Attached files

| file | filename |

|---|---|

| EX-23.1 - Frankly Inc | ex23-1.htm |

| EX-4.2 - Frankly Inc | ex4-2.htm |

| EX-3.4 - Frankly Inc | ex3-4.htm |

| EX-23.4 - Frankly Inc | ex23-4.htm |

| EX-23.3 - Frankly Inc | ex23-3.htm |

| EX-23.2 - Frankly Inc | ex23-2.htm |

| EX-10.6 - Frankly Inc | ex10-6.htm |

| EX-10.5 - Frankly Inc | ex10-5.htm |

| EX-4.5 - Frankly Inc | ex4-5.htm |

| EX-4.3 - Frankly Inc | ex4-3.htm |

| EX-3.1 - Frankly Inc | ex3-1.htm |

| S-1/A - Frankly Inc | forms-1a.htm |

Credit Agreement

BETWEEN

RAYCOM MEDIA, INC.

– and –

FRANKLY INC.

August 31, 2016

Table of Contents

| Page | |

| ARTICLE 1 INTERPRETATION | 1 |

| 1.1 Definitions | 1 |

| 1.2 Certain Rules of Interpretation | 19 |

| 1.3 Governing Law | 20 |

| 1.4 Entire Agreement | 20 |

| 1.5 Business Day | 20 |

| 1.6 Conflicts | 20 |

| 1.7 Guaranteed Amounts | 21 |

| 1.8 Accounting Changes | 21 |

| 1.9 Schedules and Exhibits | 21 |

| ARTICLE 2 CREDIT FACILITY | 22 |

| 2.1 Facility | 22 |

| 2.2 Purpose | 22 |

| 2.3 Drawdowns—Notices and Limitations | 23 |

| 2.4 Lender’s Records | 23 |

| ARTICLE 3 CALCULATION OF INTEREST, FEES AND EXPENSES | 23 |

| 3.1 Calculation and Payment of Interest | 23 |

| 3.2 Expenses | 24 |

| 3.3 General Provisions Regarding Interest | 24 |

| 3.4 Maximum Return | 24 |

| ARTICLE 4 REDUCTION OF COMMITMENT AND REPAYMENT | 25 |

| 4.1 Optional Repayment of Loans under the Facility | 25 |

| 4.2 Repayment of Facility | 26 |

| 4.3 Other Mandatory Repayments | 26 |

| 4.4 Payments—General | 27 |

| ARTICLE 5 INDEMNITIES | 27 |

| 5.1 General Indemnity | 27 |

| 5.2 Environmental Indemnity | 28 |

| ARTICLE 6 CONDITIONS PRECEDENT | 28 |

| 6.1 Conditions Precedent to the Initial Drawdown | 28 |

| 6.2 Conditions Precedent to all Loans | 31 |

| 6.3 Waiver of a Condition Precedent | 32 |

| ARTICLE 7 SECURITY DOCUMENTS | 32 |

| 7.1 Security Documents | 32 |

| 7.2 Registration of Security Documents | 34 |

| 7.3 Dealing With Security Documents | 34 |

| 7.4 Permitted Liens | 34 |

| ARTICLE 8 REPRESENTATIONS AND WARRANTIES | 35 |

| 8.1 Representations and Warranties | 35 |

| 8.2 Repetition of Representations and Warranties | 41 |

| 8.3 Survival of Representations and Warranties | 41 |

| -i- |

Table of Contents

(continued)

| Page | |

| ARTICLE 9 COVENANTS | 41 |

| 9.1 Positive Covenants | 41 |

| 9.2 Financial Covenants | 47 |

| 9.3 Negative Covenants | 48 |

| ARTICLE 10 EVENTS OF DEFAULT | 50 |

| 10.1 Events of Default | 50 |

| 10.2 Acceleration and Remedies | 53 |

| 10.3 Application of Proceeds of Realization | 54 |

| 10.4 Waivers | 54 |

| 10.5 Non-Merger | 55 |

| 10.6 Lender May Perform Covenants | 55 |

| 10.7 Grant of Licence | 55 |

| ARTICLE 11 GENERAL | 55 |

| 11.1 Time of Essence | 55 |

| 11.2 Notices | 55 |

| 11.3 Severability | 56 |

| 11.4 Submission to Jurisdiction | 57 |

| 11.5 Amendment and Waiver | 57 |

| 11.6 Further Assurances | 57 |

| 11.7 Assignment | 58 |

| 11.8 Enurement | 58 |

| 11.9 Counterparts and Electronic Delivery | 58 |

| 11.10 Conduct of Parties | 58 |

| 11.11 Remedies Cumulative | 58 |

| 11.12 Survival | 58 |

| 11.13 Telephone Instructions | 59 |

| 11.14 Judgment Currency | 59 |

| 11.15 No Contra Proferentem | 59 |

| 11.16 Consent to Disclosure of Information | 60 |

| -ii- |

Credit Agreement

THIS AGREEMENT is dated as of August 31, 2016

BETWEEN:

RAYCOM MEDIA, INC., as Lender

- and -

FRANKLY INC., as Borrower

CONTEXT

| A. | The Lender has agreed to provide the Facility to the Borrower on the terms set out in this Agreement. |

| B. | The Borrower and the Guarantors have agreed to execute and deliver to the Lender the Loan Documents to which they are a party, and to comply with the other terms set out in this Agreement. |

THEREFORE, the Parties agree as follows:

Article

1

INTERPRETATION

| 1.1 | Definitions |

In this Agreement, in addition to terms defined elsewhere in this Agreement, the following terms have the following meanings:

| 1.1.1 | “Accounting Changes” means (i) changes in accounting principles of IFRS as issued by the International Accounting Standards Board (or successor thereto or any agency with similar functions); or (ii) (x) changes in the application of such accounting principles adopted; or (y) the adoption of different accounting principles and standards by the Borrower and in each case concurred in by the Borrower’s independent chartered accountants and the Lender. |

| 1.1.2 | “Acquisition” means any transaction, or any series of related transactions, by which any Person, directly or indirectly, by means of a takeover bid, tender offer, amalgamation, merger, purchase of Property or otherwise: |

| 1.1.2.1 | acquires any business, line of business or business unit of any other Person; | |

| 1.1.2.2 | acquires all or substantially all of the Property of any other Person; | |

| 1.1.2.3 | acquires, or acquires Control of, Equity Securities of any other Person representing more than 50% of the ordinary voting power for the election of directors or other governing position, if the business affairs of that Person are managed by a board of directors or other governing body; |

| - 2 - |

| 1.1.2.4 | acquires, or acquires Control of, more than 50% of the ownership or economic interest in any other Person; or | |

| 1.1.2.5 | acquires Control of any other Person. |

| 1.1.3 | “Affiliate” means, with respect to a specified Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified. |

| 1.1.4 | “Agreement” means this credit agreement between the Borrower and the Lender, including all Schedules and Exhibits, as it may be confirmed, amended, extended, supplemented or restated by written agreement between the Parties. |

| 1.1.5 | “Anti-Money Laundering Legislation” means the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada) and other Applicable Laws relating to anti-money laundering, anti-terrorist financing, government sanctions and “know your client” matters, whether in Canada or elsewhere, together with any guidelines or orders under those laws. |

| 1.1.6 | “Applicable Law” means, at any time, and whether or not having the force of law: |

| 1.1.6.1 | any domestic or foreign statute, law (including common and civil law), treaty, code, ordinance, rule, regulation, restriction or by-law; | |

| 1.1.6.2 | any judgment, order, writ, injunction, decision, ruling, decree or award issued or made by any Governmental Authority; | |

| 1.1.6.3 | any regulatory policy, practice, guideline or directive of any Governmental Authority; or | |

| 1.1.6.4 | any other Authorization, |

in each case binding on or affecting the Person referred to in the context in which the term is used or binding on or affecting the Property of that Person.

