Attached files

| file | filename |

|---|---|

| EX-10.6 - EX-10.6 - World Gold Trust | d192212dex106.htm |

| EX-23.1 - EX-23.1 - World Gold Trust | d192212dex231.htm |

| EX-10.8 - EX-10.8 - World Gold Trust | d192212dex108.htm |

| EX-10.7 - EX-10.7 - World Gold Trust | d192212dex107.htm |

| EX-10.5 - EX-10.5 - World Gold Trust | d192212dex105.htm |

| EX-10.4 - EX-10.4 - World Gold Trust | d192212dex104.htm |

| EX-10.3 - EX-10.3 - World Gold Trust | d192212dex103.htm |

| EX-10.2 - EX-10.2 - World Gold Trust | d192212dex102.htm |

| EX-10.1 - EX-10.1 - World Gold Trust | d192212dex101.htm |

| EX-8.1 - EX-8.1 - World Gold Trust | d192212dex81.htm |

| EX-5.1 - EX-5.1 - World Gold Trust | d192212dex51.htm |

| EX-4.2 - EX-4.2 - World Gold Trust | d192212dex42.htm |

| EX-4.1 - EX-4.1 - World Gold Trust | d192212dex41.htm |

| EX-1.1 - EX-1.1 - World Gold Trust | d192212dex11.htm |

| S-1/A - S-1/A - World Gold Trust | d192212ds1a.htm |

Exhibit 99.1

GUIDELINE

Solactive GLD® Long USD Gold Index

Version 1.1 dated 12 September 2016

Contents

| Introduction |

3 | |||

| 1 Index specifications |

3 | |||

| 1.1 Short name and ISIN |

3 | |||

| 1.2 Initial value |

3 | |||

| 1.3 Distribution |

3 | |||

| 1.4 Prices and calculation frequency |

4 | |||

| 1.5 Index Disruption Events |

4 | |||

| 1.5a Extraordinary Events |

5 | |||

| 1.6 Decision-making bodies and handling of Index Disruption Events and Extraordinary Events |

5 | |||

| 1.7 Publication |

6 | |||

| 1.8 Historical data |

6 | |||

| 1.9 Licensing |

6 | |||

| 2 Composition of the Index |

7 | |||

| 2.1 Currency Pairs, Target Weights, Rebalancing |

7 | |||

| 3 Calculation of the Index |

8 | |||

| 3.1 Determination of the Index level |

8 | |||

| 3.2 Accuracy |

10 | |||

| 4 Definitions |

10 | |||

| 5 Appendix |

12 | |||

| 5.1 Contact data |

12 | |||

| 5.2 Calculation of the Index – change in calculation method |

12 | |||

This document contains the underlying principles and rules regarding the structure and operation of the Solactive GLD® Long USD Gold Index. Solactive AG shall make every effort to implement the rules. Solactive AG does not offer any explicit or tacit guarantee or assurance, neither pertaining to the results from the use of the Index nor the Index value at any certain point in time nor in any other respect. The Index is merely calculated and published by Solactive AG and it strives to the best of its ability to ensure the correctness of the calculation. There is no obligation for Solactive AG – irrespective of possible obligations to issuers – to advise third parties, including investors and/or financial intermediaries, of any errors in the Index. The publication of the Index by Solactive AG is not a recommendation for capital investment and does not contain any assurance or opinion of Solactive AG regarding a possible investment in any financial instrument based on this Index.

2

Introduction

This document is to be used as a guideline with regard to the composition, calculation and management of the Solactive GLD® Long USD Gold Index. Changes to this guideline may be initiated from time to time by the Committee, as specified in section 1.6. The Solactive GLD® Long USD Gold Index is calculated and published by Solactive AG. The name “Solactive” is copyrighted.

1 Index specifications

The Solactive GLD® Long USD Gold Index (“Solactive GLD® Long USD Gold Index”, the “Index”) is an Index of Solactive AG and is calculated and distributed by Solactive AG.

The Solactive GLD® Long USD Gold Index aims to track the daily performance of a hypothetical long position in physical gold and a short position in a basket of non-USD currencies (the “FX Basket”). The specific currencies and weights of the FX Basket are as follows: (i) Euro (57.6%), (ii) Japanese Yen (13.6%), (iii) British Pound Sterling (11.9%), (iv) Canadian Dollar (9.1%), (v) Swedish Krona (4.2%) and (vi) Swiss Franc (3.6%). Each of physical gold and each of the non-USD currencies in the FX Basket shall be an “Index Component”.

