Attached files

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on January 6, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Kimbell Royalty Partners, LP

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

1311 (Primary Standard Industrial Classification Code Number) |

47-5505475 (I.R.S. Employer Identification No.) |

777 Taylor Street, Suite 810

Fort Worth, Texas 76102

(817) 945-9700

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

R. Davis Ravnaas

President and Chief Financial Officer

Kimbell Royalty Partners, LP

777 Taylor Street, Suite 810

Fort Worth, Texas 76102

(817) 945-9700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Joshua Davidson Jason A. Rocha Baker Botts L.L.P. One Shell Plaza 910 Louisiana Street Houston, Texas 77002 Tel: (713) 229-1234 Fax: (713) 229-1522 |

William N. Finnegan IV John M. Greer Latham & Watkins LLP 811 Main Street, Suite 3700 Houston, Texas 77002 Tel: (713) 546-5400 Fax: (713) 546-5401 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1)(2) |

Amount of Registration Fee |

||

|---|---|---|---|---|

Common units representing limited partner interests |

$100,000,000 | $11,590.00 | ||

|

||||

- (1)

- Includes

common units issuable upon exercise of the underwriters' option to purchase additional common units.

- (2)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o).

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities nor a solicitation of an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

Subject to Completion, dated January 6, 2017

PROSPECTUS

Kimbell Royalty Partners, LP

Common Units

Representing Limited Partner Interests

This is the initial public offering of our common units representing limited partner interests. We are offering common units in this offering. Prior to this offering, there has been no public market for our common units. We currently expect the initial public offering price to be between $ and $ per common unit. We have been approved to list our common units on the New York Stock Exchange, subject to official notice of issuance, under the symbol "KRP." We are an "emerging growth company" as that term is used in the Jumpstart Our Business Startups Act.

Investing in our common units involves a high degree of risk. Before buying any common units, you should carefully read the discussion of material risks of investing in our common units in "Risk Factors" beginning on page 31. These risks include the following:

- •

- We may not have sufficient available cash to pay any quarterly distribution on our common units.

- •

- The amount of our quarterly cash distributions, if any, may vary significantly both quarterly and annually and

will be directly dependent on the performance of our business. We will not have a minimum quarterly distribution or employ structures intended to consistently maintain or increase distributions over

time and could pay no distribution with respect to any particular quarter.

- •

- All of our revenues are derived from royalty payments that are based on the price at which oil, natural gas and

natural gas liquids produced from the acreage underlying our interests is sold, and we do not currently hedge these commodity prices. The volatility of these prices due to factors beyond our control

greatly affects our business, financial condition, results of operations and cash available for distribution.

- •

- We depend on unaffiliated operators for all of the exploration, development and production on the properties in

which we own mineral and royalty interests. Substantially all of our revenue is derived from royalty payments made by these operators. A reduction in the expected number of wells to be drilled on the

acreage underlying our interests by these operators or the failure of these operators to adequately and efficiently develop and operate the underlying acreage could materially adversely affect our

results of operations and cash available for distribution.

- •

- We do not intend to retain cash from our operations for replacement capital expenditures. Unless we replenish

our oil and natural gas reserves, our cash generated from operations and our ability to pay distributions to our unitholders could be materially adversely

affected.

- •

- Our general partner and its affiliates, including our Sponsors and their respective affiliates, have conflicts

of interest with us and limited duties to us and our unitholders, and they may favor their own interests to the detriment of us and our unitholders. Additionally, we have no control over the business

decisions and operations of our Sponsors and their respective affiliates, which are under no obligation to adopt a business strategy that favors us.

- •

- Neither we, our general partner nor our subsidiaries have any employees, and we rely solely on Kimbell Operating

Company, LLC to manage and operate, or arrange for the management and operation of, our business. The management team of Kimbell Operating Company, LLC, which includes the individuals

who will manage us, will also provide substantially similar services to other entities and thus will not be solely focused on our business.

- •

- Our partnership agreement replaces fiduciary duties applicable to a corporation with contractual duties and

restricts the remedies available to holders of our common units for actions taken by our general partner that might otherwise constitute breaches of fiduciary duty.

- •

- Holders of our common units have limited voting rights and are not entitled to elect our general partner or its

directors.

- •

- Our tax treatment depends on our status as a partnership for federal income tax purposes, as well as our not

being subject to a material amount of entity-level taxation by individual states. If the Internal Revenue Service were to treat us as a corporation for federal income tax purposes or we were to become

subject to entity-level taxation for state tax purposes, then our cash available for distribution to you could be substantially reduced.

- •

- Even if you do not receive any cash distributions from us, you will be required to pay taxes on your share of our taxable income.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per Common Unit |

Total | |||||

|---|---|---|---|---|---|---|---|

Initial public offering price |

$ | $ | |||||

Underwriting discount (1) |

$ | $ | |||||

Proceeds to Kimbell Royalty Partners, LP (before expenses) |

$ | $ | |||||

- (1)

- Excludes an aggregate structuring fee equal to % of the gross proceeds of this offering payable to Raymond James & Associates, Inc. Please read "Underwriting."

The underwriters may purchase up to an additional common units from us at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus solely to cover over-allotments.

The underwriters expect to deliver the common units to purchasers on or about , 2017 through the book-entry facilities of The Depository Trust Company.

Joint Book-Running Managers

| RAYMOND JAMES | RBC CAPITAL MARKETS | STIFEL |

Co-Managers

| STEPHENS INC. | WUNDERLICH |

Prospectus dated , 2017

i

ii

iii

We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither the delivery of this prospectus nor sale of our common units means that information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or solicitation of an offer to buy our common units in any circumstances under which the offer or solicitation is unlawful.

iv

PRESENTATION OF FINANCIAL AND OPERATING DATA

Unless otherwise indicated, the historical financial information presented in this prospectus is that of our predecessor, Rivercrest Royalties, LLC. The pro forma financial information in this prospectus is derived from the unaudited condensed combined pro forma financial statements included elsewhere in this prospectus which reflect, among other things, the financial statements of our predecessor and the acquisition of assets to be contributed to us by the Kimbell Art Foundation, Trunk Bay Royalty Partners, Ltd., Oil Nut Bay Royalties, LP, Gorda Sound Royalties, LP and Bitter End Royalties, LP, RCPTX, Ltd., and French Capital Partners, Ltd., which make up a portion of the Contributing Parties. Please read the unaudited condensed combined pro forma financial statements included elsewhere in this prospectus.

In addition, unless otherwise indicated, the reserve and operational data presented in this prospectus is with respect to all the assets that will be contributed to us by the Contributing Parties. Please read "Summary—Formation Transactions."

This prospectus includes industry data and forecasts that we obtained from internal company sources, publicly available information and industry publications and surveys. Our internal research and forecasts are based on management's understanding of industry conditions, and such information has not been verified by independent sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. There can be no assurance as to the accuracy or completeness of the information presented herein derived from third party sources. Statements as to the industry or operator estimates and future activity are based on independent industry publications, government publications, third-party forecasts, public statements by the operators of our properties, management's estimates and assumptions about our markets and our internal research. While we are not aware of any misstatements regarding such estimates or the market, industry, or similar data presented herein, such estimates and data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings "Risk Factors" and "Forward-Looking Statements" in this prospectus, most of which are not within our control.

v

This summary highlights selected information contained elsewhere in this prospectus. It does not contain all the information you should consider before investing in our common units. You should carefully read the entire prospectus, including "Risk Factors" and the historical and unaudited pro forma condensed combined financial statements and related notes included elsewhere in this prospectus, before making an investment decision. The information presented in this prospectus assumes an initial public offering price of $ per common unit (the mid-point of the price range set forth on the cover page of this prospectus), and unless otherwise indicated, that the underwriters do not exercise their option to purchase additional common units.

