Attached files

| file | filename |

|---|---|

| 8-K - 8-K 01042017 MHPS CLOSING - TEREX CORP | f8k010417sapaclosing.htm |

| EX-99.2 - EXHIBIT 99.2 PRESS RELEASE ISSUED 01 04 2017 - TEREX CORP | a992pressreleaseredemption.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE ISSUED 01 04 2017 - TEREX CORP | a991presssreleasesaleofmhp.htm |

| EX-10.2 - EXHIBIT 10.2 REGISTRATION RIGHTS AGR - TEREX CORP | exh102registrationrightsag.htm |

| EX-10.1 - EXHIBIT 10.1 SHAREHOLDERS AGREEMENT - TEREX CORP | exh101shagreement01042017.htm |

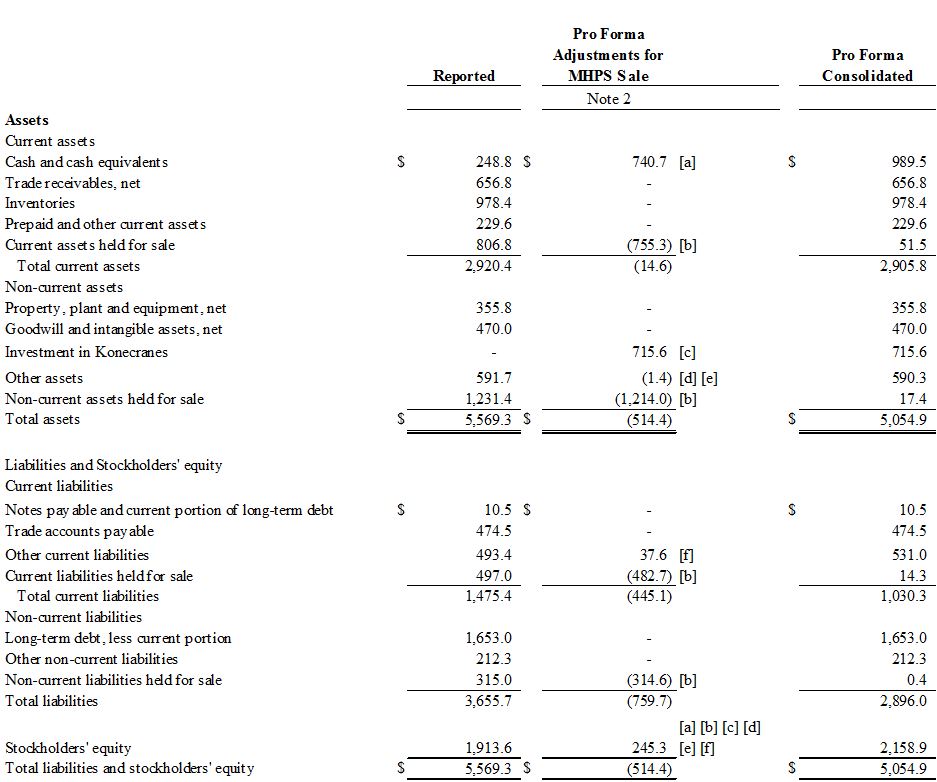

Unaudited Pro Forma Condensed Consolidated Financial Information

On January 4, 2017, Terex Corporation (“Terex”, the “Company”) completed the previously announced sale of its Material Handling and Port Solutions business (“MHPS”) to Konecranes Plc, a Finnish public company limited by shares (“Konecranes”), pursuant to that certain Stock and Asset Purchase Agreement (the “SAPA”) dated May 16, 2016, as amended (the “Disposition”), in exchange for 19,600,000 shares of newly issued Konecranes Class B stock and approximately $595 million and €200 million cash, as adjusted for estimated amounts of cash, debt, working capital and the Stahl Crane Systems (“Stahl”) divestiture being undertaken by Konecranes in connection with the Disposition. The final Disposition consideration will be adjusted based on the actual amounts of cash, debt, working capital, 2016 MHPS Business EBITDA, the 2015 EBITDA of Stahl and the Stahl divestiture proceeds.

The following unaudited pro forma condensed consolidated financial information and related notes present the historical consolidated balance sheet and statements of income of Terex adjusted to reflect the Disposition. The MHPS business has been accounted for as a discontinued operation beginning with the Company’s Form 10-Q for the period ended June 30, 2016.

The fiscal year of the Company ends on December 31. The unaudited pro forma condensed consolidated financial information is not intended to represent what the Company’s balance sheet or results of operations actually would have been had the Disposition been completed as of the dates indicated. In addition, the unaudited pro forma condensed consolidated financial information does not purport to project the future financial position or operating results of the Company and excludes one-time transaction costs. One-time transaction-related costs of approximately $18.5 million for financial advisement, legal, professional and other services are expected to be incurred in connection with the Disposition.