The Index will perform as follows:

| • | If the price of gold increases and USD appreciates against the FX Basket, the Index level will rise; |

| • | If the price of gold decreases and USD depreciates against the FX Basket, the Index level will fall; |

| • | If the price of gold increases by a greater percentage than the USD depreciates against the FX Basket, the Index level will rise; |

| • | If the price of gold increases but the USD depreciates against the FX Basket by a greater percentage, the Index level will fall. |

The Index is calculated and published in USD every Index Business Day (barring an Index Disruption Event or Extraordinary Event).

1.1 Short name and ISIN

The Solactive Solactive GLD® Long USD Gold Index is distributed under ISIN DE000SLA2K90; the WKN is SLA2K9. The Index is published on Reuters under the code < .SOLGLDWE > and on Bloomberg under the code < SOLGLDWE Index >.

Further a real time value of the index is distributed under ISIN DE000SLA2LA6; the WKN is SLA2LA. The Index is published on Reuters under the code < .SOLGLDWL > and on Bloomberg under the code < SOLGLDWL Index >.

1.2 Initial value

The Index in terms of a number of ounces of gold is based on 1 at the close of trading on the start date, 3rd January 2007.

1.3 Distribution

The Solactive GLD® Long USD Gold Index is published via the price marketing services of Boerse Stuttgart AG and is distributed to all affiliated vendors. Each vendor decides on an individual basis whether to distribute and/or display the Solactive GLD® Long USD Gold Index.

3

1.4 Prices and calculation frequency

1.4.1 Index Closing Level

In calculating the Index Closing Level, the following shall be used: (i) For gold: the LBMA A.M. Gold Price; and (ii) for each of the Currency Pairs consisting of the USD and the currencies in the FX Basket, the WMCO 9am UK FX spot rate. The precise calculation is described in more detail in Section 3.

In the event that there is: (i) an incorrect calculation made in respect of the Index Closing Level; or (ii) any Gold Price or FX Price is corrected by the price source for that price, then the Index Closing Level as previously calculated shall be adjusted, on a retrospective basis, as soon as the Committee becomes aware of the occurrence of that event, as follows: (a) where (i) applies, the Committee shall undertake a correction to the calculation made in respect of the Index Closing Level for that day; and (b) where (ii) applies, the Committee shall make such adjustment as has been made by the price source for the purposes of calculating the Index Closing Level for the affected day. In each case, the Committee shall distribute such corrected or adjusted Index Closing Level through Reuters.

In the event that there is any disruption, for any reason, to the calculation or publication of those spot prices being used for the purposes of such calculation, or in the event that data is not provided to Reuters or to the pricing services of Boerse Stuttgart AG, then this may result in a disruption to the calculation of the Index Closing Level, meaning that the Index is unable to be distributed. Such disruption shall only continue for so long as the underlying price source continues to be unavailable for the purposes of calculation of the Index Level or any of the components of the Index.

1.5 Index Disruption Events

It shall be an Index Disruption Event if either an FX Basket Disruption Event or Gold Disruption Event occurs or exists; provided that, where an Extraordinary Event has occurred or exists, such Extraordinary Event shall take precedence.

“FX Basket Disruption Event” means the occurrence and existence of any of the following on any Index Business Day with respect to the FX Basket Currencies forming part of the FX Basket:

| (i) | an event, circumstance or cause (including, without limitation, the adoption of or any change in any applicable law or regulation) that has had or would reasonably be expected to have a materially adverse effect on the availability of a market for converting such FX Basket Currency to US Dollars (or vice versa), whether due to market illiquidity, illegality, the adoption of or change in any law or other regulatory instrument, inconvertibility, establishment of dual exchange rates or foreign exchange controls or the occurrence or existence of any other circumstance or event, as determined by the Index Committee; or |

| (ii) | the failure of the FX price source to announce or publish the relevant spot exchange rates for any FX Basket Currency in the FX Basket; or |

