Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Virtu KCG Holdings LLC | d294750dex992.htm |

| EX-99.1 - EX-99.1 - Virtu KCG Holdings LLC | d294750dex991.htm |

| 8-K - FORM 8-K - Virtu KCG Holdings LLC | d294750d8k.htm |

KCG Holdings, Inc. (KCG) 4th Quarter 2016 Earnings Presentation January 19, 2017 Exhibit 99.3

Safe Harbor Certain statements contained herein and the documents incorporated by reference containing the words "believes," "intends," "expects," "anticipates," and words of similar meaning, may constitute forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These "forward-looking statements" are not historical facts and are based on current expectations, estimates and projections about KCG's industry, management's beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Any forward-looking statement contained herein speaks only as of the date on which it is made. Accordingly, readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict including, without limitation, risks associated with: (i) the inability to manage trading strategy performance and sustain revenue and earnings growth; (ii) the receipt of additional payments from the sale of KCG Hotspot that are subject to certain contingencies; (iii) changes in market structure, legislative, regulatory or financial reporting rules, including the increased focus by Congress, federal and state regulators, the SROs and the media on market structure issues, and in particular, the scrutiny of high frequency trading, alternative trading systems, market fragmentation, colocation, access to market data feeds, and remuneration arrangements such as payment for order flow and exchange fee structures; (iv) past or future changes to KCG's organizational structure and management; (v) KCG's ability to develop competitive new products and services in a timely manner and the acceptance of such products and services by KCG's customers and potential customers; (vi) KCG's ability to keep up with technological changes; (vii) KCG's ability to effectively identify and manage market risk, operational and technology risk, cybersecurity risk, legal risk, liquidity risk, reputational risk, counterparty and credit risk, international risk, regulatory risk, and compliance risk; (viii) the cost and other effects of material contingencies, including litigation contingencies, and any adverse judicial, administrative or arbitral rulings or proceedings; (ix) the effects of increased competition and KCG's ability to maintain and expand market share; (x) the relocation of KCG's global headquarters from Jersey City, NJ to New York, NY; and (xi) KCG's ability to complete the sale or disposition of any or all of the assets or businesses that are classified as held for sale. The list above is not exhaustive. Because forward looking statements involve risks and uncertainties, the actual results and performance of KCG may materially differ from the results expressed or implied by such statements. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Unless otherwise required by law, KCG also disclaims any obligation to update its view of any such risks or uncertainties or to announce publicly the result of any revisions to the forward-looking statements made herein. Readers should carefully review the risks and uncertainties disclosed in KCG's reports with the U.S. Securities and Exchange Commission ("SEC"), including those detailed in "Risk Factors" in Part I, Item 1A of KCG's Annual Report on Form 10-K for the year ended December 31, 2015 and in Part II, Item 1A of KCG’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2016, "Legal Proceedings" in Part I, Item 3, under "Certain Factors Affecting Results of Operations" in "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Part II, Item 7, in "Quantitative and Qualitative Disclosures About Market Risk" in Part II, Item 7A, and in other reports or documents KCG files with, or furnishes to, the SEC from time to time. This information should be read in conjunction with KCG's Consolidated Financial Statements and the Notes thereto contained in its Annual Report on Form 10-K, Quarterly Report on Form 10-Q, and in other reports or documents KCG files with, or furnishes to, the SEC from time to time. For additional disclosures, please see https://www.kcg.com/legal/global-disclosures.

