Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - KERYX BIOPHARMACEUTICALS INC | d286263dex991.htm |

| EX-10.1 - EX-10.1 - KERYX BIOPHARMACEUTICALS INC | d286263dex101.htm |

| 8-K - FORM 8-K - KERYX BIOPHARMACEUTICALS INC | d286263d8k.htm |

Greg Madison President & Chief Executive Officer Keryx Biopharmaceuticals, Inc. 35th Annual J.P. Morgan Healthcare Conference January 9 – 11, 2017 Building a Leading Renal Company Exhibit 99.2

Disclaimers Forward-looking Statements Some of the statements included in this presentation, particularly those regarding expected revenues, the commercialization and ongoing clinical development of Auryxia and the expected impact of the new members of management, including those statements related to Preliminary Unaudited Year-end Financial Data and the submission of an sNDA to the FDA to expand the label of ferric citrate to include the treatment of IDA in adults with stage 3-5 NDD-CKD and the potential approval in this indication and the impact thereof on Keryx, may be forward-looking statements that involve a number of risks and uncertainties. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Among the factors that could cause our actual results to differ materially are the following: the completion of our financial statements for the year ended December 31, 2016 and the audit thereof; whether we can increase adoption of Auryxia in patients with CKD on dialysis; whether we can maintain our operating expenses to projected levels while continuing our current clinical, regulatory and commercial activities; whether we will able to identify and negotiate acceptable terms with a commercialization partner in the E.U.; whether we or a partner can successfully launch Fexeric® in the E.U.; whether Riona® will be successfully marketed in Japan by our Japanese partner, Japan Tobacco, Inc. and its subsidiary Torii Pharmaceutical Co., Ltd; the risk that the FDA may not concur with our interpretation of our Phase 3 study results in NDD- CKD, supportive data, conduct of the studies, or any other part of our regulatory submission and could ultimately deny approval of ferric citrate for the treatment of IDA in adults with stage 3-5 NDD-CKD; the risk that if approved for use in NDD-CKD that we may not be able to successfully market Auryxia for use in this indication; our ability to continue to supply Auryxia following the recent resupply to the market; and other risk factors identified from time to time in our reports filed with the Securities and Exchange Commission. Any forward looking statements set forth in this presentation speak only as of the date of this presentation. We do not undertake to update any of these forward-looking statements to reflect events or circumstances that occur after the date hereof. This presentation is available on our website at http://www.keryx.com. The information found on our website is not incorporated by reference into this presentation and is included for reference purposes only. Preliminary Unaudited Financial Results The preliminary unaudited financial data for the quarter and the year ended December 31, 2016 set forth above is derived from preliminary internal financial reports. Keryx has not yet finalized its complete results of operations for the year ended December 31, 2016. In connection with the finalization of its year-end closing and reporting processes, the completion of its financial statements for the year ended December 31, 2016 and the completion of the audit of its financial statements for the year ended December 31, 2016, Keryx and its auditors may identify items that would require Keryx to make adjustments, some of which could be material, to the preliminary unaudited financial data set forth above.

Building a Leading Renal Company Today Near Term Future One medicine, multiple indications Multi-product company focused on improving the lives of people with renal disease One medicine, one indication Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis; Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia.

Positive momentum for Auryxia in dialysis ~8,700 prescriptions for 4Q16, including ~4,500 prescriptions in December Well Positioned for Growth in 2017 Commercial Update Financial Highlights* Corporate ~$8.2 million in 4Q16 net U.S. Auryxia product sales; ~$27.1 million for full year 2016 ~$112.1 million in cash and cash equivalents as of December 31, 2016 Added two new executives with broad operational and strategic experience Christine Carberry appointed as chief operating officer Melissa Bradford-Klug appointed as chief business officer Expansion Opportunity Submitted sNDA for Auryxia for iron deficiency anemia in non-dialysis dependent chronic kidney disease (IDA, NDD-CKD) Prescriptions include demand data provided to the company from third party sources. *Financial data represent preliminary unaudited results for the quarter and year ended December 31, 2016.

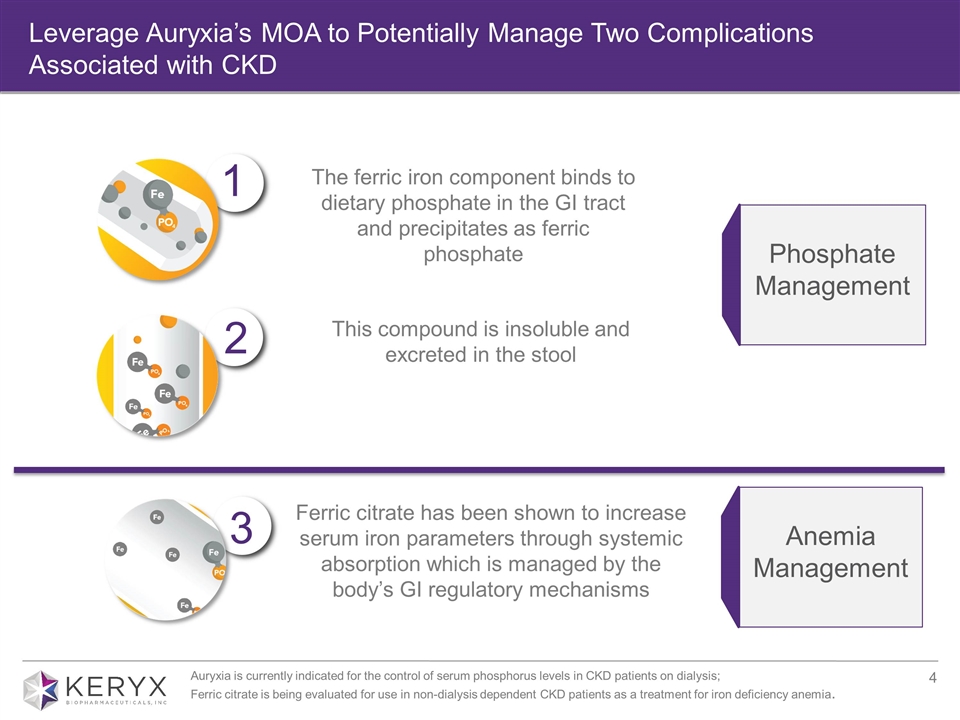

Leverage Auryxia’s MOA to Potentially Manage Two Complications Associated with CKD Phosphate Management Anemia Management 2 1 3 The ferric iron component binds to dietary phosphate in the GI tract and precipitates as ferric phosphate This compound is insoluble and excreted in the stool Ferric citrate has been shown to increase serum iron parameters through systemic absorption which is managed by the body’s GI regulatory mechanisms Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis; Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia.

