Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Rancho Santa Fe Mining, Inc. | rsfm1229form10kexh32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - Rancho Santa Fe Mining, Inc. | rsfm1229form10kexh32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - Rancho Santa Fe Mining, Inc. | rsfm1229form10kexh31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - Rancho Santa Fe Mining, Inc. | rsfm1229form10kexh31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended: September 30, 2016

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

RANCHO SANTA FE MINING, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 47-4674458 | |||

| (State or other jurisdiction of | (Commission | (I.R.S. Employer | ||

| incorporation or organization) | File Number) | Identification Number) |

500 N Rainbow Blvd, Suite 300

Las Vegas, NV 89107

(Address of principal executive offices, including zip code)

(858) 717-8090

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☑

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ☐ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ☐ | Accelerated Filer ☐ | |

| Non-Accelerated Filer ☐ | Smaller reporting company ☑ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

There was no active public trading market as of the last business day of the Company’s second fiscal quarter, so there was no aggregate market value of common stock held by non-affiliates.

As of January 12, 2017, the registrant had 31,576,000 shares of its common stock, par value $0.001, issued and outstanding.

Documents Incorporated By Reference: None.

RANCHO SANTA FE MINING, INC.

FOR THE FISCAL YEAR ENDED

SEPTEMBER 30,

2016

TABLE OF CONTENTS

| Page | ||

| PART I | ||

| Item 1. | Business. | 3 |

| Item 1A. | Risk Factors. | 9 |

| Item 1B. | Unresolved Staff Comments. | 16 |

| Item 2. | Properties. | 16 |

| Item 3. | Legal Proceedings. | 16 |

| Item 4. | Mine Safety Disclosures. | 16 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 17 |

| Item 6. | Selected Financial Data. | 18 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results Of Operations. | 18 |

| Item 7A. | Quantitative And Qualitative Disclosures About Market Risk. | 21 |

| Item 8. | Financial Statements and Supplementary Data. | 21 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. | 21 |

| Item 9A. | Controls and Procedures. | 21 |

| Item 9B. | Other Information. | 21 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance. | 22 |

| Item 11. | Executive Compensation. | 25 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 26 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 27 |

| Item 14. | Principal Accounting Fees and Services. | 27 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules. | 28 |

| 2 |

FORWARD LOOKING STATEMENTS

Included in this Form 10-K are “forward-looking” statements, as well as historical information. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that the expectations reflected in these forward-looking statements will prove to be correct. Our actual results could differ materially from those anticipated in forward-looking statements as a result of certain factors, including matters described in the section titled “Risk Factors.” Forward-looking statements include those that use forward-looking terminology, such as the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “project,” “plan,” “will,” “shall,” “should,” and similar expressions, including when used in the negative. Although we believe that the expectations reflected in these forward-looking statements are reasonable and achievable, these statements involve risks and uncertainties and we cannot assure you that actual results will be consistent with these forward-looking statements. We undertake no obligation to update or revise these forward-looking statements, whether to reflect events or circumstances after the date initially filed or published, to reflect the occurrence of unanticipated events or otherwise.

PART I

Item 1. Business.

Overview

Rancho Santa Fe Mining, Inc. (“Rancho”, “we” or the “Company). The Company was incorporated in the State of Nevada on July 24, 2015. We were incorporated and our business plan called for the Company to seek out and acquire various mining assets in the State of Nevada. We are a precious metals exploration and development Company with the objective of becoming a gold producer. The Company is currently focused on the advancement of its two principal projects: the Virginia and Vanity Fair patented claims.

On October 28, 2015, the Company entered into an Asset Purchase Agreement (the “Asset Purchase”) with Humboldt Mining Company, Inc., a Nevada corporation (“HMCI”). Pursuant to the Asset Purchase Agreement, the Company acquired 100% of the assets owned by HMCI, including, but not limited to: (i) all the real property, leasehold improvements, fixtures, furniture, machinery and equipment owned by the HMCI and relating to or used in HMCI’s operations; and, (ii) all inventory, including finished goods, raw materials and work in process as well as the right to receive inventory ordered by the HMCI for use in its operations; and, (iii) in addition to the foregoing, we acquired all the books and records of HMCI, as well as all intangible assets held, owned or controlled by HMCI (collectively, (i), (ii) and (iii) are referred to hereinafter as the “Acquired Assets”). As per the Asset Purchase we acquired various liabilities of HMCI, including: (i) the assumption of all liabilities arising out of any unfilled customer orders outstanding as of the date the Asset Purchase closed. The Company is entitled to any future payments relating to any payments made pursuant thereto; (ii) the assumption of obligations relating to a lawsuit and default judgment, including, but not limited to the obligation to pay attorneys’ fees of approximately $20,000.00, and, (iii) inherited HMCI’s reclamation liability, if any, as it is related to the property. There are no royalties due or owing on the purchased claims. The only amounts due are local property taxes, which are assessed annually.

In exchange for the Acquired Assets, the Company issued to the HMCI shareholders Thirteen Million Five Hundred Thousand (13,500,000) shares of the Company’s $0.001 par value common stock, which represented fifty (50%) percent of the Company’s issued and outstanding shares at the time of issuance.

The Company now owns land and the patented mining rights North of Elko, Nevada, nearby the formation known as the Carlin Trend. The Company’s property includes two patented claims – the Virginia and Vanity Fair patented claims - comprising what is known as the Prunty Mine Area (Vanity Fair, Virginia, 3871 Mining Survey Number). The 2 patented mining claims (Prunty Mine – Virginia and Vanity Fair Patents) total approximately 40 acres. The importance of these patented claims cannot be underestimated. We own the Patented Mining Claims and the mineral rights associated with the Patents have no expiration date, subject to property taxes being paid on the property.

Operationally, the Company intends to outsource fully 100% of the exploration, site preparation and extraction operations to a third party who provides all manpower, equipment and operational expenses associated therewith. Insomuch as this work will be outsourced and the Company income will be based on profits from the sale of gold recovered by the contractors received therefrom, the Company cannot speak to the outsourced expenditures related to exploration, site preparation and extraction.

| 3 |

As such, the proceeds will largely be utilized for payroll, outsourced consultants and asset maintenance and development. The Company plans to retain four full time staff and lease nominal executive office facilities in Nevada. All legal, accounting, shareholder relations and geology can be outsourced to consultants as needed. Business development is limited to developing and maintaining a website presence, and nominal travel and business entertainment expense. The primary additional operations entail asset development, which includes the maintenance of applicable permits and claim renewals, as well as the outsourced production of independent Reserve Reports annually.

The purpose of this exploration program is to identify a gold ore body. Geophysics (a magnetic survey and GIS compilation) was commissioned in the summer of 2011 by Humboldt Mining Company. The geophysical survey was completed in the field by Christopher McGee and interpreted by James Wright of Wright Geophysics. The data returned identified 2 anomalies on the Prunty patented claims. These anomalies that are the target of the current exploration program.

The exploration (drilling) will begin as soon as is feasible. First, the drill hole locations must be identified. The anomalies have been identified by the geophysical survey completed in 2011.

On the blow up of the 1:24,000 topo map, a 4WD drive road is marked coming up the back (north - west) side of the Prunty ridge from Union Gulch to the north. At present, there is no assurance that the USFS (United States Forest Service) would allow its use. If this road can be used for drill access, the drilling could begin as soon as the USFS approves its use. The target is on patented claims surrounded by Forest Service lands with a permitted access road up the front (south) side to the historic Prunty mine area, after fording the creek.

No drilling can begin until water drops in the creek (If 76 Creek is to be forded), which, at the earliest, would be late summer into the fall. The creek needs to be forded and an access road to the proposed drill sites may need to be constructed on patented lands from the mine site. The corners of the patented claims would be marked by Carlin Trend Mining services.

Initial drilling would be completed by a buggy or track mounted RC drill. A fence would be drilled across each of the anomalies (there are 2 total) with angle drill holes. At least one of the anomalies would be drilled as time permits. The depth of each drill hole would be no deeper than about 700 feet and the angle would be no shallower than -55.

