Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RIGHTSIDE GROUP, LTD. | name-8k_20170123.htm |

eNom Divestiture January 2017 Exhibit 99.1

Information in this presentation regarding forecasts, business outlook, expectations and beliefs of Rightside Group, Ltd. (the “Company”) are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All forward-looking statements included or incorporated by reference in this presentation, including statements regarding expected net cash proceeds from the sale of the eNom business, our anticipated use of such cash proceeds, expected benefits from the sale of eNom, expectations about plans and objectives for future operations after the eNom sale, future results of operations and financial position, business strategies and plans, and future growth and revenue opportunities from new and existing products and customers are based upon information available to the Company as of the date of this report, which may change. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described under the heading “Risk Factors” in the Company’s periodic reports filed with the Securities and Exchange Commission. New risks emerge from time to time and it is not possible for the Company to predict all risks, nor can the Company assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements the Company may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events or results. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, the Company cannot guarantee that the future results, execution of its business strategies, including with regard to the Company’s retail business, as well as short-term and long-term business operations, plans and objectives, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or will occur. The Company assumes no obligation and does not intend to update any forward-looking statements provided for any reason after the date of this presentation, or to conform these statements to actual results or changes in the Company’s expectations whether as a result of new information, future events or otherwise. Safe Harbor and Forward Looking Statements 1

Transaction Overview & Rationale On January 20, 2017, Rightside Group, Ltd. (Nasdaq: NAME) announced that it signed a definitive agreement to sell its eNom business to Tucows Inc. (Nasdaq: TCX) for $83.5 million in cash The eNom business is a leading wholesale registrar that provides domain services to a network of over 28,000 resellers Transaction closed January 20, 2017 Transaction Overview Strategic Rationale Sharpens Focus on the Core: Registry and Retail Registrar Enhances Growth and Margin Profile Improves Financial Flexibility 2

