Attached files

| file | filename |

|---|---|

| 8-K - WEC ENERGY GROUP FORM 8-K - WEC ENERGY GROUP, INC. | wecenergygroupform8-k01112.htm |

January 2017

1

Cautionary Statement Regarding

Forward-Looking Information

Much of the information contained in this presentation is forward-looking information based upon management’s

current expectations and projections that involve risks and uncertainties. Forward-looking information includes, among

other things, information concerning earnings per share, rate case activity, earnings per share growth, cash flow,

dividend growth and dividend payout ratios, construction costs and capital expenditures, investment opportunities,

corporate initiatives, and rate base. Readers are cautioned not to place undue reliance on this forward-looking

information. Forward-looking information is not a guarantee of future performance and actual results may differ

materially from those set forth in the forward-looking information.

In addition to the assumptions and other factors referred to in connection with the forward-looking information, factors

that could cause WEC Energy Group’s actual results to differ materially from those contemplated in any forward-

looking information or otherwise affect our future results of operations and financial condition include, among others,

the following: general economic conditions, including business and competitive conditions in the company’s service

territories; timing, resolution and impact of future rate cases and other regulatory decisions; the company’s ability to

successfully integrate the operations of the Integrys companies with its own operations; availability of the company’s

generating facilities and/or distribution systems; unanticipated changes in fuel and purchased power costs; key

personnel changes; varying weather conditions; continued industry consolidation; cyber-security threats; the value of

goodwill and its possible impairment; construction risks; equity and bond market fluctuations; the impact of any

legislative and regulatory changes, including changes to existing and/or anticipated environmental standards and tax

laws; current and future litigation and regulatory investigations; changes in accounting standards; and other factors

described under the heading “Factors Affecting Results, Liquidity, and Capital Resources” in Management’s

Discussion and Analysis of Financial Condition and Results of Operations and under the headings “Cautionary

Statement Regarding Forward-Looking Information” and “Risk Factors” contained in WEC Energy Group’s Form 10-K

for the year ended December 31, 2015 and in subsequent reports filed with the Securities and Exchange Commission.

WEC Energy Group expressly disclaims any obligation to publicly update or revise any forward-looking information.

2

Well Positioned for the Future

WEC Energy Group

Focused on the fundamentals:

World-class reliability

Operating efficiency

Financial discipline

Exceptional customer care

3

Well Positioned for the Future

A Compelling Value Proposition

For 2016, targeting earnings per share growth of 6-8 percent

Longer term, earnings per share growth is expected to be a

5-7 percent compound annual growth rate off 2015 base

Earnings in 2017 are expected to be in a range of $3.06 to $3.12 per share

More than 99 percent of earnings from regulated operations

Projecting dividend growth in line with earnings growth

In December 2016, the board announced plans to increase the quarterly

dividend by 2.5 cents per share or 5.1%

This represents a compound annual growth rate of 6.6% from 2015

fourth quarter annual rate of $1.83

4

Well Positioned for the Future

WEC Energy Group

$18.5 billion market cap (1)

1.6 million electric customers

2.8 million gas customers

60% ownership of ATC

70,000 miles electric distribution

44,000 miles gas distribution

$17 billion of rate base (2)

99+% of earnings from regulated

operations

Company Statistics Service Territory

(1) As of 12/31/16

(2) 2015 average rate base

We Energies

Michigan Gas Utilities Corporation

Minnesota Energy Resources Corporation

North Shore Gas Company

The Peoples Gas Light and Coke Company

Wisconsin Public Service Corporation

Upper Michigan Energy Resources Corporation

5

Well Positioned for the Future

Earnings Growth Drivers

Plus Additional Growth Opportunities

Outside ATC Traditional Footprint

Environmental goal investment

Natural gas storage investment

$2.7

$5.7

2015 average rate base

($ billions)

