Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CITIZENS FINANCIAL GROUP INC/RI | d315713d8k.htm |

| EX-99.3 - EX-99.3 - CITIZENS FINANCIAL GROUP INC/RI | d315713dex993.htm |

| EX-99.1 - EX-99.1 - CITIZENS FINANCIAL GROUP INC/RI | d315713dex991.htm |

4Q16 and FY2016 Financial Results

January 20, 2017

Exhibit 99.2 |

Forward-looking statements and use of key performance metrics and Non-GAAP

Financial Measures 2

This document contains forward-looking statements within the Private Securities Litigation Reform Act of 1995. Any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “initiatives,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements are based upon the current beliefs and expectations of management, and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. We caution you, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: negative economic conditions that adversely affect the general economy, housing prices, the job market, consumer confidence and spending habits which may affect, among other things, the level of nonperforming assets, charge-offs and provision expense; the rate of growth in the economy and employment levels, as well as general business and economic conditions; our ability to implement our strategic plan, including the cost savings and efficiency components, and achieve our indicative performance targets; our ability to remedy regulatory deficiencies and meet supervisory requirements and expectations; liabilities and business restrictions resulting from litigation and regulatory investigations; our capital and liquidity requirements (including under regulatory capital standards, such as the Basel III capital standards) and our ability to generate capital internally or raise capital on favorable terms; the effect of the current low interest rate environment or changes in interest rates on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgages held for sale; changes in interest rates and market liquidity, as well as the magnitude of such changes, which may reduce interest margins, impact funding sources and affect the ability to originate and distribute financial products in the primary and secondary markets; the effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin; financial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including the Dodd-Frank Act and other legislation and regulation relating to bank products and services; a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors or other service providers, including as a result of cyber attacks; and management’s ability to identify and manage these and other risks. In addition to the above factors, we also caution that the amount and timing of any future common stock dividends or share repurchases will depend on our financial condition, earnings, cash needs, regulatory constraints, capital requirements (including requirements of our subsidiaries), and any other factors that our board of directors deems relevant in making such a determination. Therefore, there can be no assurance that we will pay any dividends to holders of our common stock, or as to the amount of any such dividends. More information about factors that could cause actual results to differ materially from those described in the forward-looking statements can be found under “Risk Factors” in Part I, Item 1A in our Annual Report on Form 10-K for the year ended December 31, 2015, filed with the United States Securities and Exchange Commission on February 26, 2016. Key performance metrics and Non-GAAP Financial Measures Key performance metrics: Our management team uses our key performance metrics (“KPMs”) to gauge our performance and progress over time in achieving our strategic and operational goals and also in comparing our performance against our peers. In connection with our path to becoming an independent public company, we established the following financial targets, in addition to others, as KPMs. These KPMs are utilized by our management in measuring our progress against financial goals and as a tool in helping assess performance for compensation purposes. These KPMs can largely be found in our Registration Statements on Form S-1 and our periodic reports, which are filed with the Securities and Exchange Commission, and are supplemented from time to time with additional information in connection with our quarterly earnings releases. Our key performance metrics include: Return on average tangible common equity (“ROTCE”); Return on average total tangible assets (“ROTA”); Efficiency ratio; Operating leverage; and Common equity tier 1 capital ratio (Basel III fully phased-in basis). In establishing goals for these KPMs, we determined that they would be measured on a management-reporting basis, or an operating basis, which we refer to externally as “Adjusted” results. We believe that these “Adjusted” results, which exclude restructuring charges, special items and and/or notable items, as applicable, provide the best representation of our underlying financial progress toward these goals as they exclude items that our management does not consider indicative of our on-going financial performance. We have consistently shown these metrics on this basis to investors since our initial public offering in September of 2014. Adjusted KPMs are considered Non-GAAP Financial Measures. Non-GAAP Financial Measures: This document contains Non-GAAP Financial Measures. The tables in the appendix present reconciliations of our Non-GAAP Financial Measures. These reconciliations exclude restructuring charges, special items and/or notable items, which are included, where applicable, in the financial results presented in accordance with GAAP. Restructuring charges and special items include expenses related to our efforts to improve processes and enhance efficiencies, as well as rebranding, separation from RBS and regulatory expenses. Notable items include certain revenue or expense items that may occur in a reporting period, which management does not consider indicative of on-going financial performance. The Non-GAAP Financial Measures presented in the appendix include “noninterest income”, “total revenue”, “noninterest expense”, “pre-provision profit”, “income before income tax expense”, “income tax expense”, “net income”, “net income available to common stockholders”, “other income”, “salaries and employee benefits”, “outside services”, “occupancy”, “equipment expense”, “other operating expense”, “net income per average common share”, “return on average common equity” and “return on average total assets.” We believe these Non-GAAP Financial Measures provide useful information to investors because these are among the measures used by our management team to evaluate our operating performance and make day-to-day operating decisions. In addition, we believe restructuring charges, special items and/or notable items in any period do not reflect the operational performance of the business in that period and, accordingly, it is useful to consider these line items with and without restructuring charges, special items and/or notable items. We believe this presentation also increases comparability of period-to-period results. Other companies may use similarly titled Non-GAAP Financial Measures that are calculated differently from the way we calculate such measures. Accordingly, our Non-GAAP Financial Measures may not be comparable to similar measures used by other companies. We caution investors not to place undue reliance on such Non-GAAP Financial Measures, but instead to consider them with the most directly comparable GAAP measure. Non-GAAP Financial Measures have limitations as analytical tools and should not be considered in isolation, or as a substitute for our results as reported under GAAP. |

Table of contents

3 page 4Q16 highlights 4 4Q16 Adjusted financial summary 7 Adjusted FY2016 performance vs. guidance 25 FY2017 outlook 26 1Q17 outlook 31 Appendix 1 – Additional 2016 information 33 Appendix 2 – Key performance metrics, Non-GAAP Financial Measures and reconciliations 41 |

Provision expense of $102 million increased $16 million from 3Q16, largely

reflecting lower recoveries Overall credit quality continues to

improve; NPLs decreased 6% QoQ to 97 bps of loans NPL coverage

ratio of 118% vs. 112% in 3Q16 and 115% in 4Q15 Allowance to

loans and leases of 1.15% vs. 1.18% in 3Q16 and 1.23% in 4Q15 reflects proactive effort to improve underlying credit quality Generated 8% YoY average loan growth, with strength in both commercial and retail

NII up 13% YoY and 4% QoQ

NIM of 2.90% improved 6 bps from 3Q16 and 13 bps YoY, driven largely by

improved loan yields Consumer

Banking initiatives – Solid deposit and loan growth, improvement in conforming mortgage volume, and strong sales force expansion, with a record 43 net mortgage loan officer hires during the quarter, as well as 12

financial consultants. Checkup has resulted in ~400,000 scheduled appointments

YTD Commercial

Banking initiatives – Strong loan growth of 10% YoY; capital markets fees remain at near record levels with continued momentum in global markets and treasury solutions 4Q16 highlights 4 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. 2) Current-period regulatory capital ratios are preliminary. Basel III ratios assume that certain definitions impacting qualifying Basel

III capital will phase in through 2019. Improving

profitability and

returns Strong capital, liquidity and funding Excellent credit quality Continued progress on strategic growth, efficiency and balance sheet optimization initiatives Robust capital levels with a common equity tier 1 ratio of 11.2% (2) ; TBV per share of $25.69, up 4% from 4Q15 Repurchased $180 million of common shares during the quarter at an average price of $28.71

4Q16 average deposits increased $7.8 billion, or 8% vs. 4Q15; average

loan-to-deposit ratio of 98% Diluted

EPS of $0.55 up 31% from 4Q15; down 2% from 3Q16 and up 6% from Adjusted 3Q16 levels Revenue of $1.4 billion, up 11% YoY and down 1% QoQ; Adjusted revenue up 4% QoQ Positive operating leverage YoY of 6% - efficiency ratio improved ~3.6 percentage points YoY to 62% (1) Continued progress with ROTCE of 8.4% compared to 6.7% in 4Q15 and 8.6%, or 8.0% on an Adjusted basis, in 3Q16 (1) (1) (1) |

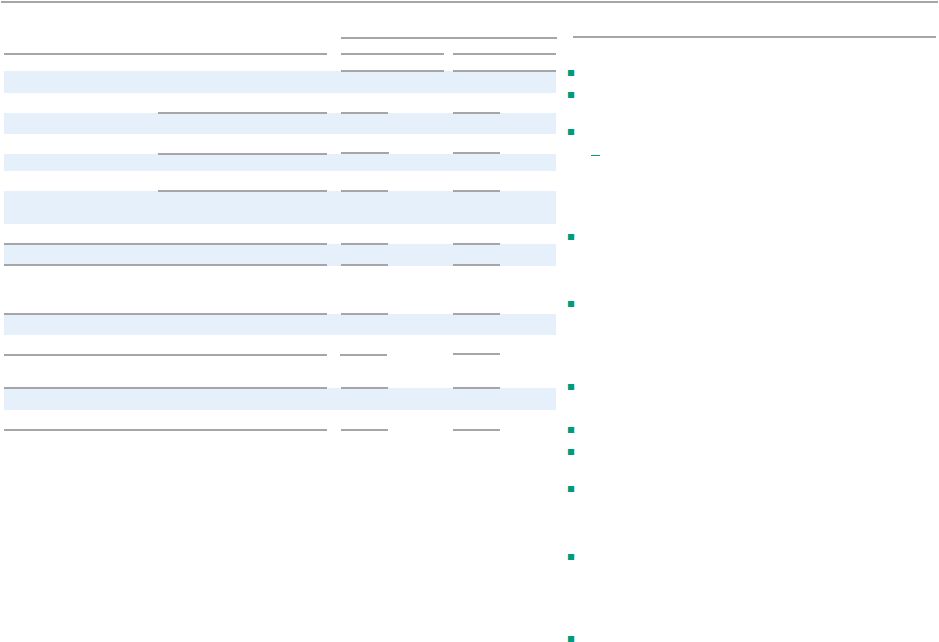

Restructuring charges, special items and/or notable items

5 $s in millions, except per share data 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. 2016 GAAP results include a net $19 million after-tax benefit tied to the 3Q16 TDR Transaction gain, partially offset by other costs associated with Asset Finance repositioning, TOP III efficiency initiatives and operational items. 2015 GAAP results were reduced by a net $31 million after tax in restructuring charges and special items related to enhancing efficiencies and improving processes across the organization and separation from The Royal Bank of Scotland Group plc (“RBS”). Restructuring charges, special items and/or notable items (1) 4Q16 change 2016 change ($s in millions, except per share data) 4Q16 3Q16 from 3Q16 2016 2015 from 2015 Pre-tax net noninterest income — $ 67 $ (67) $

67 $ — $ 67 $

After-tax noninterest income

— 41 (41) 41 — 41 Pre-tax total noninterest expense — (36) 36 (36) (50) 14 After-tax total noninterest expense — (22) 22 (22) (31) 9 Pre-tax restructuring charges, special items and notable items — 31 (31) 31 (50) 81 After-tax restructuring charges, special items and notable items — 19 (19) 19 (31) 50 Diluted EPS impact — $ 0.04 $ (0.04) $

0.04 $ (0.06) $ 0.10 $

|

GAAP financial summary

6 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. 2) Includes held for sale. Loan-to-deposit ratio is period end. 3) Full-time equivalent employees. Linked quarter: Net income available to common stockholders down 3% and EPS down 2% from 3Q16 levels that included a net $19 million in after-tax notable items NII up $41 million, or 4%, reflecting 2% average loan growth and a 6 bp improvement in NIM given higher loan yields and rates Noninterest income decreased $58 million from 3Q16 levels that included a $72 million net TDR gain Noninterest expense decreased $20 million from 3Q16 levels that included $36 million of notable items in salaries and benefits, outside services and other Provision for credit losses increased $16 million Prior-year quarter: Net income available to common stockholders up 28%, reflecting strong revenue growth and expense discipline coupled with investments to drive future growth; diluted EPS up 31% NII up $116 million, or 13%, reflecting 8% average loan growth and a 13 bp improvement in NIM given higher loan yields Noninterest income up $15 million, largely reflecting growth in capital markets, mortgage banking, other income and FX & LC fees partially offset by the card reward accounting change impact and lower trust and investment services fees Noninterest expense up $37 million driven by growth in salaries and employee benefits, largely incentive compensation tied to revenue, as well as higher other expense, amortization of software, occupancy and equipment expense partially offset by lower outside services Provision for credit losses increased $11 million Highlights 4% 113 bps LQ excluding notable Items 2% 5% 4% 6% 41 bps 4Q16 change from $s in millions 4Q16 3Q16 4Q15 3Q16 4Q15 $ % $ % Net interest income 986 $ 945 $ 870 $ 41 $ 4 % 116 $ 13 % Noninterest income 377 435 362 (58) (13) 15 4 Total revenue 1,363 1,380 1,232 (17) (1) 131 11 Noninterest expense 847 867 810 (20) (2) 37 5 Pre-provision profit 516 513 422 3 1 94 22 Provision for credit losses 102 86 91 16 19 11 12 Income before income tax expense 414 427 331 (13) (3) 83 25 Income tax expense 132 130 110 2 2 22 20 Net income 282 $ 297 $ 221 $ (15) $ (5) 61 $ 28 Preferred dividends — $ 7 $ — $ (7) $ (100) — $ — Net income available to common stockholders 282 $ 290 $ 221 $ (8) $ (3) % 61 $ 28 % $s in billions Average interest-earning assets 135 $ 132 $ 124 $ 3 $ 2 % 11 $ 8 % Average deposits 109 $ 107 $ 101 $ 2 $ 2 % 8 $ 8 % Key performance metrics (1) Net interest margin 2.90 % 2.84 % 2.77 % 6 bps 13 bps Loan-to-deposit ratio (2) 98.6 97.9 96.9 77 168 ROACE 5.7 5.8 4.5 (12) 119 ROTCE 8.4 8.6 6.7 (15) 168 ROA 0.8 0.8 0.6 (6) 12 ROTA 0.8 0.9 0.7 (7) 12 Efficiency ratio 62.2 % 62.9 % 65.8 % (70) bps (358) bps FTEs (3) 17,639 17,625 17,714 14 0 % (75) (0) % Per common share Diluted earnings 0.55 $ 0.56 $ 0.42 $ (0.01) $ (2) % 0.13 $ 31 % Tangible book value (1) 25.69 $ 26.20 $ 24.63 $ (0.51) $ (2) % 1.06 $ 4 % Average diluted shares outstanding (in millions) 513.9 521.1 530.3 (7.2) (1) % (16.4) (3) % Growth in interest-rate products and leasing fees, mortgage banking income, FX & LC fees and securities gains largely offset by lower card fees Adjusted results (1) reflect lower salaries and benefits, more than offset by higher other expense, outside services and equipment expense (1) |

