Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - DOVER Corp | a201701128-kexhibit991.htm |

| 8-K - 8-K - DOVER Corp | a201701128-k.htm |

Dover Investor Presentation

January 12, 2017

Bob Livingston

President & Chief Executive Officer

2

Forward looking statements

We want to remind everyone that our comments may contain forward-looking

statements that are inherently subject to uncertainties and risks. We caution

everyone to be guided in their analysis of Dover by referring to the documents

we file from time to time with the SEC, including our Form 10-K for 2015 and our

Form 10-Q for the third quarter of 2016, for a list of factors that could cause our

results to differ from those anticipated in any such forward-looking statements.

We would also direct your attention to our website, www.dovercorporation.com,

where considerably more information can be found.

3

Our strategy to create long-term value

Build platforms in key markets with significant growth potential

Capitalize on our expertise by providing a larger suite of products and

solutions to customers on a global basis

Innovate to launch new products to help customers win in their markets

Continue to focus on margin by actively managing our portfolio and

driving productivity

3

4

$1.3

$2.5 $2.2

$1.6

2017F Revenue

Refrigeration & Food Equipment

• Retail refrigeration

• Food equipment

• Heat transfer solutions

Fluids

• Retail fueling

• Hygienic & Pharma

• Polymer processing

equipment

• Specialty industrial pumps

Engineered Systems

• Marking & Coding

• Digital Printing

• Refuse collection,

compaction & processing

• Auto service equipment

Energy

Refrigeration &

Food Equip.

Applying performance

management systems to

incentivize Opcos to maintain and

improve margin and ROIC

Fostering a unique culture where

Opcos embrace their

responsibility of helping our

customers win

Segments, key platforms, and unique capabilities

Energy

• Drilling & Artificial Lift

• Automation

• Bearings & Compression

$ in billions

Engineered

Systems Fluids

Using in-depth knowledge of

customers and opportunities to

identify attractive companies in our

markets

≈

≈

≈

≈

5

Select growth markets at a glance - Energy

Estimated

market size $8.0B $4.0B

2017 – 2019

est. market

CAGR

Key

competitors

Drilling &

Artificial Lift

(USS, DAL)

Bearings &

Compression

(Waukesha, Cook)

2017F DOV

revenues ~$725M ~$140M

high potential growth tied

to rig count growth and

new well completions

Key growth

drivers

• Oil price stability/growth

• NA rig count growth

• Increased well completion

activity

• Shale activity growth

• New product introduction

Automation

(DEA)

$4.0B

~$290M

low-singles

• Increasing use of natural gas

in power gen

• Growing installed base of

reciprocating and rotating

machinery

• Global energy demand and

gas production

high potential growth tied

to well completions and

productivity spend

• Oil price stability/growth

• Focus on productivity

• New products

• Customer adoption

6

Select growth markets at a glance - Engineered Systems

Text

Estimated

market size

$2.0B $3.5B

2017 – 2019

est. market

CAGR

double-

digits

Key

competitors

Digital Printing

(MS & JK)

Refuse collection,

compaction & processing

(ESG)

$3.0B

Auto service

equipment

(VSG)

2017F DOV

revenues

~$835M <$200M ~$440M ~$525M

$5.5B

Marking & Coding

(MI)

mid-singles low-to-mid

singles

Key growth

drivers

• Growing consumerism

in developing

economies

• Food safety concerns

• Logistics

• New packaging

designs and materials

• Growth in fast

fashion

• Water conservation

• Print quality and

consistency

• Flexibility

• Productivity

• Productivity

• Safety

• Reduced availability

of landfills

• Growth in recycling

• Addition of Ravaglioli

(RAV)

• Increasing average age

of vehicles

• Growing global car park

• New materials used in

auto manufacturing

low-to-mid

singles

7

Select growth markets at a glance - Fluids

Estimated

market size

$2B $7B

2017 – 2019

est. market

CAGR

Key

competitors

2017F DOV

revenues

~$1.3B ~$250M

Retail Fueling

(OPW, Wayne,Tokheim,

Fairbanks)

low-to-mid

singles, plus

EMV lift

mid-to-high

singles

Key growth

drivers

Hygenic & Pharma

(Hydro, CPC, certain

PSG brands)