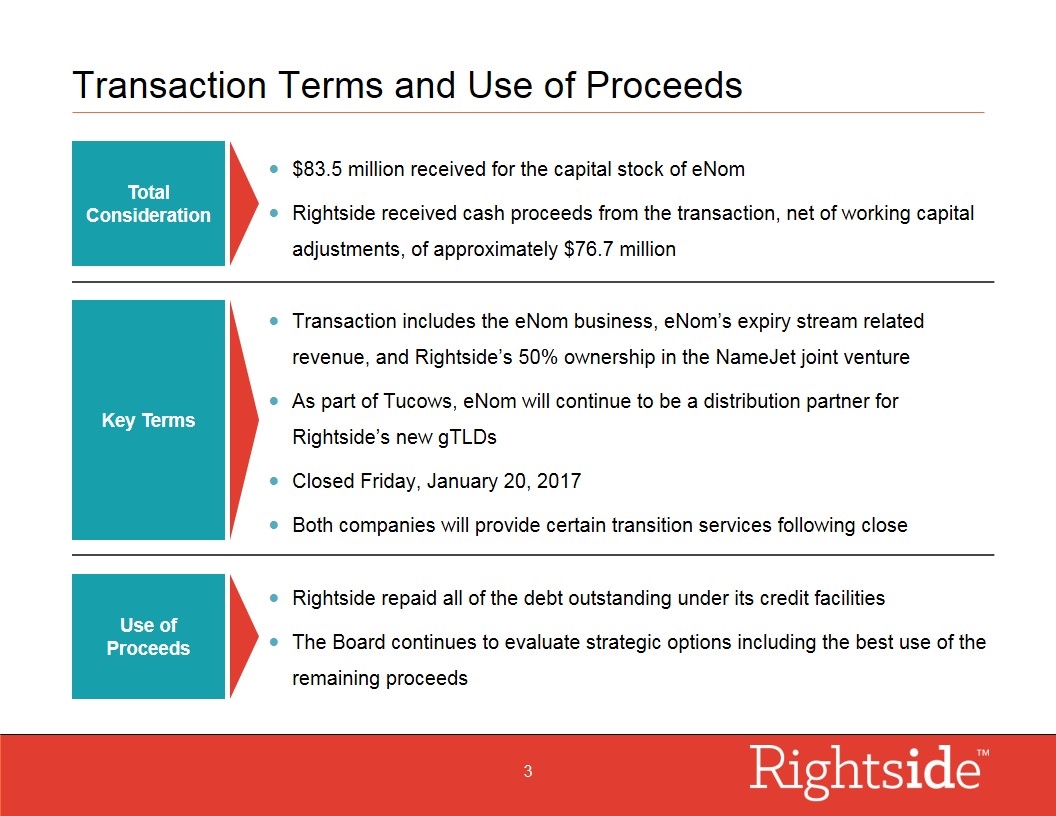

Transaction Terms and Use of Proceeds Total Consideration Key Terms Use of Proceeds $83.5 million received for the capital stock of eNom Rightside received cash proceeds from the transaction, net of working capital adjustments, of approximately $76.7 million Transaction includes the eNom business, eNom’s expiry stream related revenue, and Rightside’s 50% ownership in the NameJet joint venture As part of Tucows, eNom will continue to be a distribution partner for Rightside’s new gTLDs Closed Friday, January 20, 2017 Both companies will provide certain transition services following close Rightside repaid all of the debt outstanding under its credit facilities The Board continues to evaluate strategic options including the best use of the remaining proceeds 3

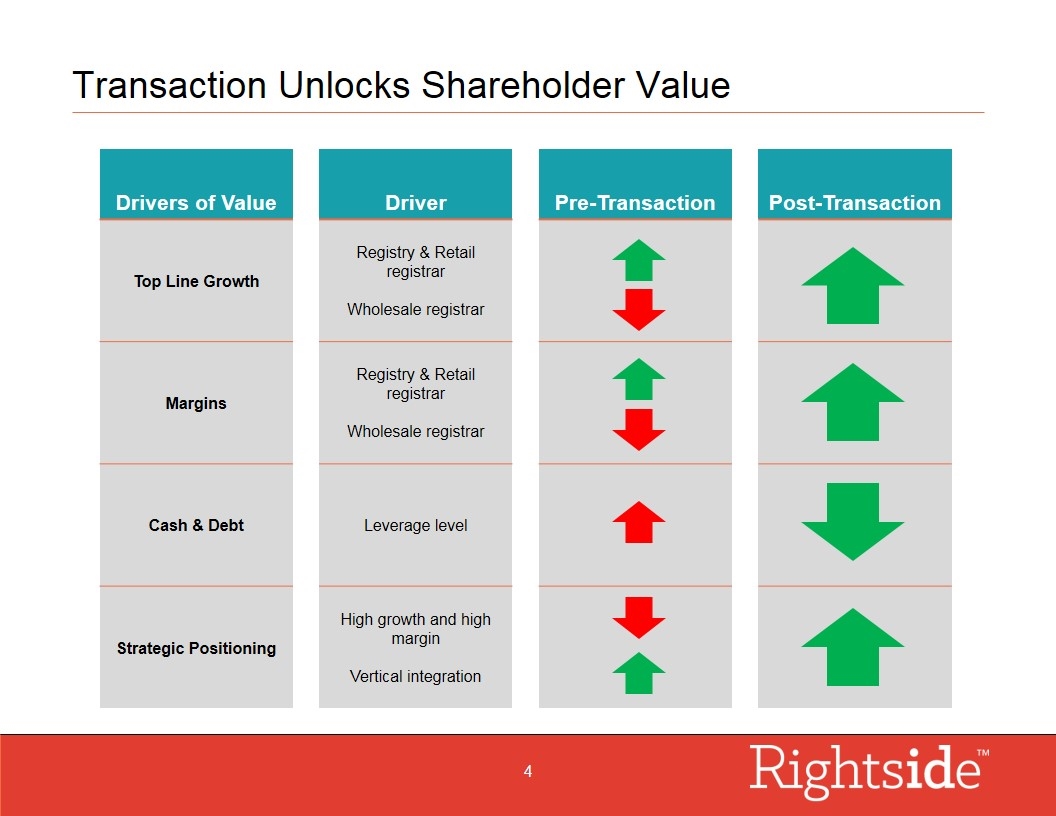

Transaction Unlocks Shareholder Value Drivers of Value Driver Pre-Transaction Post-Transaction Top Line Growth Registry & Retail registrar Wholesale registrar Margins Registry & Retail registrar Wholesale registrar Cash & Debt Leverage level Strategic Positioning High growth and high margin Vertical integration 4