| (iii) | any event or any condition that (I) results in a lack of liquidity in the market for trading any FX Basket Currency that makes it impossible or illegal for market participants (a) to convert from one currency to another through customary commercial channels, (b) to effect currency transactions in, or to obtain market values of, such, currency, (c) to obtain a firm quote for the related exchange rate, or (d) to obtain the relevant exchange rate by reference to the applicable price source; or (II) leads to a currency peg regime; or |

| (iv) | the declaration of (a) a banking moratorium or the suspension of payments by banks, in either case, in the country of any currency used to determine any FX Basket Currency exchange rate, or (b) capital and/or currency controls (including, without limitation, any restriction placed on assets in or transactions through any account through which a non-resident of the country of any currency used to determine the currency exchange rate may hold assets or transfer monies outside the country of that currency, and any restriction on the transfer of funds, securities or other assets of market participants from, within or outside of the country of any currency used to determine the applicable exchange rate. |

“Gold Disruption Event” means the occurrence and existence of any of the following on any Index Business Day with respect to Gold:

| (i) | (a) the failure of the LBMA to announce or publish the LBMA Gold Price (or the information necessary for determining the price of Gold) on that Index Business Day, (b) the temporary or permanent discontinuance or unavailability of the LBMA or the LBMA Gold Price; or |

| (ii) | the material suspension of, or material limitation imposed on, trading in Gold by the LBMA; or |

4

| (iii) | an event that causes market participants to be unable to deliver gold bullion loco London under rules of the LBMA by credit to an unallocated account at a member of the LBMA; or |

| (iv) | the permanent discontinuation of trading of Gold on the LBMA or any successor body thereto, the disappearance of, or of trading in, Gold; or |

| (v) | a material change in the formula for or the method of calculating the price of Gold, or a material change in the content, composition or constitution of Gold. |

1.5a Extraordinary Events

It shall be an Extraordinary Event if an Index Disruption Event continues for 10 Index Business Days. In the case of an Extraordinary Event, the Committee shall be responsible for selecting that price or component which is to be used in place of that price or component which is or has become unavailable (so changing the composition of the Index to substitute that price or component which has become unavailable).

1.6 Decision-making Bodies for Index Disruption Events and Extraordinary Events

A Committee composed of staff from Solactive AG is responsible for decisions regarding the composition of Solactive GLD® Long USD Gold Index from time to time, as well as any amendments that are required to be made to these Guidelines or to the rules for calculation of the Index (in this document referred to as the “Committee” or the “Index Committee”). Notwithstanding the foregoing, Solactive AG may only change these Guidelines to maintain compliance with the relevant laws and regulations applicable with the regard to an index provider or index administrator, and to ensure the continued integrity of the index. No Committee member has an active role in the markets in which the Index Components are traded (such as the LBMA for Gold). In making a determination regarding the existence of any Index Disruption Event or an Extraordinary Event, the Committee may consult with participants in the markets in which the Index Components are traded. In any event, the Index Committee shall remain independent of these market participants and shall at all times be solely responsible for the determination of the existence of any Index Disruption Event or an Extraordinary Event.

1.6.1 Decisions with Respect to an Index Disruption Event.

If the Index Sponsor determines in good faith that an Index Disruption Event has occurred and exists (and no Extraordinary Event has occurred and exists) with respect to the Reference Price of any Index component on any Index Business Day, the Index Sponsor will calculate the Index as follows –

| (i) | Where the affected Index Component is Gold and none of the FX Basket currencies are affected by an Index Disruption Event, the Index Closing Level will be kept at the same level as the previous Index Business Day for so long as that Index Disruption Event subsists, provided that, on the cessation of that Index Disruption Event, the Index Closing Level will be updated on that Index Business Day based on the Reference Price for Gold on that day and FX Basket currency prices will be calculated in the ordinary course; |

| (ii) | Where Gold is not affected, but where at least one FX Basket currency is affected by an Index Disruption Event, then the Index Closing Level will be determined as follows: |

| (a) | the determination of the value of each FX Basket currency not affected by the Index Disruption Event shall continue to be calculated in the ordinary course by reference to the Reference Price for that FX Basket currency, disregarding the effect of the Index Disruption Event on the disrupted FX Basket currency or currencies; and |

| (b) | the value for such FX Basket currency which is affected will be kept at the same level as the previous Index Business Day for so long as that Index Disruption Event subsists, provided that, on the cessation of that Index Disruption Event, the Index Closing Level will be determined on the next Index Business Day where there is neither a Gold Disruption Event nor an FX Basket Disruption Event, and the Index Closing Level will reflect such price; and |

| (iii) | Where the Index components affected by any Index Disruption Event include Gold and one or more FX Components, then the Index Closing Level will be kept at the same level as the previous Index Business Day for so long as that Index Disruption Event subsists, provided that, on the cessation of that Index Disruption Event in |

