Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Bioverativ Inc. | bioverativjanuary52017.htm |

Confidential and proprietary

Bioverativ Investor Day

January 6th, 2017

2 Confidential and proprietary

Forward-Looking Statements

• This presentation contains forward-looking statements, including statements relating to: the planned separation of Bioverativ from Biogen;

business and strategic objectives; growth prospects and potential opportunities for commercial products and pipeline programs; planned

geographic expansion; manufacturing, supply and distribution arrangements; relationships with collaborators and other third parties; research

and development activities and priorities; anticipated clinical trials and data readouts; business development plans and opportunities; and

expected capitalization, revenues, operating margin, cash flows and other financial guidance. These forward-looking statements may be

accompanied by such words as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,”

“target,” “will” and other words and terms of similar meaning. You should not place undue reliance on these statements.

• These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those reflected in such

statements, including: Bioverativ’s dependence on revenues from sales of ELOCTATE and ALPROLIX; failure to compete effectively due to

significant product competition in the markets in which Bioverativ operates; product quality or safety concerns, including the occurrence of

adverse safety events; product development risks; risks associated with clinical trials; risks relating to actions of regulatory authorities; risks

related to reliance on third parties for manufacturing, supply and distribution of Bioverativ’s products and product candidates; difficulties in

obtaining and maintaining adequate coverage, pricing and reimbursement for Bioverativ’s products; failure to obtain and maintain adequate

protection for intellectual property and other proprietary rights; risks of doing business in international markets; risks associated with current

and potential future healthcare reforms; failure to identify and execute on business development and research and development opportunities;

Bioverativ’s dependence on relationships with collaborators and other third parties for revenue and other aspects of its business; loss of key

employees or inability to attract and retain key personnel; disruptions to, or other adverse impact on Bioverativ’s relationships with its

customers and other business partners; failure to comply with legal and regulatory requirements affecting Bioverativ’s business; the impact of

global economic conditions; fluctuations in foreign exchange and interest rates; changes in the law concerning the taxation of income; risks

relating to technology failures or breaches; the outcome of any significant legal proceedings; the adequacy of the Bioverativ’s cash flows from

operations; Bioverativ’s lack of operating history as a standalone business; risks relating to the separation from Biogen, including, among

others, risks that the separation will be completed in a timely manner or at all, failure to achieve the anticipated benefits from the separation,

reliance on Biogen and other third parties to provide certain services post-separation, restrictions to preserve the tax-free treatment of the

separation that may impact Bioverativ’s strategic and operating flexibility, and Bioverativ’s ability to satisfy liabilities and potential

indemnification obligations in connection with the separation; and other risks and uncertainties described in the Risk Factors section of

Bioverativ’s Registration Statement on Form 10 and other filings with the Securities and Exchange Commission.

• These statements are based on Bioverativ’s current beliefs and expectations and speak only as of the date of this presentation. Bioverativ

does not undertake any obligation to publicly update any forward-looking statements.

• Note Regarding Trademarks. Bioverativ owns or has rights to use the trademarks, service marks and trade names that it uses in conjunction

with the operation of its business. Some of the trademarks that appear in this presentation include: ALPROLIX® and ELOCTATE®, which

may be registered or trademarked in the U.S. and other jurisdictions. Each trademark, trade name or service mark of any other company

appearing in this presentation is, to Bioverativ’s knowledge, owned by such other company.

3 Confidential and proprietary

Today’s Agenda

Time Topic Speaker

10:05-10:10am Introduction

Paul Clancy

Biogen CFO

10:10-10:50am

Investment

opportunity and

strategic vision

John Cox

Chief Executive Officer

10:50-11:10am

Global

Therapeutic

Operations

Rogerio Vivaldi, MD, MBA

Chief Global Therapeutic

Operations Officer

11:10-11:20am

Financial

overview

John Greene

Chief Financial Officer

11:20-11:25am Closing

John Cox

Chief Executive Officer

11:25-11:50am Break

11:50-12:40pm Q&A Bioverativ Leadership Team

Welcome

Paul Clancy, Biogen CFO

Investment opportunity and strategic vision

John Cox, CEO

6 Confidential and proprietary

leading hematology rare disease company

committed to creating significant progress

for patients

Our Vision is to become the…

7 Confidential and proprietary

A Unique and Compelling

Investment Opportunity

Strong hemophilia

franchise

Integrated

capabilities

Talented team

Capitalized to

create value

8 Confidential and proprietary

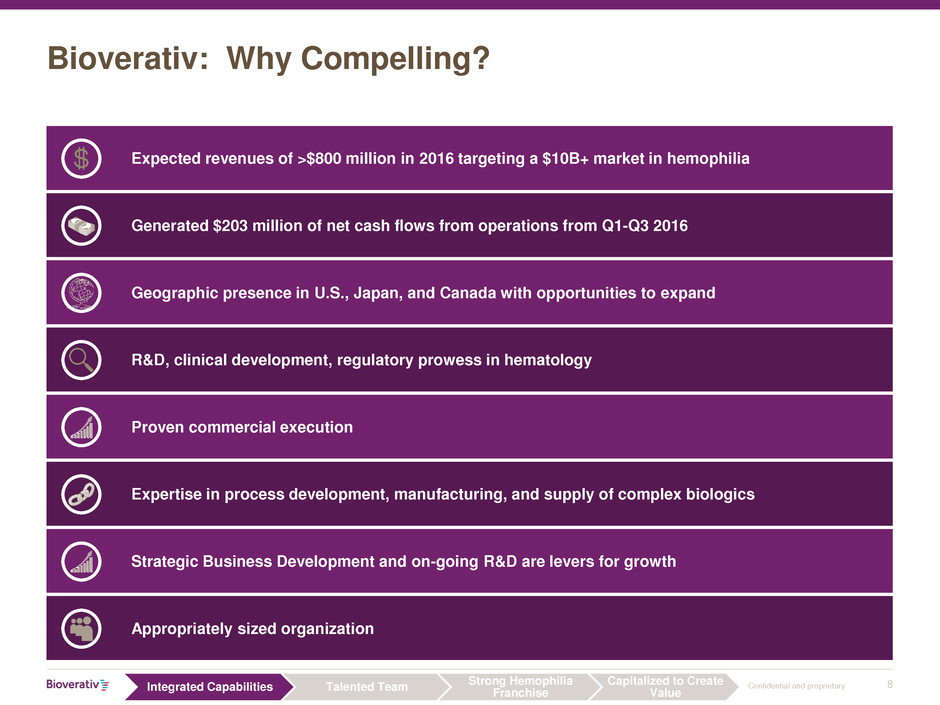

Bioverativ: Why Compelling?

Expected revenues of >$800 million in 2016 targeting a $10B+ market in hemophilia

Generated $203 million of net cash flows from operations from Q1-Q3 2016

Geographic presence in U.S., Japan, and Canada with opportunities to expand

R&D, clinical development, regulatory prowess in hematology

Proven commercial execution

Expertise in process development, manufacturing, and supply of complex biologics

Strategic Business Development and on-going R&D are levers for growth

Appropriately sized organization

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

9 Confidential and proprietary

Maximize

Potential of

ELOCTATE &

ALPROLIX

Rapidly

Advance our

Discovery

Molecules

Pursue

Strategic

Opportunities

Positioned for Growth as a Stand Alone Company

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

10 Confidential and proprietary

Accomplished and Driven Executive Leadership Team

John Cox

Chief Executive Officer

John Greene

Chief Financial Officer

Rogerio Vivaldi, MD, MBA

Chief Global Therapeutic

Operations Officer

Andrea DiFabio

Chief Legal Officer

Lucia Celona

Chief HR & Corporate

Communications Officer

Richard Brudnick

EVP of BD & Alliance

Management

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

11 Confidential and proprietary

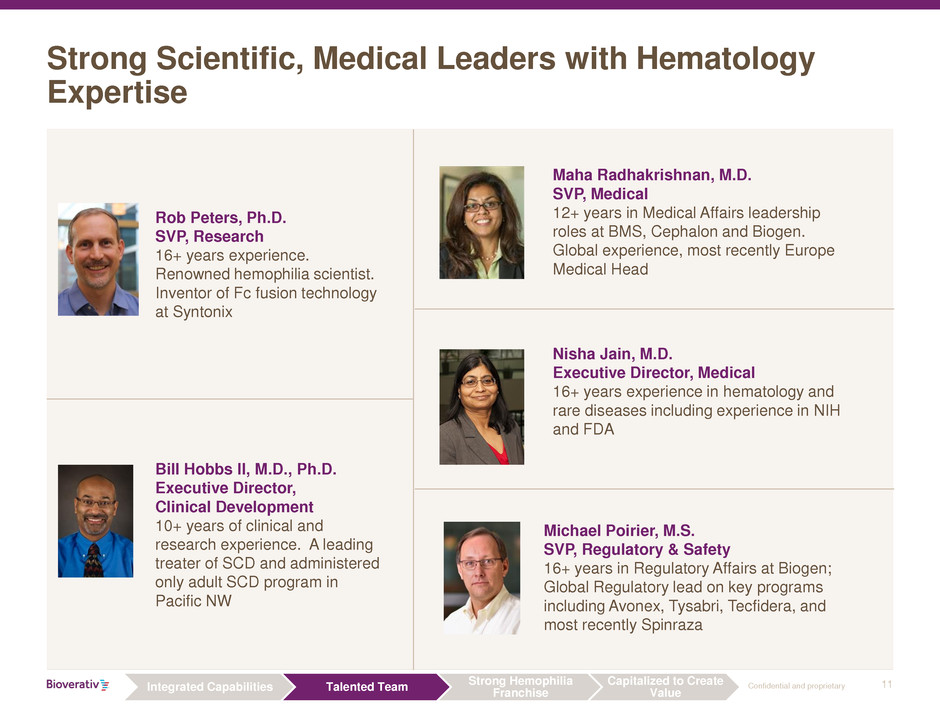

Strong Scientific, Medical Leaders with Hematology

Expertise

Bill Hobbs II, M.D., Ph.D.

Executive Director,

Clinical Development

10+ years of clinical and

research experience. A leading

treater of SCD and administered

only adult SCD program in

Pacific NW

Michael Poirier, M.S.

SVP, Regulatory & Safety

16+ years in Regulatory Affairs at Biogen;

Global Regulatory lead on key programs

including Avonex, Tysabri, Tecfidera, and

most recently Spinraza

Maha Radhakrishnan, M.D.

SVP, Medical

12+ years in Medical Affairs leadership

roles at BMS, Cephalon and Biogen.

Global experience, most recently Europe

Medical Head

Rob Peters, Ph.D.

SVP, Research

16+ years experience.

Renowned hemophilia scientist.

Inventor of Fc fusion technology

at Syntonix

Nisha Jain, M.D.

