Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8-K/A - Teligent, Inc. | v456737_8ka.htm |

Exhibit 99.1

Teligent, Inc. 35 th Annual J.P. Morgan Healthcare Conference January 11, 2017 Jason Grenfell - Gardner | CEO Jenniffer Collins | CFO NASDAQ Global Select: TLGT

Safe Harbor Statement 2 Except for historical facts, the statements in this presentation, as well as oral statements or other written statements made or to be made by Teligent , Inc . , are forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and involve risks and uncertainties . For example, without limitation, statements about the Company’s anticipated growth and future operations, the current or expected market size for its products, the success of current or future product offerings and the research and development efforts and the Company’s ability to file for and obtain U . S . Food and Drug Administration (FDA) approvals for future products, are forward - looking statements . Forward - looking statements are merely the Company’s current predictions of future events . The statements are inherently uncertain, and actual results could differ materially from the statements made herein . There is no assurance that the Company will achieve the sales levels that will make its operations profitable or that FDA filings and approvals will be completed and obtained as anticipated . For a description of additional risks and uncertainties, please refer to the Company’s filings with the Securities and Exchange Commission, including its latest Annual Report on Form 10 – K and its latest Quarterly Report on Form 10 - Q . The Company assumes no obligation to update its forward - looking statements to reflect new information and developments .

Investment Highlights Specialty Generics Targeting Attractive Markets • Fully - integrated specialty generics pharmaceutical company • Pursuing Topical , Injectable, Complex and Ophthalmic markets Growing Development Pipeline • 36 ANDAs on file in US with $2.0 bn Total Addressable Market 1 , we received 4 approvals in 4Q16 • 5 Applications on file in Canada, 8 applications submitted to Health Canada in 2016 Diversified Product Portfolio • 20 Teligent products (topical and injectable) in 50 presentations in the US • Received 9 ANDA approvals in 2016, including first GDUFA Year 3 approval • Received 8 approvals, including 2 Teligent topical products, from Health Canada High - quality Manufacturing • FDA - approved, cGMP - compliant facility, No 483 observations in the last three cGMP inspections, inspected in January 2016 • Flexible and broad capabilities, with a significant expansion underway to expand and automate topical manufacturing and add sterile manufacturing capabilities Proven, Dynamic Management Team • Experienced team with a track record of delivering • Culture founded on Impactful Science, Quality and Craftsmanship 1. Source: IMS Health, November 2016 3

4 Our Executive Management Team is dedicated to driving the company’s long - term transformation into a science - centered specialty generics pharmaceutical company. Executive Team Jason Grenfell - Gardner, President & Chief Executive Officer Jason joined Teligent in 2012 and brought significant experience in generic sales and marketing, supply chain, and management from his time at West - Ward Pharmaceuticals and Hikma Pharmaceuticals. MBA from INSEAD. Jenniffer Collins, Chief Financial Officer Jenniffer joined Teligent in 2011 and has over 20 years of experience in finance and accounting including experience at several public companies and PWC. Steve Richardson, Chief Scientific Officer Steve joined Teligent in 2015, bringing almost 30 years of experience in Regulatory and R&D efforts, including experience with Lachman Consultants, Inc., JHP Pharmaceuticals and Stiefel Laboratories.