KCG’s financial results in 4Q16 reflect a pre-tax gain of $331 million from the sales of substantially all shares of Bats Global Markets, Inc. owned by KCG, partially offset by a difficult trading environment KCG Market Making increased market share of retail SEC Rule 605 U.S. equity share volume 5.0 percent year over year KCG Algorithmic Trading grew average daily U.S. equity share volume from the 25 largest U.S. asset managers 49.5 percent year over year KCG BondPoint set a new quarterly record for average daily fixed income par value traded with a 39.1 percent rise year over year KCG reduced total shares outstanding by 22 percent during the quarter 4th Quarter 2016 Summary

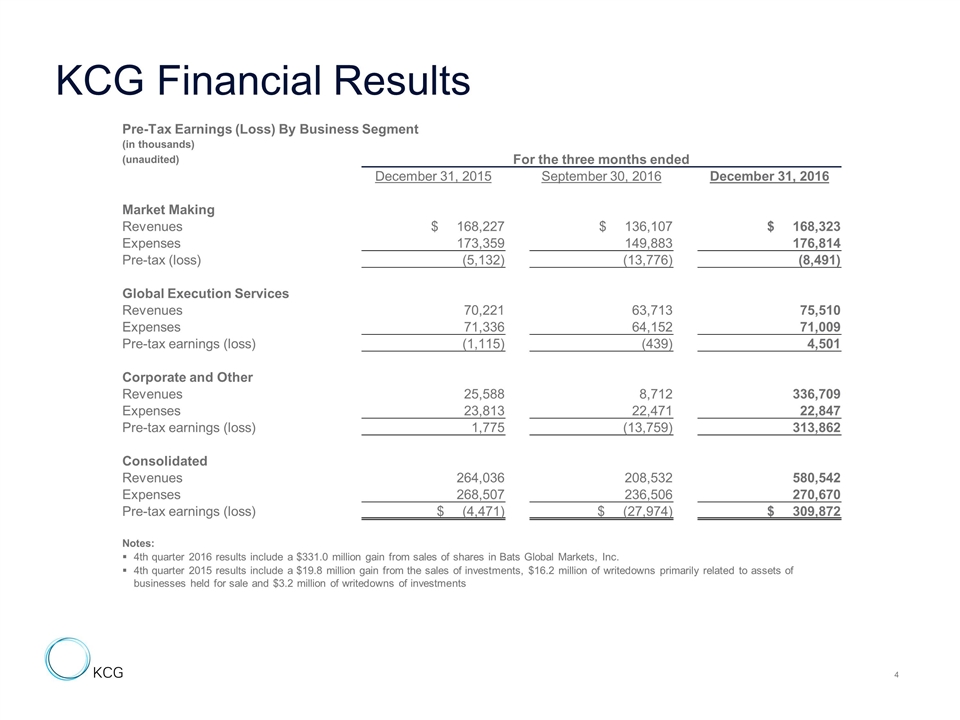

KCG Financial Results Pre-Tax Earnings (Loss) By Business Segment (in thousands) (unaudited) For the three months ended December 31, 2015 September 30, 2016 December 31, 2016 Market Making Revenues $ 168,227 $ 136,107 $ 168,323 Expenses 173,359 149,883 176,814 Pre-tax (loss) (5,132) (13,776) (8,491) Global Execution Services Revenues 70,221 63,713 75,510 Expenses 71,336 64,152 71,009 Pre-tax earnings (loss) (1,115) (439) 4,501 Corporate and Other Revenues 25,588 8,712 336,709 Expenses 23,813 22,471 22,847 Pre-tax earnings (loss) 1,775 (13,759) 313,862 Consolidated Revenues 264,036 208,532 580,542 Expenses 268,507 236,506 270,670 Pre-tax earnings (loss) $ (4,471) $ (27,974) $ 309,872 Notes: 4th quarter 2016 results include a $331.0 million gain from sales of shares in Bats Global Markets, Inc. 4th quarter 2015 results include a $19.8 million gain from the sales of investments, $16.2 million of writedowns primarily related to assets of businesses held for sale and $3.2 million of writedowns of investments