Executive Director, Medical

16+ years experience in hematology and

rare diseases including experience in NIH

and FDA

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

12 Confidential and proprietary

A Unique and Compelling

Investment Opportunity

Strong Hemophilia

Franchise

Integrated

capabilities

Talented team

Capitalized to

create value

A Unique and Compelling

Investment Opportunity

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

13 Confidential and proprietary

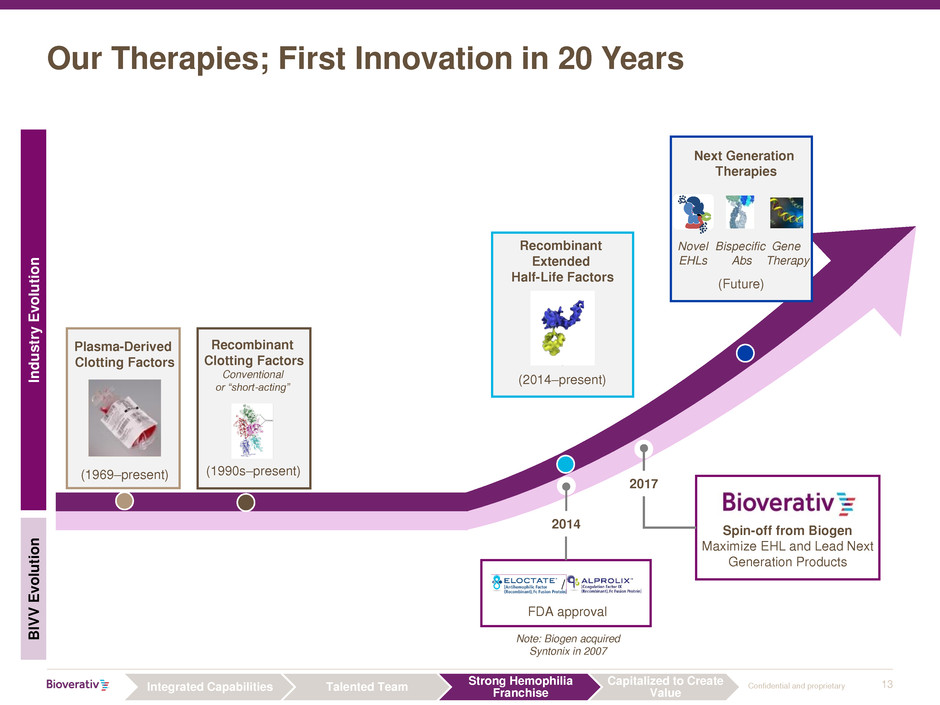

Our Therapies; First Innovation in 20 Years

BIV

V

E

v

olu

ti

o

n

In

d

u

s

tr

y

E

v

olu

ti

o

n

Plasma-Derived

Clotting Factors

FDA approval

/

Spin-off from Biogen

Maximize EHL and Lead Next

Generation Products

Recombinant

Extended

Half-Life Factors

(2014–present)

(1969–present)

2014

2017

Next Generation

Therapies

Gene

Therapy

Novel

EHLs

Bispecific

Abs

(Future)

Recombinant

Clotting Factors

Conventional

or “short-acting”

(1990s–present)

Note: Biogen acquired

Syntonix in 2007

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

14 Confidential and proprietary

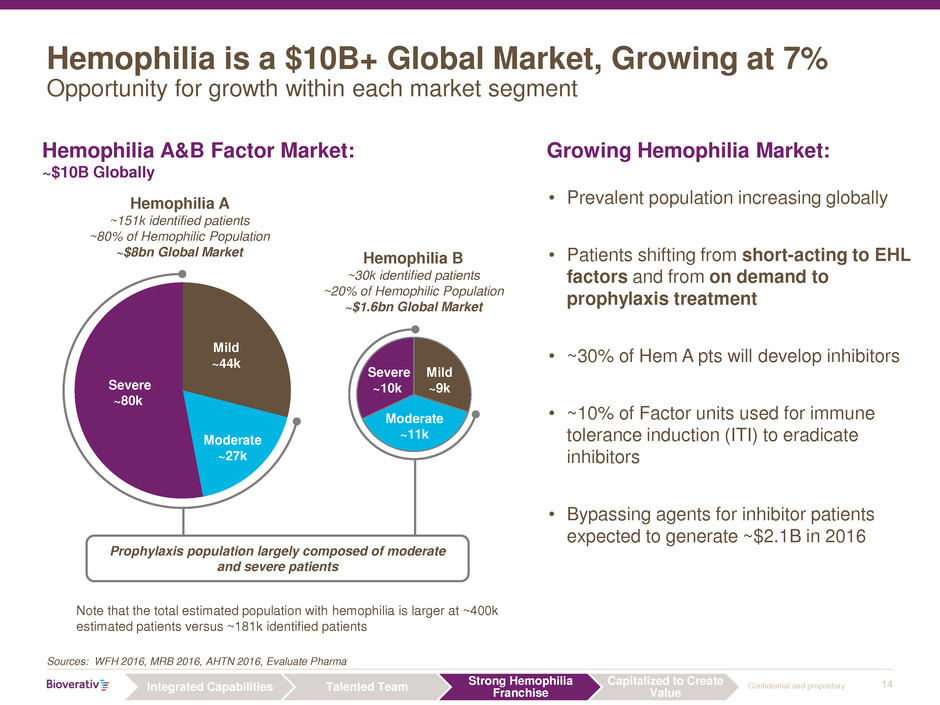

Hemophilia is a $10B+ Global Market, Growing at 7%

Opportunity for growth within each market segment

• Prevalent population increasing globally

• Patients shifting from short-acting to EHL

factors and from on demand to

prophylaxis treatment

• ~30% of Hem A pts will develop inhibitors

• ~10% of Factor units used for immune

tolerance induction (ITI) to eradicate

inhibitors

• Bypassing agents for inhibitor patients

expected to generate ~$2.1B in 2016

Growing Hemophilia Market: Hemophilia A&B Factor Market:

~$10B Globally

Sources: WFH 2016, MRB 2016, AHTN 2016, Evaluate Pharma

Mild

~44k

Moderate

~27k

Severe

~80k

Mild

~9k

Moderate

~11k

Severe

~10k

Hemophilia A

~151k identified patients

~80% of Hemophilic Population

~$8bn Global Market Hemophilia B

~30k identified patients

~20% of Hemophilic Population

~$1.6bn Global Market

Prophylaxis population largely composed of moderate

and severe patients

Note that the total estimated population with hemophilia is larger at ~400k

estimated patients versus ~181k identified patients

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

15 Confidential and proprietary

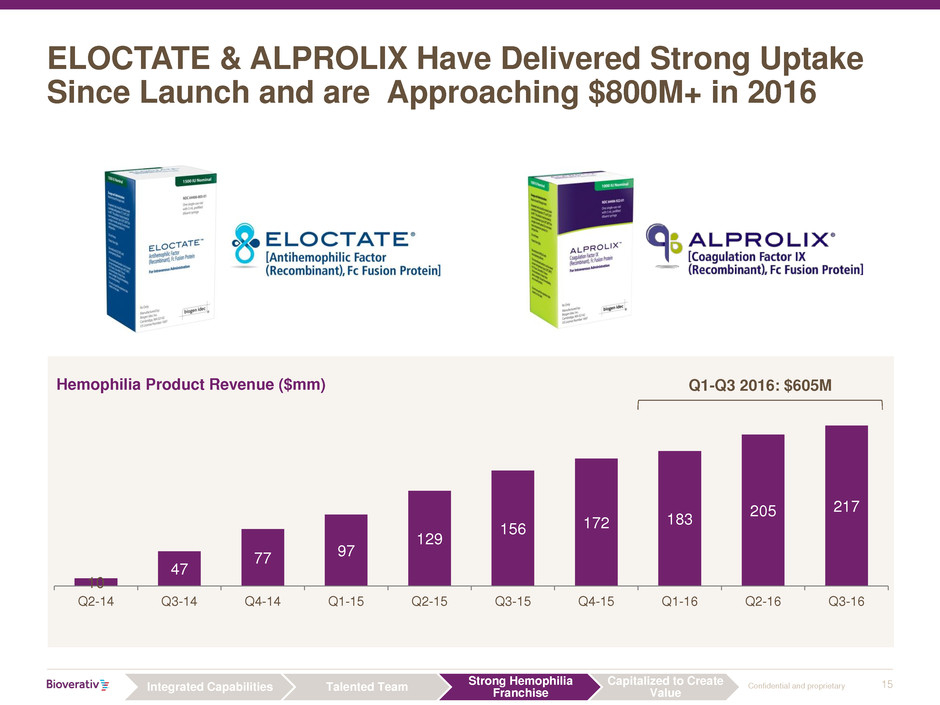

10

47

77 97

129

156 172

183

205 217

Q2-14 Q3-14 Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 Q1-16 Q2-16 Q3-16

ELOCTATE & ALPROLIX Have Delivered Strong Uptake

Since Launch and are Approaching $800M+ in 2016

Hemophilia Product Revenue ($mm)