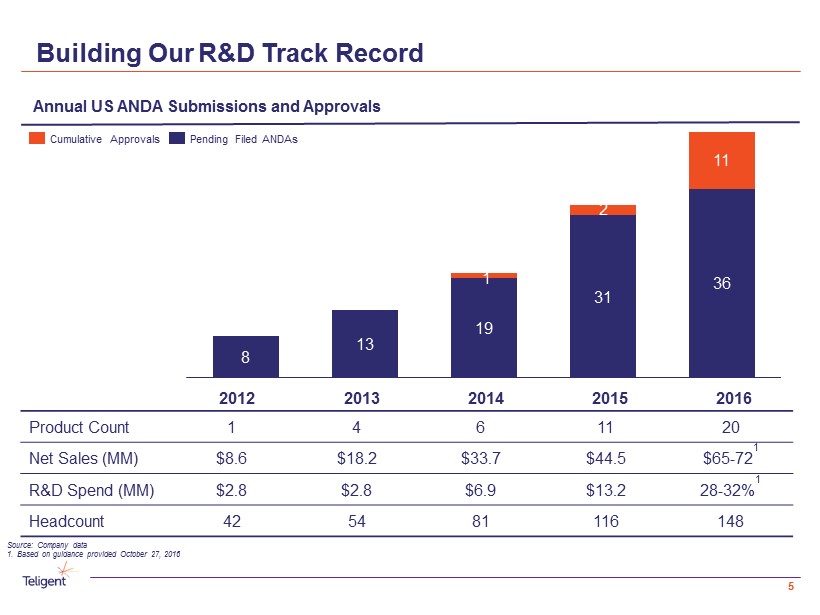

Building Our R&D Track Record 5 Annual US ANDA Submissions and Approvals 8 13 19 31 36 11 2014 2015 1 2013 2016 2 2012 Pending Filed ANDAs Cumulative Approvals Produc t Count 1 4 6 11 20 Net Sales (MM) $8.6 $18.2 $33.7 $44.5 $65 - 72 1 R&D Spend (MM) $2.8 $2.8 $6.9 $13.2 28 - 32% 1 Headcount 42 54 81 116 148 Source: Company data 1. Based on guidance provided October 27, 2016

We Continue to Diversify Our Portfolio Our expansion is underway to deliver a diversified portfolio through TICO : • T opical: Cornerstone of our expertise • I njectable: Favorable market opportunities • C omplex: Unique product/regulatory situations • O phthalmic: Leverage our infrastructure We have established a highly - productive development platform: • 36 topical ANDAs under FDA review with a TAM of $2.0 billion 1 Expanding Our Capabilities Building from Our Roots 1. Source: IMS Health, November 2016, TAM – Total Addressable Market Expanding our development and commercial focus to TICO generics leverages our proven expertise so that we can deliver a broader product mix to the market Topical Injectable Complex Ophthalmic Topical 6

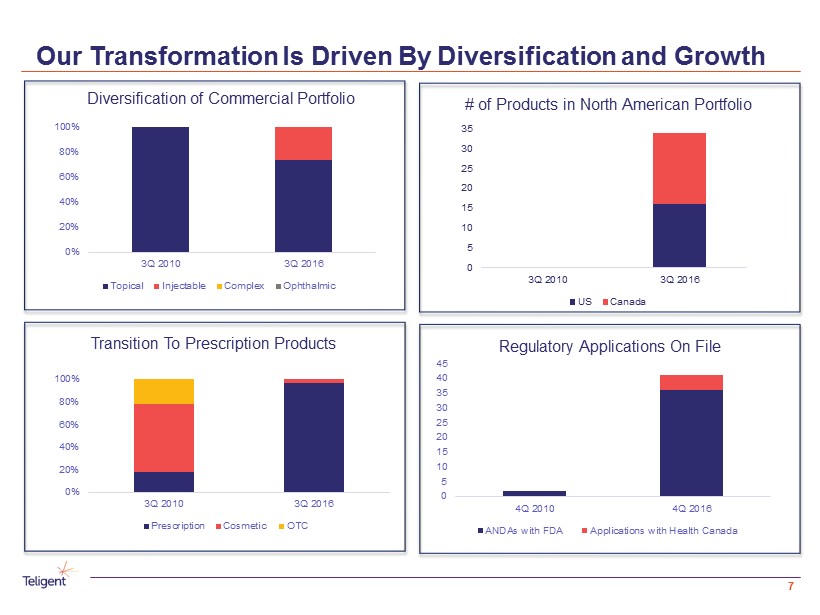

Our Transformation Is Driven By Diversification and Growth 7 # of Products in North American Portfolio Regulatory Applications On File Diversification of Commercial Portfolio Transition To Prescription Products 0 5 10 15 20 25 30 35 3Q 2010 3Q 2016 US Canada 0% 20% 40% 60% 80% 100% 3Q 2010 3Q 2016 Topical Injectable Complex Ophthalmic 0% 20% 40% 60% 80% 100% 3Q 2010 3Q 2016 Prescription Cosmetic OTC 0 5 10 15 20 25 30 35 40 45 4Q 2010 4Q 2016 ANDAs with FDA Applications with Health Canada

