Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ABRAXAS PETROLEUM CORP | a8kjanuary2017catalysts.htm |

Abraxas Petroleum

Corporate Update

January 2017

Raven Rig #1; McKenzie County, ND

Exhibit 99.1

2

The information presented herein may contain predictions, estimates and other forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Although the Company believes that its expectations are based on

reasonable assumptions, it can give no assurance that its goals will be achieved.

Important factors that could cause actual results to differ materially from those included in the forward-looking statements include the timing and

extent of changes in commodity prices for oil and gas, availability of capital, the need to develop and replace reserves, environmental risks, competition,

government regulation and the ability of the Company to meet its stated business goals.

Oil and Gas Reserves. The SEC permits oil and natural gas companies, in their SEC filings, to disclose only reserves anticipated to be economically

producible, as of a given date, by application of development projects to known accumulations. We use certain terms in this presentation, such as total

potential, de-risked, and EUR (expected ultimate recovery), that the SEC’s guidelines strictly prohibit us from using in our SEC filings. These terms

represent our internal estimates of volumes of oil and natural gas that are not proved reserves but are potentially recoverable through exploratory

drilling or additional drilling or recovery techniques and are not intended to correspond to probable or possible reserves as defined by SEC regulations.

By their nature these estimates are more speculative than proved, probable or possible reserves and subject to greater risk they will not be realized.

Non-GAAP Measures. Included in this presentation are certain non-GAAP financial measures as defined under SEC Regulation G. Investors are urged to

consider closely the disclosure in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and its subsequently filed

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and the reconciliation to GAAP measures provided in this presentation.

Initial production, or IP, rates, for both our wells and for those wells that are located near our properties, are limited data points in each well’s

productive history. These rates are sometimes actual rates and sometimes extrapolated or normalized rates. As such, the rates for a particular well may

change as additional data becomes available. Peak production rates are not necessarily indicative or predictive of future production rates, expected

ultimate recovery, or EUR, or economic rates of return from such wells and should not be relied upon for such purpose. Equally, the way we calculate

and report peak IP rates and the methodologies employed by others may not be consistent, and thus the values reported may not be directly and

meaningfully comparable. Lateral lengths described are indicative only. Actual completed lateral lengths depend on various considerations such as lease-

line offsets. Standard length laterals, sometimes referred to as 5,000 foot laterals, are laterals with completed length generally between 4,000 feet and

5,500 feet. Mid-length laterals, sometimes referred to as 7,500 foot laterals, are laterals with completed length generally between 6,500 feet and 8,000

feet. Long laterals, sometimes referred to as 10,000 foot laterals, are laterals with completed length generally longer than 8,000 feet.

Forward-Looking Statements

3

Headquarters......................... . San Antonio

Employees(1)............................ 85

Shares outstanding(2)……......... 160 mm

Market cap(2) …………………….... $401.9 mm

Net debt(2)……………………………. $33.0 mm

2017E CAPEX……………………….. $110 mm

(1) Abraxas full time employees as of October 12, 2016. Does not include 25 employees associated with the Company’s wholly owned subsidiary, Raven Drilling.

(2) Pro forma for $57.0 in estimated net proceeds to be received from recent 25 million share offering . Shares outstanding as of September 30, 2016 plus 25 million share offering. Market cap using share price as of January

22, 2017 close. Total debt including RBL facility, rig loan and building mortgage less cash as of January 22, 201 7.

(3) Enterprise value includes working capital deficit (excluding current hedging assets and liabilities) as of September 30, 2016, but does not include building mortgage or rig loan. Includes RBL facility, rig loan and building mortgage less

cash as of January 16, 2017.

(4) Proved reserves as of December 31, 2015. Uses SEC YE2015 average pricing of $41.25/bbl and $2.36/mcf. See appendix for reconciliation of PV-10 to standardized measure.

(5) Net book value of other assets as of September 30, 2016.

(6) Average production for the quarter ended September 30, 2016.

(7) Calculation using average production for the quarter ended September 30, 2016 annualized and net proved reserves as of December 31, 2015.