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

Q1-Q3 2016: $605M

16 Confidential and proprietary

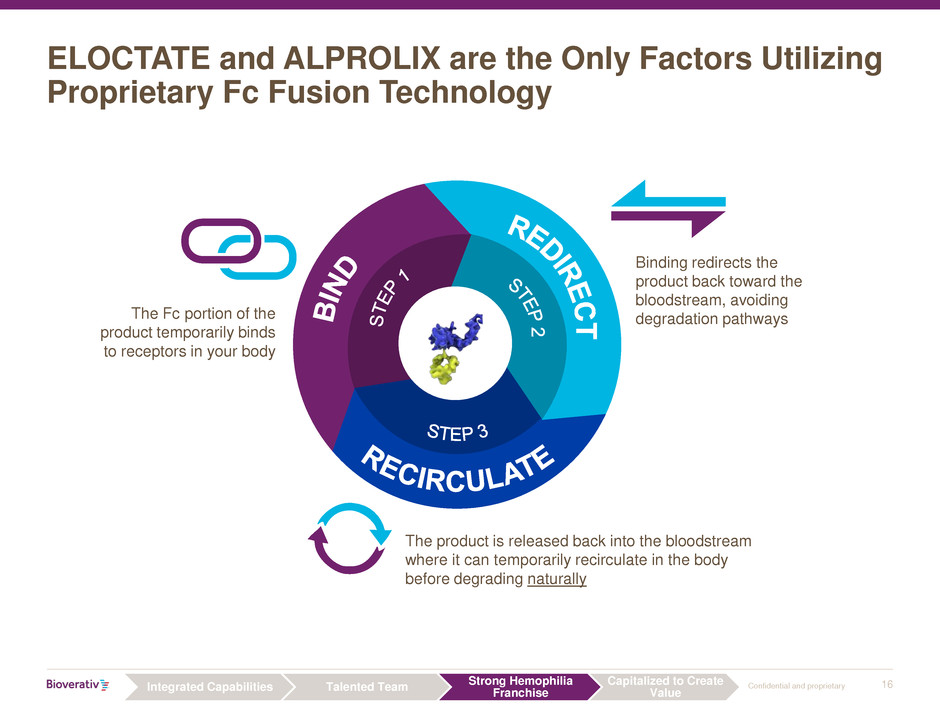

ELOCTATE and ALPROLIX are the Only Factors Utilizing

Proprietary Fc Fusion Technology

The Fc portion of the

product temporarily binds

to receptors in your body

The product is released back into the bloodstream

where it can temporarily recirculate in the body

before degrading naturally

Binding redirects the

product back toward the

bloodstream, avoiding

degradation pathways

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

17 Confidential and proprietary

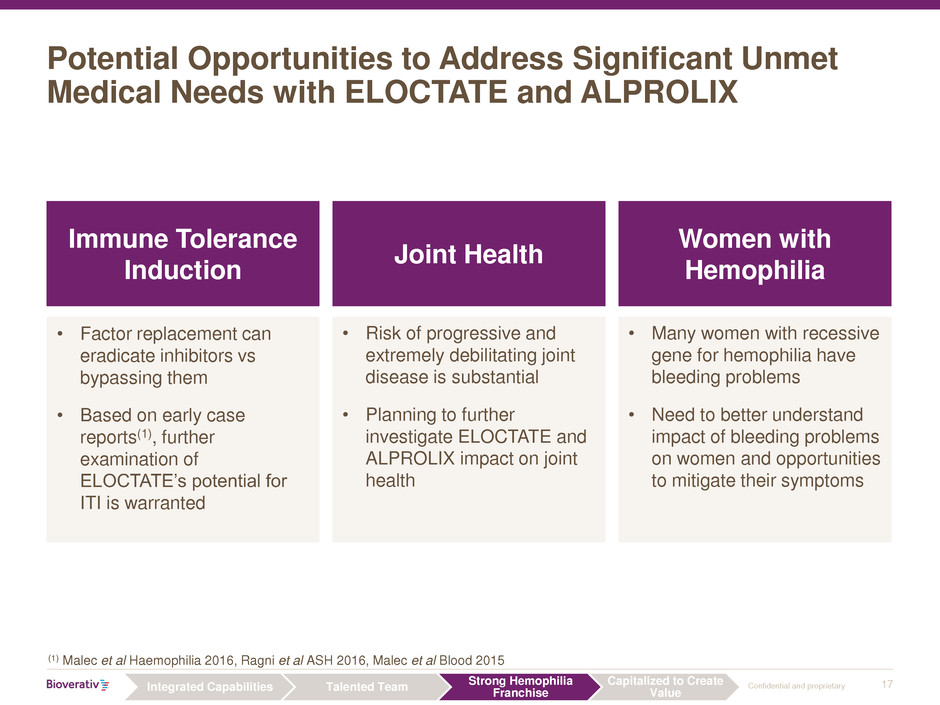

Potential Opportunities to Address Significant Unmet

Medical Needs with ELOCTATE and ALPROLIX

Women with

Hemophilia

Joint Health

Immune Tolerance

Induction

• Risk of progressive and

extremely debilitating joint

disease is substantial

• Planning to further

investigate ELOCTATE and

ALPROLIX impact on joint

health

• Many women with recessive

gene for hemophilia have

bleeding problems

• Need to better understand

impact of bleeding problems

on women and opportunities

to mitigate their symptoms

• Factor replacement can

eradicate inhibitors vs

bypassing them

• Based on early case

reports(1), further

examination of

ELOCTATE’s potential for

ITI is warranted

(1) Malec et al Haemophilia 2016, Ragni et al ASH 2016, Malec et al Blood 2015

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

18 Confidential and proprietary

A Unique and Compelling

Investment Opportunity

Strong Hemophilia

Franchise

Integrated

capabilities

Talented team

Capitalized to

create value

A Unique and Compelling

Investment Opportunity

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

19 Confidential and proprietary

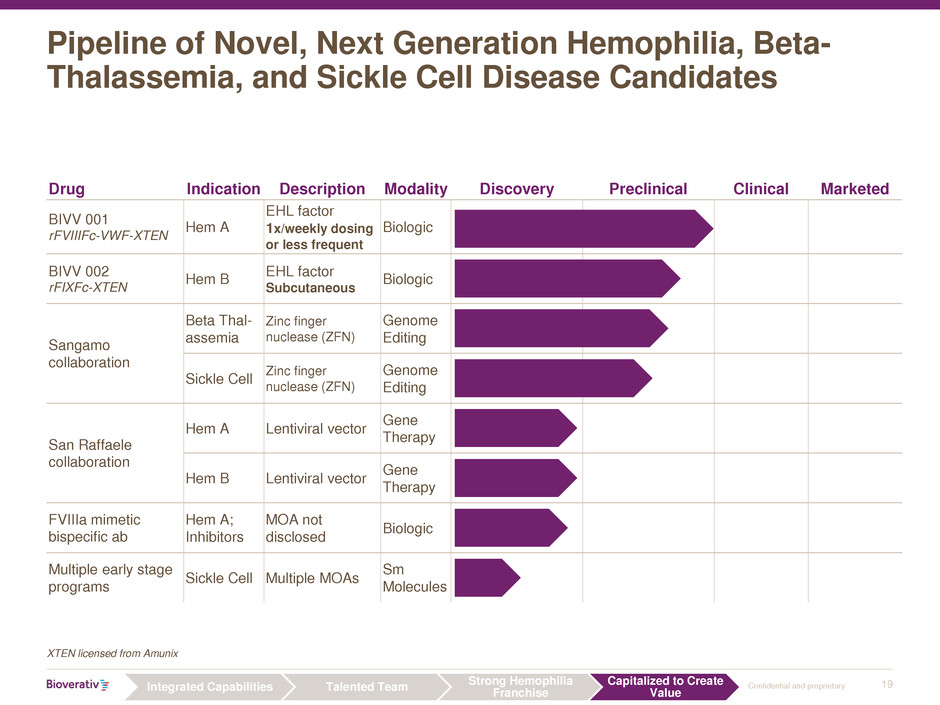

Pipeline of Novel, Next Generation Hemophilia, Beta-

Thalassemia, and Sickle Cell Disease Candidates

XTEN licensed from Amunix

Drug Indication Description Modality Discovery Preclinical Clinical Marketed

BIVV 001

rFVIIIFc-VWF-XTEN

Hem A

EHL factor

1x/weekly dosing

or less frequent

Biologic

BIVV 002

rFIXFc-XTEN

Hem B

EHL factor

Subcutaneous

Biologic

Sangamo

collaboration

Beta Thal-

assemia

Zinc finger

nuclease (ZFN)

Genome

Editing

Sickle Cell

Zinc finger

nuclease (ZFN)

Genome

Editing

San Raffaele

collaboration

Hem A Lentiviral vector

Gene

Therapy

Hem B Lentiviral vector

Gene

Therapy

FVIIIa mimetic

bispecific ab

Hem A;

Inhibitors

MOA not

disclosed

Biologic

Multiple early stage

programs

Sickle Cell Multiple MOAs

Sm

Molecules

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

20 Confidential and proprietary

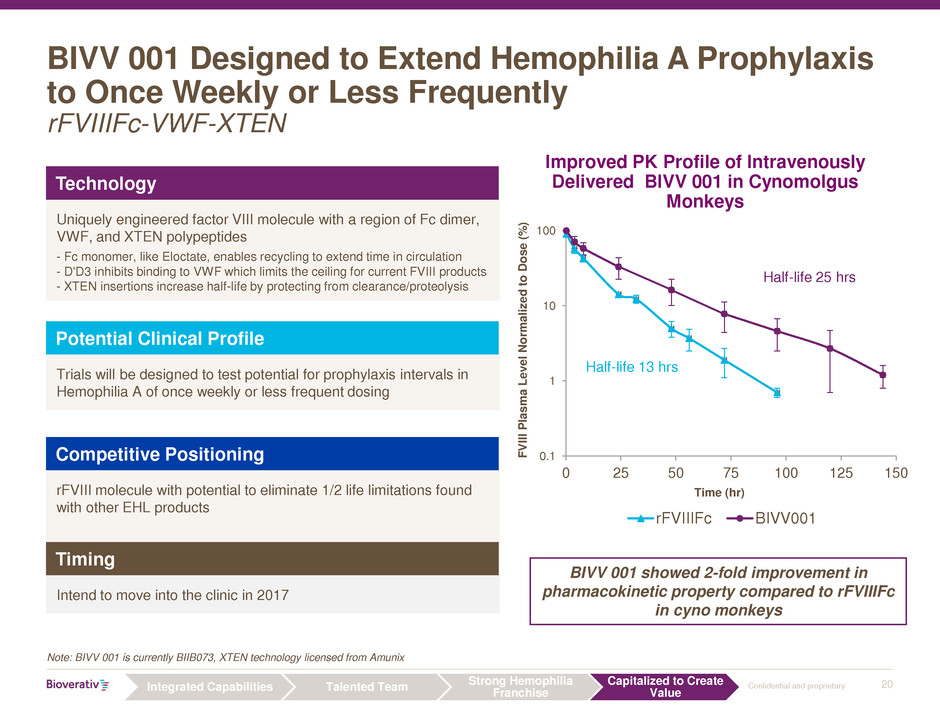

BIVV 001 Designed to Extend Hemophilia A Prophylaxis

to Once Weekly or Less Frequently

rFVIIIFc-VWF-XTEN

Note: BIVV 001 is currently BIIB073, XTEN technology licensed from Amunix

BIVV 001 showed 2-fold improvement in

pharmacokinetic property compared to rFVIIIFc

in cyno monkeys

Improved PK Profile of Intravenously

Delivered BIVV 001 in Cynomolgus

Monkeys

0.1

1

10

100

0 25 50 75 100 125 150

rFVIIIFc BIVV001

Half-life 13 hrs

Half-life 25 hrs

FV

II

I

Pl

a

s

m

a

L

e

v

e

l

Norm

a

li

z

e

d

to

Do

s

e

(

%

)

Time (hr)

Technology

Uniquely engineered factor VIII molecule with a region of Fc dimer,

VWF, and XTEN polypeptides

- Fc monomer, like Eloctate, enables recycling to extend time in circulation

- D'D3 inhibits binding to VWF which limits the ceiling for current FVIII products