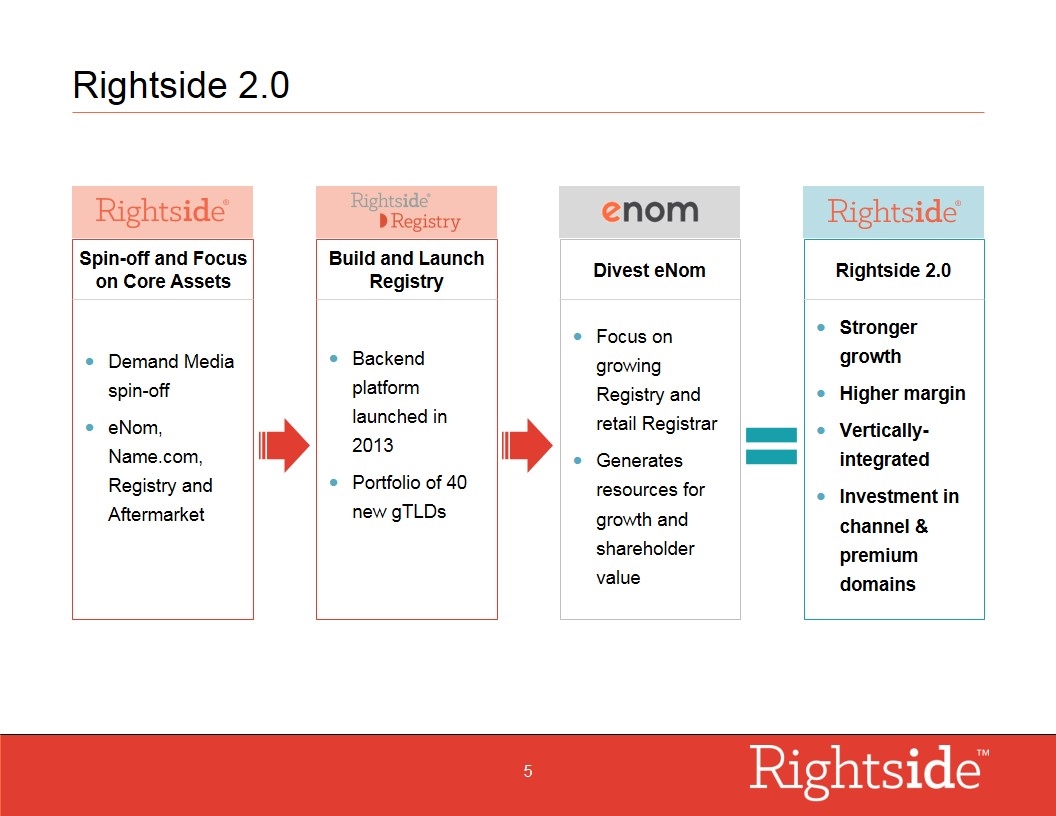

Rightside 2.0 Spin-off and Focus on Core Assets Build and Launch Registry Divest eNom Rightside 2.0 Demand Media spin-off eNom, Name.com, Registry and Aftermarket Backend platform launched in 2013 Portfolio of 40 new gTLDs Focus on growing Registry and retail Registrar Generates resources for growth and shareholder value Stronger growth Higher margin Vertically-integrated Investment in channel & premium domains 5