EV/BOE(2,3)…………………………… $10.32

Proved Reserves(4)………………. . 43.2 mmboe

PV-10(4)………………………………… $197.3 mm

NBV Non-Oil & Gas Assets(5)… $22.3 mm

Production(6).……………………….. 5,955 boepd

R/P Ratio(7)…………………………… 19.9x

NASDAQ: AXAS

Corporate Profile

4

Williston:

Bakken / Three Forks

Eastern Shelf:

Conventional & Emerging Hz Oil

Eagle Ford Shale

/ Austin Chalk

Delaware Basin:

Bone Spring & Wolfcamp

Rocky Mountain

South Texas

Permian Basin

Legend

Proved Reserves (mmboe)(1): 43.2

Proved Developed: 40%

Oil: 56%

Current Prod (boe/d) (2): 5,955

Abraxas Petroleum Corporation

Core Regions

(1) Net proved reserves as of December 31, 2015.

(2) Average production for quarter ended September 30, 2016

2017 Capex Focus Areas

5

Area

Capital

($MM)

% of

Total

Gross

Wells

Net

Wells

Permian - Delaware $52.5 47.7% 7.0 6.0

Bakken/Three Forks 42.2 38.4% 13.0 6.6

Austin Chalk 11.0 10.0% 2.0 2.0

Other 4.3 3.9% 0.0 0.0

Total $110.0 100% 22.0 14.6

2017 Operating and Financial Guidance

2017 Capex Budget Allocation 2017 Operating Guidance

Operating Costs

Low

Case

High

Case

LOE ($/BOE) $6.00 $8.00

Production Tax (% Rev) 8.0% 10.0%

Cash G&A ($mm) $10.0 $12.5

Production (boepd) 7,800 8,600

(1) Yearly CAPEX for each year ending December 31, 2012, 2013, 2014 and 2015. 2016 and 2017 based on management guidance.

(2) 2016 and 2017 estimates assume the midpoint of 2016 and 2017 guidance.

66% 22%

12%

2017 Expected Production Mix

Oil Gas NGL

$0

$50,000

$100,000

$150,000

$200,000

$250,000

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

2

0

12

A

2

0

13

A

2

0

14

A

2

0

15

A

2

0

16

E (3

)

2

0

17

E (3

)

Daily Production vs Yearly CAPEX (2)

6

Key Investment Highlights

Continue to evaluate Austin Chalk and add cost-effective leases in geologically specific areas

First well confirmed geologic concept

Two well program in 2017 designed to establish economic viability via engineering and geologic

modifications

Austin Chalk Optionality

Total bank debt of ~$29 million(3) represents the only meaningful leverage (2, 3) of the Company and is

funded under recently re-determined $115 million revolving credit facility

Liquidity of ~$86 million(3) positions the Company to remain acquisitive

Actively looking to consolidate Delaware Basin working interest position and surrounding leases

Management continues to pursue and execute on non-core asset sales

Balance Sheet Strength with

Solid Liquidity & Financial

Flexibility

7 gross (6.0 net) operated Wolfcamp/Bone Spring wells planned for 2017

13 gross (6.6 net) operated and non-operated Bakken/Three Forks wells planned for 2017

Total Capex of $110 million funded out of cash flow and RBL provides 32% YoY production growth

using the midpoints of 2016 and 2017 guidance

Visible Production Growth and

Fully Funded Capex Program

(1) Includes 480 net acres on Abraxas’ Howe lease which is currently subject to a title dispute. Abraxas does not have any reserves or planned 2017 capital expenditures relating to the acreage that is subject

to this title dispute.

(2) Company also has $5.0 million of debt associated with a rig loan and building mortgage.

(3) Pro forma for anticipated ~$57 million of net offering proceeds from recent 25 million share offering.