- XTEN insertions increase half-life by protecting from clearance/proteolysis

Potential Clinical Profile

Trials will be designed to test potential for prophylaxis intervals in

Hemophilia A of once weekly or less frequent dosing

Competitive Positioning

rFVIII molecule with potential to eliminate 1/2 life limitations found

with other EHL products

Timing

Intend to move into the clinic in 2017

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

21 Confidential and proprietary

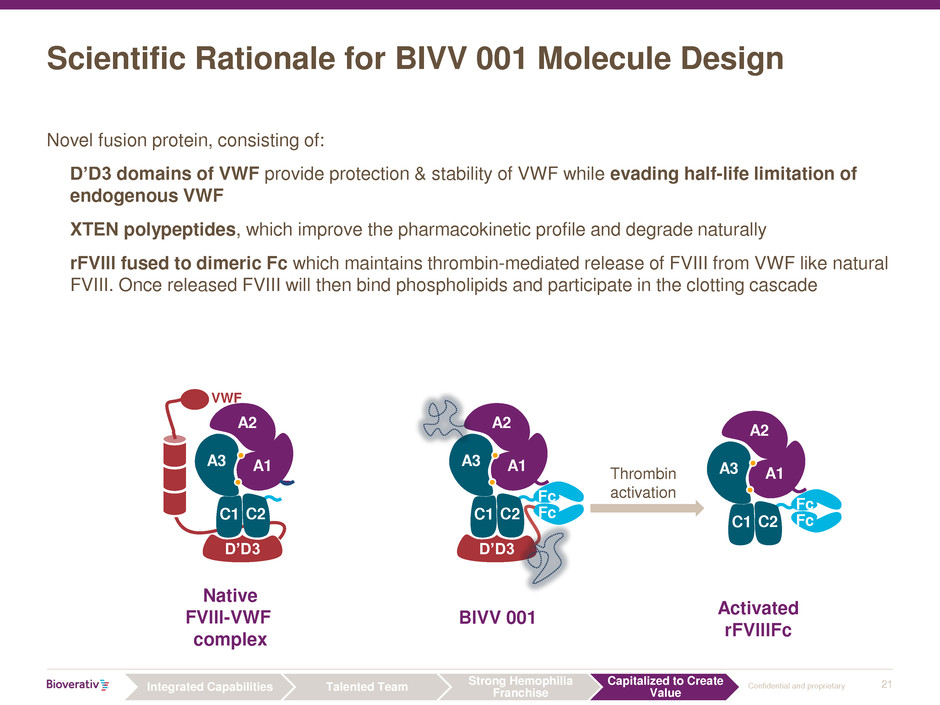

Scientific Rationale for BIVV 001 Molecule Design

Novel fusion protein, consisting of:

D’D3 domains of VWF provide protection & stability of VWF while evading half-life limitation of

endogenous VWF

XTEN polypeptides, which improve the pharmacokinetic profile and degrade naturally

rFVIII fused to dimeric Fc which maintains thrombin-mediated release of FVIII from VWF like natural

FVIII. Once released FVIII will then bind phospholipids and participate in the clotting cascade

Native

FVIII-VWF

complex

BIVV 001

A1

A2

A3

C1 C2

D’D3

Fc

Fc

Thrombin

activation

A1

A2

A3

C1 C2

D’D3

VWF

Activated

rFVIIIFc

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

A1

A2

A3

C1 C2

Fc

Fc

22 Confidential and proprietary

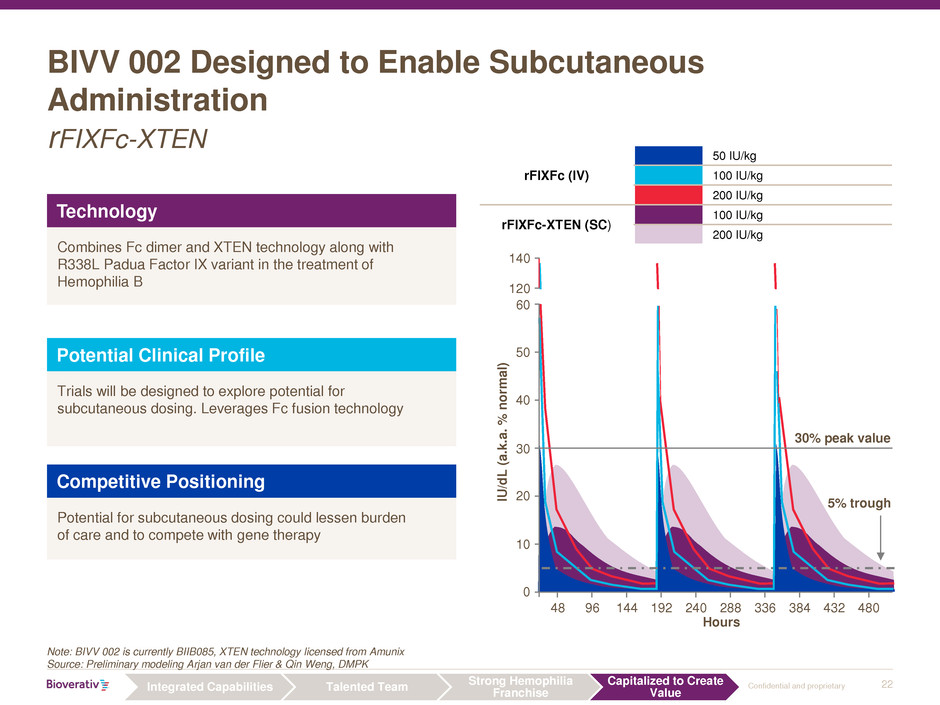

BIVV 002 Designed to Enable Subcutaneous

Administration

rFIXFc-XTEN

Note: BIVV 002 is currently BIIB085, XTEN technology licensed from Amunix

Source: Preliminary modeling Arjan van der Flier & Qin Weng, DMPK

rFIXFc (IV)

50 IU/kg

100 IU/kg

200 IU/kg

rFIXFc-XTEN (SC)

100 IU/kg

200 IU/kg

48 96 144 192 240 288 336 384 432 480

140

60

120

50

40

30

20

10

0

30% peak value

5% trough

Hours

IU

/d

L

(

a.

k

.a

.

%

n

o

rmal

)

Technology

Combines Fc dimer and XTEN technology along with

R338L Padua Factor IX variant in the treatment of

Hemophilia B

Potential Clinical Profile

Trials will be designed to explore potential for

subcutaneous dosing. Leverages Fc fusion technology

Competitive Positioning

Potential for subcutaneous dosing could lessen burden

of care and to compete with gene therapy

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

23 Confidential and proprietary

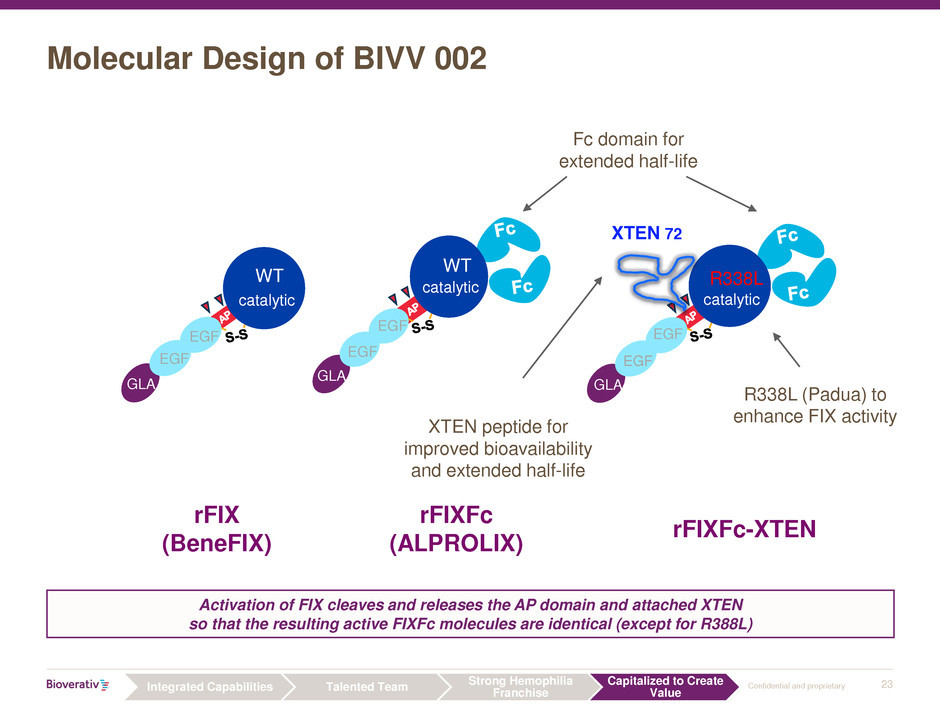

Molecular Design of BIVV 002

WT

GLA

EGF

EGF

catalytic

.

WT

GLA

EGF

EGF

catalytic

XTEN 72

R338L

GLA

EGF

EGF

catalytic

rFIX

(BeneFIX)

rFIXFc

(ALPROLIX)

Fc domain for

extended half-life

XTEN peptide for

improved bioavailability

and extended half-life

rFIXFc-XTEN

R338L (Padua) to

enhance FIX activity

Activation of FIX cleaves and releases the AP domain and attached XTEN

so that the resulting active FIXFc molecules are identical (except for R388L)

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

24 Confidential and proprietary

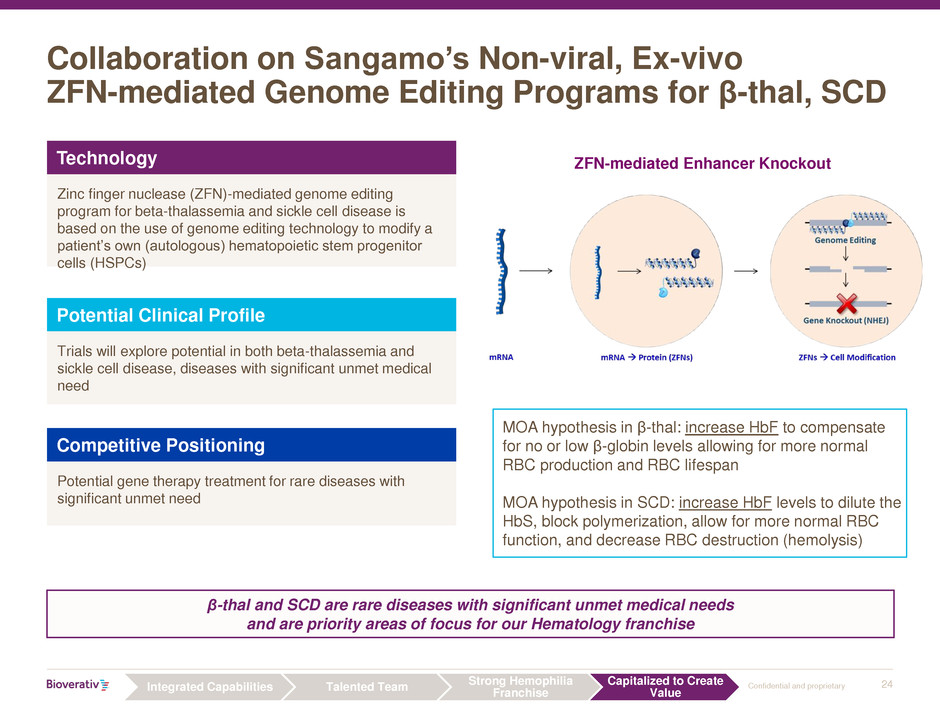

Collaboration on Sangamo’s Non-viral, Ex-vivo

ZFN-mediated Genome Editing Programs for β-thal, SCD

ZFN-mediated Enhancer Knockout

MOA hypothesis in β-thal: increase HbF to compensate

for no or low β-globin levels allowing for more normal

RBC production and RBC lifespan

MOA hypothesis in SCD: increase HbF levels to dilute the

HbS, block polymerization, allow for more normal RBC

function, and decrease RBC destruction (hemolysis)

Technology

Zinc finger nuclease (ZFN)-mediated genome editing

program for beta-thalassemia and sickle cell disease is

based on the use of genome editing technology to modify a

patient’s own (autologous) hematopoietic stem progenitor

cells (HSPCs)