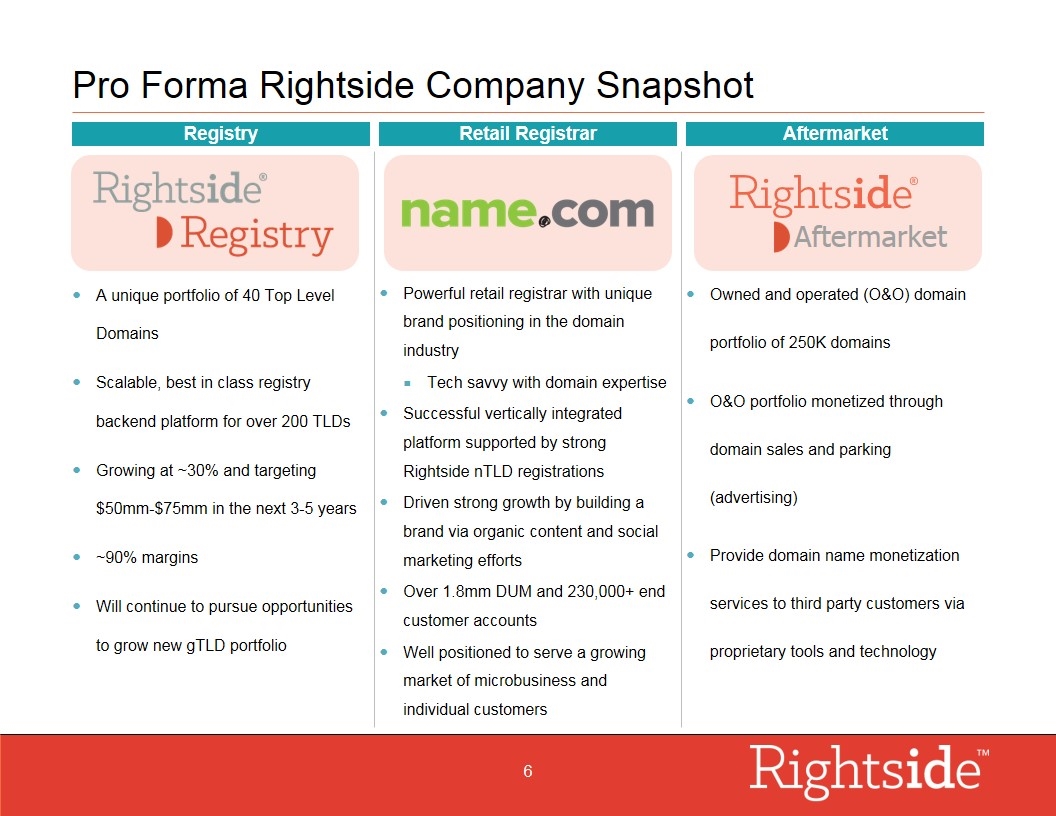

Pro Forma Rightside Company Snapshot A unique portfolio of 40 Top Level Domains Scalable, best in class registry backend platform for over 200 TLDs Growing at ~30% and targeting $50mm-$75mm in the next 3-5 years ~90% margins Will continue to pursue opportunities to grow new gTLD portfolio Registry Powerful retail registrar with unique brand positioning in the domain industry Tech savvy with domain expertise Successful vertically integrated platform supported by strong Rightside nTLD registrations Driven strong growth by building a brand via organic content and social marketing efforts Over 1.8mm DUM and 230,000+ end customer accounts Well positioned to serve a growing market of microbusiness and individual customers Retail Registrar Aftermarket Owned and operated (O&O) domain portfolio of 250K domains O&O portfolio monetized through domain sales and parking (advertising) Provide domain name monetization services to third party customers via proprietary tools and technology Aftermarket 6