$12.4

$2.8

$1.8

Utilities PTF Transmission

Note: Power the Future value represents investment book value

Core Investment

Rate Base: Projected rate base

investment from 2016 – 2020 is

$9 – $9.5 billion

ATC – Traditional Footprint

$3.6 – $4.4 billion 10 year capital plan

WEC Ownership 60%

Power the Future: ROE of 12.7% on

historical and new investment

$17 billion

6

Well Positioned for the Future

Our Portfolio of Regulated Businesses

Electric Generation

and Distribution

65%

Gas

Distribution

26%

Electric

Transmission

9%

Based on 2015 regulated earnings

71%

13%

12%

4%

WI FERC IL MI/MN

By Jurisdiction By Business

7

Balanced Regulatory Environment

Rate-Making Parameters by Company

Utility Equity Layer(1) Authorized ROE

Wisconsin Electric 48.5% - 53.5% 10.2%

WPS 49.0% - 54.0% 10.0%

Wisconsin Gas 47.0% - 52.0% 10.3%

Peoples Gas 50.33% 9.05%

North Shore Gas 50.48% 9.05%

Minnesota Energy Resources 50.32% 9.11%

Michigan Gas Utilities 52% 9.9%

1. Represents equity layer in rates

8

Well Positioned for the Future

Power the Future Investments

Natural Gas Coal

Capacity 1,090 MW 1,030 MW

1

Investment $664 million $2 billion

1

ROE 12.7% 12.7%

Equity 53% 55%

In Service Dates Unit 1 – July 2005

Unit 2 – May 2008

Unit 1 – February 2010

Unit 2 – January 2011

Lease Terms 25 years 30 years

Cost Per Unit of Capacity $609/kW $1,950/kW

1. All capacity and investment amounts reflect WEC ownership only.

Demonstrated capacity for the coal units is 1,056 MW – value shown in table is amount guaranteed in lease agreement.

