Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PTC THERAPEUTICS, INC. | exhibit991_2017-1x09ptctjp.htm |

| 8-K - 8-K - PTC THERAPEUTICS, INC. | jpmform8k.htm |

PageJan-17

PTC Therapeutics:

A Precision Medicine Platform

35th Annual JP Morgan Healthcare Conference

1

Page

Forward looking statements within the meaning of

The Private Securities Litigation Reform Act of 1995

Jan-17

All statements, other than those of historical fact, contained in this presentation, are forward-looking statements, including the information appearing under the

headings “2016 Preliminary Results” and “2017 Forecast” as well as statements regarding: the future expectations, plans and prospects for PTC; the timing and

outcome of PTC’s regulatory process in the U.S., including as related to a planned file over protest of the new drug application for TranslarnaTM for the treatment of

nmDMD, and in the European Economic Area (EEA), including as related to the European Commission’s determination as to renewal of the marketing authorization

for Translarna for the treatment of nmDMD and PTC’s plan to conduct an additional Phase 3 randomized trial of Translarna in nmDMD; the clinical utility and

potential advantages of Translarna; when top-line results of ACT CF will be available and reported and any statements related to the potential results of such trial;

PTC's estimates regarding the potential market opportunity for Translarna, including the size of eligible patient populations and PTC's ability to identify such

patients; PTC’s ability to maintain the current label under the marketing authorization in the EEA; the timing of, and PTC’s ability to, expand the approved product

label of Translarna for the treatment of nmDMD in the EEA, whether pursuant to its ongoing Phase 2 study of Translarna for nmDMD in pediatric patients, or

otherwise; the timing of, and PTC’s ability to, obtain additional marketing authorizations for Translarna in other territories, including the U.S., or for additional

indications, including nmCF; the timing, results and conduct of PTC’s clinical studies of PTC596 and Translarna for the treatment of other indications; further

advancement of the FIREFISH and SUNFISH studies under the joint SMA collaboration, including transition into the pivotal part of either study; the timing of a

milestone payment, if any, to PTC from Roche; PTC’s ability to increase commercial presence in countries where Translarna is currently available and commercially

expand into new territories; PTC’s strategy, future operations, future financial position, future revenues or projected costs; and the objectives of management. Other

forward-looking statements may be identified by the words “estimate,” “outlook,” “will,” “plan,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “may,” “potential,”

“possible,” “potential,” “would,” “could,” “should,” “continue,” and similar expressions.

PTC’s actual results, performance or achievements could differ materially from those expressed or implied by forward-looking statements it makes as a result of a

variety of risks and uncertainties, including those related to: the completion of PTC’s year-end audit; PTC’s ability to maintain its marketing authorization of

Translarna for the treatment of nmDMD in the EEA, including whether the European Commission determines to approve the renewal of such authorization and

whether the EMA determines in future annual renewal cycles that the benefit-risk balance of Translarna authorization supports renewal of such authorization; the

final design of the new nmDMD trial that PTC will undertake pursuant to the specific obligation associated with the marketing authorization (if renewed) and PTC’s

ability to enroll, fund and conduct such trial; the timing and outcome of future interactions PTC has with the FDA with respect to Translarna for the treatment of

nmDMD, including PTC's ability to resolve the matters set forth in the Refuse to File letter from the FDA or otherwise advance Translarna for the treatment of

nmDMD in the United States (whether pursuant to the file over protest process or otherwise), including whether PTC is required to perform additional clinical and

non-clinical trials at significant cost; the outcome of ongoing or future clinical trials or studies in Translarna, in particular ACT CF and the Translarna nmDMD

pediatric study; events during, or as a result of, the SUNFISH or FIREFISH studies that could delay or prevent further advancement of the SMA program, including

future actions or activities under the SMA joint development program; the eligible patient base and commercial potential of Translarna and PTC’s other product

candidates; the scope of regulatory approvals or authorizations for Translarna (if any), including labeling and other matters that could affect the availability or

commercial potential of Translarna; PTC’s ability to commercialize and commercially manufacture Translarna in general and specifically as a treatment for nmDMD;

the outcome of pricing and reimbursement negotiations in those territories in which PTC is authorized to sell Translarna; PTC’s scientific approach and general

development progress; the sufficiency of PTC’s cash resources and its ability to obtain adequate financing in the future for its foreseeable and unforeseeable

operating expenses and capital expenditures; and the factors discussed in the “Risk Factors” section of PTC’s most recent Quarterly Report on Form 10-Q as well

as any updates to these risk factors filed from time to time in PTC’s other filings with the SEC. You are urged to carefully consider all such factors.