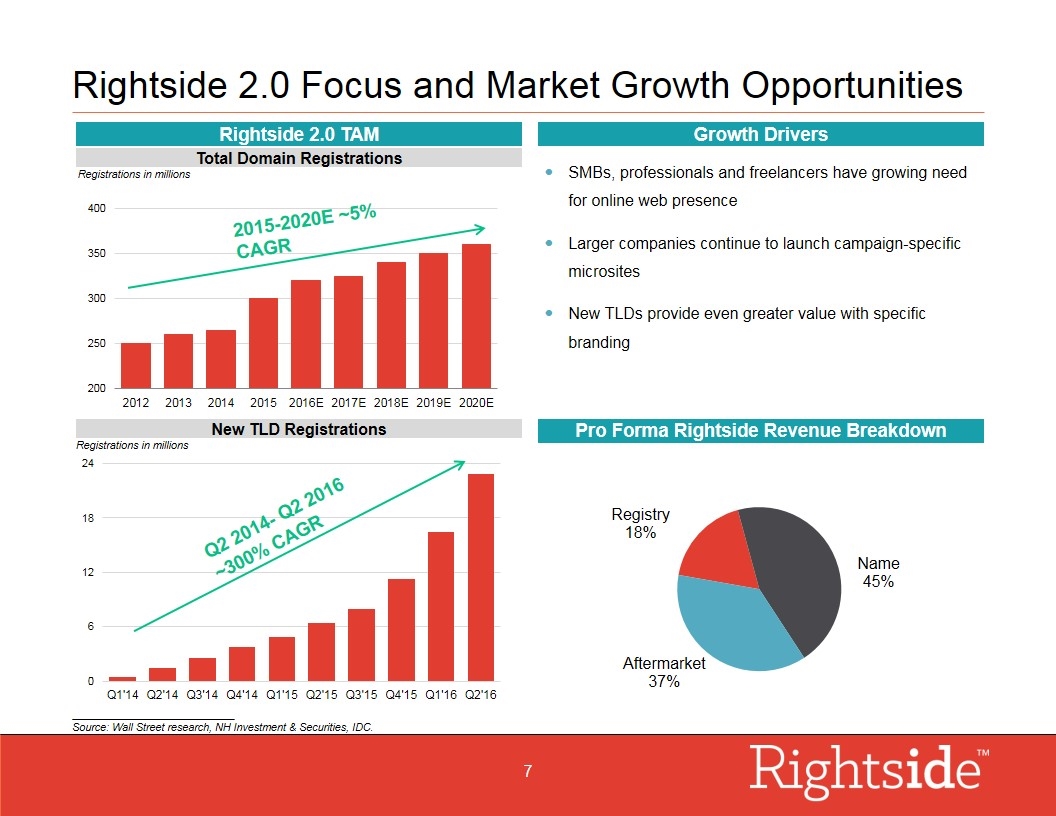

Rightside 2.0 Focus and Market Growth Opportunities OUR MARKET Rightside 2.0 TAM Growth Drivers SMBs, professionals and freelancers have growing need for online web presence Larger companies continue to launch campaign-specific microsites New TLDs provide even greater value with specific branding Pro Forma Rightside Revenue Breakdown Total Domain Registrations Registrations in millions 2015-2020E ~5% CAGR New TLD Registrations Q2 2014- Q2 2016 ~300% CAGR Registrations in millions ___________________________ Source: Wall Street research, NH Investment & Securities, IDC. 7