9

Balanced Regulatory Environment

Rate Case Update

Wisconsin

Rate case plans under evaluation

Illinois

No rate case filing in 2017

Michigan

MGU settlement approved by commission

on Dec. 11, 2015, for rates effective January 1, 2016

Minnesota

Order issued Oct. 31 setting ROE at 9.11% and authorizing rate

increase of approximately 3% or $6.8 million

10

Line of Business View

Five Year Capital Projection 2016-2020

$309 $343 $412 $317 $337

$396

$517 $502 $529 $515

$771

$1,090 $1,041 $1,052 $1,035

$-

$500

$1,000

$1,500

$2,000

$2,500

2016 2017 2018 2019 2020

Gas Delivery

Electric Delivery

Generation

In millions

Total capital spend over the five-year period of $9.0 - $9.5 billion

$1,476

$1,950 $1,955 $1,898 $1,887

*Excludes ATC projected capital expenditures

11

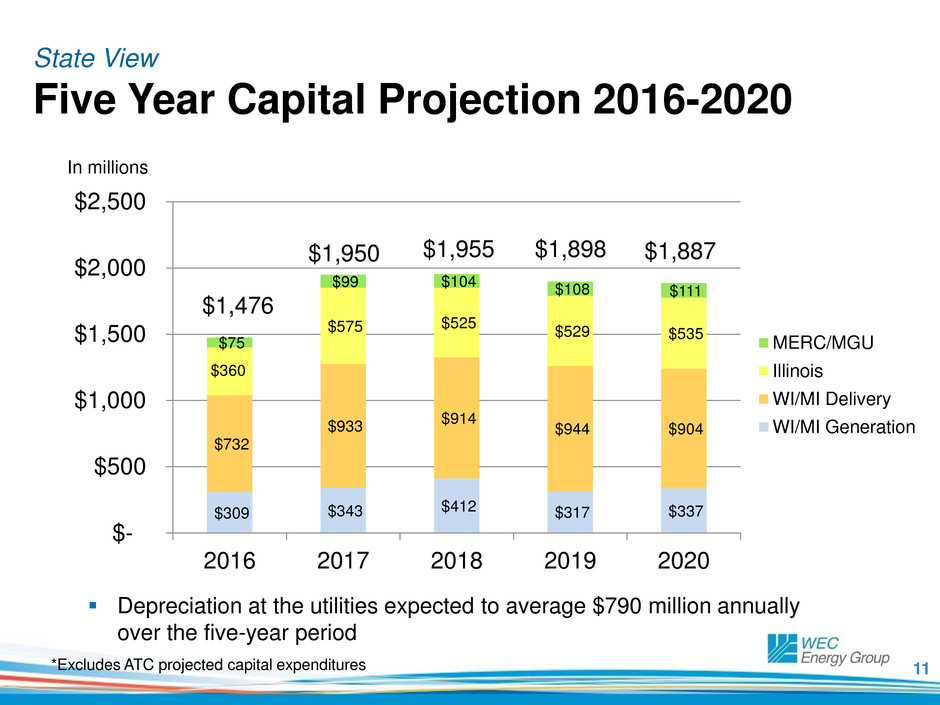

State View

Five Year Capital Projection 2016-2020

$309 $343 $412 $317 $337

$732

$933

$914

$944 $904

$360

$575 $525 $529 $535

$75

$99 $104 $108 $111

$-

$500

$1,000

$1,500

$2,000

$2,500

2016 2017 2018 2019 2020

MERC/MGU

Illinois

WI/MI Delivery

WI/MI Generation

In millions

Depreciation at the utilities expected to average $790 million annually

over the five-year period

$1,898

$1,476

$1,950 $1,955 $1,887

*Excludes ATC projected capital expenditures

12

$516

$543

$489

$399

$311 $327 $295

$241

$0

$100

$200

$300

$400

$500

$600

2016 2017 2018 2019

ATC WEC portion 60%

Well Positioned for the Future

American Transmission Company

Key Assumptions

ATC 2015 average rate base:

$3.1 billion

Implies average $197 million

effective annual (FERC) rate base

growth for WEC from 2016 to 2019

ROE currently under FERC review

Projected Capital Expenditures

(Millions of Dollars)

$3.6 – $4.4 billion projected investment from 2016 – 2025

13

Well Positioned for the Future

American Transmission Company –

Outside the Traditional Footprint

Joint venture between Duke Energy and ATC (DATC)

Ownership split 50/50 between Duke and ATC

WEC interest: 30%

Investment opportunities:

Potential expansion of California’s Path 15 transmission line

Zephyr Power Transmission Project

Other transmission projects throughout the U.S.

14

Well Positioned for the Future

Sample Merger Driven Initiatives

Category Activity

Supply Chain Achieving savings in consolidated vendor and supplier

contracts, negotiating most favorable terms

Information Technology Consolidating IT infrastructure