7 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. Highlights Linked quarter: Net income available to common stockholders (1) of $282 million increased $11 million, or 4%, from Adjusted 3Q16 levels (1) NII up $41 million, or 4%, reflecting 2% average loan growth and a 6 bp

improvement in NIM given higher loan yields and rates

Adjusted noninterest income (1) increased $9 million, or 2% Adjusted noninterest expense (1) increased $16 million, or 2% Provision for credit losses up $16 million driven by higher net charge-offs tied to a $14 million reduction in recoveries and a $7 million increase tied to a one-time methodology change in auto Prior-year quarter: Net income available to common stockholders of $282 million increased $61 million, or 28%, reflecting 6.0% positive operating leverage. Diluted EPS of $0.55 increased 31% NII up $116 million, or 13%, reflecting 8% average loan growth and a 13 bp increase in NIM given higher loan yields and rates Noninterest income (1) increased $15 million, or 4% Noninterest expense (1) up $37 million, or 5%, driven by an increase in salaries and employee benefits, largely incentive compensation tied to

revenue as well as increased amortization of software and other

expense Provision for credit losses increased $11 million 4Q16 Adjusted financial summary (1) 4Q16 (1) change from $s in millions 4Q16 Reported 3Q16 Adjusted (1) Reported 4Q15 Adjusted 3Q16 Reported 4Q15 Net interest income 986 $ 945 $ 870 $ 4 % 13 % Noninterest income 377 368 362 2 4 Total revenue 1,363 1,313 1,232 4 11 Noninterest expense 847 831 810 2 5 Net income available to common stockholders 282 $ 271 $ 221 $ 4 % 28 % Key performance metrics (1) ROTCE (1) 8.4 % 8.0 % 6.7 % 41 bps 168 bps Efficiency ratio (1) 62.2 % 63.3 % 65.8 % (113) bps (358) bps Diluted EPS 0.55 $ 0.52 $ 0.42 $ 6 % 31 % Diluted EPS of $0.55 increased 6% (1) Reflecting growth in interest-rate products and leasing fees, mortgage banking income, FX & LC fees, partially offset by lower card fees Capital markets fees stable with strong 3Q16 results Lower salaries and benefits more than offset by higher other expense, outside services and equipment expense Adjusted efficiency ratio improved ~113 bps (1) Strength in capital markets, mortgage banking, other income and FX & LC fees were partially offset by the card reward accounting change impact and lower trust and investment services fees Efficiency ratio improved 358 bps (1) |

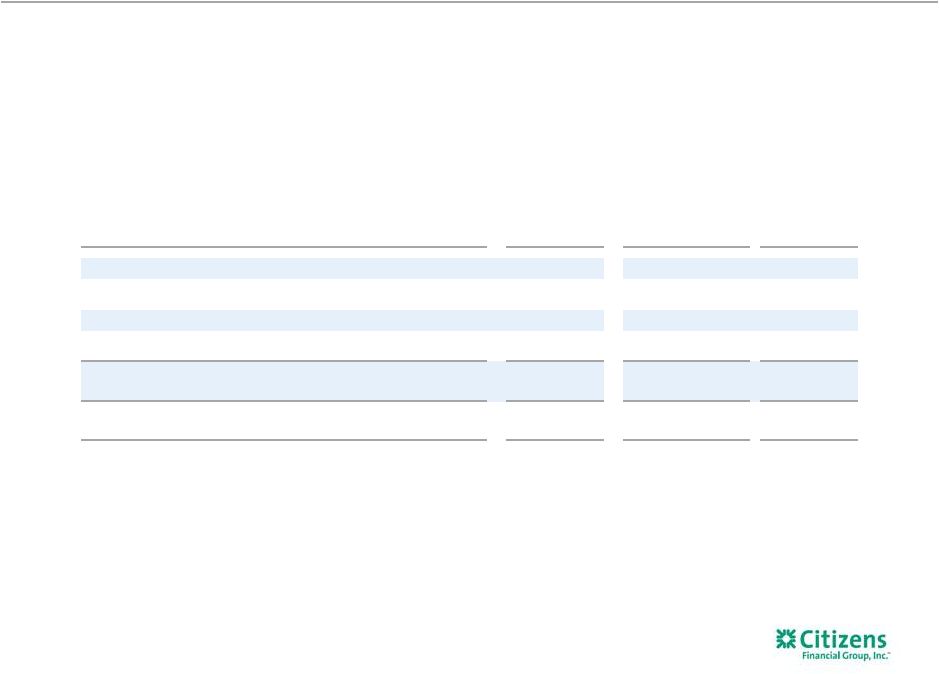

FY16 vs FY15: Net income available to common stockholders up $198 million, or 24%, from 2015. Includes a $50 million after-tax net benefit tied to the change in net restructuring charges, special items and notable items Diluted EPS of $1.97, up $0.42, or 27% NII up $356 million, reflecting 8% average loan growth and the benefit of balance sheet optimization strategies and higher rates Noninterest income increased $75 million, reflecting $67 million of notable items — Underlying results driven by strength in capital markets fees, service charges and fees and mortgage fees, partially offset by the card reward accounting change impact, lower securities gains and trust and investment services fees Noninterest expense increased $93 million from 2015 levels that included $50 million in restructuring charges, special items and notable items, $14 million more than in 2016 — Underlying results reflect higher salaries and employee benefits , amortization of software, equipment expense, occupancy and outside services, partially offset by lower other operating expense Provision for credit losses increased $67 million TBV per share of $25.69, up 4% 2016 GAAP financial summary 8 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. 2) Includes held for sale. Loan-to-deposit ratio is period end. 3) Full-time equivalent employees. Highlights 8% 260 bps YoY excluding restructuring charges/ notable 3% 14% 17% 20% 91 bps 2016 change from 2015 $s in millions 2016 2015 $ % Net interest income 3,758 $ 3,402 $ 356 $ 10 % Noninterest income 1,497 1,422 75 5 Total revenue 5,255 4,824 431 9 Noninterest expense 3,352 3,259 93 3 Pre-provision profit 1,903 1,565 338 22 Provision for credit losses 369 302 67 22 Income before income tax expense 1,534 1,263 271 21 Income tax expense 489 423 66 16 Net income 1,045 $ 840 $ 205 $ 24 Preferred dividends 14 $

7 $

7 $

100 Net income available to common stockholders 1,031 $ 833 $ 198 $ 24 % $s in billions Average interest-earning assets 131 $ 123 $ 8 $

6 % Average deposits (2) 105 $ 99 $

6 $

6 % Key metrics Net interest margin 2.86 % 2.75 % 11 bps Loan-to-deposit ratio (2) 98.6 96.9 168 ROACE 5.2 4.3 93 ROTCE 7.7 6.4 129 ROA 0.7 0.6 11 ROTA 0.8 0.7 11 Efficiency ratio 63.8 % 67.6 % (376) bps FTEs (3) 17,639 17,714 (75) (0) % Per common share Diluted earnings 1.97 $ 1.55 $ 0.42 $ 27 % Tangible book value (1) 25.69 $ 24.63 $ 1.06 $ 4 % Average diluted shares outstanding (in millions) 523.9 538.2 (14.3) (3) % items (1) |

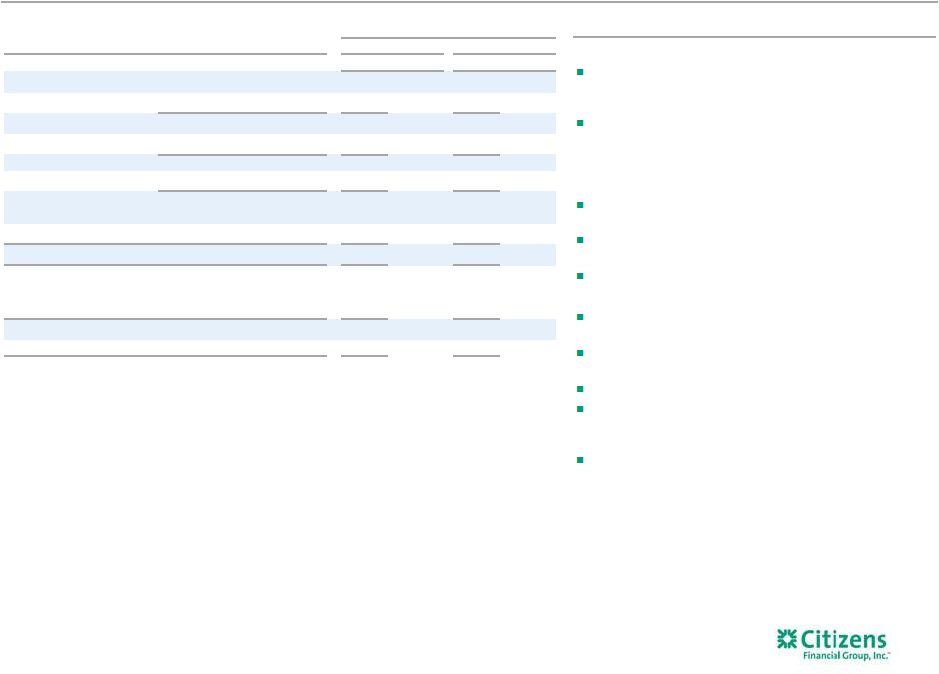

FY16 vs FY15: Net income available to common stockholders up $148 million, or 17%, from 2015 Diluted EPS of $1.93, up $0.32, or 20% NII up $356 million, reflecting 8% average loan growth and the benefit of

balance sheet optimization strategies and higher rates

Noninterest income increased 1% relative to 2015

— Strength in capital markets fees, service charges and fees and mortgage fees, was partially offset by the card reward accounting change impact, lower securities gains and trust and investment services fees Noninterest expense increased $107 million, or 3%, from 2015 levels — Results reflect higher salaries and employee benefits, amortization of software, equipment expense, outside services, and occupancy partially offset by lower other operating expense Provision for credit losses increased $67 million Efficiency ratio improved by 2.6%; positive operating leverage of 4.2% 9 Highlights 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. Adjusted 2016 financial summary (1) 2016 2015 2016 change from 2015 $s in millions Adjusted (1) Adjusted (1) $ % Net interest income 3,758 $ 3,402 $ 356 $ 10 % Noninterest income 1,430 1,422 8 1 Total revenue 5,188 4,824 364 8 Noninterest expense 3,316 3,209 107 3 Net income available to common stockholders 1,012 $ 864 $ 148 $ 17 % Key performance metrics (1) ROTCE (1) 7.6 % 6.7 % 91 bps Efficiency ratio (1) 63.9 % 66.5 % (260) bps Diluted EPS 1.93 $ 1.61 $ 0.32 $ 20 % |

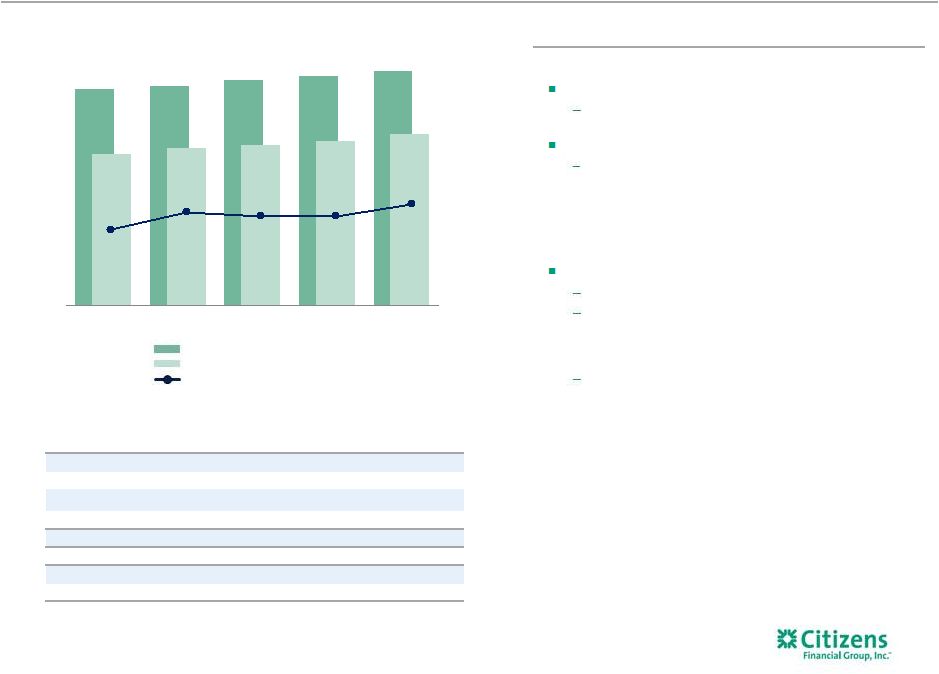

Net interest income

10 Highlights 1) Includes interest-bearing cash and due from banks and deposits in banks.

Linked quarter:

NII up $41 million, or 4%

Reflects 2% average loan growth driven by commercial,

mortgage, other unsecured retail and student loans

NIM of 2.90% improved 6 bps from the third quarter 2016

Improved commercial and consumer loan yields, including the

benefit of an increase in LIBOR, as well as lower pay-fixed swap

costs, partially offset by an increase in deposit costs and the

impact of an increase in investment portfolio

balances Prior-year quarter:

NII up $116 million, or 13%, with NIM up 13 bps

8% average loan growth

Growth in NIM driven by improved loan yields, reflecting

continued pricing and portfolio-optimization initiatives, the

benefit from higher interest rates and a reduction in

pay-fixed swap costs

NIM benefits were partially offset by a reduction in investment

portfolio yields, which included a reduction in Federal Reserve

Bank stock dividends, as well as increased funding costs

Net interest income

$s in millions,

except earning assets Average interest-earning assets Average interest-earning assets Net interest income Net interest margin $s in billions 4Q15 1Q16 2Q16 3Q16 4Q16 Retail loans 52.4 $ 53.2 $ 53.5 $ 54.3 $ 55.5 $ Commercial loans 45.8 47.0 49.1 49.7 51.0 Investments and cash (1) 25.7 25.5 26.0 27.1 27.7 Loans held for sale 0.3 0.4 0.8 0.5 0.6 Total interest-earning assets 124.2 $ 126.2 $ 129.5 $ 131.7 $ 134.8 $ Loan yields 3.34% 3.46% 3.48% 3.52% 3.58% Total cost of funds 0.41% 0.40% 0.42% 0.44% 0.44% $124B $126B $129B $132B $135B 870 904 923 945 986 4Q15 1Q16 2Q16 3Q16 4Q16 2.77% 2.86% 2.84% 2.84% 2.90% |

2.77% 2.90% 0.21% 0.01% (0.03)% (0.06)% 4Q15 NIM% Loan yields Borrowing costs/other Deposit costs Investment portfolio yield/growth 4Q16 NIM% 2.84% 2.90% 0.05% 0.03% (0.01)% (0.01)% 3Q16 NIM% Loan yields Borrowing costs/other Deposit costs Investment portfolio yield/growth 4Q16 NIM% Net interest margin 11 NIM walk 4Q15 to 4Q16 NIM walk 3Q16 to 4Q16 |

1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. $377 $368 $362 4Q16 3Q16 4Q15 Service charges and fees Card fees Trust and inv services FX & LC fees Mortgage banking fees Capital markets fee income Securities gains (losses) Adjusted other income Noninterest income Linked quarter: Noninterest income decreased $58 million, or 13%, from 3Q16 levels that included a $67 million benefit from notable items in other income Adjusted noninterest income (1) increased $9 million, or 2% Service charges and fees were up slightly Card fees declined modestly reflecting seasonally lower foreign ATM fees Mortgage banking fees increased $3 million reflecting improved mortgage servicing rights (“MSR”) valuation partially offset by lower

loan sales gains

Capital markets fees were flat, in line with near-record 3Q16 levels with

continued strong loan-syndications activity

FX & LC fees improved $2 million with continued momentum from

expanded capabilities

Securities gains of $3 million tied to portfolio adjustments

Prior-year quarter:

Noninterest income increased $15 million, or 4%

Capital markets fees increased $19 million, reflecting healthier market

conditions and ongoing momentum as we continue to broaden our

capabilities

Mortgage banking fees grew $16 million, reflecting higher application

and origination volumes with improved secondary mix, increased

loan sales and spreads and improved MSR valuation

Service charges and fees decreased $3 million on lower commercial

categories, including loan prepayment fees

Card fees were down $10 million from 4Q15 levels, largely reflecting

the card reward accounting change impact

Other income up $3 million from 4Q15 levels, driven by an increase in

interest-rate product revenue

12 Highlights $s in millions 4Q16 change from 4Q16 3Q16 4Q15 3Q16 4Q15 $ % $ % Service charges and fees 153 $ 152 $ 156 $ 1 $ 1 % (3) $ (2) % Card fees 50 52 60 (2) (4) (10) (17) Trust & investment services fees 34 37 39 (3) (8) (5) (13) Mortgage banking fees 36 33 20 3 9 16 80 Capital markets fees 34 34 15 — — 19 127 FX & LC fees 25 23 23 2 9 2 9 Securities gains, net

3 — 10 3 100 (7) (70) Other income 42 104 39 (62) (60) 3 8 Reported noninterest income

377 $ 435 $ 362 $ (58) $ (13) % 15 $ 4 % Restructuring charges, special items and/or notable items (1) — 67 — (67) (100) — NM Adjusted noninterest income (1) 377 $ 368 $ 362 $ 9 $ 2 % 15 $ 4 % Note: Other income includes bank-owned life insurance and other income.

(1) |

4Q16 change from

4Q16 3Q16 4Q15 3Q16 4Q15 $ % $ % Salaries and benefits 420 $ 432 $ 402 $ (12) $ (3) % 18 $ 4 % Occupancy 77 78 74 (1) (1) 3 4 Equipment expense 69 65 67 4 6 2 3 Outside services 98 102 104 (4) (4) (6) (6) Amortization of software 44 46 38 (2) (4) 6 16 Other expense 139 144 125 (5) (3) 14 11 Reported noninterest expense 847 $ 867 $ 810 $ (20) $ (2) % 37 $ 5 % Adjusted salaries and benefits (1) 420 $ 421 $ 404 $ (1) $ (0) % 16 $ 4 % Occupancy 77 78 74 (1) (1) 3 4 Equipment expense 69 65 67 4 6 2 3 Adjusted outside services (1) 98 94 102 4 4 (4) (4) Adjusted amortization of software (1) 44 43 38 1 2 6 16 Adjusted other expense (1) 139 130 125 9 7 14 11 Adjusted noninterest expense (1) 847 $ 831 $ 810 $ 16 $ 2 % 37 $ 5 % Noninterest expense 13 Highlights (1) (1) (1) $s in millions Full-time equivalents (FTEs) 17,639 17,625 17,714 Linked quarter: Noninterest expense decreased $20 million, or 2%, from 3Q16 levels that included $36 million of notable items Adjusted noninterest expense (1) increased $16 million, or 2% Salaries and employee benefits expense decreased $12 million from 3Q16 levels and remained stable on an Adjusted basis (1) , as higher revenue-based incentives were largely offset by a reduction in benefits FTEs increased 14, as efficiency reductions largely offset strategic hiring Equipment expense increased $4 million, reflecting increased vendor contract license and maintenance costs Outside services down $4 million; increased $4 million on an Adjusted basis (1) , largely tied to consumer loan origination and servicing costs Amortization of software decreased $2 million Other expense decreased $5 million; up $9 million on an Adjusted basis (1) , reflecting higher fraud, legal and regulatory costs Prior-year quarter: Noninterest expense increased $37 million, or 5%, reflecting higher salaries and benefits, other expense and software amortization expense partially offset by the card reward accounting change impact Salaries and employee benefits up $16 million from Adjusted 4Q15 (1) , reflecting merit increases and higher revenue-based incentives FTEs decreased 75, reflecting the benefit of our our efficiency initiatives which more than offset sales force and strategic hiring Outside services decreased $4 million from Adjusted 4Q15 (1) , related to lower regulatory costs Amortization of software was up $6 million reflecting increased technology investments Other expense increased $14 million related to higher FDIC insurance expense and higher fraud, legal and regulatory costs 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. (1) $847 $831 $810 62% 63% 66% 4Q16 3Q16 4Q15 Adjusted all other Occupancy & equipment Adjusted salary and benefits Adjusted efficiency ratio |

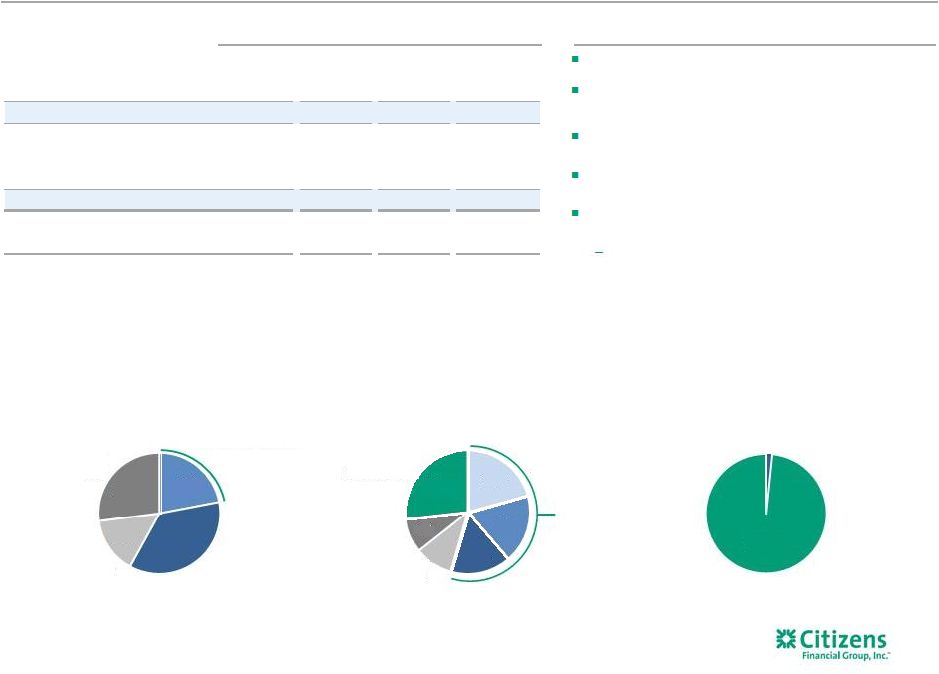

4Q16 change from

$s in billions 4Q16 3Q16 4Q15 3Q16 4Q15 $ % $ % Investments and interest bearing deposits 27.7 $ 27.1 $ 25.7 $ 0.6 $ 2 % 2.0 $ 8 % Total commercial loans 51.0 49.7 45.8 1.3 3 5.2 11 Total retail loans 55.5 54.3 52.4 1.2 2 3.1 6 Total loans and leases

106.5 104.0 98.2 2.5 2 8.3 8 Loans held for sale

0.6 0.5 0.3 0.0 3 0.2 65 Total interest-earning assets 134.8 131.7 124.2 3.1 2 10.6 8 Total noninterest-earning assets

12.6 12.7 12.1 (0.2) (1) 0.5 4 Total assets 147.3 $ 144.4 $ 136.3 $ 2.9 $ 2 11.0 $ 8 Low-cost core deposits

(1) 57.5 56.2 52.7 1.3 2 4.9 9 Money market deposits

38.4 37.6 36.5 0.8 2 1.9 5 Term deposits

13.2 12.8 12.2 0.4 3 1.0 8 Total deposits 109.1 $ 106.6 $ 101.4 $ 2.5 $ 2 7.8 $ 8 Total borrowed funds 15.2 14.4 12.6 0.8 6 2.6 21 Total liabilities 127.4 $ 124.3 $ 116.7 $ 3.1 $ 2 10.7 $ 9 Total stockholders' equity 19.9 20.1 19.6 (0.2) (1) 0.3 1 Total liabilities and equity

147.3 $ 144.4 $ 136.3 $ 2.9 $ 2 % 11.0 $ 8 % Consolidated average balance sheet Linked quarter: Total earning assets up $3.1 billion, or 2%, with loan growth of $2.5 billion, or 2% — Retail loans up $1.2 billion, or 2%, driven by growth in Home Mortgage, Education Finance and Consumer Unsecured, partially offset by Home Equity — Commercial loans up $1.3 billion, or 3%, on continued strength in Mid-corporate and Industry Verticals and Commercial Real Estate Total deposits increased $2.5 billion, or 2%, driven by growth in demand deposits, money market and term deposits Borrowed funds increased $831 million, reflecting an increase in short-term borrowings at quarter-end Prior-year quarter: Total earning assets up $10.6 billion, or 8%, with loan growth of $8.3 billion, or 8% — Commercial loans up $5.2 billion, or 11%, driven by strength in Mid-corporate and Industry Verticals, Commercial Real Estate, and Franchise Finance, partially offset by lower Asset Finance balances — Retail loans up $3.1 billion, or 6%, driven by strength in Education Finance, Home Mortgage, and Consumer Unsecured, partially offset by lower Home Equity balances Total deposits up $7.8 billion, or 8%, due to growth in low-cost core deposits Borrowed funds increased $2.6 billion, reflecting growth in long-term senior debt and incremental long- term FHLB borrowings as we continue to strengthen our term funding profile 14 Highlights Note: Loan portfolio trends reflect non-core portfolio impact not included in segment results on pages 15 and 16.

1) Low-cost core deposits include demand, checking with interest and regular savings.