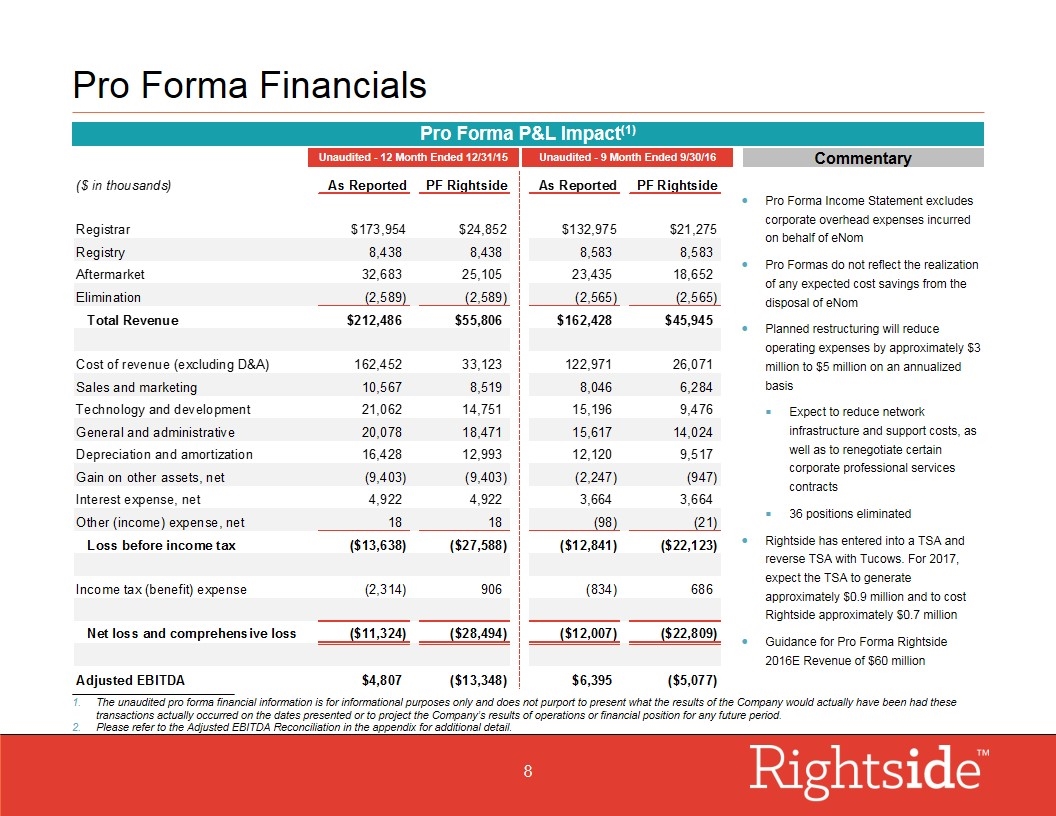

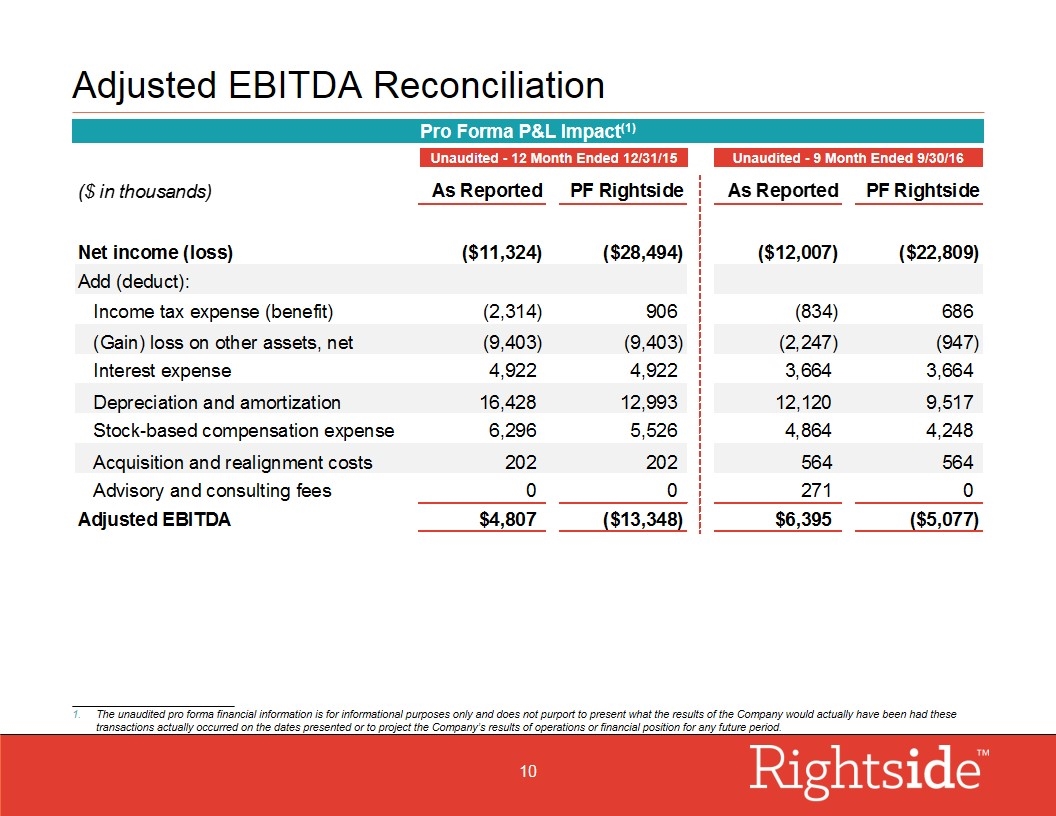

Pro Forma Financials Pro Forma P&L Impact(1) Unaudited - 12 Month Ended 12/31/15 Unaudited - 9 Month Ended 9/30/16 Commentary Pro Forma Income Statement excludes corporate overhead expenses incurred on behalf of eNom Pro Formas do not reflect the realization of any expected cost savings from the disposal of eNom Planned restructuring will reduce operating expenses by approximately $3 million to $5 million on an annualized basis Expect to reduce network infrastructure and support costs, as well as to renegotiate certain corporate professional services contracts 36 positions eliminated Rightside has entered into a TSA and reverse TSA with Tucows. For 2017, expect the TSA to generate approximately $0.9 million and to cost Rightside approximately $0.7 million Guidance for Pro Forma Rightside 2016E Revenue of $60 million ___________________________ The unaudited pro forma financial information is for informational purposes only and does not purport to present what the results of the Company would actually have been had these transactions actually occurred on the dates presented or to project the Company’s results of operations or financial position for any future period. Please refer to the Adjusted EBITDA Reconciliation in the appendix for additional detail. (2) 8

Appendix

Non-GAAP Financial Measures To provide investors, analysts and others with additional information regarding the Company’s financial results, this presentation includes adjusted earnings before interest, income taxes, depreciation and amortization, or “Adjusted EBITDA”, a non-GAAP financial measure. A reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure has been included in the Appendix to this presentation. The Company’s non-GAAP Adjusted EBITDA financial measure differs from GAAP net income (loss) in that it excludes certain expenses such as interest, income taxes, gain on sale of marketable securities, gain on other assets, net, depreciation, amortization, stock-based compensation, and the financial impact of acquisition, advisory and realignment costs. The Company uses this non-GAAP financial measure to understand and evaluate its financial performance and operating trends, including period to