5

| respect of Gold, the Index Closing Level will be updated on that Index Business Day based on the Reference Price for Gold and the Reference Price of any FX Basket currency which is no longer affected by that Index Disruption Event on that day (and thereafter, for any FX Basket currency which remains disrupted, the process in sub-paragraph (ii) above will be applied); and |

1.6.2 Decisions with Respect to an Extraordinary Event.

The Committee shall also make any decisions regarding the future composition of the Solactive GLD® Long USD Gold Index, in the event that any Extraordinary Events should occur, and shall thereafter implement any necessary adjustments to the Index that might be required.

Provided that all of the relevant information is readily available to Solactive AG, Solactive AG shall use its reasonable endeavours to provide at least two Index Business Days prior notice before the day on which the relevant change to the Index composition will become effective.

1.7 Publication

All specifications and information relevant for calculating the Index are made available on the http://www.solactive.de web page and sub-pages.

1.8 Historical data

Historical data will be maintained from the launch of the Index on 20 July 2016.

1.9 Licensing

Licences to use the Index as the underlying value for derivative instruments are issued to stock exchanges, banks, financial services providers and investment houses by Solactive AG.

6

2 Composition of the Index

2.1 Currency Pairs, Target Weights, and Rebalancing

At the close of each Index Business Day, the weight of each Currency Pair in the FX Basket shall be reset to the target weight for that currency, as is set out below:

| Currency Pair |

Target Weight | |||

| EUR/USD |

57.6 | % | ||

| USD/JPY |

13.6 | % | ||

| GBP/USD |

11.9 | % | ||

| USD/CAD |

9.1 | % | ||

| USD/SEK |

4.2 | % | ||

| USD/CHF |

3.6 | % | ||

The currency weights used in the Index are identical to those determined by the U.S. Federal Reserve in 19781 and used in the “index of the weighted-average foreign exchange value of the U.S. Dollar”. The weights were fixed and reflected the weighted average of the exchange values of the U.S. Dollar against 10 major foreign currencies. The weight of each currency in the index was equal to the country’s average share of total trade (imports plus exports) for the five years 1972 to 1976. The base period of the index is March 1973, which corresponds to the start of the period of generalized floating of exchange rate.

The U.S. Federal Reserve revised the weights in October 19982, when the Euro was about to replace 5 of the currencies initially included in the index (German deutsche mark, French franc, Italian lira, Dutch guilder and Belgium franc). The weights attributed to the Euro are equal to the aggregated weights of the 5 currencies it substituted.

Since then, the U.S. Federal Reserve has not made other changes to the currency weights.

| 1 | Federal Reserve Bulletin August 1978, Volume 64, Number 8, p. 700 Index of the Weighted-Average Exchange Value of the U.S. Dollar: Revision |

| 2 | Federal Reserve Bulletin October 1998, Volume 84, Number 10, p. 811 New Summary Measures of the Foreign Exchange Value of the Dollar |

7

3 Calculation of the Index

3.1 Determination of the Index Closing Level

(a) Index Closing Level when no Index Disruption Event has occurred on the current or previous Index Business Day and exists on the current Index Business Day

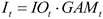

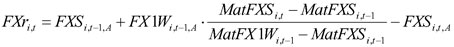

The level of the Index Closing Level shall be calculated in accordance with the following formula:

| ||||||

|

= LBMA A.M. Gold Price on Index Business Day t | |||||

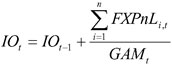

|

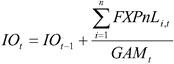

= The Index Closing Level in terms of a number of ounces of gold on Index Business Day t, calculated as | |||||

| ||||||

| Where: | ||||||

|

= Number of currencies currency pairs included in the FX Basket | |||||

|

= FX profit and loss for currency i on Index Business Day t, calculated as | |||||