| 1.1.7 | “Applicable Period” is defined in Section 1.1.26. |

| 1.1.8 | “Arm’s Length” means arm’s length as that term is interpreted in connection with its use in the Income Tax Act. |

| 1.1.9 | “Asset Disposition” means, at any time, the direct or indirect sale, transfer, assignment, conveyance, lease or other disposition of any Property by any Person. |

| 1.1.10 | “Authorization” means any authorization, order, permit, approval, grant, licence, qualification, consent, exemption, waiver, right, franchise, privilege, certificate, judgment, writ, injunction, award, determination, direction, decree, by-law, rule or regulation of any Governmental Authority having jurisdiction over any Person, whether or not having the force of law. |

| 1.1.11 | “Borrower” means Frankly Inc., a continued incorporated under the laws of British Columbia, and its successors and permitted assigns. |

| 1.1.12 | “Borrower’s Obligations” means, at any time, all of the indebtedness, liabilities and obligations, absolute or contingent, direct or indirect, matured or not matured, liquidated or unliquidated, of the Borrower to the Lender arising under the Facility or created by reason of or relating to this Agreement or any other Loan Document, including all Loans and any unpaid interest on them, all fees due under this Agreement and all reasonable costs and expenses of the Lender, and any other sums payable by the Borrower to the Lender, under the Loan Documents. |

| - 3 - |

| 1.1.13 | “Business Day” means any day excluding a Saturday, Sunday or other day on which commercial banking institutions are generally closed in Toronto, Ontario or New York, New York. |

| 1.1.14 | “Capital Expenditure” means any expense classified and accounted for as a capital expenditure pursuant to IFRS. |

| 1.1.15 | “Capital Lease” means any lease of Property by a Person as lessee that is required by IFRS to be classified and accounted for as a capital lease on the balance sheet of that Person. |

| 1.1.16 | “Capital Lease Obligations” means, for any Person, as of the date of determination, the obligations of that Person to pay rent and other amounts under a Capital Lease. |

| 1.1.17 | “Closing Date” means August 31, 2016 or any other date agreed to in writing by the Lender and the Borrower. |

| 1.1.18 | “Commitment” means, at any time, the commitment of the Lender to make a Loan available under the Facility in the amount of $14,500,000, as that amount may be reduced, adjusted or amended at any time under the terms of this Agreement, including without limitation Section 2.1.3. |

| 1.1.19 | “Communication” means any notice, demand, request, consent, approval or other communication which is required or permitted by this Agreement to be given or made by a Party. |

| 1.1.20 | “Compliance Certificate” means a compliance certificate substantially in the form attached to this Agreement as Exhibit 9.1.1.4, to be executed by a Responsible Officer of the Borrower and delivered to the Lender as set out in Section 9.1.1.4. |

| 1.1.21 | “Consolidated Basis” means, in relation to any Financial Statements or financial results of the Borrower (or any determination derived from them), the Financial Statements and financial results of the Borrower and the other Obligors, prepared and calculated on a consolidated basis all in accordance with IFRS. |

| 1.1.22 | “Constating Documents” means: |

| 1.1.22.1 | for a corporation, unlimited liability company, limited liability company or other body corporate, its articles of incorporation, amalgamation, arrangement or continuance or similar organizational documents, by-laws and any unanimous shareholder agreement or other shareholder agreement; | |

| 1.1.22.2 | for a partnership, limited liability partnership or limited partnership, its partnership declaration, partnership agreement or similar related organizational documents; |

| - 4 - |

| 1.1.22.3 | for a trust, the declaration, indenture or agreement under which it is created and its affairs are governed, or similar related organizational documents; or | |

| 1.1.22.4 | for any other entity or relationship of entities, the documents and agreements by which they are created and organized. |

| 1.1.23 | “Control” means the power to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting power, by contract or otherwise, and “Controlled” has a corresponding meaning. |

| 1.1.24 | “Criminal Code” means the Criminal Code, R.S.C. 1985, c. C-46. |

| 1.1.25 | “Current Liens” is defined in Section 6.1.1.13. |

| 1.1.26 | “Current Year Excess Cash Flow Amount” means, with respect to any Fiscal Year, commencing the Fiscal Year ending December 31, 2017, and as of any date of determination during the period (the “Applicable Period”) commencing with the date of receipt by the Lender of the consolidated financial statements required by Section 9.1.1.1 for the Fiscal Year ending December 31, 2017, the amount of Excess Cash Flow (which shall not be less than zero) for such Fiscal Year as determined by the Borrower in good faith and supported by calculations of such Excess Cash Flow amount in form and substance satisfactory to the Lender. For avoidance of doubt, the Current Year Excess Cash Flow Amount shall be zero on any date that is not part of the Applicable Period and all references to the definition of Excess Cash Flow to “Fiscal Year” shall be deemed to refer to the Applicable Period. |

| 1.1.27 | “Debt” means, at any time, without duplication, and on a Consolidated Basis, the obligations of any Person that are considered as debt in accordance with IFRS, including: |

| 1.1.27.1 | all indebtedness of that Person for money borrowed by or otherwise advanced to it for which the principal bears interest, including bankers’ acceptances, letters of credit or letters of guarantee and all indemnity and reimbursement obligations under them; | |

| 1.1.27.2 | all indebtedness of that Person for the deferred purchase price of Property or services; | |

| 1.1.27.3 | all indebtedness of that Person created or arising under any conditional sale or other title retention agreement with respect to Property acquired by that Person, including indebtedness under agreements that limit the rights and remedies of the seller or lender if default occurs to repossession or sale of that Property; | |

| 1.1.27.4 | all interest or other obligations of that Person that are capitalized; | |

| 1.1.27.5 | all Capital Lease Obligations of that Person; | |

| 1.1.27.6 | the aggregate amount at which any Equity Securities of that Person that are redeemable or retractable at the option of the holder may be redeemed or retracted for cash or other payment, provided that all conditions precedent for the redemption or retraction have been satisfied; |

| - 5 - |

| 1.1.27.7 | all other obligations of that Person upon which interest charges are customarily paid by that Person; | |

| 1.1.27.8 | all obligations arising from any right of recourse against that Person relating to any sale of accounts receivable to a Person that is not a Related Party, including in any securitization transaction; | |

| 1.1.27.9 | all obligations of that Person under any Guarantee; and | |

| 1.1.27.10 | all Debt of any other Person secured by (or for which a holder of that Debt has an existing right, contingent or otherwise, to be secured by) any Lien on Property, including accounts and contract rights, owned by the first Person, whether or not that Person has assumed or become liable for the payment of the obligation, provided that the amount of that Debt will be deemed to be the lesser of the unpaid amount of that Debt or the fair market value of that Property. |

| 1.1.28 | “Default” means any event or condition that with the passage of any time specified, the giving of any notice or the satisfaction of any condition subsequent would constitute an Event of Default. |

| 1.1.29 | “Depreciation Expense” means, for any period, depreciation, amortization, depletion and other similar reductions to income of a Person for that period not involving any outlay of cash, all determined in accordance with IFRS. |

| 1.1.30 | “Distribution” means any payment by a Person: |

| 1.1.30.1 | of any dividends or other distributions in cash on any of its Equity Securities; | |

| 1.1.30.2 | on account of, or for the purpose of setting apart any Property for, the purchase, redemption, retirement or other acquisition of any of the Equity Securities of that Person or any of its Subsidiaries or any warrants, options or rights to acquire any of those Equity Securities, or the making by that Person of any other distribution in cash relating to any of those Equity Securities; | |

| 1.1.30.3 | of any principal of, or interest or premium on or of, any Debt of that Person to a shareholder of that Person or to any other Person not at Arm’s Length to that Person or shareholder; | |

| 1.1.30.4 | of any: |

| 1.1.30.4.1 | management, consulting or similar fee or any bonus payment or comparable payment; | |

| 1.1.30.4.2 | gift or other gratuity; or | |

| 1.1.30.4.3 | amounts for services rendered, Property leased or acquired, or for any other reason, |

in each case, to any Related Party or to any Person not at Arm’s Length to that Person; or

| - 6 - |

| 1.1.30.5 | the setting aside of any cash or other Property to make any of the payments referred to above. |

| 1.1.31 | “Drawdown Date” means the Business Day specified as the date on which the Borrower is requesting that a Loan occur or on which it will occur pursuant to this Agreement. |

| 1.1.32 | “Adjusted EBITDA” means, for any period, the Net Income of a Person on a consolidated basis for that period, plus: |

| 1.1.32.1 | without duplication, but only to the extent any of those amounts were deducted in determining the Net Income for that period: |

| 1.1.32.1.1 | the Interest Expense of that Person for that period; | |

| 1.1.32.1.2 | the Income Tax Expense of that Person for that period; | |

| 1.1.32.1.3 | the Depreciation Expense of that Person for that period; | |

| 1.1.32.1.4 | the actual amortization expenses of that Person for that period; and | |

| 1.1.32.1.5 | extraordinary and non-recurring losses of that Person for that period; and | |

| 1.1.32.1.6 | any non-cash equity based compensation; less |

| 1.1.32.2 | without duplication, but only to the extent any of those amounts were added in determining Net Income for that period, extraordinary and non-recurring gains of that Person for that period. |

| 1.1.33 | “Environmental Activity” means any past, present or future activity, event or circumstance in respect of any Hazardous Materials, including their storage, use, holding, collection, purchase, accumulation, assessment, generation, manufacture, construction, processing, treatment, stabilization, disposition, handling or transportation, or their Release, escape, leaching, dispersal or migration into or movement through the Natural Environment. |

