Attached files

| file | filename |

|---|---|

| EX-99.2 - UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS OF STARLIGHT, AS OF - Starlight Supply Chain Management Co | f8k111816a2ex99ii_starlight.htm |

| EX-99.1 - CONSOLIDATED FINANCIAL STATEMENTS OF SING KONG SUPPLY CHAIN MANAGEMENT CO., LTD. - Starlight Supply Chain Management Co | f8k111816a2ex99i_starlight.htm |

| EX-10.12 - AGREEMENT BETWEEN HEBEI PROVINCE SHA HE ECONOMIC DEVELOPMENT ZONE MANAGEMENT COM - Starlight Supply Chain Management Co | f8k111816a2ex10xii_starlight.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

Amendment No. 2

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 18, 2016

STARLIGHT SUPPLY CHAIN MANAGEMENT COMPANY

(Exact name of registrant as specified in Charter)

| Nevada | 333-197291 | 90-1035363 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File No.) | (IRS Employee Identification No.) |

Room 805-806, Xinghe Century Towers A, CaiTian Road No. 3069

Shenzhen City, Futian District, People’s Republic of China

(Address of Principal Executive Offices)

+86-755-8254-8283.

(Registrant’s telephone number)

Live Fit Corp.

Room 1001, Unit 5, Building 8, ShangPin FuCheng FuZe Garden,

YanJiao Development District, SanHe City, Hebei Province, China

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

This Amendment No. 2 on Form 8-K/A (“Amendment No. 2”) is being filed by Starlight Supply Chain Management Company (“Starlight” and “Company”) to amend the Current Report on Form 8-K filed with the Securities and Exchange Commission on November 21, 2016 (the “Initial Report”). The sole purpose for filing this Amendment No. 2 is to provide additional disclosures to the readers of this report based upon comments received from the Division of Corporation Finance, United States Securities and Exchange Commission.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On November 18, 2016 (the “Closing Date”), Starlight Supply Chain Management Company (“Starlight” or the “Company”), a Nevada corporation, closed on the share exchange described below with the shareholders (the “Sing Kong Stockholders”) of Sing Kong Supply Chain Management Co. Limited (“Sing Kong-HK”), a Hong Kong company. As a result, Sing Kong-HK is now a wholly owned subsidiary of Starlight. Starlight, the Sing Kong Stockholders and Sing Kong-HK shall sometimes be collectively referred to as the "Parties." Under the Exchange Agreement, the Sing Kong Stockholders exchanged all of the shares that they held in Sing Kong-HK for 4,752,217,304 shares of Starlight’s common stock. A copy of the Exchange Agreement was attached as Exhibit 2.1 to the Starlight Form 8-K filed with the Securities & Exchange Commission on October 6, 2016. The consummation of the exchange transaction under which Starlight acquired 100% of the equity ownership of Sing Kong-HK shall be referred to as the “Transaction.”

Sing Kong-HK operates its supply chain management business through the use of a variable interest entity structure (“VIE”). It has established a wholly foreign owned entity, Starlight Consultation Service (Shenzhen) Co., Ltd. (“WFOE”) in the People’s Republic of China (“PRC”) that has acquired effective control of Sing Kong Supply Chain Management Co., Ltd. Shenzhen (“Sing Kong-China” or the “Operating Company”) through the VIE structure. Sing Kong-China is 100% owned by a citizen of the PRC—Jessica Qu – who also serves as its Chief Executive Officer. The contractual arrangements between Sing Kong-China and the WFOE enable us to exercise effective control over, and realize substantially all of the economic risks and benefits arising from the activities of Sing Kong-China. As a result, we include the financial results of Sing Kong-China in our consolidated financial statements in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, as if Sing Kong-China were a wholly-owned subsidiary. However, the contractual arrangements may not be as effective in providing operational control as direct ownership. See “Risk Factors — Risks Related to Our Structure.” Sing Kong-HK, the WFOE and Sing Kong-China shall be collectively referred to as “Sing Kong.”

For accounting purposes, the Transaction was treated as a reverse acquisition with Sing Kong-HK as the acquirer and Starlight as the acquired party. When we refer in this report to business and financial information for periods prior to the consummation of the Transaction, we are referring to the business and financial information of Sing Kong-HK unless the context suggests otherwise.

The sole officer and director of Starlight is CHAN Wai Lun. As a result of the closing of the Transaction with Sing Kong-HK, the former shareholders of Starlight, including CHAN Wai Lun who was issued 1,833,148,178 shares of the Company’s common stock in connection with the closing, own approximately 28.1% of the total outstanding shares of our common stock. Without including the new shares issued to CHAN Wai Lun in connection with the closing, the former shareholders of the Company own less than 1% of the Company’s outstanding shares of common stock following the closing. Prior to the closing and before the issuance of shares to CHAN Wai Lun in connection with the closing, the former shareholders (other than CHAN Wai Lun) held 40% of the Company’s outstanding shares of common stock.

2

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, on November 18, 2016, we acquired Sing Kong-HK in a reverse acquisition transaction. Item 2.01(f) of Form 8-K states that if the registrant was a shell company, the status of the Company immediately before the reverse acquisition transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10.

Accordingly, we are providing below the information that would be included if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the acquisition of Sing Kong-HK except that information relating to periods prior to the date of the reverse acquisition, other than financial data, only relates to Starlight Supply Chain Management Company.

In this report, we rely on and refer to information and statistics regarding our industry that we have obtained from a variety of sources. This information is publicly available for free and has not been specifically prepared for us for use in this report or otherwise, although we believe that this information is generally reliable.

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This Form 8-K and other reports filed by the Company from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, the Company’s management as well as estimates and assumptions made by the Company’s management. When used in the filings the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” or the negative of these terms and similar expressions as they relate to the Company or the Company’s management identify forward-looking statements. Such statements reflect the current view of the Company with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) relating to the Company’s industry, operations and results of operations and any businesses that may be acquired by the Company. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the Company’s pro forma financial statements and the related notes included herein.

3

BUSINESS

History of Starlight Supply Chain Management Company

Starlight Supply Chain Management Company (the “Company” or “Starlight”) was originally incorporated in Nevada under the name “Live Fit Corp.” on December 13, 2013 and, since the date of the Transaction reported herein, it maintains its principal executive offices at Room 805-806, Xinghe Century Towers A, CaiTian Road No. 3069, Shenzhen City, Futian District, People’s Republic of China. The Company was formed to develop and market online personal training through its website, www.livefittime.com, which, when fully developed, would have allowed its clients to hire personal trainers who would oversee their training, nutrition and overall health lifestyle. It was anticipated that the core of the website would be a teleconferencing tool which would allow trainers to remotely view and communicate with their clients.

The Company filed a registration statement on Form S-1 with the U.S. Securities and Exchange Commission (the “SEC”) on July 8, 2014, which was declared effective on September 3, 2014. However, the Company did not generate any revenue and, in September 2015, management of the Company determined that it would be in our stockholders’ best interests to abandon the Company’s business plan and to seek a possible business combination.