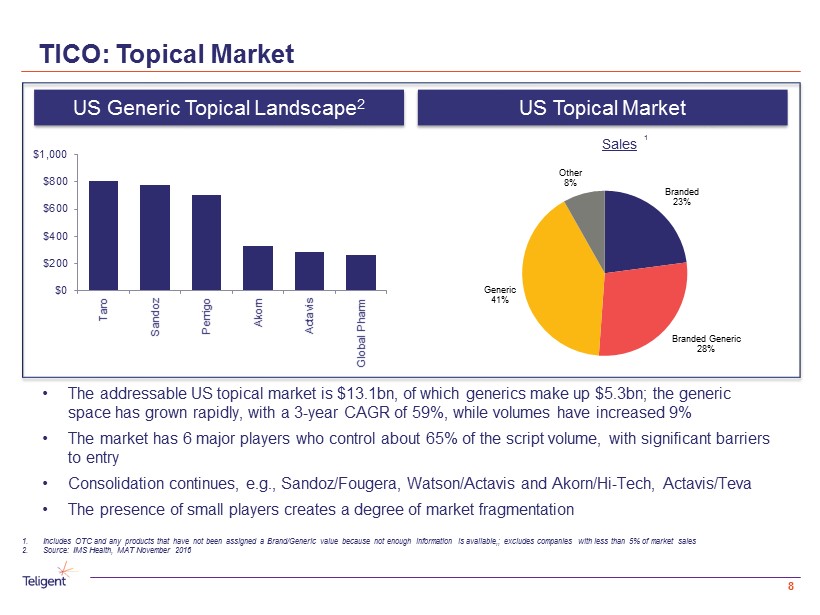

1 • The addressable US topical market is $13.1bn, of which generics make up $5.3bn; the generic space has grown rapidly, with a 3 - year CAGR of 59%, while volumes have increased 9% • The market has 6 major players who control about 65% of the script volume, with significant barriers to entry • Consolidation continues, e.g., Sandoz/ Fougera , Watson/Actavis and Akorn /Hi - Tech, Actavis/ Teva • The presence of small players creates a degree of market fragmentation TICO: Topical Market 8 1. Includes OTC and any products that have not been assigned a Brand/Generic value because not enough information is available,; ex cludes companies with less than 5% of market sales 2. Source: IMS Health, MAT November 2016 US Generic Topical Landscape 2 US Topical Market Sales Branded 23% Branded Generic 28% Generic 41% Other 8% $0 $200 $400 $600 $800 $1,000 Taro Sandoz Perrigo Akorn Actavis Global Pharm