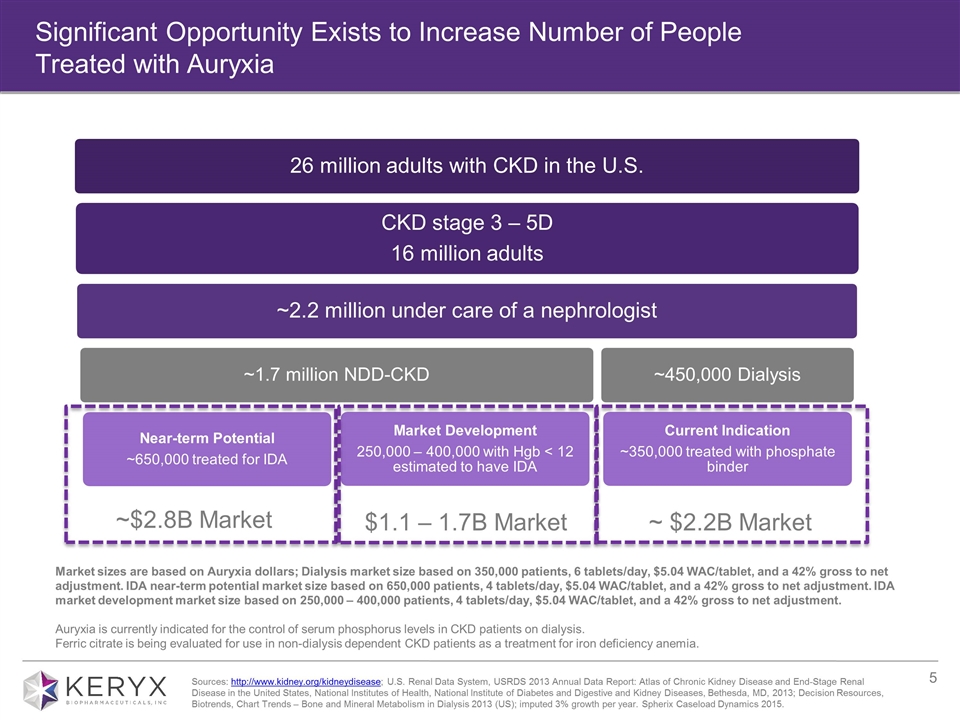

Significant Opportunity Exists to Increase Number of People Treated with Auryxia ~ $2.2B Market ~$2.8B Market Market sizes are based on Auryxia dollars; Dialysis market size based on 350,000 patients, 6 tablets/day, $5.04 WAC/tablet, and a 42% gross to net adjustment. IDA near-term potential market size based on 650,000 patients, 4 tablets/day, $5.04 WAC/tablet, and a 42% gross to net adjustment. IDA market development market size based on 250,000 – 400,000 patients, 4 tablets/day, $5.04 WAC/tablet, and a 42% gross to net adjustment. Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis. Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia. $1.1 – 1.7B Market Sources: http://www.kidney.org/kidneydisease; U.S. Renal Data System, USRDS 2013 Annual Data Report: Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the United States, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases, Bethesda, MD, 2013; Decision Resources, Biotrends, Chart Trends – Bone and Mineral Metabolism in Dialysis 2013 (US); imputed 3% growth per year. Spherix Caseload Dynamics 2015. CKD stage 3 – 5D 16 million adults ~2.2 million under care of a nephrologist ~450,000 Dialysis ~1.7 million NDD-CKD Near-term Potential ~650,000 treated for IDA Current Indication ~350,000 treated with phosphate binder 26 million adults with CKD in the U.S. Market Development 250,000 – 400,000 with Hgb < 12 estimated to have IDA

Phosphate Management Growth Driver Marketed Medicine, Auryxia® Today Hyperphosphatemia in people with CKD on Dialysis Building a Leading Renal Company

Overview/Recent Accomplishments: Three FDA-approved drug product manufacturing sites provide redundant supply to support growth Sound commercial strategy and expanded field force engagement set stage for growth Strong commercial fundamentals remain in place 2017 program goals: Drive growth and ensure that patients have access to the benefits of Auryxia Hyperphosphatemia in Dialysis Program Overview

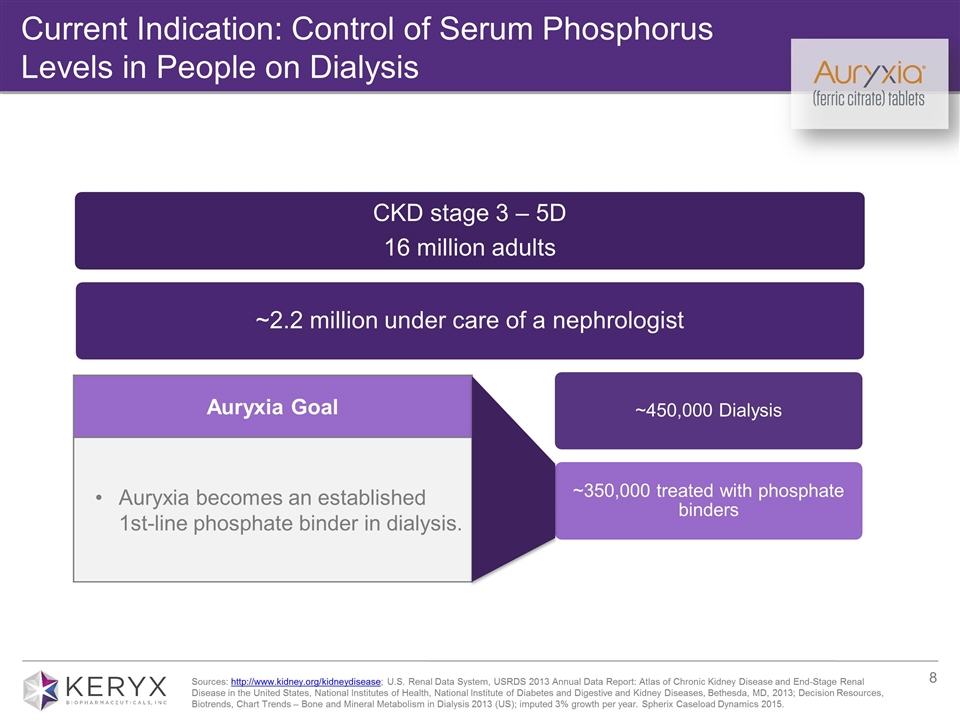

Current Indication: Control of Serum Phosphorus Levels in People on Dialysis Auryxia Goal Auryxia becomes an established 1st-line phosphate binder in dialysis. Sources: http://www.kidney.org/kidneydisease; U.S. Renal Data System, USRDS 2013 Annual Data Report: Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the United States, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases, Bethesda, MD, 2013; Decision Resources, Biotrends, Chart Trends – Bone and Mineral Metabolism in Dialysis 2013 (US); imputed 3% growth per year. Spherix Caseload Dynamics 2015. CKD stage 3 – 5D 16 million adults ~2.2 million under care of a nephrologist ~450,000 Dialysis NDD-CKD* 1.7 million ~350,000 treated with phosphate binders