As a result, the Company became a "shell company" (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) with nominal assets and no business operations, and it sought to identify, evaluate and investigate various companies with the intent that, if such investigation warranted, a reverse merger transaction could be negotiated and completed pursuant to which the Company would acquire a target company with an operating business with the intent of continuing the acquired company’s business as a publicly held entity. On May 19, 2016, the Company changed its name to Starlight Supply Chain Management Company and on the Closing Date, it completed the Transaction described in Item 2.01, above.

From and after the Closing Date of the Transaction described in Item 2.01, above, the Company’s primary operations will now consist of the operations of Sing Kong.

Throughout the remainder of this report, when we use phrases such as "we," "our," "company" and "us," we are referring to Starlight, Sing Kong-HK, the WFOE and Sing Kong-China as a combined entity.

Sing Kong Supply Chain Management Company Limited

Sing Kong Supply Chain Management Company Limited (“Sing Kong-HK”) was incorporated under the laws of Hong Kong on April 16, 2016, and established a wholly foreign owned entity, Starlight Consultation Service (Shenzhen) Co., Ltd. (“WFOE”) in the Peoples Republic of China (“China”) on May 6, 2016. The WFOE entered into variable interest entity agreements (“VIE”) with Sing Kong Supply Chain Management Co. Ltd. Shenzhen (“Sing Kong-China” or the “Operating Company”), under which we exercise effective control over, and realize substantially all of the economic risks and benefits arising from the activities of Sing Kong-China. Sing Kong-China was organized in Shenzhen under the laws of China on October 29, 2015. Sing Kong-HK is a development stage company, providing supply chain management (SCM) services through Sing Kong-China. Although Sing Kong-China is only a year old, its management team has in excess of 25 combined years working in the SCM business, and its business has grown rapidly.

4

We have sixteen SCM customers in China, and our services have principally involved sourcing of raw materials in the minerals and glass area for their manufacturing operations, assistance with the logistics associated with delivering raw materials to our manufacturing customers and delivery of our manufacturing customers’ products to their customers. Between May 1, 2016 and October 31, 2016, out principal suppliers were Shenzhen Tongdao Fuqiang Supply Chain Management Co., Ltd., Shanghai Lihao Metal Materials Co., Ltd., Shenzhen Fengxi Supply Chain Management Limited, Guangzhou Yi Yun Hui Xin trade limited company. We purchased aluminum from these suppliers and then resold the aluminum to our supply chain customers.

Sing Kong has developed a proprietary SCM online software system that is integrated with logistics service centers located in Foshan, Shenzhen, Shanghai and Guangzhou in China. We anticipate that as we grow we will enter into similar arrangement in other key distribution/manufacturing cities. Although our SCM online software is primarily used internally, it is available to our customers to support their development and growth. We anticipate that we will need to conduct further development and that we will be contracting with a significant provider of IT services such as SAP or Oracle to utilize their data base platform as our customer base grows and demand for our product offerings or services increases. Further, Sing Kong’s finance team will consult with customers to help them to transform and adapt to the new supply chain model.

Sing Kong expects to primarily serve three types of customers:

| 1. | Customers who need nonferrous metals like copper, aluminum and zinc to begin with, as well as other mineral resources in the future. We expect to also focus upon the glass industry in Hebei Province. |

| 2. | SME (small and medium enterprise) owners who have a big trading volume in their industry but lack a SCM online system to support further company development and growth; and |

| 3. | SME owners who want to grow sufficiently to become a listed company. |

We anticipate that we will offer our customers three categories of services:

| 1. | SCM services; | |

| 2. | SCM online platform services; and | |

| 3. | SCM company transformation services to assist with the goal of becoming a listed company. |

Principal Products or Services

SCM Services. We are a provider of supply chain management solutions, consisting of various software and service offerings. Supply chain management is the set of processes, technology and expertise involved in managing supply, demand and fulfillment throughout divisions within a company and with its customers, suppliers and partners. The business goals of our solutions include increasing supply chain efficiency, reducing costs and enhancing customer and supplier relationships by managing variability, reducing complexity, improving operational visibility and increasing operating velocity. Our initial business has been focused upon sourcing nonferrous metals for customers at prices that allow us to make a profit in the resale of those products to our customers. We are optimistic that our business will grow and that we will be providing the services outlined in this description of our plan in the future to our customers.

5

Our offerings will be designed to help customers better achieve the following critical operational objectives:

| ● | Visibility – a clear and unobstructed view up and down the supply chain |

| ● | Planning – supply chain optimization to match supply and demand considering system-wide constraints |

| ● | Collaboration – interoperability with supply chain partners |

| ● | Control – management of data and business processes across the extended supply chain |

The first task that our management undertook was to develop a comprehensive, detailed business plan (our “Starlight Supply Chain Business Brochure”) which covers all the services which we intend to offer our customers. Specifically, those services are as follows:

| IT Overall Planning | ||

| ● Supply chain process planning – overview | ||

| ● Supply chain process planning – procurement | ||

| ● Supply chain process planning – logistics | ||

| Major Data | ||

| ● Raw materials data maintenance | ||

| ● Supplier data maintenance | ||

| ● Client data maintenance | ||

| Purchasing and Warehousing Management | ||

| ● Expense and asset procurement | ||

| ● Expense and asset check and receipt check | ||

| ● Inventory counting | ||

| ● Purchase return | ||

| ● Outsourcing | ||

| ● Supplier delivery | ||

| Sales and Distribution | ||

| ● Service sales | ||

| ● Loan applications | ||

| ● Consignment | ||

| International Trade Management | ||

| ● Project review | ||

| ● Importing | ||

| ● Exporting | ||

| ● Domestic third party trade | ||

| ● Domestic trade control | ||

| ● Commodity trading | ||

| ● Trade expenses and payment | ||

| ● Product returns | ||

| Client Management | ||

| ● Client credit maintenance | ||

| ● Client credit control | ||

6

SCM Online Platform Services. We believe that the continuous development of our technology systems is essential not only to improve our internal operations and financial performance, but also to provide our customers with the most cost-effective, timely and reliable solutions. We have one full time IT specialist and anticipate that as we grow we will hire other IT programmers and specialists to work in the further development of the Company’s online platform. Although we believe that our platform is adequate for our needs in the near future, we anticipate that we will need to conduct further development and that we will be contracting with a significant provider of IT services such as SAP or Oracle to utilize their data base platform as our customer base grows and demand for our product offerings or services increases.

Information technology is a critical differentiator for customers in the supply chain logistics industry, providing the crucial ability to track the locations of products and raw materials along the supply chain. We have developed and maintain a proprietary technology platform that we utilize within the Company and that we also offer to customers to assist them in developing, maintaining and accessing key data on their customers and the location of products and raw materials. We believe that our processes and our software solutions enhance productivity, optimize decision-making and result in more efficient and cost-effective processes for our customers.