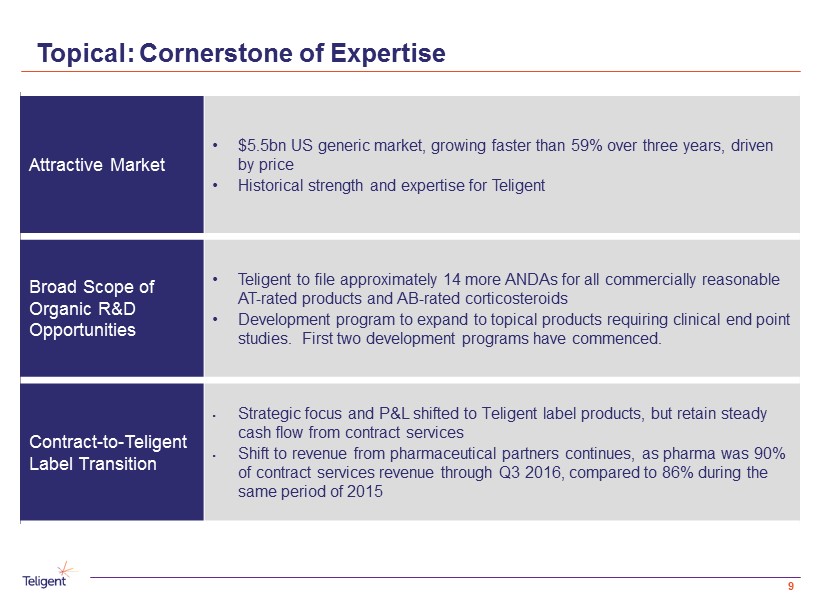

Topical: Cornerstone of Expertise Attractive Market • $5.5bn US generic market, growing faster than 59% over three years, driven by price • Historical strength and expertise for Teligent Broad Scope of Organic R&D Opportunities • Teligent to file approximately 14 more ANDAs for all commercially reasonable AT - rated products and AB - rated corticosteroids • Development program to expand to topical products requiring clinical end point studies. First two development programs have commenced. Contract - to - Teligent Label Transition • Strategic focus and P&L shifted to Teligent label products, but retain steady cash flow from contract services • Shift to revenue from pharmaceutical partners continues, as pharma was 90% of contract services revenue through Q3 2016, compared to 86% during the same period of 2015 9

Expansion Underway to Increase R&D and Production Capacity and Capabilities Site Overview • 33,500 sq ft campus, including an FDA - approved facility to make pharmaceuticals and medical devices • Capability to develop and produce creams, ointments, lotions, gels, solutions and suspensions • Most recent FDA inspection in January 2016, with no 483 observations • Capacity utilization is approximately 75% based on compounding 1 - 2 products/day and filling one/day • Based on current forecasts, capacity constraints begin in 2017 Expansion Supports TICO Growth Strategy • New high - speed tube - filling line is now on - line for commercial production • Product Development lab renovations completed and new lab started up in 2016 • Broke ground on facility expansion, estimated $50 million to be completed by end of 2017 10

11 Where We Are Going Teligent is investing in high - tech and high - speed equipment to strengthen our capabilities.

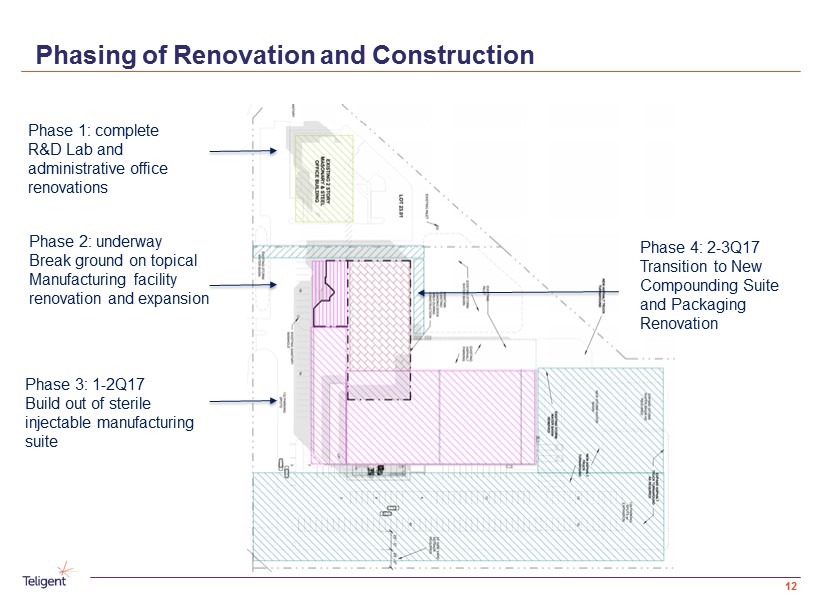

Phasing of Renovation and Construction 12 Phase 1: complete R&D Lab and administrative office renovations Phase 2: underway Break ground on topical Manufacturing facility renovation and expansion Phase 3: 1 - 2Q17 Build out of sterile injectable manufacturing suite Phase 4: 2 - 3Q17 Transition to New Compounding Suite and Packaging Renovation