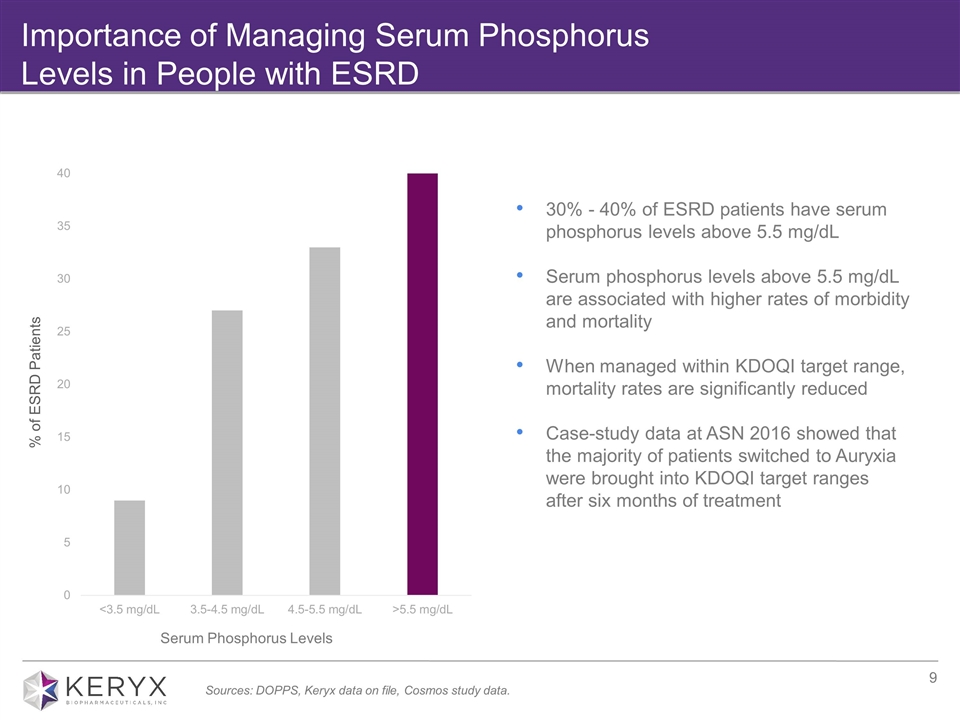

Importance of Managing Serum Phosphorus Levels in People with ESRD % of ESRD Patients Serum Phosphorus Levels Sources: DOPPS, Keryx data on file, Cosmos study data. 30% - 40% of ESRD patients have serum phosphorus levels above 5.5 mg/dL Serum phosphorus levels above 5.5 mg/dL are associated with higher rates of morbidity and mortality When managed within KDOQI target range, mortality rates are significantly reduced Case-study data at ASN 2016 showed that the majority of patients switched to Auryxia were brought into KDOQI target ranges after six months of treatment

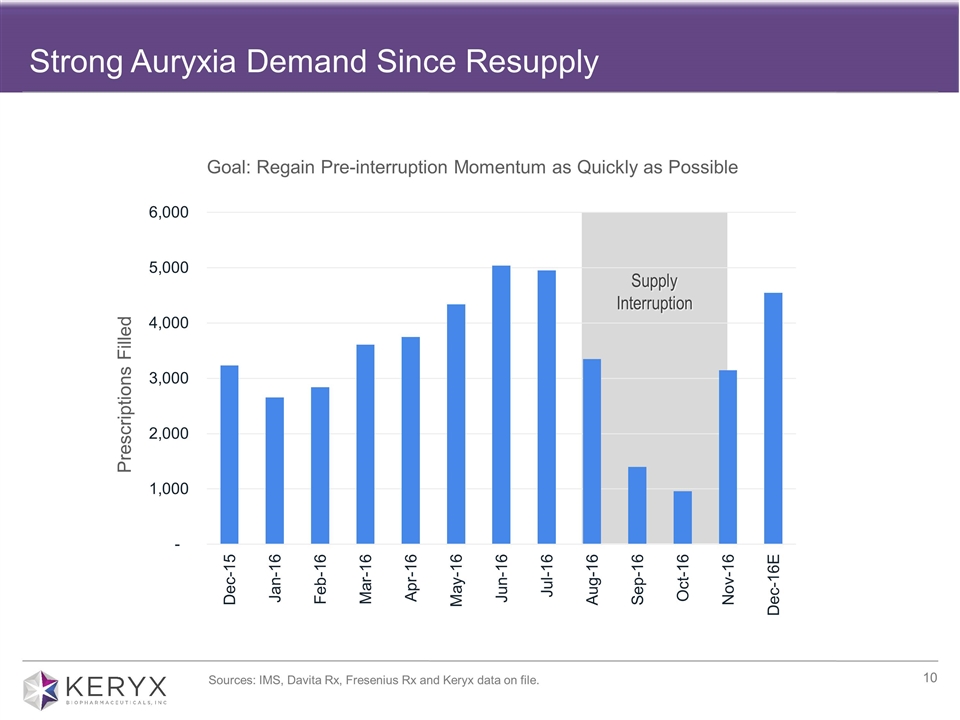

Strong Auryxia Demand Since Resupply Goal: Regain Pre-interruption Momentum as Quickly as Possible Supply Interruption Prescriptions Filled Sources: IMS, Davita Rx, Fresenius Rx and Keryx data on file.