Unless the context otherwise requires, references in this prospectus to "Kimbell Royalty Partners, LP," "our partnership," "we," "our," "us" or like terms refer to Kimbell Royalty Partners, LP and its subsidiaries. References to "our general partner" refer to Kimbell Royalty GP, LLC. References to "our Sponsors" refer to affiliates of our founders, Ben J. Fortson, Robert D. Ravnaas, Brett G. Taylor and Mitch S. Wynne, respectively. References to "Kimbell Holdings" refer to Kimbell GP Holdings, LLC, a jointly owned subsidiary of our Sponsors and the parent of our general partner. References to the "Contributing Parties" refer to all entities and individuals, including affiliates of our Sponsors, that are contributing, directly or indirectly, certain mineral and royalty interests to us. References to "our predecessor" refer to Rivercrest Royalties, LLC, our predecessor for accounting purposes. References to "Kimbell Operating" refer to Kimbell Operating Company, LLC, a wholly owned subsidiary of our general partner, which will enter into separate service agreements with certain entities controlled by Benny D. Duncan and Messrs. R. Ravnaas, Taylor and Wynne as described herein.

We are a Delaware limited partnership formed to own and acquire mineral and royalty interests in oil and natural gas properties throughout the United States. As an owner of mineral and royalty interests, we are entitled to a portion of the revenues received from the production of oil, natural gas and associated natural gas liquids from the acreage underlying our interests, net of post-production expenses and taxes. We are not obligated to fund drilling and completion costs, lease operating expenses or plugging and abandonment costs at the end of a well's productive life. Our primary business objective is to provide increasing cash distributions to unitholders resulting from acquisitions from our Sponsors, the Contributing Parties and third parties and from organic growth through the continued development by working interest owners of the properties in which we own an interest.

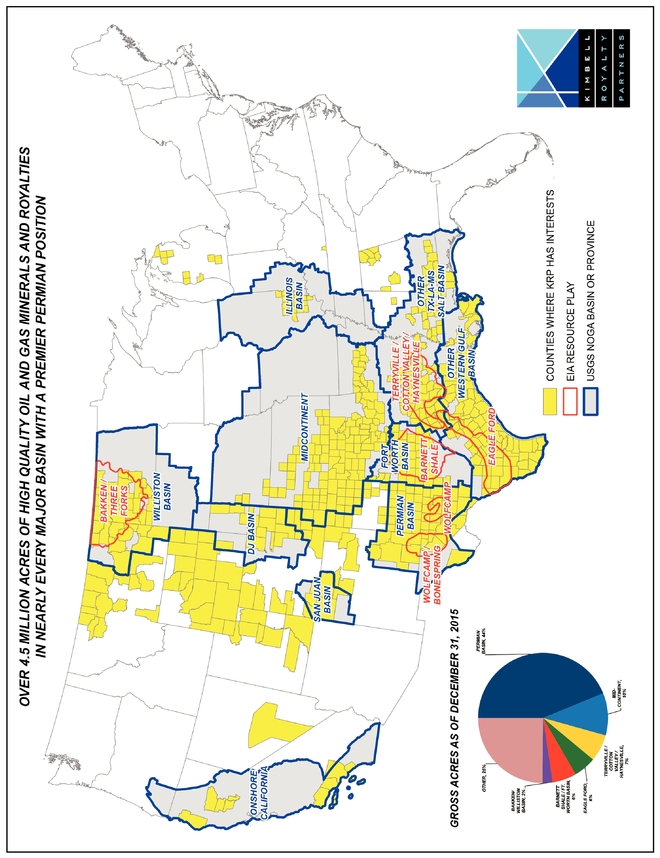

As of December 31, 2015, we owned mineral and royalty interests in approximately 3.7 million gross acres and overriding royalty interests in approximately 0.9 million gross acres, with approximately 44% of our aggregate acres located in the Permian Basin. We refer to these non-cost-bearing interests collectively as our "mineral and royalty interests." As of December 31, 2015, over 95% of the acreage subject to our mineral and royalty interests was leased to working interest owners (including 100% of our overriding royalty interests), and substantially all of those leases were held by production. Our mineral and royalty interests are located in 20 states and in nearly every major onshore basin across the continental United States and include ownership in over 48,000 gross producing wells, including over 29,000 wells in the Permian Basin. For the six months ended June 30, 2016, approximately 52.6% of our production was from the Permian Basin, Eagle Ford, Terryville/Cotton Valley/Haynesville and the Bakken/Williston Basin, which are some of the most active areas in the country. The geographic breadth

1

of our assets gives us exposure to potential production and reserves from new and existing plays. Over the long term, we expect working interest owners will continue to develop our acreage through infill drilling, horizontal drilling, hydraulic fracturing, recompletions and secondary and tertiary recovery methods. As an owner of mineral and royalty interests, we benefit from the continued development of the properties in which we own an interest without the need for investment of additional capital by us.

Certain members of our management team have completed over 160 acquisitions of mineral and royalty interests and have significant experience in identifying, evaluating and completing strategic acquisitions. Mr. R. Ravnaas, our Chief Executive Officer, and our directors Messrs. Fortson, Taylor and Wynne, who we refer to collectively as our founders, began actively acquiring mineral and royalty interests in 1998 when they began to jointly acquire mineral and royalty interests in conventional onshore U.S. basins. They initially focused on mineral and royalty interests in the Permian Basin, and later expanded their acquisition efforts to several other basins. Beginning in 2000, this group expanded to include nearly all the Contributing Parties. Our founders have focused on acquiring properties characterized by long-life, shallow decline production and significant oil and natural gas reserves.

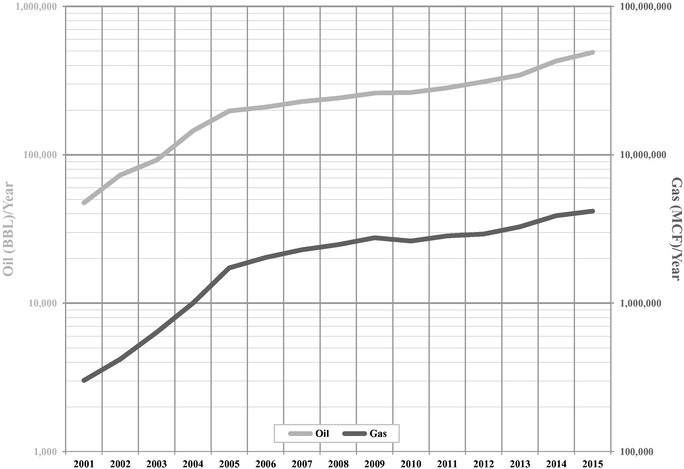

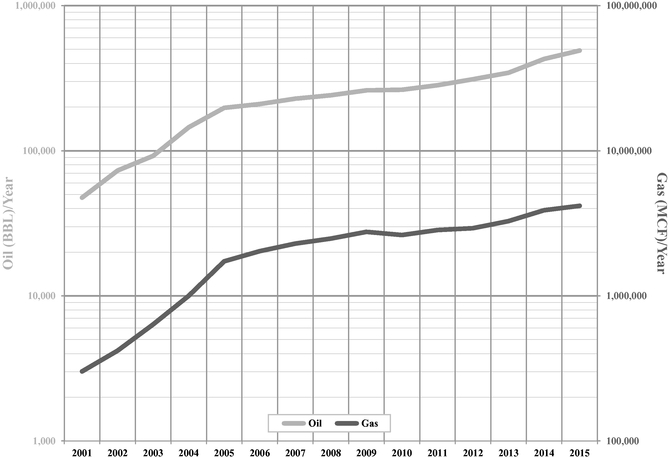

For the 15-year period ended December 31, 2015, the net oil and net natural gas production from our assets, including acquisitions, has grown at a compound annual growth rate of 16.8% and 19.2%, respectively. The chart below shows the compound annual growth rate of production from our mineral and royalty interests for such period:

Net Production Growth (Including Acquisitions) (2001-2015)

Note: Net oil and net natural gas production information was gathered from state reporting records. Natural gas liquids, which are not reported by the states, are excluded from the chart.