| 1.1.34 | “Environmental Laws” means, at any time, all Applicable Laws relating to Hazardous Materials, Environmental Activity and to the protection and regulation of the Natural Environment, or to human health and safety as it relates to Environmental Activity or the Natural Environment. |

| 1.1.35 | “Environmental Liabilities” means all Losses of any kind suffered by or against any Person or its business or Property, including or as a result of any order, investigation or action by any Governmental Authority, arising from or with respect to any one or more of the following: |

| 1.1.35.1 | the Release, threat of Release or presence of any Hazardous Materials, affecting any Property, whether or not originating or emanating from a Person’s Property or any contiguous Real Property or immovable Property, including any loss of value of any Property as a result of that Release, threat of Release or presence of any Hazardous Materials; |

| - 7 - |

| 1.1.35.2 | the Release of any Hazardous Materials owned by, or under the charge, management or Control of, that Person, or any assignor of that Person; | |

| 1.1.35.3 | liability incurred under any Environmental Laws for any costs incurred by any Governmental Authority or any other Person, or for damages from injury to, destruction of, or loss of natural resources in relation to, a Person’s Property or related Property, including the reasonable costs of assessing that injury, destruction or loss; and | |

| 1.1.35.4 | liability for personal injury or Property damage arising in connection with breach of any Environmental Laws, including by reason of any civil law offences or quasi-criminal offences or under any statutory or common law tort or similar theory, including damages assessed for the maintenance of a public or private nuisance or for the carrying on of a dangerous activity at, near, or with respect to a Person’s Property or elsewhere. |

| 1.1.36 | “Equity Incentive Plan” means the Borrower’s Stock Option and RSU Plan, as it exists as of the date hereof. |

| 1.1.37 | “Equity Securities” means, at any time, all shares or stock of, units of interest in, or participations or rights in, any Person’s capital (or other equivalents), whether voting or non-voting, including any interest in a partnership, limited partnership or other similar Person and any beneficial interest in a trust, and all rights, warrants, debt securities, options or other rights exchangeable for or convertible into any of the equity securities and related interests listed above. |

| 1.1.38 | “Event of Default” is defined in Section 10.1. |

| 1.1.39 | “Excess Cash Flow” means EBITDA less Interest Expense paid in cash for any Fiscal Year, aggregate tax expenses of the Borrower to the extent paid in cash during such Fiscal Year, Capital Expenditures to the extent paid in cash during such Fiscal Year, the aggregate of all scheduled payments of principal on Debt (other than mandatory prepayments of Loans) made in cash by the Borrower during such Fiscal Year, but only to the extent that such payments or repayments by their terms cannot be reborrowed or redrawn. |

| 1.1.40 | “Facility” means the non-revolving credit facility in the initial maximum principal amount of US$14,500,000, made available by the Lender to the Borrower under this Agreement and described in Section 2.1. |

| 1.1.41 | “Financial Statements” means a balance sheet, statement of income and retained earnings, statement of cash flow and any other statements required by IFRS, together with all schedules and notes to them. |

| 1.1.42 | “Fiscal Quarter” means, relating to any Person, the fiscal quarter of that Person. |

| 1.1.43 | “Fiscal Year” means, relating to any Person, the fiscal year of that Person. |

| 1.1.44 | “Governmental Authority” means: |

| 1.1.44.1 | any federal, provincial, state, local, municipal, regional, territorial, aboriginal, or other government, governmental or public department, branch, ministry, or court, domestic or foreign, including any district, agency, commission, board, arbitration panel or authority and any subdivision of any of them exercising or entitled to exercise any administrative, executive, judicial, ministerial, prerogative, legislative, regulatory, or taxing authority or power of any nature; and |

| - 8 - |

| 1.1.44.2 | any quasi-governmental or private body exercising any regulatory, expropriation or taxing authority under or for the account of any of them, and any subdivision of any of them. |

| 1.1.45 | “Guarantee” means any absolute or contingent liability of any Person under any guarantee, agreement, endorsement (other than for collection or deposit in the ordinary course of business), discount with recourse or other obligation to pay, purchase, repurchase or otherwise be or become liable or obligated upon any Debt of any other Person, and including any absolute or contingent obligations to: |

| 1.1.45.1 | advance or supply funds for the payment or purchase of any Debt of any other Person; | |

| 1.1.45.2 | purchase, sell or lease (as lessee or lessor) any Property, services, materials or supplies primarily for the purpose of enabling any other Person to pay its Debt or to assure the holder of it against loss relating to payment of that Debt; or | |

| 1.1.45.3 | indemnify or hold harmless any other Person from or against any losses, liabilities or damages, in circumstances intended to enable that other Person to incur or pay any of its Debt or to comply with any agreement relating to it or otherwise to assure or protect creditors against loss relating to that Debt. |

| 1.1.46 | “Guaranteed Obligations” means all indebtedness, liabilities and obligations, absolute or contingent, direct or indirect, matured or not matured, liquidated or unliquidated, of the Guarantors and each of them to the Lender under the Guarantee granted by each Guarantor to the Lender at any time. |

| 1.1.47 | “Guarantors” means, collectively: |

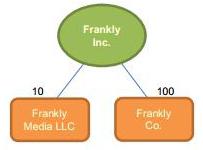

| 1.1.47.1 | Frankly Co. and Frankly Media LLC; | |

| 1.1.47.2 | each present or future Subsidiary of the Borrower; and | |

| 1.1.47.3 | each other Person who at any time grants a Guarantee of the Borrower’s Obligations to the Lender, in form and substance satisfactory to the Lender, |

and “Guarantor” means any one of them.

| 1.1.48 | “Hazardous Materials” means any substance that when Released into the Natural Environment creates a material risk of causing material harm or degradation, immediately or at some future time, to the Natural Environment, or any ascertainable risk to human health or safety, including any pollutant, contaminant, waste, hazardous waste, dangerous goods (as defined by applicable Environmental Laws), asbestos and polychlorinated biphenyls. |

| - 9 - |

| 1.1.49 | “IFRS” means the International Financial Reporting Standards as issued by the International Accounting Standards Board. |

| 1.1.50 | “Income Tax Act” means the Income Tax Act, R.S.C. 1985, c. 1 (5th Supp.). |

| 1.1.51 | “Income Tax Expense” means, with respect to any period, the aggregate of all Taxes on the income or capital of a Person, determined in accordance with IFRS, for that period. |

| 1.1.52 | “Indemnified Party” is defined in Section 5.1. |

| 1.1.53 | “Insolvency Law” means the Bankruptcy and Insolvency Act, R.S.C. 1985, c. B-3, the Companies’ Creditors Arrangement Act, R.S.C. 1985, c. C-36, the Winding-up and Restructuring Act, R.S.C. 1985, c. W-11, and any other laws relating to bankruptcy, insolvency, reorganization, compromise of debts or similar laws of any jurisdiction affecting creditors’ rights generally. |

| 1.1.54 | “Insurance” is defined in Section 9.1.14.1. |

| 1.1.55 | “Intellectual Property” means trade-marks and trade-mark applications, trade names, certification marks, patents and patent applications, copyrights, domain names, industrial designs, trade secrets, know-how, formulae, processes, inventions, technical expertise, research data and other similar property, all associated registrations and applications for registration, and all associated rights, including moral rights. |

| 1.1.56 | “Intellectual Property Rights” is defined in Section 8.1.17. |

| 1.1.57 | “Interest Coverage Ratio” means, as of any date of determination, the ratio of (a) Adjusted EBITDA for the then applicable Reference Period to (b) Interest Expense for the then applicable Reference Period. |

| 1.1.58 | “Interest Expense” means, with respect to any Reference Period and on a consolidated basis, the aggregate amount of interest and other financing charges incurred by a Person, determined in accordance with, and characterized under, IFRS as interest, during that period with respect to Debt (including, without duplication, interest, capitalized interest, discount and financing fees, unused commitment fees, commissions, discounts, costs related to factoring or securitizing accounts receivable and other fees and charges payable with respect to letters of credit and bankers’ acceptances, standby fees and the interest component of Capital Lease Obligations and PMSI Obligations). |

| 1.1.59 | “Interest Payment Date” means, the first Business Day of each month. |

| 1.1.60 | “Investment” means: |

| 1.1.60.1 | any direct or indirect purchase or other acquisition by any Investor of Equity Securities, or a beneficial interest in them, of any other Person that does not otherwise constitute an Acquisition, including any exchange of Equity Securities for indebtedness; | |