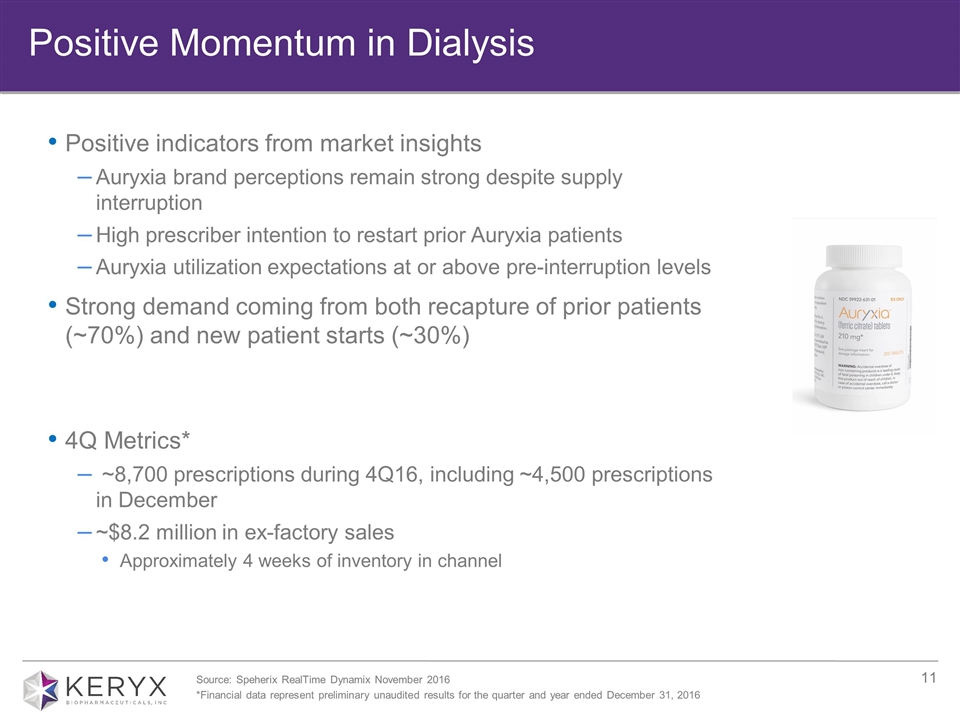

Positive indicators from market insights Auryxia brand perceptions remain strong despite supply interruption High prescriber intention to restart prior Auryxia patients Auryxia utilization expectations at or above pre-interruption levels Strong demand coming from both recapture of prior patients (~70%) and new patient starts (~30%) 4Q Metrics* ~8,700 prescriptions during 4Q16, including ~4,500 prescriptions in December ~$8.2 million in ex-factory sales Approximately 4 weeks of inventory in channel Positive Momentum in Dialysis Source: Speherix RealTime Dynamix November 2016 *Financial data represent preliminary unaudited results for the quarter and year ended December 31, 2016

Iron Deficiency Anemia, NDD-CKD Potential Late 2017 Launch Near-Term Growth Opportunity Iron Deficiency Anemia in People with NDD-Chronic Kidney Disease Building a Leading Renal Company

Achievements: Completed Pivotal Phase 3 Trial: Comprehensive data of final results presented at ASN in November Demonstrated statistically significant differences versus placebo for the primary and all pre-specified secondary endpoints Submitted publication to peer-reviewed journal Submitted sNDA January 2017 2017 program goals: Raise awareness of clinical trial data through publication of results Prepare for potential launch in late 2017 IDA, NDD-CKD Program Overview Potential to be first FDA-approved oral iron medicine for IDA, NDD-CKD

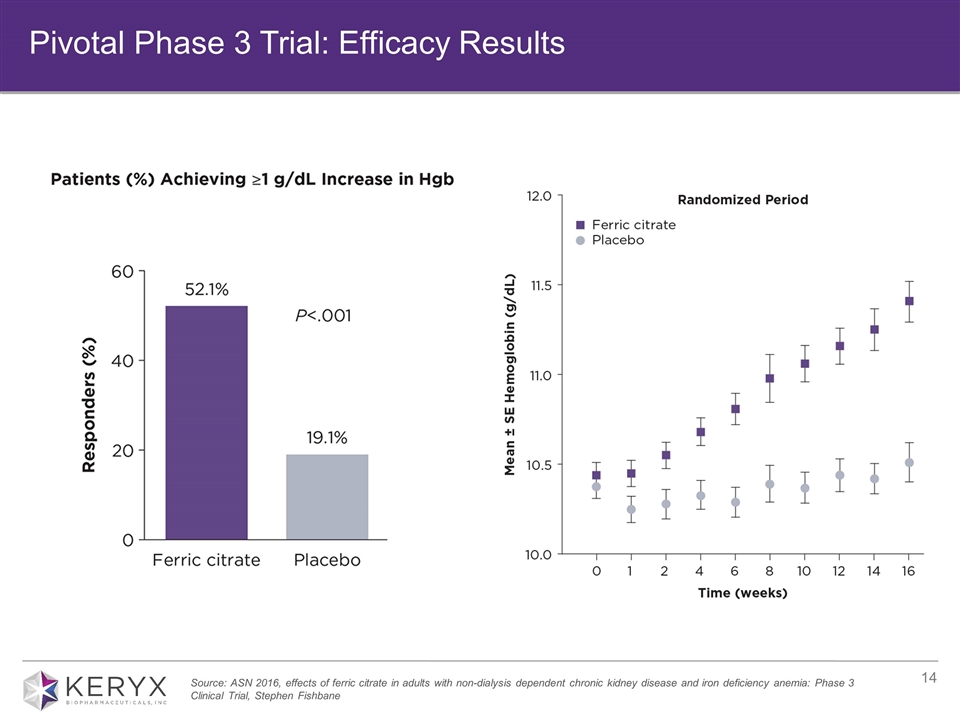

Source: ASN 2016, effects of ferric citrate in adults with non-dialysis dependent chronic kidney disease and iron deficiency anemia: Phase 3 Clinical Trial, Stephen Fishbane Pivotal Phase 3 Trial: Efficacy Results

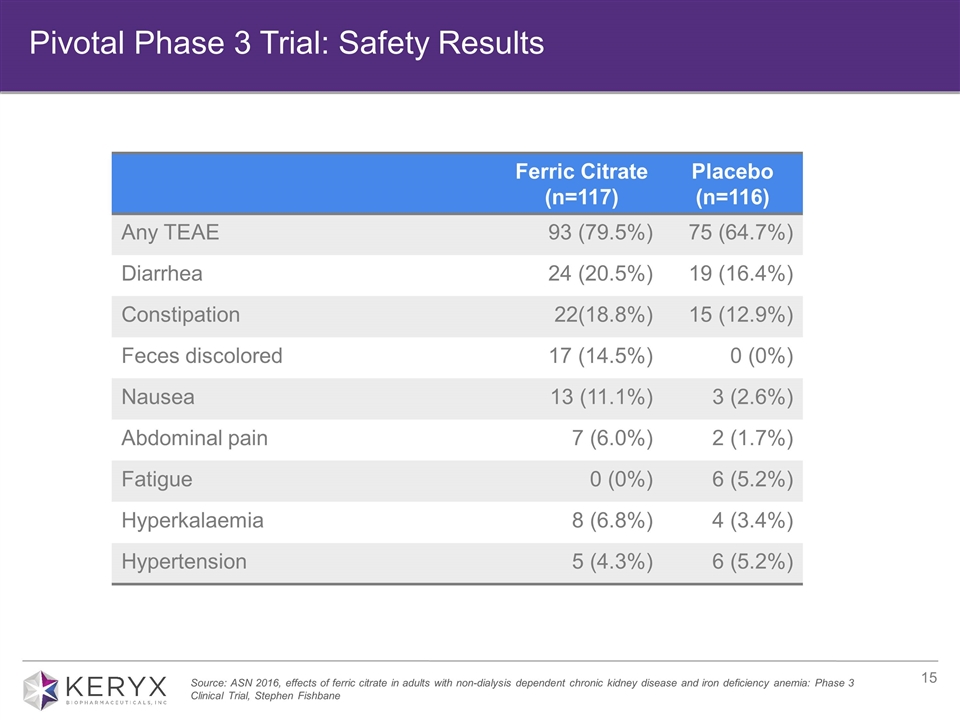

Ferric Citrate (n=117) Placebo (n=116) Any TEAE 93 (79.5%) 75 (64.7%) Diarrhea 24 (20.5%) 19 (16.4%) Constipation 22(18.8%) 15 (12.9%) Feces discolored 17 (14.5%) 0 (0%) Nausea 13 (11.1%) 3 (2.6%) Abdominal pain 7 (6.0%) 2 (1.7%) Fatigue 0 (0%) 6 (5.2%) Hyperkalaemia 8 (6.8%) 4 (3.4%) Hypertension 5 (4.3%) 6 (5.2%) Source: ASN 2016, effects of ferric citrate in adults with non-dialysis dependent chronic kidney disease and iron deficiency anemia: Phase 3 Clinical Trial, Stephen Fishbane Pivotal Phase 3 Trial: Safety Results