2

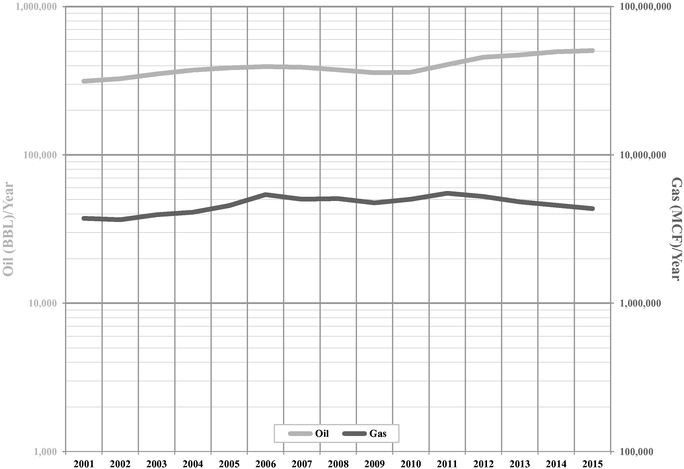

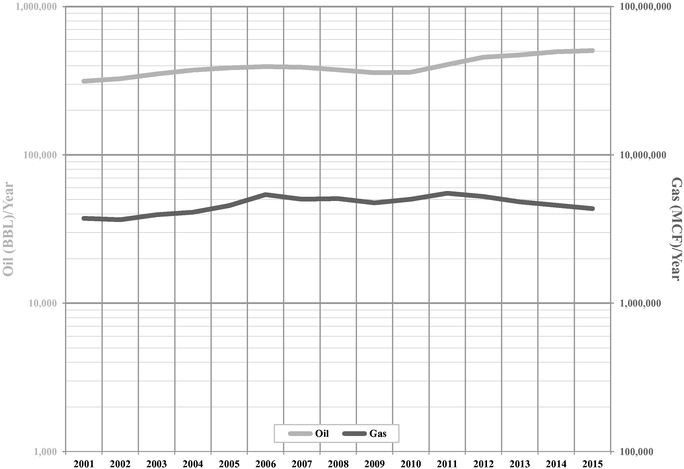

For the 15-year period ended December 31, 2015, the net oil and net natural gas production from our assets has grown organically (assuming we had acquired all of our interests on January 1, 2001 and made no additional acquisitions) at a compound annual growth rate of 3.2% and 1.0%, respectively. The chart below shows the compound annual growth rate attributable to our combined mineral and royalty interests as if we had acquired all of such interests on January 1, 2001 and made no additional acquisitions.

Organic Net Production Growth (2001-2015)

Note: Net oil and net natural gas production information was gathered from state reporting records. Natural gas liquids, which are not reported by the states, are excluded from the chart.

As of December 31, 2015, the estimated proved oil, natural gas and natural gas liquids reserves attributable to our interests in our underlying acreage were 18,120 MBoe (52.4% liquids, consisting of 79.7% oil and 20.3% natural gas liquids) based on a reserve report prepared by Ryder Scott Company, L.P., an independent petroleum engineering firm ("Ryder Scott"). Of these reserves, 70.4% were classified as proved developed producing ("PDP") reserves, 0.8% were classified as proved developed non-producing ("PDNP") reserves and 28.8% were classified as proved undeveloped ("PUD") reserves. The properties underlying our mineral and royalty interests typically have low estimated decline rates. Our PDP reserves have an average estimated initial five-year decline rate of 10%. PUD reserves included in this estimate are from 759 gross proved undeveloped locations. For the six months ended June 30, 2016, our average daily net production was 3,317 Boe/d.

3

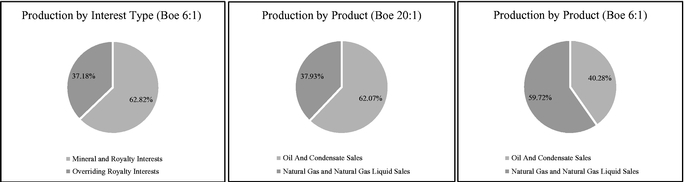

For the year ended December 31, 2015, on a pro forma basis, our revenues were derived 63.0% from oil sales, 30.0% from natural gas sales and 7.0% from natural gas liquid sales. Our revenues are derived from royalty payments we receive from the operators of our properties based on the sale of oil and natural gas production, as well as the sale of natural gas liquids that are extracted from natural gas during processing. As of December 31, 2015, we had over 700 operators on our acreage, with our top ten operators (Occidental Permian Ltd., Newfield Exploration Company, Range Resources Corporation/Memorial Resource Development Corp., Aera Energy LLC (a joint venture of Royal Dutch Shell plc and ExxonMobil Corporation), XTO Energy, Inc., Jonah Energy LLC, Campbell Development Group, LLC, EOG Resources, Inc., Chesapeake Energy Corporation and Devon Energy Corporation) together accounting for approximately 46.9% of our combined discounted future net income (discounted at 10%). Our revenues may vary significantly from period to period as a result of changes in volumes of production sold or changes in commodity prices. Oil, natural gas and natural gas liquids prices have historically been volatile, and we do not currently hedge our exposure to changes in commodity prices.

We believe that one of our key strengths is our management team's extensive experience in acquiring and managing mineral and royalty interests. Our management team and board of directors, which includes our founders, have a long history of creating value. We expect our business model to allow us to integrate significant acquisitions into our existing organizational structure quickly and cost-efficiently. In particular, Messrs. R. Ravnaas, Taylor and Wynne average over 30 years sourcing, engineering, evaluating, acquiring and managing mineral and royalty interests. In connection with this offering, we will enter into a management services agreement with Kimbell Operating, which will enter into separate service agreements with certain entities controlled by Messrs. R. Ravnaas, Taylor and Wynne, pursuant to which they will identify, evaluate and recommend to us acquisition opportunities and negotiate the terms of such acquisitions. Please read "Certain Relationships and Related Party Transactions—Agreements and Transactions with Affiliates in Connection with this Offering—Management Services Agreements."

Upon completion of this offering, our Sponsors will indirectly own and control our general partner, and the Contributing Parties will own an aggregate of approximately % of our outstanding common units (excluding any common units purchased by officers and directors of our general partner under our directed unit program). The Contributing Parties, including affiliates of our Sponsors, will retain a diverse portfolio of mineral and royalty interests with production and reserve characteristics similar to the assets we will own at the closing of this offering. In connection with this offering and pursuant to the contribution agreement that we have entered into with our Sponsors and the Contributing Parties, certain of the Contributing Parties have granted us a right of first offer for a period of three years after the closing of this offering with respect to certain mineral and royalty interests in the Permian Basin, the Bakken/Williston Basin and the Marcellus Shale. We believe the Contributing Parties, including affiliates of our Sponsors, will be incentivized through their direct or indirect ownership of common units to offer us the opportunity to acquire additional mineral and royalty interests from them in the future. Such Contributing Parties, however, have no obligation to sell any assets to us or to accept any offer that we may make for such assets, and we may decide not to acquire such assets even if such Contributing Parties offer them to us. In addition, under the contribution agreement, we have a right to participate, at our option and on substantially the same or better terms, in up to 50% of any acquisitions, other than de minimis acquisitions, for which Messrs. R. Ravnaas, Taylor and Wynne provide, directly or indirectly, any oil and gas diligence, reserve engineering or other business services. Please read "Certain Relationships and Related Party

4

Transactions—Agreements and Transactions with Affiliates in Connection with this Offering—Contribution Agreement."

We categorize our assets into two groups: mineral interests and overriding royalty interests.