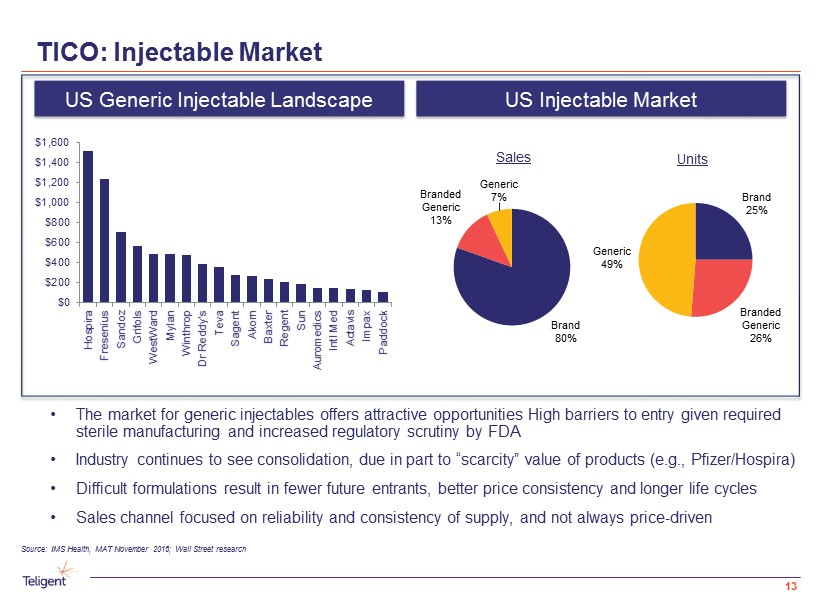

Sales Brand 25% Branded Generic 26% Generic 49% TICO: Injectable Market 13 Source: IMS Health, MAT November 2016; Wall Street research • The market for generic injectables offers attractive opportunities High barriers to entry given required sterile manufacturing and increased regulatory scrutiny by FDA • Industry continues to see consolidation, due in part to “scarcity” value of products (e.g., Pfizer/ Hospira ) • Difficult formulations result in fewer future entrants, better price consistency and longer life cycles • Sales channel focused on reliability and consistency of supply, and not always price - driven US Injectable Market US Generic Injectable Landscape Units Brand 80% Branded Generic 13% Generic 7% $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 Hospira Fresenius Sandoz Grifols WestWard Mylan Winthrop Dr Reddy's Teva Sagent Akorn Baxter Regent Sun Auromedics Intl Med Actavis Impax Paddock

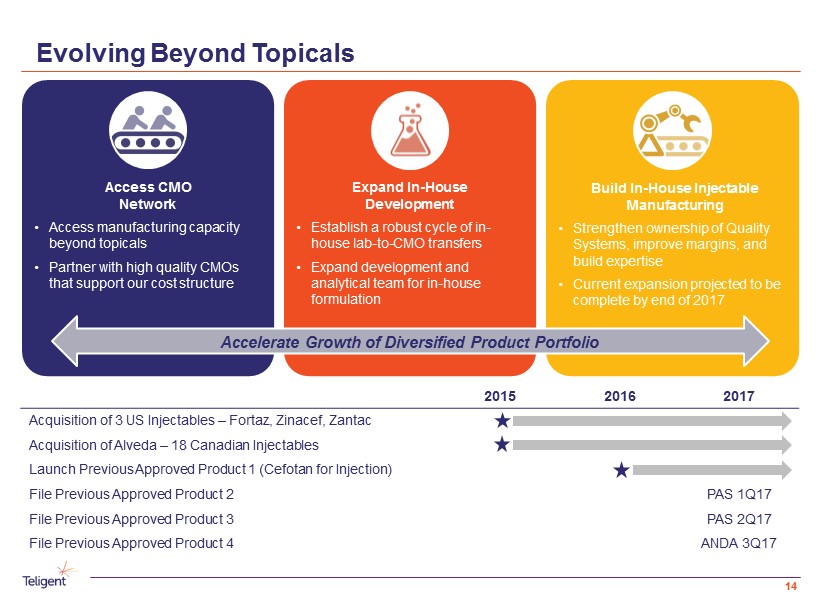

Evolving Beyond Topicals Expand In - House Development • Establish a robust cycle of in - house lab - to - CMO transfers • Expand development and analytical team for in - house formulation Access CMO Network • Access manufacturing capacity beyond topicals • Partner with high quality CMOs that support our cost structure Build In - House Injectable Manufacturing • Strengthen ownership of Quality Systems, improve margins, and build expertise • Current expansion projected to be complete by end of 2017 Accelerate Growth of Diversified Product Portfolio 2015 2016 2017 Acquisition of 3 US Injectables – Fortaz, Zinacef , Zantac Acquisition of Alveda – 18 Canadian Injectables Launch Previous Approved Product 1 ( Cefotan for Injection) File Previous Approved Product 2 PAS 1Q17 File Previous Approved Product 3 PAS 2Q17 File Previous Approved Produc t 4 ANDA 3Q17 14