At this point in time, we do not know how many holes would be needed, but based on the map, we expect about 8 to 12 drill holes in the 1st phase if both anomalies are drilled. Following phases would likely be core drill holes and possibly deeper. If anything is found, the hole likely would need to be twinned by a core hole. Whether or not a 2nd phase can be completed before winter sets in, is weather dependent. The assay results need to be in hand and evaluated. ALS Chemex in Elko, Nevada would be used for assaying.

As discussed, an access road to the drill site would likely need to be constructed to the drill sites from the historic Prunty mine site. All of this would be on parented lands and of less than 5 acres’ total disturbance. The NDEP has told me that no specific permit is required for this level of disturbance. Filing a Small Miner's notice would be sufficient. A reclamation bond may need to be posted to NDEP and the USFS would need to be notified, however.

Initial funding will mark the beginning of the development of the initial drill site. Further exploration phases will be conducted as needed in the following year. This further exploration may include opening of the Prunty mine. This decision will be made upon successful completion of the initial phases.

The best estimate is that a minimum of approximately USD 350,000 to a maximum of USD 900,000 would be needed to adequately fund the projects as envisioned. However, the following Drill Budget is a preliminary estimate of potential costs associate with the drilling program:

| DRILL BUDGET 2017 | ||||||||||||||||||||

| Unit | Price | Quantity | Amount | |||||||||||||||||

| 1 | Mobilize Drill Rig | $ | 7,500.00 | |||||||||||||||||

| 2 | Drilling | FT | $ | 17.50 | 9800 | $ | 171,500.00 | |||||||||||||

| 3 | Install temporary surface casing 20 ft | FT | $ | 95.00 | 280 | $ | 26,600.00 | |||||||||||||

| 4 | Drilling, Pulling Casing, Moving etc. | Hr | $ | 300.00 | 14 | $ | 4,200.00 | |||||||||||||

| 5 | Standby, surveying | HR | $ | 300.00 | 14 | $ | 4,200.00 | |||||||||||||

| 6 | Per Diem (3 men) | DAY | $ | 300.00 | 30 | $ | 9,000.00 | |||||||||||||

| 7 | Travel Time | DAY | $ | 250.00 | 30 | $ | 7,500.00 | |||||||||||||

| 8 | Backhoe | WK | $ | 1,200.00 | 4 | $ | 4,800.00 | |||||||||||||

| 9 | Backhoe (operating Rate) | HR | $ | 70.00 | — | |||||||||||||||

| 10 | Water Truck - Service Vehicle | WK | $ | 1,200.00 | 4 | $ | 4,800.00 | |||||||||||||

| 11 | Water Truck - Service Vehicle (operating Rate) | HR | $ | 80.00 | 60 | $ | 48,000.00 | |||||||||||||

| 12 | Fuel | DAY | $ | 750.00 | 30 | $ | 22,500.00 | |||||||||||||

| 13 | Demobilize Drill Rig | $ | 7,500.00 | |||||||||||||||||

| 14 | Survey Drill Hole | EA | $ | 1,000.00 | 14 | $ | 14,000.00 | |||||||||||||

| 14 | Estimated Sub-Total Drilling | $ | 332,100.00 | |||||||||||||||||

| 15 | Contingencies 20% | $ | 66,420.00 | |||||||||||||||||

| 16 | Estimated Grand Total Drilling | $ | 398,520.00 | |||||||||||||||||

| 17 | Drill Road Construction | $ | 9,000.00 | |||||||||||||||||

| 18 | ALS Minerals Sample Code Dry-21 | EA | $ | 2.64 | 2400 | $ | 6,336.00 | |||||||||||||

| 19 | ALS Minerals Sample Code Prep-31 | EA | $ | 7.35 | 2400 | $ | 17,640.00 | |||||||||||||

| 20 | ALS Minerals Sample Code AU-AA23 | EA | $ | 14.42 | 2400 | $ | 34,608.00 | |||||||||||||

| 21 | ALS Minerals Sample Code ME-ICP41 | EA | $ | 10.00 | 2400 | $ | 24,000.00 | |||||||||||||

| 22 | ALS Contingency (15%) | $ | 12,000.00 | |||||||||||||||||

| 23 | ALS Minerals Grand Total | $ | 82,584.00 | |||||||||||||||||

| 24 | Geologist - Logging, mapping, etc. | DAY | $ | 400.00 | 30 | $ | 12,000.00 | |||||||||||||

| 25 | Overhead, Supervision | $ | 25,000.00 | |||||||||||||||||

| GRAND TOTAL: | $ | 527,104.00 | ||||||||||||||||||

The proposed exploration work will be completed by Paul A. Pelke, Certified Professional Geologist No. 11461. Please see resume attached.

There are no specific permit requirements if the disturbance is less than 5 acres and on private land. The United States Forest Service (USFS) needs to be informed and the Nevada Department of Environmental Protection (NDEP) Reclamation division has no requirements for such a level of disturbance. The NDEP would like a Small Miner's Permit filed so they know what is happening. The NDEP's Division of Reclamation may pay a visit to the site. On unpatented claims, the USFS needs a Plan of Operation (POO) filed and bonding posted for any level of disturbance. Even in designated road less areas, historic old roads can be used, especially with low impact vehicles. This is decided on a case-by-case basis, and only when a POO is filed. The USFS has a spreadsheet for determining the level of bonding required.

| 4 |

Asset Analysis

Background

In 1912, Dr. Pinkard Prunty purchased 1,200 acres of Nevada wilderness from the then future President of the United States, Herbert Hoover. Gold was discovered on the land soon after. Dr. Prunty immediately employed day workers with pick axes to begin extraction, and over the next decades purchased an additional 120,000 acres with his gold revenues. After his death, the property passed to his children, who continued to successfully mine gold on the property with pick-axes. In 1979, family member Charles Leavitt reviewed the mine’s books and uncovered the fact that revenues had been mishandled. This lead to a dispute and the family closing of the mine in 1980.

In 1997, David Leavitt, inherited the land and the associated patented mining claims on the property. Leavitt was the Chairman of Humboldt Mining Company, Inc.

Management believes there is persuasive evidence the geological structure of the area is potentially on a major mineralized zone, perhaps part of the Carlin Trend.

Based on management’s experience and all available documentation, we believe we have a “Carlin-type deposit”. This type of deposit possess what geologists call “disseminated gold.” It generally takes a microscope to see the gold in such deposits. In such deposits, the grade may be low but they make up for low-grade in high-volume. To extract gold from such low-grade deposits, miners crush tons of rock, which is piled into heaps and irrigated with cyanide, an industrial-scale mining technique that was actually pioneered at the Carlin Trend. As the gold price shot up at the end of the 1970s, mining companies rushed to look for similar deposits around the world - just as the Prunty family’s lands were closed in a family dispute.

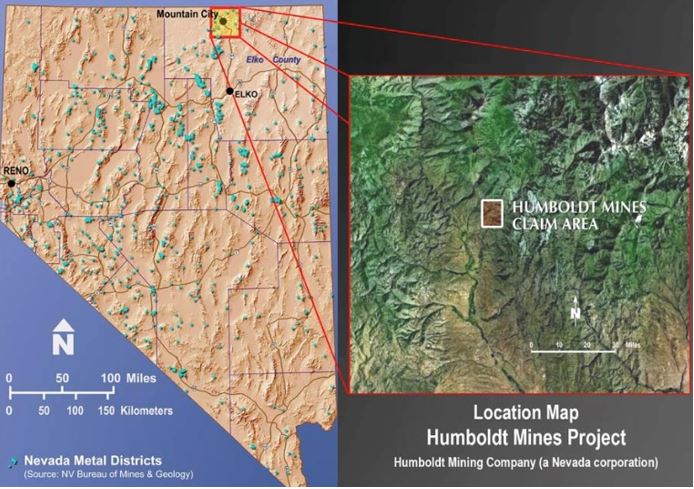

The claims are located on private land in Elko County in Sections 13, 14, 23, and 24, Township 44 North, Range 57 East, Mount Diablo Baseline and Meridian, approximately 63 miles north of the town of Elko. The site can be accessed by traveling east on Interstate-80 to exit 333, turning north and then immediately taking the frontage road east. After approximately 1.25 miles, turn north on Charleston-Deeth Road. After approximately 41 miles, turn right onto county road NF-062 (Jarbidge-Charleston County Road - County Road 748), continuing for approximately 9 miles. Turn left onto the unnamed dirt road, ford 76 Creek and continue approximately 0.5 mile to the mine site.

