Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Staffing 360 Solutions, Inc. | staf-ex322_8.htm |

| EX-32.1 - EX-32.1 - Staffing 360 Solutions, Inc. | staf-ex321_7.htm |

| EX-31.2 - EX-31.2 - Staffing 360 Solutions, Inc. | staf-ex312_9.htm |

| EX-31.1 - EX-31.1 - Staffing 360 Solutions, Inc. | staf-ex311_6.htm |

| EX-10.2 - EX-10.2 - Staffing 360 Solutions, Inc. | staf-ex102_474.htm |

| EX-3.2 - EX-3.2 - Staffing 360 Solutions, Inc. | staf-ex32_475.htm |

| 10-Q - 10-Q - Staffing 360 Solutions, Inc. | staf-10q_20161130.htm |

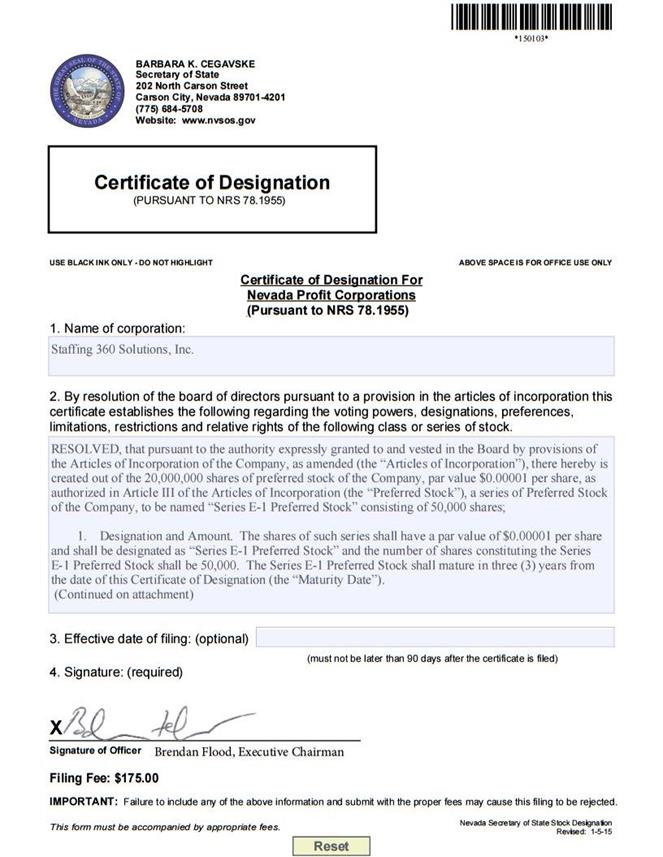

Exhibit 3.1

BARBARA K. CEGAVSKE Secretary of State 202 North Carson Street Carson City, Nevada 89701-4201 (775) 684-5708 Website: www.nvsos.gov Certificate of Designation (PURSUANT TO NRS 78.1955) USE BLACK INK ONLY - DO NOT HIGHLIGHT ABOVE SPACE IS FOR OFFICE USE ONLY Certificate of Designation For Nevada Profit Corporations (Pursuant to NRS 78.1955 1. Name of corporation: Staffing 360 Solutions, Inc. 2. By resolution of the board of directors pursuant to a provision in the articles of incorporation this certificate establishes the following regarding the voting powers, designations, preferences, limitations, restrictions and relative rights of the following class or series of stock. RESOLVED, that pursuant to the authority expressly granted to and vested in the Board by provisions of the Articles of Incorporation of the Company, as amended (the “Articles of Incorporation”), there hereby is created out of the 20,000,000 shares of preferred stock of the Company, par value $0.00001 per share, as authorized in Article III of the Articles of Incorporation (the “Preferred Stock”), a series of Preferred Stock of the Company, to be named “Series E-1 Preferred Stock” consisting of 50,000 shares; 1. Designation and Amount. The shares of such series shall have a par value of $0.00001 per share and shall be designated as “Series E-1 Preferred Stock” and the number of shares constituting the Series E-1 Preferred Stock shall be 50,000. The Series E-1 Preferred Stock shall mature in three (3) years from the date of this Certificate of Designation (the “Maturity Date”). (Continued on attachment) 3. Effective date of filing: (optional) (must not be later than 90 days after the certificate is filed) 4. Signature: (required) Brendan Flood, Signature of OfficerBrendan Flood, Executive Chairman Filing Fee: $175.00 IMPORTANT: Failure to include any of the above information and submit with the proper fees may cause this filing to be rejected. This form must be accompanied by appropriate fees. Nevada Secretary of State Stock Designation Revised: 1-5-15

1.1 Initial Purchase. Series E-1 Preferred Stock purchased on or prior to November 30, 2016 (the “Initial Purchased Stock”) shall have a stated value of $770.02 per share (the “Initial Stated Value”).