Mineral Interests

Mineral interests are real property interests that are typically perpetual and grant ownership to all of the oil and natural gas lying below the surface of the property, as well as the right to explore, drill and produce oil and natural gas on that property or to lease such rights to a third party. Mineral owners typically grant oil and gas leases to operators for an initial three-year term with an upfront cash payment to the mineral owners known as a lease bonus. Under the lease, the mineral owner retains a royalty interest entitling it to a cost-free percentage (usually ranging from 20-25%) of production or revenue from production. The lease can be extended beyond the initial term with continuous drilling, production or other operating activities. When production or drilling ceases on the leased property, the lease is typically terminated, subject to certain exceptions, and all mineral rights revert back to the mineral owner who can then lease the exploration and development rights to another party. We also own royalty interests that have been carved out of mineral interests and are known as nonparticipating royalty interests. Nonparticipating royalty interests are typically perpetual and have rights similar to mineral interests, including the right to a cost-free percentage of production revenues for minerals extracted from the acreage, without the associated executive right to lease and the right to receive lease bonuses.

We combine our mineral and nonparticipating royalty assets into one category because they share many of the same characteristics due to the nature of the underlying interest. For example, we receive similar royalties from operators with respect to our mineral interests or nonparticipating royalty interests as long as such interests are subject to an oil and gas lease. As of December 31, 2015, over 95% of the acreage subject to our mineral and nonparticipating royalty interests was leased. When evaluating our business, our management team does not distinguish between mineral and nonparticipating royalty interests on leased acreage due to the similarity of the royalties received by the interests.

Overriding Royalty Interests

In addition to mineral interests, we also own overriding royalty interests, which are royalty interests that burden the working interests of a lease and represent the right to receive a fixed, cost-free percentage of production or revenue from production from a lease. Overriding royalty interests, or ORRIs, typically remain in effect until the associated lease expires, and because substantially all of the underlying leases are perpetual so long as production in paying quantities perpetuates the leasehold, substantially all of our overriding royalty interests are likewise perpetual.

5

The following table summarizes our ownership in U.S. basins and producing regions:

| |

Gross Acreage as of December 31, 2015 |

|

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Average Daily Production for Six Months Ended June 30, 2016 (2) (Boe/d) |

|||||||||

| Basin or Producing Region | Mineral Interests (1) |

ORRIs | ||||||||

Permian Basin (3) |

1,764,954 | 232,723 | 934 | |||||||

Mid-Continent |

336,481 | 139,513 | 200 | |||||||

Terryville/Cotton Valley/Haynesville |

261,762 | 41,812 | 267 | |||||||

Eagle Ford |

180,367 | 72,970 | 469 | |||||||

Barnett Shale/Fort Worth Basin (4) |

216,367 | 54,888 | 422 | |||||||

Bakken/Williston Basin (5) |

82,704 | 31,554 | 73 | |||||||

San Juan Basin |

28,852 | 47,233 | 229 | |||||||

Onshore California |

7,666 | 9,286 | 109 | |||||||

DJ Basin/Rockies/Niobrara |

3,967 | 3,182 | 360 | |||||||

Illinois Basin |

6,351 | 13,304 | 52 | |||||||

Other Western (onshore) Gulf Basin |

539,625 | 71,435 | 158 | |||||||

Other TX/LA/MS Salt Basin |

144,186 | 22,616 | 9 | |||||||

Other |

93,857 | 133,093 | 33 | |||||||

| | | | | | | | | | | |

Total |

3,667,139 | 873,609 | 3,317 | |||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

- (1)

- Includes

both mineral and nonparticipating royalty interests.

- (2)

- "Btu-equivalent"

production volumes are presented on an oil-equivalent basis using a conversion factor of six Mcf of natural gas per barrel of "oil

equivalent," which is based on approximate energy equivalency and does not reflect the price or value relationship between oil and natural gas. Please read "Business—Oil and Natural Gas

Data—Proved Reserves—Summary of Estimated Proved Reserves."

- (3)

- Includes

mineral interests and overriding royalty interests in approximately 740,244 gross acres and 149,173 gross acres, respectively, in the Wolfcamp/Bone

Spring.

- (4)

- Includes

mineral interests and overriding royalty interests in approximately 198,229 gross acres and 50,217 gross acres, respectively, in the Barnett Shale.

- (5)

- Includes mineral interests and overriding royalty interests in approximately 74,504 gross acres and 29,813 gross acres, respectively, in the Bakken/Three Forks.

- •

- Permian Basin. The Permian Basin extends from southeastern New Mexico into west Texas and is currently one of the most active drilling regions in the United States. It includes three geologic provinces: the Midland Basin to the east, the Delaware Basin to the west, and the Central Basin in between. The Permian Basin consists of mature legacy onshore oil and liquids-rich natural gas reservoirs and has been actively drilled over the past 90 years. The extensive operating history, favorable operating environment, mature infrastructure, long reserve life, multiple producing horizons, horizontal development potential and liquids-rich reserves make the Permian Basin one of the most prolific oil-producing regions in the United States. Our acreage underlies prospective areas for the Wolfcamp play in the Midland and Delaware Basins, the Spraberry formation in the Midland Basin, and the Bone Springs formation in the Delaware Basin, which are among the most active plays in the country.

6

- •

- Mid-Continent. The Mid-Continent is a broad area containing hundreds of fields in

Arkansas, Kansas, Louisiana, New Mexico, Oklahoma, Nebraska and Texas and including the Granite Wash, Cleveland and the Mississippi Lime formations. The Anadarko Basin is a structural basin centered

in the western part of Oklahoma and the Texas Panhandle, extending into southwestern Kansas and southeastern Colorado. A key feature of the Anadarko Basin is the stacked geologic horizons including

the Cana-Woodford and Springer shale in the SCOOP and STACK.

- •

- Terryville/Cotton

Valley/Haynesville. We own a substantial position in the core of the Terryville Field. Our mineral interests are leased and operated by

Range Resources Corporation/Memorial Resource Development Corp. Producing since 1954, the Terryville Field is one of the most prolific natural gas fields in North America. Redevelopment of the field

with horizontal drilling and modern completion techniques has resulted in high recoveries relative to drilling and completion costs, high initial production rates with high liquids yields, and long

reserve life with multiple stacked producing zones.

- •

- Eagle

Ford. The Eagle Ford shale formation stretches across South Texas and includes some of the most economic and productive areas in the

United States. The Eagle Ford contains significant amounts of hydrocarbons and is considered the source rock, or the original source, for much of the oil and natural gas contained in the Austin Chalk

Basin. The Eagle Ford shale formation has benefitted from improvements in horizontal drilling and hydraulic fracturing.

- •

- Barnett Shale/Fort Worth

Basin. The Fort Worth Basin is a major petroleum producing geological system that is primarily located in north central Texas and

southwestern Oklahoma. This area is best known for the Barnett Shale, which was one of the first shale plays to utilize horizontal drilling and hydraulic fracturing, and is one of the most productive

sources of shale gas. In addition to the Barnett Shale, this area is also known for the Marble Falls, Mississippi Lime, Bend Conglomerate and Caddo plays.

- •

- Bakken/Williston

Basin. The Williston Basin stretches through North Dakota, the northwest part of South Dakota, and eastern Montana and is best known for

the Bakken/Three Forks shale formations. The Bakken ranks as one of the largest oil developments in the United States in the past 40 years. Development of the Bakken became commercial on a

large scale over the past ten years with the advent of horizontal drilling and hydraulic fracturing.

- •

- San Juan

Basin. The San Juan Basin is located in the Four Corners region of the southwestern United States, stretching over 4,600 square miles

and encompassing much of northwestern New Mexico, southwestern Colorado and parts of Arizona and Utah. Most gas production in the basin comes from the Fruitland Coalbed Methane Play, with the

remainder derived from the Mesaverde and Dakota tight gas plays. The San Juan Basin is the most productive coalbed methane basin in North America.