The sedimentary units seen in the mine area are referred to as shales and limestones instead of their actual metamorphic counterparts. Limestones are Devonian. Pilot shale and Joana limestone are Pennsylvanian in age. Near the margins of the intrusive, the sediments have all been metamorphosed. The granodiorite plug is the oldest igneous unit on the property and is probably Jurassic in age. The intrusive is elongate to the northwest, parallel to the trace of the range-front fault. Along the southern edge of the intrusive in the Prunty mining area is a series of diabase dikes. It appears the Prunty mine was actually developed on this dike. The dike is composed mainly of plagioclase, chloritized hornblend and biotite. Volcanic rocks on the property area are all of the Jarbidge rhyolite formation. Mineralization is hosted in relatively narrow (four [4] to six [6] feet wide) quartz veins that dip at approximately 45 degrees.

The only work completed to date is the drilling described in the report "The Humboldt Mines Project, Elko County, Nevada" dated March 2, 2012, and there are, at present, no improvements or equipment on site. There is no equipment, infrastructure or other facilities on site. The nearest places to stay are Wild Horse Reservoir, Elko County Nevada, Owyhee, Idaho or Elko, Nevada. For the geophysical survey, the field operations were based out of Owyhee, Idaho. Once necessary, power will be sourced from diesel power and diesel powered generators if needed. The water will be obtained from the Black Warrior mine if accessible. If a USFS Permit is obtained, water can be obtained from 76 Creek. If this cannot be obtained, there are private wells in the town of Charleston, which is less than 5 miles from the project.

The property has no known reserves and the proposed program is exploratory in nature.

| 5 |

Map of the Mining Claims

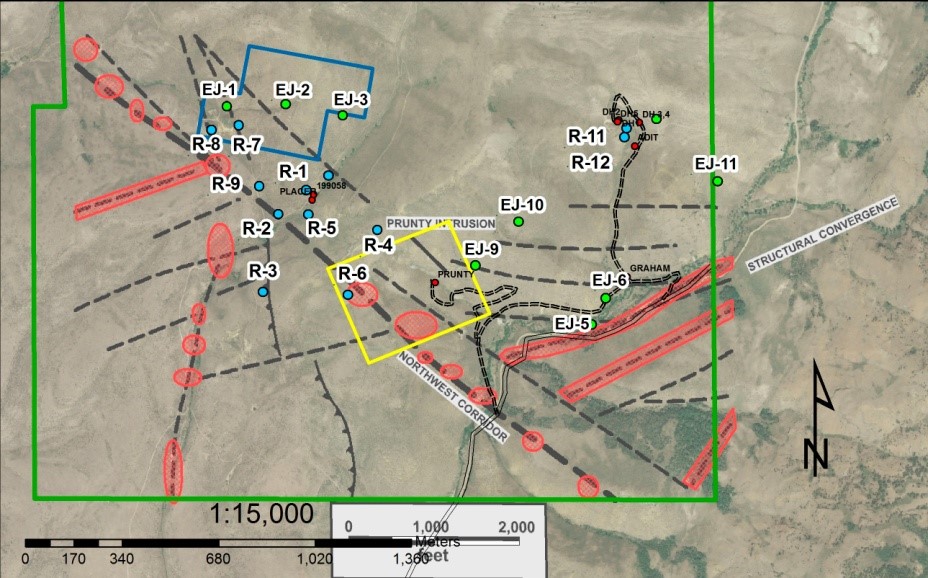

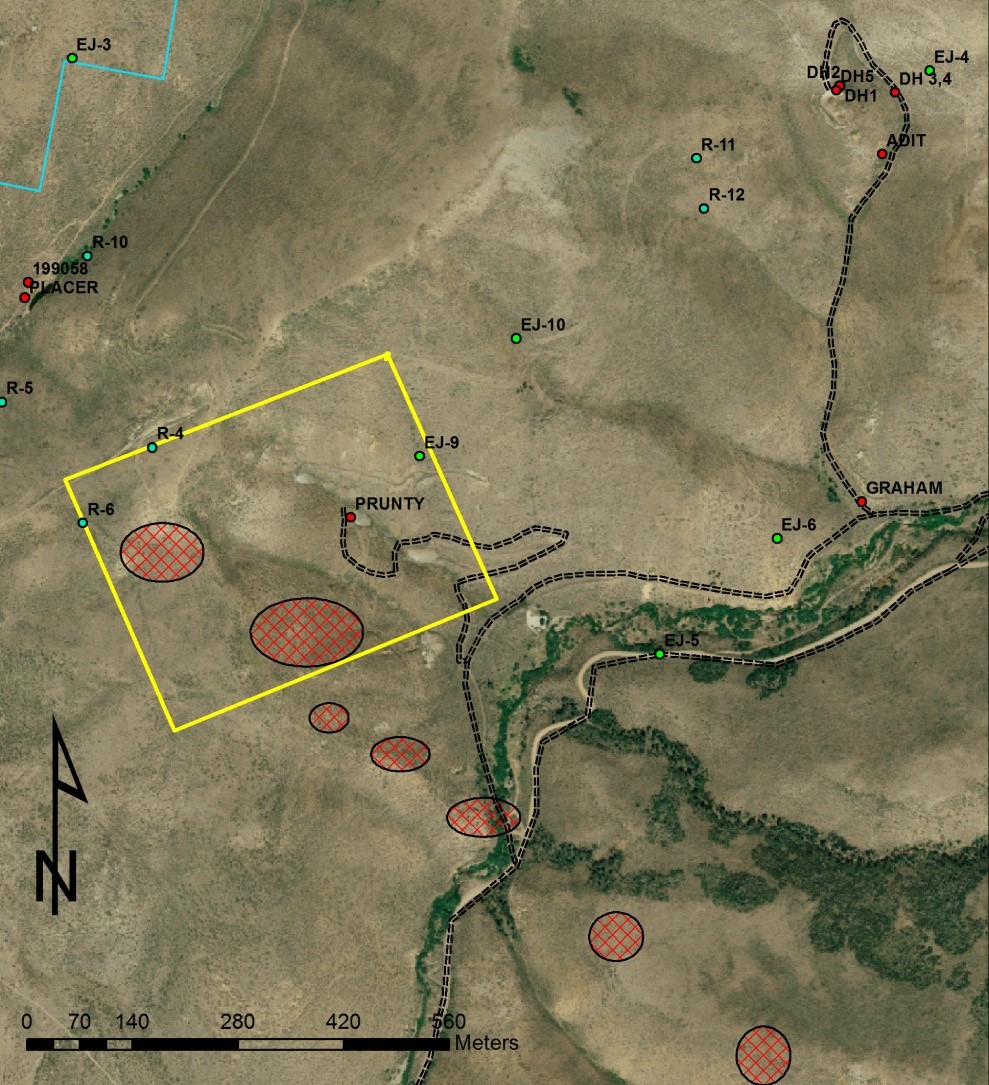

The above map indicates that the area enclosed in the yellow box represents the Virginia and Vanity Fair Patented Claims held by the Company. These lie along the broader “Northwest Corridor”.

Pelke Technical Evaluation Report

In addition to his September 2015 opinion letter, in August, 2011, Paul Pelke was retained as a consulting geologist to prepare a technical evaluation report (hereinafter referred to as the “Pelke Report”) on the Humboldt Mines Project in northern Elko County, Nevada. The Pelke Report was completed February 24, 2012 and details the assets, locations, geology, production and exploration history of the Company’s patented lands. The key findings of the Pelke Report are summarized below.