This unaudited pro forma condensed consolidated financial information is derived from and should be read in conjunction with the Company’s audited annual consolidated financial statements and the unaudited interim condensed consolidated financial statements, which are available in the Company’s Form 10-K for the year ended December 31, 2015 and the Company’s Form 10-Q for the quarter ended September 30, 2016, respectively.

1

Terex Corporation and Subsidiaries

Unaudited Pro forma Condensed Consolidated Balance Sheet

As of September 30, 2016

(in U.S. $ millions)

See accompanying notes to the unaudited pro forma condensed consolidated financial information.

2

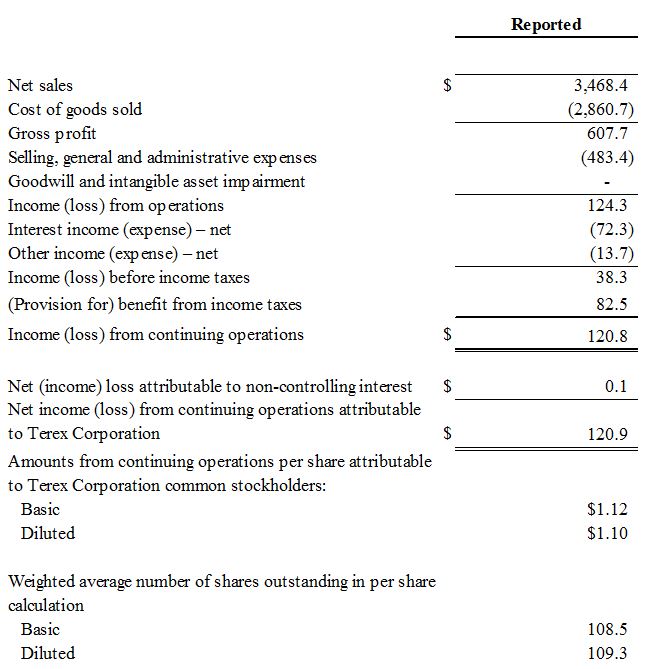

Terex Corporation and Subsidiaries

Unaudited Pro Forma Condensed Consolidated Statement of Income

For the Nine Months Ended September 30, 2016

(in U.S. $ millions, except per share data)

See accompanying notes to the unaudited pro forma condensed consolidated financial information.

