasized

Houston Term: DSCR’s and LTV’s are in line with

overall term portfolio. Adverse migration of loan

grades is occurring; portfolio benefits from

conservative advance rates, > 1.0 DSCR’s and

guarantor support

All Term: continued portfolio diversity; ¾ is

Office, Retail, Multifamily and Industrial

Note: Collateral type as of 4Q16; DSCR and LTV as of 3Q16. DSCR excludes loans < $500M,

many < 1.0 DSCR term loans maintain pass grade status due to guarantor support.

CRE Term by Collateral Type

($9.3 billion)

0%

10%

20%

30%

40%

50%

60%

<1.0 <1.25 <1.50 <1.75 <2.0 2.0+

Term CRE - DSCR

All CRE Houston Only

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

<50% <60% <70% <80% <90% <100% 100%+

Term CRE - LTV

All CRE Houston Only

Office, $2.1 ,

23%

Multifamily,

$1.9 , 20%

Retail, $1.7 ,

19%

Industrial,

$1.3 , 14%

Other, $0.9 ,

10%

Hospitality,

$0.7 , 8%

Hospital/Med

. Centers,

$0.3 , 3%

Rec./Rest.,

$0.2 , 2%

Unsecured

CRE, $0.1 ,

1%

CRE Construction Portfolio

27

Balanced, performing portfolio

Note: Data as of 4Q16.

Diversified construction portfolio with 37%

Homebuilder Residential, 63% Commercial

Commercial construction is 6.1% criticized – some

stress in Houston CRE. Homebuilder Residential

performing well

YoY construction growth of 9.6%. Construction as a

% of total loans is < 5%

Construction by Collateral Type

($2.0 billion)

$7.5

$5.6

$3.5

$2.3 $1.9 $2.2 $2.0 $1.8 $2.0

$6.2

$7.3

$7.7

$7.9

$8.1 $8.0 $8.1 $8.5 $9.3

20%

22%

24%

26%

28%

30%

32%

34%

$0

$2

$4

$6

$8

$10

$12

$14

$16

YE 2008 YE 2009 YE 2010 YE 2011 YE 2012 YE 2013 YE 2014 YE 2015 YE 2016

Bi

llio

n

s

CRE: Maintaining Construction Discipline

CRE Const. and Land Dev. CRE Term CRE as a % Of Total Net Loans

Homebuilder

Residential,

$0.75 , 37%

Multifamily,

$0.38 , 19%

Other, $0.29

, 15%

Land,

$0.15 , 7%

Retail, $0.14 ,

7%

Office, $0.13

, 6%

Industrial,

$0.11 , 5%

Hospitality,

$0.07 , 4%

Takeaways:

Consumer loans from high O&G employment counties performing in line with overall

consumer portfolio; nearly all of these consumer loans are with Amegy (96%) located in

Texas, primarily in the Houston area

82% of consumer loans in high O&G counties are residential mortgage and home equity lines

Consumer FICO scores are stable in counties with high O&G employment, with some

improvement in the 5th and 10th percentiles

28

High O&G Employment Counties: Consumer Credit Scores

Consumer credit score deterioration has not been substantial in high O&G counties

Credit Score (FICO) Migration in High Oil & Gas Employment Counties

Source: Company documents.

Note: Data as of 4Q16.

Percentile HOGECs Others HOGECs Others HOGECs Others HOGECs Others HOGECs Others

5% 619 647 605 640 14 7 595 636 24 11

10 657 680 650 678 7 2 645 677 12 3

50% 760 776 761 777 -1 -1 762 780 -2 -4

Data includes consumer loans with FICO scores refreshed during the quarter shown.

2016 Q4 2015 Q4 1-Year Difference 2014 Q4 2-Year Difference

29

Loan Growth by Bank Brand and Loan Type

Note: National Real Estate (NRE) is a division of Zions Bank with a focus on small business loans with low LTV

ratios, which generally are in line with SBA 504 program parameters. “Other” loans includes municipal and

other consumer loan categories.

Linked Quarter Loan Growth

($mm)

Zions

Bank

CB&T Amegy NBAZ NSB Vectra CBW

ZBNA

Other

Total

C&I (ex-O&G) (125) 84 85 13 (10) (2) 3 -- 48

Owner Occupied (ex-NRE) 87 41 12 6 (32) 1 4 -- 119

C&D 6 (70) (39) (33) 9 6 (8) -- (129)

Term CRE (ex-NRE) -- (5) 14 (11) 54 11 21 -- 84

1-4 Family 18 -- 69 2 (1) 22 -- (3) 107

National Real Estate (112) -- -- -- -- -- -- -- (112)

O&G 24 -- (162) (4) -- (13) -- -- (155)

Home Equity (7) 18 14 14 12 13 1 -- 65

Other 45 (4) 41 1 3 (2) (1) -- 83

Total (64) 64 34 (12) 35 36 20 (3) 110

30 (1) In Q1 2016, to be consistent with industry practice, the Company reclassified its bankcard rewards expense

from “Other noninterest expense” to “Other service charges, commissions and fees”, offsetting this expense

against associated noninterest income. Prior period amounts have also been reclassified.

GAAP to Non-GAAP Reconciliation

(Amounts in thousands) 4Q16 3Q16 2Q16 1Q16 4Q15

Efficiency Ratio

Noninterest expense (GAAP) (1) (a) $ 404,515 $ 403,292 $ 381,894 $ 395,573 $ 397,353

Adjustments:

Severance costs 496 481 201 3,471 3,581

Other real estate expense 396 (137) (527) (1,329) (536)

Provision for unfunded lending commitments 3,296 (3,165) (4,246) (5,812) (6,551)

Debt extinguishment cost — — 106 247 135

Amortization of core deposit and other

intangibles 1,909 1,951 1,979 2,014 2,273

Restructuring costs 3,283 356 47 996 777

Total adjustments (b) 9,380 (514) (2,440) (413) (321)

Adjusted noninterest expense (non-GAAP) (a) - (b) = (c) 395,135 403,806 384,334 395,986 397,674

Taxable-equivalent net interest income (GAAP) (d) 487,823 475,699 470,913 458,242 453,780

Noninterest income (GAAP) (1) (e) 128,244 144,887 125,717 116,761 118,641

Combined income (d) + (e) = (f) 616,067 620,586 596,630 575,003 572,421

Adjustments:

Fair value and nonhedge derivative income (loss) 6,885 (184) (1,910) (2,585) 688

Equity securities gains (losses), net (3,432) 8,441 2,709 (550) 53

Fixed income securities gains (losses), net 10 39 25 28 (7)

Total adjustments (g) 3,463 8,296 824 (3,107) 734

Adjusted taxable-equivalent revenue (non-GAAP) (f) - (g) = (h) 612,604 612,290 595,806 578,110 571,687

Pre-provision net revenue (PPNR), as reported (f) – (a) $ 211,552 $ 217,294 $ 214,736 $ 179,430 $ 175,068

Adjusted pre-provision net revenue (PPNR) (h) - (c) $ 217,469 $ 208,484 $ 211,472 $ 182,124 $ 174,013

Efficiency Ratio (1) (c) / (h) 64.5 % 66.0 % 64.5 % 68.5 % 69.6 %