Our goal is to grow our technology department and capability so that we can design and implement customized solutions that integrate multiple systems into a functional, compatible and seamless communication and operating environment. We believe that this will be a critical differentiator for customers, many of whom operate disparate and disjointed systems. We are hopeful that the development of highly tailored and integrated solutions will provide significant benefits to our customers, and translate into longer relationships and opportunities to realize higher margins. We anticipate that our services will be targeted primarily at SME owners who need a SCM online system to support further company development and growth.

SCM Company Transformation Services. We intend to offer our services to SME owners who want to grow sufficiently to become a listed company. We intend to assist these business owners through three channels:

| ● | Pooled procurement – which should lead to lower prices for raw materials purchase prices and as a result higher gross margins on products |

| ● | Pooled sales – decreased costs of sales and expanded sales channels |

| ● | Pooled logistics – decreased costs in the logistics associated in sourcing raw materials and components and in delivering products to customers, and concentration of information |

7

Financing Assistance. We anticipate being able to assist our customers in obtaining financing as a result of their utilization of our SCM processes. Recently, we entered into an agreement with China Postal Bank, through which our customers will be able to obtain financing if they satisfy the criteria established through the use of our SCM processes. Financing for small and medium sized enterprises in China is difficult, and we believe that this relationship with China Postal Bank will give us a competitive advantage and will assist our customers to obtain financing, which they would otherwise have difficulty obtaining on their own. The availability of financing for raw materials and components to build out orders should enable our customers to increase their sales volume at a much faster rate than would be possible without such financing and, therefore, to accelerate their growth in order to meet the goal of becoming a listed company.

Relationships with suppliers

We have a network of approximately 16 suppliers and manufacturers with whom we have developed relationships through the prior business experience of our management team. Our experience, market knowledge and ability to negotiate on the basis of bulk purchases enable us to deliver lower cost supply options for our customers. We negotiate with suppliers on behalf of our customers.

Sales and Marketing

We market our services to both existing and potential clients through our director of marketing. His marketing efforts have been primarily directed towards businesses with whom he had previously done business when employed by another supply chain management company that is no longer in business. We intend to hire additional personnel in sales and marketing to work under his direction to market our services in China. We have also begun working with the provincial government in Hebei Province, and believe that they will assist us with introductions to small and medium sized enterprises that could use our services and processes.

We intend to foster relationships between our senior team members and our clients’ senior management. We believe that these relationships ensure that both parties are focused on establishing priorities, aligning objectives and driving client value. We are optimistic that this approach will provide us with a forum for addressing client concerns and to grow our business.

Competition

The markets in which we operate are highly competitive. Our competitors are diverse and offer a variety of solutions targeting various segments of the extended supply chain as well as the enterprise as a whole. Some competitors compete with suites of applications, while most offer solutions designed specifically to target particular functions or industries. We face strong competition across the entire competitive landscape, including competition on breadth and quality of product and service offerings, pricing, delivery times and after-sales support.

8

We consider our closest competitor to be Shenzhen Eternal Asia Supply Chain Management Ltd., as well as the larger trading companies and importers and the in-house buying functions of retailers. However, we believe that we are able to distinguish ourselves from all other participants in the industry because of our financing assistance program, independently researched and developed Starlight Supply Chain Business Brochure, IT platform, industry trading center and management team.

Properties

The Company’s headquarters is currently located in approximately 116.48 square meters of office space at Room 805-806, Xinghe Century Towers A, CaiTian Road No. 3069, Shenzhen City, Futian District, People’s Republic of China. The Company leases this office space from an unaffiliated third party for a monthly rental of RMB21,500 (US$3,180). The lease expires on April 10, 2017, and may be extended upon the mutual agreement of the parties. We believe that our existing office facilities will be sufficient for our operations for the next year.

The Company also anticipates leasing office space in Hebei province, People’s Republic of China, and anticipates entering into a lease for such space within the next three months. The Hebei Province office will be used to serve customers located in that area, and management is optimistic that with the support of the local government, it will be able to develop a number of new SCM customers.

Sing Kong’s Chairman, Mr. WU Yun Fai, provides the Company with free use of office space located at Room 1001, Chaowai SOHO Building A, Chaoyang District, Beijing, People’s Republic of China. The office space is leased by an affiliate of Mr. Wu.

Employees

At September 30, 2016, we had six full-time employees. Our future success depends upon the continued service of our key technical, sales and senior management personnel and our ability to attract, train and retain other highly qualified personnel.

Pursuant to the relevant regulations in the PRC, we are required to make contributions for each of our PRC employees, at rates based upon the employee’s standard salary base as determined by the local Social Security Bureau, to a defined contribution retirement scheme organized by the local Social Security Bureau in respect of the retirement benefits for Sing Kong-China’s employees in the PRC.

Government Regulation

The sourcing and export trade industry is not subject to specific industry regulatory oversight. To the extent that we are involved with the logistics of shipping our customers’ products to countries outside of China, we rely upon the international freight companies with whom we work to help us comply with any applicable legal requirements (licenses, approvals and permits) in the destination countries.

9

We are aware that our supply chain partners are subject to regulations within China and they are responsible for their own compliance with relevant local labor and occupational health and safety requirements.

Legal Proceedings

We are not currently involved in any material litigation or similar proceedings.

Principal Executive Office

Our principal executive office is located at Room 805-806, Xinghe Century Towers A, CaiTian Road No. 3069, Shenzhen City, Futian District, People’s Republic of China and our telephone number is +86-755-8254-8283.

Filing Status

We file reports with the SEC. You can read and copy any materials we file with the SEC at its Public Reference Room at 450 Fifth Street, NW, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports and other information regarding issuers that file electronically with the SEC, including us.

CONTRACTUAL ARRANGEMENTS AMONG OUR WHOLLY-FOREIGN OWNED ENTITY, THE VARIABLE INTEREST ENTITY AND THE VARIABLE INTEREST ENTITY HOLDER

We are structured to conduct our business operations through a wholly-foreign owned entity and a variable interest entity. The variable interest entity, which is incorporated in the PRC and 100% owned by a PRC citizen, operates our business. Specifically, our variable interest entity is Sing Kong-China. Sing Kong-China is 100%-owned by QU Ting Ting, who is also its Chief Executive Officer. We have entered into certain contractual arrangements, as described in more detail below, which collectively enable us to exercise effective control over the variable interest entity and realize substantially all of the economic risks and benefits arising from the variable interest entity. As a result, we will include the financial results of the variable interest entity in our consolidated financial statements in accordance with U.S. GAAP as if it were our wholly-owned subsidiary.

