Attached files

| file | filename |

|---|---|

| EX-2.1 - AGREEMENT AND PLAN OF REORGANIZATION, DATED AS OF JANUARY 7, 2017, BY AND AMONG - NextDecade Corp. | f8k0117ex2i_harmony.htm |

| EX-99.1(B) - PRESS RELEASE OF HARMONY MERGER CORP. DATED JANUARY 9, 2017 - NextDecade Corp. | f8k0117ex99ib_harmony.htm |

| EX-99.1(A) - PRESS RELEASE OF HARMONY MERGER CORP. DATED JANUARY 9, 2017 - NextDecade Corp. | f8k0117ex99ia_harmony.htm |

| EX-10.2B - LOCK-UP AGREEMENT - NextDecade Corp. | f8k0117ex10iib_harmony.htm |

| EX-10.2A - FORM OF LOCK-UP AGREEMENT - NextDecade Corp. | f8k0117ex10iia_harmony.htm |

| EX-10.1 - FORM OF ESCROW AGREEMENT - NextDecade Corp. | f8k0117ex10i_harmony.htm |

| 8-K - FORM 8-K - NextDecade Corp. | f8k0117_harmonymerger.htm |

Exhibit 99.2

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) jas 1 Merger of H ARMONY M ERGER C ORP . ( N ASDAQ :HRMN ) & A GLOBAL LEADER IN DATA - DRIVEN MOBILE MARKETING

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) 2 IMPORTANT DISCLOSURES Harmony Merger Corp . (“Harmony”) is holding presentations for certain of its stockholders, as well as other persons who might be interested in purchasing Harmony’s securities, regarding its proposed business combination with MundoMedia Ltd . (“ Mundo ” or the “Company”) . William Blair is Mundo’s advisor in connection with the business combination and will receive a fee in connection therewith . In addition, Cantor Fitzgerald (“Cantor Fitzgerald”) acted as managing underwriter of Harmony’s initial public offering (“IPO”) and as Harmony’s investment banker and will receive a fee upon consummation of the business combination . Harmony and its directors and executives officers, and William Blair and Cantor Fitzgerald may be deemed to be participants in the solicitation of proxies for the special meeting of Harmony’s stockholders to be held to approve the business combination . STOCKHOLDERS OF HARMONY AND OTHER INTERESTED PERSONS ARE ADVISED TO READ, WHEN AVAILABLE, HARMONY’S JOINT PROXY STATEMENT/REGISTRATION STATEMENT (“PROXY STATEMENT”) WHICH WILL CONTAIN IMPORTANT INFORMATION . Such persons may read Harmony’s Proxy Statement and Harmony’s final Prospectus, dated March 23 , 2015 , for a description of the security holdings of Harmony’s officers and directors and of Cantor Fitzgerald and their respective interests in the successful consummation of the business combination . The definitive Proxy Statement will be mailed to stockholders as of a record date to be established for voting on the business combination . Stockholders will also be able to obtain a copy of the preliminary Proxy Statement and definitive Proxy Statement, once available, without charge, by directing a request to : Harmony Merger Corp . , 777 Third Avenue, 37 th Floor, New York, New York 10017 . The preliminary Proxy Statement and definitive Proxy Statement, once available, and final Prospectus can also be obtained, without charge, at the Securities and Exchange Commission’s internet site (http : //www . sec . gov) .