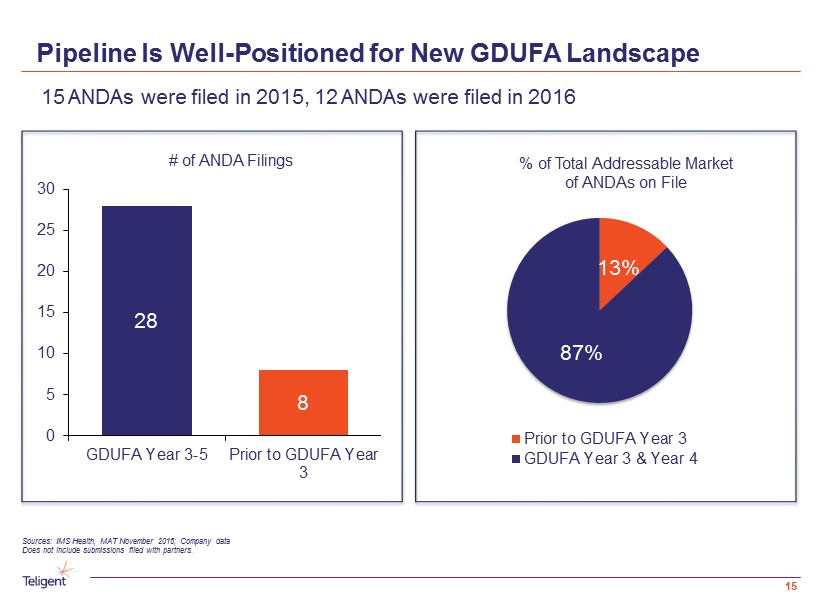

Pipeline Is Well - Positioned for New GDUFA Landscape 15 15 ANDAs were filed in 2015, 12 ANDAs were filed in 2016 Sources: IMS Health, MAT November 2016; Company data Does not include submissions filed with partners. # of ANDA Filings % of Total Addressable Market of ANDAs on File 28 8 0 5 10 15 20 25 30 GDUFA Year 3-5 Prior to GDUFA Year 3 13% 87% Prior to GDUFA Year 3 GDUFA Year 3 & Year 4