Implementing uniform processes and consolidating to

a single Enterprise Resource Planning (ERP) system

Customer Care Established consistent measurements of customer

satisfaction across all six utilities

Rolling out advanced metering functionality

Expanding mobile options for our customers

Operations Implementing improved, standard order dispatch

Upgrading work management capabilities across the

Wisconsin fleet

15

A Track Record of Performance

Industry-Leading Dividend Growth

Raised the dividend by 17.3% in 2015 and 8.2% in 2016

Continuing to target dividend payout of 65-70% of earnings

Dividend expected to grow in line with earnings

*Annualized based on 4th quarter 2015 dividend of $0.4575

Annualized Dividends Per Share

$0.80

$1.04

$1.20

$1.445

$1.56

$1.83*

$1.98

2010 2011 2012 2013 2014 2015 2016

16

Poised for Growth

Key Takeaways for WEC Energy Group

Leading electric and natural gas utility in the Midwest

The eighth largest natural gas distribution company

in the nation

Projected long-term earnings per share growth of

5-7 percent compound annual growth rate off 2015 base

Targeting dividend growth in line with growth in

earnings per share

Majority ownership of American Transmission Company

brings additional transmission investment opportunity

Positioned to deliver among the best risk-adjusted returns

in the industry

Appendix

18

Electric Distribution Electric

Transmission

60% ownership

Natural Gas Distribution Electric Generation

19

Strategic Rationale

Transaction Overview

WEC Energy Group formed in 2015 when Wisconsin Energy

acquired Integrys in a transaction valued at $9 billion

Acquisition created the leading electric and natural gas

utility in the Midwest

Meets or exceeds WEC’s acquisition criteria

Accretive to earnings per share starting in first full calendar year of

combined operations

Largely credit neutral

Long-term growth prospects of combined entity equal to or greater than

stand-alone company

20

An “Earn and Return” Company with a Low Risk Profile

Well Positioned for the Future

Diversified across four state jurisdictions

and FERC

Strong financial condition

Top-tier record of producing shareholder

value

Strong, experienced management

Larger transmission

and gas business

No required equity

issuances

Attractive EPS

growth potential

Continued strong

dividend growth

potential

21

Major Construction Projects

Delivering the Future

Committed to infrastructure

investment that will:

Renew and modernize our

delivery networks

Meet new environmental

standards

Reduce operating costs

for customers

22

Major Construction Projects - Wisconsin Public Service

System Modernization and Reliability Project

$220 million of projected investment

from 2014-2018

Converting more than 1,000 miles of

overhead distribution power lines to

underground in northern Wisconsin

Adding distribution automation

equipment on 400 miles of lines

Proposed $200 million extension

2018-2021

23

Major Construction Projects – Upper Michigan Energy Resources Corp. (UMERC)

Proposed New Generation in the Upper Peninsula

Provides a long-term generation solution for electric reliability in

Upper Peninsula

~170 MW of clean, natural gas-fired Reciprocating Internal

Combustion Engine (RICE) generation

Estimated $255 million investment is made by the new Michigan utility

– UMERC

Half of the investment recovered in retail rates

Half of the investment recovered by a 20-year agreement with

Cliffs Natural Resources

Commercial operation targeted for 2019

Expect to file for approval with the Michigan Commission

in January 2017

270 day approval timeline based on state statute

Allows for the retirement of Presque Isle Power Plant

24

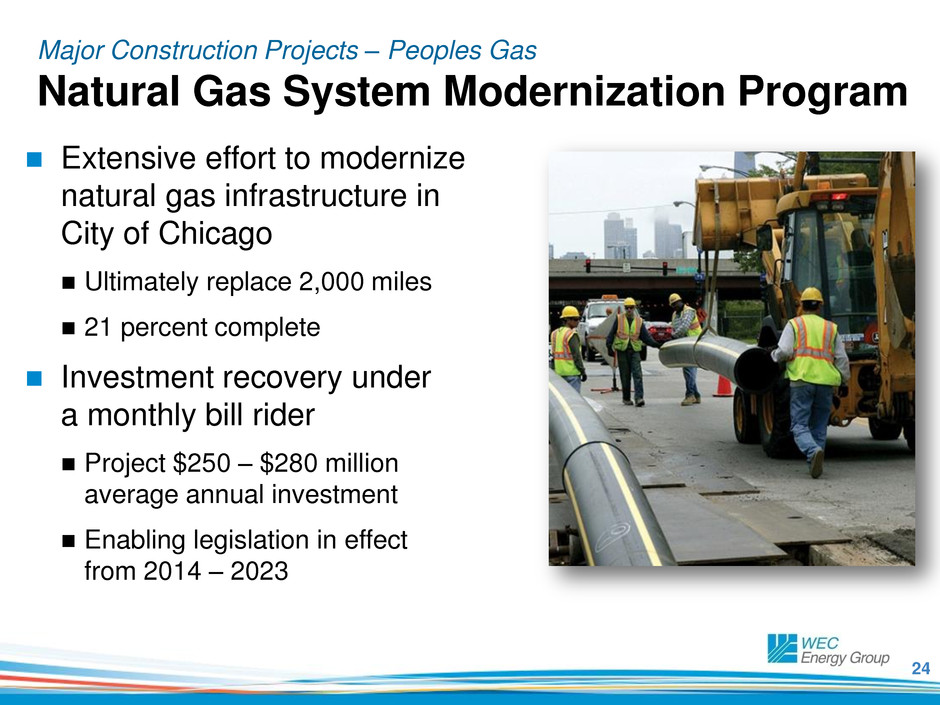

Major Construction Projects – Peoples Gas

Natural Gas System Modernization Program

Extensive effort to modernize

natural gas infrastructure in

City of Chicago

Ultimately replace 2,000 miles

21 percent complete

Investment recovery under

a monthly bill rider

Project $250 – $280 million

average annual investment

Enabling legislation in effect

from 2014 – 2023

25

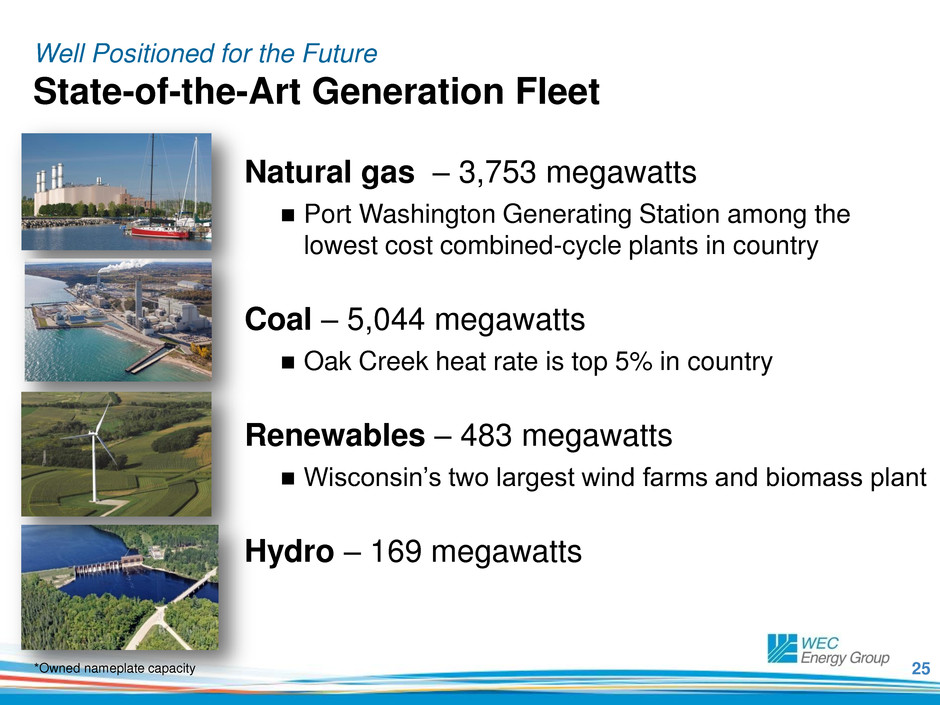

Well Positioned for the Future

State-of-the-Art Generation Fleet

Natural gas – 3,753 megawatts

Port Washington Generating Station among the

lowest cost combined-cycle plants in country

Coal – 5,044 megawatts

Oak Creek heat rate is top 5% in country

Renewables – 483 megawatts

Wisconsin’s two largest wind farms and biomass plant

Hydro – 169 megawatts

*Owned nameplate capacity

26

Well Positioned for the Future

Supporting a Clean Energy Future

WEC Energy Group has implemented a

multi-emission strategy to achieve greater

environmental benefit for lower cost

Retired older, less efficient coal-fired generation

Added two combined cycle natural gas units

Added state-of-the-art, coal-fired generation with

performance that ranks among the most thermally

efficient coal-fired units in the nation

Invested more than $1 billion in renewable energy –

including biomass and the state’s two largest

wind energy sites

Invested more than $1.5 billion in air quality systems

27

Reducing Emissions

Environmental Performance

0%

20%

40%

60%

80%

100%

120%

140%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

SO2 (88% reduction)

NOx (81% reduction)

Mercury (84% reduction)