10

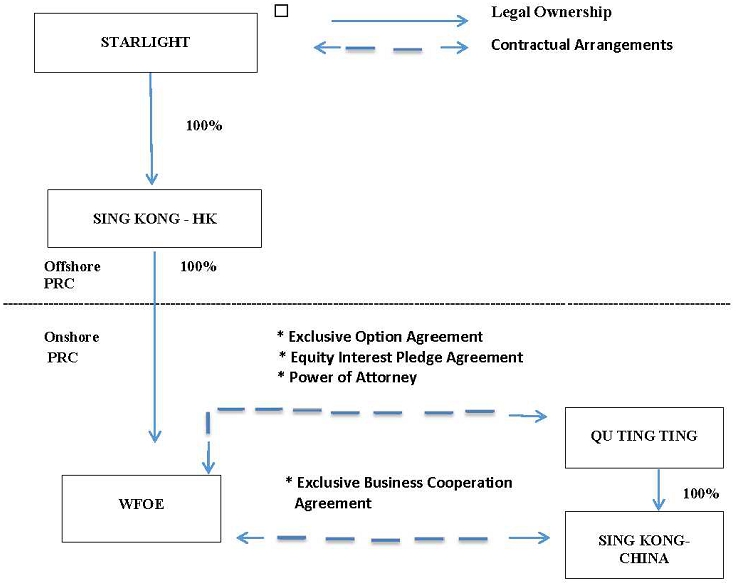

The following diagram is a simplified illustration of the ownership structure and contractual arrangements that we have in place for our variable interest entity:

Contracts that Give Us Effective Control of the Variable Interest Entity

The following is a summary of the common contractual arrangements that provide us with effective control of our variable interest entity and that enable us to receive substantially all of the economic benefits from its operations.

Exclusive option agreement. The variable interest entity equity holder has granted the wholly-foreign owned entity an exclusive call option to purchase her equity interest in the variable interest entity at an exercise price equal to the higher of (i) the base price of RMB10; and (ii) the minimum price as permitted by applicable PRC laws. The wholly-foreign owned entity may nominate another entity or individual to purchase the equity interest under the option. The option is exercisable subject to the condition that applicable PRC laws, rules and regulations do not prohibit completion of the transfer of the equity interest pursuant to the option. The wholly-foreign owned entity can require the variable interest entity to distribute all distributable profits to its shareholders, and the variable interest entity equity holder has agreed to promptly donate any profit, interest, dividend or proceeds of liquidation to the WFOE. The exclusive option agreement remains in effect until the equity interest that is the subject of such agreement is transferred to the WFOE. The parties to the exclusive option agreement are QU Ting Ting as the variable interest entity equity holder, Sing Kong-China and the WFOE.

Power of Attorney. Pursuant to the power of attorney, the variable interest entity equity holder, QU Ting Ting, irrevocably authorizes the WFOE, or any person designated by the WFOE, to exercise her rights as an equity holder of the variable interest entity, including the right to attend and vote at equity holders' meetings and to appoint directors, supervisors, the chief executive officer and other senior management members.

11

Equity interest pledge agreement. Pursuant to the equity interest pledge agreement, the variable interest entity equity holder has pledged all of her interests in the equity of the variable interest entity as a continuing first priority security interest in favor of the WFOE to secure the performance of obligations by the variable interest entity and/or its equity holder under the other structure contracts. The WFOE is entitled to be paid in priority with the equity interest of the variable interest entity equity holder based on the monetary valuation that such equity interest is converted into or from the proceeds from the auction or sale of the equity interest in the event of any breach or default under the other structure contracts. In addition, during the term of the pledge, the WFOE is entitled to receive dividends distributed on the equity interest. The equity interest pledge agreement remains in force for the duration of the other structure contracts. The parties to the equity pledge agreement are QU Ting Ting as the variable interest entity equity holder, the variable interest entity and the WFOE. The equity interest pledge relating to our variable interest entity will be registered with the appropriate office of the Administration for Industry and Commerce in China.

Contracts that Enable Us to Receive Substantially All of the Economic Benefits from the Variable Interest Entity

Exclusive business cooperation agreement. The variable interest entity has entered into an exclusive technical services agreement with the wholly-foreign owned entity pursuant to which the wholly-foreign owned entity provides exclusive technical services to the variable interest entity. In exchange, the variable interest entity pays a service fee to the wholly-foreign owned entity which typically amounts to what would be substantially all of the variable interest entity's pre-tax profit (absent the service fee), resulting in a transfer of substantially all of the profits from the variable interest entity to the wholly-foreign owned entity.

The exclusive option agreement and the equity interest pledge agreement described above also entitle the WFOE to all dividends and other distributions declared by the variable interest entity.

12

RISK FACTORS

Before investing in our common stock you should carefully consider the following risk factors, the other information included herein and the information included in our other reports and filings. Our business, financial condition and the trading price of our common stock could be adversely affected by these and other risks.

Risks Related to Our Business

Our limited operating history makes it difficult to evaluate our future prospects and results of operations.

The Company is in the process of developing its business and has a limited operating history. You should consider our future prospects in light of the risks and uncertainties experienced by early stage companies. Some of these risks and uncertainties relate to our ability to:

| ● | offer products of sufficient quality to attract and retain a larger customer base; | |

| ● | attract additional customers and increase spending per customer; | |

| ● | increase awareness of our products and continue to develop customer loyalty; | |

| ● | respond to competitive market conditions; | |

| ● | respond to changes in our regulatory environment; | |

| ● | maintain effective control of our costs and expenses; | |

| ● | raise sufficient capital to sustain and expand our business; and | |

| ● | attract, retain and motivate qualified personnel. |

If we are unsuccessful in addressing any of these risks and uncertainties, our business may be materially and adversely affected.

Our business is sensitive to general economic conditions.

Our business may be negatively affected by a downturn in general economic conditions in major importing countries and regions and rising labor and material costs in China.

13

Negative perception or publicity of Chinese products may hurt our business.

Any negative perception or publicity of Chinese products may cause a decline in demand for Chinese products outside of China and in turn negatively affect our sales and revenue.

We envision a period of rapid growth that may impose a significant burden on our administrative and operational resources which, if not effectively managed, could impair our growth.

Based upon management’s experience with other supply chain management companies and our experience during the six month period ended October 31, 2016, we envision a period of rapid growth that may impose a significant burden on our administrative and operational resources. The growth of our business will require significant investments of capital and management’s close attention. Our ability to effectively manage our growth will require us to substantially expand the capabilities of our administrative and operational resources and to attract, train, manage and retain qualified management, IT, sales and marketing and other personnel; We may be unable to do so. In addition, our failure to successfully manage our growth could result in our sales not increasing commensurately with capital investments. If we are unable to successfully manage our growth, we may be unable to achieve our goals.

We may not be able to raise the additional capital necessary to execute our business strategy, which could result in the curtailment of our operations.

We will need to raise additional funds to fully fund our existing operations and for development and expansion of our business. We have no current arrangements with respect to sources of additional financing and the needed additional financing may not be available on commercially reasonable terms, on a timely basis or at all. The inability to obtain additional financing when needed would have a negative effect on us, including possibly requiring us to curtail our operations. If any future financing involves the sale of equity securities, the shares of common stock held by our stockholders could be substantially diluted. If we borrow money or issue debt securities, the Company will be subject to the risks associated with indebtedness, including the risk that interest rates may fluctuate and the possibility that it may not be able to pay principal and interest on the indebtedness when due. Insufficient funds will prevent us from implementing our business plan and will require us to delay, scale back or eliminate certain of our operations.

We will be required to hire and retain skilled managerial personnel, IT and sales and marketing personnel.