5,853(1) net HBP acres prospective for the Wolfcamp A & Bone Spring intervals

Plan to test multiple prospective zones in 2017

Continue to actively lease and pursue acquisitions in the basin

2017 capital budget increasing to $53MM (48% of total allocation)

Delaware Basin Exposure

7

Asset Base Overview

8

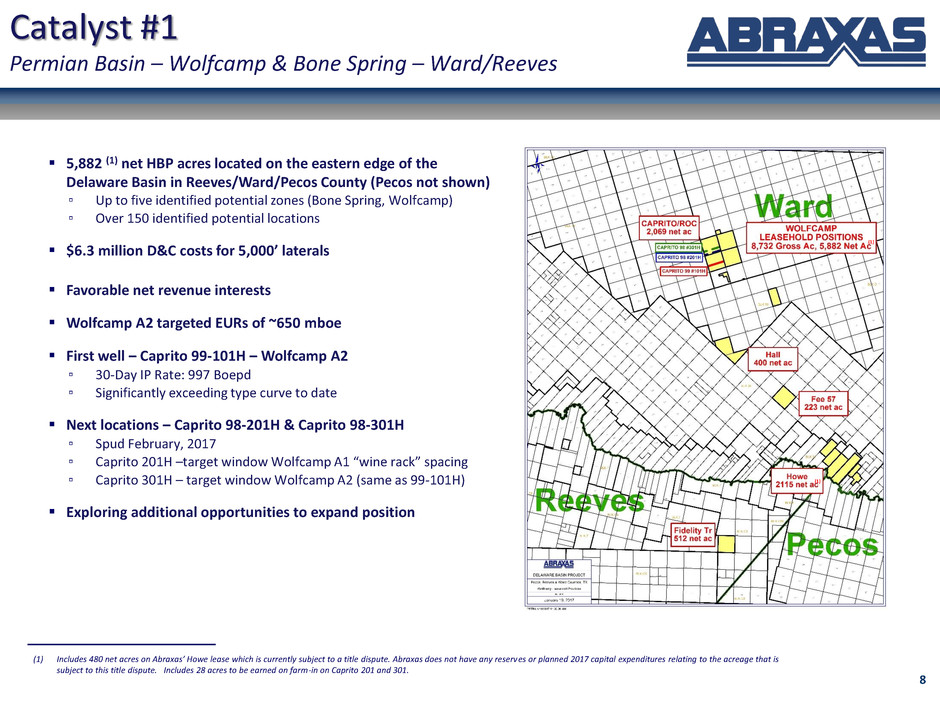

Catalyst #1

Permian Basin – Wolfcamp & Bone Spring – Ward/Reeves

5,882 (1) net HBP acres located on the eastern edge of the

Delaware Basin in Reeves/Ward/Pecos County (Pecos not shown)

▫ Up to five identified potential zones (Bone Spring, Wolfcamp)

▫ Over 150 identified potential locations

$6.3 million D&C costs for 5,000’ laterals

Favorable net revenue interests

Wolfcamp A2 targeted EURs of ~650 mboe

First well – Caprito 99-101H – Wolfcamp A2

▫ 30-Day IP Rate: 997 Boepd

▫ Significantly exceeding type curve to date

Next locations – Caprito 98-201H & Caprito 98-301H

▫ Spud February, 2017

▫ Caprito 201H –target window Wolfcamp A1 “wine rack” spacing

▫ Caprito 301H – target window Wolfcamp A2 (same as 99-101H)

Exploring additional opportunities to expand position

(1) Includes 480 net acres on Abraxas’ Howe lease which is currently subject to a title dispute. Abraxas does not have any reserves or planned 2017 capital expenditures relating to the acreage that is

subject to this title dispute. Includes 28 acres to be earned on farm-in on Caprito 201 and 301.

(1)

(1)

9

Wolfcamp

Caprito 99-101H Completion Design

Completion Design

Stages: 25

Total Prop: 10.5mm lb (2,400 lbs/ft)

Total Fluid: 358,000 bbls (80 bbls/ft)

Avg PPA: 0.71 ppg

Avg Rate: 80 BPM

Diversions: 52

Treating Plot Example

10

Delaware Wolfcamp

Wolfcamp A2 Well Economics

Wolfcamp: ROR vs CAPEX (1)

(1) Uses strip pricing as of Jan 3, 2017.