3

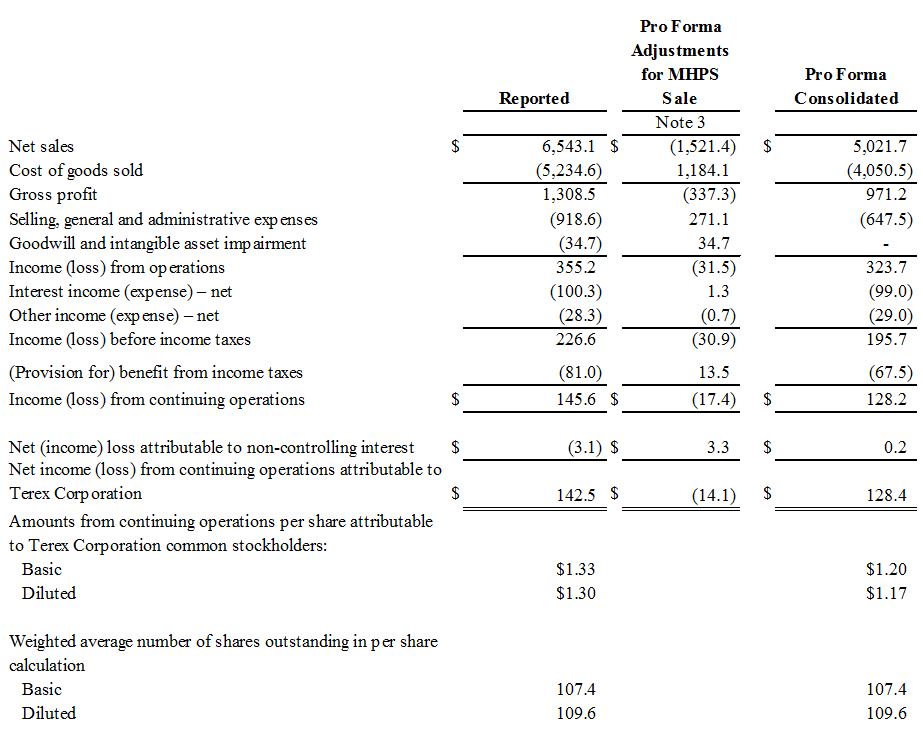

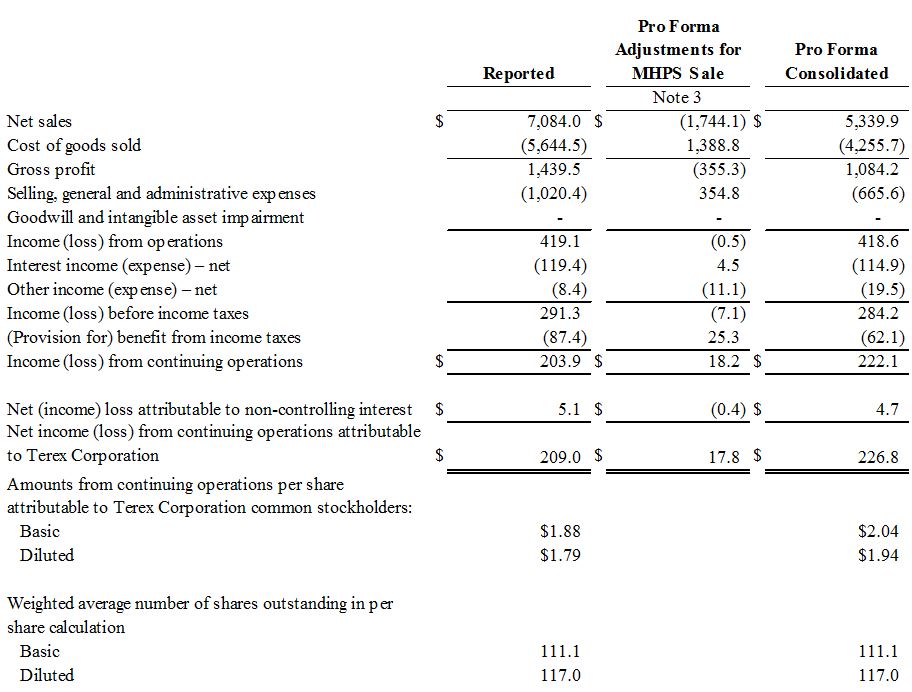

Terex Corporation and Subsidiaries

Unaudited Pro Forma Condensed Consolidated Statement of Income

For the Year Ended December 31, 2015

(in U.S. $ millions, except per share data)

See accompanying notes to the unaudited pro forma condensed consolidated financial information.

4

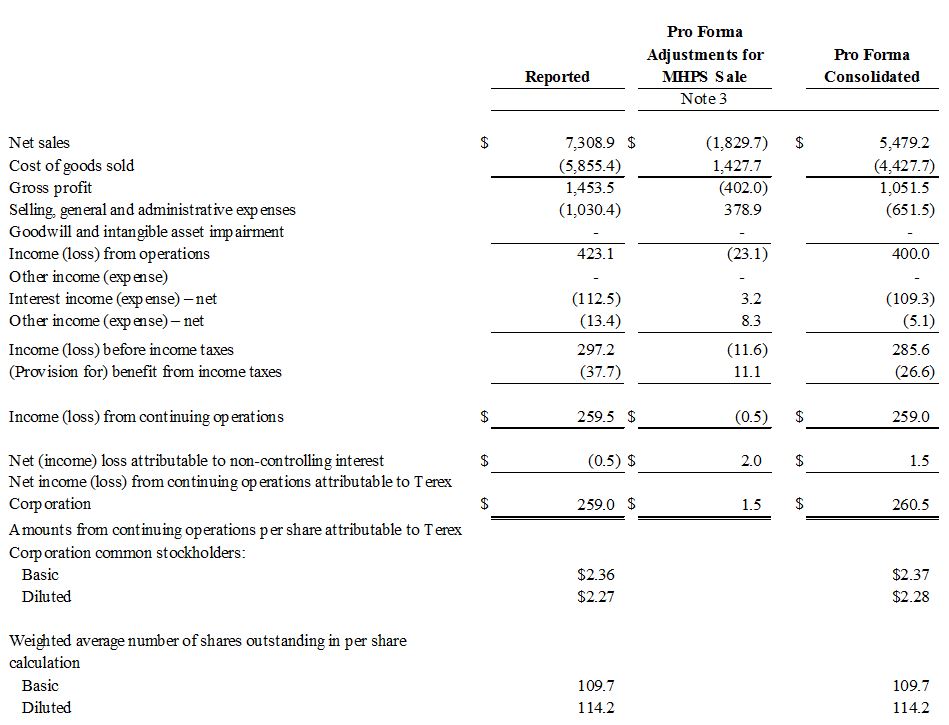

Terex Corporation and Subsidiaries

Unaudited Pro Forma Condensed Consolidated Statement of Income

For the Year Ended December 31, 2014

(in U.S. $ millions, except per share data)

See accompanying notes to the unaudited pro forma condensed consolidated financial information.