| If currency i is EUR/USD or GBP/USD, then | ||||||

| ||||||

| Otherwise | ||||||

| ||||||

| Where: | ||||||

|

= Target Weight of currency i on Index Business Day t, as defined in Section 2.1. | |||||

|

= LBMA P.M. Gold Price on Index Business Day t. However, on days where the LBMA does not plan to publish an LBMA P.M. Gold Price (for instance on the Index Business Day before 25th December or 31st December), it should be the LBMA P.M. Gold Price on the Index Business Day immediately preceding Index Business Day t. | |||||

|

= WMCo 4pm UK FX spot rate for currency i on Index Business Day t | |||||

|

= FX return of currency i on Index Business Day t, calculated as | |||||

| If currency i is EUR/USD or GBP/USD, then | ||||||

| ||||||

| Otherwise | ||||||

| ||||||

8

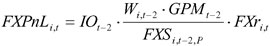

| Where: | ||||||||

|

= WMCo 9am UK FX spot rate for currency i on Index Business Day t | |||||||

|

=WMCo 9am UK FX 1 week forward fixing for currency i on Index Business Day t | |||||||

|

=FX spot settlement date for currency i entered on Index Business Day t as determined by market conventions | |||||||

|

= FX 1 week forward settlement date for currency i entered on Index Business Day t as determined by market conventions | |||||||

(b) Index Closing Level when an FX Index Disruption Event with respect to the WMCO 9am UK FX Spot Rate has occurred and exists

On any day that an FX Index Disruption Event has occurred and exists with respect to an affected currency, the return for the affected currency on Index Business Day t shall be equal to zero but the return for the non-affected currencies will be calculated in the ordinary course.

(c) Index Closing Level when a Gold Index Disruption Event with respect to the LBMA AM Gold Price has occurred and exists

On any Index Business Day that a Gold Index Disruption Event has occurred and exists, then the Index Closing Level on that Index Business Day shall be equal to Index Closing Level from the prior Index Business Day.

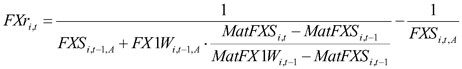

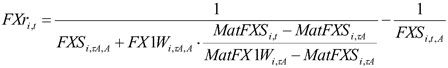

(d) Index Closing Level after Index Disruption Event no longer exists

If currency i is EUR/USD or GBP/USD, then

Otherwise

is the Index Business Day before the first Index Business Day of one of the following Index Disruption Events - (i) an FX Basket Disruption Event with respect to the WMCO 9am UK FX Spot Rate or (ii) a Gold

Disruption Event with respect to the LBMA AM Gold Price.

is the Index Business Day before the first Index Business Day of one of the following Index Disruption Events - (i) an FX Basket Disruption Event with respect to the WMCO 9am UK FX Spot Rate or (ii) a Gold

Disruption Event with respect to the LBMA AM Gold Price.

9

is the Index Business Day before the first Index Business Day of one of the following Index Disruption Events – (i) an FX Basket Disruption Event with respect to the WMCO 4pm UK FX Spot Rate, or

(ii) a Gold Disruption Event with respect to the LBMA PM Gold Price.

is the Index Business Day before the first Index Business Day of one of the following Index Disruption Events – (i) an FX Basket Disruption Event with respect to the WMCO 4pm UK FX Spot Rate, or

(ii) a Gold Disruption Event with respect to the LBMA PM Gold Price.

3.2 Accuracy

The Index Closing Level will be rounded to 10 (ten) decimal places.

FX return and FX profit and loss will be rounded to 10 (ten) decimal places.

4. Definitions

“CAD” or Canadian Dollar means the lawful currency of Canada.

“CHF” or Swiss Franc means the lawful currency of Switzerland.

“Currency Pair” has the meaning ascribed to it in Section 2.1.

“EUR” or Euro means the lawful currency of the participating member states of the European Union adopted in accordance with the Treaty establishing the European Communities, as amended by the Treaty on the European Union.

“FX Basket” has the meaning ascribed to it in Section 1.

“FX Basket Business Day” means any day (other than a Saturday or Sunday) on which WM Company is scheduled to publish prices for each of the Currency Pairs in the FX Basket – USD/EUR, JPY/USD, USD/GBP, CAD/USD, SEK/USD, and CHF/USD.