Potential Clinical Profile

Trials will explore potential in both beta-thalassemia and

sickle cell disease, diseases with significant unmet medical

need

Competitive Positioning

Potential gene therapy treatment for rare diseases with

significant unmet need

β-thal and SCD are rare diseases with significant unmet medical needs

and are priority areas of focus for our Hematology franchise

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

25 Confidential and proprietary

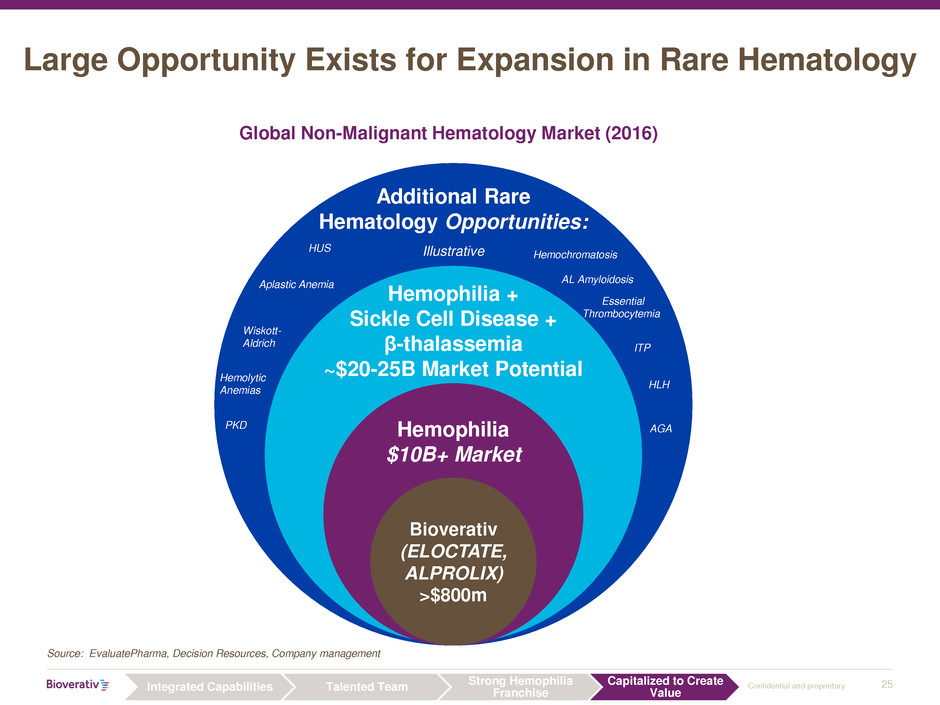

Large Opportunity Exists for Expansion in Rare Hematology

Source: EvaluatePharma, Decision Resources, Company management

Global Non-Malignant Hematology Market (2016)

Additional Rare

Hematology Opportunities:

Bioverativ

(ELOCTATE,

ALPROLIX)

>$800m

Hemophilia +

Sickle Cell Disease +

β-thalassemia

~$20-25B Market Potential

Hemophilia

$10B+ Market

HUS

Aplastic Anemia

PKD

Hemochromatosis

ITP

Wiskott-

Aldrich

Illustrative

Essential

Thrombocytemia

AL Amyloidosis

Hemolytic

Anemias

AGA

HLH

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

26 Confidential and proprietary

Business Development Vision: Sector Expert and

Partner of Choice

• Numerous rare hematologic diseases with

high unmet need and interesting accessible

clinical stage assets

• Committed to exploring such opportunities

to bolster our pipeline

• With our expertise we believe we can drive

programs rapidly through the clinic and we

aim to be the partner of choice

• Financial capacity provides potential

to grow inorganically

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

Global Therapeutic Operations

Rogerio Vivaldi, MD, MBA

28 Confidential and proprietary

Strategic Imperatives for Therapeutic Operations

Maximize

Potential of ELOCTATE

and ALPROLIX

Enhance

Value with Patient-Centric

Approach

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

29 Confidential and proprietary

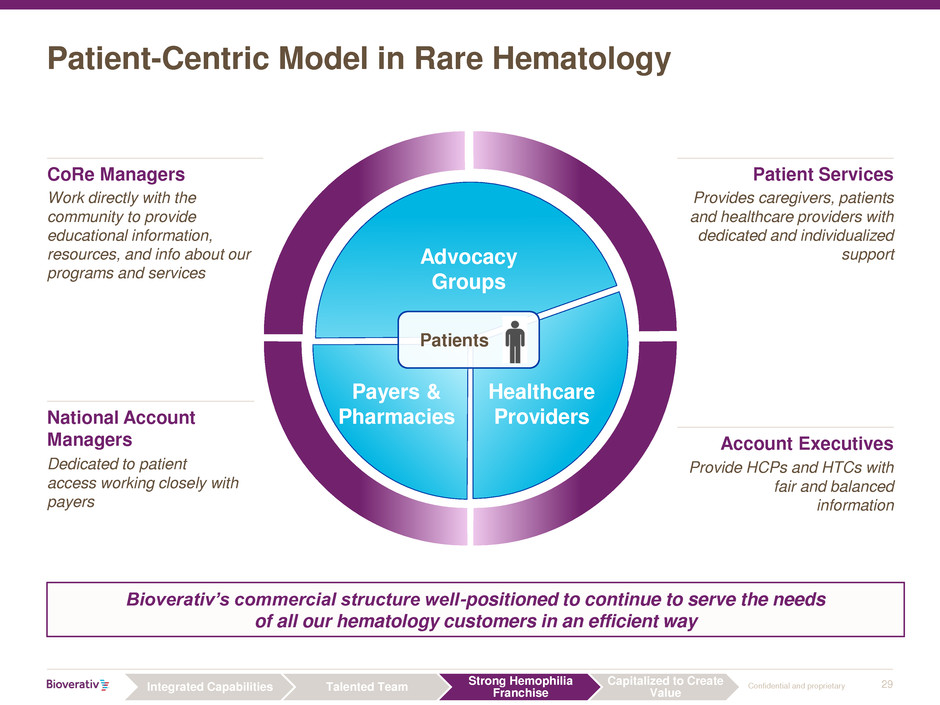

Patient-Centric Model in Rare Hematology

Bioverativ’s commercial structure well-positioned to continue to serve the needs

of all our hematology customers in an efficient way

Work directly with the

community to provide

educational information,

resources, and info about our

programs and services

Provides caregivers, patients

and healthcare providers with

dedicated and individualized

support

Provide HCPs and HTCs with

fair and balanced

information

Dedicated to patient

access working closely with

payers

Patient Services

Account Executives

National Account

Managers

CoRe Managers

Advocacy

Groups

Payers &

Pharmacies

Healthcare

Providers

Patients

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

30 Confidential and proprietary

13%

10%

0%

2%

4%

6%

8%

10%

12%

14%

0 2 4 6 8 10 12 14 16 18 20 22 24 26 28

Strong Launches Position ELOCTATE & ALPROLIX for

Future Success

US launch Q2 2014, Japan Q1 2015, Canada Q1 2016 US launch Q2 2014, Japan Q3 2014, Canada Q4 2015

Months from Launch

Total Market Share

US

Japan

25%

31%

0%

5%

10%

15%

20%

25%

30%

35%

0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30

Months from Launch

US

Japan

*Note: Japan reporting for Alprolix share starting Jan 2015 only

Launch = March 2015

Launch = July 2014

Launch = September

2014 *

Launch = May 2014

Total Market Share

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

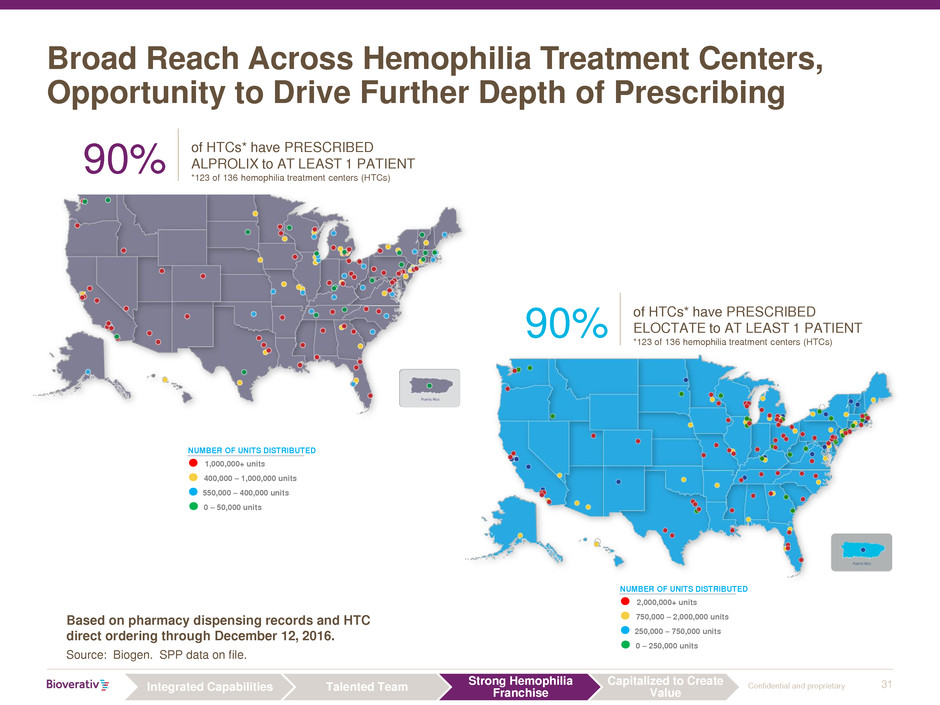

31 Confidential and proprietary

Broad Reach Across Hemophilia Treatment Centers,

Opportunity to Drive Further Depth of Prescribing

Based on pharmacy dispensing records and HTC

direct ordering through December 12, 2016.

Source: Biogen. SPP data on file.

90%

of HTCs* have PRESCRIBED

ALPROLIX to AT LEAST 1 PATIENT

*123 of 136 hemophilia treatment centers (HTCs)

NUMBER OF UNITS DISTRIBUTED

2,000,000+ units

750,000 – 2,000,000 units

250,000 – 750,000 units

0 – 250,000 units

NUMBER OF UNITS DISTRIBUTED

1,000,000+ units

400,000 – 1,000,000 units

550,000 – 400,000 units

0 – 50,000 units

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

90%

of HTCs* have PRESCRIBED

ELOCTATE to AT LEAST 1 PATIENT

*123 of 136 hemophilia treatment centers (HTCs)

32 Confidential and proprietary

Opportunity Remains for Further Growth from Shift to

Prophylaxis and EHL Therapies

H

emo

p

hi

li

a

A

H

emo

p

hi

li

a

B

Market Share of Patients on Prophylaxis (U.S.)