As with any pharmaceutical under development, there are significant risks in the development, regulatory approval and commercialization of new products. There

are no guarantees that Translarna will receive full regulatory approval in any territory or maintain its current marketing authorization in the EEA, or prove to be

commercially successful in general, or specifically with respect to the treatment of nmDMD. The forward-looking statements contained herein represent PTC’s views

only as of the date of this presentation and PTC does not undertake to update or revise any such forward-looking statements occurring after the date of this

presentation except as required by law.

2

Page

Our mission

To leverage our knowledge

of RNA biology to bring

novel therapeutics to patients

affected by rare and neglected

disorders

Jan-17 3

Page

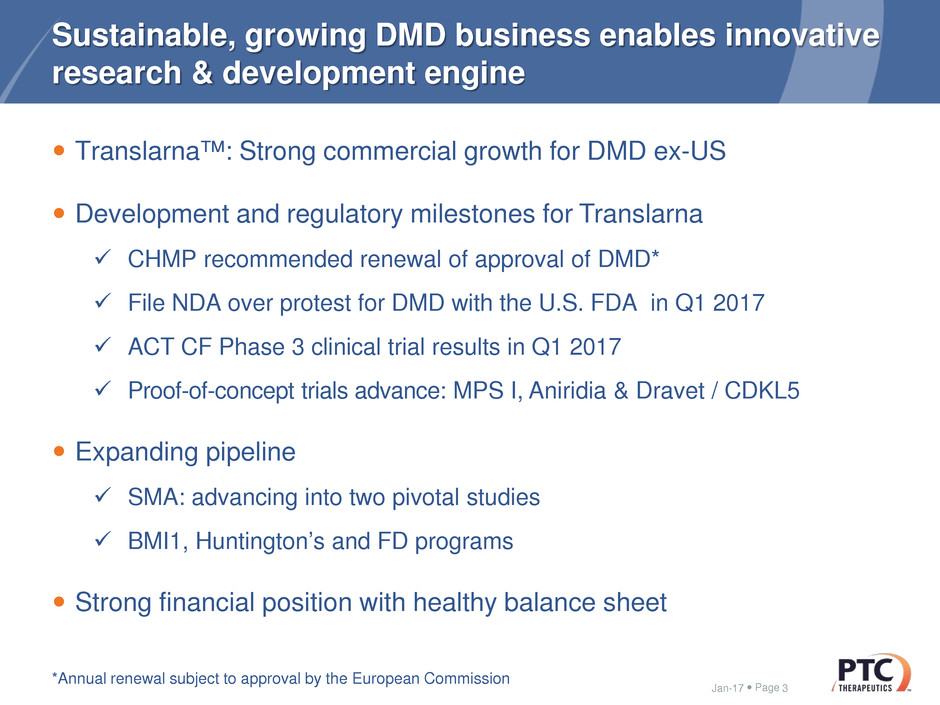

Sustainable, growing DMD business enables innovative

research & development engine

Translarna™: Strong commercial growth for DMD ex-US

Development and regulatory milestones for Translarna

CHMP recommended renewal of approval of DMD*

File NDA over protest for DMD with the U.S. FDA in Q1 2017

ACT CF Phase 3 clinical trial results in Q1 2017

Proof-of-concept trials advance: MPS I, Aniridia & Dravet / CDKL5

Expanding pipeline

SMA: advancing into two pivotal studies

BMI1, Huntington’s and FD programs

Strong financial position with healthy balance sheet

Jan-17 3

*Annual renewal subject to approval by the European Commission

PageJan-17

Translarna™

Precision medicine platform: Realizing Translarna’s full value

through multiple indications

5

Page

Translarna™ : Sustainable, growing DMD

business supporting long term success

Jan-17 6

25+ Countries worldwide with Translarnacommercial therapy*

Preliminary 2016 Translarna unaudited net sales of ~$81M*

Established footprint in 47 countries worldwide

EMA renewal establishes sustainability of ex-US business

Experienced commercial team in orphan disease

*Commercial sales through commercial or early access programs

Page

$1

$34

$81

$105

$0

$20

$40

$60

$80

$100

$120

$140

2014 2015 2016 2017

Strong demand drives substantial year-over-year net

sales growth

Jan-17 7

2017 Translarna net sales guidance of $105 - $125M

Translarna™ ex-US DMD Net Sales

($ in millions)