1.2 Second Purchase. Series E-1 Preferred Stock purchased on or after December 1, 2016 and purchased on or prior to December 21, 2016 (the “Secondary Purchased Stock”) shall have a stated value of $777.95 per share (the “Secondary Stated Value”).

1.3 Additional Purchase. Series E-1 Preferred Stock purchased on or after December 22, 2016 and purchased on or prior to January 31, 2017 (the “Additional Purchased Stock”) shall have a stated value of $793.83 per share (the “Stated Value”).

2. Payment and Rank.

2.1 Payment. The holders of the Series E-1 Preferred Stock (each a “Holder”) will be entitled to receive an original issue discount yielding eight percent (8%) of the Stated Value per annum, payable on the Maturity Date, prior to and in preference to any declaration or payment of any yield, discount or dividend on the common stock of the Company, par value $0.00001 per share (the “Common Stock”).

(a) The Initial Purchased Stock shall have an original issue discount equal to the Initial Stated Value plus $23.81 per share of Series E-1 Preferred Stock.

(b) The Secondary Purchased Stock shall have an original issue discount equal to the Secondary Stated Value plus $15.88 per share of Series E-1 Preferred Stock.

(c) The Additional Purchased Stock shall have an original issue discount equal to the Stated Value.

2.2 Rank. So long as any shares of Series E-1 Preferred Stock are outstanding, the Company shall not declare, pay or set apart for payment any yield, discount or dividend on any shares of Common Stock or classes and series of preferred securities of the Company which by their terms do not rank senior to the Series E-1 Preferred Stock (“Junior Stock”), unless at the time of such yield, discount or dividend the Company shall have paid all accrued and unpaid yields, discounts or dividends on the outstanding shares of Series E-1 Preferred Stock.

3. Redemption.

3.1 Redemption. Within thirty (30) days of November 9, 2019 (the “Redemption Date”), the Company shall redeem all of the shares of Series E-1 Preferred Stock (a “Redemption”) from each Holder for cash in the amount set forth in this Section 3.1. The redemption price paid to each Holder shall be e equal to one thousand dollars ($1,000) multiplied by the number of shares of Series E-1 Preferred Stock held by such Holder (the “Redemption Purchase Price”). On the Redemption Date, the Company shall confirm the number of shares of Series E-1 Preferred Stock held by each Holder as set forth on Annex A attached hereto.

3.2 No Impairment. The Company will not, through any reorganization, recapitalization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Company.

3.3 Transfer of Preferred Stock.

(i) Unless the Series E-1 Preferred Stock becomes listed or traded on a national securities exchange or on any market run by the OTC Markets Group, the Holder shall not, directly or indirectly, sell, give, assign, hypothecate, pledge, encumber, grant a security interest in or otherwise dispose of (whether by operation of law or otherwise) (each a “Transfer”) the Series E-1 Preferred Stock, in whole or in part, or any right, title or interest herein or hereto, except to the estate of the Holder upon death or to the administrator of the Holder upon complete disability and in accordance with the provisions of this Certificate of Designation. Any attempt to Transfer the Series E-1 Preferred Stock or any rights hereunder in violation of the preceding sentence shall be null and void ab initio and the Company shall not register any such Transfer. Upon the Transfer of the Series E-1 Preferred Stock, in whole or in part, through the use of an assignment form in a form reasonably satisfactory to the Company, and in accordance with applicable law or regulation, and the payment by the Holder of funds sufficient to pay any transfer tax, the Company shall issue and register the Series E-1 Preferred Stock in the name of the estate or administrator of the Holder. Notwithstanding any other provision of this Certificate of Designation, no Transfer may be made pursuant to this Section 3.3 unless (a) the Transfer complies in all respects with the applicable provisions of this Certificate of Designation and (b) the Transfer complies in all respects with applicable federal and state securities laws, including, without limitation, the Securities Act of 1933, as amended.