- •

- Onshore

California. The majority of our mineral and royalty interests in California are in the Ventura Basin. The Ventura Basin has been active

since the early 1900s and is one of the largest oil fields in California. The Ventura Basin contains multiple stacked formations throughout its depths, and a considerable inventory of existing

re-development opportunities, as well as new play discovery potential.

- •

- DJ Basin/Rockies/Niobrara. The Denver-Julesburg Basin, also known as the DJ Basin, is a geologic basin centered in eastern Colorado stretching into southeast Wyoming, western

7

- •

- Illinois

Basin. The Illinois Basin extends across most of Illinois, Indiana, Kentucky and parts of Tennessee. The Illinois Basin is a mature area

dominated by conventional oil production with some coalbed methane production. The Bridgeport, Cypress, Aux Vasses, Ste. Genevieve, Ullin, Fort Payne and New Albany are some of the formations with a

current commercial focus in the Illinois Basin.

- •

- Other. Our other assets are primarily located in the Western Gulf (onshore) Basin and the Louisiana-Mississippi Salt Basins. The Western Gulf region ranges from South Texas through southeastern Louisiana and includes a variety of conventional and unconventional plays. The Louisiana-Mississippi Salt Basins range from northern Louisiana and southern Arkansas through south central Mississippi, southern Alabama and the Florida Panhandle.

Nebraska and western Kansas. The area includes the Wattenberg Gas Field, one of the largest natural gas deposits in the United States, and the Niobrara formation. The Niobrara includes three separate zones and stretches from the DJ Basin up into the Powder River Basin in Wyoming. Development in this area is currently focused on horizontal drilling in the Niobrara and Codell formations.

Our primary business objective is to provide increasing cash distributions to unitholders resulting from acquisitions from our Sponsors, the Contributing Parties and third parties and from organic growth through the continued development by working interest owners of the properties in which we own an interest. We intend to accomplish this objective by executing the following strategies:

- •

- Acquire additional mineral and royalty interests from our Sponsors and

the Contributing Parties. Following the completion of this offering, the Contributing Parties, including affiliates of our Sponsors,

will continue to own significant mineral and royalty interests in oil and gas properties. We believe our Sponsors and the Contributing Parties view our partnership as part of their growth strategy. In

addition, we believe their direct or indirect ownership in us will incentivize them to offer us additional mineral and royalty interests from their existing asset portfolios in the future. In

connection with this offering and pursuant to the contribution agreement, certain of the Contributing Parties have granted us a right of first offer for a period of three years after the closing of

this offering with respect to certain mineral and royalty interests in the Permian Basin, the Bakken/Williston Basin and the Marcellus Shale. These mineral and royalty interests include ownership in

over 4,000 gross producing wells in 10 states. Such Contributing Parties, however, have no obligation to sell any assets to us or to accept any offer that we may make for such assets, and we may

decide not to acquire such assets even if such Contributing Parties offer them to us. Please read "Certain Relationships and Related Party Transactions—Agreements and Transactions with

Affiliates in Connection with this Offering—Contribution Agreement."

- •

- Acquire additional mineral and royalty interests from third parties and leverage our relationships with our Sponsors and the Contributing Parties to grow our business. We intend to make opportunistic acquisitions of mineral and royalty interests that have substantial resource and organic growth potential and meet our acquisition criteria, which include (i) mineral and royalty interests in high-quality producing acreage that enhance our asset base, (ii) significant amounts of recoverable oil and natural gas in

8

- •

- Benefit from reserve, production and cash flow growth through organic

production growth and development of our mineral and royalty interests to grow distributions. Our initial assets consist of diversified

mineral and royalty interests. For the six months ended June 30, 2016, approximately 52.6% of our production was from the Permian Basin, Eagle Ford, Terryville/Cotton Valley/Haynesville and the

Bakken/Williston Basin, which are some of the most active areas in the country. Over the long term, we expect working interest owners will continue to develop our acreage through infill drilling,

horizontal drilling, hydraulic fracturing, recompletions and secondary and tertiary recovery methods. As an owner of mineral and royalty interests, we are entitled to a portion of the revenues

received from the production of oil, natural gas and associated natural gas liquids from the acreage underlying our interests, net of post-production expenses and taxes. We are not obligated to fund

drilling and completion costs, lease operating expenses or plugging and abandonment costs at the end of a well's productive life. As such, we benefit from the continued development of the properties

we own a mineral or royalty interest in without the need for investment of additional capital by us, which we expect to increase our distributions over time.

- •

- Maintain a conservative capital structure and prudently manage our business for the long term. We are committed to maintaining a conservative capital structure that will afford us the financial flexibility to execute our business strategies on an ongoing basis. The limited liability company agreement of our general partner will contain provisions that prohibit certain actions without a supermajority vote of at least 662/3% of the members of the board of directors of our general partner. Among the actions requiring a supermajority vote will be the incurrence of borrowings in excess of 2.5 times our Debt to EBITDAX Ratio for the preceding four quarters and the issuance of any partnership

place with geologic support for future production and reserve growth and (iii) a geographic footprint complementary to our diverse portfolio.

Our Sponsors and their affiliates have significant experience in identifying, evaluating and completing strategic acquisitions of mineral and royalty interests. In connection with the closing of this offering, we will enter into a management services agreement with Kimbell Operating, which will enter into separate service agreements with certain entities controlled by Messrs. R. Ravnaas, Taylor and Wynne, pursuant to which they will identify, evaluate and recommend to us acquisition opportunities and negotiate the terms of such acquisitions. We believe that these individuals' knowledge of the oil and natural gas industry, relationships within the industry and experience in identifying, evaluating and completing acquisitions will provide us opportunities to grow through strategic and accretive acquisitions that complement or expand our asset portfolio.

We also may have opportunities to acquire mineral or royalty interests from third parties jointly with our Sponsors and the Contributing Parties. In connection with this offering and pursuant to the contribution agreement that we have entered into with our Sponsors and the Contributing Parties, we have a right to participate, at our option and on substantially the same or better terms, in up to 50% of any acquisitions, other than de minimis acquisitions, for which Messrs. R. Ravnaas, Taylor and Wynne provide, directly or indirectly, any oil and gas diligence, reserve engineering or other business services. We believe this arrangement will give us access to third-party acquisition opportunities we might not otherwise be in a position to pursue. Please read "Certain Relationships and Related Party Transactions—Agreements and Transactions with Affiliates in Connection with this Offering—Contribution Agreement."

9

interests that rank senior in right of distributions or liquidation to our common units. Please read "The Partnership Agreement—Certain Provisions of the Agreement Governing our General Partner." We expect to enter into a $50.0 million secured revolving credit facility with an accordion feature permitting aggregate commitments under the facility to be increased up to $100.0 million (subject to the satisfaction of certain conditions and the procurement of additional commitments from new or existing lenders), which will be minimally drawn at the closing of this offering. We initially expect to use borrowings under the secured revolving credit facility for general partnership purposes, including the repayment of certain transaction expenses at the closing of this offering. We believe that this liquidity, along with internally generated cash from operations and access to the public capital markets, will provide us with the financial flexibility to grow our production, reserves and cash generated from operations through strategic acquisitions of mineral and royalty interests and the continued development of our existing assets.

We believe that the following competitive strengths will allow us to successfully execute our business strategies and achieve our primary business objective:

- •

- Significant diversified portfolio of mineral and royalty interests in

mature producing basins and exposure to undeveloped opportunities. We have a diversified, low decline asset base with exposure to

high-quality conventional and unconventional plays. As of December 31, 2015, we owned mineral and royalty interests in approximately 3.7 million gross acres and overriding royalty

interests in approximately 0.9 million gross acres, with approximately 44% of our aggregate acres located in the Permian Basin. As of December 31, 2015, over 95% of the acreage subject

to our mineral and royalty interests was leased to working interest owners (including 100% of our overriding royalty interests), and substantially all of those leases were held by production. As of

December 31, 2015, the estimated proved oil, natural gas and natural gas liquids reserves attributable to our interests in our underlying acreage were 18,120 MBoe (52.4% liquids, consisting of

79.7% oil and 20.3% natural gas liquids) based on the reserve report prepared by Ryder Scott. Of these reserves, 70.4% were classified as PDP reserves, 0.8% were classified as PDNP reserves and 28.8%

were classified as PUD reserves. PUD reserves included in this estimate are from 759 gross proved undeveloped locations. The geographic breadth of our assets gives us exposure to potential production

and reserves from new and existing plays without further required investment on our behalf. We believe that we will continue to benefit from these cost-free additions to production and reserves for

the foreseeable future as a result of technological advances and continuing interest by third-party producers in development activities on our acreage.