$125

Page

Key Drivers of Continued Market Growth

Jan-17 8

Increase penetration in current countries

New geographies

>90% patient compliance to Translarna

Opportunities for label expansion

PageJan-17 9

Europe

~2,000 pts.

Asia Pac:

~600 pts.

U.S. &

Canada:

~1,000 pts.

>7,000 addressable nmDMD patients worldwide

Lat Am/ Mex:

~2,000 pts.

~85% of patients outside the U.S.

MENA

~1,400 pts.

Internal estimates of potential patient population based on data derived from a variety of sources

and are subject to change

Page

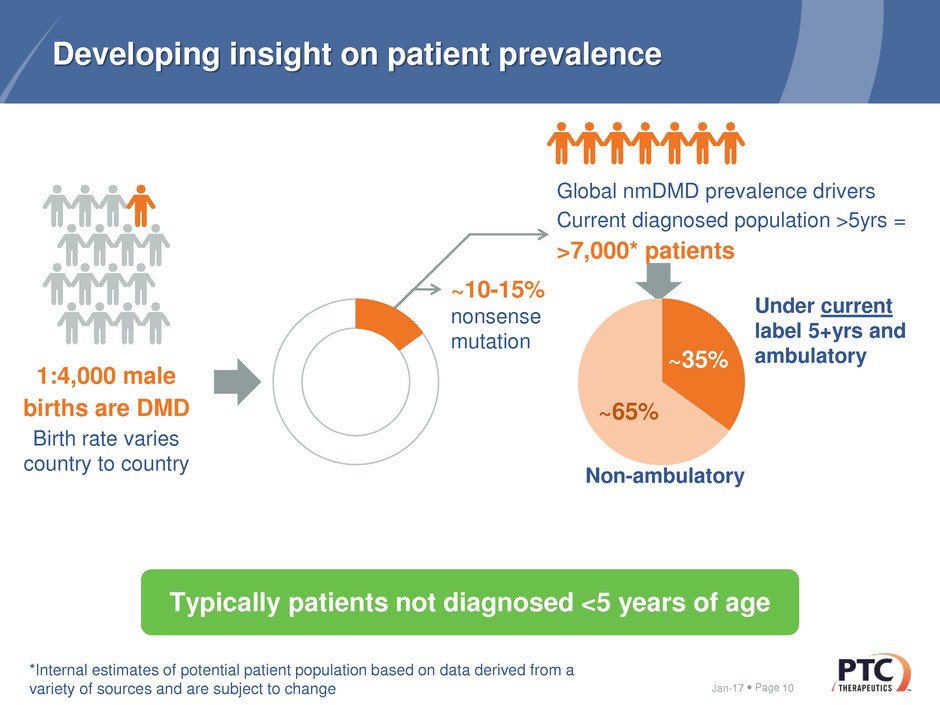

Developing insight on patient prevalence

Jan-17 10

1:4,000 male

births are DMD

Birth rate varies

country to country

Global nmDMD prevalence drivers

Current diagnosed population >5yrs =

>7,000* patients

Typically patients not diagnosed <5 years of age

~10-15%

nonsense

mutation

Under current

label 5+yrs and

ambulatory~35%

~65%

Non-ambulatory

*Internal estimates of potential patient population based on data derived from a

variety of sources and are subject to change

Page

Current efforts to grow addressable DMD population

11

Earlier diagnosis Increase disease awareness

Genotyping Improving standards of

care

Jan-17

Identifying 2-4 year olds increases potential addressable

population by ~20%

?