3.4 Acceleration of Redemption Upon Change in Control. Upon the consummation of any transaction resulting in a Change of Control of the Company, the Holders shall have the right to declare the Redemption Purchase Price due and payable immediately. A “Change of Control” means a consolidation or merger of the Company with or into another company or entity in which the Company is not the surviving entity or the sale of all or substantially all of the assets of the Company to another company or entity not controlled by the then existing stockholders of the Company in a transaction or series of transactions.

3.5 Event of Default. In the event that the Company does not pay the Redemption Purchase Price to the Holders within thirty (30) days following the Redemption Date, there shall be an event of default against the Company (“Event of Default”). If an Event of Default occurs, interest shall accrue on each share of Series E-1 Preferred Stock at a rate of eighteen percent (18%) per annum until paid.

4. Liquidation. In the event of a liquidation, dissolution or winding up of the Company, the Holders shall be entitled to receive out of the assets of the Company legally available for distribution, prior to and in preference to distributions to the holders of Common Stock or Junior Stock (other than the holders of Series A Preferred Stock or Series D Preferred Stock), and either in preference to or pari pasu with the holders of any other series of preferred stock that may be issued either (a) concurrently with the Series E-1 Preferred Stock or (b) in the future that is expressly made senior or pari pasu the Series E-1 Preferred Stock, as the case may be, an amount equal to the Stated Value of the Series E-1 Preferred Stock less any dividends previously paid out on the Series E-1 Preferred Stock. The remaining assets of the Company shall be distributed to the holders of the outstanding equity securities of the Company in accordance with their liquidation rights.

5. Conversion Rights. The Series E-1 Preferred Stock shall not be convertible into or exchangeable for shares of Common Stock or any other security currently outstanding or subsequently issued by the Company.

6. Voting Rights; Waiver of Dissenters’ Rights. Except as otherwise required by law, the Series E-1 Preferred Stock shall have no voting rights. Each Holder hereby irrevocably and unconditionally waives, and agrees not to exercise, asset or perfect, any rights of dissent and appraisal under Section 92A.380 of the Nevada Statutes to the extent such Holder is entitled to such rights under such Section 92A.380 in connection with any proposed reincorporation of the Company from the State of Nevada to the State of Delaware.

7. No Other Rights. Except as set forth in this Certificate of Designation, the Holders have no preemptive or preferential or other rights to purchase or subscribe to any stock, obligations, warrants or other securities of the Company.

8. Covenants of Company. The Company covenants and agrees that, so long any shares of Series E-1 Preferred Stock are outstanding, it will perform the obligations set forth in this Section 8:

8.1 Taxes and Levies. Except for the payment of taxes pursuant to payment plans or otherwise with governmental taxing authorities that would not, individually or in the aggregate, have or reasonably be expected to result in a material adverse effect on the Company, the Company will promptly pay and discharge all taxes, assessments, and governmental charges or levies imposed upon the Company or upon its income and profits, or upon any of its property, before the same shall become delinquent, as well as all claims for labor, materials and supplies which, if unpaid, might become a lien or charge upon such properties or any part thereof; provided, however, that the Company shall not be required to pay and discharge any such tax, assessment, charge, levy or claim so long as the validity thereof shall be contested in good faith by appropriate proceedings and the Company shall set aside on its books adequate reserves in accordance with GAAP with respect to any such tax, assessment, charge, levy or claim so contested;

8.2 Maintenance of Existence. The Company will do or cause to be done all things reasonably necessary to preserve and keep in full force and effect its corporate existence, rights and franchises and comply with all laws applicable to the Company, except where the failure to comply would not have a material adverse effect on the Company;

8.3 Maintenance of Property. The Company will at all times maintain, preserve, protect and keep its property used or useful in the conduct of its business in good repair, working order and condition, and from time to time make all needful and proper repairs, renewals, replacements and improvements thereto as shall be reasonably required in the conduct of its business;

8.4 Insurance. The Company will, to the extent necessary for the operation of its business, keep adequately insured by financially sound reputable insurers, all property of a character usually insured by similar corporations and carry such other insurance as is usually carried by similar corporations; and

8.5 Books and Records. The Company will at all times keep true and correct books, records and accounts reflecting all of its business affairs and transactions in accordance with GAAP.