P

e

rce

n

ta

g

e

o

f

Re

m

a

ini

n

g

E

m

iss

io

n

s

P

e

rce

n

ta

g

e

o

f

Re

m

a

ini

n

g

E

m

iss

io

n

s

28

Planning for Carbon Regulations

0%

20%

40%

60%

80%

100%

120%

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

2

0

1

5

P

erce

n

ta

g

e

C

omp

a

red

t

o

2

0

0

0

L

e

v

el

s

CO2 rate - lbs/mwh

23% Reduction in Carbon Intensity

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2015 Fuel Sources

Coal

Nuclear

Natural

Gas

Renewables

Other

29

EPA’s Clean Power Plan

Plan calls for Wisconsin to reduce CO2 emissions by 41%

Approximately two-thirds of the reductions must be

achieved by 2022

Stay by U.S. Supreme Court introduces delay and

additional uncertainty

30

Committed to Protecting the Environment

Balancing the delivery of safe, reliable and affordable energy

Working to develop alternative generation solutions so we can

retire coal-fueled units over time

Examples – Presque Isle and Pulliam Power Plants

Continuing evaluation of possible future retirements of other

coal-fueled units

Received research and test exemptions to evaluate co-firing of

natural gas in some of our coal units – testing began June

2016

As regulations of GHG emissions take shape, our plan is to

work with our industry partners, environmental groups, and

the State of Wisconsin with a goal of reducing CO2 emissions

by approximately 40 percent below 2005 levels by 2030

31

Line of Business View

Ten Year Capital Projection 2016-2025

$309 $343 $412 $317 $337 $250 $350 $250 $250 $250

$396

$517

$502

$529 $515

$538

$476

$476 $476 $476

$771

$1,090 $1,041 $1,052 $1,035

$1,016 $956

$951 $951 $951

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

In millions

Total capital spend over the 10-year period of approximately $18 billion

*Excludes ATC projected capital expenditures

32

0

20

40

60

80

100

120

AA - A A- BBB+ BBB BBB- Below

Investment

Grade

A Track Record of Performance

Strong Financial Condition

Number of

Issuers

*Source: Standard & Poor’s Financial Services LLC (April 2016)

Utilities

Electric and Gas Utilities Credit Ratings Distribution*

Utility Rating

Wisconsin Electric A-

Wisconsin Gas A

Wisconsin Public Service A-

Peoples Gas A-

North Shore Gas A-

33

Paper 21%

Mining/Minerals 13%

Foundry (SIC 33) 11%

Other Manufacturing 9%

Food/Agriculture 8%

Metal (SIC 34,35,37) 7%

Medical 5%

Office 5%

Education 4%

Chemical 4%

Printing 3%

Other 10%

37% Large C&I by Segment

Wisconsin Retail Deliveries

Balanced Sales Mix

Large C&I

37%

Residential

and Farm

28%

Small C&I

35%

2015 Retail Mwh Deliveries Mix*

*Wisconsin segment includes Michigan electric and retail choice customers in the Upper Peninsula