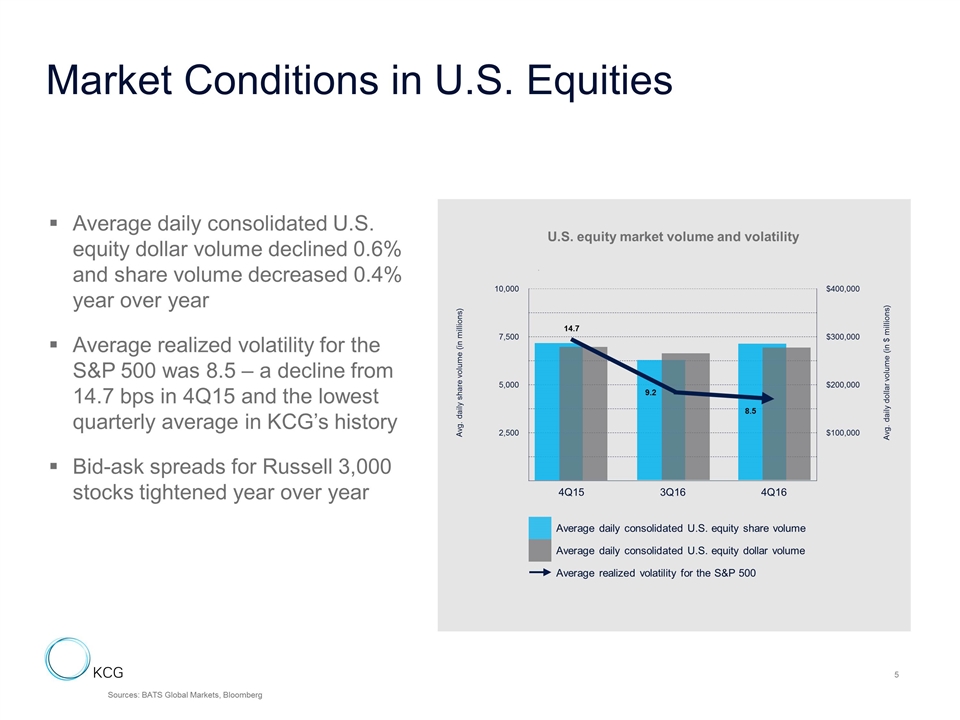

Market Conditions in U.S. Equities Average daily consolidated U.S. equity dollar volume declined 0.6% and share volume decreased 0.4% year over year Average realized volatility for the S&P 500 was 8.5 – a decline from 14.7 bps in 4Q15 and the lowest quarterly average in KCG’s history Bid-ask spreads for Russell 3,000 stocks tightened year over year Sources: BATS Global Markets, Bloomberg Average daily consolidated U.S. equity share volume Average daily consolidated U.S. equity dollar volume Average realized volatility for the S&P 500 U.S. equity market volume and volatility Avg. daily share volume (in millions) 10,000 2 $400,000 Avg. daily dollar volume (in $ millions) 7,500 $300,000 5,000 $200,000 2,500 $100,000 4Q15 3Q16 4Q16 14.7 9.2 8.5