The property has been drilled three times; in 1984, 1986 and 2010. Mr. Pelke collected 2 samples from various locations on the property and subsequently for analysis by the ALS Chemex analytical laboratory in Reno, Nevada. These returned gold traces between 0.028 ppm (parts-per-million) and 32.4ppm. A concentration of 34.2857 ppm is 1.0 OPT. All samples have been taken in a 7" x 12.5" poly-propylene sample bag. It is well known that a full sample bag of that size weighs between 7 and 8 pounds and that is the weight of each grab sample taken.

During the early summer of 2011, Humboldt Mining commissioned a ground magnetic survey of the Claim Group. Magee Geophysical Services of Reno, Nevada, carried out the survey and Wright Geophysics of Spring Creek, Nevada, completed the interpretation. Based on this data, Wright Geophysics produced two maps showing Areas of Interest (AOI). The ground magnetic survey delineates what is interpreted as a heavily intruded sedimentary terrain dominated by two primary structural orientations. Most prominent among the structures is a Northwest Corridor traversing the entire project area for 2 kilometers. This zone should be considered to be a principal target area. Wright interprets the corridor to be composed of one large continuous structure as well as several smaller parallel structures to the northeast.

At this time, the Company has performed no verification work of its own. The drilling and geophysics discussed above was completed in 2012. Both the drilling and the Ground Magnetic Survey and GIS Compilation were completed to industry standards.

The Pelke Report recommends initial work should be done in the Prunty Mine area. The quartz with sulfides recovered returned values of 32.4 ppm (about 1.0 OPT). Consequently, it may be possible to develop underground vein deposit. In addition, the Prunty Patented Claims cover the most important parts of the Northwest Corridor based on Areas of Interest (AOI) identified by Wright Geophysics.

Exploration Work: Prunty Claims Virginia and Vanity Fair Patents

When Pelke arrived on the claim group, the initial work that was showed consisted of three areas: the Prunty Mine itself and the Cleveland and Manhattan Patents area.

Samples 199056 and 199057 were grab samples taken from the Prunty Dump. The mine itself was not accessible because the portal was caved. 199056 was a grab sample of a quartz fraction which contained visible sulfides. The sulfides included pyrite, chalcopyrite and possible arsenopyrite. 199057 was a grab sample of the dark fraction which appeared to be a fine grained mafic intrusive with possible disseminated sulfides. 199056 (Quartz fraction) returned 32.4 ppm Au (which is equivalent to just over 1 ounce of Au per metric ton), while 199057 (mafic intrusive) returned 0.028 ppm Au. The sample locations can be found on Figure 5 at the point labeled “PRUNTY”. (Figure 5 attached).

Sample results are given in “Table of Detailed Sample Results” which was prepared by ALS Chemex in Reno, Nevada. The weights are given along with the results.

Later, after the area was run for ground magnetics by Magee Geophysics of Reno, Nevada, and interpreted by Wright Geophysics of Elko, Nevada.

The patented Prunty Claims present a very interesting target area (Figures 5, 6, 8 and 9). Not only does the high grade Prunty Mine lie on this patented ground but also the intrusive interpreted to be present by Wright as well as the portion of the Northwest Corridor that has several of the largest and most important AOI's as defined by Wright 2011.

The yellow box outlines the Virginia and Vanity Fair Patented Claims. The red hachured areas represent Areas of Interest (AOI) as defined by Wright Geophysics (2011). The mapped road shows access to the Prunty Patents, which is already permitted by the USFS.

| 6 |

The ground magnetic survey delineates what is interpreted as a heavily intruded sedimentary terrain dominated by two primary structural orientations. Most prominent among the structures is a Northwest Corridor traversing the entire project area for 2 kilometers. Diabase dikes, which have been noted to be associated with mineralization at the Prunty Mine, are interpreted along the entire length of the Northwest Corridor (Wright, 2011). Consequently, this zone which was defined by Wright Geophysics, should be considered to be the principal target area. Wright interprets the corridor to be composed of one large continuous structure as well as several smaller parallel structures to the northeast. The Prunty is located within this corridor, and have the best geophysical anomalies in the entire area.

Figure 5 – 2010 Drill Hole and Sample Locations

Figure 6 – Interpretation with Residual Magnetics

(After Wright, 2011)

Figure 8 – AOI’s over NAIP Aerial Photography

(After Wright, 2011)

Figure 9 - Prunty Area Enlarged

RECOMMENDATIONS

It is recommended that the initial work be done in the Prunty Mine area. The quartz with sulfides recovered from the dump returned Au values of 32.4 ppm Au. This amounts to approximately 1 ounce per metric ton (tonne). Consequently it may be possible to develop a high grade underground vein deposit. In addition the Prunty Patented Claims also cover one of the most important parts of the Northwest Corridor (Figure 9), based on the size of the AOI's identified by Wright Geophysics(2011).

Since this is Patented land (Private) no direct US Forest Service approval is needed to begin work. The USFS is interested in work completed on Patented Lands in so far as it impacts adjoining USFS Lands. Apparently, Humboldt Mining Company already has approval from the Forest Service to rehabilitate the access road located on the unpatented surrounding ground up the hill to the Prunty Mine portal area.

The Humboldt Mining Company (and its successor Rancho Santa Fe Mining Inc.) has been in contact with the Nevada Department of Environmental Protection (NDEP). Rock and water samples have been submitted to an approved environmental laboratory for analysis. The sample results raised no obvious red flags and a waste water discharge permit should be approved within the standard time frame, i.e., about 5 to 6 months.

| 7 |

Since the Virginia and Vanity Fair is private land, roads can then be constructed to access drill sites on the principal Northwest Corridor structure. There generally is no close monitoring by the NDEP (Nevada Department of Environmental Protection) but a plan does need to be filed.

The Humboldt Mining Company (and its successor Rancho Santa Fe Mining Inc.) has been in contact with the Nevada Department of Environmental Protection (NDEP). Rock and water samples have been submitted to an approved environmental laboratory for analysis. The sample results raised no obvious red flags and a waste water discharge permit should be approved within the standard time frame, i.e., about 5 to 6 months.

Since the Virginia and Vanity Fair is private land, roads can then be constructed to access drill sites on the principal Northwest Corridor structure. There generally is no close monitoring by the NDEP (Nevada Department of Environmental Protection) but a plan does need to be filed.

If the Prunty Mine were reopened and rehabilitated, underground drilling can be considered for use in trying to define other high grade veins. Underground drilling may prove to be less expensive and more efficient in locating extensions of and/or parallel structures to the Prunty than by drilling from the surface.

Table of Detailed Sample Results

| ROCK SAMPLES | ||||||||||||||||||||||||||||||||||||||

| WEI-21 | Au-AA23 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ||||||||||||||||||||||||||||||

| Sample | Recvd Wt. | Au | Ag | Al | As | Ba | Bi | Ca | Co | |||||||||||||||||||||||||||||

| Description | kg | ppm | ppm | % | ppm | ppm | ppm | % | ppm | |||||||||||||||||||||||||||||

| 199056 | 2 | 32.4 | 62.3 | 0.11 | >10000 | 10 | 655 | 3.9 | 13 | |||||||||||||||||||||||||||||

| 199057 | 1.48 | 0.028 | 0.2 | 1.96 | 52 | 290 | 3 | 1.56 | 18 | |||||||||||||||||||||||||||||

| Sample | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ||||||||||||||||||||||||||||||

| Description | Cr | Cu | Fe | Ga | La | Mg | Mn | Mo | ||||||||||||||||||||||||||||||

| 199056 | ppm | ppm | % | ppm | ppm | % | ppm | ppm | ||||||||||||||||||||||||||||||

| 199057 | 9 | 3930 | 2.88 | <10 | <10 | 0.08 | 348 | <1 | ||||||||||||||||||||||||||||||

| 155 | 100 | 2.73 | 10 | 10 | 2.15 | 303 | 1 | |||||||||||||||||||||||||||||||

| Sample | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ||||||||||||||||||||||||||||||

| Description | Na | Ni | P | Pb | S | Sb | Sc | Sr | ||||||||||||||||||||||||||||||

| % | ppm | ppm | ppm | % | ppm | ppm | ppm | |||||||||||||||||||||||||||||||

| 199056 | <0.01 | 14 | 60 | 1570 | 2.35 | 3310 | 1 | 42 | ||||||||||||||||||||||||||||||

| 199057 | 0.14 | 100 | 950 | 4 | 0.07 | 22 | 6 | 76 | ||||||||||||||||||||||||||||||

| Sample | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | ME-ICP41 | |||||||||||||||||||||||||||||||

| Description | Th | Ti | Tl | U | V | W | Zn | |||||||||||||||||||||||||||||||

| ppm | % | ppm | ppm | ppm | ppm | ppm | ||||||||||||||||||||||||||||||||

| 199056 | <20 | <0.01 | <10 | <10 | 1 | <10 | 2710 | |||||||||||||||||||||||||||||||

| 199057 | <20 | 0.17 | <10 | <10 | 89 | <10 | 45 | |||||||||||||||||||||||||||||||