- •

- Exposure to many of the leading resource plays in the United States. We expect the operators of our properties to continue to drill new wells and to complete drilled but uncompleted wells on our acreage, which we believe should substantially offset the natural production declines from our existing wells. We believe that our operators have significant drilling inventory remaining on the acreage underlying our mineral or royalty interest in multiple resource plays. Our mineral and royalty interests are located in 20 states and in nearly every major onshore basin across the continental United States and include ownership in over 48,000 gross producing wells, including over 29,000 wells in the Permian Basin. For the six months ended June 30, 2016, approximately 52.6% of our production was from the Permian Basin, Eagle Ford, Terryville/Cotton

10

- •

- Financial flexibility to fund

expansion. Our conservative capital structure after this offering will permit us to maintain financial flexibility to allow us to

opportunistically purchase strategic mineral and royalty interests, subject to the supermajority vote provisions of the limited liability company agreement of our general partner. We expect to enter

into a $50.0 million secured revolving credit facility with an accordion feature permitting aggregate commitments under the facility to be increased up to $100.0 million (subject to the

satisfaction of certain conditions and the procurement of additional commitments from new or existing lenders), which will be minimally drawn at the closing of this offering. Please read "Management's

Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Indebtedness—New Revolving Credit Agreement" for further

information. We believe that we will be able to expand our asset base through acquisitions utilizing our credit facility, internally generated cash from operations and access to the public capital

markets.

- •

- Experienced and proven management team with a track record of making acquisitions. The members of our management team and board of directors have an average of over 30 years of oil and gas experience. Our management team and board of directors, which includes our founders, have a long history of buying mineral and royalty interests in high-quality producing acreage throughout the United States. Certain members of our management team have managed a significant investment program, investing in over 160 acquisitions. We believe we have a proven competitive advantage in our ability to source, engineer, evaluate, acquire and manage mineral and royalty interests in high-quality producing acreage.

Valley/Haynesville and the Bakken/Williston Basin, which are some of the most active areas in the country.

We are managed and operated by the board of directors and executive officers of our general partner, Kimbell Royalty GP, LLC, a wholly owned subsidiary of Kimbell Holdings, which is a jointly owned subsidiary of our Sponsors. As a result of controlling our general partner, our Sponsors will have the right to appoint all members of the board of directors of our general partner, including at least three directors meeting the independence standards established by the New York Stock Exchange (the "NYSE"). All three of our independent directors will be appointed by the time our common units are first listed for trading on the NYSE. Our unitholders will not be entitled to elect our general partner or its directors or otherwise directly participate in our management or operations.

In connection with the closing of this offering, we will enter into a management services agreement with Kimbell Operating, which will enter into separate service agreements with certain entities controlled by Messrs. Duncan, R. Ravnaas, Taylor and Wynne, pursuant to which they and Kimbell Operating will provide management, administrative and operational services to us. In addition, under each of their respective service agreements, Messrs. R. Ravnaas, Taylor and Wynne will identify, evaluate and recommend to us acquisition opportunities and negotiate the terms of such acquisitions. Neither we, our general partner nor our subsidiaries will have any employees. Although certain of the employees that conduct our business will be employed by Kimbell Operating, we sometimes refer to these individuals in this prospectus as our employees. In addition, certain of the executive officers and directors of our general partner currently serve as executive officers or directors of our Sponsors, the Contributing Parties and

11

Kimbell Operating. Please read "Management" and "Certain Relationships and Related Party Transactions."

Summary of Conflicts of Interest and Duties

Under our partnership agreement, our general partner has a duty to manage us in a manner it believes is in, or not adverse to, our best interests. However, because our general partner is an indirect wholly owned subsidiary of our Sponsors, the officers and directors of our general partner also have a duty to manage the business of our general partner in a manner that is beneficial to Kimbell Holdings and its parents, our Sponsors. In addition, certain of our executive officers and directors will provide management, administrative and operational services to us pursuant to service agreements with Kimbell Operating. Our partnership agreement does not limit our Sponsors' or their respective affiliates' ability to compete with us and, subject to the 50% participation right included in the contribution agreement that we have entered into with our Sponsors and the Contributing Parties, neither our Sponsors nor the Contributing Parties have any obligation to present business opportunities to us. Pursuant to the limited liability company agreement of Kimbell Holdings, the right of each of Messrs. Fortson, R. Ravnaas, Taylor and Wynne (and their designated successors) to serve as a director of our general partner is conditioned upon the applicable person not competing with us, our general partner, and our and its respective subsidiaries. As a result of these relationships, conflicts of interest may arise in the future between us and our unitholders, on the one hand, and our general partner and its affiliates, including our Sponsors, on the other hand. For a more detailed description of the conflicts of interest and duties of our general partner, please read "Risk Factors—Risks Inherent in an Investment in Us" and "Conflicts of Interest and Duties."

Delaware law provides that Delaware limited partnerships may, in their partnership agreements, expand, restrict or eliminate the fiduciary duties owed by our general partner to limited partners and the partnership. Our partnership agreement contains various provisions replacing the fiduciary duties that would otherwise be owed by our general partner with contractual standards governing the duties of our general partner and contractual methods of resolving conflicts of interest. The effect of these provisions is to restrict the remedies available to unitholders for actions taken by our general partner that might otherwise constitute breaches of its fiduciary duties. Our partnership agreement also provides that affiliates of our general partner, including Kimbell Operating and our Sponsors and their respective affiliates, are not restricted from competing with us (subject to the non-competition provision of the limited liability company agreement of Kimbell Holdings). By purchasing a common unit, the purchaser agrees to be bound by the terms of our partnership agreement, and pursuant to the terms of our partnership agreement, each holder of common units consents to various actions and potential conflicts of interest contemplated in our partnership agreement that might otherwise be considered a breach of fiduciary or other duties under Delaware law. Please read "Conflicts of Interest and Duties—Duties of Our General Partner" for a description of the fiduciary duties imposed on our general partner by Delaware law, the replacement of those duties with contractual standards under our partnership agreement and certain legal rights and remedies available to holders of our common units. For a description of our other relationships with our affiliates, please read "Certain Relationships and Related Party Transactions."

Emerging Growth Company Status

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act ("JOBS Act"). For as long as we are an emerging growth company, we may take advantage of

12

specified exemptions from reporting and other regulatory requirements that are otherwise generally applicable to other public companies. These exemptions include:

- •

- an exemption from providing an auditor's attestation report on the effectiveness of our system of internal control over financial

reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act");

- •

- an exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board ("PCAOB"), requiring

mandatory audit firm rotation or supplement to the auditor's report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer;

- •

- an exemption from compliance with any other new auditing standards adopted by the PCAOB after April 5, 2012, unless the

Securities and Exchange Commission ("SEC") determines otherwise; and

- •

- reduced disclosure of executive compensation.