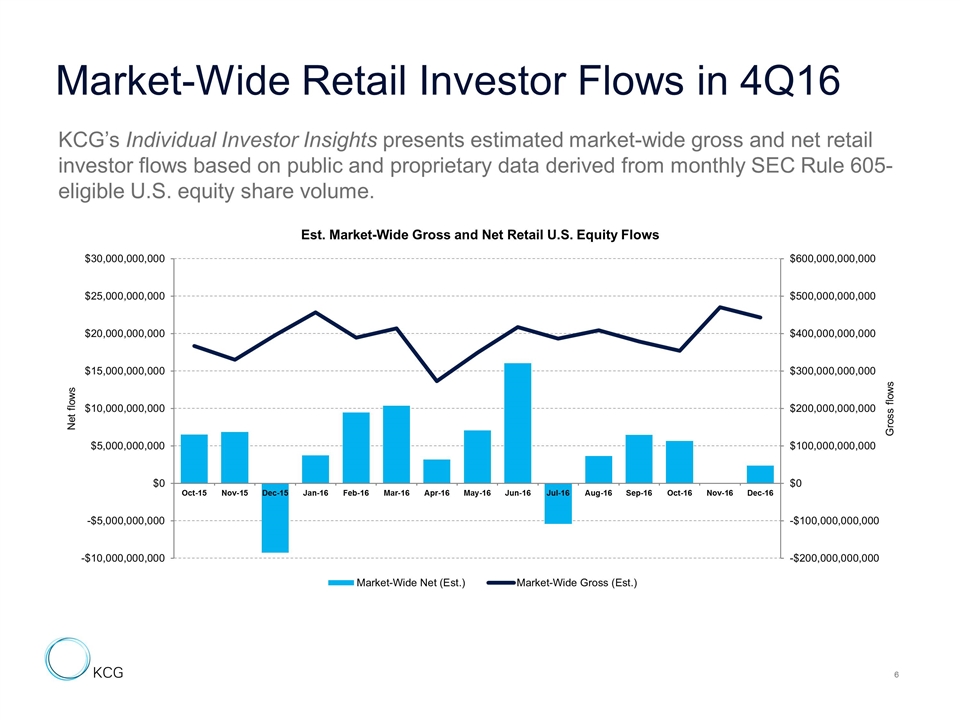

Market-Wide Retail Investor Flows in 4Q16 KCG’s Individual Investor Insights presents estimated market-wide gross and net retail investor flows based on public and proprietary data derived from monthly SEC Rule 605-eligible U.S. equity share volume.