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) 3 SAFE HARBOR This presentation includes certain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , including statements regarding future financial performance, future growth and future acquisitions . These statements are based on Mundo’s and Harmony’s managements’ current expectations or beliefs and are subject to uncertainty and changes in circumstances . Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of Mundo’s business . These risks, uncertainties and contingencies include : business conditions ; weather and natural disasters ; changing interpretations of GAAP ; outcomes of government reviews ; inquiries and investigations and related litigation ; continued compliance with government regulations ; legislation or regulatory environments ; requirements or changes adversely affecting the business in which Mundo is engaged ; fluctuations in customer demand ; management of rapid growth ; intensity of competition from other digital advertising companies ; technological changes ; general economic conditions ; geopolitical events and regulatory changes ; the possibility that the business combination does not close, including due to the failure to receive required security holder approvals or the failure of other closing conditions ; and other factors set forth in Harmony’s filings with the Securities and Exchange Commission . The information set forth herein should be read in light of such risks . Further, investors should keep in mind that certain of Mundo’s financial results are unaudited and do not conform to SEC Regulation S - X and as a result such information may fluctuate materially depending on many factors . Accordingly, Mundo’s financial results in any particular period may not be indicative of future results . This presentation also includes certain financial information (EBITDA) that does not conform with U . S . GAAP . Accordingly, such information will be adjusted and presented differently in Harmony’s future SEC filings, including the Proxy Statement . Neither Harmony nor Mundo is under any obligation to, and expressly disclaims any obligation to, update or alter its forward - looking statements, whether as a result of new information, future events, changes in assumptions or otherwise .

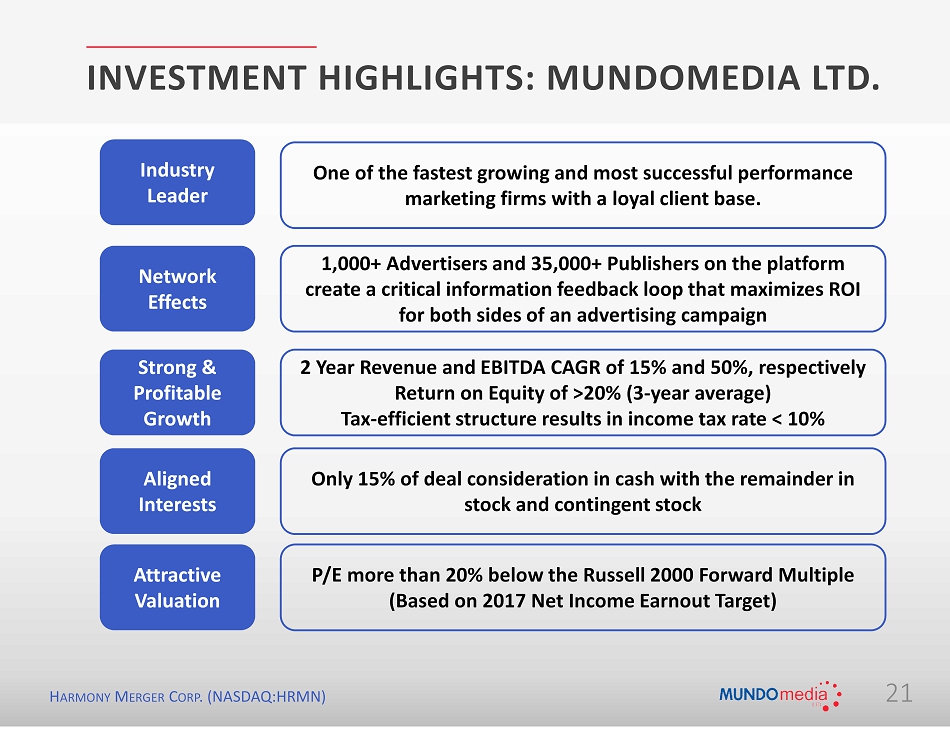

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) 4 INVESTMENT HIGHLIGHTS: MUNDOMEDIA LTD. Strong & Profitable Growth Industry Leader Aligned Interests Attractive Valuation Network Effects 2 Year Revenue and EBITDA CAGR of 15% and 50%, respectively Return on Equity of >20% (3 - year average) Tax - efficient structure results in income tax rate < 10% Only 15% of deal consideration in cash with the remainder in stock and contingent stock P/E more than 20% below the Russell 2000 Forward Multiple (Based on 2017 Net Income Earnout Target) One of the fastest growing and most successful performance marketing firms with a loyal client base. 1,000+ Advertisers and 35,000+ Publishers on the platform create a critical information feedback loop that maximizes ROI for both sides of an advertising campaign