Auryxia IDA, NDD-CKD Launch Planning Highlights Conduct primary and secondary research with nephrologists and support staff Generate key market and customer insights Situational Analysis Identify opportunities and leverage points Formulate product positioning Develop strategic priorities Strategy Development Key deliverables, timelines, and milestones critical for the successful launch of Auryxia for IDA, NDD-CKD Launch Plan

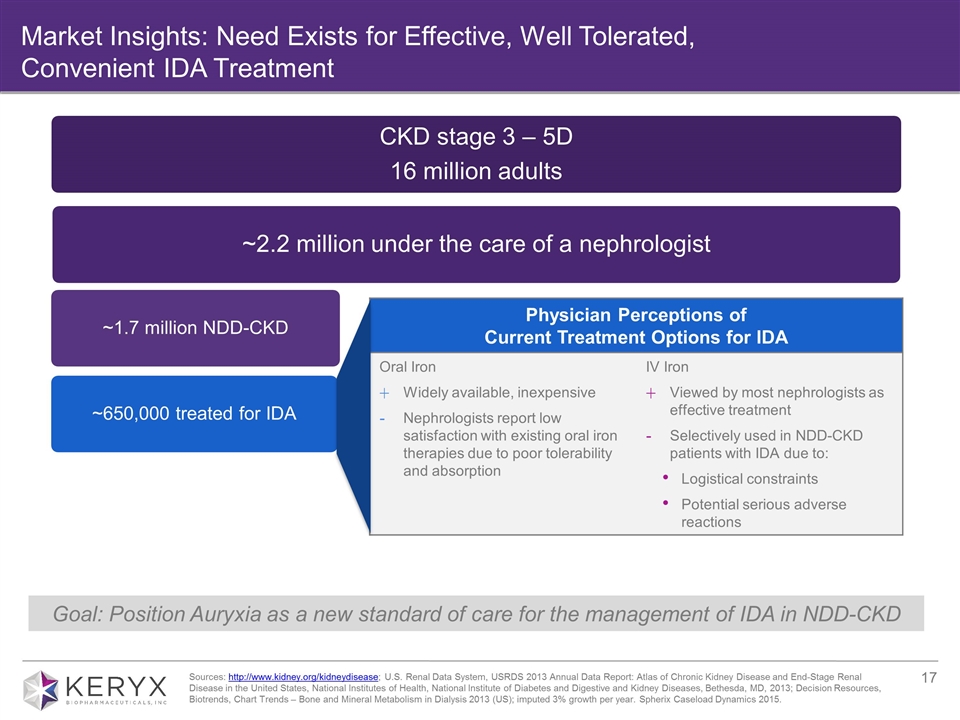

Market Insights: Need Exists for Effective, Well Tolerated, Convenient IDA Treatment Goal: Position Auryxia as a new standard of care for the management of IDA in NDD-CKD Physician Perceptions of Current Treatment Options for IDA Oral Iron Widely available, inexpensive Nephrologists report low satisfaction with existing oral iron therapies due to poor tolerability and absorption IV Iron Viewed by most nephrologists as effective treatment Selectively used in NDD-CKD patients with IDA due to: Logistical constraints Potential serious adverse reactions Sources: http://www.kidney.org/kidneydisease; U.S. Renal Data System, USRDS 2013 Annual Data Report: Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the United States, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases, Bethesda, MD, 2013; Decision Resources, Biotrends, Chart Trends – Bone and Mineral Metabolism in Dialysis 2013 (US); imputed 3% growth per year. Spherix Caseload Dynamics 2015. CKD stage 3 – 5D 16 million adults ~2.2 million under the care of a nephrologist Dialysis 450,000 ~1.7 million NDD-CKD ~650,000 treated for IDA 350,000 treated with phosphate binder (current indication)

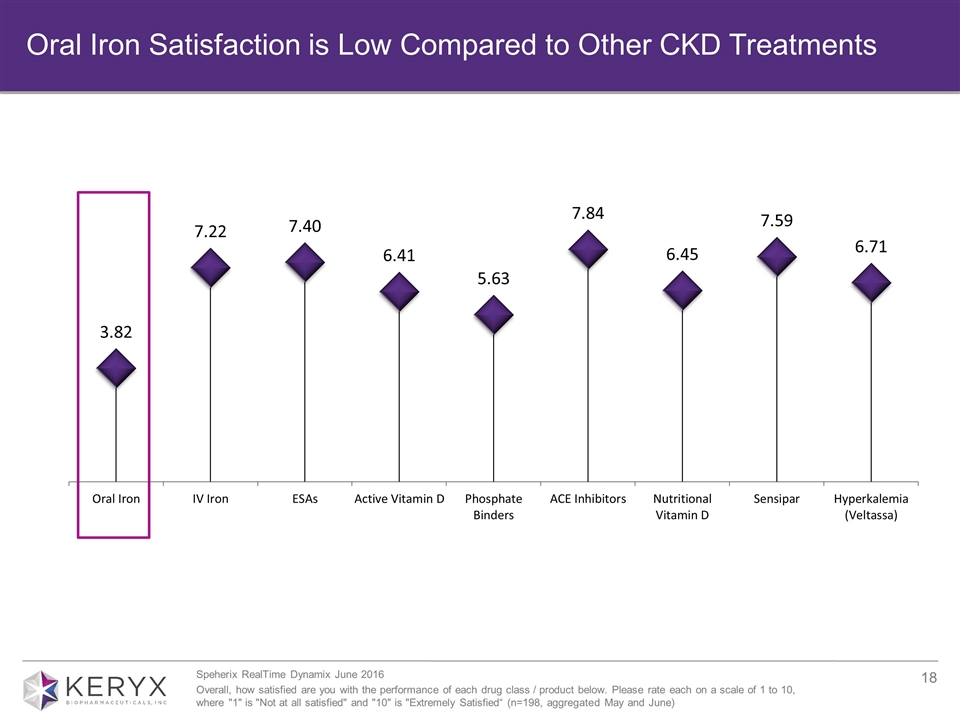

Oral Iron Satisfaction is Low Compared to Other CKD Treatments Speherix RealTime Dynamix June 2016 Overall, how satisfied are you with the performance of each drug class / product below. Please rate each on a scale of 1 to 10, where "1" is "Not at all satisfied" and "10" is "Extremely Satisfied“ (n=198, aggregated May and June)