• Recent acquisitions

• EMV upgrade cycle

• Environmental and safety

regulations

• Remote monitoring and SaaS

• Increasing miles driven

• Auto growth in developing

markets

• Health and safety

concerns

• Growing single use

adoption

• Expanding applications

• Aging demographics

Polymer

Equipment

(Maag)

$5B

~$275M

low-to-mid

singles

• Significant global

petrochemical investment

• Low feedstock prices

• Worldwide growth of

plastics usage

8

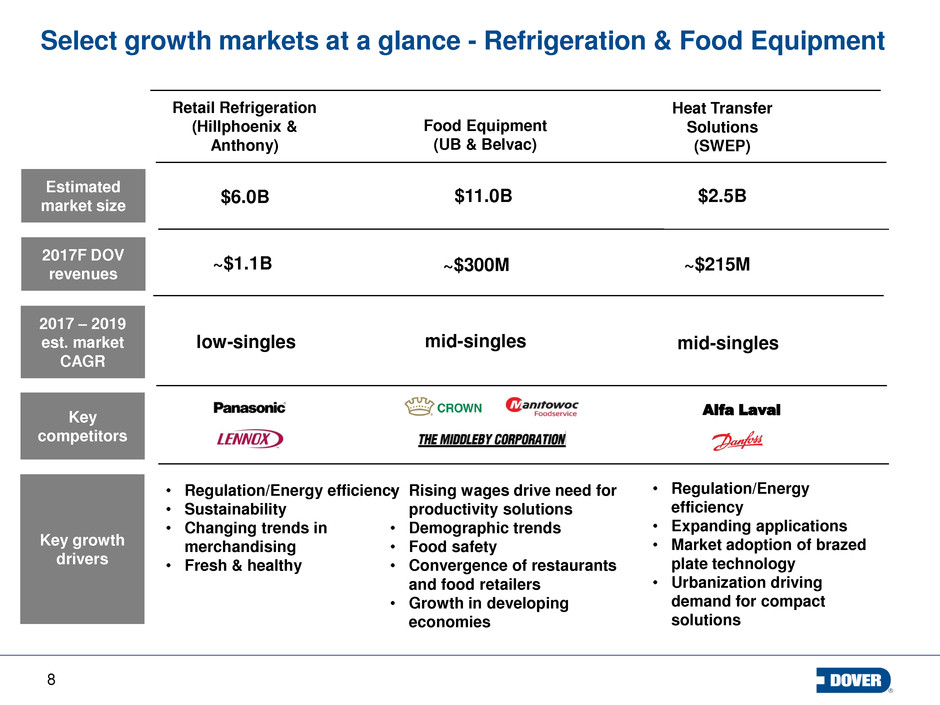

Select growth markets at a glance - Refrigeration & Food Equipment

Estimated

market size

$6.0B $2.5B $11.0B

2017 – 2019

est. market

CAGR

Key

competitors

Retail Refrigeration

(Hillphoenix &

Anthony)

2017F DOV

revenues

~$300M ~$1.1B ~$215M

Food Equipment

(UB & Belvac)

low-singles mid-singles mid-singles

Key growth

drivers

Heat Transfer

Solutions

(SWEP)