| 1.1.60.2 | any direct or indirect loan, advance (other than Loans to employees for moving and travel expenses, drawing accounts and similar expenditures in the ordinary course of business) or capital contribution (by way of cash or Property) by any Investor to any other Person, including all indebtedness and accounts receivable owing to the Investor from that other Person that did not arise from sales or services rendered to that other Person in the ordinary course of the Investor’s business; or |

| - 10 - |

| 1.1.60.3 | any direct or indirect purchase or other acquisition by any Investor of bonds, notes, debentures or other debt securities of any other Person. |

| 1.1.61 | “Investor” means any Person who makes an Investment. |

| 1.1.62 | “Judgment Conversion Date” is defined in Section 11.14.1.2. |

| 1.1.63 | “Judgment Currency” is defined in Section 11.14.1. |

| 1.1.64 | “Knowledge of the Obligors” means the knowledge that the Obligors or any of them either have, or would have obtained, after having made or caused to be made all reasonable inquiries necessary to obtain informed knowledge, including inquiries of the records of any Obligor and the management employees of any Obligor who are reasonably likely to have knowledge of the relevant matter. |

| 1.1.65 | “Lender” means Raycom Media, Inc., and its successors and assigns. |

| 1.1.66 | “Lien” means any Security Interest, lien (statutory, common law, equitable or otherwise), privilege, charge, trust deemed to exist under any Applicable Law or other encumbrance of any kind, or any other agreement or arrangement creating in favour of any claimant or creditor a right relating to any particular Property that is in priority to the right of any ordinary creditors relating to that Property, and including the right of a lessor under a Capital Lease or Operating Lease. |

| 1.1.67 | “Loan Documents” means this Agreement, the Security Documents and any other instruments and agreements entered into between the Lender and any Obligor relating to the Facility. |

| 1.1.68 | “Loans” means loans made under the Facility by the Lender to the Borrower. |

| 1.1.69 | “Losses” means all claims, suits, actions, debts, damages, costs, losses, liabilities, penalties, obligations, judgments, charges, expenses and disbursements, including all reasonable legal fees and disbursements on a solicitor and its own client basis. |

| 1.1.70 | “Material Adverse Change” means any event, development or circumstance that has had, or could reasonably be expected to have, a Material Adverse Effect. |

| 1.1.71 | “Material Adverse Effect” means any fact, circumstance or event that could result in a material adverse effect on: |

| 1.1.71.1 | the business, financial condition, operations or Property of the Obligors on a Consolidated Basis; | |

| 1.1.71.2 | the validity or enforceability of any Loan Document; | |

| 1.1.71.3 | the ability of any Obligor to perform its material obligations under the Loan Documents; or |

| - 11 - |

| 1.1.71.4 | the filing, registration, perfection or priority of any Security Interests created by the Security Documents, other than as a result of Permitted Liens that have priority under Applicable Law, against any Property of any Obligor or the rights and remedies of the Lender against that Property. |

| 1.1.72 | “Material Permits” means those Authorizations the breach, non-performance or cancellation of which, or the failure of which to renew, could reasonably be expected to result in a Material Adverse Effect. |

| 1.1.73 | “Maturity Date” means the fifth anniversary of the Closing Date, being August 31, 2021, subject to any earlier date that may result from any acceleration of the requirement to pay the Outstanding Obligations under this Agreement. |

| 1.1.74 | “Maximum Amount” is defined in Section 2.1.1. |

| 1.1.75 | “Natural Environment” means the air, land, subsoil and water (including surface water and ground water), or any combination or part of them. |

| 1.1.76 | “Net Income” means, relating to any period, the net income or loss, as applicable, of a Person for that period determined in accordance with IFRS and after Income Tax Expenses but excluding extraordinary items, as shown on that Person’s statement of operations for that period. |

| 1.1.77 | “Obligation Currency” is defined in Section 11.13. |

| 1.1.78 | “Obligor Location” means, for each Obligor, its sole place of business or chief executive office and, if different, its location as determined under the location of debtor rules in section 7(3) of the Personal Property Security Act (Ontario). |

| 1.1.79 | “Obligors” means, collectively, the Borrower and the Guarantors, and “Obligor” means any one of them. |

| 1.1.80 | “Operating Lease” means any lease of Property by a Person as lessee that is required by IFRS to be classified and accounted for as an operating lease. |

| 1.1.81 | “Operating Lease Obligations” means, under any Operating Lease entered into by any Obligor as lessee, the aggregate amount of the lease payments of the lessee, including all rent and payments to be made by the lessee in connection with the return of the leased Property, during the remaining term of the Operating Lease, including any period for which the Operating Lease has been extended. |

| 1.1.82 | “Optional Repayment Date” is defined in Section 4.1.1. |

| 1.1.83 | “Outstanding Obligations” means, collectively, the Borrower’s Obligations, the Guaranteed Obligations and all reasonable expenses and charges, whether for legal expenses or otherwise, incurred by the Lender in collecting or enforcing any of the Borrower’s Obligations or the Guaranteed Obligations, or in realizing on or protecting or preserving any security held for those obligations, including the Security Documents. |

| 1.1.84 | “Parties” means, collectively, the Borrower, the Guarantors and the Lender, and their respective successors and permitted assigns, and “Party” means any one of them. |

| - 12 - |

| 1.1.85 | “Pension Plan” means any pension plan, fund or other similar program, other than a government sponsored plan, that covers employees of an Obligor who are employed in Canada and either: |

| 1.1.85.1 | is subject to any statutory funding requirement that, if not satisfied, results in a Lien or other statutory requirement permitting any Governmental Authority to accelerate the obligation of that Obligor to fund all or a substantial portion of the unfunded, accrued benefit liabilities of that plan; or | |

| 1.1.85.2 | is, or is intended to be, a “registered pension plan”, as that term is defined in the Income Tax Act. |

| 1.1.86 | “Permitted Acquisition” means an Acquisition by an Obligor under which the aggregate consideration is less than $2,500,000 and the aggregate consideration for Acquisitions by all of the Obligors in the Fiscal Year of the Borrower in which the Acquisition takes place is less than $2,500,000, provided that at the time of and immediately after completing the Acquisition no Default or Event of Default will have occurred and be continuing or could reasonably be expected to result from it. |

| 1.1.87 | “Permitted Debt” means any of the following types of Debt: |

| 1.1.87.1 | the Outstanding Obligations; | |

| 1.1.87.2 | any Debt listed on Schedule 1.1.87.2 and any renewals, extensions and modifications that do not increase the principal amount of that Debt or otherwise make the terms of it more burdensome; | |

| 1.1.87.3 | any PMSI Obligations, provided that the aggregate amount of all PMSI Obligations outstanding at any time does not exceed $2,000,000; | |

| 1.1.87.4 | any other unsecured Debt of the Obligors or any of them not exceeding at any time $200,000 in aggregate principal amount outstanding; | |

| 1.1.87.5 | secured credit facilities from an arm’s length financial institution in a principal amount of not more than $5,000,000 on terms and conditions satisfactory to the Lender, acting reasonably; and | |

| 1.1.87.6 | Secured Debt that is subordinated to the Outstanding Obligations on terms satisfactory to the Lender, it its discretion. |

| 1.1.88 | “Permitted Disposition” means: |

| 1.1.88.1 | the sale of Inventory by any Obligor in the ordinary course of business; | |

| 1.1.88.2 | the sale or other disposition of any Property other than Inventory by any Obligor in the ordinary course of business, provided that the aggregate value of Property so sold or disposed of by all of the Obligors in any Fiscal Year of the Borrower, valued in each case at its purchase price or exchange value (in the case of Property exchanges) does not exceed $350,000; |

provided that at the time of and immediately after making a sale or other disposition referred to in Section 1.1.88.1, no Default or Event of Default will have occurred and be continuing or could reasonably be expected to result from it.

| - 13 - |

| 1.1.89 | “Permitted Distribution” means: |

| 1.1.89.1 | any dividends declared by any Obligor under its Equity Securities that are payable solely in additional Equity Securities, other than any Equity Securities constituting Debt; | |

| 1.1.89.2 | Distributions by any Obligor to its shareholders, provided that the aggregate amount of those Distributions made by all of the Obligors in any Fiscal Year of the Borrower does not exceed (i) $0 if the Borrower’s Total Leverage Ratio is equal to or more than 3.00:1.00; or (ii) $250,000, annually, if the Borrower’s Total Leverage Ratio is less than 3.00:1.00 and | |

| 1.1.89.3 | Distributions under any one or more stock option plans, profit sharing plans, employment agreements and other compensation plans for directors, officers or employees of any Obligor, provided that the aggregate amount of the payments made by all of the Obligors in any Fiscal Year of the Borrower under all of those plans and agreements will not exceed amounts that are customary for the Borrower’s past practice and in the ordinary course of business. |

provided that at the time of and immediately after paying or making a dividend or Distribution referred to in Sections 1.1.89, no Default or Event of Default will have occurred and be continuing or could reasonably be expected to result from it.