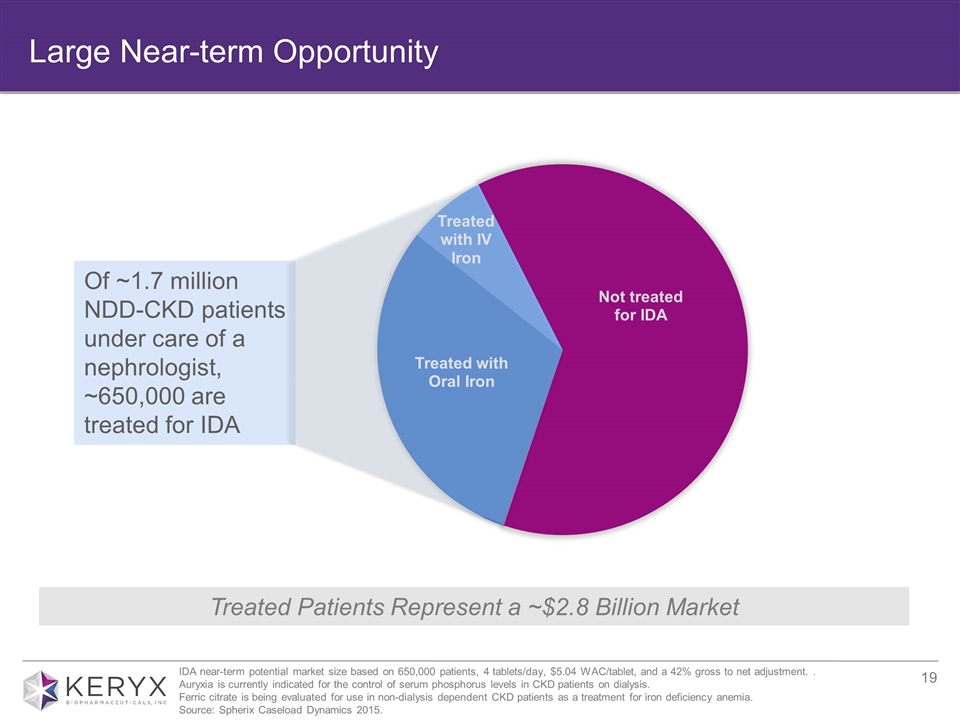

Large Near-term Opportunity Treated Patients Represent a ~$2.8 Billion Market Of ~1.7 million NDD-CKD patients under care of a nephrologist, ~650,000 are treated for IDA IDA near-term potential market size based on 650,000 patients, 4 tablets/day, $5.04 WAC/tablet, and a 42% gross to net adjustment. . Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis. Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia. Source: Spherix Caseload Dynamics 2015.

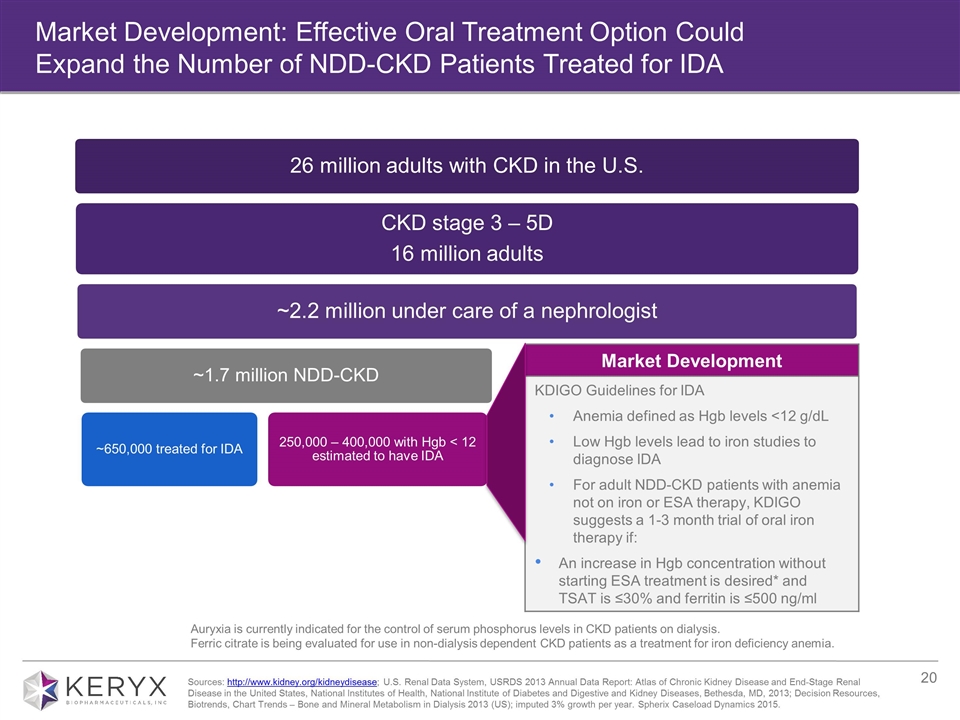

Market Development: Effective Oral Treatment Option Could Expand the Number of NDD-CKD Patients Treated for IDA Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis. Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia. Market Development KDIGO Guidelines for IDA Anemia defined as Hgb levels <12 g/dL Low Hgb levels lead to iron studies to diagnose IDA For adult NDD-CKD patients with anemia not on iron or ESA therapy, KDIGO suggests a 1-3 month trial of oral iron therapy if: An increase in Hgb concentration without starting ESA treatment is desired* and TSAT is ≤30% and ferritin is ≤500 ng/ml Sources: http://www.kidney.org/kidneydisease; U.S. Renal Data System, USRDS 2013 Annual Data Report: Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the United States, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases, Bethesda, MD, 2013; Decision Resources, Biotrends, Chart Trends – Bone and Mineral Metabolism in Dialysis 2013 (US); imputed 3% growth per year. Spherix Caseload Dynamics 2015. CKD stage 3 – 5D 16 million adults ~2.2 million under care of a nephrologist Dialysis 450,000 ~1.7 million NDD-CKD ~650,000 treated for IDA ~350,000 treated with phosphate binder (current indication) 26 million adults with CKD in the U.S. 250,000 – 400,000 with Hgb < 12 estimated to have IDA