• Regulation/Energy efficiency

• Sustainability

• Changing trends in

merchandising

• Fresh & healthy

• Rising wages drive need for

productivity solutions

• Demographic trends

• Food safety

• Convergence of restaurants

and food retailers

• Growth in developing

economies

• Regulation/Energy

efficiency

• Expanding applications

• Market adoption of brazed

plate technology

• Urbanization driving

demand for compact

solutions

Alfa Laval

9

Building the Dover Fueling Solutions platform

Pre 2013

• Hanging hardware

• Valves

• Car wash systems

• Fleet fueling

systems

2013

• Containment

systems

• Access & fill covers

• European style

piping

2016

• Dispensers

• Automation &

POS systems

• Wireless tank

gauges

• Cloud-based

/remote

monitoring

/SaaS

• Dispensers

• Automation &

POS systems

Strong market characteristics, including: steady growth, strong after-

market, periodic tailwinds, favorable customer-to-supplier ratio

Developed detailed acquisition roadmap comprising products and

geographies

Initial focus on product expansion

2016 acquisitions build out the industry’s only global end-to-end

solution

2017F Retail Fueling revenue: ≈ $1.3B

10

Dover Fueling Solutions - Wayne Fueling acquisition

Dispensers, POS systems and

service for global retail fueling

markets; strong US position

Completes end-to-end global retail

fueling solution

Full participation in US EMV upgrade

cycle

Highly synergistic with Tokheim

2017F Revenue: ≈ $600M

2017 – 2020 growth rate: high singles

New 3 year synergy target: ≈ $35 million

Costs to achieve synergy: ≈ $25 million

2017F EPS: $0.18 - $0.20

Strategic fit Key metrics

11

Q4 update

Solid fourth quarter activity

Overall operating performance within previous guidance range

– Early cycle oil & gas related end-markets showing sequential improvement

– Printing & Identification platform remains strong

– Industrial businesses generally performing at/near expectations

– Continued weakness in later cycle oil & gas markets

– Refrigeration margins remain challenged as we implement manufacturing changes;

results also impacted by product mix

Portfolio actions

– $0.31 net benefit on disposition of

business

– $0.05 impact from Wayne acquisition,

excluding financing costs

Anticipated early 2017 voluntary product

recall has $0.09 impact

11

Prior 2016 EPS Guidance: $3.00 - $3.05

Plus: Net benefit on Q4 disposition: ≈$0.31

Less: Q4 Wayne related costs: ≈($0.05)

Less: Q4 Product recall charge: ≈($0.09)

Updated 2016 EPS Guidance $3.17 - $3.22

12

2017 preview

Organic growth outlook

Significant revenue and accretion from 2016 acquisitions

Meaningful carryover benefits from prior restructuring and lower 2017 restructuring

costs

Offsets from compensation & investment, interest and corporate expense, and FX

Modest core margin* improvement at the mid-point

12

2017F EPS from continuing operations:

$3.40 to $3.60

* Core margin adjusted for the impact of completed acquisitions and dispositions, deal costs and restructuring costs for 2016E and 2017F

13

Revenue drivers in 2017

Energy (up 13% to 16%*)

– Growth in North American rig count

– Capex increases drive well completion activity

Engineered Systems (up 1% to 3%*)

‒ Completed acquisitions

‒ Continued adoption of digital printing technology; Strong Printing & Coding markets

‒ Modest industrial markets

Fluids (flat to 2%*)

– Completed acquisitions

– Solid activity in petrochemical & polymers and hygienic & pharma markets

– Challenging longer cycle oil & gas applications, including tank & rail car

Refrigeration & Food Equipment (flat to 2%*)

– Growing glass door and specialty case activity

– Strong backlog in can-shaping equipment

– Standard case and system activity remains subdued

13

* Growth rates represent forecasted organic growth rate. See appendix chart for additional information

14

2017 summary

Fully leverage recovery in North American oil & gas markets

Capture significant acquisition growth in Fluids and Engineered Systems

Core margin improvement

Acquisition integration

14

15

$-

$400

$800

$1,200

$1,600

Acquisitions Capex Dividends Share

Repurchase

$ in millions

2012 2013 2014 2015 2016E

Return to investors

Capital allocation

Invest in growth; acquisitions

and capex ≈ 60% over 5 years

Consistently return cash to

shareholders; dividends and

repurchases ≈ 40% over 5 years

We expect to continue our

longstanding record of raising

the annual dividend

Continuous focus on FCF

generation; expected to be 11%

of revenue in 2017

15

Growth

Capital Deployed 2012 – 2016E

16

Key takeaways

Our strategy remains consistent. We have great platforms serving markets that offer

ample opportunities for growth

We are anticipating strong growth and have above market expectations of this

portfolio. We continue to expand our capabilities to service our customers with a focus

on helping them win in their markets

We are committed to margin enhancement through our set of productivity tools and

processes

We will remain focused on pursuing opportunities to expand internationally and into

adjacencies

We will continue to generate strong free cash flow, while maintaining our measured

approach to capital allocation

18

Appendix

19

FY 2016 guidance update

19

Prior 2016 EPS Guidance – Continuing Ops (GAAP) $3.00 - $3.05

– Plus: Net benefit on disposition(1): ≈$0.31

– Less: Q4 Wayne related acquisition costs(2): ≈($0.05)