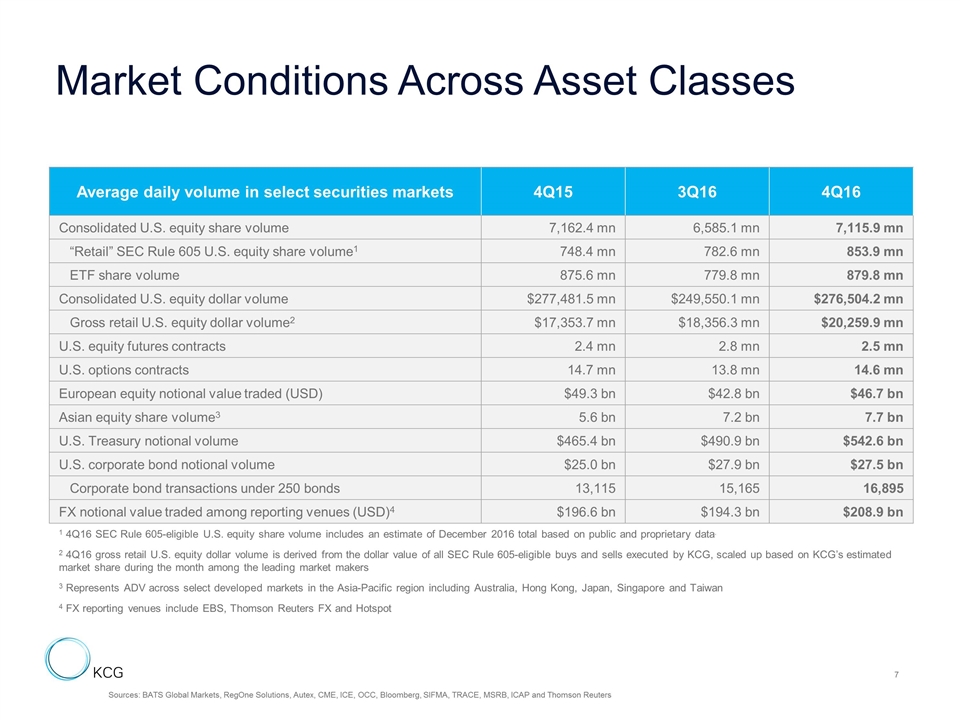

Market Conditions Across Asset Classes Average daily volume in select securities markets 4Q15 3Q16 4Q16 Consolidated U.S. equity share volume 7,162.4 mn 6,585.1 mn 7,115.9 mn “Retail” SEC Rule 605 U.S. equity share volume1 748.4 mn 782.6 mn 853.9 mn ETF share volume 875.6 mn 779.8 mn 879.8 mn Consolidated U.S. equity dollar volume $277,481.5 mn $249,550.1 mn $276,504.2 mn Gross retail U.S. equity dollar volume2 $17,353.7 mn $18,356.3 mn $20,259.9 mn U.S. equity futures contracts 2.4 mn 2.8 mn 2.5 mn U.S. options contracts 14.7 mn 13.8 mn 14.6 mn European equity notional value traded (USD) $49.3 bn $42.8 bn $46.7 bn Asian equity share volume3 5.6 bn 7.2 bn 7.7 bn U.S. Treasury notional volume $465.4 bn $490.9 bn $542.6 bn U.S. corporate bond notional volume $25.0 bn $27.9 bn $27.5 bn Corporate bond transactions under 250 bonds 13,115 15,165 16,895 FX notional value traded among reporting venues (USD)4 $196.6 bn $194.3 bn $208.9 bn 1 4Q16 SEC Rule 605-eligible U.S. equity share volume includes an estimate of December 2016 total based on public and proprietary data. 2 4Q16 gross retail U.S. equity dollar volume is derived from the dollar value of all SEC Rule 605-eligible buys and sells executed by KCG, scaled up based on KCG’s estimated market share during the month among the leading market makers 3 Represents ADV across select developed markets in the Asia-Pacific region including Australia, Hong Kong, Japan, Singapore and Taiwan 4 FX reporting venues include EBS, Thomson Reuters FX and Hotspot Sources: BATS Global Markets, RegOne Solutions, Autex, CME, ICE, OCC, Bloomberg, SIFMA, TRACE, MSRB, ICAP and Thomson Reuters

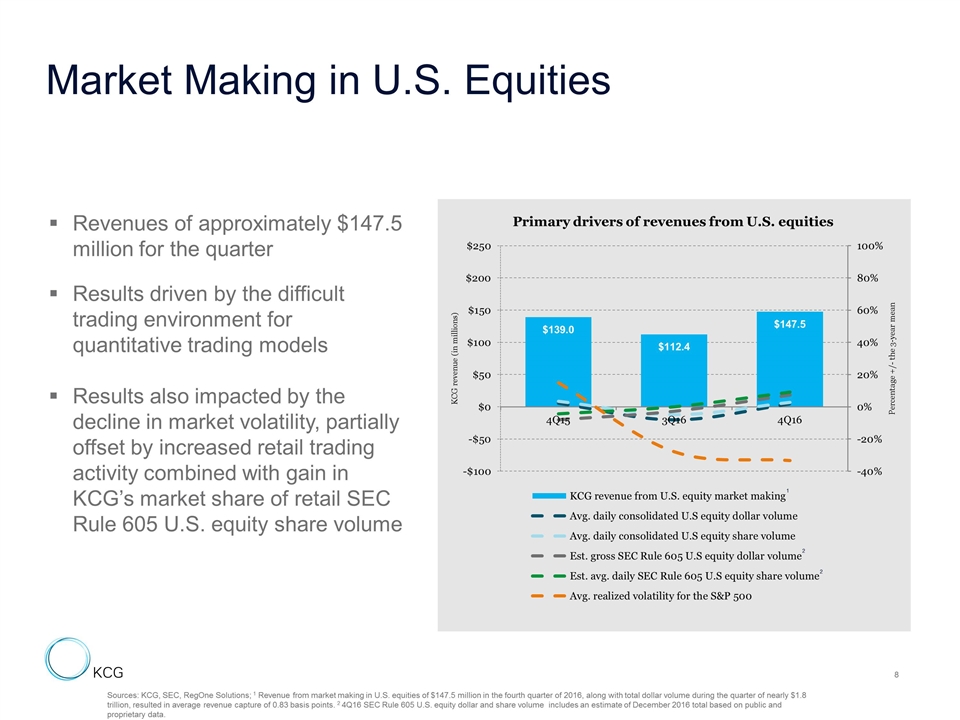

Market Making in U.S. Equities Sources: KCG, SEC, RegOne Solutions; 1 Revenue from market making in U.S. equities of $147.5 million in the fourth quarter of 2016, along with total dollar volume during the quarter of nearly $1.8 trillion, resulted in average revenue capture of 0.83 basis points. 2 4Q16 SEC Rule 605 U.S. equity dollar and share volume includes an estimate of December 2016 total based on public and proprietary data. Revenues of approximately $147.5 million for the quarter Results driven by the difficult trading environment for quantitative trading models Results also impacted by the decline in market volatility, partially offset by increased retail trading activity combined with gain in KCG’s market share of retail SEC Rule 605 U.S. equity share volume 1 2 2