In addition, Section 102 of the JOBS Act also provides that an emerging growth company can use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the "Securities Act"), for complying with new or revised accounting standards. This permits an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to "opt out" of such extended transition period and, as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

We will cease to be an "emerging growth company" upon the earliest of (i) the last day of the first fiscal year when we have $1.0 billion or more in annual revenues; (ii) the date on which we have issued more than $1.0 billion of non-convertible debt over a three-year period; (iii) the last day of the fiscal year following the fifth anniversary of our initial public offering; or (iv) the date on which we have qualified as a "large accelerated filer," which refers to when we (w) have an aggregate worldwide market value of voting and non-voting common units held by our non-affiliates of $700 million or more, as of the last business day of our most recently completed second fiscal quarter, (x) have been subject to the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), for a period of at least 12 calendar months, (y) have filed at least one annual report pursuant to Section 13(a) or 15(d) of the Exchange Act and (z) are no longer be eligible to use the requirements for "smaller reporting companies," as defined in the Exchange Act, for our annual and quarterly reports.

An investment in our common units involves a high degree of risk. You should carefully consider the risks described in "Risk Factors" and the other information in this prospectus before deciding whether to invest in our common units. If any of these risks were to occur, our financial condition, results of operations, cash flows and ability to make distributions to our unitholders would be adversely affected, and you could lose all or part of your investment.

13

Risks Related to Our Business

- •

- We may not have sufficient available cash to pay any quarterly distribution on our common units.

- •

- The assumptions underlying the forecast of cash available for distribution that we include in "Cash Distribution Policy and

Restrictions on Distributions—Estimated Cash Available for Distribution for the Twelve Months Ending December 31, 2017" are inherently uncertain and are subject to significant

business, economic, financial, regulatory, environmental and competitive risks and uncertainties that could cause actual results to differ materially from those forecasted.

- •

- The amount of our quarterly cash distributions, if any, may vary significantly both quarterly and annually and will be directly

dependent on the performance of our business. We will not have a minimum quarterly distribution or employ structures intended to consistently maintain or increase distributions over time and could pay

no distribution with respect to any particular quarter.

- •

- All of our revenues are derived from royalty payments that are based on the price at which oil, natural gas and natural gas liquids

produced from the acreage underlying our interests is sold, and we do not currently hedge these commodity prices. The volatility of these prices due to factors beyond our control greatly affects our

business, financial condition, results of operations and cash available for distribution.

- •

- We depend on unaffiliated operators for all of the exploration, development and production on the properties in which we own mineral

and royalty interests. Substantially all of our revenue is derived from royalty payments made by these operators. A reduction in the expected number of wells to be drilled on the acreage underlying

our interests by these operators or the failure of these operators to adequately and efficiently develop and operate the underlying acreage could materially adversely affect our results of operations

and cash available for distribution.

- •

- We do not intend to retain cash from our operations for replacement capital expenditures. Unless we replenish our oil and natural gas reserves, our cash generated from operations and our ability to pay distributions to our unitholders could be materially adversely affected.

Risks Inherent in an Investment in Us

- •

- Our general partner and its affiliates, including our Sponsors and their respective affiliates, have conflicts of interest with us and

limited duties to us and our unitholders, and they may favor their own interests to the detriment of us and our unitholders. Additionally, we have no control over the business decisions and operations

of our Sponsors and their respective affiliates, which are under no obligation to adopt a business strategy that favors us.

- •

- Neither we, our general partner nor our subsidiaries have any employees, and we rely solely on Kimbell Operating to manage and operate, or arrange for the management and operation of, our business. The management team of Kimbell Operating, which includes the individuals who will manage us, will also provide substantially similar services to other entities and thus will not be solely focused on our business.

14

- •

- Our partnership agreement replaces fiduciary duties applicable to a corporation with contractual duties and restricts the remedies

available to holders of our common units for actions taken by our general partner that might otherwise constitute breaches of fiduciary duty.

- •

- Holders of our common units have limited voting rights and are not entitled to elect our general partner or its directors, which could

reduce the price at which our common units will trade.

- •

- Even if holders of our common units are dissatisfied, they cannot initially remove our general partner without its consent.

- •

- Our partnership agreement restricts the voting rights of unitholders owning 20% or more of our common units (other than our general

partner and its affiliates, the Contributing Parties and their respective affiliates and permitted transferees).

- •

- Cost reimbursements due to our general partner and its affiliates for services provided to us or on our behalf will reduce cash

available for distribution to our unitholders. Our partnership agreement does not set a limit on the amount of expenses for which our general partner and its affiliates may be reimbursed. The amount

and timing of such reimbursements will be determined by our general partner.

- •

- We may issue additional common units and other equity interests without unitholder approval, which would dilute existing unitholder

ownership interests.

- •

- There is no existing market for our common units, and a trading market that will provide you with adequate liquidity may not develop.

The price of our common units may fluctuate significantly, and unitholders could lose all or part of their investment.

- •

- For as long as we are an emerging growth company, we will not be required to comply with certain disclosure requirements that apply to other public companies.

Tax Risks to Common Unitholders

- •

- Our tax treatment depends on our status as a partnership for federal income tax purposes, as well as our not being subject to a

material amount of entity-level taxation by individual states. If the Internal Revenue Service ("IRS") were to treat us as a corporation for federal income tax purposes or we were to become subject to

entity-level taxation for state tax purposes, then our cash available for distribution to you could be substantially reduced.

- •

- If the IRS were to contest the federal income tax positions we take, it may adversely impact the market for our common units, and the

costs of any such contest would reduce cash available for distribution to our unitholders.

- •

- Even if you do not receive any cash distributions from us, you will be required to pay taxes on your share of our taxable income.

15

At or prior to the closing of this offering, among other things, the following transactions will occur:

- •

- the Contributing Parties will contribute, directly or indirectly, certain mineral and royalty interests to us;

- •

- we will issue an aggregate common units, representing

a % limited partner interest in us, to the

Contributing Parties;

- •

- our general partner will maintain its non-economic general partner interest;

- •

- we will issue and sell common units to the public in this offering, representing

a % limited partner

interest in us;

- •

- we will pay the underwriting discount and structuring fee in connection with this offering and use the net proceeds from this offering

in the manner described under "Use of Proceeds";

- •

- we expect to enter into a new $50.0 million secured revolving credit facility and to borrow approximately $1.5 million at the

closing of this offering to fund certain transaction expenses, as described in "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital

Resources—Indebtedness—New Revolving Credit Agreement"; and

- •

- we will enter into a management services agreement with Kimbell Operating, which will enter into separate service agreements with certain entities controlled by Messrs. Duncan, R. Ravnaas, Taylor and Wynne, pursuant to which they and Kimbell Operating will provide management, administrative and operational services to us.

We refer to these transactions collectively as the "formation transactions."

The aggregate number of common units to be issued to the Contributing Parties includes common units that will be issued at the expiration of the underwriters' option to purchase additional common units, assuming that the underwriters do not exercise the option. Any exercise of the underwriters' option to purchase additional common units would reduce the common units shown as issued to the Contributing Parties by the number to be purchased by the underwriters in connection with such exercise. To the extent the underwriters exercise their option to purchase additional common units, we will issue such units to the public and distribute the net proceeds to the Contributing Parties. Any common units not purchased by the underwriters pursuant to their option will be issued to the Contributing Parties at the expiration of the option period for no additional consideration. We will use any net proceeds from the exercise of the underwriters' option to make a distribution to the Contributing Parties.

Our principal executive offices are located at 777 Taylor Street, Suite 810, Fort Worth, Texas 76102 and our telephone number is (817) 945-9700. Our website address will be . We intend to make our periodic reports and other information filed with or furnished to the SEC available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to

16

the SEC. Information on our website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

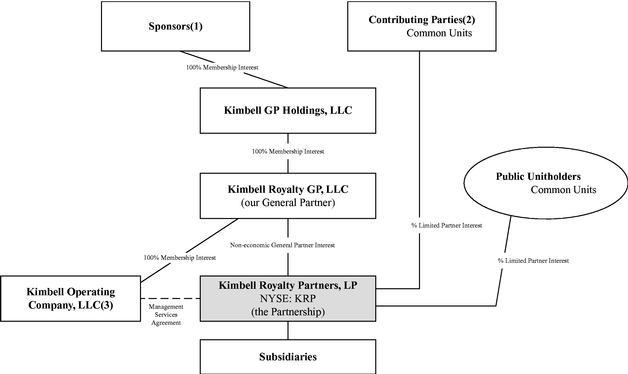

Organizational Structure After the Formation Transactions

The following chart illustrates our organizational structure after giving effect to this offering and the other formation transactions described above:

- (1)

- The

Sponsors are affiliates of our founders, Messrs. Fortson, R. Ravnaas, Taylor and Wynne.