| 1.1.90 | “Permitted Fundamental Change” means: |

| 1.1.90.1 | any amalgamation of a Wholly-Owned Subsidiary with the Obligor that owns it, if that Obligor is the continuing or surviving corporation, or with or into one or more other Wholly-Owned Subsidiaries of an Obligor if one of the Wholly-Owned Subsidiaries will be the continuing or surviving corporation, provided that: |

| 1.1.90.1.1 | the amalgamated corporation confirms to the Lender in writing, in form and substance satisfactory to the Lender, that the amalgamated corporation is an Obligor under this Agreement and is liable for the Outstanding Obligations; | |

| 1.1.90.1.2 | the amalgamated corporation immediately delivers to the Lender a certificate of a senior officer attaching the new Constating Documents and incumbency information for that corporation; and | |

| 1.1.90.1.3 | the Lender receives all Security Documents, legal opinions and other acknowledgements or agreements from all applicable Persons as the Lender may reasonably require; or |

| 1.1.90.2 | any sale, lease, transfer or other disposition by a Wholly-Owned Subsidiary of any or all of its Property, upon voluntary liquidation or otherwise, to the Obligor that owns it or any other Wholly-Owned Subsidiary of an Obligor; |

provided that at the time of and immediately after a change referred to in Sections 1.1.90.1 or 1.1.90.2 no Default or Event of Default will have occurred and be continuing or could reasonably be expected to result from it.

| - 14 - |

| 1.1.91 | “Permitted Investment” means: |

| 1.1.91.1 | certificates of deposit, time deposits or overnight bank deposits that mature in six months or less from the date of acquisition of them, with or issued by the Lender or any bank listed on Schedule I to the Bank Act (Canada); | |

| 1.1.91.2 | Investments by one Obligor in or to another Obligor, provided that if the Investments are in the Equity Securities of an Obligor, the Lender has a Security Interest in those Equity Securities under a Security Document; | |

| 1.1.91.3 | at any time that no Default or Event of Default has occurred and is continuing, Investments by an Obligor in any Obligor’s Wholly-Owned Subsidiary which is not itself an Obligor, provided that the aggregate amount of those Investments made by all of the Obligors in any Fiscal Year of the Borrower does not exceed $500,000; | |

| 1.1.91.4 | Investments existing on the Closing Date in Equity Securities listed on Schedule 1.1.91.4 or any Replacement Schedule; | |

| 1.1.91.5 | loans to officers of an Obligor, provided that the aggregate principal amount of all of those loans outstanding at any time does not exceed $150,000; and | |

| 1.1.91.6 | Investments approved by the Borrower’s shareholders for securities into other companies for an Obligor under which at the time of and immediately after completing the Acquisition, no Default or Event of Default will have occurred and be continuing or could reasonably be expected to result from it; such Investments not to exceed $5,000,000. |

| 1.1.92 | “Permitted Liens” means, at any time, any of the following: |

| 1.1.92.1 | any Lien for Taxes levied or imposed by a Governmental Authority against an Obligor: |

| 1.1.92.1.1 | that are not due or delinquent at that time; or | |

| 1.1.92.1.2 | the validity of which the Obligor is contesting in good faith at that time and relating to which the Obligor has set aside a reserve sufficient to pay those Taxes, or which at that time is not a material risk to the Property of the Obligor, whether because no steps or proceedings to enforce that Lien have been initiated at that time or because the value of the Property affected by the Lien is not material to the Property of the Obligors collectively; |

| 1.1.92.2 | any Lien for any judgment rendered, or order filed, against Property of an Obligor which the Obligor is contesting in good faith at that time: |

| 1.1.92.2.1 | relating to which the Obligor has set aside a reserve sufficient to pay that judgment or order in accordance with IFRS; or | |

| 1.1.92.2.2 | that is not material, because the value of the Property affected by the Lien is not material to the Property of the Obligors collectively; |

| - 15 - |

| 1.1.92.3 | any Lien against an Obligor or Property of an Obligor imposed or permitted by Applicable Law which: |

| 1.1.92.3.1 | is inchoate and relates to obligations of an Obligor not yet due or delinquent; | |

| 1.1.92.3.2 | in the case of any repairer’s or storer’s Lien that has been filed, the aggregate amount of the obligations to which the Lien relates does not exceed $250,000, and that Lien is not a material risk to the Property subject to it, whether because no steps or proceedings to enforce the Lien have been initiated at that time or because the value of the Property affected by the Lien is not material to the Property of the Obligors collectively; or | |

| 1.1.92.3.3 | is not a material risk to the Property of the Obligor, whether because no steps or proceedings to enforce the Lien have been initiated at that time or because the value of the Property affected by the Lien is not material to the Property of the Obligors collectively; |

| 1.1.92.4 | any undetermined or inchoate Lien against an Obligor or Property of an Obligor arising in the ordinary course of and incidental to construction by or current operations of that Obligor: |

| 1.1.92.4.1 | that relates to obligations that are not yet due or delinquent; | |

| 1.1.92.4.2 | that has not been filed under Applicable Law against an Obligor or its Property, or if filed, the Obligor has obtained an order of a court of competent jurisdiction discharging that Lien within 15 days of the filing of it; | |

| 1.1.92.4.3 | relating to which no steps or proceedings to enforce that Lien have been initiated; or | |

| 1.1.92.4.4 | that is not a material risk to Property of the Obligors, because the value of the Property affected by the Lien is not material to the Property of the Obligors collectively; |

| 1.1.92.5 | easements, rights-of-way, servitudes or other similar rights or restrictions relating to land in which any Obligor has an interest (including rights-of-way and servitudes for railways, sewers, drains, pipe lines, gas and water mains, and electric light, power, telephone internet and cable television conduits, poles, wires, cables and optic fibre cables), granted to or reserved or taken by other Persons, which either alone or in the aggregate do not materially detract from the value of the Property of the Obligors collectively or materially impair the use or operation of that Property; |

| - 16 - |

| 1.1.92.6 | any Lien given by an Obligor to a public utility or any Governmental Authority when and to the extent required by that public utility or Governmental Authority that relates to obligations that are not yet due or delinquent and which Lien does not, either alone or in the aggregate, materially detract from the value of the Property of the Obligors subject to that Lien or materially impair the use or operation of that Property; | |

| 1.1.92.7 | the reservation in any original grant from the Crown of any Real Property of an Obligor or interests in it, and statutory exceptions to title; | |

| 1.1.92.8 | any Lien attaching to or against any Property of an Obligor which is in favour of another Obligor and is subordinated in favour of the Lender; | |

| 1.1.92.9 | cash, marketable securities or bonds deposited by an Obligor in connection with bids or tenders, deposited with a court as security for costs in any litigation, deposited to secure workers’ compensation or unemployment insurance liabilities, or deposited to secure the performance of statutory obligations of an Obligor; | |

| 1.1.92.10 | Liens securing the performance of statutory obligations, surety or performance bonds and other obligations of similar nature incurred in the ordinary course of business of an Obligor, provided that those Liens are subordinate to the Security Interests created by the Security Documents; | |

| 1.1.92.11 | Purchase Money Security securing PMSI Obligations that constitute Permitted Debt; | |

| 1.1.92.12 | any Operating Leases of an Obligor under which the aggregate Operating Lease Obligations outstanding at any time under leases of personal Property do not exceed $2,000,000, and the aggregate Operating Lease Obligations outstanding at any time under any Real Property Leases of an Obligor constituting Operating Leases do not exceed $10,000,000; | |

| 1.1.92.13 | Security Interests securing Debt permitted pursuant section 1.1.87.5, which may permit the lender providing such Debt to have a first priority security interest on cash and accounts receivable of the Obligors, subject to an interecreditor arrangement satisfactory to the Lender, acting reasonably; | |

| 1.1.92.14 | other than as set out in Section 1.1.92.13, any Lien securing Permitted Debt; and | |

| 1.1.92.15 | the Liens set forth in Schedule 8.1.19 | |

| 1.1.92.16 | the Security Interests created by the Security Documents. |

| 1.1.93 | “Person” will be broadly interpreted and includes: |

| 1.1.93.1 | a natural person, whether acting in his or her own capacity, or in his or her capacity as executor, administrator, estate trustee, trustee or personal or legal representative, and the heirs, executors, administrators, estate trustees, trustees or other personal or legal representatives of a natural person; |