Our continued success depends in large part on our ability to attract, train, motivate and retain qualified management, IT, sales and marketing personnel. Any failure to attract and retain the required managerial and technical personnel that are integral to our business may have a negative impact on the operation of Sing Kong, which would have a negative impact on revenues. There can be no assurance that we will be able to attract and retain skilled persons and the loss of skilled technical personnel would adversely affect us.

14

We are dependent upon our officers and management for direction and the loss of any of these persons could adversely affect our operations and results.

We are dependent upon our officers for implementation of our proposed strategy and execution of our business plan. The loss of any of our officers could have a material adverse effect upon our results of operations and financial position. We do not maintain “key person” life insurance for any of our officers. The loss of any of our officers could delay or prevent the achievement of our business objectives.

We may be sued or become a party to litigation, which could require significant management time and attention and result in significant legal expenses and may result in an unfavorable outcome, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We may be subject to a number of lawsuits from time to time arising in the ordinary course of our business. The expense of defending ourselves against such litigation may be significant. The amount of time to resolve these lawsuits is unpredictable and defending ourselves may divert management’s attention from the day-to-day operations of our business, which could adversely affect our business, results of operations and cash flows. In addition, an unfavorable outcome in such litigation could have a material adverse effect on our business, results of operations and cash flows.

We have identified material weaknesses in our internal control over financial reporting. If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, stockholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our common stock.

Effective internal control over financial reporting is necessary for us to provide reliable financial reports and, together with adequate disclosure controls and procedures, are designed to prevent fraud. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could cause us to fail to meet our reporting obligations. Ineffective internal control could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our common stock.

We have identified material weaknesses in our internal control over financial reporting in Starlight, Sing Kong-HK and Sing Kong-China. As defined in Regulation 12b-2 under the Exchange Act, a “material weakness” is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim consolidated financial statements will not be prevented, or detected on a timely basis. Specifically, we determined that we had the following material weaknesses in our internal control over financial reporting: (i) we have limited controls over information processing; (ii) we have inadequate segregation of duties; (iii) we do not have a formal audit committee with a financial expert; and (iv) we do not have sufficient formal written policies and procedures for accounting and financial reporting with respect to the requirements and application of both generally accepted accounting principles in the United States of America, or GAAP, and SEC guidelines.

15

Starlight has in the past and we intend in the future to utilize a third party independent contractor for the preparation of our financial statements in an effort to remediate the deficiency. The implementation of this initiative will not fully address any material weakness or other deficiencies that we may have in our internal control over financial reporting. Although the financial statements and footnotes are reviewed by our management, we do not have a formal policy to review significant accounting transactions and the accounting treatment of such transactions. The third party independent contractor is not involved in the day to day operations of the Company and may not be provided information from management on a timely basis to allow for adequate reporting/consideration of certain transactions.

Even if we develop effective internal controls over financial reporting, such controls may become inadequate due to changes in conditions, or the degree of compliance with such policies or procedures may deteriorate, which could result in the discovery of additional material weaknesses and deficiencies. In any event, the process of determining whether our existing internal control over financial reporting is compliant with Section 404 of the Sarbanes-Oxley Act (“Section 404”) and sufficiently effective requires the investment of substantial time and resources by our senior management. As a result, this process may divert internal resources and take a significant amount of time and effort to complete. In addition, we cannot predict the outcome of this process and whether we will need to implement remedial actions in order to establish effective controls over financial reporting. The determination of whether or not our internal controls are sufficient and any remedial actions required could result in us incurring additional costs that we did not anticipate, including the hiring of additional outside consultants. We may also fail to timely complete our evaluation, testing and any remediation required to comply with Section 404.

We are required, pursuant to Section 404, to furnish a report by management on, among other things, the effectiveness of our internal control over financial reporting. However, for as long as we are a “smaller reporting company,” our independent registered public accounting firm will not be required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404. While we could be a smaller reporting company for an indefinite amount of time, and thus relieved of the above-mentioned attestation requirement, an independent assessment of the effectiveness of our internal control over financial reporting could detect problems that our management’s assessment might not. Such undetected material weaknesses in our internal control over financial reporting could lead to financial statement restatements and require us to incur the expense of remediation.

Our independent auditors have issued an audit opinion for our company, which includes a statement describing our going concern status. Our financial status creates a doubt whether we will continue as a going concern.

Our auditors have issued a going concern opinion regarding our company. This means there is substantial doubt we can continue as an ongoing business for the next twelve months. The financial statements do not include any adjustments that might result from the uncertainty regarding our ability to continue in business. As such we may have to cease operations and investors could lose part or all of their investment in our company.

Risks Related to the People’s Republic of China

Our Chinese operations subject us to certain risks inherent in conducting business operations in China, including political instability and foreign government regulation, which could significantly impact our ability to operate in such countries and impact our results of operations.

We conduct substantially all of our business in China. Our Chinese operations are, and will be, subject to risks generally associated with conducting businesses in foreign countries, such as:

| ● | foreign laws and regulations that may be materially different from those of the United States; | |

| ● | changes in applicable laws and regulations; | |

| ● | challenges to, or failure of, title; | |

| ● | labor and political unrest; | |

| ● | foreign currency fluctuations; |

16

| ● | changes in foreign economic and political conditions; | |

| ● | export and import restrictions; | |

| ● | tariffs, customs, duties and other trade barriers; | |

| ● | difficulties in staffing and managing foreign operations; | |

| ● | longer time periods in collecting revenues; | |

| ● | difficulties in collecting accounts receivable and enforcing agreements; | |

| ● | possible loss of properties due to nationalization or expropriation; and | |

| ● | limitations on repatriation of income or capital. |

Specifically, foreign governments may enact and enforce laws and regulations requiring increased ownership by businesses and/or state agencies, which could adversely affect our ownership interests in then existing ventures. The Company’s ownership structure may not be adequate to accomplish its business objectives in China. Foreign governments also may impose additional taxes and/or royalties on our business, which would adversely affect our profitability. In certain locations, governments have imposed restrictions, controls and taxes, and in others, political conditions have existed that may threaten the safety of employees and our continued presence in those countries. Internal unrest, acts of violence or strained relations between a foreign government and Sing Kong or other governments may adversely affect our operations. These developments may, at times, significantly affect our results of operations, and must be carefully considered by our management when evaluating the level of current and future activity in such countries.

China’s economic policies could affect our business.

Substantially all of our assets are located in China and substantially all of our revenue is derived from our operations in China. Accordingly, our results of operations and prospects are subject, to a significant extent, to economic, political and legal developments in China.

While China’s economy has experienced significant growth in the past twenty years, growth has been irregular, both geographically and among various sectors of the economy. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall economy of China, but may also have a negative effect on us. For example, our operating results and financial condition may be adversely affected by the government control over capital investments or changes in tax regulations.