Page

Potential market opportunity for Translarna™ in DMD

Jan-17 12

Ex-US,

5+ yrs and

ambulatory

U.S.

all patients

ambulatory and

non-ambulatory

Ex-US 2-4 yrs

Potential peds

label in 2018

~$50M peak

NDA

submission

in 2017

Ex-U.S.,

5+ yrs and

non-ambulatory

Gathering

long-term

data (FVC)

Current

Label ~$250M

peak

Page

Translarna™ regulatory update: CHMP recommends

renewal of approval, NDA to be reviewed by FDA

EMA

Renewal of Translarna DMD approval recommended by CHMP

– Commitment to conduct post marketing DMD trial

FDA

Multiple interactions with FDA officials and advisors over the last several

months

Feedback indicated best path forward for full and fair review of the current

Translarna NDA is to file over protest rather than continue appeal of RTF

NDA to be supplemented with additional efficacy data utilized by CHMP in

renewal recommendation

Jan-17 13

Page

Potential Market opportunity for Translarna™ in nmCF:

>9,000 patients worldwide

Jan-17 14

Cystic Fibrosis

nmCF represents a significant commercial opportunity

DMD CF US CF ex-US Potential peak for

nmDMD & nmCF

Global CF

trial data

Q1:17

DMD

~3,000 pts

estimated

~6,000 pts

estimated

Internal estimates of potential patient population based on data derived from a

variety of sources and are subject to change

>7,000 pts

estimated

~16,000 pts

estimated

Page

Cystic fibrosis is caused by a malfunction of the

CFTR protein due to different mutations

Jan-17

CFTR channel

through

cell membrane

CFTR protein

cftr gene in

cell nucleus

V

Reduced

SynthesisClass Normal

IV

Conductance

I

No Synthesis

III

Gating

II

Processing

Block

% CF Patients 2%10% ~5%70%

Compounds Translarna Kalydeco®Orkambi®

CFTR

CFTR

CFTR

CFTR

CFTR

CFTR

CFTR

CFTR

CFTR

CFTR

CFTR

CFTR

CFTR

15

Translarna™ is only compound in development targeting Class I CF

Page

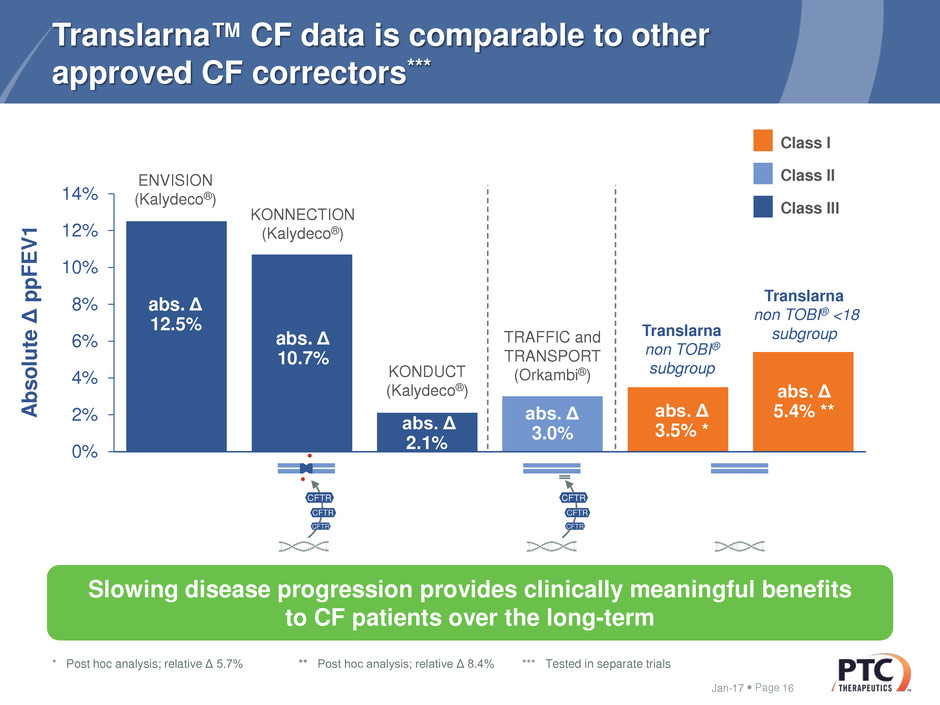

Slowing disease progression provides clinically meaningful benefits

to CF patients over the long-term

Translarna™ CF data is comparable to other

approved CF correctors***

Jan-17

0%

2%

4%

6%

8%

10%

12%

14%

A

bs

ol

ut

e

Δ

pp

FE

V

1

Class III

Class I

Class II

* Post hoc analysis; relative Δ 5.7% ** Post hoc analysis; relative Δ 8.4% *** Tested in separate trials