| - 17 - |

| 1.1.93.2 | a corporation or a company of any kind, a partnership of any kind, a sole proprietorship, a trust, a joint venture, an association, an unincorporated association, an unincorporated syndicate, an unincorporated organization or any other association, organization or entity of any kind; and | |

| 1.1.93.3 | a Governmental Authority. |

| 1.1.94 | “PMSI Obligation” means: |

| 1.1.94.1 | the unpaid purchase price of any tangible Property purchased or acquired by an Obligor; | |

| 1.1.94.2 | any indebtedness incurred or assumed by an Obligor to enable it to acquire rights in any tangible Property, to the extent that the indebtedness is applied to acquire those rights; and | |

| 1.1.94.3 | any Capital Lease Obligations of an Obligor, |

provided that before entering into the agreement creating the obligations described in Sections 1.1.94.1, 1.1.94.2 and 1.1.94.3, no Obligor or any Related Party to an Obligor owned or had any interest in that Property or any portion of it; and

| 1.1.94.4 | any extensions, renewals, refinancings or replacements, whether from the same or another lender or lessor, in whole or in part, of any indebtedness or lease obligations described in Sections 1.1.94.1, 1.1.94.2 and 1.1.94.3, provided that the principal amount of indebtedness of an Obligor secured by, or of the Capital Lease Obligations of an Obligor after, any extension, renewal, refinancing or replacement does not exceed the principal amount outstanding immediately before the extension, renewal, refinancing or replacement, and the Liens granted in respect of that indebtedness or those Capital Lease Obligations will be limited to all or a part of the Property or assets which secured that indebtedness or those Capital Lease Obligations immediately prior to that extension, renewal, refinancing or replacement. |

| 1.1.95 | “Priority Claims” means, at the time of any determination of them, the aggregate amount due and payable at that time which is subject to or secured by one or more statutory Liens created or arising, without any necessity for the consent or agreement of any Obligor, by operation of Applicable Law that rank or are capable of ranking in priority to or pari passu with the Security Interests created by the Security Documents, including all claims that are due and payable or past due relating to employee salaries and wages, vacation pay, employee withholdings, pension plan contributions, workers’ compensation assessment, Taxes (including municipal Taxes) and claims by public utilities. |

| 1.1.96 | “Property” means present and after-acquired property, assets, undertakings and privileges, whether real or personal, tangible or intangible, moveable or immoveable, and all interests in them. |

| 1.1.97 | “Purchase Money Security” means any Security Interest created or assumed by an Obligor to secure PMSI Obligations that extends only to the Property that the Obligor acquired or leased in incurring or assuming those PMSI Obligations, and the identifiable or traceable proceeds of that Security Interest. |

| - 18 - |

| 1.1.98 | “Real Property” means all present and future real property and all interests in it, whether held in fee simple or any lesser estate, including all Real Property Leases, mortgages, easements, rights-of-way, licences, privileges, benefits, and rights related to or connected with that real property. |

| 1.1.99 | “Real Property Leases” means all leases, agreements to lease or sub-leases relating to any Real Property, including all easements, rights-of-way, licences, privileges, benefits, and rights related to or connected with that Real Property, and all present and future licences under which the licencee is given the right to use or occupy any Real Property, all as amended, extended or renewed. |

| 1.1.100 | “Receivable” means a trade account receivable of or owned by an Obligor, and all related instruments and documents. |

| 1.1.101 | “Reference Period” means, with respect to any date of determination, the most recent four (4) consecutive Fiscal Quarter period then ended or most recently ended for which financial statements have been made available to the Lender; |

| 1.1.102 | “Related Parties” means, with respect to any Person, that Person’s Affiliates and the directors, officers, employees, agents and advisors of that Person and of that Person’s Affiliates, and “Related Party” means any one of them. |

| 1.1.103 | “Release” includes deposit, leak, emit, add, spray, inject, inoculate, abandon, spill, seep, pour, empty, throw, dump, place and exhaust, and when used as a noun has a corresponding meaning. |

| 1.1.104 | “Risk Management Transaction” means any foreign exchange or interest rate risk management transaction, commodity swap, option, cap, collar, floor or similar arrangement or other risk management arrangement to which any Person is a party. |

| 1.1.105 | “Security Documents” is defined in Section 7.1.1. |

| 1.1.106 | “Security Interest” means any mortgage, charge, pledge, assignment, hypothecation, title retention, finance lease or security interest, including any trust obligations, creating in favour of any creditor a right in respect of any Property. |

| 1.1.107 | “Seller Debt” is defined in Section 2.2.1. |

| 1.1.108 | “Software Escrow Agreement” is defined in Section 7.1.1.4. |

| 1.1.109 | “Subsidiary” means, with respect to any Person (in this Section 1.1.109 the “Parent”), at any time, any corporation, limited liability company, trust, partnership, limited partnership, association or other entity the accounts of which would be consolidated with those of the Parent in the Parent’s consolidated Financial Statements if those Financial Statements were prepared in accordance with IFRS as of that date, as well as any other corporation, limited liability company, trust, partnership, limited partnership, association or other entity: |

| 1.1.109.1 | of which Equity Securities representing more than 50% of the equity or economic interest in them or more than 50% of the ordinary voting power, or, in the case of a partnership, more than 50% of the general or limited partnership interests or the economic interest in them are, as at that time, owned, Controlled or held by any combination of the Parent and one or more Subsidiaries of the Parent; or | |

| 1.1.109.2 | that is, as at that time, otherwise Controlled by any combination of the Parent and one or more Subsidiaries of the Parent. |

| - 19 - |

| 1.1.110 | “Taxes” means all present and future taxes, levies, imposts, duties, deductions, withholdings, assessments, fees or other charges imposed by any Governmental Authority, including any interest, additions to tax or penalties applicable to them. |

| 1.1.111 | “Three Party Escrow Agreement” is defined in Section 7.1.1.5; |

| 1.1.112 | “Total Leverage Ratio” means, at any time, without duplication and on a Consolidated Basis, the ratio of: |

| 1.1.112.1 | the aggregate amount of Debt of the Borrower; to | |

| 1.1.112.2 | Adjusted EBITDA of the Borrower, |

in each c]ase, for the applicable Reference Period of the Borrower.

| 1.1.113 | “U.S. Dollars” or “U.S.$” each means currency of the United States of America which, as at the time of payment or determination, is legal tender in the United States of America for the payment or determination of public or private debts. |

| 1.1.114 | “Wholly-Owned Subsidiary” means any Subsidiary of a Person in which that Person owns, directly or indirectly, 100% of the issued and outstanding Equity Securities. |

| 1.2 | Certain Rules of Interpretation |

| 1.2.1 | In this Agreement, words signifying the singular number include the plural and vice versa, and words signifying gender include all genders. Every use of the words “including” or “includes” in this Agreement is to be construed as meaning “including, without limitation” or “includes, without limitation”, respectively. |

| 1.2.2 | The division of this Agreement into Articles and Sections, the insertion of headings and the inclusion of a table of contents are for convenience of reference only and do not affect the construction or interpretation of this Agreement. |

| 1.2.3 | References in this Agreement to an Article, Section, Schedule or Exhibit are to be construed as references to an Article, Section, Schedule or Exhibit of or to this Agreement unless otherwise specified. |

| 1.2.4 | Unless otherwise specified in this Agreement: |

| 1.2.4.1 | time periods within which or following which any calculation or payment is to be made, or action is to be taken, will be calculated by excluding the day on which the period begins and including the day on which the period ends; and | |

| 1.2.4.2 | if the last day of a time period is not a Business Day, the time period will end on the next Business Day. |

| - 20 - |

| 1.2.5 | Unless otherwise specified, any reference in this Agreement to any statute includes all regulations and subordinate legislation made under or in connection with that statute at any time, and is to be construed as a reference to that statute as amended, modified, restated, supplemented, extended, re-enacted, replaced or superseded at any time. |

| 1.2.6 | References to an amount of money in this Agreement will, unless otherwise expressly stated, be to that amount in United States Dollars. |

| 1.3 | Governing Law |

This Agreement is governed by, and is to be construed and interpreted in accordance with, the laws of the Province of Ontario and the laws of Canada applicable therein.

| 1.4 | Entire Agreement |

This Agreement, together with, any other agreement or agreements and other documents (including other Loan Documents) to be delivered under this Agreement, constitutes the entire agreement between the Parties pertaining to the subject matter of this Agreement and supersedes all prior agreements, understandings, negotiations and discussions, whether oral or written, of the Parties, and there are no representations, warranties or other agreements between the Parties in connection with the subject matter of this Agreement except as specifically set out in this Agreement or in any of the other agreements and documents (including other Loan Documents) delivered under this Agreement. No Party has been induced to enter into this Agreement in reliance on, and there will be no liability assessed, either in tort or contract, with respect to, any warranty, representation, opinion, advice or assertion of fact, except to the extent it has been reduced to writing and included as a term in this Agreement or in any of the other agreements and documents (including other Loan Documents) delivered under this Agreement.