5

Terex Corporation and Subsidiaries

Unaudited Pro Forma Condensed Consolidated Statement of Income

For the Year Ended December 31, 2013

(in U.S. $ millions, except per share data)

See accompanying notes to the unaudited pro forma condensed consolidated financial information.

6

Notes to Unaudited Pro Forma Condensed Consolidated Financial Information

(Amounts are presented in U.S. $ millions, unless otherwise stated)

Note 1: Basis of Presentation

The unaudited pro forma condensed consolidated financial information included herein is derived from historical financial statements of the Company, adjusted to give effect to the Disposition and is based upon available information and certain estimates and assumptions we believe to be reasonable. Estimates and assumptions used in the preparation of the unaudited pro forma condensed consolidated financial information are described in Note 2 below. Estimates used may change as additional information about actual 2016 operating results becomes available and such changes could be material.

The Unaudited Pro Forma Condensed Consolidated Balance Sheet gives effect to the Disposition as if it had occurred on September 30, 2016, including reflection of the Company’s equity investment in Konecranes. The Unaudited Pro Forma Condensed Consolidated Statements of Income for the nine months ended September 30, 2016 and for the years ended December 31, 2015, 2014 and 2013, respectively, give effect to the Disposition as if it had occurred at the beginning of each period presented, but do not include effect of equity method of accounting for the Company’s investment in Konecranes, because acquisition of the Konecranes shares is not deemed to be a significant acquisition.

Pro forma adjustments included in the unaudited pro forma condensed consolidated financial information are limited to those that are (i) directly attributable to the Disposition, (ii) factually supportable, and (iii) with respect to the statements of income, expected to have a continuing impact on the results of the Company. The unaudited pro forma condensed consolidated financial information should be read in conjunction with the accompanying notes to the unaudited pro forma condensed consolidated financial information.

The Unaudited Pro Forma Condensed Consolidated Statements of Income for the years ended December 31, 2015, 2014 and 2013, respectively, do not give effect to the January 1, 2016 adoption of Accounting Standards Update (“ASU”) 2015-03, “Imputation of Interest: Simplifying the Presentation of Debt Issuance Costs,”, which requires amortization of debt issuance costs to be presented as a component of interest expense, because the effect on Interest income (expense) – net and Other income (expense) – net is immaterial.

Note 2: Pro Forma Adjustments on Balance Sheet

The following pro forma adjustments are included in the unaudited pro forma condensed consolidated balance sheet:

(a) | In accordance with the terms and conditions of the Stock and Asset Purchase Agreement (the “SAPA”), the cash portion of consideration received from Konecranes for the Disposition is: (1) $676.3 million, which does not include approximately $128 million of proceeds that were withheld due to the pending sale of the Stahl business by Konecranes, plus (2) adjustments for net debt of $45.7 million and (3) net working capital of $18.7 million. The adjustments for net debt and net working capital have been computed in accordance with provisions contained in the SAPA. Upon closing of Konecranes’ sale of its Stahl business, we expect to receive substantially all of the $128 million that was withheld at the closing of the MHPS sale. In addition, there will be additional adjustments depending on the final levels of working capital and net debt. |

(b) | To remove the assets and liabilities of the MHPS business that were classified as held for sale at September 30, 2016, and corresponding equity balances. |

(c) | The Company’s equity investment in Konecranes was determined based on fair value of 19.6 million shares of Konecranes stock issued to Terex as part of the consideration for the Disposition multiplied by the closing price of Konecranes stock of €35.01 at January 4, 2017, translated to USD at the January 4, 2017 exchange rate of $1.0429. The number of shares of Konecranes stock could be adjusted based on the final 2016 EBITDA performance of the MHPS and Konecranes businesses. |

7

(d) | To release, to retained earnings, a deferred tax liability of $15.5 million that was originally recorded in the historical financials as of September 30, 2016 on the outside basis differences related to the MHPS business for the anticipated tax gain on the Disposition. |

(e) | To release, to retained earnings, a deferred tax asset of $16.9 million for net operating loss utilization resulting from the Disposition. |

(f) | Represents the estimated income taxes payable resulting from the Disposition based on available information in accordance with the SAPA, without consideration of approximately $128 million of proceeds withheld by Konecranes related to the pending sale of the Stahl business. |

Note 3: Pro Forma Adjustments on Statements of Income

These adjustments reflect the pro forma adjustments to remove the results of operations that are directly attributable to the MHPS business and will not continue following the Disposition. The reported column in the Unaudited Pro Forma Condensed Consolidated Statement of Income for the nine months ended September 30, 2016 already reflects removal of the MHPS business results of operations as it was presented as a discontinued operation in our September 30, 2016 Form 10-Q.

8