$134.8 billion Interest-earning assets $124.3 billion Deposits/borrowed funds Total Retail 41% Total Commercial 38% CRE Other Commercial Residential mortgage Total home equity Automobile Other Retail Investments and interest-bearing deposits Retail / Personal Commercial/ Municipal/ Wholesale Borrowed funds 8% 30% 11% 13% 10% 7% 21% 47% 41% 12% |

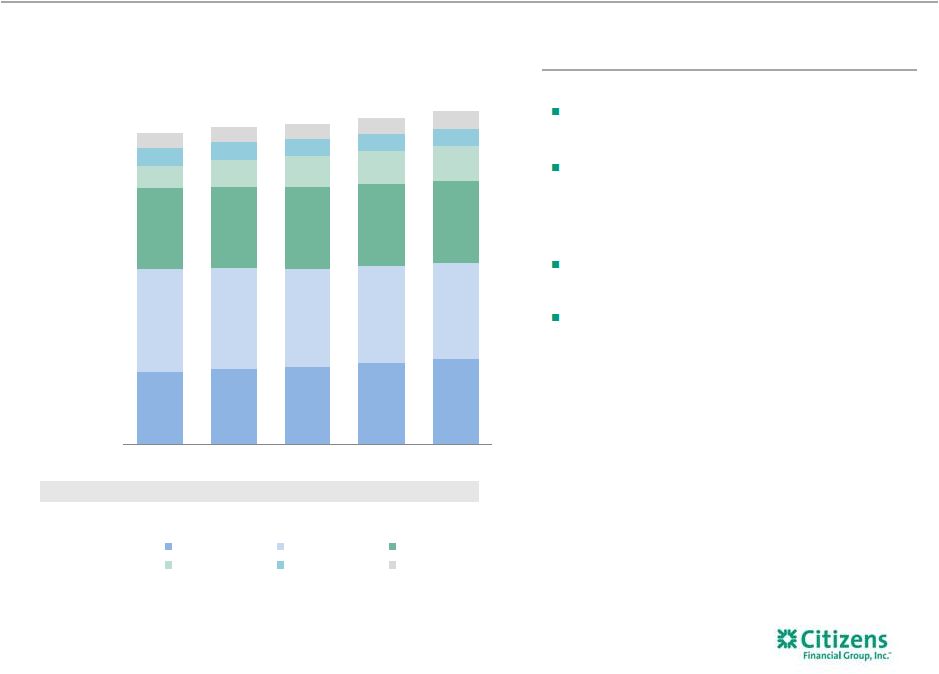

$12.2 $12.7 $12.9 $13.6 $14.4 $17.2 $17.0 $16.6 $16.3 $16.0 $13.8 $13.8 $14.0 $14.1 $14.0 $3.7 $4.5 $5.1 $5.5 $5.9 $3.0 $3.0 $2.9 $2.9 $2.9 $2.6 $2.5 $2.5 $2.6 $3.0 $52.5B $53.5B $54.0B $55.0B $56.2B 4Q15 1Q16 2Q16 3Q16 4Q16 Mortgage Home Equity Auto Student Business Banking Other Consumer Banking average loans and leases 15 1) Other includes Credit Card, RV, Marine, Other. $s in billions Linked quarter: Average loans increased $1.2 billion, or 2%, largely reflecting growth in residential mortgages, student and other unsecured retail loans, partially offset by lower home equity balances Consumer loan yields up 5 bps, reflecting the benefit of continued improvement in mix toward student and other unsecured retail Prior-year quarter: Average loans increased $3.7 billion, or 7%, driven by student loans, residential mortgages and unsecured retail loans partially offset by lower home equity outstandings Consumer loan yields up 23 bps, reflecting initiatives to improve risk-adjusted returns, along with higher interest rates Highlights Average loans and leases (1) Yields 3.73% 3.84% 3.88% 3.91% 3.96% |

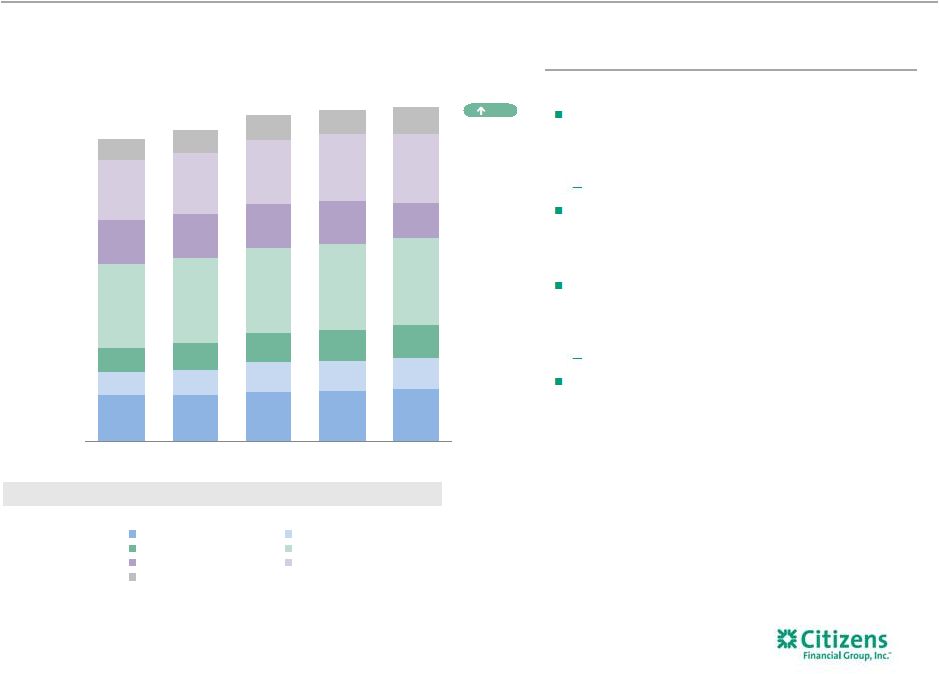

Yields 2.57% 2.75% 2.80% 2.82% 2.93% $6.5 $6.4 $6.9 $7.0 $7.3 $3.1 $3.5 $4.1 $4.2 $4.3 $3.5 $3.9 $4.2 $4.5 $4.7 $11.8 $11.9 $11.9 $12.0 $12.2 $6.1 $6.2 $6.1 $6.0 $4.9 $8.5 $8.7 $9.2 $9.5 $9.8 $3.0 $3.2 $3.5 $3.3 $3.7 $42.5B $43.8B $45.9B $46.5B $46.9B 4Q15 1Q16 2Q16 3Q16 4Q16 Mid-corporate Industry Verticals Franchise Finance Middle Market Asset Finance Commercial Real Estate Other Commercial Banking average loans and leases Linked quarter: Average loans up $371 million, or 1%, as continued strength in Mid-corporate and Industry Verticals and Commercial Real Estate was partially offset by the impact of the 3Q16 transfer of $1.2 billion of leases and loans to non-core Underlying average loans up 3% Loan yields improved 11 bps given higher short-term LIBOR rates Prior-year quarter: Average loans up $4.4 billion, or 10%, on strength in Mid- corporate and Industry Verticals, Commercial Real Estate , Franchise Finance and partially offset by the impact of the 3Q16 transfer to non-core Underlying average loans up 13% Loan yields increased 36 bps, reflecting improved mix and higher rates 16 1) Other includes Business Capital, Govt, Corporate Finance, Treasury Solutions, Corporate and Commercial Banking Admin.

Highlights $s in billions Average loans and leases (1) 3% Growth rate excluding 3Q16 impact of lease portfolio move to non-core (1) |

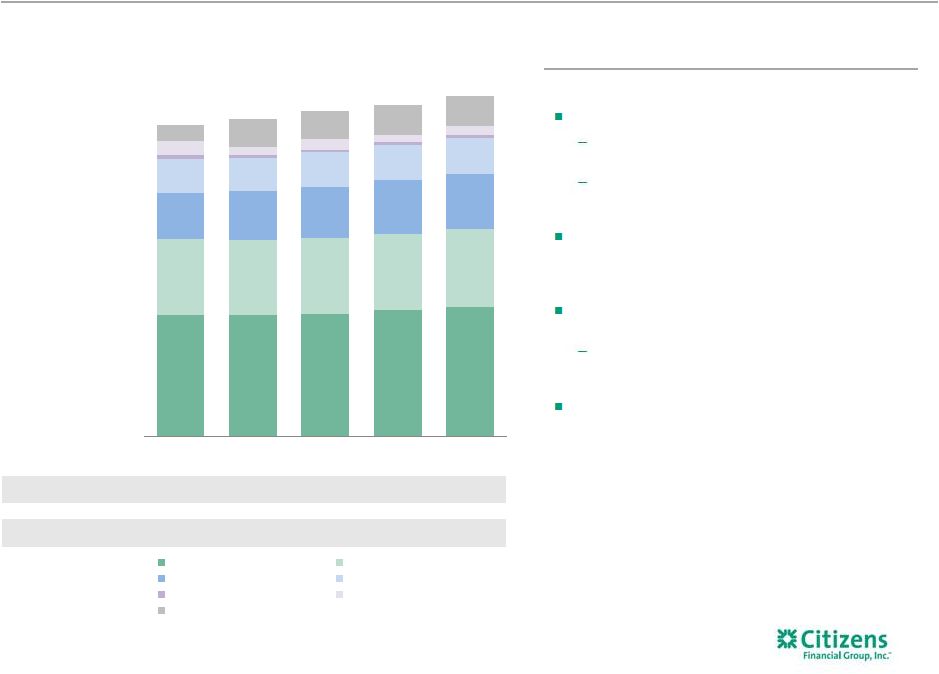

$44.6 $44.6 $44.9 $46.4 $47.2 $27.5 $27.2 $27.5 $27.5 $28.4 $17.1 $18.0 $19.0 $20.0 $20.3 $12.2 $12.2 $12.6 $12.8 $13.2 $1.6 $0.9 $1.0 $0.9 $1.0 $5.0 $3.1 $3.7 $2.6 $3.2 $6.0 $9.9 $10.3 $10.9 $11.0 $114.0B $115.9B $119.0B $121.0B $124.3B 4Q15 1Q16 2Q16 3Q16 4Q16 Money market & savings DDA Checking with interest Term deposits Total fed funds & repo Short-term borrowed funds Total long-term borrowings Deposit cost of funds 0.24% 0.24% 0.24% 0.27% 0.28% Total cost of funds 0.41% 0.40% 0.42% 0.44% 0.44% Average funding and cost of funds Linked quarter: Total average deposits up $2.5 billion, or 2% Largely growth in demand deposits, money market and term deposits Total deposit costs of 0.28% increased 1 bp, driven by higher incremental commercial deposit growth and rising short-term interest rates Total cost of funds remained stable Prior-year quarter: Total average deposits increased $7.8 billion, or 8%, on strength across all deposit categories Total deposit costs increased 4 bps, driven by higher short-term rates, which was largely offset by continued pricing discipline Total borrowed funds cost increase reflects continued shift away from short-term funding 17 Highlights Average interest-bearing liabilities and DDA $s in billions |

1,216 1,224 1,246 1,240 1,236 115% 113% 119% 112% 118% 4Q15 1Q16 2Q16 3Q16 4Q16 Allowance for loan and lease losses NPL coverage ratio ($3) $9 $2 $19 $16 $73 $67 $56 $59 $82 $7 $7 $7 $5 $6 $77 $83 $65 $83 $104 0.31% 0.33% 0.25% 0.32% 0.39% 4Q15 1Q16 2Q16 3Q16 4Q16 Commercial Retail SBO Net c/o ratio $77 $83 $65 $83 $104 $91 $91 $90 $86 $102 $1.1B $1.1B $1.0B $1.1B $1.0B 4Q15 1Q16 2Q16 3Q16 4Q16 Net charge-offs Provision for credit losses 1.23% 1.21% 1.20% 1.18% 1.15% Allowance to loan coverage ratio Overall credit quality continued to improve, reflecting the benefit of growth in high quality lower

risk retail loans and stabilization in commercial

NPLs to total loans and leases improved to 0.97% compared from 1.05% in 3Q16

and 1.07% in 4Q15

NPLs decreased $62 million, reflecting a $53 million decrease in retail and a

$9 million decrease in commercial

Net charge-offs of $104 million, or 0.39% of average loans and leases,

increased $21 million from 3Q16

Commercial net charge-offs of $16 million decreased $3 million from

3Q16 Retail net charge-offs of $88 million increased $24

million due to increases in Auto and Home Equity, driven by

lower recoveries and a $7 million increase tied to a one-time

methodology change in auto

Provision for credit losses of $102 million increased $16 million, largely

driven by a $14 million reduction in recoveries of

prior-period charge-offs from relatively high third quarter levels; YoY reflects impact of credit normalization and loan growth Allowance to total loans and leases of 1.15% vs. 1.18% in 3Q16 and 1.23% in 4Q15 reflects

proactive efforts to improve underlying credit quality

Strong credit-quality trends

continue 18

Highlights 1) Allowance for loan and lease losses to nonperforming loans and leases. $s in millions Net charge-offs (recoveries) NPLs to loans and leases NPLs (1) 1.07% 1.07% 1.01% 1.05% 0.97% Provision for credit losses, charge-offs, NPLs Allowance for loan and lease losses |

as of $s in billions (period-end) 4Q15 1Q16 2Q16 3Q16 4Q16 Basel III transitional basis (1,2) Common equity tier 1 capital 13.4 $ 13.6 $ 13.8 $ 13.8 $ 13.8 $ Risk-weighted assets 114.1 $ 116.6 $ 119.5 $ 121.6 $ 123.9 $ Common equity tier 1 ratio 11.7 % 11.6 % 11.5 % 11.3 % 11.2 % Total capital ratio 15.3 % 15.1 % 14.9 % 14.2 % 14.0 % Basel III fully phased-in (1,3) Common equity tier 1 ratio 11.7% 11.6% 11.5% 11.3% 11.1% 15.3% 15.1% 14.9% 14.2% 14.0% 11.7% 11.6% 11.5% 11.3% 11.2% 4Q15 1Q16 2Q16 3Q16 4Q16 Total capital ratio Common equity tier 1 ratio 97% 99% 98% 98% 99% 4Q15 1Q16 2Q16 3Q16 4Q16 Capital and liquidity remain strong 19 Highlights 1) Current-reporting period regulatory capital ratios are preliminary. 2) Basel III ratios assume that certain definitions impacting qualifying Basel III capital will phase in through 2019. Ratios also reflect

the required U.S. Standardized methodology for calculating RWAs,

effective January 1, 2015.

3) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. 4) Based on the September 2014 release of the U.S. version of the Liquidity Coverage Ratio (LCR). Note that as a modified LCR company,

CFG’s minimal LCR requirement of 90% began January 2016.

Reflects current understanding of Net Stable Funding Ratio (NSFR).