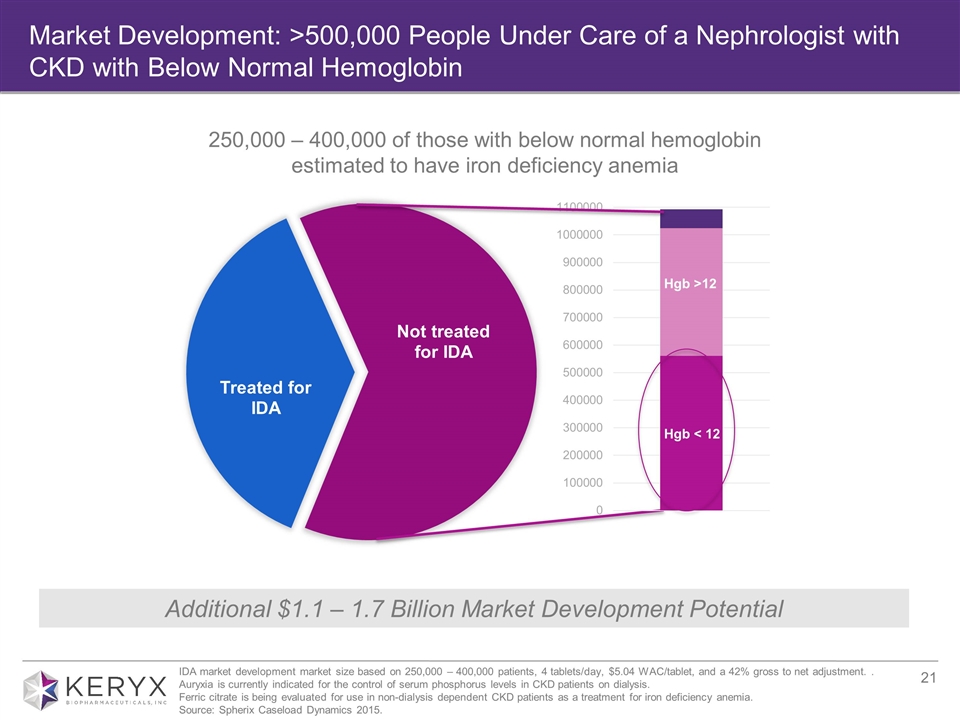

Market Development: >500,000 People Under Care of a Nephrologist with CKD with Below Normal Hemoglobin Hgb < 12 Hgb >12 Additional $1.1 – 1.7 Billion Market Development Potential 250,000 – 400,000 of those with below normal hemoglobin estimated to have iron deficiency anemia IDA market development market size based on 250,000 – 400,000 patients, 4 tablets/day, $5.04 WAC/tablet, and a 42% gross to net adjustment. . Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis. Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia. Source: Spherix Caseload Dynamics 2015.

Auryxia Strategic Priorities in IDA, NDD-CKD Establish a new oral iron-centric treatment paradigm for anemia in NDD-CKD Differentiate Auryxia from traditional oral irons Position Auryxia as a new standard of care for the management of IDA in NDD-CKD

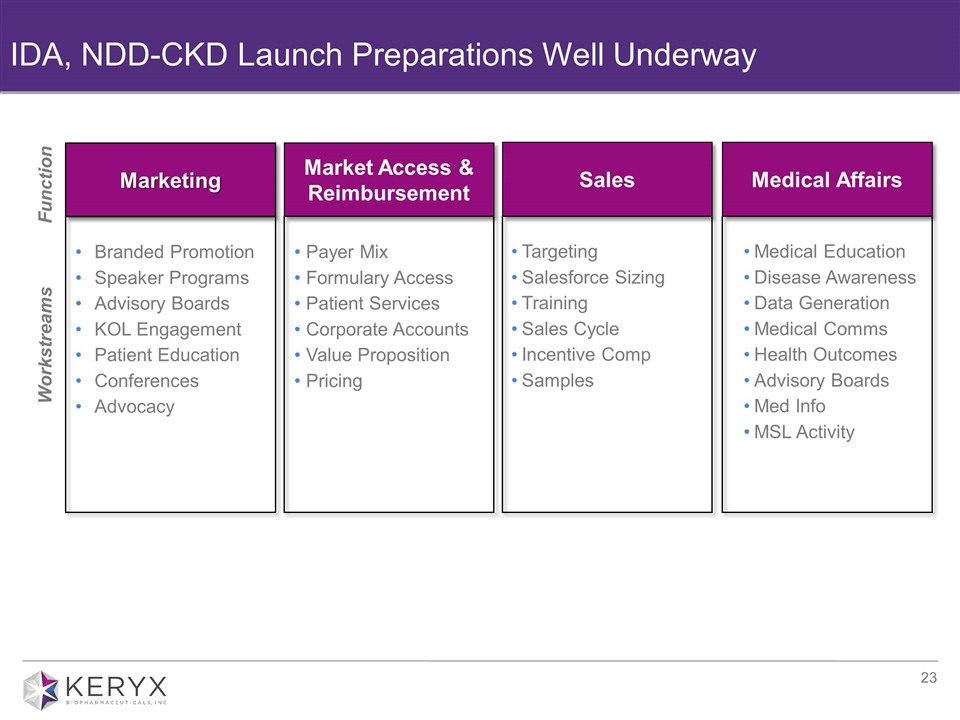

Marketing Market Access & Reimbursement Sales IDA, NDD-CKD Launch Preparations Well Underway Medical Affairs Workstreams Function Branded Promotion Speaker Programs Advisory Boards KOL Engagement Patient Education Conferences Advocacy Payer Mix Formulary Access Patient Services Corporate Accounts Value Proposition Pricing Targeting Salesforce Sizing Training Sales Cycle Incentive Comp Samples Medical Education Disease Awareness Data Generation Medical Comms Health Outcomes Advisory Boards Med Info MSL Activity

Current commercial infrastructure Current Keryx phosphate binder nephrology targets account for ~80% of oral iron prescriptions in CKD Broad awareness and familiarity of Auryxia Established access and reimbursement Similar payer mix dynamics to dialysis Existing formulary coverage would provide access to majority of IDA, NDD/CKD patients Existing reimbursement hub would provide patient support IDA, NDD-CKD Indication Would Provide Significant Leverage IMS, custom data summary for prescription oral Iron and phosphate binder prescribing, Aug 2015-Jul 2016.