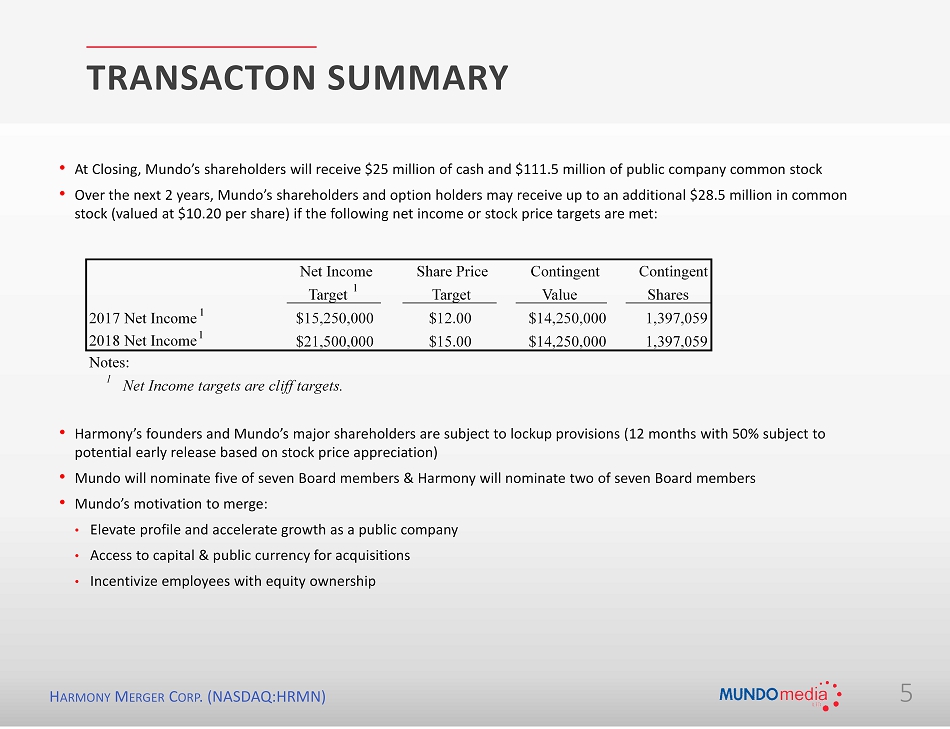

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) 5 TRANSACTON SUMMARY • At Closing, Mundo’s shareholders will receive $25 million of cash and $111.5 million of public company common stock • Over the next 2 years, Mundo’s shareholders and option holders may receive up to an additional $28.5 million in common stock ( valued at $10.20 per share) if the following net income or stock price targets are met : • Harmony’s founders and Mundo’s major shareholders are subject to lockup provisions (12 months with 50% subject to potential early release based on stock price appreciation) • Mundo will nominate five of seven Board members & Harmony will nominate two of seven Board members • Mundo’s motivation to merge: • Elevate profile and accelerate growth as a public company • Access to capital & public currency for acquisitions • Incentivize employees with equity ownership Net Income Share Price Contingent Contingent Target 1 Target Value Shares 2017 Net Income 1 $15,250,000 $12.00 $14,250,000 1,397,059 2018 Net Income 1 $21,500,000 $15.00 $14,250,000 1,397,059 Notes: 1 Net Income targets are cliff targets.