5) Period end includes held for sale. Capital levels remain above regional peers 4Q16 Basel III common equity tier 1 ratio (transitional basis) down ~16 basis points from 3Q16 Net income: ~23 bps increase RWA growth: ~21 bps decrease Dividends, treasury stock and other: ~18 bps decrease LDR of 99% increased 77 bps from 3Q16 Fully compliant with LCR and current understanding of NSFR (4) 2016 CCAR plan reflects continued commitment toward prudent return of capital with $690 million in share repurchases Repurchased $180 million, or 6.3 million common shares, during the quarter at an average price of $28.71 Loan-to-deposit ratio (5) Capital ratio trend (1,2) (1,2) |

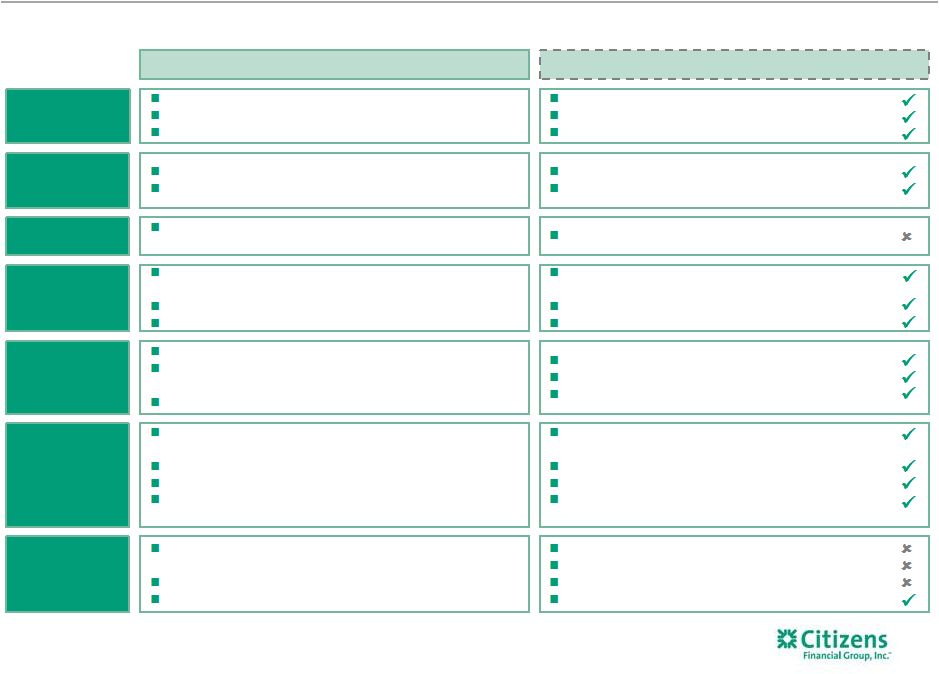

Initiative FY16 Status Commentary Reenergize household growth Primary HHs up YoY. Citizens Checkup helped drive ~400,000 appointments in FY16 with focus on deepening

relationships with mass affluent and affluent customers.

Expand mortgage sales force

Strong momentum in scaling the business; LOs up 96 in FY16 to 538,

originations up 36% FY16 and 56% in 4Q16 vs. 4Q15; conforming

mix surpassed 40% in 4Q16. Optimize Auto

Continue to optimize returns of business through focus on most profitable

dealers and increased pricing. Reducing portfolio growth to make

room for more attractive student and unsecured assets. Grow

Student/Installment Credit Sustained momentum in Student with

total loan balances up 60% compared to 4Q15 driven by steady growth in Ed Refi. Apple program continues to grow; expanding unsecured platform through marketing and new partners.

Expand Business Banking

Increasing focus on deposits, cash management, and other fee income streams,

with deposits up 6% vs. 4Q15. Cost of deposits remains

relatively stable at 11 bps and continues to provide attractive source of funds. Expand Wealth sales force Financial consultants up 13% in FY16 to 362. Total investment sales volume increased 10% vs. FY15 driven by

53% increase in fee-based sales. Revenue growth continues to take longer

due to shift to fee-based business. Build out Mid-Corp &

verticals Overall

loan growth of over 20% vs. 4Q15, driven by Healthcare and Technology industry verticals, which had loan growth of 39% vs. 4Q15. Fee income growth up $21 million, or 17% vs. FY15.

Continue development of Capital

and Global Markets activities

Continue to gain market share, fee income up 30% in FY16. Growth driven by

robust syndications and expanded capabilities

in interest rate and FX products. Middle Market bookrunner rank improved YoY from #9 to #7 (1) . Build out Treasury Solutions Fees up 11% in FY16 reflecting pricing increase, improving sales activity and 14% YoY increase in commercial

card with purchase volume up 14% YoY. Grow Franchise Finance Loans up 24% YoY and 6% QoQ. Added 64 net new clients in 2016, with continued focus on quick service, fast

casual, and retail petrol franchise concepts.

Expand Middle Market

Reinvigorated

growth in business with origination volumes up 24% in FY16 vs. FY15 and 16%

QoQ; however, loan

portfolio relatively flat, with initiatives underway to grow the overall portfolio. Deposits up $575 million, or 8%, and fee income up 12% vs. FY15 driven by efforts to deepen relationships with customers. Grow CRE Continue to deepen client penetration with top developers in core geographies, while moderating growth in a number of select areas. CRE loans grew 17% in FY16 to $9.3 billion. Reposition Asset Finance Continue to realign product offering and strategy towards core Middle Market and Mid-Corp customers to drive

improved spread and fees. Origination volume grew QoQ.

Balance Sheet Optimization

Continued execution of balance sheet strategies led to NIM increase of ~3 bps (total of 6 bps including yield curve impact), driven by improved mix and pricing, with relatively stable deposit costs. TOP II Achieved $105 million of P&L benefit in FY16. Initiatives largely completed.

TOP III TOP III Program underway and on track to meet FY17 benefit of $100-$115 million.

Summary of progress on strategic initiatives

1) Thomson Reuters LPC, FY16 data as of 12/31/16 based on number of deals for Overall Middle Market (defined as Borrower Revenues

<$500MM and Deal Size <$500MM). 1)

Thomson Reuters LPC, FY16 data as of 12/31/16 based on number of deals for

Overall Middle Market (defined as Borrower Revenues <$500MM and Deal Size <$500MM). 20 |

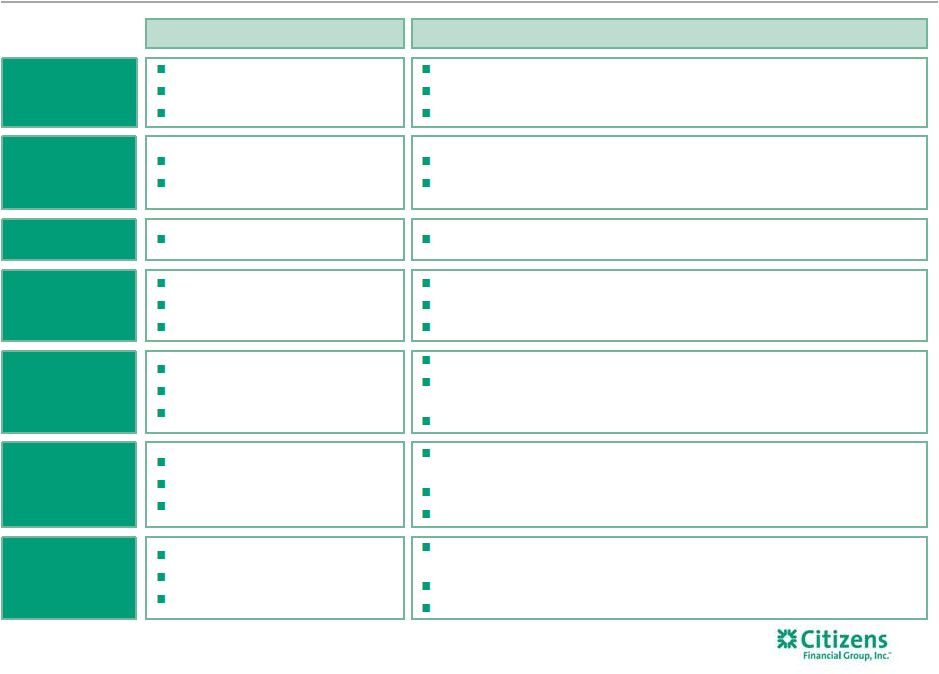

TOP II Program TOP II Program TOP III Program TOP III Program Revenue initiatives Delivered over $60 million Citizens Checkup: Launched with ~400,000 appointments

scheduled to-date; customer satisfaction has been positive with

78% very to completely satisfied

Consumer Retention: Initiative underway and showing strength in deposit retention; successful platinum launch driving retention with the Mass Affluent customer segment Middle Market Share of Wallet: Opportunity pipeline remains

~2X larger than historical levels

(1) leading to stronger capital markets penetration Commercial Pricing: Re-priced 12,000 cash management

accounts; improved loan pricing discipline and increased lending

revenue by 13% and improved IRP spreads

(2) Revenue initiatives Delivered over $60 million Citizens Checkup: Launched with ~400,000 appointments

scheduled to-date; customer satisfaction has been positive with

78% very to completely satisfied

Consumer Retention: Initiative underway and showing strength in deposit retention; successful platinum launch driving retention with the Mass Affluent customer segment Middle Market Share of Wallet: Opportunity pipeline remains

~2X larger than historical levels

(1) leading to stronger capital markets penetration Commercial Pricing: Re-priced 12,000 cash management

accounts; improved loan pricing discipline and increased lending

revenue by 13% and improved IRP spreads

(2) Expense initiatives Delivered ~$40 million Operations Transformation: Streamlining of organization

complete; focused on next wave of opportunities

Supply Chain Services: 2016 run-rate savings achieved driven

by reduction in external resources and tightening of internal

travel and office supplies policies

Expense initiatives

Delivered ~$40 million

Operations Transformation: Streamlining of

organization complete; focused on next wave of

opportunities Supply Chain

Services: 2016 run-rate savings achieved driven

by reduction in external resources and tightening of

internal travel and office supplies policies

Revenue initiatives

Target ~$25-$30 million

Commercial Attrition: Predictive tool is now in the hands of our RMs that identifies at-risk clients and allows them to proactively develop retention plans for those clients Unsecured Lending: Initiative launched with good initial

customer responses; early read on performance is positive

Business Banking Share of

Wallet: Realignment of

salesforce complete; executing on plans to deepen

relationships Revenue initiatives

Target ~$25-$30 million

Commercial Attrition: Predictive tool is now in the hands of our RMs that identifies at-risk clients and allows them to proactively develop retention plans for those clients Unsecured Lending: Initiative launched with good initial

customer responses; early read on performance is positive

Business Banking Share of

Wallet: Realignment of

salesforce complete; executing on plans to deepen

relationships Expense initiatives

Target ~$55-$65 million

Consumer Efficiencies: First phase of

streamlining non-revenue staff is complete; focus on branch optimization and efficiencies in the mortgage business Commercial Efficiencies: Streamlining end-to-end processing and portfolio management; actions are largely complete Functional Efficiencies: Good progress on reengineering

processes; streamlining forecasting and reporting in

finance and recruiting and training in HR

Fraud: Project underway; initial focus on improving algorithms and enhancing chargeback processes Expense initiatives Target ~$55-$65 million Consumer Efficiencies: First phase of streamlining

non-revenue staff is complete; focus on branch optimization and efficiencies in the mortgage business Commercial Efficiencies: Streamlining end-to-end processing and portfolio management; actions are largely complete Functional Efficiencies: Good progress on reengineering

processes; streamlining forecasting and reporting in

finance and recruiting and training in HR

Fraud: Project underway; initial focus on improving algorithms and enhancing chargeback processes Tax efficiencies Target ~$20 million (3) Tax-Rate Optimization: Aligning tax rate to peer levels; began

to see benefit in 3Q16

and showing strength in investment and

historic tax credits

Tax efficiencies

Target ~$20 million

(3) Tax-Rate Optimization: Aligning tax rate to peer levels; began

to see benefit in 3Q16

and showing strength in investment and

historic tax credits

Launched mid 2015 —

Delivered $105 million in annual pre-tax

benefit for 2016

Launched mid 2016 —

Targeted run-rate

benefit of $100-$115 million by end of 2017

21 Tapping Our Potential (TOP) programs remain on track Self funding necessary investments through our efficiency initiatives 1) Represents opportunities per product specialist as of December 2016 vs. March 2015.

2) Improved lending revenue and IRP (interest-rate products) pricing, as well as improved lending revenue on in-scope deals,

which exclude syndicated transactions, select franchise finance

customers, asset-based lending deals and letters of credit.

3) ~$20 million pre-tax benefit; noninterest income pre-tax impact ~($20) million; tax expense benefit of ~$40 million on a

pre-tax equivalent basis. |

Consumer Consumer Commercial Commercial 22 Consistently enhancing our capabilities and gaining market share Continued strong focus on customer experience — Consistent customer branch experience; scores 10% above surveyed banks; (1) — Top 5 JD Power recognition in mortgage servicing and origination; building

multi-channel

service capabilities (2) — Top 5 Greenwich study in Business Banking (3) Enhancing competitive offerings to gain share — 2016 mortgage origination volumes up 36%, versus ~13% industry growth (4) — Continued momentum in student lending with ~6% national market share, up 1% from prior year (5) — Innovative unsecured offerings through partnerships with global industry leaders Introducing targeted product offerings tailored for key segments — Premier Banking solutions offer strong value proposition with comprehensive

program that entitles clients to dedicated relationship manager

— Continued hiring of Premier relationship managers augments retirement planning, business expertise and lending solutions platform Leading with enhanced digital capabilities — Expanding digital investment advice through SigFig partnership — Launching small business automated application and underwriting process

through Fundation

partnership — Streamlining account-opening experiences across channels Continued investment in data analytics to deepen customer relationships — Customer analytics team delivered strong marketing and efficiency results, delivering a 32% increase in response rates Citizens Checkup program continues to yield results — ~400,000 scheduled appointments in 2016 — Needs-based approach adds value through service and helps build and

maintain relationships

Continued leading customer satisfaction scores

(6) — Overall satisfaction indicates continued progress in serving customers needs;

overall satisfaction score of 93% (Top 2 box score)

— Satisfaction with relationship managers at 97% (Top-2 Box score) Commenced operations of Citizens Capital Markets, Inc. — Serves customers through strategic advice for M&A, capital structure, valuation

and capital raises via pubic offerings and private placements; expect to drive

deeper share of wallet with existing credit relationships and

attract new relationships

Enhanced infrastructure and analytics

— Introduced new interest rate products- and foreign exchange-platform that facilitates risk monitoring and client delivery

— Expanded asset-based and restructuring capabilities to help clients through

the cycle — Developed client-profitability reporting to provide enhanced portfolio view to

augment relationship management

— Building digital onboarding capabilities and CRM tools for relationship managers

to continue to improve sales effectiveness

Continued strength in loan syndications

— $9.7 billion of loan syndications, with 122 transactions as lead left or joint lead

arranger; growth of 26% and 22% versus 2015

— Ranked fifth in loan overall middle market deals in 4Q16; improved from tenth

versus prior year (7) — Growth driven by thought leadership initiatives, with particular strength in

healthcare, technology, franchise finance and leveraged finance

Continued improvement in Treasury Solutions products

— Investing in new commercial online banking platform to improve cash management and other offerings — Will continue to focus on expansion of product penetration to existing base,

cross-sell to new lending customers and customer-retention efforts to

drive sustainable fee growth

1) JD Power survey results reflect 2015 – 2016 assessment period and derive from JD Power branch servicing assessment score. 2) JD Power survey results reflect 2015-2016 assessment period. 3) Greenwich survey period from October 1, 2015 to September 30, 2016. 4) 2016 CFG mortgage volumes versus 2016 MBA Mortgage Finance Forecast as of December 14, 2016.