“FX Basket Disruption Event” has the meaning ascribed to it in Section 1.5.

“Gold Business Day” means any day other than a Saturday or Sunday) on which the LBMA is scheduled to publish the LBMA Gold Price AM.

“FX Price” means any of the WMCO 4pm UK FX Spot Rate, WMCO 9am UK FX spot rate, WMCO 9am UK FX 1 Week Forward Rate.

“GBP” or British Pound means the lawful currency of the United Kingdom.

“Gold Disruption Event” has the meaning ascribed to it in Section 1.5.

“Gold Price” means either the LBMA A.M. Gold Price or the LBMA P.M. Gold Price.

“Index Business Day” means any day that is a (1) New York Business Day, (2) London Business Day, (3) Gold Business Day, and (4) FX Basket Business Day.

“Index Calculator” is Solactive AG or any other appropriately appointed successor in this function.

“Index Committee” means a Committee composed of staff from Solactive AG who are responsible for decisions regarding the composition of the Solactive GLD® Long USD Gold Index from time to time, as well as any amendments that are required to be made to the rules for the calculation of the Index.

“Index Disruption Event” means the occurrence of an FX Basket Disruption Event or a Gold Disruption Event.

“Index Closing Level” has the meaning ascribed in Section 3.1.

“Index Sponsor” is Solactive AG or any other appropriately appointed successor in this function.

“JPY” or Japanese Yen means the lawful currency of Japan.

“London Business Day” means any day (other than a Saturday or Sunday) on which commercial banks in London, England on which commercial banks in London are generally scheduled to be open for business.

“LBMA” means the London Bullion Market Association or its successor.

“LBMA A.M GOLD PRICE” means that day’s morning London gold price per troy ounce of gold for delivery in London through a member of the LBMA authorized to effect such delivery, stated in U.S. Dollars, as calculated and administered by independent service provider(s), pursuant to an agreement with the LBMA, and published by the LBMA on its website at www.lbma.org.uk that displays prices effective on that day.

10

“LBMA P.M. GOLD PRICE” means that day’s afternoon London gold price per troy ounce of gold for delivery in London through a member of the LBMA authorized to effect such delivery, stated in U.S. Dollars, as calculated and administered by independent service provider(s), pursuant to an agreement with the LBMA, and published by the LBMA on its website at www.lbma.org.uk that displays prices effective on that day.

“New York Business Day” means any day (other than a Saturday or Sunday) on which the NYSE ARCA is generally scheduled to be open for business.

“SEK” or Swedish Krona means the lawful currency of the Kingdom of Sweden.

“USD” or the U.S. Dollar means the lawful currency of the United States of America.

“WMCO 4pm UK FX spot rate” means, with respect to any Currency Pair on any Index Business Day, the WMR Spot rate for such Currency Pair appearing at or about 4:00 p.m. (London time) on such Index Business Day.

“WMCO 9am UK FX spot rate” means, with respect to any Currency Pair on any Index Business Day, the WMR Spot rate for such Currency Pair appearing at or about 9:00 a.m. (London time) on such Index Business Day.

“WMCO 9am UK FX 1 Week Forward rate” means, with respect to any Currency Pair on any Index Business Day, the WMR Spot rate for such Currency Pair appearing at or about 9:00 p.m. (London time) on such Index Business Day.

11

5 Appendix

5.1 Contact data

Information regarding the Solactive GLD® Long USD Gold Index concept

Solactive AG

Guiollettstr. 54

60325 Frankfurt am Main

Phone: +49 (0) 69 719 160 22

FAX: +49 (0) 69 719 160 25

E-Mail: complex@solactive.com

5.2 Calculation of the Index – change in calculation method

The application by the Index Calculator of the method described in this document is final and binding. The Index Calculator shall apply the method described above for the composition and calculation of the Index. However, it cannot be excluded that the market environment, supervisory, legal, financial or tax reasons may require changes to be made to this method. The Index Calculator may also make changes to the terms and conditions of the Index and the method applied to calculate the Index, which he deems to be necessary and desirable in order to prevent obvious or demonstrable error or to remedy, correct or supplement incorrect terms and conditions. The Index Calculator is not obliged to provide information on any such modifications or changes. Despite the modifications and changes the Index Calculator will take the appropriate steps to ensure a calculation method is applied that is consistent with the method described above.

12