Source: Q2 2016 US HTC Market Tracking FVIII and FIX Report

100%

83% 70%

18%

23%

7%

Q2-14 Q2-15 Q2-16

Other EHL (Pegylated)

Conventional

(Short-Acting)

85%

57% 51%

15%

44% 47%

2%

Q2-14 Q2-15 Q2-16

Other EHL

(Albumin Fusion)

Conventional (Short-

Acting)

On Demand vs Prophylaxis

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

50% 50%

On Demand Prophylaxis

40%

60%

On Demand Prophylaxis

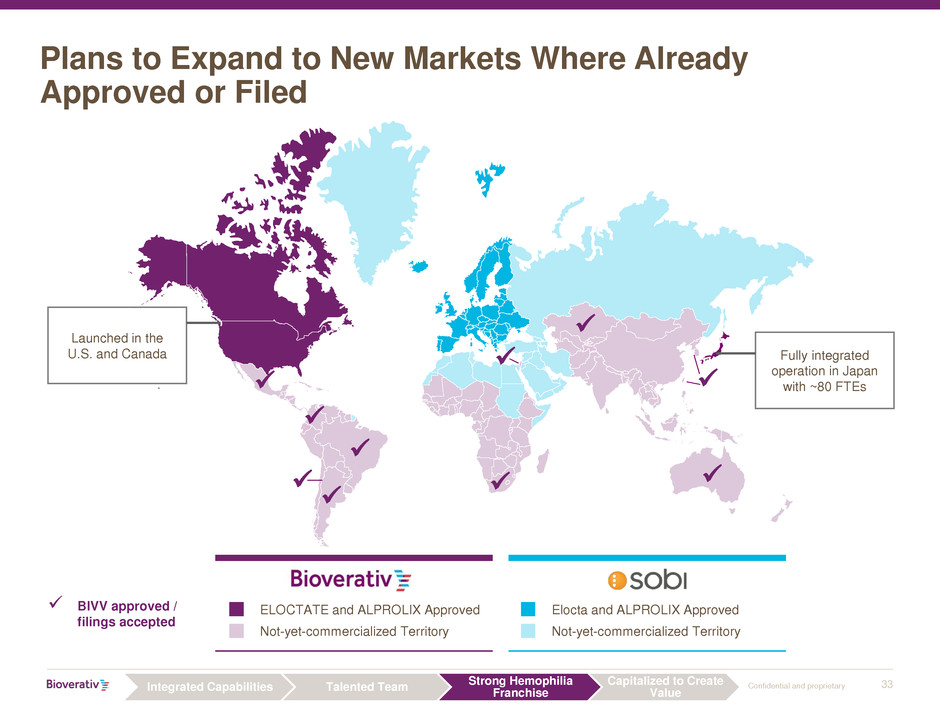

33 Confidential and proprietary

Plans to Expand to New Markets Where Already

Approved or Filed

ELOCTATE and ALPROLIX Approved

Not-yet-commercialized Territory

Elocta and ALPROLIX Approved

Not-yet-commercialized Territory

Launched in the

U.S. and Canada Fully integrated

operation in Japan

with ~80 FTEs

BIVV approved /

filings accepted

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

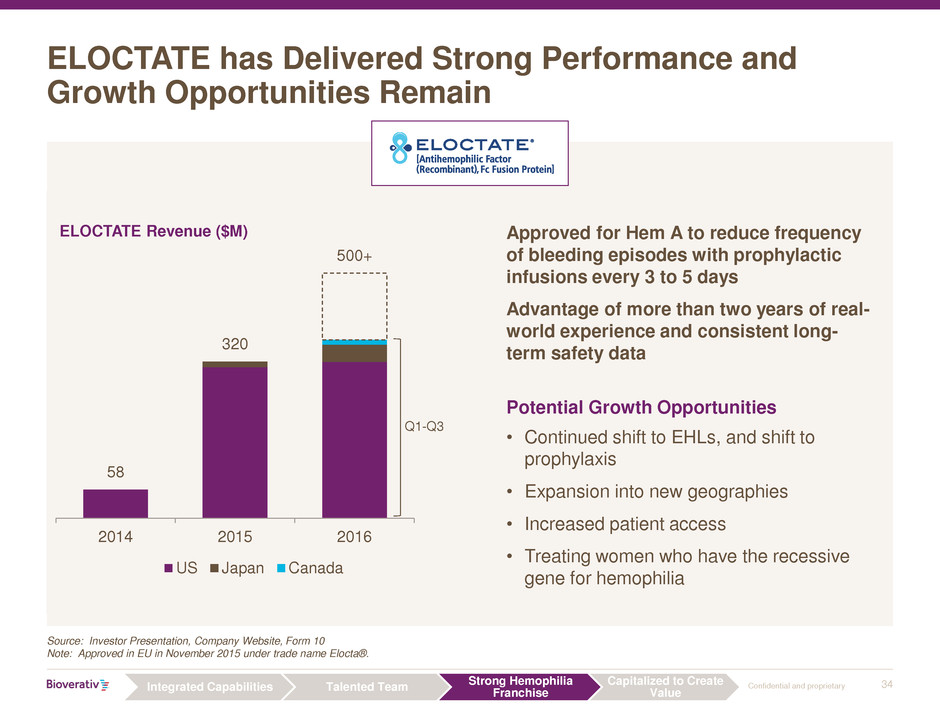

34 Confidential and proprietary

ELOCTATE has Delivered Strong Performance and

Growth Opportunities Remain

Approved for Hem A to reduce frequency

of bleeding episodes with prophylactic

infusions every 3 to 5 days

Advantage of more than two years of real-

world experience and consistent long-

term safety data

Potential Growth Opportunities

• Continued shift to EHLs, and shift to

prophylaxis

• Expansion into new geographies

• Increased patient access

• Treating women who have the recessive

gene for hemophilia

Source: Investor Presentation, Company Website, Form 10

Note: Approved in EU in November 2015 under trade name Elocta®.

ELOCTATE Revenue ($mm)

58

320

500+

2014 2015 2016

US Japan Canada

Q1-Q3

ELOCTATE Revenue ($M)

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

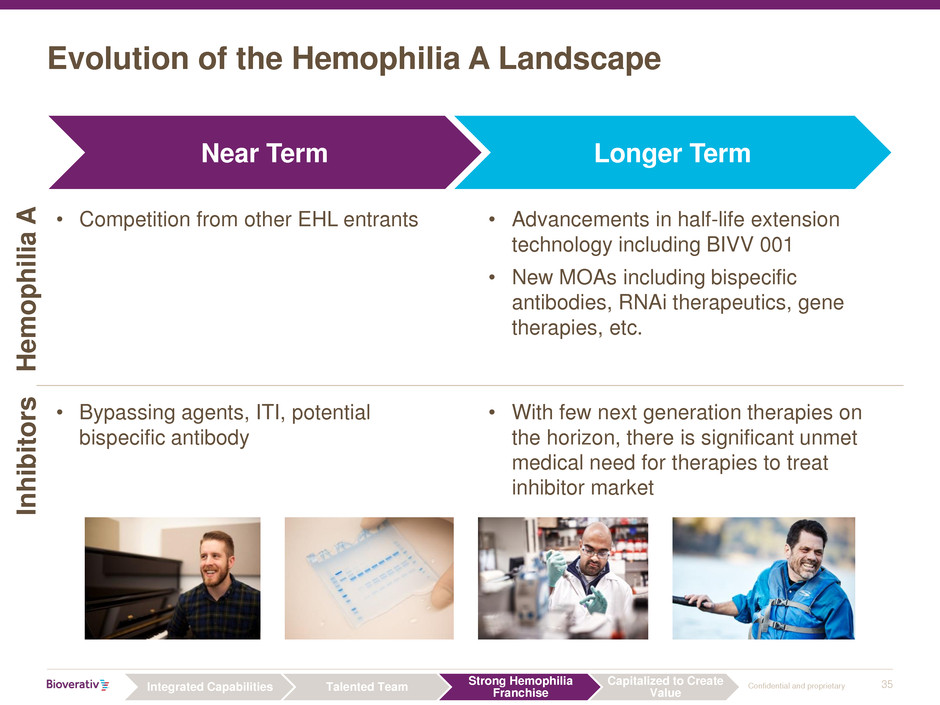

35 Confidential and proprietary

Near Term

Evolution of the Hemophilia A Landscape

Longer Term

• Competition from other EHL entrants • Advancements in half-life extension

technology including BIVV 001

• New MOAs including bispecific

antibodies, RNAi therapeutics, gene

therapies, etc.

• Bypassing agents, ITI, potential

bispecific antibody

• With few next generation therapies on

the horizon, there is significant unmet

medical need for therapies to treat

inhibitor market

H

e

mo

p

hi

lia

A

Inh

ibitor

s

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

36 Confidential and proprietary

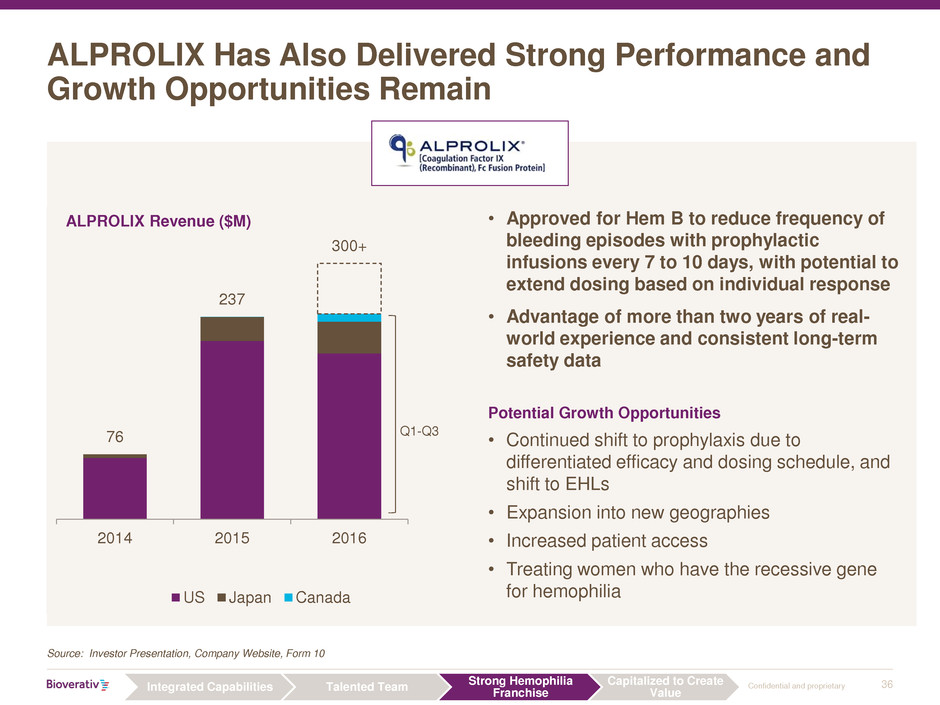

ALPROLIX Has Also Delivered Strong Performance and

Growth Opportunities Remain

• Approved for Hem B to reduce frequency of

bleeding episodes with prophylactic

infusions every 7 to 10 days, with potential to

extend dosing based on individual response

• Advantage of more than two years of real-

world experience and consistent long-term

safety data

Potential Growth Opportunities

• Continued shift to prophylaxis due to

differentiated efficacy and dosing schedule, and

shift to EHLs

• Expansion into new geographies

• Increased patient access

• Treating women who have the recessive gene

for hemophilia

Source: Investor Presentation, Company Website, Form 10

76

237

300+

2014 2015 2016

US Japan Canada

Q1-Q3

ALPROLIX Revenue ($M)