Mining Technique: Cyanide Heap Leaching

The geology of the Company’s assets dictates the Company use of Cyanide Heap Leaching similar to the mining techniques pioneered and used at the nearby Carlin Trend. More than 90% of all gold extracted worldwide relies upon the use of cyanide. Of the 1.1 million tons of hydrogen cyanide (HCN) produced annually, only 6% is for use in the mining industry. The remaining 94% is used to produce a wide variety of products such as adhesives, computer electronics, fire retardants and nylon.

In heap leaching, a cyanide solution is dripped or sprayed onto heaps of crushed ore that is placed over impervious liners. The cyanide solution dissolves minute particles of gold and silver in the ore to form a water-soluble compound. The resulting solution containing the metals in this form is collected and processed to extract the gold and silver for further refining. The remaining cyanide solution is then recycled and reused for extraction.

Mine operators have stringent safety practices to minimize risks to workers, the environment, and communities. These include strict workplace safety measures, employee training programs and emergency response plans to prepare workers to respond quickly to exposure to cyanide or spillage. To prevent any release to the environment, mines integrate protective measures such as constructing liquid containment areas around tanks, utilizing impervious liners beneath leach pads and ponds, and installing leak detection and collection systems.

| 8 |

Nevada has over 100 active cyanide leach operations. Nevada's Water Pollution Control Law has cyanide performance standards for groundwater. Guidelines specific to cyanide operations for closure and reclamation are outlined in the Nevada Department of Environmental Protection's (DEP) "Evaluations for Closure". All mining permits require stabilization of tailings and spent ore during closure. Closure is considered complete when the facility and mined areas have been stabilized and no longer have the potential to degrade waters of the state. Reclamation standards are site-specific. No design standards are prescribed in the Nevada law. The Nevada Department of Wildlife has a permit program for industrial ponds, including tailings impoundments and all cyanide process ponds.

In order to get a viable feasibility study, the Company needs to have a metallurgical test run on the potential ores from the property. This is a must in order to define an economic reserve and will determine whether or not the potential ore in question is amenable or not to heap leaching or milling. The testing will be done by a reputable and certified laboratory, such as McClelland Labs in Reno, Nevada. The amount of material will be determined by the laboratory (usually tons).

The Company intends to maintain quality assurance/quality control protocols, including when preparing samples, ensuring proper custody, assay precision and accuracy as we implement our exploration plans. There are three aspects to a proper QA/QC program: Blanks, Duplicates and CRM or Certified Reference Material.

BLANKS: Blank material can be purchased from a local supplier, which consist of crushed concrete blocks. These have been assayed and have statistics on the results. Alternatively, one can purchase decorative cobbles (usually marble) from a local hardware store. The idea is to put the reference blanks through the process of crushing and pulverization in the same manner as the gold bearing material. Proper cleaning of the crusher-pulverizer between gold bearing samples is essential due to the possibility of gold smearing inside this equipment, especially from higher-grade samples.

DUPLICATES. It is easy and straightforward to produce duplicate samples in a Reverse Circulation drill program as the company proposes. In a core program, field sample duplicates necessitate using 1/4 of the core as a duplicate. Laboratory samples need to be arraigned before hand with the assay laboratory. This duplicate will be taken after crushing and before pulverization, and will require submitting an empty sample bag with a sequential tag to the lab. This will test a laboratory's sample preparation procedure. Laboratories routinely insert blanks into each batch.

CRM or CERTIFIED REFERENCE MATERIAL. In this case, the matrix of the CRM should be similar to the sample. Since the samples consist of shales, limestones and cherts, finding a suitable CRM is not easy. In Reno, the CRM's available come from local mines and western volcanic rocks, the matrix of which is not compatible with the rock types expected.

Regulatory:

On the patented (private) lands, no direct US Forest Service (USFS) approval is needed to begin work. The USFS is primarily interested in work completed on Patented Lands only to the extent such work impacts adjoining USFS Lands. To get approval to drill in 2010, the USFS had to conduct archeological, biological, botanical and water quality evaluations of the project site and received approval at that time. The Company already has approval from the USFS to rehabilitate the access road located on the unpatented surrounding ground up the hill to the Prunty Mine portal area.

The USFS is reluctant to allow building of new roads. Consequently, drill pads need to be located along or next to existing roads. There are many old drill roads in the area, some dating from the 1984 and 1986 drilling. On private land, roads can be constructed to access drill sites on the principal Northwest Corridor structure. From the standpoint of working on the lands, topography is gentle to moderate and vegetation is mostly sagebrush. The average annual precipitation over the area varies from 8 to 15 inches, a major portion of which occurs as snow during the winter months. There is no electrical power line to the property. Elko is the most prominent population center in the area and provides a broad range of services and supplies to the mining industry.

The agency responsible for patented claims is the Nevada Division of Environmental Quality (NDEQ) in Carson City, Nevada. There are no known environmental liabilities within the claim group. Humboldt was also in contact with the Nevada Department of Environmental Protection (NDEP). Rock and water samples were submitted and there were no red flags. There generally is no stringent monitoring by the NDEP (Nevada Department of Environmental Protection), but a plan must be filed.

Employees

We currently do not have any employees but we intend to hire our current Chief Executive Officer, our current Chief Financial Officer and our two directors in the near future..

Available information

The public may read and copy any materials the Company files with the U.S. Securities and Exchange Commission (the “SEC”) at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0030. The SEC maintains an Internet website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Item 1A. Risk Factors.

You should carefully consider the risks described below, together with all of the other information included in this report, in considering our business and prospects. The risks and uncertainties described below are not the only ones facing the Company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. The occurrence of any of the following risks could harm our business, financial condition or results of operations.

| 9 |

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

We have a history of operating losses and we cannot guarantee that we can ever achieve sustained profitability.

We have recorded a net loss attributable to common stockholders in most reporting periods since our inception. Our net loss for the years ended September 30, 2016 and September 30, 2015 were $164,297 and $143,434, respectively. Our accumulated deficit at September 30, 2016 was $307,731. Losses are expected to continue for the foreseeable future. The Company expects to continue to have development costs as it develops its next generation of products. We may never achieve profitable operations or positive cash flow.

We are an exploration stage company and may never be able to carry out business or achieve any revenues or profitability; at this stage, even with good faith efforts, potential investors have a high probability of losing their entire investment.

We have not earned any revenues as of the date of this current report. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates.

There is nothing at this time on which to base an assumption that our business operations will prove to be successful or that we will ever be able to operate profitably. We anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses in the foreseeable future. There can be no assurance that we will ever achieve any revenues or profitability. The revenue and income potential of our proposed business and operations is unproven as the lack of operating history makes it difficult to evaluate the future prospects of our business.

We are dependent on our two principal projects for our future operating revenue, neither of which currently has proven or probable reserves.