abs. Δ

3.5% *

abs. Δ

5.4% **

Translarna

non TOBI®

subgroup

Translarna

non TOBI® <18

subgroup

abs. Δ

12.5%

ENVISION

(Kalydeco®)

abs. Δ

10.7%

KONNECTION

(Kalydeco®)

abs. Δ

2.1%

KONDUCT

(Kalydeco®)

abs. Δ

3.0%

TRAFFIC and

TRANSPORT

(Orkambi®)

CFTR

CFTR

CFTR

CFTR

CFTR

CFTR

16

Page

Translarna™ reduced exacerbations

Jan-17 17

62%†

Overall population

(n=232)

Non-TOBI®

(n=146)

Non-TOBI® (age 6-18 years)

(n=49)

*p=.006 Nominal post-hoc data.

†p=.024 Nominal post-hoc data

De Boeck K, et al. 39th European Cystic Fibrosis Conference, Basel, Switzerland, June 8-11, 2016.

Abstract WS13.1.

.

41%*

23%

Page

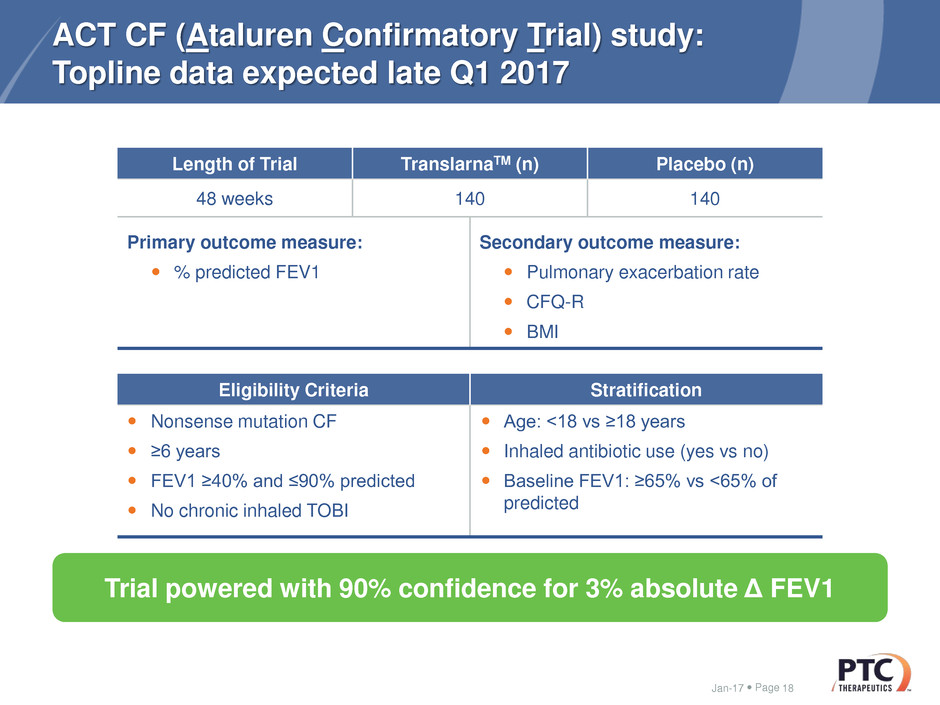

Length of Trial TranslarnaTM (n) Placebo (n)

48 weeks 140 140

Primary outcome measure:

% predicted FEV1

Secondary outcome measure:

Pulmonary exacerbation rate

CFQ-R

BMI

ACT CF (Ataluren Confirmatory Trial) study:

Topline data expected late Q1 2017

Eligibility Criteria Stratification

Nonsense mutation CF

≥6 years

FEV1 ≥40% and ≤90% predicted

No chronic inhaled TOBI

Age: ˂18 vs ≥18 years

Inhaled antibiotic use (yes vs no)

Baseline FEV1: ≥65% vs <65% of

predicted

Trial powered with 90% confidence for 3% absolute Δ FEV1

Jan-17 18

Page

Ion channel

disorders

Publications: 1

Genetically defined

epilepsy

Metabolic

disorders

Publications: 10

Muscle

disorders

Publications: 6

Eye

disorders

Publications: 3

Skin

disorders

Publications: 2

Neurological

disorders

Publications: 8

Pulmonary

disorders

Publications: 10

Translarna™: Realizing a new paradigm for the treatment

of rare diseases, progressing proof of concept studies

Jan-17 19

~ 40 publications in many disease models

Page

Translarna™ restores morphology and sight in

Aniridia mouse model

20-40% nonsense mutation

– 12 month placebo controlled trial

– Primary endpoint PAX6 levels, eye form and function

– Enrolling well, targeting up to 40 patients

Jan-17 20

Untreated

Wild type

Treated

with

Translarna

Sey+/-

Sey+/-

Scotopic

response

Photopic

response

Oscillatory

potentials

12 Hz

flicker

WT

P60

Gregory-Evans 2014 JCI

Page

Progressing proof of concept studies:

MPS I and Dravet / CDKL5

MPS I: Metabolic enzyme disorder

– 3 month open label trial currently

enrolling naïve patients

– Primary endpoint change in urinary

& CNS GAG levels

– Challenges in enrolling, targeting 8

patients

Dravet / CDKL5: Genetic epilepsy

– 32 weeks placebo controlled trials

– Primary endpoint number of

monthly seizures

– Targeting up to 16 patients (8 for

Dravet and 8 for CDKL5)

Jan-17 21

60-80%

MPS I

nonsense

mutation

50% Dravet

10% CDKL5

nonsense mutation

PageJan-17

Small molecule splicing technology platform

Multiple on-going programs

22

Page

The spinal muscular atrophy program validates PTC’s

small molecule splicing platform

Jan-17 23

Target splicing event to restore or

reduce proteinSplicing

Tumor Resistance – MCL1

SMA - SMN2

FD – IKBKAP

HD – HTT

Page

Pivotal portion of both Sunfish & Firefish trials

expected to begin in 2017

SUNFISH

Clinical study in SMA type 2/3 patients initiated in November

– Enrolling 36 patients for dose escalation phase, placebo controlled 2:1

– Pivotal phase will be 150 patients, placebo controlled 1:1, endpoint of total motor

function measure (MFM-32) at 12 months

FIREFISH

Clinical study in SMA type 1 patients <7 months old

– Enrolling 8 patients for dose escalation phase

– Pivotal phase will enroll 40 babies, open label

endpoint of sitting as measured by Bayley infant scale

Jan-17 24

Two pivotal studies expected to begin in 2017

Page

HD

Huntington’s disorder is a progressive, inherited

neurodegenerative disorder

HD is caused by expression of mutant Huntingtin (HTT) protein

Causes selective and devastating neuronal loss

– Predominantly in the striatum and cerebral cortex

Adult onset at ~30-50 years

Unmet medical need

– Patients: 30,000 US, 100,000 WW

25

Healthy

Jan-17

Page

Multiple orally bioavailable, brain penetrant compounds being

optimized

– Lowers HTT by altering splicing

Opportunity to provide first-in-class disease modifying, HTT lowering

small molecule therapy

– Potential to circumvent delivery and distribution challenges seen with the

current modalities

HD program in Lead Optimization – showcases

PTC’s alternative splicing platform

Jan-17 26Jan-17 3

V e h ic le 1 0

0

2 0

4 0

6 0

8 0

1 0 0

S tr ia tu m

%

H

T

T

l

o

w

e

ri

n

g

P 3 0 1 9 0 5 (m g /k g )

Ve h ic le 1 0

0

2 0

4 0

6 0

8 0

1 0 0

C o r te x

%

H

T

T

l

o

w

e

ri

n

g

P 3 0 1 9 0 5 (m g /k g )