- (2)

- The

Contributing Parties include entities and individuals, including affiliates of our Sponsors, that are contributing, directly or indirectly, certain

mineral and royalty interests to us.

- (3)

- Kimbell Operating will enter into separate service agreements with certain entities controlled by Messrs. Duncan, R. Ravnaas, Taylor and Wynne for the provision of certain management, administrative and operational services. In addition, the entities controlled by Messrs. R. Ravnaas, Taylor and Wynne will provide certain acquisition services to us. Please read "Certain Relationships and Related Party Transactions—Agreements and Transactions with Affiliates in Connection with this Offering—Management Services Agreements."

17

Common units offered to the |

common units ( common units if the underwriters exercise in full their option to purchase additional common units from us). | |

Option to purchase additional |

We have granted the underwriters a 30-day option to purchase up to an additional common units. |

|

Units outstanding after this |

common units. If and to the extent the underwriters do not exercise their option to purchase additional common units, in whole or in part, we will issue up to an additional common units to the Contributing Parties at the expiration of the option for no additional consideration. To the extent the underwriters exercise their option to purchase additional common units, we will issue such units to the public and distribute the net proceeds to the Contributing Parties. Any common units not purchased by the underwriters pursuant to their option will be issued to the Contributing Parties at the expiration of the option period for no additional consideration. Accordingly, the exercise of the underwriters' option will not affect the total number of common units outstanding. |

|

|

In addition, our general partner will own a non-economic general partner interest in us. |

|

Use of proceeds |

We will receive net proceeds of approximately $ million from this offering (based on an assumed initial offering price of $ per common unit, the mid-point of the price range set forth on the cover page of this prospectus), after deducting the estimated underwriting discount and structuring fee payable by us in connection with this offering. We intend to use the net proceeds of this offering to make a distribution to the Contributing Parties. |

|

|

If the underwriters exercise their option to purchase additional common units in full, the additional net proceeds to us would be approximately $ million, after deducting the estimated underwriting discount and structuring fee. We will use any net proceeds from the exercise of the underwriters' option to purchase additional common units from us to make an additional cash distribution to the Contributing Parties. Please read "Use of Proceeds." |

18

Cash distributions |

Within 60 days after the end of each quarter, beginning with the quarter ending , 2017, we expect to pay distributions to unitholders of record on the applicable record date. We expect our first distribution will consist of available cash (as described below) for the period from the closing of this offering through , 2017. |

|

|

Our partnership agreement requires us to distribute all of our cash on hand at the end of each quarter, less reserves established by our general partner. We refer to this cash as "available cash," and we define its meaning in our partnership agreement, in the glossary of terms attached as Appendix B and in "How We Pay Distributions." We expect that available cash for each quarter will generally equal our Adjusted EBITDA for the quarter, less cash needed for debt service and other contractual obligations and fixed charges and reserves for future operating or capital needs that the board of directors may determine is appropriate. |

|

|

Unlike a number of other master limited partnerships, we do not currently intend to retain cash from our operations for capital expenditures necessary to replace our existing oil and natural gas reserves or otherwise maintain our asset base (replacement capital expenditures), primarily due to our expectation that the continued development of our properties and completion of drilled but uncompleted wells by working interest owners will substantially offset the natural production declines from our existing wells. The board of directors of our general partner may change our distribution policy and decide to withhold replacement capital expenditures from cash available for distribution, which would reduce the amount of cash available for distribution in the quarter(s) in which any such amounts are withheld. Over the long term, if our reserves are depleted and our operators become unable to maintain production on our existing properties and we have not been retaining cash for replacement capital expenditures, the amount of cash generated from our existing properties will decrease and we may have to reduce the amount of distributions payable to our unitholders. To the extent that we do not withhold replacement capital expenditures, a portion of our cash available for distribution will represent a return of your capital. |

19

|

It is our intent, subject to market conditions, to finance acquisitions of mineral and royalty interests that increase our asset base largely through external sources, such as borrowings under our secured revolving credit facility and the issuance of equity and debt securities, although the board of directors of our general partner may choose to reserve a portion of cash generated from operations to finance such acquisitions as well. The limited liability company agreement of our general partner will contain provisions that prohibit certain actions without a supermajority vote of at least 662/3% of the members of the board of directors of our general partner. Among the actions requiring a supermajority vote will be the reservation of a portion of cash generated from operations to finance such acquisitions. We do not currently intend to maintain excess distribution coverage for the purpose of maintaining stability or growth in our quarterly distribution or otherwise reserve cash for distributions, or to incur debt to pay quarterly distributions, although the board of directors of our general partner may change this policy. |

|

|

Because our partnership agreement will require us to distribute an amount equal to all available cash we generate each quarter, our unitholders will have direct exposure to fluctuations in the amount of cash generated by our business. We expect that the amount of our quarterly distributions, if any, will fluctuate based on variations in, among other factors, (i) the performance of the operators of our properties, (ii) earnings caused by, among other things, fluctuations in the price of oil, natural gas and natural gas liquids, changes to working capital or capital expenditures and (iii) cash reserves deemed appropriate by the board of directors of our general partner. Such variations in the amount of our quarterly distributions may be significant and could result in our not making any distribution for any particular quarter. We will not have a minimum quarterly distribution or employ structures intended to consistently maintain or increase distributions over time. |

20

|

Based upon our forecast for the twelve months ending December 31, 2017, and assuming the board of directors of our general partner declares distributions in accordance with our initial cash distribution policy, we expect that our aggregate distributions for the twelve months ending December 31, 2017 will be approximately $ million, or $ per common unit. Please read "Cash Distribution Policy and Restrictions on Distributions—Estimated Cash Available for Distribution for the Twelve Months Ending December 31, 2017." Unanticipated events may occur which could materially adversely affect the actual results we achieve during the forecast period. Consequently, our actual results of operations, cash reserve requirements and financial condition during the forecast period may vary from the forecast, and such variations may be material. Prospective investors are cautioned not to place undue reliance on our forecast and should make their own independent assessment of our future results of operations and financial condition. In addition, the board of directors of our general partner may be required to, or may elect to, eliminate our distributions for various reasons, including reduced prices or demand for oil and natural gas. Please read "Risk Factors." |

|

|

For a calculation of our ability to pay distributions to unitholders based on our pro forma results of operations for the year ended December 31, 2015 and the twelve months ended September 30, 2016, please read "Cash Distribution Policy and Restrictions on Distributions—Unaudited Pro Forma Cash Available for Distribution for the Year Ended December 31, 2015 and the Twelve Months Ended September 30, 2016." Our pro forma cash available for distribution generated during the year ended December 31, 2015 and the twelve months ended September 30, 2016 would have been $16.3 million and $10.9 million, respectively. However, the pro forma cash available for distribution information for the year ended December 31, 2015 and the twelve months ended September 30, 2016 that we include in this prospectus does not necessarily reflect the actual cash that would have been available for distribution with respect to each of these periods. |

|

Subordinated units |

None. |

|

Incentive distribution rights |

None. |

|

Issuance of additional units |

Our partnership agreement authorizes us to issue an unlimited number of additional units without the approval of our unitholders. Please read "Units Eligible for Future Sale" and "The Partnership Agreement—Issuance of Additional Partnership Interests." |

21

Limited voting rights |