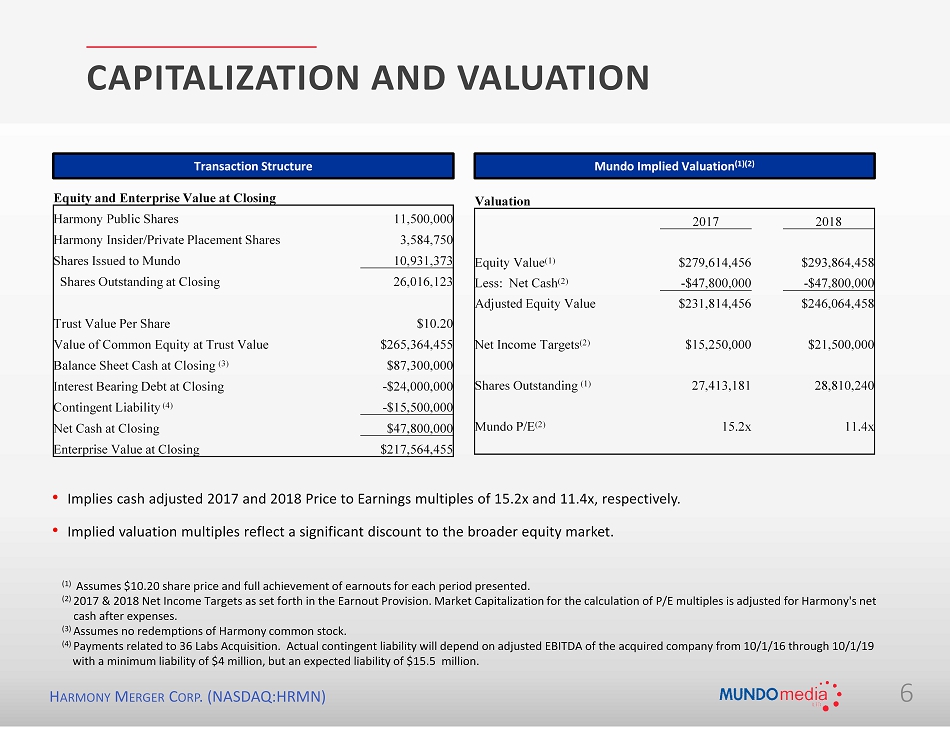

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) 6 Mundo Implied Valuation (1)(2) Transaction Structure ( 1 ) Assumes $10.20 share price and full achievement of earnouts for each period presented. (2) 2017 & 2018 Net Income Targets as set forth in the Earnout Provision. Market Capitalization for the calculation of P/E multiples is adjusted for Harmony's net cash after expenses . (3) Assumes no redemptions of Harmony common stock. (4) P ayments related to 36 Labs Acquisition. Actual contingent liability will depend on adjusted EBITDA of the acquired company f rom 10/1/16 through 10/1/19 with a minimum liability of $4 million, but an expected liability of $15.5 million. • Implies cash adjusted 2017 and 2018 Price to Earnings multiples of 15.2x and 11.4x, respectively. • Implied valuation multiples reflect a significant discount to the broader equity market. CAPITALIZATION AND VALUATION Equity and Enterprise Value at Closing Harmony Public Shares 11,500,000 Harmony Insider/Private Placement Shares 3,584,750 Shares Issued to Mundo 10,931,373 Shares Outstanding at Closing 26,016,123 Trust Value Per Share $10.20 Value of Common Equity at Trust Value $265,364,455 Balance Sheet Cash at Closing (3) $87,300,000 Interest Bearing Debt at Closing - $24,000,000 Contingent Liability (4) - $15,500,000 Net Cash at Closing $47,800,000 Enterprise Value at Closing $217,564,455 Valuation 2017 2018 Equity Value (1) $279,614,456 $293,864,458 Less: Net Cash (2) - $47,800,000 - $47,800,000 Adjusted Equity Value $231,814,456 $246,064,458 Net Income Targets (2) $15,250,000 $21,500,000 Shares Outstanding (1) 27,413,181 28,810,240 Mundo P/E (2) 15.2x 11.4x

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) Ross Levinsohn Executive Chairman Of The Board Jason Theofilos CEO & Co-Founder Philip Jones, BA, CPA, CA, CF Chief Financial Officer Eric So Chief Legal and Strategy Officer Jeff Cordeiro Chief Operations Officer Mitchell Richler Executive Vice President, Performance Media TEAM 7