The Virginia and the Vanity Fair Project do not have identified proven and probable mineral reserves. The costs, timing and complexities of upgrading either property to proven and probable reserves may be greater than we anticipate. Mineral exploration and development involves a high degree of risk that even a combination of careful evaluation, experience and knowledge cannot eliminate, and few properties that are explored are ultimately developed into producing mines. There is no assurance that our mineral exploration programs will establish the presence of any proven or probable mineral reserves. The failure to establish proven or probable reserves would severely restrict our ability to implement our strategies for long-term growth.

| 10 |

We cannot be certain that our acquisition, exploration and evaluation activities will be commercially successful.

We currently have no properties that produce gold in commercial quantities. Substantial expenditures are required to acquire existing mining properties, to establish ore reserves through drilling and analysis, to develop metallurgical processes to extract metal from the ore and, in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining. We cannot provide assurance that any gold or other metal reserves or mineralized material acquired or discovered will be in sufficient quantities to justify commercial operations or that the funds required for development can be obtained on a timely basis. Factors including costs, actual mineralization, consistency and reliability of ore grades and commodity prices affect successful project development, could have a material adverse effect on our future results of operations.

Actual capital costs, operating costs, production and economic returns may differ significantly from those we have anticipated and there are no assurances that any future development activities will result in profitable mining operations.

The capital costs to take our claims into production may be significantly higher than anticipated. We may ultimately base our decisions about the development of the projects based on a feasibility study. We have not prepared a feasibility study for the either, but we may use a portion of the proceeds of the offering to produce one if we deem it necessary or appropriate to do so. Our evaluations of our business and prospects are subject to change, including after any feasibility study has been conducted, which could materially adversely affect our prospects.

Historical production at either of our claims may not be indicative of the potential for future development.

There is currently no commercial production at either claim and, since acquiring ownership, we have never recorded any revenues from commercial production. You should not rely on the fact that there were historical mining operations at the either claim as an indication that we will ever have future successful commercial operations. In order for us to develop new mining operations, we will be required to incur substantial operating expenses and capital expenditures to refurbish and/or replace existing infrastructure.

Land reclamation and mine closure may be burdensome and costly.

Land reclamation and mine closure requirements are generally imposed on mineral exploration companies, which require us to, among other things, to minimize the effects of land disturbance. Such requirements may include controlling the discharge of potentially dangerous effluents from a site and restoring a site’s landscape to its pre-exploration form. The actual costs of reclamation and mine closure are uncertain and planned expenditures may differ from the actual expenditures required. Therefore, the amount that we are required to spend could be materially higher than current estimates. Any additional amounts required to be spent on reclamation and mine closure may have a material adverse effect on our financial performance, financial position and results of operations, and may cause us to alter our operations. In addition, we are required to maintain financial assurances, such as letters of credit, to secure reclamation obligations under certain laws and regulations. The failure to acquire, maintain or renew such financial assurances could subject us to fines, penalties, or suspension of our operations. Additionally, even if we cease exploration at either claim, we will be required to expend cash and other resources to satisfy ongoing care and maintenance obligations.

Our operations involve significant risks and hazards inherent to the mining industry.

Our operations involve the operation of large pieces of drilling and other heavy equipment. Hazards such as fire, explosion, floods, structural collapses, industrial accidents, unusual or unexpected geological conditions, ground control problems, cave-ins, flooding and mechanical equipment failure are inherent risks in our operations. Hazards inherent to the mining industry can cause injuries or death to employees, contractors or other persons at our mineral properties, severe damage to and destruction of our property, plant and equipment and mineral properties, and contamination of, or damage to, the environment, and can result in the suspension of our exploration activities and any future development and production activities. While the Company aims to maintain best safety practices as part of its culture, safety measures implemented by us may not be successful in preventing or mitigating future accidents.

The mining industry is very competitive.

The mining industry is very competitive. Much of our competition is from larger, established mining companies with greater liquidity, greater access to credit and other financial resources, newer or more efficient equipment, lower cost structures, more effective risk management policies and procedures and/or a greater ability than us to withstand losses. Our competitors may be able to respond more quickly to new laws or regulations or emerging technologies, and devote greater resources to the expansion or efficiency of their operations. In addition, current and potential competitors may make strategic acquisitions or establish cooperative relationships among themselves or with third parties. Accordingly, it is possible that new competitors or alliances among current and new competitors may emerge and gain significant market share to our detriment. We may not be able to compete successfully against current and future competitors, and any failure to do so could have a material adverse effect on our business, financial condition, or results of operations.

| 11 |

Mining exploration, development and operating activities are inherently hazardous.

Mineral exploration involves many risks that even a combination of experience, knowledge and careful evaluation may not be able to overcome. Operations in which we have direct or indirect interests will be subject to all the hazards and risks normally incidental to exploration, development and production of gold and other metals, any of which could result in work stoppages, damage to property and possible environmental damage. The nature of these risks is such that liabilities might exceed any liability insurance policy limits. It is also possible that the liabilities and hazards might not be insurable, or, that the Company could elect not to be insured against such liabilities due to high premium costs or other reasons, in which event, significant costs could be incurred that could have a material adverse effect on our financial condition.

Reserve calculations are estimates only, subject to uncertainty due to factors including metal prices, inherent variability of ore, and recoverability of metals in the mining process.

There is a degree of uncertainty attributable to the calculation of reserves and corresponding grades dedicated to future production. Until reserves are actually mined and processed, the quantity of ore and grades must be considered as an estimate only. In addition, the quantity of reserves and ore may vary depending on metal prices. Any material change in the quantity of reserves, mineralization, grade or stripping ratio may affect the economic viability of our properties. In addition, there can be no assurance that gold recoveries or other metal recoveries in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

We may be unable to raise additional capital on favorable terms.

The exploration and development of our development properties will require significant capital investment to achieve commercial production. We may have to raise additional funds from external sources in order to maintain and advance our existing property positions and to acquire new gold projects. There can be no assurance that additional financing will be available at all or on acceptable terms and, if additional financing is not available, we may have to substantially reduce or cease operations.

Our exploration and eventual development operations are subject to environmental regulations which could result in the incurrence of additional costs and operational delays.

All phases of operations are subject to environmental regulation. Environmental legislation is evolving in some jurisdictions in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulations, if any, will not adversely affect the Company’s projects. We will be subject to environmental regulations with respect to properties in Nevada, under applicable federal and state laws and regulations. Production at either claim may involve the use of sodium cyanide, which is a toxic material. Should sodium cyanide leak or otherwise be discharged from the containment system, we may become subject to liability for cleanup work that may not be insured. While appropriate steps will be taken to prevent discharges of pollutants into the ground water and the environment, we may become subject to liability for hazards that it may not be insured against.

| 12 |

U.S. Federal Laws

Under the U.S. Resource Conservation and Recovery Act, mining companies may incur costs for generating, transporting, treating, storing, or disposing of hazardous waste, as well as for closure and post-closure maintenance once they have completed mining activities on a property. Mining operations may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, storage facilities, and the use of mobile sources such as trucks and heavy construction equipment which are subject to review, monitoring and/or control requirements under the Federal Clean Air Act and state air quality laws. Permitting rules may impose limitations on the Company’s production levels or create additional capital expenditures in order to comply with the rules.

The U.S. Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended (CERCLA), imposes strict joint and several liability on parties associated with releases or threats of releases of hazardous substances. The groups who could be found liable include, among others, the current owners and operators of facilities, which release hazardous substances into the environment and past owners and operators of properties who owned such properties at the time the disposal of the hazardous substances occurred. This liability could include the cost of removal or remediation of the release and damages for injury to the surrounding property. The Company cannot predict the potential for future CERCLA liability with respect to its properties.

Increased costs could affect our financial condition.

We anticipate that costs will frequently be subject to variation from one year to the next due to a number of factors, such as changing ore grade, metallurgy, and revisions to mine plans in response to the physical shape and location of the ore body. In addition, costs are affected by the price of commodities, such as fuel and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production at certain operations less profitable. A material increase in costs at any significant location could have a significant effect on profitability.

Difficult conditions in the global capital markets and the economy generally may materially adversely affect our business and results of operations.