5) Source: MeaureOne based upon 2015-2016 Academic year. 6) Source: Barlow 2015 Voice of the Customer Survey. 7) Thomson Reuters LPC, Loan syndications 3Q16 ranking based on number of deals for Overall Middle Market (defined as Borrower Revenues <

$500MM and Deal Size < $500MM) as of 12/31/2016. |

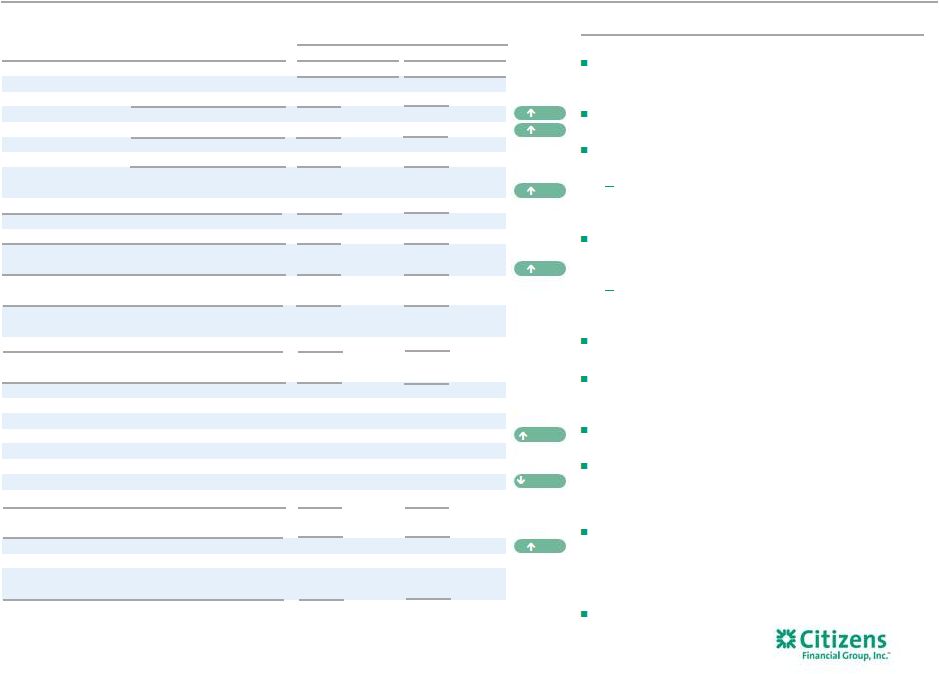

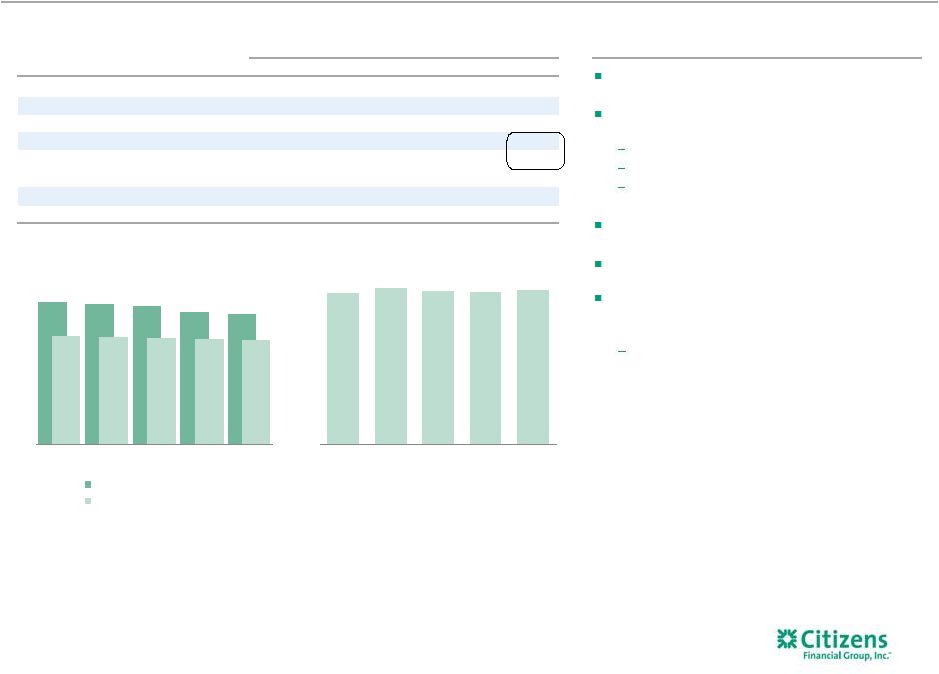

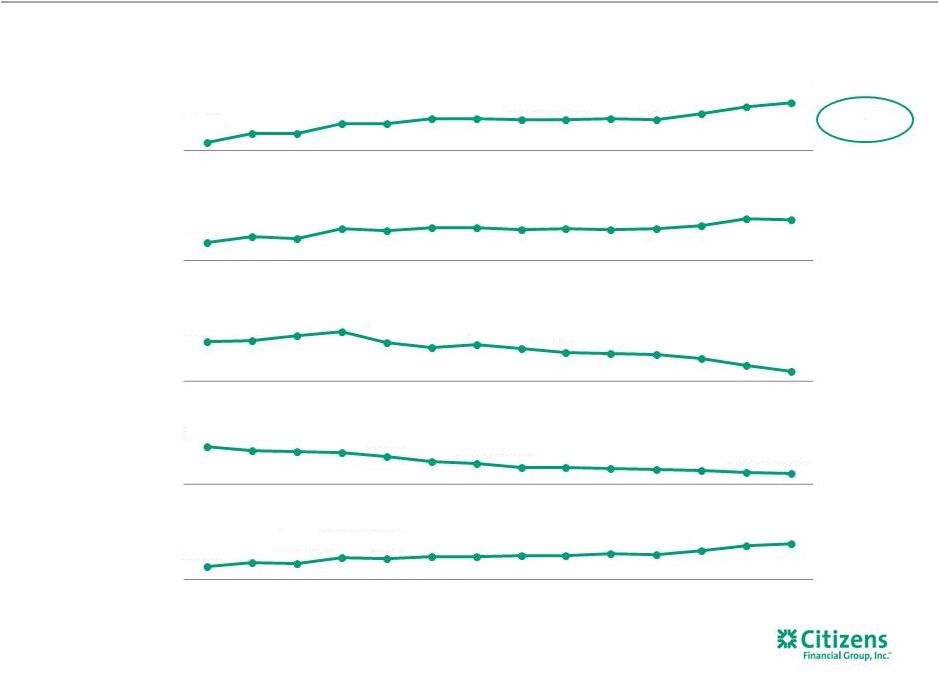

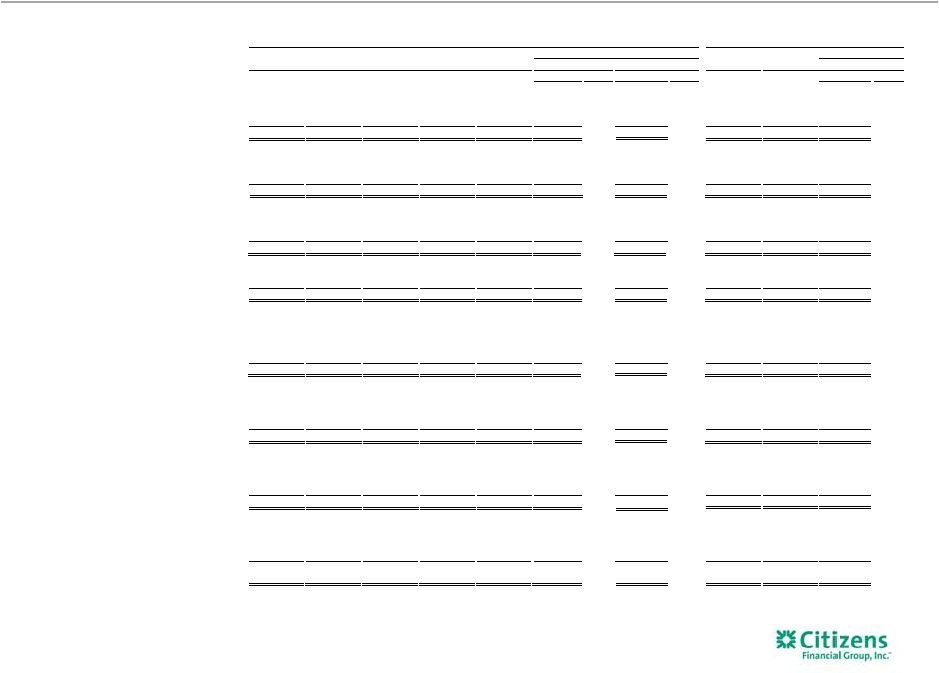

Goal is to deliver a 10%+ run-rate ROTCE in the medium term

23 1.0%+ Adjusted efficiency ratio (1) ~60% 10%+ Making consistent progress against our financial goals Medium-term Targets Key Indicators Adjusted ROTCE (1) Adjusted return on average total tangible assets (1) EPS Adjusted Diluted EPS (1) Common equity tier 1 ratio (2) 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. 2) Common equity tier 1 ("CET1") capital under Basel III replaced tier 1 common capital under Basel I effective January 1,

2015. 3)

Commencement of separation effort from RBS.

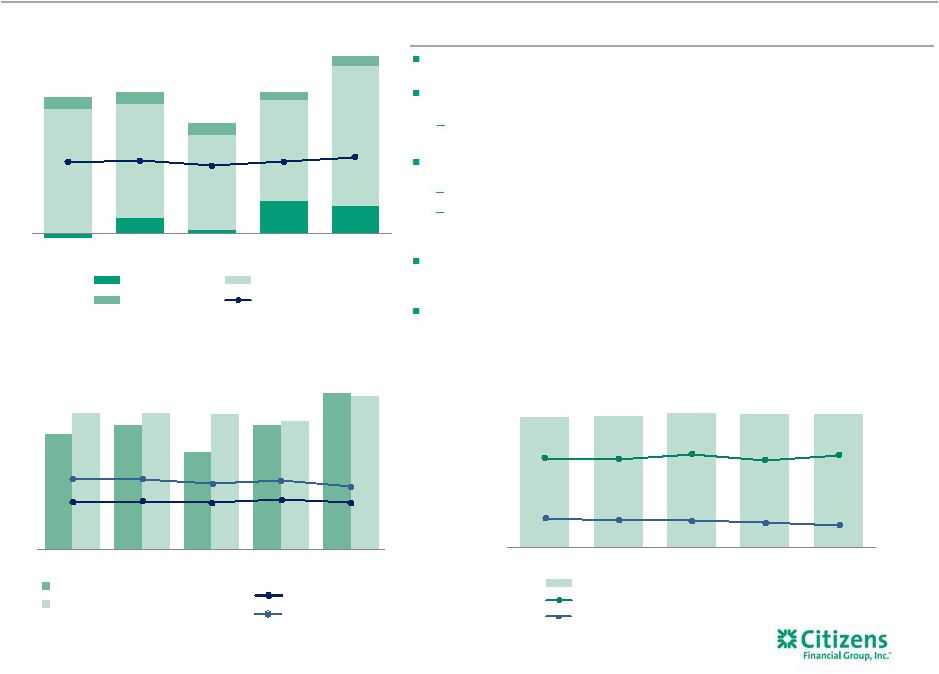

(3) 4.34% 5.24% 5.24% 6.28% 6.22% 6.76% 6.73% 6.67% 6.60% 6.75% 6.61% 7.30% 8.02% 8.43% 0.52% 0.59% 0.57% 0.68% 0.66% 0.69% 0.69% 0.67% 0.68% 0.67% 0.68% 0.72% 0.80% 0.79% 68% 68% 69% 70% 68% 67% 68% 67% 66% 66% 66% 65% 63% 62% 13.9% 13.5% 13.4% 13.3% 12.9% 12.4% 12.2% 11.8% 11.8% 11.7% 11.6% 11.5% 11.3% 11.2% $0.26 $0.30 $0.30 $0.37 $0.36 $0.39 $0.39 $0.40 $0.40 $0.42 $0.41 $0.46 $0.52 $0.55 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 |

Keys to successful 2017 financial performance

24 Expect improved economic environment with steady GDP growth, solid loan demand, and gradual rate hikes

Drive strong, prudent loan growth across consumer and commercial

Deliver improving NIM with continued focus on asset optimization and gathering

low-cost deposits Achieve improved noninterest income growth

through realization on investments in key areas Home Mortgage,

Wealth Management, Capital Markets and Treasury Solutions

Maintain strong expense discipline while continuing to fund investments in technology, products and services Strong focus on continuous improvement and delivering benefits from TOP efficiency programs

Deliver 3-5% positive operating leverage

Will be the key to continued net income and EPS growth, must offset gradual

normalization in provision expense

Continue efforts to normalize capital ratios and drive enhanced shareholder

returns |

Adjusted FY2016 guidance vs. Adjusted FY2015

(1,2) FY2016 performance vs. guidance 25 Adjusted FY2016 actual results vs. Adjusted FY2015 (1) Results reflect strong execution against targets 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. 2) Guidance as provided on 4Q15 January 22, 2016 earnings call. 3) Reflects impacts linked to higher revenues. Net interest income, net interest margin Operating leverage, efficiency ratio Credit trends, tax rate Capital, liquidity and funding Key economic assumptions Balance sheet growth Noninterest income Net interest income growth of 7-10% NIM improvement of 6-12 bps Expense growth of 2.5-3.5%*; 1.3-2.3% including the impact of the card reward accounting change Target 3-5% of positive operating leverage* Efficiency ratio improves to 63-65%* Provision expense $375-$425 million Charge-off rates normalize modestly from unusually low levels with modest reserve build to fund loan growth Tax rate of ~33% Targeting dividend payout ratio in the 25-30% range, common stock buyback TBD with CCAR Year-end Basel III common equity tier 1 ratio 11.2-11.5% Loan-to-deposit ratio ~98% Continue to diversify funding sources with modest amount of senior debt issuance YE 2016: fed funds rate of ~85-90 bps (rate increases in July and December), 10-year Treasury rate of ~2.40%-2.50% range Full-year GDP growth in the 2%-3% range YE-2016 unemployment rate in the 4%-5% range 5-6% average earning asset growth 6-8% average loan growth 5-7% average deposit growth 5-7% noninterest income growth*; 2.5-4% including the impact of the card reward accounting change Net interest income growth of 10% NIM improvement of 11 bps Expense growth of 3% 4.2% positive operating leverage Efficiency ratio improved to 64% (1) Provision expense of $369 million Charge-off rate of 32 bps up modestly from 30 bps Tax rate of 31.7% Dividend payout ratio of 24%, common stock buyback Year-end Basel III common equity tier 1 ratio of 11.2% Loan-to-deposit ratio of 99% We issued $1.75 billion senior bank debt to broaden our market access and diversify funding sources YE 2016: fed funds rate of 75 bps 10-year Treasury rate of 2.00% Full-year GDP growth of 1.6% YE-2016 unemployment rate of 4.7% 6% average earning asset growth 8% average loan growth 6% average deposit growth Growth in noninterest income of 1% *Before the estimated effect of a prospective card reward accounting change.