Portfolio Expansion Opportunity Building a Leading Renal Company Future

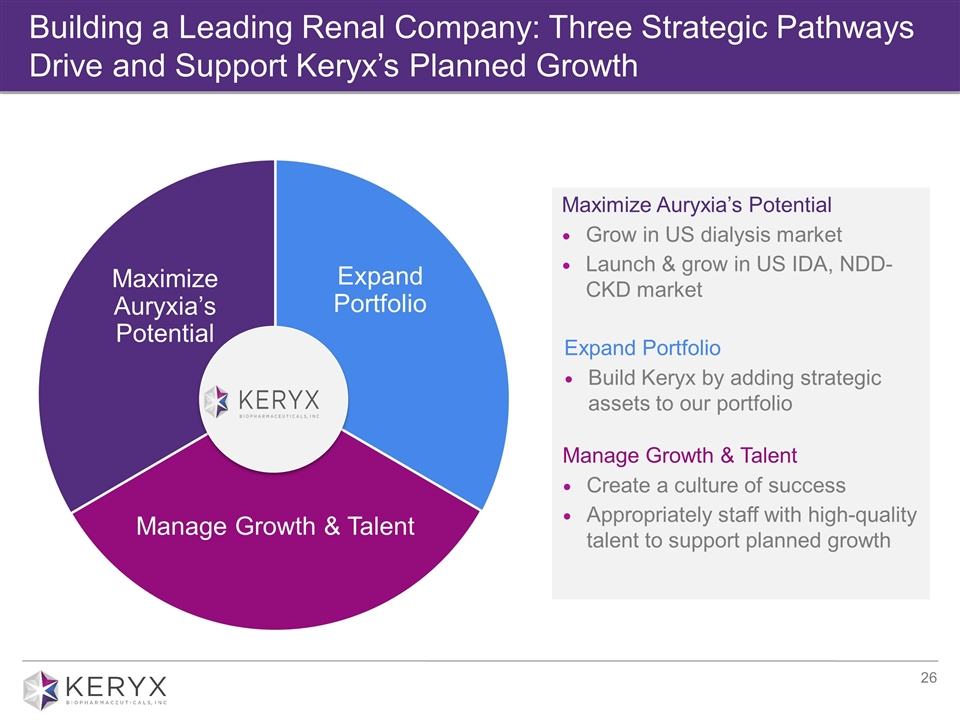

Building a Leading Renal Company: Three Strategic Pathways Drive and Support Keryx’s Planned Growth GROW INSPIRE Maximize Auryxia’s Potential Grow in US dialysis market Launch & grow in US IDA, NDD- CKD market Expand Portfolio Build Keryx by adding strategic assets to our portfolio Manage Growth & Talent Create a culture of success Appropriately staff with high-quality talent to support planned growth Expand Portfolio Manage Growth & Talent Maximize Auryxia’s Potential

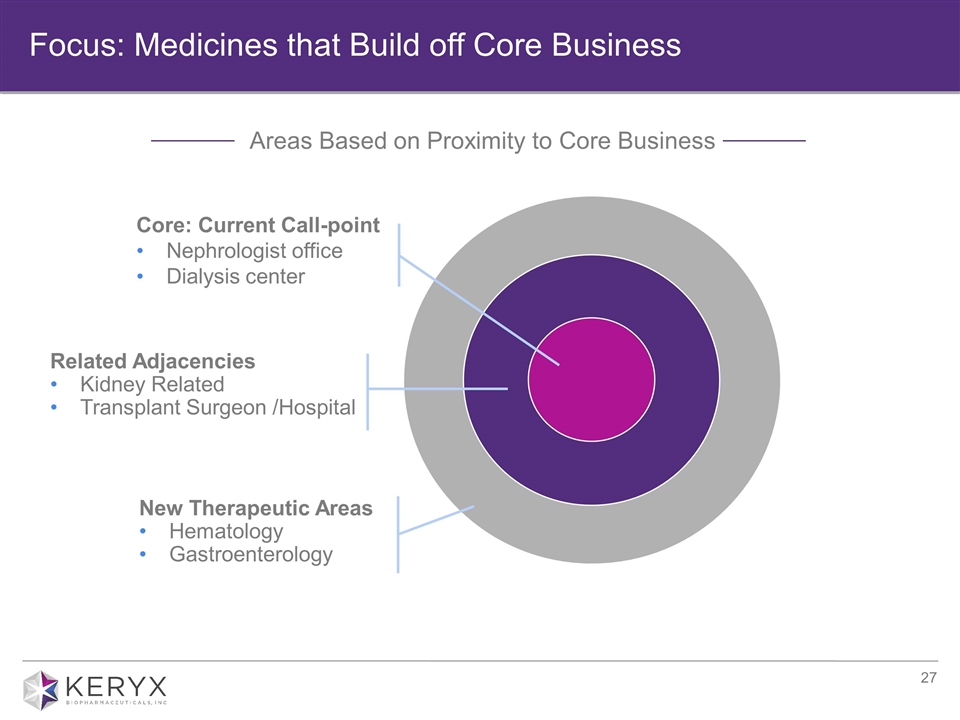

Focus: Medicines that Build off Core Business Areas Based on Proximity to Core Business Related Adjacencies Kidney Related Transplant Surgeon /Hospital New Therapeutic Areas Hematology Gastroenterology Core: Current Call-point Nephrologist office Dialysis center

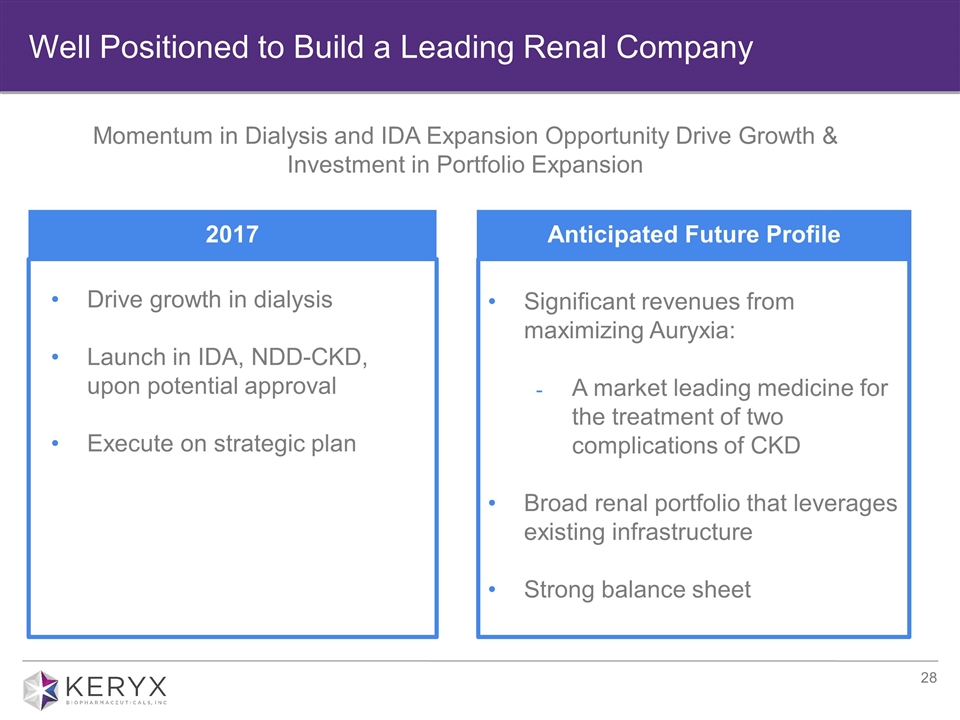

Significant revenues from maximizing Auryxia: A market leading medicine for the treatment of two complications of CKD Broad renal portfolio that leverages existing infrastructure Strong balance sheet Well Positioned to Build a Leading Renal Company Momentum in Dialysis and IDA Expansion Opportunity Drive Growth & Investment in Portfolio Expansion 2017 Anticipated Future Profile Drive growth in dialysis Launch in IDA, NDD-CKD, upon potential approval Execute on strategic plan

Greg Madison President & Chief Executive Officer Keryx Biopharmaceuticals, Inc. 35th Annual J.P. Morgan Healthcare Conference January 9-11, 2017 Building a Leading Renal Company