Abraxas Booked Assumptions

588 MBOE gross type curve

▫ 82% Oil

▫ Initial rate: 793 boepd

▫ di: 99.0%

▫ dm: 5.0%

▫ b-factor: 1.4

Booked CWC: $5.6 million

Wolfcamp: Type Curve Assumptions

Abraxas Updated Assumptions

650 MBOE gross type curve

▫ 92% Oil

▫ Initial rate: 1225 boepd

▫ di: 99.9%

▫ dm: 5.0%

▫ b-factor: 1.6

CWC: $5.6 million

11

Catalyst #2

Bakken / Three Forks

4,013 net HBP acres located in the core of the Williston Basin

in McKenzie County, ND – de-risked Bakken and Three Forks

▫ 37 operated completed wells

▫ 1 non-operated well waiting on completion

▫ Expected to be on production 1Q17

▫ Estimated 56 additional operated wells at 660-1,320 foot

spacing

Stenehjem 10H-15H Completions

▫ 64.2% net revenue interest

▫ 30-day MB average rate(1) 1,226 boepd

▫ 30-day TF average rate(1) 1,059 boepd

Stenehjem 6H-9H

▫ Four well pad currently drilling

▫ 62.0% net revenue interest

Five gross non-operated wells planned for 2017

▫ 28-36% working interest

(1) The 30-day average rates represent the highest 30 days of production and do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas.

12

Old Design

2,400 bbls / 165k prop

30 BPM

Xlink gel

New Design

3,500 bbls / 185k prop

45 BPM

Ramped & diverted HCFR

Bakken / Three Forks

Stenehjem 10H-15H Completion

13

Bakken / Three Forks

North Fork Economics

Middle Bakken: ROR vs CAPEX (1)

(1) Uses strip pricing as of January 3, 2017.

Abraxas Booked Assumptions

533 MBOE gross type curve

▫ 78% Oil

▫ Initial rate: 910 boepd

▫ di: 99.3%

▫ dm: 8.0%

▫ b-factor: 1.5

Booked CWC: $7.25 million

Middle Bakken: Type Curve Assumptions

Abraxas Updated Assumptions

728 MBOE gross type curve

▫ 78% Oil

▫ Initial rate: 1183 boepd

▫ di: 98.5%

▫ dm: 8.0%

▫ b-factor: 1.5

CWC: ~$6.0 million

14

First 2 AC wells

7,685 total net acres located in the

Jourdanton Field prospective for the

Austin Chalk in Atascosa County, TX

$5.5 million D&C costs for 5,000’

laterals

2017 Capex plans call for drilling 2

net (2 gross) 5,000’ lateral wells for

total cost of $5.5 million each

First well, Bulls Eye 101H

▫ 5,865’ effective lateral

▫ 30-Day IP Rate: 366 Boepd

Abraxas continues to evaluate

acreage at terms that will ensure

acceptable full cycle economics

Catalyst #3

Austin Chalk

15

Catalyst #4

Potential Asset Sales

(1) Average for the month of June, 2016

Since January 1, 2016, Abraxas has monetized approximately $26.9 million of non-core assets.

Abraxas is currently marketing several additional non-core assets. If successful, proceeds will be

used to further reduce borrowings with little Borrowing Base impact

Opportunity Overview Abraxas Assets Status

Powder

River Basin -

Other

Stacked pay, liquids-rich horizontal

opportunities primarily in

Campbell, Converse Counties,

Wyoming

~2,088 net acres at Porcupine

~2,667 “other” acres

~150 boepd (~45% oil) net production (1)

Bids not acceptable to date – will

continue to explore opportunities

to exit position

Powder

River Basin –

Brooks Draw

Stacked pay, liquids-rich horizontal

opportunities in Converse and

Niobrara Counties, Wyoming

~14,229 net acres

~28 bopd net production (1)

Sold January, 2017

Portilla

Large inventory conventional

targets; EOR potential

Avg production ~150 boepd, ~87% oil (1) Sold September, 2016

Surface /

Yards / Field

Offices /

Building

Surface ownership in numerous

legacy areas

Surface :

1,769 acres in San Patricio, TX;

12,178 acres Pecos, TX;

Yards/Offices/Structures: Sinton, TX

Preparing to market Sinton office

Continuing to market Hudgins

Ranch (Pecos County)

16

Appendix

17

Abraxas Hedging Profile

(1) Straight line average price.