(3) |

FY2017 outlook 26 Net interest income, net interest margin Net interest income growth of 8-9% NIM improvement of 8-10 bps Operating leverage, efficiency ratio Credit trends, tax rate Expense growth of 3-3.5% Target 3-5% of positive operating leverage Efficiency ratio improves to 61-62% Provision expense $425-$475 million Charge-off rates normalize modestly with additional reserve build to fund loan

growth Tax rate of ~32% FY2017 expectations vs. Adjusted FY2016 (1) Capital, liquidity and funding Targeting dividend payout ratio in the 30-35% range, common stock buyback TBD with CCAR Year-end Basel III common equity tier 1 ratio 10.7-10.9% Loan-to-deposit ratio ~98% Key economic assumptions YE 2017: fed funds rate of ~1.25% (rate increase in June & November/December),

10-year Treasury rate of ~2.50-2.75% range

Full-year GDP growth in the 2-2.5% range

YE-2017 unemployment rate 4.5-4.7%

Balance sheet growth 5.5-6.5% average earning asset growth 5.5-7% average loan growth 5.5-7% average deposit growth Noninterest income 3-5% noninterest income growth (2) 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. 2) Tax credit investments nets down by 1% $3,758 million net interest income 2.86% NIM $3,316 million noninterest expense 4% operating leverage 63.9% efficiency ratio $369 million provision expense 32 bps of net charge-offs 31.7% tax rate 24% dividend payout ratio 11.2% CET1 ratio 99% loan-to-deposit ratio YE 2016: fed funds rate of 75 bps Full-year GDP growth of 1.6% YE-2016 unemployment rate of 4.7% $130.5 billion average earning assets $103.4 billion average loans $105.4 billion average deposits $1,430 million noninterest income Adjusted FY2016 (1) |

FY2017 outlook compared with 2016

27 Net interest income, net interest margin Operating leverage, efficiency ratio Credit trends, tax rate Capital, liquidity and funding Adjusted 2016 vs. Adjusted 2015 (1) FY2017 expectations vs. Adjusted 2016 (1) Balance sheet growth 5.5-6.5% average earning asset growth 5.5-7.0% average loan growth 5.5-7.0% average deposit growth Noninterest income 3-5% noninterest income growth (1) Net interest income growth of 10% NIM improvement of 11 bps Expense growth of 3% 4.2% positive operating leverage (1) Efficiency ratio improved to 64% (1) Provision expense of $369 million Charge-off rate of 32 bps up modestly from 30 bps Tax rate of 31.7% Dividend payout ratio of 24%, common stock buyback Year-end Basel III common equity tier 1 ratio of 11.2% Loan-to-deposit ratio of 99% 6% average earning asset growth 8% average loan growth 6% average deposit growth Stable noninterest income 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. Net interest income growth of 8-9% NIM improvement of 8-10 bps Expense growth of 3-3.5% 3-5% operating leverage Efficiency ratio improves to 61-62% Provision expense of $425-$475 million Charge-off rates normalize modestly with additional reserve build to

fund loan growth

Tax rate of ~32%

10.7-10.9% Basel III CET1

~98% LDR |

NIM drivers and growth

28 Comments Earning asset mix and yields Some additional benefit from shift in loan mix to higher return products

Reduced back book runoff helping to mitigate

competitive commercial

pricing dynamics

Deposit/ funding

costs Enhanced customer product offerings targeted at mass affluent and affluent deposit segments Ongoing customer segmentation strategies helping to limit pricing pressures from higher-than-peer deposit-growth targets Yield curve and rate hike benefits Dec 2016 rate increase expected to contribute $45-55 million to NII, or 3-4 bps to NIM (1) Steepening yield curve expected to contribute $20-30 million to NII, or

~2 bps to NIM

(1) Two rate increases anticipated in 2017 June rate increase expected to contribute $25-35 million to NII, or 2-3 bps to NIM (1) November/December rate increase expected to contribute ~$5 million to NII (1) 1) Assumes December 31, 2016 implied forward curve. |

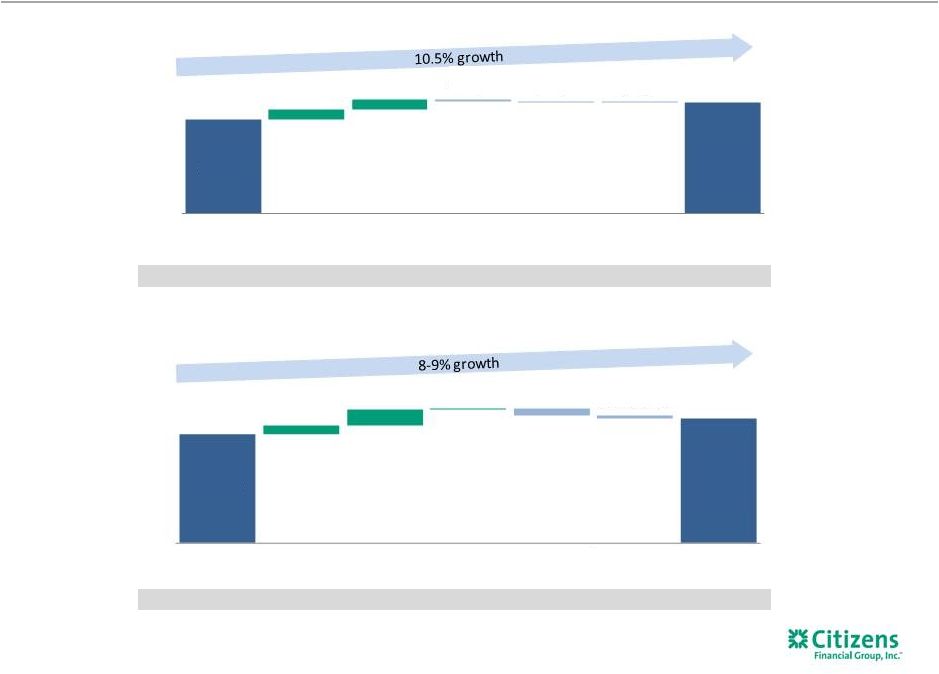

NIM% 2.86% (~1) bps +21-27 bps 0 bps (11-13) bps Strong growth in net interest income 29 Net interest income outlook 2016-2017 (2) NIM% (1) bp 0 bps 2.75% 2.86% +16 bps (3) bps (1) bps (1) Net interest income growth 2015-2016 2.94–2.96% (1-3) bps $3,402 $3,758 6.1% 6.2% (1.2)% (0.4)% (0.3)% 2015 Loan growth Loan mix/ yields Investment portfolio Deposit costs Borrowings/ other 2016 $3,758 8-9% growth range 4.5-5.5% 8.0-9.0% 0.5-1.5% (4.0-5.0%) (1.0-2.0%) 2016 Loan growth Loan mix/ yields & other Investment portfolio Deposit costs Borrowings/ other 2017 outlook Other includes funding costs broadly offset by the benefit of swaps. Assumes December 31, 2016 implied forward curve. December 2016 rate increase expected to contribute $65-$85 million to NII, or 5-6

bps to NIM. Two 2017 rate increases contribute $30-$40 million

to NII or 2-3 bps to NIM. 1)

2) (1) |

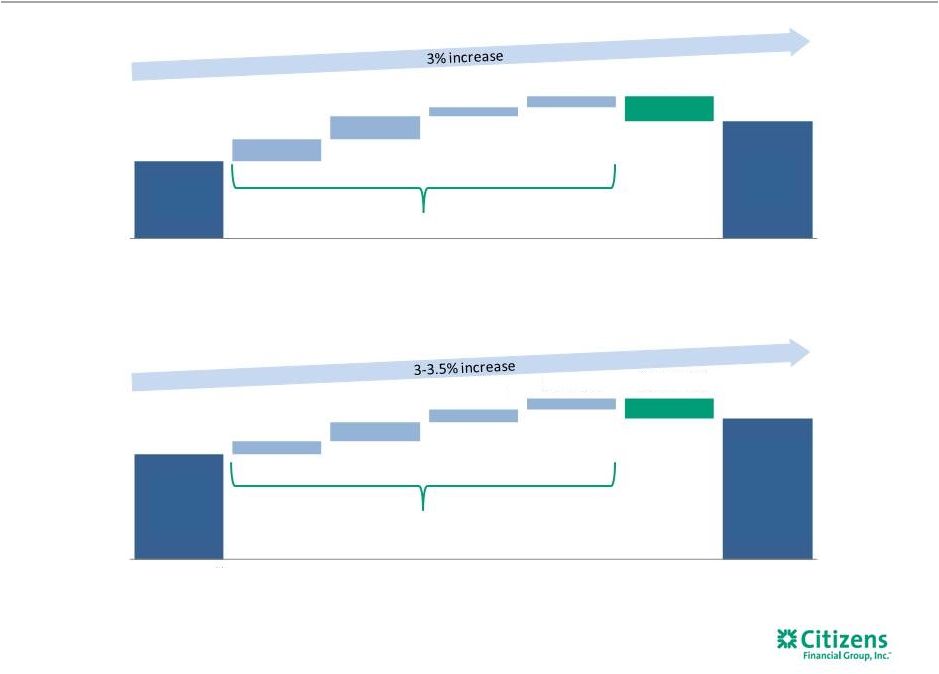

Noninterest expense remains well controlled

30 Adjusted noninterest expense (1) trend 2015-2016 Noninterest expense outlook 2016-2017 (1) (1) $s in millions 5.5% 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. Midpoint of 5.1% (1) $3,209 $3,316 1.8% 2.0% 0.7% 0.9% (2.1)% Adjusted 2015 Other salaries & employee benefits expense Business growth initiatives Outside services, occupancy & other expense Equipment and amortization of software expense Efficiency initiatives Adjusted 2016 $3,316 3.0-3.5% growth range 1.1-1.3% 1.6-1.9% 1.0-1.2% 0.9-1.1% (1.7-1.9%) Adjusted 2016 Other salaries & employee benefits expense Business growth initiatives Outside services, occupancy & other expense Equipment and amortization of software expense Efficiency initiatives 2017 outlook |

1Q17 outlook 31 Net interest income, net interest margin Noninterest expense Credit trends, tax rate ~1.5% loan growth Expect ~2-3 basis point improvement in net interest margin given recent rate rise

Day count impact of ~$14 million decrease to NII

Up 1-2% given seasonal compensation impacts

Provision expense stable, lower NCOs

Tax rate of 30-31%

1Q17 expectations vs. 4Q16

Capital, liquidity

and funding Quarter-end Basel III common equity tier 1 ratio ~11.1% Loan-to-deposit ratio of ~98% Preferred stock dividend of $7 million Noninterest income Seasonally lower, particularly capital markets and service charges and fees, as well

as rate impact on mortgage banking |

Key messages 32 Citizens once again delivered strong results in 4Q16 Strong EPS growth, robust operating leverage, improving efficiency ratio and active capital management

ROTCE of 8.4% up from 4.3% three years ago in 3Q13

Delivering against strategic initiatives with strong growth in Capital Markets

and improving results in Mortgage Banking

Continued execution on growing attractive return portfolios and lower cost

deposits Prudent loan growth with continued improvement in credit

quality Tangible book value per share of $25.69 at quarter end,

up 4% from 4Q15 Strong focus on continuous improvement and

delivering benefits from TOP efficiency programs Well positioned

as we enter 1Q17 to capitalize on improving economic environment and rising rates Key to financial results is to grow the balance sheet smartly with continued focus on building out fee

businesses and delivering positive operating leverage

Capital and credit position remain strong

Peer-leading CET1 ratio permits both strong loan growth and returns to

shareholders Focused on delivering enhanced shareholder

returns 1)