8.6 Notice of Certain Events. The Company will give prompt written notice (with a description in reasonable detail) to the holders of Series E-1 Preferred Stock in the event the Company shall:

(a) become insolvent or generally fail or be unable to pay, or admit in writing its inability to pay, its debts as they become due;

(b) apply for, consent to, or acquiesce in, the appointment of a trustee, receiver, sequestrator or other custodian for the Company or any of its property, or make a general assignment for the benefit of creditors;

(c) in the absence of such application, consent or acquiesce in, permit or suffer to exist the appointment of a trustee, receiver, sequestrator or other custodian for the Company or for any part of its property; or

2

(d) permit or suffer to exist the commencement of any bankruptcy, reorganization, debt arrangement or other case or proceeding under any bankruptcy or insolvency law, or any dissolution, winding up or liquidation proceeding, in respect of the Company, and, if such case or proceeding is not commenced by the Company or converted to a voluntary case, such case or proceeding shall be consented to or acquiesced in by the Company or shall result in the entry of an order for relief.

9. Protective Provisions. So long as any shares of Series E-1 Preferred Stock are outstanding, the Company shall not alter or change the rights, preferences or privileges of the Series E-1 Preferred Stock, or increase the authorized number of shares of Series E-1 Preferred Stock without first obtaining the approval (by vote or written consent) of the holders of a majority of the issued and outstanding Series E-1 Preferred Stock. Notwithstanding the foregoing, each Holder hereby irrevocably and unconditionally waives, and agrees not to exercise, asset or perfect, any rights of dissent and appraisal under Section 92A.380 of the Nevada Statutes to the extent such Holder is entitled to such rights under such Section 92A.380 in connection with any proposed reincorporation of the Company from the State of Nevada to the State of Delaware.

10. Miscellaneous.

10.1 Uncertificated Shares. The Series E-1 Preferred Stock may be held in registered book-entry form or through an intermediary, in each case, as determined by the Board in its sole discretion.

10.2 Amendments in Writing. Except as otherwise provided herein, the provisions of the Series E-1 Preferred Stock may be amended and the Company may take any action herein prohibited, or omit to perform any act herein required to be performed by it, only if the Company has obtained the written consent of the Holders representing at least two-thirds of the outstanding Series E-1 Preferred Stock.

10.3 Mutilated, Lost, Stolen or Destroyed Certificate. In case the Series E-1 Preferred Stock certificate shall be mutilated, lost, stolen or destroyed, the Company shall issue and deliver in exchange and substitution for and upon cancellation of the mutilated certificate, or in lieu of and substitution for the certificate, mutilated, lost, stolen or destroyed, a new certificate of like tenor and representing an equivalent right or interest, but only upon receipt of evidence reasonably satisfactory to the Company of such loss, theft or destruction and an indemnity or bond, if requested, also reasonably satisfactory to it.

10.4 Notices. Notice to any Holder of the Series E-1 Preferred Stock shall be given to the registered address set forth in the Company’s records for such Holder. With respect to any notice to a Holder required to be provided herein, neither failure to mail such notice, nor any defect therein or in the mailing thereof, to any particular Holder shall affect the sufficiency of the notice or the validity of the proceedings referred to in such notice with respect to the other Holders or affect the legality or validity of any distribution, rights, warrant, reclassification, consolidation, merger, conveyance, transfer, dissolution, liquidation or winding-up, any other corporate action or the vote upon any such action. Any notice which was mailed in the manner herein provided shall be conclusively presumed to have been duly given whether or not the holder receives the notice.

10.5 Timing of Payments. Any payments required to be made hereunder on any day that is not a Business Day shall be made on the next succeeding Business Day without interest or additional payment for such delay. Unless otherwise stated herein, any actions required to be made hereunder on any day that is not a Business Day shall be taken on the next succeeding Business Day. As used herein, “Business Day” means a day other than Saturday, Sunday or any day on which banks located in the State of Nevada are authorized or obligated to close.

10.6 Lost Certificates. Upon receipt by the Company of evidence satisfactory to the Company of the loss, theft, destruction or mutilation of any preferred stock certificates representing the shares of Series E-1 Preferred Stock, and, in the case of loss, theft or destruction, of any indemnification undertaking by the holder to the Company and, in the case of mutilation, upon surrender and cancellation of the preferred stock certificate(s), the Company shall execute and deliver new preferred stock certificate(s) of like tenor and date.

10.7 Amendments. This Certificate of Designation may be amended with the approval of the Board of Directors and the consent of the holders of a majority of the then outstanding shares of the Series E-1 Preferred Stock.

10.8 Effectiveness. This Certificate of Designation shall become effective upon the filing thereof with the Secretary of State of the State of Nevada.

3

|

Name of Holder |

Number of Shares of Series E-1 Preferred Stock Held |

4