The economy of China has been transitioning from a planned economy to a more market-oriented economy. In recent years the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform and the reduction of state ownership of productive assets and the establishment of corporate governance in business enterprises; however, a substantial portion of productive assets in China are still owned by the Chinese government. In addition, the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies. It also exercises significant control over China's economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

17

Fluctuation of the RMB may affect our financial condition by affecting the volume of cross-border money flow.

The value of the RMB fluctuates and is subject to changes in the PRC’s political and economic conditions. Since July 2005, the conversion of RMB into foreign currencies, including USD, has been based on rates set by the People’s Bank of China which are set based upon the interbank foreign exchange market rates and current exchange rates of a basket of currencies on the world financial markets.

We may face obstacles from the communist system in the PRC.

Foreign companies conducting operations in the PRC face significant political, economic and legal risks. The Communist regime in the PRC, including a stifling bureaucracy, may hinder Western investment.

We may have difficulty establishing adequate management, legal and financial controls in the PRC.

The PRC historically has been deficient in Western style management and financial reporting concepts and practices, as well as in modern banking, computer and other control systems. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards.

Because our assets and operations are located in China, you may have difficulty enforcing any civil liabilities against us under the securities and other laws of the United States or any state.

We are a holding company, and all of our assets are located in the PRC. In addition, our directors and officers are non-residents of the United States, and all or a substantial portion of the assets of these non-residents are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon these non-residents, or to enforce against them judgments obtained in United States courts, including judgments based upon the civil liability provisions of the securities laws of the United States or any state.

There is uncertainty as to whether courts of the PRC would enforce:

| ● | Judgments of United States courts obtained against us or these non-residents based on the civil liability provisions of the securities laws of the United States or any state; or |

| ● | In original actions brought in the PRC, liabilities against us or non-residents predicated upon the securities laws of the United States or any state. Enforcement of a foreign judgment in the PRC also may be limited or otherwise affected by applicable bankruptcy, insolvency, liquidation, arrangement, moratorium or similar laws relating to or affecting creditors' rights generally and will be subject to a statutory limitation of time within which proceedings may be brought. |

18

The PRC legal system embodies uncertainties, which could limit law enforcement availability.

The PRC legal system is a civil law system based on written statutes. Unlike common law systems, decided legal cases have little precedence. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation over the past 27 years has significantly enhanced the protections afforded to various forms of foreign investment in China. Our PRC operating subsidiary and affiliate is subject to PRC laws and regulations. However, these laws and regulations change frequently and the interpretation and enforcement involve uncertainties. For instance, we may have to resort to administrative and court proceedings to enforce the legal protection that we are entitled to by law or contract. However, since PRC administrative and court authorities have significant discretion in interpreting statutory and contractual terms, it may be difficult to evaluate the outcome of administrative court proceedings and the level of law enforcement that we would receive in more developed legal systems. Such uncertainties, including the inability to enforce our contracts, could affect our business and operation. In addition, confidentiality protections in China may not be as effective as in the United States or other countries. Accordingly, we cannot predict the effect of future developments in the PRC legal system, particularly with regard to our business, including the promulgation of new laws. This may include changes to existing laws or the interpretation or enforcement thereof, or the preemption of local regulations by national laws. These uncertainties could limit the availability of law enforcement, including our ability to enforce our agreements.

Risks Related to Starlight’s Stock

There can be no assurance that a liquid public market for our common stock will exist.

Although Starlight’s shares of common stock are eligible for quotation on the OTC Markets, no shares trade on a regular basis and there may not be a significant market in such stock in the future. There can be no assurance that a regular and established market will be developed and maintained for our common stock, nor can there be any assurance as to the strength or liquidity of any market for our common stock or the prices at which holders may be able to sell their shares.

It is likely that there will be significant volatility in the trading price of our common stock.

In the event that a public market for our common stock is created or maintained in the future, market prices for the common stock will be influenced by many factors and will be subject to significant fluctuations in response to variations in operating results of Sing Kong and other factors. Our stock price will also be affected by the trading price of the stock of our competitors, investor perceptions of Sing Kong, interest rates, general economic conditions and those specific to our industry, developments with regard to Sing Kong’s operations and activities, our future financial condition and changes in our management.

19

Risks relating to low priced stocks.

Although Starlight’s common stock currently is quoted and traded on the OTC Markets, the price at which the stock will trade in the future cannot currently be estimated. The trading price of the common stock will most likely be below $5.00. If our common stock trades below $5.00 per share, trading in the common stock may be subject to the requirements of certain rules promulgated under the Exchange Act, which require additional disclosure by broker-dealers in connection with any trades involving a stock defined as a penny stock (generally, any non-Nasdaq equity security that has a market price share of less than $5.00 per share, subject to certain exceptions) and a two business day “cooling off period” before broker-dealers can effect transactions in penny stocks. For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to the sale. The broker-dealer also must disclose the commissions payable to the broker-dealer, current bid and offer quotations for the penny stock and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. These, and the other burdens imposed upon broker-dealers by the penny stock requirements, could discourage broker-dealers from effecting transactions in our common stock which could severely limit the market liquidity of our common stock and the ability of holders of our common stock to sell it.

We do not intend to pay dividends.

We have not paid any cash dividends on any of our securities since inception and we do not anticipate paying any cash dividends on any of our securities in the foreseeable future.

Future sales of our securities, or the perception in the markets that these sales may occur, could depress our stock price.

Following the consummation of the Transaction, we will have issued and outstanding approximately 6,606,065,482 shares of common stock. Of this amount only 7,850,000 shares are unrestricted; the balance of 6,588,215,482 will be eligible for public sale only if registered under the Securities Act or if the stockholder qualifies for an exemption from registration under Rule 144 or Rule 701 under the Securities Act, or other applicable exemption. The market price of our capital stock could drop significantly if the holders of these restricted shares sell them or are perceived by the market as intending to sell them. These factors also could make it more difficult for us to raise capital or make acquisitions through the issuance of additional shares of our common stock or other equity securities.

The ability of the Board of Directors of Starlight to issue “blank check” preferred stock and any anti-takeover provisions we adopt may depress the value of our common stock.

The authorized capital of Starlight includes 20,000,000 shares of “blank check” preferred stock. The Starlight Board has the power to issue any or all of the authorized but unissued shares of its preferred stock, including the authority to establish one or more series and to fix the powers, preferences, rights and limitations of such class or series, without seeking stockholder approval. They may, in the future, adopt anti-takeover measures. The authority of the Starlight Board of Directors to issue “blank check” preferred stock and any future anti-takeover measures it may adopt may, in certain circumstances, delay, deter or prevent takeover attempts and other changes in control of Starlight not approved by its Board of Directors. As a result, Starlight stockholders may lose opportunities to dispose of their shares at favorable prices generally available in takeover attempts or that may be available under a merger proposal and the market price of the common stock and the voting and other rights of its stockholders may also be affected.

20

Risks Related to Our Structure

If the PRC government deems that the contractual arrangements in relation to our variable interest entity do not comply with PRC governmental restrictions on foreign investment, or if these regulations or the interpretation of existing regulations changes in the future, we could be subject to penalties or be forced to relinquish our interests in those operations.