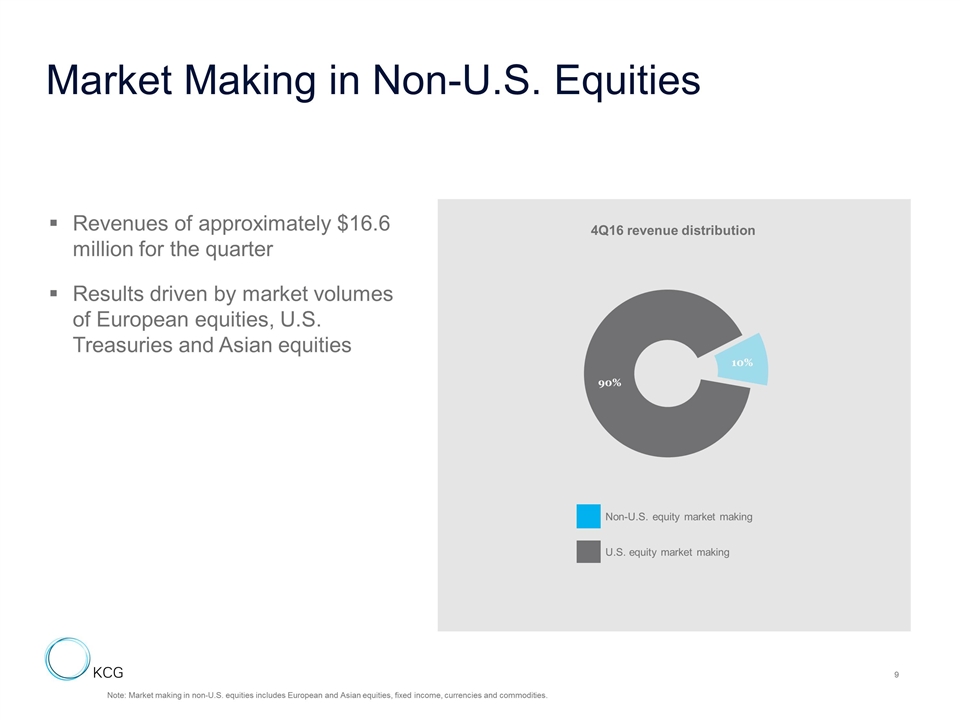

Market Making in Non-U.S. Equities Note: Market making in non-U.S. equities includes European and Asian equities, fixed income, currencies and commodities. Revenues of approximately $16.6 million for the quarter Results driven by market volumes of European equities, U.S. Treasuries and Asian equities Non-U.S. equity market making U.S. equity market making 4Q16 revenue distribution