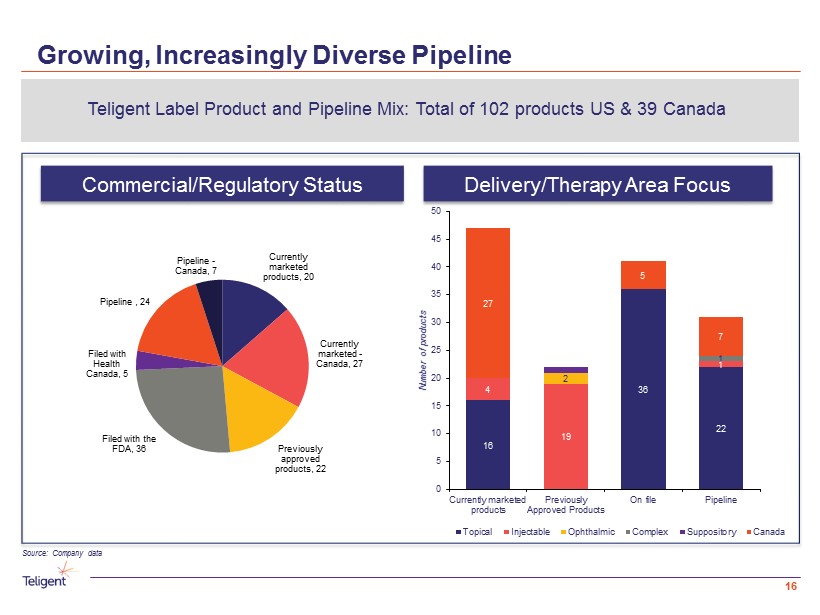

Growing, Increasingly Diverse Pipeline Delivery/Therapy Area Focus Commercial/Regulatory Status Teligent Label Product and Pipeline Mix: Total of 102 products US & 39 Canada Source: Company data 16 16 36 22 4 19 1 2 1 27 5 7 0 5 10 15 20 25 30 35 40 45 50 Currently marketed products Previously Approved Products On file Pipeline Number of products Topical Injectable Ophthalmic Complex Suppository Canada Currently marketed products , 20 Currently marketed - Canada , 27 Previously approved products , 22 Filed with the FDA , 36 Filed with Health Canada , 5 Pipeline , 24 Pipeline - Canada, 7

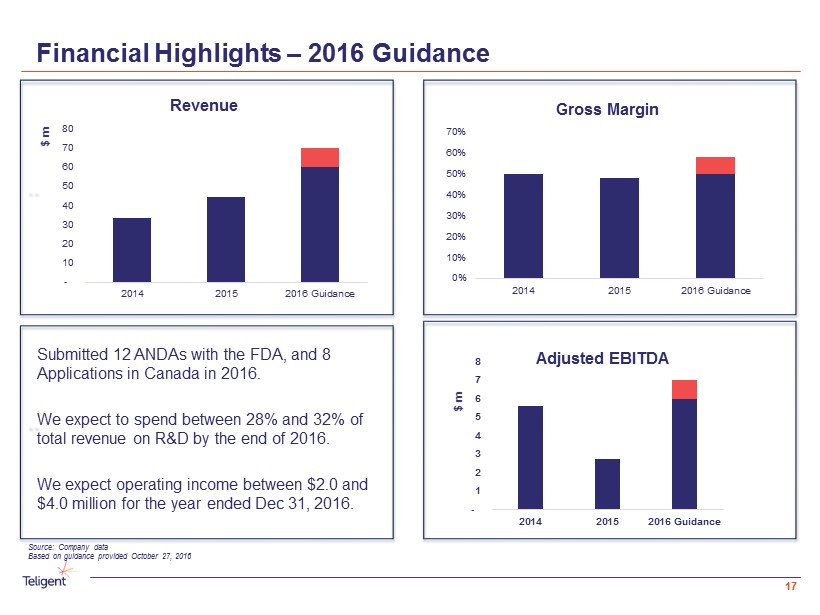

Financial Highlights – 2016 Guidance `` - 1 2 3 4 5 6 7 8 2014 2015 2016 Guidance $ m Adjusted EBITDA Submitted 12 ANDAs with the FDA, and 8 Applications in Canada in 2016. We expect to spend between 28% and 32% of total revenue on R&D by the end of 2016. We expect operating income between $2.0 and $4.0 million for the year ended Dec 31, 2016. 0% 10% 20% 30% 40% 50% 60% 70% 2014 2015 2016 Guidance Gross Margin `` - 10 20 30 40 50 60 70 80 2014 2015 2016 Guidance $ m Revenue 17 Source: Company data Based on guidance provided October 27, 2016

Investment Highlights Specialty Generics Targeting Attractive Markets • Fully - integrated specialty generics pharmaceutical company • Pursuing Topical , Injectable, Complex and Ophthalmic markets Growing Development Pipeline • 36 ANDAs on file in US with $2.0 bn Total Addressable Market 1 , we received 4 approvals in 4Q16 • 5 Applications on file in Canada, 8 applications submitted to Health Canada in 2016 Diversified Product Portfolio • 20 Teligent products (topical and injectable) in 50 presentations in the US • Received 9 ANDA approvals in 2016, including first GDUFA Year 3 approval • Received 8 approvals, including 2 Teligent topical products, from Health Canada High - quality Manufacturing • FDA - approved, cGMP - compliant facility, No 483 observations in the last three cGMP inspections, inspected in January 2016 • Flexible and broad capabilities, with a significant expansion underway to expand and automate topical manufacturing and add sterile manufacturing capabilities Proven, Dynamic Management Team • Experienced team with a track record of delivering • Culture founded on Impactful Science, Quality and Craftsmanship 1. Source: IMS Health, November 2016 18

19