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

37 Confidential and proprietary

Evolution of the Hemophilia B Landscape

• Competition from other EHL entrants • Potential subcutaneous EHLs, including

BIVV 002

• New MOAs including gene therapies,

RNAi

Near Term Longer Term

Integrated Capabilities Talented Team

Strong Hemophilia

Franchise

Capitalized to Create

Value

Financial Overview

John Greene, CFO

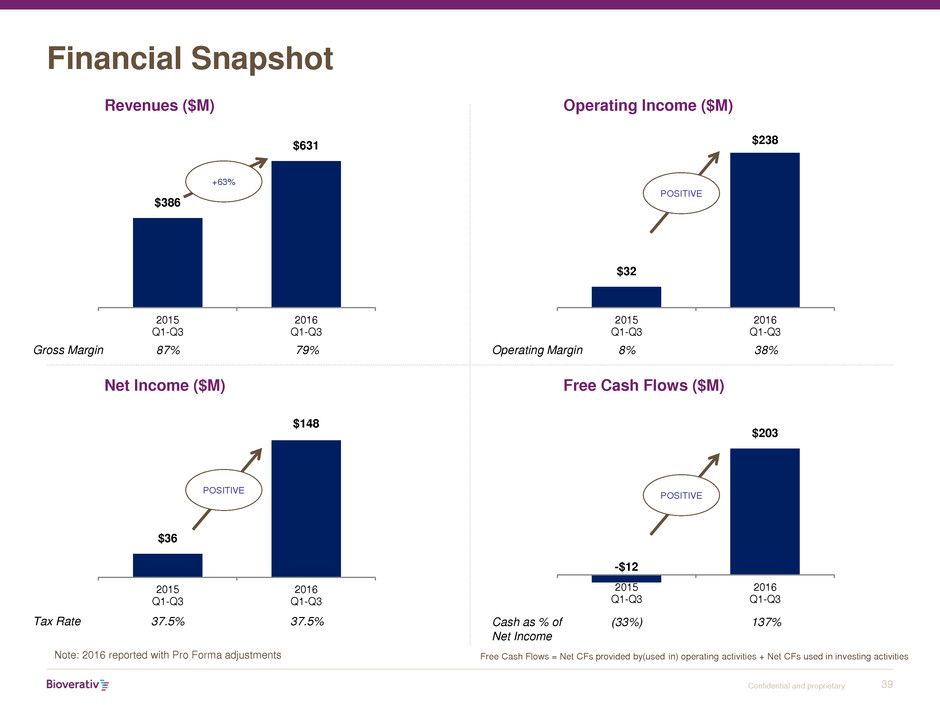

39 Confidential and proprietary

Financial Snapshot

$32

$238

2015

Q1-Q3

2016

Q1-Q3

Operating Income ($M)

Operating Margin 8% 38%

$386

$631

2015

Q1-Q3

2016

Q1-Q3

+63%

Revenues ($M)

Gross Margin 87% 79%

$36

$148

2015

Q1-Q3

2016

Q1-Q3

Net Income ($M)

Tax Rate 37.5% 37.5%

-$12

$203

2015

Q1-Q3

2016

Q1-Q3

Free Cash Flows ($M)

Cash as % of

Net Income

(33%) 137%

Note: 2016 reported with Pro Forma adjustments

POSITIVE

POSITIVE

POSITIVE

Free Cash Flows = Net CFs provided by(used in) operating activities + Net CFs used in investing activities

40 Confidential and proprietary

2017 Financial Guidance

Guidance as of January 6, 2017

Non-GAAP outlook excludes: One time separation and set up costs, equity based compensation and amortization of intangible assets. These

items impact operating margin. The GAAP to Non-GAAP reconciliation of these items is included in the Appendix. Our guidance does not include

the impact of potential business development.

* No adjustment.

Revenue

Growth

17 – 19%

Operating

Margin

Tax Rate

Guidance Opening Balance Sheet

(In millions) Pro Forma

as of Sept 30, 2016

Total current assets $575.5

Cash and cash equivalents $325.0

Accounts receivable, net $126.8

Inventory $113.6

Other current assets $10.1

Total current liabilities $79.6

Net Working Capital $495.9

GAAP Non-GAAP

38 – 42% 43 - 47%

36 – 38%

17 – 19%*

36 – 38%*

Closing

John Cox, CEO

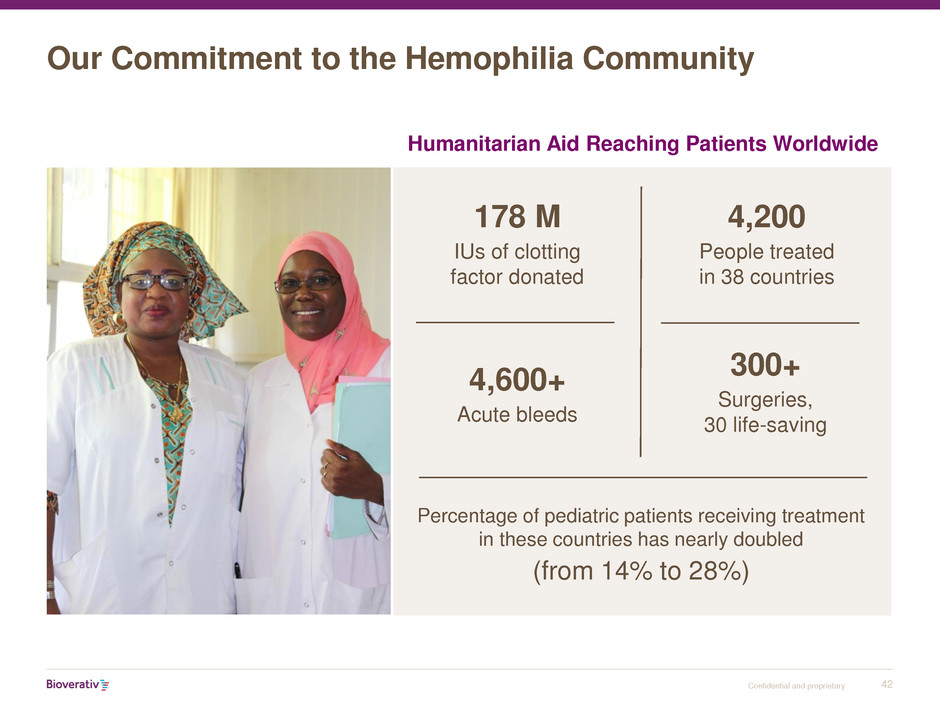

42 Confidential and proprietary

Our Commitment to the Hemophilia Community

178 M

IUs of clotting

factor donated

4,200

People treated

in 38 countries

4,600+

Acute bleeds

300+

Surgeries,

30 life-saving

Percentage of pediatric patients receiving treatment

in these countries has nearly doubled

(from 14% to 28%)

Humanitarian Aid Reaching Patients Worldwide

43 Confidential and proprietary

A Unique and Compelling

Investment Opportunity

Strong Hemophilia

Franchise

Integrated

capabilities

Talented team

Capitalized to

create value

Appendix

45 Confidential and proprietary

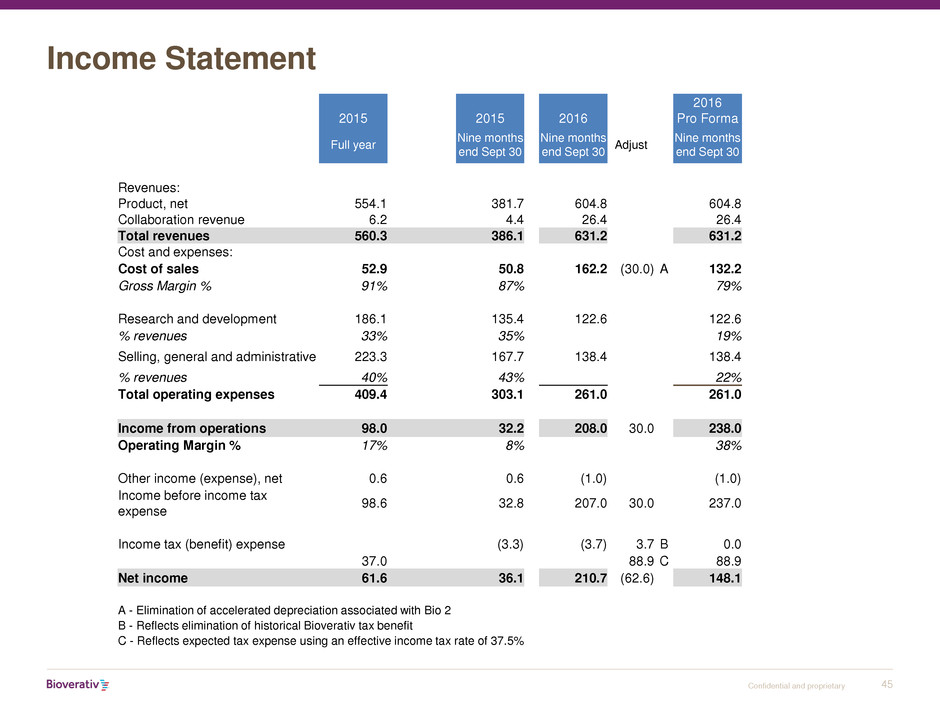

Income Statement

2015 2015 2016

2016

Pro Forma

Full year

Nine months

end Sept 30

Nine months

end Sept 30

Adjust

Nine months

end Sept 30

Revenues:

Product, net 554.1 381.7 604.8 604.8

Collaboration revenue 6.2 4.4 26.4 26.4

Total revenues 560.3 386.1 631.2 631.2

Cost and expenses:

Cost of sales 52.9 50.8 162.2 (30.0) A 132.2

Gross Margin % 91% 87% 79%

Research and development 186.1 135.4 122.6 122.6

% revenues 33% 35% 19%

Selling, general and administrative 223.3 167.7 138.4 138.4

% revenues 40% 43% 22%

Total operating expenses 409.4 303.1 261.0 261.0

Income from operations 98.0 32.2 208.0 30.0 238.0

Operating Margin % 17% 8% 38%

Other income (expense), net 0.6 0.6 (1.0) (1.0)