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) EXECUTIVE SUMMARY • A Global Leader in Performance - Based , Data - Driven Customer Acquisition and Monetization . • Profitable since inception with upside scale. Projecting $ 113M in revenue for 2016 with $13.1M of A djusted EBITDA and $11.6 of Net Income. • Risk free high ROI user growth for our advertiser clients and better monetization for publishing partners 8

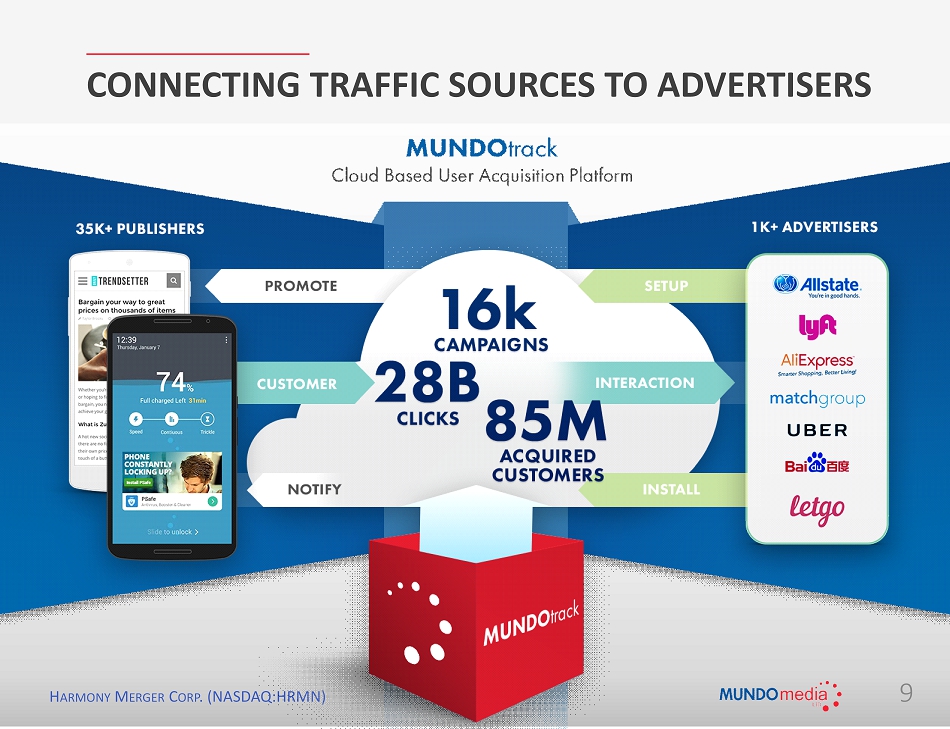

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) CONNECTING TRAFFIC SOURCES TO ADVERTISERS 9

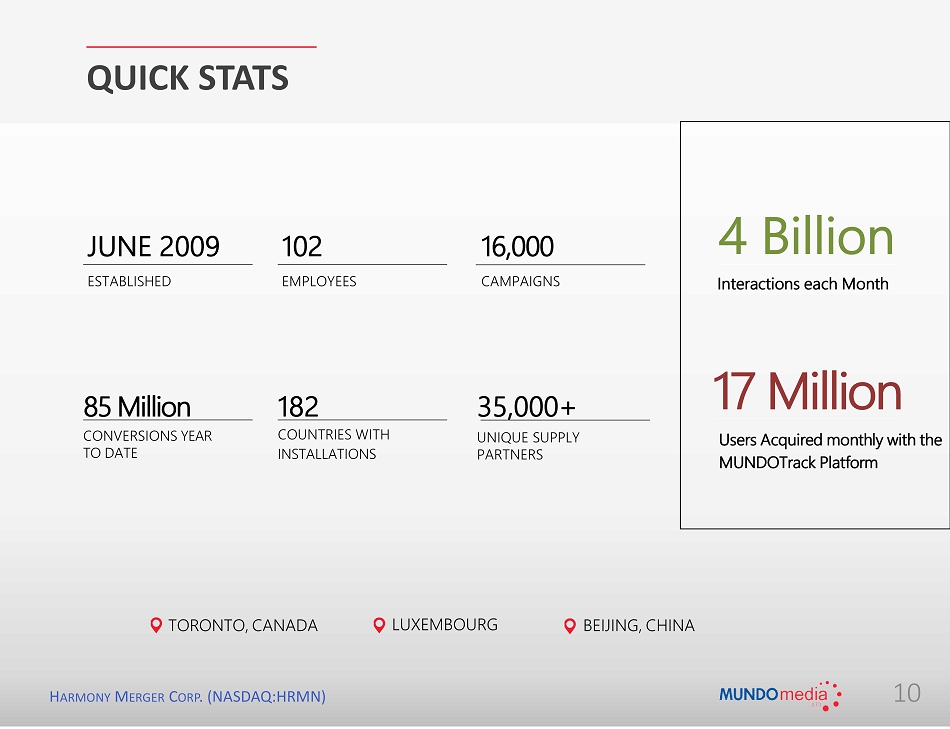

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) TORONTO, CANADA LUXEMBOURG BEIJING, CHINA CONVERSIONS YEAR TO DATE 85 Million 182 COUNTRIES WITH INSTALLATIONS JUNE 2009 102 16,000 ESTABLISHED EMPLOYEES CAMPAIGNS 35 ,000+ UNIQUE SUPPLY PARTNERS 17 Million Users Acquired monthly with the MUNDOTrack Platform 4 B illion Interactions each Month QUICK STATS 10

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) • Flexible Cost per Engagement / Cost per Install performance based customer acquisition. • Quality customers at scale. • Access MUNDOmedia’s proprietary data optimized users. • Direct integration with both advertisers and publishers. • Flexible KPI driven campaigns that adjust to advertisers needs WHAT WE OFFER 11