Factors such as business investment, government spending, the volatility and strength of the capital markets, and inflation all affect the business and economic environment and, ultimately, the profitability of our business. In an economic downturn characterized by higher unemployment, lower corporate earnings and lower business investment, our operations could be negatively impacted. Purchasers of gold production may delay or be unable to make timely payments. Adverse changes in the economy could affect earnings negatively and could have a material adverse effect on our business, results of operations and financial conditions.

A shortage of equipment and supplies could adversely affect our ability to operate our business.

We will be dependent on various supplies and equipment to carry out our mining exploration and development operations. The shortage of such supplies, equipment and parts could have a material adverse effect on our ability to carry out our operations and therefore, limit or increase the cost of production.

If we lose key personnel or are unable to attract and retain additional personnel, we may be unable to establish and develop our business.

Our development in the future will be highly dependent on the efforts of key management employees. We do not have and currently have no plans to obtain key man insurance with respect to any key employees. We will need to recruit and retain other qualified managerial and technical employees to build and maintain our operations. If we are unable to successfully recruit and retain such persons, then development and growth could be significantly curtailed.

Principal stockholders will be able to exert significant influence over matters submitted to stockholders for approval, which could delay or prevent a change in corporate control or result in the entrenchment of management or the Board of Directors, possibly conflicting with the interests of other stockholders.

Major shareholders and the President’s position on the board of directors could exert significant influence in determining the outcome of corporate actions requiring stockholder approval and otherwise control of our business. This control could have the effect of delaying or preventing a change in control or entrenching management or the board of directors, which could conflict with the interests of our other stockholders and, consequently, could adversely affect the market price of our common stock.

Our Articles of Incorporation exculpates our officers and directors from certain liability to our Company or our stockholders.

Our Articles of Incorporation contain a provision limiting the liability of our officers and directors for their acts or failures to act, except for acts involving intentional misconduct, fraud or a knowing violation of law. This limitation on liability may reduce the likelihood of derivative litigation against our officers and directors and may discourage or deter our stockholders from suing our officers and directors based upon breaches of their duties to our Company.

| 13 |

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

| • | pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; |

| • | provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and |

| • | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements. |

Our internal controls may be inadequate or ineffective, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public. Investors relying upon this misinformation may make an uninformed investment decision.

We have a “going concern” opinion from our auditors, indicating the possibility that we may not be able to continue to operate.

Our independent registered public accountants have expressed doubt about our ability to continue as a going concern. This opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. If we fail to raise sufficient capital when needed, we will not be able to complete our proposed business. As a result, we may have to liquidate our business and investors may lose their investment. The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish its plan of operations described herein and eventually attain profitable operations. Investors should consider our independent registered public accountant’s comments when deciding whether to invest in the Company.

We will incur significant costs as a result of being a publicly traded company and such costs may increase when we cease to be an emerging growth company.

As a publicly traded company, we will incur legal, accounting and other expenses estimated to range from $250,000 to $350,000 per year, including costs associated with the periodic reporting requirements applicable to a company whose securities are registered under the Exchange, as well as additional corporate governance requirements, including applicable requirements under the Sarbanes-Oxley Act and other rules implemented by the SEC. The expenses incurred by public companies generally for reporting and corporate governance purposes have been increasing. We expect compliance with these public reporting requirements and associated rules and regulations to increase our legal and financial costs, particularly after we are no longer an emerging growth company, and to make some activities more time-consuming and costly, although we are currently unable to estimate these costs with any degree of certainty. These laws and regulations could also make it more difficult or costly for us to obtain certain types of insurance, including director and officer liability insurance, and we may be forced to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. These laws and regulations could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, our board committees or as our executive officers. Further, if we are unable to satisfy our obligations as a public company, we could be subject to delisting of our common stock, fines, sanctions and other regulatory action and, potentially, civil litigation.

The recently enacted JOBS Act reduces certain disclosure requirements for emerging growth companies, thereby decreasing related regulatory compliance costs. We qualify as an emerging growth company. However, when we cease to be an emerging growth company, we will be unable to take advantage of the reduced regulatory requirements and any associated cost savings.

| 14 |

Efforts to comply with the applicable provisions of Section 404 of the Sarbanes-Oxley Act will involve significant expenditures, and non-compliance with Section 404 of the Sarbanes-Oxley Act may adversely affect us and the market price of our common stock.

Under current SEC rules, we will be required to report on our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act, and related rules and regulations of the SEC; although, as an emerging growth company, we are exempt from the requirement to provide an auditor attestation to management’s assessment of its internal controls as required by Section 404(b) of the Sarbanes-Oxley Act. We will be required to review on an annual basis our internal control over financial reporting, and on a quarterly and annual basis to evaluate and disclose changes in our internal control over financial reporting. As a result, we expect to incur additional expenses in the near term that may negatively impact our financial performance and our ability to make distributions. This process also will result in a diversion of management’s time and attention. We cannot be certain as to the timing of completion of our evaluation, testing and remediation actions or the impact of the same on our operations, and we may not be able to ensure that the process is effective or that our internal control over financial reporting is or will be effective in a timely manner. In the event that we are unable to maintain or achieve compliance with the applicable provisions of Section 404 of the Sarbanes-Oxley Act and related rules, we and the market price of our common stock may be adversely affected.

The Company’s stock price may be volatile.

The market price of the Company’s common stock is likely to be highly volatile and could fluctuate widely in price in response to various potential factors, many of which will be beyond the Company’s control, including the following:

| • | competition; |

| • | additions or departures of key personnel; |

| • | the Company’s ability to execute its business plan; |

| • | operating results that fall below expectations; |

| • | loss of any strategic relationship; |

| • | industry developments; |

| • | economic and other external factors; and |

| • | period-to-period fluctuations in the Company’s financial results. |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of the Company’s common stock.

We do not expect to pay dividends in the foreseeable future.

We do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any future earnings in the development and growth of our business. Therefore, investors will not receive any funds unless they sell their common stock, and stockholders may be unable to sell their shares on favorable terms or at all. We cannot assure you of a positive return on investment or that you will not lose the entire amount of your investment in our common stock.

We may in the future issue additional shares of our common stock which would reduce investors’ ownership interests in the Company and which may dilute our share value.

Our Articles of Incorporation authorize the issuance of 200,000,000 shares of common stock, par value $0.001 per share. The future issuance of all or part of our remaining authorized common stock may result in substantial dilution in the percentage of our common stock held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

The Financial Industry Regulatory Authority (“FINRA”) has adopted rules that relate to the application of the SEC’s penny stock rules in trading our securities and require that a broker/dealer have reasonable grounds for believing that the investment is suitable for that customer, prior to recommending the investment. Prior to recommending speculative, low priced securities to their non-institutional customers, broker/dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information.

Under interpretations of these rules, FINRA believes that there is a high probability that speculative, low priced securities will not be suitable for at least some customers. FINRA’s requirements make it more difficult for broker/dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity and liquidity of our common stock. Further, many brokers charge higher transactional fees for penny stock transactions. As a result, fewer broker/dealers may be willing to make a market in our common stock, reducing a shareholder’s ability to resell shares of our common stock.

| 15 |

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Property.

Our executive offices are located at 500 N Rainbow Blvd, Suite 300, Las Vegas, NV 89107. We currently rent this space for approximately $1,500 a month. Currently, this space is sufficient to meet our needs. We do not foresee any significant difficulties in obtaining any required additional space if needed. We do not own any real property.

Item 3. Legal Proceedings.

From time to time, we are a party to litigation and subject to claims incident to the ordinary course of business. Future litigation may be necessary to defend ourselves and our customers by determining the scope, enforceability and validity of third party proprietary rights or to establish our proprietary rights.

On March 25, 2015, Robert Robison filed suit against Humboldt Mining Company, Inc. (“Humboldt”) seeking declaratory judgment with respect to Robison’s (i) alleged ownership of certain unpatented mining claims in Elko, Nevada, for which he is seeking a declaratory judgment; and (ii) alleged 10% ownership in Humboldt. In addition, Robison claims that he is owed $24,200 under a prior consulting agreement with Humboldt. (Robison v. Humboldt Mining Company, Inc., CV-BU15-169, Department 1, Fourth Judicial District of the State of Nevada, County of Elko).