Income before income tax

expense

98.6 32.8 207.0 30.0 237.0

Income tax (benefit) expense (3.3) (3.7) 3.7 B 0.0

37.0 88.9 C 88.9

Net income 61.6 36.1 210.7 (62.6) 148.1

A - Elimination of accelerated depreciation associated with Bio 2

B - Reflects elimination of historical Bioverativ tax benefit

C - Reflects expected tax expense using an effective income tax rate of 37.5%

46 Confidential and proprietary

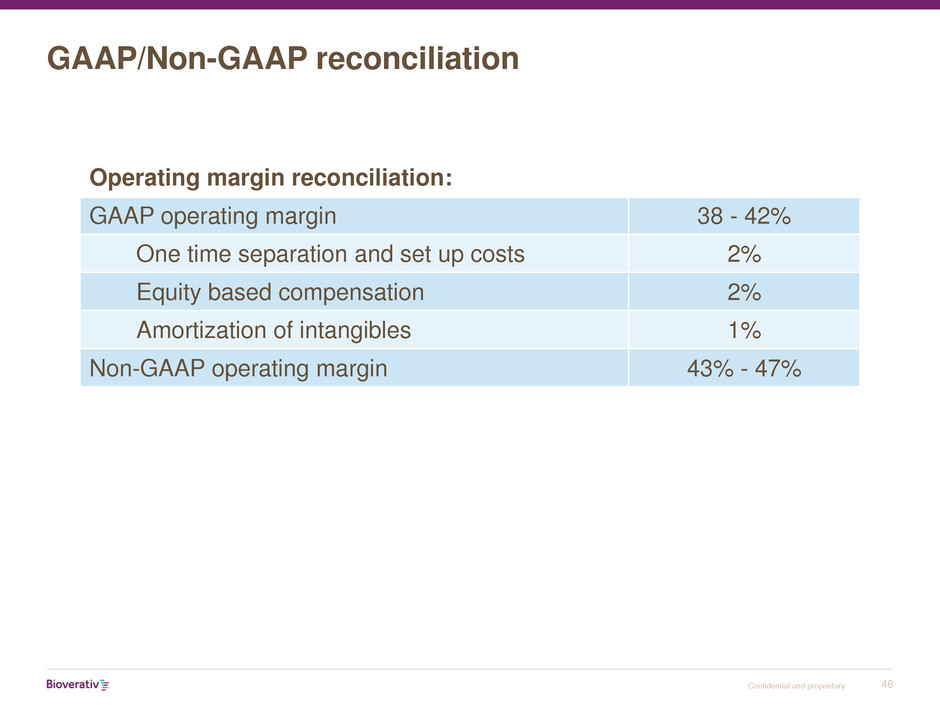

GAAP/Non-GAAP reconciliation

Operating margin reconciliation:

GAAP operating margin 38 - 42%

One time separation and set up costs 2%

Equity based compensation 2%

Amortization of intangibles 1%

Non-GAAP operating margin 43% - 47%

47 Confidential and proprietary

Balance Sheet

2015 2016

2016

Pro Forma

Full year

Nine months

end Sept 30

Adjust

Nine months

end Sept 30

Balance Sheet

ASSETS

Current assets:

Cash 0.0 325.0 A 325.0

Accounts receivable, net 94.4 126.8 126.8

Inventory 252.1 283.3 (169.7) B 113.6

Other current assets 4.0 10.3 (0.2) C 10.1

Total current assets 350.5 420.4 155.1 575.5

Property, plant and equipment, net 75.5 45.0 (26.9) C 18.1

Intangible assets, net 30.0 53.1 53.1

Other long-term assets 19.6 22.4 22.4

Total assets 475.6 540.9 128.2 669.1

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable 10.8 12.3 12.3

Accrued expenses and other current

liabilities

49.4 68.9 (1.6) C 67.3

Total current liabilities 60.2 81.2 (1.6) 79.6

Long-term liabilities 30.7 53.8 53.8

Total liabilities 90.9 135.0 (1.6) 133.4

Commitments and contingencies

Equity:

Net parent company investment 384.4 401.6 129.8 531.4

Accumulated other comprehensive loss 0.3 4.3 4.3

Total equity 384.7 405.9 129.8 535.7

Total liabilities and equity 475.6 540.9 128.2 669.1

Working Capital 290.3 495.9

A- Initial cash contribution from Biogen to Bioverativ

B - Drug substance (raw material and work-in progress inventory) retained by Biogen

C - Biogen manufacturing facility, related assets and liabilities that will not transfer to Bioverativ

48 Confidential and proprietary

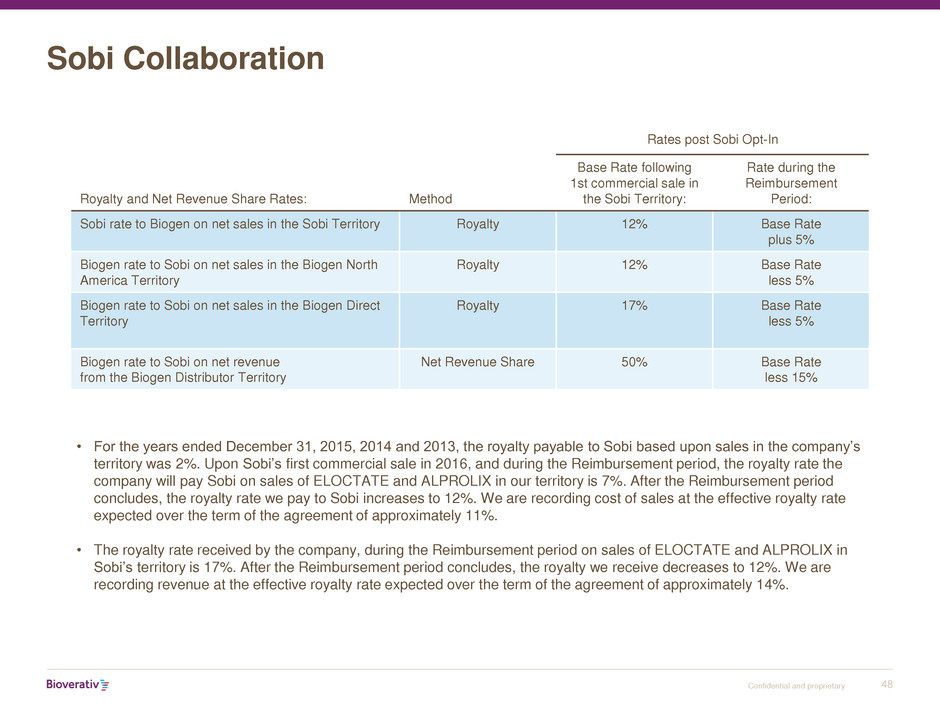

Sobi Collaboration

• For the years ended December 31, 2015, 2014 and 2013, the royalty payable to Sobi based upon sales in the company’s

territory was 2%. Upon Sobi’s first commercial sale in 2016, and during the Reimbursement period, the royalty rate the

company will pay Sobi on sales of ELOCTATE and ALPROLIX in our territory is 7%. After the Reimbursement period

concludes, the royalty rate we pay to Sobi increases to 12%. We are recording cost of sales at the effective royalty rate

expected over the term of the agreement of approximately 11%.

• The royalty rate received by the company, during the Reimbursement period on sales of ELOCTATE and ALPROLIX in

Sobi’s territory is 17%. After the Reimbursement period concludes, the royalty we receive decreases to 12%. We are

recording revenue at the effective royalty rate expected over the term of the agreement of approximately 14%.

Rates post Sobi Opt-In

Royalty and Net Revenue Share Rates: Method

Base Rate following

1st commercial sale in

the Sobi Territory:

Rate during the

Reimbursement

Period:

Sobi rate to Biogen on net sales in the Sobi Territory Royalty 12% Base Rate

plus 5%

Biogen rate to Sobi on net sales in the Biogen North

America Territory

Royalty 12% Base Rate

less 5%

Biogen rate to Sobi on net sales in the Biogen Direct

Territory

Royalty 17% Base Rate

less 5%

Biogen rate to Sobi on net revenue

from the Biogen Distributor Territory

Net Revenue Share 50% Base Rate

less 15%

49 Confidential and proprietary

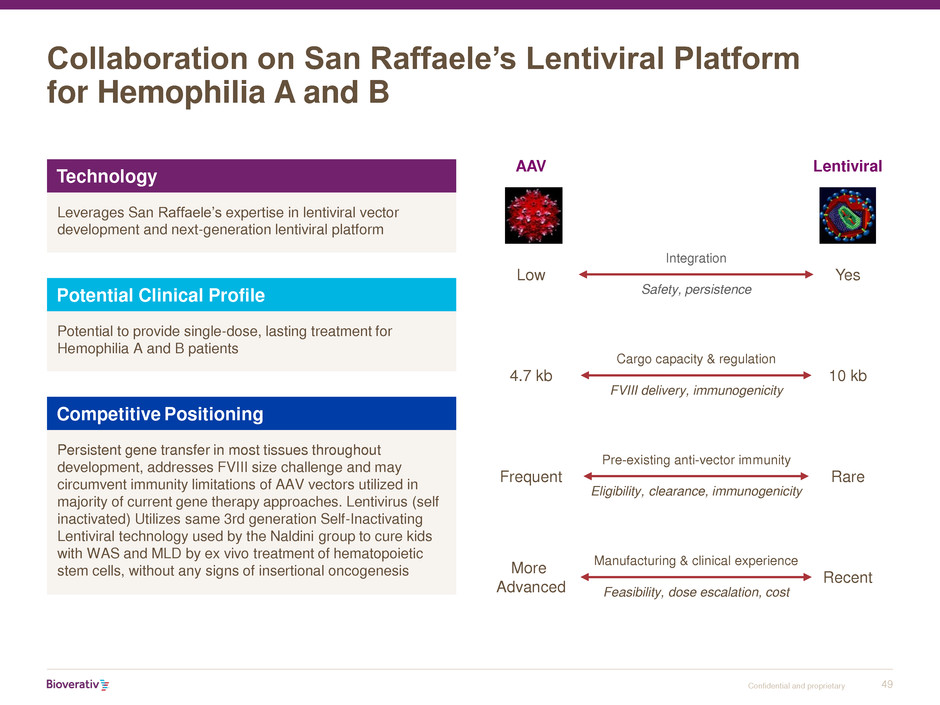

Collaboration on San Raffaele’s Lentiviral Platform

for Hemophilia A and B

AAV Lentiviral

Integration

Safety, persistence

Low Yes

Cargo capacity & regulation

FVIII delivery, immunogenicity

4.7 kb 10 kb

Pre-existing anti-vector immunity

Eligibility, clearance, immunogenicity

Frequent Rare

Manufacturing & clinical experience

Feasibility, dose escalation, cost

More

Advanced

Recent

Technology

Leverages San Raffaele’s expertise in lentiviral vector

development and next-generation lentiviral platform

Potential Clinical Profile

Potential to provide single-dose, lasting treatment for

Hemophilia A and B patients

Competitive Positioning

Persistent gene transfer in most tissues throughout

development, addresses FVIII size challenge and may

circumvent immunity limitations of AAV vectors utilized in

majority of current gene therapy approaches. Lentivirus (self

inactivated) Utilizes same 3rd generation Self-Inactivating

Lentiviral technology used by the Naldini group to cure kids

with WAS and MLD by ex vivo treatment of hematopoietic

stem cells, without any signs of insertional oncogenesis

50 Confidential and proprietary

Leading Medical Experts in Sickle Cell Disease and a

Portfolio of Research Stage Assets

α

α g

HbS

bs

Healthy Diseased

α bs

α bs

HbS

• Sickling

• Hemolytic anemia

• Sickle crises

Technology

Small molecule approaches primarily addressing the

causative defect leading to the pathophysiology of SCD

Potential Clinical Profile

Goal is to develop disease-modifying therapies to treat

significant unmet needs in SCD

Competitive Positioning

Opportunity to nurture a robust discovery pipeline that

could make BIVV the only company with a comprehensive

approach to addressing SCD

Fragmented competition