Please see important information on Key Performance Metrics and Non-GAAP

Financial Measures at the beginning of this presentation for an explanation of their use and the appendix for their calculation and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items

and/or notable items, as applicable. |

Appendix 1 –

Additional 2016 information

33 |

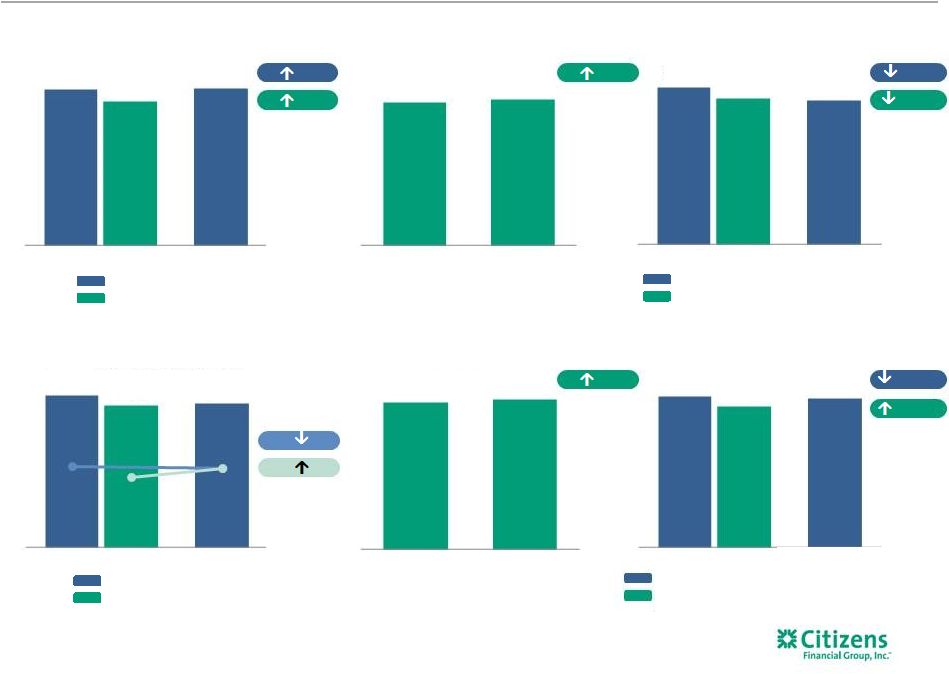

Linked-quarter results

34 Period-end loans $s in billions (2) 2% 1% 1% 7% Net income and EPS $s in millions, except per share data Equity return metrics Period-end deposits $s in billions (1) GAAP results Adjusted results (1) Return on average total tangible assets Adjusted return on average total tangible assets (1) Return on average tangible common equity Adjusted return on average tangible common equity EPS 2% EPS 6% 7 bps 1 bps 15 bps 41 bps Asset return metrics $0.56 $0.52 $0.55 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. 2) Excludes loans held for sale. Pre-provision profit $s in millions (1) GAAP results Adjusted results (1) 4Q16 4Q16 4Q16 4Q16 $513 $516 $482 3Q16 $105.5 $107.7 3Q16 4Q16 0.86% 0.79% 0.80% 3Q16 8.6% 8.4% 8.0% 3Q16 $297 $282 $278 3Q16 $108.3 $109.8 3Q16 4Q16 |

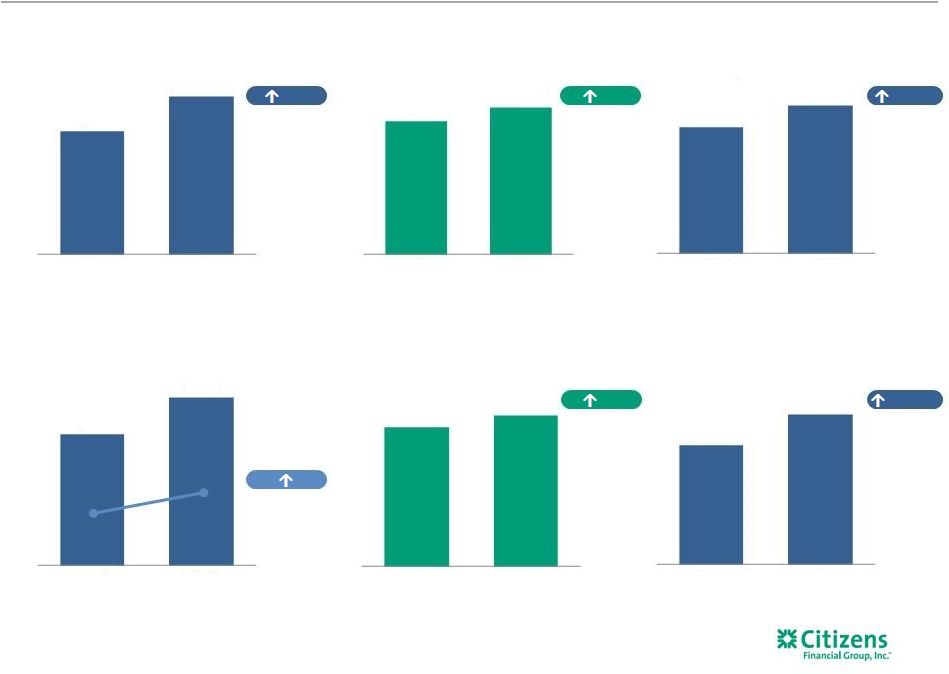

Quarter-over-quarter results

35 Pre-provision profit $s in millions Return on average total tangible assets $s in billions Net income and EPS $s in millions, except per share data Return on average tangible common equity $s in billions 22% Period-end loans $s in billions Period-end deposits $s in billions (1) 9% 7% $0.42 $0.55 EPS 31% 12 bps 168 bps 1) Excludes loans held for sale. $221 $282 4Q15 4Q16 $422 $516 4Q15 4Q16 $99.0 $107.7 4Q15 4Q16 0.67% 0.79% 4Q15 4Q16 $102.5 $109.8 4Q15 4Q16 6.7% 8.4% 4Q15 4Q16 |

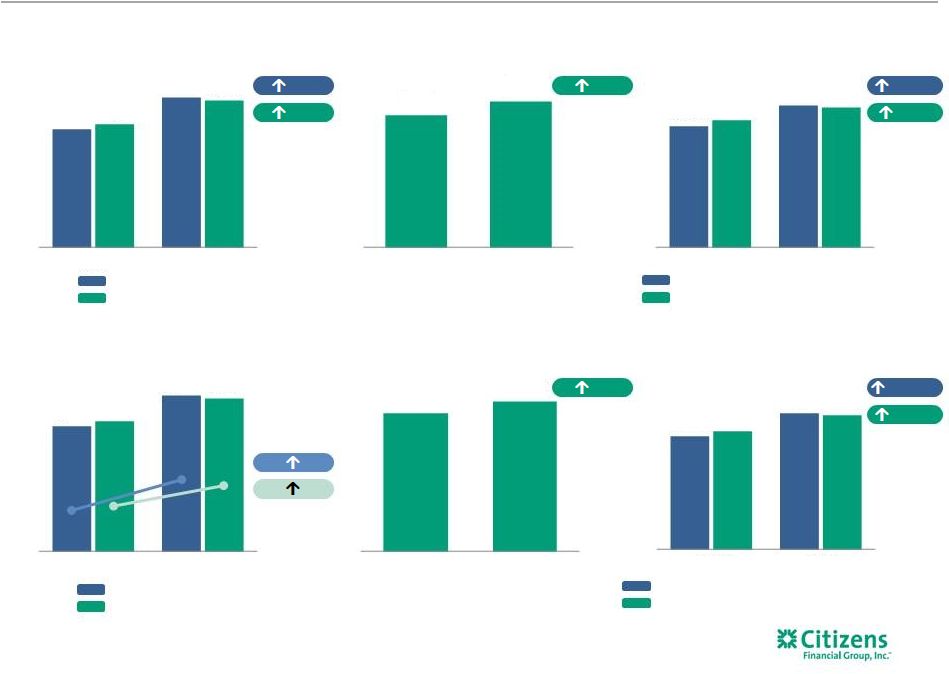

Full-year results

36 Pre-provision profit $s in millions Asset return metrics Net income and EPS $s in millions, except per share data Equity return metrics 22% Period-end loans $s in billions Period-end deposits $s in billions (2) (1) 9% 7% 16% GAAP results Adjusted results (1) GAAP results Adjusted results $1.55 $1.61 $1.97 $1.93 EPS 27% EPS 20% 11 bps 7 bps 129 bps 91 bps 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning of this presentation for

an explanation of their use and the appendix for their calculation

and/or reconciliation to GAAP Financial Measures, as applicable. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. 2) Excludes loans held for sale. (1) Return on average tangible common equity Adjusted return on average tangible common equity (1) (1) Return on average total tangible assets Adjusted return on average total tangible assets $1,565 $1,903 $1,615 $1,872 2015 2016 $99.0 $107.7 2015 2016 0.65% 0.76% 0.68% 0.75% 2015 2016 6.4% 7.7% 6.7% 7.6% 2015 2016 $102.5 $109.8 2015 2016 $840 $1,045 $871 $1,026 2015 2016 |

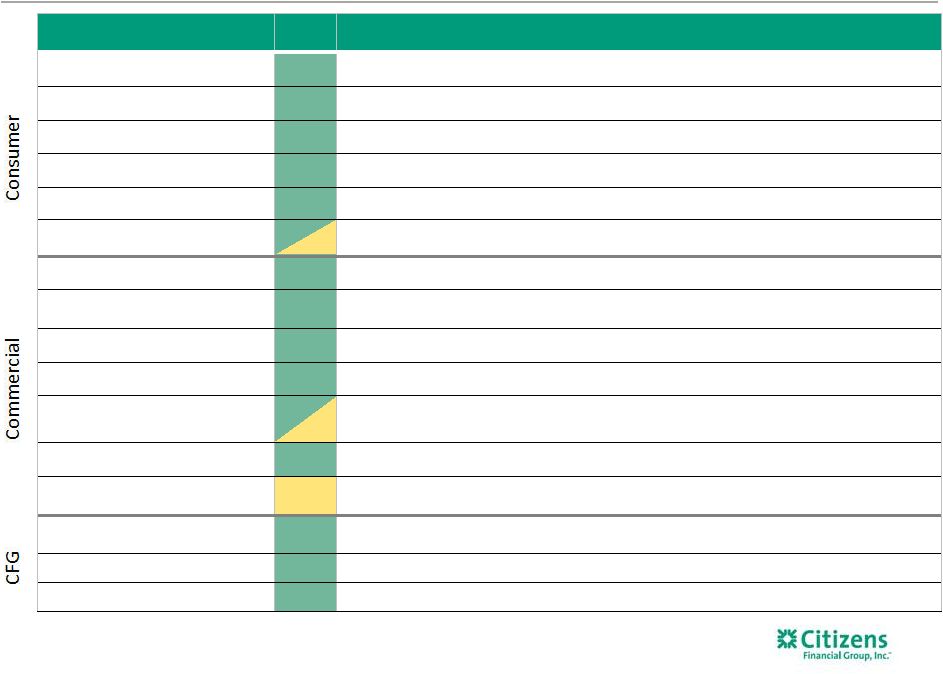

Consumer Banking segment

37 - - Highlights Linked quarter: Net income was relatively flat Net interest income up $18 million, or 3%, led by higher mortgage, student and unsecured retail loans and improved loan yields, partially offset by higher deposit costs Average loans up $1.3 billion, or 2%, and average deposits up $1 billion, or 1%, from 3Q16 Noninterest income was relatively stable as higher mortgage banking fees, driven by improved MSR valuations, despite lower sale gains, was more than offset by lower trust and investment fees and a seasonal reduction in card fees Noninterest expense decreased modestly from 3Q16 levels that included $7 million of home equity notable items. (1) Results excluding these items were largely driven by higher fraud and regulatory and legal costs and increased equipment and outside services costs offsetting lower salaries and benefits, nonperforming asset costs and occupancy expense Provision for credit losses up $17 million Prior-year quarter: Net income up $25 million, or 37% Net interest income up $74 million, led by higher student, mortgage and unsecured retail balances as well as improved loan yields and deposit spreads Average loans up $4.0 billion, or 8%, and average deposits up $2.2 billion, or 3%, from 4Q15 Noninterest income was relatively stable, driven by higher mortgage banking fees tied to wider gain on sale spreads, secondary volume and an MSR valuation increase, partially offset by the impact of the card reward accounting change Noninterest expense increased $25 million, or 4%, driven by higher fraud, regulatory and legal costs, insurance costs and salaries and benefits expense, partially offset by the card reward accounting change impact Provision for credit losses up $9 million, largely driven by higher net

charge-offs in auto related to a one-time

methodology change

4Q16 change from

$s in millions 4Q16 3Q16 4Q15 3Q16 4Q15 $ % $ % Net interest income 639 $ 621 $ 565 $ 18 $ 3 % 74 $ 13 % Noninterest income 227 229 226 (2) (1) 1 — Total revenue 866 850 791 16 2 75 9 Noninterest expense 649 650 624 (1) — 25 4 Pre-provision profit 217 200 167 17 9 50 30 Provision for credit losses 74 57 65 17 30 9 14 Income before income tax expense 143 143 102 — — 41 40 Income tax expense 51 51 35 — — 16 46 Net income 92 $ 92 $ 67 $ — $ — % 25 $ 37 % Average balances $s in billions Total loans and leases (2) 57 $ 55 $ 53 $ 1 $

2 % 4 $

8 % Total deposits 73 $ 72 $ 71 $ 1 $

1 % 2 $

3 % Mortgage Banking metrics Originations 2,220 $ 2,187 $ 1,426 $ 33 $ 2 % 794 $ 56 % Origination Pipeline 1,868 2,835 1,684 (967) (34) % 184 11 % Gain on sale of secondary originations 1.81% 2.77% 1.77% (96) bps 4 bps Key performance metrics ROTCE (1,3) 7.0% 7.0% 5.5% (7) bps 147 bps Efficiency ratio (1) 75% 76% 79% (156) bps (395) bps 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the end of this release for an

explanation of our use of these metrics and Non- GAAP Financial

Measures and their reconciliation to GAAP financial measures. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable. 2) Includes held for sale. 3) Operating segments are allocated capital on a risk-adjusted basis considering economic and regulatory capital requirements. We

approximate that regulatory capital is equivalent to a sustainable

target level for tier 1 common equity and then allocate that approximation to the segments based on economic capital. |

Commercial Banking segment

38 1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the end of this release for an

explanation of our use of these metrics and Non-GAAP

Financial Measures and their reconciliation to GAAP financial measures. Adjusted results exclude restructuring charges, special items and/or notable items, as applicable.

2) Includes held for sale. 3) Operating segments are allocated capital on a risk-adjusted basis considering economic and regulatory capital requirements. We

approximate that regulatory capital is equivalent to a