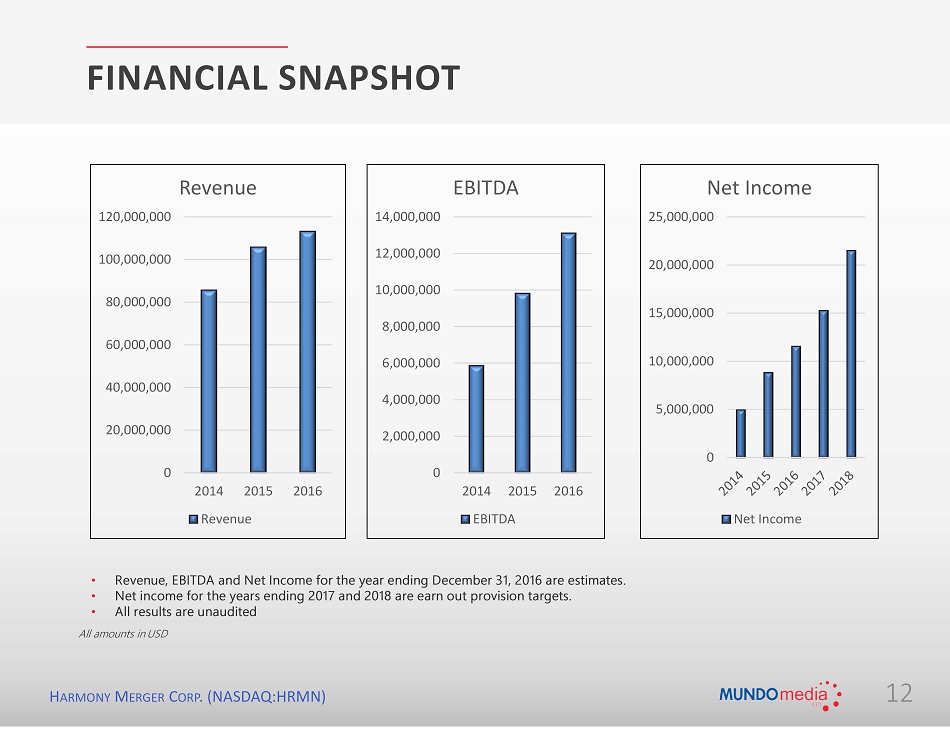

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) All amounts in USD • Revenue, EBITDA and Net Income for the year ending December 31, 2016 are estimates. • Net income for the years ending 2017 and 2018 are earn out provision targets. • All results are unaudited FINANCIAL SNAPSHOT 12 0 20,000,000 40,000,000 60,000,000 80,000,000 100,000,000 120,000,000 2014 2015 2016 Revenue Revenue 0 2,000,000 4,000,000 6,000,000 8,000,000 10,000,000 12,000,000 14,000,000 2014 2015 2016 EBITDA EBITDA 0 5,000,000 10,000,000 15,000,000 20,000,000 25,000,000 Net Income Net Income

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) Global mobile ad spending market size and forecast 2015 - 2017 ($billions ) OUR MARKET • Mundo projecting greater than market growth. • Advertising spend in social media channels (platforms including networking, gaming and apps across desktop, laptop, smartphone and tablet) continue to increase. • Demand for quality users continues to increase globally. • With the advertiser needs for users and pricing flexibility evolving at a rapid pace, MUNDOmedia’s performance - based pricing remains the preferred model in today’s market. 13 50 60 70 80 90 100 110 2015 2016 2017 Ad Spend Market Global Market (B) Source: Technavio

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) BAIDU P L A Y TI K A F ANDUEL AIBABA L YFT IAC APPLICATIONS ADVERTISER / DEMAND PARTNERS 14 • While expanding it’s business Mundo retains majority of ad revenue from existing advertisers. • Approximately 80% of 2016 revenue was derived from Advertisers that have been with us since 2014 • We use a consultative approach, based on knowledge derived from our data store. 0 20,000,000 40,000,000 60,000,000 80,000,000 100,000,000 120,000,000 2016 Advertiser Retention 2014 - 2016 New Existing

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) 15 POWERFUL NETWORK EFFECTS 26% more campaigns in November 2016 vs. January 2016 Unique data set enables powerful audience segmentation and granular targeting capabilities 4x number of User interactions in November 2016 vs. January 2016 Exclusive and third - party publishing partner network continues to expand as Demand increases

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) Determine best match to each campaign Profile users and analyze retargeting opportunity Extract User trends in app downloads Analyze campaign performance for scale and profitability 16 DATA AS AN ASSET

OUR TECHNOLOGY Users Interface MUNDO Track Partners Mobile App Mobile Web Desktop User Process Engine Elastic Search User Profile Event Data Repositories Data Access Security API Layer Event Management Optimization Advertisers App Developers Content Owners Agency Publishers 17 H ARMONY M ERGER C ORP . (NASDAQ:HRMN) Proven • Stable platform producing revenue at scale Cloud Based • Scale and stability End - to - End Integration • Automation and efficiency, reduced cost Client Integration • Offer direct access to shared data

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) GROWTH OPPORTUNITIES $ 18

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) BARRIERS TO ENTRY • Data: 8 years of accumulated learnings and data in the performance marketing vertical. • Timing: Mundo started at the beginning of the smart device expansion. • Technology: End - to - end automation and deep client integration. • Executive team: Extensive industry experience, 75 years+. 19