34

35.5%

16.5%

16.2%

10.6%

6.6%

1.4%

1.2%

1.2%

10.8%

Wisconsin Electric

Power the Future

Wisconsin Public Service Corporation

Peoples Gas

Wisconsin Gas

Minnesota Energy Resources

North Shore Gas

Michigan Gas Utilities

ATC

Composition of Rate Base

Total 2015 Rate Base of $17.0 billion

35

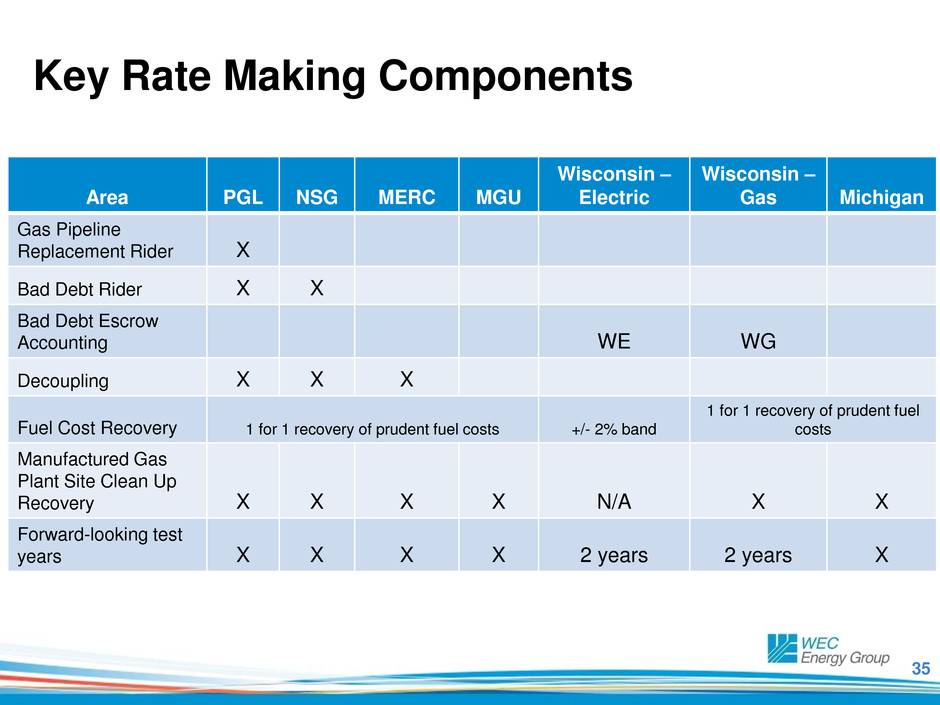

Key Rate Making Components

Area PGL NSG MERC MGU

Wisconsin –

Electric

Wisconsin –

Gas Michigan

Gas Pipeline

Replacement Rider X

Bad Debt Rider X X

Bad Debt Escrow

Accounting WE WG

Decoupling X X X

Fuel Cost Recovery 1 for 1 recovery of prudent fuel costs +/- 2% band

1 for 1 recovery of prudent fuel

costs

Manufactured Gas

Plant Site Clean Up

Recovery X X X X N/A X X

Forward-looking test

years X X X X 2 years 2 years X

36

Regulatory Environment

Wisconsin

Governor Scott Walker (R)

Commission

Gubernatorial appointment,

Senate confirmation

Chairman: Gubernatorial appointment

6-year staggered terms

Michigan

Governor Rick Snyder (R)

Commission

Gubernatorial appointment,

Senate confirmation

Chairman: Gubernatorial appointment

6-year staggered terms

Wisconsin Commissioners

Name Party

Began

Serving

Term

Ends

Ellen Nowak

Chair

R 07/2011 03/2019

Mike Huebsch

R 03/2015 03/2021

Phil Montgomery

R 03/2011 03/2017

Michigan Commissioners

Name Party

Began

Serving

Term

Ends

Sally Talberg

Chair

I 07/2013 07/2019

Norm Saari R 08/2015 07/2021

Rachel Eubanks I 08/2016 07/2017

37

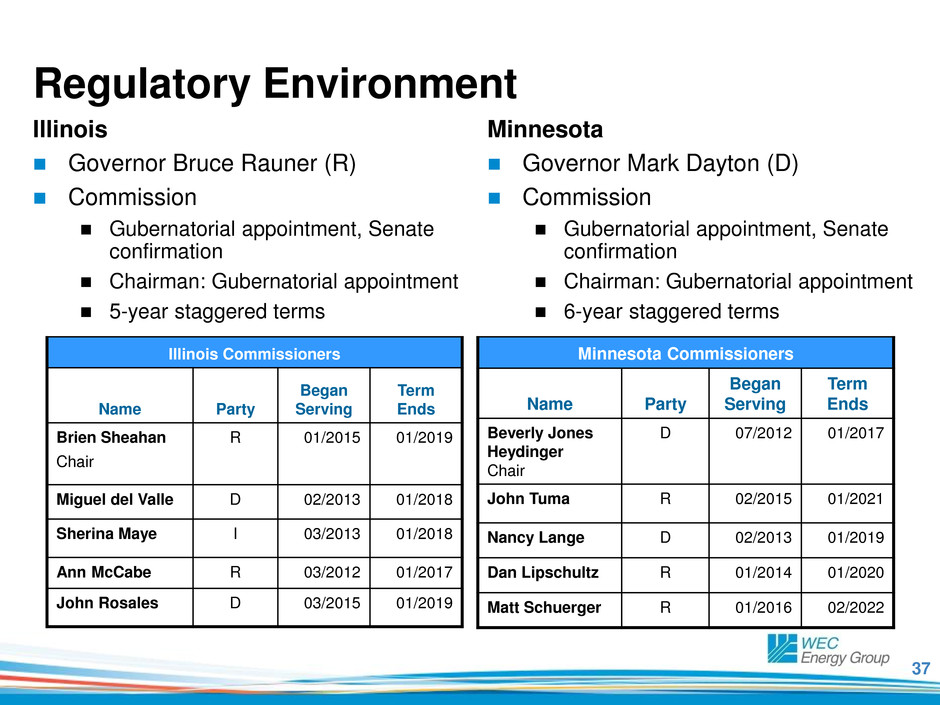

Regulatory Environment

Illinois

Governor Bruce Rauner (R)

Commission

Gubernatorial appointment, Senate

confirmation

Chairman: Gubernatorial appointment

5-year staggered terms

Minnesota

Governor Mark Dayton (D)