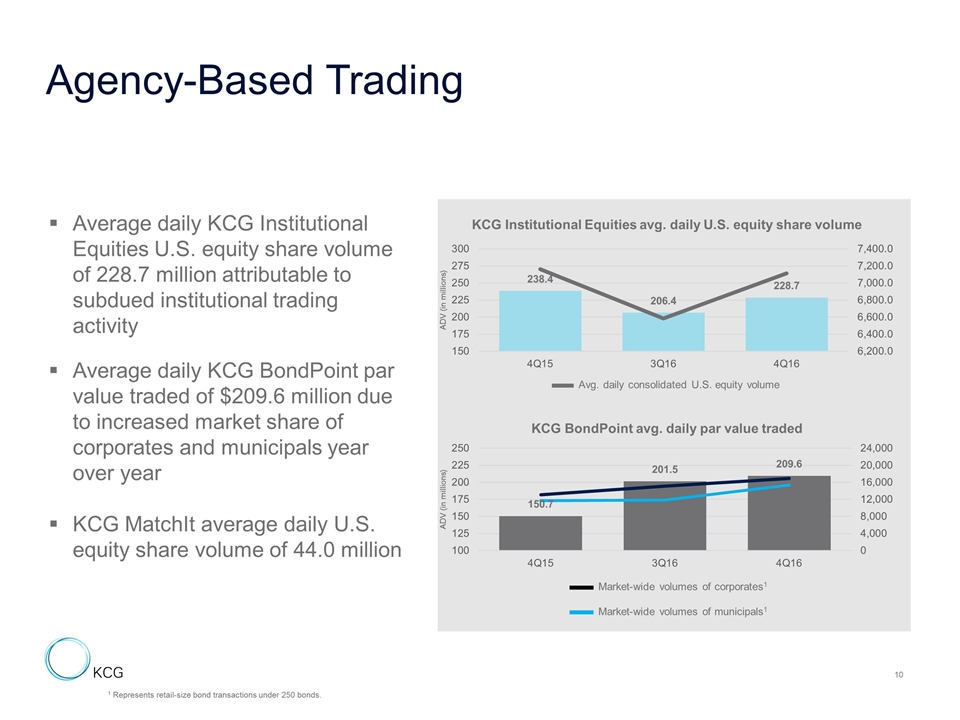

Agency-Based Trading Average daily KCG Institutional Equities U.S. equity share volume of 228.7 million attributable to subdued institutional trading activity Average daily KCG BondPoint par value traded of $209.6 million due to increased market share of corporates and municipals year over year KCG MatchIt average daily U.S. equity share volume of 44.0 million KCG Institutional Equities avg. daily U.S. equity share volume KCG BondPoint avg. daily par value traded Market-wide volumes of corporates1 Market-wide volumes of municipals1 Avg. daily consolidated U.S. equity volume 1 Represents retail-size bond transactions under 250 bonds.