In order to simplify the acquisition of Sing Kong, we adopted a structure whereby we will provide our services through a PRC incorporated variable interest entity. The variable interest entity is owned by QU Ting Ting, the Chief Executive Officer of the variable interest entity. The contractual arrangements give us effective control over the variable interest entity and enable us to obtain substantially all of the economic benefits arising from the variable interest entity as well as consolidate the financial results of the variable interest entity in our results of operations. Although the structure we have adopted is consistent with longstanding industry practice and is commonly adopted by comparable companies in China, the PRC government may not agree that these arrangements comply with PRC licensing, registration or other regulatory requirements, with existing policies or with requirements or policies that may be adopted in the future. In addition, the contractual arrangements between our wholly-foreign owned entity, our variable interest entity and our variable interest entity equity holder governed by PRC law may be held not to be valid, binding and enforceable in accordance with their terms and applicable PRC laws and regulations.

It is uncertain whether any new PRC laws, rules or regulations relating to variable interest entity structures will be adopted or if adopted, what they would provide. If we or our variable interest entity is found to be in violation of any existing or future PRC laws, rules or regulations, or fails to obtain or maintain any of the required permits or approvals, the relevant PRC regulatory authorities would have broad discretion to take action in dealing with such violations or failures, including revoking the business and operating license of our PRC subsidiary or the variable interest entity, requiring us to discontinue or restrict our operations, restricting our right to collect revenue, requiring us to restructure our operations or taking other regulatory or enforcement actions against us. The imposition of any of these measures could result in a material adverse effect on our ability to conduct all or any portion of our business operations. In addition, it is unclear what impact the PRC government actions would have on us and on our ability to consolidate the financial results of our variable interest entity in our consolidated financial statements, if the PRC government authorities were to find our legal structure and contractual arrangements to be in violation of PRC laws, rules and regulations. If the imposition of any of these government actions causes us to lose our right to direct the activities of our variable interest entity or otherwise separate from that entity and if we are not able to restructure our ownership structure and operations in a satisfactory manner, we would no longer be able to consolidate the financial results of our variable interest entity in our consolidated financial statements. Any of these events would have a material adverse effect on our business, financial condition and results of operations.

21

Our contractual arrangements may not be as effective in providing control over the variable interest entity as direct ownership.

We rely on contractual arrangements with our variable interest entity to operate our business. For a description of these contractual arrangements, see “Contractual Arrangements Among Our Wholly-Foreign Owned Entity, Variable Interest Entity and the Variable Interest Entity Equity Holder.” These contractual arrangements may not be as effective as direct ownership in providing us with control over our variable interest entity.

If we had direct ownership of the variable interest entity, we would be able to exercise our rights as an equity holder directly to effect changes in the board of directors of that entity, which could effect changes at the management and operational level. Under our contractual arrangements, we may not be able to directly change the members of the board of directors of that entity and would have to rely on the variable interest entity and the variable interest entity equity holder to perform their obligations in order to exercise our control over the variable interest entity. The variable interest entity equity holder may have conflicts of interest with us or our shareholders, and she may not act in the best interests of our company or may not perform her obligations under these contracts. For example, our variable interest entity and its equity holder could breach their contractual arrangements with us by, among other things, failing to conduct operations in an acceptable manner or taking other actions that are detrimental to our interests. Pursuant to the exclusive option agreement, we may replace the equity holder of the variable interest entity at any time pursuant to the contractual arrangements. However, if the equity holder is uncooperative and any dispute relating to the contract or the replacement of the equity holder remains unresolved, we will have to enforce our rights under the contractual arrangement through the operations of PRC law and arbitral agencies, which may be costly and time-consuming and will be subject to uncertainties in the PRC legal system. Any failure by our variable interest entity or its equity holder to perform their obligations under the contractual arrangements would have a material adverse effect on our business, financial condition and results of operations. Consequently, the contractual arrangements may not be as effective in ensuring our control over our business operations as direct ownership.

Any failure by our variable interest entity or its equity holder to perform their obligations under the contractual arrangements would have a material adverse effect on our business, financial condition and results of operations.

If our variable interest entity or its equity holder fails to perform their respective obligations under the contractual arrangement, we may have to incur substantial costs and expend additional resources to enforce such arrangements. Although we have entered into an option agreement in relation to our variable interest entity, which provides that we may exercise an option to acquire, or nominate a person to acquire, ownership of the equity in that entity to the extent permitted by applicable PRC laws, rules and regulations, the exercise of this option is subject to the review and approval of the relevant PRC governmental authorities. We have also entered into an equity interest pledge agreement with respect to our variable interest entity to secure certain obligations of such variable interest entity or its equity holder to us under the contractual arrangements. However, the enforcement of such agreements through arbitral or judicial agencies may be costly and time-consuming and will be subject to uncertainties in the PRC legal system.

22

In addition, although the terms of the contractual arrangements provide that they will be binding on the successors of the variable interest entity equity holder, as those successors are not a party to the agreements, it is uncertain whether the successors in case of the death, bankruptcy or divorce of the variable interest entity equity holder will be subject to or will be willing to honor the obligations of such variable interest entity equity holder under the contractual arrangements. If the variable interest entity or its equity holder (or its successor), as applicable, fails to transfer the shares of the variable interest entity according to the option agreement or equity interest pledge agreement, we would need to enforce our rights under the option agreement or equity pledge agreement, which may be costly and time-consuming and may not be successful.

The contractual arrangements are governed by PRC law and provide for the resolution of disputes through arbitration in China. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. The legal system in the PRC is not as developed as in some other jurisdictions, such as the United States. Moreover, there are very few precedents and little formal guidance as to how contractual arrangements in the context of a variable interest entity should be interpreted or enforced under PRC law, and as a result it may be difficult to predict how an arbitration panel would view such contractual arrangements. As a result, uncertainties in the PRC legal system could limit our ability to enforce the contractual arrangements. Under PRC law, if the losing parties fail to carry out the arbitration awards within a prescribed time limit, the prevailing parties may only enforce the arbitration awards in PRC courts, which would require additional expense and delay. In the event we are unable to enforce the contractual arrangements, we may not be able to exert effective control over the variable interest entity, and our ability to conduct our business, as well as our financial condition and results of operations, may be materially and adversely affected.

We may lose the ability to use, or otherwise benefit from, the licenses, approvals and assets held by our variable interest entity, which could severely disrupt our business, render us unable to conduct some or all of our business operations and constrain our growth.

Although the significant majority of our revenues will be generated, and the significant majority of our operational assets will be held, by our wholly-foreign owned entity, which is our subsidiary, our variable interest entity holds licenses and approvals and assets that are necessary for our business operations. The contractual arrangements contain terms that specifically obligate the variable interest entity equity holder to ensure the valid existence of the variable interest entity and restrict the disposal of material assets of the variable interest entity. However, in the event the variable interest entity equity holder breaches the terms of these contractual arrangements and voluntarily liquidates our variable interest entity, or our variable interest entity declares bankruptcy and all or part of its assets become subject to liens or rights of third-party creditors, or are otherwise disposed of without our consent, we may be unable to conduct some or all of our business operations or otherwise benefit from the assets held by the variable interest entity, which could have a material adverse effect on our business, financial condition and results of operations. Furthermore, if our variable interest entity undergoes a voluntary or involuntary liquidation proceeding, its equity holder or unrelated third-party creditors may claim rights to some or all of the assets of such variable interest entity, thereby hindering our ability to operate our business as well as constrain our growth.