Commission

Gubernatorial appointment, Senate

confirmation

Chairman: Gubernatorial appointment

6-year staggered terms

Illinois Commissioners

Name Party

Began

Serving

Term

Ends

Brien Sheahan

Chair

R 01/2015 01/2019

Miguel del Valle D 02/2013 01/2018

Sherina Maye I 03/2013 01/2018

Ann McCabe R 03/2012 01/2017

John Rosales D 03/2015 01/2019

Minnesota Commissioners

Name Party

Began

Serving

Term

Ends

Beverly Jones

Heydinger

Chair

D 07/2012 01/2017

John Tuma R 02/2015 01/2021

Nancy Lange D 02/2013 01/2019

Dan Lipschultz R 01/2014 01/2020

Matt Schuerger R 01/2016 02/2022

38

Regulatory Environment

FERC

Presidential appointment, Senate confirmation

5-year term

FERC Commissioners

Name Party

Began

Serving

Term

Ends

Norman Bay Chair D 08/2014 06/2018

Cheryl LaFleur D 07/2014 06/2019

Colette Honorable D 01/2015 06/2017

Open

Open

39

Key Provisions in Merger Approval

• Earnings cap at Wisconsin Electric and Wisconsin Gas

• Joint Resource Plan for capacity needs of Wisconsin Electric and

Wisconsin Public Service

Wisconsin

• 2-year requirement for minimum level of jobs

• 2-year base rate freeze

• 3-year capital commitment

• Follow the recommendations of the 3rd party audit of the gas pipeline

replacement program

Illinois

• If requested, either invest in and/or purchase power from a new power

plant (which would enable retirement of the Presque Isle Plant)

• Pursue the formation of a Michigan-only utility for our customers in

Michigan’s Upper Peninsula

Michigan

• No workforce reductions beyond normal attrition for two years Minnesota

• For policy issues, WEC will only vote legacy TEG ownership of 34% of

ATC FERC

40

Precedent Transactions

Announce

Date

Closing

Date

Target Acquiror 1-Day

Premium

FY1

P/E

FY2

P/E

Transaction

Value ($mm)

Equity

Value

($mm)

Price/Book Enterprise

Value/

Rate Base

07/29/2016 Pending Oncor NEE n/a 26.5x 23.8x $18,400 $11,898 1.6x 1.77x

05/31/2016 Pending WR GXP 36%(1) 24.6x 23.7x $12,231 $8,600 2.3x 1.72x

02/09/2016 Pending EDE AQN.CN 50%(1) 22.4x 21.1x $2,366 $1,489 1.9x 1.49x

02/09/2016 Pending ITC FTS.CN 33%(1) 21.6x 20.0x $11,269 $6,889 4.1x 1.98x

02/01/2016 09/16/2016 STR D 23% 19.1x 18.9x $5,960 $4,371 3.4x 2.29x(2)

10/26/2015 Pending PNY DUK 42% 29.8x 28.0x $6,700 $4,916 3.5x 2.5x

09/04/2015 07/01/2016 TE EMA.CN 48%(1) 23.3x 21.5x $10,361 $6,480 2.5x 1.60x(3)

08/24/2015 07/01/2016 GAS SO 38% 21.5x 20.6x $11,978 $7,926 2.0x n/a

02/25/2015 12/16/2015 UIL Iberdrola 25%(1) 21.7x 20.4x $4,674 $2,983 2.2x 1.95x

10/20/2014 04/13/2016 CNL Multiple n/a(4) 20.5x 18.7x $4,700 $3,343 2.1x 1.68x

06/23/2014 06/29/2015 TEG WEC 17% 20.0x 18.5x $9,020 $5,758 1.7x 1.55x

04/30/2014 03/26/2016 POM EXC 25%(1) 22.5x 20.8x $12,193 $6,872 1.6x 1.58x

12/11/2013 08/15/2014 UNS FTS.CN 30% 18.0x 17.9x $4,282 $2,515 2.2x 1.55x

05/29/2013 12/19/2013 NVE Berkshire 20% 18.3x 17.6x $10,465 $5,592 1.6x 1.45x

Average 32% 22.1x 20.8x 2.3x 1.78x

Median 32% 21.6x 20.5x 2.1x 1.68x

1. Based on unaffected date.

2. Historical rate base. Includes E&P investment base.

3. Based on press releases.

4. Company disclosed engagement in strategic transaction discussions prior to announcement of transactions.

41

Contact Information

M. Beth Straka

Senior Vice President – Investor Relations and Corporate Communications

Beth.Straka@wecenergygroup.com

414-221-4639