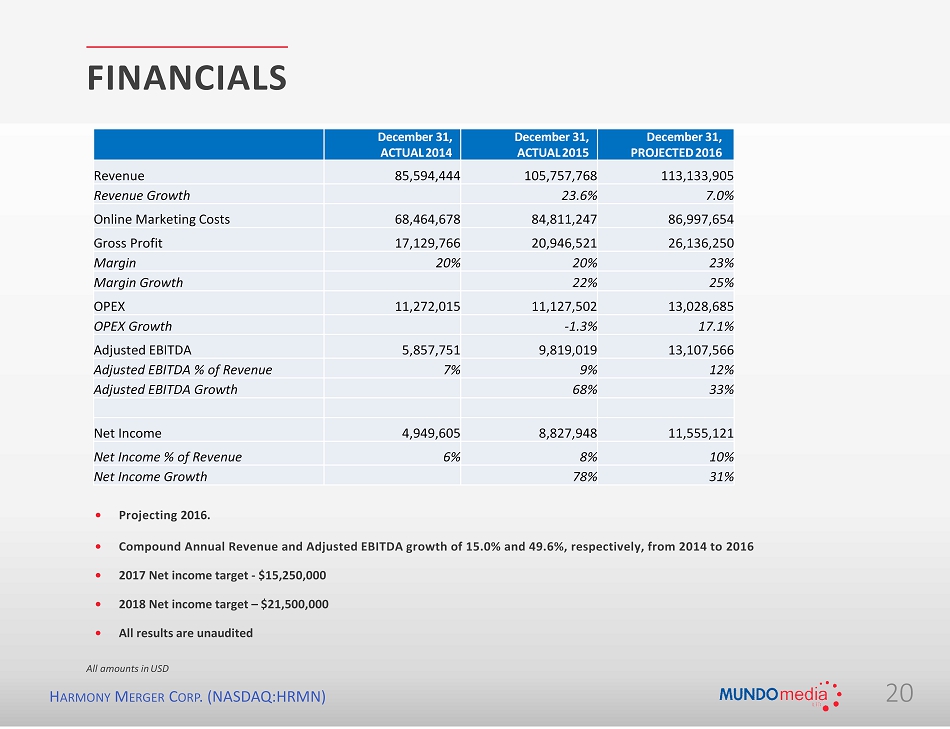

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) All amounts in USD • Projecting 2016. • Compound Annual Revenue and Adjusted EBITDA growth of 15.0% and 49.6%, respectively, from 2014 to 2016 • 2017 Net income target - $15,250,000 • 2018 Net income target – $21,500,000 • All results are unaudited FINANCIALS 20 December 31, ACTUAL 2014 December 31, ACTUAL 2015 December 31, PROJECTED 2016 Revenue 85,594,444 105,757,768 113,133,905 Revenue Growth 23.6% 7.0% Online Marketing Costs 68,464,678 84,811,247 86,997,654 Gross Profit 17,129,766 20,946,521 26,136,250 Margin 20% 20% 23% Margin Growth 22% 25% OPEX 11,272,015 11,127,502 13,028,685 OPEX Growth - 1.3% 17.1% Adjusted EBITDA 5,857,751 9,819,019 13,107,566 Adjusted EBITDA % of Revenue 7% 9% 12% Adjusted EBITDA Growth 68% 33% Net Income 4,949,605 8,827,948 11,555,121 Net Income % of Revenue 6% 8% 10% Net Income Growth 78% 31%

H ARMONY M ERGER C ORP . (NASDAQ:HRMN) 21 INVESTMENT HIGHLIGHTS: MUNDOMEDIA LTD. Strong & Profitable Growth Industry Leader Aligned Interests Attractive Valuation Network Effects 2 Year Revenue and EBITDA CAGR of 15% and 50%, respectively Return on Equity of >20% (3 - year average) Tax - efficient structure results in income tax rate < 10% Only 15% of deal consideration in cash with the remainder in stock and contingent stock P/E more than 20% below the Russell 2000 Forward Multiple (Based on 2017 Net Income Earnout Target) One of the fastest growing and most successful performance marketing firms with a loyal client base. 1,000+ Advertisers and 35,000+ Publishers on the platform create a critical information feedback loop that maximizes ROI for both sides of an advertising campaign