2017 2018 2019

Oil Swaps (bbls/day) 2,401 1,796 1,200

NYMEX WTI (1) $54.53 $47.48 $54.54

WTI Midland / WTI CMA (bbls/day) 500

Differential ($/bbl) ($0.65)

Henry Hub Costless Collar (mmbtu/day) 5,000

Ceiling ($/mmbtu) $3.90

Floor ($/mmbtu) $3.00

18

Adjusted EBITDA Reconciliation

Adjusted EBITDA is defined as net income plus interest expense, depreciation, depletion and amortization expenses, deferred income taxes and other non-cash

items. The following table provides a reconciliation of Adjusted EBITDA to net income for the periods presented.

(In thousands) 3 Months Ending

2013 2014 2015

Net income $38,647 $63,268.73 ($119,055)

Net interest expense 4,577 2,009 3,340

Income tax expense 700 (287) (37)

Depreciation, depletion and amortization 26,632 43,139 38,548

Amortization of deferred financing fees 1,367 934 1,130

Stock-based compensation 2,114 2,703 3,912

Impairment 6,025 0 128,573

Unrealized (gain) loss on derivative contracts (2,561) (24,876) (18,417)

Realized (Gain) loss on interest derivative contract 0 0 0

Realized (Gain) loss on monetized derivative contracts 0 0 5,061

Earnings from equity method investment 0 0 0

(Gai ) loss on dis ontinued operations (33,377) (1,318) 20

Expenses incurred with offerings and execution of loan agreement

Other non-cash items 539 0 883

Adjusted EBITDA $44,663 $85,572 $43,957

Credit facility borrowings $33,000 $70,000 $134,000

Debt/ Adjusted EBITDA 0.74x 0.82x 3.05x

19

TTM Adjusted EBITDA Reconciliation

Adjusted EBITDA is defined as net income plus interest expense, depreciation, depletion and amortization expenses, deferred income taxes and other non-cash

items. The following table provides a reconciliation of Adjusted EBITDA to net income for the periods presented.

(In thousands)

31-Dec-15 31-Mar-16 30-Jun-16 30-Sep-16 TTM

Net income ($67,661) ($40,880) ($46,937) ($3,260) ($158,738)

Net interest expense 983 1,103 1,015 850 3,951

Income tax expense (37) 0 0 0 (37)

Depreciation, depletion and amortization 7,677 5,892 5,669 6,371 25,608

Amortization of deferred financing fees 162 164 448 151 925

Stock-based compensation 826 807 835 768 3,237

Impairment 68,682 35,085 28,735 3,806 136,308

Unrealized (gain) loss on derivative contracts (3,608) 4,642 12,374 (3,484) 9,925

Realized (Gain) loss on interest derivative contract 0 0 0 0 0

Realized (Gain) loss on monetized derivative contracts 0 4,360 10,010 0 14,370

Earnings from equity method investment 0 0 0 0 0

(Gain) loss on discontinued operations 0 0 0 0 0

Expens s incurred with offerings and execution of loan agreement 0 0 1,665 82 1,747

Other non-cash items 457 583 36 (264) 813

Adjusted EBITDA $7,480 $11,756 $13,851 $5,021 $38,108

Credit facility borrowings $90,000

Debt/ Adjusted EBITDA 2.36x

20

Standardized Measure Reconciliation

PV-10 is the estimated present value of the future net revenues from our proved oil and gas reserves before income taxes discounted using a 10% discount

rate. PV-10 is considered a non-GAAP financial measure under SEC regulations because it does not include the effects of future income taxes, as is required in

computing the standardized measure of discounted future net cash flows. We believe that PV-10 is an important measure that can be used to evaluate the

relative significance of our oil and gas properties and that PV-10 is widely used by securities analysts and investors when evaluating oil and gas companies.

Because many factors that are unique to each individual company impact the amount of future income taxes to be paid, the use of a pre-tax measure provides

greater comparability of assets when evaluating companies. We believe that most other companies in the oil and gas industry calculate PV-10 on the same

basis. PV-10 is computed on the same basis as the standardized measure of discounted future net cash flows but without deducting income taxes.

The following table provides a reconciliation of PV-10 to the standardized measure of discounted future net cash flows at December 31, 2015:

As of December 31, 2015

Standariz d M asure (in thousands) 197,251

Present Value of f ture income taxas discounted at 10% (in thousands) -

V-10 (in thousands) 197,251

21

NASDAQ: AXAS