V e h ic le 1 0

0

2 0

4 0

6 0

8 0

1 0 0

S k in

%

H

T

T

l

o

w

e

ri

n

g

P 3 0 1 9 0 5 (m g /k g )

Page

Expanding pipeline through in-house innovation

Jan-17 27

Product /

Platform

Discovery Preclinical Phase 1 Phase 2 Phase 3

DMD

CF

BMI1

SMA

HD

TranslarnaTM

(ataluren)

nonsense readthrough

SMA

alternative splicing

PTC596

tumor stem cell targeting

Huntington’s

alternative splicing

Commercial

Aniridia

Oncology

Orphan genetic disorders

MPS I

Next Generation

nonsense readthrough

Dravet / CDKL5

* Marketing authorization (MA) recommended by CHMP in the European Economic Area, which is subject to approval by the European Commission; MA requires

annual renewal following reassessment by the European Medicines Agency (EMA)

*

FDFamilial

Dysautonomia

Page

Strong financial position with sustainable,

growing DMD business

2016 Preliminary Results

Preliminary 2016 Translarna™ unaudited net sales of ~$81 million

Commercial business cash flow positive 2yrs post launch

12/31/16 year-end cash position of ~$230 million

2017 Guidance

2017 Translarna net sales guidance of $105 – $125 million*

$20 million SMA milestone payment expected mid-2017

2017 non-GAAP operating expenses of $190 - $200 million (excludes

~$35M in non-cash stock based compensation)

12/31/17 year-end cash position anticipated to be ~$160 million

Jan-17 28

• ex-US DMD sales

• Based on current exchange rates.

Page

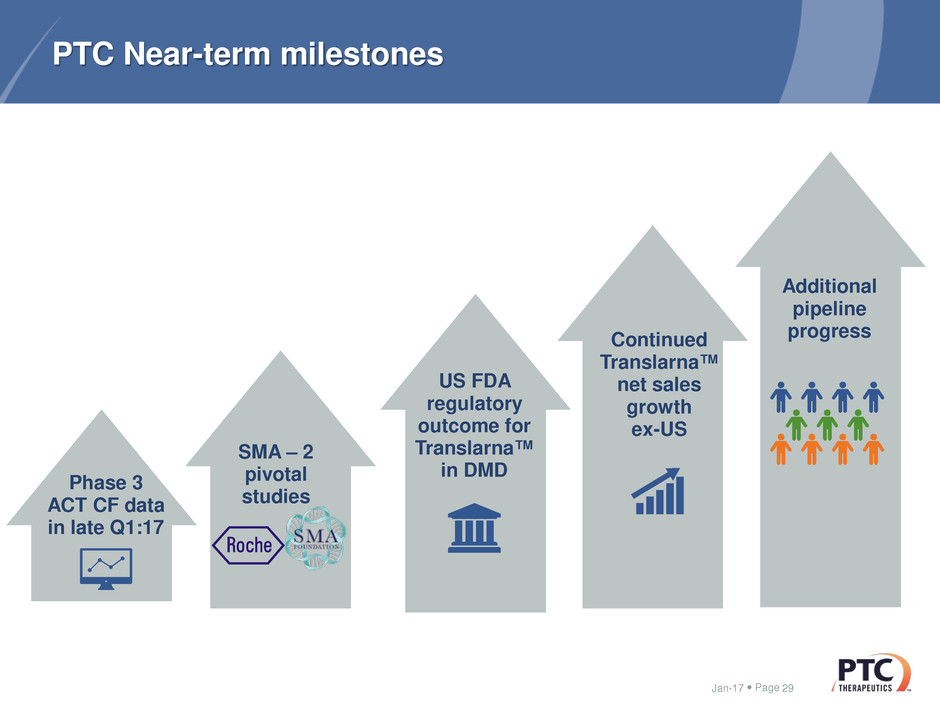

PTC Near-term milestones

Jan-17 29

Phase 3

ACT CF data

in late Q1:17

SMA – 2

pivotal

studies

Continued

Translarna™

net sales

growth

ex-US

Additional

pipeline

progress

US FDA

regulatory

outcome for

Translarna™

in DMD