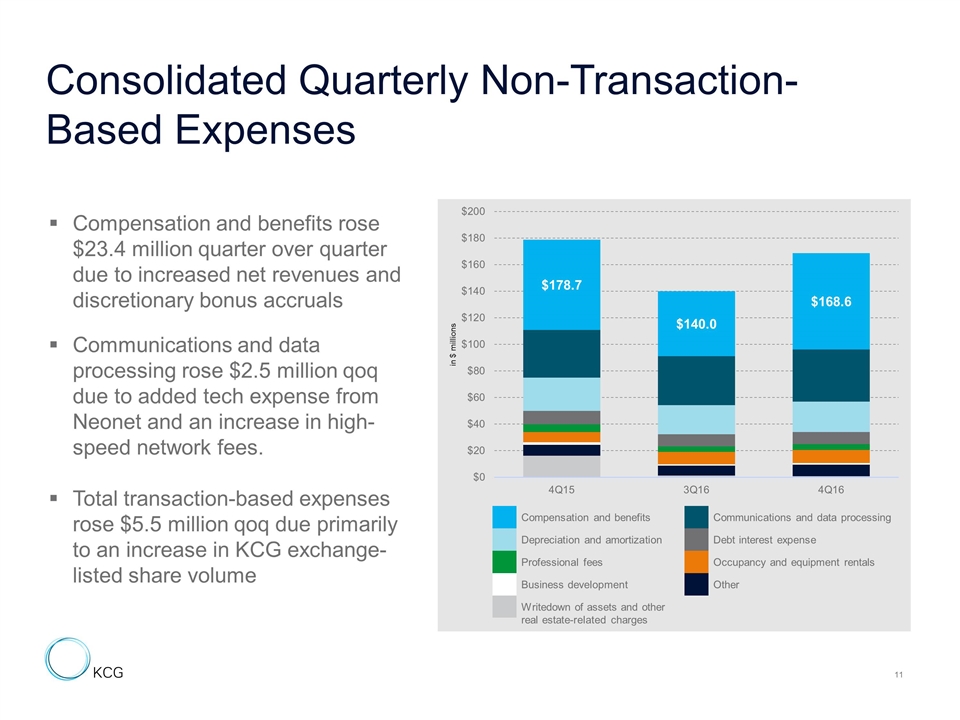

Consolidated Quarterly Non-Transaction-Based Expenses Compensation and benefits rose $23.4 million quarter over quarter due to increased net revenues and discretionary bonus accruals Communications and data processing rose $2.5 million qoq due to added tech expense from Neonet and an increase in high-speed network fees. Total transaction-based expenses rose $5.5 million qoq due primarily to an increase in KCG exchange-listed share volume Compensation and benefits Communications and data processing Depreciation and amortization Debt interest expense Professional fees Occupancy and equipment rentals Business development Other Writedown of assets and other real estate-related charges

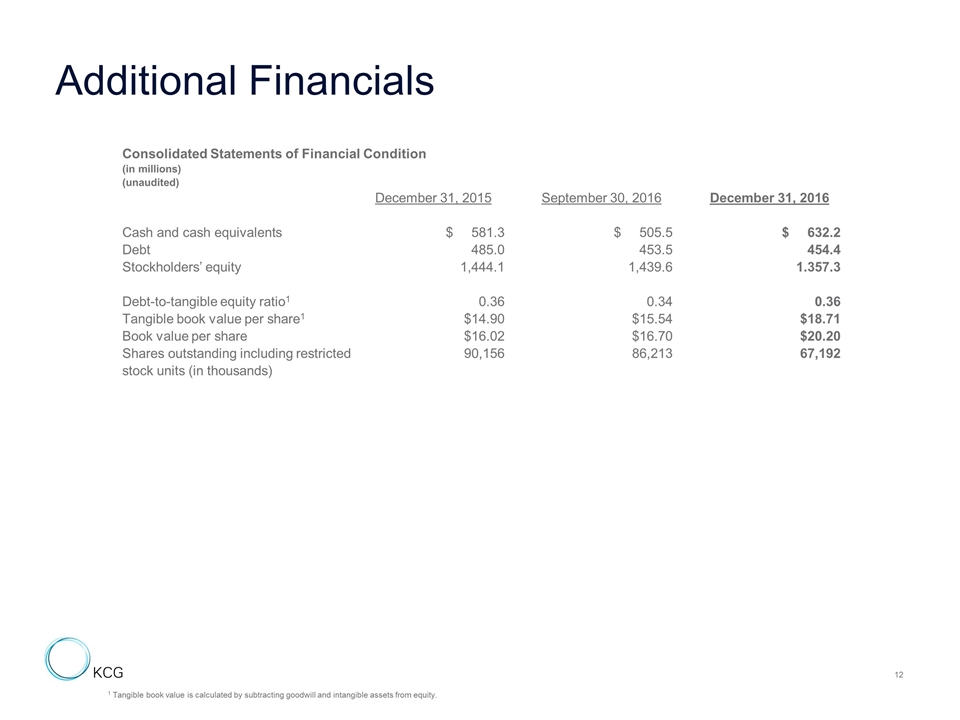

Additional Financials Consolidated Statements of Financial Condition (in millions) (unaudited) December 31, 2015 September 30, 2016 December 31, 2016 Cash and cash equivalents $ 581.3 $ 505.5 $ 632.2 Debt 485.0 453.5 454.4 Stockholders’ equity 1,444.1 1,439.6 1.357.3 Debt-to-tangible equity ratio1 0.36 0.34 0.36 Tangible book value per share1 $14.90 $15.54 $18.71 Book value per share $16.02 $16.70 $20.20 Shares outstanding including restricted 90,156 86,213 67,192 stock units (in thousands) 1 Tangible book value is calculated by subtracting goodwill and intangible assets from equity.