period comparisons, to prepare and approve its annual budget and to develop short and long term operational plans. The exclusion of certain expenses in calculating Adjusted EBITDA can provide a useful measure for period to period comparisons of the Company’s underlying recurring revenue and operating costs which is focused more closely on the current costs necessary to utilize previously acquired long-lived assets. In addition, management believes that it can be useful to exclude certain non-cash charges because the amount of such expenses is the result of long-term investment decisions in previous periods rather than day-to-day operating decisions. Accordingly, the Company believes that this non-GAAP financial measure provides useful information to investors and others in understanding and evaluating the Company’s operating results in the same manner as the Company’s management and in comparing financial results across accounting periods and to those of peer companies. The use of this non-GAAP financial measure has certain limitations because it does not reflect all items of income and expense that affect the Company’s operations. The Company compensates for these limitations by reconciling the non-GAAP financial measure to the most comparable GAAP financial measure as set forth in the Appendix to this presentation. This non-GAAP financial measure should be considered in addition to, not as a substitute for, measures prepared in accordance with GAAP. Further, this non-GAAP measure may differ from the non-GAAP information used by other companies, including peer companies, and therefore financial comparability may be limited. The Company encourages investors and others to review the Company’s financial information in its entirety and not rely on a single financial measure. 9

Adjusted EBITDA Reconciliation Unaudited - 12 Month Ended 12/31/15 Unaudited - 9 Month Ended 9/30/16 Pro Forma P&L Impact(1) ___________________________ The unaudited pro forma financial information is for informational purposes only and does not purport to present what the results of the Company would actually have been had these transactions actually occurred on the dates presented or to project the Company’s results of operations or financial position for any future period. 10