| 1.5 | Business Day |

Whenever any calculation or payment to be made or action to be taken under this Agreement is required to be made or taken on a day other than a Business Day, then unless otherwise specified in this Agreement, the calculation or payment is to be made, or action is to be taken, on the next Business Day.

| 1.6 | Conflicts |

In the event of a conflict in or between the provisions of this Agreement and the provisions of any other Loan Document, then, despite anything contained in that other Loan Document, the provisions of this Agreement will prevail and those provisions of that other Loan Document will be deemed to be amended to the extent necessary to eliminate the conflict. If any act or omission is expressly prohibited under a Loan Document, other than this Agreement, but this Agreement does not expressly permit that act or omission, or if any act is expressly required to be performed under a Loan Document, other than this Agreement, but this Agreement does not expressly relieve the applicable Obligor from that performance, that circumstance will not constitute a conflict in or between the provisions of this Agreement and the provisions of that other Loan Document.

| - 21 - |

| 1.7 | Guaranteed Amounts |

In this Agreement, a Guarantee will be deemed to be in an amount equal to the amount of the Debt relating to which the Guarantee is given, unless the Guarantee is limited to a determinable amount, in which case the amount of the Guarantee will be deemed to be the lesser of the amount of the Debt relating to which the Guarantee is given and that determinable amount.

| 1.8 | Accounting Changes |

If any Accounting Changes occur and such changes result in a material change in the calculation of the financial covenants, standards or terms used in this Agreement or any other Loan Document, the Borrower and the Lender agree to enter into negotiations in order to amend such provisions of this Agreement or such Loan Document, as applicable, so as to equitably reflect such Accounting Changes with the desired result that the criteria for evaluating the Borrower’s financial condition shall be the same after such accounting changes as if such accounting changes had not been made.

If the borrower and the Lender agree upon the required amendments, then after appropriate amendments have been executed and the underlying Accounting Changes with respect thereto has been implemented, any reference to IFRS contained in this Agreement or in any other Loan Document shall, only to the extent of such Accounting Changes, refer to IFRS, consistently applied after giving effect to the implementation of such Accounting Changes.

If the Borrower and the Lender cannot agree upon the required amendments within thirty (30) days following the date of implementation of any Accounting Change, then all calculations of financial covenants and other standards and terms in this Agreement and the other Loan Documents shall continue to be prepared, delivered and made without regard to the underlying Accounting Change. In such case, Borrower shall, in connection with the delivery of any financial statements under this agreement, provide a management prepared reconciliation of the financial covenants to such financial statements in light of such Accounting Changes.

| 1.9 | Schedules and Exhibits |

The following is a list of Schedules and Exhibits:

| Schedules | Subject Matter | |

| 1.1.87.2 | Permitted Debt | |

| 1.1.91.4 | Investments on Closing Date | |

| 8.1.6 | Litigation | |

| 8.1.8 | Organizational Structure | |

| 8.1.9 | Equity Securities | |

| 8.1.10.2 | Taxes | |

| 8.1.11.1 | Owned and Leased Real Property | |

| 8.1.11.2 | Operating Leases and Capital Leases | |

| 8.1.15 | Environmental Disclosure | |

| 8.1.17 | Intellectual Property Rights | |

| 8.1.18 | Software | |

| 8.1.19 | Permitted Liens |

| Exhibits | Subject Matter | |

| 7.1.1.4 | Code Escrow Agreement | |

| 7.1.1.5 | Three-Party Escrow Service Agreement | |

| 9.1.1.4 | Compliance Certificate |

| - 22 - |

Article

2

CREDIT FACILITy

| 2.1 | Facility |

| 2.1.1 | Subject to the terms and conditions of this Agreement, the Lender establishes in favour of the Borrower a non-revolving credit facility as described in this Section 2.1 (the “Facility”) for the period from and after the Closing Date until the Maturity Date, and agrees to make Loans available to the Borrower under the Facility, provided that the sum of all Loans outstanding under the Facility will not at any time exceed US$14,500,000 (subject to Section 2.1.3, the “Maximum Amount”); |

| 2.1.2 | Within the limits and restrictions set out in Section 2.1.1, the principal amount outstanding to the Lender under the Facility may not revolve but the Borrower may repay Loans in full or in accordance with the terms hereof without penalty. |

| 2.1.3 | Subject to the consent of the Lender, at its sole discretion, if the Borrower requires further loans for working capital or general operating requirements, it may request from time to time on not less than thirty (30) Business Days written notice, that the Maximum Amount be increased by minimum increments of US$500,000 up to an aggregate amount of US$1,500,000. Such requests once delivered shall be irrevocable. No such request may be delivered later than ninety (90) days prior the Maturity Date. If the Lender agrees, in its sole discretion, to an increase in the Maximum Amount, it shall so advise the Borrower in writing and the Borrower and the Lender shall agree on the date or dates on which further Loans shall be made (which shall be in the full amount of the agreed upon increase to the Maximum Amount). If the Lender does not advise the Borrower in writing within fifteen (15) Business Days that it has agreed to an increase in the Maximum Amount, the Lender shall be deemed to have refused such increase and the Maximum Amount shall remain unchanged. If any Event of Default or Default shall have occurred, no increase to the Maximum Amount shall be available. For certainty, no amounts repaid may be reborrowed pursuant to this Section. |

| - 23 - |

| 2.2 | Purpose |

The Borrower will use the Loans obtained by it under the Facility as follows:

| 2.2.1 | the initial Loan will be used to repay in full the indebtedness, liabilities and obligations of the Borrower to the sellers in connection with the Borrower’s purchase of Frankly Media LLC (other than $1,000,000 in principal Debt owing to the Lender in respect thereof) (“Seller Debt”) on the Closing Date; and |

| 2.2.2 | each subsequent Loan will be used by the Borrower solely to finance the working capital and other general operating requirements of the Obligors. |

| 2.3 | Drawdowns—Notices and Limitations |

| 2.3.1 | The first Loan hereunder shall be in the Maximum Amount as of the Closing Date and shall be made on the day after the Closing Date; |

| 2.3.2 | No Loan may occur if a Default or Event of Default is subsisting, or all of the conditions precedent in Article 6 have not been satisfied and all other terms and conditions of this Agreement have been met. |

| 2.4 | Lender’s Records |

The Lender will maintain records of:

| 2.4.1 | the Borrower’s Obligations for outstanding Loans and accrued interest on them, fees relating to them, and other amounts payable under this Agreement; |

| 2.4.2 | the amounts paid at any time by the Borrower to the Lender under this Agreement for Loans, interest, fees and other amounts. |

The Borrower agrees that all records kept by the Lender will constitute prima facie evidence of the matters referred to in this Section, but the failure of the Lender to make any entry in its records will not limit or otherwise affect the obligations of the Borrower under this Agreement or with respect to any Loans, Loans, interest, fees or other amounts owed by it to the Lender.

Article

3

CALCULATION OF INTEREST, FEES AND EXPENSES

| 3.1 | Calculation and Payment of Interest |

| 3.1.1 | The Borrower will pay interest on each Loan outstanding at any time at a rate per annum of 10%. Interest will accrue and be calculated, but not compounded, daily on the principal amount of each Loan on the basis of the actual number of days each Loan is outstanding in a year of 365 or 366 days, as applicable, and will be compounded and payable monthly in arrears on each Interest Payment Date. |

To the maximum extent permitted by Applicable Law, the Borrower will pay interest on all overdue amounts owing by the Borrower under this Agreement, including any overdue interest payments, from the date each of those amounts is due until the date each of those amounts is paid in full. That interest will be calculated daily, compounded monthly and payable on demand of the Lender at a rate per annum of 12%.