23

The equity holder, directors and executive officers of the variable interest entity may have potential conflicts of interest with our company.

PRC laws provide that a director and an executive officer owe a fiduciary duty to the company he or she directs or manages. The directors and executive officers of the variable interest entity must act in good faith and in the best interests of the variable interest entity and must not use their respective positions for personal gain. We cannot assure you that Ms. Qu will always act in the best interests of our company should any conflicts of interest arise, or that any conflicts of interest will always be resolved in our favor. We also cannot assure you that Ms. Qu will ensure that the variable interest entity will not breach the existing contractual arrangements. If we cannot resolve any such conflicts of interest or any related disputes, we would have to rely on legal proceedings to resolve these disputes and/or take enforcement action under the contractual arrangements. There is substantial uncertainty as to the outcome of any such legal proceedings. See “— Any failure by our variable interest entity or its equity holder to perform its obligations under the contractual arrangements would have a material and adverse effect on our business, financial condition and results of operations.”

The contractual arrangements with our variable interest entity may be subject to scrutiny by the PRC tax authorities. Any adjustment of related party transaction pricing could lead to additional taxes, and therefore substantially reduce our consolidated net income.

The tax regime in China is rapidly evolving and there is significant uncertainty for taxpayers in China as PRC tax laws may be interpreted in significantly different ways. The PRC tax authorities may assert that we or our subsidiary or the variable interest entity or its equity holder owe and/or are required to pay additional taxes on previous or future revenue or income. In particular, under applicable PRC laws, rules and regulations, arrangements and transactions among related parties, such as the contractual arrangements with our variable interest entity, may be subject to audit or challenge by the PRC tax authorities. If the PRC tax authorities determine that any contractual arrangements were not entered into on an arm’s length basis and therefore constitute a favorable transfer pricing, the PRC tax liabilities of the subsidiary and/or variable interest entity and/or variable interest entity equity holder could be increased, which could increase our overall tax liabilities. In addition, the PRC tax authorities may impose late payment interest. Our net income may be materially reduced if our tax liabilities increase.

Changes to PRC tax laws may subject us to greater taxes.

We base our tax position upon the anticipated nature and conduct of our business and upon our understanding of the tax laws of the various administrative regions and countries in which we have assets or conduct activities. However, our tax position is subject to review and possible challenge by taxing authorities and to possible changes in law, which may have retroactive effect. We cannot determine in advance the extent to which some jurisdictions may require us to pay taxes or make payments in lieu of taxes.

SELECTED CONSOLIDATED FINANCIAL DATA

You should read the summary consolidated financial data set forth below in conjunction with “Management’s Discussion and Analysis of Financial Condition or Plan of Operations.” The financial data of Sing Kong-China for the period from October 29, 2015 (inception) through April 30, 2016 and as of April 30, 2016, and the financial data for the six months ended October 31, 2016 and as of October 31, 2016, are derived from the audited consolidated financial statements and the unaudited consolidated financial statements, respectively, appearing in Exhibit 99.1 hereto. The historical results are not necessarily indicative of the results to be expected for any future period.

SING KONG-HK

Consolidated Income Statement Data:

For the period from April 29, to April 30, 2016 | For the six months ended October 31, 2016 | |||||||

| Revenue | $ | - | $ | - | ||||

| Cost of revenue | - | - | ||||||

| Gross profit | - | - | ||||||

| General and administrative expenses | 593 | 4,332 | ||||||

| Loss from operations | (593 | ) | (4,332 | ) | ||||

| Other expenses: | ||||||||

| Bank charges | - | (14 | ) | |||||

| Loss before provision for income taxes | (593 | ) | (4,346 | ) | ||||

| Provision for income taxes | - | - | ||||||

| Net loss | (593 | ) | (4,346 | ) | ||||

| Foreign currency translation adjustment | - | 74 | ||||||

| Comprehensive loss | (593 | ) | (4,272 | ) | ||||

24

Consolidated Balance Sheet Data:

| As at April 30, 2016 | As at October 31, 2016 | |||||||

| Cash and cash equivalents | $ | - | $ | - | ||||

| Working capital | (593 | ) | (4,865 | ) | ||||

| Total assets | - | - | ||||||

| Total liabilities | 593 | 4,865 | ||||||

| Total shareholders’ equity | (593 | ) | (4,865 | ) | ||||

SING KONG-CHINA

Consolidated Income Statement Data:

For the period from October 29, 2015 (inception) to April 30, 2016 | For the six months ended October 31, 2016 | |||||||

| Revenue | $ | 14,791,123 | $ | 23,195,106 | ||||

| Cost of revenue | 14,771,500 | 23,159,551 | ||||||

| Gross profit | 19,623 | 35,555 | ||||||

| General and administrative expenses | 77,603 | 131,028 | ||||||

| Loss from operations | (57,980 | ) | (95,473 | ) | ||||

| Other expenses: | ||||||||

| Bank charges | (139 | ) | (202 | ) | ||||

| Interest expense | - | (9 | ) | |||||

| Other expenses | (166 | ) | - | |||||

| Other income | - | 8 | ||||||

| Total other expenses | (305 | ) | (203 | ) | ||||

| Loss before provision for income taxes | (58,285 | ) | (95,676 | ) | ||||

| Provision for income taxes | - | - | ||||||

| Net loss | (58,285 | ) | (95,676 | ) | ||||

| Foreign currency translation adjustment | (85 | ) | (1,782 | ) | ||||

| Comprehensive loss | (58,370 | ) | (97,458 | ) | ||||

Consolidated Balance Sheet Data:

| As at April 30, 2016 | As at October 31, 2016 | |||||||

| Cash and cash equivalents | $ | 14,481 | $ | 6,442 | ||||

| Working capital | (60,772 | ) | (161,608 | ) | ||||

| Total assets | 130,350 | 4,939,144 | ||||||

| Total liabilities | 188,720 | 5,094,887 | ||||||

| Total shareholders’ equity | (58,370 | ) | (155,743 | ) | ||||

25

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

The following discussion and analysis of the results of operations and financial condition of Sing Kong for the period from October 29, 2015 (inception) through April 30, 2016 and as of April 30, 2016, and for the six months ended October 31, 2016 and as at October 31, 2016, should be read in conjunction with “Selected Consolidated Financial Data” and Sing Kong’s financial statements and the notes to those financial statements that are included elsewhere in this Form 8-K Current Report. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under the “Risk Factors,” “Cautionary Notice Regarding Forward-Looking Statements” and “Business” sections in this Form 8-K Current Report. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could” and similar expressions to identify forward-looking statements.

OVERVIEW