– Less: Q4 Product recall costs: ≈($0.09)

Updated 2016 EPS Guidance – Continuing Ops (GAAP) $3.17 - $3.22

(2) Reflects Q4 operating performance, deal costs and purchase accounting amortization associated with Wayne, totaling ($0.05) EPS

(1) Reflects Q4 net benefit on sale of Tipper Tie

Expected Q4 2016 GAAP EPS: $0.95 - $1.00 (3)

(3) Includes Q4 operating performance, deal costs and purchase accounting amortization associated with Wayne, totaling ($0.05) EPS, $0.31 EPS

associated with net benefit on disposition of Tipper Tie, and charge of $0.09 for expected product recall

20

FY 2017 Guidance – Revenue & margin by segment

2017F

Energy

Engineered

Systems

Fluids

Refrigeration

& Food Equip

Total

Organic rev. 13% - 16% 1% - 3% 0% - 2% 0% - 2% 3% - 5%

Acquisitions - ≈ 7% ≈ 31% - ≈ 10%

Dispositions - (1%) - (5%) (1%)

Currency (1%) (2%) (2%) (1%) (2%)

Total revenue 12% - 15% 5% - 7% 29% - 31% (6% - 4%) 10% - 12%

2017F

Energy

Engineered

Systems

Fluids

Refrigeration

& Food Equip

Total

Margin - midpoint ≈11.6% ≈15.8% ≈13.3% ≈13.3% ≈13.7%

Chg. vs 2016 up

> 600 bps

down

< 75 bps(b)

up

> 150 bps

down

< 400 bps(b)

up

> 10 bps

Chg. vs 2016 -

adjusted core(a)

up

> 450 bps

down

< 70 bps

down

< 300 bps(c)

up

> 100 bps

up

≈ 10 bps

(a) Adjusted for the impact of completed acquisitions and dispositions, deal costs, restructuring costs and recall charges for 2016E and 2017F

(c) Reflects the impact of Tokheim, which is now treated as organic for purposes of organic revenue and adjusted core margin

(b) Includes the impact of the gains on the 2016 dispositions of Texas Hydraulics in DES, and the disposition of Tipper Tie in DFRE

21

FY 2017F Guidance

Revenue

– Organic revenue: 3% - 5%

– Completed acquisitions: ≈10%

– Dispositions: (1%)

– FX impact: (2%)

– Total revenue: 10% - 12%

Corporate expense: ≈ $125 million

Net interest expense: ≈ $133 million

Full-year tax rate: ≈ 28%

Capital expenditures: ≈ 2.3% of revenue

FY free cash flow: ≈ 11% of revenue

22

2017F EPS Guidance – Bridge

2016E EPS – Continuing Ops (GAAP) – Mid-point: $3.19

– Less 2016 gain on dispositions(1): (0.40)

– Less 2016 earnings from dispositions(2) : (0.05)

– Plus 2016 charges related to expected recall: 0.09

2016E Adjusted EPS $2.83

– Net restructuring(3): 0.08 - 0.10

– Performance including restructuring benefits: 0.80 – 0.94

– Compensation & investment: (0.15 - 0.13)

– Interest / Corp. / Tax rate / Shares / Other (net): (0.16 - 0.14)

2017F EPS – Continuing Ops $3.40 - $3.60

(2) Includes 2016 operating earnings from THI and Tipper Tie

(3) Includes restructuring costs of approximately $0.19 in FY 2016 and $0.09 - $0.11 in FY 2017F

(1) Includes $0.07 gain on the disposition THI in Q1 2016 and $0.33 gain on disposition of Tipper Tie in Q4 2016

23

Energy commentary

Segment revenue driven by pace of rig count and capex spending

(influenced by oil price dynamics)

‒ Directly impacts drilling, artificial lift and automation markets (two-thirds

of segment revenue)

Drilling more correlated with rig count

Artificial lift and automation more tied to oil well completion activity

Base case assumptions:

– Drilling, artificial lift and automation up: ≈ 20%*

– 2017 average US rig count: ≈ 680 - 700

– 2017 average WTI: ≈ $55

* Represents forecasted organic growth rate