The Company, in its Asset Purchase Agreement with Humboldt, agreed to pay for any future payments owed on this lawsuit in addition to up to $20,000 in legal fees. A default judgment was entered into against Humboldt. On July 7, 2016, Humboldt filed a motion to set aside the default judgment which was granted by Order of the Court on July 26, 2016.

On October 6, 2016 Robert Robison refiled the above suit against Humboldt Mining Company Inc. and included Rancho Santa Fe Mining, Inc. seeking a jury trial with respect to Robison’s (i) alleged ownership of certain unpatented mining claims in Elko, Nevada, (ii) 10% ownership in Humboldt and Receipt of a $24,200 bond under a 2013 contract with Humboldt as payment for prior services (iii) misuse of Robison name, (iv) and failure to allow minority stockholder decent.

Case is Robert R Robison, individually and derivatively on behalf of Humboldt Mining Company Inc. Plaintiff, vs. Humboldt Mining Company Inc.; “Baron” William David Leavitt; Robert D. Dennis; and Rancho Santa Fe Mining, Inc. Civil No. 3:16-cv-00583-RCJ-WGC

Rancho has filed a reply and a countersuit on November 28, 2016 for damages. The reply states that Robison (i) fraudulently has title to the claims 1-109 discussed in the compliant, (ii) that Robison has received all shares due based on the 2013 Cancellation Contract and that his shares are 10% of Humboldt and the $24,200 bond has not been released from the U.S. Forestry Services, (iii) Rancho has removed Robison’s name from all publicly available locations, (iv) and Humboldt’s duly elected board of directors made the decision to sell Humboldt to Rancho in a manner completely consistent with the clearly stated objectives of the company.

The countersuit against Robison consists of (i) failing to register claims staked by Humboldt, paid for and maintain by Humboldt Mining in the name of Humboldt Mining, (ii) while acting as CEO of Humboldt mining, Robison was directly representing to Rancho that the claims 1-109 were part of the Humboldt assets being acquired by Rancho, (iii) that Robison converted Humboldt property to his personal property, that Robison has unjustly retained Humboldt Mining’s money and other property to include the claims, technical reports, and other documents paid for by Humboldt Mining, expenses incurred in maintaining, drilling, developing and exploring claims 1-109 including a trailer provided, (iv) Robison, as a consultant and later as Chief Executive Officer of Humboldt Mining provided negligent representations to the Humboldt Board of Directors as well as to the CEO of Rancho Santa Fe Mining who was in the process of acquiring Humboldt; (v) that Robison’s actions created harm to Rancho at a critical time when going public;

Counter claim is Humboldt Mining Company Inc. and Rancho Santa Fe Mining, Inc. vs. Robert Robison. Case no. 3:16-CV-00583-RCJ-WGC.

Robison’s response is due on January 13, 2017.

With the exception of the foregoing dispute, the Company is not involved in any disputes and does not have any litigation matters pending.

Item 4. Mine Safety Disclosures.

Not applicable.

| 16 |

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

(a) Market Information

There is currently no public trading market for our Common Stock and no such market may ever develop. While we intend to seek and obtain quotation of our Common Stock for trading on the OTC Markets (“OTCQB”), there is no assurance that our application will be approved. An application for quotation on the OTCQB must be submitted by one or more market makers who: 1) are approved by the Financial Industry Regulatory Authority (“FINRA”); 2) who agree to sponsor the security; and 3) who demonstrate compliance with SEC Rule 15(c)2-11 before initiating a quote in a security on the OTCQB. In order for a security to be eligible for quotation by a market maker on the OTCQB, the security must be registered with the SEC and the company must be current in its required filings with the SEC. There are no listing requirements for the OTCQB and accordingly no financial or minimum bid price requirements. We intend to cause a market maker to submit an application for quotation to the OTCQB upon the effectiveness of this Registration Statement of which this Prospectus forms a part. However, we can provide no assurance that our shares will be traded on the bulletin board or, if traded, that a public market will materialize. Our common stock is not currently quoted on any market or national exchange.

(b) Holders

As of January 12, 2017, there were approximately 19 holders of record of our common stock. This figure does not take into account those shareholders whose certificates are held in the name of broker-dealers or other nominees.

(c) Dividends

We have never paid any cash dividends on our common shares, and we do not anticipate that we will pay any dividends with respect to those securities in the foreseeable future. Our current business plan is to retain any future earnings to finance the expansion development of our business.

(d) Securities Authorized for Issuance under Equity Compensation Plan

None.

Transfer Agent

Our transfer agent is Action Stock Transfer and its phone number is (801) 274-1088. The transfer agent is responsible for all record-keeping and administrative functions in connection with the common shares.

Recent Sales of Unregistered Securities

During the year ended September 30, 2016, there were no sales of unregistered securities by the Company.

Rule 10B-18 Transactions

During the year ended September 30, 2016, there were no repurchases of the Company’s common stock by the Company.

| 17 |

Item 6. Selected Financial Data.

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

THE FOLLOWING DISCUSSION OF OUR PLAN OF OPERATION AND RESULTS OF OPERATIONS SHOULD BE READ IN CONJUNCTION WITH THE FINANCIAL STATEMENTS AND RELATED NOTES TO THE FINANCIAL STATEMENTS INCLUDED ELSEWHERE IN THIS REPORT. THIS DISCUSSION CONTAINS FORWARD-LOOKING STATEMENTS THAT RELATE TO FUTURE EVENTS OR OUR FUTURE FINANCIAL PERFORMANCE. THESE STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER FACTORS THAT MAY CAUSE OUR ACTUAL RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS TO BE MATERIALLY DIFFERENT FROM ANY FUTURE RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY THESE FORWARD-LOOKING STATEMENTS. THESE RISKS AND OTHER FACTORS INCLUDE, AMONG OTHERS, THOSE LISTED UNDER “FORWARD-LOOKING STATEMENTS” AND “RISK FACTORS” AND THOSE INCLUDED ELSEWHERE IN THIS REPORT.

Overview

The Company was incorporated in the State of Nevada on July 24, 2015. We were incorporated and our business plan called for the Company to seek out and acquire various mining assets in the State of Nevada. Rancho Santa Fe Mining Inc. is precious metals exploration and development company with the objective of becoming a gold producer. The Company is currently focused on the advancement of its two principal projects: the Virginia and Vanity Fair patented claims.

On October 28, 2015, the Company entered into an Asset Purchase Agreement (the “Asset Purchase”) with Humboldt Mining Company, Inc., a Nevada corporation (“HMCI”). Pursuant to the Asset Purchase Agreement, the Company acquired 100% of certain assets owned by HMCI, including, but not limited to: (i) all the real property, leasehold improvements, fixtures, furniture, machinery and equipment owned by the HMCI and relating to or used in HMCI’s operations; and, (ii) all inventory, including finished goods, raw materials and work in process as well as the right to receive inventory ordered by the HMCI for use in its operations; and, (iii) in addition to the foregoing, we acquired all the books and records of HMCI, as well as all intangible assets held, owned or controlled by HMCI (collectively, (i), (ii) and (iii) are referred to hereinafter as the “Acquired Assets”).

In exchange for the Acquired Assets the Company issued to the HMCI shareholders Thirteen Million Five Hundred Thousand shares of the Company’s $0.001 par value common stock, which represented fifty (50%) percent of the Company’s issued and outstanding shares at the time of issuance.

The Company now owns land and the patented mining rights North of Elko, Nevada nearby the formation known as the Carlin Trend. The Company’s property includes two patented claims – the Virginia and Vanity Fair patented claims - comprising what is known as the Prunty Mine Area (Vanity Fair, Virginia, 3871 Mining Survey Number). The 2 patented mining claims (Prunty Mine – Virginia and Vanity Fair Patents) total approximately 40 acres. The importance of these patented claims cannot be underestimated. We own the Patented Mining Claims and the mineral rights associated with the Patents have no expiration date, subject to property taxes being paid on the property.