| - 24 - |

| 3.2 | Expenses |

The Borrower will pay to the Lender on the Closing Date, or reimburse the Lender for, the following reasonable out-of-pocket expenses, including reasonable legal fees and disbursements (on a solicitor and its own client basis):

| 3.2.1 | the expenses of the Lender incurred in negotiating, preparing, registering and executing the Loan Documents; and |

| 3.2.2 | the expenses of the Lender incurred in enforcing the Loan Documents, including the costs of legal counsel acting on behalf of the Lender. |

| 3.3 | General Provisions Regarding Interest |

| 3.3.1 | Each determination by the Lender of the amount of interest, fees or other amounts payable by the Borrower to the Lender under this Agreement will be prima facie evidence of the accuracy of the determination. |

| 3.3.2 | Except as otherwise provided in this Agreement, all interest, fees and other amounts payable by the Borrower under this Agreement will accrue daily, be calculated as described in this Agreement, and be payable both before and after demand, maturity, default and judgment. |

| 3.3.3 | To the full extent permitted by Applicable Law, the covenant of the Borrower to pay interest at the rates provided in this Agreement will not merge in any judgment relating to any obligation of the Borrower to the Lender. |

| 3.3.4 | For the purposes of the Interest Act, R.S.C. 1985, c. I-15: |

| 3.3.4.1 | the principle of deemed reinvestment of interest will not apply to any calculation or determination of interest under this Agreement; | |

| 3.3.4.2 | the rates of interest specified in this Agreement are intended to be nominal rates and not effective rates; and | |

| 3.3.4.3 | unless otherwise stated, each rate of interest specified in this Agreement as an interest rate “per annum” or a similar expression, is to be calculated on the basis of a calendar year of 365 or 366 days, as applicable, and the annual rate of interest which is equivalent to that interest rate will be that rate multiplied by a fraction, the numerator of which is the total number of days in each year and the denominator of which is 365 or 366 days, as applicable. If the amount of any interest is determined or expressed on the basis of a period of less than a year of 365 or 366 days, as applicable, the equivalent annual rate is equal to the rate so determined or expressed, divided by the number of days in the period, and multiplied by the actual number of days in that calendar year. |

| - 25 - |

| 3.4 | Maximum Return |

| 3.4.1 | In no event will any interest, fees or other amounts payable under this Agreement exceed the maximum rate permitted by Applicable Law. If any provisions of this Agreement would require the Borrower to pay any interest or make any other payment that is construed by a court of competent jurisdiction to be interest in an amount or calculated at a rate that would be prohibited by Applicable Law or would result in receipt by the Lender of interest at a criminal rate (as those terms are construed under the Criminal Code), then despite those provisions, that amount or rate will be deemed to have been reduced to the maximum amount or rate recoverable under Applicable Law, as if the Parties had agreed to that amount or rate by contract. That reduction will be effected, to the extent necessary: |

| 3.4.1.1 | firstly, by reducing the amount or rate of interest otherwise required to be paid under Article 3 of this Agreement; and | |

| 3.4.1.2 | secondly, by reducing any fees, commissions, premiums and other amounts that would constitute interest for the purposes of Section 347 of the Criminal Code. |

| 3.4.2 | If, despite the provisions of this Section 3.4 and after giving effect to all reductions under it, the Lender has received an amount or rate in excess of the maximum permitted by the Criminal Code, then that excess will be applied by the Lender to reduce the principal balance of the Borrower’s Obligations outstanding and not to the payment of interest, with any remaining portion being paid to subsequent secured creditors or to the applicable Obligors, as determined by Applicable Law. |

| 3.4.3 | Any amount or rate of interest referred to in this Section 3.4 will be determined in accordance with generally accepted actuarial practices and principles at an effective annual rate of interest over the term of this Agreement on the assumption that any charges, fees, expenses or other amounts that fall within the meaning of “interest” (as defined in the Criminal Code) will, if they relate to a specific period of time, be prorated over that period of time and otherwise be prorated over the term of this Agreement and, in the event of dispute, a certificate of a Fellow of the Canadian Institute of Actuaries appointed by the Lender will be conclusive for the purposes of that determination. |

Article

4

REDUCTION OF COMMITMENT AND REPAYMENT

| 4.1 | Optional Repayment of Loans under the Facility |

| 4.1.1 | The Borrower will have the right at any time on any Business Day (an “Optional Repayment Date”) to repay all, or a portion of, Loans outstanding under the Facility without premium, penalty or bonus on the following terms and conditions: |

| 4.1.1.1 | the Lender will have received an irrevocable written notice by 12:00 (noon) (Toronto time) not fewer than three Business Days before the Optional Repayment Date specifying the Loans will be repaid in full; | |

| 4.1.1.2 | on the applicable Optional Repayment Date, the Borrower will repay the outstanding Loans in accordance with the notice given under Section 4.1.1.1 together with all interest, fees and other amounts accrued and unpaid under this Agreement, and any amounts payable under Section 5.1. |

| - 26 - |

| 4.2 | Repayment of Facility |

| Subject to the terms and conditions of this Agreement, all Loans outstanding under the Facility, together with all accrued interest, fees and other amounts unpaid relating to those Loans, will be due and payable in full on the Maturity Date, and the Facility will be automatically terminated at that time. | |

| 4.3 | Other Mandatory Repayments |

| 4.3.1 | Subject to the other subsections of this Section 4.3, if at any time the sum of all Loans outstanding under the Facility exceeds the Maximum Amount the Borrower will immediately repay to the Lender an amount of the applicable Loans outstanding at least equal to that excess. |

| 4.3.2 | The Borrower shall make all of the following mandatory repayments: |

| 4.3.2.1 | a mandatory repayment of US $2,000,000 prior to August 31, 2019; | |

| 4.3.2.2 | commencing on November 30, 2019 and on the last day of the month of each three month period thereafter, an amount of US$687,500 per three month period; | |

| 4.3.2.3 | proceeds (less actual costs paid and income taxes) on any asset sales or issuances of debt or equity (subject to certain priority of payment in favour of Silicon Valley Bank or Bridge Bank only in respect of accounts receivable of the Obligors); | |

| 4.3.2.4 | upon a successful listing of Borrower’s shares on the NASDAQ with a capital raise of between US$8,000,000 to $US11,000,000 mandatory repayment in the amount of US$2,000,000, which will be applied toward fulfilling the repayment obligation required by Section 4.3.2.1 by August 31, 2019 if completed by March 31, 2017; | |

| 4.3.2.5 | upon a successful listing of Borrower’s shares on the NASDAQ with a capital raise of more than US$12,000,000, a mandatory repayment in the amount of US$3,000,000 which will be applied toward fulfilling the $2,000,000 repayment obligation required by Section 4.3.2.1 by August 31, 2019 if completed by March 31, 2017 and any amounts raised in excess of US$2,000,000 will be applied pro rata to repayment obligations required by Section 4.3.2.2 commencing November 30, 2019; and | |

| 4.3.2.6 | commencing on the financial year ending December 31, 2017, and each financial year ending after December 31, 2017, 100% of the Current Year Excess Cash Flow Amount in excess of $2,000,000 shall be paid to the Lender as a mandatory repayment amount no later than May 1 of the following year until a Total Leverage Ratio of not more than 3.00:1.00 has been met for such Fiscal Year, at which point 50% of the Current Year Excess Cash Amount in excess of $2,000,000 shall be paid to the Lender as mandatory repayment amounts. Such Excess Cash Flow payments shall be applied pro rata to reduce other mandatory payments due hereunder. |

| - 27 - |

| 4.3.3 | Prepayments under this Section 4.3 of Loans outstanding will be applied by the Lender: |

| 4.3.3.1 | firstly, to repay principal of Loans outstanding under the Facility; and | |

| 4.3.3.2 | secondly, to repay any other Outstanding Obligations. |

| 4.3.4 | The payments set out in this Section 4.3 are in addition to all other payments of principal, interest, fees, expenses or other amounts required under this Agreement. |

| 4.4 | Payments—General |

| 4.4.1 | Except as otherwise provided in this Agreement, all payments of principal, interest, fees, expenses and other amounts payable under the Borrower’s Obligations and owing at any time by the Borrower to the Lender under this Agreement will be made in immediately available, freely transferable same day funds in the currency in which the Loans are outstanding, at the Lender’s address for notice provided herein. All payments received after 12:00 (noon) (Toronto time) will be deemed to be received on the next Business Day. |

| 4.4.2 | The Borrower will make all payments required under this Agreement, whether of principal, interest, fees, expenses or other amounts payable under the Borrower’s Obligations or otherwise owing by the Borrower to the Lender: |

| 4.4.2.1 | in accordance with the terms of this Agreement; and | |

| 4.4.2.2 | without regard to any defence, counterclaim, deduction or right of set off available to the Borrower. |

| 4.4.3 | Except as otherwise provided in this Agreement, if any payment required under this Agreement becomes due and payable on a day that is not a Business Day, that payment will be made on the next following Business Day, and any extension of time in those circumstances will be included in computing interest and any other amounts payable under this Agreement relating to that payment. |

Article

5

INDEMNITIES

| 5.1 | General Indemnity |

The Borrower will indemnify and save harmless the Lender and its Affiliates, officers, directors, employees, agents and attorneys (in this Article 5, each an “Indemnified Party”), immediately on demand by the Lender, from and against all Losses that any Indemnified Party may sustain or incur as a result of or in connection with the Facility or the Loan Documents, including as a result of or in connection with: